-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: Budget for Energy 2014-15: An Autopsy!

ANALYSIS/ISSUES

Ø India’s Solar Mission: Make it work for the economy class not just the business class

DATA INSIGHT

Ø Remote Village Electrification in India

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· GAIL proposes Srikakulam-Nellore gas pipeline grid

· Rajasthan to set up JV with GAIL for CNG supply

· ONGC set to skip 2nd Aug naphtha export cargo

· Shell makes third major discovery in Norphlet play in Gulf of Mexico

· Iraq Kurds use army to boost control of Kirkuk oilfields

· Dragon Oil says on track for 2015 milestone target

· Total says Europe refining margins rebound from 4 year low

· Petrofac to construct oil gathering center project for KOC in Kuwait

· Rosneft, Petrobras sign natural gas accord for Brazil's Amazon

· East Libya rebels commit to keep open largest crude export-port

· Thailand turns off tap on gas imports as economy falters

· Shale seen shifting flows at America’s biggest oil port

· Japan's MOL to launch Arctic Ocean LNG route from Russia's Yamal in 2018

· Semen Indonesia, Japan’s JFE to build power plant in East Java

· Egat's power plant project gets go-ahead in Quang Tri

· TAPGC to construct three hydropower plants in Philippines

· Marubeni begins construction of small hydro power project in Japan

POLICY & PRICE

· Oil ministry seeks advice on payment to Judges in the arbitration case over KG-D6 block

· Price of diesel sold to bulk consumers cut by ` 1.09 per litre

· Cabinet to soon decide on 10 per cent ethanol blending: Oil Minister

· Budget 2014: LNG exports to Pakistan to be exempt from import duty

· Budget 2014: Govt to set up 15,000 km gas pipelines in public-private-partnership mode

· Goyal seeks regulators' inputs for power sector growth

· Capital outlay for 7 power PSUs at ` 514.2 bn in FY15

· Govt readies ` 500 bn equity fund for power sector

· Budget 2014 proposals cheer power sector

· Budget 2014: DAE allocated ` 104.4 bn

· Spain's Repsol could start drilling off Canary Islands in Oct

· Chile eyes use of US shale gas in early 2016, ENAP says

· Russia's Rosneft to explore for offshore oil in Cuba: Putin

· OPEC sees 2015 demand for its crude as least in six yrs

· China signs $1.6 bn engineering deal for Siberian LNG project

· Putin and Argentine leader agree on nuclear power project

· German bank to help finance San Gabriel power plant

· Sunil Hitech to set up 5 MW solar plant in Maharashtra

· Alstom, NASL to renovate & modernise NTPC's Odisha plant

· France says vast solar energy, urban development potential in Rajasthan

· Industry welcomes boost to renewable energy in Budget 2014

· Orient Green Power seeks shareholders' approval for fund raising

· Itochu to build 45 MW solar power plant with partners

· Sumitomo Corp to build 75 MW biomass power plant in Japan

· First Solar drops plan for world’s biggest plant in China

· China to exempt electric cars from 10 per cent purchase tax

· Tariff-free solar panels aim of trade negotiations

WEEK IN REVIEW

ENERGY

Budget for Energy 2014-15: An Autopsy!

ORF Energy Team

The Budget 2014-15 is out and it is time to dish out customary observations and comments. Though there are some good and not do good aspects in the recent energy budget the more important thing would be to see how some of the positive aspects actually unravel in each energy sub-sector. Here is a quick autopsy of the budget that could serve as a guide to the future.

Budget 2014-15

|

Coal Sector |

|

` 12, 561 Crore (Cr) is given to the Ministry of Coal (an increment of 14.8% (` 10, 940 Cr) from the last budget) |

|

* Increase in outlay is positive but there is no established link between increase in outlay and increase in efficiency in the sector |

|

2.5 % basic customs duty and 2% Counter Veiling Duty (CVD) imposed on all kinds of coal |

|

* Rationalisation of duty on all kinds of coal will offset 2.5% imported duty on coking coal |

|

CVD on metallurgical coal reduced from 6% to 2%. Basic customs duty on metallurgical coal is increased to 2.5% from nil |

|

* Lower CVD on metallurgical coal will reduce cost and benefit large steel plants which can save up Rs. 100-200/tonne on their cost of production (whether this saving will be passed on to the customer remains to be seen!) |

|

Clean energy cess on coal has been increased from ` 50/ tonne to ` 100/ tonne |

|

* Clean energy cess will make the coal mining costly. There is no clarity on use of clean energy cess but coal is likely to continue with subsidising renewable power. Whether or not this will bring any sustainable benefit in terms of reducing carbon emissions is yet to be established |

|

CIL is expected to increase the production to 630 Million tons (MT); Lignite production is estimated at 26.6 (MT) |

|

* The target for coal production by CIL is highly ambitious given CIL historic production growth rates. Missing targets is the rule not an exception |

|

The government is expected to amend the Mines & Minerals Development & Regulation Act (MMDR Act), 1957, if required |

|

* If MMDR Act, 1957 is amended wisely it could boost the investment in the mining sector |

|

Ministry of Railways (MoR) have been allocated ` 63, 949 Cr (9.7% increment from the last allocation of ` 58, 257 Cr; MoR is expected to renew/ add 5, 475 km railways lines |

|

* To achieve target CIL needs more than 200 rakes annually which is not mentioned in the budget |

|

Disinvestment in CIL is suggested |

|

* Disinvestment will bring huge revenue for the government but whether or not it will increase CIL efficiency remains to be seen |

|

Increase in coal freight rate by 6.5% |

|

* May become just another excuse for increasing power tariff |

|

|

|

Petroleum & Natural Gas |

|

MoPNG has been allocated ` 80, 678 Cr (decrease of 33% from the allocation given in last budget ` 1, 07, 406 Cr) |

|

* There is no established link between change in budget allocation and performance of the sector |

|

The government will share the 50% under-recovery burden |

|

* Details on how the government aims to share under-recover burden is not clear; it contradicts policy of phasing out diesel subsidies |

|

Basic customs duty has been reduced on reformate from 10% to 2.5%; from 5% to 2.5% on propane, ethylene, propylene, butadiene & ortho-xylene; from 7.5% to 5% on methyl alcohol and denatured ethyl alcohol; from 10% to 5% on crude naphthalene |

|

* May benefit petrochemical industry |

|

Regular hikes in diesel prices but temporary suspension of LPG price hike |

|

* Regular hikes in diesel prices will reduce the attractiveness of the narrative of under-recoveries but may contribute to inflation in the short run * Suspension of LPG price hike will be welcomed by residential consumers, but it will be an additional liability not only for the govt., but also to the public sector oil units which serve 166 million domestic LPG consumers |

|

Central excise duty on branded petrol is reduced to ` 2.35/ litre |

|

* Excise duty reduction on branded petrol will not have much impact as it accounts for less than 5% sales. But it is the first baby step towards reduction of carbon foot print by encouraging diesel car fleet to shift to petrol if seen together with hike in diesel prices |

|

Older CBM blocks will be revived using modern technology |

|

* CBM blocks will remain in the back seat as companies involved want to focus in their core area of expertise. Exploration of CBM blocks is expensive and uncertainty over pricing issues will continue to be a major hurdle |

|

Addition of 15, 000 km of gas pipeline infrastructure through PPP mode |

|

* Private sector will be benefitted in gas pipeline infrastructure projects. But unless the question of gas availability and pricing is resolved pipelines may become stranded assets due under utilisation of pipeline capacity. This is a critical issue even today as present gas infrastructure of more than 15000 kms has less than 50% capacity utilisation |

|

|

|

Power Sector |

|

The Ministry of Power (MoP) allocated ` 60, 384 Cr (11.8% increment from the last year estimate of ` 53, 963 Cr); ` 8, 000 Cr allocated for Transmission and Distribution segment |

|

* While increase in allocation is necessary the more important issue would be how they are utilised |

|

Extension of 80 IA for projects in generation, transmission & distribution commissioned up to March, 2017 |

|

* Will benefit around 20 GW projects under competitive bidding. Extension of tax holiday is always positive for the sector but not for the final consumer |

|

` 100 Cr is set aside for preparatory research work on Ultra Modern Super Critical Coal based Power Technology |

|

* Investment in R& D is a welcome move but once again we need to wait and see how funds are actually utilised |

|

` 200 Cr is set aside for supporting power sector in Delhi |

|

* The word support is not qualified. Who is to be supported at whose expense must be clarified |

|

|

|

Renewable Sector |

|

Exemption of basic customs duty on specific inputs used in solar photovoltaic cells Exemption of 5% customs duty on machinery and equipments for setting up solar projects ` 500 Cr is set aside for Ultra Mega Solar projects ` 400 Cr for solar driven water pumps |

|

* Customs duty exemption for solar projects is negative for domestic solar industry but positive for project developers. This is the result of lack of clarity on whether India aims to be a supplier or consumer of technology |

|

Reduction of basic customs duty from 10% to 5% on forged steel rings used in wind operated generators. Exemption of Special Additional Duty of 4% for raw materials used in wind operated generators |

|

* Wind sector will continue to flourish under the new exemptions. The renewable sector will continue to grow at the expense of subsidies |

|

|

|

Nuclear Sector |

|

` 3, 430 Cr is set aside for R& D ` 150 Cr for investment in Uranium Corp. of India ` 440 Cr for investment in Bhartiya Nabhikiya Vidyut Nigam Ltd ` 181 Cr for investment in Nuclear Power Corporation of India |

|

* More money for an already pampered sector may not bring any benefit for the energy sector but will keep it going for whatever purpose it is intended to serve |

Comments and opinions expressed are those of the energy team and not those of ORF. Inputs may be sent to [email protected].

