-

CENTRES

Progammes & Centres

Location

[Crude Oil: The Problem of Plenty]

“This raises some interesting questions. What led to the problem of too much oil when all along we were anticipating a problem of too little oil? Was it the creation of an industry that thrived on making predictions of the world running out of oil? Was technology developed in response to these ‘end of the world’ predictions? Or is it the new Malthusian error?…”

Energy News

[GOOD]

The reduction of T&D losses would release millions of units of electricity into the grid!

The new agreement over the Nuclear Liability Bill adds to its lack of clarity!

[UGLY]

The expensive badge of Global leader in tackling climate change will allow rich countries to free ride on the backs of the poor in India!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Crude Oil: The Problem of Plenty

ANALYSIS / ISSUES…………

· 13th Petro India: The Future of Energy: Will Availability meet Demand? (A Brief Report)

DATA INSIGHT………………

· Petroleum Subsidies and GDP

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn India may spend ` 130 bn on KG-Basin block

· DGH for fresh approach to solve oilfield disputes

Transportation / Trade………………

· Indian diesel cargoes head to Australia in rare move

· Swiss company buys diesel cargo from MRPL in rare move

· Petronet in race to build LNG terminal in Bangladesh

Policy / Performance…………………

· Rajasthan withdraws subsidy on domestic cylinders

· ‘Heavy water likely to be used in oil exploration studies in India shortly’

· Govt frees non-PDS kerosene from regulatory control

· Oil ministry seeks more share in extended production contract

· PAHAL Yojana will end black marketing in LPG: PM Modi

[NATIONAL: POWER]

Generation………………

· Ashok lays stone for hydel project

· BHEL commissions 270 MW thermal unit in Maharashtra

· CIL needs to produce 120 mn tonnes more to meet target

Transmission / Distribution / Trade……

· Power T&D losses may come down to 18 percent by end of 13th plan: CEA

· Distribution franchisees mushroom even as power discoms up base rate

· Fuji Electric to set up smart energy grid near Andhra’s new capital

· Delhi power rate cut a poll issue but falters on economics

· Adani Power, GMR Energy bid for all coal blocks reserved for power sector

· CERC proposes round the clock trading on power exchanges

Policy / Performance…………………

· Power projects to get coal from CIL till auctions are over

· CIL likely to scrap Mozambique production project on poor deposits

· Coal Ministry receives 69 applications for 36 coal blocks from PSUs

· Budget 2015: Interesting proposals for power sector expected, says Goyal

· Centre clarifies on nuclear deal, caps compensation at ₹ 21.6 bn

· Odisha taking steps to expedite coal block development: Coal Secretary

· Delhi Post Poll plan: Discoms biding time to seek fuel surcharge

· CCI clears JSW Energy - Jaiprakash Hydro deal

· ‘Karnataka has taken steps to reduce power cuts’

· Maharashtra govt to set up committees to check power theft

· Uttarakhand notifies policy on small hydel units

· Power Ministry to issue Cabinet note on tariff policy changes

· ` 15 bn relief fund in place for nuclear disaster victims: DAE

· Scheme to swap coal supplies with nearest fuel source gets govt nod

· Kerala turning increasingly dependent on other States for power: Aryadan

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· China finds natural gas reserve in disputed South China Sea

· Argentina says 2014 oil, gas output fell despite increase by YPF

· Oil majors fail to find reserves to counter falling output

· CNOOC joins peers with 35 percent cut in capital spending

Downstream……………………

· Cameroon plans to raise $1.5 bn for refinery, other projects

Transportation / Trade…………

· Russia and Turkey agree on Turkish Stream onshore route

· China demand not as weak as import slump suggests

· Oil could plunge to $20, and this might be 'the end of OPEC': Citigroup

· Venezuelan sales of new crude blends to US double in January

· Gulf Keystone suspends trucked oil exports from Iraqi Kurdistan

· LNG supply seen falling after 2020 as oil plunge delays projects

· Plains All American to build new pipelines in West Texas

· Why oil prices are falling

Policy / Performance………………

· Abu Dhabi gas firms award $1.6 bn expansion contracts

· Russia to increase 2015 crude exports by 5 mn tonnes: Energy Ministry

· UAE to look at controlling petrol costs

[INTERNATIONAL: POWER]

Generation…………………

· Russia agrees to build Egypt's 1st nuclear power plant

· Ghana President directs Minister to increase power generation

· Turkey plans to spend $50 bn to boost power generation by 2018

· ContourGlobal could start building Kosovo power plant in 2016

Transmission / Distribution / Trade……

· Tepco, Chubu Electric to merge existing thermal power plants

Policy / Performance………………

· South Australia to review nuclear power policy

· China assisted Pakistan to build 6 nuclear reactors: Wang Xiaotao

· Japan aims to restart nuclear reactor in June

· China signs agreement to develop two nuclear power plants in Argentina

· Coal price drop cost South Africa $2 bn last year

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India call for additional aid to developing nations to deal with climate change

· Maharashtra plans to cut power tariff for farmers, aims to install solar pumps in fields

· Gamesa signs up with Greenko for 300 MW wind power

· Adani, Rajasthan govt to set up India's largest solar park

· Claro Energy gets $2 mn credit facility from RBL Bank

· Okhla missionary hospital to generate solar power

· Inox Wind bags 166 MW contract from Green Infra

· Odisha to set up solar parks of 1 GW capacity by 2020

· Companies set to back huge India solar expansion

· 'India can lead global effort to tackle climate change'

· Northeast India gets its first solar power plant at Monarchak

· Brakes India, SunEdison tie up for solar power

GLOBAL………………

· California opens 550 MW solar power plant

· Israeli company to build 20 hour per day solar power plant

· EU wants India to contribute to the UN Green Climate Fund

· Yingli energizes solar power plant in East Malaysia

· Germany's 10 percent wind, solar rise piles pressure on power

· Scatec Solar selects Swinerton to built 104 MW Utah plant

· Marubeni picked to build two offshore wind projects in Japan

· Shell Foundation may invest $75 mn in clean energy in India over next 5 yrs

[WEEK IN REVIEW]

COMMENTS………………

Crude Oil: The Problem of Plenty

Lydia Powell, Observer Research Foundation

|

I |

n the article titled ‘The Shocks of a World of Cheap Oil’ published in the January / February 2000 issue of Foreign Policy, the authors Amy Myers Jaffe and Robert A Manning argued that the shocks of a World of cheap oil could be more damaging than the shocks of a World of expensive oil. At the time the article was published (early 2000s) crude oil prices were $25-$30 per barrel (above $ 100/bbl in today’s dollars) and many observers were beginning say that it could materialise in to a crisis similar to the oil crises of the 1970s. World oil demand, especially Asian oil demand had recovered from the drop suffered during the 1997 currency crisis but supply had fallen on account of low investment. Most observers of the oil market did not see the possibility of change in this scenario of growing demand and dwindling supply. They predicted disaster for oil importing countries as crude oil prices were expected to keep rising to levels not seen before. Geo-political commentators anticipated a significant imbalance in power relations as wealth was transferred from oil importing countries to oil exporting countries which were invariably dominated by countries in the Persian Gulf.

The authors of the article cited above took a contrarian view and argued that the long term trend of low oil prices on account of prolonged surplus in the oil market could destabilise oil producing States ‘especially those in the ellipse stretching from the Persian Gulf to Russia’ as the authors put it. They pointed out that oil reserves (recoverable at prices of the day) had increased to more than a trillion barrels, double the level predicted by the Limits to Growth report for the year 2000. The authors added that if unconventional oil sources such as tar sands and shale oil were included, global oil reserves would touch 4 trillion barrels.

Other arguments that the authors made in the paper to support their prediction of a glut in the oil market included the falling costs of finding and producing oil on account of technological improvements, the emergence of alternative fuels in the transportation segment and the fall in oil required to produce a unit of GDP. One of the most interesting part of the paper is the high probability the authors attached to oil prices staying in the range of $12-$20/bbl (about $ 20-32/bbl in current dollars) over the period 2000-2020 and the impact this could have on oil export dependent countries. Though actual oil prices did not exactly follow these predictions for the first half of the period, the second half appears to be edging close to the levels predicted.

