-

CENTRES

Progammes & Centres

Location

[Energy Forecasts: More than what meets the Eye?]

“The objective of forecasts, especially from Western funded research bodies such as the IIASA, the International Energy Agency (IEA), the energy think tank for OECD countries and Intergovernmental Panel on Climate Change (IPCC) by the UN is not that of being accurate but that of shaping or colonising the future in which the West comes out on top. The World Energy Outlook brought out annually by the IEA routinely predicts a supply crunch in oil followed by a dramatic increase in the price of oil…”

Energy News

[GOOD]

ATF costs less than diesel because it is influenced by the global market while diesel is not!

The persisting need for PPAs shows that the Indian market for power is not one of unlimited growth in demand!

[UGLY]

Investor commitments for 130 GW of solar power is good for records but bad for balance sheets!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Energy Forecasts: More than what meets the Eye?

· One Billion Tonne per annum Coal Production Conundrum

ANALYSIS / ISSUES……………

· The German Energiewende turns around Policy Framework (Part II)

DATA INSIGHT………………

· Capacity Additions- Targets & Achievements: Eleventh and Twelfth Plan

[NATIONAL: OIL & GAS]

Upstream…………………………

· BP writes off $830 mn investment in KG-D6 block

· Videocon says consortium discovers new oil in Brazil block

· ONGC arrests decline in crude oil production: Chairman

· ONGC says natural gas output to jump 81 percent by 2019

· RIL, BP to invest about ` 60 bn to improve gas recovery

Downstream……………………………

· IOC to invest ` 53 bn in LPG import facility

· MRPL buys Iraqi Basra oil to replace Iran oil

Transportation / Trade………………

· Transporter's strike likely to affect LPG supply: IOC

· Unipec buys rare gasoil cargo from India

· GAIL converting LPG recovery plant to supply feed stock for the petrochemical unit of BCPL

· RIL and Essar Oil compete with state companies to sell diesel to Railways

Policy / Performance…………………

· Petrol price cut by ` 2.42 a litre; diesel by ` 2.25 per litre

· Oil Ministry wants to recoup KG-D6 profit share from Panna fields

· ATF price cut by 11.3 percent, to cost less than diesel

· India to commission 5 mn tonnes underground oil storages by October

· India should seize weak oil price to woo experts: Sesa Sterlite

· Clarity on subsidy sharing soon: Oil Minister

· Over 9.35 crore consumers sign up for LPG cash-subsidy scheme

[NATIONAL: POWER]

Generation………………

· RattanIndia Power commissions 270 MW unit 3 of Amravati plant

· ONGC starts supplying gas to Tripura power project

· BHEL commissions 600 MW thermal unit in Odisha

Transmission / Distribution / Trade……

· Adani Power to bid for all six coal blocks reserved for the power sector

· Alstom commissions Rajasthan's first 765 kv substation

· Punjab takes steps to check energy theft

· India, Bhutan, Nepal, Bangladesh explore scope for power trade

· CCI rejects complaint against Tata Power

· Absence of PPAs with state utilities to hit companies like JSPL, GMR and Lanco

Policy / Performance…………………

· GVK Power files petition in Delhi HC challenging mine auction

· Power tariff hike imminent in Andhra Pradesh

· Telangana CM writes to PM Modi seeking more power and coal blocks

· Oil ministry proposes to bring gas-based power plants under price pooling scheme

· CIL January output at 46.6 mn tonnes, misses target by 7 percent

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· CNOOC flows first oil at Jinzhou 9-3 field in north Liaodong Bay off China

· No hope of $100 oil for a ‘long time’: BP Chief

· Petrobras finds oil at third extension well in Sergipe Basin off Brazil

· Shell plans to start North Sea Brent platform decommissioning

· Indonesia plans to produce 825,000 bopd in 2015

· Obama to oil industry: Drill there, not here

Downstream……………………

· Chevron to close South African oil refinery for maintenance

· Oman’s Orpic plans IPO no earlier than 2017 amid market turmoil

· Yasref refinery in Saudi Arabia to load 2nd diesel cargo

Transportation / Trade…………

· US oil railcar market collapses as foreign crude makes comeback

· Tohoku Electric's LNG purchase sets new Asian spot price level

· Myanmar opens deep sea port for Chinese oil pipeline

· Kinder eyes pipeline to export ultra light oil from west

Policy / Performance………………

· Total to relinquish Papua exploration block: Indonesia's energy regulator

· Poland will continue to explore for shale gas: PM Kopacz

· Iraq oilfield output suspended after IS fighting: Oil Minister

· OPEC delegates cautious over oil price rebound

· Is there money to be made in oil? New grads don't think so

· Oil will recover once producers quit spending: Hamm

· Oil’s slide triggers LNG drop as Indian demand seen rising

[INTERNATIONAL: POWER]

Generation…………………

· South Hook CHP says plans for new UK power plant on hold

· Five firms file bids to develop $1.1 bn hydropower plant in Romania

Transmission / Distribution / Trade……

· Wallingford reaches new deal with power plant operator

· Areva, CNNC sign agreement for nuclear transport and logistics

· South Africa's nuclear power plant loses half its capacity

· Mozambican power company EDM invests in construction of power transmission lines

Policy / Performance………………

· Nigeria's power generation approaching 5,000MW: Igali

· Iran to build power plant in Turkey

· Tenaska clears last hurdle on $500 mn Texas power plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Doctor plans 15 more biogas plants across state

· India in a leadership position to deal with climate change issues: Javadekar

· India to add up to 2.3 GW wind capacity in FY15: ICRA

· AP govt gives 'powerful' policy push to solar, wind energy

· SMC approves setting solar panels to produce 540 KW of solar power

· Investor commitments received for 1.3 lakh MW renewable energy: Goyal

· India's climate change pledge won't hinder its coal output plan

· Inox Wind to set up wind farms in Gujarat, Rajasthan

· NTPC bans foreign bidders from participating in bid for three solar projects

· Chandigarh invites private players in solar power sector

· Punjab govt plans to set up Asia's first bio-ethanol refinery

· Solar plants to power UP schools

· Need to ramp up power generation from green sources: Govt

· In a first, panchayat, villagers float firm for solar project

GLOBAL………………

· US EPA Keystone review links oil sands to carbon emission jump

· Obama's budget goes all-in on climate change

· Hyundai cuts price of fuel cell car, eyes competition with Toyota

· Brazil's govt asked to consider energy auctions for biomass

· Babcock & Wilcox get $200 mn for Welsh biomass power plant

· Oil-price drop threatens to undercut Obama’s clean-energy legacy

[WEEK IN REVIEW]

COMMENTS………………

Energy Forecasts: More than what meets the Eye?

Lydia Powell, Observer Research Foundation

|

R |

eports that emerged in the early 1980s from high profile global conferences such as the Workshop on Alternative Energy Strategies, the Istanbul World Energy Conference and the voluminous report ‘Energy in a Finite World’ by the International Institute for Applied Systems Analysis (IIASA) which included the contribution of over 250 scientists concluded that the most important development in the 21st century would be the exponential growth of third world energy needs.

By year 2000, third world countries were expected to be consuming energy of the same order of magnitude as Western European or U.S. consumption in 1980s. A vicious cycle of growth of third world energy needs that leads to heavier demand on the petroleum market which increases oil prices which in turn aggravates the world economy and limits growth in the oil-importing third world countries was anticipated. This trend towards catastrophic world energy growth gave rise to a common consensus to accelerate nuclear programmes and the exploitation of coal in both industrialised and third world countries by year 2000. Once this was accomplished, third world nations, including OPEC countries were expected to be net importers of energy and the OECD countries net energy exporters. This reversal of energy flows was based essentially on the exploitation of coal. 78 percent of known reserves of coal are located in western countries and only 3 percent in the third world (not including China).

The fundamental implication was that the future of energy growth was already fully determined and that the only possible path-namely, a coal-nuclear strategy must be pursued without fail. The proposals called for a mechanical transposition of the solution that had been applied in the industrialised countries: reduction of the demand for traditional energies and the introduction of commercial energies with priority given to large inter-connected grids for electricity. This outlook clearly neglected many aspects that were important for future projections for the third world: (1) the specific features of the energy service needs and links between energy and specific development paths of the third world (2) the relevance of taking energy as a homogeneous product the requirements of which were linked to economic growth by a technical elasticity coefficient (3) the versatility of oil as a fuel and its competitiveness vis-à-vis other fuels. Western economies looked at the traditional sector of developing countries strictly as a technical reality that would progressively disappear following the introduction of commercial energy sources. They estimated energy demand in synthetic units (tonnes of oil equivalent-toe, MW) that essentially masked the real composition of energy needs and limited the possibilities of modulating energy profiles.

In general, long-run forecasting models assume that there exist underlying structural relationships in the economy that vary in a gradual fashion. In the real world, discontinuities and disruptive events abound as demonstrated by global financial crisis and the latest oil price collapse. The longer the time frames of the forecast, the more likely it is that key events will change the underlying economic and behavioral relationships that all models attempt to replicate.