ANALYSIS/ISSUES

India’s Solar Mission: Make it work for the economy class not just the business class

Praveen Kumar Kulkarni*

|

I |

ndia has been doling out subsidies to the solar Industry that includes cheap land, infrastructure, capital subsidy, income tax holiday, VAT or ED exemption custom duty exemption and more such incentives during the plant construction. But, manufacturers in the PV sector are not competent to use the incentives productively even when they get interest free equity through the stock market. Nor are the manufacturers willing to pass on the benefits received from the Government to the People of India. Instead they indulge in political funding. China has a one party system and so the interest subsidy, tax holiday, reduced corporate taxes, etc are passed on to the people of China and the solar industry in China is competitive.

It is worth mentioning a fact that ingot, wafer manufacturing can be scattered in parts of India. However, the PV panel manufacturing companies have to be more focused. It can be an SME activity to support many new generation entrepreneurs with 100% funding support from large companies. Large corporate manufacturing units and the allied / ancillary small PV assembly and panel manufacturing units (with investment support from the large corporate company like in the auto industry) can co-exist to reduce the manufacturing overhead, transportation over heads etc while maintaining uniform manufacturing /quality procedure and taxation to have best quality products. Thus, a healthy production planning and control on the quality and delivery in the supply chain with distributed job creation throughout Indian states can be envisioned in the solar sector. This will help to revive manufacturing lines.

If there is any change in technology or process, the risk is not to a single company as there will be a cluster of companies. The ‘animal-spirit’ of the small entrepreneur will lead to innovative ideas and thus the sector will have long term business and financial sustainability. Minimum government with maximum governance that promotes the industry with uniform taxation and transparent policies to avoid undue benefit to few manufacturers who are located in SEZ etc is desirable.

Instead of doling out capital subsidy, tax holiday or the simple tax loss at SEZ, support local manufacturing units at many places with uniform / standard taxation with access to low cost finance and technology because it is the only sustainable long term solution to many of India’s problems. Despite Government of India and state governments providing huge subsidy to the tune of ` 5.5 lakh crore (over $100 Billion) to the corporate manufacturing sector, India’s manufacturing GDP is very low and does not create enough jobs or business activity. No new generation entrepreneurs are created despite liberalisation of the economy with many indulging in unsustainable business practices under the garb of a free market. The time has come to create large number of local entrepreneurs with mentorship through joint ventures with uniform taxation along with impeccable accountability and transparency.

Imposing anti-dumping duties is not the right approach but this does not mean that strong domestic manufacturing sector should be scuttled. A sustainable domestic industry can be involved in post sales servicing, replacement of panels after 25 years, design of panels with a scientific approach and so on.

· Many project developers will either walk out or ask for higher tariff to compensate the increase in CAPEX which is not good. There will be loss of jobs due to lower number of projects, lower investments and lower share of clean energy. All this will have an impact on GDP.

· Assembly manufacturing units will suffer and there will be job loss as a result.

· Few scrupulous PV manufacturers may indulge in import of (from the low cost country) finished cells as wafers and thus avoid anti dumping duty and put the stamp of ‘made in India’ with clever RFID etc (like what they did when only panels were ‘made in India’ during the domestic content requirement (DCR) days of 2010/11), with a show case cell manufacturing line with all required certificates, hence, no local jobs will be created in the manufacturing sector. Good companies may have to shut shop which will kill more jobs.

The authors’ suggestion is to continue with anti dumping duty along with a counter bank guarantee from the foreign supplier to set up manufacturing shops or import from India equal value of supply (to boost Indian manufacturing economy) with the necessary incentives for promoting the Indian manufacturing. This will give us 3 years time to improve and set up our PV manufacturing units. Indian manufacturers may also learn to pass on the benefits that they get from the Government in the form of capital subsidy or low cost land or tax holidays or accelerated depreciation etc, to the customer like Chinese manufacturers are doing which will show that low cost manufacturing is feasible in India too. China has learnt this art of giving grant (or very low tax due to tax subsidy, interest subsidy etc) to the people / manufacturing units and asking for it to be given back in the form of low cost manufactured products or energy or public services due to the one party system without democracy.

Indian companies must learn to be competitive and not depend on anti dumping or domestic content requirement forever, despite taking away all government benefits. The next three years are more than enough to prove their competitiveness with all the raw material production base creation in India. This needs political will with good new generation manufacturers, transparent policy stimulus with JVs to reduce the learning curve. Lower dependence on the freebies from the government will create an efficient administration with good governance.

Indians may outsmart Americans and Europeans / Germans with anti dumping duty, but instead the option of business guarantee from foreign suppliers to boost local PV manufacturing facilities, without hampering project development or without increasing the CAPEX or Tariff will create a more sustainable industry. China, without the show of democracy, has learnt the art of giving huge subsidy to companies and turning it into low cost benefit to the people of China and in the process also grabbed the world market. Can India learn?

Roughly, out of 5920 Talukas / blocks (each taluka has 3 to 7 villages), there is agro waste (biomass) generation. We need to convert this to briquettes to increase kcal/kg, to consume less space for storage and to ensure 24 x7 running of power plant based on bio-waste. The plant with assured raw material (around 8000 tonnes/MW/Year) through rural entrepreneurs, will convert waste to (disposal is also a need of the hour) energy and in the process create rural jobs. The added benefit is energy security of due to ‘firm’ (as opposed to ‘infirm’ energy) at low cost.

1 MW biomass produces 6.5 Million kwh (MU)/year = 4 MW of solar which produces 1.6 Million kwh/year. With only investment of ` 7 crore/MW for biomass (including briquetting) we can have 6.5MU/year, whereas, solar route needs ` 7 Cr/MW x 4 MW = ` 28 crore to generate around 6.4MU/year. But, solar is ‘infirm’ power even though it does not have raw material related challenges.

Ironically, the `/kwh costs of biomass and solar are converging (tariff gap is reducing) but, biomass tariff is likely to go up on account of raw material cost escalations. But, we can pay for firm energy and also to reduce dependence on oil (diesel), coal and gas based energy generation (which will also increase exponentially due to supply constraints and geopolitics).

In authors’ opinion, India must nurture many rural entrepreneurs to harness solar, biomass energy with a good hybrid mix to have a base load like scenario with ‘firm’ energy with lower spending on evacuation due to the existing feeder. With strengthening of rural networks to harness renewable energy at low cost with small business entrepreneurs (the dependence on the presence of large companies like Welspun, Adanai, Ambani, Tata, to provide energy is a myth). India climate diplomacy position will be strengthened.

At these rural project locations, the use of solar irrigation pumping solutions with rain water harvesting to convert the dry land to wet lands will ensure food security to the next generation, despite huge industrialisation. Consequently we do not need to depend on Walmart and such companies to sell junk food to the country by killing our farmers. Let Indians benefit from policy first. Through hydroponic wheat fodder (highly nutritious fodder) promoted as CSR projects through rural entrepreneurs, cattle can start producing more milk and dairy technology can also get a boost through reduced price of milk with good processing units.

There are good designs available to develop solar PV projects with 2.5 acres/MW and use the land below the panels. The PV panels and can be improved further so that we do not convert the land in to non agriculture land. Instead, we can promote growth of vegetables, ayurvedic medicinal plants below the PV panel area, thus, a total inclusive growth paradigm through renewable energy in Each Taluka can be achieved. Please note that at least in 4500 talukas, we have good solar irradiation (much more than Germany or Japan in comparison) and hence, we have a wonderful opportunity. We need not get fixated on Rajastahan or Gujarat with large project development through few corporate companies or non tax payers (through accelerated depreciation)!!

