[Death Warrant for Fossil Fuels?]

“The entire population of the world is internal to the problem and not external observers as it was the case with the movement against tobacco and apartheid. In their rush to embrace a just cause, civil society movements against fossil fuels may essentially be asking millions of poor people to wait in poverty for technologies that are yet to discovered or yet to become viable…”

Energy News

[GOOD]

LNG imports from USA holds the greatest potential for energy and climate security not dreams of technology transfer!

[BAD]

Breaking records in renewable energy is neither a substitute for energy policy nor a sustainable policy!

[UGLY]

If all and sundry are rushing into solar energy it may a pork barrel and not a substitute for the oil barrel!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Death Warrant for Fossil Fuels?

· SWOT Analysis of Overseas Coal Opportunities

DATA INSIGHT………………

· Statewise Scenario of Power Generation from Waste to Energy

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC agrees to Cairn India being given Rajasthan block extension

· Govt at loggerheads with RIL over $1 bn Panna Mukta-Tapti oilfields

· Domestic crude oil production falls 1.4 percent in Dec

Downstream……………………………

· RIL, Essar to operate 2,800 pumps, offer discounts

· Indian oil launches 'XTRAREWARDS' in Kerala

Transportation / Trade………………

· Tamil Nadu petroleum dealers not to buy fuel on Jan 31

· India to discuss LNG imports with US President on his India visit

· ONGC-RIL gas siphoning row: Expert body will not help, says PSU

Policy / Performance…………………

· ONGC plans to achieve target in gas and oil production

· OIL, ONGC unlikely to benefit even as govt reworks subsidy sharing formula

· Oil ministry moves new subsidy plan

· Petrol costs more than ATF in India

[NATIONAL: POWER]

Generation………………

· NLC plans to acquire power plants in India

· Shiv Sena still not on board with BJP on Nuclear power project

Transmission / Distribution / Trade……

· Cost cutting: Discoms give alternatives in Delhi

· More private firms needed in power transmission: Advisory Group

Policy / Performance…………………

· Additional 455 GW capacity needed to meet power demand by 2034

· Coal scam: CBI files progress report in a sealed cover

· Railway ministry shifts blame to Coal India for fuel crisis

· Govt expects negative bidding in coal block auction

· Panel on cards to monitor power watchdog bosses

· India, US trying to resolve differences over nuclear deal ahead of Obama trip

· India's power sector set for $250 bn investment: Goyal

· Quality of coal will determine each block’s floor price

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· US seen limiting oil drilling in Arctic, may open Atlantic

· Green dragon on target for 12 bcf of gas in 2015

· Africa oil boom on hold as prices spur explorer caution

· Faroe Petroleum expects to raise exploration Capex in 2015

· Eni makes new oil, gas find in Egypt's Western Desert

· BHP cuts US shale rigs as oil to Iron ore prices slip

Downstream……………………

· Russia's refinery runs in Dec down 2.1 percent on month

Transportation / Trade…………

· Russia's Gazprom eyes first gas via new route to Turkey by 2017

· Lithuania LNG importer Litgas to supply gas to Estonia

· Traders delaying Russian gas imports tap declining EU stores

· Senate Republicans block Keystone export and steel amendments

· Pakistan fuel shortage crisis forces Sharif to cancel Davos trip

· Bernstein sees US LNG plants scrapped as buyers look elsewhere

Policy / Performance………………

· For Saudis, falling demand for oil is the biggest concern

· Hedge funds bet on oil dropping further

· Where to buy gasoline for ` 0.03 a litre

· BP freezes employee pay in response to oil price slump

· Tethys gets 15 yrs extension to Kyzyloi production contract

· OPEC will blink first in battle with shale drillers, poll shows

· Indonesia plans to offer 8 O&G exploration blocks in 2015

· Shale oil growth in US hurts Canadians as well as OPEC

· OPEC’s El-Badri says oil will rebound instead of fall to $20

· Oman joins other oil nations saying OPEC decision wrong

· Iraq says oil output must rise to compensate for price drop

· Oil won’t recover until supply growth slows, says Yergin

· Oil law reviewed in South Africa as low prices curb drilling

[INTERNATIONAL: POWER]

Generation…………………

· GE says to build 1.2 GW power plant in Ghana

· Aggreko wins three-year contract extension for 200 MW power project in Ivory Coast

· Voith completes tests at several hydropower plants in China

· Bhote Koshi resumes power generation

· CSAIL plans to facilitate power generation up to 4 GW

· Holland leaders approve power plant construction contract

Transmission / Distribution / Trade……

· Pakistan restores power after blast blacks out 80 percent of country

· EDF seeks options for $17 bn distribution network RTE

Policy / Performance………………

· US NRC starts special inspection at River Bend Station nuclear power plant

· Obama-Modi nuclear ‘breakthrough’ has CEOs wary of fine print

· Indonesia coal miners seek output cuts as prices hit 8 year low

· Nuclear liability law: Westinghouse Electric ‘optimistic’ about resolution before Obama's trip

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· AP to promote rooftop solar energy

· India, Germany to hold talks on environment, climate change

· Indian suppliers to MNCs like L’Oreal, Dell may lose out if they fail to address climate concerns

· India gets Obama’s backing for $160 bn solar push

· Mahindra to expand renewables business amid India's clean energy push

· Clean energy: US to place investment officer in India

· After Jan Dhan, govt eyes renewable energy world record

· India clean-energy investments rise 13 percent to $7.9 bn

· Welspun Renewables to set up ` 7 bn solar project in Andhra Pradesh

· India to push renewable energy drive during Obama visit

· Spain's Gamesa signs 100 MW wind power project in Maharashtra

· PM's climate change council discusses emission reduction in farm sector

GLOBAL………………

· Fenix gets $12.6 mn for solar in developing nations

· US approves Argentina joining biofuel credit program

· FPL to add 225 MW of solar in 2016

· Sharp said near deal to sell recurrent energy solar unit

· Mitsubishi Electric completes 6 MW Fukushima solar power station

· Obama congratulated for clean energy agreement with India

· Global wind energy projects' funding worth $32 bn in 2014

· UK lawmakers urge fracking delay on water, climate risk

· New technique to produce cheaper solar energy

· US wind-power installations rose sixfold in 2014: BNEF

· Japan could cut solar tariffs as much as 18 percent following cost drop

· Hong Kong tells public to avoid going outside as pollution soars

· Abengoa to build world’s largest solar desalination plant

· Finland’s Taaleritehdas orders six wind power plants from Vestas

[WEEK IN REVIEW]

Death Warrant for Fossil Fuels?

Lydia Powell and Akhilesh Sati, Observer Research Foundation

ne of the news items in this week’s international news in this journal says that among Saudi Arabia’s key concerns today is that of the oil age ending before we run out of oil just like the Stone Age ended before we ran out of stones. Saudi Arabia is justified in its concern as there are many forces actively writing the death warrant for fossil fuels. Some of these forces are natural such as the overall decline in demand for oil and other fossil fuels from OECD countries. Some are man-made such as the mitigation mandates issued by multilateral climate bodies that have taken it upon themselves to reduce the use of fossil fuels and the civil society organisations that are determined to make up for any lack of commitment from multilateral climate bodies.

Among many civil society organisations that have sprung up in the recent past with fossil fuels as their biggest enemy are the Carbon Tracker Initiative (CTI) and the Grantham Institute for Climate Change at the London School of Economics. They are actively issuing reports on ‘un-burnable’ carbon which is based on an academic paper published in Nature in 2009. According to the paper published in Nature, the world has a Carbon Budget of 886 Giga tonnes of Carbon dioxide (GtCO2) for the period 2000-2050. Out of this 423.10 GtCo2 has already been emitted between 2000 and 2013. This leaves a budget of only 462.90 GtCo2 for the period 2014-2050 but global fossil fuel resources hold Carbon that is equivalent to about 6 times the Carbon budget for the next 35 years. If so, oil, gas and coal resources held by large energy companies are likely to become sub-prime assets. Drawing inspiration from this conclusion, CTI has issued its report targeting the top 200 listed fossil fuel Companies with resources estimated at $7.42 trillion in February 2011. CTI’s hope is to initiate large scale divestment from these Companies so as to potentially reduce the probability of the release of 745 GtCO2 Carbon embedded in their fossil fuel assets.

