-

CENTRES

Progammes & Centres

Location

[Over-Supply in Global Coal Market is an Opportunity for India]

“India will be importing coal from various coal exporting countries like Australia, Indonesia, and South Africa but India’s vulnerability is decided by coal prices in the global coal market. Though India and China are considered as major coal markets, India does not decide the price in the global coal market. It is China which will continue to set coal prices in the near future…”

Energy News

[GOOD]

Money should flow into resource rich poor States through coal auctions!

Gas price pooling may bail out stranded generation assets but it will equate unequal gas suppliers!

[UGLY]

Large scale solar and roof top are economically unsustainable and will come at the expense of more urgent public spending!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Auctioning Coal: Will it Clean the Stable?

· Over-Supply in Global Coal Market is an Opportunity for India

DATA INSIGHT………………

· Renewable Energy Scenario in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC to induct heavy duty rigs in Tripura

· Cairn not to get back relinquished Barmer block areas

Downstream……………………………

· GRMs of IOCL, HPCL and BPCL at four fiscal low

· RIL reopens fuel stations

· HPL closure impact minimal on IOC

· BPCL plans ` 230 bn capacity expansion at Bina refinery

Transportation / Trade………………

· India considers laying LPG pipeline to Nepal

· India oil imports from Iran jump sharply in 2014

· Blast at a GAIL gas pipeline in South Delhi

Policy / Performance…………………

· ONGC signs agreement with IITs to develop indigenous technology

· Oil retailers to open 35,600 new outlets in next 3 yrs

· Trade unions assure full support for timely completion of IREP

· Oil firms will decide on price revision: Oil Minister

· Modi govt identifying small oil fields for auction

· Gas price pooling proposal being worked out: Power Secretary

· Railways starts first train that chugs on CNG

· Petrol, diesel prices may slump as oil tumbles to $45 per barrel

[NATIONAL: POWER]

Generation………………

· Kudankulam nuclear plant restarts power generation

· NTPC Mouda plant may run up to full capacity soon

· BALCO gets nod for 1.2 GW power plant in Chhattisgarh

· CESC's Haldia Unit-I starts full-load generation

· BHEL bags ` 12 bn power project order in Karnataka

Transmission / Distribution / Trade……

· India to facilitate cross-border power trading with SAARC Nations

· Delhi HC rejects Adani plea to stop Lanco from selling Udupi power

· 2.29 crore power consumers used IT services for bill payment in 2014

· Kejriwal alleges nexus between BJP's Satish Upadhyay and power companies

· JK governor directs PDD to ensure stable power supply

· NLC seeks public opinion for import of coal for power project

· Govt approves ` 9.9 bn for augmenting transmission network

Policy / Performance…………………

· Over 100 bidders for coal mine auctions: Goyal

· Govt sets up panel on UMPP bids

· Entertaining JSPL plea to affect coal block auction: Govt to HC

· Himachal mulls power bill payments in post offices

· PMO asks Coal Ministry to closely monitor mine auction

· 'Proposal to allow multiple power suppliers anti-people'

· Agartala to be fully lit with LED lights by March

· Centre open to privatisation of Dabhol power project: Goyal

· Poor states in for ` 3.5 lakh crore coal bonanza

· Swaraj calls on Bhutan PM; discusses security, hydropower

· NTPC 'advised' to shift location of proposed power plant in AP

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Schlumberger to pay $1.7 bn for stake in Russia driller

· Huntington oilfield output in UK to remain restricted

· Russia's Rosneft starts oil production at Arkutun-Dagi field

· Det Norske starts up Boeyla oil field in North Sea

· Russia confronts stagnant oil output after crude price slump

· Iraq produces record 4 mn bpd of crude in Dec

· Oil heads for longest weekly losing streak since 1986

· Total, BG start gas production at North Sea West Franklin field

Downstream……………………

· BP completes Indiana refinery reformer startup

· Refineries process record amount of crude in Dec: IEA

· New Saudi-Sinopec oil refinery starts exports

Transportation / Trade…………

· Oil Pipeline through Myanmar to China expected to open in Jan

· TransCanada takes steps to acquire Keystone pipeline land

· Truckers gain from diesel’s drop after gasoline plunge

· ExxonMobil Papua New Guinea gas deal could help expand LNG project

· Welcome to ‘normal’ crude oil price, trading at 100 year average

· Attempts made to disguise Iranian Oil near UAE, Insurers say

Policy / Performance………………

· Iran sees ‘no threat’ from oil at $25 as prices keep falling

· LNG to snap 4 year run as sub $10 price seen amid oil’s drop

· Iran lowers oil price for budget to $40 after collapse

· Indonesia scraps land tax on O&G exploration

· IEA sees oil-price recovery

· Norway’s oil crisis talks lead to stimulus pledges if needed

· Big oil companies get serious with cost cuts on worst slump since 1986

· Judge puts BP's top fine at $13.7 bn for Gulf oil disaster

· Iran President says oil drop to hurt Saudi Arabia, Kuwait

[INTERNATIONAL: POWER]

Generation…………………

· China renews atomic ambition with 5 reactors planned in 2015

Transmission / Distribution / Trade……

· Appalachian Power plans area transmission line upgrades

Policy / Performance………………

· Pakistan implements nuclear safeguards agreement: IAEA

· Industry underwhelmed by China’s new gas-power policy

· Fukushima Meltdowns pervade South Korea debate on reactor life

· Russia plans data centers running on Siberian hydropower

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Fortum Company's 10 MW solar power plant in MP goes on stream

· ABB joins Solar Impulse 2 on its round-the-world flight

· Govt releases book on climate change

· PM Modi chairs first meet of reconstituted climate panel

· Rooftop, large solar projects not long term solutions: Puri

· Manage Himalayan ecosystems to reduce effects of climate change: Javadekar

· Sunil Hitech bullish to develop 200 MW solar capacity in next 5 yrs

· Govt allows direct sale of bio-diesel by manufacturers

· India to get clean energy, water from Australia

· UN official meets Naidu, pitches for solar power promotion

· IWL to set up wind turbine manufacturing facility in Madhya Pradesh

GLOBAL………………

· Saudi Arabia delays $109 bn solar plant by 8 yrs

· Defective panels threatening profit at China solar farms

· German utility RWE hasn’t ruled out EON-style split, CFO says

· Cheap gas makes electric cars harder to sell, BMW warns

· Dubai doubling size of power plant to make cheapest solar energy

· US solar jobs climb 22 per cent as clean power aids economic recovery

· Global solar sector sees corporate funding worth $26.5 bn in 2014

· Obama said to target methane emissions in next climate task

[WEEK IN REVIEW]

COMMENTS………………

Auctioning Coal: Will it Clean the Stable?

Lydia Powell, Observer Research Foundation

In a recent interview on coal block auctions, the Minister of State for Coal has said that he had ‘inherited a mess’ and that his mission was to ‘clean the stable’.[1] In the same interview, the Minister has implied that some parties could be hurt and that justice could also be compromised but that all this would be a price worth paying to ‘clean the stable’. The Minister was probably referring to the ‘mess’ caused by the Supreme Court ruling in August 2014, or more correctly the mess caused by Government policy (not just those of the previous Government) rather than the larger mess that coal sector is seen to be in.

The idea of auctioning coal blocks was introduced through an Amendment to the 1997 Mines and Minerals (Development & Regulation) Act in 2012. As per the said Amendment, ‘the grant of reconnaissance permit or prospecting licence or mining licence in respect of an area containing coal or lignite can be made only through auction by competitive bidding even among the eligible entities’. The sensational report of the Comptroller and Auditor General of India (CAG) on ‘Allocation of Coal Blocks and Augmentation of Coal Production’ for the year ending March 2012 brought this provision into the limelight. It argued that the delay in introducing competitive bidding for coal blocks to captive users of coal in the power, cement and steel sectors had ensured continuation of undue benefits to private coal block alottees. The report estimated that financial gains to the tune of ` 1.86 trillion or roughly $ 30 billion could have accrued to the national exchequer if the decision taken in 2012 to introduce competitive bidding for allocation of coal blocks had been implemented. The CAG arrived at a value for the potential monetary loss to the Government on the basis of average cost of production and average sale price of coal from opencast mines of CIL in the year 2010-11.

The methodology used by the CAG has been criticised by many observers. However, the popular media latched on to the ‘mediagenic’ quality of the allegation that the public exchequer had potentially lost ` 1 trillion and framed the discourse as one of graft arising from the nexus between politics and business. In reality, the original sin (allocating coal blocks rather than auctioning them) does not appear to have been the result of pre-meditated graft.