The report by Citibank released last week argues that crude oil prices would fall to $20/bbl over the short term and that OPEC’s hold over oil prices is over. According to the report, the new oil world order is said to depend on a ‘call on shale’ rather than a ‘call on OPEC’ as it used to be. The reason is that with shale oil technologies, oil production had become more like manufacturing in the sense that it got cheaper with better technology. Unlike traditional resource extraction which was characterised by high upfront costs, long gestation periods and extended periods of production that amounted to inelasticity of supply, shale oil production had low capital costs, very low gestation periods and small production cycles that underpin elasticity of supply. When oil prices are above $60/bbl more fracking wells will come on line and when oil prices fall below $60/bbl, many wells go offline.

This raises some interesting questions. What led to the problem of too much oil when all along we were anticipating a problem of too little oil? Was it the creation of an industry that thrived on making predictions of the world running out of oil? Was technology developed in response to these ‘end of the world’ predictions? Or is it the new Malthusian error?

There is an eerie sense of accuracy in the author’s geo-political prediction that low oil prices would complicate Russia’s troubled transformation and contribute to the political turmoil in Venezuela. The author’s recommendations, largely addressed to the United States, include a revision of American policy towards oil export dependent countries that it should not be limited to military assistance but include political and social institution building and diversified economic development. Once again some interesting questions could be raised: Were high oil prices just ‘protection money’ being paid to keep oil exporting countries off the backs of the rest of the World? What happens now when technology has wiped out this ‘protection money’?

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

13th Petro India: The Future of Energy: Will Availability meet Demand?

(A Brief Report)

K K Roy Chowdhury, Energy & Environment Expert, Delhi

|

T |

he India Energy Forum (IEF) and the Observer Research Foundation (ORF) presented the conference on the “Future of Energy” incorporating 13th Petro India in partnership with the media group Mail Today on 16th January 2015 in New Delhi. A glimpse of the important deliberations in the Conference is presented below.

Inaugural Session:

After Mr Sandeep Bomzai, Editor, Mail Today, made the welcome remarks, the inaugural address was delivered by the Hon’ble Minister of State (independent charge) for Oil & Gas, Government of India, Mr Dharmendra Pradhan. The Minister dwelt at length upon the new Government’s plans for designing the future energy basket for India with emphasis on renewable energy and energy efficiency that were also in line with the spirit of Prime Minister Narendra Modi’s vision ‘Make in India’.

On the issue of petrol and diesel prices, the Minister said that the issue of reducing petrol and diesel prices was not in the hands of the Government as the two fuels were deregulated commodities whose pricing was decided by oil companies. He said that ‘what oil companies felt appropriate would be done’.

Mr S C Tripathi, former Secretary, Petroleum, in his address reiterated his long-time proposition for addressing energy as an integrated whole, and not through divided Ministries as it has been historically. Drawing some amount of satisfaction from the fact that the new Government had reformed it into two Ministries, namely, one for, ‘Coal, Power and Renewable’, and the other for ‘Petroleum’, he however opined that coal and petroleum should be together since both are extractive in nature. Pointing at the restrictive policies India had adopted in harnessing fossil fuels such as coal, etc., he hoped that the new Government at the Centre would be rational in times to come. Mentioning that India’s developmental path had been energy-intensive, Mr Tripathi stated that if India were to follow the Chinese path with emphasis on manufacturing, then India’s energy requirements would have been more. He expected a spurt in energy demand as India embarks on the ‘make in India’ policy.

Commenting on India’s exploration policy, Mr Tripathi called for increasing the focusing on gas and oil, this being the right time to acquire assets abroad, and also to focus on trans-border pipeline and LNG projects. In view of the fact that there is no UN Agency for Energy, such acquisition strengthens the commanding position of a country, he opined. Towards India’s quest for prosperity, he suggested a move towards long-term contract for LNG, with Australia, Qatar, or Iran, or may be, other producers of LNG.

Oil & Gas: Where Next?

This session included a panel discussion with Mr R S Butola, former CMD, IOC, MrAtul Chandra, former MD, ONGC Videsh and Mr VipulTuli, Partner, McKinsey & Co. Adresses by GoI Secretary-Power, Mr P K Sinha, and by Dr Arup Roy Chowdhury, CMD, NTPC followed this panel discussion.

The Panel discussed various aspects of overseas oil & gas investments by India, exploration status, fiscal incentives, internationalcompetitiveness, etc. Regarding investment prospects in India, Mr Chandra informed that foreign companies like Exxon, BP and Chevron would not go to a country where the investment level is less than $ 1 billion and added that BP had come to build a gas business in India. Another aspect he pointed out is the apprehension of the foreign companies of the fact that litigation risk persists in exploratory drilling and that this is a deterrent for foreign investment. He said that the large foreign companies had extensive knowledge of oil & gas prospects which he illustrated with investment by Cairn in Rajasthan. He said that large companies invest in Saudi Arabia and other countries in the Middle East even though profits are low there because the geological prospects were attractive. The Government’s tight control of the hydrocarbon sector through its bureaucracy made it difficult to do business in India, Mr Chandra observed. He further added that acquisition of hydrocarbon assets had been more of a fashion than the result of research. He also observed that reforms may not be possible without privatization.

Mr Butola threw some light on India’s frontier geology which remained largely unexplored and observed that large acreages for exploration make it attractive. Emphasizing upon the need for retaining manpower in a competitive environment he also said that costs can be controlled if companies are better managed. Mr Butola further added that OPEC share of the market had declined compared to that in the 1980s and that there is a much bigger role for other players in the market. On the issue of reforms, he said that the public sector had to follow State norms and the concerned Ministry was answerable to the Parliament.

Acknowledging that fiscal incentive and the pricing regime of the sector certainly mattered, Mr Vipul Tuli referred to India being one amongst the top five consumer-driven economies and that large oil companies looked for large projects with high prospectivity. But he observed that prospectivity was low in India as of now. He called for organizing roadshows to attract Tier II and Tier III companies of which there were many. Commenting on the drop in oil prices, he said that the increase in production from Iraq, Nigeria and the USA and the absence of peak oil along with subdued demand were key reasons. He said that China’s growth of oil demand was expected to fall from 3.5% to 2.5% and that demand growth would be negative in Europe. He said that USA may export to Asia or other regions as their storage was full. He observed that within OPEC, there is was a conflict between typical low-cost producer such as the GCC countries and higher cost producers that led to conflict within OPEC. He also said that there was conflict between OPEC and non-OPEC producers for market share. He felt that this period of low energy prices presented a unique opportunity for investing in long-term infrastructure and urged the oil companies to play a role. He also mentioned that less than 50 percent of our basins were mapped and that investment must be made towards this.

On the question of India being both capital and energy deficient Mr Atul Chandra said that the abundance in manpower could be leveraged. He emphasized that the Government should play the role of a facilitator. In this context he observed that ONGC was empowered to take decisions. Mr Butola added that deep-water exploration of oil was expensive and that his interactions with foreign companies revealed that they have interest in India. He pointed out that lack of exploration data as a problem.

On the question of ‘What difference needs to be done to get better returns’, the Panelists conveyed the following message:

i) Mr Vipul Tuli said that the target companies must be identified based on size and that our commitment must be communicated clearly.

ii) Mr Atul Chandra agreed with the remarks made by Mr Tuli and urged for collection of more data. He expressed the need for distinguishing between Individuals and Institutions.

iii) Mr Butola too agreed with fellow panellists and he emphasized the need for nurturing talent even within the public sector.

ELECTRIFYING INDIA

In his key note address Mr P K Sinha, Secretary, Power said that highlighted the growth of the power industry which started with an installed capacity of 1360 MW in 1947 and expanded to over 250 GW of installed capacity over six decades. He highlighted key milestones such as the passing of the Electricity Supply Act of 1948, the separation of Water and Power Ministries in the 1970s, the creation of NTPC and NHPC that followed, the setting up of the Power Grid Corporation in the 1980s, the passing of the CERC Act in the 1990s that enabled the creation of Central and State level electricity regulators and passing of the new Electricity Act in 2003 that enabled the entry of the private sector into power generation. He also highlighted some of the challenges facing the industry such as the lack of sufficient transmission capacity that could transfer surplus power available in the western region to the power deficit southern region. He pointed out that distribution remained the weakest link in the chain but expressed hope that the next wave of reforms would begin with the distribution end. He also pointed out that renewable energy would play a greater role in power generation in the future. Answering a question on stranded assets, the Secretary said that assets were stranded primarily because their expectations on gas supply did not materialise and that this would be addressed through the price pooling mechanism.

