-

CENTRES

Progammes & Centres

Location

[Growth without Emissions]

“One of the significant announcements made last month in the context of energy was that the economy had decoupled from emission of carbon-di-oxide (CO2). The evidence is from preliminary data of the International Energy Agency (IEA) which says that global emission of CO2 stood at 32.3 billion tonnes in 2014 which is the same as that in 2013 even though the global economy grew by 3 percent in this period. The IEA observed that in the 40 years in which it has been collecting data on CO2 emissions, there have been instances when emission of CO2 has stalled but all these were associated with a decline in economic growth rates…”

Energy News

[GOOD]

Fall in domestic gas prices shows that market based prices can go both ways – up or down!

Reviving sub-prime gas power generation assets with subsidies will privatise profits and socialise costs!

[UGLY]

Delhi Discoms must come clean on their accounts if they want consumer sympathy!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Growth without Emissions

ANALYSIS / ISSUES…………

· 3rd Green Energy Summit (Summary of Proceedings)

DATA INSIGHT………………

· Hydro Generation- Targets for 2015-16

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL signs production sharing pact for offshore blocks in Myanmar

· ONGC plans to optimize production from wells

· ONGC to invest ` 400 bn in KG Basin in 4 yrs

Downstream……………………………

· MRPL seeks rare low sulphur fuel oil for May

· IOCL to join hands with Chhattisgarh for "total energy solution"

Transportation / Trade………………

· India skips Iran oil imports in March under US pressure

· PM Modi sets sight on 10 percent cut in oil imports by 2022

· GAIL seeking 7 LNG cargoes from Oct 2015-Dec 2016

Policy / Performance…………………

· Domestic natural gas prices slashed by 8 percent

· ` 49.4 bn budgetary support to oil cavern programme

· 1 lakh homes in Indore, Ujjain to get piped gas supply: Oil Minister

· ONGC renews insurance 35 percent cheaper from United India for $20 mn

· Govt targets 1 crore consumers to give up LPG subsidy

· Need to look at our oil exploration programme: FM

· Gujarat govt spent more than ` 130 bn on KG Basin

· Govt approves supply of cheap LNG to power plants

· India 'throws up' investment opportunities for Qatar investors

[NATIONAL: POWER]

Generation………………

· RINL commissions green power project to generate 120 MW

· BHEL to set up power plant in Telengana

· Reliance Power’s Sasan UMPP fully operational

· NTPC invites tenders for 4 GW power plants in Vizag

· Steam release valves to be tested at Kudankulam n-plant

Transmission / Distribution / Trade……

· Distribution companies expect Delhi's power demand to touch 6.4 GW

· Crompton Greaves wins ` 1.1 bn order from PGCIL

· APTCL commissions transmission line

· Kamarajar Port to import 18 mn tonnes of coal in 2 yrs

· Torrent Power surges as govt to provide subsidy directly to power firms

· Power distribution arms of Reliance Infrastructure and Tata Power faces severe financial crunch

· Tata Power to buy 50 percent stake in Zambia's Itezhi Tezhi Power

Policy / Performance…………………

· SC lets Adani Power defend compensatory tariffs

· CIL asked to light up 30 ongoing power projects

· J&K govt seeks to harness 20 GW power potential of state

· Telangana will be a power surplus State by 2018: CM

· Coal India may surpass 1 bn tonne output target by 2020: Goyal

· Coal ministry eyeing 15-20 blocks for next auction round

· OERC hikes farm power tariff by 36 percent

· AAP to allocate ` 16.9 bn towards power, water subsidies

· New round of coal block auctions from April: Goyal

· Chhattisgarh’s power tariff among lowest: CM

· Cabinet allows use of imported gas to revive stuck power plants

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· ExxonMobil starts production at Hadrian South gas field off Gulf of Mexico

· Maersk Oil commences production from new platform in Danish North Sea

· Statoil discovers more gas offshore Tanzania

· PetroChina to swap North American oil and gas assets to cut costs

· OGDCL discovers oil at Palli Deep-1 well in Pakistan's Sindh Province

Downstream……………………

· Japan Okinawa refinery closure could cut oil product exports

· Qatar companies to invest $5 bn in China for LNG projects

· Tokyo Gas to build second LNG tank terminal in Hitachi

· Total, DNO keep pumping oil and gas in Yemen after airstrikes

Transportation / Trade…………

· Japan's Toho Gas to buy LNG from Malaysia's Petronas

· Pemex to sell 45 percent stake in two Mexican natural gas pipelines for $900 mn

· Shell reopens Nigeria's Nembe Creek oil pipeline

· BP sees TANAP gas pipeline project deal

Policy / Performance………………

· Gazprom asks state to extend Ukraine gas discount until July

· New Zealand opens Block Offer 2015 for exploration permits

· Alberta budget deficit soars to record on oil collapse

· Russia may allow more firms to offshore oil: Energy Minister

· Indonesia's Pertamina to operate Mahakam block from 2018: Energy Minister

· Canada govt asks pipeline regulator for safety guidelines by 2016

· Oil to reach $100 a barrel by end of 2016: Pickens

[INTERNATIONAL: POWER]

Generation…………………

· Ayala plans to expand power generation by another 500 MW

· Toshiba to support 308 MW Upper Yeywa hydropower project in Myanmar

· Emerson wins $76 mn power plant contract in Poland

· Dominion plans to build natural gas power plant in Southside

Transmission / Distribution / Trade……

· Major power outage leaves Turkey in darkness

· EDF Energy secures £1 bn electricity supply contract in UK

· Hydro One to invest $688 mn in transmission upgrade projects in Canada

· PSC chooses route for Badger-Coulee transmission line

· GDF Suez Energy extends electricity supply contract with baseball team Philadelphia Phillies

· EBRD lends €65 mn for Ukrenergo’s transmission network in Ukraine

Policy / Performance………………

· Regulators plan to drop case at closed California nuke plant

· Ghana launches ambitious program to hike power generation

· Coal miners say Obama change to royalties aims to shut them down

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India wants a global agreement to focus on climate change prior to 2020

· KSEB to take solar route to overcome power crisis

· Cheap power must be balanced with green energy: Goyal

· Odisha to encourage people on renewable energy: CM

· UP power watchdog approves rooftop solar regulation

· India to rich world: Give us cash and we’ll cut emissions faster

· Every house in Goa will soon get three LED bulbs: CM

· Goyal eyes bidding in dollar to cut solar tariff

GLOBAL………………

· Cheap oil unlikely to slow growth of renewable: Citigroup

· Asian solar spending helps drive renewable energy boom

· Southern acquiring wind power plant in Oklahoma

· Climate change making droughts in Australia worse as rain patterns shift

· China contemplates development of space solar power station

· Bluefield buys UK solar power plant for $84 mn

· SEFA to support solar power plant in Chad

· UN GCF can be spent on coal-fired power generation

· Mexico pledges to cut emissions 25 percent in climate-change milestone

· EU nations reach deal to start carbon-market reserve in 2021

· EGP commences construction on 74 MW US wind project

· UK Green Bank agrees $298 mn of lending to Africa, India

[WEEK IN REVIEW]

COMMENTS………………

Growth without Emissions

Lydia Powell & Akhilesh Sati, Observer Research Foundation

|

O |

ne of the significant announcements made last month in the context of energy was that the economy had decoupled from emission of carbon-di-oxide (CO2). The evidence is from preliminary data of the International Energy Agency (IEA) which says that global emission of CO2 stood at 32.3 billion tonnes (BT) in 2014 which is the same as that in 2013 even though the global economy grew by 3 percent in this period. The IEA observed that in the 40 years in which it has been collecting data on CO2 emissions, there have been instances when emission of CO2 has stalled but all these were associated with a decline in economic growth rates.

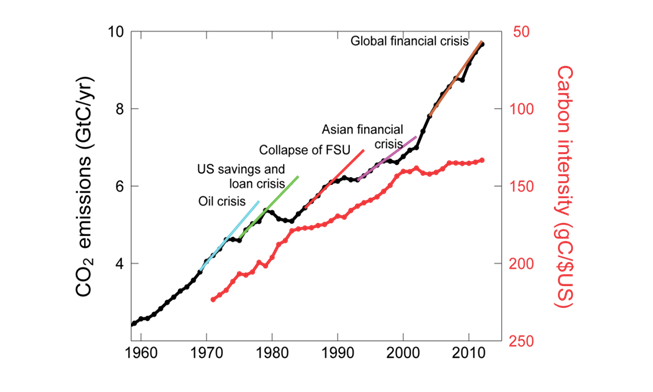

Chart 1: Growth in CO2 Emissions and Carbon Intensity

Source: CDIAC Data; Le Quéré et al 2013; Global Carbon Project 2013

The Chart 1 which maps emissions from 1960 to 2012 shows the trend of increasing emissions that is broken by brief periods of stagnation in emission growth linked to periods of economic stagnation or decline. What one would infer from the above chart is that emissions decrease only when economic growth slows down. Latest data from the IEA appears to contest this observation.

