-

CENTRES

Progammes & Centres

Location

[Time to end ‘Make Believe’ in India]

“The cornucopian energy narrative promoted by the new Government is understandable. It has come to power on the premise that growth, abundance and prosperity are substitutes for everything including freedom, ethics and justice. It has to create illusions of grandeur with exaggerated figures and projections to keep the narrative alive. But this narrative of make-believe is unsustainable…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Time to end ‘Make Believe’ in India

· Emerging Coal Scam: Inflate Imported Coal prices to claim ‘Double Benefits’?

READER’S VIEW

· on article ‘Lima outcome: the quiet mutation of Kyoto Protocol’

DATA INSIGHT………………

· Gas Based Power Generation & Shortage of Gas

[NATIONAL: OIL & GAS]

Upstream…………………………

· 116 NELP blocks suffered due to delays in statutory clearances

· Oil Ministry says $5.6 bn production loss at PMT fields

· ONGC, PDVSA aim to raise around $1 bn for Venezuela JV

· ONGC and BPCL discover gas in Tamil Nadu

Downstream……………………………

· IOC to invest ` 68 bn on capacity expansion at Gujarat plant

· HPCL opens fuel pump at world's highest motorable road in Leh

Transportation / Trade………………

· Rupee volatility declines as oil seen cutting India’s deficit

· SC allows GAIL to take part in tender for laying pipeline

· CGD projects to get first priority

· OVL wants to dip into RIL payments to clear Venezuelean dues

Policy / Performance…………………

· After UP, Oil Minister reviews roll-out of DBTL in Bihar

· GAIL to pay royalty on Reliance Industries gas price

· Gas pricing regime should be remunerative for producers: Panel

· SC appointed judge not yet onboard KG-D6 arbitration

· Oil Minister seeks more information on innovative smokeless stove

· OMCs scrap 10 mn cooking gas connections

· Petrol, Diesel to cost more in Rajasthan after VAT increase

· Gujarat HC ruling gives ` 10 bn VAT relief to ONGC

· Clean energy cess mop-up in FY15 nearly doubles to ` 68.5 bn

· Gujarat has become energy hub of the nation: Anandiben

· Centre overrules GSPC's demand for $8.5 gas price

· Diesel deregulation, gas price to have positive impact on oil companies: Fitch Ratings

[NATIONAL: POWER]

Generation………………

· Aditya Birla Group plans an entry into power sector

· Tata Power's Trombay plant develops technical snag

· NTPC keen for 50 per cent stake in OTPCL power plant

Transmission / Distribution / Trade……

· West Bengal to sell power to other states after 2 yrs: Mamata Banerjee

· Alstom wins ` 1.8 bn order from NTPC

· Proposal to import coal for NLC's thermal power project in UP

· Review financial rejig plan for power discoms: Panel

· Mizoram will draw additional power from Tripura

· Power discoms, SEBs owe Railways more than ` 10.3 bn

· Power producers under scanner for inflating coal import bills

· Power Grid Corp nominated for largest transmission line

Policy / Performance…………………

· Telangana Govt to build two thermal power stations

· Govt's Christmas treat: Tenders for 42 coal blocks on 25 Dec

· Coal India ready for conciliation as unions threaten strike

· Govt for ` 10 mn penalty on entities violating Electricity Act

· Private sector needs to contribute 600 MT coal by 2020: Govt

· India, US experts meet on operationalising civil n-deal

· Units 3, 4 of Kudankulam nuclear plant to be commissioned in 2020-21: Govt

· Hike in power tariff will have adverse impact: Madras Chamber

· Tripura emerges as only power surplus state in northeast

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil makes small oil discovery near Oseberg South

· Crude below $60 tests Petrobras’ deepwater discoveries

Downstream……………………

· Japan refiners surge as Idemitsu and Showa shell hold talks

Transportation / Trade…………

· US talking oil exports just when world needs it least

· Oil plunge sets stage for energy defaults

· Repsol agrees to buy Canada’s Talisman for $8.3 bn

Policy / Performance………………

· OPEC oil market defense eludes Libya as production drops

· Biggest Arctic gas project seeks route around US sanctions

· Natural gas falls to two-year low with no cold in sight

· Age of plenty seen over for Gulf Arabs as oil tumbles

· Non-OPEC producers called on to cut oil output after rout

· Saudi Arabia confident in oil rebounding on global growth

· Norway is ‘very vulnerable’ to oil as switch sought, PM says

· Russia will keep oil output steady with prices to stabilize

[INTERNATIONAL: POWER]

Generation…………………

· BC Hydro's $8.3 bn hydro power project gets approval in Canada

Transmission / Distribution / Trade……

· Oman awards $255 mn power transmission contracts

· New York to see lower power bills as oil drop caps gas costs

Policy / Performance………………

· Geopolitics key to South Africa’s $100 bn nuclear plan

· Sweden doubles waste fee for nuclear power plant operators

· Japan vouches for safety of second set of atomic reactors

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India to be pro-active in enhancing energy efficiency: Govt

· Suzlon arm Senvion bags contracts worth ` 4.2 bn

· Rolta Power scouts for Chinese partner for solar cell facility

· New energy technologies can boost Indian economy: Report

· Rajasthan CM signs MoU for 1 GW solar plant

· Power discom TPDDL finalises deal for 1k MU of clean energy

· MahaGenco invites tenders for 75 MW solar projects worth ` 6 bn

GLOBAL………………

· Kyocera to build 13.4 MW floating solar power plant near Tokyo

· Electric cars hurt most among renewables on oil’s slump

· Alberta extends carbon levy amid policy revamp, oil slump

· Obama sets guidelines for climate review in agency decisions

· China solar-glass exports may face increase in EU duties

· UN carbon credit supply to drop on climate vows: GDF Suez

· Rame Energy planning $6.4 mn sun-power plant in Chile

· Solar with batteries to hit $1 bn in US by 2018

· Duties set by US on imports of China, Taiwan solar goods

[WEEK IN REVIEW]

COMMENTS………………

Time to end ‘Make Believe’ in India

Lydia Powell, Observer Research Foundation

|

2 |

014 has been an eventful year for energy. During the first half of the year, narratives of shortages in coal, gas and power dominated the sector. Scams in each of these sectors supposedly scripted and executed by the previous Government were blamed for the dire state of the energy sector. Commentators highlighted how India was becoming one of the biggest importers of coal despite having large reserves of coal. Alarming figures were presented for future volumes of imported coal. Charts of the hockey stick variety that predicted economic doom for the country on account of growing trade deficit that imported coal would impose on the country could be seen everywhere. Observers lamented that natural gas could not be pumped out because of poor governance of the oil & gas sector. Power shortages were said to be the consequence of fuel shortages and governance shortages. Renewable energy sectors such as solar and wind were said to be on the decline as policies such as Accelerated Depreciation and Generation Based Incentives were withdrawn and Mandatory Purchase Obligations (such as Renewable Purchase Obligations or RBOs) for renewable energy sources were not imposed.

The second half of the year brought a new Government that was supposedly going to set right all the mistakes that were made by the previous Government. We were told that once the new Government completes reform, shortages will be history. Recently we were also told that India’s coal production would increase to 1 billion tonnes (BT) by 2019 and that we will simultaneously have 200 GW of solar power probably to off-set all that dirty carbon that burning of 1 BT of coal would produce. An amendment of the Electricity Act would supposedly impose punitive penalty for violation of RBOs that would boost solar power. In just five years India will simultaneously be fossil fuel driven, energy abundant, clean and green or so we are told.

The cornucopian energy narrative promoted by the new Government is understandable. It has come to power on the premise that growth, abundance and prosperity are substitutes for everything including freedom, ethics and justice. It has to create illusions of grandeur with exaggerated figures and projections to keep the narrative alive. But this narrative of make-believe is unsustainable. As illustrated by many of the analysis pieces and news items that have appeared in various issues of ORF Energy News Monitor, reality appears to slowly undermining the Big Story of the new Government. Coal shortages, power shortages and even governance shortages appear to be more nuanced than what we were led to believe. Clearly, there is something wrong with the simple meta-narratives that are force fed to us by the Government and its client, the media.

The liberal philosopher Isaiah Berlin distinguished between foxes and hedgehogs among thinkers drawing from an ancient Greek saying which said that ‘the fox knows many things but the hedgehog knows one big thing’. Berlin favoured foxes over hedgehogs. Unfortunately, for the new Government energy policy is just one big ‘hedge hog’ idea: Think Big: Big Coal, Big Solar and so on. (Effectively it is a ‘take projections for supply and multiply it by five’ policy). Complications and exceptions are marginalised or compressed into this World View. Foxes of energy policy that have a variegated view are not comfortable with one big slogan. Foxes are sceptical of grand theories as they feel that complexities in the sector prevent generalisations. The hedgehog Government thinks that one big idea is substitute for policy but foxes think that the devil is in the details. Emerging reality supports the foxes. Energy policy cannot be a daily exercise of exaggeration. In the New Year, we need to put an end to this Make Believe in India. Otherwise we cannot make anything in India, including energy policy.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Emerging Coal Scam: Inflate Imported Coal prices to claim ‘Double Benefits’?