Delivering the key note address for the session Mr Arup Roy Choudhry, CMD, NTPC said that power projects were stranded because plans for investment in power generation had not been coordinated with simultaneous plans for increasing coal production and plans for streamlining transport linkages. He also noted that most of India’s coal was in tribal forest land which resulted in inevitable delays in obtaining approvals. He said that the result was that coal based power generation capacity had growth rates that were three times the growth in coal production.

He clarified that stranded assets in the power sector included assets that were almost complete and those that had barely begun and that the stranded assets affected the balance sheets of banks that put money in these projects. He pointed out that while the power plants operated by NTPC were well adapted to the type of coal available in India and also to the climatic conditions under which they operate but newer plants constructed at higher cost were not well adapted to Indian conditions. He also raised some fundamental questions over increasing economic growth through increased energy consumption. He pointed out that many in India cannot afford to pay for power generated by NTPC which had one of the lowest generation costs in India. He expressed concern over the sad situation where households around huge well lit power plants that remained in the dark without power on account of poverty.

Mr. Anil Razdan, former Secretary Power Mr H.L. Bajaj, former Chairperson of CEA, Mr. S.K. Soonee, CEO, POSOCO, Mr M K Madan, CEO Adani Power and Mr Roy Choudhury participated in the panel discussion that followed. The panellists felt that Power for All was a good slogan as it sought to empower the people but raised some issues in implementing the programme. They agreed that the distribution end remained a challenge and affordability was a key issue. They said that unless the distribution end was made self-sustainable and viable, the goal of supplying power to all would not be achieved. One of the panellists pointed out that there was a strong expectation that power would be free even from fairly affluent households. The panellists pointed out that increase in power tariff was not necessarily a vote losing proposition and offered examples from different parts of India. They said that the sector was open to participation from the private sector even in the 1980s and that more than one license for distribution was allowed even at that time.

One of the panellists suggested that the Government should amend the Constitution and make access to power a fundamental right so that the State had the responsibility to provide power. Another panellist challenged the notion of scarcity of power and pointed out that just as famines did not occur because of a problem in the supply of food, power shortages did not occur because of a shortage in the supply of power but rather because of problems in other linkages necessary such as transmission and distribution lines and the ability to pay for power.

There was general agreement that as distribution was a State subject, the budgetary provision was not enough for upgrading the distribution network and that short election cycles inhibited long term projects to improve the distribution segment. The neglect of the hydro power segment on account of its long gestation period was also highlighted. There was agreement that things were moving in the right direction as power deficit has been reduced to about 3 percent from about 10-12 percent. The question of inadequate capacity for transmission was discussed in depth and the issue of availability based tariff and peaking tariff was raised. The panellists agreed that demand was being suppressed by illiquid distribution companies and that this could be behind lower figures for power deficit. The success story of power trading and price discovery through short term trade was acknowledged by all the participants.

The panel discussion was followed by a theme address by Mr Sunjoy Joshi, Director, Observer Research Foundation. He said that India which imported 50 percent of its energy needs could not be isolated from global movements and that global coal prices collapsed when the United States shifted to gas for power generation because energy markets were integrated. He highlighted that the strongest Government in the world was weaker than the weakest market and that the shift in prices across the world of energy commodities would cause a tectonic shift in moving wealth across the world. He observed that the PPP model had failed to deliver in India as the model was not implemented well. He concluded that the low oil price regime presented an opportunity for reform and that the moment must seized before it closes.

ENSURING COAL SUPPLY

Mr. Suresh Prabhu, Union Minister for Railways who delivered the valedictory address in the concluding session began with observations on the uncertainty in global energy markets and the resulting change in prospects for different types of energy sources. He said that though India was a marginal player in the energy markets currently it would be the largest consumer of energy on an incremental basis by 2030. He concluded his brief address by requesting suggestions on how the Railways can reduce the cost of energy.

Mr. Anil Razdan, former Secretary, Power, Mr. Alok Perti, Former Secretary, Coal, Dr. M. P. Narayanan, Former CMD-CIL, Mr. Nitin Zamre, MD, ICF International participated in the panel discussion on coal. Mr Perti said that raising production of the coal by and the prospect of movement towards underground mining were key issues in the short term. He observed that the potential existed for increasing coal production to 1 billion tonnes per year but he expressed doubts over transport capacity and the consuming industries to absorb such a dramatic increase in production.

Mr. Narayanan commented that there was demand for 1 billion tonnes of coal and that he was optimistic over the industry’s ability to absorb the increase in production. He said that the Board of CIL was not sufficiently empowered and that a shift to under-ground mining would require serious thought on technologies that would be required. Mr. Nitin Zamre also expressed doubts over the demand for 1 billion tonnes of coal and the evacuation infrastructure that would be required to meet the spurt in production. He said that unless there was pressure on companies to perform or perish, their performance would not improve.

There was agreement that the coal mining sector must be thrown open to competition. The question of productivity of coal was discussed and the burdens of State owned companies were brought out. There was general agreement among the panellists for improving productivity and for washing coal to reduce the cost of transport. The need for rationalising the location of power plants and the location of coal washeries was discussed and the session concluded with agreement over the need to focus on better governance of the coal sector.

Views are those of the author

Author can be contacted at [email protected]

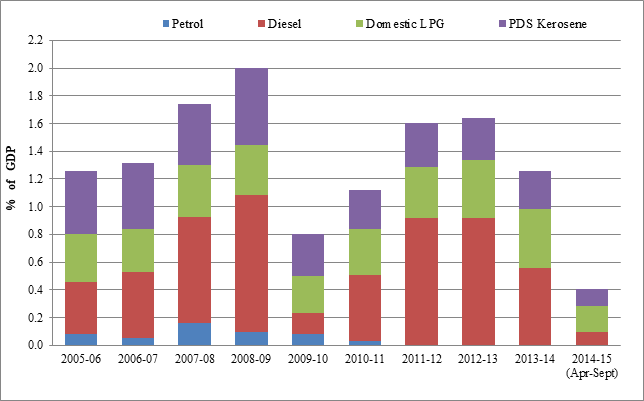

DATA INSIGHT……………

Petroleum Subsidies and GDP

Akhilesh Sati, Observer Research Foundation

|

Year |

Petroleum Subsidies (in ` Crore) |

||||||||

|

Under Recoveries |

Fiscal Subsidy |

Total |

|||||||

|

Petrol |

Diesel |

Domestic LPG |

PDS Kerosene |

PDS Kerosene |

Domestic LPG |

PDS Kerosene |

Domestic LPG |

||

|

2005- 06 |

2723 |

12647 |

10246 |

14384 |

1057 |

1605 |

6 |

15 |

42683 |

|

2006- 07 |

2027 |

18776 |

10701 |

17883 |

970 |

1554 |

9 |

17 |

51937 |

|

2007- 08 |

7332 |

35166 |

15523 |

19102 |

978 |

1663 |

6 |

22 |

79792 |

|

2008- 09 |

5181 |

52286 |

17600 |

28225 |

974 |

1714 |

6 |

16 |

106002 |

|

2009- 10 |

5151 |

9279 |

14257 |

17364 |

956 |

1814 |

6 |

16 |

48843 |

|

2010- 11 |

2227 |

34706 |

21772 |

19484 |

931 |

1974 |

5 |

17 |

81117 |

|

2011- 12 |

- |

81192 |

29997 |

27352 |

863 |

2137 |

5 |

18 |

141564 |

|

2012- 13 |

- |

92061 |

39558 |

29410 |

741 |

1989 |

5 |

18 |

163782 |

|

2013- 14 |

- |

62837 |

46458 |

30574 |

676 |

1904 |

5 |

16 |

142470 |

|

2014- 15 (Apr-Sept) |

- |

11656 |

24597 |

14857 |

- |

- |

- |

- |

51110 |

Petroleum Subsidies as percentage of GDP (Current Prices)

Source: PPAC & CSO.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn India may spend ` 130 bn on KG-Basin block

February 8, 2015. Cairn India may spend ` 13,000 crore in developing an oil and gas block in Krishna-Godavari Basin over a period of time even as it geared up to undertake drilling of 64 exploratory and appraisal wells in that block. The oil and gas major has sought permission to prepare Terms of Reference for undertaking drilling of the wells in the block- KG-OSN-2009/3 in the Bay of Bengal, according to minutes of meeting of Expert Appraisal Committee under the Ministry of Environment and Forests. Cairn India had said it declared force majeure of two of its oil and gas blocks including KG-OSN-2009/3 due to the objections raised by the Ministry of Defence for taking up exploratory works. However, the company, last year, got necessary clearance from the ministries concerned. (economictimes.indiatimes.com)

DGH for fresh approach to solve oilfield disputes

February 4, 2015. The Directorate General of Hydrocarbons (DGH) has suggested a fresh approach, based on an open mind and technical merit or overall perspective of cases, for dealing with disputes with explorers to minimize incidence of arbitration cases against the government. A strategy paper prepared by the caretaker of the country's hydrocarbons treasure suggests that the "over-cautious approach" in evaluating disputes and an overarching focus on protecting government's share rather than technical merit has resulted in a rash of arbitration cases against the government.

The principle objective behind the PSC (production sharing contract) regime is to speed up discovery of petroleum resources and exploit them for the benefit of people in accordance with the best global petroleum industry practices, the paper explains. The ministry has been ensnared in a rash of arbitrations, most notably the ones initiated by Reliance Industries, BP and BG as well as Cairn. The high-profile cases involving MNCs and claims running into several billions of dollars remain a bump in the government's efforts to improve the investment climate in exploration. Several of these arbitrations, numbering over 35, have been festering for years. The government has taken several policy steps to attract investors by making it easier for companies to do business and wants to ensure these and future efforts are not wasted by unnecessary legal disputes in future. The approach by DGH does not indicate any dilution in government's rights or revenue. Analysing the key areas of disputes, the paper suggests a more professional approach with emphasis on preventing differences from blowing up into a full-fledged legal bout. DGH suggests a layered mechanism of resolving differences with explorers, with clear-cut role, powers as well as discretion allowed to DGH or ministry officials. (timesofindia.indiatimes.com)

Transportation / Trade…………

Indian diesel cargoes head to Australia in rare move

February 10, 2015. Indian diesel cargoes are being shipped to Australia in a rare move as rising competition from new Middle East refineries has made it more difficult to land the fuel in India's core traditional markets in Europe and Africa. Diesel is typically shipped to Australia from North Asia or Singapore as freight rates for the India-Australia route can cost as much as 50 percent more, traders and shipbrokers said. Yet several vessels have been chartered on the higher-priced route since late last year, the traders and brokers said.

Chevron, for instance, has been moving 1-2 cargoes a month to Australia from private Indian refiner Reliance Industries' facility at Jamnagar port on the west coast of India, traders said. As refining capacity expands in the Middle East, India and China, imports of oil products such as diesel and gasoline into Australia have become more attractive. Australia imports about 770,000 to 875,000 tonnes of diesel a month, with the volume set to rise from mid-2015 when BP halts operations at its 102,000 barrels-per-day Bulwer Island refinery in Brisbane, Queensland. Oil giant Saudi Aramco, which has been a major term buyer of diesel from Reliance in India, reduced its import requirements for this year, one trader said. This could also be placing pressure on Reliance to explore new markets to sell excess cargoes in Australia. (in.reuters.com)

Swiss company buys diesel cargo from MRPL in rare move

February 5, 2015. Oil trading house Gunvor has bought a diesel cargo from Mangalore Refinery and Petrochemicals Ltd (MRPL) in a rare move, traders said. The Swiss-based company bought 65,000 tonnes of 500 ppm sulphur gasoil for March 1 to 3 loading from MRPL at a premium of $1.10 to $1.15 a barrel to Middle East quotes, traders said. While Gunvor has bought naphtha cargoes from MRPL, it has rarely bought gasoil from the Indian refiner. Gunvor normally buys gasoil from Russia and ships it to countries in Asia such as Vietnam, traders said. It is unclear where Gunvor was planning to ship the Indian gasoil cargo. (www.thehindubusinessline.com)

Petronet in race to build LNG terminal in Bangladesh

February 5, 2015. India's biggest gas importer Petronet LNG is one of the companies shortlisted to build a liquefied natural gas (LNG) terminal in neighbouring Bangladesh, the company said. The company selected will be responsible for sourcing of gas, building and operating of the terminal, which will have a capacity of 2.5 to 5 million tonnes per annum. (in.reuters.com)

Policy / Performance………

Rajasthan withdraws subsidy on domestic cylinders

February 10, 2015. Rajasthan government has withdrawn the subsidy of ` 25 on domestic cylinders which was extended by former Congress government, inviting a sharp reaction from the opposition party. The central subsidy will continue. The additional subsidy of ` 25 was announced by Ashok Gehlot led former Congress government in June 2011. With the government's decision, the subsidised domestic cylinder will now cost ` 420 instead of the earlier ` 395. (economictimes.indiatimes.com)

‘Heavy water likely to be used in oil exploration studies in India shortly’

February 10, 2015. Rajnish Prakash, Chairman and Chief Executive of Heavy Water Board, a unit of Department of Atomic Energy said that heavy water is likely to be used in oil exploration studies in India shortly. Heavy water is a form of water with a unique atomic structure and properties coveted for the production of nuclear power.

He said that some oil exploring companies, especially having contract with the Oil and Natural Gas Corporation (ONGC), have approached the Board in this connection. He said that heavy water is used in West Asian (Gulf) countries in oil exploration studies as it helped in making accurate analysis. In India, it is likely to be used for the same (technically called core-invasion study) shortly. Heavy water could be used in non-nuclear programmes also, he said. (www.thehindu.com)

Govt frees non-PDS kerosene from regulatory control

February 10, 2015. With a view to ease the availability of market-priced kerosene, the government has freed sale of non-PDS kerosene from regulatory control. The government has amended the Kerosene (Restriction on Use and Fixation of Ceiling Price) Order, 1993, to free all activities of storage, transportation and sale of white kerosene (market-priced kerosene or non-PDS kerosene) from regulatory control. Subsidised kerosene sold through public distribution system (PDS) is blue in colour while the market priced fuel is colourless. While PDS kerosene is priced at ` 15.14 per litre, the non-subsidised or market-priced fuel comes for ` 27.68 a litre. (economictimes.indiatimes.com)

Oil ministry seeks more share in extended production contract

February 10, 2015. The oil ministry proposes to raise the government's share by 5% and insist on explorers accepting Delhi as the seat of any future arbitration, irrespective of any other provision in the agreement, for granting extension to production sharing contracts for small and marginal fields. Government said the extension policy being worked out in the ministry does not envisage any concession on royalty and cess to explorers but lays down time limits for the ministry and its technical arm, Directorate General of Hydrocarbons (DGH), to process and decide applications for extensions. Under the proposed policy, explorers would have to continue to pay royalty and cess at normal rate.

At present, explorers have to pay 20% royalty on crude from onland fields, 10% from offshore blocks and a uniform 10% on gas. Cess is to be paid at ` 4,500 per tonne. The government's share would be calculated with a floor of 50% for small fields and 60% for medium-sized fields. The policy, once approved by the government, would cover 28 fields with an estimated reserve of 43 million tonnes of oil and oil-equivalent gas. The extension is being proposed to be granted for 10 years or the life of a field, whichever is earlier. The explorers would be asked for a bank guarantee equal to 10% of the total estimated annual expenditure in respect of the yearly work programme approved by the respective oversight panels. Displaying a pragmatic approach by the ministry, the policy blueprint accepts that it would make more sense to extend the production sharing contracts since the size of these fields would not justify the extra effort needed to put them to bidding.

