-

CENTRES

Progammes & Centres

Location

[Falling oil prices: who is celebrating?]

“All parties in power know that increase in global crude prices, if passed through fully to the retail consumer, would not only earn the wrath of the consumer (voter) but also contribute to inflation which would in turn add to the wrath of the voter. If so should not the present Government be pleased that it can claim to be responsible for both reducing the price of key petroleum products at the pump level and for containing inflation at the country level?…”

[GOOD]

DMRCs removal of 390,000 vehicles in Delhi must be celebrated; further removal of vehicles must be encouraged!

Lack of bidders for new LNG carriers in India raises doubts over both ‘make in India’ and demand for LNG!

[UGLY]

We will return to square one of power sector reforms if we end of tariff based competitive bidding for power projects!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Falling oil prices: who is celebrating?

· Indian Energy Sector in 2014: A Review

DATA INSIGHT………………

· Fuel Minerals: Public Vs Private Production 2013-14

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC targets 81 per cent jump in gas output by 2019-20

Downstream……………………………

· IOC to commence commissioning Paradip refinery from Q1 of 2015

Transportation / Trade………………

· With no takers, GAIL again postpones LNG tender date

· Petronet receives 1,000th cargo from Qatar-based RasGas

Policy / Performance…………………

· Congress questions Centre on fuel pricing

· 5 kg cylinder to be available at all LPG centres

· Oil Ministry plans extending formula to exempted blocks predating NELP

· Non-subsidised LPG rate cut by ` 43.50 per cylinder

· Jet fuel rates cut sharply by 12.5 per cent

· Petrol, diesel price cut likely as New Year’s gift

[NATIONAL: POWER]

Generation………………

· Coal India strike to hit UP thermal power generation

· MahaGenco pins hopes on allocation of new mines after SC scraps licence

· Reliance Power starts boiler for sixth unit at Sasan UMPP

Transmission / Distribution / Trade……

· Gadkari lays foundation of Powergrid 400/220 KV GIS Sub-Station in New Delhi

· Strike may not have much impact on coal production: SCCL

· L&T construction wins ` 40 bn contracts

· OPTCL pegs power carrying cost at 37.12 ppu for 2015-16

· Power discoms petition for 15-20 per cent hike

· Kalpataru Power gets ` 5.6 bn worth new orders

Policy / Performance…………………

· Ramping up coal production a priority: new CIL chairman

· Electricity (Amendment) Bill 2014 may be delayed

· Govt drops 1 coal mine from list of blocks put under auction

· UP Power Minister suggests Centre to set up hydro power plants in Nepal

· Prabhu-led panel bats for more empowered players in coal mining

· Govt to decide fate of Odisha, Tamil Nadu UMPPs

· CCI to probe Great Eastern Energy for unfair business practices

· Centre asks Chhatisgarh to expedite clearances to mining projects

· Private power companies may shift to regulated tariff regime

· Coal stock position improves at thermal power plants: CEA

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Brazil O&G production rises 13 per cent in November: ANP

· MOL says Shaikan block crude output reached 40k bpd

· Oil below $60 tests US drive for energy independence

· Statoil starts up new Valemon gas, condensate field in North Sea

Downstream……………………

· Petrobras said to slow refinery projects amid graft probe

Transportation / Trade…………

· Russia, Iraq supply most oil in decades as 2015 begins with glut

· Global LNG-prices hold steady in weak trade

· Libyan tanker spills crude after collision near Singapore

· OPEC resolve on supply promises no calm for oil markets

Policy / Performance………………

· Canada's BC bans transport of oil in pipelines built for LNG

· China struggles to find prospective blocks for shale auction: Govt

· Bernstein cuts Brent forecast to $80 as price seen near bottom

· AAA sees US drivers saving $75 bn on gasoline

· US opening door to more oil exports seen foiling OPEC strategy

[INTERNATIONAL: POWER]

Generation…………………

· Azerbaijan increased electricity generation in 2014

· Pakistan begins construction of two hydro power projects

· South Korean company to build a power plant in Kazakhstan

· Sahara Group to build thermal plant in Ghana

· China's Three Gorges Power Plant claims new world record for hydropower generation

Transmission / Distribution / Trade……

· NGCP to build new transmission line in Philippines

· AEP hires Goldman for potential power plant sale

· Ukraine to import coal from ‘far away’ as war curtails mines

Policy / Performance………………

· Rurelec commissions Peruvian hydroelectric plant

· New York reactor’s survival tests pricey nuclear

· New Mexico regulators consider future of major coal power plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India cuts floor price for solar-energy credits to boost demand

· KKNPP gives solar lanterns to students

· Govt aims 100 MW solar power generation by 2016

· Climate change is natural, not just man-made: Experts

· Solar subsidy: Centre plans cut, Haryana may give more

· Telangana ideal for harnessing renewable energy: IT Minister

· 18 Jharkhand villages identified under 'Green India Mission'

· DMRC comes under UN's CDM

· China's cheap solar panels cause dark spots in Indian market

· Maharashtra to launch integrated policy for renewable sector

· PM Modi raises solar investment target to $100 bn by 2022

· Solar rooftop systems to do Delhi a power of good

GLOBAL………………

· Google backs Utah’s largest solar power plant

· Canadian Solar sells two power plants to Renewable Energy Trust

· US solar tariff review hints at halved rate for Chinese cells

· Scotland could be fossil fuel-free by 2030

· South Africa mulls giving credits for rooftop solar electricity

· Saudi solar-gas power plant to be built near Red Sea

· GE to provide $1.2 bn new power plant in Tabuk

· Fortum connects 10 MW solar plant to India’s power grid

[WEEK IN REVIEW]

COMMENTS………………

Falling oil prices: who is celebrating?

Lydia Powell, Observer Research Foundation

|

I |

n the last few decades we have been told repeatedly that increase in oil prices was orchestrated either by oil revenue dependent dictatorships in the Persian Gulf or by evil oil corporations that sought to profit at the expense of the consumer. If this were true then the dramatic fall in global crude oil prices must have brought glad tidings to the helpless consumer. When two powerful forces supposedly controlling the price of oil have been slain by a mysterious force every oil consumer must be happy. But there is almost no sign of the consumer celebrating.

We have also been told that high oil prices contribute to everything from inflation and under-recoveries (for Indian downstream companies) to geo-political tension. If this were so then there is much to celebrate for economists, planners, central bankers and oil company bosses. Once again we see no sign of cheer from these important people. The stock market which is supposed to capture glad tidings before anyone else does is falling in India and elsewhere and falling oil prices are being blamed. The pink news papers in India that rushed to assign full credit to the new macho Prime Minister for moving up the Indian stock markets are now blaming oil prices for pushing it down. If oil price can push down what a magical PM pushed up, something is definitely wrong with the electoral and economic calculations of the pink news papers and corporate forces behind them.

According to one of the news items in this week’s issue of the news monitor, the opposition party has raised the question as to why petroleum product prices have fallen by less than 15 percent when global crude oil prices have fallen by roughly 50 percent. This is a valid question but the opposition party surely knows why this cannot be done as it has been in power during the last ten years when oil prices touched highs of $150/bbl and lows of $50/bbl. The opposition party did not pass on the increase or the decrease in global prices to the retail consumer when it was in power and it has no valid reason to expect the ruling Government to do otherwise. The Government at the Central and State levels are dependent on tax take from petroleum products which accounts for anything between 30-60 percent of the retail price of key products. All parties in power know that increase in global crude prices, if passed through fully to the retail consumer, would not only earn the wrath of the consumer (voter) but also contribute to inflation which would in turn add to the wrath of the voter. If so should not the present Government be pleased that it can claim to be responsible for both reducing the price of key petroleum products at the pump level and for containing inflation at the country level? Not even the slightest sign of celebration can be detected on these counts.

The constant lament of oil refiners and retailers in India during times of high oil prices has been that they are losing money (the so called under-recoveries) on every unit of petroleum product that they sell. In every conference platform, representatives from these companies claimed that they cannot invest in technology, pipelines and people because they are bearing the brunt of high oil prices. If so, we must now be hearing a lot on ‘over-recoveries’ and how these are contributing to investment in technology, skills and infrastructure. There has not been even a whimper on this from down-stream oil companies.

