-

CENTRES

Progammes & Centres

Location

[Is the budget the only hope for coal & power sector?]

“The General Budget will be presented in the last week of February, 2015 and the industry is coming out with its wish list and coal & power sector is no exception. Both the industries are in dire need of financial help. The Minister for coal, power and renewable is hopeful that the budget will provide innovative funding for power projects. This is good news but apart from funding both the sectors need more in terms of policy reforms…”

Energy News

[GOOD]

DVCs threat to cut off power may enlighten AAP that power can be distributed only if it is generated!

How many times can Mahavitaran terminate Ratnagiri power before we think of euthanasia for Dabhol?

[UGLY]

The hype over renewable energy has the makings of a super sub-prime crisis!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Is the budget the only hope for coal & power sector?

ANALYSIS / ISSUES…………

· Ramping up Coal Production: Planning Experience

DATA INSIGHT………………

· Fossil Fuels Contribution to GDP in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Oil Ministry clears development of discoveries worth ` 1.5 lakh cr

Downstream……………………………

· IOC to invest ` 78.1 bn for expansion

· BPCL reports ` 25 bn of inventory loss in FY15Q3 but manages to swing to profits

Transportation / Trade………………

· RIL January oil imports up 1.1 percent from December

· TAPI pipeline: India asks Turkmenistan to ease rules

Policy / Performance…………………

· Niko to sell stake in Reliance Industries block on lower gas price hike

· Falling oil prices shrink VAT collection in Punjab, Haryana

· ONGC to pay ` 87.1 bn fuel subsidy as Finance Ministry gives only ` 50.8 bn cash subsidy

· Budget 2015: It’s time to expand the tax basket for fiscal prudence

[NATIONAL: POWER]

Generation………………

· Inox Wind signs ` 45 bn pact with Gujarat for power plant

· Mithivirdi nuclear power plant gets crucial CRZ nod

Transmission / Distribution / Trade……

· CERC asks Power Grid Corp to consider Kerala plea for transmission corridor

· Jyoti Structures bags ` 5.8 bn orders for transmission lines

· DVC gives power jolt to new AAP govt in Delhi

· Delhi discoms wait for DERC order on purchase charges

· Power, Transmission projects to get a push during Modi-Sirisena meet

· Modi's dig at AAP over reduced power bills

· Maharashtra terminates PPA with RGPPL for Dabhol power purchase

· CAG audit of Delhi discoms may come up with 'irregularities'

· Reliance Infrastructure, Tata Power may feel AAP heat

Policy / Performance…………………

· Hydro projects no reason for 2013 deluge: Uttarakhand govt

· Coal India's e-auction: Shortage of coal pushes up prices

· Coal auction to benefit poor states: Coal Secretary

· Kejriwal tasks departments with halving power rates

· India signs nuclear energy pact with Sri Lanka

· Govt planning special policy to boost hydel power generation: Goyal

· Power Ministry wants Cabinet to decide on gas pooling for power stations

· Maharashtra seeks ` 100 bn from Centre for power infrastructure

· Power Finance's profit rises on increased income from operations

· 'MEA's details on nuclear liability act unsatisfactory'

· Coal auction process won't be delayed: Goyal on HC order

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil seeks to develop $29 bn Johan Sverdrup field

· Russia's Rosneft says replaced reserves by 154 percent

· RH Petrogas gets clearance to develop North Klalin field in West Papua

· Statoil makes minor oil discovery in North Sea

Downstream……………………

· RT Global Resources-led consortium to develop $2.5 bn oil refinery in Uganda

· Pemex to delay refineries upgrade plan in Mexico

· China ‘teapot’ refineries may access imported oil under new rule

· Russia's Lukoil signs contract to build gas processing plant in Uzbekistan

Transportation / Trade…………

· Hungary says agreement reached on new gas deal with Russia

· Cyprus, Egypt to explore ways of transporting offshore gas

· BHP agrees to sell Pakistan gas business

· Montana governor calls for deeper pipelines after oil spills

· GDF Suez sells Hungary free market gas portfolio to MET

Policy / Performance………………

· China is considering merging state-owned oil companies

· Oil price downturn creates need for 'cost culture' in industry

· Higher Dutch gas production possible from July: Minister

· Mass layoffs complicate oil industry's long-term plans

· Chariot sees opportunities due to oil price decline

· Somali Petroleum Minister sees start of oil, gas output by 2020

· OPEC producers cut oil prices to Asia in battle for market share

· Nigeria’s rating may be reduced by S&P on lower oil prices

[INTERNATIONAL: POWER]

Generation…………………

· NERC separates Zuma’s licence for 1.2 GW coal power plant into four

· Clinton power plant station petition being circulated

Transmission / Distribution / Trade……

· Sarawak Cable getting better power deal in Sumatra

· ABB wins $35 mn power equipment order for Belgian power transmission system

· ED5-PVH power transmission project energized in Arizona

Policy / Performance………………

· Nepal IPB approves development of hydropower projects

· Kansai Electric secures approval to restart two nuclear reactors in Japan

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Implement green laws to protect environment: Environment Minister

· Budget 2015: Renewable energy ministry seeks incentives for solar sector

· Suzlon, Myrah, Vikram, M&M say clean energy goal possible if govt helps overcome constraints

· Goyal confident of $100 bn investment in green energy in 5 yrs

· MP to have world's largest solar power plant

· TN awarded for 8.4 GW installed capacity in new energy

· Chhattisgarh gets award for renewable power development

· PM Modi for innovation in renewable energy for affordable power

· SBI commits ` 750 bn for financing clean energy generation

· AP inks MoU for generation of wind, hybrid power

· MoEF seeks enhanced budget for National Adaptation Fund

· Govt aims to achieve 40 GW of power from rooftop solar projects by 2022

· CLP India awards 100 MW wind power project in MP to Gamesa

· NTPC invites bids to set up solar projects in southern India

· Solar plan will not skid on oil prices: Goyal

· Reliance Power to set up 6 GW solar park in Rajasthan

· Solar power developers evinces interest in Punjab

· Renewable energy sector to attract $200 bn: Goyal

GLOBAL………………

· UK approves offshore wind farm with power for 2 million homes

· Huge rise in energy demand at odds with climate change fight: BP

· Worst ‘megadrought’ in 1k yrs in US due to global warming

· Mainstream powers forward with $760 mn South African wind energy project portfolio

· EU draft deal proposes carbon-market fix by end of 2018

· Big oil must ditch low profile in climate clash: Shell CEO

· Sumitomo Bank, others to invest in solar power fund by Sparx

· Apple clinches $850 mn deal with first solar for renewable energy

· TransCanada disputes EPA on Keystone XL’s role in climate change

· EU shutters most coal, natural gas power in six yrs

[WEEK IN REVIEW]

COMMENTS………………

Is the budget the only hope for coal & power sector?

Ashish Gupta, Observer Research Foundation

|

T |

he General Budget will be presented in the last week of February, 2015 and the industry is coming out with its wish list and coal & power sector is no exception. Both the industries are in dire need of financial help. The Minister for coal, power and renewable is hopeful that the budget will provide innovative funding for power projects. This is good news but apart from funding both the sectors need more in terms of policy reforms. What are the reforms needed for these two crucial sectors?

Coal Sector

· The Government is very keen to give a large constructive role to the private sector in the coal mining through Coal Ordinance, 2014. Before moving ahead the Government must separate power producers and coal miners and allow professional coal miners to undertake commercial mining.

o These commercial miners should be allowed to sell coal in the open market.

o Commercial mining will induce interest from global mining giants who will not only bring desired investments but also cutting edge technology.

o Coal blocks which have been allotted to the companies in the recently concluded auctions need to be incentivised by allowing them to sell extra coal in the open market.

· The Central Government must provide additional funding especially to upgrade existing coal evacuation infrastructure in the country. The funding should be in addition to Dedicated Freight Corridor projects. The funding must go directly to the coal ministry and should be incorporated in the General Budget rather than in the Railway Budget, 2015.

o The funding can be used for upgrading the existing rail links between Ludhiana to Dankuni and Mumbai to Delhi to Khurja.

o Separate policy framework for coal evacuation must be introduced to impose penalties in case of delay in transportation.

o Apart from the above, other new transport infrastructure that will be created either by Railways, Coal India (CIL) or any private players must be open to use for all on “use and pay” basis.

