-

CENTRES

Progammes & Centres

Location

Local Pollution and the Politics of Outrage (part II)]

“The elite in India may dismiss this point of view as rambling of the left or non-sense from the ill-adjusted. What they may be failing to see is that when they stand as negotiators of climate response mandates in global multilateral platforms, they will be the ill-adjusted and economically challenged party seeking priority for development and poverty alleviation over controlling carbon emissions. They will be labelled as climate criminals because they are seeking to avoid emission mandates…”

Energy News

[GOOD]

Crossing the 1 trillion unit mark in power generation is a significant milestone for the power sector!

300 million Indians do not have power because we failed to give them purchasing power!

[UGLY]

The sooner we realise that coal woes cannot be auctioned off the better it would be for the economy!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Local Pollution and the Politics of Outrage (part II)

· Key Requirement for Setting up Coal Washeries on Coal Company’s Land in India

ANALYSIS / ISSUES…………

· The German Energiewende turns around Industry’s Business Models (Part IIIa)

DATA INSIGHT………………

· Average cost of Electricity Supply in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Essar plans exploration drilling in two offshore blocks in India, Vietnam

· Shanghvi may pump $1.5 mn into gas fields

· ONGC's acquisition in Mozambique gas field saw seller reap $1.5 bn profit

· After dipping for 7 yrs, ONGC oil production inches upwards

Downstream……………………………

· IOC spend on petrochemical plants

Transportation / Trade………………

· GGCL, GSPC Gas to set up network in Thane, Dadra and Nagar Haveli

· Ennore to get networked to gas grid in 2017

· Enforce order on LPG supply: Kerala HC

Policy / Performance…………………

· Demand for petroleum products likely to rise

· India requires $100 bn per year investment for energy needs: IEA

· LPG cash transfer plan takes commercial cylinder sales up

· India to invest $6 bn more in Mozambique gas block: Oil Minister

· Oil Ministry submits proposal on premium for difficult gas fields

· KCCI seeks LNG handling facilities at New Mangalore Port

· Oil Minister to visit Mozambique

[NATIONAL: POWER]

Generation………………

· India to produce about 1,100 bn units of power in 2015-16

· BHEL commissions 600 MW thermal unit in Chhattisgarh

· Essar Power commissions the first unit of Paradeep Power Plant

· NTPC to soon appoint MDOs to develop 5 re-alloted mines

· NPCIL and France’s AREVA sign PEA for Jaitapur Nuclear Power Project

Transmission / Distribution / Trade……

· Coal imports jump 34 percent in 2014-15

· GVK’s Alaknanda hydropower project synchronised with Northern Grid

· Canada, India in advanced talks on nuclear fuel supply

· Delhi's power distribution companies seek to explore open market

· Post coal auction worries for power sector

· Karnataka to oppose privatisation of power distribution

· Investment in T&D sector in next 4 yrs to be ` 3 lakh crore: Goyal

Policy / Performance…………………

· SC grants time to Centre for assessing 18 hydro power projects

· Aim to save 200 bn units of electricity in 5 yrs: Goyal

· States to get 85 percent of electricity from projects set up by central utilities

· Maharashtra CM’s plea: Don’t oppose nuclear project

· 280 mn Indians don't have power connection: Goyal

· Will examine Margherita thermal power project proposal: Goyal to Gogoi

· J&K govt demands transfer of Dulhasti and Uri hydropower projects

· Centre to invest ` 100 bn in northeast power sector

· TN asks for additional coal block allocation

· Good news for TN as power project secures funding

· Nuclear fuel production hits a record

· Haryana approves 800 MW unit at Panipat plant

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil makes gas find near Aasta Hansteen field

· Saudi’s oil output projected at 9.8 mbpd this year

· Total's Skirne East well finds gas offshore Norway

· 'Significant' oil discovery made in Britain

· Shell in ‘advanced’ talks to buy BG for LNG, Brazilian oil

Downstream……………………

· Refiner Delek to buy Alon Israel' 48 percent stake in Alon USA

· Shell sells 185 UK petrol stations as retail divestments continue

· Total to present French refining restructuring plan

· KBR secures contract for Corpus Christi West refinery expansion in US

Transportation / Trade…………

· Western Australia hopes to expand LNG ties with Singapore

· ConocoPhillips to launch US asset sales

· Australian manufacturers fear Shell-BG deal may hurt gas market

· Lithuania considers re-exporting LNG as Russian gas gets cheaper

· 2nd major gas pipeline would link Pennsylvania, Northeast

· Dodge & Cox increases stake in Italy's Saipem

· Oil holds advance as recovery in Iran crude exports seen delayed

· Pakistan takes first LNG cargoes as list of importers grows

· Gazprom bid for second China deal seen challenged by crude slump

Policy / Performance………………

· Russia sees Europe relying heavily on its gas for next 25 yrs

· Obama sets rules for offshore oil wells 5 yrs after BP

· Dutch court will rule in Groningen gas suit

· Saudi Arabia’s plan to extend the age of oil

· US begins formal review of shell's arctic drilling plan

· TAPI construction to begin this year: Turkmen President

· Japan March LNG spot price rises slightly to $8 per mmBtu

· Saudi Arabia sees crude price rising as it boosts oil production

· Iran to commission 11 new petrochemical units to boost production

· Ghana state oil company cuts borrowing plan in half on oil price

[INTERNATIONAL: POWER]

Generation…………………

· Nepal clears $1.6 bn hydropower project by China's Three Gorges

· Trans-Asia Oil eyes doubling power generation to 1.2 GW in 5 yrs

· $800 mn power plant planned for Carroll County

· Power China to build power plant outside Karachi

· Turkey's Limak to invest $1 bn in power generation in 2015

Transmission / Distribution / Trade……

· GBPC signs supply deal with Iloilo power co-ops

· American Transmission plans $25 mn Franklin-to-Mukwonago power line project

Policy / Performance………………

· PPL secures NRC approval to transfer nuclear power plant licenses

· More German power plant projects not viable: BDEW

· Coal fired power plant in Neno awaits US$600 mn loan approval: Malawi

· Poland to explore FDI opportunities in agriculture, power sectors

· Japan-Indonesia power plant to break ground in Java

· Japan bets on nuclear, and coal, for future power

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India will set Climate Change conference agenda: PM Modi

· Three month action plan to combat air pollution in Delhi-NCR

· NITI Aayog to bring integrated energy policy soon: Panagariya

· Chinese firm keen to invest in AP

· Assam to give 800 bigha land for solar power facility: Goyal

GLOBAL………………

· Hanergy Thin Film outlines solar cells on vehicles plan

· Scrap fossil fuel subsidies now and bring in carbon tax: Kim

· California utility to make gas from solar for pipeline storage

· US EPA strikes deal on biofuel blending targets with oil groups

· Brazil to launch $6.5 bn fund to boost renewable power generation

· Vancouver commits to run on 100 percent renewable energy

· Japan to pledge 20 percent greenhouse gas cut

· China’s pollution assault boosting solar, electric vehicles

[WEEK IN REVIEW]

COMMENTS………………

Local Pollution and the Politics of Outrage (part II)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Continued from Volume XI, Issue 43

|

D |

rawing on the hypothesis of the Environmental Kuznets Curve (EKC), last week’s column ended with a rather sceptical observation that the problem of local pollution in Delhi is getting disproportionate attention because it is being raised by the articulate elite. It also questioned the argument of the elite that it is out of concern for the poor (who were likely to develop health problems or die because of urban pollution as the elite claim) that they are raising the issue of urban pollution (Please refer ORF Energy News Monitor Volume XI, Issue 43). These sweeping statements need to be qualified.

Let us begin by looking at the history of urban air pollution from cities in developed countries. In the winter of 1930, the highly industrialised parts of Belgium experienced high levels of pollution, particularly sulphur-di-oxide (SO2) which is claimed to have caused ill health among 6000 people and presumably also killed 60 people. In 1948, a similar situation in Pennsylvania USA is said to have killed 20 people and made 6000 people seriously ill. In 1952, over 4000 deaths were attributed to a dense fog in London over a two week period.

Studies that suggested a strong casual link between pollution levels and health in the above cases used statistical and graphical techniques dependent on questionnaire based surveys conducted among a small group of people. These studies essentially established the link between the health of urban dwellers and urban pollution levels by pointing out that the number of visits to the Doctor or events of death were above normal during the periods of pollution. Critiques of such studies point out that the procedures used in these studies are inadequate to establish a clear link between pollution and health problems and that extreme care was required when interpreting such small sets of data. Studies also questioned the use of questionnaires and other voluntary responses to measure the effect of air pollution. They argued that as awareness of high pollution levels is increased by news media, survey responses were likely to be influenced by the nature of news coverage. Some studies also pointed out that people who ‘died’ of pollution would have to have a serious prior illness and that pollution would have merely hastened death by a few days.