Ashish Gupta, Observer Research Foundation

|

A |

nother coal scam appears to be brewing and it is shocking not just for the coal sector but also for electricity consumers. The Directorate of Revenue Intelligence pegged the overvaluation of coal imports at ` 29,000 crore during the period 2011-2014. The agency has been probing the scam for a very short period but the continuance of such practices for a long time cannot be ruled out. The agency clearly stated that overvaluation has an impact on the tariff paid by consumers as power companies could seek higher tariff based on inflated rates for imported coal. These companies benefitted twice, first on account of inflated coal import bills and second through higher tariff. If the inflated amount was invested in the power sector much could have been achieved.

To illustrate let us consider the example of Madhya Pradesh Power Generating Company (MPPGenco). The power plant was not chosen arbitrarily. It has reported by the media that coal is misappropriated in these plants. Madhya Pradesh Chief Minister Shivraj Singh Chouhan has on June, 2014 stated that coal with higher calorific value (imported coal) was not suitable for thermal power plants of the state. In a seemingly contradictory move MPPGenco has invited tenders for importing coal having GCV above 5800 kcal/kg.

The MPPGenco has four coal based power plants with total installed capacity of 4,320 MW. Coal requirement of these power plants as provided in the website is about 20.6 Million Tonnes (MT).

Financial Analysis

|

Value of over-invoiced coal: ` 29,000 Crore (` 290,000 Mn) during 2011 – 14 ie 3 years |

In $ terms ( Assuming 1 US$ = ` 60) = 290,000/ 60 = US $ 4,833 Million (Mn) On an average the inflated value of imported coal during the last three years = 4,833/3 = US$1,611 Mn/ per annum |

|

Domestic Coal Middle grade coal that is mostly used by Indian power plants, costs ` 860 or 860/ 60 = US$ 14.3 per tonne |

Therefore 1,611 US$ can buy = 1,611/ 14.3 = 113 MT of domestic coal (rounded off) Coal requirement of the power plant = 20.6 MT per annum Therefore 113 MT of coal will fulfil the requirement = 113/ 20.6 = 5.5 years No imports will be required for 5.5 x 3 = 16.5 years |

|

If the requirement is fully met with imported coal Indonesian coal roughly costs US$ 60 – 65 or US$ 62.5 average per tonne |

Since 1 MT (Imported Coal) = 1.5 MT of domestic coal The requirement of coal works out to be = 20.6/ 1.5 = 14 MT (Imported coal) But 1,611 US$ can buy = 1,611/ 62.5 = 26 MT (rounded off) 26 MT of coal will fulfil the requirement = 26/14 = 2 years (rounded off) The power plant can get = 2 x3 = 6 years of imported coal supply |

The above analysis is indicative only and the example of MPPGenco is taken only to reflect a realistic case and not to label MPPGenco as the source of the problem. The probe for misappropriation of coal is going on and the investigation results are yet to come.

The Directorate has stated that the power tariff would be reduced possibly by ` 1 per unit - if the value of imported coal was not inflated. However the above indicative calculation shows clearly that there has been mis-appropriation of the value of imported coal. The cover was the story of coal shortage. Costly imported coal is brought into the country by artificially creating coal shortage scenario in the country. The consumers of power become victims as these costs are a pass through item in tariff. Rather than getting any relief, they are burdened with high electricity tariffs. The crucial question that remains to be answered is: Is there really a coal shortage or it is man made?

Views are those of the author

Author can be contacted at [email protected]

READER’S VIEW………………

on article ‘Lima outcome: the quiet mutation of Kyoto Protocol’ Volume XI, Issue 27, 10 – 16 December 2014

|

R |

ef your write-up on Lima Outcome in the ORF Energy News Monitor Volume XI, Issue 27, I feel with this you have ably and justifiably covered the whole series in UNFCCC's preparation to facilitate now a Global Convergence to a New Climate Treaty in about a year.

Given the fact that key political issues of Differentiation and Finance remaining unresolved, however, the two key outcomes from Lima, the decision in Advancing the Durban Platform and its annex containing elements for a draft negotiating text, may have served to move the process forward and create a shared feeling of achievement and confidence in the process.

Question remains now if the Spirit of Lima sustains to ultimately herald an era of Coexistence for all the Parties, in Paris! In the process, it is hoped the Parties keep in mind, there is one Party that does not negotiate-Nature.

K K Roy Chowdhury

DATA INSIGHT……………

Gas Based Power Generation & Shortage of Gas

Akhilesh Sati, Observer Research Foundation

|

Category |

2012-13 |

2013-14 |

||||

|

Gas Allotted |

Gas Supplied /Consumed* |

Shortage (as % of Gas Allotted) |

Gas Allotted |

Gas Supplied /Consumed* |

Shortage (as % of Gas Allotted) |

|

|

MMSCMD |

MMSCMD |

|||||

|

Central Sector |

27.63 |

15.89 |

42% |

31.51 |

10.12 |

68% |

|

State Sector |

19.5 |

11.95 |

39% |

22.49 |

10.68 |

53% |

|

Pvt Sector |

34.6 |

12.1 |

65% |

35.68 |

6.33 |

82% |

|

Total |

81.73 |

40 |

51% |

89.69 |

27.13 |

70% |

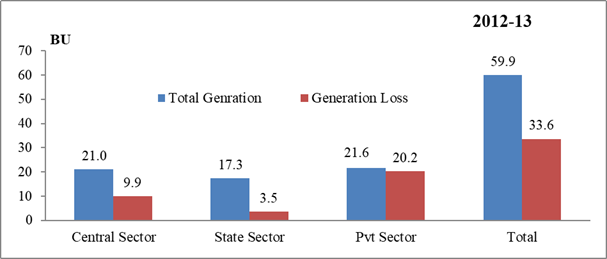

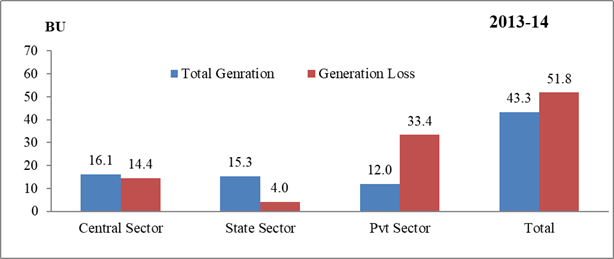

Power Generation Loss Due to Gas Shortage

*include RLNG MMSCMD: Million Metric Standard Cubic Meters per Day BU: Billion Units

Source: Lok Sabha (Un-starred Question No.3049)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

116 NELP blocks suffered due to delays in statutory clearances

December 22, 2014. As many as 116 exploration blocks under the New Exploration and Licensing Policy (NELP) have been affected due to delay in grant of statutory clearances. Exploration operations have suffered in NELP exploration blocks due to delay in grant of various statutory clearances required from Ministry of Defence and other central government or state government regulatory authorities, Minister of Petroleum and Natural Gas Dharmendra Pradhan said. Exploration operations have suffered in 116 NELP exploration blocks due to delays in grant of Petroleum Exploration Licence by state governments including 76 blocks affected due to delay in Defence Ministry approval. On the progress of revival of sick oil and gas wells, Pradhan said, it is a continuous process. The revival process includes measures such as periodical well intervention through work-over jobs, well stimulation, installation of suitable artificial lift systems and side tracking of wells etc. Sick wells are also abandoned by the contractors either on completion of their economic life or due to fact that they could not be economically revived. He said that the revival of sick wells of fields of ONGC and Oil India under nomination regime is monitored on continuous basis by Directorate General of Hydrocarbons (DGH). (economictimes.indiatimes.com)

