-

CENTRES

Progammes & Centres

Location

[Carbon Emissions: Peaking Prematurely in China and India]

“The energy sector was responsible for 35 percent of total anthropogenic green house gas (GHG) emissions and that despite the efforts of the united nations framework convention on climate change and the Kyoto protocol, emissions from the energy sector grew more rapidly between 2001 and 2010 than in the previous decade. Energy sector GHG emissions accelerated from 1.7 percent a year in the period 1991-2000 to 3.1 percent a year from 2001-2010. The main contribution to this growth is said to have come from rapid economic growth in developing countries…”

Energy News

[GOOD]

If confidence in 24*7 power supply is turned into concrete action it will mean 24*7 happiness for the nation!

Claims of power sector turnaround will be true only when circular debt flowing from discoms to power companies to CIL stops!

[UGLY]

Pushing unconventional power in a country where demand for conventional power has not been satisfied despite 60 years of effort will come at a huge price for the poor!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· Carbon Emissions: Peaking Prematurely in China and India (Part I)

BRIEFING………………

· UNFCCC Principles Non-Negotiable: India and China

DATA INSIGHT………………

· Solar Power Scenario in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC seeks green nod for ` 530 bn KG-Basin infra

· ONGC, its partners developing LNG terminal in Mozambique

· India’s gas output to grow by 50 percent in the next three years

Transportation / Trade………………

· IOC, GAIL in gas deal with Adani

· Completion of Bathinda-Srinagar gas pipeline to depend on clearances: Govt

· RIL-BP among four in race for Mumbai LNG terminal

Policy / Performance…………………

· Proposal likely to allow gas companies to freely price output

· Cairn seeks revision in Rajasthan block crude oil pricing formula

· Oil Minister to lead Indian delegation to Mexico, Columbia

· Govt to allow market price for some natural gas

· India to engage in active ‘oil diplomacy’

· Assam govt prohibits strike by oil sector employees

· ONGC finds major crude reservoir in Mumbai High: Govt

· Petrol price in India more than Pakistan: Oil Minister

[NATIONAL: POWER]

Generation………………

· India Power Corp to commission Haldia Project in September

· Second unit of KNPP to be commissioned this year

· Arunachal restarts five defunct hydro projects

· BHEL beats power capacity addition target by 19 percent

Transmission / Distribution / Trade……

· Bescom urges consumers to declare electricity overuse with 'voluntary disclosure'

· J&K suffers ` 92.6 bn deficit on power purchase: CAG

· 'NTPC, DVC owe ` 90 bn to CIL'

· JICA loan to augment power transmission in Odisha

· Transmission projects of ` 1 lakh cr to be bid out in 6 months: Goyal

Policy / Performance…………………

· Fuel cost hike offsets recent power tariff reduction: Punjab

· Goyal confident of 24x7 power supply to all

· Govt may bar multiple bids by one company in coal auctions

· CIL yet to sign FSAs for 4 GW

· India-Bangladesh agree on private sector partnership to swap electricity

· Nuclear project will be completed at Jaitapur: Vinod Tawde

· Govt plans to auction 11 coal mines soon

· Hope of power from Jharkhand plant

· Govt takes back coal block from Reliance Power’s Sasan unit

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Albania opens O&G exploration bid process for 7 blocks

· Nigeria plans to split gas from oil leases to boost output

· Tokyo Gas targets more US shale gas investments

· Goldman Sachs sees Brent crude oil at $55 a barrel in 2020

Downstream……………………

· US refiners dominate western hemisphere markets

· Ecopetrol's Cartagena refinery to restart later in year

Transportation / Trade…………

· Georgia denies key permit for Kinder's Palmetto pipeline

· Poland-Lithuania Gas Interconnection gets EU financial aid

· Saudi Arabia's March oil exports highest in over nine years

· Russia urges EU to support gas pipeline crossing Turkey

· Mexico's Pemex signs 5 mn barrel crude contract with Hyundai

· Pipeline carrying Nigeria's Bonny Light crude for export shut down

· Poland's PGNiG seeks arbitration in Gazprom dispute

· Philippines' First Gen readies plans for $1 bn LNG import terminal

· China reduces oil product export quotas in second quarter

Policy / Performance………………

· Libya's NOC chief sees higher oil prices, not relying on OPEC

· World Bank targets Chinese gas amid largest global demand growth

· Australia offers 29 offshore blocks for bidding in 2015 Acreage Release

· Oil groups ask court to temporarily block US fracking rules

· BP agrees to cut spending on Iraq's Rumaila field after oil price drop

· Oil price likely to hold up for rest of year: Kuwait OPEC governor

· Qatar Petroleum sees rising OPEC demand as price drop hits shale

· Venezuela eyes $100 oil price, deal with non-OPEC producers

· Myanmar rules out launch of bidding round for exploration blocks this year

[INTERNATIONAL: POWER]

Generation…………………

· Enel and Abengoa will build Pemex's 517 MW CHP project in Mexico

· 2.8 GW of power capacity could be added in Southern Africa by 2018

· Chinese investors to invest in power generation in Bangka-Belitung

· Ethiopia seeks Turkish companies to invest in power generation

· EIA forecasts lower power generation capacity additions in the US

· Hydropower leads investments in power generation in the Americas

Transmission / Distribution / Trade……

· EBRD signs MoU with Tajikistan for CASA-1000 transmission project

· ITC to invest $4.5 bn in US power transmission

· Regulators accept the need for big northern Minnesota transmission line

Policy / Performance………………

· Czech long-term energy plan continues to rely on nuclear power

· Re-open tender for 1MDB’s Jimah power plant

· Electrabel extends nuclear plants unavailability by 4 months

· Pakistan receives ADB funding for power plant projects

· Regulators approve plan to build power plant in Oxford

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Environment Ministry denies green clearance to 6 hydel projects in Arunachal Pradesh

· Infosys will spend ` 4 bn to become carbon neutral

· India seeks climate change roadmap from developed nations

· Telangana solar policy aims to offer swift solutions for developers

· Suzlon bags 98.7 MW contract from Mytrah Energy

· Essel Group, JA Solar JV to set up ` 9.5 bn facility in India

· NMRCL may use solar power to run the service

· India, China commit to work together on climate change

· NTPC to buy 15 GW of solar power through reverse auction

· Goyal calls for more efforts to meet renewable energy generation target

· Enzen Global Solutions acquires wind turbine maker Luminous for $2 mn

· Suzlon gets turnkey project job from ReNew Power

GLOBAL………………

· JinkoSolar to supply 1 GW of PV panel to CMNE

· Get ready for solar boom from China plants as Asia demand swells

· German ministry softens CO2 emission demands for power plants

· Georgia Power begins construction on 90 MW solar power projects in US

· NGPI plans 300 MW solar and wind project in Sindh

· Obama seeks oil demand, climate balance with shell Arctic permit

· Germany, France seek curb on fossil fuel pollution this century

· Canada to regulate O&G emissions with new 30 percent target

· Brazil completes 1.5 GW wind power transmission system

· Duke Energy commissions 200 MW Los Vientos III wind project

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

Carbon Emissions: Peaking Prematurely in China and India (Part I)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

T |

he report by working group III of the intergovernmental panel on climate change (IPCC) released last year contained a chapter on energy systems.[1] It noted that the energy sector was responsible for 35 percent of total anthropogenic green house gas (GHG) emissions and that despite the efforts of the united nations framework convention on climate change (UNFCCC) and the Kyoto protocol, emissions from the energy sector grew more rapidly between 2001 and 2010 than in the previous decade. Energy sector GHG emissions accelerated from 1.7 percent a year in the period 1991-2000 to 3.1 percent a year from 2001-2010. The main contribution to this growth is said to have come from rapid economic growth in developing countries (primarily China and India) and the increase in the share of coal in global fuel mix (on account of growth in coal consumption in India and China).

The report argues that in the absence of mitigation policies, energy related CO2 (the largest component of GHG) emissions are likely to increase to 50-70 GtCO2 by 2050. It then goes on to say that concentration of CO2 in the atmosphere can only be stabilised if global net emissions of CO2 emissions peak and decline towards zero in the long term.

The report also says that in majority of low stabilisation scenarios (limiting concentration of CO2 equivalent in the atmosphere to 450-530 ppm), the share of low carbon energy in electricity supply increase from 30 percent to 80 percent. This conclusion which according to the IPCC is based on ‘robust evidence’ and ‘high agreement’ among the contributors was probably used to extract the following statement from China in 2014 when the president of the United States visited China in 2014:

‘China intends to achieve the peaking of CO2 emission around 2030 and make best efforts to peak early and intends to increase the share of non-fossil fuels in primary energy consumption to around 20 percent by 2030.’

