-

CENTRES

Progammes & Centres

Location

[2015: It will be different for energy]

“It is likely that businesses and the Government are not passing on the benefits of low oil prices to consumers because they know that these prices are unsustainable in the longer term. They are probably aware that the fundamentals of oil extraction have not changed. Low oil prices are definitely not the result of the return to the era cheap easy to extract oil…”

Energy News

[GOOD]

Rationalising coal supply through swap arrangements will improve coal availability!

Cash subsidy scheme for LPG may be the World’s biggest but that does not make it the World’s best!

[UGLY]

Natural gas price formulae set by the bureaucracy is no match for price set by the market - with or without caps!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· 2015: It will be different for energy

ANALYSIS / ISSUES…………

· Review of India’s Forest and Environment Related Laws - A Glance at MoEF&CC HLC Report

DATA INSIGHT………………

· Installed Thermal Power Capacity & Fly Ash

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn-ONGC moots $700 mn proposal to drill Barmer gas

· L&T Hydrocarbon bags ` 8.9 bn offshore contract from ONGC

· RIL, BP, Hardy Oil give up gas block in KG basin

Downstream……………………………

· Oil firms face ` 100 bn inventory loss, depreciating rupee

· India refiners boom amid oil bust as investors eye risks

· IOC to start land acquisition for expansion of Gujarat facility

Transportation / Trade………………

· Diesel worth lakhs stolen from pipeline in Mathura

· RIL signs shipping deal with Japan's Mitsui

Policy / Performance…………………

· Cap in gas pricing formula in the works to combat global volatility

· Oil Minister hails quick registration of DBTL in Odisha

· India's oil consumption rises 4.9 per cent in November

· Centre to provide subsidy to BPL families for new LPG connections

· Modi govt set to lure investors to O&G rich North-East

· Cash subsidy on LPG world's largest direct benefit transfer scheme

· Govt may give ONGC, RIL disputed gas sites to develop

· Get mini LPG cylinders at petrol pumps, grocery stores soon

· Petrol prices to be hiked in Goa

[NATIONAL: POWER]

Generation………………

· KNPP first unit to start commercial operation

· AP to add about 16 GW capacity in five yrs

· Govt to set up new power plant in Yamunanagar: Haryana CM

Transmission / Distribution / Trade……

· ` 31.9 bn for power transmission in Arunachal

· Punjab power utility plans to use imported coal

· CIL arm BCCL plans to allocate accumulated coal to power consumers

· States face power deficit as Power Grid delays transmission lines

· BSES plans to launch mobile app for power supply transparency

Policy / Performance…………………

· Govt may allow power companies to swap coal supplies with nearest fuel source

· Give coal to EUPs linked to cancelled mines: Panel

· TN govt opposes allotment of KNPP power to Telangana

· Dabhol Management, Maharashtra oppose plan to sell LNG terminal

· India to complete process of placing nuclear power reactors under IAEA safeguards

· Govt invites bids for 24 coal mines

· Competition in power sector will help rationalise tariff: FM

· TN electricity demand set to grow by 20 per cent in 2014-15

· Power Minister may cut short the term of power regulators

· Peak power deficit lowers slightly to 3.7 per cent in November: CEA

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Oil rigs in US drop by 37 to lowest level since April

· Iran earmarks $15.2 bn for joint oilfields

· PPL finds gas, condensate at Faiz X-1 well in Gambat South Block in Sindh

· Sinopec starts pumping gas from Sichuan's Yuanba field

· BP said in talks for share in Rosneft East Siberia oil producer

· Oil drillers are under pressure to scrap rigs to cope with downturn

Downstream……………………

· Vietnam cuts refinery capacity to 8.5 mn tonnes in upgrade

· Cheap oil bonanza eludes overextended Chinese refiners

Transportation / Trade…………

· Guard of Libyan oil ports calls in strikes on Islamist militias

· Canadian oil surge to US Gulf puts Mexico on defensive

· BG loads first cargo of LNG from the QCLNG project in Australia

· Thai PTT plans to invest nearly $10 bn during 2015-2019

· BP says US shale boom is making energy trading more global

· Cheap oil is dragging down the price of gold

Policy / Performance………………

· Russia said to mull cash-for-clunker oil-rig plan to cut imports

· Oil’s slump gives Nigeria chance to end $7 bn subsidy

· Iraq cabinet approves lower spending plan on oil’s drop

[INTERNATIONAL: POWER]

Generation…………………

· Rostov nuclear power plant third unit starts producing electricity

· Malaysia's Janakuasa, Vietnam reach deal on 1.2 GW power plant

· Serbia's Kostolac power plant delays restart of 348 MW unit again

Transmission / Distribution / Trade……

· Increasing power import of Hydropower rich Bhutan is a concern for India

Policy / Performance………………

· Beijing plans to resume nuclear power projects

· Russia to build first nuclear power plant in Jordan

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· SJVN, Hindustan Salt to set up renewable energy plants in Gujarat