This is not just climate change response but a complete shift in the economy with sustainable project development solutions for the people of India. When the large corporate companies with Indian government sovereign guarantee are accessing very low cost funds like pension funds, ADB funds, Kfw funds etc, why not the government create a pool of such funds with autonomy to States to have such funds? We need to kill the monopoly of IREDA which has a ‘Delhi bias / nexus’ that increases interest percentages on account of high administration overheads.

Assuming that ` 100 Crore / taluka is needed to develop 1 MW of biomass power plant + 10 MW of solar, to have minimum base load for a taluka with peak load option, we will be requiring around (say 5000 talukas x 100 Crore) ` 5,00,000 Crores to have 50,000 MW of solar and 5000 MW of biomass energy (i.e 50,000 x 1.6 + 5000 x 6.5) 80,000 million kwh of solar energy per year and 32,500 million kwh from biomass).

Where will ` 5 Lakh Crore to develop 5000 talukas come from? Since the last seven years, on an average, every year the Indian government is doling out ` 5.5 Lakh crore subsidies / incentives to the industry but how may talukas have energy security? India has the money (this is low cost money as it is free, so interest free funding is possible) and so low tariff from solar and biomass is practical and possible, if this Government can walk the talk: “SABKA SAATH SABKA VIKAAS” by nurturing many rural entrepreneurs and not just a few crony capitalists or big industrialists. This will generate huge employment to rural people and many talukas will get converted to RURBAN cities!!

Eliminate reverse bidding in solar PV and make the rural entrepreneurs who have dry land as the project partners through 100% debt funding with very low cost (please note that TATA NANO got over ` 3000 crore at only 0.105% annual interest rate for 20 years, so why not to these rural entrepreneurs who serve the nation for the Next 25 years!!). What is needed is accountable, transparent, responsible and good governance at the Centre and State but with uniform policy on Renewable Energy across the States with location specific benefits to the people of India and not just a few cronies of the powerful politicians.

India needs to plan renewable energy generation as a necessity and not just because of climate diplomacy with low cost solutions by creating a large number of rural entrepreneurs with sustainability and to ensure the growth of each Taluka rather than give away the country's wealth to a few corporate cronies by allowing them to avoid paying taxes (billions of dollars are doled out free: over 1 Lakh Crore and still counting). In contrast a common salaried man is sucked dry through income tax rules (which does not even give away ` 2000 for a sweeper or a peon!!). A mature Indian democracy provides options for the rich to avoid tax through World bank funded / guided / supported projects to worsen the Indian economy further. This is unacceptable in a democratic country. What is the point of international funding agency influence if it only offers irrational suggestions like accelerated depreciation and capital subsidy?

Considering the proposal of every taluka renewable energy development with ` 100 Crore per taluka (with 10 MW solar PV + 1 MW Biomass energy generation), we will be needing a maximum of ` 5 lakh crores (less than a Trillion dollar) i.e just one year subsidies paid to the large industries!! This will reduce the dependence on fossil fuel and develop at least 5000 taluka (viz. county in USA) through small / new generation entrepreneurs. If ` 5 lakh crore is offered as 100% debt fund without interest subsidy (i.e no free money), these small entrepreneurs can sell the energy at ` 4.85/kwh with ` 1 crore/ year as income which will help them survive till they pay back this debt in 15 to 18 years. If this is treated as grant to entrepreneurs with government as stakeholder (to mentor and ensure prompt payment of bills), the tariff will be even lower!

Can India turn the table with innovative financing through new generation entrepreneurs (this is the real SABKA SAATH SABKA VIKAS) who want to remain in their taluka and serve the nation instead of few industrialists who ask for ` 9/kwh or more (no relief for the common man) in the coming years to recover the funds they have offered to politicians for election (as reported in several media).

It is the high time that the National Solar Mission revises its policy and provides a mandate to generate renewable energy through rural entrepreneurs (with engineering education from rural engineering colleges) to improve and innovate with R & D activity while maintaining the plant) with easy access to the low cost funds. This will improve the health of our economy as there will be no capital subsidy, viability gap funding or tax loss through accelerated depreciation.

Views are those of the author

* The author, BE (MECH), MIE, Ex- JICA /UNIDO, is a solar entrepreneur.

Author can be contacted at [email protected] / www.kknesar.com

DATA INSIGHT

Remote Village Electrification in India

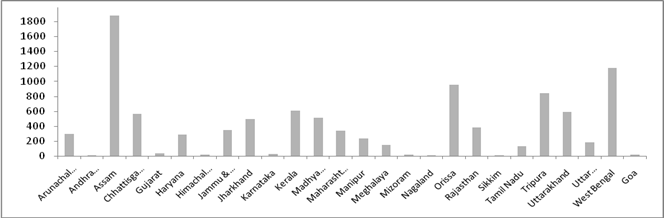

Akhilesh Sati, Observer Research Foundation as of June 2013

|

State |

Villages |

Hamlets |

||

|

Sanctioned |

Completed as % of Sanctioned |

Sanctioned |

Completed as % of Sanctioned |

|

|

Arunachal Pradesh |

297 |

100 |

1 |

0 |

|

Andhra Pradesh |

0 |

- |

13 |

100 |

|

Assam |

2192 |

86 |

0 |

- |

|

Chhattisgarh |

682 |

83 |

0 |

- |

|

Gujarat |

38 |

100 |

0 |

- |

|

Haryana |

0 |

- |

286 |

100 |

|

Himachal Pradesh |

21 |

100 |

1 |

0 |

|

Jammu & Kashmir |

451 |

74 |

20 |

75 |

|

Jharkhand |

720 |

68 |

0 |

- |

|

Karnataka |

22 |

73 |

57 |

25 |

|

Kerala |

0 |

- |

607 |

100 |

|

Madhya Pradesh |

623 |

83 |

0 |

- |

|

Maharashtra |

353 |

96 |

0 |

- |

|

Manipur |

237 |

100 |

3 |

100 |

|

Meghalaya |

163 |

91 |

0 |

- |

|

Mizoram |

20 |

100 |

0 |

- |

|

Nagaland |

11 |

100 |

0 |

- |

|

Orissa |

1720 |

55 |

23 |

17 |

|

Rajasthan |

340 |

86 |

90 |

100 |

|

Sikkim |

0 |

- |

13 |

100 |

|

Tamil Nadu |

0 |

- |

184 |

71 |

|

Tripura |

85 |

71 |

944 |

83 |

|

Uttarakhand |

671 |

71 |

147 |

80 |

|

Uttar Pradesh |

284 |

35 |

223 |

39 |

|

West Bengal |

1201 |

98 |

9 |

22 |

|

Goa |

- |

19 |

100 |

|

|

Total |

10131 |

79 |

2640 |

83 |

Total Number of Villages & Hamlets Electrified

Source: Ministry of New and Renewable Energy.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

Govt considers selling $3 bn stake in ONGC

July 15, 2014. Prime Minister Narendra Modi's government will decide next month on the sale of a $3 billion stake in Oil and Natural Gas Corp (ONGC). The government will decide in August whether to sell a 5 percent stake in ONGC, the oil ministry said, in a deal that would be worth $2.9 billion at current market prices. The government was interested in selling stakes in ONGC and other state companies given their high market valuations. If completed, the sale would raise more than a quarter of the $10.5 billion target for asset sales announced by finance minister Arun Jaitley for the fiscal year to March 2015. He will need to hit or exceed that figure to cap the budget deficit at 4.1 percent of gross domestic product, a goal set by his predecessor that he has vowed to uphold. The proposal to sell a 5 percent stake follows reports that the government may sell a stake of as much as 10 percent in ONGC, which produces the equivalent of 1.2 million barrels per day, or two-thirds of India's oil and gas. The state directly owns 69 percent of ONGC, while further stakes are owned by the Life Insurance Corporation of India (LIC) (7.8 percent), Indian Oil Corp (IOC) (7.7 percent) and Gas Authority of India (GAIL) (2.4 percent). ONGC, with a market value of $57 billion, has struggled for years with stagnant production and a lack of commercially viable discoveries. It is burdened by a subsidy regime that forces it to sell oil and gas cheaply. Still, even without wholesale restructuring, some analysts back the stock on expectations that the government will replace the existing, ad hoc, regime for sharing the burden of energy subsidies with a more predictable model. (in.reuters.com)

Govt slaps $579 mn additional penalty on RIL

July 14, 2014. The Government has slapped an additional penalty of $579 million on Reliance Industries Ltd (RIL) for producing less than targeted natural gas from its KG-D6 block, Oil Minister Dharmendra Pradhan said. With this, the total penalty on RIL for missing the target in four fiscal years beginning April 1, 2010 now stands at a cumulative $2.376 billion, he said. The penalty is in the form of disallowing costs incurred.