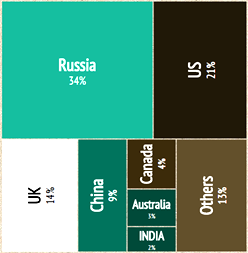

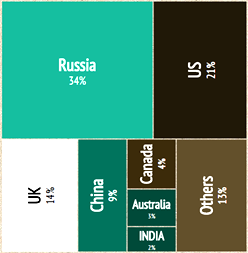

Share of Carbon in World Fossil Fuels

Reserves

Share of Carbon by country of listing of Fossil Fuel Company

The activist organisations seeking radical action against fossil fuel investment are quite optimistic on large scale divestment from fossil fuels. They point out that over 27 cities, 29 religious institutions and 17 major investment foundations have already agreed to divest their interest in fossil fuel Companies and that well known personalities including the President of the World Bank, the Governor of the Reserve Bank of England, Desmond Tutu and Naomi Klein have endorsed the move. Institutional investors including Stanford University and the Rockefeller Fund have announced that their funds would exit the fossil fuel sector. The US Natural Resources Defence Council along with the big investment house Blackrock and the FTSC group are promoting a global equity index that specifically excludes fossil fuels. All this has added momentum to the CTI. If this momentum is sustained in the longer term, developing countries may have to prepare for far reaching consequences.

First, in the short term we may conclude that the risk for Indian fossil fuel companies is limited. The Government of India owns about 90% of CIL shares and about 70% of ONGC shares and it is very unlikely that the Carbon Tracker report would convince the Government to act against its own interest and divest its interest in these companies. If foreign institutional investors who hold about 5% of CIL shares and about 6% of ONGC divesting their interests, the valuation of these companies and consequently their ability to borrow and invest may suffer.

Second, the world would not become carbon free and climate proof when all investors pull out of listed fossil fuel companies. Fossil fuels will continue to be available because companies listed in the Carbon Tracker report represent only 27% of the global proven fossil fuel reserves. The remaining 73% lies with large national coal and oil & gas companies which may continue to produce fossil fuels. Third, the price of fossil fuels may increase substantially in the global market on account of the loss of roughly a third of production from listed companies. This will increase the import costs for net fossil fuel importing countries like India. Fourth, there may be actual physical shortage of energy in India. Though Indian companies hold only 3.5% of the ‘un-burnable carbon’ with the top 200 listed fossil fuel companies, the production of coal from CIL accounts for roughly two thirds of power generation in India and the production of oil and gas by ONGC accounts for about a third of oil consumption in India.

If a limit is placed on how much coal CIL can extract or how much oil ONGC can extract, there would be a substantial loss of production, reduction in profit and loss of many jobs. If India’s fiscal constraints limit import of expensive fossil fuels, domestic production will struggle to meet even basic needs. Second order impacts such as a substantial reduction in economic growth on account of energy scarcity and a sharp division in the society as to who can and who cannot access energy could follow. The impact on power generation, transportation and consequently most other economic activities would be far more widespread and damaging than the impact of frequent floods and droughts in India that is attributed to climate change. Geo-political tensions between countries that produce and do not produce fossil fuels cannot be ruled out.

While these consequences appear severe, the probability of this actually materialising may be small. Even as the President of Stanford University accepted the demands of his students and pulled funds out of coal, he remarked ‘Stanford like the rest of the world runs mostly on fossil fuels’. This is an inconvenient truth that the Carbon Tracker effort may find difficult to contest. As of today, the market continues to value fossil fuels far more than it does alternatives. Using the global oil & gas index STOXX (including Exxon and Chevron) and global renewable energy index RENNIXX which includes Tesla and Vestas, Bjorn Lomborg has pointed out that $100 invested in fossil fuels in 2002 would be worth $ 238 today while the same invested in renewable energy would be worth $28.

Carbon Tracker and other civil society movements such as the Smith School of Entrepreneurship and Environment and Oxford University may be drawing their inspiration from the contribution of Harvard and other University activism in defeating apartheid and arresting the growth of tobacco companies. But unlike Apartheid and Tobacco addiction, carbon is an inevitable by-product of modern society and not the murder weapon of crimes committed by Governments and fossil fuel companies as some civil society organisations like to portray fossil fuels. The entire population of the world is internal to the problem and not external observers as it was the case with the movement against tobacco and apartheid. In their rush to embrace a just cause, civil society movements against fossil fuels may essentially be asking millions of poor people to wait in poverty for technologies that are yet to discovered or yet to become viable.

(A shorter version of this article appeared in Oped section of the Pioneer on December 26, 2014)

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

SWOT Analysis of Overseas Coal Opportunities[1]

Ashish Gupta, Observer Research Foundation

|

Countries

|

Australia

|

Indonesia

|

South Africa

|

Mozambique

|

Colombia

|

|

Reserves in Billion Tonnes (BT)

|

76.4

|

28

|

30

|

16 (extensive study required)

|

6.7

|

|

R/ P Ratio (years)

|

160

|

67

|

117

|

Not known

|

79

|

|

Coal Regions

|

Queensland & New South

Wales (exploited).

Surat Basin & Galilee Basin

(partly exploited)

|

Sumatra & Kalimantan

(exploited).

Papua, Java, Maluku

& Sulawesi (partly

exploited).

|

Highveld (exploited),

Witbank, Ermelo,

Waterberg, Vereeniging

South Rand, Utrechet and

Klip River are open for exploration.

|

Tete and Niassa are open for exploration

|

Cesar, Guagira,

Boyaca and

Cundinamarca are open for exploration

|

|

Coal Quality

|

High

|

Medium & low

|

Medium & low

|

Good

|

High

|

|

Mining Status

|

Highly mechanised

|

Labour intensive

|

Labour intensive

|

Labour intensive

|

Not known

|

|

Cost of Mining

|

Very costly

|

Labour is cheap

|

Labour prices increased dramatically by 9.6% in 2013

|

Labour is cheap

|

Labour is cheap

|

|

Policy Framework

|

Conducive

|

Skewed towards indigenous players

|

Conducive. Does not have any concrete energy policy in place

|

Conducive. No local equity/ ownership required

|

Conducive

|

|

Rail Infrastructure

|

Heavy investment required

|

Heavy investment required

|

Not very good

|

Not very good

|

Not very good

|

|

Port Infrastructure

|

Expanding

|

Not a problem

|

Expanding but heavy investment required

|

Expanding but heavy investment required

|

Expanding but heavy investment required

|

|

Cumulative Additions to coal terminal capacity 2015 -19 (MT)

|

40

|

55

|

27

|

10

|

43

|

|

Planned Investment in Port Infrastructure

|

$ 10 billion Dudgeon Point

Coal Terminal

|

$ 5 million PT Bara Ria Sukses’s Jambi

Coal Terminal

|

$ 1.5 billion terminal at Richards

Bay by Transnet

|

Expansion of port of Macuse

|

Cerrejon $ 1.3 billion infrastructure

expansion programme

|

|

Planned Investment in Rail Infrastructure

|

$ 700 million rail track at the Port of Newcastle

|

$ 2.4 billion for b 191 km rail line from Kutai Barat to Balikpapan in East Kalimantan

|

$ 1 billion railway coal link project from Mpumalanga region to

Richards Bay

|

$ 4 billion rail link under study for

530 km from Moatize to the port of Macuse

|

$ 700 million railway line project from

Colombia’s new port of Puerto Brisa with Central Railway and $ 1.3 billion infrastructure project at Rio Magdalena

|

|

Proximity to Indian Ports

|

18 days to-Indian west coast and 14 days to Indian east coast

|

12 days to-Indian west coast and 9 days to Indian east coast

|

12 days to-Indian west coast and 14 days to Indian east coast

|

10 days to-Indian west coast and 12 +1/2 days to Indian east coast

|

Voyage distance will be long and will further increase the cost

|

|

Shipping Cost $/Tonne

|

79

|

50

|

50

|

48

|

55

|

|

Attractiveness

|

Import only coking coal

|

Good

|

Better

|

Best

|

Moderate

|

Views are those of the author

Author can be contacted at [email protected]

Statewise Scenario of Power Generation from Waste to Energy

Akhilesh Sati, Observer Research Foundation

|

State

|

Installed Capacity (MW)

as on Oct 31, 2014

|

Estimated power generation

(Million Units)

(from 2011-12 to 2013-14)

|

|

Biomass Cogeneration

|

Waste to Energy

|

|

Delhi

|

-

|

16

|

252.27

|

|

Andhra Pradesh

|

380.75

|

50.66

|

182.1

|

|

Gujarat

|

43.9

|

-

|

60.6

|

|

Karnataka

|

623.28

|

1

|

99.9

|

|

Madhya

Pradesh

|

26

|

3.9

|

24.6

|

|

Maharashtra

|

1,001.40

|

12.72

|

325.2

|

|

Punjab

|

140.5

|

9.25

|

15.6

|

|

Tamil Nadu

|

571.3

|

8.05

|

120.9

|

|

Uttarakhand

|

30

|

-

|

30.6

|

|

Uttar Pradesh

|

776.5

|

5

|

335.1

|

|

West Bengal

|

26

|

-

|

12.2

|

Source: Rajya Sabha Unstarred Questions 2413 & 72.

