-

CENTRES

Progammes & Centres

Location

[Can the new Gas Price 2.0 drop below former APM price of $4.2/MMBtu!? Cap or floor needed?]

“Since the markets for energy commodities are inherently interlinked by various interconnections the ongoing downturn of crude oil price will certainly spread out with some effect to other energy markets. Particularly regarding natural gas markets it can be expected that it will trigger some more drive in an already downward spiralling gas and LNG price environment worldwide…”

Energy News

[GOOD]

The realisation that power supply quality is important for reducing kerosene demand may be coming a bit late but it is correct!

India is probably the only country which has oil producers that would end up paying refiners to purchase crude!

[UGLY]

The Environment Ministry’s rush to become pro-industry may just make it anti-people!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· Can the new Gas Price 2.0 drop below former APM price of $4.2/MMBtu!? Cap or floor needed?

· Can we avoid massive power blackouts in India?

DATA INSIGHT………………

· State-wise Demand and Supply of Electricity from Central Generating Stations

[NATIONAL: OIL & GAS]

Upstream…………………………

· Govt clears 30 O&G discoveries for production: Oil Minister

· ONGC to start production in Nagayalanka

Downstream……………………………

· Essar plans ₹ 60 bn capex at Vadinar refinery

Transportation / Trade………………

· IOC yet to start work on ` 51.5 bn LNG project

· Adani Group, Woodside sign pact on LNG sourcing and marketing

· RIL finalises 2015 gasoil and jet fuel term contracts

Policy / Performance…………………

· Power supply quality important for a cut in kerosene to electrified households: Oil Minister

· Govt to auction 69 small, marginal oil fields: Oil Minister

· RIL announces ` 1 lakh crore investment in 12-18 months

· Oil Ministry to appeal rich & powerful to opt out of LPG subsidy scheme

· Oil regulator to submit gas premium formula by month-end

· Govt to exempt ONGC, OIL from fuel subsidy

· ONGC stake sale after new subsidy sharing formula: Oil Minister

· RIL gas payments to be invested in interest bearing deposits

· Oil price slump to bring down profits of upstream firms: ICRA

[NATIONAL: POWER]

Generation………………

· NTPC to invite tenders for $1.2 bn Bangladesh JV power project

· CLP Holdings plans power plant in Gujarat with a projected cost of $2 bn

· IL&FS plans to set up 6 GW power plants in Kutch

· Extreme cold hits power generation in Himachal

· MP's power generation not hit by coal workers' strike

Transmission / Distribution / Trade……

· JSW Energy to bid for coal blocks via debt

· Small industries down shutters over power tariff hike

· Coal imports jump 19 per cent in 2014

Policy / Performance…………………

· Australian delegation compliments India for progressive changes in mining sector

· Singareni Collieries expects to commission unit in Telangana by November

· Timing of CIL stake sale to be decided by Finance Ministry: Coal Secretary

· Govt asks coal block bidders to fix dates for site visit

· States asked to revisit NoC for industrial power connection

· Coal block auction to private companies to start soon: Finance Minister

· Shiv Sena continues to oppose 9.9 GW JNPP

· MERC to review power tariff soon: Bawankule

· Govt to invest ` 3 lakh crore for building power infrastructure: Goyal

· NTPC to help revive Patratu thermal power plant in Jharkhand

· CIL unions to make up for output loss of 1 mn tonnes: Goyal

· Power Ministry cancels UMPP bidding

· Power Ministry to finalise draft cabinet note on tariff policy by Jan 15

· MIA against power tariff hike

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil plans to extend operational life of Norne oil field to 2030

· Jereh begins production at first shale gas liquefaction plant in China

· Petrobras and Indian partners find more oil in Brazil

· CNOOC finds gas at Lingshui 25-1 deepwater well in South China Sea

Downstream……………………

· China agrees to finance development projects for Iran’s Abadan oil refinery

Transportation / Trade…………

· South Africa scuppers PetroSA’s bid to buy Petronas’s unit

· China imports record crude as price collapse spurs buying spree

· US oil export ban poised to loosen with Mexico request

· British Columbia prohibits oil transport on pipelines built for LNG facilities

· Oil trades near $48 as US stocks seen adding to global glut

· Poland raises capacity of its gas link from Germany

Policy / Performance………………

· Argentine oil provinces prepare for $45 crude

· UAE sticks with oil output boost even as prices drop

· Iraq raises Basrah crude price for Asia, follows Saudi lead

· US drivers start 2015 with cheapest gas in six yrs

· Egypt signs six new O&G exploration deals

· Mexico proposes historic crude oil swap with United States

· Thailand to raise LPG wholesale price by almost half

[INTERNATIONAL: POWER]

Generation…………………

· Angola to boost energy output with $1 bn power plant

· China-backed consortium to develop 240 MW hydroelectric plant in Mexico

· Nigeria’s power generation drops to 3 GW

Transmission / Distribution / Trade……

· Appalachian Power plans to upgrade transmission power line

· ABB to develop two new 220kV substations in Sri Lanka

· Power Grid under cyber-attack every minute sees UK up defenses

Policy / Performance………………

· Cambodia commissions 338 MW hydropower project

· German power-price tumble echoes oil slump as utilities suffer

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· SunEdison signs MoU with Karnataka govt for 5 GW renewable energy

· Development and environment to be balanced: Goyal

· Modi advances solar plan for India with $4 bn plant

· Green issues 'hijacking' growth in power sector: Arunachal CM

· Welspun Renewables to invest ` 83 bn in Gujarat

· India issues draft guidelines for 3 GW of solar projects

· Environment ministry has shed its anti-industry image: Javadekar

· Ban Ki Moon to inaugurate Narmada Canal's solar power plant

· Suzlon Energy denies German unit sale report

GLOBAL………………

· China’s Suntech Power US unit seeks bankruptcy protection

· Energy security in Caribbean to be focus of January US summit

· Buffett’s MidAmerican to complete Iowa wind project by year-end

· EU nations to discuss Latvia bid to strengthen carbon fix

· China to cut subsidies for non-electric vehicles

· US can reach 50 per cent renewable generation by 2030: IRENA

· Terna Energy to complete $177 mn wind park by year-end

· Sky Solar to partner with Sino-Century in solar energy fund

· Protection 1 raises $250 mn for residential solar systems

· Keystone XL ruling returns climate-energy clash to Obama

· Turkey's wind power generation increases 11.65 per cent

· Investec arranges $195 mn in financing for Sunrun Solar

· Nautilus Solar Energy gets $39 mn for projects in Ontario

· SolarReserve, ACWA win bid to build South African solar plant

· China to boost support for NGOs that sue environment polluters

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

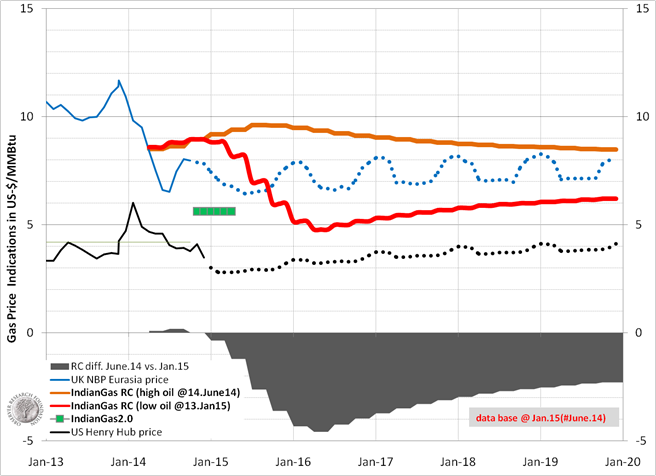

Facing Downside Risks – The Oil Price Slump and how it might affect Gas Prices (update2) - Can the new Gas Price 2.0 drop below former APM price of $4.2/MMBtu!? Cap or floor needed?

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

R |

eferring to recent publications on gas prices in this news letter, this article presents an update by acknowledging the ongoing slump of global oil and gas prices and what might be the consequences for formula based gas pricing.