According to the world energy outlook 2014 (WEO 2014) of the international energy agency (IEA) coal’s share in global primary energy fuel mix has increased by 5 percentage points over the past decade to reach 29 percent in 2013 making it the second most important fuel behind oil.[2] WEO 2014’s projections under the new policies scenario show coal use growing by one-third in non-OECD countries to 2040 but coal’s relative importance is expected to change markedly over the projection period in leading coal consuming countries.

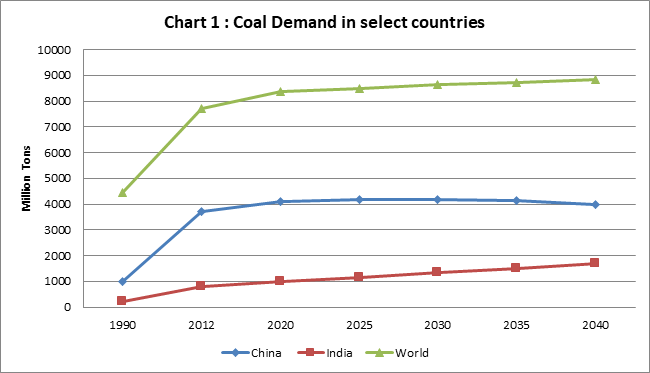

Though China is expected to remain the leading source of coal demand growth in the current decade as per WEO 2014 projections, growth is expected to slow sharply thereafter as China’s policies to limit coal consumption take effect. WEO 2014 expects China’s coal demand to peak around 2030 (the same text used in China’s joint statement with the United States on climate change) at which stage India is expected to become the largest source of incremental non-OECD coal demand till 2040.

India is also expected to become the second largest consumer of coal during the current decade overtaking the United States. BP’s projections for 2035 expect India and China to contribute 87 percent of global coal growth till 2035 (chart 1).[3]

Source: WEO 2014 projections under new policies scenario & used generalised conversions from (MTCE to Million Tons) IEA’s Medium Term Coal Market Report 2014.

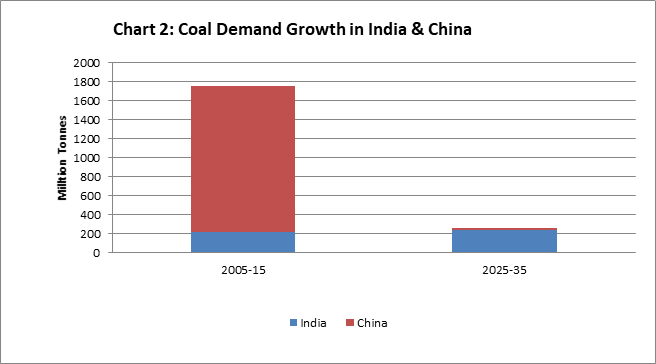

China is expected to remain the single largest coal consumer accounting for 51 percent of global consumption while India is expected to take the second place with 13 percent of global consumption overtaking the United States in 2024. BP’s projections which reflect its ‘most likely’ scenario expect China’s coal demand growth to decelerate rapidly from 1.3 billion tonnes (6.1 % a year) in 2005-15 to just 19.5 million tonnes (0.1 % a year) in 2025-35 (Chart 2).

Source: BP Energy Outlook 2035

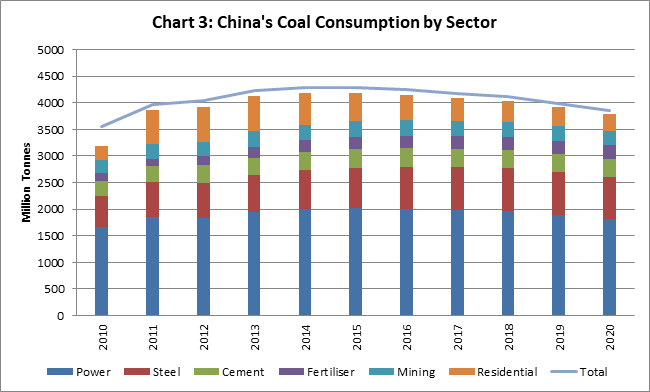

BP also expects China’s coal demand to peak around 2030 and for it to decline at -0.1 percent a year from then on. Both the IEA and BP give credit to structural changes and policy measures such as China’s move from a manufacturing and industry driven economy to a service and domestic demand driven economy along with efficiency improvements and stringent environmental policy for the rapid fall of coal demand in China. India did not receive the importance that China did over the question of emission peaking year because India’s coal consumption is less than one fourth of that of China and consequently its carbon emissions peaking year is expected only by 2040. A report by Bernstein argues that China will stop importing coal by 2015 and that China’s coal demand will start declining by 2016 (Chart 3).[4]

Source: Bernstein Research

This series will analyse some issues that arise around the narrative of carbon ‘peaking year’ such as (1) Is the ‘event’ of carbon emissions peaking in India and China part of natural course of economic development or policy induced (especially policies taken up under pressure from multilateral bodies committed to address global warming) (2) Does this reflect a positive development if so why and for whom?

to be continued.......

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

UNFCCC Principles Non-Negotiable: India and China

|

I |

ndia and China issued a joint statement on climate change on 15 May on the occasion of Indian Prime Minister Narendra Modi’s recent visit to China. In the statement issued, the two governments recognized that “climate change and its adverse effects are the common concern of mankind and one of the greatest global challenges of the 21st century, which needs to be addressed through international cooperation in the context of sustainable development”.

Recalling their bilateral agreement on cooperation on addressing climate change signed in 2009 and the memorandum of understanding (MoU) on cooperation on green technologies signed in 2010 the two countries have decided to “further promote bilateral partnership on climate change and enhance the role of this partnership in their overall strategic cooperation partnership through the implementation of this Joint Statement and the MoU as well as the Agreement”.

The two countries have emphasized that the United Nations Framework Convention on Climate Change (UNFCCC) remains the “most appropriate framework for international cooperation” to address climate change. They reaffirmed the principles of equity and common but differentiated responsibilities and called for the leadership of developed countries in reducing greenhouse gas emissions and providing finance, technology and capacity building support to developing countries.

The statement also said that China and India would work together, along with other countries, and advance multilateral negotiations under the UNFCCC “to achieve a comprehensive, balanced, equitable and effective agreement under the UNFCCC in 2015, with a view to ensuring the full, effective and sustained implementation of the UNFCCC”. They expressed their full support for the success of the Conference of Parties (COP) to be held in Paris this year.

The countries reaffirmed that the 2015 agreement “shall be in full accordance with the principles, provisions and structure of the UNFCCC, in particular the principles of equity and common but differentiated responsibilities and respective capabilities, reflecting different historical responsibilities, development stages and national circumstances between developed and developing countries”. The 2015 agreement shall address all the pillars: “mitigation, adaptation, finance, technology development and transfer, capacity building and transparency of action and support in a comprehensive and balanced manner,” according to the joint statement.

To increase the pre-2020 ambition and build mutual trust among countries, the countries stressed the equal importance and urgency of implementing the outcomes of the Bali Road Map (enhanced implementation of the UNFCCC and the second commitment period of greenhouse gases emissions reduction by developed countries under the Kyoto Protocol). The countries urged the “developed countries to raise their pre-2020 emission reduction targets and honour their commitment to provide 100bn US dollars per year by 2020 to developing countries”.

The statement further said that as the two biggest developing countries, China and India are undertaking ambitious actions domestically to combat climate change through “plans, policies and measures on mitigation and adaptation despite the enormous scale of their challenges in terms of social and economic development and poverty eradication”.

The countries also said that they are fully engaged in their “domestic preparations for their respective intended nationally determined contributions (INDCs) in the context of the 2015 agreement and will communicate their INDCs as early as possible and well before the Paris Conference”.

Referring to their bilateral partnership as “mutually beneficial”, they also said that it contributes to the global efforts to address climate change. They have decided to “enhance high-level bilateral dialogue on domestic climate policies and multilateral negotiations and to further strengthen practical bilateral cooperation, including in areas of clean energy technologies, energy conservation, energy efficiency, renewable energy, sustainable transportation including electronic vehicles, low-carbon urbanization and adaptation”.