· 122 solar powered pumps installed in Koraput district

· Hindustan Powerprojects to invest ` 120 bn in renewable power projects

· NDMC plans to meet its power needs from waste

· OIL commissions 5 MW solar power plant in Rajasthan

GLOBAL………………

· United Photovoltaics sells convertible bonds to Ping An venture

· Enel Green connects two new solar farms to Chilean grid

· China forms $32 bn energy company to help clean up Beijing

· Germany to loan Morocco $796 mn for solar thermal projects

[WEEK IN REVIEW]

COMMENTS………………

2015: It will be different for energy

Lydia Powell, Observer Research Foundation

2015 is likely to be very different for energy. What exactly will be different and for whom is difficult to articulate precisely. But there is a big clue in the price of oil and its impact on global economies. If the collapse of oil prices is the straightforward consequence of the geo-political game between OPEC and the United States then oil prices are likely to return to their upward trend. In this case the usual lament over high oil prices, growing subsidies and widening fiscal deficit could be expected in India. However if the fall in oil prices is the result of a more fundamental change in global economy, then the consequences would not be straightforward for India.

There is a belief that the collapse in oil prices is bad news for oil revenue dependent oil exporting countries but good news for oil importing countries such as India. In the very short term this is true. Low oil prices have enabled India to reduce subsidies on petroleum products. Low oil prices have also contributed to keeping inflation under control. But in the longer term the benefits of low oil prices are unlikely to be positive. To begin with, the benefits of low oil prices to consumers are likely to be less than the adverse impact of high oil prices. When oil prices rose in 2014, businesses added surcharges to their prices almost overnight. They are yet to pass on the benefits of low oil prices by way of discounts and rebates. Business will keep profits to themselves as long as it is possible to do so. For its part, the Government has already claimed a share of the benefits by increasing its tax take from petroleum products.

It is likely that businesses and the Government are not passing on the benefits of low oil prices to consumers because they know that these prices are unsustainable in the longer term. They are probably aware that the fundamentals of oil extraction have not changed. Low oil prices are definitely not the result of the return to the era cheap easy to extract oil. Oil available now is expensive and it is difficult to extract. If so, then why are current oil prices not reflecting this reality?

No one knows the answer yet but according to some observers it is because the World is beginning to see the limits to growth. For a very long time the price of commodities including oil has been close to the cost of production, at least for the marginal producer. Now the price of commodities is close to what consumers can afford. This is not necessarily a good thing. As long as oil prices remain low, much of this difficult to extract oil will be left in the ground. This development is not what one would have expected going by the general expectations for the future of energy. It was generally believed that once half the World’s oil is extracted, the remaining oil would be extracted much more slowly and at greater cost because of geological reasons. The higher cost of oil extraction would lead to development of substitutes. People would demand less oil because substitutes are available at lower cost. This would have been a happy situation because demand for oil would have run out before oil ran out.

This is not what is happening now. People are demanding less oil not because substitutes are available but because their wages have not increased sufficiently to purchase more oil (or other forms of energy). High cost oil producers such as tight oil producers in the United States are not drilling as much as they used to before the crash in oil prices despite claims to the contrary. Reuters news indicates that new permits for drilling in the USA fell by 40% in November 2014. Transocean, the owner of the world’s largest fleet of deep sea drilling rigs is reported to have taken a charge of over $ 2 billion on account of a drilling rig glut. As drilling rates fall, cash flow will slow down for shale and tight oil drillers. This in turn will lead to debt default. The consequences of these debt defaults could be transmitted to the rest of the world through the interconnected banking system. Faltering debt could be a sign of the difficulty in the World’s ability to borrow from the future. If the World cannot borrow from the future, it can only mean that the World economy is beginning to shrink rather than grow. India cannot claim to be an exception to this trend and no macho leader can do anything about it.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Review of India’s Forest and Environment Related Laws - A Glance at MoEF&CC HLC Report

K K Roy Chowdhury, Energy & Environment Expert, Delhi

1. The Ministry of Environment, Forests & Climate Change (MoEF&CC) administers a number of statues enacted by the Parliament. These statues inter-alia include the following:

1.1. Environment (Protection) Act, 1986 (EP Act)

1.2. Forest (Conservation) Act, 1980 (FC Act)

1.3. Wildlife (Protection) Act, 1972 (WLP Act)

1.4. The Water (Prevention and Control of Pollution) Act, 1974 (Water Act)

1.5. The Air (Prevention and Control of Pollution) Act, 1981 (Air Act).

Based on experience gained in the implementation of aforesaid Acts, MoEF&CC decided and constituted a High Level Committee (HLC) under the Chairmanship of Shri T S R Subramanian, Former Cabinet Secretary, to review these Acts and suggest appropriate amendments to bring them in line with their objectives. The MoEF&CC Office Order in this regard was issued on 29th August 2014. The HLC was asked to submit its report to the Ministry within two months. In partial modification of this Order, the Ministry through its Office Order of 18th September 2014, included The Indian Forests Act, 1927 (IF Act) into the Terms of Reference of the HLC. Further, the tenure of the HLC was extended for a further period of one month i.e. from 29th October 2014 to 28th November 2014.