NEWS BRIEF

[NATIONAL: OIL & GAS]

ONGC agrees to Cairn India being given Rajasthan block extension

January 26, 2015. Oil and Natural Gas Corp (ONGC) has without any condition agreed to its partner Cairn India retaining the prolific Rajasthan oil block beyond the contractual deadline of 2020. The Board of ONGC in its meeting recognised that the signed contracts provides for extension of the block licence only on mutually agreeable terms by all parties -- the two partners ONGC and Cairn as well as the government. But unlike 2011 when it had conditional approval for Cairn being acquired by Vedanta Group to resolve the royalty dispute, ONGC has not put any pre-condition this time. The Board merely stated that the licence can be extended on mutually agreeable terms and asked the government to decide on the issue. After internal approval by ONGC, the matter will now come up for discussion at Management Committee (MC) - a panel headed by DGH and comprising the two partners. Once the MC clears the extension proposal, it will go to the government. Cairn's contractual term for exploring and producing oil and gas from the Rajasthan Block RJ-ON-90/2 expires in 2020 and the area is to return to the block licensee, ONGC. ONGC, which currently holds 30 percent stake in the block, had previously told the oil ministry that the production sharing contract (PSC) can be extended beyond 2020 if all parties to the contract agree on mutually agreeable terms. ONGC as a licensee of the block, which produces about 181,000 barrels per day of oil, pays royalty to the government on not just its 30 percent stake but also on Cairn's 70 percent interest. (economictimes.indiatimes.com)

Govt at loggerheads with RIL over $1 bn Panna Mukta-Tapti oilfields

January 22, 2015. The government has hardened its position in a $1 billion dispute over the Panna Mukta and Tapti oil and gas fields, alleging the contractors (Reliance Industries and BG) presented arbitrators with financial statements different from audited accounts, and indulged in heavy exaggeration of tax payments which reduces the state's share of profit. It has also questioned the neutrality of arbitrators in the dispute between the oil ministry and Reliance Industries Ltd (RIL) and BG (British Gas). The fields were discovered by ONGC but in the 1990s it was given to consortium of Enron Corp (which sold its stake to BG later), Reliance Industries with 30% interest each, and ONGC with 40%. The disputes are over taxes and royalties and the computation of state's share of profit. Oil Minister Dharmendra Pradhan has held discussions on legal implications of the alleged excessive tax deduction and the submission of accounts to the arbitrators, which were different from the audited accounts and has asked appropriate agencies and legal advisors for opinion if these amounted to "fraud". (conomictimes.indiatimes.com)

Domestic crude oil production falls 1.4 percent in Dec

January 21, 2015. India's crude oil production fell 1.4 percent in December as output from oilfields operated by private companies like Cairn India fell sharply. Crude oil production at 3.21 million tons in December 2014 was 1.4 percent lower than 3.25 million tons in the same month a year ago, according to latest data released by Petroleum Ministry. Oil and Natural Gas Corp (ONGC) reported a 0.7 percent rise in output at 1.9 million tons on the back of 5 percent surge in offshore production. However, privately operated fields reported a 5.2 percent drop in production at 1.02 million tons. Rajasthan oilfields of Cairn saw production drop 7.8 percent to 765,049 tons, it said. Natural gas production dipped 3.5 percent to 2.89 billion cubic meters as output from privately operated fields like Reliance Industries' eastern offshore KG-D6 block continued to decline. ONGC's gas production was down 5.1 percent at 1.89 bcm while output by private firms from offshore fields too declined by 4.5 percent to 641.86 million cubic meters. The nation's 22 refineries produced 19.72 million tons of petroleum products in December, 6.1 percent more than 18.6 million tons fuel produced in December 2013. While RIL's older refinery at Jamnagar in Gujarat saw crude throughput surging 26.7 percent to 2.8 million tons, its adjacent only-for-exports unit reported a 1.6 percent drop at 3.1 million tons. Essar Oil's neighbouring Vadinar refinery throughput was up nearly a percent to 1.75 million tons. Crude throughput or the quantum of crude oil turned into petroleum products (fuel), by public sector refiners was up 4 percent at 10.54 million tons. While RIL's older refinery operated at 99.93 percent of its 660,000 barrels per day capacity, the newer export-oriented unit (SEZ refinery) slogged 138 percent of its 580,000 bpd capacity. Public sector refiners saw a capacity utilisation of 103.46 percent. (economictimes.indiatimes.com)

RIL, Essar to operate 2,800 pumps, offer discounts

January 23, 2015. Reliance Industries Ltd (RIL) and Essar Energy are re-entering the fuel retailing business with aggressive growth plans and efforts to lure customers away from state-run rivals by offering discounts and benefits. The retail fuel market has been warming up for competition since the government lifted price controls on diesel in October. RIL said it has reopened 230 outlets and aims to have 1,400 stations operational. Essar owns 1,400 outlets and plans to expand.

Private players are trying to garner a bigger share of the market by providing good services, trying to convert dealer-owned-and-operated pumps into exclusive retailers and offering bulk deals to fleet operators. They are also believed to be considering a demand by dealers for cheaper loans to set up petrol pumps. But what's started hurting the retail outlets of state-run oil companies is the price discount. According to petrol pump operators, Essar offers a discount of up to ` 2 a litre on petrol, while RIL waives ` 5 on petrol worth ` 300 and ` 10 on diesel of ` 1,000.

In 2002, private companies such as Reliance, Essar and Shell had captured almost 15% of the fuel retail market. However, they were unable to compete with the subsidised sales by state-run oil companies and became unviable, making RIL exit the business while Shell and Essar scaled it down significantly. (economictimes.indiatimes.com)

Indian oil launches 'XTRAREWARDS' in Kerala

January 21, 2015. Indian Oil Corporation Limited launched its "XTRAREWARDS' Cash Customer Loyalty programme in Kerala. The Corporation is focused on ensuring Quality and Quantity of Auto Fuels delivered through its 25,000 Retail Outlets across India through Automation and Hardware upgrade.

This is the first on-line loyalty programme in the country which facilitates instant earning and burning of reward points. The reward points thus earned through the "XTRAREWARDS' loyalty programme can be instantly redeemed for free fuel or other gift items from the catalogue, at their participating Retail Outlets.

About 30 Indian Oil Retail Outlets in Kochi are part of this programme at present. The aim is to cover 400 to 500 Retail Outlets in Kerala by March, 2016, thereby offering wide reward earning options for their Retail Auto Fuel Customers in Kerala. (economictimes.indiatimes.com)

Transportation / Trade…………

Tamil Nadu petroleum dealers not to buy fuel on Jan 31

January 27, 2015. Tamil Nadu Petroleum Dealers Association has decided not to buy fuel from oil companies on January 31 to highlight inventory losses they incurred due to unscheduled price cut and also to protest against the Centre's move to impose a hefty fine on them for improper maintenance of toilets in retail fuel outlets. The association said more than 4,800 retail petrol bunks in Tamil Nadu and Puducherry would not buy fuel from oil companies. The association said unscheduled decline in fuel prices had caused the dealers huge losses ranging from ` 3 lakh to ` 5 lakh.