· The Government has already mopped up INR 240,000 from the stake sale in CIL:

o It must be ensured that large chunk of the sale must go towards infusing cutting edge technology for increasing output per man efficiency in CIL.

o Another share of the sale proceedings may be utilised for boosting Coal bed methane exploration and under-ground coal mining where technology and funding proving to be major hurdle.

o The remaining money can be utilised to acquire coking coal assets overseas and planning for rehabilitation and resettlement program for new coal mining projects in advance.

· The practice of cross subsidising among CIL subsidiaries should be stopped. Additional funding should be provided by the Central Government for making sick units of CIL financially viable as one time settlement.

o Apart from the above the subsidiaries should be made independent on the pattern of Singareni Collieries Ltd. with State Government as equity partners.

Power Sector

Generation

· On the new generation capacity front, the Government must do some retrospection on whether new generation capacity is really required.

· For power plants based on imported coal, reducing excise and import duty on coal will reduce generation cost.

· All new power plants must be awarded near the coal mines.

· Existing power plants showing efficiency in coal use need to be financially incentivised.

· The power plants which are importing coal from overseas should be audited so as to ensure that these imports are genuine and not just for inflating bills. In case fraud is detected penalty must be imposed on power plants.

· The new Renewable Generation Obligation should be put on hold.

Transmission

· The new transmission projects should not be awarded in haste and it must be ensured that whether the requirement can be fulfilled through upgrading the concerned transmission network. It will save money as well as time.

· Rules needs to be made uniform for the government utilities and private players for compensatory land provision. It is currently imposed for private players but not players such as Power Grid Corporation of India Ltd (PGCIL).

· Biased treatment among transmission players should be stopped. PGCIL is a part of the Empowered Group which plays a crucial role in approving the projects and at the same time PGCIL also acts as bidder for the projects.

· The bidding qualification criteria should be made on the pattern of Ultra Mega Power Projects so as to eliminate non-serious players.

· The transmission projects which come online before the power projects need to be compensated through temporary financial relief.

· Innovative ideas/ technology should be encouraged rather than sticking to old conventional benchmark standards.

o The Standard Bidding Document for transmission line projects provides no scope for innovative technological solutions. The developer has to choose the technology/ materials as per the Bid Process Coordinator guidelines. For example the tower has to be built using mild/ tensile steel.

· Financial institutions also discriminate between PGCIL and private companies. The cost of debt for PGCIL is only 8 percent while for private players it is 12 percent.

o Financial institutions can continue lending to PGCIL on the same terms but they can at least provide some cushion to private players by reducing the cost of debt to 10.5 percent or 10 percent.

Distribution

· Enforcement of green obligation should be implemented taking into account whether the concerned distribution utility is capable of absorbing such costs.

o For green obligation, the distribution companies should be compensated beforehand through budgetary support.

· The State Governments that want to subsidise any class or section of the society must be done through direct cash subsidy transfer on the pattern of LPG subsidy program. The distribution companies must be allowed to charge the actual cost of service from the consumers.

o The subsidy amount not paid by the State Governments in past years must be transferred immediately.

· Private participation must be boosted on the pattern of Delhi model where some equity must be owned by the Government so as to maintain accountability and transparency.

o Financial restructuring of the debt ridden distribution utilities must be undertaken through additional budgetary support.

· Most importantly, distribution utilities should be allowed to work in the professional manner.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Ramping up Coal Production: Planning Experience

Saumitra Chaudhuri, Former Member, Planning Commission

(Transcript of comments made at the round table ‘Ramping Up Coal Production: Policy Pathways’ organized by the Observer Research Foundation on 18 February 2015 at New Delhi)

1.0 Since the nationalization of the coal industry in 1971−73 and to date, the industry has been largely run by the State. To that extent the plans and targets set for it and the policy structure designed and run by the administration has been central to the industry. I will dwell on the plans briefly, but not exclusively, for in order to profit from the lessons of the past one must be focused on the future.

2.0 We have some prime coking coal and some what we call semi-coking coal that we use for blending for use in steel plants and foundries. The deposits are relatively small and the quality mediocre. Ever since the mid-1980s when import of coking coal was first permitted, an increasingly large share of coking coal used by steel plants has been imported. Some steel plants have come up over the last 25 years that use low ash non-coking coal in direct reduction furnaces. However, what is material and relevant to our discussion here is non-coking coal and lignite for use in our power plants and to a much lesser extent in cement and other areas. In 2013-14, we produced 605 million tonnes (MT) of coal & lignite, of which 507 MT was non-coking coal and 44 MT was lignite – a total of 552 MT.

3.0 It is interesting to note that average production increase of thermal coal & lignite in the decade that followed nationalization was actually a bit lower than in the decade that preceded it – namely 4.0% (1970-71 to 1980-81) and 4.3% (1960-61 to 1970-71) per annum respectively. Output growth picked up in the eighties to an average of 7.8% − with four years posting 9.3 to 10.5% growth. This experience was not repeated in the nineties; average growth slowed to 5.2% per annum and in only two years growth was close to 10%. Some non-coking coal blocks began to be allocated to power and steel producing companies since the mid-nineties, but any augmentation to overall supply materialized in the next decade.

4.0 Between 2000-01 and 2010-11, average growth picked up slightly to 5.9% − though it collapsed to a decline of (−) 0.2% in 2010-11, to be followed by marginal increases of 1.9% in 2011-12, of 3.9% in 2012-13 and of 0.1% in 2013-14. The average growth in the four-year period 2010-11 to 2013-14 was thus a mere 1.4%.

5.0 In Apr-Dec 2014, total coal output growth was up at 9.1% (and more for thermal coal). It is likely that for 2014-15 as a whole, total coal output growth will be about 9%, despite the strike last month and associated loss of output; and output growth for thermal coal and lignite will be about 9.5%.

6.0 In the 4-year period when coal output was held down on account of over-regulation, not only was there lower growth, but the output trajectory was shifted downwards. Had output growth continued at the pace in evidence over the past two decades – that is between1991-92 and 2009-10, we would have produced 90 MT more thermal coal & lignite in 2013-14 than we actually did.

7.0 Despite the smart pick-up in 2014-15, the “notional” loss of output this year would still be 72 MT. When can we catch up with the old trajectory and reduce this “notional” output loss to zero? If output were to increase at a steady 7.3% per annum every year, then we would catch up with the old trajectory by 2020-21. At 9.3% rate of growth catch-up can be by 2017-18. Somewhere in between would be a satisfactory achievement.

8.0 Returning to planning. We should remember that the conventional wisdom even in the late nineties a decade after “power-cuts” became a word in every Indian language was that we could at best hope to add 25 GW in each 5-year Plan period. BHEL perhaps reflected this and had a capacity till well into the next decade of 5 GW a year. How much did we really add? In the Seventh Plan (1985-90) 21 GW; in the Eighth Plan (1992-97) 16 GW; in the Ninth Plan (1997-2002) 19 GW and in the Tenth Plan (2002-07) 21 GW. The targets were of course higher – 40 GW in the Tenth Plan. It is only in the Eleventh Plan that targets were set higher (78 GW), actual capacity creation was much higher at 55 GW and new capacity for power equipment manufacture was created. BHEL increased its capacity fourfold to 20 GW. The several joint venture units by L&T/Mitsubishi Heavy Industries, Doosan, BGR-Hitachi, Toshiba-JSW, Alstom-Bharat, Ansaldo-Gammon, Thermax-Babcock and Cethar-Riley for complete BTG and/or boiler an TG sets reportedly aggregate in excess of 40 GW boiler and 35 GW TG (Ministry of Heavy Industries, IEEI Mission Plan 2021-22).

9.0 Just as power capacity addition and equipment manufacture stepped up on to a new trajectory, coal output decided to step down to a lower one: A most perverse outcome. The Twelfth Plan (2012-17) had slated total new capacity creation of 88.5 GW, of which thermal was to be 72.3 GW. Of this, 49.2 GW or 68% had been completed by the end of January 2015. Of the total increase to capacity the completion rate was lower at 55% on account of large shortfalls in hydro and nuclear. The direction of coal output was in this scenario, a complete shocker. The reasons were diverse – from the institutional weakness of the state-owned monopoly, to regulatory obstruction, to grave charges of financial impropriety and a general state of disorder.

10.0 The Twelfth Plan has two projections of domestic thermal coal output. In the business-as-usual (BAU) the slated output for non-coking coal was 715 MT by 2016-17; in the “Optimistic” scenario it was 795 MT. Lignite is treated as a separate department. This was against actual coal output of 540 MT in 2011-12. As against the projection of 605 MT in 2013-14, actual output was lower at 560 MT. In 2014-15, as against projection of 635 MT, actual output may be 611 MT. The BAU projection is so safe: you can catch up in one year! The “Optimistic” scenario which posited output of 795 MT in 2016-17 and 1,102 MT in 2021-22 were more realistic as planning objectives and of course were harder to keep pace with. But with a 7.5% steady and sustained output growth from now onwards it is possible to catch up with even the “Optimistic” scenario by 2021-22.