The Production Sharing Contract (PSC) allows RIL and its partners BP Plc and Niko Resources to deduct all capital and operating expenses from the sale of gas before sharing profit with the government. Disallowing costs will result in government’s profit share rising by $195 million from 2010-11 to 2013-14, he said. He said gas output from the Dhirubhai-1 and 3 gas field in the eastern offshore KG-D6 block was supposed to be 80 million standard cubic meters per day (mmscmd), but the actual production was only 35.33 mmscmd in 2011-12, 20.88 mmscmd in 2012-13 and 9.77 mmscmd in 2013-14. This year, the output has been only 8.05 mmscmd. (www.thehindubusinessline.com)

Gujarat govt firm seeks $13 gas price

July 13, 2014. Gujarat government company Gujarat State Petroleum Corp (GSPC) has asked the government to approve a price of about USD 13 for the natural gas it plans to produce from its field in KG basin this month. GPSC is almost ready to begin production from its Deen Dayal West (DDW) gas field in Block KG-OSN-201/3 off the Andhra coast and wants a price approved immediately.

GSPC wants to price DDW gas at a rate equivalent to the price at which India imports long-term gas in its liquid form (liquefied natural gas or LNG) from Qatar. GSPC had run a price discovery process using the Qatar price formula, generating demand which was more than 12 time the available gas, and sought approvals. At USD 100 per barrel oil price, this price comes to USD 12.93 per million British thermal unit, three-times the current rate of USD 4.2 paid to domestic producers. While the previous UPA government had ignored the price discovery by GSPC and approved a formula which would have doubled the price of all domestic gas to USD 8.4, the new government has deferred its implementation till September 30 to see if users can pay this new price.

GSPC said it produce about 28 million standard cubic feet per day (0.8 mmscmd) from two development wells (DDW#D1 and DDW#D3), which will be ramped up to 55 mmscfd (1.55 mmscmd) after addition of two more development wells by February, 2015. (economictimes.indiatimes.com)

Rajasthan govt to renegotiate Barmer refinery project with HPCL

July 14, 2014. Rajasthan Chief Minister Vasundhara Raje announced renegotiate the oil refinery-cum- petrochemical complex project with HPCL started by the former government in Barmer district as the state share was just 26 per cent despite offering free infrastructure facilities.

Raje said the previous government entered into an agreement with HPCL for setting up the complex and committed to give interest free annual loan of ` 3,736 crore per annum for a period of 15 years. Raje said that the decision of the former government was not viable hence the decision to renegotiate with the HPCL was taken up. (economictimes.indiatimes.com)

IOC seeks nod to fix borrowing limit at ` 1100 bn

July 14, 2014. Indian Oil Corp (IOC), the nation's largest oil firm, has sought shareholders' nod for fixing its borrowing limit at ` 110,000 crore as well as for raising ` 11,000 crore through a privately placed debenture issue in the current fiscal.

IOC's current borrowing limit stands at 110,000 crore and it is seeking shareholders' nod to meet the new Companies Act requirement. The company's current borrowing stands at about ` 70,000 crore. The company plans to raise ` 11,000 crore through redeemable non-convertible bonds/debentures this fiscal to meet its capital needs. (economictimes.indiatimes.com)

Transportation / Trade

GAIL proposes Srikakulam-Nellore gas pipeline grid

July 15, 2014. Public sector Gas Authority of India Limited (GAIL) has proposed to establish a gas pipeline grid in Andhra Pradesh. The proposal was highlighted by GAIL chairman and managing director BC Tripathi who called on Andhra Pradesh chief minister N Chandrababu Naidu. While the length covered by the pipeline and the capacity did not come up for discussion, GAIL, however, would take up a detailed project report soon. The earmarked gas from the pipeline would significantly boost the industrial activity and aid the state government's efforts for augmenting power supply. The development comes against the backdrop of Naidu announcing his vision to develop the state’s coastline into a logistics hub of the country’s east coast. Naidu in the meeting also raised the Cabinet’s decision to induct multinational oil major Shell with a 26 per cent equity in the proposed special purpose vehicle (SPV) for setting up a liquefied natural gas floating, storage and re-gasification unit (FSRU) at Kakinada. GAIL is a joint venture partner with the AP Gas Infrastructure Corporation in the project. (www.business-standard.com)

Rajasthan to set up JV with GAIL for CNG supply

July 14, 2014. Rajasthan Chief Minister Vasundhara Raje announced to set up a joint venture (JV) with GAIL India Ltd for city gas (CNG) distribution in selected cities in the state. Rajasthan State Petroleum Corporation would be strengthen through the joint venture with the GAIL for supply of CNG, Raje said. In first phase for supply of CNG through GAIL, One mother station would be set up in Neemrana, and a daughter station in Jaipur, she said.

On petroleum and mineral areas, she said the state would encourage zero waste mining by reducing pollution, a new policy of mining would be prepared soon, and the Rajasthan Minor Mineral Concession Rules would be amended, she said. (economictimes.indiatimes.com)

ONGC set to skip 2nd Aug naphtha export cargo

July 14, 2014. Oil and Natural Gas Corp (ONGC) is set to skip a second naphtha export cargo for August after shutting a pipeline supplying gas to its western India plant. ONGC, which on average exports two 35,000-tonne naphtha cargoes a month from Hazira, previously cancelled a tender to sell a cargo for Aug. 9-10 loading from the western India port. The company has shut a 42-inch subsea pipeline supplying gas to the plant to carry out repairs after sand was displaced beneath the pipe by high tides. (economictimes.indiatimes.com)

India pays $550 mn in oil dues to Iran

July 9, 2014. India paid a second instalment of $550 million in oil dues to Iran under an interim deal that has allowed Tehran access to $4.2 billion in blocked funds globally. Asian buyers such as Japan and South Korea have already cleared some of the money they owe for imports of Iranian oil under a payment schedule approved by world powers in an interim nuclear deal with Iran last November. Iran wanted the last three payments under the joint plan of action (JPA) totalling $1.65 billion from India, but New Delhi could not clear the May and the June instalments on time as the banking mechanism to remit the funds was not in place.

The current mechanism involving the central bank of the United Arab Emirates allows Tehran access to funds in Dirahms as a reward for cooperating in talks with world powers over its nuclear programme. India last month made the first payment to Iran under the interim deal.

The settlement of the final instalment of $550 million to Iran due on July 20 depends on Iran fulfilling all of its commitments under the joint action plan. Iran and six major powers resumed talks and negotiators continued meetings in Vienna, but there was no immediate sign of substantive progress.

Mangalore Refinery and Petrochemicals Ltd, Essar Oil, Indian Oil Corp., Hindustan Petroleum Corp and HPCL-Mittal Energy Ltd. together owed about $4.6 billion to National Iranian Oil Co as of May 31.

India, which imports a total of 4 million barrels per day of oil, has been steadily reducing its dependence on Iran, whose share in its overall oil imports has fallen by two-thirds over the last five years to 5.7 per cent in 2013/14. (economictimes.indiatimes.com)

Policy / Performance

Oil ministry seeks advice on payment to Judges in the arbitration case over KG-D6 block

July 15, 2014. The oil ministry has sought the law ministry's advice on payment to judges involved in the upcoming arbitration between the government and Reliance Industries Ltd (RIL) over the KG-D6 block.

The foreign arbitrator has proposed that each member of the tribunal would be paid $13,500, or ` 8.1 lakh each per hearing and another $1,350 per hour for "interlocutory matters" apart from administrative expenses.

The arbitration was initiated by RIL which has challenged the oil ministry's decision to disallow cost recovery of $2.4 billion to penalise the company for the sharp fall in gas production from the KG-D6 block. The company has attributed the decline to geological complexity and has argued that in any case its product sharing contract does not have any provision for penalty due to fall in production.

Oil minister Dharmendra Pradhan reiterated the government's position on disallowing cost. The government has so far disallowed cost recovery of $1.797 billion as on March 31 last year. Pradhan said a notice had been served to increase the amount to $2.376 billion. RIL said it hopes to resolve the matter expeditiously. (economictimes.indiatimes.com)

Price of diesel sold to bulk consumers cut by ` 1.09 per litre

July 15, 2014. Price of diesel sold to bulk consumers like Railways and State Transport Corporations was today cut by ` 1.09 per litre in line with falling international rates. However, diesel sold to retail consumers like cars and trucks have not been revised. Price of bulk diesel sold in Delhi has been cut from ` 60.41 per litre to ` 59.32 per litre.