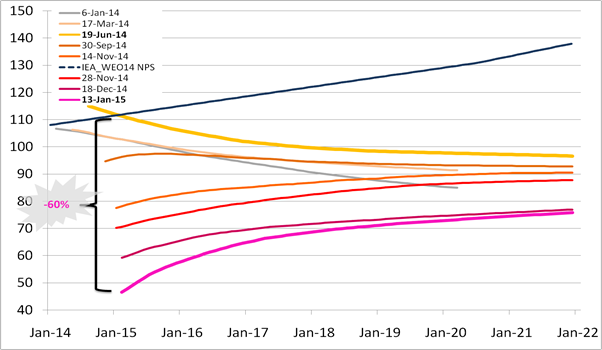

The mere market expectations on the future oil market in contrast to the IEA's current World Energy Outlook 2014 forecast are illustrated by Figure 1 that shows the development of oil future curves from Jan. 2014 till present-day’s settlement at Jan 13th, 2015. Within the last seven months Brent crude oil price tumbled by 60% from $115/bbl as of June 19th, 2014 (orange line above) down to about $46/bbl settled at Jan 13th, 2015 (pink line below). The market signals particularly near-term oversupply concerns expressed by significantly diverging curves at the very front end, and showing up the dramatic spread of almost $70/bbl for the respective front month settlement, a destruction of far more than half of crude oil’s market value. In contrast, the assessment of the market participants was less dramatic at the back end of the curve since till Nov. 2014, the curves were converging more or less and the spread peaks off to far less than $10/bbl by the end of the decade. However, more recent settlements in Dec. 2014 and Jan. 2015 demonstrate a sharp $ 10/bbl odd slide of the entire curve, indicating an increasing mistrust of market participants in a recovery of global oil prices from then on. As opposed to this the current World Energy Outlook (WEO) 2014 from the IEA predicts a modelled crude oil price rise to about $130/bbl by 2020 in its central New Policy Scenario (blue line).[1]

Figure 1: Brent Crude Oil Futures and WEO2014 Forecast (2014-2022)

Source: Brent future front month settlements (as of dates stated) from CME (www.cme.com); Forecast from IEA World Energy Outlook 2014. Compiled by author.

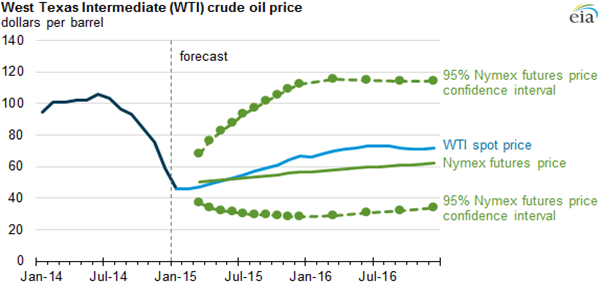

The reasons for the ongoing oil price slump are diverse and includes supply (e.g. high tight oil output in U.S.) and demand (lower growth led by weak demand from China) side issues, or is seen to be triggered by global economic as well as political and strategic circumstances (Saudi Arabia defending its market shares at the expense of OPEC’s stability). According to EIA’s most recent short-term energy outlook as of Jan. 2015 market uncertainty surrounding oil prices is growing. [2] As illustrated in Figure 2 the 95% confidence interval for market expectations, revealed by the current values of futures and options of WTI contracts at NYMEX, widens considerably over time, with lower and upper limits of about $30/bbl and $110/bbl for prices towards the end of 2015. This bandwidth between bearish and bullish future market expectations reflects the margins of two principal development paths that the global oil market mechanism can pursue within the foreseeable future: (I) market or (II) OPEC driven.

(I) Sustained low prices will increase pain for OPEC exporters (particularly Saudi Arabia), most of them already incurring growing budget deficits, to such an extent that effective cartel pricing is going to be re-established, which will trigger price increase of up to the levels we have seen in recent years at about $100/bbl odd. However, we will have to await a strategic move, otherwise will oil keep flowing.

(II) The global oil market will evolve into regular competitive conditions (without price being influenced by monopolistic power) in which the driver of international price is the marginal cost of production that varies significantly between lower-cost conventional and higher-cost non-conventional basins, but can push global prices below $50/bbl for a quite long period of time. According to upstream specialist consultancy group Wood Mackenzie, a mere 1.6% of global oil supplies would be loss-making if crude oil prices dip below $40/bbl (mostly oil sands projects in Canada), but even this level would not necessarily spark shutdowns, since operators may prefer to continue producing oil at a loss rather than stop production (that is true especially for large projects like oil sands as well).[3] In line with this, Goldman Sachs had recently cut its 2015 forecast for Brent by 40% to $50/bbl and WTI to $47/bbl, respectively.[4] EIA slashed its forecast to an average Brent price of $58/bbl in 2015 and expects global oil inventories to continue to build in 2015, keeping downward pressure on oil prices.[5]

Figure 2: WTI Crude Oil Price and Futures and Market Expectations of Uncertainty (2014-2016)

Note: Confidence interval derived from options market information for the five trading days ending Jan. 8, 2015. Intervals not calculated for months with sparse trading in near-the-money options contracts.

Source: IEA (2015b).

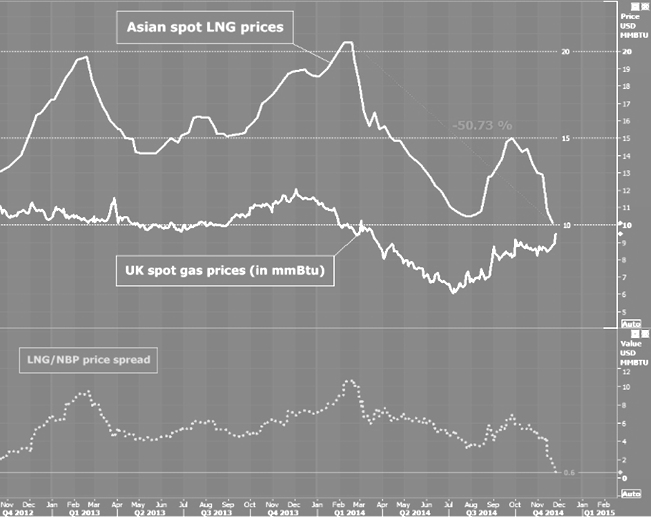

Since the markets for energy commodities are inherently interlinked by various interconnections the ongoing downturn of crude oil price will certainly spread out with some effect to other energy markets. Particularly regarding natural gas markets it can be expected that it will trigger some more drive in an already downward spiralling gas and LNG price environment worldwide. As illustrated in Figure 3 the transformation in the global LNG market balance throughout 2014 has already unleashed a severe slump in Asian spot LNG prices and the spreads according to UK NBP spot gas prices has been coming down towards zero by the end of the year.[6]

Figure 3: Asian Spot LNG and UK NBP Gas Prices (2012-2014)

Source: Timera Energy (2014).

European natural gas prices have already tumbled to the lowest levels since August all over Europe’s largest traded markets (even amidst its seasonal high), because of a lower disruption risk of import flows from Russia since Ukraine has cleared some debts.[7] Apart from gas spot markets the worst is yet to come in Europe since the downturn move in crude oil will subsequently pull down all the ‑ still existing ‑ bulk of long term import contract (LTC) prices that are typically linked to oil with a six or nine month time-lag. Thus a substantial decline in European gas hub prices in 2015 might be expected. UK NBP gas futures are signalling prices at an average of about $7/MMBtu for the year to come (Figure 5 blue dotted line). Taking the border price of actual German gas imports (BAFA[8]) as an indicator for the expected evolution of oil-linked import gas prices into Europe, then – in a rough calculation based on current price data – LTC prices can be expected to plunge down by about 40% in the course of 2015 and about 30% in the years thereafter in comparison to average 2014 price.

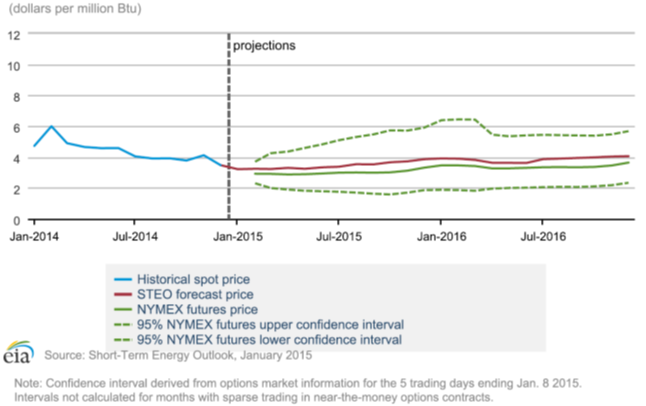

Natural gas prices in the U.S. have dropped significantly in 2014 as well (Figure 5 black line). From its high in Feb. 2014 Henry Hub natural gas prices were almost continuously coming down to a $3.5/MMBtu in Dec 2014. The front month future for Feb. 2015 marks a low at 2.8 $/MMBtu and futures indicate prices to maintain below 3/MMBtu by Nov. 2015.[9] EIA expects spot prices to remain less than $4/MMBtu until the end of 2016. Downside risk as evaluated by the market participants (95% confidence interval) is even in the lows of under $2/MMBtu throughout 2015.

Figure 4: Henry Hub Natural Gas Prices and Forecast (2014-2016)

Source: EIA (2015a).

Indian natural gas price has recently been determined by a gas price formula 2.0 that links the gas price to Henry Hub, Alberta and NBP as well as to the wild card of the Russian gas price term. Therefore the new gas price formula seems to be not that much oil price-prone as the previous proposal (according to the Rangarajan Committee). However, since gas prices all over the world are expected to tumble downwards further on (as we have seen in the expectations for European and North American markets above) one might expect the Indian gas price 2.0 to follow soon.

