-

CENTRES

Progammes & Centres

Location

[Lima outcome: the quiet mutation of Kyoto Protocol]

“Instead of an international law on climate change imposing commandments such as ‘thou shalt not emit carbon’ on Nation States, or International Carbon Markets saying ‘thou shalt pay for emitting carbon’, Nation States are now allowed to say ‘I will or will not emit carbon’. This may or may not be positive for action on climate change but it is definitely positive for sustaining the power of Nation States…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Lima outcome: the quiet mutation of Kyoto Protocol

ANALYSIS / ISSUES…………

· Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (update) - Rangarajan Committee Gas Price meets Indian Gas Price 2.0

· Solar Power: Fact or Fiction?

DATA INSIGHT………………

· Renewable Energy: Grid interactive and Off-grid Systems

[NATIONAL: OIL & GAS]

Upstream…………………………

· Govt runs into hurdles in recovering revenues from RIL-operated KG-D6 block

· ONGC to use GSPC's under-sea infrastructure for KG find

· OIL signs contract for two oil blocks in Myanmar

Transportation / Trade………………

· RSGL to develop infrastructure for retail gas supply

· Essar Group, Rosneft to sign 10 year oil deal

· Oil Minister for petroleum pipeline from Siliguri to Parvatipur

Policy / Performance…………………

· Oil Minister strives to ensure success of LPG direct cash transfer

· No roll-back of excise duty hike on diesel, petrol: Govt

· Only few giving up LPG subsidy voluntarily

· O&G sector benefits from reforms: Fitch

· Oil Ministry wants fuel conservation to be introduced in school books

· Govt weighs revenue sharing model for basins to attract global companies

· Govt fixes ` 48.5-49.5 price for ethanol procurement by OMCs

[NATIONAL: POWER]

Generation………………

· Hot run of Unit II at KNPP

· Centre decides to form committee on Subansiri project: AASU

Transmission / Distribution / Trade……

· Alstom T&D India bags ` 1.5 bn order from Rajasthan

· Power sector unable to utilise full capacity due to poor transmission

· Alstom T&D India gets ` 2.4 bn substation projects in Maharashtra

· Coal India receives first consignment of imported coal of 1.7 lakh tonnes from Indonesia

· CCEA clears ` 15.9 bn transmission project for Tamil Nadu

Policy / Performance…………………

· Centre to clear stand on Uttarakhand hydropower projects in 2 months: SC

· Coal auction may push up fuel price for power sector: ICRA

· ` 120 bn investment to develop a coal block: West Bengal CM

· Govt may not give free power to coal producing states: Goyal

· Polish companies eye re-entering Indian underground coal mining

· Coal block e-auction rules: Current mine owners to get head start over new bidders

· Energy conservation can help save ` 500 bn: Power Minister

· Power Ministry rules out direct regulation of tariff

· Fitch retains stable outlook on power sector in 2015

· India, Russia ink pact to build two nuclear reactors in Tamil Nadu

· Uttarakhand CM vouches for hydropower projects, slams Centre's stand

· Coal auction phase I to offer 92 mines with 350 mt reserves

· Congress to oppose coal sector reforms

· Plan to get clearances for 112 mines before auction: Govt

· Bill on coal mine allocation introduced in Lok Sabha

· Cabinet may take up Electricity (Amendment) Act soon

· Russian, Indian funds to invest $1 bn in hydro power

· Govt may soon rationalise coal linkages of 40 power projects

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Shale veteran takes on Argentina’s $6 bn shortfall

· Total delays Bulgaria exploration citing oil price tumble

· Australia's Woodside postpones decision on Browse LNG project

· Petrobras said to cut exploration spending in cash crunch

· Technip abandons plan to take over seismic surveyor CGG

· Israel's offshore Royee gas field may hold 3.2 Tcf

· Mexico expects $14 bn spending in first oil blocks

· Malaysia's Petronas says open to selling assets in Africa

· Canadian crude discount widens as Kearl production increases

Downstream……………………

· Bangchak Petroleum plans to boost refining output in 2015

· Thai Bangchak Petroleum to invest $305 mn in 2015, boost refining output

· Chile Aconcagua refinery back to full capacity

· Chinese refiners pump out fuel near record pace amid oil slump

Transportation / Trade…………

· Cameroon signs $438 mn oil pipeline partnership with consortium

· Oil pipeline to top US senate agenda next year

· Morocco revives $4.6 bn LNG import plan

· US agency considers exports of oil, gas from deepwater ports

· Libya imposes force majeure on 2 oil ports after clashes

· Poland's LNG terminal operator in talks with North American suppliers

· Australia backs proposed gas link seen as ‘pipeline to nowhere’

· Record oil tankers sailing to China amid stockpiling signs

· Turkey may suggest LNG project to Russia

· Why Texas is now home to bargain-hunting Japan oil buyers

Policy / Performance………………

· Strategic oil hoarding seen driving China demand in next 2 yrs

· Russia Energy Minister says to maintain 2014 oil output into 2015

· Sudan to drill hundreds of wells to boost oil, gas reserves

· Iran said to discount light crude to Asia to deepest in 14 yrs

· UAE sees OPEC output unchanged even if oil drops to $40

· Peru opens bidding on seven energy blocks in Amazon

· IEA cuts global oil demand forecast for 4th time in five months

· Halliburton cuts 1k employees as sanctions slow Russia

· US cuts oil price forecast for 2015 to $62.75 a barrel

· Cheap oil also means cheaper commodities amid surpluses

· Iran sees any break in OPEC solidarity sending oil lower

[INTERNATIONAL: POWER]

Generation…………………

· China to help Serbia build 350 MW coal-fired power plant

· Nigeria signs MoU with Strancton Ltd to build 1 GW power plant

Transmission / Distribution / Trade……

· ABB, Hitachi to tie up for HVDC power grid in Japan

· Emerson to sell power transmission business to Regal Beloit

· Pakistan signs $248 mn loan deal with ADB

· Abengoa nets $24.7 mn Oman power transmission deal

Policy / Performance………………

· UK set for £2.5 bn power bill to keep lights on

· Bangladesh proposes setting up coal-based power plant in India

· Australia looks to sell uranium, coal to Ukraine as ties tighten

· 500 Nuclear plants across the world by 2030: Russian expert

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· World's biggest solar power station to come up in Madhya Pradesh

· Tata Power commissions wind farm in Maharashtra

· Govt working on new renewable energy policy: Goyal

· Govt plans to amend national biofuel policy

· Modi govt's big solar push: Several power projects announced

· Tata Power and Gamesa Wind Turbine sign pacts with Russia

· India counts climate costs above $100 bn at UN talks

· Welspun achieves financial closure for ` 6.3 bn wind power project in Rajasthan

GLOBAL………………

· China General Nuclear unit buys stake in 3 EDF UK wind farms

· China’s ET Solar to build 40 MW solar power plant in Israel

· Istanbul to get Turkey’s largest wind power plant

· Fossil-fuel limits in all nations closer after UN deal

· South Africa plans to raise renewable energy to curb blackouts

· Fossil-fuel exposure may need to be disclosed in UK

· UN seeks India's support on climate change

[WEEK IN REVIEW]

COMMENTS………………

Lima outcome: the quiet mutation of Kyoto Protocol

Lydia Powell, Observer Research Foundation

|

G |

lobal institutional regimes, such as that for trade (WTO), are seen to evolve from the world of capricious politics and diplomacy to a stable world of rules and laws. Climate change regimes on the other hand appear to be moving in the opposite direction, from one of global rules and laws to that of politics and diplomacy. At least that is what the outcome at Lima indicates. What was attempted at Lima was a first shot at drafting an international climate agreement under the Ad-hoc Durban Platform that would commit all countries to specific mitigation action plans. Observers who are concerned with State interests seem to like this development. For example those from the United States who have always seen the ‘common but differentiated responsibilities’ principle enshrined in the Kyoto Protocol as discriminatory are happy that the principle has been undermined. Top US negotiator Tod Stern declared that ‘it was a good outcome that would get countries started on the way to Paris’. Observers from large developing countries such as India are also happy that their commitment of mitigation would be determined nationally and these commitments may not be subject to international verification. India’s environment Minister Prakash Javadekar declared that the ‘final text addresses all of India’s concerns and that India got what it wanted’. The question that we must ask now is why two countries labelled as the largest polluters are happy with the Lima outcome notwithstanding the fact that they are very different on most counts. For one, the former is a developed country with a per person income of over $50,000 and the other is a developing country with a per person income of less than $5000. Possible answers to the question posed above are not likely to make those who are seriously concerned over growing carbon emissions happy.