The government had decided to sell diesel to bulk consumers like State Transport Corporations, Railways and Defence while the subsidised fuel was meant only for retail users like automobiles, car owners and trucks. The price of retail diesel has not been changed. It currently costs ` 57.84 per litre in Delhi. (economictimes.indiatimes.com)

Diesel price deregulation likely by Dec if global price trend stays

July 14, 2014. Diesel prices may be deregulated as early as December if the current trend in global prices continues, while the number of subsidised cylinders supplied to households may be cut again as the government strives to cut fuel subsidies and achieve the fiscal discipline targeted by the finance minister.

Brent crude oil, which had soared above $115 last month due to the crisis in Iraq, has fallen to $106.7 as fears of supply disruption receded. Prospects of higher supply from Libya has also dampened prices. This is expected to reduce the gap between India's diesel price and the international price. The gap had fallen to Rs 1.6 a litre but rose to ` 3.4 last month.

The finance minister Arun Jaitley said the government would deregulate diesel and reduce cooking gas subsidy though several measures such as checking diversion though direct cash transfer and reducing the number of subsidised LPG cylinders per household annually to a realistic level. Diesel is a major drag on the public exchequer as state oil firms incurred a revenue loss of ` 62,837 crore in the previous fiscal year.

The government also plans to cut cooking gas subsidies with steps such as checking its diversion and reducing the number of subsidised cylinders. On an average each household consumes 7.2 cylinder a year but they can buy 12 if they need. Subsidy on the cooking gas in 2013-14 was ` 46,458 crore. The UPA government had initially cut the supply of subsidised cylinders to six. Subsequently, this was raised to nine and then 12 just before elections. (economictimes.indiatimes.com)

Cabinet to soon decide on 10 per cent ethanol blending: Oil Minister

July 14, 2014. Cabinet will soon take a decision on mandatory blending of 10 per cent ethanol with petroleum, Oil Minister Dharmendra Pradhan said. At present, it is compulsory to blend 5 per cent ethanol with petroleum but the oil marketing companies have achieved only 1.37 per cent.

The government is of the view that farmers can get good price for their sugarcane when there is value addition. The sugarcane farmers feel that the move will yield better income for farmers, as ethanol is a by-product of sugarcane and will generate huge revenues if it is blended with petrol.

In November, 2012, the Cabinet Committee on Economic Affairs had decided that 5 per cent mandatory ethanol blending with petrol should be implemented across the country and achieved by June, 2013.

Pradhan had earlier said that the state governments have been asked to simplify the procedure and expedite clearances to ease the availability of ethanol for blending. In the year 2008, the Government announced its National Policy on biofuels, mandating a phase-wise implementation of the programme of ethanol blending with petrol in various states. (economictimes.indiatimes.com)

Budget 2014: Impact on petroleum sector

July 10, 2014. The Union Budget projected petroleum sector's gross under-recoveries at ` 104,500 crore for 2014-15, with the budget providing for ` 33,200 crore in addition to the carry forward of ` 30,220 crore towards FY2013-14. The budget emphasised on reducing fuel subsidies; but remained silent on the details.

The budget proposes to build 15,000 km gas transportation pipelines to complete national gas pipeline grid under public-private partnership (PPP) model. Besides, rapidly scaling up usage of piped natural gas (PNG) in a Mission mode, since it is a cheaper and cleaner fuel. All this to reduce dependence on any single source of energy viz. crude oil. Overall, enhanced focus on gas sector is key positive of gas transportation players (like GAIL, GSPL etc) and city gas distribution (CGD) entities. (economictimes.indiatimes.com)

Budget 2014: LNG exports to Pakistan to be exempt from import duty

July 10, 2014. The government proposes to exempt natural gas supply to Pakistan from import duty, boosting GAIL India's plans to invest ` 500 crore to set up a 100-km pipeline from Jalandhar in Punjab to the Wagah border. However, the importer will have to produce a certificate from the assistant commissioner or deputy commissioner of customs that the imported liquefied natural gas (LNG) has been exported to Pakistan.

LNG imports currently attract a duty of 5%. GAIL India said that export of gas to Pakistan made business sense since that country is short of the fuel. The company has held several rounds of discussions with Indian and Pakistani government officials in this regard. (economictimes.indiatimes.com)

Budget 2014: Govt to set up 15,000 km gas pipelines in public-private-partnership mode

July 10, 2014. The government will set up 15,000 km of additional gas transport infrastructure under the public-private-partnership mode, finance minister Arun Jaitley said. India has an existing gas pipeline network of 15,000 km and there is a necessity to add an additional 15,000 km which will be developed in the PPP mode, Jaitley said.

The enhanced grid will promote usage of gas, both domestic and imported, reducing dependence on one source of energy, he said. The finance minister also said the government will accelerate exploitation from coal bed methane reserves and evaluate old and closed wells to maximise production. (economictimes.indiatimes.com)

POWER

Generation

Rajasthan aims 6.5 GW power in next five yrs

July 14, 2014. Rajasthan Chief Minister Vasundhara Raje y said the state aims to generate capacity addition of 6,500 MW power in next five years. Three DISCOMs -- Jaipur Vidyut Vitran Nigam Ltd, Jodhpur Vidyut Vitran Nigam Ltd and Ajmer Vidyut Vitran Nigam Ltd -- were facing massive losses to the tune of ` 75,000 crore due to transmission and distribution (T&D) losses as of March 31, 2014, and these companies were paying ` 10,000 crore on loan repayment, Raje said. Due to the huge losses, the power tariff goes up every year by ` 1.80 per unit, she said. (economictimes.indiatimes.com)

Odisha reels under power crisis as water level in reservoirs falls

July 9, 2014. Low water-level in reservoirs and technical snags in certain thermal electricity generation station have led to power crisis in Odisha. Odisha requires at least 3,000 MW of power to meet its demands while only about 2550 MW of electricity is now available, Grid Corporation of Odisha (Gridco) said. Scarcity of power has forced Gridco to regulate electricity supply in the state, Gridco said. Gridco said that while the state was availing about 1,000 MW of power from hydro-power stations in July last year, this time it has come down to about 400 MW.

This apart, five units, one of in NTPC Kaniha, two of TTPS, Kahalgam (Bihar), Pharaka (WB), which usually provides 476 MW electricity to Odisha, have remained non-functional for renovation work. The Gridco was also facing problem in purchasing electricity from outside due to high cost. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

Power demand in Delhi breaks all previous records

July 12, 2014. Power demand in Delhi again broke all records, touching an all-time high of 5810 MW, a day after registering the highest demand. The power demand soared to 5789 MW. The demand touched all time high as mercury rose to 42 degrees Celsius. The rise in electricity demand caused power cuts ranging from one to two hours. (economictimes.indiatimes.com)

` 42 bn Ganga waterway plan to help power sector

July 12, 2014. The beleaguered power sector will be among the first beneficiaries of the government's proposal to develop the Ganga waterway. Experts say the ` 4,200-crore plan will help speed up transportation of coal to power plants in the north and east of the country. Coal accounts for about 55per cent of India's energy needs. Despite the country's high dependency on the fuel, problem with logistics means coal from pit heads generally lies idle for months before it can be moved to railway sidings for transportation to power plants.

Finance Minister Arun Jaitley announced the government's intent to develop the river route between Allahabad in Uttar Pradesh and Haldia in West Bengal over the next six years. The National Waterway project will entail building the river channel and river ports along the banks of the Ganga. Experts say power producers are awaiting the development of inland waterways to transport coal. National Thermal Power Corporation started transporting imported coal through the inland waterways route to its Farakka plant in West Bengal. (economictimes.indiatimes.com)

CDRC imposes ` 50 lakh fine on Torrent Power

July 9, 2014. The Consumer Disputes Redressal Cell (CDRC) of Gujarat has imposed a fine of ` 50 lakh on the Torrent Power Ltd for alleged illegal recovery of a hefty amount from a user by cutting off electric supply. The CDRC quorum comprising judicial member acted upon the appeal of Torrent Power in which they challenged the Surat district Consumer Forum's judgement in which the company was asked to reimburse ` 78,000 to a consumer. (economictimes.indiatimes.com)

Goyal seeks regulators' inputs for power sector growth

July 15, 2014. Signalling the government and regulators are on the same page to push growth in the sector, power minister Piyush Goyal has asked the Forum of Regulators (FOR) to form working groups suggest ways to increase generation capacity and ensure 24x7 power supply. Goyal wants FOR to submit its recommendations on energy management involving off-grid, renewable water conservation, and dip irrigation by revising the existing system of determining floor price for renewable energy certificates. According to Goyal, FOR members should first provide 24x7 quality power supply and then consider appropriate tariff revision in a calibrated manner, while keeping the sensitivities of the consumers in mind. (www.business-standard.com)

CERC rejects NTPC's plea to revisit tariff norms for 2014-19

July 15, 2014. India's largest power producer National Thermal Power Corporation Limited (NTPC) will continue to pursue legal action against new tariff determination parameters in the country after the industry regulator rejected its request to reconsider the tariff regulations for 2014-19.