Oil Ministry says $5.6 bn production loss at PMT fields

December 21, 2014. The Oil Ministry has informed the Prime Minister's Office (PMO) that a consortium-led by BG Group had caused a production loss of $ 5.6 billion in western offshore Panna/Mukta and Tapti (PMT) oil and gas fields by not completing committed work programme. The Oil Ministry wrote to PMO that it is trying in all possible ways to protect government's interest by strengthening the legal team, hiring of expert witnesses and moving to Supreme Court for filing curative petition. The ministry told PMO that BG and its partners Reliance Industries Ltd (RIL) and Oil and Natural Gas Corp (ONGC), had initiated arbitration on the issue related to cost recovery limit prescribed in the Production Sharing Contract (PSC), calculation of royalty on gas production and government audit issues. The ministry said the total profit petroleum earned by the contractors from the PMT fields was $ 11.05 billion. Of this, BG Group and Reliance Industries, which hold 30 per cent stake each, got $ 3.32 billion. ONGC, which holds the remaining 40 per cent interest, got $ 4.42 billion. The government's share was $ 1.3 billion. Besides, the government also earned $ 590 million as royalty and $ 472 million as cess from these fields. The Ministry accused the three partners of not completing the committed work programme, which has resulted in a production loss for the government. The loss is estimated at $ 3.7 billion in Panna-Mukta and $ 1.9 billion in the Tapti production-sharing contract. (economictimes.indiatimes.com)

ONGC, PDVSA aim to raise around $1 bn for Venezuela JV

December 17, 2014. India's Oil and Natural Gas Corp (ONGC) and Venezuela's state oil company PDVSA are seeking around $1 billion in credit to stem an output decline at their San Cristobal joint venture (JV). Indian banks are poised to lend the money to the joint venture, though ONGC would provide the guarantee and the breakdown of the loan's repayment has not yet been decided. The deal is expected to ensure ONGC receives between $400 million and $500 million of unpaid dividends that have accrued over five years. The sides have negotiated for more than a year and are close to a deal to overhaul wells, machinery and other items over three to four years to shore up output and change the terms of sales. Crude would be sold to a handful of buyers, likely Indian and Asian, under 10-year agreements Under the venture's original terms, India's largest oil and gas explorer is due to receive dividends, though it does not control the crude's marketing or receive revenue from sales. (in.reuters.com)

ONGC and BPCL discover gas in Tamil Nadu

December 17, 2014. Bharat Petroleum Corporation Ltd (BPCL) said its partner Oil and Natural Gas Corporation (ONGC) has discovered gas in one of its oil blocks in Tamil Nadu's Nagapattinam district. The block is held jointly by ONGC and Bharat PetroResources Ltd (BPRL), a subsidiary of BPCL. ONGC had previously entered into an exploration partnership agreement with BPCL for the Cauvery basin. According to BPCL, the exploration well in the block - MD 5 - was drilled down to a target depth of 2,175 metres and trapped natural gas in the block flowed at a rate of 61,800 cubic meters per day. It also showed the presence of condensate (a form of volatile light oil) at the rate of 9.6 cubic meters per day. The discovery has been termed Thirunagari Gas Discovery after the name of the nearby village where the gas was found. This is the second hydrocarbon discovery made by ONGC in the NELP-IV block. The first discovery in this block was made in October 2012, which established the presence of crude oil. However, these sets of discoveries are exploratory in nature and the two companies will be starting the appraisal to find out the exact amount of reserves in the block. If found commercially viable, production may start from MD 5. BPRL has a 40 percent interest in the block and the rest is held by ONGC. (www.newindianexpress.co)

Downstream………….

IOC to invest ` 68 bn on capacity expansion at Gujarat plant

December 23, 2014. Indian Oil Corp (IOC) said it will be investing ` 6,800 crore on capacity expansion and improving fuel quality at its Gujarat refinery unit. The state-run refiner in the country will invest ` 5,000 crore to increase its overall capacity to 18 million metric tonnes from the present 13.7 million metric tonnes. Besides, it will invest ` 1,800 crore to make the end product compliant with the low-sulphur Bharat Stage (BS-IV and BS-V) norms. The new capacity addition at its plant at Koyali village in the outskirts of the city will also be compliant with the latest fuel norms. The BS-IV norms involve upgradation of diesel quality by reducing the sulphur content in the diesel to 50 part per million (PPM) from the current 350 PPM. This is aimed at reducing air pollution in the country, he said, adding that the norms first came into force on April 1, 2010 in 13 cities. The ` 1,800 crore fuel output quality enhancement project will be completed by April 2017 while the ` 5,000 crore fuel enhancement project will be completed by 2020. The shift to cleaner fuels will also help the company's profitability as the operating costs will go down and hence, lead to an uptick in the gross refining margins (GRMs). (economictimes.indiatimes.com)

HPCL opens fuel pump at world's highest motorable road in Leh

December 17, 2014. Hindustan Petroleum Corp Ltd (HPCL) has opened a petrol pump at world's highest motorable road in Leh to make available fuel to the remotest part of Jammu and Kashmir. HPCL inaugurated a Kerb Side Pump (KSP) at a height of 15,300 feet at South Pullu on Leh-Khardungla road, which is the world's highest motorable road. The KSP was inaugurated by the Commanding Officer, Indian Army and Border Roads despite temperature being a minus 15 Degree Celsius. HPCL's Chandigarh Direct Sales Regional Office services a major share of the Army and Border Roads business and was assigned with the task of installation of 125 KSPs, mostly in challenging terrains. (economictimes.indiatimes.com)

Transportation / Trade…………

Rupee volatility declines as oil seen cutting India’s deficit

December 22, 2014. A gauge of expected swings in the rupee fell for a third day on speculation oil prices near a 2009 low will help cut India’s current-account deficit. Brent crude has retreated 34 percent since the end of September, reducing costs for India, which imports more than three-fourths of its oil. It sank to $58.50 a barrel on Dec. 16, the least since May 2009. Lower oil prices will improve the current-account deficit and make India less vulnerable to capital outflow from higher U.S. interest rates, according to Skandinaviska Enskilda Banken AB. Oil prices dropping significantly is a huge positive for the management of India’s external situation and the rupee, said Sujan Hajra, a Mumbai-based economist at Anand Rathi Financial Services Ltd. It can shield the rupee in case an increase in U.S. rates causes outflows from emerging markets, he said. One-month implied volatility in the rupee dropped 35 basis points, or 0.35 percentage point, to close at 7.60 percent in Mumbai, data show. The gauge, which surged 242 basis points, climbed to as high as 8.14 percent earlier. In the spot market, the currency advanced 0.1 percent to 63.2450 a dollar, according to prices from local banks. It slumped to 63.8850 on Dec. 17, the weakest level since November 2013, amid a selloff in emerging markets. The July-September shortfall in India’s broadest measure of trade widened to $10.1 billion, the largest since the quarter ended June 2013, the Reserve Bank of India said. Three-month offshore non-deliverable forwards rose 0.2 percent to 64.27 a dollar, data show. The yield on Indian sovereign bonds maturing July 2024 was little changed from Dec. 19 at 7.96 percent, prices from the Reserve Bank of India’s trading system show. One-year interest-rate swaps, derivative contracts used to guard against swings in funding costs, fell three basis points to 7.88 percent, according to data. (www.bloomberg.com)

SC allows GAIL to take part in tender for laying pipeline

December 18, 2014. The Supreme Court (SC) gave green signal to PSU Gas Authority of India Ltd (India) Ltd to take part in the tendering process for laying Ennore-Tuticorin pipeline. The order came in the backdrop of the finding of Petroleum and Natural Gas Regulatory Board (PNGRB) that the PSU had indulged in unfair trade practices in the past. GAIL was also asked by PNGRB to pay a fine of Rs 1, 00,000 and the Appellate Tribunal for Electricity had upheld the order and the penalty. The apex court was hearing GAIL's plea against the December 2013 order of PNGRB. GAIL said it had already submitted its technical bid for the project but its commercial bid would not be considered due to the orders passed by PNGRB and the Tribunal against it. The apex court allowed GAIL's plea observing that both GAIL and Gujarat State Petroleum Corp were government-owned companies and barring the PSU from participating in the project would only benefit private companies. The apex court said it will further hear GAIL's plea against PNGRB and the Tribunal's order in January. (economictimes.indiatimes.com)

CGD projects to get first priority

December 18 2014. In a major rejig of natural gas allocation policy, the government will give firms selling CNG and piped cooking gas top-most priority for allocating the scarce domestic resource. Presently, urea manufacturing fertiliser plants have the first right over the domestically produced gas, followed by liquefied petroleum gas (LPG) plants and power stations. City gas distribution (CGD) projects selling CNG to automobiles and piped cooking gas to households are ranked fourth currently. The Oil Ministry is moving Cabinet to alter this by giving CGD firms top priority, followed by plants providing inputs to strategic sectors of atomic energy and space research. Compressed natural gas (CNG) and piped natural gas (PNG) are clean fuels and will help replace subsidised diesel in automobiles and LPG in households, respectively. According to the new allocation policy, additional requirement for CGD will be first met by imposing proportionate cuts in the domestic gas, presently being supplied to sectors other than priority sectors as decided by the Oil Ministry. Since domestic gas production is now stagnant, it is being proposed to freeze allocation to all sectors expect CGD and LPG sector, at supply levels of 2013-14. (economictimes.indiatimes.com)