In a letter on December 22, 2014, the ministry directed IOCL, BPCL and HPCL to ensure separate toilets for men and women in each outlet. It also mandates a maintenance sheet for toilets in each outlet to ensure their upkeep. Some motorists in Chennai say most fuel outlets don't provide the mandatory free services like drinking water, air and toilets. (timesofindia.indiatimes.com)

India to discuss LNG imports with US President on his India visit

January 21, 2015. India will strongly raise the issue of LNG imports with United States (US) President Barack Obama as the country wants liquefied natural gas to be exported only in vessels built in USA, manned by US crew and insured by American companies. India wants to make sure that the US government does not take any action against top energy firms Oil and Natural Gas Corp and Indian Oil Corp, which were named by the US government Accountability Office in a list of companies that have done business with Iran. US sanctions against Iran can create hurdles for such companies. GAIL (India) Ltd has an agreement to ship 5.8 million tonnes a year of LNG from two projects in the United States although it needs the approval of US government to bring gas. It plans to buy gas at Henry Hub prices, a US benchmark, where prices are below $3 a unit, making it the cheapest source of gas.

However, liquefaction and transport charges would raise the price significantly by the time it lands in India. The requirement also upsets the Make in India campaign. The Indian government was keen to make sure that Indian vessels are used for LNG shipments, and was seeking technology for this purpose as the country has emerged as a major LNG importer, particularly after domestic output of natural gas has declined. GAIL India said that it had signed a sourcing agreement between its subsidiary GAIL Global USA LNG LLC (GGULL) and US based company WGL Midstream Inc. (WGLM) for procurement of natural gas required to produce about 2.5 MTPA of LNG at the Cove Point Terminal located in Maryland, US.

WGLM is a subsidiary of WGL Holdings Inc., a prominent natural gas company of the United States. It said the definitive gas sale and purchase agreement has been signed for a period of 20 years and supplies are expected to commence from late 2017 when the LNG terminal, in which GGULL holds liquefaction capacity, becomes operational. GAIL has signed a 20 year sales and purchase agreement with Sabine Pass Liquefaction LLC, a unit of Cheniere Energy Partners, USA for supply of 3.5 million tonnes per year of LNG. GAIL also signed a Terminal Service agreement for 2.3 million tonnes per year of LNG liquefaction capacity with Dominion Cove Point LNG LP, USA. (economictimes.indiatimes.com)

ONGC-RIL gas siphoning row: Expert body will not help, says PSU

January 21, 2015. Oil and Natural Gas Corporation (ONGC) has suffered a loss of over ` 30,000 crore due to alleged siphoning off of natural gas by Reliance Industries Ltd (RIL) from the PSU's well in Krishna- Godavri (KG) basin and appointment of an experts body on the issue "will not help", the state-run oil firm said. Making this submission before the Delhi High Court, the ONGC also asked as to where it would go for restitution if such a panel established that around 18 billion cubic metres of natural gas has been "siphoned off" causing a loss of over ` 30,000 crore. The court asked ONGC to file its reply by the next date of hearing on April 22, after which it would decide the matter. RIL, in its plea for dismissing ONGC's petition, has also sought the PSU's board resolution authorising the filing of its writ petition.

RIL said that an independent expert body, US-based DeGolyer and MacNaughton, has been appointed as per the PSU's plea, to "establish continuity of reservoir and for gas balancing" across the two blocks of RIL and ONGC in the KG basin. The court had issued notice to ONGC on RIL's plea, but the PSU yet to file its reply. RIL in its application has said that the matter was a contractual dispute between the parties and the only issue, of appointment of an independent third party, has been settled amicably, and thus ONGC's petition should be dismissed. (economictimes.indiatimes.com)

ONGC plans to achieve target in gas and oil production

January 27, 2015. Republic Day was celebrated at the Oil and Natural Gas Corp (ONGC), Cauvery Asset campus. S.C. Singh, its Executive Director-Asset Manager, said the ONGC has been sparing no efforts to achieve the target in the areas of oil and gas production. In drilling front, the Cauvery Asset has performed well and drilled eight against the target of nine exploratory wells. As for development wells, the Cauvery Asset had drilled five against the target of eight. Two more are being drilled.

Mr. Singh said that GCS Kuthalam of the Cauvery Asset has been selected for an excellence award for 2014 under the category of ‘best onshore installation for 2013-14.’ It has been selected for the annual Green Tech Environment Award for 2013 in gold category in petroleum sector. The awards would be given away shortly at Dehradun and Kolkatta. (www.thehindu.com)

OIL, ONGC unlikely to benefit even as govt reworks subsidy sharing formula

January 22, 2015. Oil India Ltd (OIL) and Oil and Natural Gas Corporation (ONGC) may not get a full exemption from sharing the oil subsidy. This is because the government is reworking the subsidy sharing formula to cope up with difficult situation posed by falling crude prices, only as a temporary relief. This formula will not be a long term solution which in any case will be reworked later. At present, as per the current formula, OIL and ONGC sell crude to domestic oil marketing companies at $56 per barrel with $112 per barrel fixed as the full price for crude purchase. Thus the two companies share their subsidy burden. However the crude prices are on a downslide with the international crude oil price of Indian Basket is currently around $45.16 per barrel and the low oil prices are expected to help the Centre save at least ` 40,000 crore on fuel subsidy in 2014-15. As per the new formula, the slab of $56 per barrel in itself will be lowered largely to help the exploration companies in the immediate future to manage their finances. (www.business-standard.com)

Oil ministry moves new subsidy plan

January 22, 2015. The government may exempt upstream oil companies from sharing the subsidy burden as long as international crude price stays below the $60-a-barrel mark as it rushes to divest stake in ONGC during the current fiscal. The subsidy-sharing formula, which is holding up the stake sale, is expected to be cleared over the next few days even as the disinvestment department has said that the proposed selloff may be tough during the current financial year. The fall in global crude prices and the deregulation of diesel prices have completely changed the oil arithmetic and made the earlier subsidy-sharing formula redundant. The government is estimating under-recoveries of around ` 78,000 crore for the oil retailers during the current financial year, of which ` 51,000 crore relates to the first half, leaving the estimated unpaid bill for the whole year at around ` 26,500 crore. In 2013-14, the oil subsidy bill was around ` 1.3 lakh crore. The petroleum ministry has asked for reworking of the subsidy-sharing mechanism as the current formula for upstream players such as ONGC and Oil India, which shell out $73 a barrel as subsidies, cess and taxes, is unviable when the cost of crude is less than $50 a barrel. As a result, the ministry has suggested that the earlier formula be retained for the first half but starting October, the upstream players should be exempted from any burden as long as crude costs $60 a barrel or less. Between $60 and $100 a barrel, these companies can take over 85% of the under-recoveries and 90% in case price exceeds $100.

Based on the assumption that crude will cost around $76 a barrel during the second half of the year, and the rupee will be around 62 a dollar, the upstream players and GAIL (India) will have to shell out ` 37,000 crore, while the Budget will have to provide around ` 40,500 crore for oil subsidy. With ` 22,000 crore already available with the government after taking care of last fiscal's liability, finance minister Arun Jaitley may have to set aside a little over ` 18,000 crore in the supplementary demand for grants that he presents along with the Budget on February 28. Alternatively, he can carry forward the liability to the next financial year - as has become a norm of sorts for the past few years.

What may come as a further relief for Jaitley is Saudi Arabia's expectation in its Budget that oil prices will hover around $80 a barrel in 2015-16, which translates into an allocation of under ` 40,000 crore for the next fiscal. A lower subsidy bill will be a major positive for the government, which is seeking to limit the fiscal deficit within 4.1% of GDP this year, while looking for resources to step up public investment during the next financial year. (timesofindia.indiatimes.com)

Petrol costs more than ATF in India

January 21, 2015. Perhaps for the first time, petrol in India costs more than the superior aviation turbine fuel (ATF) or jet fuel used in airplanes, as the government has levied a record excise duty on the fuel used in two-wheelers and cars. A litre of petrol in Delhi costs ` 58.91 per litre. On the other hand, ATF, which has a higher octane than petrol and is a heavier fraction in the distillation process, is priced at ` 52.42 a litre. Traditionally, petrol, being of lesser quality than ATF, would cost less. But four consecutive excise duty hikes in three months have reversed this. After four duty hikes totalling ` 7.75 per litre, petrol now attracts the highest ever excise rate of ` 16.95 per litre. According to data available from Petroleum Ministry, excise duty on petrol was ` 10.53 per litre in April 2002 when the fuel was first deregulated or freed. This rose to ` 14.59 by May 2005 by when government control was back in place.

