-

CENTRES

Progammes & Centres

Location

[April 2015: an uneventful month for energy]

“April 2015 could be labelled as an uneventful month for the Indian energy sector going by standards set in the past: there were no new scams; power generators had sufficient coal stock; power outages were limited to the rural poor (which are accepted as the norm); oil prices were relatively low and stable; the routine statements from the energy ministers of the new government that power outages will be history and that India will re-write energy history with solar energy were made at regular intervals…”

Energy News

[GOOD]

Aligning high-grade coal prices to international prices is the first step towards global market integration!

‘One group, one bid’ idea for coal block auctions may pave the way for diversions!

[UGLY]

CO2 emissions from Indian thermal plants is higher than global standards because inefficacy has no penalty!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· April 2015: an uneventful month for energy

· Will coal washing become an attractive option ever?

DATA INSIGHT………………

· Price Scenario of Crude Oil & Petroleum Products

[NATIONAL: OIL & GAS]

Upstream…………………………

· Nobody can prevent India's oil exploration in our waters: Vietnam

· India's national oil companies may spend $20 bn on E&P in 3 yrs

· ONGC to conduct DGH prescribed test to get KG gas going

Downstream……………………………

· IOC's Paradip refinery's up and running

Transportation / Trade………………

· India seeks first cut in LNG imports under Qatar deal

· LPG supply to south Kerala hit

· GAIL to lay gas pipeline in Yamunanagar Industrial Area

· Bharat Petroleum arm, Bangladeshi company ink deal

· Optimising the supply chain key to success for LNG projects: KPMG

Policy / Performance…………………

· Shell to raise India LNG plant capacity by 50 percent in 2016-17

· Complaints on petrol pump allotment have declined: Govt

· Oil Ministry rejects RIL arbitration notice

· Indian petrochemical industry may touch $100 bn by 2020

· CCI closes anti-competitive case against Gujarat Gas

· Govt exempts ONGC, OIL from LPG subsidy payments

· Anil Ambani gives up LPG subsidy, urges 1 lakh employees to follow

[NATIONAL: POWER]

Generation………………

· Reliance Power terminates 3.9 GW Tilaiya UMPP

· Revival of 2.7 GW of stranded gas-power capacity in AP on cards

· ‘Kudgi thermal plant 11 months away from power generation’

· Auditor slams Himachal Pradesh over ADB-funded hydel project

Transmission / Distribution / Trade……

· India, Spain agree to advance bilateral talks on nuclear energy

· India sends team to restore power supply in Nepal

· NTPC not to import coal in Q1, cites sufficient CIL supply

· JSPL to invest ` 200 bn to augment power business

· Indian railways projects growth in coal freight

· Peak power deficit in March improves to 3.2 percent: CEA

· REC transfers two transmission projects to Power Grid

· Power consumers to save ` 693.1 bn due to negative coal block bids

Policy / Performance…………………

· Govt to continue with coal block auctions

· India misses power capacity addition target for 2nd year in row

· 163 compensation cases for land acquisition pending in ECL: Goyal

· India undertake exploration of essential nuclear fuel source: Govt

· Coal mines' surplus land would be returned to states: Goyal

· 'Atomic energy important for India'

· Coal block auction II: Ministry looking at ‘one group, one bid’ cap

· No restrictions on buying power from multiple sources: Appellate Tribunal of Electricity

· UP CM warns of strict action against the guilty in power scam

· India received 3,968 tonnes nuclear fuel after signing agreements with foreign suppliers

· CIL plans to align prices of high-grade coal to international rates

· Four indigenous nuclear reactors will be ready by 2019: Govt

· Power plants to be soon allowed to swap coal supplies: Goyal

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Wintershall makes small oil find in Norwegian Sea

· Statoil must move ahead with Snorre field expansion: Govt

· CNOOC starts production at Kenli 10-1 oilfield offshore China

· Russia's sole offshore Arctic field to double oil output in 2015

· Abu Dhabi to invest $25 bn to boost production at offshore oilfields

· Half of US fracking companies will be dead or sold this year

Downstream……………………

· Chevron's South African unit offers to supply diesel to Eskom

· Russia's refinery runs down 5.3 percent in March month-on-month

Transportation / Trade…………

· Africa’s richest man courts private equity to boost Nigerian gas

· Global investors kick off lawsuit against Norway in gas pipeline row

· TransCanada seeks US permit on upland line as Keystone waits

· E.ON signs 20 year gas purchase agreement with Meridian LNG

· Japan's Toho Gas to buy Cameron LNG from Mitsubishi Corp

· BP to sell UK gas pipeline stake to infrastructure fund

· China’s Iran oil imports up 15 percent on year in March

· Technip to construct gas pipeline in Peru

· BP said to seek bids for $2 bn in US infrastructure

· World’s biggest oil trader sees $50 floor for crude prices

Policy / Performance………………

· Refining helps BP and Total weather oil price storm

· Venezuela may have missed $24 bn in oil revenue in 2014

· Fair, stable oil prices to benefit everyone: Saudi Arabia's Oil Minister

· Norway's giant Sverdrup oil field could face 6 month delay

· South Korea to cut retail gas prices by 10.3 percent on average in May

· New England governors meet to talk long-term energy plans

· Billions at risk for Ghana, oil firms from ocean boundary ruling

· Canada aims to boost investment with 40 year gas licenses

[INTERNATIONAL: POWER]

Generation…………………

· Brazil and Bolivia plan a 3 GW hydroelectric power project along border

· FirstEnergy resumes operations at Perry nuclear power plant in US

· Voith to upgrade hydropower plant in Sri Lanka

· JAPEX teams up with Mitsui for Fukushima gas-fired plant

Transmission / Distribution / Trade……

· TenneT commissions 864 MW SylWin1 offshore grid project in North Sea

· ABB wins power infrastructure supply contract for Brazilian wind farms

· US power grid’s $2 trillion push needs European efficiency

Policy / Performance………………

· China mulls inland nuclear power plants

· US examining coal cleanup program for shortfalls

· Japan's cabinet considers target of 20-22 percent nuclear for electricity generation

· GDF Suez plans name change to ‘Engie’

· Russia signs $5 bn energy deals with Argentina

· US signs 20 year nuclear cooperation agreement with South Korea

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· UP signs two MoUs for solar power

· Govt working on renewable energy target for 2015-16: Goyal

· CO2 emission from thermal plants higher than global standards: Govt

· Odisha mulls new renewable energy policy

· WTO verdict on India's solar dispute with US soon

· Solar energy brings light to 48 villages in Arakkonam

· Telangana solar power policy soon

· Sembcorp to invest $1 bn in India to double clean energy portfolio

· NTPC signs PPA for phase 1 of 1 GW ultra solar project with AP discoms

· Govt plans 10-nation consortium to boost renewable energy sector

· JBM Group to invest ` 16 bn in solar energy

· PM is confident that India will lead in combating climate change: Javadekar

· Maharashtra targets 14.4 GW of renewable capacity by 2019

GLOBAL………………

· New EU proposal suggests Jan 1, 2019 start for carbon market reform

· Germany seeks G7 climate financing pledge to aid poorest nations

· 75 percent of heat waves are attributable to climate change

· Immediate steps needed to mitigate climate change impact: Obama

· France reviews solar tariffs for rooftop installations

[WEEK IN REVIEW]

COMMENTS………………

India monthly energy briefing

April 2015: an uneventful month for energy

Lydia Powell and Akhilesh Sati, Observer Research Foundation

April 2015 could be labelled as an uneventful month for the Indian energy sector going by standards set in the past: there were no new scams; power generators had sufficient coal stock; power outages were limited to the rural poor (which are accepted as the norm); oil prices were relatively low and stable; the routine statements from the energy ministers of the new government that power outages will be history and that India will re-write energy history with solar energy were made at regular intervals.

The only party that may have been a little uncomfortable in April may be the participants and organisers of coal auctions. While the government has already declared victory as it has supposedly secured ` 4 trillion as revenue through the auction of coal blocks for captive consumption, the dramatic variation in bid prices, the invalidation of bids on account of presumed gaming, the fear among power generators, consumers as well as lenders to the power sector over how destructive bidding will play out in the longer term appear to tell a different story. Not unlike the story of the United States declaring premature victory over Iraq, the sad and destructive reality will probably unfold slowly and haunt the power industry for years.