First the emerging regime on climate action that seeks nationally determined commitments is unlikely to have a significant impact on climate change if we go by models that establish a link between the stock and flow of green house gas emissions in the atmosphere and increase in global average temperatures. According to calculations by Climate Action Tracker, commitments by the USA, EU and China for 2030 if fully implemented would reduce global temperature increase by 0.2C to 0.4C by 2100. This means that global temperatures would still increase by more than 3C above pre-industrial levels.

Second, the Lima Call for Climate Action draft leaves sufficient margin for countries to set their own priorities in the Intended Nationally Determined Commitments (INDCs). INDCs are expected to cover quantifiable information on the reference point such as the base year or the reference level, time frame for implementation, scope and coverage of plans (such as sectors included), assumptions and methodology for estimating and accounting for GHGs etc. But countries are not expected to put forward financial commitments as part of their INDCs and the INDCs are not subject to external scrutiny and verification. This means that the bottom-up process may not add up to much in terms of actual carbon emission reductions

Third, though the Lima Call for Climate Action draft reiterates that the new agreement should reflect the principle of ‘common but differentiated responsibilities’, very little of differentiation is preserved in what is required by way of commitments from different countries. Paragraph 11 of the Lima Call for Action offers marginal concessions for Least Developed Countries and Small Island States in that their INDCs can reflect their ‘special circumstances’. But these countries hardly matter when it comes to mitigation action and even if they were excluded from submitting INDCs it would not have made any difference to mitigation action.

In summary, the new architecture on climate action that is being drafted amounts to a quiet mutation on Kyoto as it (a) undermines differences between countries that Kyoto had acknowledged explicitly and (b) is not legally binding on any party as opposed to Kyoto which had legally binding commitments from Annex I or developed countries. However the new architecture does not compromise on the supremacy of the State over Capitalist Markets as the ideology around rational relations of exchange on climate policy. This goes against the trend of international economic exchanges that have created an international legal space in which behaviour is regulated by international rules that are in turn decided by interests of multinational corporate that engage in international trade. Instead of an international law on climate change imposing commandments such as ‘thou shalt not emit carbon’ on Nation States, or International Carbon Markets saying ‘thou shalt pay for emitting carbon’, Nation States are now allowed to say ‘I will or will not emit carbon’. This may or may not be positive for action on climate change but it is definitely positive for sustaining the power of Nation States. Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (update) - Rangarajan Committee Gas Price meets Indian Gas Price 2.0

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

R |

eferring to recent publications this article presents an update by acknowledging the ongoing slump of oil prices and how it would have influenced a formula based gas price linked to the proposal of the Rangarajan Committee.

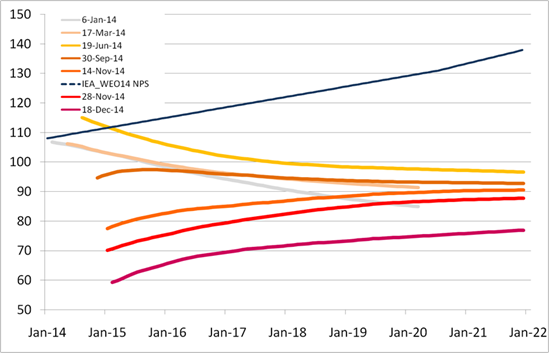

The mere market expectations on the future oil market in contrast with IEA's World Energy Outlook forecast are illustrated by Figure 1: five different oil future curves are plotted, with the highest (orange line) settled only five months ago at June 19th and the lowest as of Dec 18th (purple line). The curves were moving apart especially at the very front end, showing up the dramatic spread of about $ 55/bbl for the respective front month settlement, a destruction of almost half value. However, at the back end of the curve, the assessment of the market participants was less dramatic till November as the curves were converging more or less and the spread peaks off to far less than $ 10/bbl by the end of the decade. However, recent future settlement as of Dec 18th demonstrates a sharp $ 10/bbl fall at the back end, now indicating an increasing mistrust of market participants in a recovery of global oil prices. As opposed to this, the recently published World Energy Outlook 2014 from energy analyses heavyweight International Energy Agency predicts a modelled rise to about $ 130/bbl by 2020 in its central New Policy Scenario (dark blue line).

Figure 1: Brent Crude Oil Futures and WEO2014 Forecast (2014-2022)

Source: Brent future front month settlements (as of dates stated) from CME (www.cme.com); IEA Word Energy Outlook 2014. Compiled by author.

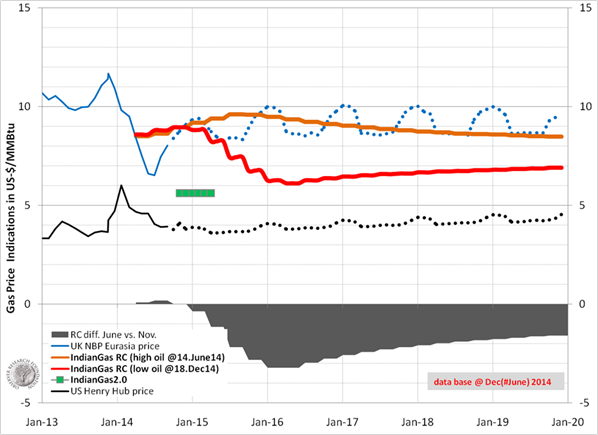

Since the details of the new gas price formula 2.0 are not yet known, in lieu thereof the robustness of a gas price formula like the proposal from the Rangarajan Committee (RC) against oil price volatility is illustrated hereinafter. Based on recent market assessments the domestic RC gas price formula at high/low oil prices (yellow/red line) as well as the spread between these (grey area) is shown in Figure 2 (gas price 2.0 indicated in a green sketch for its first known half-year period as a reference point US-$5.6/MMBtu). The divergence in the course of those two RC gas price curves can be largely explained by the historic Brent oil volatility during the last half year and changing Brent future curve shape. The largest exposure of more than US‑$ 3/MMBtu can be observed in the beginning of 2016, representing the large spread of the Brent crude futures at the front end of the curves (about US-$ 55/bbl) and the concomitantly arithmetic of the RC gas price formula (set up of three months time-lag and creation of twelve months average).

Figure 2: Sensitivity of Rangarajan Gas Price Formula to Crude Oil Prices Changes (2014-2020)

Source: Own assumptions and calculations based on oil and gas futures as of 18th Dec. 2014 (and 19th June, respectively).

The computed RC gas price might have fallen to about US‑$ 6/MMBtu by 2016 (Figure 2). It has therefore almost levelled with the validated gas price 2.0 that by now is only known to be at about US‑$ 5.6/MMBtu until April 2015. It can be assumed that with ongoing lower Brent crude price, ceteris paribus, the RC price formula will yield the current gas price 2.0 (US-$5.6/MMBtu). (Please see ORF Energy News Monitor Volume XI, Issue 23/24)

Concluded

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Solar Power: Fact or Fiction?

Praveen Kumar Kulkarni*

|

T |

he Government of India has sanctioned ` 228 crore to subsidise solar photovoltaic projects built on tops and banks of water canals. Through this grant, the government hopes to help creation of 50 MW of canal top and 50 MW of canal bank solar projects. Canal-top solar plants have caught the fancy of people ever since American solar major, SunEdison, put the country’s first such plant, of 1 MW capacity on the Narmada canal in Gujarat in 2012. More recently, the Hyderabad-based Megha Engineering built a 10 MW plant again on another branch of the Narmada canal system, near the city of Vadodara. The Ministry of New and Renewable Energy has assumed a total cost of ` 975 crore for the 100 MW it wants to help develop – or, ` 9.75 crore a MW, compared with ` 11 crore a MW of the 10 MW that Megha Engineering built. Under the scheme, the government offers ` 3 crore per MW or 30 per cent of the project cost, whichever lower, for canal-top projects, and ` 1.5 crore a MW or 30 per cent of the project cost for canal bank projects, says ‘Guidelines for pilot-cum-demonstration project for grid-connected solar PV plants on canal tops and banks’. The idea is to encourage state power utilities or any other state government organisations or undertakings either on their own or through private sector developers. Central public sector undertakings that operate in the power sector, or have their own canal systems could also apply for the subsidy. Canal top solar projects come with some significant advantages. First, they are quick to build-SunEdison took four months to build a MW. They prevent evaporation of water, roughly 7 million tonnes a year under the shade of one MW. The water keep the solar panels cool, which is good for power generation.