Excise duty on petrol touched its peak of ` 14.78 in March 2008 before it was slashed to ` 9.48 in 2012. The fuel was again deregulated in June 2010 and since then, retail rates have more or less moved in tandem with international trends. Since August, the retail rates have been on the decline as global oil prices slumped to multi-year lows. In nine cuts, petrol price has been reduced by a cumulative ` 14.69 per litre. This reduction would have been higher but for the excise duty hikes - first by ` 1.50 on November 12, then by ` 2.25 on December 2, and ` 2 each on January 2 and January 16.

Government raised excise duty to meet its budgetary deficit. It had collected ` 94,164 crore, or 52 percent of the total excise collections, from duty on petroleum products, according to the ministry data. The excise duty hike will give the government at least ` 18,000 crore more this fiscal year. The excise duty is made up of basic duty of ` 8.95, special excise duty of ` 6 and additional excise duty of ` 2 per litre.

ATF attracts an excise duty of 8 percent. On diesel, excise duty was ` 2.85 a litre in April 2002, which rose to ` 4.74 in March 2008 before dipping to ` 2.06. It now stands at ` 9.96 per litre - the highest ever. The fuel was deregulated in October and has seen five retail price cuts totalling ` 10.71 a litre. These cuts would have been higher but for the excise duty hikes - ` 1.50 on November 12, ` 1 on December 2 and ` 2 each on January 2 and January 16. Diesel currently costs ` 48.26 - the lowest since April 2013. Petrol in April 2002 was priced at ` 26.54 a litre while diesel cost was ` 16.59 per litre. (profit.ndtv.com)

[NATIONAL: POWER]

NLC plans to acquire power plants in India

January 26, 2015. The Neyveli Lignite Corporation (NLC) has said it was planning to acquire power plants in India and coal blocks outside the country. During the 13th Five Year Plan (FYP) period, the company intends to add 11,206 MW at an outlay of ` 65,000 crore. The development comes at a time when its projects are increasingly facing problems due to delay in various clearance and time-delay from Bharat Heavy Electricals Ltd (BHEL), among other factors. NLC said for a faster growth, the company was looking to acquire power plant assets in India. NLC need to pursue ways to expedite implementation of the new projects more efficiently, NLC said. NLC said the TPS-II expansion project at Tuticorin totaling 500 MW capacity, in collaboration with BHEL, reached Unit-I on January 6, 2015.

NLC said the scheduled dates of commissioning NTPL's 2X500-MW Thermal Power Project at Tuticorin have been postponed due to the delay in obtaining forest clearance. It is expected by March 2015. The 2X500-MW Neyveli New Thermal Power Project is also being constructed as a replacement for the existing TPS-I. The contracts have been awarded for all the three major packages and activities have been commenced. Unit-I is expected to be commissioned by October 2017 and Unit-II by April 2018. (www.business-standard.com)

Shiv Sena still not on board with BJP on Nuclear power project

January 26, 2015. As India and the United States reached a breakthrough over nuclear energy that will boost nuclear projects across the nation, Shiv Sena, the BJP’s ally, reiterated its stand against the Jaitapur nuclear power project in Maharashtra and suggested that the government opt for tidal energy instead. Reacting to the pact, Shiv Sena MP and a strong opponent of Jaitapur project Vinayak Raut said that Sena would continue its opposition to the project. Raut had recently met the parliamentary committee on energy and made a pitch for tidal energy. (www.asianage.com)

Transmission / Distribution / Trade…

Cost cutting: Discoms give alternatives in Delhi

January 24, 2015. Discoms have written to the power ministry on various suggestions to bring down power purchase costs in the city. While pointing out that withdrawing the power purchase adjustment surcharge (PPAC) had hit them financially, the companies have proposed other mechanisms like reallocation of expensive stations of NTPC such as Aravalli, Badarpur, Anta, Auraiya, Dadri Gas and their substitution with lost-cost plants. The discoms also proposed more gas allocation to the Bawana plant. Discoms claim they source nearly 90% of power through long-term power procurement from central generating stations of NTPC, NHPC, DVC, SJVNL etc and fromDelhi power plants like Pragati, Rajghat, Bawana etc as allocated by ministry of power. The discoms also reiterated their old claim that inefficient coal-based plants such as Badarpur and Rajghat have outlived their useful life. The companies said that inadequate availability of domestic coal linkages for new and efficient plants like Aravali and Jhajjar makes them dependent on imported coal apart from transportation cost from Port in eastern part of India to Jhajjar in Haryana, thereby making the plant expensive. Gas supply was another issue raised by the discoms. (economictimes.indiatimes.com)

More private firms needed in power transmission: Advisory Group

January 22, 2015. An advisory group has said that there should be private participation in power transmission sector. Advisory Group for Integrated Development of Power, Coal, and Renewable Energy chaired by Suresh Prabhu (Union Minister for Railways) in its report to the Ministry of Power, stressed on need for private participation in power transmission sector. Private firms account for 35 percent in power generation as against only 3 percent in transmission. It also suggested that bidding for transmission projects should be expedited, the time period for clearances should be shortened and the transfer of SPVs (special purpose vehicles) should be done within three months. Prepare a list for the projects to be opened up for development by public and pvt players at the earliest. Prepare long term transmission plan and monitor progress, availability of transmission infrastructure should be ahead of power generation. The group also suggested that the mechanism to identify critical transmission constraints, formulate specific projects and have them executed in the most effective manner, should be put in place. (economictimes.indiatimes.com)

Policy / Performance………….

Additional 455 GW capacity needed to meet power demand by 2034

January 27, 2015. India will require an additional 455 GW of installed capacity and significant investment in setting up transmission and distribution network to meet the country's power demand by 2034, research firm PwC said. According to its recent report, titled 'The Future of India: The Winning Leap', there was a need to shift power generation capacity toward non-coal sources and increase use of digital and communication technology to automate information gathering, which can help reduce costs. Using traditional sources to achieve these targets would require investments of almost USD 900 billion over the next two decades, the report said. According to PwC, if India shifts its power generation capacity toward non-coal sources, only then it can meet the increased need for power in an environmentally sustainable way. It further said that the government should encourage private participation in transmission and distribution. It further suggested that investing and developing capabilities in advanced storage and distributed power could go a long way toward addressing the challenge of rural power distribution in India. (economictimes.indiatimes.com)

Coal scam: CBI files progress report in a sealed cover

January 27, 2015. The Central Bureau of Investigation (CBI) filed the progress report of its further investigation in a sealed cover before a special court in connection with a coal blocks allocation scam case allegedly involving former Coal Secretary P C Parakh, industrialist Kumar Mangalam Birla and others. The agency informed the court that they are also filing statements of various persons recorded during the further investigation and requested the judge that the sealed cover be not opened until it complete the probe into the case. The progress report was filed in pursuance to the court's December 16, 2014 order in which it had directed the agency to examine former Prime Minister Manmohan Singh and some other top PMO officials.

The progress report of further investigation has been filed along with statements of various persons as recorded during further investigation in sealed cover besides some documents, Special CBI Judge Bharat Parashar said. Senior Public Prosecutor V K Sharma filed the progress report before the court, saying they have complied with the December 16, order passed by the judge. Sharma told the court that the agency needs to two weeks time to complete the ongoing further investigation. After the court had passed order on December 16, the CBI has recorded statements of Manmohan Singh, Birla, Singh's then Principal Secretary TKA Nair and ex-PM's then private secretary BVR Subramanyam and others in connection with the case.

The case pertains to allocation of Talabira II coal block in Orissa to M/s HINDALCO in 2005. The CBI had earlier lodged an FIR against Kumar Mangalam Birla, former Coal Secretary P C Parakh, M/s HINDALCO Industries Ltd and other unknown persons and officials for the offence under section 120-B (criminal conspiracy) of the IPC and under provisions of the Prevention of Corruption Act. The CBI, however, had later filed a closure report in the case on August 27, last year opining that no criminal offence was committed by any of the persons involved in the entire process of allocation of Talabira-II coal block to HINDALCO. (www.firstpost.com)

Railway ministry shifts blame to Coal India for fuel crisis

January 27, 2015. Rubbishing the APP’s (Association of Power Producers) allegation of discrimination in coal rake allocation, the railway ministry has put the blame on Coal India Ltd (CIL) and the ministry of coal for the fuel crisis. A lower than promised supply of coal by CIL and the coal ministry’s inability to coordinate with the railways are the main issues, it said. During the peak season (December-March), demand for transportation from various sectors, including imported coal, picks up. However, loading by CIL during the April-November, 2014 period was much less than the agreed quantity, even though adequate railway wagons were available.