Source: Third World Network, http://www.twn.my/title2/climate/info.service/2015/cc150502.htm

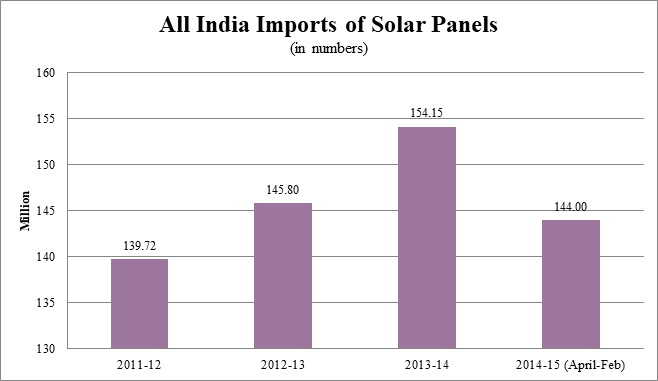

DATA INSIGHT……………

Solar Power Scenario in India

Akhilesh Sati, Observer Research Foundation

|

State |

No. of Villages (covered with solar street lights) |

|

Andhra Pradesh |

60 |

|

Arunachal Pradesh |

20 |

|

Assam |

20 |

|

Haryana |

580 |

|

Himachal Pradesh |

2500 |

|

Madhya Pradesh |

537 |

|

Maharashtra |

6423 |

|

Manipur |

103 |

|

Mizoram |

100 |

|

Nagaland |

207 |

|

Punjab |

130 |

|

Tamilnadu |

1500 |

|

Uttarakhand |

1034 |

|

Uttar Pradesh |

8288 |

|

West Bengal |

58 |

|

Total |

21560 |

Source: Lok Sabha, Unstarred Question Nos. 6769 & 6779.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC seeks green nod for ` 530 bn KG-Basin infra

May 19, 2015. Oil and Natural Gas Corporation (ONGC) has approached the Ministry of Environment and Forests (MoEF) seeking clearance for drilling 45 development wells and other related infrastructure involving a cost of over ` 53,000 crore in Krishna-Godavari (KG) basin. An expert appraisal committee (EAC) under the MoEF, however, sought more information in this regard. The block KG-DWN-98/2 or KG-D5 is divided into two parts - northern development area (NDA), which is deep waters with a depth of up to 1,800 metres, and southern development area (SDA), which has ultra-deep waters with depth ranging up to 3,100 metres. The current proposal is submitted for development in the northern development area. The NELP-I offshore block KG-DWN-98/2 is located off Godavari delta on the east coast of India. ONGC is slated to begin production in 2019, with a peak output of 4.5 million tonnes a year, 20 percent more than previous estimates. The Krishna Godavari basin block KG-DWN-98/2, or KG-D5, will see first large oil production from the east coast, which has 10 gas discoveries, ONGC had said. KG-D5 sits next to Reliance Industries' producing KG-DWN-98/3 or KG-D6 area. (profit.ndtv.com)

ONGC, its partners developing LNG terminal in Mozambique

May 18, 2015. In a step towards start of gas production from its giant Mozambique gas fields, Oil and Natural Gas Corp (ONGC) and its partners have awarded contract for development of an onshore LNG terminal. About 75 trillion cubic feet of natural gas reserves found in offshore Rovuma Area-1, where Indian firms led by ONGC Videsh Ltd hold a total of 30 percent stake, are to be converted into LNG for transportation by ships to consuming nations like India. US firm Anadarko Petroleum Corp, the operator of the block, announced the selection of a consortium consisting of CB&I, Chiyoda Corporation and Saipem for the initial development of the onshore LNG park in Mozambique. The onshore LNG park includes two LNG trains, each with capacity of 6 million tons per annum, which is an increase of 1 million tons per train over the original plan. The LNG park will include two storage tanks, each with capacity of 180,000 cubic meters, condensate storage, multi-berth marine jetty and associated utilities and infrastructure. An estimated USD 18.4 billion will be required to bring first set of discoveries in Rovuma Area-1 on to production and convert that gas into liquid (liquefied natural gas or LNG) for ease of shipping to consuming nations like India. (economictimes.indiatimes.com)

India’s gas output to grow by 50 percent in the next three years

May 13, 2015. India’s natural gas production from hydrocarbon resources is expected to rise 52% in the next three years, outstripping the growth in demand from power and fertilizer firms during the same period, according to the oil ministry. Oil Minister Dharmendra Pradhan said India’s natural gas output is projected to increase to almost 230 million metric standard cubic metres per day (mmscmd) by 2017-18 from the current 138.33 mmscmd as at the end of 2014-15, a growth of 52%. This is against a growth in demand of 27% from the core natural gas consuming sectors—power and fertilizer. At the end of March, India’s total natural gas consumption stood at 134 mmscmd against an availability of 90 mmscmd, with the remaining met through imports of R-LNG, according to petroleum planning and analysis cell (PPAC), a statistical body under the oil ministry. In fact, India had been a laggard in even meeting its natural gas production target with the production at 3.365 billion cubic metres (bcm), down 5% from 3.54 bcm produced in 2013-14 and down 8.1% from the target production of 3.66 bcm, according to the oil ministry. In the last 10 years, while India’s domestic production has grown by 10%, India’s imports of regassified liquefied natural gas (R-LNG) has grown by 335% due to a major growth in demand, which has risen by almost 46%, according to PPAC. (www.livemint.com

Transportation / Trade…………

IOC, GAIL in gas deal with Adani

May 14, 2015. Indian Oil Corp (IOC) and gas utility GAIL have inked a deal with an Adani Group firm for booking capacity at a liquid gas import terminal in Odisha, with the option of taking equity in the project at a later stage. GAIL said the two firms signed an MoU with Dhamra LNG Terminal which proposes to build a terminal at the Dhamra port in Bhadrak district of the state for importing gas in ships and regassify it for feeding customers in the eastern region. Dhamra LNG Terminal proposes to build the project with an initial capacity of handling imports of 5 million tonnes per year of imported gas. Both the state-run entities are separately pursuing projects for importing gas in ships in the coastal region. IOC is planning a project in Ennore district of Tamil Nadu. Similarly, GAIL is working on projects at Kakinada in Andhra Pradesh. GAIL's participation in the Dhamra project comes within a month of the company shelving its plan to set up a floating gas import terminal at Paradip in Odisha, where Indian Oil is close to starting a refinery. In March, GAIL said in a filing that it has withdrawn its notice of October 18, 2014 calling for expressions of interest for becoming a strategic partner in the Paradip project. The proposed facility was planned to start with a capacity of 4 million tonnes per annum and double it in the second phase to 8 million tonnes a year. GAIL had signed an MoU with the Paradip Port Trust in October 2013 for the project. (economictimes.indiatimes.com)

Completion of Bathinda-Srinagar gas pipeline to depend on clearances: Govt

May 13, 2015. Completion of Bathinda-Srinagar gas pipeline project, scheduled to be executed by July last year, would depend on statutory clearances from the state governments and the completion of studies on potential customers, the government said. Oil Minister Dharmendra Pradhan blamed the delay on absence of "anchor load customers" and non-availability of statutory clearance. The tendering process has also been delayed as a result, he said. Pradhan said studies are being carried out about the potential customers. The Petroleum and Natural Gas Regulatory Board had authorised GSPL India Gasnet Ltd, Indian Oil Corp, Bharat Petroleum Corp Ltd and Hindustan Petroleum Corp Ltd for laying the pipeline from Bathinda to Sringar via Jammu. The original completion date for laying the 725 km long pipeline project was July 6, 2014. (economictimes.indiatimes.com)

RIL-BP among four in race for Mumbai LNG terminal

May 13, 2015. RIL-BP joint venture, Excelerate Energy of US and Japan's Mitsui are among the four in race to set up a ` 2,740 crore floating LNG import terminal at Mumbai. Reliance Industries Ltd (RIL) and BP's equal joint venture India Gas Solutions, Mitsui, Excelerate Energy and a consortium of IMC and Norway's Hoegh LNG are the four which bid for setting up of a floating LNG receipt terminal. Mumbai Port Trust (MbPT) had invited bids for setting up of 5 million tonnes per year floating storage and re-gasification unit (FSRU) on PPP (public-private partnership) mode. The selected bidder will set up the FSRU as well as operate it on Design, Build, Finance, Operate and Transfer (DBFOT) basis, according to the tender document. MbPT, one of the oldest ports in the country, is looking at a FSRU to meet the growing market demand of natural gas in the western coast of India. Mumbai will be the fifth LNG terminal on the west coast and the second in Maharashtra. Gujarat has two operational terminals -- Petronet LNG Ltd's 10 million tonnes a year at Dahej terminal and Shell's 5 million tonnes at Hazira plant. A third one is being constructed by Gujarat State Petroleum Corp (GSPC) at Mundra. In Maharashtra, GAIL operates a 5 million tonnes facility at Dabhol. Petronet also has a 5 million tonnes terminal at Kochi in Kerala. According to MbPT tender document, the winner will have to set up a FSRU vessel with storage capacity of 170,000 cubic meters and 5 million tons per annum gas production capacity. It will also set up Marine terminal including of berthing and mooring facilities for FSRU and LNG carriers, pipeline to transfer the gas to onshore and landfall receipt facility. MbPT has already applied to the Ministry of Environment and Forests for approval. MbPT wants state gas utility GAIL India Ltd to connect the port to the national gas grid at Uran. (economictimes.indiatimes.com)

Policy / Performance………

Proposal likely to allow gas companies to freely price output

May 19, 2015. Producers of gas from marginal fields will be able to freely price their output and choose buyers under a proposed policy awaiting Cabinet approval aimed at making such areas attractive for exploration companies. Currently, gas producers have to use a formula linked to international prices. The local price of gas went up by a third after the formula was first applied in November and dropped about 8% in the first revision in April as international prices fell. Most agreements for field operators also provide for a 'market-determined' price with a rider that it must be approved by the government. The government also decides which customers will get the gas. X the sharp fall in output from the KG-D6 block operated by Reliance Industries Ltd. The oil ministry has completed an inter-ministerial consultation on the proposed policy to allow free pricing of gas from marginal fields and ability to choose customers and will likely send it to the Cabinet for consideration this month. The government gives priority in gas allocation to sectors such as fertilisers and city gas because of the scarcity of the fuel in the country. Local gas production fell 5.5% in 2014-15, when the country imported about a third of the natural gas it consumed. Lower availability of cheap local gas and expensive liquefied natural gas imports have kept many of India's power plants idle or underutilised.

