-

CENTRES

Progammes & Centres

Location

[High Oil Price Risk Remains]

“As a country with one of the highest rates of growth in demand for oil, India must keep its eye on how the oil markets evolve. Hope of low oil prices on account of shrinking market for oil, carbon penalties, growing use of electric vehicles or unconventional oil production may be unfounded. The price of oil will be determined by the cost of the incremental barrel and this is unlikely to be affected by the presumed reduction in the size of the oil market…”

Energy News

[GOOD]

Greater investment in power transmission is likely to ease power outages!

Central scheme of gas pooling is a benefit for power plants but a burden for government budgets!

[UGLY]

The need to probe coal bids shows that any system of allocating resources can be gamed!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· High Oil Price Risk Remains

· Merchant Mining: Can We Learn from Past Mistakes?

ANALYSIS / ISSUES…………

· The German Energiewende turns around Industry’s Business Models (Part IIIb)

DATA INSIGHT………………

· Oil Demand by Region- Select Countries

[NATIONAL: OIL & GAS]

Upstream…………………………

· India pitches for rights to Iranian gas field in Persian Gulf

· Videocon-BPCL consortium discovers oil off Brazilian coast

· ONGC to take over Tapti gas field facilities

· Cambay basin in Gujarat holds 206 Bcf gas in one zone: Oilex

Downstream……………………………

· IOC plans foray into petrochemical production in US

Transportation / Trade………………

· India ONGC's sale prices dive on higher naphtha supply hopes

· Speculation over Saudi Aramco and RIL oil deal as talks drag on

Policy / Performance…………………

· Reliance Industries’ credit metrics to improve over next 2 yrs: Moody’s

· Hydro-carbon vision document for Northeast soon: Oil Minister

· Assam wants Centre to arrange natural gas for its thermal power plants

· Govt rejects BP's application for selling ATF

· Indian delegation to visit Iran to discuss oil deals

· Govt to auction oil fields of ONGC to private companies

[NATIONAL: POWER]

Generation………………

· CEA retains Karcham Wangtoo project capacity at 1 GW

· BHEL commissions 250 MW thermal power plant in Gujarat

· NHPC gets govt nod for land diversion at Dibang power project

· BHEL commissions Jindal Power's 2.4 GW thermal project

· NEEPCO hydel power project facing opposition

· India's electricity generation crosses 1 trillion units a yr, first time

Transmission / Distribution / Trade……

· Telangana to end power sharing arrangement with AP

· Power Grid board approves ` 55.4 bn investment

· Railways, Coal Ministry, Odisha govt sign MoU on transportation of coal by rail

· Lanco Infra sells Udupi plant at ` 63 bn to Adani Power

· Rockefeller pledges $75 mn to light up 1k villages

Policy / Performance…………………

· PFC to raise up to ` 600 bn in FY16

· Central scheme spells hope for out-of-use power plant

· Maharashtra govt targets 14.4 GW power generation by 2019

· Manoharpur coal mine operation likely in 2017

· To probe details, Ministry rejected coal block bids

· Discoms await comfort letter from govt to get loan

· No backing out of Jaitapur nuclear power project: Maharashtra CM

· Ten percent hike in electricity tariff in MP

· Telangana and AP govts want 85 percent power from upcoming NTPC projects in the two states

· India to get Canadian uranium from 2nd half of 2015

· JPL to retain control of its washery, CIL can't have it: HC

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· GDF Suez says natural gas discovery made in southeast Algeria

· Kuwait discovers 4 new oil fields in Kingdom

· Norway's Minister of Petroleum opens Valemon field

· Petrobras discovers oil, gas in Brazil's Amazon and Espirito Santos Basins

· OVL betting on Imperial Energy’s shale reserves

Downstream……………………

· Puma Energy may invest $400 mn in Angola oil terminal

· Air Products and ACWA to build gas complex for Saudi Aramco's Jazan refinery

· Production normal at South Africa's largest refinery after fire

Transportation / Trade…………

· Russia pushing Greece gas-pipeline accord before Turkey signs on

· Energy-Hog China seen sitting out big global oil & gas deals

· Iraq oil exports slip so far in April, still near record

· BP, Shell ship Canada crude cargoes from Texas to Europe

· Canada pipelines still need better spill response, Clark says

· PDVSA says Venezuela oil exports at 2.4-2.5 mn bpd

· Australia's Santos nears start of its $18.5 bn gas export development

· Indonesia's Bontang LNG export plant closes sell tender

Policy / Performance………………

· Norway considers support for Statoil project

· Nigeria needs to raise gas prices to bridge $55 bn gap

· Naimi says Saudi oil production near record high in April

· UK govt threatens to revoke oligarchs' North Sea oil licences

· Russia economy recovering as oil reliance eases, Dvorkovich says

· BP says taking more oil from Iraq as payment

· Abu Dhabi says still in talks with companies on oil concessions

· Hedge funds turn most bullish on oil in 8 months as output slows

· NGTL’s $1.7 bn Canadian pipeline project secures NEB approval

· TransCanada’s pipeline benefit vows fail to sway Quebec’s Arcand

· Ukraine to curb EU gas import as oil drop cuts Russian price

[INTERNATIONAL: POWER]

Generation…………………

· Amec Foster Wheeler wins power generation contract

· Chinese coal giant to cut production by 50-60 mn tonnes

Transmission / Distribution / Trade……

· Canada to supply uranium to India for its civil nuclear plants for next 5 yrs

Policy / Performance………………

· China picks Pakistan dam as first stop on $40 bn Silk Road

· AGL to close coal power stations by 2050

· China extends pilot power sector reform to more regions

· Australia-India civil nuke pact possible by year end: Australian Foreign Minister

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Orange Renewable Power triples capacity with plants in MP and Rajasthan

· Delhi's Tihar jail gets 430 KW solar power plant

· UP organises summit on emerging biz opportunities in solar energy

· Developed world have to walk the talk on climate change: Environment Minister

· Wind energy target of 60 GW by 2022 is easily achievable: CPI-ISB report

· India reverses stance on potent greenhouse gases ahead of talks

· OIL commissions 54 MW wind energy project in Gujarat, MP

· ‘No abundant reserves of coal and gas’

· Solar power lights up Bengaluru cricket stadium

· Green energy potential remains untapped: MNRE

· Solar power to NDMC households

· Sterling and Wilson develops 140 MW solar power in 2014-15

· Bio-fuels need of the hour for India: Gadkari

GLOBAL………………

· Total CEO says spurning US shale for solar investment

· Obama climate plan seen making coal plants less efficient

· Energy review warns of rising US costs from climate change

· British Columbia carbon plan eyes buildings while caps ruled out

· China adds solar power the size of France in first quarter

· SunPower and Apple to develop solar power projects in China

· EDF completes construction of 200 MW Hereford wind power project in US

· Hanergy Thin Film solar venture to start first in Saipan

· Climate change blamed as shifting flood plains plague Mozambique

· ET Solar, Gate Solar team up to build solar power plant in Philippines

· Closing Germany’s dirty old coal plants seen aiding utilities

· Algonquin completes two renewable power generation projects

· Brazil to offer ambitious climate plan with more renewables

· South Africa to double clean-power plans as new bidders named

· Energia Reino signs EPC agreement for 12 MW biomass power plant in Nicaragua

[WEEK IN REVIEW]

COMMENTS………………

High Oil Price Risk Remains

Lydia Powell and Akhilesh Sati, Observer Research Foundation

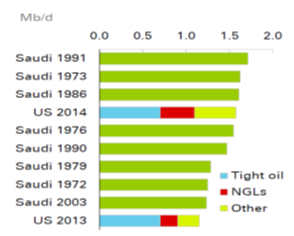

Delivering a lecture on critical drivers of the global oil market in Washington in 2013 Dr Fereidun Fesharaki, well known analyst of world hydrocarbon markets observed that it was God, Saudi Arabia and market fundamentals (in that order) that decided global crude prices. The list of factors as well as the order in which Dr Fesharaki listed them may still be valid even if those uncomfortable with the idea of God having something to do with the oil market use factors such as geology, technology, policy, politics or institutions instead. Those who want to stick to the market as the underlying driver of oil price would take the cost of the marginal barrel of oil as the determinant of price. However the cost of producing the marginal barrel depends on where it is produced. ‘Where the marginal barrel is produced’ depends on factors including but not limited to the oil market. This is reflected in some of the recent reports on oil markets which suggest that they would probably replace Saudi Arabia with the United States in Dr Fesharaki’s list of factors driving the oil market (Chart 1).