As observed in a 2012 paper by ORF, allocations of coal blocks began in the early 1990s when Coal India Limited (CIL) was asked to prepare a list of coal blocks which CIL was not likely to need in the next 50 years.[2] These blocks were to be allocated to end users of Coal by a Steering Committee set up for allocating coal blocks comprised of State and Central Ministries and CIL. In the early years about half a dozen blocks were said to be allotted to the applicants who were all associated with well-known independent power projects (IPPs). It was a time when blocks were chasing projects rather than projects chasing blocks as one expert put it. IPPs preferred coal supplied by CIL rather than having their attention diverted to an extraneous activity like mining. In this period it would have been irrational to auction coal blocks because the demand for mining leases was less than that of supply. This changed as the private sector entered into power generation in a big way following the Electricity Act of 2003. The established method of allocating coal to power generators failed to keep up with the pace with which thermal power plants were being set up.

In 1991-91, installed power generation capacity by the private sector was 2.5 GW or 3 percent of the total. It has increased to over 78 GW or 33 percent of total installed capacity in 2014, which gives a compounded annual growth rate (CAGR) of about 16 percent.[3] In the same period CAGR of domestic coal production was about 3.4 percent.[4] If we are blind enough to look narrowly at these two figures, it would be easy to assign blame on the inefficiency of the coal industry and its monopolistic structure. However a more rounded and balanced analysis would suggest that the blame could be assigned to policy makers who failed to note that a push to open the flood gates for power generation should be accompanies by a similar policy push for fuels. After all, power generation and fuel production are just parts of a long continuum.

Returning to statements by the Minister, auctioning of coal is unlikely to clean the stable as the stable in question is only part of this long continuum. It could however introduce an element of competition in the sector; it could also change the dominant rationality in coal production from one of administrative planning to one of commerce. However, auctioning of a set of coal blocks is in no way a match for policy adrenalin that continues to be injected into the power generation side (possibly driven by private sector lobbying). In fact much of the pressure on coal production is the consequence of the rush of adrenalin in the power generation side. Private investors rushed to install capacity without conducting even basic analysis on growth of fuel supply and growth in power demand which would have been standard practice for investment in any other industrial sector. These power sector investors are now pressing policy makers to find ways to monetise their so called ‘stranded assets’. Given that private sector concerns are the only concerns that matter today, the Government is rushing to lend a helping hand.

Cleaning the stable is part of this rush but once again, but the Government seems to be overlooking the fact that power generation is just one part of the continuum that begins at the coal mine and ends in the homes, offices, trains and factories of consumers through transmission and distribution networks. As of today production of fuels (coal) and generation of power are the only parts of the continuum that are profitable. Transmission and distribution continue to lose money. 90 percent of the accumulated losses in the power sector (which amount to about 1 percent of GDP) are on account of losses at the distribution end. In fact losses at the distribution end have been growing at a CAGR of 9 percent since 2003, the year in which the Electricity Act was introduced. These losses will continue to exert pressure on other parts of the continuum, including the Coal Minister’s stable.

The idea that there is limitless unmet demand for electricity in India justifies a dramatic increase in coal production is also questionable. 27th of August 2014, which recorded the highest demand for electricity last year required only 122 GW of capacity which was roughly half the installed capacity at that time with 15 GW spare capacity was available on power exchanges. The fact that there is no market demand for power does not mean that there is no need for power but from an economic perspective any rational investor would think twice before adding capacity in this environment.

Then there is the murky area of how much coal is produced in India, how much is round-tripped as imported coal and how much is sold in grey markets. As noted in IEA’s medium term coal market report 2014, in 2013, demand for thermal coal increased by 2 percent while coal based power generation increased by 8.4 percent. Both cannot be true unless we take into account significant volumes of coal available in the grey market (the report gives a figure of 60 million tonnes). Any Government that wants to clean the stable must look at all these issues along the continuum. It must also look beyond the concerns of the capitalist entrepreneur, because unfortunately a democracy also has people who are also rate payers and tax payers. If they don’t pick up the entrepreneur’s bills the continuum will collapse.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Over-Supply in Global Coal Market is an Opportunity for India

Ashish Gupta, Observer Research Foundation

|

R |

ising import of coal is a cause for concern especially on account of increasing current account deficit. There have been many warnings from expert observers that coal imports will accentuate India’s delicate position. Given the prevailing coal shortages and the recent Supreme Court ruling, coal imports are likely to increase. Will such an increase be detrimental for India?

Years

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13

|

2013-14

|

Coal Imports ($ Bn)

|

3.2

|

3.87

|

4.58

|

6.43

|

10.08

|

8.97

|

9.78

|

15

|

16.2

|

16.4

|

Coal Import Bills

India will be importing coal from various coal exporting countries like Australia, Indonesia, and South Africa but India’s vulnerability is decided by coal prices in the global coal market. Though India and China are considered as major coal markets, India does not decide the price in the global coal market. It is China which will continue to set coal prices in the near future.

China remains the world’s largest market for imported coal with increase in coal demand of around 5.3 percent (196 Mt) for the period up to 2019. This growth rate was substantially lower compared to its ten-year average of 9.7 percent. Despite a growth of 4.1 percent over 2012 coal prices are low in the global coal market. This is due to China growth which is now projected to grow at 7 percent compared to previous years when it was growing at the rate of 9 – 9.6 percent. Apart from this development China is overproducing coal indigenously and therefore coal suppliers in China are selling coal at discounted rates to maintain market share giving no room for any arbitrage opportunity to imported coal. China is now looking for coal with less ash content and so inclined more towards Australian coal market rather than Indonesian coal. This shift has affected Indonesian coal suppliers negatively. Indonesia has increased its coal production capacity to export from approximately 57 Mt in 2000 to 426 Mt in 2013. The share of exports in overall production rose from approximately 72 percent in 2000 to 88 percent in 2013, as domestic coal demand grew only at 8.1 percent per year whereas production increased by 15 percent and exports by 16.8 percent. Therefore if China mostly consumes only internal production and limits the extent of import coal from Australia, then the coal prices in the global market will go down further.

As per IEA’s medium term coal market report 2014, India’s coal demand will grow at around 4.9 percent per year till 2019 compared to China which will grow at round 2.6 percent per year during the same period. A caveat is required that this report was prepared before important developments in India’s coal sector. The recent Supreme Court ruling is one of such incident which changes the coal dynamics all together in India. Apart from this India’s economic growth has come down from 8.5 percent to around 5 percent which puts a downward pressure on electricity demand. Large projections for new power plants need a relook. Given the current dilemma over the policy framework in the coal sector, these new plant capacities may not come online and consequently reduce coal demand in the country. However in the answer given by the Power Minister (to starred question no. 203) on 8th December, 2014 at Rajya Sabha that that ‘in view of the negative coal balance reported by subsidiary coal companies of CIL, new linkages/Letters of Assurance (LoA) have not been granted to any of the sectors since 2010 and there is no proposal to provide fresh coal linkages to private companies for new and upcoming projects’ reflects a deficit scenario. India will therefore be importing coal but since coal is in over supply in the global coal market, the prices will be generally low. Many of the large coal producers in Indonesia are expecting to raise coal production further to achieve further economies of scale. This production if not absorbed in China has to be absorbed by India to some extent but not at a high price. A positive development for India is that it gets some breathing space before it can increase domestic coal production through appropriate policy. Effective utilization of power generating capacity is also a key issue for India as utilization stands at 50 percent currently. Irrespective of whether India reaches the target of 1 billion tonnes of coal production by 2019, India now is now looking at a much better global market, if it has to import coal.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