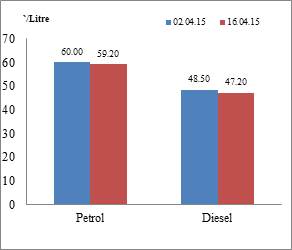

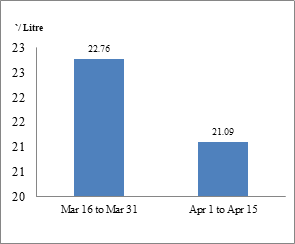

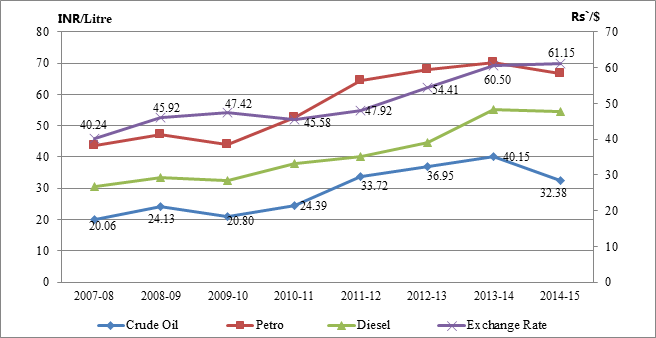

As shown in Chart 1 petrol and diesel prices decreased by ` 0.80 & ` 1.30 per litre respectively in Delhi during the month. While the change in retail prices were different across the different States in India on account of the different state level taxes, the retail price in Delhi could be taken as an indicative benchmark for the country. The fall in the retail price was the direct consequence of the price of the Indian crude basket (Chart 2) falling from ` 3618.92 per barrel (` 22.76/Litre) for the period Mar 16 to Mar 31, 2015 to ` 3352.77/bbl (` 21.09/Litre) for the period Apr 1 to Apr 15, 2015.

Chart 1- Petrol & Diesel Prices at Delhi

Chart 2- Crude Price- Indian Basket

Source: PPAC & IOC

A ` 1.67 per litre fall in the price of Indian crude basket has translated into only a ` 0.80 per litre (50 percent) reduction in the price of petrol and ` 1.30 per litre (78 percent) for diesel in Delhi. The pass through is different for different petroleum products even though there is no difference in cost of production. This raises some questions on the claims over complete ‘deregulation’ of the price of petrol & diesel.

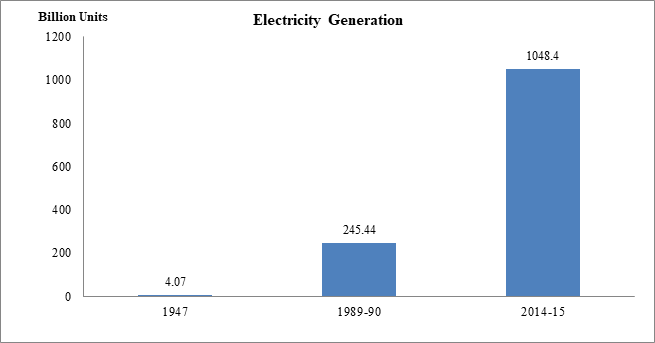

In the electricity sector a significant milestone was crossed at the end of the financial year 2014-15 and announced in April that power generation (from Utilities) crossed the 1 trillion unit (or over 1000 billion unit) mark. This is more than 250 fold increase in generation compared to that in 1947 and around fourfold increase compared to generation in 1990 (Chart 3). If we distribute 1 trillion units (kWh) of electricity uniformly among India’s 1.2 billion people each would get about 874 units which is still way below electricity consumption in OECD economies that stands at more than 5000 units (European Union) per capita.

Chart 3

Source: CEA

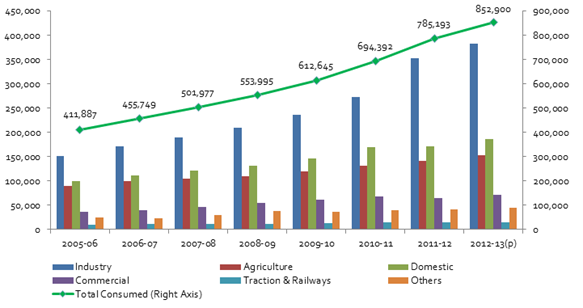

As the Chart 4 (which appeared in India Energy Daily News Bulletin) shows industry consumes 44 percent of electricity and other sectors 34 percent leaving only 22 percent for household consumption. If we remove 222 million (NSS 68 Round) number of people who are officially without electricity, and then distribute the total electricity supply available for households among 887 million (NSS 68 Round) people we get a figure of 1180 units per person.

Chart 4

Source: Ministry of Statistics & Programme Implementation

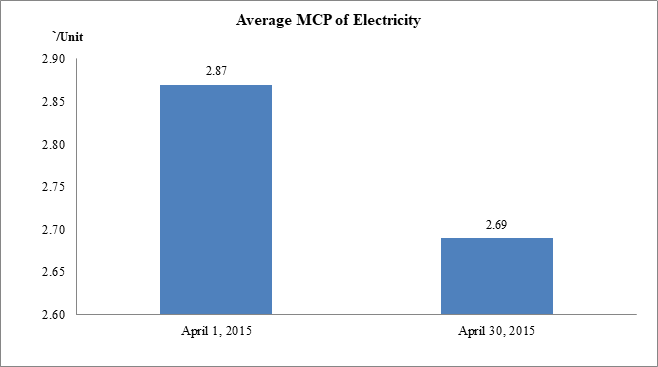

If we treat the price of electricity traded at the exchange as an indicator of the shortfall in supply, we could say that April reflected no substantial change in electricity supply (at least for urban consumers in major cities) with prices at ` 2.87 per unit (Avg. Market Clearing Price, Day Ahead Market) in the beginning of the month to ` 2.69 per unit by the end of the month (Chart 5).

Chart 5

Source: Indian Energy Exchange

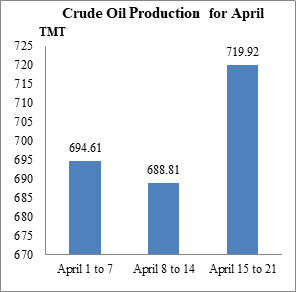

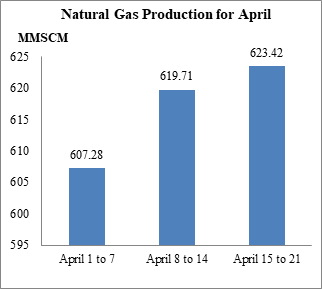

Domestic production of oil and gas (Chart 6) for April from first week of the month till third week has increased by 3.6 percent and 2.7 percent respectively.

Chart 6

Source: MoPNG

Overall the month was an ordinary month in terms of supply, demand, price and policy. May is likely to be a hotter month for energy in India!

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Will coal washing become an attractive option ever?

Ashish Gupta, Observer Research Foundation

|

T |

he Environment (Protection) Act, 1986 came into existence after India participated in the United Nations Conference on the Human Environment held at Stockholm in 1972. The objective of the Act was to take appropriate steps for the protection and improvement of the human environment. The Act also empowered the government to impose penalty and award punishment whosoever is violating the Act.

Given the negative effect of coal fired power plants and associated environmental and health hazard the Ministry of Environment & Forests (MoEF) in 1977 decreed that all the coal based power plants which are at the distance of 1000 kilometres (km) from the mine or located in critically polluted urban areas must use coal not exceeding 34 percent of ash content. The regulation was meant to be operative since 2001, but has not been implemented on large scale. The reason for the long time lag is not revealed in publicly available sources.

On 2nd January, 2014, The MoEF has amended the rules in respect of use of washed coal/ blended or beneficiated coal with ash content not exceeding 34 percent on quarterly basis in thermal power plants. As per the amended rules power plants located between 500 – 700 km, 750 – 1000 km shall be supplied with and shall use raw or blended or beneficiated coal with ash content not exceeding 34 percent on quarterly average basis w.e.f January, 01, 2016 & 2015 respectively while power plants located beyond 1000 km from pit head shall be supplied with and use raw or blended or beneficiated coal with ash content not exceeding 34 percent on quarterly average basis with immediate effect.

In the past significant research has been undertaken to demonstrate the qualitative and quantitative benefits of beneficiation. The results of the coal beneficiation studies are given below[1]:

|

Name of the Power Plant |

Qualitative Benefits |

Quantitative Benefits |

|

Satpura Thermal Power Plant, NTPC |

Ø PLF increased from 73% to 96% Ø Coal consumption reduced by 29% Ø Boiler efficiency increased by 3% Ø Coal mill power consumption reduced by 48% Ø Reduction in auxiliary consumption reduced by 1.5% |

Ø Savings of $1.04 million (mn) (` 42.6 mn/ year) or $ 0.0006 (` 0.024)/kwh |

|

Dadri Power Plant, NTPC |

Ø Increment in operating hours by 10% Ø PLF increased by 4% Ø PUF increased by 12% Ø Breakdown period reduced by 60% Ø Overall efficiency increased by 1.2% Ø Reduction in support fuel by 0.35ml/kwh Ø Additional generation of 2.4 MUs/day Ø Savings in land area for ash dumping, 1 acre per year Ø Coal consumption reduced by 0.05 kg/kwh Ø Reduction in carbon emissions (reduced transportations/ coal combustions; >600,000 ton/year) |

Ø Savings of $2.9 mn (` 119 mn/year) or $0.0005 (` 0.02)/kwh |

|

Danahu Thermal Power station, BSES |

Ø Ash generation reduced by 8.5% Ø PLF increased by 15.8% Ø Cost per unit reduced by 10% Ø Plant availability increased by 6.6% Ø Auxiliary power consumption reduced by 5.4% Ø Power generation increased by 16% |

Ø Savings of $26.73 mn (` 1,096 mn/year) or $0.0069 (` 0.28)/kwh |

All these studies demonstrate the economic benefits of coal beneficiation and the need for why it should be persuaded. It also contests the misleading perception that coal beneficiation adds to the cost of electricity generation. The incremental cost will be offset by efficiency gain. Unfortunately, all these studies failed to make an impact.