According to railways, CIL’s inability to supply adequate coal to the respective independent power producers (IPPs) might have led to a fall in actual supply in FY15. The APP had complained to railway minister Suresh Prabhu, alleging that Indian Railways is discriminating “against IPPs in placement of (coal) rakes”. The association also indicated that the lack of coordination between CIL and railways is leading to coal shortage for the IPPs in the country.

The supply of rakes for the power sector is monitored regularly by a committee comprising coal, railways and power ministry officials. And it has been successful to bring down losses for the critical power plants and reduced their numbers to 13 from 30 earlier. The power producers who have coal stock for running four or lesser days is considered ‘critical’. (www.financialexpress.com)

Govt expects negative bidding in coal block auction

January 22, 2015. The government expects fierce competition by power producers in the upcoming auction of coal blocks that may lead to negative bids — a situation where the winners will pay the government instead of charging consumers for their cost on developing the fields. Under current guidelines, power firms have to bid lower than the price arrived after the technical stage for coal block auctions. The final price at which a company wins a block is the coal cost that can be passed on to electricity consumers — the company quoting the lowest charge will win. Power companies have to pay ` 100 for every tonne of coal mined to the governments in states where the mines are located. Since power companies are so desperate to ensure the supply of coal that at least some of them may forgo the charge that they can levy on consumers. A shortage in coal is forcing several power stations to run at below capacity or even halt generation, and a captive coal block will offer the producers a lot more certainty to run their plants than depending on state-run monopoly Coal India for supplies. The government has provided for a scenario where the bid price for a block during the auction comes to zero when the companies agree to forego the fuel costs to bag a mine. The provision has been made after the coal ministry received queries on zero-coal cost during pre-bid conference held on January 11, Coal Secretary Anil Swarup said. (economictimes.indiatimes.com)

Panel on cards to monitor power watchdog bosses

January 22, 2015. The performance of members and chairpersons of state electricity regulatory commissions will be assessed by an evaluation committee that will have the power to remove or reappoint them based on their record. The Electricity (Amendment) Bill, 2014, proposes formation of an evaluation committee under the forum of regulators that will examine the performance of each member. The central government will constitute the forum of regulators consisting of the chairperson of the central commission and chairpersons of the state commissions. The forum of regulators shall, from time to time, constitute an independent committee consisting of not less than three persons of eminence to review the performance of any appropriate commissions and submit a report with recommendations of this committee to the central government. The bill also proposes to cap the upper age of members at 65 years and their tenure will be reduced from five years now to three years under the proposed bill. The proposed amendment also aims to increase the number of members of state commissions from three now to five under the bill. Three members in this five-member team will be appointed by the centre. Once the Electricity (Amendment) Bill becomes law, the performance of each member will be based on introducing new tariffs as and when required. (economictimes.indiatimes.com)

India, US trying to resolve differences over nuclear deal ahead of Obama trip

January 22, 2015. India and the United States (US) were trying to narrow differences on nuclear trade ahead of President Barack Obama's visit, but New Delhi ruled out a change in its liability law that has choked off US investment. Nuclear commerce worth billions of dollars was meant to be the centrepiece of a new strategic relationship between the United States and India, allowing New Delhi access to nuclear technology and fuel without giving up its weapons programme. But the 2010 Indian nuclear liability law that makes equipment suppliers ultimately responsible for an accident has held back firms including GE-Hitachi, Toshiba's Westinghouse Electric Company and France's Areva from proceeding with the construction of reactors. India has offered to set up an insurance pool to indemnify companies which have won the right to construct reactors in the country against liability in the case of a nuclear accident, as a way around the law. Under the plan readied by state-run reinsurer GIC Re, insurance would be bought by the companies contracted to build the nuclear reactors who would then recoup the cost by charging more for their services. Alternatively, state-run operator Nuclear Power Corporation of India (NPCIL) would take out insurance on behalf of these companies. India's law, written under the shadow of the Bhopal gas disaster, is a deviation from the global norm in which the nuclear operator bears responsibility for an accident, not the equipment providers. Foreign nuclear firms are also worried about another part of Indian law which they say exposes them to tort claims. (timesofindia.indiatimes.com)

India's power sector set for $250 bn investment: Goyal

January 21, 2015. Power, Coal and Renewable Energy Minister Piyush Goyal said the country's power sector is set for $250 billion investment across different segments. Goyal said his message to foreign investors is that India story is getting stronger and back to its high growth phase. Investments are expected across diverse areas of the energy sector including in renewables as well as transmission and distribution segments, he said. Goyal said renewables is set for $100 billion, while transmission and distribution segment is to get $50 billion. Another $60-70 billion will be for power generation including for restarting stalled projects and for new ones while $5-6 billion is set for energy efficiency projects, Goyal said. Besides, $20-25 billion investments would come for associated infrastructure required in replacement of old and out-dated equipments, among others, the Minister said. (www.dnaindia.com)

Quality of coal will determine each block’s floor price

January 21, 2015. Floor prices for coal blocks that will be auctioned to steel, sponge iron, cement and captive power companies will vary from ` 150 to possibly about ` 500-600 per tonne, said several officials aware of preparations currently under way ahead of bids being sought. The floor price will be different for each block and will be a factor of the quality of coal, rising in line with the energy content. Although the auction methodology only mentions that the floor price will not be less than ` 150 per tonne, it does not give any indication on the upper limit. The floor price for each block will be a factor of the energy content of coal the reserve holds and the price for a similar quantity of the fuel that Coal India sells to steel, sponge iron, cement and captive power units. Coal India sells its coal at prices that are 10-20 percent higher to these sectors compared with the power sector, depending on the quality of the fuel. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

US seen limiting oil drilling in Arctic, may open Atlantic

January 27, 2015. The U.S. Interior Department will lay a framework as soon as for oil exploration in the nation’s coastal waters in a five-year plan that is expected to withdraw areas off Alaska while possibly adding parts of the Atlantic. Republican Lisa Murkowski said the head of the offshore energy office told her the agency will place areas of the energy-rich U.S. Arctic off limits. Those areas had been previously deferred from new leasing. Current leases in the Arctic, such as those held by Royal Dutch Shell Plc, won’t be affected. The agency’s proposed plan will control leasing in the Outer Continental Shelf, such as the Gulf of Mexico and Arctic Ocean. The plan may open some areas in the Atlantic for the first time, especially off Virginia, North Carolina and South Carolina, where governors and many lawmakers support drilling. The administration of President Barack Obama provoked a furious backlash from Alaska’s political leaders after first pushing Congress to declare the disputed Arctic National Wildlife Refuge as a wilderness area, then disclosing plans to curtail future Arctic drilling. Alaska’s leaders are struggling with a budget gap created by a plunge in state oil production and the price of oil. Governor Bill Walker said he is considering “aggressive options” against Interior’s proposal. Walker said Interior won’t withdraw the leases held by Shell, which had mishaps in 2012 while trying to explore in the Beaufort and Chukchi seas. Both Shell and ConocoPhillips put their exploration plans in those seas on hold in 2014. They must decide soon whether to try again this year. Obama announced he was blocking the leasing parts of Bristol Bay, Alaska, for oil and gas exploration and production. (www.bloomberg.com)

Green dragon on target for 12 bcf of gas in 2015

January 26, 2015. China-focused junior Green Dragon Gas reported that it was on target to achieve its 2015 year-end production objective of 12 billion cubic feet (bcf) of gas. Green Dragon said its production for 2014 was unchanged over the previous year at 8.2 billion cubic feet. The firm completed 10 wells using the LiFaBriC (lined inseam faulted brittle coals) drilling technology during 2014. For 2015, it plans to drill further exploration wells across all eight of its blocks onshore China. (www.rigzone.com)