Henry Hub prices were noted on average at $4.4/MMBtu in 2014, down to probably $3/MMBtu in 2015, which would mark a probable decrease by more than 30%. At about the same scale we can expect European gas prices to fall this year compared to 2014. Since the notation of Russian gas prices is not yet published and Russian gas exporters have always been among the most hard-liners in defending oil-linked gas pricing schemes, one can tentatively suppose also Russian prices to dip by that scope. Transferring these calculations to the actual price level of the Indian gas price 2.0 at $5.6/MMBtu, will mean that even a mere 25% deduction (instead of 30% odd) will already imply a plunge below the former administered gas pricing regime (APM) that had fixed the price of specified domestic production at $4.2/MMBtu (indicated by green line in Figure 5).

Figure 5: Sensitivity of Rangarajan Gas Price Formula to Crude Oil Prices Changes (2014-2020)

Source: Own assumptions and calculations based on oil and gas futures as of Jan 13th, 2015 (and 19th June, respectively).

Besides that, some speculations have been recently reported that the government is mulling over a cap in the gas pricing formula to protect consumers from global price volatility.[10] However, according to what was determined in the analysis above, this sounds quite like a farce, since capping low prices in an already global low price environment across most energy commodity sectors is even worse than having an administered gas price mechanism (because this would come through the backdoor) and might even lead to mistrust and scaring away of potential (international) investors in Indian upstream sector. Based on the reflections above, the need for setting a floor for gas prices to avoid the failure of the much aspired makeup of indigenous gas production in India becomes greater. In a formula like the 2.0 gas price formula, one cannot expect too much volatility as per the definition, because it is supposed to change only every half year. If a formula is known and is transparent in its terms, the companies can easily hedge against volatility by using their own middle office skills since Henry Hub and NBP are traded liquidly in futures and OTC. The joker remains Russia, however, even that can be dealt better with to release it to the market than restrict the formula by administration. Beyond that, suppose that a capped gas price set in this low price period area (low HH US prices, falling European prices (spot and LTC), low oil prices, Russia conundrum) will be immediately pushed out of the market once the markets are going to rebound, which might be triggered by a mere move of Saudi Arabia towards re-establishing OPEC power.

Notwithstanding that, since the details of the new gas price formula 2.0 are not yet fully known, in lieu thereof the robustness of a gas price formula like the proposal from the Rangarajan Committee (RC) against oil price volatility is illustrated in Figure 5: based on recent market assessments the domestic RC gas price formula at high/low oil prices (yellow/red line) as well as the spread between these (grey area) is plotted (and gas price 2.0 is indicated in a green sketch for its first known half-year period as a reference point). The divergence in the course of those two RC gas price curves can be largely explained by the historic Brent oil volatility during the last half year and changing Brent future curve shape. The largest exposure of almost $5/MMBtu can be observed in the 2nd quarter of 2016, representing the large spread of the Brent crude futures at the front end of the curves (about US-$ 70/bbl) and the concomitantly arithmetic of the RC gas price formula (set up of three months time-lag and creation of twelve months average).

The computed RC gas price might have fallen to below $5/MMBtu by 2016. It would have been significantly below the validated gas price 2.0 that by now is only known to be at about US‑$ 5.6/MMBtu until April 2015. (Please refer ORF Energy News Monitor Volume XI, Issue 23/24/27)

Sources:

Bloomberg (2015), Gas Falls to Four-Month Low in Europe Amid Reduced Ukraine Risk, by I. Almeida, Jan 2, 2015; http://www.bloomberg.com/news/2015-01-02/gas-falls-to-four-month-low-in-europe-amid-reduced-ukraine-risk.html .

The Economic Times (2015), Cap in gas pricing formula in the works to combat global volatility, By R. Jayaswal, 30 Dec, 2014; http://articles.economictimes.indiatimes.com/2014-12-30/news/57528798_1_aogo-oil-gas-operators-imported-gas.

EIA (2015a) [U.S. Energy Information Administration], Short-Term Energy Outlook, Release Date: January 13, 2015; http://www.eia.gov/forecasts/steo/report/prices.cfm.

EIA (2015b) [U.S. Energy Information Administration], Market expectations of oil price uncertainty have increased in recent months, Today in Energy, Jan. 14, 2015; http://www.eia.gov/todayinenergy/detail.cfm?id=19571&src=email.

Reuters (2015a), Only 1.6 percent of world's oil production at risk at $40: WoodMackenzie, Jan 9, 2015; http://www.reuters.com/article/2015/01/09/us-oil-supplies-idUSKBN0KI1M020150109.

Reuters (2015b), Goldman Sachs slashes oil price forecasts, Jan 12, 2015; http://www.reuters.com/article/2015/01/12/us-research-goldmansachs-crude-idUSKBN0KL0RR20150112

Timera Energy (2014), Market interconnectivity and the next 6 months, Posted on December 1, 2014; http://www.timera-energy.com/commodity-prices/market-interconnectivity-and-the-next-6-months/.

Concluded

Views are those of the author

Author can be contacted at [email protected]

Can we avoid massive power blackouts in India?

An overview of the interconnected power network in the backdrop of blackouts in July/Aug 2012

Shankar Sharma, Power Policy Analyst

|

T |

wo power blackouts in the North and Eastern parts of the country on 31st July and 1st August 2012 have thrown up many issues to our society. The second blackout impacting three regions (Northern, Eastern and North Eastern regions) and covering 21 states was preceded by another blackout the previous day impacting fewer states in the northern region. The media have reported that about 600 Million people were affected by the larger blackout. Many sections of the media have termed this blackout as the most sever blackout in the history; certainly it can be termed as one of the severest power outage events in independent India.

Though power blackouts impacting one or more districts/states at the same time are not rare in our country, what has caught the attention of the media is the effect of this blackout on 21 states during the day time impacting millions of people in one way or the other. Many knee jerk reactions have suggested that massive addition to the power generating capacity is the solution. A dispassionate analysis of the power sector in the country keeping the possibilities of such blackouts in future can throw up deeper malaise than the “inadequacy of generating capacity” as being advocated in some parts of the print media. With the ever growing complexity and expansion of power network to nooks and corners of the country, it is reasonable to assume that the power blackout cannot be entirely eliminated, but can be minimised if necessary steps are taken on a war footing.

In recent years an advanced economy such as US too has seen increasing number of annual outages. It is reported that whereas between 1965 and 2000 there was on an average of one major blackout every two years, between 2001 and 2011 this figure was one major blackout every six months. There have been examples of blackouts in other countries also. With the increased complexity of the network a fault in one part can spread out to other parts quickly. Chronic deficit situation in India can only aggravate the problem.

Some of the major blackouts in recent history are:

(i) Auckland, New Zealand (20.2.1998) affecting 70,000 people for four weeks;

(ii) Brazil (11.03.1999) affecting 70% of the territory

(iii) India (02.01.2001) affecting 220,000,000 people for 12 hours

(iv) US (north-east) + Canada (central) (14.08.2003) affecting 50,000,000 people for four days

(v) Italy (28.09.2003) affecting 56,000,000 people for 18 hours

(vi) Spain (29.11.2004); 5 blackouts within 10 days affecting 2,000,000

(vii) South West Europe (parts of Germany, France, Italy, Belgium, Spain and Portugal,

04.11.2006) affecting 15,000,000 for 2 hours

(Source: https://www.allianz.com/v_1339677769000/media/responsibility/documents/position_paper_power_blackout_risks.pdf )

In the Indian context we can look at two credible options to minimise such blackouts.

Option I entails the following:

Ø Massive additional investments in power sector

Ø Build huge redundancy in the network

Ø Create huge surplus in generating capacity by massive additions to conventional power plant capacity

This option will invariably lead to huge social and environmental impacts due to conventional power plants, which will add to Global Warming impacts. It would also mean diversion of scarce natural resources such as land, water, minerals etc. from other priority sectors such as poverty alleviation, health, drinking water, irrigation, education etc. The question is whether a poor and densely populated country like ours can afford the associated economic, social and environmental impacts on our communities?

Option II entails the following:

Ø Reduced reliance on the grid quality power, and strengthen the relevance of micro / smart grids

Ø Increased reliance on distributed renewable energy sources (RES): solar, wind and bio-mass

Ø Shifting of all smaller loads on to distributed RES

Ø Focus on strengthening distribution system requiring much higher efficiency, reliability & accountability

Ø Effective feed-in- tariff for distributed power sources such as roof top solar power or community based bio-mass plants etc. will lead to reduced investment by STATE.

This option will assists in accelerated rural electrification & development. It will lead to vastly reduced pressure on the existing integrated grid, and increased reliability due to the resultant redundancy. It is evident that this option is sustainable & environmentally friendly leading to improved reliability of the existing grid. It also can be termed as highly sensible option leading to overall welfare of the society.