This excerpt is from the Hindu Business Line article titled Centre sanctions ` 228 cr to subsidise canal top solar plants by M Ramesh dated 11 December 29014 available at http://www.thehindubusinessline.com/economy/policy/centre-sanctions-rs-228-cr-to-subsidise-canal-top-solar-plants/article6682822.ece

The scheme is designed to promote Narmada Canal Authority and indirectly to lower burden on the Gujarat Government. Canal top PV projects can be promoted only when costs are clear. Canals are the Property of the State Government (i.e Public) and through the narrative of generating solar power, this loot will continue for the next few decades. The Central Government is planning to help Narmada Authority with 30% capital subsidy for an inefficient energy generation model, which is widely commented in many forums including THINK INDIA. The CAPEX is pegged at ` 9.75 Cr/MW as per their estimate, when, other schemes can be carried out are at ` 6.5 to 7.2 Cr/MW and the land below the PV can be utilised for agriculture.

The Central Government is aggressively pushing to help contractors of Narmada canal authorities to give them permanent repair orders, a typical Gujarat business / development model with Government support i.e without sustainability or using low cost solutions. Ultimately the costs will be paid by loyal tax payers.

In Narmada Canal authority area and other places, lots of land (land acquired that was more than what was necessary) is available on the canal bank (again State government property) and it will be given a subsidy of ` 1.5 Cr/MW. The justification is that the subsidy is an intra government subsidy. But the sum will be sucked up by private interests through bidding process. On the one hand we hear that the Government has no business to do business; on the other the Government is promoting certain businesses at high cost (high capital subsidy and feed in tariff) in the name of captive power consumption. There are no checks and balances. The CAG may comment after 20 years i.e after the life of the Solar PV plant.

When small solar entrepreneurs ask for 100% debt fund that would be paid back by these New Generation Entrepreneurs (unlike large corporate that do not pay despite RBI Governor's intervention) there is no response. But large grants like Capital Subsidy, Viability Gap funding and tax evasion tools like Accelerated Depreciation benefits are offered on a platter to the large corporations that are running other businesses. This will generate losses for the country and the tax payer in the name of solar power that is combating climate change.

Views are those of the author

* The author, BE (MECH), MIE, Ex- JICA /UNIDO, is a solar entrepreneur.

Author can be contacted at [email protected] / www.kknesar.com

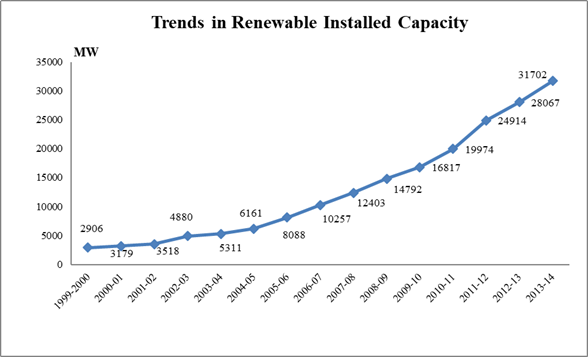

DATA INSIGHT……………

Renewable Energy: Grid interactive and Off-grid Systems

Akhilesh Sati, Observer Research Foundation

|

Particulars |

Cumulative Installed Capacity (MW) As on |

|

|

Jan-14 |

Sep-14 |

|

|

A) Grid Interactive Power |

||

|

Wind Power |

20149.5 |

21996.78 |

|

Small Hydro Power |

3763.15 |

3856.68 |

|

Biomass Power and Gasification |

1284.6 |

1365.2 |

|

Bagasse Cogeneration |

2512.88 |

2689.35 |

|

Waste to Power |

99.08 |

106.58 |

|

Solar Power |

2180 |

2765.81 |

|

Sub Total |

29989.21 |

32780.4 |

|

B) Off-grid Captive Power |

||

|

Waste to Energy |

119.63 |

136.33 |

|

Biomass (non-bagasse) Cogenration |

509.69 |

555.66 |

|

Biomass Gasifiers-Rural |

17.05 |

17.48 |

|

Biomass Gasifiers-Industrial |

141.67 |

149.467 |

|

Aero-Generators/Hybrid Systems |

2.15 |

2.34 |

|

SPV Systems |

144.38 |

209.89 |

|

Water Mills/Micro Hydel |

10.18 |

13.21 |

|

Biogas-based Energy System |

- |

4.07 |

|

Sub Total |

944.75 |

1088.38 |

|

Total [A) & B)] |

30933.96 |

33868.78 |

Source: Akshya Urja, Vol 8, Issue3 and Issue 1, Ministry of New & Renewable Energy

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Govt runs into hurdles in recovering revenues from RIL-operated KG-D6 block

December 16, 2014. The government's move to recover part of a $2.4 billion penalty it has imposed on Reliance Industries Ltd (RIL) hit a roadblock after GAIL India and Chennai Petroleum Corp (CPCL) told the oil ministry that they cannot collect revenues from RIL-operated KG-D6 block as they are not buyers of oil and gas from the field. Oil Minister Dharmendra Pradhan had said that the oil ministry had directed GAIL and CPCL to remit sale proceeds of oil and gas from RIL-operated D6 block in the government's account. (economictimes.indiatimes.com)

ONGC to use GSPC's under-sea infrastructure for KG find

December 14, 2014. Oil and Natural Gas Corp (ONGC) plans to use Gujarat firm GSPC's undersea infrastructure to bring gas from its KG-basin fields in Bay of Bengal to land. ONGC had signed an agreement to use Reliance Industries' under-utilised KG-D6 infrastructure to move gas from neighbouring KG-D5 block, to land. The company has now submitted plans to the government to use infrastructure of Gujarat State Petroleum Corp (GSPC), which has laid out under-sea pipelines and other systems to take gas from its block in the vicinity of Andhra Pradesh. ONGC has made 11 discoveries in KG-D5 which it plans to develop in three clusters or groups. In the first cluster, it plans to club gas finds D and E in the northern part of KG-D5 with a discovery in its adjoining G-4 block. These finds are in close proximity to the pipeline system that are to take gas from GSPC's KG-OSN-2001/3 block to on-land. So, ONGC will pump 14.5 million standard cubic meters per day of peak output envisaged from Cluster-1 to the GSPC network for onward transmission to land. Cluster-2, which is also in the northern part of KG-D5, will have two components - 91,000 barrels per day of oil which will be transported to a floating processing system from where it will be sent to refineries by tankers. About 12.5 million standard cubic metres a day (mmscmd) of gas will be transported to an onshore terminal at Odalarevu through a separate ONGC-laid sub-sea pipeline network. The third Cluster is made up of UD-1 gas discovery in the Southern part, which lies in extremely challenging water depths of 2400-3200 meters. ONGC is currently not pursuing development of this as it is yet to get a suitable technological solution. The company is targeting mid-2018 for start of natural gas production from the block and mid 2019 for oil. The block KG-D5, which sits next to RIL's KG-D6 block, is divided into the Northern Discovery Area (NDA) and Southern Discovery Area (SDA). NDA has 121 million tons of in-place oil reserves and 78 billion cubic meters (bcm) of gas while SDA has an in-place reserve of 80.9 bcm. ONGC and RIL won KG-D5 and KG-D6 block in the first round of auction under New Exploration Licensing Policy (NELP) in 2000. RIL began production from the oil discovery in KG-D6 in September 2008 and put gas find on production in April 2009. It created capacities to carry as much as 80 mmscmd of gas but current output of less than 12 mmscmd utilises only 15 per cent of this resource. (economictimes.indiatimes.com)

OIL signs contract for two oil blocks in Myanmar

December 13, 2014. Oil India Ltd (OIL) has signed contract for two offshore oil and gas blocks it had bagged in Myanmar. OIL along with its consortium partners signed Production Sharing Contract (PSC) with Myanma Oil and Gas Enterprise (MOGE) for two offshore blocks M4 and YEB at Nay Pyi Taw, the company said. OIL-led consortium won these blocks under Myanmar offshore bidding round 2013 which was launched on April 11, last year. A total of 30 blocks were put on offer in this bidding round. OIL and partners bid for three offshore blocks M-4, M-8 and YEB and won two of them. OIL is the operator with 60 per cent interest in both the blocks. Other consortium partners are Mercator Petroleum Ltd (25 per cent), Oilmax Energy Pvt Ltd (10 per cent), and Oil Star Management Services Co Ltd (a local company of Myanmar with 5 per cent stake). (economictimes.indiatimes.com)