11.0 The point of course is what will get us on that path and help realize those goals. The problem has been that the Plans for the past four decades were about Coal India and Coal India only: about being offered explanations (aka excuses), deconstructing it with varying zeal, goading and coaxing it and getting caught up in intra-ministerial warfare as in the period end 2009 to 2012.

12.0 A travesty where goal setting and development of policy frameworks became largely replaced by investing all resources in micro-managing a reluctant monolith caught up in the cross-hairs of another overweening arm of government: all losses are presumed to be non-material and which could co-exist with other “notional” losses of trillions. The consequence was inevitably that that insufficient attention was paid to dealing with institutional and framework issues.

13.0 The idea that a monolith like Coal India Limited – a holding company with several subsidiaries each of which is a monopoly in their particular geographies – is not out-dated even by the standards of the central public sector is absurd. The several recent initiatives taken in law can create space for private sector units not only to meet its own requirements (captive blocks), but also to compete in the market through merchant mining. The several changes in the law that seek to create this framework are at the present time ordinances that will need parliamentary approval at some point in time.

14.0 But for the sake of Coal India a useful step would be to de-merge the several constituent companies – BCCL, ECL, CCL, WCL, NCL, MCL, SECL and NECL – and leave them to perform on their own and in friendly competition with each other. It will do wonders. A problem with having such a colossus is that each of its several parts observes the first dharma of a joint family – covering up for their sins, severally and jointly. Each one of these companies has large reserves and can define and face up to their individual corporate challenges. The problems that enterprises face must be solved in the regular course of affairs. They should not routinely migrate to the very top for resolution. The successor companies formed as a result of the de-merger can also tie up in joint venture or other associations with Indian and foreign companies for mine development and service facilities. Without doubt the process would get much simplified in a competitive framework.

15.0 Then there is the issue of working on coal deposits at greater depths. The clear preference for open-cast or what used to be called “strip mining” once has limitations for extracting coal at greater depths. There seems to be reluctance for underground mechanized mines. But that is the obvious solution for working coal at greater depths, for producing better coal and working in areas that are not suitable for open-cast operations for surface reasons – be it forest cover or cultivated fields and habitation. The “fire zone” at Jharia has remained unresolved even 50 years after its identification and the first “plans” to deal with the problem. Bringing appropriate technologies to bear – be it in mechanized underground mining where conventional long-wall equipment has reportedly found to be not suitable to our seams or with raging underground fires that consume millions of tonnes of good quality coal each year or for that matter to identify and develop coal bed methane (CBM) resources need institutional change. The patch work that we have been doing is simply inadequate.

16.0 Finally, a word on coal washeries. The freight composition of Indian Railways is 47% coal by tonnage and 44% by Net Tonne Kilometres. Of this 40−45% is mineral content, i.e. ash or non-coal. Moving washed coal with half of the mineral content/ash can free up 20% of the railway’s freight carrying capacity besides improving performance at the power house. The efficiency gains are enormous. However, Indian coals wash poorly. With a target clean coal ash content of 20% we will get 30 to 40% of rejects, which contain 20−35% coal. Of course, the rejects will be less if the target ash drop is shallow, but then the logistical and other economics will work differently. The objective should be to create a framework so that these choices are made on a commercial and rational basis. In any case, we must not waste the coal contained in the rejects or store them in towering heaps that smoke in forbidding desolation. It can be used in fluidized bed furnaces for steam and power generation.

Views are those of the author

Author can be contacted at [email protected]

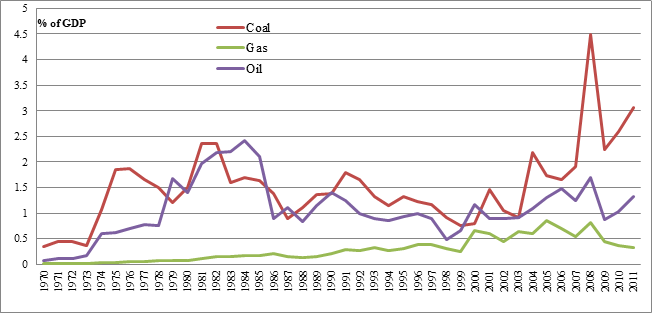

DATA INSIGHT……………

Fossil Fuels Contribution to GDP in India

Akhilesh Sati, Observer Research Foundation

|

Year |

Coal |

Gas |

Oil |

Year |

Coal |

Gas |

Oil |

|

Fossil Fuel Value* as % of GDP |

Fossil Fuel Value* as % of GDP |

||||||

|

1970 |

0.35 |

0.01 |

0.08 |

1991 |

1.8 |

0.29 |

1.24 |

|

1971 |

0.44 |

0.01 |

0.12 |

1992 |

1.65 |

0.26 |

0.99 |

|

1972 |

0.44 |

0.01 |

0.12 |

1993 |

1.32 |

0.33 |

0.9 |

|

1973 |

0.36 |

0.01 |

0.16 |

1994 |

1.14 |

0.27 |

0.85 |

|

1974 |

1.07 |

0.03 |

0.59 |

1995 |

1.33 |

0.3 |

0.93 |

|

1975 |

1.86 |

0.04 |

0.62 |

1996 |

1.22 |

0.39 |

0.99 |

|

1976 |

1.87 |

0.05 |

0.7 |

1997 |

1.16 |

0.38 |

0.89 |

|

1977 |

1.66 |

0.05 |

0.77 |

1998 |

0.92 |

0.3 |

0.49 |

|

1978 |

1.5 |

0.07 |

0.75 |

1999 |

0.76 |

0.25 |

0.66 |

|

1979 |

1.21 |

0.08 |

1.67 |

2000 |

0.8 |

0.66 |

1.16 |

|

1980 |

1.5 |

0.07 |

1.41 |

2001 |

1.46 |

0.6 |

0.9 |

|

1981 |

2.36 |

0.11 |

1.97 |

2002 |

1.05 |

0.44 |

0.89 |

|

1982 |

2.36 |

0.14 |

2.19 |

2003 |

0.92 |

0.64 |

0.91 |

|

1983 |

1.6 |

0.14 |

2.2 |

2004 |

2.19 |

0.6 |

1.09 |

|

1984 |

1.69 |

0.17 |

2.42 |

2005 |

1.73 |

0.85 |

1.31 |

|

1985 |

1.64 |

0.16 |

2.11 |

2006 |

1.65 |

0.7 |

1.47 |

|

1986 |

1.39 |

0.2 |

0.89 |

2007 |

1.91 |

0.54 |

1.24 |

|

1987 |

0.9 |

0.14 |

1.11 |

2008 |

4.48 |

0.82 |

1.7 |

|

1988 |

1.11 |

0.13 |

0.83 |

2009 |

2.25 |

0.45 |

0.87 |

|

1989 |

1.36 |

0.14 |

1.14 |

2010 |

2.6 |

0.36 |

1.03 |

|

1990 |

1.39 |

0.21 |

1.4 |

2011 |

3.06 |

0.32 |

1.32 |

*It is the difference between the value of fossil fuel production at world prices and its total costs of production.

Note: Green cell denotes the lowest value while Yellow cell denotes the highest value for fossil fuels from 1970 to 2011.

Source: Index Mundi

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Oil Ministry clears development of discoveries worth ` 1.5 lakh cr

February 17, 2015. The Oil Ministry has used the recently granted freedom to clear development of oil and gas discoveries worth about ` 150,000 crore. The ministry has used the flexibility granted by the Cabinet in October 2014 in deciding on timelines for development of oil and gas discoveries to clear as many as 30 pending cases. This would enable early monetisation of oil and gas discoveries in two blocks each of Gujarat State Petroleum Corp (GPSC) and Oil and Natural Gas Corp (ONGC) and one of Focus Energy, according to a note by upstream regulator DGH. This is expected to result in exploitation of about 34.06 million barrels of oil and about 0.731 trillion cubic feet of gas reserves valued at about ` 35,000 crore considering oil price of $50 per barrel and gas price of $5.61 per million British thermal unit. The Cabinet had provided operational flexibility in enforcing contracts by way of relaxing some of timelines prescribed for discoveries so that exploration and production (E&P) activities do not suffer on account of excessive rigidity in decision making.