While no one is sure as to what is going on, the explanation that is most rational appears to be one that tempers the infinite growth ideology of economists with finite world of the scientists. As mentioned in the earlier article in this news letter, it is becoming more and more expensive to extract energy and the demand it makes on other dwindling resources such as water, metals and minerals is also growing. However wages (or debt that allows us to borrow from the future) is not growing simultaneously as it did in the past. This means that demand for available energy is falling. We have seen something similar during the financial crisis. Soon after the financial crisis debt dried up and oil prices that had skyrocketed collapsed almost over-night. It inflated again after quantitative easing released more cheap money. Some see the collapse of oil prices as a sign of debt drying up which is not very different from what happened in 2008. Another round of quantitative easing effort could re-start the cycle but even the uninitiated would know that this cycle cannot go on forever.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Indian Energy Sector in 2014: A Review

Ashish Gupta, Observer Research Foundation

Power

|

T |

he year started with political flip-flop over energy prices due to elections in the country. All parties struggled to establish their positions and the issue of power and petroleum product prices were gaining significance in party positions. In the case of Delhi, the subsidy for residential consumers consuming up to 400 units of electricity was withdrawn from 31st March, 2014. The government also rolled back the decision to increase diesel prices even though it committed to increase the same by ` 0.50/litre every month. But as petrol prices were deregulated, it was reduced by ` 0.75/litre (excluding state levies) from 1st April 14 in Delhi though it was revised upwards by ` 0.60/litre (excluding state levies) from 1st March 14. While the already unpopular monthly hike in diesel rates was put off during the election season. In the later part of the year, the Delhi Electricity Regulatory Commission withdrew the up to 7 percent power tariff hike announced earlier, attributing the roll-back unconvincingly to the requirement of ‘some more inputs on price of fuel’ from the generation companies supplying power to the capital. What was the reason for the multiplicity of positions? Partly political perhaps but mostly unknown!

Civil Nuclear Energy

On the Nuclear energy front, the share of nuclear energy has declined from 4% (2012) to 3.4% (2013) due to dramatic increase in generation from other sectors. In April 2013 a bilateral safeguards agreement was signed between the Department of Atomic Energy (DAE) and the Canadian Nuclear Safety Commission (CNSC), allowing trade in nuclear materials and technology for facilities which are under IAEA safeguards. A similar bilateral agreement with Australia was signed in 2014. Both were signed essentially for uranium supply. Despite this the nuclear energy sector cannot claim to have made significant progress.

The Atomic Energy Regulatory Board (AERB) was criticised for playing a subordinate role to the Atomic Energy Commission (AEC) as the AERB is mandated to inspect the working of AEC. Therefore, how far the government’s decision to institutionalize another regulatory authority such as the proposed ‘Nuclear Safety and Regulatory Authority’ would help in bringing transparency is not clear. Apart from this, many sites have been proposed for civil nuclear power but none have made progress excluding Kudankulam where one unit went critical but is yet to produce power at full potential as some tests are yet to be performed. The Kudankulam projects got the approval in 1988 with an estimated cost of US $ 2.6 billion and till date only one unit has started working partially with cost escalation to US $ 3.4 billion. These delays and cost overruns are draining the exchequer. Low public acceptance for civil nuclear projects means public agitation will continue and there will be more cost overruns. Despite many issues which need to be resolved particularly Section 17 (b) and Rule 24 of the Civil Nuclear Liability Act but the civil nuclear industry is optimistic. How far this optimism is justified and to what extent nuclear energy will contribute to India’s energy security is still very uncertain.

Climate Change

Climate Change remained the hottest topic during 2014 because the crucial decisions were to be made at Lima in 2014 and concluded in Paris in 2015. The Lima outcome was not considered a great success but India's biggest gain was the renewed solidarity among the 134-country developing economies group - G77 plus China and the successful strategizing by the Likeminded Developing Countries (LMDC) group. The group suffered a setback when the Philippines, reportedly under pressure from developed countries, backed out. It was grudgingly accepted by all that ‘common but differentiated responsibility (CBDR)’ that took into account historical responsibilities would remain a basic and fundamental principle of future negotiations. However it was clear that rich nations continued to be unwilling to open their pockets either to share financial resources or offer technological assistance.

Indeed measures must be adopted to combat climate change, but the ‘dos’ and ‘don’t’ should not be restricted to developing nations only. Climate change deliberations are put forward on the basis of sustainable growth in the energy sector. But sustainability is also interlinked with affordability; therefore an inclusive approach for adopting various sources of energy where sustainability is complemented with affordability, viability and accessibility is required. India’s climate morality has already begun at home; the question remains open on the climate morality of rich countries.

Renewable Energy

On the renewable energy front, India made reasonable progress with total installed capacity of 31,692 MW. The government announced solar power generation target of 100,000 MW by 2022, up from the 20,000 MW goal planned by the UPA government. Finance Minister Arun Jaitley allocated ` 1,000 crore for the solar power sector in Budget 2014-15. The government also aimed to construct Ultra Mega Solar Power Projects or high capacity plants in the radiation rich states of Rajasthan, Gujarat, Tamil Nadu and Ladakh. Apart from that, a package of incentives have been announced (except wind) including fiscal concessions such as 80% accelerated depreciation, concessional custom duty for specific critical components, excise duty exemption, income tax exemption on profits for power generation etc. State Electricity Regulatory Commissions in Andhra Pradesh, Haryana, Punjab, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Gujarat, Kerala, Punjab, Orissa and West Bengal have announced preferential tariffs for purchase of power from wind power projects.

Having said that, the Jawaharlal Nehru National Solar Mission was launched on the 11th January, 2010 by the then Hon’ble Prime Minister has flourished but not at the pace envisaged. The important question remains why JNNSM, after so much genuine efforts, did not pick up? On the contrary, most of the renewable projects awarded under state programs have flurished. Gujarat is a classic example as it offered much higher tariff.

During the year it became very difficult for the government to strike a balance between imported content and indigenous components. Empowering the indigenous renewable industry was a key objective but overseas companies were not in favour of Domestic Content Requirement (DCR) and claimed that it went against global trade practices. On the other hand indigenous companies wanted some protection through DCR as they were (and continue to be) vulnerable to Chinese silicon and American thin film manufacturers. Apart from this claims were made during the year that renewable energy had reached grid parity but the ground reality suggests otherwise. Claims of grid parity must be seen in the context of financial viability. Interestingly renewable energy projects are part of infrastructure financing but this priority provision has not been sufficient to change the negative perception of renewable energy sources by financial institutes.

The government has taken all possible measures to promote renewable energy whether through subsidies or through Viability Gap Funding. The only thing that is missing is the lack of proper monitoring system. The early exit clause has made the situation worse. During the year we have witnessed that Renewable Purchase Obligation (RPO) was once again not fulfilled by most of the discoms. The answer is in the balance sheets of the discoms which show clear illiquidity. RPO is no longer a matter of obligation but the question is of financial viability. Central Electricity Regulatory Commission also passed an order to penalize the CMDs/ MDs of dicoms at the personal level if the obligation is not fulfilled. These are very encouraging orders but adopting the stick approach is not a feasible solution. The need of the hour is to make the power sector financially strong so that they will take the obligation willingly and not forcefully.

Coal

On the coal front, the year started with clubbing of coal, power and renewable under one Ministry head which was a much desired decision. Coal cess was increased from ` 50/tonne to ` 100/tonne to finance green activities. Between April 2014 and Oct. 2014, Coal India’s overall production increased by 6.6 percent but remains at only 97 percent of the desired target of 259.85 million tonnes. Coal shortages started creeping in but fortunately by the end of the financial year the situation eased a little. However there are inconsistencies in the figures quoted by various agencies on coal imports. The media and even some of the experts exaggerate the figure and show a trend of steep growth in imports. The situation worsened after the Supreme Court judgement which came in September 2014. It resulted in the cancellation of 214 of the 218 coal blocks allocated by the successive governments since 1993 and gave the companies awarded coal blocks just six months to wind up their operations. In the wake of these challenges, the Government announced that Indian coal production must touch a target of1 billion tonnes by 2019. Unfortunately until the structural issues are addressed in a time bound manner, this ambitious target is unlikely to be met.

In order to counter the coal shortages and to give private sector more freedom in the coal sector, the government came out Coal Ordinance 2014. The Government is looking to supersede the Coal Mines Nationalisation (Amendment) Bill 2000 which is still pending in the Parliament. Though the ordinance has been approved by the Lok Sabha (lower house) it is yet to be approved by the Rajya Sabha (upper house).