OVL wants to dip into RIL payments to clear Venezuelean dues

December 17, 2014. ONGC Videsh Ltd (OVL) wants to dip into payments Reliance Industries makes for importing crude oil from Venezuela to recover $421 million (` 2,610 crore) that the Latin American nation owes to it. OVL, the overseas investment arm of Oil and Natural Gas Corp (ONGC), holds 40 per cent stake in the San Cristobal oil project in Venezuela. It hasn't received dividend on its investment in the project that is operated by Venezuelan national oil company PDVSA since 2009 and total outstanding as on March 31, 2014 was $421 million. To get back its dues, OVL first demanded staggered payments but Venezuela did not oblige. The firm has proposed two options - either Venezuela offers it crude oil in lieu of the dues or adjustments are made with 300,000 to 400,000 barrels per day of crude oil being imported by RIL. OVL wants a mechanism to be put in place wherein part of the proceeds for payment of crude oil exported from Venezuela to India could be maintained in Indian rupees. This, besides settling dues, could be used to pay for exports of other projects from India to Venezuela. This would encourage exports from India. (economictimes.indiatimes.com)

Policy / Performance………

After UP, Oil Minister reviews roll-out of DBTL in Bihar

December 23, 2014. Oil Minister Dharmendra Pradhan checked the readiness of the DBTL (direct benefit transfer for LPG) scheme in eight districts of Bihar. Pradhan has been monitoring the roll-out of DBTL with oil marketing companies (OMCs) ever since the programme's soft launch. A day earlier, he had run a similar check for six districts of Uttar Pradesh (UP). At a meeting attended by district-level officials and executives of OMCs from Patna, Gaya, Muzafarpur, Madhepur, Saran, Bhagalpur, Saharsa and Banka, the minister said that coordination was essential to achieve the desired results. The scheme, rechristened 'Pahal', is to be introduced nationwide. The Modi government has re-launched the scheme after making it more consumer-friendly. Now, consumers not having an 'Aadhar' number can also link their bank account to their LPG connection number for getting the subsidy directly. Pradhan has asked ministry officials and oil company executives to simplify the system and have options of Hindi and regional languages in the LPG portal - www.mylpg.in. Forms for availing of the subsidy or linking bank account numbers to the LPG consumer number has already been simplified. The forms are available in English and Hindi. (economictimes.indiatimes.com)

GAIL to pay royalty on Reliance Industries gas price

December 23, 2014. GAIL India Ltd has been asked to pay royalty on the $ 1.41 per unit it is collecting on natural gas produced from Reliance Industries' eastern offshore KG-D6 fields. While announcing a 33 per cent hike in natural gas price to $ 5.61, the government had said Reliance Industries Ltd (RIL) will continue to get the old rate of $ 4.2 for the main D1&D3 gas field in KG-D6 block and the incremental $ 1.41 per unit will go into a gas pool account, managed by GAIL, till the dispute over fall in output is settled. The Oil Ministry said the royalty at the rate of 5 per cent would be paid on each of the two components of the gas price separately. RIL and its partners BP plc of UK and Canada's Niko Resources would pay royalty on $ 4.2 per million British thermal unit (mmBtu) as is being done presently. For the balance amount, the royalty would be calculated and paid by GAIL from the Gas Pool Account on a monthly basis to the government. Rejecting RIL's proposal to collect entire $ 5.61 per mmBtu amount and depositing the incremental revenue after payment of royalty in the Gas Pool Account, the Ministry said consumers will pay $ 4.2 to the three contractors and the incremental revenue to GAIL. For this purpose, the KG-D6 partners will raise two sets of invoices - one for $ 4.2 to be paid into their accounts and the other for the incremental price which will go to a HDFC account maintained by GAIL. (economictimes.indiatimes.com)

Gas pricing regime should be remunerative for producers: Panel

December 22, 2014. A Parliamentary committee said the domestic gas pricing regime should be remunerative so as to ensure fresh investment in the sector even as it stated that a hike gas price will heighten the subsidy burden. The Standing Committee on Finance, headed by former Oil Minister M Veerappa Moily, said that all actions of the government should be dictated by "public interest" and also fair to all stakeholders. Government in October had approved raising natural gas price to $ 5.61 per mmBtu from November 1. It also modified the Rangarajan formula approved by previous UPA government to bring down the increase in rates from $ 8.4 to $ 5.61. The rates will be revised every six months with the next revision being on April 1. (economictimes.indiatimes.com)

SC appointed judge not yet onboard KG-D6 arbitration

December 22, 2014. Supreme Court (SC) appointed former Australian judge Micheal Kerby has so far not accepted becoming the presiding arbitrator in the KG-D6 cost recovery dispute as Oil Ministry hasn't given its no-objection. Kerby is willing to take up the assignment but before that he made a disclosure of his late father being at one point of time associated with UK's BP, which partners Reliance Industries Ltd (RIL) in KG-D6 block. He wanted a no-objection from the ministry before taking up the job. But the Ministry has so far not given the no-objection. The apex court had on September 29 named Kerby as the presiding judge of a three-member arbitration panel to decide if government was right in disallowing USD 2.3 billion of KG-D6 cost for output lagging early projections. RIL and BP have given no-objection to Kerby being appointed the presiding arbitrator. Earlier in April, SC had appointed former Australian judge Michael Hudson McHugh as the presiding arbitrator but he withdrew after government counsel objected to his remaining on the panel after initially refusing to accept the appointment. (economictimes.indiatimes.com)

Oil Minister seeks more information on innovative smokeless stove

December 22, 2014. Oil Minister Dharmendra Pradhan has asked officials at his ministry and public sector oil companies to study and report to him on the energy-efficient industrial stove Bengaluru based I-T Joint commissioner-cum-innovator Hari Rao has developed. The minister phoned Rao after reading a report about his work in developing a smokeless industrial stove that promises to save on LPG. Pradhan also invited the food technology expert to Delhi, and share his ideas with the ministry officials. The Union government is very serious about the efficient use of energy resources as that will ease the pressure on oil imports, Rao said. (economictimes.indiatimes.com)

OMCs scrap 10 mn cooking gas connections

December 19, 2014. State oil marketing companies (OMCs) have quietly disconnected about one crore bogus cooking gas connections and plugged leakages of over ` 3,400 crore annual subsidy, while continuing their effort to track unscrupulous consumers with multiple connections through know-your-customer (KYC) details. More than 50% of the multiple connections have been identified in last six months. Now, companies are eliminating any chance of duplicate connections through KYC for all new customers and inactive consumers, who have not purchased gas for more than six months. Companies insist on KYC for those customers who want to regularise their connections or transfer them. KYC is also required in cases where consumers request for change of names. Using KYC, companies immediately detect whether a customer in a particular address has more than one cooking gas connection. Consumers can not change agencies to avoid detection of duplicate connection as the three firms — Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Hindustan Petroleum Corp (HPCL— seamlessly share computerised data. KYC verification requires proof of address and proof of identity. Unlike in the past, KYC is now implemented without much hassle. About a year ago, KYC exercise was seen as harassment of consumers and also faced stiff resistance from dealers. Leaders of the then ruling UPA had tacitly slowed down the exercise months before the general election, fearing a political fallout of the unpopular move. Now, the government is making every effort to stop leakage of cooking gas subsidy without denying connections to new consumers, the oil ministry said. Diversion of subsidised cooking gas is quite rampant as it is priced nearly half of its market rate. Diverted subsidised cylinders are used by automobiles, restaurants and catering units. The government is expected to check the leakage through its ambitious Direct Benefit Transfer of LPG (DBTL) scheme. Oil minister Dharmendra Pradhan met Prime Minister Narendra Modi and appraised him about the preparedness of launching the scheme from January 1. Pradhan interacted with collectors of 21 districts in Haryana and 22 districts in Punjab through video conference to evaluate their preparedness for the launch of DBTL scheme. (economictimes.indiatimes.com)

Petrol, Diesel to cost more in Rajasthan after VAT increase

December 19, 2014. Rajasthan government has announced an increase in Value Added Tax (VAT) on petrol and diesel prices, making the fuel costlier. It raised VAT on both the products by 4 per cent, leading to an increase of ` 1.98 per litre in petrol and ` 1.76 per litre in diesel. As a result, petrol will cost ` 66.28 per litre, while diesel will be priced at ` 55.16 a litre in Jaipur. Revised VAT in the state stands at 30 per cent for petrol and 22 per cent on diesel. Petroleum and Diesel Association of Rajasthan has opposed the move of the government and convened a meeting of the dealers to discuss the issue. The association after discussion may agitate against the government's decision. Opposition Congress has also targeted the state government for its decision, saying it has betrayed the people of the state. (economictimes.indiatimes.com)

Gujarat HC ruling gives ` 10 bn VAT relief to ONGC

December 18, 2014. In a major relief to government-run Oil and Natural Gas Corporation (ONGC), the Gujarat High Court (HC) upheld its plea in a dispute with the state which had demanded value added tax (VAT) dues of around ` 1,000 crore. The High Court held that the state government was entitled to recovering VAT on the basis of subsidised rates and not on the basis of original rates of the petroleum products sold by ONGC. (economictimes.indiatimes.com)

Clean energy cess mop-up in FY15 nearly doubles to ` 68.5 bn

December 18, 2014. Government has collected ` 6,857.50 crore in clean energy cess this fiscal, nearly the double the amount it garnered in the previous year. Finance Minister Arun Jaitley in Budget 2014-15 has raised the cess rate from ` 50 per tonne to ` 100 per tonne to promote and finance clean environment initiatives and fund research in this area. The cess is presently levied on coal, peat and lignite.