The policy will help auction 69 smaller fields to public and private explorers, which will compete on the basis of the revenue-share they offer to the government to win the bid. It will be a debut for the revenue-sharing model in India's hydrocarbon sector, which has witnessed a debate for years on which fiscal regime to opt for to accelerate exploration and production. The policy to develop marginal fields is aimed at boosting oil and gas production in the country. Prime Minister Narendra Modi recently laid out an aggressive road map for the industry to slash the country's import dependence in oil by 10% in seven years from 78% now. (economictimes.indiatimes.com)

Cairn seeks revision in Rajasthan block crude oil pricing formula

May 18, 2015. Cairn India has demanded a change in the pricing formula for crude oil from its prolific Rajasthan block saying the current pricing mechanism does not capture the full value of oil. Rajasthan crude oil, mostly used by private refiners like Reliance Industries Ltd (RIL) and Essar Oil, is currently sold at a discount to prevailing price of benchmark Brent crude oil. Government’s share of taxes and royalty is linked to the price of crude oil.

The company wrote to the oil ministry saying the price currently being realised was around 8-10% lower than the benchmark Dated Brent price. This current sub-optimal realization in pricing of Barmer crude is impacting the value for all stakeholders, it said. That is resulting in potential yearly revenue loss for the government due to lower realization. There is an immediate need to review the pricing formula, it wrote. Rajasthan crude oil is being priced using the indigenous crude oil pricing formula linked to Bonney light of west African origin and quality adjustment based. The current price formula doesn’t capture the value provided by high quality secondary conversion unit feed, Cairn said. (www.livemint.com)

Oil Minister to lead Indian delegation to Mexico, Columbia

May 17, 2015. Oil Minister Dharmendra Pradhan will be leading an Indian delegation to Mexico and Columbia to foster mutual cooperation in the area of hydrocarbons and to seek long-term linkages for the country's energy security. During his visit, Pradhan is scheduled to meet his counterparts as well as leaders of the hydrocarbon industry in both countries. Mexico and Columbia are very important economic and energy partners of India, with ONGC Videsh having seven oil and gas blocks in Colombia. India imports a reported 10 million metric ton crude oil from Mexico and Columbia. (www.business-standard.com)

Govt to allow market price for some natural gas

May 17, 2015. The government may allow a part of the natural gas produced by firms like Oil and Natural Gas Corp (ONGC) and Reliance Industries Ltd (RIL) from new discoveries to be sold at market price as it looks to boost domestic exploration and production. The government, while approving a new gas pricing formula based on international hub rates in October last year, had decided that new gas discoveries in deep-water, ultra-deep sea or high-temperature and high-pressure fields will be given a premium over and above the approved price. The premium will be in form of allowing a fixed percentage of natural gas produced from difficult fields to be sold at market price and the remaining as per the approved price, the oil ministry said. While the current domestic gas price is $4.66 per million British thermal unit (mmBtu), the market price as measured by the rate at which the fuel is imported, is $7-8. The formula suggested by DGH was a middle path of balancing the industry expectations of market price for all of the gas and government concerns of not allowing too high a price that could have a cascading impact on cost of fertilizer and power as well as CNG and cooking gas. All gas producers including ONGC have stated that it was uneconomical to produce gas from difficult fields at the current price of $4.66 per mmBtu. As per mechanism approved in October 2014, price of domestically produced natural gas is to be revised every six months using weighted average or rates prevalent in gas-surplus economies of US/Mexico, Canada and Russia. Gas price, according to the formula, was $5.05 per mmBtu till March 31 and has subsequently been cut to $4.66 in line with international movements. The current price is among the lowest in Asia Pacific. China pays explorers $11.9 per mmBtu rate for new projects while Indonesia and the Philippines price the fuel at $11 and $10.5 respectively. Gas from offshore fields in Myanmar, where Indian firms ONGC and GAIL have stake, are sold to China for $7.72. Thailand prices gas from new projects at $8.2 per mmBtu. Vietnam has a gas price of $5.2 and Malayasia $5. (profit.ndtv.com)

India to engage in active ‘oil diplomacy’

May 16, 2015. The government will focus more keenly on ‘oil diplomacy’ and leverage its position as a big-time oil importer while brokering new oil deals abroad, Oil Minister Dharmendra Pradhan said. The government is considering buying oil and gas assets abroad, Pradhan said, particularly in Africa and South America. India currently imports 77 percent of its crude oil needs.

The Modi government has a set a target of reducing the total import requirement by 10 percent by 2022. At current lower levels of crude oil prices, the environment has changed into a buyer’s market. While the government would keep away from the deal-making process, Pradhan said he would encourage public sector explorers, particularly ONGC’s foreign arm ONGC Videsh, in striking new deals. Regarding ONGC’s investment in the Farzad-B gas block in Iran, which Iran had threatened to re-auction, he said. India will increase its “active engagement” with the block, the minister said. On exploration within India, Pradhan declined to set a timeline for the tenth new exploration and licensing policy (NELP – X) to be announced. The experience with the previous rounds of NELP has been mixed, he said, and the new policy has received approvals from the Union Cabinet on removing bottlenecks. (www.thehindubusinessline.com)

Assam govt prohibits strike by oil sector employees

May 16, 2015. Assam Government has prohibited strike by employees of oil sector in the state through a notification under the Essential Services Maintenance (Assam) Act. The government said the notification would remain in force for a period of six months or until further orders, in exercise of powers conferred by section 3 of the Essential Services Maintenance (Assam) Act, 1980. The notification prohibits strike of work by officers, workmen, contract labour, tanker drivers and also khalasis involved in the services in any oil field or refinery of any establishment or undertaking dealing with the production, supply or distribution of petroleum and petroleum products, including natural gas. (www.thehindubusinessline.com)

ONGC finds major crude reservoir in Mumbai High: Govt

May 15, 2015. Oil and Natural Gas Corp (ONGC) has discovered a substantial reserve of crude oil between its Mumbai High north and south fields in the Arabian Sea, Oil Minister Dharmendra Pradhan said. The new find, which comes almost 50 years after ONGC began production in Mumbai High, will help the company maintain production levels from the basin for a longer time than currently estimated, the minister said.

The Mumbai High basin is ONGC’s flagship oil producing asset. Along with the other smaller fields along the western offshore, the asset currently produces 16 million tonnes per annum (mtpa) of crude oil, which is nearly 40% of India’s total crude oil production of 37 mtpa. (www.livemint.com)

Petrol price in India more than Pakistan: Oil Minister

May 13, 2015. Petrol in India costs more than neighbouring Pakistan and Sri Lanka but is cheaper than Bangladesh and Nepal, Oil Minister Dharmendra Pradhan said. Petrol price of ` 63.16 per litre in Delhi is more than ` 44.05 per litre rate of the fuel in Pakistan and ` 54.75 in Sri Lanka. However, it is cheaper than ` 76.97 per litre price in Bangladesh and ` 68.13 a litre in Nepal.

Diesel at ` 49.57 per litre in Delhi is however cheaper than all neighbouring nations except Sri Lanka, where it costs ` 44.29 for a litre, he said. A litre of diesel in Pakistan costs ` 51.15, ` 54.27 in Bangladesh and ` 54.27 in Nepal. Nepal sources all its auto fuel needs from India. India had on four occasions between November 2014 and January 2015 raised excise duty on petrol and diesel to take away gains coming by way of global oil prices dipping to six-year low. Cumulatively, excise duty on petrol was hiked by ` 7.75 per litre and that on diesel by ` 6.50 a litre. Post these duty hikes, retail price of petrol in Delhi should have been ` 55.41 a litre and diesel ` 43.07 per litre.