NTPC had approached the Central Electricity Regulatory Commission (CERC) following a direction from the Delhi High Court and it will now go back to the court. While framing the new guideline in December, CERC had altered various parameters and methods for determining power tariff, which NTPC said will impact the return on equity (RoE) of projects. Since then the firm's share price has fallen 11% to a five-year low.

NTPC, which controls over 43,000 MW of country's total power production of 2,49,500 MW, approached Delhi High Court to seek modifications in the tariff guideline for five years starting April 1. The court then directed it to go back to the regulator. (economictimes.indiatimes.com)

Power usage beyond 300 units to now cost ` 54 more with 7 pc rise in power rates on clean cess

July 15, 2014. Power tariffs will rise at least 6-7% due to an increase in clean energy cess and rise in customs duty announced in the Union Budget, as well as the freight rate hike announced in June, forcing consumers to pay anything between 18 and 21 paise per unit of power consumed. A middle class family, for instance, which uses at least 300 units of power every month, will now have to pay at least ` 54 more. Rise in power cost also increases other costs: the cost of power paid by railways to transport coal will have a spiralling effect.

The rise in customs duty by 0.5% on imported coal will affect companies that source coal from foreign countries, including NTPC and coastal thermal power companies. This is expected to raise cost by 1% to 1.5%, depending on the volume of coal consumed. (economictimes.indiatimes.com)

Roadblocks in process of power generation

July 14, 2014. Finance minister Arun Jaitley's announcement to ensure adequate coal supplies to power plants already commissioned and those due for completion by 2015 should come as a relief to the promoters of these projects.

While the private sector accounted for approximately 55 per cent of the total capacity addition in the 11th Plan, it has contributed 68 per cent, or 30,500 MW, of the 45,516 MW capacity put up so far against the targeted 94,285 MW for the full 12th five-year plan. (economictimes.indiatimes.com)

Capital outlay for 7 power PSUs at ` 514.2 bn in FY15

July 13, 2014. Seven power PSUs, including the country's largest electricity generator NTPC, have drawn up total capital expenditure plans of ` 51,425.84 crore during the current financial year 2014-15. The total capex or capital expenditure of the seven PSUs for FY2014-15 is just 3.4 per cent higher than that of ` 49,731.90 crore in 2013-14. NTPC's capex for the year will be ` 22,400 crore followed by central transmission utility Power Grid Corporation's ` 20,000 crore.

In 2013-14, NTPC, which has diversified into hydro power, power trading, coal mining etc, had planned ` 20,200 crore as capex. Power Grid's capex is same as last fiscal's. Hydro power generator NHPC will have a capital expenditure of ` 3,224.26 crore this year against ` 3,058.12 crore in 2013-14.

Damodar Valley Corporation (DVC) and North Eastern Electric Power Corporation (NEEPCO) have reduced their capex for the period to ` 2,764.99 crore from ` 3,515.97 crore and ` 1,087.98 crore from ` 1,661.77 crore in 2013-14, respectively.

While the expenditure on expansion in THDC (Tehri Hydro Development Corporation) has increased nearly 50 per cent at ` 856.68 crore from ` 331.96 crore, the one in Satluj Jal Vidyut Nigam has increased to ` 1,091.93 crore from ` 964.08 crore, last fiscal. These expenses will be incurred by the companies towards meeting their expansion plans during the period. Finance Minister Arun Jaitley announced a slew of measures for energising the country's power sector including extension of the 10-year tax holiday benefit by another three years (March 2017) to the companies. Power companies can claim tax exemption for up to 10 years within the first 15 years of a project's operations. The government extended the scheme until March 31, 2014. Association of Power Producers' has said that the extension of 10 year tax holiday will provide a significant boost in investor interest in the power sector and also benefit the end consumer. (economictimes.indiatimes.com)

Govt readies ` 500 bn equity fund for power sector

July 12, 2014. The government is readying a mega ` 50,000 crore equity fund for the power sector as it looks at 24x7 electricity supply in villages in at least those states that are ruled by BJP. The initial corpus is expected to flow in from state-run banks and power sector FIs such as Rural Electrification Corporation and Power Finance Corporation. Simultaneously, the government is also working an asset reconstruction company (ARC) for the power sector, along with a separate one for roads. These ARCs will take over stalled power and road projects and help revive them to ensure that funds lent by banks don't end up as bad loans. (economictimes.indiatimes.com)

Centre sanctions ` 1 bn to AP to establish SCADA

July 11, 2014. The Centre has sanctioned ` 100 crore to establish Supervisory Control and Data Acquisition (SCADA) in four towns of the state. SCADA, approved by the Union Ministry of Power, will come up in Vizag, Vijayawada, Guntur, and Nellore under the Re-structured Accelerated Power Development and Reforms Programme (R-APDRP) Scheme. Under the plan, SCADA would facilitate centralised data collection which enables to improve system stability, easy accessibility to each and every consumer, instantaneous collection of parameters like voltage, current, power. R-APDRP, a flagship programme of Government of India, paves the way to strengthen the power sector by way of taking up of IT initiatives in urban areas for enhancing customer services. (economictimes.indiatimes.com)

Budget 2014: ` 7 bn allocated for power, water sector reforms in Delhi

July 10, 2014. The NDA government allocated ` 700 crore to overcome problem of power transmission and water distribution system in Delhi. Finance Minister Arun Jaitley proposed ` 500 crore for reform in the water sector while ` 200 crore has been set aside for reform in the power sector. Separately, Delhi government was allocated ` 349 crore as central assistance for 2014-15, which is a decrease of ` 682 crore compared to last year's provision of ` 1,031 crore. (economictimes.indiatimes.com)

Budget 2014 proposals cheer power sector

July 10, 2014. India's ailing power industry has welcomed Finance Minister Arun Jaitley's budget proposals, with most seeing them as a sign that the government views the sector as one of the key drivers of economic growth. Over the last few years, though the country saw 87,622 MW of capacity addition by private players, the sector has been plagued by a host of issues, including a sluggish clearance mechanism and lack of fuel and transmission network.

Piyush Goyal, minister for power, coal and renewable energy, called it a transformative budget that is focusing on policy initiatives and investment-led growth. Goyal welcomed the standardisation of custom duty on coal, which he said would help to end disputes.

Association of Power Producers, which represents project developers from the private sector, such as Tata Power, Adani Power, CLP, GMR and Lanco, welcomed the proposals. It said it is looking forward to expeditious implementation of these proposals at the earliest. The association said that the budget proposals would boost investor interest in the power sector while also benefiting the consumer. (economictimes.indiatimes.com)

Budget 2014: DAE allocated ` 104.4 bn

July 10, 2014. With Kudankulam unit 2 likely to become operational in this financial year, the government has allocated ` 10,446 crore to the Department of Atomic Energy (DAE) for power generation and research.

For power generation, ` 1709 crore has been allocated to the department. This includes ` 30 crore for India's first Prototype Bast Breeder reactor at Kalpakkam at the Indira Gandhi Centre for Atomic Research (IGCAR).