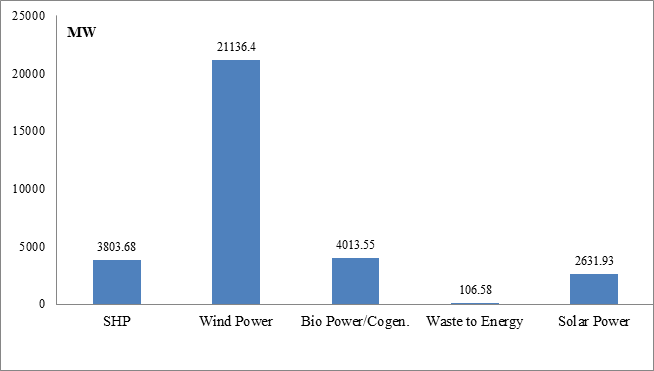

Renewable Energy Scenario in India

Akhilesh Sati, Observer Research Foundation

As on March 31, 2014

|

Region |

Installed Capacity |

|

|

Mega Watt (MW) |

% Share (State, Private, Central) |

|

|

Northern |

5935.77 |

(21%, 79%, 0%) |

|

Western |

11271.07 |

(4%, 96%, 0%) |

|

Southern |

13784.67 |

(11%, 89%, 0%) |

|

Eastern |

432.86 |

(67%, 33%, 0%) |

|

North Eastern |

256.67 |

(99.99%, .01%, 0%) |

|

Islands |

11.1 |

(47%, 53%, 0%) |

|

All India |

31692.14 |

(12%, 88%, 0%) |

Source: Executive Summary (December, 2014), Central Electricity Authority.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC to induct heavy duty rigs in Tripura

January 19, 2015. Oil and Natural Gas Corp Ltd (ONGC) would soon induct more rigs to speed up exploration drive across Tripura. Currently, the oil giant is committed to supply five million standard cubic meters a day (mmscmd) gas per day to OTPC, Tripura State Electricity Corporation Ltd (TSECL) and NEEPCO for power generation. The present gas reserve is capable of meeting the demand of three customers – OTPC, TSECL and NEEPCO including Manarchak plant till 2032. If more gas is required, the ONGC will require more gas wells to meet the demand for future. At present, four rigs are functioning in the State and the ONGC has decided to induct two more heavy duty rigs in the next eight months to intensify the exploration drive in special locations, ONGC Tripura Asset Manager VP Mahawar said. He said heavy duty rigs would be capable of drilling 4,500 metre well while the ONGC is having rigs capable of drilling only 3000/3200 metre deep well. (www.assamtribune.com)

Cairn not to get back relinquished Barmer block areas

January 15, 2015. The oil ministry has rejected Cairn India Ltd's request to return areas in its Barmer oil and gas block the company had relinquished in accordance with the terms of contract. The ministry had conveyed its decision to Cairn. It was explained to Cairn that there was no legal ground for accepting the company's proposal, which would have created a precedence. Cairn is operating three development areas in the block totalling 3,111 sq km out of the total block area of 11,108 sq km and surrendered 7,997 sq km. The ministry has rejected the arguments mainly on the ground that there is no legal provision and the fact that five CBM (coal bed methane) blocks have been carved out of the surrendered areas, two of which have already been offered for bidding. Returning these areas to Cairn would, thus, give rise to litigation and set a precedence for others to seek similar dispensation, which would defeat the very purpose of having the term for relinquishment. (economictimes.indiatimes.com)

Downstream………….

GRMs of IOCL, HPCL and BPCL at four fiscal low

January 20, 2015. State-run oil marketing firms – Indian Oil Corp (IOCL), Hindustan Petroleum Corp (HPCL) and Bharat Petroleum Corp (BPCL) -- are operating at gross refining margins which are the lowest in the last four fiscals, HDFC Securities in its research said. Gross refining margin (GRM) is what the company earns from turning every barrel of crude oil into fuel. IOCL's GRM has slipped to $0.09 per barrel during April-September 2014, against $5.19 per barrel in April-September 2013. HPCL has seen its GRM drop to $2.09 per barrel between April-September 2014, against $3.27 per barrel in April-September 2013. BPCL's GRM stood at $2.36 per barrel during April-September 2014 against, $4.38 per barrel in April-September 2013. Singapore gross refining margins (GRMs) have increased quarter-on-quarter from $4.8 per barrel in second quarter of FY15 to $6.3 per barrel in third quarter of FY15. Oil prices have fallen 60 per cent from their June 2014 peak. Rising production, particularly US shale oil and weaker demand in Europe and Asia have driven the prices down. Brent and US WTI crude oil prices fell to their lowest levels in almost six years as OPEC producers decided not to cut output to tackle a glut in the market. For the upstream companies decline in crude oil prices and stronger rupee will have negative impact on gross realization. However, fall in subsidy burden will partially compensate. Gross crude oil under-recoveries are estimated to decrease quarter-on-quarter from ` 22,419 Crore in second quarter of FY15 to ` 15,400 crore in the third quarter of FY15 on account of deregulation of diesel prices and decline in crude oil prices. (www.business-standard.com)

RIL reopens fuel stations

January 19, 2015. Buoyed by diesel price decontrol, Reliance Industries Ltd (RIL) has reopened about one-fifth of its 1,400 fuel stations, which were shut down when state firms were selling heavily subsidised fuel. RIL and Essar Oil Ltd, the only other private refiner in India, had together captured about 17 per cent of domestic retail market for diesel and 10 per cent of petrol by 2006 before heavily subsidised sales by state-run firms took a heavy toll on private firms' fuel sales. RIL had shut down all of its 1,432 petrol pumps around March 2008 because of huge losses in incurred in trying to match its public sector firms, who sold fuel at rates much lower than their cost as they got government subsidies. The government in June 2010 deregulated or freed petrol pricing by not providing any more subsidies. This allowed Essar to re-enter the retailing arena, selling only petrol from most of its 1,400 outlets. Diesel, India's most consumed fuel, was deregulated in October last year and since then private retailers have again entered the market. Essar started diesel sales from all its outlets and has expanded its network to 1,600, which is likely to go up to 2,500 in one year's time. The company said it will leverage technology to provide superior customer value across the network with the motto of "Right Quantity and Quality of fuel at the Right price." RIL had captured the market share in 2006 by owning just 4 per cent of the total petrol pumps in the country. State-run retailers have since then swelled the network to 51,870. The company is again starting the fleet management program wherein large fleet operators like truckers were given smartcards which their drivers could use buy fuel without cash with deliveries that can be monitored online, thereby eliminating pilferage or theft. Also, aggressive automation based 'Instant Reward scheme' will provide an edge over the competition, which lacks nationwide automation, it said. RIL's present network comprises of about 900 retail outlets that are owned by the company and the rest by dealers. (economictimes.indiatimes.com)

HPL closure impact minimal on IOC

January 16, 2015. Indian Oil Corp (IOC) said the impact of closure of Haldia Petrochemicals Ltd (HPL) on its refinery was minimal as the facility had switched to other product mix. IOC said the refinery used to supply about 50,000 tonnes of naptha per month to IOC. IOC said Haldia refinery also supplied about 10,000 tonnes of naptha to the Panipat facility of the company. IOC was banking on the new 15 million tonne capacity petrochemicals plant coming up at Paradip which is likely to be on stream by March. This new petrochemicals plant may help in better utilisation of Haldia refinery. HPL is closed for the last six months over management and fresh fund crisis. The Bengal plastic based industry has claimed that their cost has moved up due to closure of HPL. (economictimes.indiatimes.com)

BPCL plans ` 230 bn capacity expansion at Bina refinery

January 14, 2015. Bharat Petroleum Corp Ltd (BPCL) plans to more than double capacity of its Bina refinery in Madhya Pradesh to 15 million tonnes at a cost of about ` 23,000 crore. BPCL and its partner Oman Oil Corp Ltd will in phase-I raise the capacity of 6 million tonnes Bina refinery to 7.8 million tonnes at a cost of ` 3,500 crore by 2018. In Phase-II, the capacity would be raised to 15 million tonnes at an additional investment of ` 18,000-20,000 crore. This was disclosed when Madhya Pradesh Chief Minister Shivraj Singh Chauhan met Oil Minister Dharmendra Pradhan. (economictimes.indiatimes.com)