The idea of presenting the above detail is not to argue that nothing should be done about urban pollution. Pollution at the local and global level is a problem that the industrial society has failed to come to terms with and it needs to be addressed. What we are trying to highlight is how issues are framed politically to grab disproportionate attention. As Pratap Bhanu Mehta pointed out in a recent column outrage (for example, over urban pollution) is more about ‘us’ (the rich who are less affected by pollution) than about ‘them’ (the poor). There is sufficient evidence that the number of deaths increases during times of extreme summer or winter weather in Delhi. Most of those who die are poor, old and homeless. The articulate elite rarely get outraged about the loss of these lives as they do about presumed loss of life on account of urban pollution. Headlines in the English media rarely scream for action against lack of homes with electricity for cooling or heating to save these poor lives. Urban pollution, unlike winter and summer, is a negative environmental externality that the economic elites cannot manage without government intervention and they know how to get it. History has shown them that they have disproportionate political power even in democratic countries where everyone is supposed to have equal voice.

Nobel Laureate Dani Rodik quotes a study by Gilens and Page to show that when the elite manage to frame issues (such as immigration or pollution) as concerns of the poor (such as presenting the impact of immigrants on entry level jobs and wages or linking pollution to health) it has a strong positive influence on the government response. He cautions that this could give a misleading positive impression of the representativeness of the government especially over policies on strong national defence or a healthy economy where interests of the economic elites and the economic destitutes converged. Rodik points out that one of the tests in the study by Gilens and Page showed that when the preferences of the economic elite and the economic destitute diverged, it was economic elites that counted. Rodik also highlights conclusions of the study by Gilans and Page on the powerful impact of well-organised interest groups (which only economic elites and business groups can afford) on government policy.

Gordon Tullock, who pioneered work on lobbying for rent-seeking said that the influence of lobbyists came from their ‘ability to become an essential part of the policymaking process by flooding understaffed, under-experienced and overworked government offices with enough information and expertise to help shape their thinking’. This is essentially what seems to be shaping policy making in India with respect to the environment. Tullock’s partner in research, James Buchanan, a Nobel Laureate, coined the term ‘politics without romance’ which essentially said that politicians and bureaucrats are rational actors who strive to do what is in their best interest just as market actors do. What is in their best interest is to follow the elite.

The elite in India may dismiss this point of view as rambling of the left or non-sense from the ill-adjusted. What they may be failing to see is that when they stand as negotiators of climate response mandates in global multilateral platforms, they will be the ill-adjusted and economically challenged party seeking priority for development and poverty alleviation over controlling carbon emissions. They will be labelled as climate criminals because they are seeking to avoid emission mandates.

Technological solutions to limit or avoid carbon emissions that pollute the global atmosphere are not very different from solutions proposed for reducing urban pollution – phasing out of cheap inefficient cars, ban on burning, strict enforcement of pollution emission payments etc. These don’t matter if you are part of the economic elite because you don’t have to burn anything in your backyard to make a living or drive cheap two-wheelers and cars to cover long distances between your home and work place. What you consume, be it large quantities of electricity for heating or cooling or litres of petroleum products for your comfortable cars and colourful plastic products are all produced by burning fuels far away from your borders – some products such as air conditioners are made as far away as China. China can be held responsible for the pollution, not you.

The politics of synthetic outrage (over local pollution or incidents of rape) works on this sentiment as it is branded and sold as a call for justice in an unjust society. But as Pratap B Mehta puts it elegantly outrage often comes out of collective narcissism more than identification with the victims. What the outrage against urban pollution is seeking is clean air during walks in the park, not better lives for everybody.

Concluded

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Key Requirement for Setting up Coal Washeries on Coal Company’s Land in India

Ashish Gupta, Observer Research Foundation

|

Quality Parameter of Ministry of Coal |

Ø Develop India coal industry in an eco-friendly, environmentally sustainable and cost effective manner to support various associated industry. Ø Facilitate state of the art technology for optimisation of coal resources of the country. Ø To promote compliance of all the quality management systems. Ø To promote transparent governance system. |

|

Setting up of washery |

Ø Any consumer company with Fuel Supply Agreement (FSA) or a long term linkage can set up a coal washery for its own consumption. Ø Any public or private company can set up a washery or operate on behalf of a coal company on the land of any of the subsidiaries of Coal India Ltd (CIL). Ø If the land is acquired under Coal Bearing Areas Act, 1957 and the rights are vested with a coal company, the land can be leased for a maximum period of 30 years. Ø In case the land is not utilised for the coal washing, the land will be given back to the coal company. Ø The lease rent needs to be approved by the Board of the Coal Company. |

|

Qualifying Parameter |

Ø Operator should have a Memorandum of Understanding with coal consumer or group of consumer who have FSA or long term linkage. Ø Should have a financing plan for erecting coal washery supported with a comfort letter from financial institution or banks. |

|

Life of the washery |

Ø The life should not be less than 20 years. |

|

Maximum throughput |

Ø For optimum utilisation, the throughput of the washery should not be less than 2 Million Tonnes/ Per Annum. |

|

Technology |

Ø It should be selected on the basis of coal quality in such a way that it may produce less rejects with minimum heat value and dumped or stacked as per the Environment Management Plan (EMP). |

|

Environment Management Plan |

Ø The operator should prepare EMP as per the government guidelines and on regular basis shall get the same approved by the concerned authority. Ø The operator shall ensure close water circuit operation so that no effluent is discharged in the natural streams. |

|

Utilities Provision |

Ø During the construction phase, water and electricity can be provided by the coal company at one point on chargeable basis. Ø The washery operator can also obtain water and electricity on his own. |

|

Railway siding |

Ø The siding facility will be provided by the coal company to the washeries or their operators on chargeable basis. |

|

Monthly Reports |

Ø Details of the parties for whom washing was undertaken. Ø Quantity and quality of receipts of raw coal. Ø Quantity of raw coal processed. Ø Quantity of washed coal dispatched to the consumers. Ø The quantity of rejects generated, dumped, stacked or disposed off. |

|

Access |

Ø During the operation of the washery the coal companies shall have the right to access the plant to ascertain the suitability and maintainability of the plant. |

|

Washery of CIL under Build Own Operate mechanism |

Ø Entire raw coal produced from the identified mine will be linked to the concerned washery for supply of washed coal to the consumers as decided by the company. |

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

The German Energiewende turns around Industry’s Business Models (Part IIIa)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 34

|

T |

he ongoing Energiewende in Germany (“energy turnaround”) is not only turning around the basic structure of the energy market and prices – particularly in the power generation sector ‑ but also requires considerable transformation of the utilities’ business models. This series of articles about the world’s experimental laboratory in the effort to green the energy industry intends to catch up with recent (I) structural and (II) legislative developments that tackle German electricity markets. It will - in this current edition - focus on the shift in (III) corporate business models, which might also serve as a template for any other energy market in motion towards more decarbonised and smarter energy systems.

Since 2000, Germany has triggered the Energiewende, an ambitious restructuring program of the German energy industry with the aim to decarbonise the energy system in the long-run. Additionally the German government has decided to phase out nuclear power plants finally by no later than 2022, as a consequence of Japan’s Fukushima Daiichi nuclear disaster in 2011. The Energiewende is widely regarded as an ongoing showcase project in experimental mode, worth of being narrowly observed around the globe.

The restructuring process is challenging numerous and diverse market players in the German energy industry that are continuously forced to react and adapt their business models to the ongoing change in the structural and economical market conditions in order to safeguard their investments and appreciate shareholder value. Both risks and opportunities matter: on the one hand the odds are long for the conventional players like the ‘big four’ ex‑incumbent electricity producers E.ON, RWE, EnBW and Vattenfall. On the other hand is the chance for several smaller players to enter into the evolving energy market with smart and innovative ideas in the course of shifting towards a more renewable based, decentralised and smarter as well as interconnected market structure.

The intended structural changes are particularly hammering the core business of the incumbent utilities: the double whammy of Energiewende regulations towards a higher share of renewables and lower lignite and hard coal power stations as well as the gradual phasing-out of nuclear power is going to little by little eliminate the business model that they hitherto used to run: For decades some large utilities have dominated the German electricity sector by legally established, regionally demarcated and vertically integrated monopolies. Some of these companies could successfully survive the consolidation process resulting from the ongoing liberalisation process of the German (and European) energy market that took off in the mid nineties and maintain its dominating positions regionally: e.g. RWE in the industrially important Rhine-Ruhr region, EnBW in Baden-Wurttemberg and Vattenfall in the eastern parts of Germany.

