-

CENTRES

Progammes & Centres

Location

[Local Pollution and the Politics of Outrage]

“This is not to argue that Delhi is not polluted or that even if Delhi is polluted we should not do anything about it. It is to ask whose priorities are being addressed at whose cost? Would the poor get the same response if they ask for a healthy meal or a school for their kids or a roof above their head? What is the use of clean air in an empty stomach? The wealthy clamouring for clean air in urban areas have a ready-made response. They say that it is out of concern for the poor that they are seeking action against pollution. According to them dirty air is more dangerous than poverty and if we don’t act now the poor will die of dirty air before they die of poverty…”

Energy News

[GOOD]

If giving up LPG subsidy is made as fashionable as giving up traditional clothes, subsidies will become a thing of the past!

Pushing solar water pumps to Punjab farmers despite their lack of interest is bad for the economy and no good for the environment!

[UGLY]

Private firms will be interested in nuclear power when it needs no subsidy crutches!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Local Pollution and the Politics of Outrage (part I)

DATA INSIGHT………………

· Recent Coal Block Auctions

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL's MJ-1 discovery may hold 1.4 Tcf of gas resources

· Essar Oil becomes India's largest CBM gas producer

· ONGC eyes Mexican O&G blocks

· Cairn to treble gas production from Rajasthan block by 2018

· ONGC plans to bring smaller fracking companies in Texas to India

Downstream……………………………

· IOC refineries to process 55 mn ton crude in FY16

· Essar defers refinery maintenance to July-August

Transportation / Trade………………

· India's oil imports likely to rise on Iran nuclear deal

· ‘GAIL pipeline will be fully operational by June’

Policy / Performance…………………

· Oil Ministry allows ONGC to sell gas from small fields through bids

· ONGC looks to maximize benefits as global oil prices crash

· Govt to set up crude oil storage units

· Oil Minister makes a pitch for giving up LPG subsidy

· Don’t claim LPG subsidy, PM tells banks, industries

· CNG, piped cooking gas rates cut in Delhi by 60 paise

· CNG, PNG gas prices slashed in Gujarat

[NATIONAL: POWER]

Generation………………

· ‘Private firms indifferent to n-power generation’

· AP plans to double power generation

· Emerson completes automation for 800 MW AP unit

· NTPC to be 90 GW company in 10 yrs: CMD

· Mukerian hydel power project to start from December

· SJVNL targets 8,520 mn units of power generation in FY'15-16

· NTPC eyes 2.1 GW capacity addition in new fiscal

· Telangana to get 2 power plants in Karimnagar district

Transmission / Distribution / Trade……

· 'One nation, one grid' plan hurts power supply in the South

· Delhi discoms ready plan to slash power bills by 12 percent from October

· NTPC to bring down coal import bill to nil in 5 yrs

· India raises coal import by 35 percent to aid power plants

· Short-term fuel supply to power projects extended till June

· Indian power firms want ban on Chinese equipment

Policy / Performance…………………

· Central committee report on power sharing by month-end

· Delhi govt wants to shut down 5 power plants

· Working hard for progress on Jaitapur: France ahead of Modi visit

· Delhi govt asks BSES to pay ` 60 bn dues

· Govt withdraws duty benefits for power plants within SEZs

· No more power holidays for industries in Telangana

· Centre to finalise policy paper on fuel linkages by June: Coal Secretary

· Tata Power discom suggests ways to reduce tariff in Delhi

· Coal ministry plans easier qualification norms for next round of coal auctions

· BJD support for MMDR and coal Bills is fishy: Yechury

· Power tariff hiked by 2.47 percent in Gujarat

· NHPC aims at ` 54 bn power sales in FY'16

· After 20 yrs, UP gets a 500 MW power plant

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Gazprom, PetroVietnam to work on Pechora Sea shelf's upstream projects

· Sino G&E raises gas production at Sanjiaobei PSC in China's Ordos Basin

· Libya's AGOCO producing 317k bpd, Brega oil port still closed

Downstream……………………

· Russia's refinery modernisation push slowed by sanctions

· US refiners rely on North American oil most in 29 yrs

· China’s fuel demand to peak sooner than oil giants expect

Transportation / Trade…………

· Undoing Chavez’s $50 bn of oil giveaways eases default risk

· Russia's Gazprom says no delays in gas deliveries to China

· Colombia's Cano Limon oil pipeline halted by bomb attack

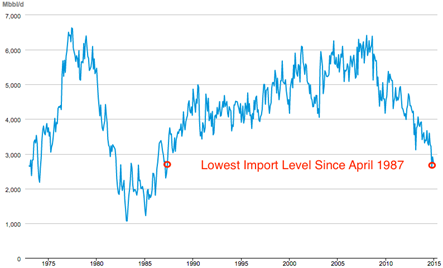

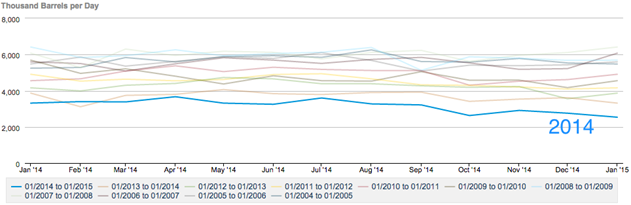

· US oil imports from OPEC have plunged to a 28-year low

· The Saudis are losing their lock on Asian oil sales

Policy / Performance………………

· Iran oil return may be slow amid jostling for foreign investors

· Iran nuclear deal seen cutting oil prices by $15 a barrel

· Cheap oil is squeezing US property owners in energy hubs

· North Dakota oil producers complying with new treatment rules

· Global LNG-Weak demand pulls Asian prices slightly lower

· Russian oil output in March hits new post-Soviet high

· Canada pipeline regulator planning deep budget cuts

[INTERNATIONAL: POWER]

Generation…………………

· German 445 MW gas-fired power plant set for testing

· Fortis commissions 335 MW hydroelectric plant in British Columbia

· Azerbaijan ups power generation

· Turkey approves law for construction of second nuclear plant

Transmission / Distribution / Trade……

· Pakistan, Lanka ink agreement for nuclear cooperation

· BPA to build Caribou County transmission line

Policy / Performance………………

· Iran agrees on comprehensive deal on nuclear programme set by world powers

· Jordan, Russia sign $10 bn deal on nuclear power plant

· Japan’s reliance on atomic power may top 20 percent in 2030

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Sterling and Wilson develops 140 MW of solar power plants for FY14-15

· Rajalakshmi Group acquires Ashok Leyland Wind Energy

· Solar power cost to come down to ` 4.50 per unit by December

· Mineral, mining sector face test in sustaining growth: President

· Punjab farmers show little interest in solar water pumps

· Modi launches India's first air quality index

· Modi says India to strike own path in climate battle

· Renewable energy forms one-eighth of country's power

· DU students harness wind energy produced by Metro trains

· Haryana plans solar plants on 2k acres panchayat land

· Southern Railway starts tapping solar power

· ONGC gets US Patent on hydrogen generation process

· NTPC’s solar power plans may become unviable as states reluctant to buy expensive clean energy

· Water reservoirs left with 35 percent of storage capacity

· Rays Power to make 7 MW solar rooftop project for Delhi Metro

· Rajasthan overshoots solar power investment target

· Centre will encourage use of green fuel: Gadkari

GLOBAL………………

· Solar war games to test green power’s resilience for NATO

· Utility sales may drop by half as US homes make their own power

· Japan could triple power from renewables by 2030

· UAE's FEWA plans to develop 100 MW of solar power plants in Northern Emirates

· Kazakh solar power plant ups power generation

· Canada conservatives shun carbon price to shield fragile economy

· EGP, Marubeni sign MoU for Asia-Pacific renewable projects

· Duke Energy proposes tripling Florida’s solar-power capacity

· China's first biomass-solar power plant begins initial operation

· Mild 2014 seen cutting EU carbon market emissions to record

· Mexico sets national target of 5 percent renewable energy by 2018

[WEEK IN REVIEW]

COMMENTS………………

Local Pollution and the Politics of Outrage (part I)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

T |

he last few weeks have been dominated by news paper stories on the causes and consequences of pollution in Delhi, labelled the World’s dirtiest city. The media driven outrage against local pollution has been so loud that it has elicited an immediate response from the Prime Minister’s office in the form of a coloured pollution index for Delhi and a few more cities. The presumption is probably that what is measured will be managed.

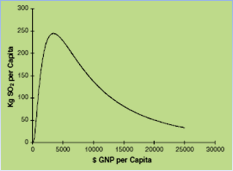

Unlike the response to climate change for which there is no historic precedent, the response to local pollution has precedents. Cities such as New York and London were highly polluted when they were industrialising and relatively poor. They cleaned up as they got richer. This gave rise to the concept of Environmental Kuznets Curve (EKC).