The Production Sharing Contract (PSC) between the government and the explorer has rigid timelines for each stage of exploration and actions have been initiated against firms even if deadlines are missed by a day. Three-to-six month extension in the current 18-60 month timeframe for submission of declaration of commerciality (DoC) of discoveries, a prerequisite before investment plans can be finalised, has been approved, the note said. Also, the deadline for submission of investment plan for the discoveries too would be extended by up to six months. The PSC provides for time period for submission of field development plan (FDP) for hydrocarbon discovery after DOC. There is no provision in the PSC for extension of this time period and non-acceptance of FDP due to late submission results in non-monetisation of discoveries. Also, upstream regulator DGH has been given flexibility to accept discoveries for which operators had failed to provide prior notification to the government. (www.firstpost.com)

Downstream………….

IOC to invest ` 78.1 bn for expansion

February 16, 2015. Indian Oil Corp (IOC) said it will invest ` 7,812 crore in fuel quality upgradation projects at two key refineries as well as other expansion projects. The company approved an investment of ` 1,843 crore in upgrading the 13.7 million tons Koyali refinery in Gujarat to produce Euro-IV complaint petrol and diesel. Another, ` 1,327 crore will be spent on similar fuel quality upgradation project at Barauni refinery in Bihar, IOC said. IOC will invest another ` 890 crore in construction of a dedicated naphtha pipeline from Jaipur to Panipat along with augmentation of Koyali-Sanganer product pipeline.

The company sanctioned ` 170 crore for pre-project activities and preparation of detailed feasibility report for implementation of project for producing Euro-IV of BS-IV complaint petrol and diesel at Gujarat refinery. For Barauni refinery upgrade, ` 112 crore have been sanctioned for carrying out a detailed feasibility report. (economictimes.indiatimes.com)

BPCL reports ` 25 bn of inventory loss in FY15Q3 but manages to swing to profits

February 13, 2015. Bharat Petroleum Corporation Ltd (BPCL) booked an inventory loss of ` 2,500 crore in the third quarter of 2014-15 as crude prices plummeted, denting the refining margin of the company. Despite the inventory loss, the state-run oil marketing company reported a profit of ` 551.16 crore in the December quarter as against a loss of ` 1,088.94 crore, driven by full compensation for losses on fuel sales. Its net sales declined to ` 57,914.51 in October-December from ` 64,767.62 crore earlier. BPCL earned $1.5 on converting every barrel of crude oil into fuel in the quarter as compared to gross reefing margin (GRM) of $1.7 per barrel a year ago. BPCL received ` 1,080 crore by way of cash subsidy from the government. The upstream oil producers, primarily ONGC, gave BPCL an assistance of ` 2,330 crore to compensate for the losses on selling domestic LPG and PDS kerosene at rates lower than cost. (economictimes.indiatimes.com)

Transportation / Trade…………

RIL January oil imports up 1.1 percent from December

February 16, 2015. Reliance Industries Ltd (RIL) imported about 1.1 percent more oil in January compared with the previous month and resumed purchases from Iraq after a gap of four months, tanker arrival data showed. Reliance, which has a diversified crude slate and shifts purchases to maximise revenue, bought about 21.8 percent more oil last month compared with a year earlier when it had cut runs at its older plants. The refiner also stepped up shipments last month to build its inventory, taking advantage of falling oil prices, traders said. It raised purchases from Latin America in January to about 49.5 percent from about 46 percent a year earlier, while that from the Middle East fell to 36.5 percent from about 38 percent, the data showed. African grades accounted for about 14 percent of the refiner's crude purchase in January compared with about 9 percent a year earlier. Reliance's two advanced refineries in Gujarat state in western India can together process 1.2 million barrels per day (bpd) of oil, or about 28 percent of the country's overall capacity. (economictimes.indiatimes.com)

TAPI pipeline: India asks Turkmenistan to ease rules

February 11, 2015. With construction of the USD 10 billion TAPI pipeline stuck for want of a credible operator, India pressed Turkmenistan to relax its domestic law to help get an international firm for building the project. The four-nations to the Turkmenistan-Afghanistan- Pakistan-India gas pipeline project met in Islamabad to resolve issues so that work on the project can start this year. TAPI project has remained on the drawing board since the four nations have not been able to get an international firm to head a consortium, which will lay and operate the pipeline. French giant Total SA had initially envisaged interest in leading a consortium of national oil companies of the four nations in the TAPI project. However, it backed off after Turkmenistan refused to accept its condition of a stake in the gas field that will feed the pipeline. Since the four state-owned firms, including GAIL of India, neither have the financial muscle nor the experience of cross-country line, an international company that will build and also operate the line in hostile territories of Afghanistan and Pakistan, is needed. Turkmenistan has so far maintained that its law does not provide for giving foreign firms an equity stake in upstream gas field, without which western energy giants will not be interested to take the risk. The TAPI pipeline will have a capacity to carry 90 million standard cubic metres a day (mmscmd) gas for a 30-year period and will be operational in 2018. India and Pakistan would get 38 mmscmd each, while the remaining 14 mmscmd will be supplied to Afghanistan. TAPI will carry gas from Turkmenistan's Galkynysh field, better known by its previous name South Yoiotan Osman that holds gas reserves of 16 trillion cubic feet. From the field, the pipeline will run to Herat and Kandahar province of Afghanistan, before entering Pakistan. In Pakistan, it will reach Multan via Quetta before ending at Fazilka (Punjab) in India. Oil Minister Dharmendra Pradhan said that TAPI project will play an important role in contributing to gas infrastructure project. Oil Minister met Minister of Mines and Petroleum of Afghanistan on the sidelines of the TAPI Steering Committee meeting. He was accompanied by a high-level delegation including Oil Secretary Saurabh Chandra, High Commissioner of India in Islamabad, his ministry's Joint Secretary (International Cooperation), as well as chairmen of state gas utility GAIL India and ONGC Videsh Ltd Managing Director. (economictimes.indiatimes.com)

Policy / Performance………

Niko to sell stake in Reliance Industries block on lower gas price hike

February 15, 2015. Canada's Niko Resources has put up for sale its stake in Reliance Industries' KG-D6 gas block saying there is uncertainty over long-term price outlook in India. Niko holds 10 percent stake in the KG-D6 block where a total of 20 oil and gas discoveries had been made and three out of them are in production. The government had announced raising natural gas price to USD 5.61 per million British thermal unit (mmBtu) from USD 4.2. The increase was lower than USD 8.4 that the industry was expecting and prevailing USD 5.71 rate applicable to gas from western offshore fields. The announced price for the period from November 2014 to March 2015 is a 33 percent increase over the price received previously, but is lower than expected. RIL is the operator of the block with 60 percent interest while the remaining 30 percent is with BP plc of UK. The partners have first right of refusal over the stake and it remains to be seen if RIL will exercise that right. Niko also holds a 10 percent interest in gas discovery block NEC-25, off the Odisha coast, with RIL and BP. While the higher gas price is applicable uniformly across fields, Dhirubhai-1 and 3 (D1&D3) gas fields in KG-D6 block will continue to get the old rate of USD 4.2 till it is settled through arbitration if the output falling by over 80 percent to about 8 million standard cubic meters per day was due to natural reasons or was a deliberate ploy. As per the pricing guidelines announced, the gas price will be determined on a semi-annual basis. Notification of the gas price for the period of April 1, 2015 to September 30, 2015 is expected to occur in mid-March 2015. Prices will be calculated based on a volume weighted average of prices in the US, Canada, Europe and Russia based on the twelve month trailing average price with a lag of three months. Niko said the guidelines state that all discoveries after the announcement of the new price, in ultra deep water areas, deep water areas and High Pressure-High Temperature areas, would get a premium. (economictimes.indiatimes.com)

Falling oil prices shrink VAT collection in Punjab, Haryana

February 12, 2015. Declining prices of petrol and diesel in the domestic market has become of cause of concern for the Punjab government, as these will have an impact on the revenues collected in the form of tax on the sale of oil. Value-added tax (VAT) on petrol and diesel is an important source of revenue for the states. The dwindling fuel prices have compressed the VAT base for the state exchequers. The VAT collection in Punjab stood at ` 17,760 crore and that in Haryana was ` 19,930 crore in 2014-15. Punjab is in discussions with Haryana and Chandigarh to revise VAT on fuel in tandem to check the illegal cross-border trade of fuel.