Besides, the blueprint takes into account the fact that existing explorers would be in a better position than a newcomer to extract the remaining reserves since they would have the best knowledge about the fields and their geology. Explorers seeking extension of their contracts would be allowed to submit their application at least two years before the contract expires. The policy proposes a time limit of eight months for the DGH to make its recommendations and four months for the ministry to take a final call with the approval of the minister. (economictimes.indiatimes.com)

PAHAL Yojana will end black marketing in LPG: PM Modi

February 5, 2015. Prime Minister (PM) Narendra Modi said direct cash transfer schemes like the "PAHAL Yojana" will bring an end to black-marketing and subsidies will reach people more effectively. Expressing satisfaction at the registration of 10 crore citizens as part of the "PAHAL Yojana", the prime minister said the scheme has a major role in nation-building. Modi reviewed the progress of the direct benefit transfer of LPG (DBTL) scheme - Pratyaksh Hanstantarit Labh (PAHAL) - for paying consumers subsidy on cooking gas (LPG) directly into their bank accounts. The scheme aims to reduce diversion and eliminate duplicate or bogus LPG connections.

The Prime Minister has been actively batting for the PAHAL Yojana which he earlier described as the next big scheme which will substantially benefit the economy after the Jan Dhan financial inclusion programme. The direct benefit transfer scheme was re-launched in 54 districts 15 November, 2014, and is envisaged to cover over 15.3 crore consumers across 676 districts of the country. (www.firstpost.com)

[NATIONAL: POWER]

Generation……………

Ashok lays stone for hydel project

February 8, 2015. Union Civil Aviation Minister P. Ashok Gajapathi Raju laid the foundation stone for a 12 MW hydel power project under the private sector at Sikhaparuva, a tribal village near Thonam in Salur mandal. Anticipating trouble from CPI leaders and tribal people, police, as a preventive measure, arrested four CPI leaders S. Ramachandra Rao, G. Ramu, Pydi Chitti, and A. Ananda Rao.

Ashok emphasised the need to tap natural resources such as solar and wind energy for power generation and check transmission losses. On opposition from tribals, the Minister said there would be no hurdles in the execution of the project. M/s Mohanarupa Power Projects (P) Limited, Vijayawada, is executing the project at a cost of ` 112 crore. (www.thehindu.com)

BHEL commissions 270 MW thermal unit in Maharashtra

February 5, 2015. BHEL said it has commissioned a 270 MW unit of a coal-based thermal power plant in Maharashtra. The third unit was commissioned at Rattan India Power Limited's (formerly Indiabulls Power) upcoming thermal power project located at Amravati in Maharashtra, BHEL said. This is the third 270 MW unit commissioned by BHEL in Phase-1 of the project. The project is being executed in two phases, each of 1,350 MW. (economictimes.indiatimes.com)

CIL needs to produce 120 mn tonnes more to meet target

February 4, 2015. Coal India Ltd (CIL) needs to produce and sell around 120 million tonnes of coal in February and March to meet its targets for the year. But that's unlikely going by the production and sales trend thus far in FY15. The company has missed production and sales targets every month from May 2014 to January 2015. As a result, the backlog has touched 118 million tonnes for production and 121 million tonnes for sales.

The highest volume of coal produced in any single month was December 2014 — 47 million tonnes. The highest sales was in January — 44 million tonnes. To meet targets, CIL needs to produce and sell at least 60 million tonnes each in February and March. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Power T&D losses may come down to 18 percent by end of 13th plan: CEA

February 10, 2015. The power transmission and distribution (T&D) losses are likely to come down to 18 per cent by the end of 13th Plan period from the current level of 23 per cent, the Central Electricity Authority (CEA) said. CEA said that T&D losses is still very high when compared to international standards, adding that by the end of the current plan period it is expected to come down hardly by one per cent to 22 per cent. The government had said that power sector is set for $250 billion investments across different segments, including transmission and distribution. Power and Coal Minister Piyush Goyal had said renewables is set to get $100 billion, while transmission and distribution segment is likely to attract $50 billion. Electric power transmission and distribution losses include losses in transmission between sources of supply and points of distribution including distribution to consumers. (economictimes.indiatimes.com)

Distribution franchisees mushroom even as power discoms up base rate

February 9, 2015. In a sector fraught with challenges, if margins are to be determined by the pace of loss reduction, the business model can hardly be termed prudent. But this is exactly what power distribution franchisees are doing - some of them in more cities than one. While a new set of players - India Power, Crompton Greaves, Torrent and Essel Utilities - have taken the job of distribution franchisees with much enthusiasm, industry players advise caution over distribution firms' modified bidding norms. According to India Power Corporation, states have increased the base rate for companies to bid for distribution franchise contracts. India Power is the distribution franchisee for Gaya in Bihar. It received the rights for the city after Essel Utilities did so for Muzaffarpur and SPML Infra for Bhagalpur, for 15-year contract periods. The distribution-franchise model was first tried in December 2006, when Maharashtra State Electricity Distribution Company Ltd (MSEDCL) gave Torrent Power the rights for the Bhiwandi circle. The textile hub, where 60 per cent of the demand comes from the power loom sector, has a customer base of about 200,000, spread over 721 square kilometres. Eight years on, Bhiwandi is not alone. There are more than a dozen cities, including Nagpur in Maharashtra; Sagar, Gwalior and Ujjain in Madhya Pradesh; Agra in Uttar Pradesh; and Muzaffarpur, Gaya and Bhagalpur in Bihar; that have adopted the distribution-franchise model. State government-owned distribution companies adopt this model in areas where losses are high. Under Section 14 of Electricity Act, a power distribution company can appoint another entity to supply power in a particular area within its distribution territory without the requirement of a separate distribution licence. (www.business-standard.com)

Fuji Electric to set up smart energy grid near Andhra’s new capital

February 6, 2015. Japanese giant Fuji Electric has agreed to set up a smart grid near Andhra Pradesh's new capital city to help the state government to monitor the energy consumption and forecast the demand, aimed at developing an efficient energy management system. Fuji had already committed to conduct a feasibility study on smart energy grid for Panipat in Haryana. The Japanese firm, which will set up the smart energy grid on a pilot basis near Vijayawada as a part of cooperation between the two governments, has recently conducted a feasibility study. Chief Minister Chandrababu Naidu asked the Japanese company representatives to help the state with technologies to bring down the transmission and commercial losses to 6% from the existing 12.9%. (economictimes.indiatimes.com)

Delhi power rate cut a poll issue but falters on economics

February 5, 2015. The Aam Aadmi Party, Bharatiya Janata Party and Congress are promising to halve Delhi's power rate if elected to office but any lower than ` 2.8 a unit could play havoc with the state's budget. The combined financial loss of Delhi's three power distribution companies was ` 22,000 crore in 2012-13 when the state government provided a subsidy of ` 118 crore to them. If rates are halved, the subsidy would need to be doubled.

Delhi's power supply business was handed over to private companies in 2000, when technical and commercial losses were 47 per cent. The three distribution companies - Tata Power Delhi Distribution Ltd (TPDDL) and BSES Rajdhani Private Limited (BRPL) and BSES Yamuna Power Limited (BYPL) - have brought these losses down to 11 per cent in the past 10 years, leading to annual savings of ` 13,000 crore. The companies said Delhi's power customers had saved ` 45,000 crore in 12 years because of this. The energy charge levied by the power distribution companies increased to ` 3 a unit in from ` 1.8 in 2002, but power purchase costs tripled to ` 5.6 per unit during the same period. The additional revenue which cannot be passed to the consumers has created over-dues of ` 30,000 crore for the distribution companies, as they bear the cost. (www.business-standard.com)

Adani Power, GMR Energy bid for all coal blocks reserved for power sector

February 4, 2015. Adani Power and GMR Energy bid for all six coal blocks reserved for the power sector, while Essar Power is eyeing four of such coal mines. Jindal Power submitted bids for three of the six coalmines, while Reliance Power is in race for two coal blocks. Adani Power is eyeing all blocks reserved for power sector. West Bengal Power Development Corporation Ltd (WBPDCL) is the only government company that took part in coal auction, while the government is in the process of allotting blocks to public companies. Tokisud coal block in Jharkhand that earlier belonged to GVK Power attracted most number of bids among the six coal blocks earmarked for power plants. The block received bids from 12 firms including Essar Power, DB Power, Dhariwal Infrastructure, India Power Corp, Lanco Infratech and WBPDCL. The block with 2.32 million tonnes of annual coal production capacity has rail connectivity within 2.5 km distance.