The EKC concept was first put forward in a 1991 paper on the impacts of NAFTA. It was popularised through World Bank’s World Development Report of 1992. According to the EKC hypothesis, in the early years of economic growth local environmental pollution increases but beyond a level of income per person (which is different for different types of pollution) the trend reverses. In other words local pollution is an inverted ‘U’ shaped function of income per person.

Source: Stern, David L, 2004. The Rise and Fall of Kuznets Curve,

World Development, Vol 32, No 8, pp 1419-1439

This means that economic growth may be the cause of local pollution in the early years of development but beyond a certain point, it becomes the means to reduce pollution. The EKC is named after Simon Kuznets, an economist whose original hypothesis said that income inequality would grow in the initial stages of development and fall after a peak.

If one ignores nuances of econometrics and statistics, the EKC concept appears to be a reasonable idea. In the early years of rapid economic growth, scale effects of local pollution and environmental degradation dominate over the time effect of pollution reduction efforts. In later years, growth slows down or shifts from heavy manufacturing to services and consequently the time effect of pollution reduction efforts dominate over scale effects of pollution and environmental degradation. Despite its logical clarity, the EKC has not been accepted as the last word on local environmental pollution and a rigorous academic debate continues on its validity.

The EKC is believed to be the source of the idea of ‘sustainable development’ which essentially conveys the message that ‘we can have the cake and eat it too’ when it comes to the environment. Under this perspective, the problem of environmental degradation is framed primarily as a problem of poor environmental management. In other words our lifestyles based on production and consumption need not be compromised if only we can ‘manage’ the environment. The means of managing the environment is supposedly provided by technology along with economic or legal techniques such as making the polluter pay. The 1992 World Development report of the World Bank endorses this view. According to the report:

‘The view that greater economic activity inevitably hurts the environment is based on static assumptions about technology, tastes and environmental investments...As incomes rise, the demand for improvements in environmental quality will increase as with resources available for investments’

This leads to the controversial conclusion that the only way to address local (urban) environmental problems is to get rich. The outrage over local pollution in Delhi appears to confirm this conclusion to some extent. Pollution as a problem in Delhi (and Beijing) was first raised by the wealthy expat community which presumably wanted to breathe clean air when its esteemed members went out of their well insulated and comfortable homes (or cars) to walk or play. They installed air quality monitors in their premises and sent out press releases on the pollution levels in cities such as Delhi and Beijing. They coined words such as ‘Beijing cough’ in the 1990s to name and shame the cities which, in their view, were ignorant of pollution management techniques and technologies. The rich and middle class of the respective countries embraced the view as their own as they always do with any view that come from the West. Beijing went on an overdrive to get a clean certificate from the West and now it is Delhi’s turn.

This is not to argue that Delhi is not polluted or that even if Delhi is polluted we should not do anything about it. It is to ask whose priorities are being addressed at whose cost? Would the poor get the same response if they ask for a healthy meal or a school for their kids or a roof above their head? What is the use of clean air in an empty stomach? The wealthy clamouring for clean air in urban areas have a ready-made response. They say that it is out of concern for the poor that they are seeking action against pollution. According to them dirty air is more dangerous than poverty and if we don’t act now the poor will die of dirty air before they die of poverty. If this is true, we need to ask why the poor leave their homes in pristine forests and fields and come to live in filthy slums of Delhi? Why do they choose to sell trinkets to people in well sealed cars even if that meant breathing the worst possible air from those very same cars? We need to refrain from over-simplifying the problem of pollution. We need to understand that the instrumental goal of reducing pollution should not take precedence over intrinsic values of fairness and equity.

to be continued.......

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

DATA INSIGHT……………

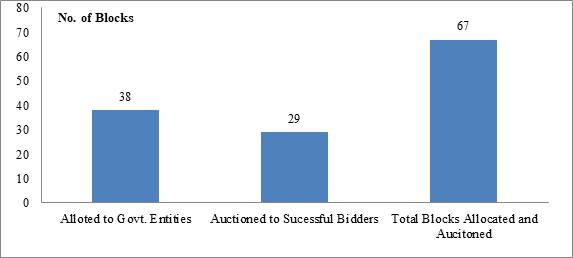

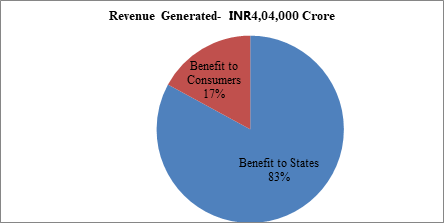

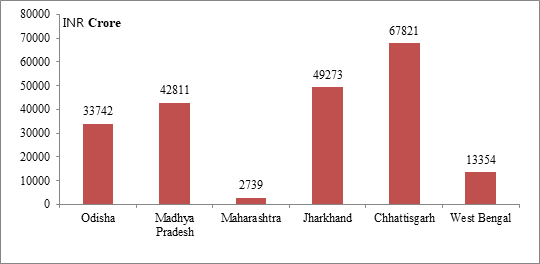

Recent Coal Block Auctions

Akhilesh Sati, Observer Research Foundation

Likely Distribution of Revenue Generated through 67 Coal Blocks

Source: Lok Sabha (Starred Q. No. 230) & Business Standard (News dated April 5, 2015)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL's MJ-1 discovery may hold 1.4 Tcf of gas resources

April 7, 2015. Reliance Industries' most significant recent gas discovery MJ-1 in KG-D6 block may hold 1.4 trillion cubic feet (Tcf) of gas resources, roughly half of the reserves in the block's main gas fields. Located about 2,000 meters below the producing D1-D3 field in the eastern offshore KG-D6 block, MJ-1 may hold contingent resource of between 0.988 Tcf of gas and condensate (low estimate) and 2 Tcf (high estimate), according to the firm's minority partner Niko Resources of Canada. The estimate compare to the downgraded reserves of 3.10 Tcf in the main Dhirubhai-1 and 3 gas fields, which have been on production for six years now. If proved correct, MJ-1 would the third biggest gas field in KG-D6 after D1&D3 and R-Series which holds about 2 Tcf of recoverable reserves. Reliance Industries Ltd (RIL), which is the operator of the Krishna Godavari basin KG-D6 block with 60 percent interest, has so far made 19 gas discoveries, of which D1&D3 were put on production in April 2009. MA oil and gas field was put on production in September 2008. The Canadian firm holds 10 percent interest while the balance 30 percent is with BP plc of UK. Niko, which had put up for sale its stake in the KG-D6 block, got resource estimation done on its own and RIL and BP were not party to the exercise. (economictimes.indiatimes.com)

Essar Oil becomes India's largest CBM gas producer

April 6, 2015. Indian oil and gas producer Essar Oil said it has become India's largest coal-bed methane (CBM) gas producer as its gas unit in Raniganj in West Bengal crossed production of 5 lakh standard cubic metres per day recently. The company said that with an investment outlay of ` 4,000 crore for the project in Burdwan district in the state, it has placed nearly 100 wells on gas production and an additional 155 wells have been drilled and are at various stages to further gas production. It has built compression stations and in-field pipelines of 120 km and another 60 km to ferry gas to end-users. Also, investments have been made for gas conditioning facilities. The company anticipates completing the development programme ahead of the May 2016 deadline as per the contract with the central government. Gas from this project shall be the feedstock to the priority fertiliser sector with the anchor customer being Matix Fertiliser & Chemicals Ltd located in West Bengal, the company said. It has two gas blocks in Assam in the prolific Assam-Arakan frontier basin. (www.newkerala.com)

ONGC eyes Mexican O&G blocks

April 5, 2015. Oil and Natural Gas Corp (ONGC) is among three dozen global energy majors vying for oil and gas (O&G) blocks in Mexico's maiden licensing round. ONGC Videsh Ltd (OVL) was among the international firms which signed up to pre-qualify for Mexico's inaugural Round-1 bid offering at the end of deadline on March 31. The company is pitched against the US majors ExxonMobile and Chevron, Anglo-Dutch firm Shell as well as national oil companies and Mexican players for 14 shallow water exploration blocks in the country's southern region. OVL has interests in 33 oil and gas assets in 16 countries and contributes to 14.5 percent and 8 percent of oil and natural gas production of India, respectively. In terms of reserves and production, it is the second largest petroleum company of India, next only to its parent ONGC. (www.dnaindia.com)