The government also intends to invest Rs 203 crore and Rs 440 crore in NPCIL and Bhartiya Nabhikiya Vidyut Nigam Ltd, two PSUs under DAE. ` 8737 crore has been allocated for research in the field of nuclear energy. There are several research centres under the DAE, major being Bhabha Atomic Research Centre, Raja Ramanna Centre for Advanced Technology and IGCAR and Atomic Minerals Directorate for Exploration and Research (AMDER). The allocation also includes provisions for projects such as survey, prospecting, and exploration by AMDER and setting up a Centre for Global Centre for Nuclear Energy Partnership in Haryana. In last budget, the department had been allocated ` 8,449 crore for Atomic Energy Research, but it was revised to ` 6,969 crore. (economictimes.indiatimes.com)

All nuclear power plants safe: Govt

July 9, 2014. All nuclear power plants (NPPs) in the country are safe and can withstand natural calamities like earthquakes and tsunamis, the government said. Following the March 2011 Fukushima nuclear accident in Japan, safety review of all Indian NPPs was conducted by task forces of NPCIL and the expert committee of AERB (Atomic Energy Regulatory Board), Minister of State in the PMO Jitendra Singh said. These safety reviews have confirmed that Indian NPPs plants are safe and have adequate margins and features in design to withstand extreme events like earthquakes and tsunamis, he said. He said that the designs of NPPs located in coastal areas take into account the technical parameters related to earthquake, tsunami, storm surges, floods, etc at respective sites and at all NPPs, state of art safety measures are being provided. (www.business-standard.com)

INTERNATIONAL

OIL & GAS

Upstream

Shell makes third major discovery in Norphlet play in Gulf of Mexico

July 15, 2014. Shell announced its third major discovery in the Norphlet play in the deep waters of the Gulf of Mexico with the successful Rydberg exploration well. After more than 10 years of exploration activities in the Eastern Gulf of Mexico, Shell continues to lead industry in exploring this Jurassic play. The Rydberg well is located 75 miles (120 kilometers) offshore in the Mississippi Canyon Block 525 in 7,479 feet (2,280 meters) of water. It was drilled to a total depth of 26,371 feet (8,038 meters) and encountered more than 400 feet (122 meters) of net oil pay.

Shell is completing the full evaluation of the well results but expects the resource base to be approximately 100 million barrels of oil equivalent. Together with the Appomattox and Vicksburg discoveries, this brings the total potential Norphlet discoveries to over 700 million barrels of oil equivalent. (www.rigzone.com)

Iraq Kurds use army to boost control of Kirkuk oilfields

July 12, 2014. Iraq’s semi-autonomous Kurds increased their control over oil resources in the north of the country after deploying armed forces to the Kirkuk and Bai Hassan oilfields. Kurdish Peshmerga forces took control of the two sites at the country’s fourth-biggest oil field and ordered workers from Iraq’s North Oil Co. to leave, the oil ministry said. The Kurdistan Regional Government said in response that it acted to prevent the central government damaging an oil export pipeline. The oil ministry in Baghdad denied the claim. Iraq’s minority Kurds, who historically have resisted control by Arab-dominated governments in Baghdad, are charting a course to independently develop oil reserves the KRG calculates at 45 billion barrels -- equivalent to almost a third of Iraq’s total deposits according to BP Plc data. Kurdish armed forces moved outside their region in northern Iraq and occupied the long-disputed territory around Kirkuk after the Iraqi army fled from Islamist militants. (www.bloomberg.com)

Dragon Oil says on track for 2015 milestone target

July 11, 2014. Turkemistan-focused oil explorer Dragon Oil said it was on track to meet its 2015 production milestone of 100,000 barrels of oil per day (bopd), despite disappointing drilling results at some of its Turkmen fields.

The explorer also said it would reach a 2014 output level of 87,000-90,000 bopd. The company decided to suspend a new appraisal well at its Dzhygalybeg (Zhdanov) field in Turkmenistan after disappointing results. (www.rigzone.com)

Fracking guidelines issued by API to ease community fears

July 10, 2014. The oil industry’s largest lobbying group began a new effort to ease public fears about hydraulic fracturing after a legal setback in New York state and a voter push in Colorado to ban the drilling practice. The American Petroleum Institute (API), a Washington-based group that includes Exxon Mobil Corp. and Chevron Corp., released guidelines for improving community relations as “fracking” extends to more towns, raising concerns about pollution risks.

Fracking has helped set records for natural gas production and turned the U.S. into the world’s largest oil producer. The technique, which shoots a watery mix of sand and chemicals underground to release gas and oil trapped in shale rock, has raised concerns about pollution of drinking water sources. API released its guidelines after New York’s highest court let cities and towns block hydraulic fracturing within their borders. (www.bloomberg.com)

Downstream

Total says Europe refining margins rebound from 4 year low

July 15, 2014. French oil company Total, Europe's biggest refiner, said refining margins in the region rose to a one-year high in the second quarter of 2014, ticking up slightly after hitting a four-year low in the previous three months.

Total's European refining margins indicator rose to $10.9 per tonne in the second quarter from $6.6 in the previous quarter. That was the highest since the second quarter of 2013, but still less than half the levels seen in the first half of last year. The economic slowdown has hit European oil demand in the past few years, leaving European refineries operating at overcapacity and margins shrinking. (www.downstreamtoday.com)

Petrofac to construct oil gathering center project for KOC in Kuwait

July 11, 2014. Petrofac, the international oil and gas services provider, has been awarded a contract for the construct an oil gathering center for Kuwait Oil Company (KOC).

The project is one of three gathering facilities being built to support KOC's plans, next five years, to increase as well as maintain oil production. Each facility will have the capacity to produce about 100,000 barrels of oil per day along with associated water and gas. (www.energy-business-review.com)

Transportation / Trade

Rosneft, Petrobras sign natural gas accord for Brazil's Amazon

July 14, 2014. Russian state oil group NK Rosneft' AOA signed an agreement with Brazil's Petroleo Brasileiro SA to seek ways to sell natural gas trapped in Brazil's remote Amazon jungle, the companies said. Rosneft owns 51 percent of HRT O&G, a Brazilian company that owns three giant oil and gas exploration blocks in the Solimoes Basin, west of Manaus, a city of about 1.8 million that is the capital of Amazonas state.

They contain an estimated 542 million barrels contingent oil and equivalent natural gas resources, 83 percent of it gas, according to HRT Participacoes em Petroleo, a Rio de Janeiro-based company that is Rosneft's 49 percent partner in the Solimoes blocks. (www.downstreamtoday.com)

East Libya rebels commit to keep open largest crude export-port

July 14, 2014. Rebels in Libya’s east committed to keeping open the country’s largest oil port, Es Sider, and dissociated themselves from a protest that shut a smaller crude export terminal. Brent traded near the lowest in three months. Es Sider and Ras Lanuf, Libya’s third-largest oil port, have a combined daily loading capacity of 560,000 barrels. Brega, which was reported July 12 to have been shut by guards seeking better pay, can export 60,000 barrels a day, according to the oil ministry.

The Executive Office for Barqa seeks self-rule for the eastern region also known as Cyrenaica. It took control of four oil ports about a year ago, handing back two of them to the government in April and the remaining two this month. Although located in eastern Libya, Brega was not among the four ports that fell under the rebel group’s control, and it continued to supply a refinery controlled by the government in the nation’s western region. (www.bloomberg.com)

CNPC sees PetroChina closing $1.2 bn Dover purchase soon

July 13, 2014. PetroChina Co. is committed to completing its C$1.32 billion ($1.23 billion) purchase of the stake it doesn’t own in the Dover oil-sands project in Canada soon, according to the Beijing-based company’s parent. PetroChina, China’s biggest oil and natural gas producer, is working with Calgary-based Athabasca Oil Corp. to close the purchase of Athabasca’s 40 percent stake in Dover. The two energy producers formed a joint venture in 2010 to develop Dover. (www.bloomberg.com)

Oil prices to keep falling on Libya to US supply

July 12, 2014. New U.S. pipelines and a revival in Libyan supply are increasing the likelihood that oil prices will slump through year-end after climbing in the first six months. Brent is poised to decline in part on increased output in Libya as key export terminals were reopened. In the U.S., traders are focused on supplies at Cushing, Oklahoma, the delivery point for the West Texas Intermediate (WTI) futures contract. Tallgrass Energy Partners LP plans to complete the conversion of the Pony Express pipeline to carry crude to Cushing from Wyoming. Enbridge Inc.’s Flanagan South will connect to the hub from Illinois. Cushing supplies began falling two years ago when the direction of the Seaway pipeline was reversed to move oil away from the hub. Enbridge and Enterprise Products Partners LP said that they completed a 512-mile (833-kilometer) loop that’s expected to boost Seaway’s capacity to 850,000 barrels a day from 400,000. (www.bloomberg.com)

Thailand turns off tap on gas imports as economy falters

July 11, 2014. Thailand is cutting natural gas imports after consumption growth in Asia's fourth-largest user of the fuel has sagged to two-decade lows, threatening to idle costly fuel import facilities and force suppliers to turn to rival buyers such as China. Growth in gas use has stalled as the economy has taken a hit from political turmoil, putting in doubt long-term plans to boost imports of liquefied natural gas (LNG) and buy more piped gas from neighbouring Myanmar as domestic output wanes.