Though the projected reality of IIASA did not materialise, development in the Western mould has transferred the general pattern of Western economic growth and affluence to the developing world. Increase in the price of oil has made developing countries increasingly dependent on developed countries for additional foreign currency to pay for petroleum products. Countries with oil and gas resources remain dependent on Western capital and technologies for developing their resources. Despite the rule of the market, the system of international interdependencies remains one of hierarchical dependence, one of asymmetric vulnerability, i.e., unequal ability of the interacting units to inflict damage on one another, therefore making the welfare of some units dependent on the will of others.

The objective of forecasts, especially from Western funded research bodies such as the IIASA, the International Energy Agency (IEA), the energy think tank for OECD countries and Intergovernmental Panel on Climate Change (IPCC) by the UN is not that of being accurate but that of shaping or colonising the future in which the West comes out on top. The World Energy Outlook brought out annually by the IEA routinely predicts a supply crunch in oil followed by a dramatic increase in the price of oil. This is a hidden call on OPEC to invest in increasing oil production. When OPEC obliges, the West along with the rest of the world benefits even though OPEC pays a price.

Recent projections by the IPCC that portray developing countries that use fossil fuels as villains follow the same logic. The IPCC projections have convinced most countries that the use of fossil fuels by developing countries would sink small islands and lead the world into extinction unless an immediate shift towards non-fossil fuels is made. Developing countries are actively responding to these projections and lining up to show case the investment they are making in renewable energy sources. They call for ‘technology-transfer’ from developed countries so that their shift towards renewable energy sources can be accelerated. Rather than aiming to climb on top of the energy hierarchy by becoming owners of knowledge and patents they are once again lining up to become large consumers of new and expensive energy technologies. Developed countries could not have asked for more. They hold most of the cards in the non-fossil renewable energy sources and they want markets for these and other technologies in the developing world. As Churchill said, those who fail to learn from history are condemned to repeat it.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

One Billion Tonne per annum Coal Production Conundrum

Ashish Gupta, Observer Research Foundation

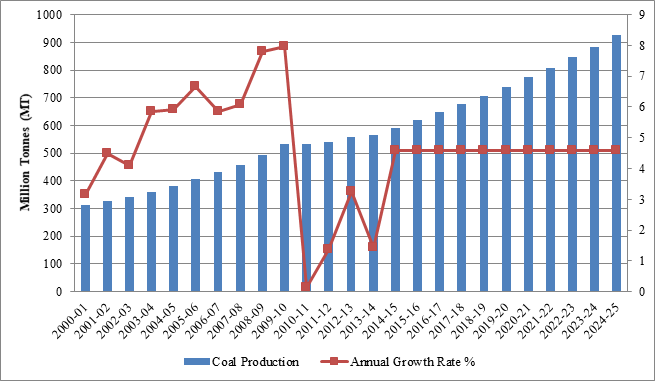

Actual Production Target is taken till 2013-14

Given the current growth rate of coal production in the country, it will be next to impossible to achieve the 1 Billion Tonne (BT) per year coal production target by 2019. According to Business as Usual (BAU) scenario from 2014 till 2025, the coal production is envisaged to reach 1 BT after 2024-25. Even the target for coal production for 2016-17 set in the Twelfth Five Year Plan is estimated to each 715 MT by 2016-17 in BAU scenario and 795 MT in the optimistic scenario may not be achieved. As per the ORF estimates (if production grows at 4.5 percent during the projected period, while other things remaining constant), by the terminal year of Twelfth Five Year Plan, the coal production will reach only 647 MT and 707 MT by 2019 under the two scenarios.

Given the current administrative, political and policy framework in the coal sector, the ambitious target appears unrealistic. The separation of consuming sectors from mining operations is necessary. However the target is not impossible to achieve in theory if circumstances change and if the Government is able to implement deeper and far reaching reforms.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

The German Energiewende turns around Policy Framework (Part II) Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 26

|

T |

he ongoing Energiewende in Germany (“energy turnaround”) is not only turning around the structure of the energy market and prices – particularly in the power generation sector ‑ but also requires considerable transformation of the utilities’ business models. This series of articles about the world’s experimental laboratory in the effort to green the energy industry intends to catch up with recent structural and legislative developments that tackle the German electricity markets. It will also focus on evolving new business models, which might also serve as a blue print for any other energy market in motion towards more decarbonised and smarter energy systems.

The legal framework for the Energiewende in a broader sense is set by international legislation like the commitments due to the ratification of the Kyoto-Protocol as well more stringently by the policies of the European Union (EU) to achieve the completion of the internal energy market and the efforts to combat climate change that are wrapped up in Energy and Climate Packages.

Beyond that, the German Government has decided to be at the forefront of international climate policy and set even more challenging regulations to meet Germany’s responsibility as a leading industrial country for a sustainable development and climate protection: At national level, Germany is making inroads with the transformation of its energy system and has set ambitious targets for reducing greenhouse gas emission.

However, it turned out over time that some unintended developments have challenged the Renewable Energy Act from 2000, that should to be tackled by the adoption of the reform of Germany Renewable Energy Act (EEG = Erneuerbare-Energien-Gesetz) from August 2014. This article shall help to catch up with the state of play of the legal framework in Germany that stipulates the terms of the ongoing restructuring process of the German energy industry, starting with a glance on international agreements towards more national regulations.

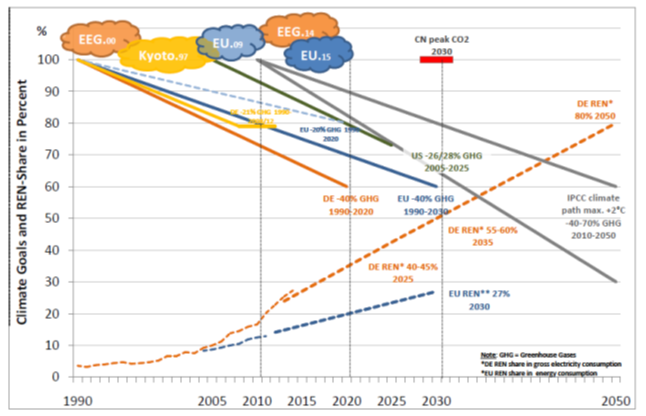

Some crucial characteristics of main climate legislations and agreements with their associated obligations are compiled in Figure 1 as a synopsis. The illustration compares different greenhouse gas (GHG) reduction paths over time (starting from upper part) as well as intended goals for renewable energy share (lower part). Based on the Kyoto Protocol, EEG and the EU’s framework for energy and climate (denoted in the clouds above) the GHG timelines for Germany (orange lines) and the EU (blue lines) are plotted and specified.

In contrast, the outcome of the recent agreement on climate change between the U.S. (green line) and China (red bar) are indicated and altogether challenged by the IPCC mitigation pathway zone that is expected to likely limit warming to below 2°C relative to preindustrial levels (grey lines). These ‘sustainable’ scenarios are characterized by far-reaching global anthropogenic GHG emissions cuts by 2050 and emissions levels near zero or below in 2100.

Since most climate legislation in Europe and Germany comes along with expansion goals of renewable energy the intended pathways for Germany and Europe and actual shares are demonstrated in the lower part of the diagram (dotted lines).

Figure 1: Timelines of “Climate Obligations” [1990-2050]

Source: Compiled by author based on given sources.

As one out of 192 Parties (191 States and 1 regional economic integration organization) Germany has ratified the Kyoto Protocol to the UNFCCC that is the first international agreement to set binding obligations to limit and reduce GHG emissions. As part of the EU’s burden-sharing agreement Germany is committed to reduce its GHG emissions by 21 % during the period from 2008-2012 compared to 1990 levels. According to the German Environment Ministry Germany already has considerably surpassed its GHG reduction commitment since 2009, even if GHG emissions have temporarily increased thereafter. Recently Germany has become the first large EU member state to start ratifying the extension of the Kyoto Protocol treaty for the second commitment period (2013-2020), even though the emission reduction targets therein are not considered as sufficient.

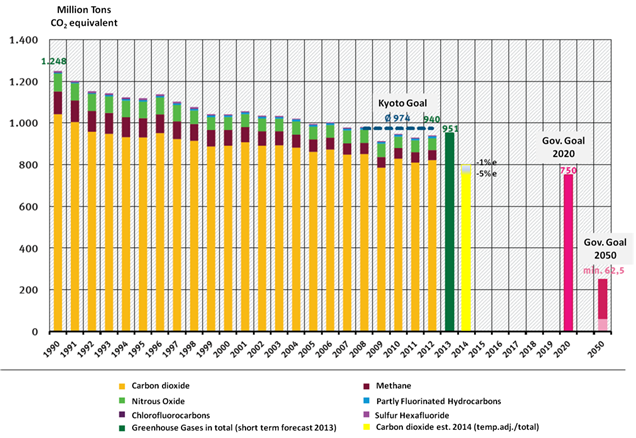

As shown in Figure 2 Germany has quite successfully achieved to cut down its climate footprint since 1990 by now: GHG emissions have decreased by about one quarter within the last two decades and therefore complied with the Kyoto-protocol. More than 80% of the overall emissions of greenhouse gases can be attributed to be energy related, which fell by 23% from 1990 until 2012. However, since the low in 2009 the continuous slump has come to a temporary standstill for the time being.

Notwithstanding the negative developments in recent years initial estimations for 2014 are indicating that the Energiewende is getting back on track. As indicated in Figure 2 (bright yellow bar) CO2 emissions (and overall energy consumption as well) are expected to fall significantly by about 5%, of which more than the half can be attributed to the power generation sector.

Since the slump is largely influenced by mild weather condition the temperature-adjusted drop is expected to be more in the order of one percent. Moreover the structure of electricity generation usage points in the intended direction: significant decrease of lignite (-3%) and hard coal (-12%) on the one hand, strong growth (+3.3%) of renewables overall and especially photovoltaic (+14%) on the other hand. Thus the share of renewables at the gross electricity consumption is expected to rise by 2% to 27.3%.

Figure 2: Emissions of Greenhouse Gases in Germany (1990-2012, est. 2013/14, Goals)

Source: German Federal Environmental Agency (2014), AG Energiebilanzen (2014). Amendments by author.

In Europe the overall legal framework that applies to energy markets and climate protection is most widely predefined by the EU policies. Building upon the commitments made under the Kyoto Protocol the EU adopted the climate and energy package (“20-20-20” targets) as binding legislation for member countries that aims to ensure the ambitious climate and energy targets for 2020:

· 20% reduction in GHG emissions by 2020 (compared with 1990 levels);

· 20% rise in the share of renewables of EU energy consumption by 2020;

· 20% improvement of the EU’s energy efficiency by 2020.

Theses 20-20-20 targets are made up by certain principles and tools as well as binding directives. The pioneering EU emissions trading system (EU ETS) – already launched in 2005 – is regarded as the key tool for reducing carbon dioxide emissions in Europe cost-effectively. It was therefore decided to strengthen the 3rd phase of the Emissions Trading Directive with effect from 2013. For sectors not included in the EU ETS divergent national emission targets for 2020 are determined by the ‘Effort Sharing Decision’ on the basis of member states’ relative wealth. Recent figures from the European Environment Agency (EEA) show the EU's overall emissions have already met the 2020 goal to cut GHG emissions by 20% versus 1990.

In October 2014 the EU leaders agreed upon a revised and more ambitious GHG emission goal that is expected to become legal in 2015 and will follow the 20-20-20 goals. The 2030 climate and energy package plans to cut EU’s GHG emissions by at least 40% from 1990 levels by 2030 in order to meet the track towards the longer term reduction roadmap 2050 by at least 80%. The sectors that are covered by the EU ETS are called to reduce their emissions by 43% compared to 2005 on a more restrictive path by curtailing the number of allowances by ‑2.2% p.a. from 2021 onwards (vs. the rate of ‑1.74% up to 2020). Currently the EU ETS (3rd phase 2013-2020) covers barely half of total EU’s greenhouse gas emissions predominantly from power and heat production, energy-intensive industry sectors and commercial aviation.[1] Furthermore a market stability facility with the power to withhold or release allowances shall help to strengthen the efficiency of the EU ETS. Other sectors beyond the EU ETS are required to cut emissions by an EU-wide 30% but with national diverse targets according to their GDP.

Thus - like before – some regulations are set to be broken down to individually different national targets: Though the Commission targets a binding increase of the renewable energy share to 27% of the aggregate EU's energy consumption by 2030, the target is in fact voluntary for individual member states and was pushed down by U.K. and Poland in the negotiation process from proposed 30%. Even though the climate package is labelled as the toughest climate change target of any region in the world, environmentalist groups are rather disappointed by the outcome since some state that some goals barely presents more than the business-as-usual track.

In 2000, Germany was one of the first countries setting up a Renewable Energy Act (EEG) to implement a feed-in tariff law to boost renewable energy expansion, thus becoming the worldwide prototype model thereafter. This ambitious energy industry restructuring program has intended to decarbonise the German energy system in the long-run (80%-share of renewables in electricity generation by 2050). Based on political decisions the load-bearing walls for Germany’s future energy architecture have been clearly set: much more renewables (due to strong subsidies), no more nuclear power stations (phasing out by 2022) and beyond that declining shares of lignite (brown coal) and hard coal power stations as well as oil (all environmentally unfavourable). The role of gas in power generation has been constantly left over as a kind of undefined joker role, rarely mentioned in political energy strategy, although due to its clear advantages gas-fired power stations are assigned to play a key role in Germany’s electricity generation transition to provide back up to intermittent solar and wind generation.

The EEG has hitherto undergone several major amendments with one of the most significant was coming into effect in 2014. According to the German Ministry of Economy (BMWI 2015) the EEG has been developed and amended as follows since coming into force on April 1, 2000:

· The EEG 2000 itself was already built upon its predecessor regulations in the Electricity Feed-in Act (Stromeinspeisegesetz) from 1990 that was the first legal scheme in Germany intending to boost electricity production by renewables by the means of a feed-in tariff and a purchase obligation for the power utilities. The need for this new EEG law mainly resulted from the rising wind energy plants, obligations from the Kyoto Protocol to reduce GHG emissions, and steps necessary to adapt the remuneration for renewables arising from increasing electricity prices.

· The first amendment EEG 2004 for the first time determined a concrete expansion target for renewable energies in Germany (up to 12.5% by 2010 and at least 20% by 2020).

· The amendment of EEG 2009 was more fundamental and comprehensive with most important extensions according to the compensation rules for hardship in case of capacity constraints and in relation the direct marketing of electricity from renewable energy sources. However, due to the drastically reduced capital cost of photovoltaic (PV) systems there was a need of a reduction in rates for new PV system to avoid an over-funding, therefore the EEG 2009 was soon amended by the PV 2010 amendment.

· With the EEG 2012 amendment the government proposed goals for the power sector were settled in legislation: the share of renewable energies should be at least 35% of electricity consumption by 2020, 50% by 2030, 65 % by 2040 and 80 % by 2050. Furthermore, more attention was attributed to optimisation of the overall system, i.e., the improvement of the interplay between renewable and conventional energy sources as well as storage and consumers. An optional market premium should give incentive to EEG plant operators to operate more market-oriented. Besides EEG, another PV amendment in 2012 aims to limit the increase of total feed-in-payments linked to PV facilities by setting an overall target of 52 GW of PV power reimbursed, a further decrease of tariffs, a modification of the degression scheme reducing tariffs by about 1% per month, and setting the maximum power of a single facility to 10 MW.

· The EEG 2014 amendment particularly aims to stabilise the rising cost burden of the EEG surcharge by more controlled development paths of specific renewable energies.

In general, the latest amendment of the EEG is set to tackle some key problems that were arising in the course of the intended energy industry restructuring throughout the process while continue progress towards the specified renewable energy targets expansion targets, i.e.:

· PV and (onshore) wind power costs were falling dramatically and are now more competitive. To curb the renewable expansion costs by focusing on the most cost-effective technologies onshore wind and solar photovoltaic; consequently decreasing the incentives for other energy types. E.g. extension of biogas plants will be restricted to 100 MW per year. The law introduces a so-called “flexible cap” to reach the specific quantitative target.

· The market share of renewables is now substantial, thus renewables require better market integration according to wholesale market price signals;

· The burden linked to the administered Feed-in Tariff has substantially risen due to drastic growth of solar especially, and has therefore evoked issues of cost and distribution of renewables among consumers. Currently the surcharge for some industrial consumers is kept low through exemptions, which drive costs up for mainly the household consumers. However, finally to ensure international competitiveness of German industries, no dramatic shift can be expected and private consumers will continue to bear the brunt.

In addition to the new EEG regulations the ministry of economy is considering to force energy companies to shut down eight more coal-fired power plants in order to reduce carbon emissions by at least 22 mt by 2020 to bring the development back on track according to Germany’s ambitious climate goals. The plan may prompt the main players like E.ON and RWE to mothball dirty coal power stations and to mitigate against the unintended outcome of flatlining GHG emissions of the German power sector in recent years. Even IEA (2014) expects that the “coal renaissance in Europe was only a dream”, since the temporary rise of coal use in Europe in recent years is more regarded as a temporary spike largely due to low coal and CO2 prices, high gas prices, and the ongoing shutdown of German nuclear plants.

The German energy restructuring towards a lower carbon footprint and national as well as international energy and climate legislation are interdependent, as the legislation determines the framework and incentives for the restructuring process, however, the outcome of the process (including wider issues as cost distribution etc, too) as well as market conditions influence the evolution of legal amendments. Therefore, it cannot be assumed that EEG 2014 has been the last reform of the Germany’s Renewable Energy Act. Indeed, the government has announced that in 2016, a new reform will be put forward to parliament that will trigger a more competitive auction process of tariff setting for renewables. Besides, the idea of setting up a capacity market for power generation back-up to overcome the mothballing of several gigawatts of unused gas-fired capacity is still ongoing, even if the German energy minister Sigmar Gabriel is (currently) opposed to it. However, it seems that capacity markets may provide a suitable solution and are making their way in Europe. In the upshot, the adaption of legislation will continue to make progress, depending on various factors, be it political (e.g. changing governments, outcomes of international agreements (EU, Kyoto and COPs)) or triggered by changing market conditions (e.g. oil price slump, low coal and CO2 prices etc). The case of last-mentioned market distortions shows that even if politics might start with the right action to correct market-failure (like carbon pricing) or pursue other political aims (e.g. support green energy), the monitoring and possibly adaption over time is of utmost importance to avoid inefficiencies in the aftermath. These could arise within different political levels, be it on international, national or federal level and moreover if different markets/commodities are involved.

Sources

AG Energiebilanzen (2014), Energieverbrauch ist 2014 kräftig gesunken, pressedienst Nr. 08|2014, 17.12.2014.

Agora Energiewende (2014a), Zehn Fragen und Antworten zur Reform des Erneuerbare-Energien-Gesetzes 2014, August 2014.

Agora Energiewende (2014b), The German Energiewende and its Climate Paradox - An Analysis of Power Sector Trends for Renewables, Coal, Gas, Nuclear Power and CO2 Emissions 2010 – 2030.

Bloomberg (2014a), Merkel Seeks Extra Emissions Cuts to Meet 2020 Climate Targets, By Stefan Nicola and Brian Parkin, Dec 3, 2014. http://www.bloomberg.com/news/2014-12-03/merkel-seeks-extra-emissions-cuts-to-meet-2020-climate-targets.html

Bloomberg (2014b), Germany Takes First Steps to Ratify Kyoto Extension, By Stefan Nicola, Sep 17, 2014, http://www.bloomberg.com/news/2014-09-17/germany-takes-first-steps-to-ratify-kyoto-extension.html

BMUB (2014) [Bundesministerium fuer Umwelt, Naturschutz, Bau und Reaktorsicherheit], Kyoto Protokoll, Stand: 25.08.2014, http://www.bmub.bund.de/themen/klima-energie/klimaschutz/internationale-klimapolitik/kyoto-protokoll/

BMWI (2015) [Bunderministerium fuer Wirtschaft und Energie], Das Enerneuerbare-Energien-Gesetz, Informationsportal Enerneuerbare Energien, http://www.erneuerbare-energien.de/EE/Navigation/DE/Gesetze/Das_EEG/das_eeg.html, accessed Feb 5th, 2015,

German Federal Environmental Agency (2014) [Umweltbundesamt], Treibhausgas-Emissionen in Deutschland; Treibhausgas-Emissionen nach Quellkategorien, 11.08.2014, http://www.umweltbundesamt.de/daten/klimawandel/treibhausgas-emissionen-in-deutschland

European Union (2014a), The 2020 climate and energy package, Last update: 19/12/2014, http://ec.europa.eu/clima/policies/package/index_en.htm

European Union (2014b), 2030 framework for climate and energy policies, Last update: 19/12/2014 http://ec.europa.eu/clima/policies/2030/index_en.htm

European Union (2014c), The EU Emissions Trading System (EU ETS), Last update: 19/12/2014 http://ec.europa.eu/clima/policies/2030/index_en.htm

European Union (2014d), Roadmap for moving to a low-carbon economy in 2050, Last update: 11/12/2014, http://ec.europa.eu/clima/policies/roadmap/index_en.htm

IEA (2014) [International Energy Agency], Medium-Term Coal Market Report 2014, Executive Summary, p. 12.

IPPC (2014), Fifth Assessment Report (AR5), Summary for Policymakers, http://www.ipcc.ch/pdf/assessment-report/ar5/syr/SYR_AR5_SPMcorr1.pdf

Reuters (2014a), EU on track so far with green energy goals, 2030 a challenge, by B. Lewis, Oct 28, 2014, http://www.reuters.com/article/2014/10/28/us-eu-climatechange-idUSKBN0IH0YX20141028

Reuters (2014b), Germany may shut down eight more coal power plants-document, Nov 23, 2014, http://www.reuters.com/article/2014/11/23/germany-energy-climate-idUSL6N0TD0EG20141123

Sueddeutsche Zeitung (2014), Europa wil ein bisschen umweltfreundlicher werden, 24/10/2014.

to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

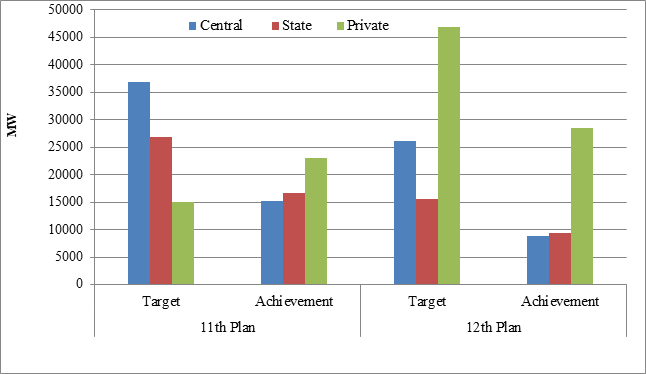

Capacity Additions- Targets & Achievements: Eleventh and Twelfth Plan

Akhilesh Sati, Observer Research Foundation

|

Year/ Sector |

Capacity Additions (Achievements) in MW |

|||

|

Central |

State |

Private |

Total |

|

|

2007-08 |

3240 |

5273 |

750 |

9263 |

|

2008-09 |

750 |

1821.2 |

882.5 |

3453.7 |

|

2009-10 |

2180 |

3118 |

4287 |

9585 |

|

2010-11 |

4280 |

2759 |

5122 |

12161 |

|

2011-12 |

4770 |

3761 |

11971 |

20502 |

|

2012-13 |

5397.3 |

3968 |

11257.5 |

20622.8 |

|

2013-14 |

2574.01 |

3367 |

11884 |

17825.01 |

|

2014-15 (as on Aug. 31, 2014) |

867.34 |

2076.1 |

5375 |

8318.44 |

Source: Central Electricity Authority

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

BP writes off $830 mn investment in KG-D6 block

February 3, 2015. BP Plc has written down the value of its investment in eastern offshore KG-D6 block by $830 million, following a lower-than-expected gas price hike. BP in 2011 bought 30 per cent interest in Reliance Industries' eastern offshore KG-D6 as well as 20 other oil and gas exploration blocks for $7.2 billion. Bulk of this was for the producing the block of KG-D6 and the gas discovery area of NEC-25. The government had on October 18 last year approved a new formula for pricing of all domestic gas. The rate, when the formula comes into effect from November 1, would be $5.61 per million British thermal unit (mmBtu) as against current $4.2. The price is lower than $8.4 approved by the previous UPA government and general expectation of a rate around $6.5 after some deductions from that price. Both BP and RIL have been advocating market-linked gas pricing and had initiated an arbitration against the government for not revising rates from the due date of April 1, 2014. The $4.2 per mmBtu rate, fixed in 2007, was for the first five years of production from KG-D6 fields. KG-D6 fields started gas output from April 1, 2009. RIL is the operator of the KG-D6 block with 60 per cent stake while the balance 10 per cent is with Canada's Niko Resources. Output at KG-D6 block has fallen over 80 per cent to below 13 million standard cubic meters per day as unanticipated water and sand ingress shut wells after wells. Besides the write-off at KG-D6, BP also wrote off $845 million in the value ascribed to block BM-CAL-13 offshore Brazil, following the acquisition of upstream assets from Devon Energy in 2011. (profit.ndtv.com)

Videocon says consortium discovers new oil in Brazil block

February 3, 2015. A consortium that includes Bharat Petroleum Corp Ltd (BPCL) and Videocon Industries has made a significant crude oil discovery off the Brazil's Northeast coast. The discovery was made in a well drilled in the BM-SEAL-11 exploration block in the Sergipe basin off Brazil's Northeast coast, the two companies said. The well was drilled to appraise the 'Farfan' discovery made in August 2013. Brazilian state-run oil company Petroleo Brasileiro SA (Petrobras), which is the operator of the block, expects to start producing oil in the area in 2018. The discovery, located 103-km from the city of Aracaju, is one of several in recent years in an area believed to hold more than 1 billion barrels of recoverable oil. Petrobras is the operator of the block BM-SEAL-11 with 60 per cent interest. IBV Brazil - a 50:50 joint venture of Bharat PetroResources Ltd and Videocon Industries, holds the remaining 40 per cent. Bharat PetroResources Ltd is a wholly owned subsidiary of BPCL. (economictimes.indiatimes.com)