Cairn to treble gas production from Rajasthan block by 2018

April 5, 2015. Cairn India plans to treble natural gas production from its predominantly oil-rich Rajasthan block to 3 million standard cubic meters per day by mid-2018. Cairn currently produces around 1 million standard cubic meters a day (mmscmd) of gas from the Raageshwari gas field in the Barmer district block RJ-ON-90/1. In an application to the downstream regulator Petroleum and Natural Gas Regulatory Board (PNGRB) seeking approval to lay a pipeline to Gujarat for transporting gas, Cairn said it plans to drill a minimum of 42 more wells to augment and sustain the gas supply in the next three years. The gas produced from the Raageshwari Deep Gas (RDG) field would be gathered and treated at the proposed RDG terminal at Gudamalani in Barmer district, from where it will be evacuated through a new 194-km, 24-inch pipeline to the nearest available gas grid which is the GSPL's Gujarat Gas Grid with connectivity at Palanpur terminal. The field has recoverable gas reserves of 359 billion cubic feet (10.25 billion cubic meters). Cairn is the operator of the block with 70 percent interest while state-owned Oil and Natural Gas Corp (ONGC) holds the remaining 30 percent. Cairn has so far made 26 oil and gas discoveries in the Rajasthan block and is currently producing around 1,75,000 barrels of oil per day. (economictimes.indiatimes.com)

ONGC plans to bring smaller fracking companies in Texas to India

April 2, 2015. Oil and Natural Gas Corporation (ONGC) is planning to bring smaller fracking companies in Texas and North Dakota to Indian fields to compete with the dominant oilfield services giants, such as Schlumberger and Haliburton, and bring down prices. ONGC does part of existing fracking job of about 100 wells annually in-house and outsources the balance to top global firms such as Schlumberger, Haliburton and Baker Hughes. The need to raise output at its onshore fields facing declines for years requires ONGC to use more of fracking—a key part of the oil and gas drilling technique where hydrocarbon formations in a rock are fractured by injecting fluid into cracks to extract oil and gas. ONGC will have to outsource about 100 additional wells per year to fracking companies. A collapsing oil price that has forced explorers and producers to slash tens of billions of dollars from their capital budgets and defer many projects has also made oilfield services cheap and easily available. In a month, ONGC will hold road shows in the US, with an aim to educate smaller fracking firms about the business opportunity in India. (economictimes.indiatimes.com)

Downstream………….

IOC refineries to process 55 mn ton crude in FY16

April 1, 2015. Indian Oil Corp (IOC), the nation's largest oil refiner, plans to process 55 million tons of crude oil into fuel in the 2015-16 fiscal. IOC refineries had turned 53.61 million tons of crude oil into petroleum products like diesel and petrol during 2014-15. The capacity utilisation was 98.9 percent in spite of a few shutdowns for improvements, the company said. IOC will add 15 million tons a year state-of-the-art refinery at Paradip in Odisha this year. The firm already has refineries at Guwahati in Assam, Barauni in Bihar, Koyali in Gujarat, Haldia in West Bengal, Mathura in Uttar Pradesh, Panipat in Haryana, Digboi and Bongaigon. The company will this year have opportunities to increase gross refining margin (GRM) and overall profitability. With focused efforts towards energy conservation refineries have achieved best ever overall specific energy consumption at 54.5 units per barrel against previous best of 56 achieved during 2013-14 with implementation of various energy saving schemes and close monitoring of energy parameters. (economictimes.indiatimes.com)

Essar defers refinery maintenance to July-August

April 1, 2015. Essar Oil will defer planned maintenance at its Vadinar refinery in western Gujarat state by about two months to July-August. The delay was intended to avoid an overlap with scheduled repairs at other refineries in India and to profit from current robust refining margins. Essar had planned to shut the 405,000-barrel-per-day Vadinar refinery for about four weeks of maintenance in May-June, the company said. (in.reuters.com)

Transportation / Trade…………

India's oil imports likely to rise on Iran nuclear deal

April 4, 2015. The landmark interim nuclear deal between Iran and permanent members of the UN Security Council apart from Germany and EU, which India described as a significant step, has the potential to once again increase Delhi's oil imports from Tehran and make the payment process much easier. India is Iran's second-biggest buyer of oil annually after China. But last month, India did not import oil from Iran - first time in a decade — with Delhi deciding to keep its hydrocarbon shipments from Tehran within sanctioned limits. But all this could change rapidly once India studies the implications of the interim deal reached in Lausanne. India's oil imports from Iran are expected to rise if sanctions on Iran are lifted and Tehran decides to export oil to Delhi on current terms. Essar Oil and Mangalore Refinery and Petrochemicals Ltd are expected to import oil from Iran this month. Tehran had hinted that it would continue to offer crude oil on 90-day credit terms and at a discount if sanctions were lifted, diplomatic sources claimed. Shortly after the deal, US President Barack Obama stated that the international community has agreed to provide relief to Iran from sanctions. Ahead of President Obama's visit to India last January, there were reports that the Essar Oil, Mangalore Refinery and Petrochemicals Ltd and Indian Oil Corp were suggested to cut their imports from Iran in February and March to keep the shipments with sanctioned limits. (economictimes.indiatimes.com)

‘GAIL pipeline will be fully operational by June’

April 2, 2015. The repair works undertaken on the Gas Authority of India Ltd (GAIL), which was blown in Nagaram village in East Godavari district on June 27 last year, claiming 19 lives, is on a brisk pace and in all likelihood, the gas major will resume supply to its all stakeholders by June, the authorities have said. Of the 870-km pipeline in the entire KG Basin, line spanning over 600 km has been put to service, resuming the gas supply to small and medium stakeholders, except the Lanco power generation unit in Kondapalli. According to M.V. Iyer, General Manager, GAIL, Rajahmundry Region, except for Tatipaka and Yendada areas, the pipeline on the entire stretch has either been repaired or restored. The GAIL, which hitherto supplied 5.2 million standard cubic metres a day (mscmpd) to its customers, was able to give 4.3 to 4.4 mscmpd. Asked about the replacement of pipeline with leakages which was found by expert committees, Iyer said that another 100-km pipeline including the ones at Nagaram, Tatipaka, Yendada needed total replacement, adding that Mumbai-based Kalpataru power transmission had bagged the works of laying new pipelines. Welding works in 30 km has been completed and rest of the 70 km is in progress. (www.thehindu.com)

Policy / Performance………

Oil Ministry allows ONGC to sell gas from small fields through bids

April 6, 2015. Oil Ministry has allowed national oil companies Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) to sell any new natural gas supplies from their small and isolated fields through an open tender. While the BJP-led government had approved an international gas hub-based formula for all of the domestically produced natural gas in November last year, small and isolated fields were exempt. The Oil Ministry on April 1 issued amendment to the guidelines for pricing of gas from small and isolated fields by allowing producers to sell gas at market rates by inviting competitive bids from prospective consumers. Companies will fix minimum price for their gas, which would be the prevailing government-determined rate, and ask interested buyers to offer more through bidding. Government had on March 31 announced USD 4.66 per million British thermal unit (mmBtu) as the gas price for six-month period ending September 30 based on the approved formula. The ministry guidelines state that it was imperative that NOCs (national oil companies) are able to quickly monetise the output of their discoveries particularly marginal ones where where production is small and fields are isolated. The guidelines defined such fields as ones "whose peak production is less than 0.1 million standard cubic meters per day and they are situated more than 10 km away from the gas grid." Also, "fields whose peak production is less than 0.1 mmscmd and have a gas pressure which is less than the grid pressure" have also been defined as small/isolated fields. ONGC and OIL have several such discoveries, which cumulatively produce around 3-4 million standard cubic meters a day (mmscmd), enough to generate about 900 MW electricity. While the guidelines issued on April 1 are for additional or new production from small/isolated fields, ONGC had in November last year used e-tendering to finalise a price of USD 10.10-11.20 per mmBtu for sale of gas from new marginal fields in Gujarat and Andhra Pradesh. ONGC has finalised a price of USD 10.10 per mmBtu for gas from Gamij-GGS-2 field and a rate of USD 11.10 per mmBtu for Gamij-GGS-3 field, both in Gujarat. For the Warosan-4 field in Mehsana basin of Gujarat, it has finalised a rate of USD 10.50 per mmBtu. In case of Triputallu, Kaza, Mandapeta-23, Gokarnapuram and Suyyaraopeta marginal fields in Andhra Pradesh, the firm has finalised a price of USD 11.20 per mmBtu. (economictimes.indiatimes.com)