Chart 1: Largest Oil Production Increases

Source: BP Energy Outlook 2035, February 2015

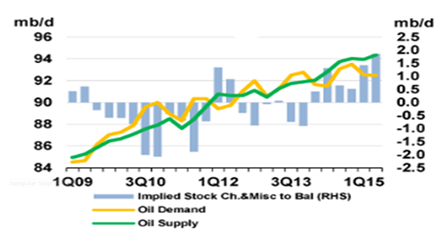

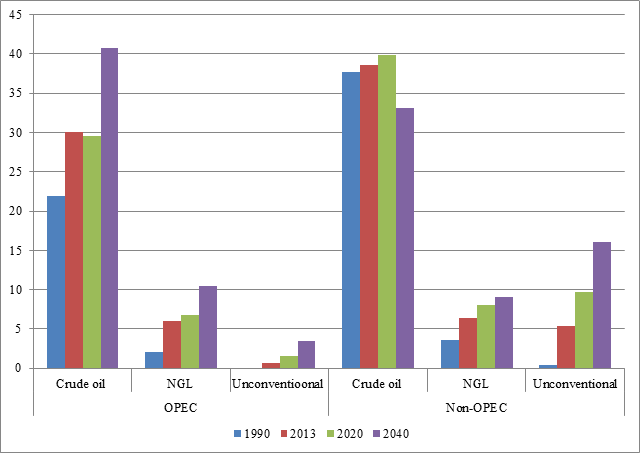

Chart 2 from the medium term oil market report of the International Energy Agency (IEA) released in February 2015 captures the emergence of the United States as the new swing producer who balances the market. In chart 2, a deficit supply situation in the oil market shifts into a surplus situation in the beginning of the second quarter of 2012 with a sustained surplus of over 1.5 million barrels per day (bpd) emerging by the first quarter of 2015. Much of this surplus is attributed to production of non-conventional oil from non-OPEC regions. According to IEA’s World Energy Outlook 2014 (WEO 2014), non-OPEC production of unconventional oil mainly light tight oil (LTO) from the United States increased from 0.4 million bpd in 1990 to 5.4 million bpd which is more than a ten-fold increase in just over a decade (chart 3).

The medium term oil market report of the IEA concludes that ‘this time the oil market correction would be different’ because (1) the United States as the new swing producer is not Saudi Arabia (politically, institutionally and otherwise) and (2) that the production of LTO in the United States will respond very quickly to changes in supply and demand conditions unlike conventional crude oil. As IEA puts it, ‘LTO production in the United States has upended the traditional division of labour between OPEC and Non-OPEC countries and the resilience of LTO production will ensure that price corrections in the oil market will happen as fast as the price rallies’. OPEC’s pursuit of market share rather than price management is compared with a similar move in 1986 by most of the recent oil market reports but the IEA is optimistic that OPEC strategy is unlikely to drive out surplus production and that LTO production may actually come out stronger after the price correction.

Chart 2: Oil Demand-Supply Balance

Source: Medium Term Oil Market Report 2015, IEA

Others, such as analyst Arthur Berman are not so optimistic over the prospects for LTO production in the United States. In his recent blog post, he points out that in an environment of low interest rates, the desire for yields is leading investment banks to direct capital into US E & P companies to fund tight oil plays. He points out that the financial performance of many of the companies engaged in tight oil plays is characterised by falling cash flows and growing debt. Based on data from Schlumberger he concludes that US Shale companies had to drill 100 times more wells than Saudi Arabia to reach the same daily production as that of Saudi Aramco. This relates to the point made earlier that who gets to produce the last barrel does not depend entirely on the oil market. We will have to wait probably until 2020 to find out who is more accurate.

Chart 3: Crude Oil Production and Liquids Supply by Source (Current Policies Scenario)

Source: World Energy Outlook 2015, IEA, NGL – Natural Gas Liquids

If we return to WEO 2014 projections for oil supply under a current policies scenario captured in Chart 3, it appears that the role of non-OPEC conventional and unconventional liquids production would remain significant until 2020 but after that it would once again be OPEC conventional oil production that would dominate. This means that after 2020 the market may look very much like what it did before the United States emerged as a swing producer.

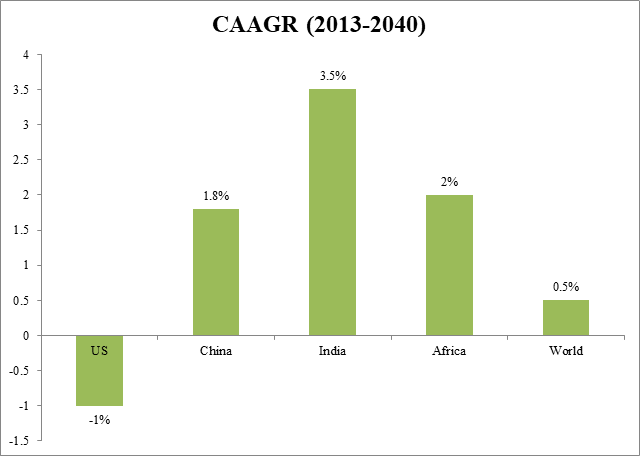

How the oil markets evolve has significant implications for India. As per the WEO 2014, net growth in oil demand is expected to come almost entirely from non-OECD countries till 2040. Projections by WEO expect that for each barrel of oil eliminated from demand in OECD countries, two additional barrels of oil will be consumed in the developing world. WEO highlights India and Nigeria as countries with the highest rates of oil demand growth (3.5% until 2040) with oil demand in India projected to touch 9.2 million bpd (under new policies scenario, could be more under current policy scenario), 2.5 times that of today (3.7 million bpd in 2013) pushed mainly by 70% growth in demand from the transport sector.

As a country with one of the highest rates of growth in demand for oil, India must keep its eye on how the oil markets evolve. Hope of low oil prices on account of shrinking market for oil, carbon penalties, growing use of electric vehicles or unconventional oil production may be unfounded. The price of oil will be determined by the cost of the incremental barrel and this is unlikely to be affected by the presumed reduction in the size of the oil market.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Merchant Mining: Can We Learn from Past Mistakes?

Ashish Gupta, Observer Research Foundation

Coal auctions are happening in a big way but unfortunately, India has not incorporated lessons learnt from past mistakes. The idea of giving coal blocks to State Public Sector companies so as to prepare the coal sector for the commercial mining is a genuine move. But the way it is being carried out will not produce any fruitful results. Why? The analysis chart is given below:

List of Allotees – Schedule II Mines

|

No. of Blocks allotted |

Name of the Allotee |

Core Business |

Can be treated as Commercial Miner |

End Result |

|

1 |

Damodar Valley Corporation |

Power & Mining |

Yes |

More efficiency |

|

1 |

Karnataka Power Corporation Ltd. |

Power |

No experience in mining |

No efficiency improvement in coal mining |

|

1 |

Punjab State Power Corporation Ltd. |

Power |

No experience in mining |

No efficiency improvement in coal mining |

|

1 |

Rajasthan Rajya Vidyut Utpadan Nigam Ltd. |

Power |

No experience in mining |

No efficiency improvement in coal mining |

|

5 |

West Bengal Power Development Corporation Ltd. |

Power |

Have some experience in mining through State Utility (West Bengal Mineral Trading & Development Corporation) |

Some efficiency improvement |

List of Allotees – Schedule III Mines

|

No. of Blocks allotted |

Name of the Allotee |

Core Business |

Can be treated as Commercial Miner |

End Result |

|

1 |

Bihar State Power Generation Company Ltd. |

Power |

No |

Continue with same MDO practice and hence no improvement |

|

2 |

Chhattisgarh State Power Generation Company Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Gujarat State Electricity Corporation Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Jharkhand Urja Utpadan Nigam Ltd. |

Power |

No |

No efficiency improvement |

|

4 |

National Thermal Power Corporation Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Odisha Coal and Power Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Rajasthan Rajya Vidyut Utpadan Nigam Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Maharashtra State Power Generation Company Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Tenughat Vidyut Nigam Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

Telangana State Power Generation Corporation Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

The Singareni Collieries Company Ltd. |

Mining |

Yes |

More efficiency |

|

1 |

Steel Authority of India Ltd. |

Steel & Mining |

Yes |

More efficiency |

|

1 |

UP Rajya Vidyut Utpadan Nigam Ltd. |

Power |

No |

No efficiency improvement |

|

1 |

West Bengal Power Development Corporation Ltd. |

Power |

Have some experience in mining through State Utility |

Some efficiency improvement |

One can observe from the above chart that most of the Central/State Utilities that have got coal blocks do not have any prior experience in coal mining. These companies are very efficient in their core business but they will not play a role in achieving the one billion tonne coal output target set for 2019. The reason is that they are not commercial miners. They need to hire Mine Development Operator (MDO) through tendering process which unnecessarily delays mining operations. To achieve efficiency these coal blocks must be given to public sector companies which have some experience in coal mining and should be allowed to operate as merchant miners. The move will infuse competition and increase productivity. The same holds true for private power producers who are treated at par with miners. The idea of auction is not to increase revenue but to optimise the usage of natural resource. This is the area where the government should proceed with diligence. Is anyone listening?

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

The German Energiewende turns around Industry’s Business Models (Part IIIb)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 44

|

T |

he ongoing Energiewende in Germany (“energy turnaround”) requires considerable transformation of the utilities’ business models. The prevoius part (IIIa) has focussed on the ‘big four’ incumbents and how they meet the strategic challenges. This present second part (IIIb) will take a look at new business models that are concomitantly evolving with the industry’s restructuring. It concludes with a more global foresight relating to some ongoing tendencies that are expected to strengthen the green paradigm further on.