2. It is understood that the aforesaid High Level Committee, in course of their work, also conducted several public consultations with NGOs, environmental activists, industry associations, and others, and invited suggestions from different stakeholders. Subsequently, the Committee submitted its Report on Forest and Environment Related Laws to MoEF&CC in November 2014. The summary of recommendations of the High Level Committee is briefly reproduced below.

3. Summary of Recommendations of the High Level Committee

3.1. It is suggested to identify and pre-specify ‘no go’ forest areas, mainly comprising PAs and forest cover over 70% canopy.

3.2. It is suggested that the Ministry may define the term ‘forest’ at an early date.

3.3. It is suggested to offer economic incentives for increased community participation in farm and social forestry by way of promoting and proving statutory safeguards to ‘treelands’ as distinct from ‘forest’.

3.4. It is suggested that plantation of approved species on private lands could be considered for compensatory afforestation with facility for ‘treeland’ trading.

3.5. It is suggested to revise procedure for clearance under FC Act as above, which is intended to reduce the time taken, without compromising the quality of examination. For linear projects, it is recommended that FR Act needs amendment to consider removal of thecondition of Gram Sabha approval.

3.6. It is suggested that Compensatory Afforestation guidelines be revised; CA (compensatory afforestation) on revenue land to be enhanced to 2:1 as against 1:1 at present; CA in degraded forest land be now fixed at 3:1; the NPV (net present value) should be at least 5 times the present rates fixed. An appropriate mechanism to be created to ensure receipt of the CA funds, and their proper utilisation, delinking the project proponent from the CA process, after he obtains other approvals, and discharges his CA financial obligations.

3.7. It is suggested that the quantum of NPV for compensatory afforestation needs to be sharply increased. A reliable mechanism for ensuring that CA is actually implemented, utilising either private or forest land, needs to be put in place.

3.8. It is suggested that Schedule 1 be amended to include species likely to be threatened by illegal trade. An expert group should review the existing schedules and address discrepancies relating to several species and sub species.

3.9. With regard to the issue of tackling damage to agriculture and farmland by amendments in Schedule 3, it is suggested that the MoEF&CC may issue circulars to all States apprising them of the legal position, suggesting that they may take appropriate action based on legal provisions.

3.10. It is suggested that preparation of Wildlife Management Plans be made mandatory and a provision to this effect inserted in the WLP Act.

3.11. It is suggested that Section 26A sub section (3) and section 35(5) be amended so that permission from the Central Government would only be necessary when the State Government proposes to reduce the boundaries of an existing PA (protected area).

3.12. It is suggested that manufacture and possession of leg and mouth traps be completely prohibited, except where they are required for visual display for educational purposes.

3.13. It is suggested that officers entrusted with the task of settlement be given minimum tenure of 2 years. Regular review of such work should be done to ensure completion within time.

3.14. It is recommended that ‘expert’ status may be given to the forensic facility of WII (Wildlife Institute of India), after suitably strengthening it.

3.15. It is recommended that Section 50 and 55 of the WLP Act may suitably provide for adequate and purposeful delegation appropriate for faster and better prosecution in respect of a wildlife crime.

3.16. It is suggested that officers of the Wildlife Crime Control Bureau under the MOEF&CC are authorised to file complaints in Courts.

3.17. It is suggested that polythene bags and plastic bottles be added to the banned list in Section 32.

3.18. It is recommended that MoEF&CC to take immediate steps for demarcation of eco-sensitive zones around all the protected areas; States may be asked to send proposals in a time-bound manner.

3.19. It is recommended that powers to approve applications for bona fide observational research, through photography, including videography may be delegated to the level of Park Director, after verifying the credentials.

3.20. It is recommended that the Schedules provide appropriate provision for taking into account the needs of local festivals, subject to no harm or injury to animals.

3.21. It is proposed to revamp this project clearance/ approval process.

3.22. It is proposed to create a National Environment Management Authority (NEMA) at the Central and State Environment Management Authority (SEMA) at the State level as full time processing / clearance / monitoring agencies.

3.23. The committee has proposed the following:

3.23.1. Composition, functions and responsibilities of NEMA.

3.23.2. