-

CENTRES

Progammes & Centres

Location

[Pressure on Property Rights: The Case of Coal in India]

“The value of output from fuel minerals of which coal constitutes the bulk in India has increased by over ten times in the last three decades and consequently the pressure to alter or reduce Governments control of property rights over coal has been growing. What the private sector wants is a bigger share of increase in value of these resources through a larger role in exploiting coal resources…”

Energy News

[GOOD]

Aggressive bidding for coal blocks is a good sign only it is not a sign of desperate self-destructive bidding!

Delhi government should stay out of the business of bidding for coal blocks unless it wants to go out of business!

[UGLY]

Auction of coal blocks may not lower power tariff but competition and efficiency will!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Pressure on Property Rights: The Case of Coal in India

· Outstanding dues of Power Utilities payable to Central Public Sector Undertakings: What does the data reveal?

DATA INSIGHT………………

· Petroleum Product’s Consumption: Indian Scenario

[NATIONAL: OIL & GAS]

Upstream…………………………

· KG Basin’s offshore block can change the face of economy: ONGC

· ONGC partners private company for technology development

Transportation / Trade………………

· PNGRB invites licence bids for retailing CNG, piped gas

· Association seeks fair deal with ONGC for extension of gas supply agreements

· GAIL LNG tender to ferry gas from US finds no bidder

Policy / Performance…………………

· Jharkhand govt increases VAT, imposes cess on petrol, diesel

· Proposed gas price pooling to boost GDP by up to 0.88 percent

· India looks to Oman for energy security

· Oil ministry to set up manufacturing zones focused on oilfield services

· Budget 2015: Make natural gas "declared good", exempt customs duty

· Stable policy regime must for investments in gas sector: Expert

· Oil ministry moves proposal to pool gas price for fertiliser plants

[NATIONAL: POWER]

Generation………………

· Stress on safety in nuclear power generation

· Tata Power signs pact with SUEK

· Lanco seeks restructuring of ` 10 bn loan of Andhra Pradesh power plants

· PM Modi pitches for increasing power generation in Arunachal Pradesh

· Delhi wants coal block to set up power plant in another state

· India's power generation challenges highlighted at SA meet

Transmission / Distribution / Trade……

· Power Grid among four companies bidding for two transmission lines worth ` 60 bn

· Two Delhi private discoms term fiancial position 'unviable'

Policy / Performance…………………

· World Bank wants more transparency in India's power subsidy

· Auction of nearly operational coal mines from next week: Delhi HC

· Power consumers to gain ` 300 bn in long-term: Goyal

· Auction of coal mines to lower power tariff: President

· Monnet Ispat & Energy wins coal block in Chattisgarh

· Coal auction to raise ` 1.47 lakh crore: Vedanta Chief

· ‘Nuclear waste is a misnomer in KKNPP’

· BJP govt not helping to overcome UP power crisis: SP

· ADB loan to support Assam's power sector improvement

· CAO to continue monitoring Tata Power's Mundra project

· Discoms raise alarm over buying low-grade coal at higher prices

· AAP govt tells Delhi HC that CAG has full right to audit Discoms

· CIL to spend ` 120 bn in FY16 for capex, infra

· Coal block auctions in India see aggressive bidding

· US welcomes civil nuclear pact between India and Sri Lanka

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil starts production from Oseberg Delta 2 in North Sea

· Gulfsands confirms DOB-1 well as a gas discovery

· Chevron says plans to give up Romania shale gas project

· Shale giant says US output will fall this year on drastic cuts

· GeoPark discovers new oil field in Colombia

· Aminex moves closer to 1st gas production from Kiliwani field, Tanzania

Downstream……………………

· Total CEO says to add German petrol stations

· US refinery strike affects one-fifth of national capacity

· Petrobras refinery cracker unit should be fixed by March 7

Transportation / Trade…………

· Oil-by-rail shipments are playing Russian roulette

· Gazprom, Sonatrach mull cooperation on LNG supplies

· Slovak pipeline says demand high for capacity to ship gas to Ukraine

· TransCanada to seek US approval for $600 mn Upland Pipeline

· Qatargas, Pakistan close to 15 year LNG supply deal

· Russia pumps up sales of oil to Asia

Policy / Performance………………

· OPEC said not to plan emergency meeting amid oil price drop

· Arctic oil drillers face tighter US rules to stop spills

· Woodside to reduce spending by 20 percent after declines in oil price

· South Africa January inflation slows to 4.4 percent on cheaper gasoline

· Buffett dumping Exxon points investors to review oil bets

[INTERNATIONAL: POWER]

Generation…………………

· Banovici shortlists four bidders to develop 350 MW coal-fired power plant in Bosnia

· Nigeria’s power generating capacity now 5.5 GW

· Zambia, Zimbabwe power plant plan expanded by 800 MW

· Brazil disconnects nuclear power plant

Transmission / Distribution / Trade……

· China stake in power transmission firm bothers Senator Santiago

· Transmission line repairs in Labrador

· France, Spain inaugurate power link doubling connection capacity

· Prysmian to support power transmission system expansion projects in Kuwait

Policy / Performance………………

· Qatar-Japan consortium to study projects in Turkey's Afsin Elbistan

· Kerry joins Iran nuclear talks and critics speak up

· Colombia coal railway takes legal action as ban threatens output

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Govt to take call on green nod to hydro-power projects

· ABB India bets big on converting diesel pump sets to solar

· Maharashtra okays central scheme to distribute solar pumps to farmers

· Sumeet Industries to setup 10.5 MW wind power plant

· Clean energy share will be at 15 percent of basket in 7 yrs: President

· Govt promoting use of solar cookers

· Aakriti group plans to diversify in renewable energy sector

· Efficiency of India's coal-based power plants way below global standards

· NTPC, Coal India, SAIL plan to produce green energy

· Hallmark Group to set up 50 MW solar power plant in Tamil Nadu

· Biogas from Koyambedu market to fuel households

· ACME Group to invest ` 6 bn in Punjab solar projects

· Defence Minister launches solar powered initiative

GLOBAL………………

· EU wants Paris climate deal to cut carbon emissions 60 percent by 2050

· Southern buys two solar projects in Georgia from Tradewind

· Deutsche Bank seeks to buy $1 bn in green bonds

· Apple wants to start producing cars as soon as 2020

· Pattern and Cemex Energia sign JV for renewable energy projects in Mexico

· GM to buy first wind power in deal with Enel on Mexican project

· US EPA to propose biofuels standards this spring

· Citigroup sets $100 bn funding goal for green projects

· Iberdrola net drops 9.5 percent as Spain cuts renewables subsidies

· Orix, Kyudenko begin building 23 MW solar power station in Japan

[WEEK IN REVIEW]

COMMENTS………………

Pressure on Property Rights: The Case of Coal in India

Lydia Powell, Observer Research Foundation

|

T |

he dramatic changes in the supply and demand for primary energy resources (such as coal, oil and natural gas) and the consequent increase in their value have brought property rights of these resources under stress. When India opened up its economy in 1991, it freed up product markets to some extent but left factor markets (markets for land, resources, labour, capital, institutions) untouched. Product markets transformed beyond recognition in the decades that followed but factor markets remained static. What we are witnessing now in the coal sector and to a lesser extent in the natural gas sector is part of the broader the pressure product markets are exerting on static factor markets.

As per the Indian constitution, property rights over key fuel and non-fuel mineral resources are with the people but the State legally owns them on behalf of the people and has the fiduciary responsibility of using it to the benefit of the people. The legislative framework drawn within the provisions of the Constitution decide rules governing the utilisation and transfer of rights to fuel mineral wealth. Under the existing framework, major minerals including coal, petroleum, natural gas and atomic minerals come under the purview of the Federal Government while minor minerals are under the respective State Governments. Grant of concessions of all fuel minerals (oil, gas, coal and atomic resources) are with the Central Government and therefore are uniform throughout the country. But State Governments are the owners of the minerals in their respective territorial jurisdiction and are entitled to payments such as royalty (which constitutes the bulk of the revenue from mining), dead rent (which is area based and designed to discourage miners from keeping properties idle) and a set of sundry fees and local taxes. In offshore areas, exclusive economic zones and in the continental shelf, all rights are with the Central Government.