It is widely said that the German utilities have relied too long on an obsolete business model that was profoundly based on large scale and long term investments in centralised base-load power generation plants fired by fossil fuels (first and foremost lignite/coal) and nuclear. Having overinvested in gas- and coal-fired plants before the financial crisis, the two largest players E.ON and RWE were building up too much capacity in the subsequent downturn while the subsidy-incentivised new and “green” competitors were upsetting the market. On top of that the nuclear accident at the Fukushima Daiichi reactor in 2011 has triggered an unprecedented turnaround manoeuvre by the German government that decided - just few months after having granted some lifetime extensions – to downturn eight out of 17 nuclear power stations in short term and the complete decommission of nuclear power in Germany by 2022, bringing forward the enormous decommissioning costs to the operators. Wholesale power prices have been deteriorating due to the rapid expansion of heavily subsidised renewables with low running costs and have additionally worsened the financial conditions for the big four even more, since they largely blew their chance of entering into green energy markets.

The Economist (2013) has put the rigorous situation for European utilities already out 2013 by titling “How to lose half a trillion euros - Europe’s electricity providers face an existential threat”: At their peak in 2008 the top 20 European energy utilities were stated to be worth about 1 trillion Euro. Till late 2013 they were losing half of their value. As illustrated in Figure 1 the share price of the two German top dogs E.ON (red line) and RWE (blue line) tanked till 2014 and have not recovered one jot since then. The sheer magnitude of the massive value destruction at the capital market becomes very clear by paying attention to the widening gap between the utility’s market value and the German blue chip stock market index DAX that has almost doubled within the last three years (grey line).

Figure 1: Share Price of selected German Utilities vs. DAX 2006-2015 (Index May 2006 = 100%)

Source: www.finanzen.net, accessed March 13, 2015. Compiled by author.

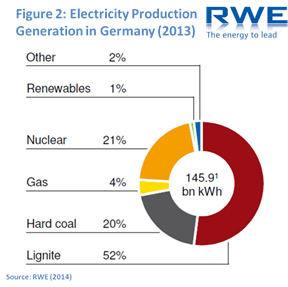

Casting a glance on the generation mix of RWE in Germany already reveals a lot of the dire straits the large utilities are actually facing. Figure 2 illustrates that more than half of RWE’s German power generation in 2013 was from lignite with hard coal accounting for another 20%; thus more than two-thirds of RWE power generation in 2013 was coal fired (and 59% capacity, respectively). Even if generation from indigenous lignite was thriving again in recent years, this is widely deemed as a temporary phenomenon. Currently the political pressure on that vastly available and cheap but most carbon-intensive type of fossil fuel is definitely on the rise: Since the German government firmly seeks to realise its intended carbon reduction targets the economy ministry has drafted a legislation that might urge the utilities to cut emissions by at least an extra of 22 mt CO2 by 2020. Accordingly a kind of new climate levy of about 18‑20 EURO/t CO2 is supposed to tackle the oldest and most carbon-intensive power stations meaning that several coal-fired power stations may be closed down. These are bad news particularly for RWE that alone runs four of the biggest lignite power stations. Besides, nuclear power stations are accounting for more than one fifth odd in RWE’s generation mix, yet another end-of-range model.

On the other hand E.ON is not that much dependent on lignite, however, nuclear power make up almost one third of its overall generation capacity in Germany, even if already two reactors were forced to shut down in 2011, right after the Fukushima disaster. Another reactor in Grafenrheinfeld is planned for being decommissioned by May 2015. Vattenfall is profoundly involved in lignite mining and generation in the Eastern parts of Germany; the Swedish state company has recently announced to offload all its German lignite assets. More or less the same picture can be drawn for the fourth big player EnBW that has large stakes in nuclear as well as coal/lignite power generation. Figure 2

What is more, even natural gas fired power stations that are much required for overall (technical) system stability needs have been widely mothballed in recent years due to losses resulting from longer lasting negative clean spark spreads. Therefore - as one aspect of the so-called ‘Energiewende-Paradox’ (higher CO2-emissions despite higher share of renewables) – natural gas power stations are continuously squeezed out of the market by cheaper coal-powered blocks. Quite recently E.ON has officially announced the closedown of its just two years old, most efficient state-of-the-art natural gas fired blocks 4 and 5 at the Irsching power plant in Bavaria with due effect on April 2016 because of its expected ongoing poor economics. Up to now these blocks were put under a so-called redispatch agreement for two years until March 2016 under that the plant operators are reimbursed from the grid operator TenneT (yet still the regulator can prohibit the closure for operational network security reasons).

Even the formerly most lucrative chunk of power generation in Germany has been thwarted by the rise of renewables since at peak hours in the middle of the day there’s no big profit to cash in anymore on sunny days, because massive solar power generation tends to significantly control the profitable price spread between peak-hour and base-load prices.

In a nutshell, the big four altogether suffer from the break-off of their core business, the centralized large-scale power generation. On the downside, the big four’s stakes in renewables is partly nominal as can drastically be seen in Figure 2 looking at the marginal share of renewables in RWE’s generation portfolio in Germany (that is only slightly higher on company-wide international scope). The data from RWE’s quite recently published annual report 2014 reveals that the group-wide power generation from renewables decreased by 27% year-on-year to a lousy 10 TWh in 2014 (due to closure of a biomass combustion plant in UK), that is less than 5% in RWE’s overall power generation mix. The share of RWE’s power generation from renewables in Germany itself is yet lower; it fell from 0.7% in 2013 to poor 0.5% in 2014. On a first glance E.ON seems to be better invested into renewables, however, far more than 90% of renewable generation and capacity can be attributed to hydro. E.ON’s renewable power generation fell in Germany from 2013 to 2014 by 22%; in 2014 renewables (i.e. hydro) made up about 7% in E.ON’s overall German power output.

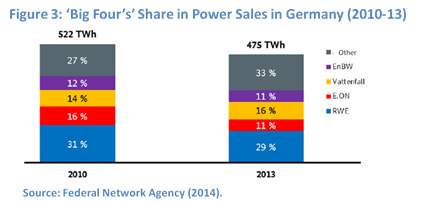

Figure 3

Figure 3

Therefore, the big four have bet not only too long on discontinued fossil fuel and nuclear power stations on the one hand, they even seem to have missed the opportunity of investments into the booming sector of renewable energy. According to the Federal Network Agency’s (2014) recently published monitoring review the big four utilities’ aggregated market share of power generation capacity in Germany has collapsed another 11%-age points within only three years 2010-2013 down to 68%. Their combined share in overall power generation in Germany has fallen from 84% to 74%, respectively, primarily due to the generation attributed to E.ON, that went down by 38%. As a result, one can state that over the course of the Energiewende restructuring process the ownership profile of the power generation assets has been broken up from only a handful of former incumbents led by E.ON and RWE towards a wide variety of smaller and independent power producers like private citizens and farmers (together owning almost half of the renewable generation in Germany), followed up by project developers as well as industry and banks. And even the approx. 800 so-called Stadtwerke are yet playing vital role in the German energy companies landscape, gaining from their potential of local power production and particularly from options in co-generation plants. (The Stadtwerke currently stage a comeback with numerous municipal new establishments after a large wave of privatisation during the 1990s.) The corresponding power sale market shares for Germany (as shown in Figure 3) are highlighting the same deconcentrating trend, as the former incumbents’ stake in the sales market is plunging (to a combined share of 67% in 2013) as well, particularly E.ON but RWE, too.

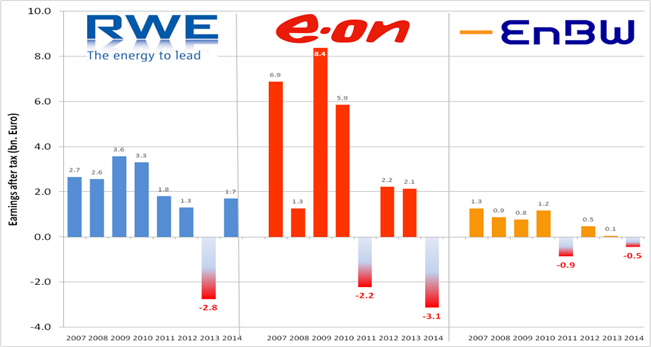

The bottom line is that the big four are getting more and more into the red due to the insidious breakup of the utilities’ longstanding fossil fuel and nuclear driven business model. E.ON has recently announced a huge loss of more than 3 bn Euro (over 2 lakh crore rupees) for its business year 2014, the second one in the company history after 2011 (see Figure 4). RWE already faced a similar loss in 2013 due to strong depreciations. Besides the falling power prices and falling business volume, E.ON is troubled by other problems including its Russian subsidiary suffering from the weakness of the ruble as well as trade sanctions, its Brazilian power producer Eneva filed for bankruptcy protection at the end of 2014, mistaken asset investments in Spain that were again offloaded end of 2014 and last but not least the massive oil price drop. Not that long ago E.ON experienced some bonanza years with annual profits of 6-8 bn Euro.