Transportation / Trade…………

RSGL to develop infrastructure for retail gas supply

December 16, 2014. Rajasthan State Gas Ltd (RSGL) will lay pipelines for retail gas supply in Alwar, Baran and Jhalawar districts. RSGL is a joint venture of Rajasthan State Petroleum Corporation Ltd (RSPCL) and Gas Authority of India Ltd (GAIL). RSGL aims to provide clean, secured and green fuel to public through its own infrastructure, RSGL said. Laying pipeline for domestic and industrial consumption and gas supply was also projected to achieve RSGL's targets, RSGL said. (economictimes.indiatimes.com)

Essar Group, Rosneft to sign 10 year oil deal

December 10, 2014. Essar Oil will sign a 10-year deal to import crude oil from Russia as President Vladimir Putin pushes to deepen energy ties with India to counter to US sanctions. Essar Oil's Memorandum of Understanding (MoU) with Rosneft, Russia's biggest oil producer, is among the agreements that are to be signed during Putin's two-day visit. Energy cooperation will figure prominently in talks between Prime Minister Narendra Modi and Putin. ONGC Videsh Ltd (OVL) and Oil India Ltd (OIL) are likely to sign MoUs for exploration in Arctic and Eastern Siberia. OVL and Russia's biggest oil company Rosneft had in May signed a MoU for cooperation in the Artic shelf. Putin said Russian gas monopoly Gazprom delivered two LNG shiploads last year and has signed a long-term agreement with GAIL India Ltd for supply of 2.5 million tonnes a year of LNG for 20 years. (economictimes.indiatimes.com)

Oil Minister for petroleum pipeline from Siliguri to Parvatipur

December 10, 2014. Oil Minister Dharmendra Pradhan pushed for laying of a petroleum product pipeline from Siliguri to Parvatipur in Bangladesh for supply of fuel. Pradhan met Dr Tawfiq-e-Elahi Chowdhury, Energy Advisor to the Prime Minister of Bangladesh, to discuss the pipeline. Pradhan requested cooperation from Bangladesh government for materialisation of Indo-Bangla product pipeline from Siliguri to Parvatipur, which is a part of Prime Minister Narendra Modi's view that North-East is our Natural Economic Zone (NEZ). (economictimes.indiatimes.com)

Policy / Performance………

Oil Minister strives to ensure success of LPG direct cash transfer

December 16, 2014. As the government prepares to roll out its biggest ever project to check subsidy diversions, Oil Minister Dharmendra Pradhan is literally burning midnight oil to ensure success of direct cash transfer on LPG. Besides holding almost daily review meetings to ensure no hickups in roll out of the programme to give cash subsidy to LPG consumers from January 1, Pradhan has been personally attending to complaints received from the 54 districts where the plan was rolled out in initial phase from November 15. He has driven the public sector oil companies to come up with a consumer-friendly portal - www.MyLPG.in that provides solutions to all problems - from enrolling for the scheme, the procedure to get Aadhaar number, linking bank account to cooking gas account and checking status of subsidy transfer and tracking refil booking. The minister at a review meeting wiped out his mobile phone to dial a consumer in Ludhiana who had complained about not receiving cash subsidy. From January 1, LPG consumers across the country will have to buy cooking gas at market rates. They will get the difference between current subsidised rate and market price for 12 cylinders in a year in cash that will be transferred to their bank accounts. The Direct Benefit Transfer Scheme for LPG, which has now been renamed PAHAL, has been modified to exclude the requirement of unique identification number (Aadhaar) for availing the cash subsidy. Aadhaar is now optional but consumers should have a bank account linked to their LPG connection number. PAHAL or Pratyaksh Hanstantarit Labh has been rolled out in 54 districts from November 15 and will extend to rest of the country from January 1. Pradhan at a review meeting instructed officials to ensure that the LPG portal has Hindi as well as regional language options to help consumers. Under the scheme, LPG consumers will get cash subsidy in their bank accounts so they can buy a cooking gas cylinder at market price. Cash equivalent to the difference between the current subsidised rate and the market price is transferred to the bank account of a consumer the moment he or she makes the first booking for a cylinder after joining the scheme. The moment a consumer takes delivery of the cylinder, another advance cash subsidy is transferred to the bank account. DBT (direct benefit transfer) is designed to ensure that the subsidy meant for the genuine domestic customer reaches them directly and is not diverted. Government is looking at saving ` 10,000 crore in subsidy by curbing diversions and pilferages. In 54 districts covering 11 states, the scheme covers 2.33 crore households. Currently, the Aadhaar generation level is 95 per cent in these districts. Under the scheme, consumers will now receive SMS at every stage of enrollment in the scheme. (economictimes.indiatimes.com)

No roll-back of excise duty hike on diesel, petrol: Govt

December 16, 2014. The government said it has no plans to roll-back the recent hike in excise duty on diesel and petrol. "No, Sir," Minister of State for Finance Jayant Sinha said in a written reply when asked whether the government would review and withdraw the increase in central excise duties. The government recently hiked excise duty in two tranches on diesel as well as petrol in order to garner about ` 10,500 crore in the current financial year. Sinha said the increase in the duty has been effected, inter alia, "taking into consideration the continued fall in international prices of crude". He also said that the "present circumstances" do not warrant a change in the excise duty structure on petrol and diesel. The excise duty on diesel is ` 5.96 per litre (unbranded) and ` 8.25 per litre (branded). For unbranded and branded petrol, the excise duty is ` 12.95 per litre and ` 14.10 per litre, respectively. The international crude oil price of Indian Basket was USD 60.10 (` 3,765.27) per barrel on December 15, down from USD 60.58 (3,782.62) per bbl on December 12. (economictimes.indiatimes.com)

Only few giving up LPG subsidy voluntarily

December 15, 2014. Over 12,450 LPG users have so far voluntarily given up their subsidies, but this accounts for only 0.008 per cent of about 15 crore domestic cooking gas consumers in the country. The government has been since 2012 urging the rich to give up subsidies on LPG to make them available to people who deserve it. The last such call was given soon after the NDA government came to power. The oil ministry has urged ministers, MPs, MLAs, senior government officials and executives of public sector companies to give up their subsidies. Consumers are currently entitled to 12 14.2-kg cylinders or 34 5-kg bottles in a year at subsidised rates. Any requirement above that has to be procured at market price. A subsidised 14.2-kg cylinder is currently available at ` 417 per bottle in Delhi. The subsidised cooking gas is also available in 5-kg packs, costing ` 155 per such cylinder in Delhi. Any requirement beyond the subsidised quota is to be met through purchase of cooking gas at market price - ` 752 per 14.2-kg cylinder and ` 351 per 5-kg bottle. Oil Minister Dharmendra Pradhan said there was "no proposal under consideration of the government" to withdraw subsidy on LPG. (economictimes.indiatimes.com)

O&G sector benefits from reforms: Fitch

December 15, 2014. The on-going reforms in India's oil and gas sector - namely the diesel deregulation and new gas pricing policy - will have a positive impact on the rated oil and gas companies, especially those engaged in oil product retailing and gas production, Fitch Ratings said in a new report. However, the rating outlook for Indian oil and gas entities remains stable in 2015. The benefits from the oil price reforms and lower global oil prices for refining and marketing companies will be offset by their large capex needs in the medium term, which will lead to negative free cash flows. The low global oil prices will hurt the cash generation of the upstream companies that have heavy exposure to oil, while the state-owned production companies will have to also cope with the still-large discounts that they have to offer to local refiners. (economictimes.indiatimes.com)

Oil Ministry wants fuel conservation to be introduced in school books

December 12, 2014. Fuel conservation will soon be introduced in school books as part of the government's effort to lower consumption and wastage of fossil fuels. The ministry of petroleum and natural gas will write to the human resource development ministry in this regard, oil minister Dharmendra Pradhan said. The focus of this outreach programme will be students, homemakers, domestic helps, drivers and diesel genset users, he said. The ministry will also launch a citizens' drive to connect with the masses on the issue as part of the annual Oil and Gas Conservation Fortnight, which will be held from January 16 through 31. The Conservation Fortnight will include activities such as technical seminars, symposiums, quizzes, painting competitions and marathons. Pradhan said a national-level essay competition will be organised to propagate the message of conservation among students, while orientation programmes will be held for homemakers, domestic help and public transport drivers. (economictimes.indiatimes.com)