In 2014 reform narratives continued to be equated with tariff hike. Most power distributers have sought and continue to seek tariff hike in the name of reform or costly coal imports. But the recent imported coal scam estimating a loss of ` 29,000 crore (` 290,000 million) unearthed by the Directorate of Revenue Intelligence has raised questions over this strategy. Are companies claiming to be using imported coal just to justify higher tariff? The question remains open. The solution is real reforms but unfortunately that is unlikely to happen in the coal sector. But it is probably time for those promoting the narrative of shortage of energy in India to revise their stories!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

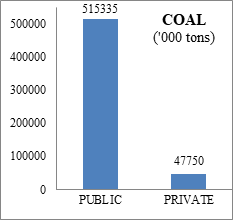

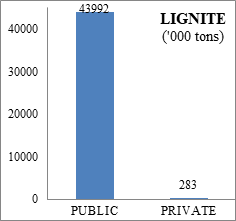

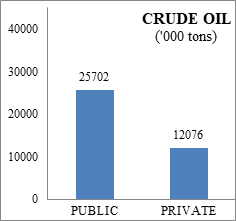

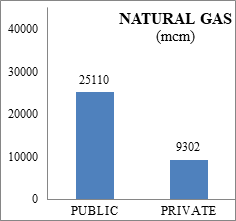

Fuel Minerals: Public Vs Private Production 2013-14

Akhilesh Sati, Observer Research Foundation

|

STATE |

Coal ('000 tonne) |

Lignite ('000 tonne) |

Natural Gas (MCM) |

Crude Oil ('000 tonne) |

|

ANDHRA PRADESH |

50469 |

1168 |

298 |

|

|

ARUNACHAL PRADESH |

|

12 |

110 |

|

|

ASSAM |

663 |

2649 |

4712 |

|

|

CHHATTISGARH |

127093 |

|||

|

GUJARAT |

11596 |

1569 |

5061 |

|

|

JAMMU & KASHMIR |

19 |

|||

|

JHARKHAND |

113322 |

|||

|

MADHYA PRADESH |

76055 |

|||

|

MAHARASHTRA |

37221 |

|||

|

MEGHALAYA |

2696 |

|||

|

ODISHA |

112914 |

|||

|

RAJASTHAN |

6069 |

921 |

9178 |

|

|

TAMIL NADU |

26610 |

1300 |

225 |

|

|

TRIPURA |

816 |

|||

|

UTTAR PRADESH |

14258 |

|||

|

WEST BENGAL |

28375 |

142 |

||

|

OFF SHORE |

25835 |

18194 |

||

|

ALL INDIA |

563085 |

44275 |

34412 |

37778 |

Source: Indian Bureau of Mines.

MCM- Million Cubic Meters

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC targets 81 per cent jump in gas output by 2019-20

January 6, 2015. ONGC (Oil & Natural Gas Corp) is targeting to hike its natural gas output by 81% to 116 million metric standard cubic metres per day (mmscmd) by 2019-20. Currently, ONGC producers roughly four-fifth of domestic gas. The projection is being shared by the government-owned explorer with the ministry of petroleum and natural gas. The aggressive pitch to increase output follows petroleum minister Dharmendra Pradhan’s stern directions to the explorer to increase hydrocarbon production. ONGC’s production of oil and gas has been stagnant for the past few years, partly due to huge subsidy burden on the firm that forced it to cut on capital spending, but also, analysts say, because of a slippage in efficiency.

In order to achieve the new target for gas production, ONGC said that projects worth ` 22,500 crore in the western offshore have already been approved by the PSU’s board. Other projects worth nearly ` 30,000 crore for the East Coast are under advanced stages of execution and would be taken up by the board latest by March 30, ONGC said. Incremental production is expected from KG basin (KG-DWN-98/2), Vashistha, Bassein and Daman fields. ONGC’s most-talked-about project in the deepwaters of KG basin is advancing and Intec Sea of Malaysia has been assigned to prepare the field development plan. The firm would develop the northern discovery area (NDA) in the first phase and first gas is expected by 2018.

The biggest exploration company in India saw its standalone crude oil output falling from 24.67 million tonne in FY10 to 22.25 million tonne in FY14. Similarly, gas output has increased marginally from 23.11 billion cubic metres in FY10 to 23.28 billion cubic metres in FY14. The delay in implementation of several projects is making ONGC struggle to resist the falling output from aging fields and no incremental production is coming from new blocks bagged under the New Exploration Licensing Policy (NELP) auction. ONGC said nearly three-fourth of projects have been executed and the remaining are under process. (www.financialexpress.com)

Downstream………….

IOC to commence commissioning Paradip refinery from Q1 of 2015

January 1, 2015. Indian Oil Corp (IOC) will begin commissioning of its long-delayed ` 34,500 crore Paradip refinery from the first quarter of 2015. Paradip refinery was originally to be built by April 2012 but has faced delays because of law and order problem. The 11th refinery of IOC was to cost ` 29,777 crore but the delays have taken the cost to ` 34,500 crore. IOC has always given highest priority to environment and its operations are in total harmony with ecology. (economictimes.indiatimes.com)

Transportation / Trade…………

With no takers, GAIL again postpones LNG tender date

January 6, 2015. Finding no takers for its ` 42,370 crore tender to hire newly-built LNG ships, GAIL India Ltd has for the third time postponed the last date of bidding. GAIL had in August last year floated a global tender to charter nine newly built ships for transportation of natural gas in its liquid form at sub-zero temperature (LNG) from the US. The tender, however, required bidders to build one-third of the ships in India, a condition that has found no takers. The company first postponed the last date of bidding from October 30 to December 4 and then to January 6. It put it off till February 17, according to a notice issued by GAIL. GAIL had originally not been in favour of the condition but fell to oil ministry's dictate once it was threatened with a Presidential directive. The company board had on April 4 last year approved hiring of up to 11 new build LNG ships. The Ministry, however, saw the chunky contract to be the perfect opportunity for India to exercise buyer's clout and wanted a part of the contract be set aside for Indian shippers to kickstart domestic manufacturing by compelling global majors to transfer LNG shipbuilding technology to India. Oil Minister Dharmendra Pradhan as well as External Affairs Minister Sushma Swaraj have tried to persuade South Korea, the world's largest LNG tanker manufacturer, to rescue the tender. Four Korean shipyards qualify for GAIL's tender requirements - Samsung Heavy Industries, Daewoo Ship Building and Marine Engineering, Hyundai Heavy Industries and STX Offshore and Shipbuilding. But none of them has so far shown interest in the tender. GAIL to start receiving LNG from US from December, 2017 and it needs the tankers before that. (economictimes.indiatimes.com)

Petronet receives 1,000th cargo from Qatar-based RasGas

January 2, 2015. Petronet LNG Ltd, India's biggest importer of liquefied natural gas, has received its 1000th cargo under its long-term import contract with RasGas of Qatar. Petronet buys 7.5 million tons a year of LNG from RasGas on a 25-year contract. Supplies began in 2004 and the company received 1000th cargo, Petronet said. Its LNG carrier 'Disha' brought the 1000th cargo at the Dahej import terminal in Gujarat.

Petronet ships the LNG in its three vessels -- Disha, Raahi and Aseem. The company said it has expanded the Dahej terminal by including a second LNG jetty that can accommodate larger vessels of up to Q-Max size. Besides the 10 million tons a year Dahej terminal, Petronet also has a 5 million tons import facility at Kochi in Kerala. The firm meets about 30 per cent of the country gas demand. (economictimes.indiatimes.com)

Policy / Performance………

Congress questions Centre on fuel pricing

January 6, 2015. As the BJP seeks to take credit for the drop in petrol and diesel prices, particularly in its Delhi election campaign, the Congress questioned why the reduction was not commensurate with the sharp fall in the price of international crude. Against the 50 per cent fall in international crude prices, petrol prices in India have been reduced only by 15.73 per cent and diesel by 11.38 per cent, much less than the 31.24 per cent reduction in aviation fuel, which is now cheaper than petrol, Congress said.