The state governments are also mulling to convert VAT on fuel to specific tax. The specific tax is charged on the quantity of the product and VAT on the value of the product. This may help insulate their tax receipts from the price volatility in the international and domestic market. The average retail sale price of petrol in Punjab is ` 63.30 a litre and that of diesel is 46.38 a litre. Petrol in Haryana is cheaper and costs ` 59.36 and diesel costs ` 46.60 a litre. VAT on Petrol in Punjab is 32.5 percent and is 26.25 percent in Haryana. VAT on diesel in Punjab is 12.36 percent and is 12.07 percent in Haryana. As the collection of VAT on fuels is hassle-free and leakage-proof, the state governments find it the easiest way to raise the revenue, the All Haryana Petroleum Dealers' Association said.

Both Punjab and Haryana have the central sales tax outstanding with the Centre and pressed under financial stress due to power subsidies and huge Plan expenditure. The estimated power subsidy in Punjab is ` 5,200 crore and is projected to be ` 5,338.5 crore in Haryana in 2014-15 With limited sources of revenue generation, and burgeoning expenditure, the lower revenue returns on account of VAT collection on fuel has pressed the states to seek higher funds allocations. (www.business-standard.com)

ONGC to pay ` 87.1 bn fuel subsidy as Finance Ministry gives only ` 50.8 bn cash subsidy

February 12, 2015. Oil and Natural Gas Corp (ONGC) and other state-run explorers may have to pay about ` 10,900 crore in fuel subsidy after Finance Ministry has agreed to provide only ` 5,085 crore in cash subsidy for the December quarter. Out of the ` 15,981 crore of revenue losses fuel retailers incurred on selling LPG and kerosene at government-controlled rates in October-December, the Finance Ministry has agreed to make good only less than one-third or ` 5,085 crore by way of cash subsidy. The remaining ` 10,896 crore will have to be borne by ONGC and Oil India Ltd (OIL). ONGC may have to shell out close to 80 percent of this amount (` 8,716 crore). Efforts are being made to impress on Finance Ministry to give out more as the subsidy payout for ONGC and OIL is unsustainable given that oil prices have halved to $50 per barrel. In the first half of current fiscal, fuel retailers IOC, BPCL and HPCL had together lost ` 51,110 crore in revenue on selling fuel below cost. Most of this was made good by way of ` 31,926 crore dole from upstream players and ` 17,000 crore coming from Budget as cash subsidy.

Oil Ministry had ` 22,101 crore in subsidy to cover for losses on LPG and kerosene sale in the second half of current fiscal so as to almost exempt ONGC and OIL from any payments. This was because ONGC and OIL hardly made any money at prevailing global oil prices of about $50 per barrel. The gross-realisation of ONGC during October-December was $75-76 per barrel and after accounting for subsidy payout, which are in form of discounts it will give on crude oil sold to IOC, BPCL and HPCL, the net realisation was likely at $35-36. ONGC's cost of production is around $40 per barrel. Under-recoveries, or revenue retailers' loss on selling fuel below cost, is projected at ` 74,773 crore in full 2014-15 fiscal. Out of this, ` 51,109.53 crore was in first half, which was met by ` 17,000 crore in government subsidy and ONGC paying ` 26,841 crore. OIL paid ` 4,085 crore and gas utility GAIL paid ` 1,000 crore.

The Ministry has put the under-recoveries in October-December quarter at ` 15,981.28 crore and ` 7,682 crore in the fourth quarter. The Ministry had projected that government will earn ` 75,944 crore from excise duty on petrol and diesel this fiscal and even after paying for ` 39,101 crore subsidy (` 17,000 crore of first half and ` 22,101 crore in second half), it will be left with ` 36,843 crore. (economictimes.indiatimes.com)

Budget 2015: It’s time to expand the tax basket for fiscal prudence

February 11, 2015. Falling oil prices have given policy makers enough headroom to prepare a multi-pronged roadmap, which could have a benign impact on India's fiscal prudence in medium to long term. India's fiscal health has been an issue of concern in the past few years for the international credit rating agencies and the same had led to the sovereign rating downgrade in 2012. Now, all the three top global rating agencies are keeping Indian debt at the lowest investment grade rating. With just few days left for the Narendra Modi government to table the Union Budget 2015, these agencies have been batting for fiscal consolidation-centric reforms. Recent reports also say the government is seriously looking into their concerns and might unveil a roadmap in the upcoming Budget for limiting fiscal deficit to 3 percent of GDP within 2 years despite the challenge of reviving the economy with more spending on infrastructure. As far as Current Account Deficit (CAD) is concerned, oil prices have given a huge respite but there are still concerns looming over the fiscal deficit, which has surpassed the budgeted target in just nine months (April-December) of this fiscal. The fiscal deficit in the first 9 months of this fiscal stood at ` 5.32 lakh crore or 100.2 percent of the 2014-15 estimates. However, some experts feel that the government can’t take falling oil prices for granted in the long run.

Oil prices have already been bottomed out and changing dynamics might trigger higher prices, resulting in the increasing vulnerability of balance of payment. Something seems to be happening on the same lines earlier, as the oil which had plunged last month to its six-year-low (nearly USD 45 per barrel), recovered by over 10 percent to above USD 55 per barrel in the last few trading sessions. Nonetheless, the decline in global oil prices since mid-2014 has given room to the Modi government to mop up nearly USD 3.5 billion by repeated hikes in excise duty on petrol and diesel. Since November last year, the government has raised the excise duty on fuels for no less than four times.

As per estimates, lower fuel subsidies coupled with the recent duty hike on diesel and petrol could together add almost ` 1.1 trillion (USD 18 billion) to the Budget 2015-16. It’s a major concern that the revenue realization has remained subdued continuously for the last couple of years. So the government must maintain fiscal deficit at 4.1 percent of GDP either by financing through the PSUs stake sale, cutting both plan and non-plan expenditure or enhancing excise duty on fuel. (zeenews.india.com)

[NATIONAL: POWER]

Generation……………

Inox Wind signs ` 45 bn pact with Gujarat for power plant

February 17, 2015. Inox Wind has signed a ` 4,500 crore preliminary pact with Gujarat for setting up a 700 MW power plant in the state. The company said it is also setting up an integrated wind turbine manufacturing facility in Madhya Pradesh. It had an order book of 1,258 MW as of December 31. Inox's customers include Green Infra, Continuum Wind Energy, Tata Power Renewable Energy, Welspun Energy, Bhilwara Energy, ReNew Power Ventures, Hero Future Energies and a subsidiary of CESC. The MoU (Memorandum of Understanding) will be implemented over next 2 years in 3 districts of Gujarat - Rajkot, Amreli and Kutch. In Madhya Pradesh, it is setting up an integrated facility. (economictimes.indiatimes.com)

Mithivirdi nuclear power plant gets crucial CRZ nod

February 12, 2015. Nearly six years after it was announced, the 6,000 MW nuclear power plant at Mithivirdi, a coastal hamlet some 40 km from Bhavnagar, is close to getting the crucial coastal regulatory zone (CRZ) clearance. The project has been recommended for the clearance by the expert appraisal committee of the ministry of environment and forests (MoEF). The Nuclear Power Corporation of India, which is executing the project, has already moved to get the environmental clearance from MoEF. The project was announced following the signing of the India-US civil nuclear deal in 2008. Interestingly, the recommendation for CRZ clearance comes in the backdrop of Prime Minister Narendra Modi and US President Barack Obama finalizing the civilian nuclear deal during the latter's visit.