Govt weighs revenue sharing model for basins to attract global companies

December 10, 2014. The government is working out a middle path between the existing, controversial contract regime in which oilfield operators recover their costs before sharing profit with the government, and the revenue sharing system in which the state gets a share from the first day of production, irrespective of the expenditure on the field. The oil ministry was in favour of dumping the current contractual regime, which became controversial because of stern audit notes and the requirement of the state to monitor the contractor's expenditure to protect the government's share of profit. However, after detailed discussions with domestic and global investors, the oil ministry has decided to change the system, which is attractive for explorers, only for explored basins. In September 2011, while examining product sharing contracts (PSCs) of Reliance Industries Ltd (RIL), BG and Cairn India, the Comptroller & Auditor General (CAG) of India had criticised that the contractual regime provided "inadequate incentives" for private contractors to reduce capital expenditure. Reacting to CAG's comments, the then prime minister Manmohan Singh constituted a committee under his Economic Advisory Council Chairman C Rangarajan, which recommended to scrap the PSC model and adopt a non-controversial revenue sharing model where cost-recovery was not allowed. The Narendra Modi government is upset over the dismal performance of state-run explorers such as ONGC and Oil India and wants them to expeditiously carry exploration blocks in existing blocks rather than adding more blocks to their portfolio. More than three-fourth of 254 blocks auctioned under NELP are with public sector companies, particularly ONGC and Oil India. (economictimes.indiatimes.com)

Govt fixes ` 48.5-49.5 price for ethanol procurement by OMCs

December 10, 2014. The government fixed a price of ` 48.50-49.50 per litre for procurement of ethanol for blending with petrol, a rate much higher than the price oil companies presently pay to buy the sugarcane extract. In November 2012, the government had mandated compulsory 5 per cent blending of ethanol in petrol but the programme has not extended beyond certain centres because of supply and pricing issues. The procurement price of ethanol was earlier decided by oil companies and the suppliers of ethanol. The Cabinet Cabinet Committee on Economic Affairs (CCEA) fixed the delivered price of Ethanol in the range of ` 48.50 per litre to ` 49.50 per litre, depending upon the distance of sugar mill from the depot/installation of the public sector oil marketing companies (OMCs). (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Hot run of Unit II at KNPP

December 16, 2014. The 'hot run' of Unit II of Kudankulam Nuclear Power Plant (KNPP) would begin next week while preliminary work on construction of the third unit would start in March 2015. Site Director of KNPP R S Sundar said the central government had earmarked ` 39,746 crore for construction of Units III and IV. Sundar said the first unit has been maintaining its full 1000 MWe capacity and that they were expecting a nod from Nuclear Power Corp of India (NPCIL) for it to begin formal commercial production. The unit had so far generated 300 crore units, of which half was given to the Tamil Nadu power grid. Once commercial production begins, the cost of one unit would be increased from ` 1.22 to ` 4, he said. He said about two lakh people had so far been allowed to visit the KNPP site to allay apprehensions on the safety of the project. The 1000 MW capacity first unit of the Indo-Russian joint venture began power generation on October 22, 2013. Sundar handed over a cheque for ` 55 crore as KNPP's contribution to Tirunelveli District Collector M Karunakaran for construction of houses for fisherfolk of coastal villages in and around Kudankulam. (economictimes.indiatimes.com)

Centre decides to form committee on Subansiri project: AASU

December 15, 2014. The Centre has decided to form an eight-member committee to review all problematic areas of the under-construction Lower Subansiri Hydroelectric Power Project (LSHEP) along the Assam-Arunachal Pradesh border. The decision was taken at a meeting of Union Power Minister Piyush Goyal, All Assam Students' Union (AASU) and 25 other organisations in New Delhi on December 11, AASU Adviser Dr Samujjal Bhattacharya said. Four members of the committee would be from Assam and the rest from outside the state to sort out the problems in the areas where construction work was stopped for about three years ago due to protests, he said. The opinions of experts and apprehensions of agitators against the 2,000 MW project were presented before the minister, he said. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Alstom T&D India bags ` 1.5 bn order from Rajasthan

December 16, 2014. Alstom T&D India has secured an order worth around € 20 million (` 151 crore) from Rajasthan Rajya Vidyut Prasaran Nigam Ltd (RRVPNL) for supplying transmission equipment. The new grid sub-station in Bhadla will help evacuate power from the Bhadla solar park and other upcoming solar parks in the area, while the expansion of the sub-station at Bikaner will facilitate the exchange of solar power generation with the national grid. Alstom T&D India will design, engineer, manufacture, install and commission the Bhadla 400/220 kV sub-station while the Bikaner expansion project includes the supply of eight 400 kV bays, transformers, circuit breakers, control and protection relays and sub-station automation system. All equipment will be manufactured and supplied from Alstom T&D India's manufacturing facilities in India. (economictimes.indiatimes.com)

Power sector unable to utilise full capacity due to poor transmission

December 15, 2014. The power sector is unable to use at least 10 per cent of its capacity due to the choked transmission network in the country, hurting projects of Tata Power, Essar Power, Jindal Power, JSW Energy, CLP, DB Power, MB Power, Emco Energy, GMR and Adhunik Power. Inadequate transmission has kept about 25,000 MW of generation capacity idle, making the problem comparable to the issue of acute fuel scarcity that has hit about 30,000 MW of new capacity, industry executives say. In addition to the inadequate capacity, regulatory authorities impose strict restrictions on the utilisation of existing networks and keep a large amount of transmission capacity idle as a safeguard against grid collapse. They say new transmission capacity in key corridors is scheduled to come up after four years, making the outlook grim for many plants. Transmission problems are also hurting power trading, Indian Energy Exchange (IEX) said. Last month, no power could be imported into the southern region throughout the month either through the eastern or western corridor due to congestion, IEX said. Most power plants in western India have signed power purchase agreements with customers in the north or south because states in only these regions invited long-term PPAs. But there is no capacity in key power corridors to ship this power, making these plants idle. To compound matters for these plants, Coal India is not supplying coal to these plants because PPAs have not started operating. The Association of Power Producers says restrictions on capacity utilisation of transmission corridors often prevent generation companies from supplying power even after signing long-term power supply agreements. At least half a dozen transmission projects of various companies including Power Grid Corporation, Reliance Infra and Sterlite Grid with investments of over ` 7,000 crore are held up or delayed due to the slow speed of official clearances. Power companies say they are feeling the pinch. Southern states of Tamil Nadu, Kerala, Karnataka and Telangana would not have been facing power shortages if there was adequate transmission capacity available with generating firms in Madhya Pradesh, Odisha and Chhattisgarh. According to Central Electricity Regulatory Commission (CERC), IEX could not allow trade of close to 11 billion units of electricity in past three financial years due to congestion in transmission network. In fiscal 2012-13, almost 3.7 billion units were lost as a result of unavailability of the corridors while in 2013-14 the number went up by 41 per cent to 5.3 billion units. (economictimes.indiatimes.com)

Alstom T&D India gets ` 2.4 bn substation projects in Maharashtra

December 12, 2014. Alstom T&D India has received orders worth € 32 million (` 246.2 crore) from Maharashtra State Electricity Transmission Company to build 400/220 kV grid substations at Kudus, Alkud and Kondhwain in the state. Maharashtra is building these substations to strengthen its transmission network and enhance power evacuation capacity the as part of the 12th Five Year plan. Alstom T&D India will set up 400/220kV air-insulated substations at Kudus and Alkud. This contract covers power transformers, substation automation system and other auxiliary equipment. For Kondhwa, Alstom will build a 220/22 kV gas-insulated substation. All equipment will be supplied from Alstom T&D India's manufacturing facilities. Alstom has been associated with Maharashtra State Electricity Transmission Company on a number of projects, including a contract to build twenty-six 220/132 kV substations across the state. Alstom is also building a 765 kV air-insulated substation at Aurangabad, the first 400 kV gas-insulated substation at Hinjewadi and is executing a pilot project for the utility in Mumbai on remote operation and situational awareness. (economictimes.indiatimes.com)

Coal India receives first consignment of imported coal of 1.7 lakh tonnes from Indonesia

December 12, 2014. Coal India's efforts to import coal have borne fruit after nearly four years, with the first consignment of about 1.7 lakh tonnes reaching Mundra Port from Indonesia recently. The imported coal, handled by MMTC, will be supplied to Neyveli Thermal Power in Tuticorin and two independent power producers in Punjab — Talwandi Sabo Power and Nawa. The state-run monopoly miner was initially hoping to import about 5 million tonnes of coal for its consumers. However, it ended up placing an order for 0.5 million tonnes due to lack of interest among buyers. The rest of the ordered volume, about 3.3 lakh tonnes, will be imported during this financial year. Coal India has been given the responsibility of importing coal on behalf of its consumers to meet the nation's demand for the fuel. It had decided to place orders only for companies that would pay in advance. Although 40-50 companies had shown interest in the beginning, only five placed firm orders. The miner spent a couple of years trying to enter into a long-term contract with overseas coal producers in lieu of strategic stakes in these companies. However, this did not materialise as the prices quoted for the coal being supplied worked out to be more than the prevailing market price. Besides, its largest consumer NTPC backed out since it did not want to buy the coal at higher prices than prevailing market price. NTPC had earlier shown interest in sourcing 10 million tonnes of imported coal through Coal India, but it backed out when the prices quoted were higher. (economictimes.indiatimes.com)

CCEA clears ` 15.9 bn transmission project for Tamil Nadu

December 11, 2014. The Cabinet Committee on Economic Affairs (CCEA), chaired by the Prime Minister Narendra Modi, has approved the creation of an intra-state transmission system in Tamil Nadu. The project will mainly support renewable energy, mostly wind power projects in the state, and will cost ` 1,593 crore. A 400 kV grid sub-station will be built at Thannampatty, besides augmentation of various 230 kV grid sub-stations and associated transmission systems in the state. The project is proposed to be completed within a period of three years. (www.business-standard.com)

Policy / Performance………….