Coal and Power Minister Piyush Goyal said ` 3,527.75 crore was collected in the last fiscal as clean energy cess. In FY 2013, the amount was ` 3,053.19 crore, while 2011-12 it was ` 2,579.55 crore. The country began imposing clean energy cess on raw coal and lignite in 2010. The minister said at present Coal India Ltd (CIL) has not initiated any proposal for price hike. However, CIL may consider revision of the price of coal at a subsequent stage if there is any substantial increase or decrease in the input costs and the inflation indices. (economictimes.indiatimes.com)

Gujarat has become energy hub of the nation: Anandiben

December 18, 2014. Hardselling Gujarat as a major investment destination, Chief Minister Anandiben Patel interacted with Heads of Missions of many countries and sought their cooperation in the oil and gas sector. Patel said Gujarat is a good state for investment and its progressive governance, business-friendly policies, strategic location and excellent infrastructure has made it a ‘Global Business Hub’ and ‘Global Gateway to India’. The Gujarat Chief Minister said the state has a major shale gas potential and India is drilling its first shale-gas well in Gujarat. All these have made Gujarat energy hub of the nation, she said. (www.indiatvnews.com)

Centre overrules GSPC's demand for $8.5 gas price

December 17, 2014. The Centre has overruled Gujarat government-owned firm Gujarat State Petroleum Corp (GSPC)'s demand for a gas price of $8.5 for its KG basin Deendayal field, saying the approved rate of $5.05 will apply on the company. Oil Minister Dharmandra Pradhan said GSPC informed the Ministry that Gujarat Narmada Valley Fertilizer & Chemicals Ltd (GNFC) had agreed to purchase gas produced from Deen Dayal West (DDW) field at $8.5 per million British thermal unit (mmBtu). The price applicable under this guideline will be $5.05 per mmBtu on gross-calorific value (GCV) basis, he said. GSPC was in October ready to produce gas from DDW field but has so far not begun commercial production. The ministry said though it initially sought higher price, the company has now given in writing that the new pricing guidelines are acceptable to it. But it hasn't yet started production.

As per the approved field development plan, initial production of 1 million standard cubic meters per day (mmscmd) and peak output of 5 mmscmd is envisaged, he said. GSPC had won the Block KG-OSN-2001/3 in the third round of auctions under New Exploration Licensing Policy (NELP), which was launched by the BJP-led NDA government, in 2003. DDW field in the block was discovered in 2005-06. India is not endowed with rich natural resources and most of the reserves are in ultra-deep water, deepsea, and High Pressure-High Temperature (HPHT) areas which require investment of substantial capital to develop the gas fields, irrespective of time of discoveries. Pradhan said a premium over the approved price will be given for all HPHT discoveries and finds made in ultra deepwater and deepwater areas after issuance of the pricing guidelines. (economictimes.indiatimes.com)

Diesel deregulation, gas price to have positive impact on oil companies: Fitch Ratings

December 17, 2014. Key oil and gas sector reforms like diesel deregulation and a new gas pricing policy will have a positive impact on companies engaged in fuel retailing and gas production, says a report by Fitch Ratings. But the rating outlook for Indian oil and gas entities remains stable in 2015, it said. Expecting oil prices to remain under pressure, Fitch Ratings said deregulation of diesel prices in October will help in lowering the under-recoveries (which is nothing but international petroleum prices minus the subsidised retail rates). Subsidies are only applicable to household liquefied natural gas (LPG) and kerosene.

The deregulation provides a level playing field for private players -- Reliance Industries and Essar Oil Ltd -- to market petroleum products. The lower oil prices have substantially reduced the net margins of the two state-owned upstream companies, Oil India Ltd (OIL) and Oil and Natural Gas Corp (ONGC), net of the $56 per barrel discount provided to refiners to make up for part of under-recoveries. Fitch expected the government to reduce this burden considering the low oil prices as well as lower under-recoveries following diesel deregulation. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Aditya Birla Group plans an entry into power sector

December 23, 2014. Coal woes have dealt a double blow to Kumar Mangalam Birla's flagship company Hindalco, not only did the Supreme Court judgment cancel its coal blocks, the auction guidelines have reserved its mines for the power sector, leaving Aditya Birla Group high and dry. This has spurred hectic re-strategising at the Aditya Birla Group. Kumar Mangalam Birla is contemplating an entry into the power sector, a plan he had shelved a few years back. The top strategy team at the Birla Centre met to deliberate on an entry into the power sector and it is expected to be through acquisitions. JP Power's Nigrie and Bina thermal power projects are on Kumar Mangalam Birla's radar. This could be bad news for Sajjan Jindal's JSW Energy which is in talks to buy those units after announcing the deal to buy JP's hydro power assets. Aditya Birla Group is evaluating the option of a foray into the power sector to aggressively bid for coal blocks in the upcoming auctions which will take care of the coal, electricity security of the Group, especially, its flagship firm, Hindalco. While Hindalco is expected to bid for coal blocks in the capacity of a Captive Power Producer, KM Birla is hoping to take the benefit of participating as an Independent Power Producer by buying a unit which is necessary as the auction guidelines require the specifics on the end-use plant.

Aditya Birla Group is also deliberating on this opportunity as the approach paper released on the coal auctions specify that companies can bid for 150% of the total requirement of coal for 30 years. This may give the group more coal security as the government is expected to allow excess coal diversion with some restrictions. It's not necessary that Hindalco will be the entity under which the group may start its power play. Hindalco is a large power producer for captive usage in its aluminium units with an installed capacity of around 3000 MW of electricity. Talabira-1 coal mine produced 2.5 million tonnes of coal catering to 40% of the company's total coal requirement. Coal requirement of the company will keep increasing with the company more than doubling its aluminium capacity to 1.3 million tonnes by FY17. With Talabira-1, Mahan blocks reserved for the power sector, Hindalco is hunting for other blocks to bid for, while the group is looking for other means to secure coal. (economictimes.indiatimes.com)

Tata Power's Trombay plant develops technical snag

December 22, 2014. Tata Power said its Trombay thermal power station had developed a technical problem. Tata Power said that a technical snag developed in Unit 7 at Trombay thermal power generating station, the company said. The gas turbine generator rotor of the Combined Cycle Gas based unit developed an inter-turn short and ground. However, there is no associated damage to any other equipment, the company said without disclosing whether or not power generation was impacted due to the snag. It said the exact extent of the fault and the repair required would be known once the rotor end rings are dismantled and fault or damage is closely examined. The plant has a total power generation capacity of 1,580 MW. (economictimes.indiatimes.com)

NTPC keen for 50 per cent stake in OTPCL power plant

December 17, 2014. NTPC Ltd, the country’s largest thermal power producer, has evinced interest to pick up 50 per cent stake in the 2,400 MW (3x800) power project to be set up at Kamakhyanagar in Dhenkanal district. The mega power project is being developed by Odisha Thermal Power Corporation Ltd (OPTCL) where two state PSUs — Odisha Mining Corporation (OMC) and Odisha Hydro Power Corporation Ltd (OHPC) hold 50 per cent stake each.