The proposed plant with six light water reactors of 1000 MW capacity each will be spread across 777 hectares. Out of this, 603 hectares is agricultural land. The project will be executed in three stages with 2000 MW capacity addition at each stage. The first stage is proposed to be complete in 2019-20, the second by 2021-22 and third by 2023-24. (timesofindia.indiatimes.com)

Transmission / Distribution / Trade…

CERC asks Power Grid Corp to consider Kerala plea for transmission corridor

February 17, 2015. The Central Electricity Regulatory Commission (CERC) has issued orders allowing requests of KSEB Ltd for grant of a transmission corridor to Kerala. In doing so, it set aside an earlier order of Power Grid Corporation of India, which is also the notified Central Transmission Utility (CTU). Power Grid will have to reconsider applications made by the Kerala State Electricity Board Limited (KSEB) in June 2013 and issue orders for grant of transmission corridor for 400 MW for a period of three years. Power Grid is also being asked to ‘strictly follow the regulations and procedures approved by the Commission from time to time for granting medium- and long-term open access’. KSEB had challenged the denial of medium-term open access for which the applications were made by NVVN Ltd (NTPC Vidyut Vyapar Nigam Ltd) and PTC India Ltd. It requested that the denial of medium-term open access on the application made by NVVN in June and November of 2013 for the period from March 1, 2014, to February 28, 2017, may be declared as illegal and cancelled. It sought a similar treatment on the denial of access on the application made by PTC India in June and October 2013 for 100 MW from BALCO for the period from March 1, 2014, to February 28, 2017. While calculating availability of corridor in June 2014, the Commission found that the CTU had considered the available capacity as 211 MW. However, the auxiliary power consumption with reference to allocation by the Ministry of Power had not been taken into consideration while calculating the transmission margin. The Commission directed the CTU to consider the auxiliary power consumption for calculating the transmission margins. It found valid grounds to assess the application of NVVNL made in June 2013, to be considered as eligible. (www.thehindubusinessline.com)

Jyoti Structures bags ` 5.8 bn orders for transmission lines

February 16, 2015. Jyoti Structures said it has bagged orders worth ` 582 crore for transmission line projects. The projects include ` 310 crore order for 400 kv transmission line project in Sultanate of Oman, ` 32 crore 400 kv transmission line project from DEWA (Dubai Electricity and Water Authority), Dubai and ` 240 crore orders for various projects for fabrication and supply of transmission line steel structures. (economictimes.indiatimes.com)

DVC gives power jolt to new AAP govt in Delhi

February 16, 2015. At a time when the Aam Aadmi Party (AAP) has promised cheaper power to Delhi’s citizens, Damodar Valley Corporation (DVC) has warned the government of the national capital that it will snap power supply to the city if dues of ` 381.21 crore are not cleared. In a notice sent to the new AAP government in Delhi, the DVC said it would stop supplying power to BSES Delhi's two distribution companies – BSES Rajdhani Power Limited and BSES Yamuna Power Limited – by February 22 if the amount is not paid. DVC’s warning comes close on the heels of Prime Minister Narendra Modi wondering at a conference on renewable energy how the AAP government in Delhi could promise cheaper power when the city is dependent on electricity from outside. DVC confirmed that the notice had been sent. According to these regulations, all power bills have to be cleared within 60 days. The AAP, which recently scored a landslide victory in polls to the Delhi assembly, had promised in its election manifesto provide electricity at cheaper rates. Delhi has a demand for 5,000 MW a day and is largely dependent on nearby states to meet its needs. Officials said DVC supplies 286 MW every day to BSES’s two distribution firms in Delhi. Delhi received the notice close on the heels of a similar warning issued by the DVC to the Jharkhand government. Jharkhand has to pay over ` 8,000 crore to the DVC. The BSES, which is owned by Reliance ADAG, distributes electricity to nearly 34 lakh customers across two-thirds of Delhi. The row over dues snowballed into a controversy when the DVC began reducing power supply to seven districts of Jharkhand in June last year. Union power minister Piyush Goyal intervened in the matter by writing a letter to the Jharkhand government regarding the clearing of the DVC’s dues. After the BJP came to power in Jharkhand following elections held late last year, it cleared some of the dues of the DVC but power continues to be cut in seven districts of the state. The total arrears of the Delhi government include the pending bills of ` 94.45 crore for September and November 2014. The DVC's thermal power plants at Mejia in West Bengal and Chandrapura in Jharkhand supply 131.76 MW and 175. 69 MW respectively to Delhi every day. (www.hindustantimes.com)

Delhi discoms wait for DERC order on purchase charges

February 16, 2015. With the assembly polls over, power distribution companies in the city are waiting to hear from Delhi Electricity Regulatory Commission (DERC) over reinstatement of power purchase adjustment charges (PPAC). Discoms said they have submitted all bill details to the regulatory body and have been waiting for the order, which has been on hold for the last two months due to model code of conduct being in force. The power companies submitted data required by DERC. (economictimes.indiatimes.com)

Power, Transmission projects to get a push during Modi-Sirisena meet

February 16, 2015. NTPC’s 500 MW coal-based power project at Sampur, Trincomalee and Power Grid Corporation’s over-sea and under-sea transmission line project connecting India and Sri Lanka are expected to get a needed push during the coming meeting between Prime Minister Narendra Modi and new Sri Lankan President Maithripala Sirisena. The project, which NTPC had proposed in June 2005, entails an investment of Rs 2,000 crore. It is yet to get various clearances from the Sri Lankan government agencies. The transmission project, proposed in 2007-08 to transfer 1,000 MW from India to Lanka, needs an investment of ` 3,000 crore. However, both the governments, Power Grid and Ceylon Electricity Board (CEB) are yet to settle various technical and other issues before a formal agreement. The two governments signed an agreement in October 2013 to develop a coal-based plant in Trincomalee as a joint venture between CEB and NTPC. The initial capacity will be 500 MW, extendable to 1,000 MW. Further, power from the Sampur plant could be exported to India. (www.business-standard.com)

Modi's dig at AAP over reduced power bills

February 15, 2015. In an apparent dig at AAP over its poll pledge to reduce power bills, Prime Minister Narendra Modi wondered how such promises could be made by political parties in states which are dependent on electricity supply from outside. The parties make these promises in states that rely on electricity supply from other states, he said. Arvind Kejriwal-led AAP trounced the BJP in Delhi assembly polls. The party in its election manifesto had promised to cut electricity bills by half among other freebies. Delhi has a power demand of about 5,000 MW and is largely dependent on other states to meet its requirements. Reacting to Modi's apparent dig at AAP, senior party leader and AAP's Delhi Convenor Ashutosh urged the Prime Minister to help the state government to make power affordable. AAP leader Ashish Khetan said the previous governments neither promoted solar energy nor did they have any good policy of any alternate source of energy. (www.business-standard.com)

Maharashtra terminates PPA with RGPPL for Dabhol power purchase

February 13, 2015. The Maharashtra government and the Maharashtra State Electricity Distribution Company Limited (Mahavitaran) announced the power-purchase agreement (PPA) with Ratnagiri Gas and Power (former Dabhol power) has been terminated and the company was free to sell to other buyers. Both the government and the state-owner distributor said it could not afford to buy Dabhol power at ` 5.50 a unit as proposed by Ratnagiri. It was quite high when compared to the power from Maharashtra State Power Generation Company (MahaGenco) plants at ` 3.30 a unit. At a meeting, in the presence of Union Power Minister Piyush Goyal, Chief Minister Devendra Fadnavis, Ratnagiri board members, and project lenders it was decided that Mahavitaran will not pay arrears of ` 2,000 crore, claimed by the private power company, because of unilateral change in the agreement. The government and Mahavitaran said the agreement with Ratnagiri has been terminated through a letter sent. The state has put the ball in the court of the Centre and Ratnagiri to revive Dabhol project. Fadnavis also said sale of Dabhol power project to a private entity was not under consideration as it would not be a viable proposition unless adequate gas was available for its revival. He said the completion of LNG terminal by GAIL India with a total capacity 5 million tonne per annum will help Ratnagiri to mobilise an annual revenue of ` 1,200 crore. (www.business-standard.com)

CAG audit of Delhi discoms may come up with 'irregularities'

February 12, 2015. The Comptroller and Auditor General of India (CAG)'s auditors claim to have made significant breakthrough in their audit of Delhi discoms, according to sources who said a report on Delhi's power distribution companies could be out as early as this summer vindicating the Aam Aadmi Party (AAP)'s suspicion of possible irregularities. During his 49-day government, Arvind Kejriwal had recommended audit of the three power distribution companies in January 2014. AAP has alleged nexus between the discoms and Congress and BJP and blamed it for the high electricity charges in Delhi. According to sources, the auditors have found that several high value customers of most of the discoms were paying their bills in cash, which is against rules. These customers had bills of lakhs of rupees every month. The second major finding of the CAG audit is anomalies in the way the Delhi government extended a few hundred crore rupees worth of assistance to the discoms. It is not clear if the questions are over the ` 3450 crore that the government provided to cover losses of distribution companies between 2002-03 and 2006-07. The three power discoms-- Tata Power Delhi Distribution Ltd, and Reliance Power subsidiaries BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd-- had challenged the CAG's right to audit their books after the then AAP government ordered the audit in January 2014. But the Delhi High Court refused to stay the Delhi government order, asking the three discoms to give their accounts for auditing by CAG. It ordered the three companies to cooperate with CAG and asked the auditor not to submit its report to the state government until March 19 this year, the date for next hearing. Indications are that the CAG could be ready with an interim report by then, and once the court gives its go ahead it would only take a few weeks for it to be submitted to the Delhi government. If the report vindicates AAP's stand, it would strengthen its arguments for closer scrutiny of discoms, and the possibility of providing electricity at cheaper rates. (economictimes.indiatimes.com)