ONGC looks to maximize benefits as global oil prices crash

April 6, 2015. Oil and Natural Gas Corporation (ONGC) is reaping the benefits of oil price crash that has made oil field services much cheaper even as it has slashed profits and hit capital spending plans at many petroleum firms. ONGC recently awarded contracts for nine platform support vessels at $15,000 per vessel per day, about 40% less than the rate last year. ONGC, which deploys about 70 vessels round the year, plans to award contracts for 10 more vessels in a month. Oil prices have plunged 50% due to an unforeseen glut owing to a combination of factors including a supply boom from shale and oil sands in North America, lower than expected supply disruptions in the Middle East, oil cartel OPEC's decision not to cut supplies and a weak demand from Asia and Europe. Lower prices have hit profits of oil companies and made many projects unviable, forcing firms to slash billions of dollars in capital spending. This is translating into fewer contracts and cheaper rates for oilfield services companies, which do the grubby job of drilling and provide explorers with expensive equipment and expertise. ONGC may soon float tenders for rigs for fresh projects. So far, it has been mostly locked in longterm contracts for rigs and is unlikely to replace the existing contracts with fresh ones quickly. American oil companies slashed spending by 20-60% between June 2014 and January this year while oilfield services firms shed more than 30,000 jobs. Rig count, a measure of drilling activity, has halved in the US since October 2014, with the decline likely to continue for the next few months. This has impacted rates, which have slumped for ultra-deep-water rigs from a peak of about $650,000 a day two years ago to $350,000-400,000 a day now. (economictimes.indiatimes.com)

Govt to set up crude oil storage units

April 5, 2015. The downward trend of petroleum prices in the international market has got the central government mulling over quickly filling the crude oil reserve caverns which are under construction. Oil Minister Dharmendra Pradhan said that the government has cautiously decided to complete the work of three caverns of Indian Strategic Petroleum Reserves Limited (ISPRL) and fill it with crude oil soon. To ensure energy security, the government has decided to set up five million metric tonnes (MMT) strategic crude oil storages at three locations - Visakhapatnam, Mangaluru and Padur in Udupi. These strategic storages would be in addition to the existing storages of crude oil and petroleum products with the oil companies and would serve as a cushion in response to external supply disruptions, he said. The total revised cost for the project is ` 3,958 crores. The minister said that the work of storage cavern in Mangaluru is expected to complete in October this year. (timesofindia.indiatimes.com)

Oil Minister makes a pitch for giving up LPG subsidy

April 5, 2015. Oil Minister Dharmendra Pradhan has requested the employees of Mangalore Refinery and Petrochemicals Ltd (MRPL) and a Karnataka Minister to give up subsidy on LPG cylinder. Inaugurating the polypropylene unit of Mangalore Refinery and Petrochemicals Ltd (MRPL) in Mangaluru, Pradhan said the LPG customer in the country uses 6-7 subsidised LPG cylinders a year. This comes to around ₹ 1,500 a year. This will help provide LPG connection to a poor person, who otherwise is dependent on other energy sources. Employees of many corporates, including Tata Group and Kotak Mahindra Bank, and celebrities like Lata Mangeshkar and Ranabir Kapoor have given up their subsidies on LPG cylinder. He sought the same cooperation from the employees of MRPL also. Pradhan requested the Karnataka Youth Services Minister, Abhaya chandra Jain, who was present on the occasion, to give up subsidy on LPG cylinder. When there was no reply from Jain, he said even the Maharashtra Pradesh Congress Committee chief, Ashok Chavan, and the senior Congress leader, Mallikarjuna Kharge, have agreed to give up the subsidies on LPG cylinder. The Member of Parliament from Mangaluru, Nalin Kumar Kateel; former Karnataka Ministers, Krishna Palemar and Nagaraja Shetty; former Mayor of Mangaluru, Ganesh Hosabettu; gave up subsidy on LPG cylinders on the occasion. The Minister said that the Government wants to take the advantage of fall in the prices of crude oil in the global market, and it is looking at filling the underground oil caverns set up by Indian Strategic Petroleum Reserve Ltd (ISPRL) in Mangaluru soon. (www.thehindubusinessline.com)

Don’t claim LPG subsidy, PM tells banks, industries

April 2, 2015. Prime Minister NarendraModi asked banks and industrial houses, along with their employees, to give up LPG subsidies to benefit poor families. Of late, Modi has been asking well-off people to surrender their LPG subsidy and said that without any formal directive on any platform, about two lakh consumers have already surrendered their subsidy. There are about 15.3 crore LPG consumers in the country. The Prime Minister said that the Centre’s intention is not to add to its coffers by saving on the subsidy bill, but to provide LPG cylinders, which provide clean energy, to poor households who use firewood for cooking. Modi said that Direct Benefit Transfer (DBT) has brought transparency in cooking gas subsidy besides curbing leakages, with the help of banks, technology and political will. Under the DBT, the subsidy amount is directly credited into the bank accounts of consumers even as they pay the full amount for an LPG cylinder at the time of purchase. At present, consumers are entitled to 12 refills of 14.2-kg cylinders or 34 refills of 5-kg bottles in a year, at subsidised rates. So far, the government has saved ₹ 8,000 crore due to subsidy transfer through DBT. The Tatas have urged employees to voluntarily give up the use of subsidised LPG. In the 2015-16 Budget estimates, the petroleum subsidy has been halved to ₹ 30,000 crore. Of this, ₹ 22,000 crore has been earmarked for the LPG subsidy. The rest is for kerosene. (www.thehindubusinessline.com)

CNG, piped cooking gas rates cut in Delhi by 60 paise

April 1, 2015. A day after natural gas prices were cut by 8 percent, CNG and piped cooking gas rates in the national capital region were reduced by 60 paisa per kg. CNG price in Delhi will be reduced by ` 0.60 per kg to ` 37.55, while in adjoining Noida, Greater Noida and Ghaziabad it will cost 70 paisa less at ` 42.80, Indraprastha Gas Ltd (IGL) said. Also, the consumer price of piped natural gas to the households in Delhi has been reduced by ` 0.60 per standard cubic meter (scm) from` 25.50 per scm to ` 24.90 per scm up to consumption of 36 scm in two months. Beyond the consumption of 36 scm in two months, the applicable rate remains unchanged. The rate cut follows government cutting price of natural gas -- the input for CNG and piped cooking gas -- by 8 percent to $4.66 per million British thermal unit. Due to differential tax structure in the state of Uttar Pradesh, the applicable price of domestic PNG to households in Noida, Greater Noida and Ghaziabad from would be ` 26.55 per scm up to consumption of 36 scm in two months, which has been reduced by ` 0.75 per scm from ` 27.30 per scm. IGL said that reduction in prices of CNG and PNG would give a boost to the entire CGD sector in line with the vision of the government. With the revised price, CNG will offer nearly 55 percent savings towards the running cost when compared to petrol driven vehicles at the current level of prices. When compared to diesel driven vehicles, the economics in favour of CNG at revised price would be over 22 percent. IGL is currently catering to over 8,00,000 CNG vehicles in the capital, which include nearly 5,20,000 private cars. (economictimes.indiatimes.com)

CNG, PNG gas prices slashed in Gujarat

April 1, 2015. In accordance with New Domestic Natural Gas Pricing Guidelines, 2014 issued by Ministry of Petroleum and Natural Gas (MoPNG) wherein price of Domestic Natural Gas stands revised from $ 5.05 per million British thermal unit (mmBtu) to $ 4.66 per mmBtu, city gas distribution (CGD) companies in Gujarat announced cut in prices of compressed natural gas (CNG) and piped natural gas (PNG) in the state. While state-run GSPC Gas Company cut PNG and CNG prices by ` 1.17 per standard cubic meter (scm) and ` 1.30 per kg, respectively, private CGD player Adani Gas reduced the same by 0.74 per scm and ` 1.34 per kg, respectively. Adani Gas announced the price reduction for Ahmedabad and Vadodara markets.

Gujarat energy minister Saurabh Patel said that the central government has been supplying natural gas to meet demands for domestic gas and CNG. According to the state government, there are about 250,000 CNG and 1.05 million PNG consumers of GSPC Gas in Gujarat who will be directly benefited from the reduction in prices. Adani Gas said that the move will benefit its PNG and CNG consumers in cities like Ahmedabad and Vadodara. CNG prices by Adani Gas saw a downward revision of ` 1.34 kg from from 48.12 per kg to ` 46.78 per kg, while the price of PNG (domestic) was cut by 0.74 per scm from ` 24.80 per scm to ` 24.06 per scm excluding VAT. Adani Gas supplies PNG to about 190,000 households and CNG to approximately 150,000 vehicle users in Ahmedabad and Vadodara markets. (www.business-standard.com)

[NATIONAL: POWER]

Generation……………

‘Private firms indifferent to n-power generation’