Pradhan said a year ago, petrol in Delhi was second cheapest in South Asia. Petrol price of ` 71.41 a litre at Delhi was cheaper than Bangladesh (` 74.43), Sri Lanka (` 74.92) and Nepal (` 83.61) but costlier than ` 66.17 a litre price in Pakistan. Similarly, diesel price of ` 55.49 on May 1, 2014 was cheaper than Rs 71.27 in Pakistan, ` 56.17 in Sri Lanka and ` 65.84 in Nepal. It was however costlier than ` 52.55 per litre rate prevalent at that time in Bangladesh. (businesstoday.intoday.in)

[NATIONAL: POWER]

Generation……………

India Power Corp to commission Haldia Project in September

May 18, 2015. India Power Corporation plans to start commercial generation at its 450 Mw thermal power plant in Haldia in September. The company is setting up three units of 150 MW each and the first one is expected to start commercial generation by September 30, the company said. The second and third units are slated to be commissioned three months and six months hence, respectively. Construction activities are in full swing. Boiler drum lifting, one of the major milestones, was achieved on December 4, 2014 for Unit I and February 23, 2015 for Unit II. Companies working on the project include Bharat Heavy Electricals, Simplex, ABB, Scorpio, Energo, Paharpur, Ramky, WPIL, Raunaq and Honeywell. Power generated from the plant shall be evacuated through West Bengal State Electricity Transmission Company's 220 KV substation in Haldia. (economictimes.indiatimes.com)

Second unit of KNPP to be commissioned this year

May 18, 2015. Russia's nuclear energy corporation Rosatom, builders of the Kudankulam Nuclear Power Project (KNPP), plans to commission the second unit within this year, it said. The operator Nuclear Power Corp of India (NPCIL) has postponed putting the power unit into commercial operation until July 2015, Rosatom said. NPCIL is hoping to load the real fuel in the second unit around June, for which it needs to get two more permissions from the Atomic Energy Regulatory Board, the operators have said. The first unit was connected to the southern power grid in October 2013, while commercial power generation began on December 31, 2014. Meanwhile, on issues arising out of India's nuclear liability law, with the proposed nuclear insurance pool falling short by ` 600 crore towards becoming operational, some foreign companies have shown an interest in being part of the initiative, the state-run General Insurance Corp. (GIC) said. The Civil Liability for Nuclear Damage Act, 2010, prescribes that the nuclear insurance pool be made operational with funds of ` 1,500 crore. With India's nuclear liability issue holding up deals with various countries, GIC recently conducted an international workshop of stake-holders here on creation of a nuclear insurance pool. GIC had said that of the ` 1,500 crore of insurance cover required for the proposed Nuclear Insurance Pool, it would be in a position to provide only ` 750 crore equivalent of insurance. Under the Civil Liability for Nuclear Damages (CLND) Act, besides the operator Nuclear Power Corp, equipment and material suppliers are also liable to pay damages if an accident occurs. Compensation of up to $244 million will have to be paid in case of an accident at any of the nuclear plant covered by the law. Currently, nuclear plants in India only have insurance cover for zones that are outside the area of radiation and reactors. The new pool will provide insurance cover for both hot zones -- radiation and nuclear reactors -- and cold zones -- outside the reactor areas. (www.business-standard.com)

Arunachal restarts five defunct hydro projects

May 14, 2015. Despite funds crunch, the Arunachal Pradesh Hydro Power Department has restored five mini hydro projects in various parts of the state. While Rina small hydro project (2x1000 KW) in East Siang district was revived, Tinning micro hydel scheme (MHS) (2X25 KW) in Changlang district has been put into operation. The Tinning MHS built under the Prime Minister's package had been lying idle since its installation. Rina had been shut due to damage by floods in September 2014. In West Kameng district, the Saskorong MHS (3X100 KW) has been restarted this week, which is meeting the load demand of 60 KW of nearby villages. In Upper Subansiri district, only one unit of Sippi project (2X200 KW) was operational, with another which was shut for almost 2 years, also restored. Mechuka MHS (6X25 KW) in West Siang district and Siri Korong MHS (2X250 KW) at Lhallung have also been put on track. However, due to shortage of staff, both the hydel stations could not be operated at the same time. (timesofindia.indiatimes.com)

BHEL beats power capacity addition target by 19 percent

May 13, 2015. Bharat Heavy Electricals Ltd (BHEL) said that it surpassed its power generation capacity addition target for utilities by 19 percent in 2014-15. BHEL has commissioned 8,230 MW of utility sets against the target of 6,914 MW for 2014-15. BHEL has commissioned two boilers of 800 MW each during the year. In addition, sets with a cumulative of 2,000 MW have been synchronised and are ready for capacity addition. During 2014-15, BHEL commissioned 1,392 MW industrial sets and 319 MW of overseas projects, taking the overall capacity addition/synchronisation to 11,941 MW. The power plant equipment manufacturer has crossed a major milestone, with installed capacity exceeding 155 GW, including 132 GW of domestic utility sets. With this, BHEL has joined the elite club of international manufacturers that have supplied power-generating equipment with a capacity more than 150 GW. In the first three years of the 12th Plan (2012-17), BHEL has commissioned a capacity of 26,091 MW, exceeding the cumulative target of 24,737 MW set by the government. The company has surpassed its total commissioning of 25,385 MW in the entire 11th Plan (2007-12). In the 12th Plan, two supercritical sets of 660 MW rating have been commissioned for the first time by BHEL. Besides, BHEL successfully started in quick succession, three units of 270 MW each within a span of just 42 days at Amravati in Maharashtra. (profit.ndtv.com)

Transmission / Distribution / Trade…

Bescom urges consumers to declare electricity overuse with 'voluntary disclosure'

May 18, 2015. To improve supply and plug revenue leaks, Bengaluru's electricity distribution utility Bescom will ask consumers to "reset" peak power load through "self declaration" or " voluntary disclosure". Consumers have been overusing electricity above the permitted load either willfully or due to ignorance causing supply bottlenecks. With Bescom moving to electronic meters from electro-mechanical meters, it can now know the exact peak load used by individual consumers. The utility will start the drive in a month's time, Bescom said. The distribution utility levies a two-part tariff on consumers comprising fixed and energy charges. Fixed charges depend on the consumer's contract demand or the peak load the consumer prefers to have, while the energy charge depends on electricity consumed. (economictimes.indiatimes.com)

J&K suffers ` 92.6 bn deficit on power purchase: CAG

May 18, 2015. Jammu and Kashmir (J&K) government incurred ` 14,915 crore on power purchase during 2009-10 to 2013-14, and recovered only ` 5,663 crore during this five-year period, resulting in a deficit of massive ` 9,262 crore, according to Comptroller and Auditor General (CAG) of India. As per the figures of CAG on state finances for the year ended March 31, 2014, Jammu and Kashmir has incurred an expenditure of ` 14,915 crore on account of power purchase from 2009-10 to 2013-14. The state was able to recover only ` 5,653 crore during this period, thereby suffering power deficit to the tune of ` 9,262 crore, the CAG said. The state government had set a revenue target of ` 8,988 crore during the last five years period from 2009-10 to 2013-14, it said. The CAG said the targets for collection of power department tariff were not achieved. The government did not present a time bound action plan to recover minimum 50 percent of the charges after accounting for operation and maintenance expenses from the users as recommended by the 13th Finance Commission. (economictimes.indiatimes.com)

'NTPC, DVC owe ` 90 bn to CIL'

May 17, 2015. Power generation firms like NTPC and Damodar Valley Corporation (DVC) have outstanding dues of around ` 9,000 crore to Coal India Ltd (CIL). Companies which owe money to the coal PSU include West Bengal Power Development Corp and Madhya Pradesh Power Generating Co. According to industry analysts, the power generation firms owe huge dues to CIL as state electricity distribution companies which buys electricity from power PSUs are facing tough financial conditions and in the last one year the situation of these Discoms have not improved. In the wake of many state discoms facing tough financial conditions, the previous government had come out with a financial restructuring scheme for them. The scheme had a total outlay of ` 1,000 crore for the entire 12th Five-Year Plan period, which ends in March 2017. Later, it was increased and a provision of ` 1,500 crore was made only for 2013-14. A Parliamentary panel had earlier suggested that the government should review the financial restructuring package for state electricity power distribution firms as not many states have shown interest in the scheme. (timesofindia.indiatimes.com)

JICA loan to augment power transmission in Odisha

May 15, 2015. Japan International Cooperation Agency (JICA) signed an agreement with the Government of India to provide 21,787 million Japanese Yen (` 1,150 crore) Japanese Official Development Assistance (ODA) loan to augment power transmission infrastructure in Odisha. The assistance will provide for substations and transmission lines across Odisha to enhance the stability of power system and reliability of power supply and reduce transmission loss in the state with increasing electricity demand due to rapid economic growth. As a consequence of remarkable economic growth of Odisha, one of the fastest among the states, which is expected to mark around 9% in 2014-15, the installed power generation capacity in Odisha is expected to increase from 5,511 MW in 2014-15 to 10,932 MW by 2021-22. Availability of uninterrupted and stable electricity is a precursor to sustained economic growth across urban and rural areas. The assistance will further development of an efficient, coordinated and economical system of intra-state power transmission, in tandem with regional requirement for uninterrupted power supply from surplus regions to deficit regions. The civil works for the construction of substations and transmission lines would be carried out by Odisha Power Transmission Corporation Limited, Government of Odisha, and will be completed in phases by 2020. From the view point of disaster prevention, it is planned to install substations in this project that are resistant to natural disasters. (odishachannel.com)