Reliance Infrastructure, Tata Power may feel AAP heat

February 11, 2015. The power distribution companies operating in Delhi, owned by the Reliance Group and the Tatas, may feel the heat after the Aam Admi Party's (AAP) landslide victory in Delhi elections. CAG officials are learnt to have visited the offices of these firms again to conduct audit, which was ordered in January 2014 by the earlier AAP government that lasted 49 days. The distribution companies saw their share prices plunge over the last five days ever since opinion and exit polls predicted an AAP victory on fears that the new government will expedite CAG audit and reduce power tariff rates by up to 50%, as promised in its election manifesto. Shares of Reliance Infrastructure that controls BSES Delhi discoms - BSES Yamuna Power and BSES Rajdhani Power - have plunge by 16% in the last five days. Similarly, Tata Power that operates in Delhi through Tata Power Delhi Distribution saw its shares tank by 11% during the period. Reliance Infra and Tata Power distribution arms have already challenged the audit order by the earlier AAP government in the Delhi high court. (economictimes.indiatimes.com)

Policy / Performance………….

Hydro projects no reason for 2013 deluge: Uttarakhand govt

February 17, 2015. The Uttarakhand government told the Supreme Court that the June 2013 deluge was not triggered by hydroelectric power projects (HEPs) in the state and rejected the findings of the Centre's expert panel on adverse ecological and environmental impact of such projects. Fate of all power projects in the state is hanging in balance after the Centre accepted the report of the expert body (EB). It has been considering all options including scrapping of hydroelectric power projects. The state government in its affidavit said the findings of EB, constituted by the ministry of environment and forests (MoEF), had no scientific basis. Dispelling apprehensions on ecological and environment impact of projects, it said Rishikesh and Haridwar would have been flooded in 2013 if Tehri Dam had not existed. The state government said the MoEF had completely failed to balance the need for environmental safeguards and the pressing need for clean and sustainable energy. Pleading the court to grant green signal for the projects in which crores of rupees have been invested by companies, the government said it is the most promising source of energy and even China is constructing 25,000 MW project on the same ranges. The apex court had said the Centre's U-turn on the projects has created confusion and asked it to take a holistic approach and not to scrap them in a knee-jerk reaction. The apex court, which had stayed construction of all power projects in the aftermath of the deluge, asked the government to take a fresh look on the projects of National Thermal Power Corporation (NTPC), National Hydroelectric Power Corporation (NHPC), Tehri Hydro Development Coporation (THDC) and GMR among others. (timesofindia.indiatimes.com)

Coal India's e-auction: Shortage of coal pushes up prices

February 17, 2015. Shortage of coal for e-auction at state-run monopoly miner Coal India Ltd (CIL) has pushed up prices, with those of certain grades doubling to about ` 3,000 per tonne in the past one year, while the international prices have been on the decline. Coal India sells coal to the power sector at average price of ` 1,100-` 1,200 per tonne. E-auctioned coal fetched about ` 1,500 last year on average, about a third lower than this year's figure of ` 2,000 per tonne. CIL sells various grades of coal with varying energy content. The higher the energy content the higher the price. Prices of premium grades of coal with high energy content fetched at least ` 3,000 per tonne this year, compared to ` 1,600-` 1,700 per tonne last year. Fuel supply agreements are coal supply contracts required to be signed with power companies. CIL's first priority is to supply coal to the power sector. It can offer coal on e-auction only if it has adequate volumes after meeting the power companies' requirements. Between April 2013 and January 2014, CIL sold close to 47 million tonnes through the electronic auction platform. This fiscal, the monopoly managed to make available 33 million tonnes of coal during the first 10 months. Income from coal sold through e-auction is a sizeable portion of CIL's profits, which took a hit in the third quarter of the current fiscal. (economictimes.indiatimes.com)

Coal auction to benefit poor states: Coal Secretary

February 17, 2015. With aggressive bidding for coal blocks likely to continue on the fourth day, the government said that poor states would benefit from the auction. The mines on sale are Amelia (North) mine in Madhya Pradesh (power sector), Ardhagram mine in West Bengal and Chotia mine in Chhattisgarh --- non power sector. The 10 companies in the race for Amelia (North) mine are Adani Power, Bharat Aluminium Co Ltd (Balco), Essar Power M P Ltd, GMR Chhattisgarh Energy Ltd, GVK Power Goindwal Sahib Ltd, Jaiprakash Power Ventures, Jindal Power Ltd, JSW Energy Ltd, RattanIndia Power Ltd, Reliance Geothermal Power Pvt Ltd. The five companies vying for Ardhagram coal mine are Easternrange Coal Mining Pvt Ltd, Monnet Ispat and Energy Ltd, OCL Iron & Steel Ltd, SS Natural Resources Pvt Ltd and Visa Steel Ltd. The technically qualified bidders for Chotia mines are Balco, Godawari Power & Ispat Ltd, Hindalco Industries, Prakash Industries, Rungta Mines and Ultratech Cement Ltd. Amelia (North) mine has extractable reserves of 70.28 million tonnes (MT), Ardhagram has extractable reserves of 19.29 MT, Chotia mine has extractable reserves of 13.57 MT. Jai Prakash Associates, Durgapur Projects and B S Ispat -- had bagged one mine each, even as the government said that it expects more aggressive bidding for blocks as the mines were already producing. After the Supreme Court cancelled allocation of 204 mines in September, the government decided to auction the blocks. It has put 19 blocks on sale in the first tranche. The last day for the auction of first lot of mine is February 22. (economictimes.indiatimes.com)

Kejriwal tasks departments with halving power rates

February 16, 2015. Delhi Chief Minister Arvind Kejriwal tasked the finance and power departments with preparing proposals to halve power rates and provide free supply of water, up to 20,000 litres per month, to every household - his AAP's two key poll promises. The decision was taken in a meeting where Kejriwal asked the officials of these departments to send their proposals to slash power tariff by 50 percent till the audit by the Comptroller and Auditor General (CAG) of the private power companies is completed. In its previous 49-day government in 2013-14, the AAP had halved the electricity rates by 50 percent by providing subsidy and announced free supply of about 667 litres water everyday within 48 hours of coming to power. It had also ordered the account book of power distribution companies by the CAG. (www.business-standard.com)

India signs nuclear energy pact with Sri Lanka

February 16, 2015. India and Sri Lanka signed a civilian nuclear pact that would help the island nation meet its energy goals, a sign of improving ties as President Maithripala Sirisena looks to reduce his country’s dependence on China. Sirisena has promised to rebalance Sri Lanka’s foreign relations away from China. Officials under his predecessor, Mahinda Rajapaksa, had rankled India by suggesting that Pakistan -- whose reactors have mostly been built by Chinese companies -- may help it build nuclear power plants. Prime Minister Narendra Modi said that India and Sri Lanka would also expand defense and security ties. Sri Lanka and India began talks on a civilian nuclear cooperation pact in 2012 and held another two rounds of talks last year, according to government. India offers more than five decades of experience in atomic energy. Its industry has built 5.8 GW of capacity using mostly indigenous technology and plans to increase that to 62 GW by 2032. Modi and U.S. President Barack Obama announced a breakthrough on a long-stymied 2008 civilian nuclear agreement that could trigger an expansion of nuclear imports and projects. (www.bloomberg.com)

Govt planning special policy to boost hydel power generation: Goyal

February 12, 2015. To boost hydel power generation and resume those small projects in the sector which have been delayed due to various reasons, the Union Power ministry is planning to design a special policy, which will also ensure that a new project is announced only after getting necessary approvals are in place. Union Power Minister Piyush Goyal said it should be ensured that no projects are announced without the necessary approvals and land clearances, and the right of way are in place. The Modi government has set an ambitious target for renewable energy over the next five years at 3,000 billion units from the present 53 billion. The overall target is to double generation to 2 trillion units. The government is also working towards reviving large hydro projects including the 1,200 MW Teesta-III project in Sikkim, which is behind schedule by over two years, the 2,000 MW Shubhamsari project in Arunachal Pradesh, which when completed will be the largest hydel plant in the country, and the 400 MW Maheshwar being put up by SKumar's group in MP. (economictimes.indiatimes.com)