The Congress pointed out that international crude oil prices fell from $110.55 per barrel on May 26, 2014, to $56 per barrel. But the actual fall in the price of petrol was only ` 11.33 per litre and ` 6.49 per litre of diesel, Congress said. In the case of Aviation Turbine Fuel (ATF), the drop was sharper from ` 76.24 per litre to ` 52.42 per litre. (www.thehindu.com)

5 kg cylinder to be available at all LPG centres

January 5, 2015. Now subsidized cooking gas will be available in 5-kg cylinders in all LPG distribution centres in the country. Oil minister Dharmendra Pradhan would launch the scheme at Salia Sahi, city's biggest slum. The move is aimed at making cooking gas (LPG) easily available to consumers. Till now, cooking gas was available for domestic use in 14.2-kg cylinders only from gas agencies. According to BJP, the Union minister would also launch a scheme to facilitate BPL-card holders get subsidy of ` 1,600 on new LPG connections (14.2 kg cylinder). Under the scheme, the security deposit for LPG connections would be borne by oil companies from their corporate social responsibility fund. (economictimes.indiatimes.com)

Oil Ministry plans extending formula to exempted blocks predating NELP

January 2, 2015. The Cabinet has asked the oil ministry to examine if the recently approved gas pricing formula, from which a per-unit rate of $5.61 was derived, can be extended to several exempted blocks including the Cairn India-operated Rajasthan fields. Cairn charges $8.4 per unit for its Rajasthan gas. The formula has applied since November 1 to several nomination blocks held by ONGC and Oil India and 254 blocks auctioned under the New Exploration Licensing Policy (NELP). But it's not applicable to at least 17 blocks that predate NELP, including Rajasthan and Hazira fields. Their production sharing contracts (PSCs) allow explorers to sell gas at market-discovered rates without prior approval of government, the oil ministry said.

Approved by the Cabinet the formula based on the recommendations of a committee of secretaries (CoS) aligned prevailing domestic rates with global benchmarks, including gas from Reliance Industries-operated KG-D6 fields. The committee had proposed to the Cabinet that the oil ministry could see whether the pricing mechanism should apply to exploration contracts that predated NELP, a suggestion that's now being taken up. Gujarat Narmada Valley Fertilizers Co. pays Cairn $8.40 per unit for gas from its Rajasthan block. Cairn has found significant quantities of gas in the block and is currently developing some of these discoveries. According to industry estimates, Cairn's gas fields are expected to produce at least about 7 million standard cubic metres per day (mmscmd) of gas, which is more than half the current output from KG-D6 block. (economictimes.indiatimes.com)

Non-subsidised LPG rate cut by ` 43.50 per cylinder

January 1, 2015. Price of non-subsidised cooking gas (LPG) was cut by ` 43.50 per cylinder as international oil rates slumped to their lowest since May 2009. A 14.2-kg cylinder of non-subsidised LPG will now cost ` 708.50, down from ` 752 previously, in Delhi, oil companies announced. This is the fifth straight reduction in rates of non- subsidised or market-priced LPG, which the customers buy after exhausting their quota of 12 cylinders at subsidised rates, since August. A subsidised LPG refill currently costs ` 417 in Delhi. Price of non-subsidised LPG were last cut on December 1 by a steep ` 113. In six monthly reductions, non-domestic LPG rates have been slashed by Rs 214 per cylinder, bringing the price to a three-year low. Price of subsidised LPG have not been changed. Brent crude, a pricing benchmark for more than half of the world's oil, sank 48 per cent in 2014 as US producers and the Organization of Petroleum Exporting Countries (OPEC) ceded no ground in their battle for market share amid a supply glut. Brent fell to USD 57.33 a barrel, the lowest since May 2009. (economictimes.indiatimes.com)

Jet fuel rates cut sharply by 12.5 per cent

January 1, 2015. Jet fuel (ATF) rates were slashed by a steep 12.5 per cent, the sixth straight reduction in prices since August, as international oil prices slumped to five-year low levels. The price of aviation turbine fuel (ATF), or jet fuel, at Delhi was cut by ` 7,520.52 per kilolitre, or 12.5 per cent, to ` 52,422.92 per kl, oil companies announced. This is the possibly the steepest cut in rates since ATF pricing was deregulated or freed in April 2002. The cut is the sixth reduction in jet fuel rates since August. The price was last cut by 4.1 per cent, or ` 2,594.93 per kl, on December 1. Brent crude, a pricing benchmark for more than half of the world's oil, sank 48 per cent in 2014 as US producers and the Organization of Petroleum Exporting Countries (OPEC) ceded no ground in their battle for market share amid a supply glut. Brent fell to USD 57.33 a barrel, the lowest since May 2009. In Mumbai, jet fuel will cost ` 53,861.58 per kl as against ` 61,695.45 per kl previously. The rates vary because of differences in local sales tax or VAT. Jet fuel constitutes over 40 per cent of an airline's operating costs and the price cut will ease the financial burden of cash-strapped carriers. State-owned fuel retailers, Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Hindustan Petroleum Corp (HPCL) revise jet fuel prices on 1st of every month based on average imported cost and rupee-US exchange rate. (economictimes.indiatimes.com)

Petrol, diesel price cut likely as New Year’s gift

December 31, 2014. Petrol and diesel may get cheaper from midnight as the government is pushing the state-run oil marketing firms to pass on the benefit of falling global prices to consumers as a New Year's gift. Price reductions may not be very sharp though even as India's average crude oil import bill has fallen by $9-10 per barrel, pointing out that the gains on account of the global slump in oil markets have been nullified to a large extent due to the rupee depreciation. The average value of the rupee has dropped to 63.26 per dollar compared to 61.95. If announced, this will be the ninth consecutive reduction in petrol prices and the fifth cut in diesel rates since its deregulation. Pump prices of petrol and diesel in India are aligned with the international rates and change every fortnight. The exchange rate plays a major role in determining retail prices of fuels since India imports 80% of crude oil it processes and pays in US dollar. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Coal India strike to hit UP thermal power generation

January 6, 2015. The five-day strike by Coal India Ltd (CIL) employees is likely to hit thermal power plants in Uttar Pradesh (UP). Over 350,000 employees went on strike against the disinvestment in CIL. The public sector power engineers under the All India Power Engineers Federation (AIPEF) have also extended their "moral support" to the strike. Thermal power plants in the state are dependent on CIL and its subsidiaries for coal supply. Since these power units have coal inventory for the next two-five days only, the generation capacity would definitely be hit after the stock is exhausted. Uttar Pradesh Chief Minister Akhilesh Yadav had directed officials to keep a close watch on the situation unfolding in the wake of the strike, so that power generation is not hit. UP Rajya Vidyut Utpadan Nigam has dismissed possibilities of coal supply bottlenecks hitting production at five of its major plants in the state. (www.business-standard.com)

MahaGenco pins hopes on allocation of new mines after SC scraps licence

January 5, 2015. The fate of MahaGenco's power projects worth ` 20,000 crore and combined generation capacity of over 3,000 MW hinges on allocation of new mines after the Supreme Court (SC) scrapped coal extraction licences given to most private companies, the company said. MahaGenco Maharashtra's largest state-owned power generation firm, is set to add about 1,000 MW of capacity by March end. The company had permission to extract 30 million tonnes of coal per annum from the Machhakata-Mahanadi block, but the court cancelled its licence, along with those of several other companies, in September last year saying the allocations were illegal. MahaGenco has an installed capacity of 11,237 MW, 70% of which is thermal. The Koradi power project has a capacity of 1,980 MW, the Chandrapur project 1,000 MW and the Parli project 250 MW. The combined investment in these projects is ` 17,000-` 20,000 crore, all of which is debt funded by the Rural Electrication Corporation and the Power Finance Corporation. One 660 MW unit in Koradi and a 500 MW unit in Chandrapur are slated to commence power production by March end this year. (economictimes.indiatimes.com)

Reliance Power starts boiler for sixth unit at Sasan UMPP

January 2, 2015. Reliance Power said the boiler for its sixth and last unit at the 3,960 MW Sasan Ultra Mega Power Project (UMPP) in Madhya Pradesh has started functioning. The company said that 3,300 MW (five 660 MW units) of the project are already operational. Coal production has already commenced from the 20 million tonnes Moher and Moher-Amlohri coal mines associated with the power project. Reliance Power has 3,205 MW power generation capacity, including 3,120 MW thermal and 85 MW renewable energy sources. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Gadkari lays foundation of Powergrid 400/220 KV GIS Sub-Station in New Delhi