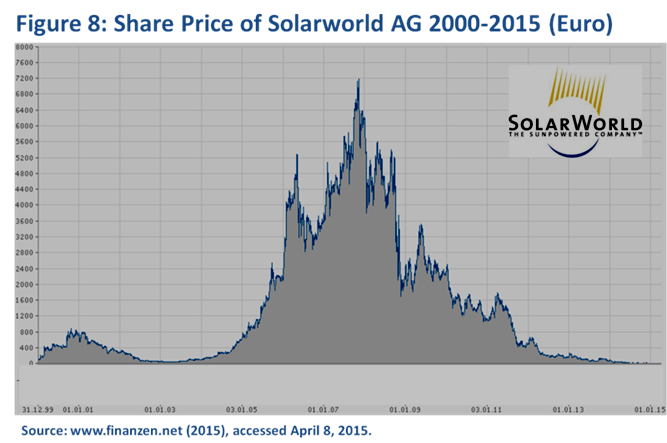

Beyond the bitter fate of the ‘big four’ even most of the thriving companies - like the prominent photovoltaic (PV) cell producers Solarworld, Q-Cells, Conergy or Solon - in the windfall of all the generous financial support associated with the Energiewende were getting into dire straits already soon after the initial boom. Primary reasons were at first the creation of excess capacity at the German solar market and then the influx of cheaper PV modules and cells from Chinese competitors entering the German market. Several German solar producers rushed into bankruptcy. Even the former showpiece company Solarworld could barely escape crash, and saved its neck so far only by acknowledging a harsh debt cut and by relinquishing autonomy in favour of its new major investor Qatar. Figure 8 illustrates the rollercoaster ride the Solarworld stocks have been on in recent years: from penny-stock level up to its all-time peak late 2007 and back down again. Recently it was blamed the second consecutive year for being the inglorious leader of ‘capital burning’ in Germany; its stock price was down 82% in 2014 alone, and moreover, since 2010 the price fell by 99.5%.

Even beyond the pioneers of the solar and wind boom it is expected that now the whole industry will adjust to the business opportunities arising from the decentralisation drive towards more data-based and interconnected smart grids solutions that will help to match growing intermittent supply and demand efficiently. Alongside the traditional providers of industrial solutions in the energy sector like U.S. General Electric (GE) or German Siemens new innovative player are entering the market: one outstanding example is Google’s $ 3.2 bn acquisition of Nest Labs in Jan. 2014 in order to be involved in the promising future business of smart-home technologies. Nest Labs manufactures a variety of smart home devices like thermostats, which learn a user’s habits over time and adjusts the room temperature accordingly. Nest Labs aims to establish itself as the operating platform for web-connected home devices: users will be able to communicate with appliances from Whirlpool, cars from Mercedes, remote controls from Logitech among others. Quite recently Nest has teamed up with solar power system manufacturer SolarCity to make savings easier for homeowners.

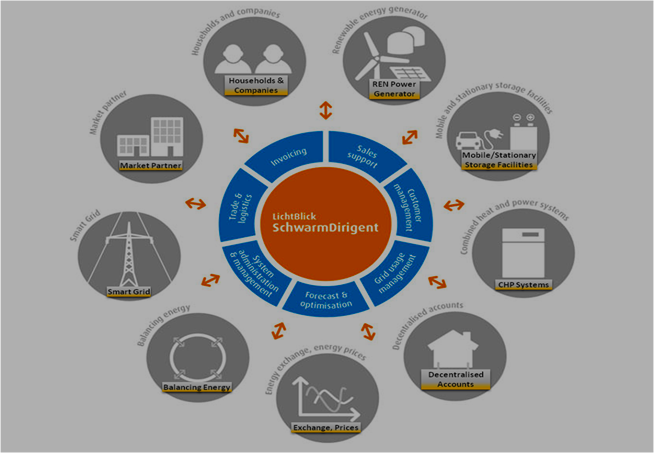

In Germany one signal example of how to carve out a fortune in the future energy industry is the so-called SchwarmEnergie-concept provided by one of the Germany’s largest green electricity and gas suppliers Lichtblick. SchwarmEnergie (“swarm energy”) intends to cope with the requirements of a fragmented and decentralised electricity market, in which more and more power is produced locally in a variety of small units (e.g. renewables like photovoltaic systems, (smallest) combined heat and power stations, heat pumps, solar batteries or the batteries of electric vehicles), and increasingly stored. Therefore the strict separation of consumers and producers is going to be superseded as we go along. The basic idea is to interconnect thousands upon thousands of involved small-scale market players (e.g. households) by means of appropriate smart control systems and an applicable software that could quickly rewire and provide a "virtual power plant" at an aggregate level (as illustrated in Figure 9). Given that, traditional back-ups for intermittent wind and solar power generation by large power plants (and mostly operated by large utilities) will become more and more redundant. The whole approach is based on Lichtblick’s IT platform SchwarmDirigent (“swarm conductor”) that aims to bundle the countless processes of an increasingly complex energy world. The pilot scheme was already successfully rolled out and provides an instructive foretaste of what is to come.

Figure 9: Synopsis of the SchwarmEnergie Concept (Lichtblick)

Source: Lichtblick.de, accessed April 16, 2015. Compiled by author.

In the upshot, energy markets must be understood to be in a constant state of flux due to diverse reasons that comprise altering resource availability, the ever-changing supply/demand (market) conditions but also (politically initiated) shifts in the institutional framework. Even if utilities have often operated under temporary exceptional permissions and/or government backed (or being a mere state company) it can be stated that there is no guarantee for a certain business model to survive. As we have seen, it is actually more important to address the changing conditions at the right time (i.e. early enough) with the right strategy (i.e. dare to advance), otherwise the risk of failure is rising enormously.

In the case of the Energiewende an institutional redeemer cannot be foreseen, politically there is currently no “too large to fail” or species protection for the ‘big four’. It seems to be more about being the last of their species as they are abandoned to their fate that results in a structural market adjustment at the end of the day: RWE might turn out to be a potential takeover target (if yet attractive enough for investors), Vattenfall seeks to get rid of its German business. Even the big four’s long established wheeling and dealing with the political circles in Berlin is evidently more and more for the birds and doesn’t provide a proper lifeline anymore.

The advantage in rapid transforming structures decidedly is with the small, flexible and innovative players. That’s a lesson we have actually also learnt from other energy markets, e.g. the US shale revolution that was actually not driven by the incumbent oil and gas majors but rather by smaller independents like Devon Energy, Chesapeake Energy or Continental Resources. Struggling to find new reserves and at times of rising uncertainty about the crude oil price, Exxon and other oil majors have now turned to gas as a proxy in fossil fuel market and consolidated the sector by several takeovers (with the last prominent merger seen just a couple of days ago when Shell announced to buy BG Group, a vital player in the global gas market).

And there is yet another story behind the ongoing adaptation of business models to spot that is very important for investors in long-lasting energy infrastructure assets to pay attention to: the trend to acknowledge the requirements of local pollution and global climate change. Beyond corporate green washing hypocrisy there are evermore concrete examples of large-scale and long-lasting energy industry’s restructuring really triggered by climate change considerations, like the shift away from lignite and brown coal in Germany, more and more investments of the oil super majors into lower carbon fossil fuel natural gas and/or renewables (or as BP’s new slogan puts it straight: “beyond petroleum”).

One could even be well-disposed to argue that the current restructurings are driven by the ‘unburnable carbon’ idea.[1] Even if there is still a lot of dispute about the genuine truth of this concept (which is likely to be verified only in the times to come), the times of being a myth are over and there is increasing evidence that the shadow of unburnable carbon becomes longer and starts to touch on a variety of crucial market players. One of the most recent paradigm is the disclosure of Norway’s Government Pension Fund Global (GPFG), actually the world’s richest sovereign wealth fund, to divest from 22 companies involved in coal mining, oil sands, cement production and coal-fired power production during 2014 on the basis of a broader assessment of companies’ business models and the sustainability of their operations over time. Moreover the GPFG has also divested from a further 27 companies, due partly to other environmental considerations.

A couple of days ago Bloomberg (2015) carried the headline “Fossil Fuels Just Lost the Race Against Renewables - This is the beginning of the end” and pointed out that now more capacity for renewable power will be added each year than coal, natural gas, and oil combined; and that the shift will continue to accelerate. The cost of wind and solar power continues to decrease and is now on par or cheaper than grid electricity in many areas of the world. Thus it’s only a matter of time that the world will see renewables cutting into the markets even without being backed by large subsidy systems, and it’s safe to assume that these will only be needed as stimulus if the institutional framework is set accordingly.

Against this backdrop the declaration of India’s largest power producer NTPC to more than double its current installed capacity to 90 GW in the next ten years might be put at risk, even if the power producer plans to include solar energy in its total installed capacity in the coming years. Given lifetimes of coal power stations of about half a decade or more the challenge to compete against cheaper renewables in times to come might be considered to turn out desperate. This is aggravated by the fact that state companies are known for their inefficiencies and stubborn market strategies. As has been shown the German ‘big four’ incumbents are struggling even in a slow evolving and foreseeable market environment due to strategic and management flaws. It is much to be hoped that players on the Indian energy market like NTPC will learn from the German experiment, envisaging the developments that are already looming ahead and shifting to more pioneering strategies – otherwise they might share the big four’s doom and face a rude awakening.

Sources

Agora Energiewende (2015a), Country Profile - Report on the German power system, Version 1.01., published February 2015.

Agora Energiewende (2015b), Zehn Fragen und Antworten zum Beitrag der Stromerzeugung zum Klimaschutzziel 2020, Hintergrundpapier von Dr. P. Graichen, Dr. G. Rosenkranz und P. Litz, März 2015.

Bloomberg (2015), Fossil Fuels Just Lost the Race Against Renewables, by Tom Randall, http://www.bloomberg.com/news/articles/2015-04-14/fossil-fuels-just-lost-the-race-against-renewables, accessed April 16, 2015.

Der Spiegel (2014a), Virtuelle Kraftwerke, No. 49/2014, 01/12/2014.

Der Spiegel (2014b), „Es geht nicht um Abwickeln“ - SPIEGEL-Gespräch E.on-Chef Johannes Teyssen, No. 50/2014, 08/12/2014.

Der Spiegel (2015), Die Kohle-Koalition, No. 14/2015, 28/03/2015.

E.ON (2015a), Annual Report 2014.

E.ON (2015b), Übersicht E.ON-Erzeugungskapazität (Geschäftsjahr 2013, rechtlich zurechenbare Kraft werksleistung), http://www.eon.com/de/geschaeftsfelder/stromerzeugung/energiemix.html, accessed April 04, 2015.

DWS [Die Deutsche Schutzvereinigung für Wertpapierbesitz] (2015), DWS-Watchlist 2015: Die groessten Kapitalvernichter, http://www.dsw-info.de/uploads/media/DSW_Watchlist_03.pdf, accessed April 08, 2015.

Federal Network Agency [Bundesnetzagentur] (2014), Monitoringbericht 2014, Nov 14, 2014, http://www.bundesnetzagentur.de/SharedDocs/Downloads/DE/Allgemeines/Bundesnetzagentur/Publikationen/Berichte/2014/Monitoringbericht_2014_BF.pdf?__blob=publicationFile&v=4

Finanzen-Net (2015), www.finanzen.net, used for various data.

Greenpeace (2015), Die Zukunft der großen Energieversorger, study carried out by Prof. Dr. Bontrup and Prof. Dr. Marquardt on behalf of Greenpeace, January 2015, https://www.greenpeace.de/sites/www.greenpeace.de/files/publications/zukunft-energieversorgung-studie-20150309.pdf

Lichtblick (2015), ‘SchwarmEnergie’: smart solutions for a new age of energy, http://www.lichtblick.de/en/schwarmenergie/, accessed June 16, 2015.

Manager Magazin (2015), Nächste Sparrunde bei Versorger - RWE-Chef drückt weiter die Kosten, April 13, 2015, http://www.manager-magazin.de/unternehmen/energie/a-1028247.html, accessed April 14, 2015.

Norges Bank (2015), CONSULTATION - REPORT FROM THE EXPERT GROUP ON INVESTMENTS IN COAL AND PETROLEUM COMPANIES, Norges Bank's letter to the Norwegian Ministry of Finance, 5 February 2015 http://www.nbim.no/en/transparency/submissions-to-ministry/2015/hearin---report-from-expert-group-on-instrumets-and-investments-in-coal-and-petroleum-companies-of-the-government-pension-fund-global/, accessed April 17, 2015.

Reuters (2014), E.ON open to talks over nuclear-decommissioning fund, December 07, 2014, http://uk.reuters.com/article/2014/12/07/uk-e-on-nuclear-funding-idUKKBN0JL0DG20141207.

Reuters (2015), Reshaped Vattenfall pursues sale of German lignite arm (UPDATE 1), Jan 15, 2015, http://www.reuters.com/article/2015/01/15/vattenfall-germany-sale-idUSL6N0UU1IK20150115.

RWE (2014), Facts & Figures 2014, October 2014, http://www.rwe.com/web/cms/mediablob/de/108808/data/0/54/Facts-Figures-2014.pdf.

RWE (2015), Annual Report 2014, March 2015.

Schuppe (2013), Brown clouds looming on the green energy horizon in Germany, in: ORF Energy Monitor, Vol. X, Issue 17, 08 Oct. 2013; http://orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=58145&mmacmaid=58146.

SolarServer (2015), SolarCity und Googles Nest Labs wollen Energiesparen für Kunden noch einfacher machen; Neue Photovoltaik-Kunden erhalten „lernenden Thermostat dazu, http://www.solarserver.de/solar-magazin/nachrichten/aktuelles/2015/kw16/solarcity-und-googles-nest-labs-wollen-energiesparen-fuer-kunden-noch-einfacher-machen-neue-photovoltaik-kunden-erhalten-lernenden-thermostat-dazu.html, accessed April 16, 2015.

Spiegel-Online (2014), Konzeptloser RWE-Chef: Jammern als Strategie, von F. Dohmen und S. Schultz, March 03, 2014, http://www.spiegel.de/wirtschaft/unternehmen/rwe-verliert-rueckhalt-bei-aktionaeren-angestellten-buergern-a-956548.html, accessed April 10, 2015.

Spiegel-Online (2015a), Energieriese in der Krise: E.on soll drei Milliarden Euro Verlust gemacht haben, http://www.spiegel.de/wirtschaft/unternehmen/e-on-soll-2014-drei-milliarden-euro-verlust-gemacht-haben-a-1021846.html, accessed March 30, 2015.

Spiegel-Online (2015b), Verluste: Betreiber beschließen Aus für Gaskraftwerk Irsching, http://www.spiegel.de/wirtschaft/unternehmen/irsching-betreiber-wollen-gaskraftwerk-stillegen-a-1026267.html, accessed April 01, 2015.

Spiegel-Online (2015c), Klimaschutz: Gabriel will neue Abgabe für alte Kohlemeiler einführen, http://www.spiegel.de/wirtschaft/service/gabriel-neue-klimaschutzabgabe-fuer-kohlekraftwerke-geplant-a-1024554.html, accessed April 03, 2015.

The Economic Times (2015), NTPC to be 90,000 MW company in 10 years: CMD Arup Roy Choudhury, Apr 3, 2015, http://articles.economictimes.indiatimes.com/2015-04-03/news/60787397_1_mw-solar-power-projects-cmd-ntpc-maximum-power, accessed April 07, 2015.

The Economist (2013), European utilities - How to lose half a trillion euros, October 10, 2013, http://www.economist.com/news/briefing/21587782-europes-electricity-providers-face-existential-threat-how-lose-half-trillion-euros

The Economist (2014), German power generators - Looking for lifelines, June 7, 2014, http://www.economist.com/news/business/21603467-embattled-eon-and-rwe-turn-government-and-courts-help-looking-lifelines

The Guardian (2015), World's biggest sovereign wealth fund dumps dozens of coal companies, D. Carrington, February 5, 2015, http://www.theguardian.com/environment/2015/feb/05/worlds-biggest-sovereign-wealth-fund-dumps-dozens-of-coal-companies, accessed April 17, 2015.

The Wall Street Journal (2014), Google's Nest Labs Opens Its Platform to Outside Developers, by A. Barr and R. Winkler, June 24, 2014, http://www.wsj.com/articles/googles-nest-labs-opens-its-platform-to-outside-developers-1403582672, accessed June 16, 2015.

to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Oil Demand by Region- Select Countries

Akhilesh Sati, Observer Research Foundation

|

Region/Country |

2013 |

2020 |

2030 |

2040 |

|

World (mb/d)* |

90.1 |

96 |

101.3 |

103.9 |

|

as % share of World |

||||

|

US |

19 |

19 |

15 |

13 |

|

China |

11 |

13 |

15 |

15 |

|

India |

4 |

5 |

7 |

9 |

|

Africa |

4 |

4 |

5 |

6 |

Oil Demand- Growth Rates- Select Countries

mb/d- Million Barrels Per day

CAAGR- Compound Average Annual Growth Rate

* Oil Demand as per New Policies Scenario of International Energy Agency

Source: World Energy Outlook 2014, International Energy Agency.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

India pitches for rights to Iranian gas field in Persian Gulf

April 21, 2015. With easing of Western sanctions against Iran in sight, India has made a renewed pitch to get rights to develop ONGC-discovered Farzad-B gas field in the Persian Gulf. A high level delegation compromising of officials from the ministries of finance and petroleum as well as executives from ONGC Videsh Ltd (OVL) and Mangalore Refinery and Petrochemicals Ltd (MRPL) visited Tehran to re-engage with Iran. The talks centered on getting development rights to the Farzad-B gas field in the Farsi block as well as on the possibilities of setting up gas-based petrochemical/urea plant in Iran. Besides getting rights of the Farzad-B field, discussions focused on putting up petrochemical projects especially in Asalouyeh Special Economic Zone and Iran's southeastern port city of Chabahar. OVL had in 2008 discovered the Farzad-B gas field in its Farsi exploration block in the Persian Gulf. To pressure India to act, Tehran last year put the field on the list of blocks it wants to auction in future, it has however not yet cancelled OVL's exploration license for the Farsi block which gives it the right to develop the discoveries it has made. OVL is the operator of the Farsi block that lies north of Qatar. It has 40 per cent interest in the 3,500 sq km block. State refiner Indian Oil Corp (IOC) too has 40 per cent stake, while the remaining 20 percent is with Oil India Ltd (OIL). The Farzad-B gas field may hold an estimated 21.68 trillion cubic feet (Tcf) of in-place reserves, of which 12.8 Tcf can be recovered. The reserves in Farzad-B are almost thrice the largest gas field in India. (www.dnaindia.com)

Videocon-BPCL consortium discovers oil off Brazilian coast

April 20, 2015. Good quality light oil has been established in a discovery made in an offshore Brazilian block where Videocon Industries and Bharat Petroleum Corp Ltd (BPCL) hold 40 percent interest. Brazilian national oil company Petrobras has completed formation test to assess the potential of a petroleum deposit in a well in the BM-SEAL-11 concession in the SEAL-M-426 block in ultra-deep waters of the Sergipe-Alagoas Basin. Drilling has identified two reservoir intervals of light oil and gas - the top with a thickness of 44 meters, and the bottom 11 meters thick, the bottom zone being a new discovery for the area. The well is located 102.7 kms from the city of Aracaju and 10.3 kms from the first discovery well 'Farfan', in a water depth of 2,467 meters. The consortium partners will continue implementation of the Discovery Assessment Plan (PAD) as approved by the Brazilian regulatory authority ANP. Petrobras holds 60 percent interest in the concession and IBV Brasil -- a Brazilian joint venture company equally held by Videocon Energy Brazil Ltd, a wholly-owned overseas subsidiary of Videocon, and BPRL Ventures NV, a wholly-owned subsidiary of BPCL -- holds the remaining 40 percent. (profit.ndtv.com)

ONGC to take over Tapti gas field facilities

April 19, 2015. Oil and Natural Gas Corp (ONGC) has agreed to take over a part of the abandoned assets of the western offshore Tapti gas field from its joint venture partners Reliance Industries Ltd (RIL) and BG once output falls to zero. With Tapti output declining rapidly, partners in the Panna-Mukta and Tapti fields — RIL, BG and ONGC, have decided to abandon the field. Gas output from the field has almost halved to 14.2 billion cubic feet (bcf) in 2014-15 while oil production was 0.2 million barrels, down 22 percent from previous fiscal. ONGC said the company plans to use the Tapti field assets, which include sub-sea pipelines and gas gathering stations as well as process platform, to advance production of gas from its neighbouring Daman field. The assets include Tapti gas processing platform, which received gas from sub-sea wells, removes water and other impurities before transmitting it to onshore. ONGC will lay a small length of pipeline from the Daman field to the process platform, which is connected by a 70-km pipeline to its facility at Hazira. The company is investing ` 5,219 crore in bringing to production the Daman gas fields. Production is expected by July 2016 at the rate of 2 million standard cubic meters per day and peak output of 8.35 mmscmd of gas and 9,286 barrels of condensate per day is likely by 2018-19. ONGC holds 40 percent interest in the Panna-Mukta and Tapti fields while RIL and BP have 30 percent each. The joint venture will continue to operate the Panna-Mukta field, which primarily is an oil bearing field located 90-km north-west of Mumbai in the Arabian Sea. It produced 7.2 million barrels of oil and 70.7 bcf of gas. According to RIL, the oil production from Panna-Mukta was almost flat while gas registered 8 percent increase. Primarily gas-bearing Tapti field is located 160 km north-west of Mumbai and is currently producing about one million standard cubic meters per day and even this output is expected to taper off to zero before the year end. The Panna-Mukta fields are expected to stay in production till fiscal 2019. (timesofindia.indiatimes.com)

Cambay basin in Gujarat holds 206 Bcf gas in one zone: Oilex

April 16, 2015. Aussie oil and gas explorer Oilex said its Cambay basin discoveries in Gujarat hold 206 billion cubic feet (Bcf) of gas and 8 million barrels of condensate reserves in just one zone. Oilex said Unrisked Contingent Resources in zone Y together with another zone, X, comes to 720 Bcf gas and 52.8 million barrels of condensate. In oil and gas terminology, 2P reserves as considered more accurate with 50 percent certainty of being recovered or produced. Contingent resource have only 10 percent chance of being produced. The Cambay block has a third zone, Z and contingent resource across the three zone may be as high as 12 trillion cubic feet. Oilex said the new estimate on the X and Y zones would provide a strong foundation for the immediate development of the Cambay field. Oilex expects to begin production from the Cambay-73 well in May and is also working towards production from the recently drilled Cambay-77H well. It plans to drill up to four wells this fiscal. The Cambay Field is located around 10 km from the gas pipeline network with spare capacity. The 2P Reserves are anticipated to support a plateau gas production rate of 50 million standard cubic feet per day, whilst together with contingent resources the plateau gas production rate of could be 125-250 million standard cubic feet per day. (www.business-standard.com)

Downstream………….

IOC plans foray into petrochemical production in US

April 15, 2015. In order to take advantage of shale gas & oil boom in the US, Indian Oil Corp (IOC) is reportedly looking at entering petrochemical manufacturing in that country. IOC is keen on having a stake in an upcoming project, which is still in the planning or is yet to reach financial closure stage. The finalisation of the deal is still a long way and will mostly fructify only after the 2016 presidential election in the United States (US), where gas exports policy has divided the industry. While energy companies want no control on the exports of shale gas, the chemical & petrochemicals companies (which can use gas to make petrochemical products) have urged the government to put some curb on the exports. Indian Oil already has a presence in the US shale market through its 10 percent stake in Carrizo’s liquid rich shale assets in the Niobrara basin in Colorado. (www.business-standard.com)

Transportation / Trade…………

India ONGC's sale prices dive on higher naphtha supply hopes

April 20, 2015. India's Oil and Natural Gas Corp (ONGC) has sold a May naphtha cargo at about $25 a tonne above Middle East quotes on a free-on-board (FOB) basis, down nearly 11 percent and 33 percent versus two April cargoes it sold from Hazira, traders said. The buyer of the 34,500-tonne cargo for May 4-5 loading from Hazira could be Total but this could not be confirmed as sellers and buyers usually do not comment on their deals, traders said.

The fresh premium ONGC has garnered for the Hazira cargo reflected a softer sentiment as talk of high volumes of naphtha arriving in Asia next month from Europe/the Mediterranean have dragged prices down. ONGC had previously sold two April cargoes out of Hazira at premiums of $37 and at least $28 a tonne to Middle East quotes on a FOB basis respectively. It also exports naphtha from Mumbai. (in.reuters.com)

Speculation over Saudi Aramco and RIL oil deal as talks drag on

April 16, 2015. Saudi Aramco and Reliance Industries Ltd (RIL) have not yet concluded a term contract to import diesel and gasoline, fanning market speculation that the long-standing annual deal may not be renewed. A deal has normally been signed by the first quarter, but negotiations have gone on longer at a time when Saudi Arabiahas become less reliant on imports following refinery expansions.

The term deal talks had stalled because the companies had not been able to agree a price yet. While Saudi Arabia is the world's top crude exporter, a lack of refineries to process crude into fuel products has meant the kingdom has traditionally relied on imports, largely from Asia. But a industry source who supplies products to Saudi Arabia said a deal might not be reached since there was less logic this year on both sides and RIL could use the barrels itself particularly given higher freight rates. (timesofindia.indiatimes.com)

Policy / Performance………

Reliance Industries’ credit metrics to improve over next 2 yrs: Moody’s

April 21, 2015. Reliance Industries’ credit metrics will improve over the next two years on completion of petrochemical and refinery projects, Moody’s said. The projects are petcoke gasification plant at its refinery, refinery off-gas cracker in petrochemicals, polyester/aromatics capacity expansion and import of ethane from the US. RIL’s profit before interest and depreciation increased by 8 per cent during the quarter ended March 31, 2015 because of the improved performance of its refining segment and despite revenues falling by 26 per cent. Revenues fell due to a slide in crude oil prices, which declined by more than 50 per cent since June 2014.

Moody’s report said revenues from RIL’s refining segment fell 31 per cent as crude oil prices plunged. Moody’s report said that RIL reported gross refining margins of USD 10.1 per barrel for Q4 versus USD 7.3 for the previous three-month period. As for the company’s petrochemical business, the segment recorded stable performance while the earnings from its upstream segment fell, in line with falling crude oil prices. (www.financialexpress.com)

Hydro-carbon vision document for Northeast soon: Oil Minister

April 20, 2015. A hydro-carbon vision document on the natural resources available in the Northeastern region will soon be released by the government, Lok Sabha was informed. Petroleum Minister Dharmendra Pradhan said the vision document will cover all natural resources available in the Northeast, as well as on possibility of finding hidden natural assets like oil and gas.