Transportation / Trade…………

India considers laying LPG pipeline to Nepal

January 19, 2015. After oil, India is studying feasibility of laying a LPG and gas pipeline to Nepal for supply of cooking fuel to the Himalayan nation. Nepal currently buys all of its cooking gas (LPG) needs from India, which supplies gas through trucks. In a meeting with Nepalese Commerce Minister Sunil Bahadur Thapa, Oil Minister Dharmendra Pradhan agreed to "sending a technical team to Nepal to study feasibility of setting up of LPG and natural gas pipeline infrastructure from India to Nepal". Pradhan also assured Nepal of uninterrupted supply of LPG. The two leaders also discussed the proposal to lay a pipeline from Bihar to Kathmandufor supply of petrol, diesel and ATF. Five months after India agreeing to foot the cost of the pipeline, the project is stuck over differences on the tenure of fuel supply. While Indian Oil Corp (IOC), which is to invest ` 200 crore for laying the pipeline, wants Nepal to commit to buying fuel for 15 years, the Himalayan nation is willing to sign agreement for only five years. The pipeline from Raxaul in Bihar to Amlekhgunj in Nepal in the first phase and to Kathmandu in the next phase, was agreed during Prime Minister Narendra Modi's visit to the Himalayan nation in August 2014. Seeking it as a 'gift' from New Delhi, Nepal wanted India to foot the cost of laying the project, which IOC agreed. While IOC and Nepal Oil Corp (NOC) were in broad agreement on the modalities of execution of the project, including the funding options, the duration of the proposed Sale Purchase Agreement was a bone of contention. IOC has maintained that the agreement should be for a period of at least 15 years but NOC wants it to be for five years only. It can be renewed with mutual agreement after every five years, the Nepalese firm had conditioned. While IOC is to fund the project, Nepal is to provide encroachment free pipeline corridor. Also, NOC will have to bear the cost for building fuel storage tanks and other facilities at Amlekhganj. Work on the 41-km pipeline was to start this month and is targeted for completion by July 2017. Nepal is dependent on India for meeting all of its fuel requirements. Petrol, diesel, domestic LPG and jet fuel (ATF) are currently trucked from IOC's depot at Raxaul to Nepal. (economictimes.indiatimes.com)

India oil imports from Iran jump sharply in 2014

January 16, 2015. India imported 42 per cent more Iranian oil last year over 2013 levels as its refiners increased purchases to take advantage of an easing in sanctions targeting Tehran's nuclear programme. The jump came with an end-of-the-year boost as imports in December surged 84 per cent from a year ago to 348,400 barrels per day (bpd), the highest since March. Diplomatic efforts to reach a final agreement last year failed for a second time in November, and a self-imposed deadline was extended to June 30 this year. India - Iran's top oil customer after China - imported 276,800 bpd of oil and condensate last year, compared with 195,600 bpd in 2013, according to tanker arrival data. Indian refiners bought about 39 per cent more Iranian oil in December compared with November, the data showed. Private-refiner Essar Oil was the biggest Indian client of Iran in 2014, followed by Mangalore Refinery and Petrochemicals Ltd and Indian Oil Corp. Iran remained the seventh-biggest oil supplier to India in 2014, while its share in overall purchases rose to 7.3 per cent last year, compared with 5.1 per cent in 2013, the data showed.

The current sanctions allow Iran access to some of its frozen oil revenue overseas and restrict its oil sales at about 1 million to 1.1 million bpd. Overall, India imported 3.84 million bpd of oil in December, up 9.4 per cent from a year earlier. Imports for the full year fell 1.4 per cent to 3.81 million bpd. In the January-December period India imported about 3.9 per cent more oil from Latin America, with the region accounting for about 20.1 per cent of overall imports, up from about 19.1 per cent a year ago. The Middle East region supplied about 59 per cent of India's oil imports in January to December, compared with 62.3 per cent a year ago. In the fiscal year to March 31, 2014, India cut its imports from Iran by 15 per cent to 220,000 bpd to get a waiver from US sanctions on the Islamic republic. India's annual oil contracts with Iran follow the country's April-March fiscal cycle. In the first nine months of the year to end March 31, 2015, Indian refiners have shipped in about 250,200 bpd of Iranian oil, up 41 per cent from the same period a year ago. (economictimes.indiatimes.com)

Blast at a GAIL gas pipeline in South Delhi

January 16, 2015. An explosion took place at a national gas pipeline of Gas Authority of India Ltd (GAIL) in South Delhi but there were no casualties reported. The explosion and the subsequent fire occurred when third part contractors working for Delhi Metro dug up the area, GAIL said. Fire tenders reached the spot and efforts were on to extinguish the fire. (economictimes.indiatimes.com)

Policy / Performance………

ONGC signs agreement with IITs to develop indigenous technology

January 20, 2015. Oil and Natural Gas Corp Ltd (ONGC) has signed an agreement with seven IITs for developing indigenous technologies to enhance exploration and production of hydrocarbons and alternate energy sources. The industry-academia collaboration is aimed at bolstering 'Make in India' campaign in energy sector, ONGC said. ONGC signed the Memorandum of Collaboration (MoC) with Pan-IIT, a consortium of seven premier Indian Indian Institutes of Technology - IIT-Kharagpur, IIT-Kanpur, IIT-Madras, IIT-Mumbai, IIT-Delhi, IIT-Guwahati and IIT-Roorkee. The MoC also ideates promoting internships, visiting and adjunct faculty programs, research oriented career programmes through an ONGC Scholar Programme. Within the ambit of this collaboration, while ONGC will make its high-tech laboratories available to students and research scholars of IITs, ONGC geoscientists and engineers will also have the opportunity of working with IITs, ONGC said. ONGC said the collaboration was in response to Prime Minister Narendra Modi's call for Make in India and develop indigenous technologies. The programme will be funded by ONGC and shall take advantage of the available infrastructure and manpower of the IITs and ONGC.

With this collaboration, while ONGC will use intellectual expertise of the IITs, the actual work will be done at the ONGC's in-house R&D Institutes and oilfields to enable the best talents of the country to supplement each other by applying their mind on cutting-edge technologies to boost oil & gas production in the country. HRD Minister Smriti Zubin Irani said her ministry will promote similar industry–academia linkages on a large scale and will also facilitate engagement of Adjunct Faculty. Oil Minister Dharmendra Pradhan said knowledge of theoretical aspects is available with IITs while the knowledge of practical aspects of energy business resides with ONGC. (www.firstpost.com)

Oil retailers to open 35,600 new outlets in next 3 yrs

January 20, 2015. India, which already has the highest number of petrol pumps in the world, will get another 35,600 retail outlets in next 2-3 years as government embarks on a massive expansion plan to boost oil product availability. The country has 51,870 petrol pumps with Indian Oil Corp (IOC) being the market leader with 23,993 outlets, followed by Hindustan Petroleum Corp Ltd (HPCL) with 12,869 pumps and Bharat Petroleum Corp Ltd (BPCL) with 12,123 outlets.

Private sector has meager presence with Reliance Industries and Essar Oil owning about 1,400 outlets each and Shell operating three. As part of their plan to increase the accessibility and availability of oil products, the retail network of public sector oil marketing companies (OMCs) is being expanded by increasing the number of retail outlets and LPG distributorship in the country, the Oil Ministry said. Besides petrol pumps, OMCs (oil marketing companies) have 13,896 LPG dealers (IOC 7,035, BPCL 3,355 and HPCL 3,506). (economictimes.indiatimes.com)

Trade unions assure full support for timely completion of IREP

January 19, 2015. Trade unions reiterated their commitment towards timely completion of BPCL's Integrated Refinery Expansion Project (IREP) and Petrochemical venture, which together is estimated to cost about ` 25,000 crore. The assurance in this regard was given by the trade unions at a meeting convened by Deputy Chief Labour Commissioner. The meeting was held on the basis of a decision taken during the IREP review meeting called by Kerala Chief Minister Oommen Chandy to conduct a coordination meeting with State leaders of Trade Unions and other stakeholders to assess the labour climate in IREP. It was also decided to extend all support to the forth coming Propylene Derivative Petrochemical Project of BPCL. For speedy implementation of IREP, which is imperative to ensure supply of Bharath Stage IV petrol and diesel by April 1 2016 as per the approved GoI guidelines, Central and state governments and Trade Unions had put into place a robust system of Industrial Relation Committee and had declared the Project site as 'Strike-Free-Zone'. (economictimes.indiatimes.com)

Oil firms will decide on price revision: Oil Minister

January 16, 2015. A day after oil companies skipped revising petrol and diesel prices despite steep fall in global rates, Oil Minister Dharmendra Pradhan said the state-owned firms will do what is "appropriate". As per the practice of revising rates every fortnight, state fuel retailers were expected to announce a cut in petrol and diesel prices as global rates had fallen by about 4 per cent. However, they skipped the revision. On the previous two occasions when they skipped revising rates, the government had raised excise duty to mop up additional revenue, thereby not passing on the benefit of fall in global oil rates to consumers.