The value of output from fuel minerals of which coal constitutes the bulk in India has increased by over ten times in the last three decades and consequently the pressure to alter or reduce Governments control of property rights over coal has been growing. What the private sector wants is a bigger share of increase in value of these resources through a larger role in exploiting coal resources. State Governments too want a larger share of the increase in value of fuel minerals through an increase in royalty and other fees. The Central Government has tried to respond by introducing small changes to the existing rules governing property rights over fuel minerals.

The first such change was an amendment to the Coal Mines (Nationalisation) Amendment Act of 1976 that excluded private companies from the right to exploit coal. The Coal Mines (Nationalisation) Amendment Act 1993 offered limited rights to private companies engaged in power generation and steel production to mine coal for captive use. In 1996 this right was extended to companies producing cement. Coal blocks were administratively allocated by the Government to captive users but this neither contributed to a substantial increase in coal production nor did it meet the expectations of the private sector in terms of greater degrees of freedom over coal production. Pressure continued to mount for deeper changes in the rules governing property rights over fuel resources and the Government responded with yet another amendment to the existing legislative framework by introducing ‘The Coal Mines (Nationalisation) Amendment Bill 2000’ in the Parliament with objective of removing the restriction of mining coal only for captive use. The Bill failed to emerge as operational law as it could not navigate its way through the two houses of the Parliament. The Bill was withdrawn in 2014.

However ‘The Mines and Minerals (Development & Regulation) Amendment Bill 2008’ which sought to introduce competitive bidding for allocation of coal blocks for captive use was passed by both houses of the Parliament and was introduced as operational law in 2012. In 2014, the Supreme court of India declared the entry of private parties into coal production for captive consumption as well as the allocation procedure that the Government had used to assign coal blocks to private companies (as opposed to auctions as required by governing rule) were ‘arbitrary and illegal’. This strengthened the case for a change in property rights through the auction of coal blocks. In 2015 the Government began auctioning coal blocks. Auctioning of limited rights to exploit resources (in this case, access to extract coal resources) effectively opens a market for property rights over coal.

Would the auction of property rights over coal not only introduce transparency, reduce opportunities for corruption, raise revenue for the Government but also generate efficient allocation of the right to extract coal (which means that the right will be assigned to the firm which values the resource the most and can use it in the most efficient way)?

It is too early to give definitive answers to these questions but some probable answers may be considered at this point. The move towards auctions of the right to extract coal was not driven by concerns over the need to change factor markets (coal resources) in response to changes in product markets (electricity) but by concerns over misallocation and loss of State revenue that arose from the administrative process of allocating coal blocks raised by agencies such as Comptroller and Auditor General of India (CAG) and the Central Bureau of Investigation (CBI). Under their diagnosis the cure is more transparency in allocating rights and increase in revenue for the State. Claims of these two objectives being achieved are already widely reported in the press (see news items in this week’s issue). However the fundamental crisis in the sector is not just the lack of transparency, the inevitability of crony capitalism and corruption but rather the need for efficient markets for fuel that can keep up with the market for electricity.

The design of the on-going auction of coal blocks does not appear to reflect this concern adequately. What it appears to reflect are (a) an effort to correct past mistakes and (b) exploit the opportunity to capitalise on it politically. The response of the bidders appears to demonstrate a desperate hurry to get out of the trap set by past mistakes in policy rather than true commercial value of the resource. The design of the auctions is hinged in past (or past mistakes to be precise) and is oriented towards the present rather than being hinged in the present and oriented towards the future of the coal sector. In a well designed and open auctions market, the social value of the coal resource would be approximately equal to the efficient firm’s valuation of it. But this is the ideal case. The price quoted in the auctions appear to reflect externalities of past mistakes which means that it reflects private value (such as a firm having no other option but to get the block as it has invested heavily in end use) rather than social value. Former Chairman of Coal India Limited, Partha S Bhattacharyya has pointed out in a recent column in the Indian Express that there is a significant probability of firms walking away from their blocks in favour of imports. Aggressive bidding is not necessarily a good sign in the Indian context. Nor is it a sign of markets coming of age. The history of auctions in the case of Ultra Mega Power Projects and Solar Projects show that self destructive bidding is common in the country given that the cost of exiting or renegotiating a bid (contract) is low.

The restriction on end-use and the absence of a secondary market for the right to exploit coal also limit opportunities of efficiency. If a perfect secondary market exists, the block would eventually find its way into the hands of the firm that is best able to use it. This means that an efficient outcome will emerge irrespective of the initial results. Let us hope, along with the so called aggressive bidders, that a market would eventually emerge either when the constraint on end-use is lifted or when a secondary market is opened up.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Outstanding dues of Power Utilities payable to Central Public Sector Undertakings: What does the data reveal?

Ashish Gupta, Observer Research Foundation

|

Regions |

Outstanding Dues INR Million |

Unrecovered subsidy INR Million[1] |

Performance & Ratings[2] |

Can they afford renewable energy? |

Government Role |

|

Select state power utilities having highest outstanding dues |

Gujarat Utilities: 2.6 Goa Utilities: 47.4 Madhya Pradesh Utilities: 44.6 |

Gujarat: 3,720 Goa: Nil Madhya Pradesh: 37,615 |

Gujarat: A+ Goa: Not Known Madhya Pradesh: B |

|

|

|

Total Western Region |

2,643 |

|

Better than earlier |

Yes, they can. |

Government can balance the tariffs through additional subsidy and demand side management. |

|

Select state power utilities having highest outstanding dues |

Assam Utilities: 3,121.3 Meghalaya Utilities: 3,023.7 Tripura Utilities: 576.9 Mizoram Utilities: 458 |

Assam: 2,833.6 Meghalaya: 707.1 Tripura: 806.8 Mizoram: 1,442.9 |

Assam: B Meghalaya: C+ Tripura: C+ Mizoram: Not Known |

|

|

|

Total North Eastern Region |

7,734 |

|

Bad |

Tariffs are very low in the North Eastern Region. Doubtful, whether the utilities can absorb additional green power. |

To increase proliferation, the funding needs to be provided from the central budget. |

|

Select state power utilities having highest outstanding dues |

Tamil Nadu Utilities: 4,678.4 Andhra Pradesh Utilities: 2,453.9 Karnataka Utilities: 1,683.2 Pondicherry Utilities: 991.8 |

Tamil Nadu: 85,842.9 Andhra Pradesh: 68,524.6 Karnataka: 2,715 Pondicherry: 445.1 |

Tamil Nadu: B Andhra Pradesh: B+ Karnataka: B+ & B Pondicherry: Not Known |

|

|

|

Total Southern Region |

11,193.9 |

|

Bad |

These utilities are already somewhat green. Any increment in the obligation will increase financial burden on the utilities. |

Government must urge private players to invest in green power with minimal subsidy support. |

|

Select state power utilities having highest outstanding dues |

Jammu & Kashmir Utilities: 24,327.9 Delhi Utilities: 10,957.5 Rajasthan Utilities: 10,534.6 Uttar Pradesh Utilities: 7,472.5 |

Jammu & Kashmir: 19,717 Delhi: Not Known Rajasthan: 110,768 Uttar Pradesh: Nil |

Jammu & Kashmir: Not Known Delhi: Not Known Rajasthan: C+ Uttar Pradesh: C |

|

|

|

Total Northern Region |

62,647 |

|

Worst |

No, they cannot afford green power |

State governments having separate budget can contribute. But for policy goals the funding needs to be provided from the central budget. |

|

Select state power utilities having highest outstanding dues |

Jharkhand Utilities: 81,118.3 Bihar Utilities: 1,867.9 Orissa Utilities: 215.7 |

Jharkhand: 4,569.9 Bihar: 19,284.2 Orissa: Not known |

Jharkhand: C+ Bihar: B Orissa: Not Known |

|

|

|

Total Eastern Region |

83,890 |

|

Worst |

No, they cannot afford. |

State government having separate budget can contribute. But for policy goals the funding needs to be provided from the central budget. |

Views are those of the author

Author can be contacted at [email protected]