This option will also minimize the widespread outages/damages which can also be credible due to Solar Storms or an act of terrorism on the integrated grid.

Salient features of Indian Power Sector which are contributing to chronic power cuts and frequent blackouts are:

Ø Conventional Power sources concentrated in few areas; requires massive infrastructure of transportation of either the fuel and/or transmission of electricity

Ø Complete absence of holistic approach / long term perspective

Ø Gross inefficiency at all levels of the power sector; true cost the society are not recovered fully

Ø Many power plants are not found to be operating economically

Ø Discernible absence of concern on overall welfare needs; focus only on producing electricity instead of the consideration of overall welfare

Ø Mostly new merchant power plants for profit motive are being planned

Ø True costs and benefits to society of conventional power plants never determined

Ø Rehabilitation & Resettlement of the displaced people and environmental compliance has been abysmally poor; insensitivity to civil society’s views; absence of public consultation.

There are many serious issues with the continued overreliance on integrated grid based power supply.

Ø Massive investment needed to expand the network to cover all villages/communities

Ø Ever increasing complexity; huge scope for massive blackouts

Ø Gross indiscipline on part of the constituent companies

Ø Absence of the much required professionalism

Ø Political considerations instead of technical & economic reasoning

Ø Unscientific pricing and subsidy regimes

Ø Massive economic and social implications from blackouts

Ø Cannot ensure connection to all villages; energy inequity will continue

Ø Perceived need for more of large size conventional power plants

Ø Social & environmental implications of large conventional power projects will be exacerbated.

In the overall context of how the power sector can contribute to the true welfare of our communities due importance must be given to the recommendations of many credible reports at national and international levels.

Ø The latest synthesis report (AR5) from IPCC and the Emissions Gap Report 2014 from UNEP have taken pains to emphasise the urgency in taking action to minimise the GHG emissions in order to save the humanity from climate catastrophe.

Ø The Intergovernmental Panel on Climate Change says in a stark report

that most of the world's electricity can - and must - be produced from low-carbon sources by 2050. If not, the world faces "severe, pervasive and irreversible" damage.

In this context the UN has said inaction would cost "much more" than taking the necessary action.

Ø Asian Development Bank's (ADB) Year 2012 report "Climate Risk and Adaptation in the Electric Power Sector" has discussed how Climate Change is likely to impact the electric power infrastructure on the costal areas in as applicable to Asian countries. Transmission lines can be the most vulnerable assets.

Ø Planning Commission in its Integrated Energy Policy (IEP) has said that CO2 generated from energy use can be reduced by 35% through effective deployment of efficiency, DSM measures and renewable energy sources

Ø IEP also considers “relentlessly pursue energy efficiency and energy conservation as the most important virtual source of domestic energy”. Business as usual scenario with the present practice of grid based large size conventional power sources cannot lead to vastly reduced losses in the system.

Ø Bureau of Energy Efficiency has concluded that at the prevailing cost of additional energy generation, it costs a unit of energy about one fourth the cost to save than to produce it with new capacity.

Ø International Energy Agency (IEA) projects that by 2050 about 22% of the global energy (totaling various forms of commercial energy) can be met by solar power alone.

Ø Greenpeace report “energy {R}evolution, A SUSTAINABLE INDIA ENERGY OUTLOOK“: estimates reduction of about 38% in electricity demand by 2050; “by 2030 about 35% of India's electricity could come from renewable energies" AND "by 2050, 54% of primary energy demand can be covered by renewable energy sources".

Ø IPCC report ‘Special Report Renewable Energy Sources (SRREN)’ has projected that renewable energy could account for almost 80% of the world's energy supply within four decades.

Ø “A path to Sustainable energy by 2030”, Stanford University study of 2009 estimates that solar, water and wind technologies which are available at commercial scale now can provide 100 percent of the world’s energy by 2030

India has a huge potential in harnessing its renewable energy. Germany and Japan are planning to replace nuclear power with RES. During May 2012 Germany was reported as having met 50% of its afternoon peak demand through RES. Energy co-operatives, equipped with micro/smart grids, are getting more popular for the reasons of local control and the desire to become carbon neutral. In 2012 Germany’s 51% of the renewable energy capacity were reported to be with 586 private co-operative societies, making public the most important stake holders, and in removing energy injustice. By the end of 2013 more than 880 energy co-operatives were reported to be operating satisfactorily in Germany, increasing at the rate of about 3 per week. In Germany, citizens not only put Solar Photo Voltaics on their own roof, but also come together to bundle resources for larger projects, such as small wind farms, local biomass units, and large solar arrays. There is even a National Office for Energy Cooperatives catering to more than 150,000 people. This concept of “Energy co-operatives” along with micro grids is eminently suitable to Indian conditions where poor/middle class people can pool their resources together to contribute for larger projects of vast benefit to them.

The summary of all these discussions is that India has no other option than to adopt a paradigm shift in the way we look at electricity demand and supply, by resolutely moving towards distributed renewable energy sources supported with micro/smart grids. True costs & benefits to society should be at the focus while determining the suitable technology/method to meet each MW of electricity demand.

Concluded

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

State-wise Demand and Supply of Electricity from Central Generating Stations

Akhilesh Sati, Observer Research Foundation

Megawatts (MW)

|

State |

Peak Demand |

Allocation |

|

Chandigarh |

367 |

176 |

|

Delhi |

6,006 |

3,440 |

|

Haryana |

9,152 |

2,509 |

|

Himachal Pradesh |

1,403 |

1,305 |

|

Jammu & Kashmir |

2,521 |

2,086 |

|

Punjab |

11,534 |

2,296 |

|

Rajasthan |

10,188 |

2,968 |

|

Uttar Pradesh |

15,670 |

6,319 |

|

Uttarakhand |

1,883 |

914 |

|

Chhattisgarh |

3,480 |

1,209 |

|

Gujarat |

13,603 |

3,608 |

|

Madhya Pradesh |

9,477 |

5,214 |

|

Maharashtra |

20,147 |

6,990 |

|

Daman & Diu |

297 |

320 |

|

Dadar & Nagar Haveli |

679 |

895 |

|

Goa |

501 |

522 |

|

Andhra Pradesh |

7,144 |

1,905 |

|

Karnataka |

10,001 |

1,896 |

|

Kerala |

3,760 |

1,716 |

|

Tamil Nadu |

13,663 |

4,096 |

|

Puducherry |

389 |

386 |

|

Bihar |

2,992 |

2,789 |

|

Jharkhand |

1,082 |

577 |

|

Odisha |

3,814 |

1,735 |

|

West Bengal |

7,544 |

1,548 |

|

Sikkim |

82 |

157 |

|

Arunachal Pradesh |

139 |

133 |

|

Assam |

1,435 |

819 |

|

Manipur |

141 |

123 |

|

Meghalaya |

350 |

163 |

|

Mizoram |

90 |

74 |

|

Nagaland |

140 |

79 |

|

Tripura |

310 |

105 |

Source: Rajya Sabha, Un-starred question no. 3226.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Govt clears 30 O&G discoveries for production: Oil Minister

January 12, 2015. The government has cleared 30 projects of firms like Cairn India and ONGC to help monetise about 2.6 trillion cubic feet of gas reserves. Oil Minister Dharmendra Pradhan said the government has approved a policy framework for relaxation, extensions and clarifications in timelines that will grant operational flexibility to help produce oil and gas from several discoveries that are mired in contractual disputes. Operational flexibility has been provided in enforcing contracts by way of relaxing some of timelines prescribed for discoveries so that E&P activities do not suffer on account of excessive rigidity in decision making. The Production Sharing Contract (PSC) between the government and the explorer has rigid timelines for each stage of exploration and actions have been initiated against firms even if deadlines are missed by a day. Three-to-six month extension in the current 18-60 month timeframe for submission of declaration of commerciality (DoC) of discoveries, a prerequisite before investment plans can be finalised, has been approved. Also, the deadline for submission of investment plan for the discoveries too would be extended by up to six months. The PSC provides for time period for submission of field development plan (FDP) for hydrocarbon discovery after DOC. There is no provision in the PSC for extension of this time period and non-acceptance of FDP due to late submission results in non-monetisation of discoveries. Also, upstream regulator DGH has been given flexibility to accept discoveries for which operators had failed to provide prior notification to the government. Pradhan said the Policy Framework for Relaxations, Extensions and Clarifications at development and production stage under PSC will help early monetisation of hydrocarbon discoveries. Discoveries, mostly of Cairn, ONGC and GSPC were stuck because of lack of flexibility in timelines. These included 10 finds of Cairn in Rajasthan which have not been endorsed by DGH. Besides, FDP approvals for more than two dozen finds are held up for some or the other reason. Fifteen discoveries lie abandoned in areas that have been relinquished by operators. (economictimes.indiatimes.com)