January 6, 2015. Union Minister of Road Transport & Highways and Shipping Nitin Gadkari laid the foundation of 400/220 kV sub-station with 2000 MVA Capacity of POWERGRID at Tughlakabad, Delhi. The function was presided over by Union Minister of State for Power, Coal and New & Renewable Energy Piyush Goyal. Ramesh Bidhuri, Member of Parliament, senior officials of Ministry of Power, Delhi Power Department and POWERGRID officials were also present at the foundation laying ceremony. Nitin Gadkari has appreciated the efforts of Ministry of Power for establishment of sub-stations for Delhi with the help of POWERGRID which will prove to be a milestone in strengthening of Delhi power scenario and provide 24hour quality power supply to its residents. It will give great relief to the Delhi people and improve economic growth. Piyush Goyal said that various projects are being implemented by the Government for strengthening the power system in Delhi. After implementation of these schemes Delhi residents will no longer need to depend on their diesel generators and invertors for power supply. 5 Lac LED lights will be installed in Delhi with an approximate cost of ` 500 crores. These schemes will also help Delhi in reducing the overall power consumption. The substation will be built with state-of the-art GIS technology and will cater to the power demand to Delhi. It will improve reliability in power supply to south and southeast Delhi. It will provide connectivity to Masjid mod, Okhla, Mehrauli, Maidangarhi and Badarpur. Considering the importance of reliable power supply to Delhi, Ministry of Power took the initiative to mitigate the problems in transmission & distribution of electricity it was emphasized that a very strong Inter State Transmission System alongwith 400/220KV Grid Sub-stations in and around Delhi are required to be established to ensure secured transmission network with adequate transformation capacity. In order to facilitate handling of increasing quantum of power with reliability, four nos. of 400/220kV substations along with associated 400kV transmission network under ISTS are being implemented within the periphery of Delhi to import power from various sources outside Delhi. These ISTS (Inter State Transmission System) 400/220 kV substations are planned to be established at Rajghat, Tughlakabad, Karampura and Papankalan by POWERGRID. (www.business-standard.com)

Strike may not have much impact on coal production: SCCL

January 6, 2015. Singareni Collieries Company Ltd (SCCL) said coal production may not have much impact due to the strike by some trade unions. According to the SCCL, the coal production from the mines will be in the range of 1.5 lakh tonnes per day and despite 50 per cent of the workforce being on strike, the production will not be affected much as most of the mining is done in open cast. Barring INTUC and AITUC, other unions are working and the situation in terms of attendance is expected to improve, the SCCL said. The trade unions began a five-day coal industry strike in protest against 'disinvestment and restructuring of state-run Coal India' and to press for their other demands, including the roll-back of what they call "process of denationalising of coal sector." The Telangana unit of Communist Party of India alleged that the government was trying to foil the strike by arresting some trade union leaders. (economictimes.indiatimes.com)

L&T construction wins ` 40 bn contracts

January 5, 2015. Engineering and construction major Larsen & Toubro (L&T) has bagged contracts worth ` 4,006 crore from domestic and international clients. These include a project for building a 48 km railway line for transportation of coal in Odisha. Its transportation infrastructure business has secured orders worth ` 2,053 crore. Scope of work also includes building a water pipeline along the railway line. Additional orders worth ` 440 crore have also been received from ongoing domestic and international projects. It said its water and renewable energy businesses have secured new orders worth ` 729 crore. Besides L&T Oman LLC, a subsidiary of L&T has received an order from Salalah Free Zone Company for the construction works of Adhan Phase 1A. The company's power transmission & distribution business has secured new orders worth ` 668 crore. Larsen & Toubro Saudi Arabia LLC, a fully owned subsidiary of L&T, has bagged orders from the National Grid, Saudi Arabia for construction of double-circuit transmission lines in Buraydah and Hail Areas of Saudi Arabia. On the domestic front, the business vertical bagged an order from Uttar Pradesh Power Transmission Corporation Limited (UPPTCL) for the turnkey construction of 400 kV double circuit quad transmission lines between Banda-Orai and Banda-Allahabad regions of Uttar Pradesh. (www.business-standard.com)

OPTCL pegs power carrying cost at 37.12 ppu for 2015-16

January 4, 2015. Odisha Power Transmission Corporation Ltd (OPTCL) has sought approval for an enhanced transmission tariff of 37.12 paise per unit (ppu) for 2015-16. In its application for approval of (annual revenue requirement) ARR and transmission tariff for the financial year 2015-16 with the power regulator Odisha Electricity Regulatory Commission (OERC), the utility has proposed the enhanced transmission rate and an ARR of ` 982.36 crore.

The transmission charge is be applicable for transmission of power at 400 kv/ 220 kv/ 132 kv over OPTCL's EHT (extra high tension) transmission system for the purpose of carrying power from generator end to the substation from where energy will be fed to discoms (distribution companies) and CGPs(captive generating plants).

At the existing transmission tariff of 25 ppu, OPTCL will have a revenue deficit of ` 320.36 crore considering the proposed ARR and the revenue to be earned from wheeling of 26,466 million units targeted for the current fiscal. Similarly, it has pegged its transmission loss of 3.75 per cent for the use of EHT transmission system and transmission of energy from a CGP to its industrial unit located at a separate place as well as for transmission of power from outside the state to an industry located inside the state. The actual transmission loss in the OPTCL transmission system from April to September, 2014, is 3.76 per cent against commission's approval of 3.75 per cent for the current fiscal. In 2015-16, the transmission utility has proposed 3.75 per cent transmission loss. (www.business-standard.com)

Power discoms petition for 15-20 per cent hike

January 2, 2015. Delhi Electricity Regulatory Commission (DERC) begins the process for electricity tariff revision in the city. All three discoms, BSES Yamuna, BSES Rajdhani and Tata Power Delhi, submitted their average revenue requirement petitions for financial year 2015-16 in which the three companies have sought a tariff increase of up to 15-20%. DERC said it's yet to admit the petitions and that the initial tariff hikes sought by the discoms are premature. (economictimes.indiatimes.com)

Kalpataru Power gets ` 5.6 bn worth new orders

December 31, 2014. Kalpataru Power Transmission Ltd (KPTL) said it has bagged new orders worth about ` 560 crore. It has got contracts valued at nearly ` 237 crore related to two transmission lines from Power Grid Corporation. Another order, valued at more than ` 190 crore, is for supply, erection and commissioning of three transmission lines nearly Agra. Besides, the company has been awarded a pipeline laying project worth ` 132 crore by Indian Oil Corporation. (economictimes.indiatimes.com)

Policy / Performance………….

Ramping up coal production a priority: new CIL chairman

January 6, 2015. Ramping up output and improving profitability will be the top-most priorities for Coal India's new Chairman Sutirtha Bhattacharya, although he admits that the coal production target of 925 million tonnes by 2019-20 is a huge challenge. Bhattacharya took charge as CIL chairman, a day before a five-day strike began in the coal industry. The CIL chairman further said that Coal India would support initiatives like hygienic sanitation in schools and in the underprivileged households, in line with Prime Minister Narendra Modi's 'Clean India' programme. Moreover, CIL would also review and take necessary measures for welfare of its employees as it was a priority concern of the company and it would work towards improving housing and sanitation facilities for staff members, Bhattacharya said. (economictimes.indiatimes.com)

Electricity (Amendment) Bill 2014 may be delayed

January 6, 2015. Reforms in the power distribution sector may have to wait as amendments to the Electricity Act cannot be presented pending the report of the Standing Committee. Power Minister Piyush Goyal said the proposed bill will be introduced post recess in the Budget session of Parliament. The recess of close to three weeks is the time when parliamentary standing committees study ministry-specific demands for grants. It is only after consideration of the standing committees that these demands for grants are brought before both the Houses, discussed, and then passed.

Cabinet approved various amendments to the existing Electricity Act 2003, aimed at enabling consumers to choose their electricity supplier, among other reforms. The amendments will also promote competition, efficiency in operations and improvement in quality of supply of electricity in the country, resulting in capacity addition and ultimate benefit to consumers. The central government has also said wherever there are existing power purchase agreements, the interests of stakeholders will be protected, which will be done in consultation with the power regulator. The government plans to allow competition at the last mile or to the end-consumer without raising tariff or compromising on better customer service. (economictimes.indiatimes.com)

Govt drops 1 coal mine from list of blocks put under auction

January 5, 2015. The government has dropped one coal block from the list of 24 mines, that have been put under the hammer in the first tranche, due to "technical reasons". After dropping Namchik Namphuk mine in Arunachal Pradesh from the list, 23 mines will be available in the first auction now. The coal block also falls in the Schedule-II coal mines. Schedule II coal mines are 42 producing blocks out of 204 cancelled by the Supreme Court.