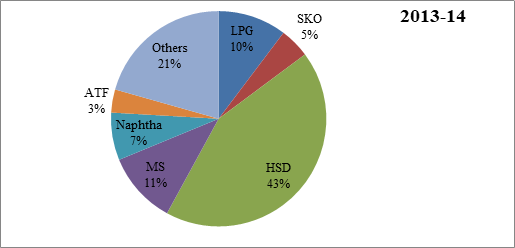

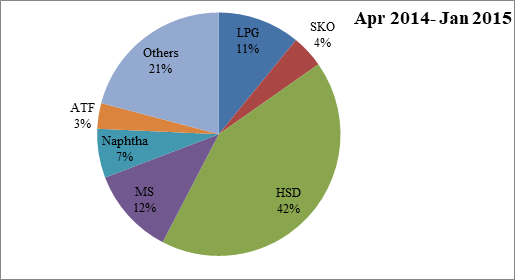

DATA INSIGHT……………

Petroleum Product’s Consumption: Indian Scenario

Akhilesh Sati, Observer Research Foundation

Thousand Metric Tonnes

|

Petroleum Products |

2013-14 |

2014-15 (till January) |

|

LPG |

16294 |

14884 |

|

SKO |

7165 |

5909 |

|

HSD |

68364 |

57739 |

|

MS |

17128 |

15762 |

|

Naphtha |

11305 |

8873 |

|

ATF |

5505 |

4641 |

|

Others |

32646 |

28455 |

|

Total |

158407 |

136262 |

Petroleum Products share in Consumption

Source: Petroleum Planning & Analysis Cell.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

KG Basin’s offshore block can change the face of economy: ONGC

February 19, 2015. Oil and Natural Gas Corp (ONGC) is planning to develop DWN-98/2 offshore block in Krishna-Godavari Basin on fast-track which start production by 2018-19. ONGC announced that projects worth ` 22,500 crore had been approved in the last six months including DWN 98/2 block in KG Basin. Once the project is through, there would be huge volume of financial output from the offshore block for the ONGC. The State would be the first beneficiary once production commenced. The production was badly affected with Nagaram GAIL pipeline blast. Production which dropped from three million cubic meters per day (mcmpd) to 0.02 mcmpd now increased to 1.7 mcmpd. It would take another four months to reach the actual target after GAIL restores all pipelines in Nagaram and other areas in East Godavari district before June. (www.thehindu.com)

ONGC partners private company for technology development

February 18, 2015. Oil and Natural Gas Corp (ONGC) said it has entered into a technological partnership with a private firm which will ease it in shale gas exploration. With this partnership, ONGC will provide assistance to Super Wave Technology Pvt. Ltd (the partner) for developing Shock Wave Assisted Fracking Technology (SWAFT), an alternate to the conventional hydraulic fracturing which if proven effective as a substitute to hydraulic fracturing, in particular for shale gas exploitation, will be a game changer for the oil & gas industry, the state-owned firm said. According to the company, hydraulic fracturing requires very large quantity of fresh water and huge quantity of energy for pumping the same at very high pressures. Post hydraulic fracturing, the well produces substantial quantity of effluent water which needs to be disposed. This issue can be addressed by adopting SWAFT. The company said the collaboration will provide impetus for development and field implementation of Shock Waves technology for oil and gas fields. (www.newkerala.com)

Transportation / Trade…………

PNGRB invites licence bids for retailing CNG, piped gas

February 24, 2015. The Petroleum and Natural Gas Regulatory Board (PNGRB) has invited bids for issuing licences for retailing CNG and piped cooking gas in 20 cities like Haridwar and Aligarh. PNGRB said that April 23 is the last date of bidding for development of city gas distribution networks in East Godavari, West Godavari, Belgaum, Ahmadnagar, Krishna, Muzaffarnagar, Badaun, Aligarh, Bulandshahr, Banaskantha, Tumkur, Latur, Dhar, Dahod, Shivpuri Haridwar, Dharwad, Bidar, Osmanabd and Udham Singh Nagar. Bidders have been asked to quote the tariff they will charge for the pipeline network to be laid in the city and the compression charge for dispensing CNG (compressed natural gas) over the 25 years. They have also been asked to quote the inch-kilometre of steel pipelines they will lay during first five years and the number of domestic consumers proposed to be connected by piped natural gas, according to the regulator. This will be the fifth bid round even though PNGRB is yet to award licenses of the previous rounds.

Fourteen cities offered in the fourth round announced in October 2013 are yet to be awarded. These were Eranakulam in Kerala; Rangareddy/ Medak, Nalgonda and Khammam in Andhra Pradesh; Bengaluru rural and urban districts in Karnataka; Raigarh, Pune and Thane in Maharashtra; Daman; Dadar & Nagar Haveli; Shahjahanpur in Uttar Pradesh; Guna in Madhya Pradesh; Panipat in Haryana and Amritsar in Punjab.

To accelerate deployment of the CGD network in the country, PNGRB had invited bids in 2009 for 13 cities in first two rounds. GAIL Gas Ltd walked away with four of the six cities offered in round one. It won Sonepat in Haryana, Dewas in Madhya Pradesh, Meerut in Uttar Pradesh and Kota in Rajasthan while Bhagyanagar Gas Ltd got Kakinada in Andhra Pradesh and DSM Infratech Mathura in Uttar Pradesh. The third round of bidding was opened in July 2010 and concluded in February 2011 (after extension), but final awards of most cities are yet to be made because of certain litigation involving PNGRB and a few other parties. City-based Jay Madhok Energy won rights to Jalandhar city, according to PNGRB. (economictimes.indiatimes.com)

Association seeks fair deal with ONGC for extension of gas supply agreements

February 19, 2015. The KG Basin Isolated Wells Consumers Association (KGBICA), an association of gas-based small and medium industries located in the interior rural areas of Andhra Pradesh, is opposing Oil and Natural Gas Corp (ONGC)’s proposal to re-auction the isolated gas wells instead of extending the current gas supply agreements (GSAs) with the allottee industries. The GSAs executed by ONGC with the industries prior to 2000 were valid initially for a period of five to six years, which on expiry were extended for additional blocks of five years. Such GSAs are now due for expiry during 2015 and 2016. It is understood that ONGC is proposing to re-auction these wells instead of extending the validity of the existing GSAs as was done on earlier occasions, said Sarath Joseph Gummadi, coordinator of KGBICA. He alleged ONGC had abruptly stopped gas supplies from Vygreswaram isolated fields (in East Godavari district) to one of their members, Steel Exchange from January this year without any notice. The corporation was supplying around 2,000 standard cubic meters per day (SCMD) as against the allocation of 10,000 SCMD to the company. Gummadi said ONGC had informed that they wanted to re-tender the gas from this well since they got a quote of $11 in one of the tenders last year elsewhere in the state. For another industry, Vijai Bhavani Power, he said the GSA for 3,000 SCMD from Kesanapally fields was expiring on March 31, 2015, and ONGC was going for re-tendering. According to Gummadi, most of these industries are also categorised as small consumers by the ministry of petroleum and natural gas (MoPNG), with gas allocations of up to 50,000 SCMD. The total gas allocation of these industries is 330,000 SCMD. (www.business-standard.com)

GAIL LNG tender to ferry gas from US finds no bidder

February 19, 2015. GAIL India Ltd has not found any bidder for its $ 7 billion tender to hire newly-built LNG ships to ferry gas from the US. GAIL's ` 42,370 crore tender to hire nine newly-built liquefied natural gas (LNG) tankers drew a blank due to the government's condition of building a third of the ships in India. GAIL had in August last year floated a global tender to charter nine newly-built ships for transportation of natural gas in its liquid form at sub-zero temperature (LNG) from the US. The tender required bidders to build one-third of the ships in India, a condition that found no takers. It first postponed the last date of bidding from October 30 to December 4, then to January 6 and February 17. GAIL was originally not in favour of the condition but succumbed to Oil Ministry's dictate once it was threatened with a Presidential directive. The company may have to re-float the tender without the 'Make in India' condition. GAIL had on April 4 last year approved hiring of up to 11 newly-built LNG ships. The Ministry saw the chunky contract to be the perfect opportunity for India to exercise buyer's clout and wanted a part of the contract be set aside for Indian shippers to kick-start domestic manufacturing by compelling global majors to transfer LNG shipbuilding technology to India. Oil Minister Dharmendra Pradhan and External Affairs Minister Sushma Swaraj had tried to persuade South Korea, the world's largest LNG tanker manufacturer, to rescue the tender. Four Korean shipyards qualify for GAIL's tender requirements -- Samsung Heavy Industries, Daewoo Ship Building and Marine Engineering, Hyundai Heavy Industries and STX Offshore and Shipbuilding -- but none of them showed any interest in the tender. GAIL will start receiving LNG from the US from December 2017 and it needs the tankers before that. It has already lost one year in the tendering process. (economictimes.indiatimes.com)