Africa oil boom on hold as prices spur explorer caution

January 22, 2015. Africa’s oil and gas boom is in jeopardy. The dash for resources that saw explorers invest billions of dollars to tap promising oil fields from Ghana on the west coast to Tanzania on the east, is stalling as the global drop in crude prices pushes drillers to reconsider the high costs of exploration on the African continent. For many drillers, 2014 was already failing to reach the promise seen in 2013 when half of the world’s 10 largest oil and gas finds were made in Africa. With oil prices dropping below $50 a barrel, analysts say they expect a more concentrated pullout in 2015. In Africa’s frontier environment, drilling may bring a higher reward, but since most exploration takes place offshore, single wells can cost hundreds of millions of dollars, increasing the industry’s susceptibility to lower oil prices. Following major discoveries in 2013 in countries including Tanzania and Kenya, the Baker Hughes Rig Count reported 154 rigs in Africa in February of last year, the most since 1983. By December, that had declined to 138. Ophir Energy Plc, a U.K. explorer that’s made several large finds in Tanzania, ended its 2014 drilling campaign in Gabon in June, after a series of dry holes. Repsol SA, Spain’s biggest oil producer, spent almost $100 million on a well that missed in offshore Namibia. Tullow Oil Plc, a British oil company that’s among the most active explorers in Africa, said it won’t drill a single offshore exploration well in the continent this year as it reduces investment in response to lower prices. For Africa to revive the momentum of its oil and gas industry, governments need to look at the terms they offer explorers and adapt them to reflect lower prices, Tullow said. Tullow has cut its exploration and appraisal budget of $1 billion by more than two-thirds and will focus on onshore drilling in East Africa, where it’s been able to reduce well costs to $7 million each. (www.bloomberg.com)

Faroe Petroleum expects to raise exploration Capex in 2015

January 22, 2015. Faroe Petroleum Plc said it expected its pretax exploration and appraisal capital expenditure to increase in 2015 as the oil and gas explorer leverages its cash flow and debt facilities. Average production in 2015 is expected at 8,000 to 10,000 barrels of oil equivalent per day (boepd). Total average economic production for 2014 was about 9,100 boepd, the London-listed company said. Faroe expects pretax exploration and appraisal capital expenditure of about 95 million pounds (about $144 million), more than the about 85 million pounds it spent in 2014. (www.rigzone.com)

Eni makes new oil, gas find in Egypt's Western Desert

January 22, 2015. Eni S.p.A. has announced a new discovery of oil and gas in the West Melehia deep exploration prospect, located in the Melehia license, in the Western Desert of Egypt, 116 square miles west of Alexandria. The exploration well began production with an initial flow of 2,100 barrels of oil per day, intended for the Melehia field infrastructure treatment. The discovery will be rapidly followed by the drilling of other delineation and development wells which should result in an estimated production of about 8,000 barrels per day by the end of 2015. In the last three years, in the Western Desert of Egypt Eni has doubled its oil production through exploration of deep sequences. The Company currently produces more than 60,000 barrels per day in five different development licences, all operated by Agiba. (www.rigzone.com)

BHP cuts US shale rigs as oil to Iron ore prices slip

January 21, 2015. BHP Billiton Ltd, the biggest overseas investor in U.S. shale, will cut the number of its rigs there by about 40 percent as plunging petroleum prices add to concerns about lower iron ore earnings. Drilling and development spending on U.S. onshore oil and gas fell to $1.9 billion in the six months to Dec. 31 from $2.1 billion a year ago, the Melbourne-based company said. BHP will cut the number of active rigs to 16 from 26 by July, it said. Brent crude, a benchmark for more than half of the world’s oil, declined 48 percent last year as increasing output in the U.S. contributed to a global glut. The price of iron ore, the biggest earner at BHP, slumped 47 percent in 2014 as the largest miners raised volumes amid weaker demand from China, the largest buyer. U.S. drillers have cut the number of oil rigs in service by 209 since Dec. 5, the steepest six-week decline since Baker Hughes Inc. began tracking the data in July 1987. The count was down 55 to 1,366 in the week to Jan. 16, the data show. Petroleum production rose 10 percent to 63.6 million barrels of oil equivalent in the three months through December, beating a median forecast of five analysts of 61.8 million barrels. Lower spending won’t curb output, BHP said, forecasting production of 255 million barrels in the year to July, from 243 million barrels a year earlier. (www.bloomberg.com)

Russia's refinery runs in Dec down 2.1 percent on month

January 23, 2015. Russian oil refinery runs in December fell by 2.1 percent month-on-month or 123,787 barrels per day (bpd) due to a series of outages, data from the Energy Ministry showed. Refineries processed 5.862 million barrels of crude oil per day in December versus 5.986 million in November. Three major Russian refineries were hit by unplanned outages in December, data showed. Due to a leak on a major pipeline delivering oil to the Black Sea port of Tuapse in December the Tuapse refinery, owned by Rosneft, dropped its capacity by 29.6 percent to 139,814 bpd from 198,716 bpd in November. As a result, an additional 0.6 million tonnes of crude oil were exported in December from that refinery via the port of Tuapse. Perm refinery, owned by Lukoil, decreased its processing in December by 29.3 percent to 203,514 bpd from 287,703 bpd in the previous month due to an accident at a crude distillation unit. The other Lukoil refinery, Norsi, was stopped in December due to power outages and was forced to suspend its processing and oil products supplies for a few days. Moscow refinery, owned by Gazprom Neft, increased its capacity by 74.4 percent to 190,060 bpd in December from 108,948 bpd in November after a major overhaul. December refinery runs were up by 3.2 percent year-on-year or 179,183 bpd. (www.downstreamtoday.com)

Transportation / Trade……….

Russia's Gazprom eyes first gas via new route to Turkey by 2017

January 27, 2015. Russia's Gazprom plans to supply the first gas via a new route to Turkey in December 2016, Chief Executive Alexei Miller said. Gazprom said it would build a new pipeline to Turkey with a capacity of 63 billion cubic metres (bcm) a year to bypass Ukraine. It had earlier scrapped a planned South Stream pipeline over disagreements with the European Union (EU). Under the new plan, the EU would have to build its own link to the proposed pipeline to Turkey to get Russian gas, which now accounts for around a third of Europe's needs. Around half of that is currently being pumped via Ukraine. Miller said the new pipeline would consist of four lines of 15.75 bcm each, with the first one to supply Turkey only. Turkey is already receiving Russian gas via existing routes, importing 27.4 bcm last year. (www.downstreamtoday.com)

Lithuania LNG importer Litgas to supply gas to Estonia

January 27, 2015. Lithuanian LNG importer Litgas has signed its first deal to supply natural gas to Estonia, the company said. Litgas, a part of Lithuania's state-owned energy group Lietuvos Energija, said the deal was to supply natural gas to Estonia's Reola Gaas, a part of Alexela Group. Lithuanian company plans to supply 30 million cubic metres of gas to Estonia in 2015, including the deal with Reola Gaas, with deliveries starting on Feb. 1. Litgas has a contract with Norway's Statoil to import 0.5 billion cubic meters of natural gas per year via its new floating LNG import terminal at the Baltic Sea Klaipeda port. (www.downstreamtoday.com)

Traders delaying Russian gas imports tap declining EU stores

January 26, 2015. Europe is accelerating withdrawals from natural gas inventories as traders delay imports of Russian fuel poised to fall with oil. The amount of gas taken from storage sites in the 28-nation European Union (EU) rose 44 percent from a year earlier since the heating season started Oct. 1, Gas Infrastructure Europe data showed. Russian flows to most of Europe and Turkey slid 29 percent last month from a year earlier after falling by a quarter in November, according to OAO Gazprom in Moscow. Russian gas supplies, usually tied to oil prices with a six- to nine-month lag, will be cheaper in the summer as crude’s 58 percent decline since June filters into long-term contracts. The collapse in oil is a “huge incentive” for traders to buy as little Russian gas as possible now in favor of future deliveries, Citigroup Inc. said. Gazprom, which provides about a third of Europe’s gas, shipped 11.5 billion cubic meters (about 406 billion cubic feet) to Europe in December, down from 16.3 billion cubic meters a year earlier, according to the state-owned exporter. Flows are also falling as Europe’s mildest year on record cut demand and sent prices tumbling 28 percent in 2014. (www.bloomberg.com)

Senate Republicans block Keystone export and steel amendments

January 21, 2015. Senate Republicans blocked two attempts to amend legislation forcing approval of the Keystone XL pipeline that would have required the project be built with domestically produced steel and that the oil be used in the U.S. With polls showing Americans support Keystone, Democrats had used the amendments to undermine the pipeline’s purported benefits to the U.S. Republicans made circumventing President Barack Obama’s review of the Keystone project their first major legislative effort since taking control of both the House and Senate this month. The Republican-backed bill the Senate is considering would let TransCanada Corp. build the $8 billion pipeline. (www.bloomberg.com)