The Union Cabinet had earlier approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations. The government on December 25 last year kick-started the auction process for cancelled coal mines with the launch of a portal for electronic bidding. E-auction of coal mines for qualified bidders will be held from February 14-22. The entire mine allocation process for Schedule II coal mines will be completed by March 23 with the signing of Coal Mine Development and Production Agreement, the government had said. (economictimes.indiatimes.com)

UP Power Minister suggests Centre to set up hydro power plants in Nepal

January 5, 2015. Uttar Pradesh (UP) Power Minister Yasir Shah suggested that India should try to use the massive possibilities of hydro power generation in neighbouring Nepal by sending a proposal for setting up plants there. The Central government should make a proposal for setting up hydro power plants in Nepal where there are massive possibilities, as is being done by China, Shah said. If such projects are taken up, Uttar Pradesh will also benefit from it, Shah said. The state will get cheaper electricity from it. The Minister said UP Chief Minister Akhilesh Yadav is making efforts to improve the power situation in the state and bring reforms in the sector. (economictimes.indiatimes.com)

Prabhu-led panel bats for more empowered players in coal mining

January 5, 2015. As the government prepares ground for overhaul of the coal mining sector, the Suresh Prabhu-led ‘Advisory group for integrated development of power, coal and renewable energy’ has quashed the idea of restructuring Coal India Ltd (CIL), which at present has a monopoly in the sector. In a report it gave the government last month, the group has instead recommended empowerment of the company’s subsidiaries.

The Narendra Modi government wants CIL to raise its production to one billion tonnes by 2019. This would entail increasing the rate of annual output growth to 18-20 per cent from the current seven-10 per cent. For enhancing production, the report suggested hiring of ‘Mining Development Operation (MDO)’ agencies and re-opening of abandoned underground mines. The committee has also asked for close monitoring of CIL targets for 2014-15, on a fortnightly basis, and engaging an experienced consultative agency to help monitor performance. On availability, the report underlines the need for swapping of coal, rationalisation of coal linkages and monitoring the sale of surplus coal from captive mines. Among the other major suggestions are improving coal evacuation facilities by forming a separate CIL subsidiary for logistics services, including rail connectivity. The report pushes the idea of private investment and joint ventures by CIL and its subsidiaries in rail-linkage projects, to reduce dependence on Indian Railways. It also mentions setting up a dedicated common rail corridor for clusters of mines in coal-rich areas.

After the Supreme Court cancelled 204 block allocations made over two decades, the government in October promulgated the Coal Ordinance (Special Provisions) Bill, 2014. Through this, it will re-allocate the cancelled blocks and open the sector for commercial mining by the private sector. For the upcoming e-auction, the committee has issued a word of caution on reserve bid prices, against cartelisation in tenders. The report also emphasises getting a regulator for the sector. (www.business-standard.com)

Govt to decide fate of Odisha, Tamil Nadu UMPPs

January 4, 2015. After the withdrawal of private players from the bidding process, the government will decide whether to accept the sole bid of NTPC for proposed ultra mega power projects (UMPPs) in Odisha and Tamil Nadu. The private firms, which had participated in the first round of bidding for both the projects, withdrew their bids citing difficulties in securing finances for these projects.

As a result, while state-owned NTPC has emerged as the sole bidder for the Tamil Nadu project, NTPC and a NHPC-BHEL joint venture are in the fray for the Odisha UMPP. Country's largest thermal power producer NTPC has emerged as the sole bidder for the 4,000 MW Cheyyur project in Tamil Nadu. The proposed imported coal-based plant will be constructed at a cost of ` 25,000 crore. Among the private players in the fray were Adani Power, CLP India, Jindal Steel & power, JSW Energy, Sterlite Energy and Tata Power.

The final price bids for a similar 4,000 MW project at Bedabahal in Odisha will be opened on January 7. Adani Power, CLP India, GMR Energy, Jindal Steel & power, JSW Energy and Sterlite Energy were among the private companies, and PSUs NTPC and NHPC participated in the first round of bidding for the Odisha plant. The pithead project is likely to entail an investment of about ` 24,000 crore.

Association of Power Producers (APP), a body representing the private firms had written to the Power Ministry explaining the private companies' inability in setting up the plants. APP also said that the DBFOT (design, build, finance, operate and transfer) model is not feasible for these UMPPs. UMPP is a coal-based power project of 4,000 MW generation capacity. (economictimes.indiatimes.com)

CCI to probe Great Eastern Energy for unfair business practices

January 2, 2015. The Competition Commission of India (CCI) has ordered an investigation against Great Eastern Energy Corp Ltd (GEECL) for allegedly indulging in unfair business practices with respect to sale of coal bed methane (CBM) gas to entities in West Bengal. GEECL is engaged in exploration, development, production, distribution and sale of CBM gas. The Commission has asked its investigation arm - Director General (DG) - to look into the case after prima facie finding the company in violation of competition norms.

On a careful perusal of the allegations and the terms of Gas Sale and Purchase Agreement (GSPA), the Competition Commission of India (CCI) said it is of the "prima facie" opinion that the "impugned terms appear to be tilted in favour of the seller and against the buyer". The market for 'the supply and distribution of natural gas to industrial consumers in Asansol-Raniganj-Durgapur region in West Bengal' was prima facie considered as the relevant market by CCI. It was alleged that GEECL, which is in dominant position in the relevant market of supply and distribution of CBM gas in Asansol-Raniganj-Durgapur belt, abused its position by imposing "unconscionable terms and conditions" in Gas Sale and Purchase Agreement (GSPA). (economictimes.indiatimes.com)

Centre asks Chhatisgarh to expedite clearances to mining projects

January 1, 2015. The coal ministry has asked the Chhattisgarh government to expedite clearances to mining projects as the Centre has set a target for Coal India Ltd (CIL) to produce 1 billion tonnes of the dry fuel by 2019. The issues relate to land acquisition, law and order and other statutory clearances, some of which are to be resolved at the state level.

Some of the coal mining projects of SECL pending in the state, includes, Dipka OC (Open cast) mine, Pelma OC, Jagannathpur, Chhal OC, Baroud OC and Kartali OC. The government has set an ambitious target for CIL to achieve coal production of nearly 1 billion tonnes by 2019. Coal and power minister Piyush Goyal had earlier said the target of doubling domestic production from the current 462 million tonnes level was "possible". (economictimes.indiatimes.com)

Private power companies may shift to regulated tariff regime

January 1, 2015. The government is considering giving a one-time option to private power companies to shift to regulated electricity tariff from tariff discovered through competitive bidding. The power ministry has agreed to look into a long-pending demand from private power developers that will help about ` 4 lakh crore stressed plants recover adequate tariffs and cover costs. The ministry has appointed a committee consisting of electricity regulators to conduct a comparative study between competitive tariff and regulatory tariff. The power ministry said the proposal is being considered based on demand from power companies and suggestion from a working group constituted by the finance ministry to resolve financing issues to power plants. The power ministry said such shift in tariff derivation has also been seconded by the advisory committee led by railway minister Suresh Prabhu that said the bid documents should provide for absorption of costs that arise due to issues outside the control of developers. Power plant developers have been demanding a one-time window for migration to regulatory tariffs after they faced issues like high imported coal costs due to changes in Indonesian laws, steep rupee depreciation, nonavailability of coal and gas, high inflation and interest rates or lack of power purchase contracts. (economictimes.indiatimes.com)

Coal stock position improves at thermal power plants: CEA

January 1, 2015. Critical coal stock position at thermal power plants showed improvement last month as compared to November, with 41 projects under the critical category, according to Central Electricity Authority (CEA) data. This data showed that 50 thermal power stations had fuel stocks for less than seven days of which 30 stations were left with less than four days of stock. However, the reason for improvement in fuel stock position was not elucidated by CEA. NTPC's plants at Badarpur, Singruali, Tanda, Korba, Korba-II, Sipat, Vindhyachal and Unchahar showed improvement in their stockpiles on December 30 as against November 30, 2014. These plants had less than four days of coal in November. However, the fuel stock position at Chandrapur plant in Maharashtra as well as Panipat and Rajiv Gandhi thermal power stations in Haryana worsened in December as they reported super critical or less than four days stock position. It was mainly due to lower supply from Coal India and its subsidiaries during the period, CEA data said. Power and Coal Minister Piyush Goyal has time again said that the government's focus is to increase domestic coal production to the maximum extent possible by facilitating environment and forest clearances expeditiously, pursuing with states for assistance in land acquisition and coordinated efforts with Railways for movement of coal. Coal India has been asked to ensure adequate supply of coal. Accordingly, it has committed to a target of 1 billion tonnes of coal production by 2019, from the current levels of 500 million tonnes. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Brazil O&G production rises 13 per cent in November: ANP