Policy / Performance………

Jharkhand govt increases VAT, imposes cess on petrol, diesel

February 24, 2015. Prices of petrol and diesel will increase in Jharkhand from midnight after the state government decided to raise VAT and impose one rupee cess per litre on the fuel to mop up additional revenue. As per the Cabinet decision, VAT on petrol has increased from 20 percent to 22 percent and on diesel from 18 percent to 22 percent, besides the cess, and would be effective from midnight tonight. Presently, the price of petrol per litre is ` 56.69 and of diesel is ` 48.63 per litre. (economictimes.indiatimes.com)

Proposed gas price pooling to boost GDP by up to 0.88 percent

February 22, 2015. The proposed gas price pooling policy of the government is expected to increase the Gross Domestic Product (GDP) by 0.50-0.88 percent, the study conducted jointly by National Council of Applied Economic Research (NCAER) and GMR Energy said. The gas price pooling policy would lead to an increase inGDP of 0.50 percent or Rs 69,431 crore with a plant load factor of 30 percent, 0.7 percent (or ` 96,107 crore) with a PLF of 40 percent, and 0.88 percent (or ` 1.23 lakh crore) with a PLF of 50 percent, the study said. The proposed gas price pooling policy would pool existing limited supply of domestic gas with imported regasified LNG to help operationalise about 16,100 MW of stranded, gas-based, power plants to start operating from their current zero percent of plant load factor (PLF) to about 30-40 percent. Also, it will help increase employment in 2015-16 by creating about 13 lakh new jobs with 30 percent PLF; 18 lakh with 40 percent PLF and 23 lakh with 61 percent PLF, the study said. However, it pointed out that price of pooled natural gas would be higher than domestic price which will hike power production cost. The revenue shortfall is proposed to be partially borne by government as subsidies and tax concessions, and partially borne by inter-linked sectors taking cuts in their revenues. NCAER said the proposed gas price pooling policy will have positive growth multiplier effects on economy. (www.business-standard.com)

India looks to Oman for energy security

February 19, 2015. India will soon revive talks with Oman for an undersea pipeline as the government looks to supplement its sources of energy. The decision was taken during external affairs minister Sushma Swaraj's meeting with her Oman counterpart Yousuf bin Alawi bin Abdullah. During Swaraj's visit, India and Oman reviewed their strategic ties and decided to expand defence and maritime cooperation in maintaining stability and security in the Indian Ocean region. The two sides explored opportunities on how Oman can plug into the expanding opportunities in India, including as a natural gas supplier. Swaraj briefed the Omani leadership about the economic reforms and growth agenda of the new Indian government and welcomed increased investments from this oil-rich nation. (timesofindia.indiatimes.com)

Oil ministry to set up manufacturing zones focused on oilfield services

February 18, 2015. The oil ministry plans to give local companies a juicy share of the ` 6-7 lakh crore investment planned in the next five years by helping local equipment makers compete successfully against foreign vendors, and setting up manufacturing clusters with attractive funding with the help of the ` 10,000-crore collected as oil industry development cess every year. The ministry hopes to make significant contribution to the NDA government's Make-in-India programme in which Prime Minister Narendra Modi wants to make the country a manufacturing hub and create jobs. The oil ministry, as part of its initiatives for the programme, plans targeted fiscal measures such as long-term funding and interest subvention for manufacturing clusters. The ministry is likely to modify procurement norms for public sector entities by aggregating their requirements and has set a target of 50% indigenisation for investments in the upstream sector over the next three years. The ministry has said in the medium term, it would aim to set up dedicated manufacturing zones and clusters focused on oilfield services such as building ships, offshore platforms and rigs. (economictimes.indiatimes.com)

Budget 2015: Make natural gas "declared good", exempt customs duty

February 18, 2015. The new government has pursued pro-growth initiatives and we expect the 2015 budget to continue in this vein to further boost the economy and restore investor confidence. We await the passage of the GST Bill and its implementation to include all petroleum products viz. Crude Oil, Motor Spirit, Aviation Turbine Fuel, High Speed Diesel, Natural Gas, LNG (including LNG regasification Services) which will go a long way in streamlining the economy and introduce efficiencies which will contribute to GDP growth. As in the case of petrol, the inclusion of Excise duty on branded diesel would help reduce the cascading effect on the economy and reduce the burden on the consumers. The proliferation of Natural Gas (including LNG) is limited due to the current taxes structure that adds costs and tests the affordability limits of the customer. Despite being a primary fuel source like coal and crude oil, Gas does not get the benefit of customs duty exemption (as does crude oil) or status of a "declared good" as enjoyed by crude oil and coal, consequently attracting VAT along the supply chain. A selective exemption of customs duty applicable only to the power sector disables customers from others sectors to leverage the benefits of Gas as their fuel source. To ensure parity, this anomaly needs correction by waiving customs duty on LNG for all users and for gas to be accorded the status of a "declared good". By doing so, this will expand the scope of Gas which is the cleanest burning fossil fuel and also enable reduction in the Government's subsidy bill (e.g. replacing household LNG). We would welcome the Government to also further augment the initiative of supporting 15,000 km of gas pipelines announced in the previous budget through encouragement of additional pipelines including city gas networks that should provide larger number of potential users' access to gas. Customers would not only benefit from financially but a move towards this will also be environmentally beneficial. In addition, development of petroleum carrying, storage and handling infrastructure alongside encouragement to private investment in the retail fuel business would help improve utilisation and efficiencies while reducing waste that will benefit the consumers. Continued focus of the government's reform agenda would help bring in more capital, employment and opportunities to India that would greatly benefit all sections of society. (economictimes.indiatimes.com)

Stable policy regime must for investments in gas sector: Expert

February 18, 2015. Slamming the new natural gas formula as making "no sense", world renowned energy expert Fereidun Fesharaki has said only guaranteed market prices along with stable policy regime would bring in investments from global majors. The $ 3-4 per million British thermal unit (mmBtu) price in United States was reflective of the surplus gas scenario in US and rates will rise the moment exports are allowed, he said. Similarly, Russia flares gas equivalent to India's annual production and rates prevalent there are not reflective of market scenario. He said US gas in form of LNG will be $ 7 higher than the current Henry Hub price of under $ 3 per mmBtu on account of liquefication, transport, pipeline and regassification cost. The rate will compare to the $ 5.61 per mmBtu price approved by the government for period upto March end. Similarly, bringing gas through a transnational pipeline like Turkmenistan-Afghanistan-Pakistan-India (TAPI) will cost no less than $ 10-11 at the Indian border, he said. The new price was 33 percent higher than $ 4.2 per mmBtu old rate but lower than $ 8.4 per mmBtu approved by the previous UPA government. The new price is also lower than $ 5.71 rate charged for western offshore gas field and $ 8 that Cairn charges for gas from its Rajasthan block. India, he said, has to allow a free float of gas price and put a cap at say $ 10. (economictimes.indiatimes.com)

Oil ministry moves proposal to pool gas price for fertiliser plants

February 18, 2015. The oil ministry has moved a proposal to pool or average out prices of domestic natural gas and imported LNG used by fertilizer plants to make the cost of fuel uniform and affordable. Fertilizer plants consume about 42.25 million standard cubic meters per day (mmscmd) of gas for manufacture of subsidised urea. Out of this, 26.50 mmscmd comes from domestic fields and the rest 15.75 mmscmd is imported liquefied natural gas (LNG). The $ 4.2 per million British thermal unit price of domestic gas is about one-third of cost of LNG. The cost of gas, which is the most important component for production of urea, varies from plant to plant owing to differential rates at which imported LNG is contracted as well as cost of transportation. The proposal moved for inter-ministerial consultations, before being put up to the Cabinet Committee on Economic Affairs (CCEA), calls for averaging of different rates of domestic and imported gas to ensure supply of fuel to all urea plants at a uniform delivery cost.