ONGC arrests decline in crude oil production: Chairman

January 29, 2015. Oil and Natural Gas Corp (ONGC) has arrested the decline in its crude oil output and will for the first time in several years end the fiscal with stable production, its Chairman Dinesh K Sarraf said. ONGC over the past decade has seen its output dip by at least 2-3 per cent annually due to declining productivity at its main fields, which are very old and matured. ONGC's crude oil production in 2013-14 declined to 22.25 million tonnes from 22.56 million tonnes in the previous year. However, in the first nine months of current fiscal, production has remained flat at 16.73 million tonnes. Oil production from offshore fields, mainly off the west coast, has increased 8-10 per cent this fiscal but there has been a dip in output from onland fields. ONGC's fields are as old as 50 years. Its prime Mumbai High, which accounts for nearly 60 per cent of its oil production, is 40 years old. In past six months, four projects with a total capex of ` 22,500 crore, to bring discoveries to production or raise output from existing fields in the western offshore, have been approved, he said. ONGC, which has been under scrutiny of the Petroleum Ministry for falling output in the last few years, is targeting 23.51 million tonnes of oil this year. Next fiscal, the production is projected to rise to 24 million tonnes and will reach 28-29 million tonnes by 2019-20. Sarraf said most of easy oil has been discovered and produced and what is now being brought into production are smaller pools, monetisation of which was either technologically difficult or entailed high cost. The drop in oil prices to near six years low of $44 per barrel have made things difficult as producing from marginal fields as well as difficult projects is economically not viable. Like in oil, ONGC is also scripting a turnaround in natural gas production with newer fields in eastern as well as western offshore will help the company raise output to 116 million standard cubic meters per day by 2019 from current 64 million metric standard cubic metres per day (mmscmd), he said. (economictimes.indiatimes.com)

ONGC says natural gas output to jump 81 percent by 2019

January 28, 2015. Oil and Natural Gas Corp (ONGC) said its natural gas output will jump 81 per cent to 116 million standard cubic meters per day (mmscmd) by 2019 after it bring newer fields in western and eastern offshore into production. The increased production will come from Krishna Godavari basin gas block KG-DWN-98/2 as well as western offshore discoveries. ONGC said four projects with a capex of ` 22,500 crore have been approved in past six months. (economictimes.indiatimes.com)

RIL, BP to invest about ` 60 bn to improve gas recovery

January 28, 2015. Reliance Industries Ltd (RIL) and its partner BP plc of UK will invest about ` 6,000 crore by 2016 to help sustain and improve recovery from the two main gas fields in the eastern offshore KG-D6 block. Also, the two firms are working to develop 3-4 Trillion cubic feet of gas discoveries off the east coast, BP India head Sashi Mukundan said at the India Energy Congress. He said the focus area was enhanced oil recovery as even a 1 per cent enhancement can add almost 8 per cent to the existing proved reserves of India - about 450 million barrels of additional reserves. Gas output from Dhirubhai-1 and 3 (D1&D3) fields in KG-D6 block has fallen from about 54 million standard cubic meters per day achieved in 2010-11 to just over 8 mmscmd due to unexpected water and sand ingress shutting wells after wells.

The block as well as NEC-25 off the Odisha has many discoveries which the two firms are focussing on. He said the government needs to support and unshackle industry to attract players to participate in this very capital intensive and risky business. The government, he said, needs to play a key role as an enabler, and provide flexibility and space for participants to work at scale and build competitiveness. India's energy consumption is rising faster than any other nation - hydrocarbon needs are expected to rise by 120 per cent to more than 1,100 million tonnes of oil equivalent by 2035. For development of the gas sector, the need of the hour is to establish a set of integrated gas players who will be the energy providers of the future to meet the call for building a gas based economy, Mukundan said. With global oil prices slumping to 5-year low, it is crunch time to bring in investments in exploring for oil and gas in new areas, developing discovered oil and gas reserves, enhancing production from existing fields and building global scale refining, petrochemicals and marketing businesses. (economictimes.indiatimes.com)

Downstream………….

IOC to invest ` 53 bn in LPG import facility

February 2, 2015. Indian Oil Corporation (IOC) said it will invest ` 5,300 crore in setting up an LPG import facility at Paradip in Odisha and laying pipelines. IOC approved laying of a 1,150 km oil pipeline from Paradip to Hyderabad at a cost of ` 2,789 crore. The pipeline would have a capacity of transporting 4.5 million tons of fuel annually. IOC is building a 15 million tons a year refinery at Paradip at a cost of ` 34,555 crore. The unit is to be commissioned in phases beginning March. IOC approved construction of 0.6 million tons per annum LPG import facility at Paradip at an estimated cost of ` 690 crore to meet the cooking gas deficit in the eastern sector. The pipeline augmentation and extension would cost ` 1,823 crore and the project is expected to be completed within 36 months from the date of statutory approvals. (economictimes.indiatimes.com)

MRPL buys Iraqi Basra oil to replace Iran oil

February 2, 2015. Mangalore Refinery and Petrochemicals Ltd (MRPL) has made a rare purchase of Iraqi Basra Light crude via a spot tender, partly to plug the gap created by reduced imports of Iranian oil. India has asked its refiners to slash oil purchases from Iran in the February-March period to keep imports at the previous fiscal year's levels and avoid the risk of contravening sanctions targeting Tehran's disputed nuclear programme. MRPL, a major Indian client of Iran, bought 1 million barrels of Basra Light oil from Europe's Total at a discount of $1.50 a barrel to Dubai prices on a delivered basis for March 1-10 lifting. The Indian refiner rarely tenders for high-sulphur crude such as Basra, since it typically imports Iranian oil also with high sulphur levels, according to the terms of an annual term contract with OPEC member Iran. In a separate tender for low-sulphur oil, the Indian refiner has purchased 1 million barrels of Congolese Coco crude from trader Vitol at a discount of $4 a barrel to dated Brent for lifting in the first half of March. MRPL operates a refinery with a capacity of 300,000 barrels per day on the west coast of in southern Indian state of Karnataka. (in.reuters.com)

Transportation / Trade…………

Transporter's strike likely to affect LPG supply: IOC

February 3, 2015. Noting that the transporters agitating was not a "healthy practice" even negotiation was "in progress", Indian Oil Corp (IOC) warned that due to the refusal of truckers to ply the trucks supply of bulk LPG and production of petrol and diesel was likely to get affected. Referring to the public tender which was floated by the three oil marketing companies Indian Oil Corporation, Bharat Petroleum Corp and Hindustan Petroleum Corp, Indian Oil Corp State Level Coordinator, U V Mannur said all the 1,694 bidders from Southern region have "uniformly quoted single high rate". Oil marketing companies have a fleet of about 3,200 bulk LPG tank trucks for moving about 2.50lakh metric tonnes of bulk LPG every month by road from supply sources to various LPG bottling plants in Southern region, he said. (economictimes.indiatimes.com)

Unipec buys rare gasoil cargo from India

January 30, 2015. Unipec, the trading arm of China's Sinopec, bought a rare gasoil cargo from India's Mangalore Refinery and Petrochemical Ltd (MRPL), traders said. The company bought 65,000 tonnes of 500 ppm sulphur gasoil for Feb. 20 to 22 lifting from MRPL at a premium of about $1.10 a barrel to Middle East quotes, they said. This is the second such time that Unipec is buying a cargo from MRPL, one of them said. It is unclear where Unipec is planning to ship the cargo. Unipec is normally a seller of the fuel from China. China's gasoil exports have increased over the past year as the country's gasoil demand has slowed due to lower economic growth. Domestic demand for gasoil has grown slightly this month as factories stockpile the fuel ahead of the Lunar New Year which falls in mid-February, traders said. (in.reuters.com)

GAIL converting LPG recovery plant to supply feed stock for the petrochemical unit of BCPL

January 29, 2015. GAIL India Ltd stated that its LPG recovery plant at Lakwa, Assam would be converted to supply feedstock for the petrochemical unit of Brahmaputra Cracker and Polymer Limited (BCPL) being set up at Lepetkata near Dibrugarh. Towards accomplishment of the Assam Accord, the Government of India had entrusted GAIL the responsibility of setting up the petrochemical plant which is coming up near Dibrugarh at a cost of ` 8920 crores. The project is being executed by BCPL which is a joint venture company of GAIL, Oil India Limited (OIL), Numaligarh Refinery Limited (NRL) and the Government of Assam. GAIL stated BCPL is in the process of commissioning the petrochemical plant and to make it operational and viable, supply of natural gas from OIL, Oil and Natural Gas Corporation Limited (ONGC) and Naphtha from NRL has been arranged for feed stock. To make the project viable, gas available in and around Lakwa region is also being considered for making available as feedstock to BCPL.