Transmission projects of ` 1 lakh cr to be bid out in 6 months: Goyal

May 13, 2015. In order to strengthen the power transmission in the country, the government would award projects totaling ` 1 lakh crore in the coming six months, minister of state for coal, power and renewable energy Piyush Goyal said. As per FICCI report in 2013, in order to meet the upcoming generation capacity, investment in the transmission sector needs to be to the tune of $35 billion. Of this, $16 billion – 46 percent of the total investments, needs to be secured from private players, the report said. Power transmission sector was opened up to the private sector in 2010 with the award of Western Regional System Strengthening to Reliance Infra and East-North Interconnection line to Sterlite. However, Power Grid Corporation of India has a monopoly in the market with more than 45 percent project allotted to it and having 99 percent market share. Currently Power Grid has more than ` 1.3 lakh crore order book of central as well as state funded projects. Currently, it has 15 major transmission projects pending owing to issues on land and delay in power generation installation. (www.business-standard.com)

Policy / Performance………….

Fuel cost hike offsets recent power tariff reduction: Punjab

May 18, 2015. The Punjab State Power Corp Ltd (PSPCL) has imposed 4 paise per unit as fuel cost adjustment (FCA) on consumers, offsetting the tariff reduction that had come after eight years. While the FCA has done away with the reduction in the first 100 units of household consumption announced by the power regulator, it has increased tariff for all other categories by 4 paise per unit, which was kept unchanged by the regulator in its tariff order. The PSPCL issued commercial orders to impose 4 paise per unit for the metered supply and ` 2 per break horse power (BHP) per month on unmetered supply (agriculture sector). The power regulator had allowed the PSPCL to impose the levy of fuel surcharge. FCA surcharge is applicable to all categories of consumers -- domestic, industry and commercial. It will be charged with retrospective effect from October 2014 and will also be levied on the current fiscal on all consumers. The power regulator has allowed the PSPCL to recover ` 36.83 crore in the FCA on account of increase in coal and power purchase cost, PSPCL said. The FCA surcharge pertains to the third quarter of 2014-15 (October to December 2014) and will be recovered from consumers from April 1 to June 2015, PSPCL said. (www.hindustantimes.com)

Goyal confident of 24x7 power supply to all

May 18, 2015. India is on the cusp of a big leap towards achieving 24x7 power supply for all its citizens and there is enough scope in the system to reduce power tariff along the way, coal and power minister Piyush Goyal has said. He accepted that transmission bottleneck was proving a handicap since for the first time, the country had surplus power and surplus coal. Goyal said the government had brought fuel supply under "some sort of control", which had brought energy deficit down to the lowest level in history at 3.6%, while generation was up 8.5%. (timesofindia.indiatimes.com)

Govt may bar multiple bids by one company in coal auctions

May 18, 2015. The coal ministry is looking at barring multiple bids by any corporate group in the next round of bidding for mines, according to coal and power minister Piyush Goyal. The move is aimed at curtailing the probability of price rigging or cartelization that the ministry believes led to wide variation in the winning bids, described as "outliers" by ministry officials, for blocks in the first round of mine auction for power projects. These outliers had prompted the ministry to put under scanner bids for several blocks and finally reject the winning bid of Naveen Jindal group firm for Gare Palma IV/2&3 blocks, first reported by TOI. Blocks for powering generation units are auctioned through reverse bidding, wherein companies have to bid below the reserve price. The lowest bidder in a block is considered winner. But, once the bidding price hits zero, companies go into forward bidding and the highest quote is chosen as the winner. Companies can take advantage of multiple bids to rig price and also create barriers for others in a block. In the last round of auctions, the Vedanta Group put in 25 bids for 14 out of 23 producing blocks that were being auctioned. The group used its various arms, some of them even competing for the same block, to put in multiple bids. The Aditya Birla Group put in 15 bids for eight blocks. Jindal Steel and Power, which was hit the most when the Supreme Court cancelled allocation of 204 blocks in September last year, put in 13 bids for six blocks. The minister did not see the proposed condition as a dampener and said it would be applied in the next round of auction. (timesofindia.indiatimes.com/business)

CIL yet to sign FSAs for 4 GW

May 15, 2015. Coal India Ltd (CIL) is yet to sign fuel supply pacts with power plants for around 4,000 MW. The government, in 2012, had issued a presidential directive to CIL asking the PSU to seal supply agreements with power producers for a capacity of 78,000 MW. There are delays in signing even as the government has time and again made promises of providing round-the-clock electricity to all by 2019. Out of 78,000 MW of capacity, CIL has inked fuel supply agreements (FSAs) for a capacity of 74,000 MW so far. FSAs for the remaining 4,000 MW could not be signed due to various issues, including non-achievement of goals by power producers. Many earlier deadlines for the signing of FSAs have lapsed, too. CIL, which accounts for over 80 percent of the domestic coal production, missed the output target for 2014-15 by 3 percent, recording 494.23 million tonnes. The output target was 507 million tonnes for the fiscal. In 2013-14, the company had clocked production of 462.53 million tonnes of coal. (economictimes.indiatimes.com)

India-Bangladesh agree on private sector partnership to swap electricity

May 15, 2015. India and Bangladesh have agreed to open ways for private sector partnership to swap electricity alongside existing government-level cooperation, officials said as power secretaries of the two countries concluded a two-day meeting. Officials familiar with the meeting said that the proposal of the private sector partnership was floated by the Indian side as several Indian companies including Reliance previously expressed interest for investment in power in Bangladesh. An official statement issued after the meeting said the meeting reviewed the progress on Bangladesh's move for import of additional 600 MW power from India, of which 100 MW would come from Tripura's Palatana power project starting next December while the remaining 500 MW was expected to reach from December, 2017. It said the meeting reviewed and discussed the progress of installation of a high capacity multi-terminal HVDC bi-pole transmission line for inter-connection between India's north and north-eastern region and the proposed 1,320 MW coal-fired Rampal power plant near Sundarbans in Bangladesh. (economictimes.indiatimes.com)

Nuclear project will be completed at Jaitapur: Vinod Tawde

May 14, 2015. Despite strong opposition from Shiv Sena over the Jaitapur nuclear power project, the Devendra Fadnavis-led BJP government said that the project would be completed at its original place. However, the concerns raised by the local people would also be addressed, human resources development minister Vinod Tawde said. He was reacting to the agitation of Sena MPs in relation to the nuclear power project on the Parliament premises. They wanted to meet the Prime Minister to express their opposition against the project and were allegedly not getting an appointment from the PMO. Later, they met the Prime Minister and requested him to move the project at another place. (dc.asianage.com)

Govt plans to auction 11 coal mines soon

May 14, 2015. The government plans to soon auction about 11 coal mines which could not be sold in the first two phases of the recent coal block auctions. The mines which the government is proposing to put on sale includes Parbatpur Central mine (producing block) in Jharkhand and MarkiMangli I mine (producing block) in Maharashtra. Besides, it includes Dongrital II mine in Madhya Pradesh, Jamkhani mine in Odisha and MarkiMangli IV in Maharashtra, among others. The government recently auctioned coal blocks in two phases, which had garnered over ` 2 lakh crore from just 29 blocks, surpassing the presumptive loss figure of ` 1.86 lakh crore estimated earlier by government auditor CAG for allotment of mines without auction. The Prime Minister's Office (PMO) had recently asked the Coal Ministry to expedite the process of next round of mines auction. (businesstoday.intoday.in)

Hope of power from Jharkhand plant

May 13, 2015. The re-bidding process for a 3,960 MW ultra mega power project at Tilaiya has revived the hope of Bihar getting 500 MW from the Jharkhand plant. The Jharkhand government has initiated the process of re-bidding of the project after Reliance Power pulled out of it because of "delay in land acquisition" for the project. Bihar was allotted 500 MW from the project when Reliance had won the contract in August 2009 to set up an ultra mega power project at Tilaiya in Hazaribagh. Energy Minister Bijendra Prasad Yadav said that the NTPC is likely to take up the job of constructing the project from which Bihar would benefit too. (www.telegraphindia.com)