Centre to clear stand on Uttarakhand hydropower projects in 2 months: SC

December 16, 2014. The Centre was granted two months time by the Supreme Court (SC) to spell out its stand on future of six hydropower projects in Uttarakhand which are facing uncertainity in the aftermath of a natural disaster last year. A bench of Justices Dipak Misra and U U Lalit accepted the plea of Attorney General Mukul Rohatgi that the final picture would be cleared after considering the stand and views of all stake-holders which include PSUs like National Thermal Power Corporation (NTPC), National Hydroelectric Power Corporation (NHPC) and Tehri Hydro Development Coporation (THDC). (www.business-standard.com)

Coal auction may push up fuel price for power sector: ICRA

December 16, 2014. The auction of 74 coal blocks is likely to witness an intense competition among bidding companies and the exercise may push up the fuel price for power sector, rating agency ICRA said. This in turn may put an upward pressure on cost of power generation and the retail tariff, it said. ICRA said the bidding for coal blocks may be intense due to low execution risks and their importance for both operational and under implementation projects. These blocks are from over 200 coal mines whose allocations were quashed by the Supreme Court, which termed their allotment as "arbitrary and illegal". The first round of auction involving these blocks would be completed by March 31. As a result, the auction process is expected to increase the cost of coal for the power sector, which in turn would put upward pressure on price of generation and retail tariff, it said. ICRA said that the provision for auction and allocation of coal block for mining with 'sale purpose' should be favourable for the coal mining sector in the long run. The process would enable the entry of private sector in coal mining business with better operational efficiency which would help to improve the availability of coal for the various end uses, ICRA said. (www.business-standard.com)

` 120 bn investment to develop a coal block: West Bengal CM

December 15, 2014. West Bengal Chief Minister (CM) Mamata Banerjee said an investment of ` 12,000 crore in a joint venture would be made to develop a coal block in the state's Birbhum district, creating employment for a large number of people. Banerjee said Deocha-Pachami coal block in the state with a reserve of 2,200 million tonnes, which was allocated to six states and a CPSU by the Centre in 2013, would be developed in a joint venture. Development of this coal block under Md Bazar block in Birbhum district in a joint venture will expedite the development process in the entire area covering Bankura, Birbhum, Purulia, Burdwan and Murshidabad districts, Banerjee said. (economictimes.indiatimes.com)

Govt may not give free power to coal producing states: Goyal

December 15, 2014. The government may not provide free power to coal producing states of Odisha, Jharkhand and Chhattisgarh on account of negative impact of industrial activity in these states. In this regard, the Planning Commission engaged TERI (The Energy and Resources Institute) to suggest a suitable methodology for compensation to the states. Thereafter, TERI submitted its report to the Planning Commission. Power Minister Piyush Goyal said that the government had already introduced in 2010 a Clean Energy Cess for which a levy of ` 100 is now imposed on every tonne of coal. The amount collected is provided to National Clean Energy Fund (NCEF) which aims to fund projects on clean energy, including the host states. (www.business-standard.com)

Polish companies eye re-entering Indian underground coal mining

December 15, 2014. Polish mining technology companies are trying to re-enter Indian coal mining sector after almost four decades. At the time when India was trying to double coal production over the next five years, the Polish mining equipment and technology was trying to make inroads in the Indian coal mining sector. Polish companies were focusing at underground coal mining sector which has technology to mine coal beneath up to 1000 metres. (economictimes.indiatimes.com)

Coal block e-auction rules: Current mine owners to get head start over new bidders

December 15, 2014. The captive coal mining firms in producing blocks might not lose their mines even after the deadline of March 31, 2015, set by the Supreme Court. The government's final rules for reallocation of cancelled mines through an e-auction process give the existing owners an advantage over new bidders. In Phase-I, the 74 operational ones among the 204 deallocated mines will be on the block. The successful bidder will mine coal only for captive use, for projects in the power, steel or cement sector. The detailed tender document that potential bidders have to file asks for precise details of end-use, amount of coal needed, distance of the end-use plant from the mine and the project's completion status. The Centre plans to conduct a two-stage bidding under the Coal Mines Special Provisions Ordinance, promulgated to reallocate the cancelled blocks. Power sector executives believe the government, by asking for technical bids first, has already separated the men from the boys. The bidder qualifying in the first stage will be asked to make a financial bid under e-auctioning. The rules specify the technical and financial qualification of participants in the auction. The court had cancelled 204 block allocations, made through the screening committee route over the past two decades, terming those “illegal” and “unconstitutional”. It had given the government time till March 31 to reallocate operational mines and asked mine owners to pay a fine of ` 295 per tonne of coal. (www.business-standard.com)

Energy conservation can help save ` 500 bn: Power Minister

December 14, 2014. Pursuing energy efficient ways will help reduce electricity consumption and save as much as ` 50,000 crore, according to Power Minister Piyush Goyal. Emphasising the need for conserving energy, he said that within next two years government buildings throughout the country would be equipped with energy saving LED (Light Emitting Diode) bulbs. India produces about one lakh crore units of electricity and if a ten per cent saving (energy) is made that can save 10,000 crore units, Goyal said. This is equivalent to as much as "` 50,000 crore" savings which can be utilised for lighting up homes of five crore people who are without electricity, he said while speaking at the National Energy Conservation Day function. Noting that energy conservation would help in the country's economic progress, Goyal said the aim should be to save 10,000 crore units of electricity by end of 2015. As part of the function, the Minister also interacted with students from different parts of the country through video conferencing for nearly an hour. In Andhra Pradesh, the state government is distributing LED bulbs to replace incandescent ones. Goyal also said that he would take up with Human Resource Development Ministry the idea of voluntary inclusion of energy management in the school curriculum. There was another suggestion about having a toll-free number in each state, where complaints can be registered regarding wastage of power due to not switching off the street lighting system during day time. Goyal said officials would be asked to make this toll-free number operational by January 31, 2015 in all states and Union Territories besides ensuring proper management. When asked about the need for government vehicles to conserve energy, the Minister said he would look into the issue and do something. Goyal, who also holds the portfolios of Coal and New and Renewable Energy, said that all islands would be made green energy islands in the next two years. (economictimes.indiatimes.com)

Power Ministry rules out direct regulation of tariff

December 12, 2014. The Ministry of Power has ruled out any direct regulation of power tariff as it will be detrimental to the efforts done by both the government and efficient power companies in streamlining the power generation, distribution and transmission. While these activities entail cost but in the long run this strategy will reduce the total cost of supply of electricity to the consumer. On one hand, the government cannot emphasise discovery of tariff through competitive bidding which is a parameter based on market driven efficiency and on the other hand, contemplate to put regulate the tariff. The issue of regulating power tariff has been suggested as an internal recommendation to bring down the overall cost of power for consumers. In fact, the ministry has launched an integrated power development scheme at a total financial outlay of ` 76,623 crore for strengthening of sub transmission and distribution networks in the urban areas, metering of distribution transformers/ feeders/ consumers in the urban areas and enablement of the distribution sector through information technology. All distribution companies including private sector and state power departments will be eligible for financial assistance under this scheme. One salient feature of the scheme which differentiates it from other scheme is that the financial assistance is for both development of distribution network for power generated from both conventional and non conventional sources like solar panels, wind mills etc. However, if private distribution companies take financial assistance, the scheme has to be run through a state government agency or state owned companies who will own the assets to be handed over to the private company over a mutually agreed period of time. Power Finance company is the nodal agency for approval of the scheme and funds will be released in phases upon completion of agreed milestones in the agreement. The ministry is of the view that it will be too short sighted measure when the overall sector is moving towards an overhaul both in terms of fuel supply, optimization of operations, adopting new business models. In fact the ministry has decided to increase the share of renewable, in addition to the generation capacity addition target of 88,537 MW from conventional sources. While the capacity addition of about 30,000 MW has been planned from Renewable sources during 12th Five Year Plan, the cumulative installed capacity of renewable power is expected to be 55,000 MW by March 2017. (www.business-standard.com)