The government raised excise duty on petrol and diesel by ` 2 per litre each to gain from slumping global oil rates. This was the third excise duty hike since November 2014 and cumulatively the government stood to gain about ` 16,000 crore in revenue this fiscal. Previously, it had raised excise duty by ` 1.50 a litre on both products from November 12 and by ` 2.25 per litre on petrol and ` 1 on diesel from December 2. (economictimes.indiatimes.com)

Modi govt identifying small oil fields for auction

January 16, 2015. The government is identifying the small and marginal oil and gas fields it plans to auction in coming months to boost domestic production, Oil Minister Dharmendra Pradhan said. State explorers Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) will surrender those small and marginal fields that they are unable to produce from due to economic size or operational issues. These fields will be demarcated into areas for auction. As many as 63 discovered oil and gas are being surrendered by ONGC as they were found to be uneconomic for a large firm with huge overheads to develop or bring to production. Smaller firms with a fraction of operating cost can develop them at much faster and economic rate. OIL will surrender 6 marginal fields. Pradhan said the fields that ONGC and OIL are surrendering are the ones where they have not been able to start production. (economictimes.indiatimes.com)

Gas price pooling proposal being worked out: Power Secretary

January 16, 2015. Non availability of additional domestic gas has made the Power Ministry rework the proposed 'gas price pooling' scheme, Power Secretary P K Sinha said. Sinha said that state-run firm GAIL even agreed to cut its marketing margin to facilitate gas price pooling. GAIL agreed to cut its marketing margin and some of states including Andhra Pradesh and Gujarat have agreed to exempt VAT but we cannot go ahead with the proposal (gas price pooling) as we do not have gas, he said. As much as 16,000 MW of gas based capacity is stranded due to lack of fuel. Gas pooling, or averaging, would mean that plants currently getting cheaper domestic gas will have to pay a slightly more. On the other hand, stations with no domestic gas supplies that are necessarily to rely on imported fuel, will pay a lot less, thereby making electricity produced affordable. Power plants, which currently cannot buy high priced LNG, will be able to buy gas at pooled rate. This would enable the existing gas based plants to significantly improve their run-rate or operating capacity. (economictimes.indiatimes.com)

Railways starts first train that chugs on CNG

January 15, 2015. In significant step towards adopting green fuel, the railways have launched their first CNG train. Railway minister Suresh Prabhu flagged off the train, run on dual fuel system — diesel and CNG — on the Rewari-Rohtak section of northern zone. Introduction of CNG trains will reduce greenhouse gas emission and also cut the transporter's fuel bill by reducing consumption of diesel. The minister has stressed on the use of alternative fuel, including use of solar and wind power, to reduce dependence on conventional energy. The railways have modified the 1,400 HP engine to run on dual fuel - diesel and CNG - through fumigation technology. The passenger train would consume over 20% of CNG, covering a distance of 81km in about two hours. The train comprising of two power cars and six car coaches has been manufactured by the Integral Coach Factory at Chennai with the CNG conversion kit being supplied by Cummins. (timesofindia.indiatimes.com)

Petrol, diesel prices may slump as oil tumbles to $45 per barrel

January 14, 2015. Petrol and diesel could become cheaper as international oil prices have tumbled to about $45 per barrel, continuing their downward spiral since June last year as the market remains oversupplied. A fuel price cut will bring cheer to the ruling Bharatiya Janata Party (BJP) ahead of the high-profile Delhi assembly election on February 7. But state-run oil marketing firms are reluctant to cut pump prices of auto fuels because of inventory losses as the value of crude oil purchased at higher rates falls in step with global prices. Indian Oil Corp (IOC), the country's biggest refiner, has lost more than ` 12,000 crore. Indian refiners purchase crude in advance, which they process after about 30-40 days. At times, prices can fall more than 20% in this period. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Kudankulam nuclear plant restarts power generation

January 19, 2015. Power generation at the Kudankulam Nuclear Power Project (KNPP) has restarted after the first unit's reactor and turbine tripped January 14, Power System Operation Corporation Ltd (POSOCO) said. According to POSOCO, power generation at the first unit of 1,000 MW KNPP commenced. The atomic power unit touched a peak generation of 658 MW since it was restarted and the average generation for the day was 168 MW, POSOCO said. India's atomic power plant operator Nuclear Power Corporation of India Ltd. (NPCIL) is setting up two 1,000 MW Russian reactors at Kudankulam in Tirunelveli district, 650 km from Chennai. The first unit attained criticality, which is the beginning of the fission process, July 2013. Subsequently it was connected to the southern grid in October 2013. However, commercial power generation began only December 31, 2014. Since then the unit was generating an average of 940 MW till it tripped Jan 14. According to G Sundarrajan, an anti-nuclear power activist and who had filed a case against the setting up of the ` 17,000 crore KNPP, the atomic power company suffers at least ` 8 crore loss per day of plant outage. He said the actual per unit commercial tariff for the first unit is still unclear with different officials giving out different figures, ranging from ` 3.50 per unit to ` 4 per unit. (www.business-standard.com)

NTPC Mouda plant may run up to full capacity soon

January 17, 2015. NTPC's first plant in Maharashtra's Mouda district may run up to its full capacity within next couple of months as it has been assured new coal supply arrangement by Western Coalfields Ltd (WCL). Currently, NTPC's Mouda facility, about 40 kms from here, gets coal supply from Mahanadi Coalfields Ltd (MCL) in Odisha, and due to the long distance of over 600 kms, power generation cost has shot up owing to high transportation expenses, Group General Manager V Thangapandian said. The generation cost which is currently Rs 3.90 a unit will come down drastically to nearly ` 2.50, which will boost the demand, he said. The Mouda plant has a power purchase agreement with the state government for 350 MW. NTPC, country's biggest power producer with a power generation capacity of 43,143 MW, has plants at Korba in Chhattisgarh where generation cost is as low as 95 paise and at Vindhyachal and Sipat, it is around ` 1.50 a unit, he said. Looking to cater the power needs, NTPC is going ahead with stage II at Mouda under which two more units of super critical 660 MW each would be set up by May and November of 2016, respectively. Work on these plans is progressing at a fast pace. On the national scenario, NTPC has set goal to achieve the production target of 1.28 lakh MW by year 2032, Thangapandian said. (www.business-standard.com)

BALCO gets nod for 1.2 GW power plant in Chhattisgarh

January 16, 2015. Bharat Aluminium Company Ltd (BALCO) has received approval from the Chhattisgarh government to start a 1,200 MW captive power plant at its Korba aluminium smelter in the state. The functioning of the power plant, set up with an investment of about ` 5,000 crore, would help boost BALCO's annual aluminium production capacity to 5.7 lakh tonnes, the company said. The power project would have four units, each having 300 MW generation capacity. The captive power plant would be in addition to two existing plants, having capacity of 270 MW and 540 MW, respectively. (economictimes.indiatimes.com)

CESC's Haldia Unit-I starts full-load generation

January 15, 2015. Private power utility CESC's unit-I of Haldia power plant started full load generation. The company said that the first unit reached full load generation capacity of 300 MW. CESC had said the second unit of 300 MW will also come on stream by March. The power plant is 600 MW capacity thermal power plant which has coal linkage with Coal India. When both units of the Haldia plant become operational, the total capacity of CESC in West Bengal would be 1800 MW. CESC had said that the company was also trying to have a back-up plan in case it fails to secure a coal mine in the coming auctions. (economictimes.indiatimes.com)

BHEL bags ` 12 bn power project order in Karnataka

January 15, 2015. State-run BHEL has bagged a ` 1,202 crore order for 370 MW gas-based combined cycle power project in Karnataka. The company has been awarded this contract for setting up a Combined Cycle Power Plant (CCPP) in Karnataka on EPC (Engineering, Procurement and Construction) basis by the Karnataka Power Corporation. This plant will replace the old diesel generator-based power capacity and improve the power supply in Karnataka and specifically Bengaluru city. The key equipment for the manufactured at BHEL's Hyderabad, Trichy, Haridwar, Bhopal and Jhansi plants, while the company's Power Sector - Southern Region shall execute the civil works and erection & commissioning. (www.business-standard.com)

Transmission / Distribution / Trade…

India to facilitate cross-border power trading with SAARC Nations

January 20, 2015. To facilitate an integrated power grid for members of the South Asian Association for Regional Cooperation (SAARC), the Centre will soon approve cross-border trading on the Indian Energy Exchange (IEX). The move will initially enable short-term buying and selling of power with Nepal, Bangladesh and Bhutan. Transactions with other SAARC members will be carried out when these countries have grid connectivity with India. In a petition, IEX has sought consent and directions for cross-border trading of 120 MW with Bhutan and 50 MW each with Nepal and Bangladesh. The petition said the key regulations governing the power market — the Indian Electricity Grid Code, open access regulations and power market regulations — didn’t have provisions barring such transactions by power exchanges.