Pradhan said the government broadly follows the order of priority in the matter of allocation of domestic gas, which is: city gas distribution network for domestic and transport sectors, existing gas-based urea plants, existing gas-based LPG plants, existing grid connected and gas-based power plants and steel, petrochemicals and refineries for feedstock purposes etc.

He said the prevailing gas utilisation policy of the government does not envisage any reservation in the matter of allocation of domestic gas, thereby implying that a plant should be in position to consume the gas as and when it is available. The Minister said due to less demand of imported LNG, out of 62.10 million standard cubic meters a day (mmscmd) of total re-gasification capacity, 17.55 mmscmd remained unutilised. In power and fertiliser sectors, installed capacity was much less than the demand projected by a working group, he said. (www.business-standard.com)

Assam wants Centre to arrange natural gas for its thermal power plants

April 20, 2015. Assam has asked the Union petroleum and natural gas ministry to make arrangement for supply of natural gas from central public sector undertakings (PSUs) for Assam's thermal power plants. Assam Chief Minister Tarun Gogoi told Dharmendra Pradhan, Union petroleum and natural gas ministry, that Assam required increased thermal power generation to meet its increasing demand and asked the Union minister to make arrangement for natural gas for Namrup and Lakwa thermal power stations. Gogoi requested that the Centre should allocate on nomination basis the small gas fields to Assam state PSUs for exploitation of gas. On royalty on crude oil, Gogoi requested Pradhan to take "steps" so that Assam gets royalty on actual market price and not on the basis of heavily discounted sale price. (www.business-standard.com)

Govt rejects BP's application for selling ATF

April 20, 2015. Government has rejected British Petroleum (BP) plc's application for selling jet fuel to airlines on the ground that its investment does not qualify to get a retailing licence, Oil Minister Dharmendra Pradhan said. BP Exploration (Alpha) Ltd, a wholly owned subsidiary of BP plc, had on June 11, 2014 submitted an application for authorisation to market aviation turbine fuel (ATF) claiming to have invested USD 477 million in the country.

The Oil ministry in March wrote to Europe's second- largest oil company saying that its USD 477 million investment in India till date does not qualify it to begin selling jet fuel to airlines. He said that of the USD 477 million BP claimed to have invested in India, USD 259 million was said to a capital investment and another USD 2.3 billion was proposed to be further invested. BP's USD 7.2 billion spending in buying 30 percent stake in 21 exploration blocks of RIL is not being considered as capital investment. BP is keen to enter the booming aviation market in Asia's third-largest economy where ATF demand is expected to rise by 3-4 percent annually over the next few years. (zeenews.india.com)

Indian delegation to visit Iran to discuss oil deals

April 16, 2015. An Indian delegation will visit Iran to scout for investment opportunities ahead of an anticipated nuclear deal between the OPEC-member and world powers that would soften sanctions against the country. Officials from India's finance and oil ministries and executives from ONGC Videsh and Mangalore Refinery and Petrochemicals Ltd are part of the delegation that will hold meeting with their Iranian counterparts. India is Iran's biggest oil client after China although its imports from Tehran have declined under pressure from western sanctions. New Delhi's oil imports from Tehran have eased from 370,000 bpd in 2010/11 to about 220,000 million tonnes in 2014/15 under pressure from international sanctions. Iran and six world powers reached a framework nuclear agreement on April 2, spurring hopes for a final deal by end-June that would lift economic sanctions imposed by the West against Tehran's disputed nuclear programme. Apart from seeking more oil at better terms and other investment opportunities in the energy sector, India will push for development rights at the Farzad-B gas field in Farsi block. (in.reuters.com)

Govt to auction oil fields of ONGC to private companies

April 15, 2015. The government plans to auction 69 small and marginal oilfields of state-owned Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) to private companies, on a new revenue-sharing model. The petroleum ministry has floated a note for the Cabinet Committee on Economic Affairs for auctioning the fields that state-owned firms are “surrendering” because they were uneconomical to develop due to the government’s subsidy sharing mechanism. The fields will be auctioned on the basis of revenue share or the share of oil and gas, a bidder offers to the government upfront, and work programme. Companies, offering the maximum revenue share or percentage of oil and gas to the government and committing to do more work, will win the field. The weightage for revenue share will be 80 percent while 20 percent would be for work programme that may include drilling of exploratory and development wells and seismic studies. ONGC and OIL too are likely to bid for the fields, which they had originally discovered. As many as 63 discovered oil and gas fields are being surrendered by ONGC and another six by OIL. Developing these small and marginal fields was uneconomical after paying for fuel subsidies. ONGC and OIL have to pay up to $56 per barrel from the revenue they earn from selling oil produced from their fields, to help subsidise domestic cooking gas (LPG) and kerosene. After the subsidy payouts, they are left with hardly any money to operate a small or marginal field. If ONGC and OIL win the fields in the auction, they will not have to pay fuel subsidy on them. The fuel subsidy payouts are only for fields allocated to the two firms on nomination basis and they don't have to share the same on blocks they won in bidding under New Exploration Licensing Policy (NELP) since 1999. The marginal field will be treated at par with NELP blocks, they said. The ministry is reasoning the auctioning of the marginal fields to they being uneconomic for a large firm with huge overheads to develop or bring to production. Smaller firms with a fraction of operating cost can develop them at a much faster and economic rate. The revenue sharing model is a shift from the much-criticised production sharing contract regime where blocks were allocated to firms that bid the highest amount of work in the area. It allowed the firms to recover all their cost before sharing profits with the government, a regime which was criticised by the Comptroller and Auditor General as one that provides incentive to operators to keep raising cost so as to postpone government share. ONGC holds about 165 marginal fields (79 offshore and 86 onshore). Of which, 63 are being surrendered for auction. Marginal fields were given to ONGC before the licensing rounds on nomination basis. Hydrocarbons resources are locked up in these fields, but they cannot be produced economically on a standalone basis, or with a conventional approach. Of the 165 fields, with total ultimate reserves of 340 million tonnes, operations are going on in 139 and work is yet to start on 26. (www.business-standard.com)

[NATIONAL: POWER]

Generation……………

CEA retains Karcham Wangtoo project capacity at 1 GW

April 21, 2015. The Central Electricity Authority (CEA) in a recent letter to the Central Electricity Regulatory Commission (CERC) has said that the project capacity of the Karcham Wangtoo Hydro Electic Project in Himachal Pradesh will have to be maintained at 1,000 MW. The project is part of the two hydro plants of Jaiprakash Power Ventures Ltd for which Sajjan Jindal’s JSW Energy had agreed to pay Rs 9,700 crore. However, the deal’s enterprise valuation was based on the Karcham Wangtoo project having 1,091 MW generation capacity and 300 MW for the Bapsa II Project, both in Himachal Pradesh. The Karcham Wangtoo project’s capacity caused an earlier agreement with Reliance Power to break down. While the Jaypee Group has installed a 1,200 MW capacity at the location, its techno-economic clearance was for only 1,000 MW. Both the CEA and the Himachal Pradesh State Government had expressed safety concerns on allowing the plant to operate at 1,200 MW capacity. Jaiprakash Power Ventures while submitting the tariff petition for 2014-19 had stated a project cost of ` 6,900 crore for 1,091 MW for the Karcham Wantoo project. (www.thehindubusinessline.com)

BHEL commissions 250 MW thermal power plant in Gujarat

April 20, 2015. State-owned power equipment maker BHEL has commissioned a 250 MW coal-based thermal power plant in Gujarat. The unit has been commissioned at the Gujarat State Electricity Corporation Ltd's (GSECL) Sikka thermal power station (TPS) by Bharat Heavy Electricals Ltd (BHEL), on EPC (engineering, procurement and construction) basis, the company said. Two units of 120 MW each, supplied and executed earlier by BHEL are already in operation at Sikka. Another 250 MW unit, presently under execution at Sikka TPS, is also in an advanced stage of commissioning, it said. GSECL has recently entrusted BHEL with an order for setting up an 800 MW supercritical coal-based project at Wanakbori in Gujarat on EPC basis. (www.business-standard.com)

NHPC gets govt nod for land diversion at Dibang power project

April 17, 2015. State-run NHPC has received government's approval for diversion of land for the construction of Dibang project in Arunachal Pradesh. The project will come up on Dibang River in Lower Dibang valley district of Arunachal Pradesh and the company has already received techno-economic clearance for the project. The 3,000 MW hydel project, being developed by NHPC, at was originally scheduled to get commissioned by 2017 but delays in necessary clearances have pushed it back by about two years. The project was cleared by the Forest Advisory Committee (FAC) of the Ministry of Environment and Forests (MoEF), last year. At present, NHPC has an installed generation capacity of 6507 MW and another 3290 MW is under construction, according to the company. (economictimes.indiatimes.com)