Eleven companies bid for Amelia North coal block in Madhya Pradesh that earlier belonged to Madhya Pradesh State Mining Corp. The bidders include Essar Power, GVK Power and Lanco Infratech. The block has reserves of 2.8 million tonnes per annum. Gare Palma IV/2 and IV/3 block in Chhattisgarh that earlier belonged to Jindal Power Ltd is also being eyed by about 11 companies including GMR Energy, Reliance Power, DB Power and KSK Energy. Jindal Power submitted two bids for the block that has a capacity to produce 6.25 million tonnes per annum but does not have a close rail link as the nearest rail head is at a distance of 55 km.

Six companies including Sesa Sterlite, Essar Power, RKM Powergen and OPG Powergenare in race for Talabira-I coal block in Odisha that was earlier owned by Hindalco. The block has a capacity to produce three million tonnes per annum. In all coal blocks reserved for power companies attracted 54 bids while those earmarked for steel and cement sectors received 124 bids. The coal ministry opened technical bids for 23 coal blocks of which six were meant for power plants while the balance 17 for steel and cement projects. (economictimes.indiatimes.com)

CERC proposes round the clock trading on power exchanges

February 4, 2015. The Central Electricity Regulatory Authority (CERC) proposes to start round the clock trading in power exchange platforms. As per the proposal, the trading of day ahead contingency/intraday contracts be extended round the clock (24 X7) on the power exchange platform. While the need and manner of introduction of ancillary market is being examined by CERC, standard contracts need to be available on power exchanges for the period between the existing trading auction timelines and the actual delivery of power.

In order to provide grid connected entities with measures to respond optimally and in line with trading mechanism present internationally, extended trading session is necessary. Thus this proposal aims at bringing the trading window as close as possible to the actual delivery and operates market on 24x7 bases. Especially for a product like electricity, an extended trading session for day ahead contingency/intraday trades is necessary to ensure round the clock power supply for the people. The salient features of this will be that the existing products for day ahead contingency and intraday markets would continue to be operated by the exchanges. The timelines for the products are extended for both exchanges so that trading window is open round the clock. Besides, contingency market to be operated for the entire day after completion of day ahead market. The contracts will be on a rolling basis and as close to real time as possible and the price discovery mechanism remains exactly same as those for the respective products presently.

The features of the evening market will be that price discovery remains same as that of morning day ahead market but the process is totally independent of the morning market and participants bid again in Day-Ahead auction or market refers to a process where trading takes place on one day for the delivery of electricity the next day. Market members submit their orders electronically, after which supply and demand are compared and the market price is calculated for each hour of the following day. (www.business-standard.com)

Policy / Performance………….

Power projects to get coal from CIL till auctions are over

February 10, 2015. All power projects receiving coal from Coal India Ltd (CIL) on an ad-hoc basis which was slated to stop after March 2015, will keep receiving coal till coal block e-auctions are complete. This assumes importance since completion of e-auction by March 2015 now seems uncertain as a clutch of former block allocates have filed petitions in the court, leading to delays in completion of coal block e-auctions. Coal was being supplied to power projects on the assumption that they would not require any coal from Coal India going forward because blocks allotted to them would start producing in the future. However, the Supreme Court declared all such coal block allotments as illegal and the ad-hoc supply of coal was to stop after March 2015.

Termed tapering linkages, such coal supply commitments assume allotted coal blocks will slowly increase production and hence requirement of coal supplied by CIL will reduce. Under this category of supply commitment, supplies are to stop on the fourth years with reduced volumes being sold to the power project every year. In the absence of any block and a reduced supply from Coal India, these power projects faced an uncertain fate.

The government has recently decided that CIL will keep supplying coal to them the volume for which would be maintained at this year's level till e-auctions are complete. Coal India will continue supplying coal to all power projects which had their blocks de-allocated following a Supreme Court order that termed them illegal. (economictimes.indiatimes.com)

CIL likely to scrap Mozambique production project on poor deposits

February 9, 2015. Coal India Ltd (CIL) is likely to scrap its maiden overseas coal production project as the deposits in the acquired blocks are "not good enough to be called coal," the company said. The company said the coal in the two blocks acquired in Mozambique is unfit for consumption by even Indian power plants, which can use the lowest variety of coal. CIL has already spent close to ` 500 crore in exploring reserves in the two blocks.

CIL won a five-year licence for exploration and development of A1 and A2 blocks, acquired about six years ago, in Mozambique's north-western province of Tete. The blocks were un-explored and it was upon CIL to explore and ascertain the quality of the coal. Following the acquisition of the blocks, CIL floated Coal India Africana in Mozambique, the company that is supposed to execute exploration and production.

CIL was given to understand that 20% of the deposits in these blocks are expected to be of superior variety, good enough to be used in steel making, while the remaining were expected to be thermal coal, which could be used as fuel in power plants. It took CIL almost two years to explore the entire area. Sample coal was sent to India for analyses. After extensive exploration, the quality of the reserve was found to be extremely inferior.

CIL had earlier targeted production from the block by 2014 but delays in securing the exploration licence held up the process. It also had to renew the licence once as a result of the delay. CIL planned to bring the mined coal to India to meet the nation's rising demand for thermal and coking coal. The company lost about a year in appointing an explorer for the blocks. It had to scrap tenders twice due to technical reasons, leading to delays in launching exploration. (economictimes.indiatimes.com)

Coal Ministry receives 69 applications for 36 coal blocks from PSUs

February 9, 2015. The Coal Ministry received a total 69 applications from various public sector undertakings (PSUs) like NTPC, SAIL, Nalco and NLC for allocation of 36 coal blocks, which would be given to state-run companies only. The maximum number of applications (9) were received for Gare Palma Sector II coal mine in Chhattisgarh.

As part of the allotment process, online applications and offline supporting documents were opened in the presence of applicants. The online applications were decrypted and opened electronically in the presence of representatives of applicants. The applications will now be evaluated by a technical evaluation committee. PSUs such as NTPC and the Singareni Collieries Company Ltd (SCCL) have applied for for Gare Palma Sector II coal mine in Chhattisgarh.

Madhya Pradesh Power Generating Co Ltd, Tamil Nadu Generation and Distribution Corp Ltd, Gujarat State Electricity Corp Ltd, Chhattisgarh State Power Generation Co Ltd, Uttar Pradesh Rajya Vidyut Utpadan Nigam Ltd, Maharashtra State Power Generation Co Ltd, Andhra Pradesh Power Generation Corp Ltd are among other PSUs which have applied for the block. The coal block was earlier alloted to Maharashtra State Power Generation Co and Tamil Nadu State Electricity Board. Gare Palma Sector III coal block in Chhattisgarh also received six applications from NTPC, Chhattisgarh State Power Generation Co Ltd, Telangana State Power Generation Corporation, and others. Utkal D and Utkal E coal blocks in Odisha together received six applications from companies like NTPC, Nalco and NLC Tamilnadu Power Ltd. However, no PSU showed interest in Bajora North coal mine in West Bengal which was earlier alloted to Damodar Valley Corporation. Steel Authority of India Ltd (SAIL) applied for Sitanala coal mine in Jharkhandwhich is earmarked for steel sector.

The allotment process for 36 coal mines to government companies started in January, with the release of Notice Inviting Applications (NIA). Of these coal blocks, one mine will be given to the steel sector while the rest will be given to the power sector. The government had said that it will be able to complete execution of allotment agreement by the end of February. The government is also putting on sale 46 coal blocks to be auctioned to private companies. (economictimes.indiatimes.com)

Budget 2015: Interesting proposals for power sector expected, says Goyal

February 9, 2015. Stating that "some interesting" proposals for infrastructure development can be expected in the Union Budget, Coal and power Minister Piyush Goyal hoped for an innovative financing model to help revive power sector and investments. The General Budget will be presented on February 28 in Parliament.