January 6, 2015. Brazil's oil and natural gas production in November increased 13.3 percent compared with the same period last year as new fields started up and older fields came back onstream after maintenance, oil agency ANP said. Oil and gas production reached 2.935 million barrels of oil and equivalent natural gas per day (boepd) in November, according to ANP. November output, though, was 1.4 percent less than in October. State-run oil company Petrobras was by far the biggest producer with 2.48 million barrels of oil equivalents per day (boepd). Britain's BG was the second largest with 110,293 boepd in November. Anglo-Dutch major Shell was third with 48,267 boepd. (www.rigzone.com)

MOL says Shaikan block crude output reached 40k bpd

January 5, 2015. Hungary's oil and gas group MOL said that daily crude production from the Shaikan block in the Kurdish region of Iraq reached 40,000 gross barrels per day on December 27 and there was "huge" further upside. MOL said that on Dec. 29 nearly 58,000 gross barrels of Shaikan crude was sent by truck to the Turkish coast for further export sale. MOL has a 20 percent working interest in the Shaikan block, where Gulf Keystone is the operator. (www.rigzone.com)

Oil below $60 tests US drive for energy independence

January 5, 2015. Oil’s biggest bust since the global recession was good for a few cases of whiplash. Continental Resources Inc., the shale driller founded by billionaire Harold Hamm, budgeted for $80-a-barrel oil and planned to spend $4.6 billion in 2015. Six weeks later, with crude down 29 percent in the interim, Continental cut its 2015 budget to $2.7 billion. Halliburton Co., the world’s biggest provider of fracking services to oil companies, announced that it would dismiss 1,000 workers. The U.S. shale boom that’s brought the country closer to energy self-sufficiency than at any time since the 1980s will be challenged in 2015 as never before. The benchmark U.S. crude price has fallen below $60, demand growth is weakening and OPEC, which controls 40 percent of supply, is unwilling to cut output. RBC Capital Markets and CIBC World Markets predict prices will remain below $60 for the first three months of 2015. Societe Generale SA’s Michael Wittner forecasts an average of $64.50 in the first quarter and $61.50 in the second. Some of the largest U.S. shale drillers, such as Irving, Texas-based Pioneer Natural Resources Co., Continental and Chesapeake Energy Corp., both based in Oklahoma City, have been spending money faster than they make it, borrowing to pay for their expansion, according to the U.S. Securities and Exchange Commission. In 2014, U.S. oil output increased by 1 million barrels a day for the third consecutive year, pushing production to the highest in more than three decades, according to the U.S. Energy Information Administration. (www.bloomberg.com)

Statoil starts up new Valemon gas, condensate field in North Sea

January 3, 2015. Norwegian oil and gas firm Statoil has started up the Valemon gas and condensate field in North Sea and expects to recover up to 192 million barrels of oil equivalents over the field's lifetime, it said. Valemon, a high pressure and high temperature field, will cost 22.6 billion crowns ($3.0 billion) once all production wells are in operation, Statoil said. Shareholders in the field include Statoil (53.77 percent), state holding firm Petoro (30 percent), Centrica (13 percent) and Royal Dutch Shell (3.23 percent). (www.rigzone.com)

Downstream…………

Petrobras said to slow refinery projects amid graft probe

December 31, 2014. Petroleo Brasileiro SA (Petrobras), the oil producer at the center of Brazil’s biggest corruption scandal, is delaying projects including a multibillion-dollar refinery after banning builders allegedly involved in the case. Petrobras will also halt payments on existing contracts that are behind schedule until projects meet their targets. The company will delay the start of the Comperj refinery complex in Rio de Janeiro for two years to 2018, costing 10,000 construction jobs. The company doesn’t plan to stop or terminate existing contracts or suspend payments for services that have been provided because of the measure, Petrobras said. (www.bloomberg.com)

Transportation / Trade……….

Russia, Iraq supply most oil in decades as 2015 begins with glut

January 3, 2015. Oil supplies in Iraq and Russia surged to the highest level in decades, signaling no respite in early 2015 from the glut that has pushed crude prices to their lowest in five years. Russian oil production rose 0.3 percent in December to a post-Soviet record of 10.667 million barrels a day, according to preliminary data by CDU-TEK, part of the Energy Ministry. Iraq exported 2.94 million barrels a day in December, the most since the 1980s, the Oil Ministry said. The countries provided 15 percent of the world’s oil in November, according to the International Energy Agency. Oil slumped 48 percent in London in 2014, the steepest decline since the 2008 financial crisis, as the Organization of Petroleum Exporting Countries (OPEC) refused to pare output in response to the highest U.S. oil production in three decades. Russian Energy Minister Alexander Novak, who met with some OPEC members in November, said the nation will maintain output this year and expects prices to stabilize. Russian output is increasing even after the U.S. and the European Union imposed sanctions last year in response to the country’s annexation of Crimea and what they say was support for separatists in eastern Ukraine. Measures included targeting the energy sector by banning exports to Russia of some equipment and technology. The country’s government gets about half of its revenue from oil and gas taxes. Iraq, OPEC’s second-biggest producer, reached a deal with its semi-autonomous Kurdish region over the Kurds’ oil exports through Turkey, after years of disagreement on the territory’s right to independently develop its energy resources. The agreement allows the shipment of as much as 550,000 barrels a day of oil from northern Iraq to the port of Ceyhan on the Mediterranean, along a pipeline to the Turkish border operated by the Kurdistan Regional Government. This includes 300,000 barrels a day from the Kirkuk oilfields in northern Iraq, under the control of Kurdish forces since they moved to repel an offensive by militants from the Islamic State in June. Iraq exported 5.579 million barrels of Kirkuk oil in December, equivalent to about 180,000 barrels a day, the Oil Ministry said. That’s more than a six-fold increase from 836,000 barrels in November, according to the Oil Ministry. (www.bloomberg.com)

Global LNG-prices hold steady in weak trade

January 2, 2015. Asian spot liquefied natural gas (LNG) prices were little changed as mild demand and the extended holiday period kept a lid on trading activity. The spot price for February was steady at about $10.10 per million British thermal units (mmBtu), in line with the previous week. Traders said, however, that prices were nominal given there was limited activity. Brazil's state-run energy giant Petrobras has shown interest in purchasing spot cargoes, one trader said, but high inventories across Asia have kept buyers on the sidelines. The LNG market has been slowly declining since September as energy prices generally have been hit by a slide in oil. Brent crude held near its weakest level in more than five years, as a global supply glut and weak demand weighed. Excelerate Energy's Texan liquefied natural gas terminal plan has become the first victim of an oil price slump threatening the economics of U.S. LNG export projects. The floating 8 million tonne per annum (mtpa) export plant moored at Lavaca Bay, Texas, planned by Houston-based Excelerate, has been put on hold. Excelerate's move may bode ill for 13 other U.S. LNG projects, which have also not signed up enough international buyers to reach final investment decisions. Only Cheniere's Sabine Pass and Sempra's Cameron LNG projects have hit that milestone. LNG cargoes stored at some European terminals, such as in Spain, were slowly being regasified and fed into local grids as weak global demand for the fuel slowed the pace of re-exports. Egypt signed a deal to import six LNG cargoes from Algeria between April and September, the oil ministry said. And Britain's BG Group is preparing to deliver a first commercial LNG cargo to China from its new $20.4 billion Queensland Curtis LNG project in Australia. (www.downstreamtoday.com)

Libyan tanker spills crude after collision near Singapore

January 2, 2015. A Libyan crude tanker spilled some of its cargo off Singapore after colliding with another ship, adding to the North African country’s challenges as it contends with escalating violence and a collapsing domestic oil industry. The Alyarmouk, owned and registered in Libya, collided with the Sinar Kapuas, a dry-bulk ship, in waters northeast of Pedra Branca island, the Maritime and Port Authority of Singapore said. One of the Alyarmouk’s tanks was damaged in the incident, resulting in the leak, it said. Worsening violence already halted two of Libya’s three largest ports and meant the country with Africa’s biggest reserves pumped 450,000 barrels a day, less than one third of its peak. Output may deteriorate further after Islamist militias set fire six storage tanks at the port of Es Sider, the biggest export terminal. Those blazes have now been extinguished, Libya’s National Oil Corp. said. (www.bloomberg.com)