Pakistan fuel shortage crisis forces Sharif to cancel Davos trip

January 21, 2015. Pakistani Prime Minister Nawaz Sharif canceled a trip to attend the World Economic Forum (WEF) in Davos, Switzerland, as the nation’s worst fuel shortages in memory threatened to revive street protests against him. Since the crisis began, he’s suspended five officials, including Pakistan State Oil Co.’s deputy chief, and has sought hourly updates on the situation. The government has sold fuel from its reserves and private companies have boosted supplies as anger grows over long waits at petrol stations. The cash-strapped distributor’s move this month to reduce shipments by 80 percent left it unable to meet a surge in demand after the government cut gas prices to match lower global costs. The Finance Ministry has arranged emergency funding to import oil, Power Minister Khawaja Asif said. The fuel shortages stem from delayed payments among different arms of Pakistan’s government. The Power and Water Ministry failed to pay Pakistan State Oil an outstanding debt of ` 171 billion ($1.7 billion), enough for about two months of oil imports. Sharif asked the ministry to recover ` 500 billion from its debtors, which will be used to pay back the oil company. About ` 300 billion is trapped between power producers, fuel retailers and refiners due to delayed payments, Asif said. Pakistan has 10 days of oil reserves, Petroleum Minister Shahid Khaqan Abbasi said, short of the 20 days that refiners are required to maintain. The government provided 19,300 metric tons of gasoline compared with the daily demand of 12,000. Two oil shipments are likely to reach the country and four shipments of 200,000 tons have been arranged for next month. (www.bloomberg.com)

Bernstein sees US LNG plants scrapped as buyers look elsewhere

January 21, 2015. Most of the proposed liquefied natural gas (LNG) plants meant to ship cargoes out of the U.S. will “never be built” as the collapse in oil prices damps global demand for the nation’s gas, according to Sanford C. Bernstein & Co. With the long-term price difference between oil and gas converging, the U.S. is no longer as competitive as it used to be, Bernstein analysts said. World LNG demand is set to increase by 9.8 percent to 268 million metric tons in 2015 after three years of slow growth as lower prices stimulate consumption in countries including India, they predicted. The U.S. has received 47 applications to export nearly 80 billion cubic feet per day of gas in its liquefied form, according to the Energy Department. While the country currently produces no LNG, Chevron Corp. and Cheniere Energy Inc. are among companies racing to supply the cleanest fossil fuel to Japan and other large consumers amid opposition to coal and nuclear power. U.S. LNG is only competitive in the Pacific if long-term Henry Hub gas prices are below $4 per million British thermal units and Brent crude is sold above $80 a barrel, according to Bernstein. So far in January, natural gas futures have averaged $2.97 in New York while London-traded Brent oil contracts are at $49.89 a barrel. (www.bloomberg.com)

For Saudis, falling demand for oil is the biggest concern

January 27, 2015. As the world’s oil producers wring their hands over a global glut that’s pushing down prices, evidence is mounting that Saudi Arabia is more concerned about shrinking demand. The world’s largest exporter has chosen not to cut production, counting instead on lower prices to stimulate consumption, said Mohammad Al Sabban, an adviser to Saudi Arabia’s petroleum minister from 1988 to 2013. The Saudis are keeping an eye on investments in fuel efficiency and renewable energy, according to Francisco Blanch, Bank of America Corp.’s head of global commodity research. The U.S. shale revolution showed that forecasts of dwindling world oil supply were premature. It also gave credence to the old adage, attributed to a Saudi oil minister more than 30 years ago, that the Stone Age didn’t end because of the lack of stone. With costs falling for clean energy and international attention focused on slowing climate change, the Saudis are more worried that the world is inching closer to peak demand. Among industrialized countries, that peak was reached 10 years ago, according to the Paris-based International Energy Agency (IEA), and fast-developing countries such as India and China won’t become as carbon-intensive, Al Sabban said. Oil supplied 31 percent of the world’s energy in 2012, compared with 46 percent in 1973, the IEA said. Even as oil prices dropped 48 percent last year, the most since 2008, global production rose 2.1 percent to 93.3 million barrels a day, according to the IEA. The price plunge was caused by years of record-high prices that spurred expanding supplies while impairing demand -- and not a Saudi conspiracy, Al Sabban said. Saudi Arabia and other members of the Organization of Petroleum Exporting Countries (OPEC) hope cheap energy will foster economic growth and, in turn, more oil consumption, he said. Not everyone expects demand to taper off. World consumption will reach 104 million barrels a day in 2040, from 90 million barrels a day in 2013, the IEA estimated. The U.S. Energy Information Administration projected daily demand reaching 117.05 million barrels in 2040, Exxon Mobil Corp predicted 114 million barrels, and OPEC forecast 111.1 million. (www.bloomberg.com)

Hedge funds bet on oil dropping further

January 26, 2015. Hedge funds boosted bearish wagers on oil to a four-year high as U.S. supplies grew the most since 2001. Money managers increased short positions in West Texas Intermediate (WTI) crude to the highest level since September 2010 in the week ended Jan. 20, U.S. Commodity Futures Trading Commission data show. Net-long positions slipped for the first time in three weeks. U.S. crude supplies rose by 10.1 million barrels to 397.9 million in the week ended Jan. 16 and the country will pump the most oil since 1972 this year, the Energy Information Administration (EIA) said. Saudi Arabia’s King Salman, the new ruler of the world’s biggest oil exporter, said he will maintain the production policy of his predecessor despite a 58 percent drop in prices since June. Salman Bin Abdulaziz Al Saud ascended to the throne after King Abdullah died. The kingdom pumped 9.5 million barrels a day in December as members of the Organization of Petroleum Exporting Countries (OPEC) exceeded their 30 million-barrel daily target for a seventh month. Production in the U.S. will be slow to decline as improvements in drilling technology boost well output even as companies drill less. Oil production per rig from new wells in the Bakken in February will be double what it was three years ago, the EIA said. (www.bloomberg.com)

Where to buy gasoline for ` 0.03 a litre

January 26, 2015. Venezuela President Nicolas Maduro told lawmakers he’s considering raising gasoline prices. That might be a good idea. It’s been two decades since the government last lifted state-set local prices, the result of politicians’ concern that the move could spark protests like those that swept across the oil-rich nation following an increase in 1989. In the interim, a string of currency devaluations has pushed down the cost in dollar terms to levels that would seem implausible to consumers in other parts of the world, even after the recent oil tumble cut prices at the pump. It now costs about 0.2 U.S. cent to buy a gallon of gasoline in Venezuela, based on black-market currency rates. Expressed another way, you can get 482 gallons with just one dollar. That’s enough to drive a Chevrolet Silverado pickup truck from one end of Venezuela’s 1,740-mile-long Caribbean coast to the other six times. It’s a perk the government may no longer be able to keep doling out to its citizens as the collapse in oil exports pushes the country to the brink of default. (www.bloomberg.com)

BP freezes employee pay in response to oil price slump

January 26, 2015. BP Plc, Europe’s third-largest oil company by market value, will freeze employee pay in the latest example of cost cuts as the world’s top oil companies respond to plunging crude. The company “needs to take a number of measures in response to the harsh trading environment,” Chief Executive Officer Bob Dudley said. BP, which employs more than 80,000 people around the world, is the first global oil company to announce a pay freeze for staff. Oil has slumped to under $50 a barrel, less than half the price six months ago, forcing producers to review spending on new projects, reduce staff and cut costs.

BP offered 1,000 workers at its Trinidad and Tobago operations a voluntary separation program, regional manager Norman Christie said. BP said it would cut about 300 jobs in the U.K.’s North Sea to cope with slumping prices and aging oilfields. The Standard & Poor’s 500 Oil & Gas Exploration & Production Index has fallen 28 percent over the last six months as investors anticipated losses. BP, which announces full-year earnings for 2014, will review salaries as normal in 2016, Dudley said. (www.bloomberg.com)

Tethys gets 15 yrs extension to Kyzyloi production contract

January 23, 2015. Central Asia-focused Tethys Petroleum announced that its subsidiary TethysAralGaz has received permission from Kazakhstan’s government to extend the Kyzyloi Gas Production Contract for another 15 years to December 31, 2029. The Kyzyloi contract area has also been increased by 56 percent to 110,950 acres and now encompasses a larger gas-bearing area. The area includes the successful AKK08 and AKK10 gas wells as well as the AKK05 well, which will be worked over later in the first quarter of 2015. (www.rigzone.com)

OPEC will blink first in battle with shale drillers, poll shows