Besides NTPC, engineering giant Larsen & Toubro (L&T) and Bharat Heavy Electricals Ltd (BHEL) were also inclined to pick up stake in OTPCL’s project. Both these central PSUs were keen for only 26 per cent stake each and that too with a rider that their equipment would be used in the power plant. This belied the state government’s initial plan of offloading 74 per cent stake presumably because both its PSUs had no previous experience of building and running thermal power plants. The power purchase agreement (PPA) for sale of entire power to be generated by the OTPCL power station has been executed with Gridco, the state owned power trading firm. The Tentuloi coal block in Talcher coalfields with reserve of 1234 million tonne has been allocated for the power plant. Annual requirement of coal is 12.62 million tonne per annum. (www.business-standard.com)

Transmission / Distribution / Trade…

West Bengal to sell power to other states after 2 yrs: Mamata Banerjee

December 23, 2014. West Bengal Chief Minister Mamata Banerjee said her state has surplus power and will sell it to other states after two years. In September this year, the state government formally handed over four new power projects to National Hydro electric Power Corporation (NHPC) hoping that completion of electricity generation schemes from them will benefit north Bengal districts. While the three power projects would be on Teesta, the fourth one would be on Darjeeling's Rambaan area. NTPC's upcoming power plant with a capacity to generate 1320 MW is coming up at Katwa in Burdwan district. The state government has provided 100 acres of land from the land bank. Similarly, land had been made available for DVC's 1,200 MW plant at Raghunathpur in Purulia district. (www.dnaindia.com)

Alstom wins ` 1.8 bn order from NTPC

December 23, 2014. Alstom T&D India has secured an order worth around €23 million (` 180 crore) from NTPC Ltd. According to company, it would supply a 765 kV switch yard at the 2x800 MW Darlipalli super thermal power project (STPP) in Sundergarh district of Odisha. The 765kV switch yard will facilitate evacuation of 1600 MW of power produced by STPP to the Odisha grid.

Alstom T&D India will design, engineer, manufacture, install and commission eleven 765kV bays and fourteen 132kV bays. All equipment will be manufactured and supplied from Alstom T&D India’s manufacturing facilities located in Padappai, Hosur and Pallavaram. (www.thehindubusinessline.com)

Proposal to import coal for NLC's thermal power project in UP

December 23, 2014. There is a proposal to import coal for Neyveli Lignite Corp (NLC)'s ` 14,375 crore thermal power project in Uttar Pradesh (UP) due to delays in development of mine allocated for the plant. NLC had signed an pact with Uttar Pradesh government in 2010 to set up 1980-MW thermal power plant in joint venture with UP Rajya Vidyut Utapadan Nigam Ltd (UPRVUNL). The joint venture (JV) agreement was signed between NLC and UPRVUNL in October 2012 and the JV company was formed in November 2012. Neyveli Lignite Corp had invited global firms for providing consultancy for the power project. (economictimes.indiatimes.com)

Review financial rejig plan for power discoms: Panel

December 22, 2014. A Parliamentary panel has suggested that the government review the financial restructuring package for state electricity power distribution firms as not many states have shown interest in the scheme. The suggestion has been made by the Standing Committee on Energy, which submitted its first report on Power Ministry's Demand for Grants (2014-15) in Parliament. In the wake of many state electricity distribution companies (discoms) facing tough conditions, the ministry came out with a financial restructuring scheme for them. The scheme had a total outlay of ` 1,000 crore for the entire 12th Five-Year Plan period, which ends in March 2017. Later, it was increased and a provision of ` 1,500 crore was made only for 2013-14.

Reduction of Aggregate Technical & Commercial (AT&C) losses, in other words reducing the gap between average cost of power supplied and average revenue realised, is a condition to be followed under the scheme. The committee has said the ministry's financial performance has not been satisfactory. While scrutinising the Gross Budgetary Support for 2013-14, the panel found that as against Budget Estimate of ` 9,642 crore - later revised to ` 5,000 crore - the actual utilisation was ` 4,529.72 crore. Observing that the financial performance of the ministry has been far from satisfactory, the committee said poor utilisation of allocated fund has become a "regular recurring feature". The panel has also asked the ministry to improve its monitoring mechanism to ensure full utilisation of allocated funds. (economictimes.indiatimes.com)

Mizoram will draw additional power from Tripura

December 21, 2014. Mizoram would draw additional power from neighbouring Tripura from December 21, 2014 which would continue till January 2, 2015, Superintending Engineer of the Mizoram State Load Dispatch Centre (SLDC) Vanlalrema said. Vanlalrema said that while Mizoram used to share its power quota with Tripura during Durga Puja, Tripura shared its power quota with Mizoram during Christmas and New Year festivities.

He said that the additional power from Tripura would be drawn from 3 PM and 12 midnight everyday for 13 days at an average of 14 MW per day. He expressed the hope that with the additional power supply from Tripura, the Christian-dominated state would have sufficient power during its most important festival. (economictimes.indiatimes.com)

Power discoms, SEBs owe Railways more than ` 10.3 bn

December 19, 2014. The outstanding dues owed by state electricity boards (SEBs) and power discoms to railways is ` 1,038.66 crore as on October 31, the government said. Punjab State Electricity Board owes railways maximum dues of ` 448.40 crore followed by National Thermal Power Corporation with ` 163.17 crore dues, Maharashtra State Electricity Board with ` 123.05 crore and Delhi Vidyut Board with ` 114.30 crore dues.

Minister of State for Railway Manoj Sinha said non-recovery of dues adversely impact the gross traffic receipts and thereby affect generation of surplus for appropriation to Development Fund and Capital Fund, which support plan expenditure of railways. He further said steps are being taken to expedite realization of outstanding dues like pre-payment of freight has been made compulsory for coal booking for all Power Houses and state electricity boards. (economictimes.indiatimes.com)

Power producers under scanner for inflating coal import bills

December 18, 2014. The Directorate of Revenue Intelligence (DRI) is probing certain companies -- both private sector and PSUs -- which import coal from Indonesia for their power plants and allegedly show inflated import value on the books to justify increase in the power tariff. The DRI said some public sector companies were also under the scanner. According to DRI, these companies get coal shipped directly from Indonesia, however, they route the invoices through an intermediary in Hong Kong, Singapore or Dubai, to show that the consignment has passed through these destinations. (economictimes.indiatimes.com)

Power Grid Corp nominated for largest transmission line

December 18, 2014. The government has awarded a critical power transmission corridor project, connecting power-starved southern states to thermal power rich, western India, to Power Grid Corporation. This has been done by "nomination", shunning private sector investment through an auction. The Central Electricity Authority, Power Finance Corporation and Power Grid confirmed the development. They said the decision was based on requests by the southern states that the central government award to Power Grid, the high voltage direct current transmission line connecting Chhattisgarh and Tamil Nadu. The ministry of power had put up eight transmission contracts with a total investment of ` 53,000 crore for rate-based global competitive bidding in September. Later, it decided to allot the largest project of ` 26,820 crore to the state-owned transmission company and central transmission utility. The Central Electricity Regulatory Commission had in 2011 ordered the power transmission projects to be awarded through rate-based competitive bids, as was the case with generation projects. (www.business-standard.com)

Policy / Performance………….

Telangana Govt to build two thermal power stations

December 23, 2014. The Telangana Government would build two thermal power stations with a total capacity of 7,600 MW in Nalgonda district. Chief Minister K Chandrasekhar Rao, who conducted an aerial survey in Damaracharla mandal of Nalgonda district, decided that the place is best suited for setting up the power plants.

The proposed location of the plants lies in a reserve forest area. Rao spoke to Union Environment Minister Prakash Javadekar and sought early permissions for them from the Centre. The Union Minister responded positively. (economictimes.indiatimes.com)

Govt's Christmas treat: Tenders for 42 coal blocks on 25 Dec

December 23, 2014. The government will issue requests for proposals (RFP) for 42 producing coal mines on December 25 for auction by mid-February. Power projects that banked on imported coal for generation would not be able to take part in the auction, the government said. The ministry of coal will go to the Cabinet with the formula to decide the bid price of coal mines. In the two-stage bidding, potential bidders will initially submit their offer price along with technical details to qualify for the next stage.

The indicative price offer will be the bid price per tonne of coal produced. In the second stage, half the qualified bidders will be allowed to participate in the auction. In order to avoid windfall gains, the government has excluded case II bidders, which source imported costly coal. The coming auction only allows case I and cost-plus linkage projects. Of the 204 coal mines cancelled by the Supreme Court, 101 will be up for bidding for end-use projects in the power, steel and cement industries. The RFPs for 42 producing coal blocks will be issued this week. Auctions will be held 69 days after the public notice. (www.business-standard.com)

Coal India ready for conciliation as unions threaten strike

December 22, 2014. Coal India Ltd (CIL) said that it is ready for the conciliation even as employees' unions of the coal PSU have threatened to go on five-day strike beginning January 6. CIL said that it has learnt from the newspaper reports that four trade unions--Indian National Mineworkers Federation, Hind Khadam Mazdoor Federation, AITUC-controlled Indian Mine Workers Federation and Bharatiya Mazdoor Sangh-- have decided to go on strike from January 6-10. CIL said that it has yet to receive an official notice from the unions.