April 7, 2015. Though discussions at various levels are happening on allowing private investment in the field of atomic energy in the past few years, no firm had so far approached the government with such a proposal, R. Battacharya, vice-chairman, Atomic Energy Regulatory Board (AERB), has said. Battacharya said that allowing private investments in the field of nuclear power generation was being debated for the past several years, but no private firm had approached the government with a formal proposal in this connection. Though private majors were allowed to enter this crucial area, the AERB would impose the same rules and regulations applicable to the government agency (Nuclear Power Corporation of India Limited). Since the AERB would always accord highest priority for safety, it would never dilute its norms for any agency involved in nuclear power generation. Battacharya made it clear that no private firm had been allowed in the business of separating thorium from beach minerals. Referring to accidents in nuclear installations, he said that the country, having nuclear reactors and research centres with highest safety standards, had not witnessed any accident with alarming magnitude. While the nuclear accidents that had taken place in Fukushima or Chernobyl came under the category of Level 7 accidents, the mishaps that took place in India had been classified only as Level 3 or even below. (www.thehindu.com)

AP plans to double power generation

April 7, 2015. To meet the increased power demand from domestic and industrial sectors and ensure the success of Power For All (PFA)- ‘24x7 power supply scheme’ in 2015-16, the Andhra Pradesh (AP) government has drawn up a big plan to double the installed capacity of power generation from the present 4500 MW in one year. Under the plan, the government has targeted to transform AP into an ‘incandescent light bulb’ free state by next March. (www.thehansindia.com)

Emerson completes automation for 800 MW AP unit

April 6, 2015. Emerson Process Management said it has completed the automation for the first 800 MW unit of 1,600 MW supercritical Sri Damodaram Sanjeevaiah thermal power project of Andhra Pradesh Power Development Company (APPDCL). Located in Krishnapatnam, the coal-based project entails an investment of USD 2 billion by the state power generation utility APGENCO for providing new, low-emissions generation capacity to support the region's rapid economic growth, the company said. The first unit at Sri Damodaram Sanjeevaiah project is ready to begin commercial operations while the work on automating the second unit is expected to be completed in the next few weeks. (www.business-standard.com)

NTPC to be 90 GW company in 10 yrs: CMD

April 3, 2015. Country's largest power producer NTPC will more than double its current installed capacity to 90,000 MW in the next ten years, its Chairman and Managing Director (CMD) Arup Roy Choudhury has said. At present, the company generates 44,398 MW of power from all sources of energy. Out of this, 12,115 MW or 27 percent of the total was added in the last four and a half years. The company, which generates maximum power from coal, plans to include solar energy in its total installed capacity in the coming years. NTPC had signed an initial agreement with Andhra Pradesh government for developing 1,000 MW solar power projects in the state. (economictimes.indiatimes.com)

Mukerian hydel power project to start from December

April 2, 2015. The Punjab government said Mukerian hydel power project will start generating electricity from December this year. 95 percent civil work of the power house had been completed and construction was in full swing to provide a permanent outfall structure for the Mukerian hydel channel stage-I into river Beas. The electro-mechanical works have been executed by Bharat Heavy Electrical Limited on EPC basis. The newly-constructed hydel project has a 3.5 km newly built channel having maximum carrying capacity of 11,500 cusecs of water. He said total capacity of 18 MW would be generated from two units of 9 MW each. (www.thehindu.com)

SJVNL targets 8,520 mn units of power generation in FY'15-16

April 1, 2015. State-owned power generation utility SJVNL has set a target of producing 8,520 million units of electricity in the current fiscal The company has signed a Memorandum of Understanding (MoU) with the Ministry of Power regarding the targets for the fiscal 2015-16. The preliminary pact also targets for implementation of 1,320 MW Buxar thermal power project in Bihar and 80 MW Doimukh hydro power project in Arunachal Pradesh. SJVNL said that against the target of generating 7,920 MUs for FY'2014-15, the power stations of SJVNL has generated around 8,130 million units. (economictimes.indiatimes.com)

NTPC eyes 2.1 GW capacity addition in new fiscal

April 1, 2015. Country's largest power generating firm NTPC has set a target of adding 2,145 MW of capacity during the current financial year (2015-16). The company has signed a Memorandum of Understanding (MoU) in this regard with the central government. As per the MoU, NTPC shall generate 246 billion units during the financial year (2015-16). The Ministry of Power shall provide necessary assistance to NTPC in the areas related to fuel security, ash utilisation, land acquisition etc. Meanwhile, NTPC announced commissioning of 195 MW unit of Muzaffarpur thermal power station. With this, the total installed capacity of Muzaffarpur thermal power station has become 415 MW and the total installed capacity of NTPC has become 44,398 MW. (economictimes.indiatimes.com)

Telangana to get 2 power plants in Karimnagar district

April 1, 2015. Executive director of the National Thermal Power Corporation’s power station in Ramagundam R. K. Srivastava said that two 800 MW plants would be established in the town this year, once the land for ash pond was handed over to the corporation.

The corporation will set up the plants as part of the assurance given by Union government to provide 4,000 MW power to Telangana state under the AP Reorganisation Act. Srivastava said that the new plants (each 800 MW) would come up in the land next to the existing station. The board of directors of the corporation approved feasibility report and gave their nod to establish the plants. (www.deccanchronicle.com)

Transmission / Distribution / Trade…

'One nation, one grid' plan hurts power supply in the South

April 7, 2015. Integration with the rest of the nation for power transmission has not helped the southern states much. Since temperatures started soaring across the country, there has been a massive power transmission constraint in the grid. During the first week of April, southern states could get only 10 million units against the demand for 50 million units. Despite decent power supply and utilities ready to buy at a higher price, the grid was not firm enough to handle the increased demand. While rains cooled demand for the northern region during the later part of March, buy bids in the South continued to be 22 percent higher than supply, leading to prices rising 41 percent in the month. Synchronisation of the national grid as ‘one nation, one grid, one frequency’ by central transmission utility Power Grid Corporation has not started getting much success so far. According to the monthly report of Indian Energy Exchange, the country’s largest power trading platform, inter-regional transmission network congestion was persistent through the year, resulting in a loss of 3.1 billion units in trading volume during FY15. The situation is expected to improve with three major transmission lines supplying the South getting operational during the second half of the year. The three lines are Gwalior-Jaipur by August 2015, Narendra-Kolhapur by September 2015 and Champa-Kurukshetra terminal capacity of 3,000 MW by January 2016. The available transfer capacity is expected to rise from the current 4.2 GW to 6.2 GW. (www.business-standard.com)

Delhi discoms ready plan to slash power bills by 12 percent from October

April 6, 2015. The five power distribution companies in Delhi have chalked out a strategy to reduce tariffs for consumers by at least 60-70 paisa per unit, reducing bills by 12% from October and sourcing up to 600 MW of clean power by getting rid of costly and inefficient plants. These measures will also enable the discoms to fill in the gap created by giving up costly electricity through increasing purchase from power exchanges. In a submission to the Delhi government for taking up the matter with the Union ministry of power, BSES Rajdhani Power Limited (BRPL), BSES Yamuna Power Limited (BYPL), Tata Power Delhi Distribution Limited (TPDDL), New Delhi Municipal Council (NDMC) and Military Engineering Service (MES) recommended shutting down of old power plants and routing other expensive sources to needy states. (timesofindia.indiatimes.com)

NTPC to bring down coal import bill to nil in 5 yrs

April 6, 2015. State-run NTPC is looking at bringing its coal import bill to 'zero' in the next five years and will rely on the fossil fuel made available by Coal India and the company's own mines. The power major is one of the country's largest consumers of coal. NTPC ventured into coal mining as part of its backward integration process for fuel security. The company has been allotted 10 coal blocks including Chatti-Bariatu, Chatti-Bariatu (South) and Kerandari in Jharkhand, Dulanga in Odisha and Talaipalli in Chhattisgarh. NTPC's present installed capacity is 44,398 MW comprising 39 generating stations. (ibnlive.in.com)

India raises coal import by 35 percent to aid power plants

April 5, 2015. After a dip in power generation owing to shortage of coal, thermal power plants across the country may get back to normal generation soon as the Central Electricity Authority (CEA) has increased coal import from 54 million tonnes to 73 million tonnes, an increase of 35% for the current fiscal. The coal being imported will be used to supplement domestic coal. NTPC has been permitted to import 22 million tonnes, the highest among all power companies, followed by Maharashtra State Power Generation Company (5.2 million tonnes) and Tangedco (5 million tonnes). NTPC has 17 plants, which use coal as fuel and its combined capacity is 33,675 MW. The other companies, which have been permitted to import coal include several private thermal plants like Reliance, Vedanta and Bajaj Energy as well as state-owned power generating and distribution companies. There are also other plants that have been permitted to import coal in small quantities. NTPC is a partner in some of them.