Figure 4: Profits of selected German Utilities 2007-2014 (Earnings after tax in bn. Euro/a)

Source: www.finanzen.net, accessed March 25, 2015. Compiled by author

Looking at the steadiness of dividends (i.e. the returning value for shareholders) that serves as a performance benchmark for the attractiveness of long-term investments, one can as well observe a clear and steady downswing (Figure 5). For example, RWE cut its current dividend by half to 1 euro that is only a fraction of the 4.5 Euro they paid some years earlier. Starting in 2015, RWE will no longer calculate dividends on recurrent after-tax profit but will base the payments on operating cash flow, debt and earnings. However, reliable dividend payouts are particularly important for RWE since the biggest single shareholder is a group of highly indebted towns and cities in North-Rhine-Westphalia that seeks a stable income to settle their budgets.

Figure 5: Dividends of selected German Utilities 2003-2014 (in Euro/kWh)

Source: www.finanzen.net, accessed March 25, 2015. Compiled by author.

Those days of high profits and dividends are over, and probably never to return. Even worse, the utilities management is blamed for having failed to cope appropriately with the market challenges; a recently published study on behalf of Greenpeace (2015) ascribes severe strategic flaws, first of all, that reactions were not timely and decisive enough to change course:

· The big four have banked too long on their high margins and profits from market power and didn’t realize the need to bring business in line with the successive market changes;

· They have unilaterally focussed on lifetime extensions of their nuclear power stations, which turned out to be faulty after the phase-out decision in the wake of the Fukushima disaster;

· They simply missed the investment options in the upcoming renewable energy sector.

About one year ago, when the CEO of RWE had to announce a historic loss, Spiegel-Online (2014) has headlined: ‘conceptless RWE CEO: lamenting as a strategy’. The critique was that the company’s strategy was built up too much on the hope that the government might take pity on them while ignoring entrepreneurial solutions. Hereof two big ideas surrounding state compensation and supply risks are repeatedly floated towards the policymakers:

· The first strategy is to increase the pressure in relation with the decommissioning of the German nuclear energy sector. The big four have filed several lawsuits against the decision to terminate the lifetime extension and the immediate shutdown of eight nuclear power plants as well as against the nuclear fuel tax regime. According to Reuters (2014) E.ON is said to claim about 8 bn Euro, RWE more than 2 bn Euro and Vattenfall 4.7 bn Euro. Furthermore, the creation of a kind of “bad bank” to hive off the four nuclear operators’ provisions of about 36 bn Euro for plant decommissioning and disposal of nuclear waste is at issue.

· Strong lobbying in order to achieve a market redesign in favour of the so-called “power capacity market” that shall help to uphold investment in power plants that provide back-up capacity, which otherwise might be mothballed due to negligible load and/or profit. So far the government is refusing to consider the creation of service payments like this, however, neighbouring markets like the UK have already acknowledged and implemented that concept by implementing capacity auctions.

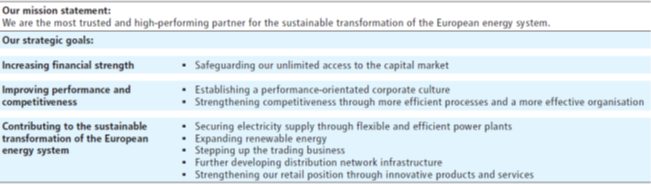

Nonetheless, the utilities’ lobbyists in Berlin have forfeited their immense power of successfully influencing the policymakers in the recent years. Therefore large rationalisation programs have been rolled out, incorporating large scale reduction in employment, organisational streamlining, outsourcing of non-core assets business areas and closing of unprofitable power plants (the start of RWEs most recent profound cost-cutting programme “Lean Steering 2.0” was heralded only a couple of days ago at mid April). The tense debt situation is pressuring to sell off assets, as quite recently the oil/gas exploration and production unit RWE Dea. RWE, E.ON and EnBW are altogether singing renewable power expansion praises now and furthermore strengthen their investment in infrastructure and smart energy products and services. Their announced mission statement obviously still lives on the credit of the old conventional energy world (see as an example RWE’s mission statement in Figure 6).

Figure 6: RWE’s Mission Statement 2015

Source: RWE Annual-Report 2014.

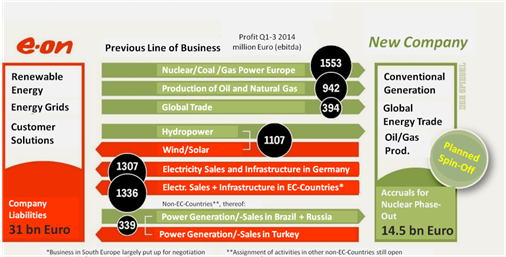

While RWE seems to head on strategically by muddling through, the most comprehensive strategic approach is pursuit by E.ON and Vattenfall. On the one hand Vattenfall has started to prepare its market exit by announcing to sell its lignite generation plants and mines in eastern Germany. On the other hand E.ON desperately tries to change track and decided to perform its second comprehensive strategy swing within a couple of years after 2010 when the management has opted to enter new international markets like Brazil. However, the most radical strategic step was announced in Nov. 2014 as Germany’s largest utility surged forward to offload its complete fossil fuel and nuclear based power generation business as well as global trading unit and it’s upstream into the so-called “New Company” (Figure 7). The new company will generally incorporate E.ONs former core business including struggling Brazil and Russia operations. The divestiture would leave E.ON to focus on environmentally friendly renewable-energy sources and is intended to become an energy network and solutions provider; E.ON’s 31 bn Euro net debt will retain with this larger part of E.ON. E.ON has repeatedly reaffirmed that the spin-off company would have sufficient financial strength to cover the liabilities associated with the decommissioning of nuclear energy in Germany; the company’s accrued liabilities for the nuclear phase-out of currently about 14.5 bn will remain with the nukes in the new company. By all means, E.ON’s restructuring agenda has startled politicians because of fears coming up in public discussion that E.ON might be creating a 'bad bank' for its seven nuclear plants that will have to be bailed out by the German taxpayer as a leading member from the Green Party has put it bluntly. (Overall provisions of the big four are about 36 bn. Euro for plant decommissioning and disposal of nuclear waste; however, there is an ongoing debate whether there are sufficient funds).

Figure 7: Planned Spin-Off Company Structure of E.ON (incl. data from 2014)

Source: Der Spiegel (2014b). Compiled by author.

The second part on evolving business models dealing with new and future concepts at the energy markets will be published in the next issue of the Energy New Monitor. to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

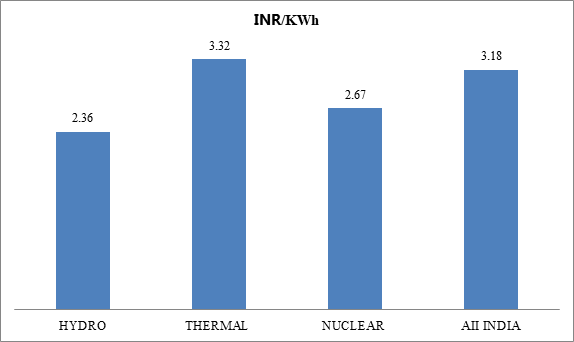

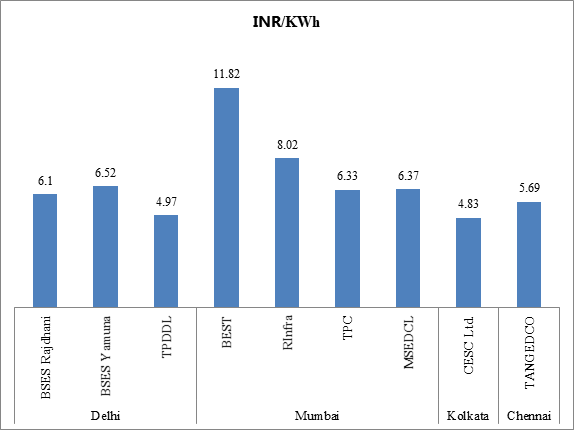

Average cost of Electricity Supply in India

Akhilesh Sati, Observer Research Foundation

A) From Power Generating Stations to Power Utilities (for year 2012-13)

B) From Power Utilities to Consumers (for year 2013-14)

Source: Rajya Sabha, Q. No. 1213 (answered on 09/03/15) & Q. No. 1640 (answered on 08/12/14)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Essar plans exploration drilling in two offshore blocks in India, Vietnam