PTT PCL, Thailand's biggest energy conglomerate and sole gas supplier, has cut estimates for LNG imports and gas sales for this year. That comes as slowing consumption for power and petrochemicals is reducing gas demand in Southeast Asia's second-biggest economy. State-controlled PTT has also cut its gas imports from Myanmar, which is now looking to China to take up some of the slack, Myanmar government said. (af.reuters.com)

Shale seen shifting flows at America’s biggest oil port

July 11, 2014. For more than 30 years, the Louisiana Offshore Oil Port LLC (LOOP) has been a symbol of U.S. dependence on foreign oil, pumping Nigerian and Saudi Arabian crude from the world’s biggest supertankers into underground storage caverns beneath the marshes of southern Louisiana.

To be an outbound hub, the port needs financial commitments from shippers to build needed infrastructure, and even under the most optimistic scenario, it will be a year before it loads the first tanker, LOOP said. Still, the fact that LOOP is considering the project underscores how shale drilling and oil-sands mining have altered energy flows in North America. (www.bloomberg.com)

Energy trading seen slumping as regulatory oversight rises

July 9, 2014. Energy trading on futures exchanges is slumping as increased oversight from regulators hinders transactions, according to Platts, a company publishing prices for physical commodities including oil.

The amount of light, sweet crude futures handled by CME Group Inc., the world’s largest derivatives exchange, slumped 22 percent to an average of 489,658 contracts a day in May from a year earlier, the bourse’s data show. Natural gas trades fell the same amount. Brent crude transactions on Intercontinental Exchange Inc. were 9 percent fewer in the first six months than the same period in 2013.

Banks including Barclays Plc, JPMorgan Chase & Co. and Morgan Stanley reduced their commodity businesses over the past several years as returns declined and regulatory scrutiny intensified. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 restricted banks from trading for their own account, under the Volcker Rule, and expanded oversight of commodities derivatives. (www.bloomberg.com)

Japan's MOL to launch Arctic Ocean LNG route from Russia's Yamal in 2018

July 9, 2014. Japan's Mitsui OSK Lines Ltd (MOL) said that it will start transporting liquefied natural gas (LNG) through the Arctic Ocean in 2018 using icebreaker LNG tankers. MOL, with its joint venture partner China Shipping, has ordered three icebreaker LNG carriers from South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd.

The new tankers will deliver LNG to Europe and Asia from a gas plant to be built on the Yamal Peninsula in northern Russia by Russia's second-largest gas producer Novatek, France's Total and China National Petroleum Corporation. (www.downstreamtoday.com)

Policy / Performance

Spain's Repsol could start drilling off Canary Islands in Oct

July 15, 2014. Spanish oil company Repsol could begin prospecting for its $7-billion oil exploration project off the Canary Islands in October, Industry Minister Jose Manuel Soria said.

Spain's Supreme Court rejected environmental appeals against 2012 government permits granted for oil exploration off the coasts of the islands of Fuerteventura and Lanzarote. (www.rigzone.com)

Chile eyes use of US shale gas in early 2016, ENAP says

July 15, 2014. Chile's state oil company ENAP said it would start using U.S. shale gas during the first half of 2016 via an ongoing supply contract with Britain's BG Group Plc. Energy Minister Maximo Pacheco said that ENAP had signed a long-term deal with Centrica-owned British Gas, Britain's largest energy supplier, to import shale gas from the United States at the end of next year.

The company said a potential future arrival of U.S. shale gas could diversify Chile's liquefied natural gas supplies and added that it can be imported without tariffs, thanks to the free trade agreement between the two countries.

BG Group has long-running LNG contracts with the Andean country's Endesa Chile, local natural gas distributor Metrogas and ENAP. (www.downstreamtoday.com)

Russia's Rosneft to explore for offshore oil in Cuba: Putin

July 11, 2014. Russian President Vladimir Putin said he was hopeful Russian oil company Rosneft and Cuban state oil company Cupet could begin jointly exploring Cuba's potential offshore oil reserves "in the very near future." Rosneft and fellow state oil company Zarubezhneft agreed to help Cupet explore offshore in Cuba, which has limited onshore production and depends on Venezuela for oil imports. Putin also said a number of Russian companies were interested in doing business in Cuba's new special economic zone at the port of Mariel near Havana. (www.rigzone.com)

OPEC sees 2015 demand for its crude as least in six yrs

July 10, 2014. OPEC predicted that demand for its crude will decline in 2015 to the lowest in six years as supplies from other producers, led by the U.S., are more than enough to cover the increase in global consumption.

The need for crude from the Organization of Petroleum Exporting Countries (OPEC) will slide to 29.4 million barrels a day next year even as growth in world oil consumption accelerates, the group said in its first assessment of 2015. That’s 300,000 a day less than OPEC’s 12 members pumped in June. It would be the third consecutive annual drop in demand for OPEC crude and the lowest since 2009. The U.S. will provide about two-thirds of next year’s supply growth, OPEC said.

The U.S. has overtaken Saudi Arabia and Russia as the world’s biggest oil producer as it taps shale formations in Texas and North Dakota by splitting apart rocks with high-pressure liquid, a process known as known as hydraulic fracturing, or fracking.

Oil prices have remained supported by threats to supplies in OPEC members such as Iraq and Libya, with the Brent benchmark’s loss this year limited to 2.3 percent. (www.bloomberg.com)

China signs $1.6 bn engineering deal for Siberian LNG project

July 10, 2014. A subsidiary of Chinese state oil giant China National Offshore Oil Corporation (CNOOC) has signed an around $1.6 billion deal to build equipment for a liquefied natural gas project in Siberia, the company said.

Under the agreement, CNOOC's Offshore Oil Engineering Co will build "core modules" for the liquefication process on the project in Yamal in the Russian Arctic. Novatek, Russia's second-largest gas producer, is developing the $27 billion Yamal LNG project with France's Total and China's top energy group, China National Petroleum Corporation (CNPC). The first production unit, with annual capacity of 5.5 million tonnes, is due to be launched in 2017. In May, CNPC signed a deal to buy 3 million tonnes of LNG per year from the Yamal project, as did Russia's Gazprom. CNPC also agreed in May to buy 38 billion cubic meters of gas per year from Russia's Gazprom, in a deal unofficially valued at $400 billion. (www.downstreamtoday.com)

POWER

Semen Indonesia, Japan’s JFE to build power plant in East Java

July 15, 2014. Indonesia’s biggest cement producer, Semen Indonesia, is partnering with Japan’s JFE Engineering Corp to build a waste-to-heat power generator in East Java, with a planned investment of around 638 billion rupiah ($54.4 million). The 30.6 MW plant, which is expected to start operations by end-2016, is aimed at cutting annual electricity costs by around $10 million for Semen Indonesia, a heavy energy user.

State-owned electricity company Perusahaan Listrik Negara said it planned to increase power tariffs for industrial users by up to 38 percent this year as Southeast Asia’s largest economy seeks to alleviate its bloated energy subsidies. (www.thejakartaglobe.com)

Egat's power plant project gets go-ahead in Quang Tri

July 15, 2014. The Quang Tri Province People's Committee and the Thai-based power firm Egat International (Egati) signed a memorandum of understanding (MoU) on the construction of a 1,200 MW thermal power project in the province. Invested in by Egati, the thermal power plant, the first of its kind in the province, will cost US$2.26 billion and will be built in Hai Lang District.

Under the MoU, the two sides will carry out necessary steps to build the project. As planned, all work related to land clearance, compensation and financial procedures will be completed, and construction on the project will start in 2018. The project will have two turbines, with the first turbine scheduled to be put into operation in 2021. The project initiated under the BOT (Build, Operate, Transfer) plan, will supply more electricity to the locality as well as connect the country’s power transmission systems in the central region and in Southeast Asia in the future. (www.nationmultimedia.com)

Russia's Inter RAO plans to help hydropower plants construction in Argentina

July 14, 2014. Russia's Inter RAO is planning to support turnkey hydropower plants construction in Argentina. The company is prepared to help construction of the turnkey Chihuido-1 and Chihuido-2 hydropower plants in Argentina's Neuquen Province.

The first plant will cost $2 bn and would have capacity of 637 MW while the second will have 296 MW. (hydro.energy-business-review.com)

TAPGC to construct three hydropower plants in Philippines

July 14, 2014. Trans-Asia Oil and Energy Development (TAPGC), a wholly-owned subsidiary of Trans-Asia Oil and Energy Development, of the Phinma Group, has been awarded three new service contracts to develop three hydropower plants with a combined capacity of 320 MW across the Philippines.