The Central Electricity Regulatory Commission has asked the Central Electricity Authority, the ministry of power and the Power System Operation Corporation for their consent in the matter. Once approved, cross-border power trading will be commenced. At an annual SAARC energy ministers’ meeting in October last year, the Centre had arrived at a consensus over an inter-country grid connecting members of the SAARC bloc. The issue had been hanging fire for four years, At that time, power minister Piyush Goyal had said initial discussions for an integrated power transmission grid connecting India and its neighbours would be held. Through such a grid, excess production in a region could be used to meet deficit elsewhere, he had said. As of now, the India-Bhutan, India-Nepal and India-Bangladesh grids are interconnected and cross-border trade is already taking place through these. While an India-Sri-Lanka asynchronous interconnection is being finalised, an India-Pakistan grid is also being considered. (www.business-standard.com)

Delhi HC rejects Adani plea to stop Lanco from selling Udupi power

January 19, 2015. Delhi High Court (HC) dismissed Adani Power Ltd's plea seeking to restrain Lanco Infratech Ltd from selling its shares in its 1200 MW thermal power plant in Udupi district of Karnataka. Justice S Muralidhar asked the parties to initiate arbitration proceedings, as per the agreement between them, to settle their dispute with respect to Adani's ` 6,000 crore proposed acquisition of Lanco's power plant. Adani had moved the high court seeking to restrain Lanco and its representatives from selling its shares in Udupi Power Corporation Ltd or creating any third party interest in the unit, saying it would be a violation of a share purchase agreement (SPA) between them. It wanted to restrain Lanco from selling shares of its Udupi unit till the time the arbitration proceedings remained pending, saying that otherwise its interests would be harmed as it had paid ` 125 crore as advance consideration. As per Adani's plea, the conditions of the SPA required Lanco to provide consent to the transaction from all of its secured lenders as well as a consent to release the shares of Udupi pledged with them. It had also obtained the requisite clearance from the Competition Commission of India, the petition had said. Adani had also accused Lanco of trying to unilaterally terminate the SPA, even though Adani had agreed to extend the same till March 31, 2015. The SPA had expired on December 29 last year. Lanco had refuted all the allegations made by Adani. (economictimes.indiatimes.com)

2.29 crore power consumers used IT services for bill payment in 2014

January 16, 2015. Nearly 2.29 crore consumers across Maharashtra paid their power bills online and through Any Time Payment (ATP) machines last year, an increase of about 34 per cent from 2013 of consumers availing these technologies. A total of 1.26 crore consumers across the state paid their bills through the online payment mode last year and the total collection was ` 1,673.94 crore, a release issued by Maharashtra State Electricity Distribution Company Limited (MSEDCL) said. In 2013, 91.18 lakh consumers had paid their bills online which fetched a collection of ` 1,222.08 crore, it said. Besides, 1.03 crore consumers paid their power bills through ATP machines last year leading to a collection of ` 1,879.34 crore through it, whereas in 2013, the total payment made through ATP machines was ` 1,558.90 crore and 79.87 lakhs consumers had availed the service. In view of the increasing response from the consumers, the MSEDCL installed 40 new ATP machines at different locations across Maharashtra. There were 128 ATP machines in January 2014 which increased to 167 by December last year. These modes of payment have now enabled the consumers to pay their bills at their convenience. Recently, the Mahavitaran received the 'Iconic Insight Award' by the International Data Corporation for its best IT-based consumer services. (economictimes.indiatimes.com)

Kejriwal alleges nexus between BJP's Satish Upadhyay and power companies

January 15, 2015. Aam Aadmi Party (AAP) convener Arvind Kejriwal alleged a nexus between Bhartiya Janata Party (BJP)’s Delhi chief Satish Upadhyay and power companies in the national capital. Kejriwal alleged Upadhyay owned six firms that install and replace meters for one of the Delhi’s two private power distribution companies. AAP also alleged BJP’s Delhi vice-president Ashish Sood, was director in one of these firms till last year. Both leaders dismissed Kejriwal’s claims and said they would file a criminal defamation case against him. Kejriwal said AAP had got the details about the firms through the website www.indiamart.com which showed these have been supplying, installing and replacing meters along with conducting metering work for power companies in Delhi. (www.business-standard.com)

JK governor directs PDD to ensure stable power supply

January 14, 2015. Jammu and Kashmir (J&K) governor NN Vohra has directed the Power Development Department (PDD) to ensure stable power supply to people in the state in view of the prevalent harsh weather conditions in the region. In view of the prevalent harsh weather conditions in the state, the governor has directed the Power Development Department to ensure stable power supply to people. (economictimes.indiatimes.com)

NLC seeks public opinion for import of coal for power project

January 14, 2015. Neyveli Lignite Corp (NLC) has sought suggestions from the general public with regard to its proposal to import coal for its ` 14,375 crore thermal power project in Uttar Pradesh. The Coal Ministry had earlier allocated the Pachwara South mine in Jharkhand for the project. With delays in development of the block, there is a proposal by Neyveli Uttar Pradesh Power Ltd (NUPPL) to use imported coal in its proposed 1980 MW project till the time the mine begins production, the company said. NLC had earlier signed an pact with Uttar Pradesh in 2010 to set up a thermal power plant in joint venture with UP Rajya Vidyut Utapadan Nigam Ltd (UPRVUNL). The joint venture agreement was signed between NLC and UPRVUNL in October 2012 and the JV company was formed in November 2012. NLC had also earlier invited global firms for providing consultancy for the power project. (economictimes.indiatimes.com)

Govt approves ` 9.9 bn for augmenting transmission network

January 14, 2015. The ministry of power has approved an investment of ` 996 crore for augmentation of transmission facilities. This will also support establishment of new test facilities in existing laboratories of Central Power Research Institute (CPRI), located at Bengaluru, Hyderabad, Kolkota, Guwahati, Noida and Nagpur. A new laboratory will also be established in Western Region at Nasik. CPRI, with its headquarters at Bengaluru, is an autonomous society under the aegis of the ministry of power. (economictimes.indiatimes.com)

Policy / Performance………….

Over 100 bidders for coal mine auctions: Goyal

January 20, 2015. Over 100 bidders have already come forward to participate in the forthcoming coal mine auctions, Coal and Power Minister Piyush Goyal said. The government will put on offer 46 coal blocks and the auction of mines are due next month. The government kick-started the auction process for coal mines that were deallocated by the Supreme Court. The government has already put on website the list of 17 coal blocks which would be allotted to government companies. The Minister further said a lot of wrong impression is being sought to be created on the government inviting financial bids along with the technical bids in the first instance. Defending the decision, he said that "we can get aggressive bidding right from the beginning". (economictimes.indiatimes.com)

Govt sets up panel on UMPP bids

January 20, 2015. Government has set up an expert panel to analyse the methodology adopted in the bidding process for ultra mega power projects (UMPPs) in Odisha and Tamil Nadu, which received tepid response from the private sector. The group will soon submit its report after examining the bidding documents to determine if the methodology adopted at the time of tendering for Odisha and Tamil Nadu UMPPs was fair, Power, Coal and Renewable Energy Minister Piyush Goyal said. He did not divulge the timeline for the submission of the report. The 5-member panel includes Pratyush Sinha (ex-Central Vigilance Commissioner), Pramod Deo (ex-CERC Chairman) and R N Choubey, Special Secretary, Ministry of Power. Goyal reiterated that the government hopes to award 4-5 UMPPs this year. He said that the country has a potential of executing up to even 9 UMPPs. (economictimes.indiatimes.com)