The IEA attributes the halt in emissions growth in 2013-14 largely to changes in energy consumption patterns in China and OECD countries. Increase in renewable energy use in China and in OECD countries and gains in energy use efficiency in OECD countries are given most of the credit.

If the economy has decoupled from emissions it must be celebrated as it will pave the way for a prosperous, equitable and clean world. However two questions must be considered before we open the champaign bottle.

The first is whether it is accurate to draw lines of causation from the share of renewable energy/increase in efficiency of energy use to the decoupling of the global economy from CO2 emissions. The second is whether the developed world is using information ‘creatively’ to nudge developing countries towards its own instrumental goals.

Ever since man started using modern fossil fuel based energy sources to improve his life, he has consistently improved the efficiency of energy use either by shifting to more efficient energy sources or by using energy sources more efficiently.

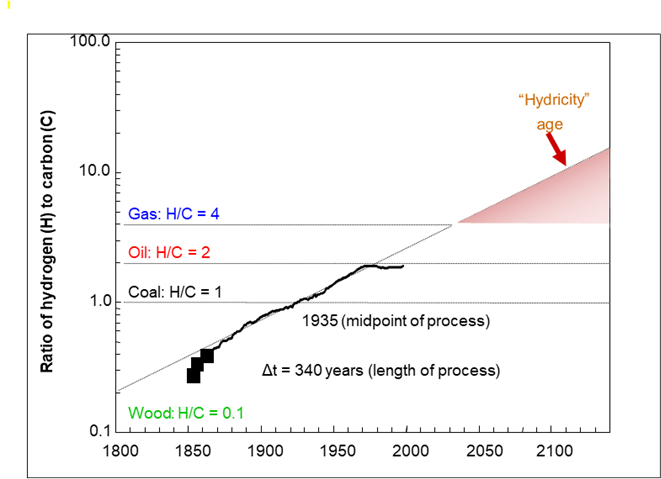

Chart 2: Falling Hydrogen to Carbon Ratio

Source: Nebojša Nakićenović, International Institute for Applied Systems Analysis and Vienna University of Technology, 2nd HyCARE Symposium, Laxenberg, Austria, 19-20 Dec 2005

As shown in Chart 2 the ratio of hydrogen to carbon has been increasing since 1800 which means that the world’s energy system is de-carbonising naturally. The shift towards hydrogen marks a shift towards more efficient sources of energy as the oxidation of hydrogen releases more energy than the oxidation of carbon.

This shift is likely to continue naturally as technologies are developed to harness low carbon energy sources. This does not necessarily mean the use of solar or wind energy. If we track the natural course of global energy systems, the shift so far has been from solid (wood, coal) to liquid sources (oil) and then towards gaseous sources (natural gas).

Experts believe that the final shift would not be towards new sources of primary energy but towards efficient ways of generating zero carbon secondary energy carriers such as electricity and hydrogen. Nuclear power is seen as a front runner in generating electricity and hydrogen (during off-peak hours as a store of energy and for use as fuel for transportation).

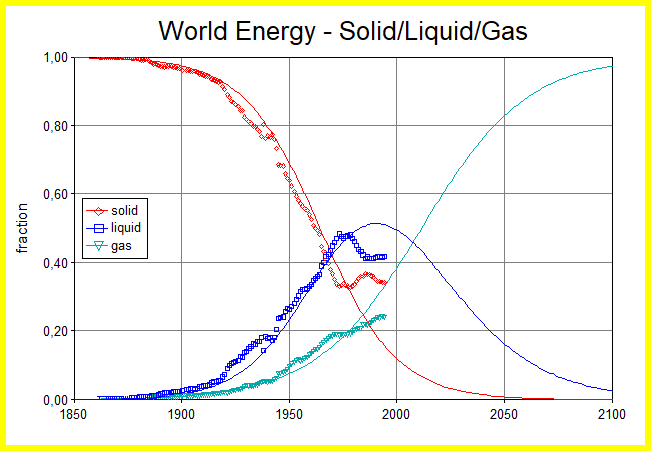

Chart 3: Shift Towards Gaseous Fuels

Source: Nebojša Nakićenović, International Institute for Applied Systems Analysis and Vienna University of Technology, 2nd hycare Symposium, Laxenberg, Austria, 19-20 Dec 2005

BPs Energy Outlook for 2040 observes that fading industrialisation will slow growth in energy demand in the future and that dramatic increase in the rate of decline of energy intensity on account of technological improvements will widen the gap between GDP and energy consumption. It adds that gains in energy efficiency would lead to far greater reduction in projected energy demand than improvement in fuel mix such as increasing the share of renewable energy in power generation. This means that increasing the share of renewables is not necessarily the only means of decoupling emissions from economic growth.

The second concern is over the creative use of data and information by OECD countries to nudge development countries towards investment in expensive energy sources. The press release of the IEA on the decoupling of emissions and economic growth includes statements by the high ranking officials of the IEA appear to convey a hidden message for participants in the upcoming climate summit in Paris that increasing the share of renewables is an effective means of controlling carbon emissions.

The IEA has been accused of under-estimating oil supply in order to nudge oil producing countries in the Middle East to invest in enhancing oil supply. Improved oil supply favoured OECD economies through lower oil prices. But IEAs persistent projection of oil supply shortages has created a glut in oil production today. The IEA may be indulging in yet another nudge towards investment in renewables to create a market for OECD technologies. Developing countries will do well to focus on efficient use of energy rather than rushing into grand programmes for renewable energy.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

ANALYSIS / ISSUES……………

3rd Green Energy Summit

(Summary of Proceedings)

K K Roy Chowdhury, Energy & Environment Expert, Delhi

|

T |

he 3rd Green Energy Summit with the Theme, “Renewable Energy: A Key Enabler for Sustainable Growth” was organised by Indian Chamber of Commerce (ICC) in association with the Ministry of New and Renewable Energy (MNRE), Government of India in New Delhi on 21st March 2015. ICF International was the Knowledge Partner in the event. The day-long programme was inaugurated by Mr Piyush Goel, Hon’ble Minister of State (Independent Charge), Ministry of Power, Coal & Renewable Energy, Government of India, and had two plenary Sessions followed by a closing Session. More than 100 energy professionals from the industry, equipment manufacturers, operators, financial institutions, government agencies, consultants, NGOs and the media participated in the highly interactive event. The key proceedings are presented below.

Inaugural Session

Dr Rajeev Singh, Director General, ICC, in his welcome address, noted that Green Power and Renewable Energy (RE) have got a fresh thrust with the new Government at the Centre that would enhance the capacity of the sector, and would be good for India and renewable energy companies. Dwelling upon some facts and figures, that, 1.3 billion of global population including 400 million in India are still without electricity, and by 2040, 20 percent of the global population will be residing in the Asian Region with 70 percent of that belonging to the working age group, Dr Singh observed that this threw a dual challenge to meet their energy needs and at the same time to consider the environment. Renewable energy (RE) constitutes 20 percent globally, and in India, the share was 12-13 percent, which implied that RE had definitely grown in India and so no longer a marginal source he mentioned.

Mr Anil Razdan, former Power Secretary, Government of India and Chairman, ICC National Expert Committee on Energy, delivered the keynote and theme Address as the Summit Chairman. In appreciation of the assembly in quest for a route to sustainability, he drew attention to ICC’s new mission to explore solar and wind now following hydro. Stressing on the need to rediscover ourselves for sustainability, since we had to live the way nature wanted us to, Mr Razdan pointed towards the dilemma in tracking the nature! Calling for productivity and efficiency to move in this path to rediscover nature, he stressed on the need for identification of technologies from this perspective, for which India had huge opportunity as it was blessed with nature’s bliss, namely, long coastline, large insolation, less dark spaces, etc. A commercial sense had to be derived from this opportunity he said. The challenge is to provide electricity to the consumers at the right rate he observed! To achieve this, he stressed on the need for developing batteries for storage of energy, indigenously, in a manner similar to the one adopted in hydro-power for water (energy) storage, that would also work towards judicious use of peoples’ money.

Mr Nitin Zamre, managing Director, ICF International, spoke on transforming the current energy landscapes in the country with the power of renewables. Underlining the need to leap-frog into modern energy sources he sought for ways and means to move in this direction. He gave an overview of the Indian Power Sector with highlights on the facts and figures published by Central Electricity Authority and MNRE in this regard and pointed out that targets had been revised, 5 folds for solar to 1,00,000 MW by 2022, and for wind to 60,000 MW by 2022, etc. He also mentioned the proposed development plans for solar/ green cities, and informed the participants that five cities had been accorded approval for implementation of renewable energy, with INR 100 crores per city allocated for the purpose. He also touched upon the aspect of grid connected power and the intricacies in its evolution. Summing up his presentation, Mr Zamre mentioned that there lay huge opportunity for significant scale-up in renewable energy in India.