Employee unions of state-owned CIL and SCCL had on December 17 threatened to go on strike. The strike call comes at a time when the country is grappling with coal shortages and as many as 43 thermal power plants are facing significant fuel deficit. The demands also includes extending National Coal Wage Agreement (NCWA) wages and other benefits to existing and prospective captive coal workers and lifting the ban on general recruitment.

Regularising contract workers engaged in mining jobs in underground as well as open cast mines is another demand. Earlier, the proposed strike on November 24 by CIL employee unions was deferred after a meeting between Coal Ministry officials and trade unions. As per latest data from the Central Electricity Authority (CEA), 43 thermal power plants had coal available for less than seven days as on December 18. (economictimes.indiatimes.com)

Govt for ` 10 mn penalty on entities violating Electricity Act

December 21, 2014. Seeking to make penal provisions more stringent in the power sector, the government has proposed imposing up to ` 1 crore fine on entities violating norms under the Electricity Act. The proposed penalty limit would be a steep jump as it is just ` 1 lakh under the existing provision. As per the government, huge penalty that could run up to ` 1 crore would be slapped on entities found to be non-complying with any orders or directions given under the Electricity Act. The provision is part of various amendments proposed by the government to the Electricity Act, 2003. In this regard, the Electricity (Amendment) Bill, 2014, which was introduced in the Lok Sabha and was later referred to the Standing Committee. With respect to a generating company that produces renewable energy, the Bill has said that in case of violations, the concerned person could face up to three months imprisonment. For the particular generating company, the penalty could extend up to ` 10 lakh and in case of continued failure to comply with the norms, the fine could be ` 10,000 per day. According to the Bill, none of the proposed provision would be applicable to the orders, instructions or directions issued under Section 121 of the Act. (economictimes.indiatimes.com)

Private sector needs to contribute 600 MT coal by 2020: Govt

December 20, 2014. With domestic demand for coal likely to soar to 1.6 billion tonnes by 2020, government said it is looking at the private sector to contribute 600 million tonnes (MT), while the rest will come from Coal India. The government believes that both public and private sectors will have to travel "together both in terms of increasing coal production. But in no way does it mean reducing the role of Coal India," Coal Secretary Anil Swarup said. On December 12, Lok Sabha passed a bill which provides for fresh auction of 204 coal blocks de-allocated by the Supreme Court in September with the government allaying apprehensions of some parties that the legislation would lead to privatisation of the sector. (economictimes.indiatimes.com)

India, US experts meet on operationalising civil n-deal

December 18, 2014. An India-US contact group on civil nuclear cooperation that met Dec 16-17 held detailed talks on a range of issues towards implementation of the civil nuclear accord, including on liability, technical issues and licensing to facilitate setting up of US-designed nuclear power plants in India. The meeting of the contact group comes ahead of the visit to India next month of US President Barack Obama to attend the Republic Day parade. The India-US nuclear deal of 2008 has been stuck due to India's liability laws. (www.business-standard.com)

Units 3, 4 of Kudankulam nuclear plant to be commissioned in 2020-21: Govt

December 17, 2014. Units 3 and 4 of the Kudankulam Nuclear Power Project (KKNPP) are proposed to be launched in 2015-2016 and are scheduled for commissioning in 2020-21, the government said. Administrative and statutory clearances for these projects have been obtained, it said. The site has been made ready for construction.

Union Minister of State for Department of Atomic Energy, Jitendra Singh said that the Environmental Impact Assessment report for the proposed nuclear power plant at Chhaya Mithi Virdhi in Gujarat has found that setting up the plant at the site would not adversely affect the environment. The plant at Chhaya Mithi Virdhi is to come up with US collaboration while Russia is extending help for the KKNPP project in Tamil Nadu. (economictimes.indiatimes.com)

Hike in power tariff will have adverse impact: Madras Chamber

December 17, 2014. The recent 15 per cent increase in power tariff by the Tamil Nadu government would have an "adverse impact" on industries by driving up operating costs, the Madras Chamber of Commerce and Industry said. The Chamber believes that this move will send out wrong signals, especially at a time when Tamil Nadu is competing with other destinations in attracting new investments to the state, the Chamber said.

Industries need "uninterrupted power supply" and it is possible to do proper scheduling and forecasting of renewable energy, a resource available in plenty in Tamil Nadu, it said. The Tamil Nadu Energy Regulatory Commission announced a 15 per cent increase in power tariff for consumers across all segments, including both domestic and commercial. (economictimes.indiatimes.com)

Tripura emerges as only power surplus state in northeast

December 17, 2014. Tripura, ravaged by insurgency for more than three decades, made considerable progress in the commercial sectors and emerged as the only power surplus state in the northeastern region in 2014. After the inauguration of second unit of the 726 MW gas- based thermal power project by Prime Minister Narendra Modi at Palatana in Gomati district on December 1, another power plant at Monarchak in Sipahijala district of Tripura would start generation in January. Seven northeastern states are being allocated their share from the project.

Assam is getting 240 MW, Tripura 196 MW, Meghalaya 79 MW, Manipur 42 MW, Nagaland 27 MW, Arunachal Pradesh 22, Mizoram 22 MW and the balance on merchant sales by ONGC Tripura Power Company Ltd (OTPC). (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Statoil makes small oil discovery near Oseberg South

December 22, 2014. Norway's Statoil Petroleum has found oil at its wildcat well 30/11-10 in the North Sea, the Norwegian Petroleum Directorate (NPD) reported. The well was drilled just north of the 30/11-8S gas/oil/condensate discovery, which was made in 2011, and approximately 16 miles southwest of the Oseberg South field. The NPD said that preliminary calculations of the size of the discovery indicate between 6.3 million barrels and 19 million barrels of oil. The well is the eighth exploration well in production license 035. The license was awarded in Norway's second licensing round in 1969. (www.rigzone.com)

Crude below $60 tests Petrobras’ deepwater discoveries

December 20, 2014. Petroleo Brasileiro SA (Petrobras) Chief Executive Officer Maria das Gracas Foster said that the development of Brazil’s giant oil discoveries beneath a layer of salt would be cheaper than competing North American projects. Petrobras, which planned to invest more than $100 billion to tap deposits trapped two miles (3.2 kilometers) beneath the seabed off Rio de Janeiro, is slowing total spending after lowering its oil price estimate next year to $70 a barrel. Pre-salt oil was formed when the South American and African continents began separating more the 100 million years ago. The repeated flooding and evaporation of salt water in what is now the South Atlantic created a layer of the mineral as thick as 2 kilometers that blankets the largest crude discoveries in the Western Hemisphere since Mexico found Cantarell, the world’s third-biggest when discovered in 1976. The pre-salt discovery in Brazilian waters triggered euphoria in 2007 in a country that had traditionally relied on imported hydrocarbons. Petrobras, which pioneered deep-water exploration in the 1970s, doubled its investment pace to tap the new riches while the country boosted taxes and toughened oil extraction rules to benefit local industry. Seven years later, Rio-based Petrobras produces more than 600,000 barrels a day from pre-salt projects, or about 28 percent of its Brazilian output. The company, which has missed production goals for the past 10 years because of project delays, expects that proportion to rise to more than half the 4.2 million barrels of production targeted by 2020. (www.bloomberg.com)

Downstream…………

Japan refiners surge as Idemitsu and Showa shell hold talks

December 22, 2014. Japan’s refiners surged after two of the largest said they were discussing a tie-up, as falling demand for fuels spurs the industry to consider consolidation. Idemitsu Kosan Co., Japan’s third-biggest refiner by capacity, and Showa Shell Sekiyu KK, the fifth-ranked, are holding talks, the companies said. On Nov. 4, Idemitsu cut its forecast for full-year operating profit by 16 percent to 67 billion yen, compared with an average estimate by analysts of 82 billion yen. The company might reduce capacity at its 220,000 barrel-a-day Chiba refinery near Tokyo, it said at the time. TonenGeneral is Japan’s second-largest refiner by capacity and Cosmo the fourth. The Chiba deal, which starts next year, could pressure other companies to follow suit. Japanese refiners should seek “restructuring and mergers” to cut processing capacity in a country where oil product demand is forecast to fall by 7.8 percent between fiscal 2013 and 2018, the Ministry of Economy, Trade and Industry said. JX Holdings and Idemitsu will maintain a refining and distribution partnership regardless of Idemitsu’s talks to acquire Showa Shell. Idemitsu operates domestic refineries with a combined capacity of 555,000 barrels a day. Showa Shell can process 445,000 barrels a day. Combined, they would rank as Japan’s second largest refiner after JX Holdings, which has a capacity of 1.06 million barrels. (www.bloomberg.com)

Transportation / Trade……….