April 14, 2015. Essar Energy plans to press on with exploration drilling at its blocks in India and Vietnam in September-October as the firm steps up efforts to increase its crude oil production even as energy companies reduced capital expenditure in response to the slump in global oil prices that began in the second half of last year, the company said. The plan to proceed with exploration drilling at the two blocks comes after joint venture partners completed mapping the prospects based on 3D seismic data for these offshore blocks. Essar Energy has a 30 percent stake in shallow water exploration block MBOSN-2005/3, located near the Mumbai High field offshore Mumbai, while Oil and Natural Gas Corp (ONGC) holds the remaining 70 percent interest. (www.rigzone.com)

Shanghvi may pump $1.5 mn into gas fields

April 14, 2015. Dilip Shanghvi's Sun Oil & Natural Gas, an associate company of Sun Petrochemicals and Sun Pharmaceuticals, signed a deal for the transfer of Interlink Petroleum's interest in the Modhera and Baola fields. Sun Oil & Natural Gas could invest $1-1.5 million in the oil and gas fields. Once the assignment is complete, Sun Oil & Natural Gas will invest to raise production and monetise the reserves. Interlink Petroleum is prospecting two oil and gas fields in Gujarat, Baola and Modhera, both blocks awarded in round one of bidding of the New Exploration Licensing Policy. Last year, the company supplied around 80,000 standard cubic meters of natural gas from its Baola field before production was suspended as water flowed into the well. The Modhera field is yet to start production. (www.business-standard.com)

ONGC's acquisition in Mozambique gas field saw seller reap $1.5 bn profit

April 12, 2015. Oil and Natural Gas Corp's (ONGC) acquisition of 10 percent stake in a giant Mozambique gas field had helped the seller make a neat profit of $ 1.5 billion or over 62 percent of the purchase price. ONGC had in June 2013 bought 10 percent stake in the Offshore Area 1 from Videocon Group for $ 2.475 billion and followed it up with another 10 percent stake buy from US energy major Anadarko Corp for $ 2.64 billion last year. Anadarko said it made a "gain" of $ 1.5 billion from the sale of 10 percent interest in Offshore Area 1. ONGC Videsh Ltd (OVL) had split the 10 percent stake it bought from Videocon for $ 2.475 billion with Oil India Ltd (OIL) in 60:40 ratio. So, OVL has 16 percent stake in Offshore Area 1, which holds as much as 75 Trillion cubic feet of gas reserves. OIL has 4 percent and a unit of Bharat Petroleum Corp Ltd (BPCL) another 10 percent. Gas from the block is to be converted into liquefied natural gas (LNG) for transportation by ships to markets like India. Indian firms will have access to 30 percent of 60-80 million standard cubic meters per day of planned gas production from the block. About $ 18.4 billion will be required to bring the first set of finds to production and convert it into LNG. The Area-1 consortium is focused in looking at bringing first gas by 2019. (economictimes.indiatimes.com)

After dipping for 7 yrs, ONGC oil production inches upwards

April 8, 2015. Oil and Natural Gas Corporation (ONGC) has reversed a seven-year decline in its crude oil production, showing a marginal increase in output in 2014-15. ONGC produced 22.263 million tons (MT) of crude oil during April 2014 to March 31, 2015, up from 22.247 MT in the previous fiscal, the company said. This is the first increase in production since 2007-08 when the slump started. ONGC had produced 26.05 MT of crude oil 2006-07, which dipped to 25.94 MT in the following year. ONGC, which produces 59 percent of India's crude oil output, has been under critical scrutiny ever since the BJP government took office 10 months back. Oil Ministry has been on a monthly basis monitoring ONGC's performance. ONGC's production fell to 25.37 MT in 2008-09, 24.67 MT in 2009-10, 24.42 MT in 2010-11, 23.71 MT in 2010-11 and to 22.56 MT in 2012-13. Offshore production rose to 16.196 MT from 15.541 MT in 2013-14 but onshore output was lower at 6.067 MT in 2014-15 as compared to 6.706 MT of the previous year. For 2015-16, ONGC is targeting a total of 26 MT of oil production - 22.732 MT from its own fields and another 3.268 MT from joint venture fields like Barmer block in Rajasthan. During 2014-15, joint venture fields produced 3.682 MT of crude oil, taking its total oil to 25.945 MT. Natural gas production was however lower at 17.27 billion cubic meters in 2014-15 as against 17.96 bcm output in the previous fiscal, the company said. The increase in offshore production was mainly due to early monetisation of marginal fields such as D-1, B-193 and CL-7 in western offshore with the help of floating platforms and other innovative technologies, the company said. These fields will continue to boost output in 2015-16 as well, the company said. Offshore production in 2015-16 is likely to rise to 16.61 MT. (economictimes.indiatimes.com)

Downstream………….

IOC spend on petrochemical plants

April 8, 2015. Indian Oil Corp (IOC), the country's largest refiner and fuel retailer, is set to spend about ` 45,000 crore over three years to build petrochemicals plants and LNG terminal, lay pipelines and upgrade its refineries, aided by a deregulation of fuel sales and oil price crash that have helped slash its debt. The state-run firm is also likely to benefit from a rise in crude oil prices since January without much price fluctuations. Inventory loss — a result of sharp fall in prices between June 2014 and January 2015, when refiners were forced to sell products at less than their cost — destroyed profits at most refiners in the quarter to December. A large inventory loss mainly contributed to IOC's losses during the three-month period. Lower crude oil price, coupled with deregulation of fuel at home, has also slashed the company's working capital requirement, reducing the need to borrow. Petrochemicals, gas and pipeline will be the focus areas for IOC's future expansion. The company plans to spend about ` 15,000 crore in 2015-16 and a similar amount in each of the two succeeding financial years. (economictimes.indiatimes.com)

Transportation / Trade…………

GGCL, GSPC Gas to set up network in Thane, Dadra and Nagar Haveli

April 13, 2015. GSPC Gas Company Ltd and Gujarat Gas Company Ltd (GGCL) will set up city gas distribution network in Union Territory (UT) Dadra and Nagar Haveli and Thane in Maharashtra. The two companies under GSPC Group received authorisation from the market regulator, Petroleum and Natural Gas Regulatory Board (PNGRB) to set up the gas network. Gujarat energy minister Saurabh Patel informed that the two companies will invest a total of around ` 1,400 crore to set up the gas network which will provide gas for domestic users, auto and small industries in Dadra and Nagar Haveli and Thane. The gas pipeline will supply gas to about 10.76 lakh households. After the competitive bidding process by PNGRB, the GSPC Gas won the bid to set up gas network in Union Territory Dadra and Nagar Haveli, while Gujarat Gas won the bid for gas network in Thane in Maharashtra.

As per the authorisation provided by the regulator, GSPC Gas will cover the areas of Sili, Silvassa, Naroli, Samrvarni, Masat, Saily, Khanvel and Sindoni in Dadra and Nagar Haveli. This will require an investment of ` 222 crore, which will cover 76,500 households under the gas pipeline network. While GGCL in Thane will cover the areas of Talsari, Dahanu, Palghar, Vikramgarh, Javhar, Mokhda, Vada, Vasai, Bhivandi, Shahpur, Kalyan, Marbad and Amba Math where about 10 lakh households will be covered with an approximate investment of ` 1,207 crore. Also, the gas will be used for small and medium industrial units as well as for auto CNG. Currently, the three state-run CGDs of the GSPC Group namely, GSPC Gas, GGCL and Sabarmati Gas put together supply gas to about 10,85,000 households in the state through pipeline. (www.thehindubusinessline.com)

Ennore to get networked to gas grid in 2017

April 11, 2015. Piped gas could finally be within the reach of Chennai’s fuel-thirsty industries by the end of 2017, with a private firm winning a bid to build a pipeline connecting the city’s northern suburb of Ennore to Nellore in Andhra Pradesh. KEI-ROS Petroleum and Energy Private Limited, based in Andhra Pradesh, has won the mandate to build, own and operate for 25 years the 250-km pipeline via Krishnapatnam Port, a company representative confirmed through email on the condition of anonymity. This is the latest attempt to build a gas pipeline in the State after a few earlier ones ended in failure. One high-profile project that bit the dust was initiated by India’s biggest natural gas distributor GAIL India. Its plan — to run a pipeline from Kochi to Mangalore via Tamil Nadu — remained a non-starter with farmers in the State opposing the laying of pipes through agricultural land. Only 50 km of the pipeline to be built by KEI-ROS Petroleum will be in Tamil Nadu. Also, the company doesn’t foresee the need for agricultural land, as the plan is to run the pipeline close to the National Highway. The ` 650 crore project needs clearance from the Union Ministry of Environment and Forests. The company expects groundwork to begin by June next year and the project to be commissioned by December 2017. Piped gas could benefit manufacturers of gas, ceramics, fertilizers, petrochemicals, tyres and automobiles, apart from helping CNG stations, refineries and foundries. These industries had earlier gone through the disappointments of seeing the GAIL project fail as well as seeing an alternative project — seeking to draw from Indian Oil Corporation’s LNG terminal at Ennore — getting excessively delayed. (www.thehindu.com)