In his address on Integration of Renewables into the Grid: Importance of Green Energy Corridors to boost renewable capacity, Mr S K Soonee, CEO, POSOCO, stressed upon the importance of Distribution System Operators. He said that we had to consider our time diversity, seasonal diversity, and climate diversity. He said that we had to adjust to falling heat rate as well as the load curve/ load factor. He pointed out that connectivity and standards were important for renewable to reach critical mass since renewable energy was a low-voltage phenomenon, Mr Soonee outlined.

Dr Ashwini Kumar, Managing Director, Solar Energy Corporation of India (SECI), talked about capacity addition targets for the next 5 years. On the question of solar scale-up potential, land was one of the major issues, he observed. Land area requirement is more for solar power, at 5 acres/MW he said. Therefore, sufficient capital needs and funding requirements are to be addressed too, he said. Given the fact that waste land had to be utilised for solar power, considering even 5 percent of the waste land available in the country, our purpose will be more than served as it would give more than 1000 GW against our target of 100 GW, Dr Kumar stated. He also talked of tariff consolidation with cheaper interest rate and long-term loans. He talked of the initiative taken for the Solar Park Scheme to support 20,000 MW capacity. NTPC had also undertaken grid based capacity for 3000 MW, he informed. He also touched upon the MNRE scheme for development of a solar park with targets of 500 MW and above to reach 20,000 MW, and in this direction, he said that Andhra Pradesh had come forward for 2000 MW park and Karnataka for 2000 MW at a single site.

A special address was delivered by Dr Ajay Mathur, Director General, Bureau of Energy Efficiency, Government of India. He highlighted on the success of wind energy in India. Banks are lending finance, with 95 percent of technology being available indigenously in the wind sector he said. Good demonstration of wind power and its performance had also prompted the state utilities to purchase wind power at the rate of Rs 2.25 per unit without escalation to facilitate wind power he said. Business models, interconnectivity and capacity are the three issues that need to be focused upon, Dr Mathur said.

Mr Piyush Goel, Hon’ble Minister of State (Independent Charge), Ministry of Power, Coal & New & Renewable Energy, Government of India, was the Chief Guest on the occasion. In his address, Mr Goel assured fast-track growth in the RE sector that would keep up with the ongoing tempo in the new Government at the Centre. He stressed upon the need for boosting investment to facilitate sale of power, given the fact that the country had surplus power. In order to facilitate growth of RE on a fast-track mode, he drew attention to the following five essential issues:

· credibility of the power-purchase agreement for reducing risk

· life of the equipment and cost to keep technology in focus

· Intra- and inter-state aspects

· RE off-grid plants for rural electrification

· Net metering for economic viability

Further, Mr Goel referred to the success in the wind sector and said that domestic manufacturing needs to be enhanced in the case of solar as well. ‘While targeting to realise 175 GW of solar power by 2022’, he said, ‘we have to do it without subsidy’. He called for a white paper with details to address the five issues flagged by him that would also reduce coal-based power since coal had the largest environmental costs. Drawing attention to the amendments in the Electricity Act 2003, he invited people to raise issues before the Standing Committee and drive consumer choice towards best supplier of electricity. ‘We cannot ignore the developmental imperatives of India keeping in mind a good government has to do good economics as well’, he observed.

The Minister also released ICC Knowledge Report on Green Power.

The summit also hosted two plenary Sessions, one on the Theme of Wind Power: Key to Future Sustainability, and the other on the Theme of 100 GW Solar Power by 2019.

The closing session revolved around the theme of ‘India’s perspective for unconventional Energy sources & their deployment.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Hydro Generation- Targets for 2015-16

Akhilesh Sati, Observer Research Foundation

|

REGION/ SECTOR |

Likely Installed Capacity- MW (as on Mar 31, 2016) |

Total GENERATION TARGET Million Units |

|

TOTAL CENTRAL |

11132.52 |

39295 |

|

TOTAL STATE |

4606.75 |

14728 |

|

TOTAL PRIVATE |

2578 |

10477 |

|

TOTAL NORTHERN REGION |

18317.27 |

64500 |

|

TOTAL CENTRAL |

1520 |

3315 |

|

TOTAL STATE |

5931 |

12051 |

|

TOTAL PRIVATE |

481 |

1486 |

|

TOTAL WESTREN REGION |

7392 |

16012 |

|

TOTAL SOUTHERN REGION |

11642.45 |

31818 |

|

TOTAL CENTRAL |

885.2 |

3532 |

|

TOTAL STATE |

3134.5 |

7499 |

|

TOTAL PRIVATE |

795 |

607 |

|

TOTAL EASTERN REGION |

4814.7 |

11638 |

|

TOTAL CENTRAL |

860 |

2783 |

|

TOTAL STATE |

382 |

1249 |

|

TOTAL NORTHERN EASTERN REGION |

1242 |

4032 |

|

TOTAL ALL INDIA |

43408.42 |

128000 |

|

TOTAL BHUTAN IMPORT |

- |

4800 |

|

TOTAL ALL INDIA (including import) |

43408.42 |

132800 |

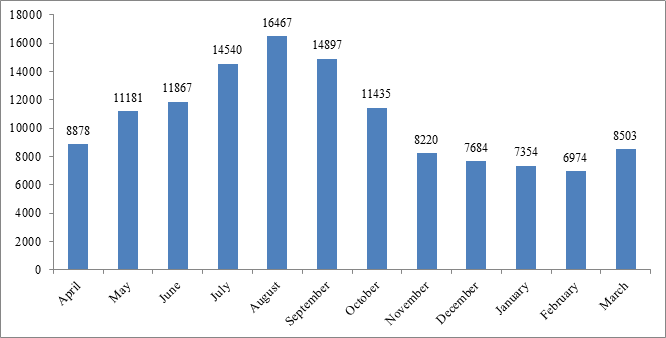

All India- Monthwise Generation (MU) Targets (2015-16)

Source: Central Electricity Authority

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL signs production sharing pact for offshore blocks in Myanmar

March 31, 2015. Reliance Industries Ltd (RIL) said it had signed an agreement with Myanmar for a production sharing contract for two offshore blocks. RIL will be the operator of the blocks with a 96 percent participating interest while United National Resources Development Services Co. Ltd, a Myanmar company, will hold the remaining stake. RIL said its participation was in line with its strategy to expand its international asset base by investing in attractive oil and gas destinations. (in.reuters.com)

ONGC plans to optimize production from wells

March 30, 2015. Oil Natural Gas Company (ONGC) has decided to optimize the production from existing wells in Tripura from April, ONGC onshore director V P Mahawar said. Mahawar said gas production in Tripura has now increased to 44 lakh standard cubic metres from 17 lakh standard cubic metres in 2012, which is the highest in India. To enhance the productivity, ONGC has brought most effective and modern hydro-fracturing technology, used for breaking the sand layer deep inside the surface of the earth to facilitate better flow of gas, he said. The ONGC management has agreed to go for massive exploration across the potential areas of India to find out new source of oil and natural gas to meet the growing demands of hydro-carbon across the globe, Mahawar said. He said that India has world's 0.7% gas reserve and 0.3% oil reserve and added that if the demand remains stable, production would be sustained for only four to five years. The productivity must be enhanced with improved technology. He said ONGC has drilled as many as 176 wells in 11 stretches of the state and of which 82 have been producing gas since 1972. The highest rate of success in exploration has convinced the authorities to make commitment to supply 36 lakh cubic meters of gas to 726 MW Palatana power project for 20 years and five lakh cubic metres to Monarchak power plant. (timesofindia.indiatimes.com)

ONGC to invest ` 400 bn in KG Basin in 4 yrs

March 25, 2015. Oil and Natural Gas Corp (ONGC) said it would invest ` 40,000 crore in Krishna-Godavari (KG) Basin in a phased manner over the next four years. ONGC informed this to Andhra Pradesh Chief Minister N Chandrababu Naidu. ONGC aims to extract 25 million standard cubic meters per day (mmscmd) gas in KG Basin by 2018 and would also look into the exploration of oil by 2019, the Andhra Pradesh government said. (profit.ndtv.com)

Downstream………….