In 2015-16, coal demand for generating power is expected to be 787.03 million tonnes. Permission to import coal is given to plants that blend domestic and imported coal to fuel the furnace. There are also plants which operate only on imported coal, which have high calorific value and yield higher output than domestic coal. Indian power companies mostly import coal from Indonesia, South Africa and Australia. While Tamil Nadu imports coal to fire its plants across the state from Indonesia, Maharashtra imports coal from South Africa. Most of the 37 companies for which CEA has given import clearance will get more allocation compared to last year. For example, Tamil Nadu was allotted 4.5 million tonnes for 2014-15 and it has been increased by 0.5 million tonnes in 2015-16. Tangedco imports coal through Ennore and Tuticorin ports. (timesofindia.indiatimes.com)

Short-term fuel supply to power projects extended till June

April 5, 2015. The government has extended till June-end short-term supply of coal to power plants, which had lost their mines after the Supreme Court cancelled licences of 204 blocks last year. The government had earlier asked state miner Coal India to supply fuel to such power plants on a tapering basis till March 31, subject to review after that date. The Coal Ministry said that supply of fuel to power plants, the blocks of which were cancelled by the Supreme Court last year, will continue till June-end.

The decision follows the recommendation of the Standing Linkage Committee (Long-Term) for Power. The short-term fuel or tapering linkage is provided to those consumers which have been allocated captive coal blocks but they could not develop mine on time. The dispensation will apply to those power plants which are part of 78,000 MW list approved by the Cabinet Committee on Economic Affairs and are running, and have long-term power purchase agreements. The apex court cancelled licences of 204 coal blocks. Recently the government conducted auction of mines in two phases and put on sale 29 mines. (www.business-standard.com)

Indian power firms want ban on Chinese equipment

April 4, 2015. Power transmission infrastructure in the country's 18 major cities could be potentially hacked leading to national security threats and major disruption of power if the concerns of a prominent trade body are to be believed. Indian Electronics and Electricals Manufacturers' Association (IEEMA), the representative body of power equipment makers, has asked for a complete ban on Chinese equipment in the Indian power sector.

These cities are spread across Rajasthan, Madhya Pradesh and Tamil Nadu and they are currently implementing smart grid projects. They could be exposing themselves to the threat of monitoring systems deployed by foreign firms, it is being feared. IEEMA alleged that over the past few years China has mounted repeated attacks on Indian computer networks and, therefore, information flowing in the Indian grid is more vulnerable to hacking than ever. Recently, the Philippines government prevented Chinese technicians from taking part in the country's electricity transmission projects because national security concerns. To make the power distribution network efficient, state grids have installed Supervisory Control and Data Acquisition System (SCADA), which is an industrial control system to monitor and control industrial processes, mostly through remote technology. As many as 18 cities in India have awarded the contract to deploy SCADA to Chinese firms. (www.business-standard.com)

Policy / Performance………….

Central committee report on power sharing by month-end

April 7, 2015. The committee constituted by the Union government to look into power sharing issues between Andhra Pradesh (AP) and Telangana including the power from Hinduja and Krishnapatnam plants will give its report on April 30. The State would follow provisions of AP State Reorganisation Act on sharing of power and the Centre distributed power in the proportion of 54:46 between A.P. and Telangana based on power consumption. The State had represented to the Central committee that its power consumption accounted for 49.5 percent but actually the Energy Department supplied more - 50.5 percent in 2014-15 in tune with the demand. (www.thehindu.com)

Delhi govt wants to shut down 5 power plants

April 7, 2015. Five fuel-guzzling power plants in the Capital are set to face closure if the Delhi government's power department has its ways. The power department has proposed shutting down the Badarpur Thermal Power Station, Rajghat Power House Station, Pragati Power Station, IPGCL's gas turbine and the Rithala power plant due to their high power production cost. The department has planned to transfer the same fuel to gas-based Bawana power plant to make it fully functional. The 1,500 MW capacity plant is currently producing less than 500 MW of electricity. The power plants will be shut down after the summer months when the peak electricity demand is expected to cross the 6,000 MW mark this year.

The Delhi Power Procurement Group, which includes multiple power utilities in Delhi, and the State Load Dispatch Centre have recommended to the Delhi government the permanent closure of Rajghat Power House after the peak summer months this year. The remaining four power stations would be initially shut down on a temporary basis but after making alternate arrangements, these plants would be closed down permanently. The special forum constituted by the Delhi government has also recommended to the government against spending money on repair and maintenance of the Badarpur Thermal Power Station, which it said, is the costliest power generation unit in Delhi. The government had planned renovation of the plant at a cost of ` 741 crore. The forum noted that most of the production units at these power plants had outlived their lives and needed to be shut down as, besides the cost of maintaining them, they pose environmental threats. The forum was set up on the directions of Delhi Power Minister Satyendra Jain, who had sought recommendations on the closure of "expensive" power generation units in Delhi. The minister had also asked the forum to assess the Capital's demand and supply for the drafting of a detailed power reallocation plan. (indiatoday.intoday.in)

Working hard for progress on Jaitapur: France ahead of Modi visit

April 7, 2015. Ahead of Prime Minister Narendra Modi's visit to Paris, France said the two sides are "working hard" to make progress on setting up Jaitapur nuclear power plant, a project which has been stuck because of differences over cost of power to be produced. The issue is expected to be high on the agenda of Modi's talks with French President Francois Hollande along with other subjects like French investments in India, including defence sector, and the country's participation in upgrading India's railways and creating smart cities.

Under an agreement signed in 2009, Areva is to set up six nuclear reactors at Jaitapur with total capacity of about 10,000 MW. The project has, however, been stuck over differences regarding the cost of power that will be produced. The French side has been insisting that the cost should be in the range of ` 9-9.50 per unit but India wants it to be lowered to ` 6-6.50 per unit. (www.newindianexpress.com)

Delhi govt asks BSES to pay ` 60 bn dues

April 6, 2015. The Aam Aadmi Party (AAP) government has directed Reliance Infra-backed BSES power distribution companies to immediately clear dues of about ` 6,000 crore to Delhi Transco Ltd and two state-run generation companies. The Delhi government said BSES Rajdhani Power and BSES Yamuna Power have been ignoring notices by the power department to pay the dues and it might now consider “punitive action” against the two discoms.

Both discoms have to pay about ` 4,500 crore to Delhi government-run power companies, Indraprastha Power Generation and Pragati Power Corporation, for supplying power in the past five years. The two power generation companies supply around 800 MW of power to BSES daily. The two discoms had also failed to clear dues of ` 1,500 crore to Delhi Transco Ltd for using its network. Delhi Transco maintains all major power transmission networks in the city and discoms have to pay it for using the network.

The financial health of the three state companies had deteriorated because of non-payment. Tata Power Delhi Distribution Ltd had been making regular payments to all three government-run companies. BSES has been maintaining it was going through a difficult financial condition and had not been allowed to recover around ` 10,000 crore in losses due to increase in power purchase cost and low rates. (www.business-standard.com)

Govt withdraws duty benefits for power plants within SEZs

April 6, 2015. The government withdrew duty benefits extended to operation and maintenance of power plants set up by developers within special economic zones (SEZs). The Commerce Ministry in a notification on guidelines for power generation in SEZs said the directive issued in March 2012 was being withdrawn and the position of February 2009 was being restored. In February 2009, the ministry had allowed SEZ developers to avail duty benefits only at the initial stage of setting up of a power plant in non-processing areas and not for operational and maintenance of the plants. But in 2012, it had extended duty benefits for operation and maintenance of power plants in SEZs also. The notification came into effect from April 1. The notification will impact developers of SEZs and not the units which are engaged in generation and trading of power in these zones. (economictimes.indiatimes.com)

No more power holidays for industries in Telangana

April 5, 2015. For the first time in the past 3-4 years, industries in Telangana will be facing no power holidays this summer, thanks to the dramatic improvement in the power supply situation helped by a host of factors. In March last year, industries were subjected to a one-day power holiday, which was subsequently increased to two-day a week in the following month. The situation in the earlier years too was no different for them. For a power deficit state, this turnaround in such a short period even though an additional 1,800 MW of installed capacity is expected to be added to the grid in Telangana only in next 7-11 months. According to Telangana Genco and Transco, around 1,050 MW is being purchased on a daily basis to meet the requirements throughout the summer season. The transmission and distribution losses were brought down from 17.54 percent to 16.32 percent during the same period.

Chief Minister K Chandrasekhar Rao recently issued instructions for release of ` 350 crore to meet any contingency through additional power purchases during this summer. The Telangana government hopes to get a major relief in terms of power availability when the 600 MW Kakatiya power plant of Telangana Genco and the 1200 MW project of Singareni Collieries Company Limited commence operations. The Telangana Electricity Regulatory Commission has envisaged a total quantum of 52,000 million units for supply during the current year, which represents an 8 percent growth in demand over the last year. (www.business-standard.com)

Centre to finalise policy paper on fuel linkages by June: Coal Secretary

April 5, 2015. Coal Secretary Anil Swarup said the Centre will finalise the policy paper to bring in transparency in offering fuel ‘linkages’ for assured supply from Coal India Ltd (CIL) by June 30. In the past, such linkages were granted by the standing linkage committee (SLC), headed by the Additional Coal Secretary. Assurances were granted based on the recommendations of the ministries of steel, cement, power and the State governments. The lack of transparency in the decision making became apparent when the Manmohan Singh government issued linkages to 108,000 MW worth electricity generation capacity, ignoring repeated reminders from the CIL board about the unavailability of coal.