Enforce order on LPG supply: Kerala HC

April 8, 2015. The Kerala High Court (HC) directed the State Government to strictly enforce the order that brings the service of transportation and supply of Liquefied Petroleum Gas (LPG) under the purview of the Essential Services Maintenance Act (ESMA). The court observed that the Chief Secretary was fully justified in taking the decision to make the supply of LPG under provisions of the Essential Services Maintenance Act. The government pointed out that the strike called by employees and the truck owners supplying LPG cylinders would adversely affect the distribution of LPG. (www.newindianexpress.com)

Policy / Performance………

Demand for petroleum products likely to rise

April 14, 2015. India's annual demand for oil products is expected to grow 3.3 percent next financial year, according to the Petroleum Planning and Analysis Cell (PPAC), India's energy data body. The country is expected to consume 167 million tonnes of refined fuels in 2015-16, against an estimated 162 million tonnes in 2014-15. With the Indian economy projected to grow close to 7.4 percent in 2014-15, the growth in demand for diesel, is set to rise 4.1 percent to 71.32 million tonnes. Diesel accounts for about 40 percent of refined fuel consumption. Demand for petrol is expected to grow 7.2 percent to about 19.7 million tonnes. The slump in crude oil prices, down 50 percent to $53.64 per barrel from its peak levels of $109 per barrel in June 2014, has made petroleum products cheaper. Petrol prices are down 11 times since August 2014 and diesel prices seven times since October 2014. On April 2, petrol prices were cut 49 paise a litre and diesel ` 1.21 when international oil rates recovered from a fall. Prices of LPG cylinders (non-subsidised domestic) have gone down by 35 percent. According to PPAC, the consumption of all petroleum products grew 2.7 percent till January, 2015, compared to that by January 2014. (www.business-standard.com)

India requires $100 bn per year investment for energy needs: IEA

April 13, 2015. India needs an investment of USD100 billion a year to meet its growing energy needs, a task which requires right pricing and legal framework, the International Energy Agency (IEA) said. India is the third largest energy consumer in the world after China and US. Its energy use will continue to increase, IEA chief economist Fatih Birol at a workshop on India Energy Outlook said. Three important factor that are needed to support India's growth prospects are "investment, investment and investment", Birol said.

Foreign and private investors, he said, were ready to come and invest "but for that, conditions need to be right. Right pricing signals and right legal framework". A quarter of Indian population is without electricity and there are concerns over air quality and other environmental indicators, Birol said. Birol said global oil prices are likely to continue to remain low in near future because of adequate supplies. Middle East, despite geopolitical issues, will remain the most important oil supplier to the world and a critical source for India, Birol said. India imports 77 percent of its crude oil needs. (dc.asianage.com)

LPG cash transfer plan takes commercial cylinder sales up

April 13, 2015. The government's direct cash transfer drive for liquefied petroleum gas (LPG) consumers has begun accomplishing its key objective of stopping the diversion of subsidised cylinders to commercial use, the data shows. There's been rapid growth in the sale of commercial cylinders even as demand for subsidised cooking gas has slowed, according to data provided by Indian Oil Corp (IOC), the country's largest LPG retailer, with almost half the market share. With 82% of cooking gas customers getting subsidy directly from the government, there is hardly any room for unscrupulous dealers to supply cheap cylinders to commercial customers.

In March, the pace of growth of subsidised LPG consumption for domestic purposes fell to 3.1% from 5.8% in February and 12.2% between April 2014 and February 2015. To be sure, the higher growth between April and February was also due to the addition of 1.4 crore LPG subscribers. Non-domestic consumption of LPG cylinders jumped 28.2% in March, accelerating from 26.9% in February. Demand in this category had declined 4.6% during April-February. Similarly, auto LPG, or the gas consumed by cars, grew by 9.8% in March and 15.9% in February and had declined 17.5% during April-February. The data show that the rapid implementation of the Direct Benefit Transfer of LPG (DBTL) scheme by fuel retailers such as Indian Oil, Hindustan Petroleum and Bharat Petroleum has borne fruit. The growth slide in domestic consumption, even with many fresh subscribers, is mainly due to the weeding out of fake subscribers with the adoption of DBTL. Subsidised domestic consumption makes up 92% of the LPG used in the country. (economictimes.indiatimes.com)

India to invest $6 bn more in Mozambique gas block: Oil Minister

April 13, 2015. In addition to the $6 billion already invested, Indian oil companies are slated to invest another $6 billion in stages by 2019 in Mozambique's Rovuma Area 1 offshore block, Oil Minister Dharmendra Pradhan said. ONGC Videsh Ltd (OVL), Oil India and Bharat Petroleum Corp have bought 30 percent stake in this Mozambique gas block and will also participate in the LNG project.

Describing Mozambique, situated on the eastern coast of Africa, as an important destination from the standpoint of India's energy security, the oil minister said a joint working group, which was decided to be set up in November 2014, met in Mozambique during his visit. On liquefied natural gas (LNG) imports from Mozambique, Pradhan said the first shipments are expected to come by 2019, and the operator consortium has already begun talks with Indian utilities like GAIL regarding supplies. Mozambique plans to produce 34 million tonnes of LNG annually from its biggest gas field. Ten LNG terminals are likely to be set up, each with a yearly capacity of five million tonnes of gas. (www.assamtribune.com)

Oil Ministry submits proposal on premium for difficult gas fields

April 8, 2015. The Oil Ministry has submitted a proposal to the Finance Ministry for paying a premium to natural gas producers for difficult fields. A formula, based on recommendation of the Directorate General of Hydrocarbons, has been approved by Oil Minister Dharmendra Pradhan and it has now been forwarded to the Finance Ministry for vetting.

The government, while approving a new gas pricing formula based on international hub rates in October last year, had decided that new gas discoveries in deepwater, ultra-deep sea or high-temperature and high-pressure fields will be given a premium over and above the approved price. Gas price, according to the formula, was USD 5.05 per million British thermal unit till March 31 and has subsequently been cut to USD 4.66 in line with international movements. The premium to gas from difficult fields will be over and above this rate.

DGH had in January submitted a formula for calculating the premium on such projects. The Cabinet headed by Prime Minister Narendra Modi had in October approved a revised natural gas price and stated that discoveries made after this announcement in difficult regions would be given a premium as exploration and drilling is costly and challenging. (economictimes.indiatimes.com)

KCCI seeks LNG handling facilities at New Mangalore Port

April 8, 2015. The Mangaluru-based Kanara Chamber of Commerce and Industry (KCCI) has requested the Union Petroleum Ministry to set up LNG handling infrastructure at New Mangalore Port. A KCCI delegation led by its president Nigam Vasani met the Union Minister of State for Petroleum and Natural Gas, Dharmendra Pradhan, during his recent visit to Mangaluru and made a plea in this regard. Vasani said the proposal for setting up an LNG terminal at New Mangalore Port has been pending for over a decade. Requesting the government to sanction a floating storage regasification unit (FSRU) to handle LNG at New Mangalore Port, he said the economic justification for the same was already established. There is a demand for over 5 million tonnes of LNG in Karnataka. In fact, the coastal districts of Dakshina Kannada and Udupi have a demand of 2.5 million tonnes. Karnataka, which has no energy resources of its own, requires special attention, he said. Stressing the need for importing methane-rich LNG, Vasani said methane can be used as feedstock for fertilisers and clean power. (www.thehindubusinessline.com)

Oil Minister to visit Mozambique

April 8, 2015. Oil Minister Dharmendra Pradhan will conduct a three-day official visit to Maputo, where he is scheduled to hold bilateral talks with his Mozambique counterpart. Pradhan will also captains of the oil and gas industry and other associated sectors in Mozambique. He will be accompanied by a business delegation, led by the Confederation of Indian Industry (CII), which will explore ways to strengthen business to business ties with Mozambique.