MRPL seeks rare low sulphur fuel oil for May

March 30, 2015. Mangalore Refinery and Petrochemicals Ltd (MRPL) is seeking a rare cargo of low sulphur fuel oil (LSFO) to meet pollution standards of Karnataka, a southern Indian state, the company said. The 25,000-tonne LSFO cargo to be delivered over the second half of May will be for the refinery's own consumption, and purchased on an on-demand basis. MRPL needs to stay under maximum sulphur limits on domestic production, which would necessitate a LSFO import as per sources. This could be due to increased output of higher sulphur refined products such as bitumen, which is used to build roads and demand for which rises over March to May. LSFO purchase could also be the result of refinery upgrades that have reduced MRPL's fuel oil production. While MRPL used to export one to two cargoes of high sulphur fuel oil and vacuum gasoil a month, shipments have been sporadic since late last year after its refinery upgrade. MRPL planned to shut its 120,000 barrel per day crude distillation unit for about 10 days from early April for maintenance. MRPL operates a 300,000 bpd refinery in Karnataka. (in.reuters.com)

IOCL to join hands with Chhattisgarh for "total energy solution"

March 30, 2015. The Indian Oil Corp Ltd (IOCL), a Maharatna national oil company would seal a deal with the Chhattisgarh government for developing natural gas infrastructure, city gas distribution and supply of gas. The company said under the plans for increasing its presence in the gas sector, the IOCL wished to develop the 'total energy solutions' especially natural gas in Chhattisgarh. Besides the development of natural gas infrastructure such as pipelines and city gas distribution networks, the company would set up CNG stations in the state for ensuring availability of natural gas to consumers in domestic, commercial, industrial and transport sectors. The agreement would also help the company to involve the state agencies in the marketing and supply of natural gas to various consumers across the state. A Joint Coordination Team (JCT) would be formed for expediting and monitoring the progress of the project. The team would comprise of four members. The state government would coordinate for the grant of all necessary permissions, approvals, clearances, statistics and other details available with various state agencies for the work. The technical and commercial expertise of the IOCL would be used to study various options and evaluate energy demand of the state. Both the parties would explore the option of forming Joint Ventures (JVs). Equity participation in such JVs by other entities would be decided mutually at appropriate time. (www.business-standard.com)

Transportation / Trade…………

India skips Iran oil imports in March under US pressure

March 31, 2015. India halted oil imports from Iran for the first time in at least a decade in March as New Delhi responded to U.S. pressure to keep its shipments from Tehran within sanction limits during the last month of negotiations on a preliminary nuclear deal. India is Iran's second-biggest buyer on an annual basis after China, yet it did not take any crude from Tehran in March, according to tanker arrival data. The halt in March comes after February imports hit a 1-1/2-year low for monthly imports, which together brought India's annual crude and condensate purchases from Iran in the year to March 31 to an average 220,000 barrels per day (bpd) or 11 million tonnes, slightly below shipments in the previous year.

Days ahead of a visit by U.S. President Barack Obama to India in January, the oil ministry had told Essar Oil, Mangalore Refinery and Petrochemicals Ltd and Indian Oil Corp - the Indian refiners that buy from Iran - to cut their imports over February and March to keep the fiscal-year figure in line with sanctions limits. Refiners in India had raised imports during the April-December period by more than 40 percent, leading U.S. authorities to raise the alarm with India's foreign ministry ahead of Obama's visit. The sanctions currently restrict Iran's overall exports to 1 million-1.1 million bpd, with Asian buyers required to keep their purchases near end-2013 levels. In February, imports by Iran's four biggest buyers - China, India, Japan and South Korea - though down on-year, bounced back to average 1.02 million bpd, a two-month high, government and tanker-tracking data showed. (in.reuters.com)

PM Modi sets sight on 10 percent cut in oil imports by 2022

March 28, 2015. India needs to reduce oil imports by 10% over the next seven years through efficient use and speedier exploration and production from domestic fields to become self-sufficient in energy, Prime Minister (PM) Narendra Modi said. India imports 77% of its oil requirement and spent ` 1.89 lakh crore, or roughly $80 billion, in 2013-14. Modi said if imports were cut by 10% by 2022, the country could look at halving it by 2030. India is the fourth largest oil importer in the world after US, China and Japan. In terms of consumption, it is the fifth largest after US, China, Japan and Russia.

The government was working towards piping gas to one crore households in the next four years, expanding the coverage of PNG (piped natural gas) from 27 lakh at present. The PM said ` 100 crore in subsidy had been saved by 2.8 lakh people, who voluntarily gave up subsidy on cooking gas. Reflecting PM's vision, Oil Minister Dharmendra Pradhan said there should be no doubt in anyone's mind that India was a welfare state.

The government could not overlook the paying capacity of consumers but would create a conducive environment for investment through decisive action and fair and transparent policies. Finance Minister Arun Jaitley said volatility of oil prices added to the unpredictability of the economic situation. The other consequence was flow of "disproportionate" amount from consuming economies to producing nations. (timesofindia.indiatimes.com)

GAIL seeking 7 LNG cargoes from Oct 2015-Dec 2016

March 26, 2015. GAIL is looking to buy seven liquefied natural gas (LNG) cargoes for delivery from Oct 2015 until Dec 2016, according to the tender document. Deliveries are to be split between India's Dabhol, Dahej and Hazira import terminals, according to preferences and vessel sizes, the document states.

The delivery windows are Oct-Nov 15, Jan-Feb 16, March-April 16, May-June 16, July-August 16, Oct 16 and Nov-Dec 16. Prices will be based on a percentage, or "slope", set at 10 percent of the three-month average of ICE Brent crude oil benchmark settlements prior to the month of delivery, plus a certain premium added by bidders. (in.reuters.com)

Policy / Performance………

Domestic natural gas prices slashed by 8 percent

March 31, 2015. The Petroleum Planning and Analysis Cell (PPAC), the pricing cell of the Ministry of Petroleum and Natural Gas, gave consumers of electricity and piped natural gas some reprieve. It slashed the price of domestically produced natural gas by almost 8 percent to $4.66/unit (gas is measured in million British thermal units) on the back of weak international prices. The new rate, calculated on the gross calorific value which measures the heat of the gas, will be applicable from April 1 for the next six months. Domestically produced natural gas was priced 39 cents higher at $5.05/mmBtu till now. Indraprastha Gas Ltd (IGL) said the move will result in reduction in retail price of CNG and domestic PNG. Indraprastha Gas is currently working out the net impact on retail prices and the revised price will be announced in a day or two. (www.thehindubusinessline.com)

` 49.4 bn budgetary support to oil cavern programme

March 31, 2015. The Cabinet Committee on Economic Affairs (CCEA) approved allocation of ` 4,948 crore for gross budgetary support (GBS) to the scheme for the Indian Strategic Storage Programme for Storage of Crude Oil (ISSPSCO). ISSPSCO involves construction of three crude oil reserves totalling 5.33 Metric Million Tonnes to meet the nation's energy security needs. Under the initiative, the entire cost for filling crude oil in Visakhapatnam cavern will be met by the central government. The CCEA decided that the petroleum and natural gas ministry will continue to explore alternative models for financing the remaining cost of crude oil to fill the Mangalore and Padur caverns which will include commercial utilization by "other interested parties". The government said the annual Operations and Maintenance (O&M) costs are estimated to be ` 47 crore for the Vishakhapatnam storage and ` 179 crore for all the three caverns. (www.business-standard.com)

1 lakh homes in Indore, Ujjain to get piped gas supply: Oil Minister

March 30, 2015. Nearly one lakh houses in Indoreand Ujjain districts will get piped gas supply within two years as a CNG mother station is being set up in the city, Union Oil Minister Dharmendra Pradhan said. In next two years nearly one lakh houses in Ujjain and Indore districts would get piped gas supply, Pradhan said after inaugurating the CNG Mother Station set up by GAIL and HPCL's joint venture, Avantika Gas Limited in Ujjain. Madhya Pradesh Chief Minister Shivraj Singh Chouhan and Union Minister for Steel and Mines Narendra Singh Tomar among others were present on the occasion. The 2,000-km long pipeline passes through Madhya Pradesh and the state would benefit from it, Pradhan said. Chouhan said that with the availability of CNG, the prospects of setting up more fertilisers plant in the state has become brighter. (economictimes.indiatimes.com)

ONGC renews insurance 35 percent cheaper from United India for $20 mn

March 30, 2015. ONGC has driven a hard bargain to renew its insurance and re-insurance covers, at USD 20 million -- a discount of 35 percent -- for its offshore assets valued at USD 34 billion from state-run United India Insurance and two global re-insurers. The insurance cover, due for renewal on May 11, has been renewed in the London markets. Global general insurance prices have been heading south as claims have been lower unlike the previous year wherein claims were higher due to many catastrophes and aviation accidents. The cover was underwritten by United India Insurance, while the reinsurance cover has come from two global reinsurers -- Endurance and Aspirin -- which outbid GIC Re, the country's sole reinsurer to bag the ONGC account until now. ONGC, which holds the biggest insurance policy in the country at USD 33 million, had floated a tender to underwriters to primarily cover its offshore assets. Air India paid USD 27 million for its cover in the outgoing fiscal, making it the second biggest account. The cover for large corporates like Reliance Industries, Jet Airways among others are about to be renewed and they may get benefit of the softening general insurance market. However, airlines may be forced to shell out more following the German wings airline crash. The Chennai-based United India Insurance, which was covering the oil and gas major for the past three years, was able to retain the account. (economictimes.indiatimes.com)