ONGC to start production in Nagayalanka

January 9, 2015. The joint venture of public sector oil major ONGC Ltd and Cairn India which struck huge oil and gas reserves at Nagayalanka and other villages in Krishna district, is all set to commence production. A Field Development Plan (FDP) will be submitted by the month-end. Besides, the ONGC is gearing up to start production in Mandapeta in East Godavari and Malleswaram oil and gas reservoirs in Krishna district explored over a year ago. The Mandapeta gas field will be developed on a fast-track mode for a yield of 2.5 lakh cubic metres of gas a day within a year while efforts are on to produce 250 tonnes of oil a day from Malleswaram plant within two years. Executive Director of ONGC, Rajahmundry Asset, Debashish Sanyal said that once the FDP was approved, a sum of $ 700 million to $ 750 million would be invested on the block in five years. The investment would include creation of production facilities, Sanyal said. As per the Declaration of Commerciality (DoC) documents, the Nagayalanka field has oil resources of about 320 million barrels, of which about 40 million barrels can be recovered. There are also small amounts of gas with recoverable reserves of around 70 billion cubic feet, Sanyal said. In phase I, five exploration wells were drilled and the Nagayalanka-1z well resulted in the Raghavapuram discovery. In phase-II, the Nagayalanka-SE-1 exploration well was drilled and resulted in discovery of hydrocarbons. On future development plans, Sanyal said 20 wells would be drilled in the next three years. ONGC would undertake cluster drilling (drilling of more than one well from a single point) in four clusters with each cluster having five wells. (www.thehindu.com)

Downstream………….

Essar plans ₹ 60 bn capex at Vadinar refinery

January 13, 2015. Essar Group plans to invest ` 6,000 crore over three years towards brown field expansion of its existing oil refinery at Vadinar near Jamnagar in Gujarat. Essar Group announced an investment of ` 6,000 crore for expansion of the company's Vadinar refinery, which has an existing capacity of 20 million tonnes per annum. The Jamnagar refinery handles diverse range of crude - from sweet to sour and light to heavy crude oil. (www.thehindubusinessline.com)

Transportation / Trade…………

IOC yet to start work on ` 51.5 bn LNG project

January 12, 2015. Indian Oil Corp (IOC) said it is yet to commence work on a ` 5,150 crore liquefied natural gas (LNG) import terminal at Ennore in Tamil Nadu. IOC had approved setting up a 5 million tonne LNG project at Ennore through a joint venture company. IOC would hold 45 per cent stake in the project while Tamil Nadu government enterprise, TIDCO will have 5 per cent holding. Balance 50 per cent will be held by financial institutions. As the project activities progress, the strategic joint venture partners would be identified and inducted as equity partners. Ennore will be the third LNG terminal on the east coast with state-owned GAIL India Ltd building a facility at Kakinada in Andhra Pradesh and Petronet LNG Ltd setting up a 5 million tons facility at Gangavaram in Andhra Pradesh. LNG is a gas that is cooled down to liquid form and takes up just 1/600th of the volume in its gaseous state, thereby easing transportation by sea. IOC plans to lay a 1,175 km of pipelines to transport the gas imported at Ennore LNG terminal to customers. It has made an application to sector regulator Petroleum & Natural Gas Regulatory Board (PNGRB) for laying natural gas pipeline from Ennore to Nagapattinum in Tamil Nadu with spurlines to Madurai, Tuticorin and Bengaluru. The company, however, did not give timelines for completion of the projects. (economictimes.indiatimes.com)

Adani Group, Woodside sign pact on LNG sourcing and marketing

January 11, 2015. Adani Group has signed an agreement with Australian energy major Woodside for sourcing of liquefied natural gas (LNG) as well as cooperation in oil and gas exploration and production. The MoU (Memorandum of Understanding) was signed by Adani Group Chairman Gautam Adani Woodside Energy CEO Peter Coleman. The two companies will jointly explore opportunities in sourcing of LNG, supply and purchase arrangements for India, LNG marketing, investment in upstream activities such as oil and gas exploration, production and liquefaction plants, knowledge sharing, training, joint technology studies, technology workshops and connecting local R&D institutions and universities with each other. (economictimes.indiatimes.com)

RIL finalises 2015 gasoil and jet fuel term contracts

January 8, 2015. Reliance Industries Ltd (RIL) has finalised its 2015 gasoil and jet fuel term contracts at lower premiums than last year, traders said. The company agreed to sell 500 ppm sulphur gasoil at a premium of about $1.30 a barrel above Middle East quotes, lower than the $2.25 to $2.50 a barrel negotiated for last year, they said. It also agreed to sell the 10 ppm sulphur diesel at a premium of about $2 a barrel above Middle East quotes, lower than the $2.50 to $3 levels it achieved for 2014 term contracts, they said. For jet fuel, Reliance finalised its 2015 term at a premium of $1.85 a barrel to Middle East quotes, lower than the $2 a barrel it negotiated last year, they said. (economictimes.indiatimes.com)

Policy / Performance………

Power supply quality important for a cut in kerosene to electrified households: Oil Minister

January 13, 2015. Oil Minister Dharmendra Pradhan said power availability was an important point in deciding whether subsidised kerosene should be supplied to such households. Kerosene is used by rural and urban poor for both lighting and cooking. Under current policy, the Union government reduces the quota of kerosene sold through the Public Distribution System in proportion to domestic gas penetration in a state. This is done on the assumption that consumers move from kerosene to LPG for cooking. The minister agreed the government had not passed on all the benefits of the steep decrease in global oil prices to the consumer by reducing that of diesel. (www.business-standard.com)

Govt to auction 69 small, marginal oil fields: Oil Minister

January 12, 2015. The government plans to auction 69 small and marginal oil and gas fields to private firms on a new revenue sharing model, oil minister Dharmendra Pradhan said. As many as 63 discovered oil and gas fields are being surrendered by Oil and Natural Gas Corp (ONGC) as they were found to be uneconomic for a large firm with huge overheads to develop or bring to production. Smaller firms with a fraction of operating cost can develop them at much faster and economic rate. Oil India Ltd (OIL) has surrendered 6 marginal fields. Under the revenue sharing model, bidders will have to upfront state how much oil and gas they will share with the government. The firm offering maximum win the right to explore and produce from the field. This is a shift from the much-criticized Production Sharing Contract (PSC) regime where blocks were allocated to firms that bid highest amount of work in the area. It allowed the firms to recover all their cost before sharing profits with the government, a regime which was criticized by CAG (Comptroller and Auditor General of India) as one that provides incentive to operators to keep raising cost so as to postpone government share. Pradhan said the policy regime for the 10th exploration licensing round is under discussion. (economictimes.indiatimes.com)

RIL announces ` 1 lakh crore investment in 12-18 months

January 11, 2015. Reliance Industries Ltd (RIL) Chairman Mukesh Ambani announced ` 100,000 crore investment across businesses in the next 12-18 months and said India was on the path to become the world's fastest growing economy. The investments will be in expanding petrochemical production capacity as well as in launch the much-awaited 4G broadband services while contributing to Make in India and Digital India initiatives. Ambani, the world's richest energy billionaire, speaking at the 7th Vibrant Gujarat Summit, said Prime Minister Narendra Modi's clarion call for boosting domestic manufacturing and job creation through Make in India campaign and Digital India initiative "have energised India and its enterprises". Ambani said as part of the investment programme, RIL will partner and enable thousands of small businesses and Gujarati entrepreneurs to create virtuous cycle of prosperity. RIL is investing in raising polyester capacity by some 60 per cent in aggregate across four locations, a new 1.5 million tonnes refinery off-gas based petrochemical cracker and downstream units in Jamnagar, enhancing refining profitability via petcoke (petroleum coke) gasification and reducing feedstock costs for petrochem by importing cheap US ethane. (economictimes.indiatimes.com)

Oil Ministry to appeal rich & powerful to opt out of LPG subsidy scheme

January 10, 2015. Finance Minister Arun Jaitley has decided to use market-priced cooking gas in his home, endorsing a campaign by the oil ministry and sending a strong message that the affluent should stop consuming subsidised LPG, which is meant for the poor. Oil company executives had stopped purchasing subsidised cooking gas last August, after which the "opt out of LPG subsidy scheme" was extended to the general public. It has attracted over 21,277 consumers. Customers get cooking gas at a subsidised rate of ` 417 per 14.2-kg cylinder, which costs ` 708.50. Each household is entitled to get 12 subsidised cylinders a year. The government estimates that about 1 crore rich customers can stop using subsidised cooking gas as the annual subsidy of ` 4,000 is not a major saving for them. After allowing petrol and diesel to be priced at market rates, the government aims to reduce cooking gas subsidy by selling LPG at market prices and directly transferring reimbursements to the bank accounts of customers. The LPG subsidy was ` 46,458 crore in the previous financial year, the oil ministry said. The direct transfer of LPG subsidy will reduce its diversion, the oil ministry said. (economictimes.indiatimes.com)