Presently, a proposal to pool gas prices for power plants is under consideration of the government. The ministry has proposed to make state- owned gas utility GAIL India Ltd as the pool operator. The Department of Fertilizer will determine the total requirement of natural gas and draw plant-wide requirement, which would then be informed to the pool operator, GAIL. The pool operator will tie-up imports after considering domestic availability and after averaging out price of both, delivery the fuel at uniform rate to all plants. The ministry wants the pooling mechanism to be effective from April 1. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Stress on safety in nuclear power generation

February 24, 2015. The importance of safety in nuclear power generation was stressed by Vinod J. Katti, Regional Director of Atomic Energy (DAE), during the inaugural function of the Atomic Science Exhibition and the Anuvigyan Week at the Islamiah College in Vaniyambadi. The exhibition and Anuvigyan Week were organised jointly by the Department of Atomic Energy (DAE), Government of India and the college. (www.thehindu.com)

Tata Power signs pact with SUEK

February 23, 2015. Tata Power announced signing an initial agreement with Russia's largest coal producer Siberian Coal Energy Company (SUEK) for tapping opportunities in the energy sector. As part of the agreement, both Tata Power and SUEK will cooperate on identifying and targeting opportunities in the energy sector in Russia and other geographies of common interest in order to develop mutually beneficial transactions. Tata Power generates about 8,621 MW of power of which 7,407 MW is from thermal power generation. According to information on SUEK website, the company delivers coal to more than 30 countries all over the world. (economictimes.indiatimes.com)

Lanco seeks restructuring of ` 10 bn loan of Andhra Pradesh power plants

February 22, 2015. Lanco Group has approached lenders to reschedule ` 1,000 crore debt of two of its gas-based power plants in Andhra Pradesh till January 2018. The infra major has also sought similar reprieve from lenders for some of its power plants under Reserve Bank of India's 5/25 formula. Lanco Kondapalli Power Limited (LKPL) operates three gas-based power plants in Andhra Pradesh. Two plants, Unit-II and III, are not able to operate due to lack of gas supplies from KG-Basin. Unit-III is yet to declare Commercial Operation Date. The Group is also in the process of approaching lenders to rescheduling of loans of some of its power plants under the Reserve Bank's 5/25 Rule. This rule enables a bank to extend loans to an infra developer for 25 years with an option to rewrite or reset the terms of the loan or transfer it to another bank or financial institution after five years. (economictimes.indiatimes.com)

PM Modi pitches for increasing power generation in Arunachal Pradesh

February 21, 2015. Prime minister, Narendra Modi pitched for increasing power generation from hydro source in Arunachal Pradesh. Several projects in Arunachal Pradesh are facing protests and have failed to take off. Centre is investing close to ` 7500 crore infrastructure projects in frontier state. Already the Arunachal Pradesh which is often referred as "power house of India" is in the process of developing 41,400.5 MW capacities of power and its hydro power potential is estimated to be around 60,000 MW. NHPC's 2000 MW Lower Subansiri Hydroelectric Power Project (LSHPP) along the Assam-Arunachal Pradesh has been stalled for the last three years. Modi said Arunachal Pradesh could provide electricity to the entire country. (economictimes.indiatimes.com)

Delhi wants coal block to set up power plant in another state

February 19, 2015. The Arvind Kejriwal government has come up with an ambitious plan to increase Delhi's electricity generation. It is exploring the possibility of setting up a coal-based thermal power station to meet the capital's rising power demand. The government has decided to bid for coal blocks to set up the new power plant and will take up the matter with the Centre soon. A meeting with the union power minister will be sought. Delhi government officials said they were aiming for the capital to generate at least 4,000 MW for its own consumption. Currently, Delhi produces less than 2,000 MW. In its manifesto, AAP had promised to make Delhi self-reliant in power generation. The city witnesses an annual growth of 10%-15% in peak power demand and produces less than 20% of its own power. For the rest, Delhi is dependent on central sector generation. Delhi currently has four power stations that are specifically meant for the city - Rajghat, Pragati I, Pragati II in Bawana, Gas Turbine and NTPC's Badarpur thermal station. A 108-MW power plant in Rithala has also been set up by Tata Power Delhi but it has not been operating for the last two years due to gas shortage. Out of these, Rajghat and Badarpur, are coal-based plants. The Bawana power plant was set up at a cost of ` 4,500 crore but generates only up to 350 MW due to non-availability of gas. The city gets 3,500 MW of power from various power plants, including of NTPC, under the central quota. As per projection by Central Electricity Authority, the power demand in Delhi will jump to 8,700 MW by 2017. The Delhi government, along with Haryana, was given a coal block in Madhya Pradesh in 2006. But it could not go ahead with exploration of that block - Mara II Mahan in Singrauli district - due to regulatory hurdles. The block was primarily allocated to Delhi and Haryana for supply of coal to the Jhajjar power plant in Haryana. (timesofindia.indiatimes.com)

India's power generation challenges highlighted at SA meet

February 18, 2015. Private power generation companies were now leading in generating additional capacity in India, but were being hampered by a number of factors, according to an Indian businessman. Venerable Energy Solutions Managing Director Mayank Garg said financial difficulties at the state-owned distribution companies were a serious threat to India's huge power demands. Speaking at the South African Coal Exports Conference, Garg said the deregulation of the sector had led to private companies generating additional capacity, but one of their primary challenges was getting sufficient coal supplies. Although India has vast coal deposits, it imports a substantial amount of its needs, including from South Africa. Garg said the financially-constrained state-owned distribution companies were reluctant to sign long term deals with private power generators who did not have their own coal mines, which in turn reduced the ability of these companies. A lack of finance at the distributors also greatly impacted on their ability to invest in new infrastructure and maintenance, and to buy power from other generators. Other factors were using power as a political instrument, such as the agricultural sector getting free power; as well as lack of control over theft, which was as high as 50 percent in some instances. But it was not all gloom and doom in the Indian power sector, he said. Garg said the new government had introduced a number of initiatives which could assist, including setting new targets for domestic coal production and speeding up administrative processes for adding new capacity. Participants at the conference drew parallels between the power challenges in India and South Africa, where the embattled national distributor Eskom has had to implement large-scale load-shedding countrywide in recent weeks due to a lack of capacity to meet demand. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Power Grid among four companies bidding for two transmission lines worth ` 60 bn

February 20, 2015. Four companies, including Power Grid Corp of India Ltd (PGCIL), have bid for two transmission projects, Gadarwara A and B, worth ` 6,000 crore even as seven other pulled out of the bids after showing interest. The four companies to bid for these projects at the end of the deadline were PGCIL, Essel Infra, Sterlite Grid and Adani Group. The Gadarwara A and B transmission lines would primarily be used to evacuate electricity generated at NTPC's power plant at Gadarwara in Narsinghpur district in Madhya Pradesh. The bid winner will be announced. Some of the other bidders pulled out anticipating aggressive bids by PGCIL, which bid 40-70% lower and bagged two projects last year — Unchahar Transmission and transmission projects under Northern Region Strengthening System for the northern grid. (economictimes.indiatimes.com)

Two Delhi private discoms term fiancial position 'unviable'

February 18, 2015. Private discoms BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd told the Supreme Court that they were in an "unviable" financial position and their revenue gap could be bridged through a 20-25 percent hike in power tariff. BSES Yamuna Power Pvt Ltd (BYPL) and BSES Rajdhani Pvt Ltd (BRPL), which owe money to various power generating PSUs including NTPC and NHPC, had moved the court seeking various reliefs including a direction that the power supply to them should not be cut by the PSUs for ensuring uninterrupted supply in Delhi. Delhi Electricity Regulatory Commission (DERC), which fixes the power tariff, opposed the plea of the private discoms saying they have "buffered up" the losses. Tata Delhi Power Distribution Limited (TDPDL) is the third private discom which supplies power in Delhi. It also acts under the same so-called draconian regulatory regime and it has paid every penny to the power generating companies. (economictimes.indiatimes.com)

Policy / Performance………….