Govt targets 1 crore consumers to give up LPG subsidy

March 29, 2015. Government expects that about one crore well off consumers will surrender the subsidy on cooking gas after Prime Minister Narendra Modi's appeal to people not to take subsidy if they can afford to buy LPG at market price. There are about 15.3 crore LPG consumers in the country. PM Modi said that as many as 2.8 lakh people have surrendered LPG subsidy which has led to savings of ` 100 crore. Since the government started the new scheme of direct benefit transfer (DBT) for cooking gas, several persons opted out of the subsidy scheme. Under the DBT, the subsidy amount is directly credited into the bank accounts of consumers even as they pay full amount for LPG cylinder at the time of purchase. Consumers are currently entitled to 12 14.2-kg cylinders or 34 five-kg bottles in a year at subsidised rates. Oil Minister Dharmendra Pradhan has already urged ministers, MPs, MLAs, senior government officials and executives of public sector companies to give up their subsidies. Public sector oil marketing companies (OMCs) have given an option to existing LPG consumers to convert their existing domestic LPG connection into a non-subsidised domestic connection. This can be done by submitting a written request to the distributor or electronically viawww.MyLPG.in. Giving up subsidised LPG will help cut the government's subsidy bill. In 2015-16 Budget estimates, petroleum subsidy has been halved to ` 30,000 crore, from estimated ` 60,270 crore in the current fiscal. Of ` 30,000 crore for next fiscal, ` 22,000 crore has been earmarked for LPG subsidy and the rest is for kerosene. (profit.ndtv.com)

Need to look at our oil exploration programme: FM

March 27, 2015. Union Finance Minister (FM) Arun Jaitley said that decreasing oil prices helped tame inflation. Jaitley said that the government is taking steps for long-term financing in infrastructure projects. Jaitley said that the government is undertaking some important steps to bring reforms on tax front. Prime Minister Narendra Modi said the country should cut oil imports by 10 percent by 2022, while exhorting domestic firms to become global players and the well off to give up subsidised cooking gas connections. Modi said if imports, which account for a staggering 77 percent of the demand, are cut by 10 percent by 2022, the country to look to halving it by 2030. India spent ` 189,238 crore on import of crude oil in 2013-14. Jaitley said that the principal challenge before the govt has been to restore credibility of Indian economy. (zeenews.india.com)

Gujarat govt spent more than ` 130 bn on KG Basin

March 27, 2015. Government-owned Gujarat State Petroleum Corporation (GSPC) has spent ` 13,469.51 crore till December last year on exploration of natural gas in Krishna- Godavari (KG) Basin block but the commercial production is yet to begin. Gujarat state energy and petrochemicals minister Saurabh Patel admitted that commercial production of oil or gas from the KG Basin block has not yet begun, but there was a "possibility" of commencement of production in "the near future". As per GSPC's annual report for the year 2013-14, which was tabled in the Gujarat Assembly, the KG-OSN-2001/3 offshore block was awarded to the GSPC under a production sharing contract with the Government of India in February 2003. (economictimes.indiatimes.com)

Govt approves supply of cheap LNG to power plants

March 26, 2015. The Cabinet has approved the supply of cheap liquefied natural gas (LNG) for power plants to rescue investments worth ` 60,000 crore that was on the verge of sinking because of fuel scarcity, for which the government has squarely blamed the fall in output from the KG-D6 field of Reliance Industries. As the supply of gas is limited by import capacity, companies that need fuel will compete in a reverse auction by bidding the lowest amount of subsidy they need to supply electricity at ` 5.50 per unit. To make gas affordable, states would forego some taxes, while gas transporters and import terminals would also offer discounts on the charges for their services rendered to import LNG for this purpose, the government said. The government said that power plants were stranded because of the steep fall in production from the KG-D6 block of Reliance Industries although the company had earlier communicated to the previous government that it could not be held responsible for the plight of the power sector. The government said the Empowered Group of Ministers (EGoM) had decided in 2009 that subject to the availability of gas, necessary allocations from RIL KG-D6 fields will be made to projects. Gujarat State Petroleum Corporation (GSPC) and Gas Authority of India Ltd (GAIL) will purchase LNG in the international spot market for supply to power plants in Gujarat and the rest of India, respectively. India's capacity to regasify LNG is a limiting factor, power minister Piyush Goyal said, and which is why only 10 million standard cubic metres per day (mmscmd) of LNG during rains and 18 mmscmd in other season will be imported for supply. A larger import could have allowed plants to operate at more than the proposed 30% plant load factor. (timesofindia.indiatimes.com)

India 'throws up' investment opportunities for Qatar investors

March 25, 2015. India invited investors from energy-rich Qatar to invest in sectors like railways, defence production, infrastructure, retail and development of Liquefied Natural Gas (LNG) terminals. The Secretary (East) in the Ministry of External Affairs Anil Wadhwa highlighted the sectors which offer immense opportunities to Qatari investors to invest in India, including railways, defence production, infrastructure, retail and development of Liquefied Natural Gas (LNG) terminals. He observed that with the country developing industrial corridors in several parts of the country, Qatar could consider investing in some of these projects. The development of LNG terminals also provides an opportunity for investment by Qatar, Wadhwa said. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

RINL commissions green power project to generate 120 MW

March 31, 2015. Rashtriya Ispat Nigam Ltd (RINL), the corporate entity of Visakhapatnam Steel Plant (VSP), crossed another milestone with the launching of a novel project to generate a completely pollution-free 120 MW captive power generation by using 100 percent blast furnace and coke oven gas. This is the first of its kind in the Indian steel Industry. The average power requirement of VSP at 6.3 million tonne stage will be 418 MW. The RINL is currently having three turbo generators each 60 MW (180 MW) capacity and two turbo generators of 67.5 (135 MW) each taking the total captive power generation capacity to 315 MW. (www.thehindu.com)

BHEL to set up power plant in Telengana

March 30, 2015. Bharat Heavy Electricals Ltd (BHEL) said it is setting up four 270 MW units valued at ` 5,000 crore for Telangana State Power Generation Corp Ltd (TSGENCO) in the state. The units would be set up at Manuguru in Khammam district of Telangana. The company said, in December last year, the Telengana state-owned power company had placed an order with BHEL to set up Telangana's first supercritical thermal power plant of 800 MW rating at Kothagudem in the state. BHEL's scope of work in the project includes design, engineering, manufacture, supply, construction, erection, testing and commissioning of the four 270 MW thermal units on EPC (Engineering, Procurement and Construction) basis. (www.business-standard.com)

Reliance Power’s Sasan UMPP fully operational

March 30, 2015. Reliance Power Ltd has announced the commissioning of the sixth and last 660 MW unit of the 3,960 MW Sasan Ultra Mega Power Project (UMPP). With this, all the six units of Sasan UMPP have been commissioned 12 months ahead of Power Purchase Agreement (PPA) schedule, the company said. The Sasan UMPP is the largest integrated power plant cum coal mining project at a single location involving investment of over ` 27,000 crore. With this unit, Reliance Power’s generation capacity has increased to 5,945 MW which includes 5,760 MW of thermal and 185 MW of renewable energy based capacity. (www.thehindu.com)

NTPC invites tenders for 4 GW power plants in Vizag

March 25, 2015. State-owned NTPC has invited tenders for sourcing equipment for its proposed ` 20,000 crore thermal power project in Andhra Pradesh. NTPC is establishing 4x1,000 MW imported coal-based thermal power plant in Visakhapatnam district in Andhra Pradesh, which will come up at an investment of ` 20,000 crore. Approximately Rs 5 crore outlay is needed for generation of one megawatt thermal power. NTPC is executing 1,000 MW coal based units with supercritical technology, thereby the efficiency will be at the maximum and emissions are reduced drastically. The power plant requires 13.7 million tonnes coal per annum to achieve 90 percent plant load factor, NTPC said. (zeenews.india.com)

Steam release valves to be tested at Kudankulam n-plant

March 25, 2015. India's atomic power plant operator, the Nuclear Power Corp Ltd (NPCIL), will soon test the steam release valves of the second 1,000 MW unit at Kudankulam in Tamil Nadu, it was announced. During these tests, only steam release (water vapour) to the atmosphere will take place for a very short period of 2 to 3 minutes. During the testing, the ambient noise level is likely to go up marginally, Kudankulam Nuclear Power Project (KNPP) site director R.S. Sundar said. The tests will be conducted during day time only. Sundar had said that the reactor is expected to be loaded with real fuel around June 2015. The NPCIL is setting up two 1,000 MW Russian reactors at Kudankulam in Tirunelveli district. The first unit attained criticality, which is the beginning of the fission process, July 2013. Subsequently it was connected to the southern power grid in October 2013 but the commercial power generation began only December 31, 2014. (www.business-standard.com)

Transmission / Distribution / Trade…

Distribution companies expect Delhi's power demand to touch 6.4 GW

March 30, 2015. The national capital's power demand, already the highest among Indian cities, is heading for a new peak of 6,400 MW this summer, according to cash-starved electricity distribution companies that have started making preparations to meet the additional load. Last year, the peak summer demand was 5,900 MW. The power distribution arms of Reliance Infrastructure and Tata Power supply electricity to Delhi. The distribution companies, including Reliance's BSES, can also buy power from exchanges. According to Delhi discom, half the cost of between ` 4.5 and ` 5 per unit consists of a fixed component that has to be paid to generating companies whether or not power is bought. At ` 5 per unit, the cost of buying power in Delhi is the most expensive in the country compared with the national average of ` 2.93, as per the tariff order of financial year 2013-14. Delhi's power requirement is dwarfed when compared with global metro cities such as Singapore, which has a fourth of Delhi's population and six times power usage, according to Anish De, partner, infrastructure and government services at KPMG. (economictimes.indiatimes.com)