Oil regulator to submit gas premium formula by month-end

January 9, 2015. Upstream oil regulator DGH (Directorate General of Hydrocarbons) will by the end of the month submit a formula to determine the premium over and above the recently hiked price to be paid for natural gas produced from difficult fields. The government while raising natural gas price by 33 per cent to $5.61 per million British thermal unit, had announced that gas discoveries made in deepwater, ultra-deep sea or high-temperature and high-pressure fields will be given a premium. The regulator has already collected comments and feedback on the proposed mechanism from industry players. The Cabinet headed by prime minister Narendra Modi had in October approved a revised natural gas price and stated that discoveries made after this announcement in difficult regions would be given a premium as exploration and drilling is costly and challenging. DGH will suggest if there should be a uniform premium or different rates for deepwater, ultra-deep sea and high-pressure and high-temperature (HPHT) fields. Also, it will suggest if the premium should be a percentage of the existing gas price or a fixed rate or a completely new formulation. Oil secretary Saurabh Chandra said the relaxation in the implementation of the production sharing contract (PSC), granted by the Cabinet at the same meeting in October, has led to 30 oil and gas projects being cleared by the DGH. In a bid to make it easier to produce oil and gas, the Cabinet had granted operational flexibility to help firms like Cairn India and ONGC start producing oil and gas from several discoveries that are mired in contractual disputes. A policy framework for relaxation, extension and clarification in timelines for development and production of oil and gas under the PSC was approved, he said. (economictimes.indiatimes.com)

Govt to exempt ONGC, OIL from fuel subsidy

January 9, 2015. The government is likely to exempt Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) from payment of fuel subsidy during the rest of the fiscal due to steep decline in global oil rates to around $50 per barrel. Upstream producers ONGC and OIL made good nearly half of the revenue loss or under- recoveries that fuel retailers incurred on selling cooking fuel and diesel until recently at government controlled rates. This subsidy contribution was by way of discount on crude oil they sold to the downstream firms and it was capped at $56 per barrel in 2013. But with global oil prices tumbling to its lowest level since April 2009, the continuation of the subsidy-sharing formula would mean that ONGC will not just have to sell crude oil to refiners like Indian Oil Corp (IOC) for free but also pay another $6 per barrel from its pocket. In such a scenario, the government is considering exempting ONGC and OIL from payment of subsidy during reminder of the current fiscal, sources privy to the development said. Oil minister Dharmendra Pradhan had stated that the government was reworking the subsidy-sharing formula. Subsidy burden on upstream oil companies has increased from ` 32,000 crore or 30 per cent of the total under-recovery in 2008-09 to ` 67,021 crore (48 per cent of the total under-recovery) in 2013-14. In 2013-14, ONGC paid a record ` 56,384 crore subsidy. This has significantly constrained the capacity of these companies to increase their exploration efforts in difficult areas, thereby adversely affecting the country's domestic oil production. Under-recoveries during current fiscal are pegged at around ` 73,000 crore. Of this, about ` 51,000 crore have already been accounted for in first half where ONGC paid ` 26,841 crore subsidy, OIL ` 4085 crore and GAIL ` 1000 crore. Government provided cash subsidy to cover the rest of it. For the remainder of the fiscal, another ` 21,000-22,000 crore of under-recoveries are estimated which can easily be met by government subsidy from budget and sparing ONGC, they said. The oil ministry is of the view that unless sufficient funds are available for increased oil recovery and enhanced oil recovery schemes from the ageing oil fields, the country may notionally lose more than 70 million tonnes of indigenous crude oil production during next 10 years. This may increase the import bill by ` 3,33,000 crore. However, if this crude is produced indigenously, it will cost only ` 112,000 crore resulting in a substantial saving of ` 2,21,000 crore. (economictimes.indiatimes.com)

ONGC stake sale after new subsidy sharing formula: Oil Minister

January 8, 2015. Government will go for its stake sale in ONGC after finalising a new subsidy sharing formula as it would help in fetching better price in the market. The Department of Disinvestment will take a call on time of divestment of ONGC, Oil Minister Dharmendra Pradhan said after meeting with Finance Minister Arun Jaitley. During the meeting, also attended by senior officials, discussions focused on selling of government stakes in oil companies other than ONGC. The Cabinet has approved 5 per cent stake sale in ONGC, which could fetch an estimated ` 11,500 crore to the exchequer. Government holds 68.94 per cent in ONGC. The Oil Ministry is reworking the fuel subsidy sharing formula to cut ONGC payout by a quarter through adjustment of statutory oil cess against its share. The move to lessen the subsidy burden is expected to give a fillip to government's plan to sell 5 per cent stake in Oil and Natural Gas Corp (ONGC). Upstream producers like ONGC met nearly half of the revenue loss or under-recoveries that fuel retailers incurred on selling cooking fuel and diesel until recently at government controlled rates. In 2013-14, ONGC paid a record ` 56,384 crore subsidy, which this fiscal is likely to come down to around ` 32,000 crore. (economictimes.indiatimes.com

RIL gas payments to be invested in interest bearing deposits

January 7, 2015. After Reliance Industries Ltd (RIL) demanded interest on KG-D6 gas payments flowing into gas pool account operated by GAIL, the state-owned firm has agreed to invest the receivables in short-term interest bearing deposits with public sector banks. GAIL has written to Oil Ministry saying it will invest monthly accruals in the gas pool account in 271 days deposits of four empanelled banks - State Bank of India, Indian Overseas Bank, Oriental Bank of Commerce and Corporation Bank. The government had in November hiked domestic natural gas prices by 33 per cent to USD 5.61 per million British thermal unit. In case of RIL's main gas field in KG-D6 block, it, however, ordered buyers to pay the firm old rate of USD 4.2 and deposit the balance USD 1.41 in the gas pool account. The incremental USD 1.41 would become due to RIL if it can legally prove that Dhirubhai-1 and 3 gas output dropping to a tenth of projected 80 million cubic meters per day was due to geological reasons and not because of hoarding. RIL has written to the Oil Ministry saying it is entitled to get the principal amount together with market interest rate in case it wins the case. As interest rate on 271 days to 1 year deposits is higher, the accruals in the gas pool account are invested in such term deposits. RIL and its partners are paying the government statutory levy of royalty at the rate of 5 per cent on the USD 4.2 gas price they got and GAIL pays the same from the gas pool account on the remainder payments of USD 1.41. (economictimes.indiatimes.com)

Oil price slump to bring down profits of upstream firms: ICRA

January 7, 2015. The 55 per cent slump in global oil prices will result in material decline in profits of crude oil producers like Cairn India, but will help oil marketing companies cut their fuel losses, ratings agency ICRA said. Global crude oil prices have declined from USD 112 per barrel in June 2014 to USD 50 now, primarily due to significant increase in supply with a record US crude oil production, demand slowdown in Europe, Japan and China. Lower crude oil prices would materially impact profits of crude oil producers in India, it said. The operating profit of Cairn India could decrease by about 35 per cent in 2014-15. ICRA expected ONGC/OIL's subsidy discount to decline from USD 59 per barrel in FY14 to USD 40-45 in FY15. If crude oil prices sustain in the range of USD 50-55 a barrel, the extent of discount for upstream companies would be a key driver of profits in FY16. Further, cash generation of overseas ventures of ONGC Videsh Ltd, OIL and Reliance Industries Ltd (RIL) would decrease significantly. The significant decline in crude oil prices, if sustained, will lead to reduction of capital spending of global E&P companies due to lower realizations and deferment of development of complex fields due to poor economics, it said. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

NTPC to invite tenders for $1.2 bn Bangladesh JV power project

January 13, 2015. NTPC, India's biggest electricity generator, will invite tenders this month for the construction of a $1.2 billion, joint venture (JV) power project to be built in Bangladesh. The coal-fired 1,320 MW plant, expected to become operational by December 2018, is aimed at meeting Bangladesh's growing energy requirements. The company has appointed Fichtner Consulting Engineers and is selecting a consultant to help in sourcing coal for the project. The plant is likely to use about 8 million tonnes of imported coal every year. The plant is being built by Bangladesh India Friendship Power Company, an equal venture between Bangladesh Power Development Board and NTPC. The first project of this venture is the 1,320 MW Maitree Project at Rampal in Bagerhat district. NTPC will set up two 660 MW units at the location on land provided by the Bangladesh government. The utility's expertise will be used to run the plant. At present, demand for power in Bangladesh is about 7,500 MW, which is barely met with its own generation capacity as well as 500 MW sourced from India. By 2021, demand is expected to touch 24,000 MW while in 2030, it is estimated to be about 40,000 MW. At least half of this demand will be met by coal based thermal power generation sources. NTPC supplies 250 MW to Bangladesh at present. (economictimes.indiatimes.com)