World Bank wants more transparency in India's power subsidy

February 24, 2015. World Bank called for more transparency in India's power subsidy regime and suggested re-identification of the target population to improve the balance-sheets of losses-stricken discoms. The global development finance body said the key sector should be allowed to operate in a commercially viable manner by making sure that who are not eligible for subsidy pay for what they consume. World Bank Senior Energy Specialist Mohua Mukherjee parried a question on the viability of the almost-free power promise made to the lower-end consumers in Delhi by the new AAP Government. The World Bank identified the customer-facing distribution companies as the vertical that needs attention. At present, the industrial and commercial users cross-subsidise by paying more for their power usage, which should be avoided to the extent possible, she said. Mukherjee said the sector should be allowed to operate in a commercially viable manner by making sure who are not eligible for subsidy pay for what they consume. Such an approach can lower the subsidy burden on the Government. (economictimes.indiatimes.com)

Auction of nearly operational coal mines from next week: Delhi HC

February 24, 2015. The Centre informed the Delhi High Court (HC) that it has revised its schedule for auction of nearly operational coal mines and the bidding process is set to begin next week. The schedule was re-worked by the Coal Ministry after the court had said it has to give a detailed hearing to the petitions, which have also challenged the tender rules of eliminating 50 percent of the players in round one of the auction, and there was no urgency as far as nearly operational mines are concerned. Bhushan Power and Steel Ltd (BPSL) had opposed the government's decision to classify end-use of Jhamkhani coal block in Odisha for non-regulated sector, saying the move went against the 2014 coal ordinance provisions. BPSL and Monet Ispat and Energy Ltd have challenged the two-round financial bidding process under the ongoing coal auction, saying such a method was "arbitrary and irrational" as the ordinance and the rules under it did not provide for such a procedure. (economictimes.indiatimes.com)

Power consumers to gain ` 300 bn in long-term: Goyal

February 23, 2015. After the auction of 19 coal blocks, power consumers in the country stand to gain over ` 30,000 crore over a period of time by way of a cut in electricity tariff, Power and Coal Ministry Piyush Goyal said. As per official estimates, auction of coal blocks will fetch over ` 1 lakh crore, including royalty, to six states. In the reverse bidding adopted for coal auction, government had set a ceiling price that was representative of production cost of Coal India. The private sector companies, which are considered more efficient, were expected to bid at lower price. For example, if the ceiling price is ` 1,000 and the bidder bids ` 800, then the benefit of ` 200 is directly passed on to consumers. This would mean if the power is sold at ` 3.50, out of which is ` 1 is cost coal and the same will become 80 paise because of pass through benefit of ` 200. Thus the new price of power will be ` 3.30 per unit. In case the bids touch zero, meaning that the private producer is ready to pass on the benefit of coal extraction to power consumers, there would be a forward bidding.

Of the total 204 coal blocks whose allocation was cancelled by the Supreme Court in September 2014, 19 were auctioned in the first tranche that concluded. Madhya Pradesh, Odisha, Jharkhand, West Bengal and Chhattisgarh and Bihar are the six states which will get ` 1 lakh crore from the auction. Hindalco Industries has bagged the maximum number of mines --three two in Chhattisgarh and one in Jharkhand. Other companies include Balco, Reliance Cement and GMR. In the entire auction, the lowest closing bid price was ` 108 per tonne for the Gare Palma IV 2 & 3 coal blocks in Chhattisgarh, won by Jindal Power Ltd. (economictimes.indiatimes.com)

Auction of coal mines to lower power tariff: President

February 23, 2015. The government is committed to bringing transparency in the allocation of natural resources including coal, the auctions for which have started and would result in lowering power tariff, President Pranab Mukherjee said. The swift and timely action taken by the government in this regard prevented the closure of mines which otherwise would have rendered thousands jobless, he said. In the coming years, the government would make focused efforts to expand exploration capacity and to increase domestic coal production to 1,000 million tonnes per annum (MTPA), he said. The government has already sold 19 coal blocks in the first phase of coal auctions. The coal auctions will fetch the states over ` 1 lakh crore. The auction of the first phase, which began on February 14, was completed. The second round of auction in which government has put on sale 21 mines will begin from February 25. (economictimes.indiatimes.com)

Monnet Ispat & Energy wins coal block in Chattisgarh

February 23, 2015. Monnet Ispat & Energy bagged one coal block in Chhattisgarh on the last day of the auction, bringing down the curtains on the first phase of coal auctions that will fetch the states over ` 1 lakh crore. Hindalco Industries has bagged the maximum number of mines in the first phase of auction, winning three that includes two in Chhattisgarh and one in Jharkhand. In the entire auction, the lowest closing bid price was ` 108 per tonne for the Gare Palma IV 2 & 3 coal blocks in Chhattisgarh won by Jindal Power Ltd, while the highest closing bid price was ` 3,502 per tonne for Gare Palma IV/5 coal mine in Chhattisgarh alloted to Hindalco Industries. Gare Palma IV-7 mine in Chhattisgarh, earmarked for the non-power sector, was the most sought after one in the current lot put on auction in the first tranche. The Coal Ministry had earlier shortlisted 12 technically qualified bidders for the mine. Besides Monnet Ispat & Energy Ltd, other companies that were in the race for the coal blocks include Balco, Hindalco, JSPL and Jaiprakash Associates. Gare Palma IV-7 mines has extractable reserves of 52.98 million tonnes. (economictimes.indiatimes.com)

Coal auction to raise ` 1.47 lakh crore: Vedanta Chief

February 23, 2015. Coal block auctions will fetch a whopping ` 1.47 lakh crore and boost job creation, mining baron Anil Agarwal, who heads Vedanta Resources, said. Vedanta group has bid for the most number, 14 coal mines, putting in as many as 25 bids through several group firms but could grab only two through BALCO in the first round of auctions that concluded. However, Coal Secretary Anil Swarup said after the first round of auctions that ` 1.09 lakh crore of e-auction amount and ` 12,800 crore royalty would go to states in the next 30 years.

Vedanta Group firm Balco had won Chotia and Gare Palma IV/1 blocks, both in Chhatisgarh in the first tranche of auctions on February 17 and 21 respectively. For Chotia, the company had quoted ` 3,025 a tonne, the highest bid beating rivals Godawari Power & Ispat Ltd, Hindalco Industries, Prakash Industries, Rungta Mines and Ultratech Cement. The mine has extractable reserves of 13.57 million tonnes. The e-auction proceeds for the mine are calculated at ` 5,593 crore (for 30 years) for the state besides ` 489 crore royalty. (economictimes.indiatimes.com)

‘Nuclear waste is a misnomer in KKNPP’

February 23 2015. Calling spent fuel of Kudankulam Nuclear Power Project (KKNPP) ‘nuclear waste’ would be a misnomer as India was one among the three countries in the world that followed “closed cycle” process in nuclear power generation, said S. Kalirajan, its Additional Chief Engineer. Delivering a talk on ‘Nuclear power and its benefits’ at a meeting organised by Tamil Nadu Chamber of Commerce and Industry, Kalirajan explained how uranium, used in KKNPP, got converted into plutonium as spent fuel, which would be used in fast breeder reactors, along with a blanket of thorium. The thorium blanket, in turn, transformed into uranium after its use and this could be used in breeder reactors as fuel. With this “closed cycle” technology, it would be possible to generate five lakh MW of power for 500 years with thorium-based reactors, he said. India had about one third of world’s thorium reserves. India, France and Russia were the only countries to adopt the “closed cycle” technology in nuclear power generation, Kalirajan said. Kalirajan said the current installed capacity from all energy sources was 2.4 lakh MW, which should provide 1,600 units per capita power per annum. But, the per capita power available was 860 units. The shortfall was caused due to low efficiency and transmission losses. By bringing down consumption levels and improving efficiency and production, the county could meet future power demands. Referring to the objective of achieving 7.5 lakh MW in 2032, Kalirajan said this would become a reality only through “energy mix,” by not depending on a single source. Power generation in the KKNPP’s second reactor was likely to begin by the year-end and tenders for excavation had been floated for the third and fourth reactors. Work on the fifth and the sixth reactors would begin in a few years, Kalirajan said. On completion, the nuclear power park would generate 6,000 MW. (www.thehindu.com)

BJP govt not helping to overcome UP power crisis: SP

February 23, 2015. The Samajwadi Party (SP) accused the Centre of being biased against Uttar Pradesh (UP) in the matter of power allocation. Chowdhary, party spokesman and cabinet minister said the casual attitude of the BJP-led NDA government at the Centre created problems for Uttar Pradesh, which is facing a power crisis. While the state government has already taken several measures, including promotion of solar energy, Chowdhary said efforts were also made to ensure more purchase of electricity with the onset of summer. The Uttar Pradesh government is committed to its promise of providing 22-hour power supply to urban areas and 16-hour to district headquarters by 2016. The government is doing everything to make it (promise) possible, he said. Modalities for the purchase of additional power to the tune of 500-1,000 MW in April from Himachal Pradesh are also underway, the minister said. Referring to letters written by Chief Minister Akhilesh Yadav to Prime Minister Narendra Modi, Chowdhary said no action has been taken on these issues. (zeenews.india.com)