Crompton Greaves wins ` 1.1 bn order from PGCIL

March 30, 2015. Crompton Greaves has bagged an order worth ` 115 crore from the Power Grid Corp of India Ltd (PGCIL) for supply of transmission equipment for the latter's Vemagiri and Srikakulam sub-stations in Andhra Pradesh, the Avantha Group company said. The order entails supply of shunt reactors, which are used high voltage energy transmission systems to stabilize the voltage during load variations, for 765kV transmission system. (economictimes.indiatimes.com)

APTCL commissions transmission line

March 29, 2015. The Amravati Power Transmission Company Ltd (APTCL), a wholly owned subsidiary of RattanIndia Power Ltd, has commissioned the transmission system for evacuation of power from Amravati power plant. The transmission system includes 104-km 400kV double circuit Quad Moose line from Amravati Project to Akola Substation and 7-km long LILO 400kV single circuit line connecting to Koradi-Akola line, informed the company. The Amravati Thermal Power Plant would supply the entire power generated, to Maharashtra State Electricity Distribution Company Ltd, under a 25-year Power Purchase Agreement, the company said. The completion of the Amravati power plant would contribute towards achieving the goal of the central government of supplying 24x7 reliable and affordable power to all by 2019. (timesofindia.indiatimes.com)

Kamarajar Port to import 18 mn tonnes of coal in 2 yrs

March 26, 2015. The state electricity board will soon be able to import 18 million tonnes of coal from Kamarajar Port in the next two years after Union Ministry of Environment, Forests and Climate Change (MoEF) accorded environmental and coastal regulation zone clearance for development of two additional coal berths. Kamarajar Port said that the clearance by MoEF was given on March 12 and now they are awaiting clearance from the state pollution control board. Kamarajar Port said that with the addition of two coal berths, Kamarajar Port would be handling 40 million tonnes of coal.

Currently, the port is handling 22 to 23 million tonnes of coal. Interestingly, Ennore Port is also planning to add another coal berth. Tamil Nadu requires an additional 3.4 million tonnes of imported coal to stave off power crisis this year. It is 60 percent more than what it imported last year. Ennore Port said that Tamil Nadu Electricity Board (TNEB) has asked Ennore Port to increase its coal handling to 34 million tonnes in the next five years. (www.newindianexpress.com)

Torrent Power surges as govt to provide subsidy directly to power firms

March 26, 2015. Shares of Torrent Power has surged 5% to ` 170 on the National Stock Exchange (NSE) in otherwise weak market after the government approved pooling of imported gas and domestic gas for gas based power plants. Torrent Power has a generation capacity of 3202 MW and distributes power to 2.87 million customers annually in Ahmedabad, Gandhinagar, Surat, Bhiwandi and Agra.

Recently the company implemented a 1200 MW gas based power project at Dahej in South Gujarat. According to media reports, gas based power producers have agreed to forgo return on equity as government would help them by arranging for buyers of the power. Government will provide subsidy directly to the distribution companies for purchasing gas based power. (www.business-standard.com)

Power distribution arms of Reliance Infrastructure and Tata Power faces severe financial crunch

March 25, 2015. The power distribution arms of Reliance Infrastructure and Tata Power, which supply electricity in Delhi, are facing a severe financial crunch as they have taken a hit of another ` 1,000 crore due to an unfavourable regulatory decision that can eventually make electricity more expensive for consumers. The worsening cash positions can potentially disrupt power supply in Delhi over the coming weekend if the distribution companies fail to resolve the issue of their dues to transmission and generation firms. The companies are seeking Power Purchase Adjustment Charges (PPAC) to compensate them for fluctuations in fuel cost. The Delhi Electricity Regulatory Commission had approved the charge of up to 7% but withdrew it the next day. The cash-starved discoms are desperate to seek this compensation due for the past nine months since July 2014. While Tata Power Delhi Distribution Ltd (TPDDL) faces a cash crunch of about ` 330 crore, Reliance Infrastructure's BSES Yamuna and BSES Rajdhani are staring at a gap of ` 700 crore. This further financial hit is making it difficult for the companies to access bank loans for their operational needs. BSES Yamuna and BSES Rajdhani were recently served supply cut notices by Power Grid Corporation of India (PGCIL), which may cause blackouts in parts of the capital. The Delhi electricity regulator DERC allows PPAC on a quarterly basis but that has been denied for the past two quarters. In November 2014, DERC provisionally granted BYPL (7%), BRPL (4.5%) and TPDDL (2.5%), before withdrawing the same within 24 hours. Political pressure due to Delhi polls was the reason behind the rollback, an executive alleged. Delhi has PPAC mechanism since 2012. In India, over 21 states have this mechanism. (economictimes.indiatimes.com)

Tata Power to buy 50 percent stake in Zambia's Itezhi Tezhi Power

March 25, 2015. Tata Power will acquire 50 percent stake in Zambia's Itezhi Tezhi Power Corp Ltd (ITPC) from Tata Africa for an undisclosed amount. ITPC, a 50-50 joint venture with the Zambian parastatal utility ZESCO Ltd, is a special purpose vehicle which has been set up to build and operate a 120 MW hydro power plant in Itezhi Tezhi district in Zambia. ITPC has a 25 year power purchase agreement with ZESCO and is expected to commission the power plant by Q4 2015. The closing of the transaction will be subject to various approvals and consents as required under the applicable law, the company said. Tata Power is the country's leading integrated power company with a growing international presence. The company together with its subsidiaries and jointly controlled entities has an installed gross generation capacity of 8,747 MW in India and a presence in all the segments--fuel security and logistics, transmission, distribution and trading. (economictimes.indiatimes.com)

Policy / Performance………….

SC lets Adani Power defend compensatory tariffs

March 31, 2015. The Supreme Court (SC) allowed Adani Power Ltd to defend its grant of compensatory tariffs from Haryana state power distribution companies based on grounds of change in law and unforeseeable circumstances. Adani Power Ltd had moved the court appealing against an order of the Appellate Tribunal for Electricity (Aptel), which had refused to consider the company’s pleas to nullify its contracts with power distribution utilities over claims of change in law and unforeseeable circumstances. The court asked Aptel to continue its proceedings in the matter of compensatory tariffs. It had stayed the same on 11 November to hear the contentions of the parties. In August, the Supreme Court had asked Aptel to expedite hearings in this case. Aptel was hearing appeals by Haryana state discoms from a 2013 order of the Central Electricity Regulatory Commission (CERC), which had granted Adani Power compensatory tariffs owing to the increased cost of production of power. (www.livemint.com)

CIL asked to light up 30 ongoing power projects

March 31, 2015. In a move that would help 30 power companies that are nearing their project completion and scouting for fuel supply, the Coal Ministry has directed Coal India Ltd (CIL) to supply coal till further arrangements are made. There are around 18 coal blocks, which are recently put for auction but will come under production in next 2-3 years period. Meanwhile, almost 18,000 MW of capacity, either completely ready or close to completion needs fuel linkages. These 30 power projects are mainly in the southern parts of the country, facing acute shortage of power. With the assurance given by the Coal Ministry, these projects can hope for early fuel supply arrangements. According to industry experts, loss-making discoms have been shying away from signing pacts with power producers for long-term supply of power because they do not want to bear the additional cost. Earlier, power projects were directly awarded coal linkages. However, scarce resources and an increasing number of applicants prompted the government to introduce a system of awarding letters of assurance that required the standing linkage committee approval. (www.newindianexpress.com)

J&K govt seeks to harness 20 GW power potential of state

March 29, 2015. The Jammu and Kashmir (J&K) government said it would explore all possibilities to harness the 20,000 MW power potential of the state with the help of private players. Deputy Chief Minister Nirmal Singh, who holds the charge of Power, Housing and Urban Development Departments, said the government was committed to ensure greater improvement in power generation, its transmission and distribution. He said the PDP-BJP coalition government would like to see the state becoming self-reliant in power generation and increasing energy generation capacity to such an extent that it is able to sell it to rest of the country. He said the issue has already been taken up with the Centre and the state government would actively pursue the case. He said that a transformer bank will be set up to meet the requirements of transformers, on account of frequent cases of damages being reported in this regard. He said the government would also initiate steps to phase out the old and frequently damaged transformers and replace them. He said the Power Ministry has taken serious note of frequent damage to transformers due to use of sub-standard and underweight material in the workshops and overloading of transformers due to power theft. The deputy chief minister said the government was contemplating stringent measures to prevent such things from happening. (www.dnaindia.com)