US talking oil exports just when world needs it least

December 18, 2014. The U.S. Congress is talking about allowing unfettered oil exports for the first time in almost four decades. Its timing couldn’t be worse. There’s space in the global market for 1 million to 1.5 million barrels a day of U.S. crude if the ban vanishes, Energy Information Administration (EIA) said. As members of Congress promise more hearings on repealing the restrictions on oil exports, the world is awash in the stuff. Global prices have fallen by almost half since June to the lowest in five years amid slower demand growth and rising supply. What’s more, the kind of crude flowing in record volumes from U.S. shale plays is already abundant in the market. Global crude prices have fallen 45 percent this year to below $60 this week for the first time since 2009. Producers say the U.S. shale boom may falter if they can’t reach overseas markets, while refiners fight to keep the limits, which have reduced domestic costs and allowed them to export record amounts of gasoline and diesel. Congress will hold more discussions on repealing the law in 2015, the House Energy and Power Subcommittee said. Congress is debating whether the U.S. still needs export restrictions passed in 1975 on the heels of the Arab oil embargo that caused gasoline shortages and long lines of cars at retail pumps. Horizontal drilling and hydraulic fracturing have pushed U.S. oil production to the highest in 31 years. Current exceptions to the ban include shipments to Canada and re-exports of foreign oil. The U.S. has sent abroad 314,000 barrels a day this year, on pace for the highest annual level on record. The U.S. also gave permission in March to companies to export ultra-light crude after lightly processing it. (www.bloomberg.com)

Oil plunge sets stage for energy defaults

December 17, 2014. Bond investors, already stung by the biggest losses from U.S. energy company debt in six years, are facing more pain as the plunge in oil leads analysts to predict defaults may more than double. While bond prices suggest traders see defaults rising to 5 percent to 6 percent, UBS AG said it may actually end up being as high 10 percent if prices of West Texas Intermediate crude approach $50 a barrel and stay there. Debt research firm CreditSights Inc. predicts a jump to 8 percent from 4 percent. Energy-sector bonds have delivered 14 percent losses to investors this quarter and are on track for the worst performance since the three months ended December 2008, Bank of America Merrill Lynch index data show. (www.bloomberg.com)

Repsol agrees to buy Canada’s Talisman for $8.3 bn

December 17, 2014. Repsol SA, Spain’s largest energy company, agreed to buy Talisman Energy Inc. for $8.3 billion, ending a months-long search for acquisitions to help boost crude reserves and production. Repsol has been seeking to spend about $10 billion on takeovers since receiving compensation in May from Argentina for the 2012 nationalization of YPF SA. The total deal value is about $13 billion, including Talisman debt, making it the biggest foreign takeover by a Spanish company since 2007, according to data compiled. Repsol’s offer comes as a slump in crude drove the Canadian explorer’s stock below C$5 for the first time in 14 years. In losing the Argentine producer YPF, Repsol gave up almost half of its oil and gas reserves and has been looking for ways to replace them. The Talisman deal will boost Repsol’s crude reserves by 55 percent and production by 76 percent, the Madrid-based company said. Talisman, which has operations spanning six continents, is focused on the Americas and Southeast Asia. (www.bloomberg.com)

Policy / Performance…………

OPEC oil market defense eludes Libya as production drops

December 23, 2014. Fighting in Libya that’s pushed oil production below consumption in the holder of Africa’s largest reserves is a reminder that not all the Organization of Petroleum Exporting Countries (OPEC) members are in a position to defend market share by maintaining output. As Iraq plans to boost supplies next year amid repeated pledges by Saudi Arabia and the United Arab Emirates to keep pumping the same amount of crude, Libya’s National Oil Corp. said output has dropped to a “very low point.” Conflict between the government and Islamist militias has spread to the region of Mellitah, where the country’s fourth-largest oil port is located, after disrupting two other export terminals, according to the company. OPEC chose to maintain its output targets last month, resisting calls for action from some smaller members including Libya to prop up plunging oil prices. Benchmark crude has since fallen a further 20 percent, exacerbating the decline in revenue from Libya’s shrinking crude production. The country was producing 350,000 barrels a day as of Dec. 15. The U.S. Energy Information Administration estimates Libya’s consumption was 239,000 barrels of oil a day in 2013. Output dropped 32 percent in November from a month earlier to 580,000 barrels, making the nation OPEC’s smallest producer after Ecuador. (www.bloomberg.com)

Biggest Arctic gas project seeks route around US sanctions

December 23, 2014. Total SA and its partners will use a record 16 ice-breaking tankers to smash through floes en route to and from the Arctic’s biggest liquefied natural-gas development. They’re still looking for a way around a freeze in U.S. financing. With 22 wells drilled, and a runway and harbor built for the $27 billion project in Russia’s Yamal Peninsula, where temperatures can reach 50 degrees below zero Celsius, Total, OAO Novatek and China National Petroleum Corp. have little choice but to push ahead. The U.S. Export-Import Bank this year halted a study into funding the plans to ship gas from Yamal, or End of Earth in the native Nenets tongue, to buyers around the world as President Barack Obama’s administration imposed sanctions on Russia. European governments, reliant on gas from Russia, have had to tread a fine line in their relations with the country since its annexation of Ukrainian Crimea led to sanctions. The U.S. and Europe have mostly targeted the Russian oil industry and individuals with ties to President Vladimir Putin rather than impose measures that could strangle the nation’s gas exports. Russian gas output will decline about 4 percent this year, and exports, excluding transit of Central Asian supplies to Europe, will fall 6.7 percent, Energy Minister Alexander Novak said. (www.bloomberg.com)

Natural gas falls to two-year low with no cold in sight

December 23, 2014. Natural gas futures tumbled to a two-year low in New York as mild weather and record production threatened to expand a stockpile surplus. Futures slumped 9 percent to the lowest settlement since Jan. 9, 2013, making the fuel the worst performer among 22 materials in the Commodity Index. Gas stockpiles totaled 3.295 trillion cubic feet as of Dec. 12, 47 billion more than a year earlier and above the year-ago level for the first time since 2012, government data showed. The surplus will “balloon to just shy of 200 billion cubic feet” by the start of 2015, according to JPMorgan Chase & Co. Temperatures may be above normal in most of the lower 48 states through Dec. 26 and on the East Coast through Dec. 31, according to Commodity Weather Group LLC in Bethesda, Maryland. Natural gas for January delivery fell 32 cents to settle at $3.144 per million British thermal units on the New York Mercantile Exchange. Volume for all futures traded was 59 percent above the 100-day average at 2:41 p.m. Prices have dropped 26 percent this year, heading for the biggest annual loss since 2011. U.S. gas production may climb 5.5 percent this year to a record 74.26 billion cubic feet a day, Energy Information Administration (EIA) data show. Gas production from the Marcellus shale formation in the Northeast may climb to 16.3 billion cubic feet a day in January, up 19 percent from a year earlier, the EIA said. (www.bloomberg.com)

Age of plenty seen over for Gulf Arabs as oil tumbles

December 22, 2014. The boom that adorned Gulf Arab monarchies with glittering towers, swelled their sovereign funds and kept unrest largely at bay may be over after oil prices dropped by almost 50 percent in the last six months. The sheikdoms have used the oil wealth to remake their region. Landmarks include man-made islands on reclaimed land, as well as financial centers, airports and ports that turned the Arabian desert into a banking and travel hub. The money was also deployed to ward off social unrest that spread through the Middle East during the Arab Spring. Brent crude, which has averaged $102 a barrel since the end of 2009, plunged to about $60. The slump accelerated after the Organization of Petroleum Exporting Countries (OPEC), whose top producer is Saudi Arabia, decided in November to keep output unchanged. At $65 a barrel, the six nations of the Gulf Cooperation Council, which hold about a third of the world’s crude reserves, would run a combined budget deficit of about 6 percent of gross domestic product, according to Arqaam Capital, a Dubai-based investment bank. (www.bloomberg.com)

Non-OPEC producers called on to cut oil output after rout

December 22, 2014. Oil producers outside OPEC should cut their “irresponsible” output with excess supplies harming the market, the United Arab Emirates energy ministry said. The oil market is oversupplied by 2 million barrels a day, Qatar’s energy ministry said. The Organization of Petroleum Exporting Countries (OPEC) has produced about 30 million barrels a day since January 2013 while global output climbed more than 2 million barrels a day to 93.6 million barrels, according to data compiled. Brent oil prices tumbled more than 40 percent this year. OPEC decided to keep production unchanged at 30 million barrels, resisting calls from cash-strapped Venezuela that the group needs to stem the rout in prices. (www.bloomberg.com)

Saudi Arabia confident in oil rebounding on global growth