On the Electricity amendment Bill, Goyal said it had already been placed before the Lok Sabha with "important elements" -- strengthening the regulatory mechanism and giving a great thrust to the renewable energy, both in terms of renewable power obligation for consumer as well as the renewable generation obligation. This type of competition in the power distribution would be a game changer in India and would give consumers sustainable affordable power at more reasonable prices besides bringing in better service standards and quality of power, Goyal said. (economictimes.indiatimes.com)

Centre clarifies on nuclear deal, caps compensation at ₹ 21.6 bn

February 8, 2015. The maximum compensation that nuclear suppliers will have to pay in case of a mishap will be pegged at ₹ 2,160 crore. The Ministry of External Affairs points out that the Civil Liability for Nuclear Damage Act of 2010 (CLND) presently prescribes that the maximum amount of liability in respect of each nuclear incident shall be the rupee equivalent of 300 million Special Drawing Rights (SDRs).

The Ministry said that there is no proposal to amend the CLND Act 2010 or the Rules of 2011. Pointing out that the operator’s maximum liability shall be ₹1,500 crore. In case the total liability exceeds ₹1,500 crore, this gap of ₹1,110 crore will be bridged by the Central Government. Beyond ₹2,610 crore, India will be able to access international funds under the Convention on Supplementary Compensation for Nuclear Damage (CSC) once it is a party to that Convention. The CSC was set up to establish a worldwide liability regime and to increase the amount of compensation available to victims of nuclear accidents. (www.thehindubusinessline.com)

Odisha taking steps to expedite coal block development: Coal Secretary

February 7, 2015. The Odisha government has taken steps to expedite activities for development of coal blocks in the state, Union Coal Secretary Anil Swarup said. Milestone of the work along with timeline has been fixed against each coal mine, Swarup said that it has been targeted to increase the total coal production from present level of 500 million tons to 1000 million tons. Accordingly, he said, it has been targeted to enhance the coal production of Mahanadi Coalfields Limited (MCL) from present level of 125 million tons to 250 million tons by 2020.

He further said that it has been decided to form two Special Purpose Vehicles (SPVs) for laying of railway lines for evacuation of coal from Talcher Coal Block and Ib Valley Coal Block. The state government has already formed one SPV for construction of railway lines in Talcher Coal Block area. Swarup said, such efforts of the state government will set an example for other States. It has been decided in the meeting that SPVs will be formed involving MCL, Indian Railways and the Government of Odisha. (economictimes.indiatimes.com)

Delhi Post Poll plan: Discoms biding time to seek fuel surcharge

February 7, 2015. Political parties may be promising lower electricity tariff to voters ahead of Delhi assembly polls, but power companies have their own agenda. The discoms are just waiting for election to be over and the model code of conduct to expire so that they can approach Delhi Electricity Regulatory Commission (DERC) to reinstate power purchase adjustment charges (PPAC). Once results are announced, discoms say they would seek availing of the fuel surcharge withdrawn in November as the city has been facing massive power cuts. Discoms claimed that three months without PPAC was a political move that has worsened their financial situation. DERC would also admit tariff petitions submitted by discoms in December last year.

The three discoms have sought tariff hikes up to 20% for fiscal 2015-16. However, DERC is known to take its own time in announcing tariffs which generally come in June July. On November 14 last year, DERC withdrew the PPAC order it passed just a day earlier. While the regulator said it had withdrawn the order till the time it received complete information from various generators on fuel pricing, discoms alleged the move was prompted by political pressure.

The PPAC order that was withdrawn had announced a 2.5 per cent hike for Tata Power consumers in north and northwest Delhi, 4.5 per cent hike for BRPL's south and west Delhi consumers and a 7 per cent hike for BYPL consumers in east and central Delhi. The PPAC hike would have been applicable till February 15, 2015. DERC said it would not pass the order till discoms provided all breakups of fuel costs from NTPC and other generating companies. Discoms, however, alleged that NTPC was not cooperating in supplying information. (economictimes.indiatimes.com)

CCI clears JSW Energy - Jaiprakash Hydro deal

February 6, 2015. The Competition Commission of India (CCI) has approved JSW Energy’s proposed ` 9,700 crore acquisitions of two hydro—electric projects from Jaiprakash Power Ventures. Under the proposed deal, JSW Energy would acquire —— 300 MW Baspa II hydroelectric project and 1,091 MW Karcham Wangtoo hydro—electric project —— located in Himachal Pradesh from Jaiprakash Power Ventures.

The deal involves transfer of the power projects to Himachal Baspa Power Company by Jaiprakash Power. Further, JSW Energy would acquire 100 per cent stake in Himachal Baspa from Jaiprakash Power and Jaypee Group Employees Welfare Trust. The deal was entered between the parties in November, last year, following which they had filed for CCI approval in December. (www.thehindubusinessline.com)

‘Karnataka has taken steps to reduce power cuts’

February 6, 2015. Karnataka Power Minister D K Shivakumar said that the state government has taken steps to ensure there is no load-shedding during exam times so that students do not suffer. The state is facing a shortage of 1,400 MW, which will reduced to 800 MW by April. Shivakumar said situation is difficult till June but would be managed and steps, including ensuring efficient working of power generation units, have been taken in this regard.

Farmers in rural areas have been requested to use the irrigation pump sets when there was less pressure, he said. Shivakumar gave details about the steps being taken by the government to improve power generation in the state and become self reliant, which include 700 MW BTPS Unit 3 and 1600 MW Yermarus project among others. (www.business-standard.com)

Maharashtra govt to set up committees to check power theft

February 6, 2015. Maharashtra government will set up review and vigilance committees at district and tehsil levels to stop power thefts and provide good services to consumers. At the district level, the committee will be headed by guardian minister and will also include superintendent engineer and district collector.

The committee will also look into complaints of power deficit and T&D losses as well as monitor basic infrastructure of setting up the power projects. It will look into whether the district is getting assured electricity supply and also review applications for agriculture pump connections. The committee will help Mahavitaran to recover electricity bills and stop power thefts, he said. (www.business-standard.com)

Uttarakhand notifies policy on small hydel units

February 5, 2015. The Uttarakhand government has notified a policy for micro and mini hydro power projects, in which it has involved local panchayats with a slew of incentives. The state has an estimated potential of 3,000 MW, largely untapped as far as micro and mini hydel projects are concerned.

Only 170 MW of small hydro projects have been installed. Under the new policy, the first priority will be given to gram panchayat within whose area the complete proposed project site is located, the Uttarakhand Energy Development Agency (UREDA). For the development of the hydel projects, the government has allowed the panchayats to take the help of companies by floating special purpose vehicles (SPVs) through bidding process. The bidder who is willing to offer the maximum percentage of revenue share to the eligible panchayat would be chosen as SPV partner to execute the project. The policy has been broadly classified into two parts - one deals with the hydel projects having capacity up to 100 kilowatts (KW) and another deals with the projects having capacity above 100 KW and up to two MW.

Among the various incentives, the government is offering developer to take the benefits of the central financial assistance according to the standing guidelines of the Union ministry of new and renewable energy. The developers could also avail the social venture capital fund. No royalty will be charged on these projects.

The government would also not levy any entry tax on power generation/transmission equipment and various building materials used for the projects. Significantly, the micro and mini hydro projects in the state would be treated as industry and all the benefits declared by the state government from time to time will be applicable to these projects. (www.business-standard.com)

Power Ministry to issue Cabinet note on tariff policy changes

February 5, 2015. The Power Ministry will come out with a Cabinet note on changes in Tariff Policy for enabling greater competition in the sector. After receiving responses from various ministries concerned, the Power Ministry will send the note on changes in Tariff Policy to the Cabinet for its approval. As part of changes in the Tariff Policy, the Power Ministry has sought extension of Section 62, under which the electricity regulatory commissions have been empowered to determine tariffs, beyond financial year 2017.

Keeping the hydro projects also under this section for the continuation of cost plus tariff structure is also a part of proposed changes. Under the cost plus tariff structure, PSUs like NTPC and NHPC charge a lump sum fee as well as a per-unit charge from distribution companies. Another proposed change is having a formula which would ensure that variation in fuel and power purchase cost is recovered by the power generating firms. (www.firstpost.com)

` 15 bn relief fund in place for nuclear disaster victims: DAE

February 4, 2015. The Variable Energy Cyclotron Centre (VECC) Kolkata said that 3 to 4% of total electricity power in India now come from nuclear power plants and a relief fund is in place for compensation in case of any nuclear disaster.