Telangana will be a power surplus State by 2018: CM

March 29, 2015. Telangana will be a power surplus State by the first quarter of 2018 generating 24,000 MW power, said Chief Minister (CM) K. Chandrasekhar Rao. Rao said energy from all sources – solar, hydel and thermal – will be used to achieve power-surplus status. On the occasion, he unveiled a pylon. The project, estimated to be constructed at a cost of ` 5,000 crore, is expected to be commissioned in the next three years. Rao said an 800 MW unit would come up at Kothagudem thermal power station, SCCL’s new power plant, and another unit of 600 MW at Bhoopalpalli in Warangal district. He said for the first time, there was no power cuts during the beginning of summer. (www.thehindu.com)

Coal India may surpass 1 bn tonne output target by 2020: Goyal

March 26, 2015. With the production of thermal coal on the rise, the government is hopeful that state-owned Coal India will surpass its one billion tonne excavation target by 2020. The production of thermal coal in the country has increased by 8 percent, Power and Coal Minister Piyush Goyal said. The government has set an ambitious one billion tonne coal production target for Coal India by 2020. Even as the Minister is optimistic that Coal India will achieve its target by 2020, the PSU firm is likely to miss the set production target for the current financial year. Coal India may miss its output target of 507 million tonnes (MT) by 10 MT, during the current fiscal, on account of various delays in operationalising mines. However, the government may set a target of 550 MT coal output for Coal India in the next financial year (2015-16). Memorandum of Understanding (MoU) between the government and Coal India on the same is likely to be signed shortly. Coal India's output for April-February period was 436.96 MT as against the target of 450.14 MT, as per official data. The company had missed its output target of 482 MT in the last fiscal (2013-14) by producing 462 MT of coal. (www.business-standard.com)

Coal ministry eyeing 15-20 blocks for next auction round

March 26, 2015. The coal ministry is identifying 15-20 blocks for the next - third - round of auction, but cannot give a deadline for completing the process for all 204 blocks whose allotments were annulled by the Supreme Court, Coal and Power Minister Piyush Goyal said. The government completed the auction of 33 coal mines in two rounds. The Delhi High Court had granted interim relief to Jindal Steel and Power Ltd. and restrained the central government from allocating to Coal India the two coal blocks - for which JSPL had emerged as the successful bidder in the recent round of auctions. The ministry said it was "re-examining" nine winning bids out of the 33 coal blocks auctioned so far, on whether there were any price discrepancies in case of the nine winning bids, including those made by companies like Jindal Steel and Balco. It was considering whether these bids were too low when compared with the winning bids for other similar blocks through an analytical tool called "outlier", which looks for unusual observations that are far removed from the mass of data. (www.business-standard.com)

OERC hikes farm power tariff by 36 percent

March 25, 2015. The Odisha Electricity Regulatory Commission (OERC) has increased the tariff of electricity used for agricultural purpose by 40 paise a unit — a rise of 36 percent — for FY16. OERC has increased the rates for other category of consumers in the state for FY16. The average rise in retail supply tariff is 20 paise a unit, which works out to 4.2 percent hike over the current rates, across all slabs. The new rates will be effective from April 1. The revised tariff of power used for agricultural purposes will be ` 1.50 a unit, compared to ` 1.10 a unit, which was last fixed in 2000. Consumers belonging to the below-poverty-line (BPL) category will now have to pay ` 80 a month, compared with ` 65 earlier, for 30 units. For industrial users, the OERC has allowed some benefits such as additional power up to 20 percent more than the contract amount during off-peak hours without having to pay penalty. Similarly, reliable surcharge, applicable for high tension and extra high tension consumers, has been halved to 10 paise a unit. Power transmission charges and open access charges for short-term consumers have been kept unchanged in the tariff order, providing relief to power generators using the network of Odisha Power Transmission Corporation. (www.business-standard.com)

AAP to allocate ` 16.9 bn towards power, water subsidies

March 25, 2015. The Aam Aadmi Party (AAP) government in Delhi proposed ` 1,690 crore towards power and water subsidy to domestic consumers for 2015-16 in a vote-on-account presented for the first three months of the next financial year, FY16. It also sought additional expenditure of ` 91 crore under these two heads for March 2014-15. As of now, the Delhi government will have a fiscal surplus of ` 834.18 crore for 2015-16. This amount will change once the full Budget for 2015-16 is presented. (www.business-standard.com)

New round of coal block auctions from April: Goyal

March 25, 2015. The government is ready to launch the next round of coal block auctions from April, as it is facing litigation by Jindal Steel and Power Limited (JSPL), which saw its bids being cancelled in the latest round of auctions. Power Minister Piyush Goyal did not give the exact number of the blocks to be sold in the next round. The government was looking at auctioning 15-20 blocks. The government has already garnered over ` 2 lakh crore by auctioning just 33 blocks, surpassing the ` 1.86 lakh crore loss estimated earlier by the comptroller and Auditor General of India for allotment of mines without auctions. The Supreme Court had in September cancelled the allocations of 204 blocks in all, terming the process as "fatally flawed", leading the current round of auctions. The government has rejected bids received in the last round for four coal blocks. The mines whose bids were rejected include Gare IV/2, Gare Palma IV/3 and Tara coal blocks in Chhattisgarh in which JSPL had emerged as the highest bidder, and Gare Palma IV/1 mine bagged by Bharat Aluminium Company. Parliament had approved Coal Mines (Special Provisions) Bill of 2015, which forms part of National Democratic Alliance government's reforms agenda, on the last day of the first half of Budget session and the Ordinance on this were to lapse on April 5. Goyal who also oversees the coal portfolio, said there has been over seven percent increase in the domestic coal output this financial year to 478 million tonnes, against the low single-digit growth in the previous United Progressive Alliance government. On the controversial Dabhol power project, Goyal said very soon there will be some solution which will be announced. (www.business-standard.com)

Chhattisgarh’s power tariff among lowest: CM

March 25, 2015. Chhattisgarh's power tariff is lowest in the country, Chief Minister (CM) Raman Singh said. He said Chhattisgarh has initiated a series of steps to drastically reduce transmission and distribution losses and to provide cheapest possible power to its consumers. He said average cost of supply during 2014-15 has been ` 4.40 per unit which, he said, is low compared to other states. He said average cost in Maharashtra is ` 4.62, Gujarat ` 5.28, and Delhi is ` 7.80 per unit. Under state's urban electrification scheme, he said, electric lines are being extended to provide power to non-electrified areas while free power connection is also being provided to people living below the poverty line. He said a budgetary provision of ` 50 crore has been made for this purpose during next fiscal. State has implemented a scheme to provide safe drinking water in remote and inaccessible areas by installing solar pumps. He said more than 2,395 solar pumps have been installed during the last three years. (timesofindia.indiatimes.com)

Cabinet allows use of imported gas to revive stuck power plants

March 25, 2015. Coming to the rescue of stranded gas-based power plants, the Government has decided to come out with a mechanism for importing natural gas. A decision to this effect was taken by the Cabinet Committee for Economic Affairs. About 14,000 MW, with an investment of over ₹ 60,000 crore, which have no domestic fuel supply, faced immediate risk of becoming non-performing assets. In addition to these, about 10,000 MW of power plants are receiving limited quantity of domestic gas and most of them are operating at very low plant load factor. The power plants are both in public as well as private sectors. In order to revive these plants, the Government decided to intervene, Minister of State for Power, Coal, New & Renewable Energy Piyush Goyal said. To ensure that electricity generated from imported gas does not become expensive, the Government has fixed a preliminary price of ₹ 5.50 a unit to begin with. Depending on the fluctuations in the imported gas price, an empowered pool management committee will review the rates, Goyal explained. Besides, the Government nominees to import the gas — GAIL and GSPL — have agreed to reduce the transportation tariff, marketing margins and re-gasification charges, while the Central and State Governments will exempt the fuel from certain applicable taxes and levies. Power developers would completely forego the return on their equity. The Government proposes to provide support to discoms from the Power System Development Fund through a transparent reverse e-bidding process. But, industry is quick to point out that only time will tell how whether there are any takers for electricity at even ₹ 5 a unit. (www.thehindubusinessline.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

ExxonMobil starts production at Hadrian South gas field off Gulf of Mexico

March 31, 2015. ExxonMobil has commenced production at the Hadrian South gas field in the Gulf of Mexico deepwater, located in the approximately 240 miles south of the Louisiana’s coast, US. The Hadrian South field produces through two subsea wells which are connected to the nearby Anadarko-operated Lucius field facilities. Daily capacity of the Lucius platform is 80,000 barrels of oil and 450 million cubic feet of gas, of which 300 million are committed to Hadrian South. The field's daily production is estimated to reach 300 million cubic feet of gas and 2,250 barrels of liquids, for a total of about 52,000 barrels of oil equivalent (boe). Daily production share of the company is expected to be around 16,000 boe once both of Hadrian South's wells are ramped up. (www.energy-business-review.com)

Maersk Oil commences production from new platform in Danish North Sea

March 31, 2015. Maersk Oil commenced production from a new unmanned platform Tyra Southeast-B in the Danish North Sea, with the platform expected to add 50 million barrels of oil equivalent of reserves over the next 30 years to Danish production. Drilling of the first well, which is projected to flow 2,600 barrels of oil equivalent per day (boepd), commenced in December 2014 with the jackup Ensco 72. Maersk Oil plans to drill a total of 8-12 horizontal wells between 2015 and 2017. The new platform, located 137 miles off Denmark’s west coast, will produce around 20 million barrels of oil and 170 billion standard cubic feet of gas, with peak production of 20,000 boepd in 2017. (www.rigzone.com)

Statoil discovers more gas offshore Tanzania

March 30, 2015. Norwegian energy firm Statoil has made another natural gas discovery in Block 2 offshore Tanzania, boosting gas volumes by 1.0-1.8 trillion cubic feet of gas (28.5-51.3 billion cubic metres) the company said. That brings the total discovered gas volumes in Block 2 to approximately 22 trillion cubic feet, it said. The company believes more discoveries can be made in the area, but said it will now concentrate on appraising one of its previous seven discoveries. The company has said it may build a liquefaction plant with Britain's BG Group, which operates neighbouring exploration blocks. (af.reuters.com)

PetroChina to swap North American oil and gas assets to cut costs

March 27, 2015. Oil and gas producer PetroChina is planning to swap its assets in North America, and cut its capital spending in exploration and production, to deal with global slump in oil prices. The company has decided to cut its capital spending by about 10% to approximately $43 bn, after it recorded a 67% fall in earnings for the fourth quarter. PetroChina is planning to swap assets, mostly oil sands in Canada, with foreign companies. The company plans to complete a multi-billion dollar plan to divest parts of its gas and oil pipelines this year. (www.energy-business-review.com)

OGDCL discovers oil at Palli Deep-1 well in Pakistan's Sindh Province

March 26, 2015. Oil and Gas Development Company Limited (OGDCL) reported an oil discovery at the exploratory well Palli Deep-I in District Tando Allah Yar, Sindh Province, Pakistan. The structure of Well Palli Deep # 01, drilled to a depth of 13,287 feet was delineated, drilled and tested using OGDCL's in house expertise. Significant reserves of oil have been found at Well Palli Deep # 01 in (Basal Sand & Middle Sand) Lower Goru Sand formation which produced 1,095 barrels of oil per day at 32/64 inch choke size. This discovery will add remarkable oil reserves to the reserve base of the Company, OGDCL said. (www.rigzone.com)

Downstream…………

Japan Okinawa refinery closure could cut oil product exports

March 30, 2015. Japan's oil product exports are expected to be cut slightly to fill domestic demand after the closure of 100,000 barrels-per-day (bpd) Nishihara refinery on Okinawa, traders said. Brazil's state oil company Petrobras said that it has decided to shut the refinery it owns on the Japanese island of Okinawa and has started the plan to withdraw. Oil demand in Okinawa is not big enough for the shutdown of the refinery to have an impact on the island, traders said. The closure of the refinery could reduce Japan's oil products exports, though the cut is not expected to be substantial, traders said. Japan is a net exporter of oil products such as diesel and jet fuel. The country's imports of jet fuel could rise during winter as refineries switch yields to maximise production of heating fuel kerosene and produce less jet fuel, traders said. (af.reuters.com)

Qatar companies to invest $5 bn in China for LNG projects

March 30, 2015. Two Qatari companies agreed to pay about $5 billion for a 49 percent stake in Shandong Dongming Petrochemical Group to help the Chinese business build an LNG receiving terminal and expand into retail gasoline sales. The investment by Hamad bin Suhaim Enterprises and Qatra for Investment and Development will pay for the construction of a receiving terminal for liquefied natural gas, with a capacity of 3 million metric tons a year, and an LNG storage facility, Ibrahim El-Tinay, Qatra’s chief executive officer said. Shandong Dongming will also use the money to built 1,000 gasoline filling stations in six provinces south of Beijing, he said. Qatar, an OPEC member and the world’s biggest exporter of liquefied gas, has been expanding investments in China and Asia, where it already sells most of its oil and LNG. The emirate and its sovereign wealth fund, the Qatar Investment Authority, plan to invest as much as $20 billion in Asia by 2020. China is the world’s largest energy consumer. Shandong Dongming, which operates an oil refinery processing as much as 450,000 barrels a day, expects to sell about a third of its output through the new gas-station network, the company said. (www.bloomberg.com)

Tokyo Gas to build second LNG tank terminal in Hitachi

March 26, 2015. Tokyo Gas Co, Japan's biggest natural gas utility, said it would build a second liquefied natural gas (LNG) tank at a receiving terminal northeast of Tokyo, to meet growing demand in the area. The company expects to start using the terminal in Hitachi, equipped with a 230,000-kilolitre LNG tank that can hold about 100,000-110,000 tonnes of LNG, as well as a large jetty, in March 2016. The company will start building the second 230,000 kl LNG tank in 2018, with construction to be completed by March 2021. (af.reuters.com)

Total, DNO keep pumping oil and gas in Yemen after airstrikes

March 26, 2015. Total SA and DNO ASA said they continue to pump oil and natural gas in Yemen after Saudi Arabia and its allies bombed rebel targets in the nation. Total is the largest of seven owners -- with a 40 percent stake -- in a $4.5 billion liquefied natural gas plant on the southern coast that is Yemen’s biggest industrial investment. Since production began in 2009, the French company and its partners have grappled with security issues including rocket attacks and pipeline blasts. Saudi Arabia and a coalition of 10 Sunni-ruled nations began airstrikes against Shiite rebel positions after an appeal from Yemen President Abdurabuh Mansur Hadi. Yemen’s government collapsed in the face of an offensive by Houthis, whom Saudi Arabia has said are tools of its Shiite rival Iran. It has vowed to halt their advance. The Oslo-based company reported output in Yemen dropped in 2014 compared with the previous year. New drilling activities were suspended due to the security environment. The Yemen LNG plant, with a capacity of 6.7 million tons a year, is located in Balhaf and supplied with gas from a field in the center of the country. The gas is transported to the plant through a 320-kilometer pipeline. (www.bloomberg.com)

Transportation / Trade……….

Japan's Toho Gas to buy LNG from Malaysia's Petronas

March 31, 2015. Japan's third-biggest city-gas supplier, Toho Gas Co, said it signed a basic agreement with a wholly-owned unit of Malaysia's Petroliam Nasional Bhd (Petronas) to buy liquefied natural gas (LNG). The company is set to accept seven to nine LNG cargoes a year during the 10-year contract starting in April 2017, it said. The prices will be linked to crude and U.S. Henry Hub prices, with an option to change the destination on condition of obtaining the seller's prior consent, it said. (www.reuters.com)

Pemex to sell 45 percent stake in two Mexican natural gas pipelines for $900 mn

March 30, 2015. Mexico's state oil and gas company Petróleos Mexicanos (Pemex) has signed an agreement to sell 45% equity interest in two natural gas pipelines, Los Ramones Phase II North and Los Ramones Phase II South, for $900 mn. Under the terms of the agreement, BlackRock and First Reserve will jointly acquire the 45% stake in 744 km of pipelines, which are expected to be operational by mid-2016. The pipelines are under transportation service agreement (TSA) for 25 years with Pemex Gas y Petroquímica Básica. The Ramones I, which was commissioned in 2014, runs from Eagle Ford in Texas to Los Ramones, Nuevo León while the Phase II will reach Guanajuato to supply the central and western parts of the country. The Los Ramones II Projects is part of a broader initiative to transport abundant, natural gas from the Eagle Ford shale in South Texas, aimed at meeting the growing demand for natural gas in central Mexico. (www.energy-business-review.com)

Shell reopens Nigeria's Nembe Creek oil pipeline

March 26, 2015. Royal Dutch Shell reopened the Nembe Creek oil pipeline after planned maintenance, Shell said. Shell said it had closed the pipeline, which carries Nigeria's Bonny Light crude, for "short term" engineering work. There was no indication that the work affected exports of Bonny Light, one of the larger crude streams from Africa's top producer. (af.reuters.com)

BP sees TANAP gas pipeline project deal

March 25, 2015. British oil major BP expects to sign a deal with the Trans-Anatolian Natural Gas Pipeline (TANAP) project within two months to become a stakeholder in the multi-billion dollar project that aims to reduce Europe's reliance on Russian gas. Chris Schlueter, BP country manager for Georgia, said that all main documents were signed. BP said it wanted a 12 percent stake in the TANAP project. Azeri firm SOCAR holds a 58 percent stake in TANAP, while Turkish pipeline firm Botas raised its stake to 30 percent from 20 percent in 2014. TANAP envisages carrying 16 billion cubic metres (bcm) of gas a year from Azerbaijan's Shah Deniz II field in the Caspian Sea, one of the world's largest gas fields, which is being developed by a BP-led consortium.