Entertaining JSPL plea to affect coal block auction: Govt to HC

January 20, 2015. Government opposed in Delhi High Court (HC) the pleas of JSPL and its promoter Naveen Jindal challenging its order changing end-use of coal blocks earlier alloted to them, saying the decision was taken to ensure optimal use of reserves of the natural resource. The Attorney General (AG) Mukul Rohatgi contended that the Supreme Court while cancelling the coal blocks had made it clear that there cannot be any link with the past. The Centre was responding to the petition in which JSPL contended that it was allocated coal blocks in Odisha and Chhattisgarh for the setting up steel and sponge iron production units respectively, and changing the end-use has resulted in making it ineligible to participate in the ongoing auction process which is expected to culminate on February 14. Rohatgi made it clear that while cancelling the coal blocks, the apex court had said not to look at prior allocation or the investment made on the same as the process of allocation was "fundamentally flawed, illegal and arbitrary". The AG said the decision to change end-use as well as merge some coal blocks, as was done in the case of Utkal B1 and B2 in Odisha (allotted to JSPL), was taken on the basis of the recommendations of a high powered committee. Rohatgi said one of the members of the panel was from Central Mines Planning and Design Institute Ltd (CMPDIL), a premier body for coal exploration and mining. He also said that the government's Coal Ordinance of 2014 was a direct fallout of the apex court verdict. The AG said the priority to power sector was given to comply with the ordinance's mandate to carry out auction in public interest, in a transparent manner and for optimal utilisation of the coal reserves. (zeenews.india.com)

Himachal mulls power bill payments in post offices

January 19, 2015. Electricity bills in Himachal Pradesh's state capital Shimla can now be deposited in post offices. The general post office (GPO) in Shimla has already started receiving electricty bills. Postal department officials said this week, 21 post offices in and around the state capital could start this service. If it is successful, this service will be introduced across the hill state. Currently, power bills have to be deposited at the nearest state electricity board office. The board has also installed unmanned machines which accept cash payments in Shimla and other places. But long queues are seen at these places. There is also an online facility of bill payment through net banking but hasn't picked up. (www.business-standard.com)

PMO asks Coal Ministry to closely monitor mine auction

January 19, 2015. The Prime Minister's Officer (PMO) has asked the Coal Ministry to monitor closely the process of allotment and auction of coal mines to ensure that there is no disruption in the production of dry fuel. It has also asked the ministry to prepare a perspective plan to step up the domestic coal output to meet the growing demand for the fossil fuel. Besides, expressing concerns that the three critical rail links were behind schedule, the PMO was of the view that the lines need to be expedited in close coordination with the concerned states. Three rail corridors are: Tori-Shivpuri-Kathotia in North Karanpura, Jharkhand; Bhupdeopur-Korichhaapar to Mand Raigadh mines in Chhattisgarh; and Barpali-Jharsuguda in IB Valley, Odisha. The Supreme Court had scrapped the allocation of 204 out of 218 coal blocks to various companies since 1993 terming it as "fatally flawed". The Union Cabinet later approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations. The government had kick-started the auction process for coal mines that were deallocated by the Supreme Court. The much-awaited auction of coal blocks is likely to begin next month. In the schedule II mines (in production) category 23 blocks will be auctioned and in the schedule III blocks list (ready to produce) 23 blocks will be put up for offer. (economictimes.indiatimes.com)

'Proposal to allow multiple power suppliers anti-people'

January 18, 2015. Government's proposal to allow multiple power suppliers is "anti-people" and would help private palyers earn "creamy profit", a federation of power engineers has said. All India Power Engineers Federation (AIPEF) would soon make a written submission before a Parliamentary Panel demanding immediate withdrawl of the Electricity (Amendment) Bill 2014, and launch a nationwide agitation. The Federation has decided to request the Government for a detailed deliberation with power employees and consumers before going for such a major amendment. The government has said amendments proposed in the Bill would usher in much needed further reforms in power sector. (economictimes.indiatimes.com)

Agartala to be fully lit with LED lights by March

January 16, 2015. The city is likely to be fully lit with LED lights by the end of this year saving power consumption by 50 per cent, its Mayor Prafullajjit Sinha said. The Agartala Municipal Corporation (AMC) has signed a MoU (Memorandum of Understanding) with Energy Efficiency Services Limited (EESL) to replace the sodium vapour and other lamps by LED (Light Emitting Diode) lights in the whole city. The work is likely to be completed by this financial year, he said.

Sinha said the first phase of the project covering about 20 km areas had already been completed by EESL, a PSU of the union power ministry, and the last two phases would be completed by March next. The project cost stands at ` 20 crore to light up 35,000 LED lights and the entire cost would be borne by EESL, the Mayor said adding the cost of the saved energy would be taken away by the PSU for the next seven years as project cost. (economictimes.indiatimes.com)

Centre open to privatisation of Dabhol power project: Goyal

January 16, 2015. The Centre is open to all options, including privatisation of the now-defunct 1,967 MW Dabhol power project operated by the Ratnagiri Gas and Power Private Ltd (RGPPL) in Maharashtra, said Union Power Minister Piyush Goyal. The minister said he would convene a meeting in the next 10 days with lenders to the troubled project, the officials of Maharashtra government and its undertaking Maharashtra State Electricity Distribution Company (MahaVitaran) to discuss the issues pertaining to the arrears of ` 2,000 crore. The purpose of the meeting is to discuss how the project could be revived. Goyal also said the Centre was planning to float tenders for five ultra mega power projects (UMPPs) with 4,000 Mw each during the current calendar year. According to the minister, the Centre has proposed an investment of $250 billion in generation, transmission, distribution, renewable energy and coal production in a bid to achieve 24x7 power supply. (www.business-standard.com)

Poor states in for ` 3.5 lakh crore coal bonanza

January 15, 2015. States, especially the relatively poorer ones, are in for a bonanza due to the coal auctions with the government estimating payments of ` 3.5 lakh crore over the next few years once the 204 coal mines cancelled by following a Supreme Court order are auctioned. The new revenue stream will be in addition to another ` 3.5 lakh crore flowing to them by way of royalty payments. Among the seven states, the initial round of auctions this are expected to benefit Chattisgarh and Odisha the most since majority of the cancellations are related to these two states. But over the next few years, mineral-rich Jharkhand is expected to steal a march over the rest. According to estimates, over the next 30 years, Jharkhand may end up pocketing close to ` 1.25 lakh crore from the 60 blocks with reserves of over 15,000 tonnes. This will translate into annual receipts of around ` 4,100 crore — which is almost 35% of the own tax revenue of ` 11,800 crore that the state has budgeted to mop up during the current financial year. Odisha is expected to be the second major beneficiary with receipts of close to ` 1 lakh crore from coal mined in the 30 blocks. So, annually it can hope to get around ` 3,200, which is around 17% of the budgeted tax collections of ` 18,300 crore for the current fiscal year. The payment calculations are baseline estimates and the actual flows could be much higher, helping some of the states garner resources to meet their development and infrastructure needs. The calculations are based on the assumption that 70% of the coal is supplied to the power sector at ` 100 a tonne, while the remaining goes to others such as steel at ` 300 a tonne. Following the Supreme Court order last year, the government has initiated the process of auctioning coal mines and the process has already been set in motion. The court has given the government time till March-end to complete the auction process, which will help keep several power and steel plants running. The realizations are expected to pick up over the years once more blocks commence production. The estimates suggest that the power sector will help states generate around ` 1.5 lakh crore, while ` 2 lakh crore will flow from the others that consume coal. (economictimes.indiatimes.com)

Swaraj calls on Bhutan PM; discusses security, hydropower

January 14, 2015. External Affairs Minister Sushma Swaraj called on Prime Minister (PM) of Bhutan Tshering Tobgay and discussed important bilateral issues including security and hydro power projects. During the meeting, Tobgay assured India that his government will not allow any anti-India activities from its soil. The two leaders also reviewed the status of various joint hydropower projects. Tobgay had held talks with Prime Minister Narendra Modi on the margins of 'Vibrant Gujarat' in Gandhinagar. (zeenews.india.com)

NTPC 'advised' to shift location of proposed power plant in AP

January 14, 2015. A committee under the Ministry of Environment and Forests (MoEF) has recommended state-owned NTPC Ltd to consider shifting the location of its proposed 4,000 MW power plant from the current site at Vishakhapatnam as the area is "ecologically sensitive". AP has allotted 1,200 acres of land on a lease basis for 33 years to NTPC for setting up the 4,000 MW power project in Visakhapatnam with an investment outlay of ` 20,000 crore. According to an earlier order issued by the government, NTPC had committed to complete the project before March, 2019 and once completed, it would be the biggest single location power project in the state. If the project is running successfully at the end of the lease period, it can be extended further on mutual terms. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Schlumberger to pay $1.7 bn for stake in Russia driller

January 20, 2015. Schlumberger Ltd will pay $1.7 billion for a stake in Eurasia Drilling Co, a bet by the world’s largest oilfield services provider that economic sanctions won’t hold back Russia’s energy industry. Schlumberger, based in Houston and Paris, will pay $22 a share for a 46.45 percent holding in London-traded Eurasia Drilling. Schlumberger has an option to buy the rest of the company’s shares three years after the deal closes. By buying into Russia’s largest driller, Schlumberger is putting aside concerns about economic sanctions and the state of the country’s economy.