The steel and cement manufacturers at meeting said the system of granting linkages should be transparent. But, considering the shortage of coal, they feared that there will be aggressive bidding for such linkages, ignoring the long-term viability of the industry. Given the aggressive bidding by steel and cement companies for coal blocks, Coal Consumers’ Association of India (CCAI) members anticipated a mad rush for linkages if the government decided to auction them. The government should either auction linkages after the supply crunch eases or they should create a bigger open market for coal. Increased offerings on spot sales by CIL were recommended. (www.thehindubusinessline.com)

Tata Power discom suggests ways to reduce tariff in Delhi

April 3, 2015. Delhi's major power discom Tata Power Delhi Distribution Limited (TPDDL) has suggested a number of steps that it claims will reduce power tariff substantially in the national capital. The government had asked the discoms to suggest ways and means to give relief to consumers by reducing power procurement costs among other measures during a meeting on February 25. In a letter to Power Minister Satyendra Jain written last month, the company listed four steps to bring down tariff, chiefly among them are reallocation or surrender of power from old power plants, allocating a coal block to Aravali power plant, reallocation of gas among Delhi's generating companies and writing off regulatory assets by issuing tax free bonds.

According to TPDDL estimates, collectively, these moves would bring down tariff by almost ` 2.70. TPDDL in its letter said plants like NTPC Badarpur, Dadri, NTPC gas-based plant at Dadri and Auriya, and power generation companies such as Rajghat coal based plant and Pragati Power are "very old" and have high variable cost. (economictimes.indiatimes.com)

Coal ministry plans easier qualification norms for next round of coal auctions

April 2, 2015. The coal ministry is considering easing qualification norms for companies in the next round of coal auction in which about 20 coal mines with about three billion tonnes of reserves will be offered. The ministry is likely to consider easing investment requirement norm for the mines that will be offered to private developers this month. During the first tranche of auction, the ministry offered producing coal blocks to steel, cement and power companies for plants where 80% of the investment was made. End-use projects where 60% investment has been put in were eligible to participate in the second tranche of auction of soon-to-be operational coal blocks.

The government will offer about 20 mines in states including Chhattisgarh, Odisha, Jharkhand, Maharashtra and West Bengal. Half of the mines are expected to be reserved for the power sector. The blocks include Icchapur with 335 million tonne (mt) of reserves, North Karapura with 212 mt, Bijahan with 130 mt, Tubed with 189 mt and Gare Palma IV/6 with 158 mt. Coal secretary Anil Swarup said the Centre has transferred ` 466 crore to host states of coal blocks received as upfront payment from bidders through auctions. States are likely to earn ` 3.35 lakh crore in next 30 years from auction of coal blocks to private companies and allotment to state-run companies.

The government auctioned 33 blocks in two tranches to private companies garnering over ` 2 lakh crore. It allotted 38 mines to central and state public sector companies including NTPC, Damodar Valley Corp and Steel Authority of India. (economictimes.indiatimes.com)

BJD support for MMDR and coal Bills is fishy: Yechury

April 2, 2015. Senior Communist Party of India (Marxist) leader Sitaram Yechury said there was something fishy about the Biju Janata Dal supporting the Narendra Modi Government in the passage of The Mines and Minerals (Development and Regulation) Amendment Bill, 2015 (MMDR) and Coal Mines Bill in RajyaSabha. He said the Naveen Patnaik Government needs to explain high rate of power tariff in Odisha. The veteran Left leader said the BJD might make a similar U-turn in case of Land Acquisition Bill. (www.thehindu.com)

Power tariff hiked by 2.47 percent in Gujarat

April 1, 2015. Gujarat Electricity Regulatory Commission (GERC) hiked power tariff by 2.47 percent for both state owned power distribution companies as well as private players like Torrent Power Ltd (TPL). Effective from April 1, 2015, the new tariff will put an additional burden of ` 781 crore annually on the consumers of the four discoms, controlled by Gujarat Urja Vikas Nigam Limited (GUVNL) while TPL consumers will bear an additional burden of ` 160 crore annually. The four power distribution companies are Dakshin Gujarat Vij Company Limited (DGVCL), Madhya Gujarat Vij Company Limited (MGVCL), Paschim Gujarat Vij Company Limited (PGVCL) and Uttar Gujarat Vij Company Limited (UGVCL).

The discoms had demanded 17 paisa per unit hike to manage loss but GERC has approved rise of 13 paisa per unit, for all the categories of consumers, except BPL, agriculture and residential consumers consuming electricity up to 200 units per month. Further, the state electricity regulator has directed these companies to make up the balance gap of ` 215.58 Crore by improving operational efficiency. While there is no increase in fixed charge of single phase residential consumers, a moderate increase will be seen in fixed charge by ` 5 per month per installation for three phase residential consumers. According to GERC, this hike will increase burden by 0.17 percent on residential consumers while on non residential consumer, it will be around 2.5 percent.

On the other hand, for Torrent Power Limited (TPL), GERC has approved 15 paisa a unit increase in tariff rates, witnessing a rise of 2.36 percent. Due to this rise, residential consumer will now have to pay 0.53 percent more on bill every year, while, non residential consumer will face rise by 2.76 percent in Ahmedabad and Surat, the GERC informed. It is estimated that, with this increase in tariff, there will be additional revenue to the tune of ` 159.75 Crore for the TPL. The commission has directed the TPL to make up the balance gap of ` 97.23 crore by improving operational efficiency.

Apparently, TPL had asked for an average increase in tariff to the tune of 53 paise per unit to address the gap of ` 566.98 crore claimed by them for both Ahmedabad and Surat area. Meanwhile, in the Multi-Year Tariff (MYT) order, GERC has given targets of distribution losses of 5.15 percent for Surat distribution area and 8.50 percent for Ahmedabad-Gandhinagar distribution area. However, the actual distribution losses achieved by TPL were 4.33 percent in Surat area and 7.27 percent in Ahmedabad and Gandhinagar area for the FY 2013-14 which is commendable. (www.business-standard.com)

NHPC aims at ` 54 bn power sales in FY'16

April 1, 2015. State-run hydro power utility NHPC aims to earn over ` 5,400 crore through the sale of power. It targets generation of 22,000 million units in the current fiscal, 2015-16. NHPC has signed a Memorandum of Understanding with the Ministry of Power for 2015-16. Under the preliminary pact, the company has a gross (power) sales target of ` 5,439 crore, NHPC said. The company has also set a generation target of 22,000 million units, as against 21,800 million units target last year. (economictimes.indiatimes.com)

After 20 yrs, UP gets a 500 MW power plant

April 1, 2015. Accusing the NDA government of a non-supportive attitude, Chief Minister Akhilesh Yadav claimed that the Samajwadi Party government in Uttar Pradesh (UP) was delivering its best by providing power, roads and social welfare measures to people despite constraints created by the Centre. He was addressing a public meeting soon after dedicating 500 MW unit of Anpara D power project in Sonbhadra district. This is after 20 years that a 500 MW power plant is coming up in the state sector in UP. Along with Aanpara D, the chief minister also inaugurated a small Harduaganj power unit.