The minister is expected discuss ways to expand and strengthen energy cooperation between New Delhi and Maputo. In November 2014, Mozambique Foreign Minister OldemiroBaloi and Pradhan had signed an memorandum of understanding on cooperation in the oil and gas sector. (www.newkerala.com)

[NATIONAL: POWER]

Generation……………

India to produce about 1,100 bn units of power in 2015-16

April 14, 2015. The government has set a target of generating close to 1,100 billion units of electricity during the current financial year as the coal supply at thermal power stations has eased. This target is over seven percent of the previous fiscal’s target of 1,023 billion units (BUs). The actual generation numbers for the fiscal gone were not available. According to the latest report by the Central Electricity Authority (CEA), the government has set a target of producing 1,098 BUs of power during 2015-16. The central sector plants will contribute 411 BUs and state sector 401 BUs to the total targeted capacity. Another report by CEA said that the fuel supply at thermal power plants has improved. Only 9 projects had less than seven days of coal supply at their disposal, of which 4 projects had stockpiles for less than four days, on April 9. This is an improvement from last month (March 9), when 12 stations had less than seven days of fossil fuel. Of the total 1,098 BUs that the government aims to generate in the current fiscal, 965 BUs will come from thermal power and the remaining from hydel plants (133 BUs). As many as seven hydro projects, which are likely to come up during the current financial year, will contribute 2,766 million units of electricity to the total generation. The peak power deficit, or the shortfall in electricity supply when the demand is maximum, stood at 2.8 percent in February this year. (www.thehindubusinessline.com)

BHEL commissions 600 MW thermal unit in Chhattisgarh

April 13, 2015. Bharat Heavy Electricals Ltd (BHEL) said it has commissioned another 600 MW unit of a thermal power project in Chhattisgarh. The unit was commissioned at Dainik Bhaskar Power Ltd's (DBPL) upcoming 2x600 MW thermal power project located at Dhabra in Janjgir Champa district ofChhattisgarh, BHEL said. This is the second unit of the power project, commissioned by BHEL, BHEL it said. The first 600 MW unit was commissioned by the company last year. With a cumulative installed capacity of 11,40O MW, the share of BHEL stands at 68 percent of the total installed capacity in the state. (economictimes.indiatimes.com)

Essar Power commissions the first unit of Paradeep Power Plant

April 13, 2015. Essar Power, one of India’s leading private sector power producers, commissioned the first unit of 30 MW power at its 120 MW captive Paradeep Power Plant in Odisha. In the coming months, the balance 90 MW (3 X 30 MW) would be commissioned in phases. The company’s 120 MW coal fired power plant will meet the power requirement of Essar Steel’s12 million tons per annum integrated pelletization facility in Odisha, comprising of a pelletisation plant at Paradeep and a beneficiation plant at Dabuna, connected through a 253 kms slurry pipeline. Upon completion, Essar Steel would have access to cheap and reliable power supply, thereby improving its competitive edge. The 220 kV transmission line from plant switchyard to Main Receiving Sub Station (MRSS) of steel plant has already been commissioned for power evacuation. The company is one of India’s leading private power producers with over 14-year operating track record and owns and operates power plants in India and Canada with a total generation capacity of 6,700 MW. (odishasuntimes.com)

NTPC to soon appoint MDOs to develop 5 re-alloted mines

April 12, 2015. NTPC will soon appoint firms to start production from five coal mines that were recently re-alloted to it. NTPC will soon appoint Mine Developer and Operators (MDOs) for the development of all mines recently alloted to it. NTPC is committed to beginning coal output from the mines in another two years. The five mines are Kerandari, ChattiBariatu, ChattiBariatu (South) in Jharkhand, Talaipalli in Chhattisgarh and Dulanga in Odisha. The state-owned power generation company was re-allotted five coal blocks that were cancelled last year by the Supreme Court. It had said the blocks alloted to it will help boost power production. The government had last allotted 38 mines to central and state public sector units including power major NTPC, DVCand steel giant SAIL. (www.business-standard.com)

NPCIL and France’s AREVA sign PEA for Jaitapur Nuclear Power Project

April 12, 2015. Nuclear Power Corporation of India Ltd. (NPCIL), a PSU under the Department of Atomic Energy, Government of India, and M/s AREVA of France have entered into a Pre-Engineering Agreement (PEA) on April 10, 2015 in connection with the proposed Jaitapur Nuclear Power Project for setting up of two EPR (Evolutional Pressurised Reactor) rectors of 1650 MWe each to be set up in collaboration with France. The PEA will facilitate NPCIL to obtain details of the EPR technology, make a detailed safety assessment of the plant and take up the licensing process with Atomic Energy Regulatory Board (AERB), as soon as the Jaitapur Nuclear Power Project is taken up for implementation. The PEA will also contribute to explore the most efficient and cost-effective pathways for project implementation, and to maximise the scope of localisation of different components of the power plant, with a view to not only make the project economical, but also enhance India’s domestic capabilities in line with the campaign for “Make in India”. These preparatory steps are going to be necessary whenever the Jaitapur Nuclear Power Project is taken up, thus saving precious time and cost in the implementation of the project. The signing of PEA with AREVA is an important reflection of India’s abiding interest in partnering with France in the civil nuclear power sector. (pib.nic.in)

Transmission / Distribution / Trade…

Coal imports jump 34 percent in 2014-15

April 14, 2015. Coal imports into India, the world's third largest buyer, jumped 33.5 percent in the last fiscal year to 242.4 million tonnes as lower purchases by China depressed prices and helped consumers elsewhere, preliminary data from online trader mjunction showed. Indian power companies typically depend on imports for about 15 percent of their annual needs but that figure looks set to climb thanks to a continuous fall in prices, which has raised the appetite for foreign coal. Imports in March were estimated to have risen 80 percent to 24.73 million tonnes, according to mjunction data based on information from shipping companies, ports and other sources. Government data on imports generally comes with a lag and varies with those from private firms like mjunction, which collects data from a greater number of ports and includes additional coal grades. Coal Secretary Anil Swarup estimated imports of 200 million tonnes for 2014/15 and 160 million tonnes for the 2015/16 fiscal year. According to data, India imported 168.4 million tonnes in 2013/14, while mjunction put the figure at 181.58 million. (www.thehindubusinessline.com)

GVK’s Alaknanda hydropower project synchronised with Northern Grid

April 12, 2015. The first Unit of GVK’s 330 MW Alaknanda Hydro Power Company's project at Shrinagar in Uttarakhand, was synchronised with the Northern Grid on the April 10 and tested to generate the full rated capacity of 82.5 MW. A thorough inspection of the machine shall now be carried out before starting commercial production from April 13. The remaining three units will be sequentially synchronised by the end of June, and full-fledged operations will commence soon after. GVK’s 330 MW hydropower project consists of four units of 82.5 MW each, and is situated on the river Alaknanda at Shrinagar in Tehri-PauriGarhwal, Uttarakhand. A power purchase agreement has been signed with Uttar Pradesh, and 12 percent output will be given free to Uttarakhand. (www.thehindubusinessline.com)

Canada, India in advanced talks on nuclear fuel supply

April 11, 2015. Canada’s biggest uranium producer Cameco is in advanced talks with India on a deal to supply it fuel for nuclear power plants and Prime Minister Narendra Modi’s visit is likely to provide impetus to clinch the agreement, a media report said. Stewart Beck, who was Canada’s high commissioner to India between 2010 and 2014, said energy security ranks high for India. Modi has made it clear that obtaining a commercial supply of uranium from Canada’s Cameco Corp is a major goal for him as he gets ready to visit Canada on April 14-16. Nuclear power is at the heart of a rapprochement between India and Canada in recent years. Canada banned exports of uranium and nuclear hardware to India in the 1970s after New Delhi used Canadian technology to develop a nuclear bomb. The two countries turned the page with a deal that took effect in 2013. A commercial deal to export Cameco’s uranium to feed India’s reactors would be another sign to the world that India is recognised as a safe, responsible nuclear power despite its refusal to sign the Nuclear Non-Proliferation Treaty. (www.thehindu.com)

Delhi's power distribution companies seek to explore open market

April 9, 2015. If power distribution companies have their way, Delhi could be heading towards complete modification of electricity acquisition. Discoms have floated a proposal to surrender power from various central sector generating units so that they can seek 'cheaper' alternatives from the open market. A list of recommendations on reducing costs made by Delhi Power Procurement Group (DPPG) has been sent to Delhi government. If it is accepted, then the issue will be taken up with the Centre. DPPG, which is constituted by the three discoms, MES, NDMC, Transco and SLDC, recently held a meeting on the issue of reallocation of power from various generating stations. The recommendations included shutdown of Rajghat power house and surrendering electricity from NTPC Badarpur station as well as from Dadri, Anta and Auraiya plants. It was decided that Rajghat power house will be closed after summers, from September 30. The forum recommended that Tata Power decommission its 108 MW plant in Rithala that has been defunct for over two years due to gas shortage. The group discussed diverting gas from Pragati power station to the newer and more efficient Bawana plant. (economictimes.indiatimes.com)