Indeed coal washing increases the upfront cost but when all the costs associated with using unwashed coal are included the generation cost using washed coal will be significantly less. Therefore, there is an urgent need for the adoption of policies that address the institutional barriers preventing the widespread adoption of coal beneficiation in India. This will require the necessary coordination from various associated ministries to promote coal washing and reduce the transport of high ash coal. Lastly, coal beneficiation must be promoted as an economic activity rather than environment protection technique for wider adoption.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Price Scenario of Crude Oil & Petroleum Products

Akhilesh Sati, Observer Research Foundation

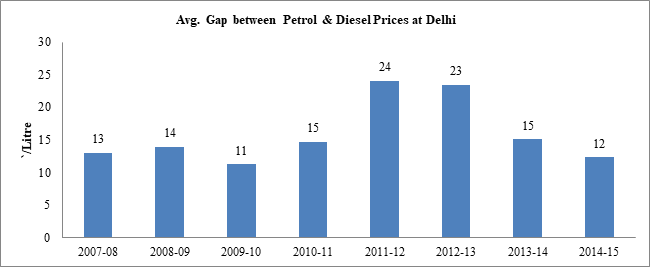

|

Year |

Avg. Crude Oil Price ($/bbl) |

Avg. Petro Prices at Delhi (`/Litre) |

Avg. Diesel Prices at Delhi (`/Litre) |

|

2007-08 |

79.25 |

43.65 |

30.6 |

|

2008-09 |

83.57 |

47.27 |

33.33 |

|

2009-10 |

69.76 |

43.9 |

32.62 |

|

2010-11 |

85.09 |

52.67 |

37.96 |

|

2011-12 |

111.89 |

64.36 |

40.28 |

|

2012-13 |

107.97 |

68.04 |

44.56 |

|

2013-14 |

105.52 |

70.31 |

55.2 |

|

2014-15 |

84.20 |

66.69 |

54.39 |

Average Prices of Crude, Petrol & Diesel & Exchange Rate

Source: PPAC & RBI

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Nobody can prevent India's oil exploration in our waters: Vietnam

April 28, 2015. In an apparent reference to China, Vietnam asserted that "nobody" could prevent India's oil exploration efforts in its country, stating it was being undertaken in Hanoi's exclusive territorial waters. Stating that the projects were awarded in the territorial waters of Vietnam to India, he said, "India's exploration of oil and gas is in exclusively economic zone of Vietnam. So, nobody can prevent it". In October 2014, China had cautioned that it would firmly oppose any exploration activity in South China Sea if it undermines its sovereignty and interests, hours after India inked pact with Vietnam for exploration in two additional oil and gas blocks in the resource-rich area. On tourist arrivals from India to Vietnam, Ambassador of Vietnam to India Ton Sinh Thanh said it was increasing 100 percent every year and was at 55,000 people in 2014. On India's corporate presence, Thanh said there were 85 companies with investments of about USD one billion in Vietnam. They included major Indian automobile players like Bajaj Auto and Hinduja group flagship company Ashok Leyland. (economictimes.indiatimes.com)

India's national oil companies may spend $20 bn on E&P in 3 yrs

April 24, 2015. India's national oil companies are likely to spend about $20 billion, or about ` 1,25,000 crore, in developing oil field services, exploration and production (E&P) between 2015-2017 even though the oil sector is in turmoil on account of falling crude oil prices world over, forecasts a new study. According to industry body PHD Chamber of Commerce and Industry (PHDCCI) and global consultancy Ernst & Young, in the present scenario oil field services (OFS) companies would be looking to expand service capabilities which would be realised through strategic joint venture opportunities both onshore and offshore. PHDCCI said the refining capacity of national oil companies would rise to 245 million metric tonne per annum (mmtpa) by 2018 from current level of 223 mmtpa. Established in 1905, PHDCCI is a multi-state apex organisation that acts as a catalyst in the promotion of industry, trade and entrepreneurship. (economictimes.indiatimes.com)

ONGC to conduct DGH prescribed test to get KG gas going

April 23, 2015. Oil and Natural Gas Corp (ONGC) has agreed to conduct tests prescribed by upstream regulator DGH to confirm three key gas discoveries in its Krishna Godavari (KG) basin block to end a standoff that stalled its USD 8 dollar project. The Directorate General of Hydrocarbons (DGH) had not approved Declaration of Commerciality (DoC) for three out of the 11 discoveries ONGC has made in its KG block KG-DWN-98/2 (KG-D5) in the Bay of Bengal. It reasoned that there was absence of surface flow as well as Drill Stem Test (DST) data. Without DoC, ONGC cannot proceed with the developing or bringing the finds to production. To resolve the standoff, ONGC has agreed to conduct DST on all the three discoveries, the company said. ONGC proposes to develop the KG discoveries in three clusters - combining finds D and E in KG-D5 block with discovery in neighbouring G-4 block as Cluster-I. All other finds except ultra deepsea UD-1 discovery are to be developed as Cluster-II. The UD-1 find will be developed as Cluster-III. While DGH is agreeable to DoC for the Cluster-II finds, it has not approved the same for discoveries D, E and UD-1 in absence of surface flow data and Drill Stem Test (DST) data. ONGC has begun conducting DST on D and E finds. UD-1 discovery alone holds 2.836 trillion cubic feet of inplace gas reserves. Discoveries D and E hold 587.6 billion cubic feet (bcm) of inplace reserves. For Cluster-II, DGH has approved 1.42 Tcf of gas reserves and 140.891 million barrels of oil that would require a capex of USD 6 billion to develop. Cluster-1 would need about USD 2 billion more. Previously, DGH had refused to recognise D-29, 30 and 31 gas finds Reliance Industries' KG-D6 block as well as those in NEC-25 block in absence of a DST. Reliance Industries Ltd (RIL) issue is yet to be resolved. KG-D5 is divided into Northern Discovery Area (NDA) and Southern Discovery Area (SDA). Estimated reserves of NDA are 121 million tonnes of oil in place and 78 billion cubic meter of initial gas in place, and that of SDA are 80.9 bcm of initial gas in place. ONGC plans to develop the discoveries in the block in three clusters -- 14.5 million standard cubic meters per day of gas for 15 years from Cluster-1 comprising of D&E finds of NDA in KG-D5 block and G-4 find in the a neighbouring area. Cluster-2A mainly comprises of oil finds in NDA which can produce 75,000 barrels per day (3.75 million tons per annum). Cluster 2B, which is made up of four gas finds in NDA, envisages a peak output of 14 mmscmd of gas, with cumulative production of 32.5 bcm of gas in 14 years. (www.business-standard.com)

Downstream………….

IOC's Paradip refinery's up and running

April 27, 2015. Commissioning its ` 34,555 crore Paradip oil refinery in Odisha, Indian Oil Corp (IOC) said it will start full-fledged production by the end of the year. IOC said the whole 15 million tonne a year refinery is likely to take about 6-8 months for becoming fully operational. The refinery is designed to process broad basket of crude, including cheaper high sulphur heavy crudes, and has an overall Nelson complexity factor of 12.2. Once fully operational, the refinery will produce 700,000 tonnes of LPG, 200,000 tonnes of propylene a year, 3.8 million tonnes of petrol, 380,000 tonnes of ATF and 6.9 million tonnes of diesel. IOC said many new features at the refinery will ensure environment-friendly operation with minimum impact on the nature. The crude oil processing at the Paradip refinery began. Paradip will be IOC's 8th refinery in the country and is expected to help the company scale up its refining capacity to 69.2 million tonnes from the current 54.2 million tonnes per annum. (economictimes.indiatimes.com)

Transportation / Trade…………

India seeks first cut in LNG imports under Qatar deal

April 27, 2015. India is in talks with Qatar to import at least 10 percent less liquefied natural gas (LNG) under a long-term deal after a slide in spot prices has cut demand by local buyers, Indian government said. New Delhi would for the first time use a 10 percent reduction permissible under a 25-year contract with Qatar's RasGas to import up to 7.5 million tonnes a year of the super cooled fuel, Indian government said. India's biggest importer Petronet LNG received its first cargo from RasGas under the current deal in 2004 with pricing linked to the oil. India's LNG import costs under the deal are currently around $13 per million British thermal units (mmBtu), versus spot prices of $6-$7 per mmBtu, according to Petronet LNG. Asian spot LNG prices LNG-AS rose as high as $20 per mmBtu last year, buoyed by soaring demand from emerging markets such as China and India as well as extra Japanese imports due to the Fukushima nuclear meltdown. But spot prices have come off by two-thirds since February 2014 as Asia's economies slow and new production, especially in Australia, comes online. (www.reuters.com)

LPG supply to south Kerala hit

April 27, 2015. The stand-off between Indian Oil Corp (IOC) and a cartel of truck operators over LPG cylinder freight charges has choked supply of subsidised cooking gas to lakhs of households in South Kerala. The artificial shortage of gas has upset the daily schedule of thousands of families in Thiruvananthapuram, Kollam and Pathanamthitta and caused civil society to react sharply to the crisis. Leader of the Opposition V.S. Achuthanandan has denounced the State government for “doing nothing” to resolve the two-month-old crisis. Most IOC agencies in the affected districts have minimum 60-day backlog of bookings. In one agency, more than 15,000 “refill calls” were pending delivery. In comparison, customers of Bharath Petroleum and Hindustan Petroleum have not reported any hitch in supply. With gas stoves running low on fuel and timely replenishment of LPG cylinders in serious doubt, many consumers have turned to hotplates and micro-wave ovens, triggering a worrisome hike in their electricity bills this summer.