Since gas available at Lakwa was to be processed for producing C2+ feed, economics were worked out for transporting natural gas vis-a-vis C2+ feed through pipeline from Lakwa to BCPL at Lepetkata with respect to the capital cost and it was found that transportation of C2+ feed is economical. C2+ is the hydrocarbon needed for production of polyethylene. Hence, it was decided in the larger interest of the project to convert the existing LPG plant to C2+ recovery unit for BCPL. More facilities are being added in the existing premises at Lakwa to convert the LPG plant into C2+ recovery unit. With respect to apprehension that there would be shortfall in the supply of LPG to Assam and the North East region, it may be mentioned that GAIL had informed Indian Oil Corporation Limited (IOCL) at the beginning of project about the conversion of GAIL's LPG plant into C2+ recovery unit by BCPL. IOCL on behalf of the Ministry of the Petroleum and Natural Gas is taking necessary action to ensure that there is no shortage in supply of LPG in the state. (economictimes.indiatimes.com)

RIL and Essar Oil compete with state companies to sell diesel to Railways

January 28, 2015. Private refiners Reliance Industries Ltd (RIL) and Essar Oil Ltd are competing with state refiners to sell diesel to Indian Railways, the state refiners said, after the government's control over diesel pricing ended last year. Indian Railways, the biggest client for diesel, consumes up to 2.5 million tonnes of the fuel each year. Tenders for supplying diesel to the railways country-wide are yet to be finalised.

Reliance offered a discount of about ` 1,800 a kilolitre to the Railways, petroleum secretary Saurabh Chandra said. Indian Oil Corp (IOC) said the private refiner, along with state-owned ones, has been short-listed by the Railways for an annual fuel supply contact beginning April 1. Till last year, the Railways received supplies from state refiners who have a nation-wide network and were entitled for compensation from the government for selling fuel at cheaper rates. (economictimes.indiatimes.com)

Policy / Performance………

Petrol price cut by ` 2.42 a litre; diesel by ` 2.25 per litre

February 3, 2015. Petrol and diesel prices fell again as the rout in the global oil market triggered the tenth cut in fuel rates since August, pleasing consumers including voters in Delhi, who are seeing a high-decibel duel between the BJP's Kiran Bedi and the Aam Aadmi Party's Arvind Kejriwal. Prices fell ironically at a time when global crude oil prices climbed 15 per cent to trade close to $57 per barrel after remaining below $50 for many days. Prices rose as global oil majors such as BP and Chevron have announced cuts in capital expenditure. However, state oil firms align local rates with the average global fuel prices in the past fortnight. The exchange rate is also a factor in determining the landed oil price in the country that imports about 80 per cent of the oil it consumes. Petrol prices fell for the tenth time since August, dropping ` 2.42 to ` 58.91 per litre in Delhi, while diesel fell by ` 2.21 to ` 46.01. Oil prices have soared since the end of last week, triggering speculation that the fall in crude prices may have ended and this may be the trend of reversal. Global oil major BP, which partners Reliance Industries in India, said it will cut capital expenditure, which analysts say will help balance the oversupplied oil market in the future. BP chief executive Bob Dudley, tempered expectations of lower production, however, he said that he expected US oil output to rise until the summer of 2015 when it would flatten. (economictimes.indiatimes.com)

Oil Ministry wants to recoup KG-D6 profit share from Panna fields

February 1, 2015. Oil Ministry is mulling recouping 195 million it believes is due from Reliance Industries Ltd (RIL) in the flagging KG-D6 block from oil and gas it sells to public sector firms from the separate Panna/Mukta and Tapti fields. The Ministry believes RIL has to remit additional profit petroleum of $195 million to the government after $2.376 billion in KG-D6 expenditure was disallowed for output lagging targets. With RIL contesting cost disallowance and taking the matter to arbitration, the Ministry first asked Chennai Petroleum Corp Ltd (CPCL) and GAIL India Ltd, which used to buy oil and gas from KG-D6 block respectively, to deduct $195 million payments to be made to RIL. But this plan could not materialise as the fall in output meant that GAIL no longer bought any of KG-D6 gas and CPCL had lost out on a tender to buy oil from the block. The Ministry asked upstream regulator DGH to suggest possible alternatives for the recovery of $195 million. The Directorate General of Hydrocarbons (DGH) wrote to the Ministry saying Indian Oil Corp (IOC) and GAIL are buyers of crude oil and gas respectively produced from Panna-Mukta field, where RIL holds 30 percent interest. It suggested to the Ministry that the sale proceeds due to RIL for the sale of oil and gas from IOC and GAIL may be sought for recovering the additional profit petroleum. Since the arbitration proceedings on cost disallowance are yet to commence, DGH suggested that the government file an application for securing the amount in dispute as interim measures. DGH also advised seeking an opinion of Solicitor General before deciding on the alternative remedy available. The Ministry has sought the opinion of the legal officer. The Ministry had disallowed $2.376 billion in cost for gas output from main fields in KG-D6 block falling short of target between 2010-11 and 2013-14. It calculated that the government should have got an additional profit share of $195 million. To recover this, it wanted CPCL and gas utility GAIL India to deduct this amount from revenues due to RIL. GAIL has not bought any gas from KG-D6 since June 2013 and could not deduct any amount. CPCL too lost out the crude tender in May 2014. RIL says the output from Dhirubhai-1 and 3 gas fields in KG-D6 block fell to about 8 million standard cubic meters per day (mmscmd) instead of rising to projected 80 mmscmd because of unanticipated water and sand ingress shutting down most wells. The Ministry and DGH, however, blame the output fall to RIL not drilling the quota of committed wells. (economictimes.indiatimes.com)

ATF price cut by 11.3 percent, to cost less than diesel

February 1, 2015. Jet fuel (ATF) price was cut by a steep 11.3 percent and now costs less than diesel. Last month, its rate had fallen below the price at which petrol is sold. While petrol and diesel prices have so far not been changed as per the fortnightly revision, non-subsidised domestic cooking gas (LPG) was cut by ` 103.5 per cylinder to ` 605 a cylinder after international oil prices slumped to near six-year lows. The price of aviation turbine fuel (ATF), or jet fuel, in Delhi was cut by ` 5,909.9 per kilolitre, or 11.27 percent, to ` 46,513.02 per kl, oil companies announced. The reduction, which followed possibly the steepest ever cut of ` 7,520.52 per kl or 12.5 percent effected from January 1, has led to ATF becoming cheaper than even diesel. Last month's reduction saw the ATF price slip to ` 52.42 a litre, below ` 58.91 a litre cost of petrol in Delhi. And after cut it costs ` 46.51 per litre and is cheaper than diesel that sells at ` 51.52 per litre. ATF has a higher octane than petrol and diesel is a heavier fraction in the distillation process. Traditionally, auto fuels being of lesser quality than ATF, would cost less. But four consecutive excise duty hikes since November -- totaling ` 7.75 a litre on petrol and ` 7.50 on diesel, have reversed this. But for these, the cumulative reduction of ` 14.69 per litre in petrol price in nine cuts since August and ` 10.71 a litre on diesel since its deregulation in October, would have been higher. Following the global trend, the price of 14.2-kg non- subsidised LPG cylinder has been cut to ` 605 from ` 708.50 previously in Delhi. This is the seventh straight reduction in rates of non-subsidised or market-priced LPG, which the customers buy after exhausting their quota of 12 cylinders at subsidised rates, since August. A subsidised LPG refill currently costs ` 417 in Delhi. Price of non-subsidised LPG were last cut on January 1 by ` 43.50. In seven monthly reductions, non-domestic LPG rates have been slashed by ` 317.50 per cylinder, bringing the price to a three-year low. State-owned fuel retailers, Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Hindustan Petroleum Corp (HPCL) revise jet fuel and non-subsidised LPG prices on 1st of every month based on average imported cost and rupee-USD exchange rate. (economictimes.indiatimes.com)

India to commission 5 mn tonnes underground oil storages by October

January 31, 2015. India has decided to commission over 5 million tonnes (mt) of underground crude oil storages by October to ensure uninterrupted oil supply to the nation for about two months in the case of disruptions in imports from oil producing countries due to geopolitical reasons. The first strategic oil reserve of 1.33 million tonnes (mt) will be ready in Visakhapatnam by next month. This will be followed by two more facilities in Mangalore (1.5 mt) and Padur (2.5 mt) in the next eight months. Four more caverns of 12.5 million tonnes capacity will be built in the second phase, for which the locations that have been identified include Bikaner, Rajkot, Chandikhol and Padur. The caverns are being developed by Indian Strategic Petroleum Reserves Ltd (ISPRL), a special purpose vehicle of the Oil Industry Development Board, a statutory body created for India's energy security. According to ISPRL, the capital cost of creating three storage facilities is about ` 3,958 crore and filling them with 5.03 million tonnes of crude oil will require about ` 25,000 crore. India — the fourth-biggest energy consumer in the world after the US, China and Russia— depends on imports for more than 80% of crude oil it processes for domestic consumption. At present, the country can store crude oil in storage tanks of refiners and oil pipelines for less than 45-50 days. In 2009, the government had decided to construct strategic caverns to store oil. India has emerged as the regional refining hub with annual capacity of over 215 million tonnes. The government is in touch with oil producing countries such as Kuwait and Abu Dhabi to store about 2 million tonnes of crude oil in Indian caverns that the country can use in case of supply disruptions. The two Gulf countries have expressed their willingness to fill crude oil in two compartments of caverns at Visakhapatnam and Mangalore. (economictimes.indiatimes.com)