Fitch retains stable outlook on power sector in 2015

December 12, 2014. Rating agency Fitch retained its stable outlook on India's power sector in 2015 but warned producers and grid operators will continue to face challenges by way of high capex levels and fuel shortages leading to negative free cash-flow in the medium-term. The sector faces lower profitability and possible uptick in acquisitions in the generation segment. However, rating outlook remains stable for the next year as the sector continues to have strong operating cash flows and healthy balance sheets, a Fitch report said. While the new tariff order passed in 2014 will have some negative implications for state-run power producer NTPC, there is regulatory certainty on rates until FY19, it said. The industry is likely to expand capacity by 15-18 GW in 2015 despite fuel supply shortages, but plant load factor (PLF) will be low, the rating outfit maintained. Fitch expects further consolidation in 2015, with stronger power generation companies looking to acquire smaller, distressed generation assets and coal upstream entities to improve vertical integration and fuel security. The report said credit profile of the industry remains steady with net leverage likely to peak over the next couple of years but warned NTPC and PowerGrid will continue to face regulatory issues until FY19. On the capex front, it said investments will remain high, driven largely by capacity growth. Fitch said India's gas production is also unlikely to rise in 2015 and gas power PLFs, which fell to 36 per cent in FY14 from 56 per cent in FY13, should remain stressed. (economictimes.indiatimes.com)

India, Russia ink pact to build two nuclear reactors in Tamil Nadu

December 11, 2014. India and Russia signed an agreement paving the way for building the third and fourth reactors at the Kudankulam Nuclear Power Plant in Tamil Nadu, besides finalising a vision document for long-term cooperation in the atomic energy sector. The pact was signed between Nuclear Power Corporation of India Limited (NPCIL) and Russia's Atomstroyexport after Summit talks between Prime Minister Narendra Modi and Russian President Vladimir Putin. The accord will operationlise the General Framework Agreement (GFA) signed in April this year between the two sides for construction of units 3 and 4 at Kudankulam. The cost of the two units is likely to be around ` 40,000 crore and they will generate a total of 2,000 MWs of power. A separate agreement was also signed between (NPCIL) and Atomstroyexport for unit 3 and 4 of Kudankulam Nuclear Power Plant for supply of some major equipment by the Russian company. Aiming to enhance cooperation in the nuclear sector, both the countries also came out with a 'Strategic Vision for Strengthening Cooperation in Peaceful Uses of Atomic Energy' under which Russia will build at least 12 reactors in India by 2035. (economictimes.indiatimes.com)

Uttarakhand CM vouches for hydropower projects, slams Centre's stand

December 11, 2014. Uttarakhand Chief Minister (CM) Harish Rawat has slammed the Centre for its stand that the hydroelectric power projects (HEPs) had caused the 2013 calamitous floods in the hill state, saying his government would move the Supreme Court shortly in support of the HEPs. Rawat said his government would shortly move the Supreme Court over the issue in the support of hydropower projects. Rawat's comments came after the Centre's stand had put the future of 24 hydel projects, with a capacity of 2,900 MW, in jeopardy. Rapping the Centre for not moving forward on hydropower projects in Uttarakhand for 18 months, the Supreme Court had asked it to find an "acceptable solution" to the problem and not to come out with a "knee-jerk" reaction. The Centre expressed reservation in allowing the projects, despite getting forest and environment clearance, which was given before the disaster hit the state last year, saying their designs were not acceptable. (www.business-standard.com)

Coal auction phase I to offer 92 mines with 350 mt reserves

December 11, 2014. The government is likely to kick-start first phase of coal blocks auction on December 23 offering about 92 mines with 350 million tonne (mt) of estimated reserves to public and private firms, coal secretary Anil Swarup said. Swarup said the coal ministry is in the process of earmarking blocks for public and private firms and segregating them further for the power, steel, cement and captive power sectors. He said the ministry is expected to complete the task in the next 2-3 days. The blocks will include 42 operational mines with about 90 million tonnes of reserves and 32 soon-to-be operational mines with 120 mt coal that could begin production in the next six to eight months. Nearly 20 additional blocks with 150 mt of estimated reserves are being identified for allotment in the first phase that could start operations in the next eight to 10 months. The government targets to finish coal blocks allotment and auction process by March 16, 2015, Swarup said. He said the government will soon launch an electronic platform to address all regulatory hurdles related to coal mines on the lines of the Project Monitoring Group that led to fast-tracking over ` 6,00,000 crore infrastructure projects. The government is also working to increase output of Coal India Ltd to one billion tonnes by 2019. (economictimes.indiatimes.com)

Congress to oppose coal sector reforms

December 11, 2014. The Congress may have come around to supporting the insurance reforms but it is against backing the government on the ordinance on coal allocation, a decision that is set to unnerve the Centre given its numerical deficit in the Rajya Sabha. The principal opposition has decided against the coal ordinance which is being brought to streamline the allocation process in the wake of Supreme Court's cancellation of post-1993 coal blocks. After consultations, Congress nailed the party stance on coal - oppose backdoor denationalization of the coal sector. While the party is okay with fixing the allocation process through ordinance, it is against privatization of coal. The Coal Mines (Special Provisions) Ordinance, 2014, allows private players to mine coal and sell it in the open market. Given that the socialist-branded parties are opposed to privatization of coal sector, a Congress red-flag can sink the ordinance if the threat is carried out. (timesofindia.indiatimes.com)

Plan to get clearances for 112 mines before auction: Govt

December 10, 2014. Government is looking at the possibility of putting in place all clearances for 112 mines before they are auctioned in the second phase, so that they fetch higher revenue for the exchequer, Coal Secretary Anil Swarup said. The cleared blocks will fetch the government more money, he said. The government had cancelled the auction of three coal blocks stating that issues related to certain clearances need to be "revisited". In the first phase, the Coal Ministry will auction or allot 92 of the 204 blocks that were cancelled by the Supreme Court in September. The sale process for these mines will start on February 11. He said that work on the 112 mines will immediately start after the government allots or allocates the 92 mines. The government is looking at coal production of 1.6 billion tonnes over the next five years. Coal India, which accounts for over 80 per cent of the domestic coal production, is expected to produce one billion tonnes by 2019, the remaining 600 million tonnes will be produced by the private sector. Out of the 92 coal blocks to be alloted and auctioned in the first lot, 57 mines would be given to the power sector, while the remaining mines would be for the sectors like steel and cement. The apex court had in September termed the allocation of 204 mines since 1993 as "arbitrary and illegal". The government had already made it clear that the number of mines a company can bid will be capped to avoid monopoly. (www.moneycontrol.com)

Bill on coal mine allocation introduced in Lok Sabha

December 10, 2014. The government introduced a bill in the Lok Sabha to begin allocation of coal blocks that were cancelled by the Supreme Court. The Coal Mines (Special Provisions) Bill, 2014, will replace an ordinance which outlines the procedure for auction of coal blocks that were cancelled by the Supreme Court in September 2014. The bill was introduced by Power Minister Piyush Goyal. Trinamool Congress MP Saugata Roy opposed the introduction of the bill, saying it opens the doors for denationalization of coal mines. It will give over the country's energy sector to private hands and will lead to exploitation of coal miners. Goyal in his clarification said the Supreme Court has held the allocation of coal blocks through screening committee rules as arbitrary. The ordinance does not seek to denationalize coal mines. (www.business-standard.com)