ADB loan to support Assam's power sector improvement

February 23, 2015. The Government of India and the Asian Development Bank (ADB) signed a $50.2 million loan agreement to continue to support improvements to transmission and distribution systems in the State of Assam for better electricity service to end users. The fourth tranche loan under the $200 million multi-tranche financing facility for the Assam Power Sector Enhancement Investment Program will build on earlier loans which aimed to improve operational efficiency in the sector through better transmission and distribution networks. The project, which is expected to be completed by December 31, 2018, will help Assam Power Distribution Company Limited (APDCL) add an additional 222 megavolt amperes (MVA) substation capacity and reduce system losses by 4%. Part of the loan will be used to enhance energy efficiency through renovation and modernization of existing 33/11 kilovolt (kV) substations. It will also deliver a dedicated power supply to tea estates by undertaking feeder separation for better service to the economically important tea sector. The loan of $50 million from ADBs ordinary capital resources makes up to 74% of the total project cost of almost $68 million, with the Government of Assam providing counterpart finance of $18 million. (www.business-standard.com)

CAO to continue monitoring Tata Power's Mundra project

February 22, 2015. World Bank Group's audit arm CAO (Compliance Advisor Ombudsman) will continue to monitor steps taken to address various environmental and social issues related to Tata Power's 4,000 MW Mundra power plant where IFC has invested USD 450 million. The move comes after CAO concluded that actions taken by the International Finance Corporation (IFC) were not "sufficient" with regard to addressing concerns over environmental and social impact of the Mundra project. In its response, the IFC -- a lender to the Gujarat-based Mundra Ultra Mega Power Project (UMPP) -- has agreed with conclusions of the CAO. The CAO reviews complaints from communities affected by development projects undertaken by IFC and the Multilateral Investment Guarantee Agency - the private sector lending arms of the World Bank Group. CAO had raised various concerns over environmental and social impact of the Mundra project. Following the same, IFC came out with an action plan in November 2013. Mundra project is being implemented by Coastal Gujarat Power Ltd (CGPL), a wholly-owned subsidiary of Tata Power. IFC said that it agrees with the CAO's conclusion. (economictimes.indiatimes.com)

Discoms raise alarm over buying low-grade coal at higher prices

February 21, 2015. At a time when the Delhi government is eyeing allocation coal blocks to set up a power plant, discoms have moved the central regulator complaining of low-grade coal being supplied to thermal stations at Dadri and Badarpur. In a letter to Central Electricity Regulatory Commission (CERC), discoms claimed they were paying more for lesser power being produced from low-grade coal and the costs were invariably being passed on to the consumers. Even the state-run NTPC expressed concern over the quality of the coal being supplied. According to the discoms, if the coal allocated to the Badarpur thermal plant is diverted to newer plants like Aravalli, the power production cost will go down and it will become affordable for the Delhi discoms. At present, the power companies do not buy power from Aravalli as it is "too costly". NTPC said it had no control over the quality of coal being used in these power plants as it was supplied directly by Coal India. Discoms said in their petition that until NTPC was completely transparent in their details of coal dispatched, coal burnt and quantum of power produced from Dadri and Badarpur stations, the increased variable costs paid to NTPC should be discontinued. Discoms said that with NTPC dilly-dallying on providing these cost details, state regulator DERC had denied them their quarterly fuel surcharge. A power plant like the one at Badarpur receives 90% of its coal supply from Coal India. Badarpur and Dadri plants collectively supply about 1,500 MW power to Delhi. According to the petition, the coal dispatched to these plants is about 5,000 kcal but the power produced from burning this coal only amounts to about 3,000 kcal coal. (economictimes.indiatimes.com)

AAP govt tells Delhi HC that CAG has full right to audit Discoms

February 20, 2015. The Aam Aadmi Party (AAP) government sought unhindered access to accounts of discoms for Comptroller and Auditor General (CAG) to carry out its comprehensive audit. It also claimed continuity with the previous regime as far as the decision to audit discom accounts is concerned, saying even the last government favoured the move. The state government assured the court it is not trying to interfere in the functioning of discoms but wants to subject the accounts to public scrutiny given the fact it has a substantial stake of 49% in them. The high court is hearing a batch of petitions filed by the discoms against the order of a single judge refusing to stay Delhi government's decision to a CAG audit of their accounts. The court is also hearing a PIL filed by NGO United RWAs Joint Action seeking the audit. (economictimes.indiatimes.com)

CIL to spend ` 120 bn in FY16 for capex, infra

February 20, 2015. Coal India Ltd (CIL) said it is gearing up to invest about ` 6,000 crore towards capital expenditure in the next fiscal and an equal amount on augmenting other infrastructure, including rail connectivity. The announcement comes at a time when the company has a target to achieve an output of one billion tonnes by 2019-20. Further, an amount of around ` 6,000 crore has been earmarked by CIL for railway and other infrastructure development for 2015-16, the company said. The capex for entire infrastructure in Coal India for 2015-16 is close to ` 12,000 crore, CIL said. CIL said that annually ` 6,000 crore would be spent on mining and the remaining ` 6,000 on rail infrastructure and other related work. CIL also unveiled its roadmap, of strategies to be adopted, to attain the one billion tone coal production by 2019-20. With the projected coal demand of the country hovering around 1,200 million tonnes by 2019-20, at an envisaged growth rate of 7 percent, CIL is expected to chip in one billion tonnes, of which, 908 million tonnes is the expected contribution from the identified projects. (economictimes.indiatimes.com)

Coal block auctions in India see aggressive bidding

February 19, 2015. Indian metal and cement companies have bid aggressively for coal blocks in the country's first auctions to sell mines as they look to cut imports and their dependence on inefficient government monopoly Coal India Ltd (CIL). The auction follows a court cancellation of all previous licences and the initial bidding suggests companies are keen to secure supplies as the economy improves. The companies are allowed to bid for enough coal to fuel a 50 percent expansion of their current metal or cement capacity. The stiff competition may strain the balance sheets of the winners, including aluminium makers Hindalco Industries and BALCO, Jaiprakash Associates, Sunflag Iron and Steel, OCL Iron & Steel, Reliance Cement and Essar Power. Most of the winning bids so far have been higher than analysts' expectations based on the benchmark price of CIL. OCL, for example, would pay ` 2,302 ($37) per tonne, 50 percent more than Coal India's average price for the grade available in the mine OCL has won. The companies have declined to comment on the auctions until the whole process is complete, which should be March 5. Though world coal prices have fallen about 30 percent over the past year, a tonne of imported steelmaking coal costs about $120 in Indian ports while the thermal variety comes for $70. India is on track to overtake the United States as the second-largest coal consumer after China this decade, but Coal India has failed to ramp up supply in line with demand. Coal India's prices are set according to cost rather than based on supply and demand in the market and its costs are high at ` 1,118 per tonne, more than half of which comes from employee and social costs. (in.reuters.com)

US welcomes civil nuclear pact between India and Sri Lanka

February 18, 2015. The United States (US) has welcomed the signing of civil nuclear cooperation agreement between India and Sri Lanka, saying it is consistent with IAEA (International Atomic Energy Agency) safeguards and other international standards and practices. India and Sri Lanka signed a civil nuclear cooperation agreement, the first such deal signed by Sri Lanka with any foreign country, reflecting the new Lankan government's pro-India approach. The pact was signed after talks between Prime Minister Narendra Modi and new Sri Lankan President Maithripala Sirisena who chose India for his maiden foreign visit after assuming charge following a bitter presidential poll. According to the nuclear deal, India will assist Sri Lanka in developing its civil nuclear energy infrastructure, including sharing of resources, training of personnel and extending expertise. It will also facilitate cooperation in radioactive waste management and nuclear and radiological disaster mitigation and environmental protection. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Statoil starts production from Oseberg Delta 2 in North Sea

February 23, 2015. Statoil ASA reported the start of production from Oseberg Delta 2 in the North Sea. The field is tied back 14 km to Oseberg field’s center by two subsea templates with total capacity for eight wells. The initial phase involves three oil producers and two gas injectors. Total investment is slightly less than 7 billion kroner, Statoil said. The development plan was submitted to the Ministry of Petroleum and Energy in May 2013 and approved that October. Recoverable reserves are estimated at 77 million barrel of oil equivalent (boe) during an estimated life of 20 years. Oil accounts for 32 million boe and gas 45 million boe. Production is from 3,100 m under the seafloor. Statoil said oil from two wells on the “Delta terrace” has been produced since 2008. (www.ogj.com)