Power Ministry wants Cabinet to decide on gas pooling for power stations

February 12, 2015. The power ministry has left it to the Cabinet to decide whether to include power stations based on administered price mechanism (APM) gas in the price-pooling scheme in a fresh proposal aimed at salvaging gas-based power projects to the tune of ` 64,000 crore being run by companies such as Essar Power, Reliance Power, GMR Energy, GVK Power and Lanco Infratech. The fresh proposal comes after the oil ministry said no additional gas output is expected from domestic sources in the next three years to pool with imported gas. The new scheme seeks about ` 7,000 crore of financial support from a fund comprising penalties paid by distribution utilities and generators for grid indiscipline besides proposing various tax reliefs to the plants. As per the proposal, gas will be imported and supplied along with domestic gas at an average 'pooled' price to run the stranded plants at 40% capacity to help them recover fixed costs. The scheme is being proposed for three financial years beginning April 2015 as the oil ministry has indicated that no incremental domestic gas is available till then. The ministry has given two options to the Cabinet. The first is a pooling proposal, including more than 6,000 MW APM gas-based plants operating at less than 40 percent capacity so that enough domestic gas is available for pooling with imported LNG. The second option excludes the APM gas-based power stations from the pooling scheme. The power ministry has sought phased implementation of the scheme by giving priority to over 10,000 MW commissioned projects in the first year that have power purchase agreements with states. The power ministry has also asked for about ` 7,000 crore in financial support from the Power System Development Fund to keep the electricity tariffs to the targeted ` 5.50 per unit against ` 7.5 per unit. Fiscal benefits such as streamlining customs duty on gas imports, waiver of value added tax and central sales tax have also been sought. The ministry has sought financial relief from banks such as extending the repayment schedule to 25 years from 10 years, extending the year of commercial operation by a year and waiver of penal interest. (economictimes.indiatimes.com)

Maharashtra seeks ` 100 bn from Centre for power infrastructure

February 12, 2015. Maharashtra government has sought about ` 10,000 crore from the Centre to create infrastructure for improving efficiency in power generation and distribution. Chief Minister Devendra Fadnavis said the government had undertaken a project for feeder separation whereby electricity supply systems for agriculture consumers are not linked to non-farm supply. He said the government will review the contracts awarded for development of infrastructure for power supply. (economictimes.indiatimes.com)

Power Finance's profit rises on increased income from operations

February 11, 2015. Power Finance Corporation (PFC), state run apex financier for the power sector reported 4.83% increase in net profit at ` 1,541.73 crore for the third quarter ending December 31 for the fiscal 2014-15. The company attributed the rise in profit to increase in income from operations. The company's total income from operations rose to ` 6,434.65 crore in the third quarter of the current fiscal, as against ` 5,540.52 crore in the year-ago period. However, PFC's other operating income fell sharply from ` 199.66 crore to ` 88 crore. The loan assets of the leading financier the end of 9 months of the FY15 increased to ` 2,05,211 crore from ` 1,77,529 crores, an increase of 16%. The company said that net non profitable assets, as a% of loan assets stood at 0.75%. The major loans sanctioned by PFC were notably - ` 7669 crore to 1320 MW thermal power plant in of Tamil Nadu Generation and Distribution Corporation, ` 3770 crore to 660 MW thermal power station of U.P. Rajya Vidyut Utpadan Nigam Ltd, ` 3178 crore to 1000 MW hydro electric project of Chenab Valley Power Projects Pvt. It also extended ` 3008 crore as regulatory assets loan of BSES Rajdhani Power Ltd. The net worth of PFC increased by 23% to ` 29,143 crores during the same period. (www.business-standard.com)

'MEA's details on nuclear liability act unsatisfactory'

February 11, 2015. Indian suppliers are not fully satisfied by the additional details provided by Ministry of External Affairs (MEA) on the nuclear liability act, asserting that it doesn’t provide enough clarity and requires Nuclear Power Corporation of India Limited (NPCIL) to step in and throw more light on the grey areas before the stalled train of nuclear commerce can chug forward. The MEA released as a set of 19 Frequently Asked Questions (FAQs) on the ‘understanding’ reached by India and US over the application of nuclear liability act – essentially concluding that the domestic act was in compliance with the IAEA’s Convention for Supplementary Compensation for Nuclear Damage. The ‘breakthrough’ in implementing the India-US civil nuclear deal was announced by the Indian Prime Minister Narendra Modi and US president Barack Obama standing side-by-side. The managing director and chief executive officer of Walchandnagar industries, GK Pillai said that FAQs were not enough for his company to re-start negotiations for supplying equipment to build NPCIL’s reactor. He said that there was only mention of domestic suppliers in context of concerns raised over definition of ‘supplier’, controversial section 46 and the creation of the nuclear insurance pool. Domestic suppliers were earlier exempt from liability as per the contract conditions with NPCIL, before the passage of the civil liability for nuclear damage act was passed in 2010. Since then, Walchandnagar, along with other players in the domestic nuclear industry like Larsen and Toubro and Godrej have stalled the construction of new power plants, like the Gorakhpur power project with no contracts signed under the new acts. India has ambitious plans to generate 62,000 MW from nuclear energy within 20 years, but this target is was in doubt after the passage of the 2010 act. (www.newindianexpress.com)

Coal auction process won't be delayed: Goyal on HC order

February 11, 2015. With the Delhi High (HC) Court asking for removal of three coal blocks from the auction list, Union Minister Piyush Goyal said the government respects the ruling and assured that the auction process would not be delayed. In a relief for Jindal Steel and Power Ltd (JSPL) and its promoter Naveen Jindal, the court directed a technical committee to review its own decision to change the end-use of two coal blocks earlier alloted to the company and removing the mines from the auction. Coal Secretary Anil Swarup said the judgement of the High Court in the Jindal Steel case will not impact the auction process of schedule II mines (producing mines) that is underway. The Delhi High Court also directed the committee, which had been set up to classify coal blocks as well as formulate criteria for their auction and allotment, to review its decision to merge Utkal B1 and B2, saying "there was no application of mind". (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Statoil seeks to develop $29 bn Johan Sverdrup field

February 16, 2015. Norwegian giant Statoil ASA proposes to advance with its plan to develop a huge oil field worth $29 billion. The offshore energy project will be the most expensive in Europe. Moreover, the field is expected to produce the world’s cheapest oil. The yield will, therefore, be profitable even after the recent price crash. The Johan Sverdrup field in the North Sea is likely to commence operations by 2019 and produce about 3 billion barrels of oil equivalents (Boe) over 5 decades. Norway’s declining oil industry is expected to be revived with the startup of Johan Sverdrup. The project is likely to break even at price levels of below $40 per barrel. Despite Brent crude’s decline to about $60 from over $100 last June, this level is anticipated to give Statoil a vast margin. The operating costs are estimated below $5 per barrel, once the project comes online. The first phase of Sverdrup is projected to develop about 2.4 billion Boe at a cost of about $15.4 billion. Lundin Petroleum and Statoil accidentally discovered Sverdrup in 2010 in a mature area that had already been largely explored. This new find has instilled confidence in smaller oil firms regarding more oil discoveries in prospects discarded by the majors. Norway had announced a 78% rebate on exploration costs 10 years ago in view of the deteriorating output. This gave the smaller explorers the financial strength to drill, as drilling wells is an expensive affair which, might cost as much as $100 million. (www.zacks.com)

Russia's Rosneft says replaced reserves by 154 percent

February 16, 2015. Rosneft, Russia's top crude producer, reported a 154 percent hydrocarbon reserves replacement ratio in 2014 thanks to increased drilling and exploration. Rosneft, jointly with ExxonMobil, made an oil discovery at an offshore Arctic field. Since then, Exxon had suspended offshore drilling in Russia due to sanctions against Moscow over Ukraine. The company reported on reserves in its financials under Russian Accounting Standards. Rosneft's reserve life -- the amount of time they would last at current rates of production -- was 24 years with 20 years for oil and 39 for gas. It said under the Securities and Exchange Commission's methodology, its proven hydrocarbon reserves rose to almost 34 billion barrels of oil equivalent as of Dec. 31, 2014 from 33 billion a year earlier. Under Petroleum Resources Management System criteria, its proven hydrocarbon reserves stood at 43.1 billion barrels of oil equivalent, up from 41.8 billion barrels a year earlier. Rosneft became the world's top listed crude producer in 2013 when it acquired Anglo-Russian TNK-BP for more than $55 billion in a cash-and-stock deal. (www.rigzone.com)

RH Petrogas gets clearance to develop North Klalin field in West Papua