Govt takes back coal block from Reliance Power’s Sasan unit

May 13, 2015. The government has issued a formal notification scrapping allocation of one of the three coal mines for the Sasanutra-mega power project built in Madhya Pradesh by Reliance Power as a fallout of the Supreme Court judgement cancelling allotment of 204 blocks. The Chhatrasal coal block is one of the three captive mines that were allotted to Sasan Power Ltd in 2006. The other two mines allotted for fuelling the Sasan project are Moher and Moher-Amlohri Extension. The Supreme Court judgement left alone allocation of blocks for ultra-mega power but said surplus coal from such mines cannot be used commercially in other plants of the promoter company. Reliance Power had formally announced completion of the 4,000 MW Sasan project in March. The project is an integrated power plant-cum-coal mining project at a single location, involving an investment of over ` 27,000 crore. Coal production has already commenced from the 20 million tonnes Moher and Moher-Amlohri mines associated with the project. This is the second setback for the group. Recently it pulled out of the contract ` 36,000-crore Tilaiya ultra-mega power project in Jharkhand over, what it called "inordinate" delays in land acquisition. (timesofindia.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Albania opens O&G exploration bid process for 7 blocks

May 19, 2015. Albania will offer companies interested in oil and gas (O&G) exploration seven offshore and onshore blocks in June 2015 in a bidding process. Energy ministry wants bids for onshore blocks 4 and 5 in southern and southeastern Albania, and Dumre in central Albania to be handed in by 15 June 2015, while bids for the offshore blocks Ionian 5 and Rodoni, and the onshore blocks Panaja and C, would be accepted until 25 June 2015. Once the bids come in, the Natural Resources Agency will evaluate the offers and recommend the best one to the ministry so that it may negotiate a production-sharing agreement. The companies would be able explore for an initial period of up to 5 years which can be extended to 7 if needed, and they can develop and produce in the block for 25 years. Offshore oil exploration caused friction between Albania and neighbouring Greece as part of the Ionian 5 block overlaps with the Ionian Sea area in which Greece seeks to search for oil. (www.enerdata.net)

Nigeria plans to split gas from oil leases to boost output

May 19, 2015. Nigeria, Africa’s biggest oil producer, plans to issue separate leases for gas assets in order to attract more investors to boost output of the fuel, the state-owned oil company said. Almost all of the West African nation’s reserves of 184 trillion cubic feet of gas, the world’s eighth-largest, were found in the course of searching for crude. The new plan seeks to provide opportunities for companies specifically exploring for gas, according to Nigeria National Petroleum Corp (NNPC). More than 80 percent of Nigeria’s hydrocarbon reserves are in leases held by Royal Dutch Shell Plc, Chevron Corp., Exxon Mobil Corp., Total SA and Eni SpA, whose priority continues to be oil, NNPC said. These companies run joint ventures with the state-owned NNPC that pump most of the country’s crude. Nigeria currently produces about 9 billion cubic feet a day of gas, half of which is exported as liquefied natural gas. While 1 billion cubic feet a day is flared in the course of oil production, another 1 billion cubic feet is reinjected into oil wells daily for pressure stability. Some 2 billion cubic feet a day is supplied to industries and power plants, where demand is estimated to more than double to 5 billion cubic feet a day in two years. (www.bloomberg.com)

Tokyo Gas targets more US shale gas investments

May 18, 2015. Tokyo Gas Co Ltd, Japan's biggest gas utility, is looking to invest in more United States (US) shale gas production as a hedge to liquefied natural gas (LNG) imports from the US to start next year, the company said. The company has inked contracts to buy 1.9 million tonnes per year (tpy) of LNG from U.S. producers and aims to invest in an equal volume in the upstream sector, Tokyo Gas said. The company has contracted to buy 1.4 million tpy of U.S. LNG from the Cove Point project, which will start shipments in the second or third quarter next year, and 0.5 million tpy from Mitsui & Co's Cameron project, Tokyo Gas said. In 2013, Tokyo Gas bought a stake in a shale gas field in Texas' Barnett Basin from Quicksilver Resources that would give it 0.35 million to 0.5 million tpy of gas output. Companies seeking to attract investments in U.S. shale projects are offering terms that could work even after oil prices fell, he said, citing a project proposed last month in Houston that would yield fixed revenue of $11 per million British thermal units for deliveries by ship to Asia. Tokyo Gas said US gas delivered to Asian destinations is competitive to oil-indexed supplies when oil is at $70 a barrel, but loses its cost competitiveness at $50 a barrel. (www.reuters.com)

Goldman Sachs sees Brent crude oil at $55 a barrel in 2020

May 18, 2015. Brent crude oil will trade at $55 a barrel in five years according to Goldman Sachs Group Inc., more than $10 lower than current prices and a discount of $20 to 2020 futures. The bank assumes that long-term oil prices could drop as companies make “efficiency and productivity” improvements, according to a report. Shale oil producers could break even with West Texas Intermediate crude, the U.S. benchmark, as low as $50 a barrel by 2020, it said. Oil’s rally from a six-year low in March is stalling as U.S. output remains near a record even as the number of rigs drilling for oil in the nation shrinks. Producers battered by the steepest market collapse in a generation are signaling for the first time that they believe the worst is behind them. U.S. shale drillers Carrizo Oil & Gas Inc., Devon Energy Corp. and Chesapeake Energy Corp. all lifted their full-year production outlooks this month. EOG Resources Inc. said it plans to increase drilling as soon as crude stabilizes around $65 a barrel, while Pioneer Natural Resources Co. has said it is preparing to deploy more rigs as soon as July. (www.bloomberg.com)

Downstream…………

US refiners dominate western hemisphere markets

May 18, 2015. The United States (US) is fast becoming the major refining hub for the entire western hemisphere as plentiful crude at home and superior efficiency enable U.S. refiners to grab market share across the region. U.S. refiners supply almost a quarter of the rest of the hemisphere’s daily fuel demand, up from less than 10 percent a decade ago. U.S. refiners are exporting more than 4 million barrels of gasoline, diesel and other fuels every day around the world, up from 1 million barrels per day in 2005. Two-thirds of the exports, almost 2.8 million barrels per day (bpd), go to markets in the western hemisphere, according to U.S. Customs. Argentina, Brazil, Canada, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, Guatemala, Honduras, Mexico, Panama, Peru and Venezuela all received record or near-record shipments last year. Other countries as far away as France, Nigeria, China, South Korea, Australia and Lebanon have also seen increased imports from the United States. But the western hemisphere has been the biggest and fastest growing market for U.S. refineries, accounting for an extra 2 million barrels per day since 2005. U.S. refiners have turned to exporting as demand for gasoline and other refined fuels has stagnated at home. Domestic consumption of petroleum products peaked in 2005, though recently there have been signs of renewed growth as oil prices have fallen. At the same time, the mostly small, old and inefficient refineries across the rest of the hemisphere have struggled to meet growing demand, creating a gap into which U.S. refiners have stepped hungrily. U.S. refineries have benefited from soaring shale production and the ban on crude exports which enables them to buy crude at home at a steeply discounted price to process it for export. (www.reuters.com)

Ecopetrol's Cartagena refinery to restart later in year

May 13, 2015. Ecopetrol's Cartagena refinery on Colombia's north coast will return to operation around October or November but could take up to five months to reach its normal production speed, the state-run company said. The refinery, which produces fuels and other oil derivatives mainly for the export market, has been undergoing a $6.4 billion renovation that is expected to double its capacity to around 165,000 barrels per day. Ecopetrol said the plant would start up in stages until all 31 of its refining units were brought online. Ecopetrol said it had returned to profit again in the first quarter of the year after reporting a rare loss in the fourth quarter of 2014, due to the plunge in crude oil prices. Profits were down 96 percent from a year ago. (www.reuters.com)

Transportation / Trade……….

Georgia denies key permit for Kinder's Palmetto pipeline

May 19, 2015. The state of Georgia's top transportation official has denied Kinder Morgan Inc's request for a key permit to build a $1.12 billion gasoline and distillate pipeline through the southeast part of the state. In a letter, Georgia's Department of Transportation Commissioner Russell McMurray said he had determined that Kinder's proposed 360-mile (579 km) Palmetto Pipeline is not critical enough to allow the company to condemn property and obtain easements along its route to allow its construction. The 167,000 barrels per day (bpd) Palmetto Pipeline would run from Belton, South Carolina, to Jacksonville, Florida. The project would also involve more storage tanks and pump stations to add 125,000 bpd of capacity on part of Kinder's 3,100-mile-long, 700,000 bpd Louisiana-to-Virginia Plantation Pipeline system. That new capacity would stretch from Baton Rouge, Louisiana, to the Palmetto connection in South Carolina. (www.reuters.com)