Post coal auction worries for power sector

April 8, 2015. The winning of captive coal mines by power generation companies in the recent auction might even stoke the sector's fund problem, given the large-scale lack of power purchase agreements (PPAs) with state governments. The fear is that the price to be paid for the blocks won in the auction will, with the lack of supply agreement, lead to losses. Around 75 percent of projects which won captive mines in the auction don't have any PPA. The capacity affected is about 10,000 MW. Around 29,000 MW of total thermal power generation capacity is estimated as stranded, since states are not issuing any new tender for long-term purchase. The calculation is that a six million tonne a year coal consumption would mean a payout in the first year of ` 1,541 crore for the winners in the recent auction, including repayment of debt amount, yearly loss and the project cost. Sector experts are concerned at the many projects with untied power sales which have won coal blocks. Apart from a tender by Kerala State Electricity Board (KSEB), there has been no major power purchase contract bid call since March 2013. KSEB called for bids for 400 MW in two tranches and received bids in the range of ` 3.6-7.29 a unit. Distribution companies across the country are financially distressed, incapable of buying expensive power. ICRA, the ratings agency, has estimated the aggregate unrecovered revenue gap at ` 25,300 crore from rate petitions filed by distribution utilities in 11 states. (www.business-standard.com)

Karnataka to oppose privatisation of power distribution

April 8, 2015. The state government has decided to oppose the Centre’s move to allow privatisation of power distribution. Karnataka Energy Minister D K Shivakumar is set to convey the state’s stand against the proposal to amend the Electricity Act to allow the entry of private companies to bid for the distribution of power in specific regions. Shivakumar said he would urge the Union government to convene a meeting of all chief ministers to discuss the issue. (www.newindianexpress.com)

Investment in T&D sector in next 4 yrs to be ` 3 lakh crore: Goyal

April 8, 2015. The transmission and distribution (T&D) sector is expected to see investments of nearly ` 3 lakh crore over the next four years, the Power, Coal and New & Renewable Energy Minsiter Piyush Goyal said. The Minister said that the ` 3 lakh crore investment from the private sector in transmission and distribution will be supported by over ` 1 lakh crore ($18 billion) from the Government through schemes such as the Deen Dayal Upadhyay Gram Jyoti Yojana and Integrated Power Development Scheme. Goyal said that last year 20,000 circuit km of transmission lines has been added in 2014-15, which is the highest ever in the country. (www.thehindubusinessline.com)

Policy / Performance………….

SC grants time to Centre for assessing 18 hydro power projects

April 13, 2015. The Supreme Court (SC) granted two more weeks to the Centre for filing "comprehensive" environment and ecological impact report of 18, out of total 24 hydroelectric power projects, to be set up on Alaknanda and Bhagirathi river basins in Uttarakhand. The Ministry of Environment and Forests (MoEF) has given a report that six, out of 24 hydroelectric power projects in the state, have substantially complied with legal requirements. Meanwhile, the counsel for Uttarakhand told the bench that the state is incurring losses due to delay on the part of MoEF. The court has fixed the case for further hearing on May 5 and asked the Centre to file its affidavit on April 29. Earlier, the court had granted time for filing comprehensive environment and ecological impact report of 24 hydroelectric power projects to be established on Alaknanda and Bhagirathi river basins. It had asked the MoEF to come out with a "concrete proposal" after scrutinising projects including the hydropower projects of PSUs -- National Thermal Power Corporation (NTPC), National Hydroelectric Power Corporation (NHPC) and Tehri Hydro Development Coporation (THDC). (zeenews.india.com)

Aim to save 200 bn units of electricity in 5 yrs: Goyal

April 13, 2015. The government aims to bring down transmission losses to save 200 billion units, or 10 percent of the power consumption achieved, in the next five years, Power Minister Piyush Goyal said. Goyal said the government plans to scale up the contribution of renewable energy. Pointing out one-fourth of the country's population still does not have access to electricity, he said that India is one of the lowest per capita carbon emitters in the world. (www.newkerala.com)

States to get 85 percent of electricity from projects set up by central utilities

April 13, 2015. A new power equation appears to be emerging between the Centre and states. The power ministry is willing to allow states, which approach central generation utilities for projects in their territory, to retain 85 percent of electricity from such units. The new approach is expected to galvanize state governments into walking the extra mile for the projects. Higher share of power is expected to make state governments cooperate and expedite land acquisition, environmental and forest clearances, water allocation, relief and rehabilitation of displaced persons as well as support in maintaining law and order situation at the project site. All these issues have emerged as roadblocks for big projects. The fresh approach has the potential to immediately benefit West Bengal, Bihar, Andhra Pradesh and Telangana. All of them have separately approached NTPC, NHPC and SJVN for setting up large power plants and demanded 85 percent to 100 percent power from these projects for themselves. The ministry was not in favour of making any changes in the Gadgil formula, an arrangement for allocation of central resources among states. States that are planning projects with central utilities can approach the ministry on a case-by-case basis. Under the present power-sharing formula, host states where central generation projects are located are entitled to 10 percent of generation. The Centre keeps 15 percent for itself, while 75 percent is distributed among states in the region as per their consumption and central plan assistance in the preceding five years. This formula was drawn up years ago when central generation projects used to be set up with budgetary support. This has changed over the years. The central utilities now operate as commercial entities and most of the projects are set up with a debt-equity ratio of 70:30 and do not enjoy any budgetary support. Bihar would benefit from three projects of 1,320 MW each — at Lakhisarai, Pirpainti and Buxar — under the new formula. Bengal would benefit from the 1,320 MW project at Katwa in Burdwan district. Andhra would benefit from the 4,000 MW Pudimadaka project and Telangana from Ramagundam Stage IV of 1,600 MW and another phase of 2,400 MW. Telangana would have the additional benefit under the AP Reorganization Act of 2014, entitling it to 100 percent power from these projects. (economictimes.indiatimes.com)

Maharashtra CM’s plea: Don’t oppose nuclear project

April 12, 2015. Maharashtra Chief Minister (CM) Devendra Fadnavis welcomed the Indo-French agreement on fast-tracking the Jaitapur nuclear power plant. He said that the proposed project is in the interest of the nation and appealed to parties not to oppose it. BJP’s partner in the state government, Shiv Sena, is the only major political party in Maharashtra that is opposing the project. The project, where French company Areva is to set up six nuclear reactors with the total power generation capacity of about 10,000 MW, is stuck for long because of differences over the cost of electricity to be generated. Sena, which is part of the BJP-led governments at the Centre and in Maharashtra, has opposed the project, saying it poses a threat to the local environment and population, and had organised protests against it. (dc.asianage.com)

280 mn Indians don't have power connection: Goyal

April 12, 2015. Around 280 million people in the country do not have basic electricity connection, Minister for Power, Coal and New and Renewable Energy Piyush Goyal said. Around 280 million people in India to this day do not have electricity connection at their homes. Till date, they are denied the basic thing like power, Goyal said while addressing the graduating class of the Indian School of Business (ISB). He said his ministry was focusing on energy efficiency in a big way. Goyal asked the ISB to come up with a proposal for an innovative laboratory on energy conservation for which his ministry was ready to provide funds. (www.business-standard.com)

Will examine Margherita thermal power project proposal: Goyal to Gogoi

April 10, 2015. Minister for Power, Coal and New and Renewable Energy Piyush Goyal assured Assam Chief Minister Tarun Gogoi that his ministry will examine on a priority basis the state government's proposal to set up a 600 MW Super Critical Thermal Project at Margherita. Goyal said he would speed up action on the pending proposals of Assam for increasing the supply of gas to the state owned generating stations at Lakwa and Namrup by taking up the matter with the Ministry of Petroleum and Natural Gas. Goyal said he would look into the proposal for the final clearance of the pending Kopili Hydro Electric Project. Referring to the Lower Subansiri Hydro Electric Project, the Chief Minister said his government would provide assistance for the project including security of equipment and manpower and also support all efforts of the Centre in implementing the project. Gogoi said the state government was keen to set up a solar power project with assistance of the Centre at Amguri in Sivasagar district. The Chief Minister requested Goyal to expedite the commissioning of Bongaigaon Thermal Power Project under the NTPC and also to increase Assam's share from the project. (economictimes.indiatimes.com)

J&K govt demands transfer of Dulhasti and Uri hydropower projects

April 10, 2015. The Jammu & Kashmir (J&K) government asked the Centre to transfer Dulhasti and Uri hydropower projects from NHPC to the state administration besides ensuring a share in the firm's profits accruing from the state's waters. Apart from this, the state wants a share in profits of NHPC emanating from Jammu and Kashmir's waters and a revision of all royalty agreements, Jammu and Kashmir Deputy Chief Minister and In-charge of Power Ministry, Nirmal Singh said. The Minister further asked the Centre that formal process of the modalities for return of the two power projects to the state should be put into place without further delay.