The deal comes as the slide in the crude price to less than $50 a barrel spurs consolidation in the services industry as demand for rigs drops and oil producers lean on suppliers to drive down costs. Though U.S. and EU sanctions have targeted Russia’s oil industry, where Schlumberger has had a significant presence since the 1990s, they don’t affect the vast majority of Eurasia Drilling’s business. The measures include a ban on export licenses for technology used in production of oil from shale, as well as from Arctic offshore and deepwater areas. The industry has also been hit by measures limiting access to international capital markets for Russia’s largest companies. The transaction foresees Eurasia Drilling’s principal shareholders taking the company private and de-listing it. The deal is expected to close in the first quarter, Schlumberger said. (www.bloomberg.com)

Huntington oilfield output in UK to remain restricted

January 20, 2015. Norwegian Energy Company continues to face production cutbacks as an output restriction on the Huntington field in Britain, its biggest asset, will remain in place until the end of February, it said. Huntington production continues at restricted rates, with output around 1,500 barrels of oil per day to Noreco, the firm said. The Huntington field is operated by Germany's E.ON. (www.rigzone.com)

Russia's Rosneft starts oil production at Arkutun-Dagi field

January 19, 2015. Russia's Rosneft has started oil production at the Arkutun-Dagi field, which is expected to produce 4.5 million tonnes of oil a year (90,000 barrels per day) at peak production, the company said. The Arkutun-Dagi offshore field is part of the Sakhalin-1 project led by U.S. major ExxonMobil. Japan's Sodeco and India's ONGC Videsh are two other shareholders in the Sakhalin-1 project. The launch of the field, one of three operating at Sakhalin-1, should add to Russia's oil production, which hit a post-Soviet record high last year, averaging 10.58 million bpd. Two other fields in the Sakhalin-1 project, Chayvo and Odoptu, began production in 2005 and 2010, respectively. Russian oil production is expected to stay at between 526 and 528 million tonnes (10.56-10.60 million bpd) this year, according to Energy Ministry forecasts. The ministry so far has played down any major risks to domestic oil output due to sanctions and oil price volatility. (www.rigzone.com)

Det Norske starts up Boeyla oil field in North Sea

January 19, 2015. Norwegian energy firm Det norske has started up its Boeyla oil field in the North Sea, expecting to recover 23 million barrels of oil equivalents after a 5 billion crown ($660 million) investment, it said. The field, produced through subsea equipment and tied to the Alvheim floating production, storage and offloading unit, will produce over 20,000 barrels of oil equivalents at its peak, the firm said. (www.rigzone.com)

Russia confronts stagnant oil output after crude price slump

January 19, 2015. Russia’s record crude oil output last year is likely to prove a high-water mark as economic sanctions and lower prices erode investment in developing deposits needed to replace aging Soviet-era fields. The world’s largest oil producer will probably see total output flat, at best, over the next two to three years, according to analysts and forecasters including OAO Gazprombank. Others, such as the Organization of Petroleum Exporting countries, predict a decline. The prospect of stagnant oil production, which has almost doubled since the chaotic years following the collapse of the Soviet Union, will add to the chronic economic challenges confronting President Vladimir Putin’s government including the slump in energy prices, sanctions and capital flight. It will also allow other oil-exporting nations to grab market share. Over the past several years, Russia has successfully offset lower production from West Siberia, the country’s primary source of crude for almost half a century, with new volumes from East Siberia. Output reached a post-Soviet record of 10.667 million barrels a day in December, according to the Energy Ministry. That will start to change this year because there isn’t same flow of new fields in the eastern part of Russia’ vast hinterland. (www.bloomberg.com)

Iraq produces record 4 mn bpd of crude in Dec

January 18, 2015. Iraq produced a record of around 4 million barrels per day (bpd) of crude oil in December, Oil Minister Adel Abdel Mehdi announced. Abdel Mehdi also revealed plans to export 375,000 bpd for the first three months of 2015 from around the northern city of Kirkuk and the Kurdistan region. He said those fields would increase production to 600,000 bpd as of April. The previous monthly record for Iraqi production was 3.56 million bpd in 1979, according to Iraq's State Oil Marketing Organization. Abdel Mehdi said that Iraq had set the level of exports for Iraq's northern and Kurdish oilfields for the first three months of 2015 after the meeting with Yildiz. The oil from Iraq's north is exported via a pipeline network from the Kurdistan region to the Turkish Mediterranean port of Ceyhan. The arrangement is the result of an interim deal reached between Baghdad and Iraqi Kurdistan in early December after years of acrimony between the two sides over oil rights. Under the deal, the sides agreed to ship 300,000 bpd of oil from Kirkuk and 250,000 bpd from Kurdistan via the Kurds' pipeline network. (www.rigzone.com)

Oil heads for longest weekly losing streak since 1986

January 17, 2015. Oil advanced, capping the first weekly gain since November, after the International Energy Agency lowered forecasts for supplies from outside OPEC and an industry report showed U.S. companies reduced drilling activity. Crude rose 5.3 percent in New York. Non-OPEC oil producers will boost output this year at a slower rate than previously forecast, aiding a recovery in crude prices, the IEA said. Rigs targeting oil in the U.S. fell for the eighth time in nine weeks, by 55 to 1,366 this week, Baker Hughes Inc. said. They are at the lowest level since October 2013. (www.bloomberg.com)

Total, BG start gas production at North Sea West Franklin field

January 15, 2015. France's Total and Britain's BG Group have started producing gas at the West Franklin field in the North Sea, the companies said. The field, located 240 kilometres (150 miles) east of the Scottish town of Aberdeen, is expected to deliver 40,000 barrels of oil equivalent per day (boepd) and has gross reserves of 85 billion boe. Britain is in need of fresh oil and gas supplies as North Sea production has declined drastically since its peak at the turn of the millennium. Gas pumped from the field will be processed at the nearby Total-operated Elgin platform. (www.rigzone.com)

Downstream…………

BP completes Indiana refinery reformer startup

January 20, 2015. BP Plc has finished restarting a 60,000 barrels-per-day (bpd) catalytic reformer at its 413,500 bpd refinery in Whiting, Indiana. The reformer, which converts refining by-products into octane-boosting additives for gasoline, was shut by a power outage more than a week ago and began restarting on Jan. 13. (www.downstreamtoday.com)

Refineries process record amount of crude in Dec: IEA

January 16, 2015. Refineries around the world processed a record volume of crude in December as plants returned from maintenance and falling oil prices boosted margins, the International Energy Agency (IEA) said. Global refinery crude throughput rose by 370,000 barrels per day (bpd) to 78.9 million bpd last month, the West's energy watchdog said in its monthly report, although it warned that volumes will drop off in the first quarter this year. The largest gains took place in the United States, where refiners increased operations following seasonal maintenance. The price of Brent crude has fallen by more than half since June to around $50 a barrel. Refinery runs are expected to fall to an average of 77.8 million bpd in the first quarter of 2015 due to growing product stock levels and deteriorating profit margins, the IEA said. (www.downstreamtoday.com)

New Saudi-Sinopec oil refinery starts exports

January 15, 2015. A major new joint-venture refinery in Saudi Arabia shipped its first clean diesel cargo, the company Yanbu Aramco Sinopec Refining Co (Yasref) said. The 400,000 barrels-per-day (bpd) refinery, a joint venture between Saudi Aramco and China's Sinopec, started trial runs in September and had originally planned its first exports by November. Yasref said it loaded 300,000 barrels of diesel from the refinery, located in Yanbu on the Red Sea coast. Yasref is the second refinery to start up in Saudi Arabia in the past two years and will complete state company Saudi Aramco's transformation into a leading exporter of diesel. Yasref will produce 263,000 bpd of diesel, 90,000 bpd of gasoline, 6,200 tonnes per day of petroleum coke, 1,200 tonnes a day of pelletized sulphur and 140,000 tonnes a year of benzene, according to the company. The first cargo will be marketed by Saudi Aramco, which holds 62.5 percent share of output from the mega refinery. Sinopec, which holds the remaining share, will target Europe and East Africa for diesel shipments from the refinery. (www.downstreamtoday.com)

Transportation / Trade……….

Oil Pipeline through Myanmar to China expected to open in Jan