India should seize weak oil price to woo experts: Sesa Sterlite

January 30, 2015. India should take advantage of weak oil prices and shrinking budgets among majors to attract top flight oil services firms and improve its own skills and technology, the head of oil and mining firm Sesa Sterlite Ltd said. Sesa Sterlite controls Cairn India, which is India's largest private crude oil producer and the operator of more than a quarter of India's domestic crude oil production. Until now, Sesa Sterlite and parent Vedanta Resources Plc Chief Executive Tom Albanese said, attracting foreign oil services firms to India meant offering a high risk premium. But that has changed as oil majors cut back. The company itself, Albanese said, would apply a "meaningful reduction" to its previously planned $2 billion spending across its businesses for the coming fiscal year. Indian Prime Minister Narendra Modi has promised to fix foreign investor concerns, including red tape and an unpredictable tax regime, and has sought to encourage manufacturing with a "Make in India" campaign. India badly needs foreign investment to reboot its sluggish economy. Albanese said India should do more to encourage foreign investment in the broader resources sector, including mining. As part of its broader reform efforts, the government has sought to sell off a string of state-owned assets. It sold 10 percent of Coal India. Other government-owned stakes include minority shares of 29.5 percent and 49 percent respectively in two of Vedanta's subsidiaries, cash-rich Hindustan Zinc and aluminium firm BALCO, in which Vedanta has long sought to raise its stake. Neither sale, though, is likely to be resolved before the end of this fiscal year in March -- disappointing for Vedanta, which is sitting on $8.8 billion of debt and has long eyed Hindustan Zinc's cash pile in particular. (in.reuters.com)

Clarity on subsidy sharing soon: Oil Minister

January 28, 2015. Clarity on subsidy sharing mechanism between the government and state-owned upstream oil companies is likely in the current financial year, Oil Minister Dharmendra Pradhan has said. The government is reworking the subsidy sharing formula which might benefit companies like ONGC by reducing their burden. The subsidy given for retail sales of LPG and kerosene is shared by the government and upstream PSUs. On ONGC divestment, the minister said it is scheduled to happen in the current fiscal but falling oil prices are a concern. He said divestment in the company was a policy decision and should be done when the time is right. The government, which holds 68.94% stake in ONGC, plans to offload 5% stake in the company. In the current fiscal, the government has budgeted a record ` 58,425 crore from stake sales in state-run firms. (economictimes.indiatimes.com)

Over 9.35 crore consumers sign up for LPG cash-subsidy scheme

January 28, 2015. More than 64 per cent of 15.3 crore LPG consumers in the country have joined the ambitious PAHAL scheme to receive cash subsidy in their bank accounts so they can buy the cooking gas at market price. Over 9.35 crore LPG consumers have joined the scheme so far, Oil Minister Dharmendra Pradhan said. Consumers joining the scheme, which was launched all over the country from January 1, has swelled from 24 per cent to 64 per cent, making it the world's largest direct cash transfer scheme. Similar cash transfer scheme in Brazil and China had a total of about 2.2 crore beneficiaries, he said.

So far, ` 2,820 crore has been transfered to consumers who have joined the Direct Benefit Transfer for LPG (DBTL) scheme. The DBTL Scheme for LPG consumers (PAHAL) was launched on November 15, 2014 in 54 districts and in the rest of the country on January 1, 2015. The Scheme aims to transfer the subsidy on LPG directly into the bank accounts of over 15 crore LPG consumers, he said. Pradhan said the government is looking at roping in 75 to 80 per cent consumers before the Budget session of Parliament begins on February 23. The MyLPG.in portal, which provides one stop solutions to cooking gas consumers - from joining DBTL to knowing their status of their refill bookings and cash subsidy received, will be also be available in 10 regional languages. From February 1, the portal will be available in Hindi, Odiya, Tamil and Gujarati besides English, he said. Portal kiosks will also be set up major cities to allow consumers to access their LPG accounts. LPG consumers have time till March 31 to join the scheme, failing which they will not get any subsidy and will be forced to buy LPG at market rate. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

RattanIndia Power commissions 270 MW unit 3 of Amravati plant

February 3, 2015. RattanIndia Power said it has started generating electricity from the third unit of 270 MW of its 1,350 MW thermal plant in Amravati in Maharashtra. The company expects to commission the remaining two units of 270 MW each in this fiscal year. RattanIndia Power is currently developing a total of 5,400 MW coal based projects comprising two 2,700 MW power plants each at Amravati and Nashik in Maharashtra. The company is developing these two projects in two phases. The company is already supplying electricity generated from the first two units of Amravati plant to state utility Mahavitaran. (www.thehindubusinessline.com)

ONGC starts supplying gas to Tripura power project

February 2, 2015. Oil and Natural Gas Corp (ONGC) has started supplying gas to a 101 MW capacity power plant, commissioned by North Eastern Electric Power Corporation (NEEPCO). NEEPCO, a mini-ratna company under the union power ministry, has set up a ` 9.50 billion ($150 million) 101 MW power plant in western Tripura's Monarchak, 70 km south of capital Agartala and just eight km from the India-Bangladesh border. The Monarchak power plant chief, S.R. Biswas said that non-supply of gas by ONGC resulted in loss of ` 5 crore a month. Tripura Power Minister Manik Dey, who visited the NEEPCO power plant, also expressed his deep anguish over the delay in generation of power from this project.

Designed by the US-based General Electric Company, the turbines for the plant were supplied by Bharat Heavy Electric Limited, producing 62 MW power through gas turbine and 39 MW through steam turbine. ONGC, the Infrastructure Leasing and Financial Services (IL&FS) and the Tripura government jointly floated the ONGC Tripura Power Co. Ltd. (OTPC) for setting up the ` 10,000-crore 726 MW capacity Palatana power plant in southern Tripura. While Prime Minister Narendra Modi dedicated to the nation the second unit (363 MW) of the 726 MW power project Dec 1 last year, the first unit (363 MW) was inaugurated by President Pranab Mukherjee June 21, 2013. The 726 MW capacity Palatana combined cycle power project is the first commercial power project of the ONGC that would utilise the huge gas reserves in Tripura. (www.newkerala.com)

BHEL commissions 600 MW thermal unit in Odisha

January 29, 2015. Bharat Heavy Electricals Ltd (BHEL) has announced commissioning of 600 MW thermal power project in Odisha. The unit was commissioned at Jindal India Thermal Power Ltd's upcoming 2x600 MW thermal power project at Derang in Angul district of Odisha, BHEL said. The company has announced commissioning of 600 MW unit of a thermal power project in Chhattisgarh. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Adani Power to bid for all six coal blocks reserved for the power sector

February 2, 2015. Adani Power is in race for all six coal blocks reserved for the power sector in the upcoming auction of 23 operational mines, while Jindal Steel & Power is eyeing four. Hyderabad-based Madhucon Group's subsidiary, Simhapuri Energy, is expected to be a surprise bidder and may vie for all the coal blocks earmarked for the captive use of power producers. The Tokisud North block that earlier belonged to GVK Power is expected to attract the highest number of bids. More than a dozen companies including Adani Power, Essar Power, GMR Energy, Jindal Power, Lanco Infratech, Sesa Sterlite, Tata Power and West Bengal Power Development Corp are likely to submit bids for this block that lies in the South Karnapura coalfields in Jharkhand, the coal ministry said. The block with 2.32 million tonnes of annual coal production capacity has rail connectivity within 2.5 kilometres. Gare Palma IV/2 and IV/3 in Chhattisgarh, previously owned by Jindal Steel & Power, is also being eyed by close to a dozen companies. Besides Adani and Simhapuri, they include GMR Energy, Jindal Power, Lanco Infratech, Reliance Power, DB Power, Sesa Sterlite and KSK Energy. The block has a capacity to produce 6.25 million tonnes a year, but the nearest rail head is about 55 km away. Some eight companies are expected to bid for the Amelia North block in Madhya Pradesh that earlier belonged to Madhya Pradesh State Mining Corp. The potential bidders include Essar Power, GVK Power, Jindal Power and Lanco Infratech. About half a dozen companies including Adani Power, DB Power, Jindal Power and Sesa Sterlite are said to be in race for Talabira-I in Odisha that was earlier owned by Hindalco. Sarisatolli and Trans Damodar in West Bengal are also expected to have attracted about half a dozen companies. Power firms have to bid lower than the price arrived after the technical stage. The last date for bid submission is February 3 while the price bidding starts February 14. The final price will be the cost of coal that the winner can pass on to electricity consumers. (economictimes.indiatimes.com)