Rural consumers, who have access to traditional firewood hearths at their homes, seemed to endure the shortage better than their urban counterparts. The IOC customarily contracted the transportation of cylinders to lowest quoted per kilometre freight rate. This year only 29 truck owners bagged the individual contracts though the company required a minimum 130 transporters to maintain its supply chain. A cartel of four businessmen, who owned more than 120 LPG trucks between them, quoted high rates and consequently lost the deal. In effect, the IOC’s transportation fleet strength had been reduced by more than a third due to the “oddities” in the company’s transport contract conditions. The State government had no control over the “impossible situation” and it was for the Union Ministry of Petroleum to take the necessary steps to resolve the crisis. (www.thehindu.com)

GAIL to lay gas pipeline in Yamunanagar Industrial Area

April 23, 2015. Haryana State Industrial and Infrastructure Development Corporation (HSIIDC) has permitted GAIL (India) Ltd for laying of a 3.85-km gas pipeline within Old industrial area, Yamunanagar for supply of gas to its prospective customers in this area. The network by GAIL will provide this gas to the entrepreneurs in the area which can be used for heating and cooling purposes. (www.business-standard.com)

Bharat Petroleum arm, Bangladeshi company ink deal

April 22, 2015. Bharat Petroleum arm Numaligarh Refinery Limited (NRL) has signed a memorandum of understanding (MoU) with Bangladesh Petroleum Corporation (BPC) for export of petroleum products to the neighbouring country. The MoU paves the way for export of petroleum products from NRL's marketing terminal in Siliguri in West Bengal to the BPC depot in Parbatipur in Bangladesh through the proposed 'Indo-Bangla Friendship Pipeline'. The proposed pipeline will be 130-km-long and have the capacity of 1 million tonnes per annum (mtpa). (www.business-standard.com)

Optimising the supply chain key to success for LNG projects: KPMG

April 22, 2015. Addressing supply chain issues at the planning stage can ensure viability of new project in the liquefied natural gas (LNG) industry, which is facing massive challenges in unprecedented wave of expansion, according to KPMG Global Energy Institute report. LNG developers are facing the challenges of lower oil and gas prices, and consequent reductions in capital expenditure, along with more remote and challenging projects. According to KPMG report, to ensure that new LNG projects are viable and successful, and to extract maximum value from existing projects, proponents and operators have to unlock their supply chain. KPMG Global Energy Institute has identified the three major challenges faced in the LNG supply chains - the size and complexity of projects; the remoteness and other challenges (for instance political and environmental) of the new wave of projects; and the construction of multiple plants in contiguous locations, leading to bottlenecks and sharply-rising costs of labor and materials. Optimising the supply chain, both during construction and operations, is key to reducing costs and speeding time to market for LNG projects. Those companies that proactively address supply chain now will be best-placed both to deliver their existing projects successfully, and to launch new ones ahead of the competition, Gaurav Moda, head, Oil & Gas Practice, KPMG in India said. KPMG Global Energy Institute report provides 10 ways to address supply chain challenges: put human resources first; adapt learning from other industries; collaborate with other operators; re-think contractual relationships with suppliers; prepare for environmental, ethical and local content supply chain requirements; unlock the potential of modularisation; consider floating LNG (FLNG); understand the local environment; foresee the handover to operations; and adapt maintenance policy to location. (www.business-standard.com)

Policy / Performance………

Shell to raise India LNG plant capacity by 50 percent in 2016-17

April 28, 2015. Hazira LNG Ltd will expand the capacity of its liquefied natural gas (LNG) terminal on the west coast by 50 percent to 7.5 million tonnes per annum (mtpa) in the fiscal year to March 2017, a government panel report said. Royal Dutch Shell owns through its unit Shell Gas a 74 percent stake in Hazira LNG, while Total GazElectricite France, a unit of France's Total, holds the remainder. India is expanding the capacity of its gas import facilities, part of efforts to increase the share of cleaner fuel in its energy mix to improve air quality. India currently has infrastructure to annually import and regassify 25 million tonnes of the super-cooled fuel and the capacity of the existing facilities is expected to rise to 41 mtpa in 2016/17. The report said that new terminals with capacities of up to 27 mtpa were at various stages of planning on both the eastern and western coasts of the country. With a 26 percent stake, Shell is also part of a consortium building Kakinada LNG on the east coast. In the current fiscal year India's gas deficit is expected to widen to 300 million standard cubic metres a day (mscmd) from 152 mscmd in 2012/13, the report said. India's local gas production currently falls far short of what was planned, due mainly to a significant decline in the output of Reliance Industries Ltd-operated KG-D6 block on the east coast. Reliance and partner BP have blamed geological complexities for the fall in output, but the oil regulator believes they failed to drill enough wells. Falling output had already prompted the government to disallow about $2.4 billion in cost recovery to Reliance up to 2013/14, leading to arbitration proceedings over the issue. (economictimes.indiatimes.com)

Complaints on petrol pump allotment have declined: Govt

April 27, 2015. Complaints of alleged malpractices in petrol pump allotment have reduced significantly with a transparent system replacing the "subjective process" followed earlier, Government said. There has been no cancellation of petrol pumps due to irregularities in allotment by various Oil Marketing Companies (OMCs) reported in the last three years, Power Minister Piyush Goyal said in the Lok Sabha during Question Hour. The number of complaints relating to alleged irregularities in allotment of petrol pumps have declined since this government came to power, he claimed. There were just four complaints in the last fiscal, three with Indian Oil Corp Ltd and one with Bharat Petroleum Corp Ltd, Goyal said. The Power Minister, replying on behalf of Petroleum Minister Dharmendra Pradhan who was not present, said the number of complaints have come down since a "transparent system" is in place. As far as the process of retail outlet dealer association and allotment is concerned, a transparent system of draw of lots/bidding has been introduced for selection of dealers which was previously based on marks and interview system, the Minister said. In earlier instances when it was found that there was substance in the complaints, either the merit panel was scrapped or the dealership terminated, he said. To a query on black marketing of petrol and diesel, the Minister said the government has taken stern action, including imposing heavy penalties, on entities indulging in such acts. Goyal said oil tankers cannot be given on an arbitary fashion as there was a definite process that is followed. (economictimes.indiatimes.com)

Oil Ministry rejects RIL arbitration notice

April 27, 2015. The oil ministry has rejected Reliance Industries’ latest arbitration notice challenging the government decision to take away 814 sq km of its KG-D6 gas block, saying it was misconceived and untenable in law. The ministry held that the move is in accordance with the provisions of the contract and there’s no dispute that needs to be arbitrated upon. The ministry gave reasons for its stand and cited provisions of the Production Sharing Contract (PSC) for that, asking Reliance Industries Ltd (RIL) to withdraw the notice forthwith. In line with the guideline on giving up non-discovery area, RIL had in 2013 offered 5,385 sq km out of a total 7,645 sq km in KG basin KG-D6 block. But the ministry on October 30, 2013, ordered 6,198.88 sq km of total area to be taken away as the time of production had expired. RIL on January 14 challenged this order, stating the 814 sq km of additional area contained five gas discoveries holding close to 1 trillion cubic feet of reserves. The ministry took the line that the exploration period for the KG-D6 block had lapsed on July 15, 2008, and so were timelines for submission of appraisal and field development plan for any discovery. Timelines for satellite discoveries — D4, D7, D8, D16 and D23 — had been overshot and no development plan was submitted by the operator, the ministry said. (www.asianage.com)

Indian petrochemical industry may touch $100 bn by 2020

April 24, 2015. Petrochemicals industry in India is likely to touch USD 100 billion by 2020, more than double the current size of about USD 40 billion, according to a study by industry body Assocham. Petrochemicals industry contributes about 30 percent to country's USD 120 billion worth chemical industry, which is likely to grow at an annual growth rate of 11 percent over the next few years and touch USD 250 billion by 2020, the study said. The domestic petrochemical industry is in the process of investing over $25 billion to meet the surging demand, the industry body said, while adding that mergers and acquisition (M&A) opportunities are among the key imperatives for the sector. The industry body said good opportunities exist in the segments like specialty chemicals and specialty polymers for catering to huge emerging domestic demand. (economictimes.indiatimes.com)

CCI closes anti-competitive case against Gujarat Gas

April 23, 2015. The Competition Commission of India (CCI) disposed of a case alleging unfair business practices by Gujarat Gas Company with respect to supply of natural gas to industrial customers in certain districts of Gujarat. The fair trade regulator's disposal came even after its investigation arm Director General (DG) in its report had concluded that there were violations of competition norms. CCI had initiated a detailed probe in the case following a complaint by Saint Gobain Glass. The float glass maker had alleged that Gujarat Gas abused its dominant market position by imposing unfair conditions in its 'Gas Supply Agreement (GSA)' and charging differential pricing. CCI observed that various companies were operating in the space of production, transmission and distribution of natural gas throughout the country. (www.business-standard.com)

Govt exempts ONGC, OIL from LPG subsidy payments

April 22, 2015. In a big boost to domestic oil and gas exploration, the government has decided to exempt state-owned ONGC and Oil India Ltd (OIL) from paying for LPG subsidies in current fiscal, Oil Secretary Saurabh Chandra said. The government regulates price of cooking fuels LPG and kerosene to shield the poor. The difference between the cost and the retail selling price, called under-recoveries, is borne by the government by way of cash subsidy and upstream producers like ONGC. Upstream oil and gas producers ONGC, OIL and GAIL had to borne a portion of subsidy on cooking fuels LPG and kerosene and diesel till October 2014. After diesel price was deregulated in October 2014, the subsidy sharing was limited to LPG and kerosene. Chandra said the government has exempted Oil and Natural Gas Corp (ONGC) and OIL from payment of fuel subsidy in the fourth quarter after the Finance Ministry agreed to meet the revenue loss on fuel sales. The Finance Ministry will pay ` 5,324 crore in fuel subsidy for the January-March quarter, effectively meeting all revenue retailers losses on selling domestic LPG and kerosene at government-controlled rates. Under-recoveries, or revenue retailers' loss on selling fuel below cost, of ` 67,091 crore in first nine months of the fiscal were fully accounted for by the subsidy support and dole out from upstream firms like ONGC. The Oil Secretary said since the government is paying LPG subsidy directly to consumers in their bank accounts under the Direct Benefit Transfer scheme, it has been decided that this will be entirely met from the Budget. ONGC and OIL will have to bear subsidy on only kerosene in 2015-16, he said. (economictimes.indiatimes.com)

Anil Ambani gives up LPG subsidy, urges 1 lakh employees to follow

April 22, 2015. Heeding to Prime Minister Narendra Modi's call, industrialist Anil Ambani has given up cooking gas subsidies and has urged his group's about one lakh employees to follow suit. Ambani joins a host of industry leaders, including Mukesh Ambani, Anand Mahindra, Anil Agarwal, Gautam Adani, Uday Kotak and Kishore Biyani, who have rallied behind Modi's call to well-to-do people to give up buying LPG at below market price so as to help cut subsidy bill. It appealed to employees, who can afford to buy LPG at market price, to "voluntarily join this moment and contribute to the cause of nation building." Modi had launched the 'Give-it-Up' campaign, nudging the well-to-do to give up LPG subsidies. Over three lakh people, including ministers, government and public sector officials and MPs have given up using subsidised LPG. While a subsidised cooking gas (LPG) cylinder costs ` 417 per 14.2-kg cylinder in Delhi, a marketed priced bottle of the same size comes for ` 621. Consumes are entitled to get 12 cylinders at the subdidised rate in a year. In its letter to employees, the Group also detailed the procedure for giving up the use of subsidised LPG. (www.dnaindia.com)

[NATIONAL: POWER]

Generation……………

Reliance Power terminates 3.9 GW Tilaiya UMPP

April 28, 2015. Reliance Power said it has terminated the contract for ` 36,000 crore Tilaiya Ultra Mega Power Project (UMPP) in Jharkhand over inordinate delays in land acquisition. The firm had, in August 2009, won rights to set up a 3,960 MW power plant at Hazaribagh in Jharkhand after bidding a levelised tariff of ` 1.77 per unit but couldn't start work on the project as the state government had not provided the required land even after more than five years. Jharkhand Integrated Power Ltd (JIPL), a special purpose vehicle created for implementing the project, had signed PPA with 18 power off-takers in 10 states for 25 years. The project was based on captive coal blocks for which coal was to be sourced from Kerendari BC coal mine block. The total land requirement for the project was over 17,000 acres. The Power Purchase Agreement (PPA) required procurers to handover land and other clearances by February 2010. The company said in spite of more than 25 review meetings and extensive and continuous follow-ups with the state government, the required land is yet to be made available. With the termination of this project, Reliance Power has reduced its future capital expenditure by ` 36,000 crore and remains financially conservative with debt equity ratio of 1.5:1, which is one of the lowest in the sector. Earlier, the company had commissioned its 3,960 MW Sasan UMPP in Madhya Pradesh, 12 months ahead of PPA schedule. The Sasan UMPP is the largest integrated power plant cum coal mining project at a single location in the world, involving an investment of over ` 27,000 crore. The company has also commissioned 1,200 MW Rosa Power project located in Uttar Pradesh, 600 MW Butibori Power project in Maharashtra as well as 185 MW of solar and wind projects located in Rajasthan and Maharashtra. Reliance Power has an operating portfolio of 5,945 MW, based on coal and renewable energy. (economictimes.indiatimes.com)

Revival of 2.7 GW of stranded gas-power capacity in AP on cards

April 27, 2015. Stranded gas-based power generation capacity totaling 2,700 MW in Andhra Pradesh (AP) is expected to be restored under a mechanism announced by the Centre targeting their revival through a mix of imported LNG supply and a subsidy grant. Gas power projects with a combined capacity of about 6,350 MW remain unutilised for want of fuel in the state, constituting 45 percent of the total 14,000 MW stranded capacity in the country. About 9000 MW of the total stranded capacity in the country is slated to be utilised under the Union government’s scheme. Imported gas would be allocated to these projects for generation of power on a reverse bidding basis, which begins at ` 5.50 wherein a grant in the range of ` 0.94 paise to ` 1.20 per unit would be offered from the Centre’s ` 3,500-crore Power Systems Development Fund. Andhra Pradesh (AP), which is expected to have 8-10 percent surplus availability of power in the current year, is already making efforts to increase the demand in a bid to absorb the additional power. (www.business-standard.com)

‘Kudgi thermal plant 11 months away from power generation’

April 25, 2015. With the completion of over 80 percent work, the first unit of NTPC-Kudgi thermal plan is just 11 months away from generating electricity. Balaji Ayengar, Group General Manager of the plant he said that the work was in full swing to meet the deadline as testing of turbines and boilers, which are critical components of the plant, was in the last phase. Informing that each 800 MW unit would be commissioned within a gap of six months each from the operation of the first unit in March next year, Ayengar said that over 4 million tonnes of coal was needed for each plant annually. Regarding doubling of railway line from Hotagi junction of Maharashtra to Kudgi plant for supplying coal, Ayengar said that the NTPC has paid ` 956 crore to Ministry of Railways for laying the line. Konkan Railway and South Western Railway were laying the line, which is expected to complete by mid-2017. He informed that the NTPC has 40 plants across the country with a combined electricity generation capacity of 44,598 MW.

With an objective of enhancing the quality of service and equipments used in NTPC plant, the Corporation, for the first time, has introduced vendor enlistment scheme. Elaborating on the scheme, Ayengar said that under the new scheme, any company or agency can now supply equipment or service to any NTPC plant of the country. Earlier, the agencies or service providers did not have this option, thus NTPC had to take the service of only locally available companies. He said that for any details of the new initiative, one could log onto www.vendor.ntpc.co.in. (www.thehindu.com)

Auditor slams Himachal Pradesh over ADB-funded hydel project

April 22, 2015. Himachal Pradesh Power Corp's mega hydropower project, being funded by the Asian Development Bank (ADB), not only faces a cost overrun of ` 606 crore but may also become commercially unviable, India's official auditor has said. The very purpose of the ADB giving the grant under its Clean Energy Development Programme for the run-of-the-river 111 MW SawraKuddu Hydroelectric Project in upper Shimla that aims to generate 385 million units a year could be defeated due to an accounting procedure adopted by the state government, a recent report of the Comptroller and Auditor General (CAG) said.

The slow progress by contractors, inadequate provisioning of some works in the detailed project report, subsequent change in design and the late handing over of the sites to contractors are the main reasons for the cost escalation and delay, the report said. The delay of more than five years from January 2012 to June 2017 in completing the project has not only resulted in a cost increase from ` ` 558.53 crore to ` 1,165.53 crore but also generation loss of ` 727.77 crore. The inordinate delay, said the auditor, will consequentially increase in per MW cost from ` 5.03 crore to ` 10.50 crore and per unit generation cost to ` 6.95 from ` 2.34.

Himachal Pradesh's hydropower generation potential is 27,436 MW - about 25 percent of the country's total. However, only 9,433 MW of power has been tapped till last December, which is 34 percent of the total potential, said the state's economic survey for 2014-15. (www.newkerala.com)

Transmission / Distribution / Trade…

India, Spain agree to advance bilateral talks on nuclear energy

April 28, 2015. India and Spain have agreed to advance their bilateral negotiations on cooperation in nuclear energy, with the European nation stating that it would support New Delhi's early membership of the four multilateral export control regimes. A joint statement issued by External Affairs Minister Sushma Swaraj and her Spanish counterpart Jose Manuel Garcia-Margallo said the intent on both sides was to further advance bilateral negotiations on a framework agreement for cooperation in the peaceful uses of nuclear energy. India and Spain have a number of bilateral treaties and agreements with each other, with the bilateral trade between the two nations from January to August 2014 standing at USD 3.37 billion. (www.newkerala.com)

India sends team to restore power supply in Nepal

April 28, 2015. India has sent a team of engineers from the Indian Power Grid to Nepal, hit by a massive earthquake, to restore power supply, Foreign Secretary S Jaishankar said. A team from Indian Oil Corp (IOC) is going to Nepal to provide fuel supplies, he said. (www.business-standard.com)

NTPC not to import coal in Q1, cites sufficient CIL supply

April 27, 2015. NTPC, India's largest power producer, has decided against importing coal in the current quarter in view of adequate supplies from the state run miner Coal India Ltd (CIL). This will lower generation costs and, therefore, tariffs for consumers because imported coal, which has higher energy content, is costlier than the domestic coal that is used in bulk in power plants. NTPC said that import requirements are reviewed every quarter and orders are placed to international suppliers depending on the supply potential from Coal India. Coal India has earmarked 78% of its planned production of 550 million tonnes, or 430 million tonnes, to be supplied to the power utility sector. In 2014-15, Coal India's supplies to power utilities increased 8.6% compared to that in the previous year, adding that dispatch of coal and coal products from the miner also increased to 384.18 million tonnes, up 30.35 million tonnes from that in the preceding year. CIL helped NTPC boost its coal stock to 9.06 million tonnes as of March 2015, from just 1.6 million tonnes at the end of September last year. The healthy coal stock was due to enhanced coal supply from Coal India's subsidiaries to NTPC, especially in the second half of 2014-15. (economictimes.indiatimes.com)

JSPL to invest ` 200 bn to augment power business

April 26, 2015. Jindal Steel & Power Ltd (JSPL) is looking to invest about ` 20,000 crore in its power business to take the generation capacity to 8,600 MW in the next five years. The company's present capacity is 5,300 MW including 3400 MW of its arm Jindal Power. The company has completed its 2,400 MW Tamnar expansion project in Chhattisgarh for about ` 13,000 crore. The company required an estimated 16.5 million tonnes of coal per annum to fuel both the projects and was actively evaluating options to secure supplies. For the power plant in Godda in Jharkhand, the company is also evaluating the options available. The Coal Ministry had rejected the bids of JSPL and Balco for four blocks. Jindal Power had emerged as successful bidder for Gare IV/2, Gare Palma IV/3 and Tara coal blocks, while Balco had successfully bid for Gare Palma IV/1 coal block. (www.business-standard.com)

Indian railways projects growth in coal freight

April 26, 2015. Indian Railways is anticipating increased freight loadings from the coal sector with the Centre removing hurdles in the allotment of coal blocks. The public sector entity has said systemic improvements and innovative measures in the area of wagon movement need to be taken keeping in view the upcoming demand. Railway Board Member (Traffic) Ajay Shukla felt that growth in the economy would result in increased potential for freight movement. The Member held a meeting with top officials of the South Central Railway zone. He asked the zone to take necessary measures to achieve a freight loading target of 128 million tonnes in the financial year 2015-16. (www.thehindubusinessline.com)

Peak power deficit in March improves to 3.2 percent: CEA

April 26, 2015. Delayed summer and unexpected rains brought the country's peak power deficit down to 3.2 percent in March, according to Central Electricity Authority (CEA) data. Peak power deficit -- shortage in electricity supply when demand is at its highest -- stood at 4.7 percent in March 2014. According to data, the power requirement in March was 1,38,938 MW of which the supply was 1,34,532 MW leaving a shortfall of 4,406 MW. As per a government, the reason for improvement is unexpected rains and delay in arrival of summer. Northeastern states of Assam, Meghalaya, Manipur, Tripura, Arunachal Pradesh, Nagaland and Mizoram saw a sharp rise in peak power deficit last month at 11.3 percent. This deficit was 5.5 percent in March 2014. Peak power deficit in the southern region states of Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Kerala, Puducherry and Lakshadweep last month was 3.1 percent as compared to 6.3 percent in March last year. North Indian states of Delhi, Punjab, Haryana, Himachal Pradesh, Uttar Pradesh, Uttarakhand, Rajasthan recorded a shortage of 6.2 percent last month. This is an improvement from previous year's 7.7 percent. The deficit in the Western region comprising Gujarat, Chhattisgarh, Madhya Pradesh, Maharashtra and Goa came down to one percent from last year's 1.5 percent in the same month. The peak power shortage in Eastern India (West Bengal, Bihar, Jharkhand, Odisha etc) improved to 0.7 percent last month as compared to 1.8 percent in March 2014. Meanwhile, the Ministry of Power has set a target of generating close to 1,100 billion units of electricity during the current financial year. Power generation during 2014-15 was 1,048.403 billion units. (www.business-standard.com)

REC transfers two transmission projects to Power Grid

April 24, 2015. Rural Electrification Corporation (REC) said it has transferred two transmission projects to Power Grid Corporation of India. REC Transmission Projects, a wholly-owned subsidiary of REC formed two project specific special purpose vehicles (SPVs) -- Gadarwara (A) Transco Ltd and Gadarwara (B) Transmission Ltd -- to establish two transmission projects. Power Grid emerged as the successful bidder for these two transmission projects, REC said in a regulatory filing to BSE. The two SPVs have been transferred to Power Grid. (economictimes.indiatimes.com)

Power consumers to save ` 693.1 bn due to negative coal block bids

April 23, 2015. Electricity consumers in the country are likely to benefit by about ` 69,311 crore from a reduction in power tariffs following negative bidding for coal blocks, the power ministry said. Of the 204 coal blocks cancelled by the Supreme Court, the government has so far auctioned and allotted 67 mines and blocks. The revenue likely to be generated from the auction and the allotment of these mines and blocks is about ` 3.35 lakh crore. In negative bidding, power producers seeking to win captive coal blocks forgo their right to pass on mining costs to consumers and instead agree to pay the government. The government has allotted 20 blocks in Jharkhand, 14 in Chhattisgarh, 11 in West Bengal, nine in Maharashtra, seven in Odisha, five in Madhya Pradesh, and one in Telangana. At the next auction in May, 11 blocks will be offered for the power sector and five for the non-power sector. The level of readiness of end-use plants for this auction will be less than in the previous round, although the percentage has not been decided, according to coal ministry. The auctioned blocks are likely to produce 500 million tonnes of coal by 2020, when Coal India's output is expected to touch 1 billion tonnes, the coal ministry said. Coal India's board of directors has cleared proposals targeting production of some 908 million tonnes. The company is identifying projects for another 100 million tonnes. (economictimes.indiatimes.com)

Policy / Performance………….

Govt to continue with coal block auctions

April 28, 2015. The government will continue the process of auctioning coal blocks after successfully putting 33 mines under the hammer earlier this year, R N Choubey, Special Secretary of the Ministry of Power said. Choubey said 18,000 to 19,000 MW of power projects in the country were still in need of coal. Under Prime Minister Narendra Modi, India has changed a decades-long method of allocating mining licenses, launching a round of auctions to reduce risk of wrongdoing after a Supreme Court last August cancelled more than 200 illegal coal block awards made over two decades. (profit.ndtv.com)

India misses power capacity addition target for 2nd year in row

April 28, 2015. India has missed the power generation capacity addition target for the second straight year in last fiscal, a report by the Standing Committee on Energy said. According to a report, the electricity generation target of 17,830 MW and 17,825 MW for the fiscals 2013-14 and 2014-15, respectively, were not achieved. During the last financial year (till February 2015), 15,935 MW was produced against the target of 17,830 MW. Similarly, during the 2013-14, 17,825 MW of power was produced against a target of 18,432 MW production. However, in the first year (2012-13) of the current Five Year Plan Period (2012-17), the power generation capacity addition was achieved. The target was 17,956 MW, while the total production was 20,623 MW.

The Power Ministry said the major difficulties faced in the capacity addition programme were delays in land acquisition, poor performance by civil contractors, delays in supplies by BHEL and contractual disputes. The hydro power projects were delayed due to law and order problems, poor geology, flash floods and difficult terrain, delay in forest clearances, among others. The Power Ministry said as part of remedial measures, the Central Electricity Authority (CEA) is monitoring power projects through frequent site visits and critical study of monthly progress reports. The Ministry is conducting periodic review of the issues related to supply of power equipment from BHEL. The central government is coordinating with the state governments on the progress of projects in their respective states. (economictimes.indiatimes.com)

163 compensation cases for land acquisition pending in ECL: Goyal

April 27, 2015. Government said there are 163 cases in Eastern Coalfields Ltd (ECL) where compensation has not been paid to people for acquisition of land for mining purposes due to various reasons. Giving details of the 163 cases, the Coal Minister Piyush Goyal said the affected areas were Mugma, Rajmahal, Kajora, Kunustoria, Pandaveswar, Salanpur, Satgram and Sodepur. The Central Coalfields Ltd (CCL) has six cases for compensation and employment. Goyal said that ` 1,048 crore worth of compensation was given during 2014-15, up from ` 761 crore in the previous year. He said the cases relating to non-submission of documents of ownership have to be settled on receipt of the same from project-affected persons and cases of disputes could be settled as per the judgments of the Tribunal or High Court. Goyal said certain grievances with reference to payment of compensation and providing employment to persons whose lands were acquired for mining by the two companies have been received by those firms. (economictimes.indiatimes.com)

India undertake exploration of essential nuclear fuel source: Govt

April 27, 2015. India is undertaking exploration of rare earth element (REE) monazite, an essential source of nuclear fuel, and has already set up a plant in Odisha for processing the mineral, Parliament was informed. Monazite is an atomic mineral and contains thorium an essential nuclear fuel. Minister of state for Steel and Mines Vishnu Deo Sai said, "Exploration and exploitation of rare earth elements are being undertaken. Monazite is a mineral of Thorium and REE and the only commercial source of REE in the country." He said, "Recently, Indian Rare Earth Ltd (IREL) has set up a plant at Orissa Sand Complex to process 10,000 tonnes of Monazite per annum." IREL processes monazite to produce rare earth compounds. The company, under the Department of Atomic Energy, has also set up a facility at its Rare Earth Division in Kerala to produce separated high purity rare earth utilising mixed rare earth chloride produced in the Odisha plant. India has the highest monazite reserve in the world with 11.39 million tonnes but stopped production since 2004 after cheap monazite became available from China. The Minister said Geological Survey of India is also carrying out exploration in different parts of the country for other sources of REE. (economictimes.indiatimes.com)

Coal mines' surplus land would be returned to states: Goyal

April 27, 2015. Surplus land not required by coal mining companies would either be returned to the state governments or could be used for building solar power plants, Power and Coal Minister Piyush Goyal said. The government has examined the issue of amending Coal Bearing Areas (Acquisition and Development) Act, 1957 to return the mined out land and the land acquired but found to be in excess of actual requirement to the state government for utilisation after reclaiming them, Goyal said. He said protection of such land against encroachment and their maintenance often involves unnecessary expenditure for the state-run coal companies. The excess land can be used for projects like afforestation, renewable energy and public utility services, the minister said. (www.business-standard.com)

'Atomic energy important for India'

April 26, 2015. Former minister and Rajya Sabha member Jairam Ramesh said that atomic energy was also important for India. He said that the Kudankulam atomic energy plant was good and that people should not protest against it. He said that power from mere solar, wind, hydel and thermal sources would not be sufficient to meet the demand of over 127 crore Indians. Thus, atomic energy was a good solution. It is risky, but there is damage everywhere, even in case of hydel power where forest land is the casualty, he said. This is besides the cost factor. He said India’s environmental context had four dimensions - demography, change in monsoon, public health and lifestyle. In other nations, environmental changes are due to deforestation, glaciers and increase in sea level. In India, the factors are more; thus a different path is needed to tackle the problem. Mining is another major problem to deal with, Ramesh said. (www.deccanherald.com)

Coal block auction II: Ministry looking at ‘one group, one bid’ cap

April 26, 2015. In the next round of auctions, the Coal Ministry may cap the number of bids a corporate can make for a mine at one time. If multiple bids are made, the best one will be counted. In the first round of auctions, one group could not only put in more than bids but all or many could make it to the final list. Now, it will be just one bid from one group. Learning from the recently concluded first round of auctions wherein corporate majors made multiple bids for the same block through group companies, the Ministry is looking to tighten up the process. Though the norms set a minimum number of bids for a mine to be put up for auction, they did not place any restrictions on multiple bids by one group. Thus, for instance, Naveen Jindal’s Jindal Steel & Power Ltd (JSPL) put in multiple bids for same mines — Gare Palma IV/8, Jamkhani, Utkal C, Gare Palma IV/1, Gare Palma IV/2&3, and Gare Palma IV/7. Aditya Birla Group and SesaSterlite used sister companies to make several bids. Players like Jaypee and Adani Power also followed the same approach. The Coal Ministry is examining this aspect and will take a call soon.

For the mines auctioned till now, bidders were required to make a price offer at the technical bid stage itself. Only 50 percent of those who qualified in the technical stage (subject to a minimum of five bidders) were allowed to participate in the financial bidding and were then ranked according to the initial price offering. This clause actually helped the government as some mines that got single bids were taken off the block. But it also resulted in limiting the competition. Now, if the government decides to cap the bids a company can make to one, it will open up the field for others. In the first round, 33 mines/blocks were auctioned raising over ₹ 2 lakh crore. The government is now preparing for the next set of auctions and allotments. The number of blocks to be auctioned could be between 15 and 20. The total number of blocks to be offered will be around 35. (www.thehindubusinessline.com)

No restrictions on buying power from multiple sources: Appellate Tribunal of Electricity

April 25, 2015. The Appellate Tribunal of Electricity has clarified that there cannot be any restriction on sourcing power from multiple sources, providing relief to industrial consumers that operate captive power plants and supply to others as well as those that source power from multiple power producers. Green Energy Association, a Maharashtra-based association of solar power generators, had approached the tribunal after Maharashtra Electricity Regulatory Commission (MERC) directed in May last year that consumers could seek power under open access only from a single source.

The association had approached MERC seeking action against the conduct of state utility, Maharashtra State Electricity Distribution Company, which did not process open access application of the members of the association for more than 400 days. According to the association, it continued to inject energy in the grid without any revenue and had to incur huge losses due to the delay in issuance of credit reports and open access permissions by the state utility. (economictimes.indiatimes.com)

UP CM warns of strict action against the guilty in power scam

April 23, 2015. Uttar Pradesh Chief Minister (CM) Akhilesh Yadav said strict action would taken against officials guilty in the alleged scam of hacking power department's billing system and reducing consumers' bills. Earlier, while attending a review meeting of the power department, the chief minister directed officials to be ready for the summer and strengthen sub-stations, transformers and electricity lines.

The state government is working towards proper generation, transmission and distribution of power in the state, so that people could get rid of power crisis, he said. He directed principal secretary of power department to ensure the 500 MW second unit of Anpara-D thermal power project begins functioning by July. Power distribution companies should start distribution of LEDs, the CM said. Directing the officials to send a proposal for an additional ultra mega power plant project in the state, Akhilesh said that it was necessary to meet energy needs of the state. The CM also emphasised on the need for purchasing of power through long-term tie-ups and from power surplus states by state-to-state power agreement. Yadav also directed officials to fill the vacant posts in UP Power Corporation, Power generation corporation and transmission companies. (www.business-standard.com)

India received 3,968 tonnes nuclear fuel after signing agreements with foreign suppliers

April 23, 2015. India has received about 3,968 tonnes of nuclear fuel to run power plants after signing agreements with foreign suppliers, the government said. As part of the civil nuclear cooperation, India had entered into inter-governmental agreements with France, the US, Russia, Namibia, the European Union, Canada, Argentina, Czech Republic, Kazakhstan, Republic of Korea, Vietnam and Sri Lanka, some of which are uranium producers and suppliers. India has an accord with Areva of France for the supply of 300 tonnes of uranium ore concentrate and has tied up with Russia's TVEL Corporation to receive 2,100 tonnes of natural uranium dioxide pellets.

Agreements have been signed with NAC Kazatomprom of Kazakhstan for 2,100 tonnes of uranium ore concentrate over six years, NMMC of Uzbekistan for 2,000 tonnes of uranium ore concentrate and with Canada's Cameco for 3,000 tonnes of uranium ore concentrate. India has so far received 299.87 tonnes of natural uranium ore concentrate from Areva and 2,095.90 tonnes from NAC Kazatomprom. It also got 1,514.69 tonnes of natural uranium dioxide pellets and 58.29 tonnes of enriched uranium dioxide pellets from TVEL, the government said. (economictimes.indiatimes.com)

CIL plans to align prices of high-grade coal to international rates

April 23, 2015. Coal India Ltd (CIL) plans to switch to market pricing for high calorie coal where prices would be aligned to international ones. To start with, Coal India (CIL) may cut local prices of high grade coal to align them with international ones. CIL said Singareni Collieries Company, another public sector coal company, has already introduced a similar model. The catch, however, is that a majority of power plants in the country cannot be fed with 100 percent high calorie coal. It needs to be blended at a 30:70 ratio with domestic low-calorie versions produced by CIL. With international prices down by almost 55 percent over the last six years, top grades of imported coal, delivered at thermal plants is turning out to be cheaper than similar coal bought from Coal India at a large number of locations. (economictimes.indiatimes.com)

Four indigenous nuclear reactors will be ready by 2019: Govt

April 22, 2015. Four indigenous nuclear power reactors under construction in two plants in Gujarat and Rajasthan will be completed by 2019, the government said. Minister for State for the Department of Atomic Energy Jitendra Singh said the Centre has also accorded 'in principle' approval to five coastal sites for locating nuclear power projects in future, based on both indigenous technologies and with foreign cooperation. (zeenews.india.com)

Power plants to be soon allowed to swap coal supplies: Goyal

April 22, 2015. The government is working on a policy to allow power generating companies to swap fuel linkages so as to clear bottlenecks in coal supply, Power and Coal Minister Piyush Goyal said. The proposed policy is towards running thermal power plants with more efficiency, reduce pollution and freight, the minister said. He further said if two different companies want to swap coal supplies they will have to get permission so as to ensure that there is no misuse and no windfall gains or profiteering is involved. (www.bignewsnetwork.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Wintershall makes small oil find in Norwegian Sea

April 28, 2015. German energy firm Wintershall, a subsidiary of chemicals giant BASF, made a small oil discovery near Statoil's Kristin field in the Norwegian Sea, the Norwegian Petroleum Directorate (NPD) said. The well encountered two oil columns in sandstone of generally poor reservoir quality and the find is estimated to contain between 6 million and 50 million barrels of recoverable oil equivalents, the NPD said. (af.reuters.com)

Statoil must move ahead with Snorre field expansion: Govt

April 27, 2015. Norway's Statoil must move ahead with the delayed upgrade of the Snorre oil and gas field in the North Sea because it is a time-critical investment, energy minister Tord Lien said. Statoil delayed a decision on the $4 billion upgrade of the Snorre field, which could yield an additional 300 million barrels of oil, as margins on the project were too low, particularly after the recent crude price drop. Statoil expects to decide in late 2016 whether to move ahead with building a new platform and extending the field's lifetime to 2040. If the project is continued, production could start in the fourth quarter of 2022. Norway has pushed the Snorre licence to go ahead because the field has been in operation since 1992, so equipment is aging and any delay could reduce the recoverable resource before decommissioning. (www.reuters.com)

CNOOC starts production at Kenli 10-1 oilfield offshore China

April 24, 2015. China National Offshore Oil (CNOOC) has started production at the Kenli 10-1 oilfield located in the South of Bohai Sea, offshore China. The Kenli 10-1 oilfield main production facilities include one central processing platform, two wellhead platforms and 70 producing wells. Currently, the company is producing approximately 10,750 barrels of crude oil a day from 12 wells. The field will reach its peak production of approximately 36,000 barrels a day in 2016. Recently, the company started oil production at its Qinhuangdao 32-6 comprehensive adjustment project, which is located in the central north of Bohai Bay with an average water depth of approximately 20m. CNOOC is the largest offshore crude oil and natural gas producer in China and one of the independent oil and gas exploration and production companies. (www.energy-business-review.com)

Russia's sole offshore Arctic field to double oil output in 2015

April 24, 2015. Gazprom Neft, the oil arm of Russia's top natural gas producer Gazprom, plans to more than double oil output this year at the Prirazlomnoye field, Russia's sole Arctic offshore oil project, the company said. Last year, oil production at the field totalled 300,000 tonnes. Development of Russia's offshore Arctic riches has been hampered by Western sanctions over Moscow's role in the Ukrainian conflict. Russia's top oil producer, Rosneft, has postponed exploration drilling in the Kara Sea after its partner, U.S. company ExxonMobil, suspended its participation in the project due to sanctions. Gazprom Neft has also been exploring another Arctic offshore oilfield, Dolginskoye, where it drilled its fourth exploration well last year. In 2014, Gazprom Neft's total hydrocarbon output rose by 6.4 percent to 66.3 million tonnes of oil equivalent. (in.reuters.com)

Abu Dhabi to invest $25 bn to boost production at offshore oilfields

April 23, 2015. Abu Dhabi is planning to boost its oil production capacity from offshore fields with an investment of over $25 bn in the next five years. Abu Dhabi National Oil Company (ADNOC) said that the investment is a part of UAE's goal to increase its crude oil output potential to 3.5 million barrels per day by 2017-18. Currently, UAE's production is around 2.8 million bpd. ADNOC is planning to invest $2.5 bn to drill 160 offshore wells annually in the next few years, ADNOC said. (www.energy-business-review.com)

Half of US fracking companies will be dead or sold this year

April 22, 2015. Half of the 41 fracking companies operating in the U.S. will be dead or sold by year-end because of slashed spending by oil companies, Weatherford International Plc said. There could be about 20 companies left that provide hydraulic fracturing services, Weatherford said. Demand for fracking, a production method that along with horizontal drilling spurred a boom in U.S. oil and natural gas output, has declined as customers leave wells uncompleted because of low prices. There were 61 fracking service providers in the U.S., the world’s largest market, at the start of last year. Consolidation among bigger players began with Halliburton Co. announcing plans to buy Baker Hughes Inc. in November for $34.6 billion and C&J Energy Services Ltd. buying the pressure-pumping business of Nabors Industries Ltd. Weatherford, which operates the fifth-largest fracking operation in the U.S., has been forced to cut costs “dramatically” in response to customer demand, Weatherford said. The company has been able to negotiate price cuts from the mines that supply sand, which is used to prop open cracks in the rocks that allow hydrocarbons to flow. (www.bloomberg.com)

Downstream…………

Chevron's South African unit offers to supply diesel to Eskom

April 24, 2015. Oil firm Chevron said it has offered to supply South Africa's electricity firm Eskom with excess diesel from its Cape Town refinery, to help run some of its generators. Steve Hegarty, the general manager for strategy at the oil major's South African unit told parliament's trade and industry committee that Chevron was able to produce diesel and store some supplies for the struggling power utility. (www.reuters.com)

Russia's refinery runs down 5.3 percent in March month-on-month

April 23, 2015. Russian oil refinery runs in March fell by 5.3 percent month-on-month or 307,882 barrels per day (bpd) due to seasonal maintenance, data from the Energy Ministry calculations showed. Russia's offline oil refining capacity is expected to double in April from March due to a seasonal increase in the number of plants undergoing maintenance. Refineries processed 5.554 million barrels of crude oil per day in March versus 5.862 million in February. In March, Lukoil and Bashneft cut the total capacity of their refineries by 9.0 percent and 9.5 percent respectively due to seasonal maintenance. The private KrasnodarEkoNeft refinery stopped its crude processing unit in March for unplanned maintenance and decreased refinery runs by 34,7 percent to 32,732 bpd. YaroslavNefteOrgsintez, jointly owned by Gazprom Neft and Slavneft, cut its capacity by 12.0 percent to 282,698 bpd due to a planned overhaul. Russia's top oil producer Rosneft stopped five secondary units, which produce gasoline and diesel, at its Achinsk refinery in Siberia at the beginning of March for several days for unplanned maintenance. Then a fire broke out at a diesel production unit of Rosneft's Komsomolsky oil refinery in Russia's far east on March 21. At the end of March the crude distillation unit was stopped for unplanned maintenance at Rosneft's Ryazan refinery. Novatek, Russia's second largest gas producer, increased in March gas condensate processing from its Purovsky plant on its Ust-Luga fractionation and transshipment complex to a record high of 604,400 tonnes. Gasoil production was down 3.6 percent month-on-month at 217,135 tonnes per day. Fuel oil output fell 8.3 percent in March to 204,232 tonnes per day, while jet kerosene production decreased by 9.7 percent to 20,474 tonnes per day. Year-on-year March refinery runs were down by 4.0 percent, or 231,462 bpd. (af.reuters.com)

Transportation / Trade……….

Africa’s richest man courts private equity to boost Nigerian gas

April 28, 2015. Aliko Dangote, Africa’s richest man, plans to quadruple the supply of gas to Nigeria by building pipelines that may be backed by Carlyle Group LP and Blackstone Group LP, the world’s two biggest private-equity firms. Dangote will invest $2.2 billion to $2.5 billion in two sub-sea 550-kilometer pipelines running from Nigeria’s oil and gas-producing Niger River delta region to the commercial hub of Lagos, Dangote said. The pipes will increase the amount of gas available in Africa’s biggest economy to 4 billion standard cubic feet per day from 1 billion, he said. While Nigeria has gas reserves of about 180 trillion cubic feet, more than any other African country, most of what’s produced is flared or exported because of a lack of infrastructure to transport it to local companies and households. Boosting domestic supply will help increase electricity generation in a country where power cuts are common and about 70 percent of electricity plants are fueled by gas, according to Dangote. Dangote plans to start laying the pipelines before the end of the year, he said. The first one should be ready by mid-2017. The pipelines could be used by oil producers in Nigeria that currently have little incentive to sell gas from their fields in the country, including Royal Dutch Shell Plc. and Exxon Mobil Corp., Dangote said. (www.bloomberg.com)

Global investors kick off lawsuit against Norway in gas pipeline row