CLP Holdings plans power plant in Gujarat with a projected cost of $2 bn

January 12, 2015. Hong Kong-based China Light & Power (CLP) Holdings Ltd is planning a 2,000 MW coal-based power plant in Gujarat at a projected investment of $2 billion (` 12,400 crore), adding to its operational gas-based 600 MW power plant in the state. CLP Holdings CEO Richard Lancaster said the company is undertaking a feasibility study for the power plant that is most likely to be fuelled by imported coal. The project cost for the 2000 MW coal-based power plant is estimated at around $2 billion. The company is also keen on developing renewable energy, especially in the form of solar and wind farms in India. The global CEO community is trying to understand how the investment environment in India will be playing out in near future, he said. (economictimes.indiatimes.com)

IL&FS plans to set up 6 GW power plants in Kutch

January 8, 2015. Infrastructure Leasing and Financial Services Ltd (IL&FS) is set to invest about ` 35,000 crore for setting up 6,000 MW of power generation capacities in Kutch – Gujarat, the company said. IL&FS Group has already laid out plans for a multi-product Special Economic Zone (SEZ) at Kutch and two power generation facilities combining 6,000 MW capacities in the SEZ. IL&FS Group company, IL&FS Maritime Infrastructure Company Ltd (IMICL) is undertaking the day-to-day project development activities for an Integrated Maritime Complex comprising a Shipyard and a multi-product SEZ at Nana Layja where IL&FS is the co-developer, the company said. The Project site is located at the mouth of Gulf of Kutch and is 95 km from Kandla Port and 65 km from Bhuj. However, the company declined to have any fresh proposal for investments to be announced in the Vibrant Gujarat Global Summit, 2015. Meanwhile, the Kutch district collector has recently announced big ticket investment plans from the power and cement sectors. (www.thehindubusinessline.com)

Extreme cold hits power generation in Himachal

January 8, 2015. Extreme cold conditions have frozen glaciers in the state, resulting in acute power shortage in "power surplus" Himachal Pradesh with generation at hydro power projects dipping by 80-85%. To meet the rising demand for power during peak winter season, the state government is relying on banking supply from neighbouring states of Punjab, Delhi, Haryana and Uttar Pradesh. The state electricity board said that, at present, daily demand for power is 260 lakh units while availability is 120 lakh units. To fill the gap of 140 lakh units, power on banking is drawn from the neighbouring states. Himachal Pradesh State Electricity Board Ltd (HPSEBL) owns 126 MW Larji hydro power project, 120 MW Bhaba hydro power project and 300 MW Baspa power project. Besides, it takes around 300 MW power from small power projects in addition to 330 MW power from Nathpa Jhakri power project in lieu of its share and 12% free power. It also draws 12% power from Chamera and BBMB projects, but there is shortage despite this. During peak summers in June-July, generation reaches 1,300 MW, but these days it has decreased to around 600-700 MW from all the sources. To meet the demand during winters, HPSEBL is drawing its full share from Nathpa Jhakri project while 100 MW is drawn on banking from Punjab, Haryana, Uttar Pradesh and Delhi to be returned in summer. HPSEBL said that all rounds efforts are being made to ensure that people do not feel the shortage. (timesofindia.indiatimes.com)

MP's power generation not hit by coal workers' strike

January 7, 2015. The coal industry workers' strike has not affected Madhya Pradesh's power generation capacity and the state has enough stock of the vital fuel to run its thermal power stations unhindered, Madhya Pradesh Power Generation Company said. The recent drizzle across the state has brought down the power demand to around 6,000 MW from nearly 8,000 MW a couple of days back, the company said. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

JSW Energy to bid for coal blocks via debt

January 8, 2015. JSW Energy plans to bid for coal blocks in the upcoming auctions and is upbeat about the fall in the dry fuel's price in the international market as it helps boost the company's financials. But the company is concerned about subdued demand for power in the country. JSW Energy to bid for coal blocks via debt, internal accruals. The company will bid in the upcoming first round of coal block auctions. If it wins, it will finance the purchase of the block with "a combination of debt and internal accruals". Mines are being auctioned after the Supreme Court cancelled previous allocations which it found "arbitrary and illegal". Experts say that merchant power rates are also low, in the range of ` 3 per unit, down from ` 5-6 in the past. This adds to the woes of power producers. JSW Energy meets 65% of its fuel requirement with imported coal. Its plants at Vijayanagar in Karnataka and Ratnagiri in Maharashtra are run on imported coal, while the one at Barmer in Rajasthan is fuelled by its captive Kapurdi lignite mines. JSW Energy sells about half its power produced under long-term power purchase agreements and the other half on the spot market. JSW Energy's power sales rose in the half year through September -by 23% in the merchant market and 34% under long-term agreements. The company has been reducing the share of sales in the merchant market, which now 50% compared with 64% in 2011-12. (economictimes.indiatimes.com)

Small industries down shutters over power tariff hike

January 8, 2015. Nearly 20,000 micro and small industries in the district downed their shutters protesting against the 15% increase in the power tariff, even as the strike by power loom job workers in Coimbatore and Tirupur districts entered the second day. Responding to a call given by the Kovai and Tirupur District Micro and Cottage Entrepreneurs Association (KOTMA), the industries closed their units and several members joined to observe one day hunger strike, to bring the attention of the Government on their plight. The government either has to withdraw the hike or bear the entire increase, by considering it as subsidy to the industries, KOTMA said. (www.business-standard.com)

Coal imports jump 19 per cent in 2014

January 7, 2015. Coal shipments to India, the world's third-largest importer, rose 19 per cent to 210.6 million tonnes last year driven by an even bigger jump in purchases of the variety used in power generation, online trader mjunction said. Imports have risen over the past four years as India adds capacity to supply round-the-clock power to its 1.2 billion people. Lower-than-expected output from state giant Coal India is also boosting imports. At 163 million tonnes, imports of thermal coal used by power companies jumped 22 per cent in 2014. Coking coal, a steelmaking raw material, saw a 4 per cent rise to 37 million tonnes, according to the provisional data from mjunction. Anthracite coal, met coke and pet coke made up the rest of the shipments. Imports fell slightly in December to 15.30 million tonnes as good weather helped Coal India ramp up supply. Coal India may not maintain the pace in January: workers at the world's top coal producer began a five-day strike in protest at PM Narendra Modi's move to allow private companies to mine and sell the fuel for the first time in 42 years. The government does not regularly release coal import figures. (economictimes.indiatimes.com)

Policy / Performance………….

Australian delegation compliments India for progressive changes in mining sector

January 13, 2015. An Australian delegation led by Andrew Robb, Trade and Investment Minister, met union minister for steel & mines, Narendra Singh Tomar. During the meeting, which was attended by senior government officials from India and Australia and CEOs from the countries, Mr Robb complimented the new government for bringing in forward-looking and progressive changes in the mining sector. Incidentally, Around one-third of the 450-strong delegation that has come to India, represent mining sector. The Australian minister commended the stable policy regime, that would help attract investors to India. Tomar invited Australian mining companies to be a partner in developing the mining sector in India. While highlighting issues of concern, he mentioned reducing the high waiting time for ships at the coal loading ports in Australia, improving availability of rail and port capacities for transporting coking coal to port and creating opportunities for sale or investments in the equity of good coking coal assets in Australia. (economictimes.indiatimes.com)

Singareni Collieries expects to commission unit in Telangana by November

January 13, 2015. The first unit of 2x600 MW power plant, being developed by the State-owned Singareni Collieries Company Ltd (SCCL), is expected to be commissioned by November this year. The recently-appointed Chairman and Managing Director of Singareni Collieries, N Sridhar, held a meeting with NTPC, BHEL and McNally Bharat — all part of the project coming up in Adilabad district of Telangana. While NTPC is the consultant for the project, BHEL is the Boiler-turbine-generator component executing agency and McNally Bharat is the balance of plant provider for the coal fired thermal plant. The meeting was convened by SCCL to take hands-on information on the project status, contingency plans for compressing time and completing the project ahead of schedule as desired by the Telangana Chief Minister K Chandrasekhar Rao, who had visited the plant site in December to oversee its progress.

As per plans, it is proposed to light up the boiler by May 2015. Boiler light up is an important milestone wherein a boiler will be ignited using light diesel oil. This ensures major completion of the boiler works and, thereafter, the boiler preparation activities such as steam blowing are readied. All the contractors have assured SCCL to speed up the approval of plans and procurement of materials to meet the timelines. The synchronisation of the first unit is expected by November. During the meeting, issues relating to water supply, land acquisition for rail connectivity, among others, which are part of Singareni Collieries, were sorted out. (www.thehindubusinessline.com)

Timing of CIL stake sale to be decided by Finance Ministry: Coal Secretary

January 13, 2015. The Coal Ministry said the timing of stake sale in Coal India Ltd (CIL), which may fetch the exchequer about ` 24,000 crore, will be decided by the Finance Ministry. Coal Secretary Anil Swarup said the Coal Ministry has already signed an agreement with trade unions of CIL and addressed their grievances aptly. The comments by the Coal Secretary comes a day after the Finance Minister said the divestment programme would be pursued on priority and involve more than one PSU during this period. Finance Minister Arun Jaitley had said that the government would sell stakes in state-owned companies before the end of the financial year in March. Coal workers, which were protesting against disinvestment in CIL, had called off their nationwide five-day strike after two days, as the government assured trade unions that the Coal India will not be privatised and the employees' interest will be protected. (economictimes.indiatimes.com)

Govt asks coal block bidders to fix dates for site visit

January 13, 2015. The government has invited bidders to come up with dates to visit the coal blocks besides inspecting land documents of the mines. The invite notice to the bidders by the Coal Ministry is for the 23 producing coal blocks to be auctioned next month. For site visit, the government has kept five days (January 16, 19, 20, 21 and 22), while for inspection of land documentation document, the ministry has fixed four days (January 16, January 19, January 20 and January 21). The government on December 25 last year kick-started the auction process for cancelled coal mines with the launch of a portal for electronic bidding. The Union Cabinet had earlier approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations. E-auction of 23 coal mines announced for qualified bidders earlier will be held from February 14-22. The entire mine allocation process for Schedule II (in production) coal mines will be completed by March 23 with the signing of Coal Mine Development and Production Agreement, the government had said earlier. (economictimes.indiatimes.com)

States asked to revisit NoC for industrial power connection

January 13, 2015. Concerned over new industrial projects hit due to delay in getting electricity connection, the Centre has asked state Pollution Control Boards to revisit the mandatory requirement of 'No Objection Certificate (NoC) for such projects for improving 'ease of doing business'. The requirement of 'NoC' or 'Consent to Establish (CTE)' certificate has been mandated by many states on their own although such a condition has not been specified under any guidelines of the Central Pollution Control Board, said a latest order issued by the Union Environment Ministry. In many states, Pollution Control Boards (PCBs) and Pollution Control Committees have made it mandatory to obtain the CTE certification as a pre-requisite for getting the industrial electricity connection for establishment of new industries/projects. The NDA government has been taking several measures to remove green hurdles that have been blocking many development projects in the country. (economictimes.indiatimes.com)

Coal block auction to private companies to start soon: Finance Minister

January 12, 2015. Government said the much-awaited auction of coal blocks to private companies will begin soon. Finance Minister Arun Jaitley said that clearing up the entire mess in coal and power sectors is one important step the government was taking. The government invited bids for 24 mines. It later dropped one block from the list of 24 due to "technical reasons". After dropping Namchik Namphuk mine in Arunachal Pradesh, 23 mines will be available in the first tranche. The coal blocks also fall in the Schedule-II coal mines. Schedule II coal mines are 42 producing blocks out of 204 cancelled by the Supreme Court. The Union Cabinet had earlier approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations. The government kick-started the auction process for coal mines cancelled by the Supreme Court with the launch of a portal for electronic bidding. (economictimes.indiatimes.com)

Shiv Sena continues to oppose 9.9 GW JNPP

January 12, 2015. Notwithstanding Prime Minister Narendra Modi's strong push for nuclear energy which he wants trebled by 2024, ally Shiv Sena said it will continue to back those opposed to the 9,900 MW Jaitapur Nuclear Power Project (JNPP) in Maharashtra. Locals and anti-nuclear activists have been holding protests against the proposed plant over "scientific and environmental" concerns and Shiv Sena has been actively backing them. The project is proposed to be set up in collaboration with French company Areva in the coastal Jaitapur village in Ratnagiri district. It will have six units of 1650 MW each built with Areva's European Pressurised Reactor technology. JNPP would be one of the costliest nuclear power plant projects considering its sheer size and the new technology. After three years of negotiations, India and France had in March last year agreed on the cost of power that will be generated, clearing a major hurdle in the path of the project. The two sides had agreed on ` 6 per unit, down from ` 9.18 per unit quoted by Areva initially which was strongly opposed by the Department of Atomic Energy (DAE) and NPCIL. Senior Shiv Sena leader and state's Industries Minister Subhash Desai said the previous UPA government had failed to convince the locals about the safety aspects of the project. India is seeking to conclude a civil nuclear cooperation pact with Japan negotiations for which started in 2010. Inking a pact with Japan is critical for India to operationalise civil nuclear power pacts already concluded with other countries. According to US Secretary of State John Kerry, on India visit to attend the Vibrant Gujarat Summit, cooperation in civil nuclear energy is likely to figure prominently in talks between Modi and President Barak Obama when the latter arrives in New Delhi to attend the Republic Day celebrations as chief guest. (economictimes.indiatimes.com)

MERC to review power tariff soon: Bawankule

January 12, 2015. The Maharashtra government has taken several measures to lower electricity rates and soon state power regulatory commission MERC (Maharashtra Electricity Regulatory Commission) will review tariffs, state Power Minister Chandrashekhar Bawankule said. The government had taken several decisions to minimise the coal transport cost, distribution losses and to ensure procurement of quality coal for state-run power plants by introducing third-party sampling mechanism, he said. Bawankule said state-run power plants were not getting good coal, which led to a dispute between Coal India and the Mahagenco. But Coal India has agreed to the proposal of testing coal samples at third-party laboratories, he said. All these initiatives would lower the tariff, he claimed. The government was also planning to revise the present power tariff, the minister said. He said the state had proposed to reduce the open access surcharge by ` 1.50 per unit for the industry in Vidarbha. The government would also come out with a solar power policy and would encourage solar pumps for the agriculture which would help the farmers in the drought-affected areas, he said. (economictimes.indiatimes.com)

Govt to invest ` 3 lakh crore for building power infrastructure: Goyal

January 10, 2015. An amount of ` 3 lakh crore would be invested in building infrastructure for transmission and distribution of power in the country, Union Power Minister Piyush Goyal said. This would facilitate a 24x7 power supply, the minister said. Goyal said the eastern states would get lakhs of crores of rupees through auction of coal blocks. Goyal said that the Centre had set a target to double coal production by 2019, thereby doubling power generation. He said the states could benefit from coal blocks auction in other ways too like progress in industrialisation, high revenue generation and business environment and others. Goyal said, the auction of coal blocks would ensure transparency in the deal. (economictimes.indiatimes.com)

NTPC to help revive Patratu thermal power plant in Jharkhand

January 9, 2015. NTPC will assist in reviving the struggling Patratu thermal power station, run by the Jharkhand government. The 840 MW Patratu thermal power station is located near Patratu town in Ramgarh district in Jharkhand. It is operated by the Jharkhand State Electricity Board. Due to paucity of time, NTPC has been selected to revive the plant with the state government over selection of bidder through the tendering process where the private sector also gets the opportunity to participate. Power and Coal Minister Piyush Goyal said he is hopeful that the process of inviting bids will start in the next three to six months. The minister also hinted at reviving Tenughat Vidyut Nigam Ltd (TVNL). The company is engaged in improving its technical performance with reference to national benchmarks by adopting the best available practices and absorbing the best available technologies subject to its financial constraints. (economictimes.indiatimes.com)

CIL unions to make up for output loss of 1 mn tonnes: Goyal

January 8, 2015. Coal India Ltd (CIL) trade unions have assured the government that they will try to make up for the loss in production of about one million tonnes on account of workers strike which was called off, Coal and Power Minister Piyush Goyal said. He said this while presenting the report card on first 200 days of the working of the ministries of Coal, Power and Renewable Energy. Coal workers had called off their five-day nationwide strike after two days following the intervention of the government. Goyal said that the unions have also assured complete cooperation in the future as well. The government had assured trade unions that CIL will not be privatised and the employees' interest will be protected. Nearly five lakh coal workers had gone on a strike after five major trade unions, including BJP-backed Bharatiya Mazdoor Sangh, gave a call for the biggest ever industrial action in four decades against what they called attempts for "disinvestment in Coal India and denationalisation of coal mining". (economictimes.indiatimes.com)

Power Ministry cancels UMPP bidding

January 8, 2015. The government has abandoned the bidding process of two ultra mega power projects (UMPPs) in Odisha and Tamil Nadu and will soon set up a committee to move it forward. The private firms, which had participated in the first round of bidding for both the projects, withdrew their bids citing difficulties in securing finances for these projects. For the Tamil Nadu UMPP, the private companies in the fray were Adani Power, CLP India, Jindal Steel & power, JSW Energy, Sterlite Energy and Tata Power. Of these, four bought the Request for Proposal document but decided not to go ahead further in the process. The Odisha UMPP saw nine interested bidders, including Adani Power, CLP India, GMR Energy, Jindal Steel and Power, JSW Energy and Sterlite Energy. After the private companies pulled out, only NTPC and NHPC were left for bidding. UMPP is a coal-based power project of 4,000 MW generation capacity. (www.business-standard.com)

Power Ministry to finalise draft cabinet note on tariff policy by Jan 15