BHEL commissions Jindal Power's 2.4 GW thermal project

April 16, 2015. Bharat Heavy Electricals Ltd (BHEL) said it has fully commissioned the 2,400 MW O.P. Jindal thermal power project in Chhattisgarh. The previous three units were commissioned by BHEL in the last three months. The scope of work in the contract included design, engineering, manufacture, supply, erection, testing and commissioning of steam turbines, generators and boilers, besides controls and instrumentation and Electrostatic Precipitators (ESPs), BHEL said. The company said it has commissioned another 600-MW unit of Dainik Bhaskar Power Ltd's upcoming 2x600 MW thermal power project in Janjgir Champa district of Chhattisgarh. This is the second unit of the power project commissioned by BHEL. (www.daijiworld.com)

NEEPCO hydel power project facing opposition

April 16, 2015. A 240 MW hydel power project of North Eastern Electric Power Corporation (NEEPCO) proposed to be set up along the Assam-Meghalaya border is facing strong opposition from locals who claim it would affect 1000 families. Both the state governments have issued no objection certificates to NEEPCO for the 100 m high dam on Umiam River near Lamalong. Local villagers said the dam will submerge 600 sq km and in the process over 20 inhabited villages will be hit directly affecting over 1000 families residing there. Besides human displacement, the dam will also submerge agricultural land, heritage sites and flora and fauna, they said. (www.thehindu.com)

India's electricity generation crosses 1 trillion units a yr, first time

April 15, 2015. India's electricity generation touched the 1 trillion units mark during 2014-15 for the first time, showing a growth of 8.4 percent over the previous year. Since 1991-92, the compounded annual growth rate of electricity generation has been around 5 to 6.6 percent, a government report said. The biggest contributor was the coal-based power stations which recorded an annual growth rate of 12.1 percent. Out of 22,566 MW added during the year 2014-15, the contribution of thermal power sector was significant i.e. 20,830 MW (92 percent of the total). The report said government's focus has increased on power transmission and distribution. The government data analysis said due to huge capacity addition along with higher generation and improved transmission capacity resulted in reducing electricity energy shortage from a level to 3.6 percent from 7 to 11 percent during the last two decades. Among the new plants added are NTPC's 660 MW unit at Barh in Bihar, which is the first indigenously manufactured super critical unit. NHPC and SJVNL completed their projects at Parbati III and Rampur respectively. The gas based Monarchak Power Plant of 65.4 MW, Agartala ST-II of 25.5 MW and Palatana Unit-II of 363.3 MW were also commissioned during the year in Tripura which will benefit the entire North East. (www.business-standard.com)

Transmission / Distribution / Trade…

Telangana to end power sharing arrangement with AP

April 21, 2015. The Telangana government has decided to forgo its stated share of electricity in APGenco-owned 1,600 MW Krishnapatnam power project and had informed the same to the Southern Region Load Despatch Centre recently. While the move looks strange considering the power-deficit status of Telangana, people in the know said the government had taken a critical view of the entire power sharing arrangement after doing a cost-benefit analysis. The issue of power became a major bone of contention between the two states soon after bifurcation when the Andhra Pradesh (AP) government turned down Telangana’s claim over Krishnapatnam project as well as the 1,050 MW Hinduja project in Visakhapatnam. While Telangana argued that these two plants were also part of the arrangement of sharing on a 54:46 basis as prescribed by the central government under the AP Reorganisation Act, 2014, AP said there were no valid power purchase agreements (PPAs) to back these claims. The first hint of a change in government’s thinking came earlier this year when Telangana chief minister K Chandrasekhar Rao declared in the Assembly that they would not take power from AP in protest of their refusal to share from Krishnapatnam. There is an average 50-60 paise per unit difference in the cost of power generation between the plants of AP and Telangana and the latter would end up paying more if it depends on AP for a long time, TelanganaGenco said giving out reasons behind the government’s move. Under the sharing arrangement, Telangana has to give 46 per cent power from its plants to AP while the latter has to give 54 per cent from its plants to Telangana at a price fixed at their end. This will increasingly work in favour of AP as it gets cheaper power from Telangana, which is adding substantial capacity in the next couple of years. However, he added Telangana power utilities could pool the power and even sell it to other states instead of forgoing their share in AP plants. According to an estimate, the supply-demand gap would increase to 2,000 MW from the present 1,000 MW in Telangana if the two states decide to end the sharing arrangement. In addition to buying power at a high cost from AP plants during their long PPA period, the existing arrangement will also act as a disincentive to go for more capacity addition in Telangana, Raghu argued. When contacted on the Krishnapatnam issue, TS Genco said AP discoms had already excluded these plants from the power sharing list in their filings to the AP Electricity Regulatory Commission. The Centre had appointed a Central Electricity Authority-headed committee to resolve the power sharing issues of both the states. (www.business-standard.com)

Power Grid board approves ` 55.4 bn investment

April 21, 2015. Power Grid Corp said its board has approved investments worth ` 5,547.90 crore in various projects including inter-state electricity transmission. Power Grid's board of directors has accorded investment approvals for "implementation of green energy corridors: Inter-State Transmission Scheme-Part A at an estimated cost of ` 1,479.30 crore, with commissioning schedule of 24 months (and) implementation of Green Energy Corridors: Inter-State Transmission Scheme-Part B at an estimated cost of ` 3,705.61 crore, the company said. (profit.ndtv.com)

Railways, Coal Ministry, Odisha govt sign MoU on transportation of coal by rail

April 20, 2015. The Ministries of Railways and Coal and the Odisha government signed a memorandum of understanding (MoU) for formation of a joint venture (JV) to undertake project development, financing and implementation of projects for evacuation of coal through rail. Minister of Railways Suresh Prabhu said the coal sector was the largest customer of the Indian Railways. He said MoUs for similar joint ventures would be signed with other statement governments also. The JV will have 64% shareholding from the Ministry of Coal or its PSU, 26% from the Ministry of Railways its PSU and 10% from Government of Odisha or its PSU. (netindian.in)

Lanco Infra sells Udupi plant at ` 63 bn to Adani Power

April 20, 2015. Lanco Infratech announced the successful closure of the sell-off of its Udupi power plant to Adani Power, making it the largest acquisition till date in India's thermal power sector. The transaction was announced in August 2014, as part of Lanco's debt restructuring strategy. Lanco has set up 2 X 600 MW fully imported coal-based power project in the Udupi district of Karnataka. Following the completion of the transaction, Lanco Infratech has realised the enterprise value of around ` 6,300 crore by reducing long-term debt and realising its equity value. Lanco said the transaction will support the company in reducing its debt and infuse capital in other projects including Lanco Amarkantak Power. (www.newkerala.com)

Rockefeller pledges $75 mn to light up 1k villages

April 15, 2015. The Rockefeller Foundation committed USD 75 million (` 468 crore) for financing an initiative to provide electricity to 1,000 villages through mini-transmission grids. The Smart Power model is an innovative way to deliver clean energy via decentralised mini grids. A mini grid can carry 65-75 kilowatt hours (units) and cater to 150-250 households with some 1,000 people. New Delhi-based Smart Power India will be The Rockefeller Foundation's key partner in working with energy service companies (ESCOs) for supplying power to the hinterland. Smart Power India will provide project development support to assist ESCOs in structuring their engagement in terms of financing, business model, site and cluster selection, procurement, training, and so on. (www.business-standard.com)

Policy / Performance………….

PFC to raise up to ` 600 bn in FY16

April 21, 2015. Power Finance Corporation (PFC) plans to raise up to ` 60,000 crore through short- and long-term borrowings in the current financial year to primarily meet the funding requirements of power sector units and projects. It disbursed approximately ` 44,300 crore in loans during 2014-15 and sanctioned loans worth ` 60,000 crore. PFC’s loan assets at end of March 2015 stood at ` 2.18 lakh crore — 15 percent growth over the previous year. CARE Ratings has assigned ‘AAA’ rating to the borrowing plan for the current financial year.

The ratings factor in the majority ownership by the government of India and strategic importance of the development of power infrastructure in India. CARE Ratings said during the nine months ended December 2014, PFC reported a net profit of ` 4,399 crore on a total income of ` 18,671 crore. Its gross non-performing loans stood at 0.96 percent. Capital adequacy was 21.05 percent at the end of 2014. Another rating agency, CRISIL, said PFC caters only to the power sector, with 68 percent of its advances to state power utilities (SPUs) as on December 31, 2014. SPUs constitute an inherently weak asset class owing to their poor financial risk profiles. The aggregate losses (excluding subsidy) of SPUs were around ` 93,000 crore in 2011-12. Steps such as tariff hikes by many states over the past two years and restructuring of debt of some SPUs were likely to strengthen the power distribution sector over the long run, CRISIL said. However, effective execution is extremely critical for the debt restructuring to produce the desired positive impact. (www.business-standard.com)

Central scheme spells hope for out-of-use power plant

April 21, 2015. Tata Power Delhi's 108 MW power plant in Rithala has been lying defunct for over three years, since the project was first commissioned, due to lack of gas. However, the plant is finally going to start generation this summer thanks to a new proposal by the Union power ministry for subsidized allocation to stranded gas-based power plants. Established at a cost of ` 250 crore, the Rithala project was Delhi's first power plant commissioned by a private discom and meant to help bridge the demand-supply gap in peak summers and winters. The foundation stone for the plant was laid by chief minister Sheila Dikshit in March 2008, and it was inaugurated in early 2011. However, a gas crisis led to only partial generation and from March 1, 2013, the plant stopped production completely. The Rithala power plant was the only project in Delhi that qualified for the ministry's scheme, which was for projects operating at less than 30% plant load factor. The scheme is for the current and next fiscal with a total disbursement of up to ` 4,000 crore. (timesofindia.indiatimes.com)

Maharashtra govt targets 14.4 GW power generation by 2019

April 21, 2015. In a bid to cut down cost and reduce carbon footprint, Maharashtra government has decided to exploit non-conventional resources to generate 14,400 MW electricity by 2019 and will soon come out with a policy on it. The policy has been finalised from the administrative perspective and soon a presentation will be made before the chief minister, following which it will be sent for cabinet approval. (www.business-standard.com)

Manoharpur coal mine operation likely in 2017

April 20, 2015. Odisha Coal and Power Limited (OCPL) will furnish bank guarantee and make part payment of the upfront amount before April 30 to the Ministry of Coal for allotment of Manoharpur and dipside Manoharpur coal blocks. The newly-floated OCPL, a joint venture company of Odisha Power Generation Corporation (OPGC) and Odisha Hydro Power Corporation (OHPC), has been awarded two coal blocks under the public sector undertaking (PSU) dispensation route. Though OPGC was allocated the same coal blocks under the Government dispensation route by the previous UPA Government, the two blocks were among 204 coal blocks deallocated by the Supreme Court in August last year. Meanwhile, OCPL has signed allotment agreement with the Coal Ministry for the two coal blocks for OPGC’s 1320 MW expansion plan at Ib Valley thermal power station. As per the Coal Mine Development and Production Agreement, the successful allocatee needs to provide a performance bank guarantee equal to the aggregate of one year’s royalty and the annual peak rated capacity of the mine multiplied by winning bid amount. The coal block owner will conduct mining operations at the coal mine in accordance with the milestones or efficiency parameters. Failure to comply with the efficiency parameters would result in appropriation of the performance security. OCPL has to submit a ‘Commencement Plan’ about starting mining operations. The plan will form the basis for the user agency to follow the timeline to achieve peak rated capacity of mine. If everything goes as per plan, OCPL will start coal production by May or June of 2017. (www.newindianexpress.com)

To probe details, Ministry rejected coal block bids

April 20, 2015. The Centre had rejected bids for three coal blocks in the recently concluded auctions to find “conclusive evidence” of possible “outliers” in the bidding process. The Coal Ministry had rejected the bids for three blocks, two won by Jindal Power Ltd and one by Balco. While the Government was firming up its stance on a further probe, the winners of the blocks had taken legal recourse. The Government still has the right to carry out an investigation, but as the matter is sub judice, the findings of such an investigation cannot be made public before the court proceedings are over. (www.thehindubusinessline.com)

Discoms await comfort letter from govt to get loan

April 20, 2015. The Delhi government appears to be in no mood to grant the BSES discoms a comfort letter that would enable them to get an ` 11,000 crore loan from Power Finance Corporation (PFC). Power minister Satyendar Jain said, they were "not comfortable" with the BSES companies when questioned on the government extending cooperation to BSES to secure the loan. The two discoms, who supply power to about 70% of the Delhi's population, meanwhile said unless they get the loan, they would not be able to pay generators, and any payment failure could lead to outages in Delhi. The discoms said they had been pursuing the issue of a comfort letter since early January. The companies said that there was no legal binding on the government for providing the letter, in the event that the BSES discoms defaulted on loan repayment.

The two discoms, BSES Rajdhani and BSES Yamuna, have sought a loan of ` 11,006 crore from PFC to pay their dues and stabilize their financial situation. However, the loan is subject to getting a "comfort letter" from Delhi government so as to signify that BSES was a Joint Venture of the government performing public utility service. Reliance Infra, which owns the two BSES discoms, has committed to pledge its entire 51% of shareholding in the two companies to PFC for availing the loan. (timesofindia.indiatimes.com)

No backing out of Jaitapur nuclear power project: Maharashtra CM

April 19, 2015. Ignoring ally Shiv Sena's opposition to the proposed Jaitapur nuclear power plant, Maharashtra Chief Minister (CM) Devendra Fadnavis asserted that there is no question of going back on the project as it will be a big national waste and also India needs to make a major leap in power generation. The project was among the 17 pacts signed between the two countries during Prime Minister Narendra Modi's recent visit to France.

The Jaitapur project in Maharashtra's Ratnagiri district, where French company Areva is to set up six nuclear reactors with total power generation capacity of about 10,000 MW, is stuck for long following protests and differences over the cost of electricity to be generated. According to Shiv Sena, the energy produced from the project will be beneficial for the whole country, but Maharashtra would be at the maximum risk. Sena MP Sanjay Raut had earlier said that the government should take into consideration the farmers' concerns on the Jaitapur nuclear power project. He had said that his party will support the people who decide to protest against the project. (www.newindianexpress.com)

Ten percent hike in electricity tariff in MP

April 18, 2015. The Madhya Pradesh Electricity Regulatory Commission (MPERC) has allowed an average 10 percent hike in power tariff for all categories, including the domestic consumers. The increased rates would be effective from April 25. Though the three power distribution companies had sought a hike of 22 percent, MPERC okayed an average 10 percent rise. There would be no hike for the domestic consumers whose consumption is 0-30 units per month (single point connection) or 0-50 units per month. Half the domestic consumers fall in this group. MP Power Management Company said after the hike comes into effect, the domestic consumers who use upto 300 units of electricity per month will have to pay ` 2,130 instead of the current ` 1,980. The power companies were seeking hike in tariff, saying that the coal price had shot up to ` 3,296 per ton from ` 1,663 per ton in 2009-10. In 2012-13, the tariff had been hiked by 7 percent. (www.newindianexpress.com)

Telangana and AP govts want 85 percent power from upcoming NTPC projects in the two states

April 17, 2015. Telangana and Andhra Pradesh (AP) governments have asked NTPC to allocate 85 percent power from two of its upcoming ultra mega power projects of 4,000 MW each proposed to be set up in the respective states. NTPC has already initiated the tender process for the 4,000 MW Pudimadaka project in Visakhapatnam district and also for the initial 1,600 MW plant at the existing Ramagundam power station in Telangana.

For the remaining 2,600 MW capacity in the state, the Telangana government is considering a couple of locations, including the land allocated in the past to a private power developer in Ramagundam, according to company. NTPC would finalise tenders for the two upcoming projects once it receives clearances from the Ministry of Environment and Forests. The company has a combined installed capacity of 6,458 MW in the two states. (www.business-standard.com)

India to get Canadian uranium from 2nd half of 2015

April 17, 2015. Canadian company Cameco, which has signed an agreement for the supply of uranium to India, will start delivery in the second half of this year with the end-use being strictly monitored. The company is excited over the pact, which it says marks the "start of a new relationship" between the two countries. Cameco's president and CEO Tim S Gitzel said that the company will start delivery of uranium by the second half of this year as per a schedule. Cameco and the Department of Atomic Energy (DAE) signed an agreement two days back during the visit of Prime Minister Narendra Modi. Under the pact, the Canadian company will supply uranium over five years at a cost of 350 million Canadian dollars. Canada is only the third country which will be supplying uranium to India.

The other two countries are Russia and Kazakhstan. Canada banned exports of uranium and nuclear hardware to India in the 1970s after it was alleged that New Delhi used Canadian technology to develop a nuclear bomb. The two countries put this behind them with the Canada- India Nuclear Cooperation Agreement that took effect in 2013. When asked about apprehensions in Canada for long with regard to India over the nuclear issue, Gitzel said it was "history". (zeenews.india.com)

JPL to retain control of its washery, CIL can't have it: HC

April 16, 2015. Jindal Power Ltd (JPL) will retain control of its coal washery and related plant facilities near two coal mines in Chhattisgarh, which Coal India Ltd (CIL) was trying to take over, Delhi High Court ordered. The court said the washery and the other plant facilities which CIL wanted to takeover were excluded from auction as per the tender document, and thus the PSU cannot have it.

The court issued notice to CIL and the Coal Ministry seeking their responses on Jindal Power Ltd's (JPL) plea by May 7 the next date of hearing. CIL contended that JPL had no right over the mining land on which the washery and other plant facilities were located as the lease is now with it. But the court refused to accept the argument saying the units had been excluded from the auction so they cannot be taken over. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

GDF Suez says natural gas discovery made in southeast Algeria