Gulfsands confirms DOB-1 well as a gas discovery

February 23, 2015. Gulfsands Petroleum has confirmed as a gas discovery the Douar Ouled Balkhair 1 gas exploration well (DOB-1) in northern Morocco. Gulfsands said that, during testing of the discovery, gas flowed to the surface at rates in excess of 10 million cubic feet per day. DOB-1 has been suspended as a future gas production well. The first two wells – LTU-1 and DRC-1 – to be drilled on this permit were also successful in finding gas and flowing it to surface. While the primary reservoir target found gas that flowed at a rate of 10 million cubic feet per day, the secondary target was unable be tested due to mechanical problems with well bore integrity above the interval. The company is currently attempting to determine the optimal path for further exploration of this reservoir. (www.rigzone.com)

Chevron says plans to give up Romania shale gas project

February 22, 2015. Chevron Corp said it will give up shale gas exploration plans in Romania, after an assessment showed the Black Sea state does not compete favourably with other investment opportunities. Energy firms have been attracted by estimates of massive shale gas reserves in Poland and Romania. The U.S. energy major took a similar decision to discontinue its operations in Poland. (www.reuters.com)

Shale giant says US output will fall this year on drastic cuts

February 19, 2015. U.S. oil production is set to fall this year as drastic drilling cutbacks take hold faster than world governments expected, according to the biggest, fastest-growing shale company. EOG Resources Inc.’s forecast contradicts most estimates that see U.S. production rising, including those by the U.S. Energy Information Administration and the International Energy Agency. The company said the crude market would rebound quickly and labeled the current downturn a “short cycle.” The Texas producer said its own production would bottom in the second and third quarter, resulting in output remaining unchanged for the year compared to last year’s breakneck pace of growth. The deciding factor in what has been viewed as a price war with Saudi Arabia and its OPEC allies is how many of the thousands of U.S. producers will follow suit. So far company response has been mixed as some producers focus on preserving cash flow to fund their operations. Others are insulated from the effect of the market crash by hedging contracts that locked in a higher price for some of their production in 2015. Noble Energy Inc., Devon Energy Corp. and Marathon Oil Corp., three other companies with significant shale operations, said they will boost output this year. More than half of Devon’s 2015 oil production is hedged at a price of $90.75 a barrel. Apache Corp. plans to pump about the same volume of oil as last year. Meanwhile, Saudi Arabia is boosting production in a bid to maintain market share. Crude oil output is about 10 million barrels a day, New York-based Pira Energy Group said. That would be the highest since July and up from an average of 9.7 million barrels a day in the second half of 2014, according to data from the Joint Organisations Data Initiative, an industry group supervised by the Riyadh-based International Energy Forum. (www.bloomberg.com)

GeoPark discovers new oil field in Colombia

February 19, 2015. GeoPark has discovered new oil field following completion of drilling operations on exploration well Tilo 1, which is located on the Llanos 34 Block in Colombia. GeoPark operates the Llanos 34 Block with 45% working interest. The tests resulted in a production rate of approximately 1,000 barrels of oil per day of 14.2 degree API, with approximately 10% water cu, the company said. The company will carry out technical evaluation to determine if the Tilo field is potentially a northeast extension of the larger Tigana field. GeoPark is an oil and gas explorer, operator and consolidator and has operations in Chile, Colombia, Brazil, Argentina and Peru. (www.energy-business-review.com)

Aminex moves closer to 1st gas production from Kiliwani field, Tanzania

February 18, 2015. Independent oil and gas firm Aminex has edged closer to first commercial gas production from its Kiliwani North field in Tanzania, after reporting that the pipeline construction from Songo Songo has been completed. The firm reported that Tanzanian Petroleum Development Corporation is constructing the skid metering unit within the boundaries of the Kiliwani North Development Lease prior to tying-in the Kiliwani North-1 wellhead. Pressure testing of the pipeline is expected to begin shortly and the final construction equipment required to connect KN-1 is also expected soon. The KN-1 well, when connected to the export pipeline, is expected to produce at least 20 million cubic feet of gas per day. Gas from KN-1 will be processed at Songo Songo and then be sold in the Dar es Salaam to Mnazi Bay pipeline. (www.rigzone.com)

Downstream…………

Total CEO says to add German petrol stations

February 23, 2015. French energy company Total is planning to expand its network of petrol stations in Germany, its chief executive Patrick Pouyanne said. Total operates about 1,200 petrol stations in Germany, ranking it a distant third after Aral and Shell. Pouyanne called for dialogue in the current spat between Moscow and the West. Total's refinery in Leuna, Germany, uses Russian oil, Pouyanne said. (af.reuters.com)

US refinery strike affects one-fifth of national capacity

February 22, 2015. The largest U.S. refinery strike in 35 years entered its fourth week as workers at 12 refineries accounting for one-fifth of national production capacity were walking picket lines. Talks may resume by mid-week to end the walkout by 6,550 members of the United Steelworkers union (USW) at 15 plants, including the 12 refineries. Representatives of both sides said no date has been set to restart negotiations, however. The strike comes as U.S. workers seek more pay in a strengthening economy. Wal-Mart Stores Inc has said its U.S. workers will get a raise to at least $9 an hour, while West Coast port workers have reached a tentative deal for a new contract after a months-long dispute. The refinery work stoppage began on Feb. 1 when talks for a new three-year contract between the USW and lead oil company negotiator Shell Oil Co broke down. The work stoppage includes the nation's largest refinery, Motiva's 600,250 barrel per day (bpd) Port Arthur, Texas, refinery. USW members are also picketing at Motiva's 235,000 bpd Convent, Louisiana, and 238,000 bpd Norco, Louisiana, refineries and the Shell chemical plant in Norco. (www.downstreamtoday.com)

Petrobras refinery cracker unit should be fixed by March 7

February 21, 2015. Brazil's state-run oil company Petroleo Brasileiro SA (Petrobras) plans to complete repairs to a broken catalytic cracking unit at its REDUC refinery by March 7, the union representing workers at the plant said. The problem at the 240,000-barrel-a-day refinery near Rio de Janeiro forced Petrobras to cut oil processing by about 7,000 cubic meters (44,029 barrels) a day for more than 10 days. The U-1250 unit produces gasoline and liquefied petroleum gas (LPG). It had to be shut down unexpectedly of problems inside the unit tower led to lower-than-normal output and a leak of catalysts. Petrobras said that the stoppage of the U-1250 unit was planned. The union says the stoppage was an emergency shutdown, the result of the company reducing maintenance in order to run its 13 principal refineries in Brazil at nearly full capacity to meet surging local demand and reduce imports. Until the recent decline in world oil and fuel prices, Petrobras was forced by Brazil's government to sell imported fuel at below world market prices, causing large losses for the company at a time when it was making some of the world's largest corporate investments. (www.downstreamtoday.com)

Transportation / Trade……….

Oil-by-rail shipments are playing Russian roulette

February 23, 2015. Train derailments involving crude oil and ethanol in the United States will cost more than $18 billion over the next 20 years, according to an assessment by the United States Department of Transportation (USDOT). USDOT forecasts there will be just over 200 derailments involving trains carrying 20 or more tank cars of crude or ethanol between 2015 and 2034, an average of more than 10 per year, based on analysis of previous accidents and predicted growth in traffic volumes. USDOT calculates the risks posed by oil and ethanol by rail shipments using the same method RAND Corp has developed for estimating risks associated with terrorism. Risk is the product of threat, vulnerability and consequence. In the case of oil by rail, the threat is the probability of a major rail accident involving multiple tank cars carrying flammable liquid. Vulnerability is the probability flammable liquids will be released and catch fire, given an accident has occurred. And consequence is based on estimated damages. USDOT identified 36,500 miles of rail corridors being used to transport crude and ethanol across the United States in 2012. Population density averages about 283 persons per square kilometre along these rail corridors, according to USDOT. (www.reuters.com)

Gazprom, Sonatrach mull cooperation on LNG supplies

February 19, 2015. Russia's Gazprom said it had discussed possible cooperation with Algeria's state energy firm Sonatrach on supplies of liquefied natural gas (LNG). It said that drilling at the El Assel oil and gas block in Algeria, jointly developed by Gazprom and Sonatrach, has confirmed the existence of hydrocarbon resources. (www.downstreamtoday.com)

Slovak pipeline says demand high for capacity to ship gas to Ukraine

February 19, 2015. Slovak gas pipeline operator Eustream has sold additional capacity in a pipeline carrying supplies to Ukraine through the end of 2016, bringing total capacity to 14.6 billion cubic metres per year, it said. Eustream said demand was high for extra capacity in the pipeline. (www.downstreamtoday.com)

TransCanada to seek US approval for $600 mn Upland Pipeline