OPEC resolve on supply promises no calm for oil markets

December 31, 2014. Oil’s biggest price swings in three years are poised to continue as OPEC cedes no ground to competing suppliers. Oil traders’ expectations for future swings, known as implied volatility, surged since Saudi Arabia and fellow members of the Organization of Petroleum Exporting Countries (OPEC) decided on Nov. 27 to keep pumping crude despite a supply glut. That will mean prices fluctuating in the next several years by even more than the $57-a-barrel move in 2014, Bank of America Corp said. OPEC’s policy of testing rival producers’ tolerance for lower prices has sparked the search for a new equilibrium, increasingly shaped by the readiness of U.S. shale drillers to sustain projects as returns shrink. This year’s drop in Brent is threatening investment in new crude supply, creating the potential for more volatility in years to come. Futures are down 48 percent in London, the most since 2008. (www.bloomberg.com)

Policy / Performance…………

Canada's BC bans transport of oil in pipelines built for LNG

January 6, 2015. British Columbia (BC) has banned the transport of oil on pipelines built specifically for proposed liquefied natural gas (LNG) terminals, in an effort to quell fears that those lines could eventually be converted to carry oil sands crude to coastal markets. The regulation covers six proposed pipelines, which would all carry natural gas destined for LNG export terminals planned for the Pacific Coast province. The government said the legislation could also be applied to future gas pipelines. The ban is in response to concerns raised by Aboriginal leaders and environmental groups that pipelines built to serve British Columbia's nascent LNG industry could ultimately be used to transport crude oil or diluted bitumen. The ban follows a pledge by the provincial government last year to ensure LNG pipelines would never be converted to carry oil. British Columbia is banking on an LNG boom to create thousands of new jobs and help bolster government coffers. (www.downstreamtoday.com)

China struggles to find prospective blocks for shale auction: Govt

January 5, 2015. China is struggling to find attractive shale gas blocks to offer in a third auction of concessions, the government said, increasing the sense that the country's output potential may be overblown. Some 400 wells have been drilled and geological surveys conducted in blocks awarded in China's first two exploration auctions, yet the world's top energy user has only one large shale find and few international investors in the sector. Last year, despite potentially holding the largest technically recoverable shale gas reserves, complex geology, water scarcity and high drilling costs led Beijing to more than halve its 2020 output target to 30 billion cubic metres (bcm), or 18 percent China's current demand. The Ministry of Land and Resources' (MLR) expected third auction may be held up. Two years after the second auction, the 16 winning firms - none of which had any previous shale experience - have sunk just eight exploration wells across 19 blocks, and only four have completed or reached the stage of horizontal fracturing, or fracking. In the United States, pioneers of horizontal fracking drilled more than 65,000 shale wells in less than a decade, according to the U.S. Energy Information Administration. China's biggest shale strike so far lies in southwest China's Fuling field in the Chongqing municipality. The find has a proven reserve of nearly 107 bcm, but experts say this success is hard to repeat due to higher costs and more challenging geology in other areas. Sinopec plans to produce 10 bcm a year from Fuling by 2017, still leaving a big gap to fill if annual output of 30 bcm is to be reached by 2020. (www.rigzone.com)

Bernstein cuts Brent forecast to $80 as price seen near bottom

January 5, 2015. Oil prices are bottoming and will recover later this year as supply and demand outside of OPEC re-balances, Sanford C. Bernstein & Co. said. Brent will average $80 a barrel this year, down from an earlier forecast of $104, analysts said. North American shale oil production is set to slow in the next few years as fields mature and prices will recover to $100 in 2017, Bernstein said. Brent almost halved last year as the U.S. pumped the most crude in more than three decades and the Organization of Petroleum Exporting Countries (OPEC) resisted output cuts to defend market share. An analysis of all major oil collapses since 1980 shows it takes about five to nine months for prices to fall from peak to trough, according to Bernstein. Bernstein also cut its Brent prediction for 2016 to $90 a barrel from $109 amid lower-than-expected demand and supply strength seen last year. Global oil demand is projected to increase at least 1 million barrels a day in 2015, compared with 700,000 a day last year, it said. (www.bloomberg.com)

AAA sees US drivers saving $75 bn on gasoline

January 1, 2015. The rout in crude oil prices may mean as much as $75 billion in gasoline savings for U.S. drivers in 2015, according to AAA. Americans saved $14 billion on the motor fuel last year compared with 2013, Heathrow, Florida-based AAA, the country’s largest motoring group, said. Pump prices dropped a record 97 consecutive days to a national average of $2.26 a gallon, the lowest since May 12, 2009. A global glut of crude oil and a standoff between U.S. producers and the Organization of Petroleum Exporting Countries (OPEC) over market share has been a boon for consumers. U.S. production climbed in 2014 to the highest in three decades amid a surge in output from shale deposits. Oil capped its biggest annual decline since the 2008 financial crisis. U.S. benchmark West Texas Intermediate crude dropped 46 percent in 2014 while Brent oil, the international benchmark that contributes to the price of gasoline imports, fell 49 percent. The average U.S. household will save about $550 on gasoline costs this year, with spending on track to reach the lowest in 11 years, the Energy Information Administration said. Gasoline expenditures account for about 5 percent of household costs, according to the Bureau of Labor Statistics’ Consumer Price Index. (www.bloomberg.com)

US opening door to more oil exports seen foiling OPEC strategy

December 31, 2014. The Obama administration’s move to allow exports of ultra light crude without government approval may encourage shale drilling and thwart Saudi Arabia’s strategy to curb U.S. output, further weakening oil markets, according to Citigroup Inc. A type of crude known as condensate can be exported if it is run through a distillation tower, which separates the hydrocarbons that make up the oil, according to U.S. government guidelines. That may boost supplies ready to be sold overseas to as much as 1 million barrels a day by the end of 2015, Citigroup analysts said. Saudi Arabia led the Organization of Petroleum Exporting Countries (OPEC) to maintain its production quota at a meeting even as a shale boom boosted U.S. output to the highest in more than three decades. That prompted speculation OPEC was willing to let prices fall to force some companies with higher drilling costs to stop pumping. Current U.S. export capacity is at about 200,000 barrels a day, which could be expanded to 500,000 a day by the middle of 2015, according to the bank. (www.bloomberg.com)

[INTERNATIONAL: POWER]

Generation……………

Azerbaijan increased electricity generation in 2014

January 6, 2015. The power stations of Azerenergy JSC in Azerbaijan generated around 22.7 billion kilowatt hours of electricity in 2014, the company said. Azerenergy JSC is the main producer of electricity in the country. The power stations of Azerenergy JSC produced around 2.2 billion kilowatt hours of electricity in December 2014 and December 2013 each, according to the company. This is while the company’s power stations generated over 21.5 billion kilowatt hours of electricity in 2013. The generation capacity of Azerbaijan's power supply system has increased by 30 percent in the last five years. Currently, its capacity is 7,105 MW and this allows to generate around 24 billion kilowatt hours of electricity per year and subsequently, export of 2.1 billion kilowatt hours of electricity annually. (en.trend.az)

Pakistan begins construction of two hydro power projects

January 6, 2015. Pakistan has begun construction of two hydro-power projects, worth $84 mn, on Nara and Rohri canals near Sukkur. One of the hydro projects is scheduled to be developed on Nara Canal while the other on Rohri Canal. Pakistan People's Party (PPP) co-chairman and former president Asif Ali Zardari said Pakistan that the 15 MW Nara hydro power project will be developed with an investment of $47.6 mn at RD-26 of Nara Canal. Capable of generating 9 MW of electricity, the Rohri hydro power project will be developed with an investment $36.4 mn at RD-15 of Rohri Canal. Additionally, Pakistan is planning to install another mega project of 40 MW hydro power project at Guddu Barrage. (hydro.energy-business-review.com)

South Korean company to build a power plant in Kazakhstan

January 5, 2015. Doosan Heavy Industries & Construction Co., South Korea’s leading power equipment manufacturer, said that it has reached a US $308 million deal to build a power plant in Kazakhstan. Under the deal with Karabatan Utility Solutions, the Korean company will build the coal-fired power plant with a 310 MW capacity in Atyrau, on the Caspian Sea coast. Construction of the power plant will be completed by February 2018, according to Doosan.