Alstom commissions Rajasthan's first 765 kv substation

February 2, 2015. Alstom T&D India has commissioned a substation in Anta, Rajasthan, that will help in more efficient evacuation of electricity from three power plants in the state. The substation, will play a significant role in pooling and evacuating the power flow from the three major power plants in the state -- Kalisindh, Kawai and Chhabra -- to the national grid. Anta is Rajasthan's first 765 kv substation, and the second largest with a total of 26 bays, 10 765 kv bays and 16 400 kv bays. The turnkey project for Anta substation was awarded to Alstom T&D India in September 2011. The contract includes installation of 3x500 MVA, 765/400 kv transformers, 765 kv reactors, other 765 kv equipment and civil works with a total order value of nearly ` 4,21.2 crore. The Anta substation was set up by Rajya Vidyut Prasaran Nigam Ltd under the transmission system augmentation scheme to meet the growing energy demand in the state. Rajasthan has an installed capacity of more than 5,000 MW. (economictimes.indiatimes.com)

Punjab takes steps to check energy theft

February 2, 2015. Punjab has adopted various technical measures and innovative initiatives to cut down transmission and distribution (T&D) losses and check theft of energy. It has also resulted in dropping of considerable peak demand by 1000 MW annually. Punjab has invested ` 2000 crore for an underground power cables network in order to have wire-free roads and uninterrupted power supply. On the directions of Punjab Deputy Chief Minister Sukhbir Singh Badal, who also holds the power portfolio, to create best power infrastructure in the state, Punjab State Power Corporation Limited (PSPCL) has implemented major initiatives to control theft of energy and scaling down T&D losses that included shifting of low voltage distribution system to high voltage distribution system, replacement of ordinary lamps with CFLs, addition of capacitors, shifting of meters outside consumers premises, up-gradation and strengthening of distribution system, automated meter reading (AMR) facilities etc. He said that such measures had resulted in dropping of peak demand by about 1000 Mw and saving of 1200 million units (MUs) annually. He said that T & D system of major towns in Punjab was being up-graded and strengthened in a phased manner. He informed that Punjab would be the first state in the country to have all urban areas with underground power cables network in order to have a wire free roads and uninterrupted power supply within next two years. (www.business-standard.com)

India, Bhutan, Nepal, Bangladesh explore scope for power trade

January 31, 2015. The joint working group (JWG) on sub-regional cooperation between Bangladesh, Bhutan, India and Nepal explored the scope for power trade and inter-grid connectivity between the four countries. The delegations from the participating countries discussed potential for closer cooperation at a sub-regional level in water resources management, power and hydro-power as well as in connectivity and transit. In the meeting, the four countries agreed to collaborate in harnessing water resources, including hydro-power and power, from other sources available in the sub-region. The representatives also deliberated on the need for trade facilitation at land border stations for effective sub-regional connectivity. Usefulness of sharing trade infrastructure at land border stations and harmonization of customs procedures were also discussed. The next meeting of the JWG would be held in Bangladesh later this year. (www.business-standard.com)

CCI rejects complaint against Tata Power

January 30, 2015. Competition Commission of India (CCI) has rejected Brihan Mumbai Electric Supply and Transport's (BEST) complaint that Tata Power indulged in anti-competitive practices with regard to transmission of electricity. BEST is an undertaking of the Municipal Corporation of Greater Mumbai. Rejecting the complaint, CCI said there is no "prima facie" evidence that Tata Power violated competition norms. BEST also has the licence to distribute electricity only in the island city of Mumbai (the area from Colaba upto Mahim and Sion) and has no operation elsewhere. In this case, "services of transmission of electricity in the city of Mumbai," has been considered as the relevant market. BEST had also alleged that since it is a competitor as well as a consumer, Tata Power intentionally abused its dominant position by unilaterally putting a brake on the electricity supply to the Informant on September 2, 2014 which caused serious load shedding within the island city of Mumbai. It was also alleged that Tata Power has been responsible for developing the said constraints in transmission network to create a monopolistic market for its generation business. (economictimes.indiatimes.com)

Absence of PPAs with state utilities to hit companies like JSPL, GMR and Lanco

January 28, 2015. India's power producers that are adding fresh capacity of more than 25,000 MW in the next few years face a bleak future amid reluctance of state utilities to sign power purchase agreements (PPAs) as they prefer to cut supply or buy cheap power from the spot market. Many companies do not have any PPA in place, which analysts say is due to weak industrial demand and the poor finances of state electricity boards (SEBs) that prefer to buy merchant power, which currently costs ` 2.70 per unit. According to data compiled by CRISIL, the power demand in 2013-14 was much lower than the average annual demand growth of 5.2% in the past five years. During 2013-14, supply grew 5.3% compared to the average growth of 6.8% in the five-year period. The share of industrial consumers in the power demand pie declined to 44% in 2013-14 from 47% in 2009-10. The fresh power capacities are being planned by Jindal Steel and Power, GMR, Lanco, Avantha, RattanIndia Power and the KSK Group, with new plants coming up in Odisha, Chhattisgarh, Jharkhand and Maharashtra. (economictimes.indiatimes.com)

Policy / Performance………….

GVK Power files petition in Delhi HC challenging mine auction

February 3, 2015. GVK Power & Infrastructure said it has filed a petition before the Delhi High Court (HC) challenging the coal block auction process. The company said that since the matter is sub-judice, it does not wish to comment any further. GVK Power (Govindwal Sahib) Ltd's Tokisud North coal block in Jharkhand was among 204 mines whose licences were quashed by the Supreme Court last year. The mine falls in the schedule II (producing mine) list of the coal blocks to be auctioned. The government will auction 46 coal blocks to private companies. Under the schedule II (producing mines) category, 23 blocks will be put on offer. The auction would be held between February 14 and February 22 and the vesting orders will be issued by March 23. Under the Schedule III (ready to produce mines) category, another set of 23 mines will be auctioned between February 25 and March 5. The vesting orders will be issued by April 2. The Coal Ministry has already started the process for allocation of 36 mines to PSUs. Of the 36 blocks listed by the government, 35 will go to power PSUs while the remaining one has been earmarked for a steel PSU. (economictimes.indiatimes.com)

Power tariff hike imminent in Andhra Pradesh

February 3, 2015. Giving indications that power tariff might be hiked in Andhra Pradesh, Information and Public Relations Minister Palle Raghunatha Reddy said the government has decided to ensure that the poor were not burdened in case of increase in electricity rates. The power tariff hike issue was discussed in detail at Cabinet meeting and some of the Ministers were believed to have opposed even a 10 per cent hike, which was reportedly indicated by the Andhra Pradesh Electricity Regulatory Commission earlier. The Ministers reportedly wanted it to be around 6 per cent. Reddy said discussions were still on and there was time till March-end to take a decision on revising tariff. Reddy said that AP would have to meet power demand of 58,191 million units during 2015-16 financial year and the expenditure for its production was estimated to be ` 30,300 crore. (www.thehindu.com)

Telangana CM writes to PM Modi seeking more power and coal blocks

February 3, 2015. Telangana Chief Minister (CM) K Chandrasekhar Rao urged Prime Minister (PM) Narendra Modi to allocate power, coal and coal blocks to the State to meet its electricity shortage. The committee appointed by the Ministry of Power to look into the power sharing arrangements is yet to give its final report. The situation has only worsened and going to be severe in the coming four months - February–May 2015, Rao said. He requested that at least 500 MW from surplus power available in the Eastern Region be allocated to Telangana. Rao said his Government has undertaken an ambitious project to add 4,200 MW additional capacity in the next four years for which coal requirement is 21 million tonnes per annum (MTPA). (www.dnaindia.com)

Oil ministry proposes to bring gas-based power plants under price pooling scheme

February 2, 2015. The oil ministry wants all domestically produced gas to be included in the price pooling scheme to save about ` 1,00,000 crore of private power projects, a proposal that would adversely affect some electricity generation plants operated by state-owned NTPC. The Ministry for Petroleum and Natural Gas has informed the power ministry that no additional gas output will be available from fields auctioned under the New Exploration Licensing Policy until March 2017. If the price pooling scheme is to be a success, it is imperative to include gas produced by state-owned companies.

Under a gas price pooling proposal prepared jointly by both ministries earlier, any additional gas produced in the country in the next four years, along with imported liquefied natural gas, would be supplied to help operate power plants at 40 per cent capacity. The gas would be sold at an average 'pooled' price, while electricity from the plants sold to distribution companies would be capped at ` 5.5 per unit. Of the country's 24,000 MW of gas-based generation capacity, plants with 16,000 MW capacity are stranded, while the remainder is underutilised.