Cabinet may take up Electricity (Amendment) Act soon

December 10, 2014. The Cabinet may soon take up Ministry of Power's proposal to make necessary changes to the Electricity Act 2003. Power Minister Piyush Goyal said that the Electricity (Amendment) Act proposals will be out shortly. The proposed changes would include strengthening the penalty provisions, making it more stringent, more enforceable and increasing the penalty many-fold. Also as part of the proposed amendments, the consumers will soon be able to choose their power supply. These are aimed at encouraging greater competition in the distribution sector. The government is working on allowing competition at the last mile delivery so that consumers have a choice of supplier of electricity. Goyal had said the interests of stakeholders will be protected in the existing power purchase agreements and it would be done in consultation with the power regulator. He had said that the Electricity (Amendment) Act may be introduced during the current Parliament session. The proposed amendments are aimed at reducing the losses of discoms as well as improving overall electricity supply. As per the proposal, a new model where a power supplier will not manage the electricity distribution network, is being looked at. It is on the lines of existing system in the United Kingdom which has separate suppliers and electricity network providers. At present, power discoms supply as well as manage network that provides electricity for residential as well as commercial purposes. (economictimes.indiatimes.com)

Russian, Indian funds to invest $1 bn in hydro power

December 10, 2014. The Russian Direct Investment Fund (RDIF) will team up with an Indian partner to invest $1 billion in hydroelectric projects in Asia's third-largest economy, RDIF head Kirill Dmitriev said. The RDIF and India's IDFC, a leading infrastructure investor, will each commit $500 million to projects under a deal to be signed during Russian President Vladimir Putin's visit to India. Prime Minister Narendra Modi wants to overcome India's chronic power shortages, and the country has vast untapped hydroelectric potential in its northern Himalayan belt. Dmitriev said the investments would back projects involving a large Russian hydro-power company but he declined to name the company. The only large Russian player in this area is state-controlled Rushydro. IDFC, which is 16 percent state owned, confirmed it would sign a partnership with RDIF but declined to comment on the details. The Russian fund was set up in 2011 with $10 billion in state funds. It can back investments as long as its partners match it at least dollar for dollar. Dmitriev said he expected to commit funds to the Indian projects next year. The RDIF has so far invested $1.3 billion of its own money along with $6 billion by outside investors, mainly sovereign wealth funds from the Middle East and Asia. Dmitriev said the RDIF had managed to turn profits on investments in a Russian telecoms company and the Moscow stock exchange despite Western sanctions, a slowing economy and sliding oil prices. (in.reuters.com)

Govt may soon rationalise coal linkages of 40 power projects

December 10, 2014. The government could soon finalise the proposal for coal linkage rationalisation and swapping arrangements of about 40 thermal power projects, a move that is expected to save up to ` 6,000 crore in logistics cost. The proposal includes swapping agreements for power projects of companies including Adani Power, Indiabulls Power and NTPC, among others. The Inter Ministerial Task Force (IMTF), which was formed to undertake a comprehensive review of existing coal sources and consider feasibility for rationalisation of linkages, has approved coal linkage rationalisation for 18-20 thermal power plants. IMTF comprises officials from the Ministries of Power, Coal, Railways and the Central Electricity Authority. Consultancy firm KPMG has listed out 20 proposals for the coal swapping arrangements. KPMG, in its report to the Ministry of Power, has stated that 20 proposals for the swapping arrangements are feasible. The swapping arrangement between NTPC for its thermal power plant in Chhattisgarh with Gujarat State Electricity Corp Ltd are estimated to save about ` 720 crore per year on the logistics front. The western Maharashtra's plants which are closer to the ports can swap domestic linkages with imports of hinterland plants in eastern Maharashtra. It estimated possible logistic saving of ` 303 crore annually. KPMG also gave a list of possible swaps including Indiabulls plant and Sterlite Energy's project in the region. Rajasthan Rajya Vidyut Utpadan Nigam Ltd (RRVUNL), which is nearly equidistant from both port and the Northern Coalfields Ltd (NCL) mines, can swap domestic linkages with imports of hinterland plants of NTPC. Similarly, thermal power projects in Haryana, Uttar Pradesh and Punjab can benefit from the swapping pacts saving close to ` 456 crore. KPMG also suggested that the generating stations of Tamil Nadu Generation and Distribution Corporation (TANGEDCO) are closer to the coast and even domestic coal is taken by the sea route to these stations. These plants can increase the coal import quantities through port arrangements. NTPC can switch its coal imports with domestic linkages providing coal to TANGECO. Approximately between ` 4,500 crore to ` 6,000 crore logistics cost can be saved through these proposals of coal linkage rationalization and swapping arrangements. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Shale veteran takes on Argentina’s $6 bn shortfall

December 16, 2014. Argentina is depending on two things to reverse a three-year energy shortfall that’s costing $6 billion a year: a shale formation bigger than Massachusetts and Miguel Galuccio, who has worked on drilling operations from North Dakota to Poland and India. President Cristina Fernandez de Kirchner appointed Galuccio chief executive officer of YPF SA in 2012 after she seized control from Spain’s Repsol SA. Since then, Galuccio has tripled investment in the state-run oil company in an effort to reverse a decline in output that’s led to crippling energy shortages and drove Argentina’s energy imports to record highs. As oil plunges through $60 a barrel for the first time in five years and producers revise their spending, Galuccio is sticking with a strategy for the Vaca Muerta shale formation that relies on foreign partners with a long-term view. His $16 billion Loma Campana venture with Chevron Corp. is Argentina’s second-largest producer and YPF announced a $550 million partnership with Malaysia’s Petrolian Nasional Bhd. (www.bloomberg.com)

Total delays Bulgaria exploration citing oil price tumble

December 16, 2014. Drilling for oil and gas at an exploration block off Bulgaria's Black Sea coast will be delayed by at least six months until early 2016 following the fall in global oil prices, French oil firm Total said. Total, operator of the offshore 1-21 Han Asparuh block, has cancelled tenders for drilling services in a decision agreed with its partners in the block, Austria's OMV and Spain's Repsol. The tenders are likely to be reopened in the first quarter of 2015 with a view to the first drilling starting in the first quarter of 2016, Total said. The initial drilling date for two exploration wells was the middle of 2015. The drilling of a deep water well is estimated to cost about € 300 million ($376 million). (www.rigzone.com)

Australia's Woodside postpones decision on Browse LNG project

December 16, 2014. Woodside Petroleum Ltd said it was postponing an investment decision on whether to proceed with development of the Browse floating liquefied natural gas (LNG) project off the coast of Australia due to low oil prices. Australia's top oil and gas producer had expected to make a final investment decision on the joint venture project, estimated by analysts to cost up to $40 billion, in mid 2015 but it has now postponed that decision to mid 2016.

Woodside pulled plans to build processing facilities onshore, opting to study a cheaper floating facility concept using partner Royal Dutch Shell's Prelude FLNG plant as a model. Woodside, which competes with companies like Anadarko Petroleum, BG, ConocoPhillips and Norway's Statoil, is also making a push into exploration, hunting in unexplored basins and building up oil reserves to balance its strong gas reserves. (www.rigzone.com)

Petrobras said to cut exploration spending in cash crunch

December 16, 2014. Petroleo Brasileiro SA, the biggest oil producer in ultra-deep waters, is curbing refining and exploration spending in response to the collapse in prices and difficulties tapping debt markets during a corruption probe. The state-run oil company known as Petrobras plans to freeze investments in the Premium I and Premium II refineries in northeastern Brazil and sell assets to protect its cash position. The exploration cuts will focus on projects that are behind schedule.

Petrobras plans to review its fuel-price strategy and curb operating expenses to preserve cash, which stood at 62.5 billion reais ($23 billion) at the end of September. The price of crude oil plunged through $60 a barrel for the first time in five years amid a supply glut. While Petrobras is looking to contain spending in Brazil, it’s delaying a planned exit from Argentina’s petrochemical business as the graft case in Brazil slows signing of new contracts. (www.bloomberg.com)

Technip abandons plan to take over seismic surveyor CGG

December 15, 2014. Technip SA, Europe’s largest oil engineer, plans to expand the range of service it offers energy companies after a bid to buy French seismic surveyor CGG SA failed. The Paris-based company said that it doesn’t intend to make an offer for CGG. The end of talks with CGG won’t deter Technip from expanding into seismic surveying of oil and natural gas reservoirs, either through internal growth, acquisitions or alliances, Technip Chief Executive Officer Thierry Pilenko said. Technip’s bid for CGG is “sensitive” for the French economy, and the government is watching the potential deal closely, Economy Minister Emmanuel Macron said. Alternative scenarios being considered would have given Technip access to the business of studying images of oil and gas reserves, while allowing CGG to “keep its identity,” Pilenko said. The two companies don’t have overlapping businesses. CGG uses seismic equipment to uncover and determine the size of oil and gas reservoirs, helping explorers to improve their chances of making discoveries. Technip makes pipes and builds infrastructure including platforms and refineries. (www.bloomberg.com)

Israel's offshore Royee gas field may hold 3.2 Tcf