He congratulated the engineers from Bharat Heavy Electricals Limited (BHEL) and the power department of the state for achieving an unprecedented feat by raising the plant over an ash dyke. After the plant got energized, Akhilesh said it was a proud moment for him as Anpara plants were conceptualized by his father. SP Chief Mulayam Singh Yadav had inaugurated the first unit of the plant in 1994 when he was the chief minister. (timesofindia.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Gazprom, PetroVietnam to work on Pechora Sea shelf's upstream projects

April 7, 2015. Gazprom Neft reported that it has signed several agreements with Vietnam Oil and Gas Group (PetroVietnam), including a memorandum on joint oil and gas exploration, production and development projects on the Pechora Sea shelf in Russia. The upstream agreement, covering Pechora Sea shelf projects with a focus on the Dolginskoye field and the Severo-Zapadnyi (North West) licensed block, was signed in Hanoi, Vietnam by Gazprom and PetroVietnam. Gazprom and PetroVietnam will then execute the Pechora Sea shelf oil and gas projects through joint ventures and stakes in these partnerships will be decided through negotiations. (www.rigzone.com)

Sino G&E raises gas production at Sanjiaobei PSC in China's Ordos Basin

April 7, 2015. Sino Gas & Energy Holdings Limited announced that field operations are well underway and the second compressor at the Sanjiaobei central gathering station in the Sanjiaobei Production Sharing Contract (PSC) in the Ordos Basin in China's Shaanxi Province has been brought online, increasing capacity from approximately 4 to 8 million standard cubic feet per day (MMscf/d). Current production has increased to approximately 6 MMscf/d with 13 wells online from the pool of 16 wells currently connected. New wells which have been brought online to fill the additional capacity are currently choked back and will gradually be opened up as flow rates stabilize. The average uptime production for the first quarter was 4.2 MMscf/d, with 94 percent uptime recorded. (www.rigzone.com)

Libya's AGOCO producing 317k bpd, Brega oil port still closed

April 6, 2015. Libyan state firm Arabian Gulf Oil Company (AGOCO) is producing 317,000 barrels per day (bpd), the highest level in the last two years, the company said. Libya produces around 600,000 barrels of crude per day, less than half the 1.6 million bpd it produced before the fall of strongman Muammar Gaddafi in 2011. Several oil ports and major fields have been closed by fighting but the two biggest ports, Ras Lanuf and Es Sider with a combined capacity of 600,000 bpd, may open soon. Gas production was over 2 billion cubic feet per day. Crude revenues are at the heart of a battle for control of the North African OPEC producer that has pitted the two rival governments against each other in a growing conflict. Libya's internationally recognised Prime Minister Abdullah al-Thinni said his government would run its own oil sales and deposit revenues abroad in a bid to divert proceeds away from a rival self-declared administration in Tripoli. But the Tripoli-based National Oil Company (NOC) still handles all oil sales and revenues, and AGOCO - although located in eastern Libya - is an NOC subsidiary. NOC has tried to stay out of the conflict between the rival governments. Ports and oilfields are also the favourite target of both militants loyal to the Islamic State group and local protesters with their own specific demands. A source from the Brega oil point near Benghazi said that the port and Sirte Oil Company, located in the port area, have been closed by protesters. Brega port is used mainly for crude shipments to the refinery in Zawiya, near Tripoli in the western part of the country. (www.rigzone.com)

Downstream…………

Russia's refinery modernisation push slowed by sanctions

April 3, 2015. Russian oil companies have asked the government for permission to delay a vast oil refinery modernisation programme. Russian oil and gas institute VNIPIneft oversees the refinery modernisation programme. The institute said foreign companies are delaying equipment supplies for the refineries in fear of breaching sanctions. In 2011, Russian oil firms and the government agreed on plans to modernise Russia's refineries, which were predominantly built in the 1940s and 1970s. Russia's gasoline supplies almost ran dry in 2011 due to a lack of modern refining capacity, riling a portion of the electorate not long before Putin's election to a third term as president. In 2011, oil companies had pledged to install 130 new units by 2020 that will enable Russia to increase yields of lighter products. A further snag for the new modernisation programme was that Russia introduced a new tax regime last year, encouraging production of high-quality fuel. The tax regime favours some oil producers over others. Gazprom Neft and Bashneft have been most affected by the tax changes due to their high exposure to the downstream sector. Russia's top oil producer Rosneft is the most active in plans to modernise its plants, such as the Kuibyshev and Syzran refineries. Since 2000, refinery output in Russia has grown by over 45 percent, reaching 294 million tonnes in 2014. Until now, the growth in refinery production and improvements in oil product quality has not been slowed by sanctions. According to the Energy Ministry, 19 new units are expected to be commissioned at Russian refineries in 2015 compared with eight in 2014. (uk.reuters.com)

US refiners rely on North American oil most in 29 yrs

April 2, 2015. U.S. refiners are relying more on North American crude than at any time since 1986 as a glut of supply makes local oil cheaper than imports from overseas. Domestic production and imports from Canada and Mexico made up 85 percent of crude processed at U.S. plants in January, the most since March 1986, according to U.S. Energy Department data. Refiners are buying locally as surging output in the U.S. and Canada helped boost U.S. stockpiles to 471.4 million barrels, the highest since 1930. West Texas Intermediate, the U.S. benchmark, averaged $6.26 a barrel less than international marker Brent in the first quarter, widening from $3.94 in the fourth quarter of 2014. Surging U.S. oil production from shale transformed the U.S. into the world’s third-largest crude producer in 2013, BP Plc data show. Rising supplies helped cut crude prices by more than half last year with WTI falling to $42 a barrel last month from a high last year of $108. As U.S. production rose, imports declined by 36 percent in eight years, the data show. U.S. imports from Saudi Arabia, the world’s biggest crude producer, fell to a five-year low of 788,000 barrels a day in January. (www.bloomberg.com)

China’s fuel demand to peak sooner than oil giants expect

April 1, 2015. China’s biggest oil refiner is signalling the nation is headed to its peak in diesel and gasoline consumption far sooner than most Western energy companies and analysts are forecasting. If correct, the projections by China Petroleum & Chemical Corp., or Sinopec, a state-controlled enterprise with public shareholders in Hong Kong, pose a big challenge to the world’s largest oil companies. Sinopec has offered a view of the country that should serve as a reality check to any oil bull. For diesel, the fuel that most closely tracks economic growth, the peak in China’s demand is just two years away, in 2017, according to Sinopec. That forecast, from a company whose 30,000 gas stations and 23,000 convenience stores arguably give it a better view on the market than anyone else, runs counter to the narrative heard regularly from oil drillers from the U.S. and Europe that Chinese demand for their product will increase for decades to come. (www.bloomberg.com)

Transportation / Trade……….

Undoing Chavez’s $50 bn of oil giveaways eases default risk

April 7, 2015. Debt investors are finding a little comfort in Venezuelan President Nicolas Maduro’s decision to quietly dismantle a pet program of his late predecessor, Hugo Chavez. As sinking crude prices stoke concern that Venezuela will run out of money, Maduro has cut sales of cheap oil to allies to about half what they were in 2012, according to Barclays Plc. Since 2005, Venezuela has allowed countries from Nicaragua to Jamaica to fund shipments at below-market rates, using 25-year loans with annual interest rates of 1 percent and trades of everything from rice to jeans. In January, the Dominican Republic struck a deal to repay Venezuela $1.9 billion for the nearly $4.1 billion of crude shipments it owed the country under the oil program. Jamaican Finance Minister Peter Phillips said that the country is also in talks to pay back the debt it incurred through Petrocaribe. Venezuela relies on crude for more than 95 percent of its exports. The price for its oil has plunged 53 percent since June to $46.19 a barrel. While the Andean nation has $20.8 billion of foreign reserves, its obligations next year will prove onerous. It has $4.84 billion of bond payments in the next 12 months and may also need to repay about $7.4 billion of debt to China, according to Barclays. State-owned oil company Petroleos de Venezuela SA, or PDVSA, has $6.2 billion coming due before March alone. (www.bloomberg.com)

Russia's Gazprom says no delays in gas deliveries to China

April 6, 2015. Russian natural gas will start flowing to China in 2019 as planned but construction of the pipeline carrying it will not be fully completed until 2022, Gazprom said. The state-run gas producer said the huge Power of Siberia pipeline to carry gas from new East Siberian fields to China would not be completed until 2022, three years later than originally projected, but did not give details about gas deliveries. Russian President Vladimir Putin oversaw the start of the Power of Siberia construction in September in the Far Eastern Republic of Yakutia. He pays close attention to the energy projects as oil and gas sales account for a half of state budget's revenues. Power of Siberia will start at 5 billion cubic metres (bcm) of gas in 2019, ramping up to 38 bcm eventually, he said. The pipeline construction costs are 800.000 billion roubles ($14.4 billion). Russia is also pushing for plans to sell China additional 30 bcm of gas per year through the so-called western route, or Altai project. Moscow wants to secure the deal with Beijing later this year. (af.reuters.com)

Colombia's Cano Limon oil pipeline halted by bomb attack

April 6, 2015. Colombia's Cano Limon oil pipeline has been shut down following a bomb attack, state-run oil company Ecopetrol said. Attacks on the Andean country's oil pipeline network by the country's leftist FARC and ELN guerrilla movements are frequent, with more than 130 in 2014, but Ecopetrol said this was the first targeting the key Cano Limon duct since last November. Ecopetrol stocks crude at both ends of the 780 km pipeline, which typically carries around 80,000 barrels per day. This could help cover export needs pending repairs, a process that usually takes three to five days. Ecopetrol operates the Cano Limon pipeline through its subsidiary Cenit. It has capacity to pump up to 220,000 barrels of crude per day to Covenas port and also carries oil for other companies including U.S. producer Occidental Petroleum. (www.downstreamtoday.com)

US oil imports from OPEC have plunged to a 28-year low