Department of Atomic Energy (DAE) has created a relief fund of ` 1500 crore after the Bhopal gas disaster of 1984 to give immediate compensation to the victims of atomic power plant accident. DAE under the government of India was established in 1954 and it is celebrating its Diamond Jubilee Year this year. (www.newkerala.com)

Scheme to swap coal supplies with nearest fuel source gets govt nod

February 4, 2015. The government has approved a scheme to swap coal supplies between various power plants with nearest source of the fuel to save costs and de-congest railway network. The scheme, envisaged to save up to ` 6,000 crore transportation costs, has been started with 19 power plants of public companies like NTPC, Damodar Valley Corp (DVC) and electricity generation utilities of states like Haryana, Rajasthan and Punjab. The coal swapping scheme is envisaged to be implemented in three phases.

The coal ministry has directed Coal India Ltd (CIL) and Singareni Collieries Company Ltd to immediately implement the first stage consisting of swapping in 19 power plants that would result in ` 1,000 crore logistic saving. These projects belong to state entities of Haryana, Rajasthan, Gujarat, Maharashtra, Telengana, besides projects of NTPC and DVC. The second stage consists of swaps between utilities of six states — Uttar Pradesh, Haryana, Rajasthan, Gujarat, Tamil Nadu, Maharashtra and Punjab — and power stations of NTPC and DVC. (economictimes.indiatimes.com)

Kerala turning increasingly dependent on other States for power: Aryadan

February 4, 2015. Electricity Minister Aryadan Mohammed has said that Kerala will have to increasingly purchase power from other States if it does not take energy conservation seriously. He was addressing a meeting to inaugurate the third phase of the 400 kV sub-station at Madakkathara.

The scheme to provide free power connection to those in the BPL category and those in the APL category who have houses below 1,000 sq ft had been extended till April 31, he said. The third phase has been completed by raising the capacity of the sub-station from 1,050 MVA to 1,365 MVA. The work has been done at a cost of ` 18.65 crore. The project benefits 54 lakh consumers in Thrissur, Palakkad, Malappuram, Kozhikode, Wayanad, Kannur, and Kasaragod districts. (www.thehindu.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

China finds natural gas reserve in disputed South China Sea

February 10, 2015. China announced the discovery of a huge gas field in the politically charged South China Sea that could yield over 100 billion cubic metres of natural gas, raising its stakes in the waters claimed by several South East Asian nations. The Lingshui 17—2, approved as a large scale gas field by Ministry of Land and Resource, was discovered 150 kilometres south of China’s southernmost island of Hainan. China National Offshore Oil Corporation (CNOOC) said Lingshui 17—2’s average operational depth is 1,500 metres below the sea surface. The company’s deepwater drilling rig CNOOC 981 discovered Lingshui 17—2, the country’s first self—support deepwater gas field, in September 2014. CNOOC said the approved gas reserves of Lingshui 17—2 will help the corporation build a gas trunk line to connect other gas fields in the South China Sea (SCS), so as to meet the huge gas demand of southern provinces, Hong Kong and Macao. The field, however, could meet only about six to seven months of Chinese gas supply currently, experts say. Observers say the discovery may raise further tensions in the SCS, one of the world’s busiest shipping routes but dominated by overlapping claims by several nations including Malaysia, Vietnam, Taiwan, the Philippines, Brunei and China, which virtually claims all of the sea. China has objected to India’s ONGC accepting a Vietnamese invite to take up oil exploration in the SCS. (www.thehindubusinessline.com)

Argentina says 2014 oil, gas output fell despite increase by YPF

February 9, 2015. Argentine oil output fell 1.4 percent last year versus 2013 to 30.88 million cubic meters while the country's natural gas production edged 0.5 percent lower to 41.48 billion cubic meters, according to data provided by the Energy Secretariat. A fall in production by private companies during 2014 outweighed increases reported by state-controlled YPF, the country's top energy company, according to data. YPF crude production increased 8.85 percent last year versus 2013 while its gas output shot 12.5 percent higher, the data said. Argentina is running an energy deficit of about $7 billion per year, which the government wants to close by attracting investment to the vast but mostly untapped Vaca Muerta shale oil and gas field in Patagonia. (www.rigzone.com)

Oil majors fail to find reserves to counter falling output

February 5, 2015. Big oil companies had a poor record of finding and producing oil and gas last year, according to figures out in the past week - and big cuts in spending in response to falling crude prices could undermine their plans to turn that around. Four of the world's six biggest oil firms by market value - Royal Dutch Shell, Chevron, BP and ConocoPhillips - released provisional figures showing together they replaced only two-thirds of the hydrocarbons they extracted in 2014 with new reserves. Combined, those four and industry leader Exxon Mobil posted an average drop in oil and gas production of 3.25 percent last year. All predict their output will increase and new reserves will be added in coming years. But the 2014 results echo longer-term trends. Over the past decade, the biggest Western oil companies have seen reserves growth stall, production drop 15 percent and profits fall by almost a fifth - even as oil prices almost doubled, an analysis of corporate filings shows. Analysts and industry executives have blamed the sector's anaemic performance in that period, in part, on companies' approach to spending on new fields and infrastructure, tending to ramp it up when oil prices rise and cut when prices plummet, such as in the late 1990s and after the 2008 financial crisis. The latest collapse has seen prices halve since June. In recent months, the biggest oil groups on both sides of the Atlantic have announced sharp cuts in capital expenditure (capex) out as far as 2017, as they seek to preserve cash to maintain dividends. Investors have largely welcomed the focus on dividends. But some say the cuts could come back to bite the industry. The ability of oil companies to replace reserves has not been as much of a concern for some executives and investors in recent years due to the shale oil boom. But the high cost of extracting shale oil makes doing so profitably a challenge where prices are low - making traditional and less expensive reserves more relevant in a downturn. BP and Chevron have announced around 13 percent cuts in capex for 2015, while ConocoPhillips upped its planned reductions in spending for 2015 to 33 percent. Shell and Exxon have not issued budget plans yet. (www.reuters.com)

CNOOC joins peers with 35 percent cut in capital spending

February 4, 2015. China National Offshore Oil Corp. (CNOOC) China’s main offshore oil and gas producer, intends to slash its capital expenditure by up to 35% in 2015 – becoming the latest international energy producer to rein in spending as a response to the plunge in crude prices. The company’s state-owned listed unit said that it would cut its capital budget for the first time since 2010, to RMB 70-80 billion ($11.21-12.8 billion) – a drop of 26-35% over last year’s estimated spend of RMB 108.3 billion. Despite the reduction, the Hong Kong-listed firm said it was targeting 10-15% growth in production to 475-495 million barrels of oil equivalent (MMboe) in 2015 – up from 432 MMboe in 2014. CNOOC’s spending rollback goes deeper than those announced by some Western peers in recent days. On the same day, BP and Gazprom said they would slash investment by around 20%, while Shell aims to trim a relatively modest $15 billion over the next three years. The spending cut – the first to be announced by any of China’s three NOCs – underscores how the Chinese oil groups are embarking on a path of quality over quantity. For the first time, CNOOC gave production targets for coming years rather than an average output growth range. CNOOC will bring seven new projects onstream this year – including the Jinzhou 9-3 field, which has already started production, and the Dongfang 1-1 gas field. The bulk of CNOOC’s 432 MMboe output in 2014 – 68% – came from China, while 32% was from overseas. The company expects this ratio to remain roughly the same up to 2017. CNOOC has made a number of gas finds in the South China Sea in recent months. It independently made a deepwater gas discovery in the northern part of the South China Sea. (interfaxenergy.com)

Downstream…………

Cameroon plans to raise $1.5 bn for refinery, other projects

February 9, 2015. Cameroon's finance ministry will seek to raise $1.5 billion from banks to refinance the state refinery and fund other development projects, according to two presidential decrees. The decrees, signed by President Paul Biya, authorise the ministry to sign an agreement on fund-raising with Standard Chartered and Societe Generale. Other projects for construction, infrastructure and agriculture are also covered by the decrees. The central African country has been seeking to revamp its 45,000 barrel per day Sonara oil refinery for years. But falling oil prices have cut available spending, prompting the government to seek other forms financing. In another decree signed, Biya authorised the government to triple its debt issuance plans in 2015. (www.reuters.com)

Transportation / Trade……….

Russia and Turkey agree on Turkish Stream onshore route