Poland-Lithuania Gas Interconnection gets EU financial aid

May 19, 2015. Poland's gas transmission system operator, Gaz-System S.A. and Lithuania's natural gas transmission system operator, AB Amber Grid signed a tripartite agreement with the European Union's (EU) Innovation Network Executive Agency (INEA) on the financial assistance of the EU to the Project Preparatory Works for the Poland-Lithuania Gas Interconnection (GIPL). Under this Agreement, the Project was granted financial assistance of the EU of €10.6mn under the Connecting Europe Facility (CEF). The GIPL project aims at the integration of the Baltic States gas markets into a single gas market of the EU, at the diversification of gas supply sources and at the enhancement of the security of gas supplies. Preparatory works for the implementation of the GIPL Project were started back in 2009. The year 2011 saw the preparation of the GIPL Business Environment Analysis and the year 2013 marked the preparation of the Feasibility Study of the GIPL Project. The GIPL Project's Environmental Impact Assessment Procedures on the Polish territory began back in 2013 and are scheduled for completion in 2016. The prospective gas transmission pipeline will connect gas compressor stations of the two countries: the Lithuanian Gas Compressor Station of Jauniūnai and the Polish one of Rembelszczyzna. Total length of the prospective gas pipeline is 534 km, of which about 357 km fall within the territory of Poland. The GIPL Project is estimated to require an investment of €558mn, of which €422mn in the territory of Poland and €136mn in the territory of Lithuania. Launch into operation of the GIPL is scheduled for 2020. (www.enerdata.net)

Saudi Arabia's March oil exports highest in over nine years

May 18, 2015. Saudi Arabia's crude exports rose in March to their highest in almost a decade, official data showed, a sign of unexpectedly strong global demand as the top oil exporter revved up its output to the loftiest rate on record. The Organization of the Petroleum Exporting Countries (OPEC) heavyweight shipped 7.898 million barrels per day (bpd) of crude in March, up from 7.350 million bpd in February and 7.474 million bpd in January, figures supplied by Riyadh to the Joint Organisations Data Initiative (JODI) showed. That was the highest level since November 2005, when the kingdom shipped 7.962 million bpd, according to JODI. Oil Minister Ali al-Naimi has said Saudi Arabia produced some 10.3 million bpd of crude in March, highlighting the strength of global demand, which has helped lift refinery profit margins to their highest in years. The increase underlined Saudi Arabia's determination not to cede market share to higher-cost producers, such as U.S. shale drillers. The kingdom and others in the OPEC have resisted cutting production to shore up oil prices. (www.reuters.com)

Russia urges EU to support gas pipeline crossing Turkey

May 15, 2015. Russia's foreign minister Sergei Lavrov has urged the European Union (EU) to support the idea of a Moscow-backed pipeline that would bring natural gas across the Black Sea to Turkey and the rest of Europe. Sergei Lavrov said the pipeline — which could include Greece, Macedonia, Serbia and Hungary — would bring "energy stability" to Europe. Greece's left-wing government has expressed interest in the project, dubbed Turkish Stream. The United States, however, has been encouraging the Trans-Adriatic Pipeline, which will take Azeri gas from the Caspian Sea to Italy. Russia scrapped plans for another pipeline for Southern Europe amid a deepening crisis with the West over Ukraine. (www.downstreamtoday.com)

Mexico's Pemex signs 5 mn barrel crude contract with Hyundai

May 14, 2015. Mexican state oil company Pemex said it has signed a contract with South Korea's Hyundai to sell the company crude in the second half of this year. Pemex said the contract calls for 5 million barrels to be sold to Hyundai Oilbank Co Ltd, mostly heavy Maya crude as well as some of Pemex's Isthmus light crude. Hyundai Oilbank Co Ltd is a major producer and distributor of oil and refined products in South Korea, and is part of conglomerate Hyundai Group. In March, the head of Pemex's trading arm PMI said that by the end of this year the company expected to double crude exports to South Korea, one of the firm's top markets as it seeks to diversify its sales away from the United States. Pemex announced a 1 million barrel crude shipment to South Korea's second-biggest refiner, GS Caltex Corp, the first installment of a separate 5 million barrels in shipments to the country that was expected to be finalized in April. (www.reuters.com)

Pipeline carrying Nigeria's Bonny Light crude for export shut down

May 14, 2015. The Trans Nigeria Pipeline that carries Nigeria's Bonny Light crude oil to an export terminal has been shut down since May 12, Shell said. The company closed the pipeline, which has the capacity to carry around 180,000 barrels per day of crude oil to the Bonny Export Terminal, following a leak in the Ogoni area of Nigeria. Shell said the closure has not led to a force majeure declaration, but would not otherwise comment on exports. The expected duration of the closure was not immediately clear, but traders have said Bonny Light loadings were delayed by four to six days, and that some of the June-loading cargoes could be deferred to July as a result. (af.reuters.com)

Poland's PGNiG seeks arbitration in Gazprom dispute

May 13, 2015. Poland's largest gas distributor PGNiG said it had filed for arbitration with the Stockholm Arbitration Tribunal in a dispute with its biggest gas supplier Gazprom, looking to change the pricing of their long-term contract. The steps taken by PGNiG aim to bring the contract in line with the current conditions on the European natural gas market, the company said. The Polish firm lodged the arbitration suit after it failed to renegotiate the contract with Gazprom in talks that began in November last year. (af.reuters.com)

Philippines' First Gen readies plans for $1 bn LNG import terminal

May 13, 2015. The Philippines' First Gen Corp said construction of its $1 billion LNG terminal should begin by next year to ensure unhampered operation of its power plants when the country's Malampaya natural gas fields run dry in the next decade. The company intends to keep a 50 percent stake in the project and give partners the other half, including a foreign investor, First Gen President Francis Giles Puno said. First Gen's regasification terminal is one of at least four such projects that would open the Southeast Asian country's doors to natural gas imports. Australian-listed Energy World Corp Ltd is looking to switch on its Quezon LNG import hub and power plant this year, while Manila Electric Co recently said it was in talks with Osaka Gas Co Ltd to build natural gas facilities, including a regasification terminal. Shell, operator of Malampaya, is also looking to set up a floating regasification facility near its Tabangao refinery in the Philippines. Construction of First Gen's terminal should begin in the second half of 2016 or early 2017 so that it will be ready by 2020 or 2021, before Malampaya is depleted by 2024, Puno said. (af.reuters.com)

China reduces oil product export quotas in second quarter

May 13, 2015. Beijing has cut the pace at which it is allowing Chinese refiners to ship out oil products this year by more than 40 percent in its second quarter review of annual export volumes, traders familiar with China's oil markets said. China controls oil product exports through quotas to state-run refiners after assessing domestic needs. Sinopec Corp, CNOOC Ltd and China National Petroleum Corp (CNPC) were given an additional oil product export quota of 5.6 million tonnes for the year, down from the 9.75 million tonnes initially awarded for the year in the first quarter. The state refiners could not be reached for official comment on the matter. The refiners can usually apply for more allowances once initial quotas are used up. The quotas are typically given every quarter after a review of domestic supply and demand balances. The drop in the volumes issued this quarter are likely due to expectations of lower operating rates, high domestic prices and high inventory, traders said. Through April, Chinese refineries have been running at near-record levels of around 10.5 million barrels per day (bpd), according to data from the National Bureau of Statistics (NBS), but traders are expecting a heavy refinery maintenance season this month. The largest drop in the quarterly quota issue was in gasoline, with the allowance cut by nearly half to 1.4 million tonnes from an initial 2.7 million tonnes, traders said. The additional jet fuel export volume quota was cut to nearly 3 million tonnes, from a first-quarter quota issue of 5.6 million tonnes, they said. Gasoil posted the least reduction of about 7 percent to 1.26 million tonnes added in the second round. Chinese refiners are expected to boost diesel exports in May, with shipments climbing to over 500,000 tonnes, as the refiners try to utilize unused portions of the quota from the first round. (www.reuters.com)

Policy / Performance…………

Libya's NOC chief sees higher oil prices, not relying on OPEC

May 19, 2015. The head of Libya's National Oil Corp (NOC) sees higher oil prices and said the company is working to boost output and regain market share taken by other producers. NOC Chairman Mustafa Sanallah said he saw signs of oil demand increasing across the globe and a fall in the supply of shale oil in the United States. Brent crude was trading at around $65 a barrel, up from a low near $45 seen in January but still nearly half the level set in June 2014 before a collapse due to a global glut. OPEC member Libya produced almost 1.6 million barrels of oil per day (bpd) before the 2011 revolution which ousted Muammar Gaddafi, but output is now far lower due to unrest. Sanallah said Libya is pumping around 436,000 bpd, a total he hoped would increase by 200,000 bpd in the next two months through the repair of damaged fields and keeping dialogue with elements who have blocked pipelines and oilfields. The Organization of the Petroleum Exporting Countries (OPEC) meets on June 5 to review its 2014 decision not to cut production and focus on market share. Sanallah said his priority was boosting Libyan output rather than the OPEC meeting. He said he shared the view of Saudi Arabian Oil Minister Ali al-Naimi, seen as the driver of OPEC's 2014 decision not to cut output. (www.reuters.com)

World Bank targets Chinese gas amid largest global demand growth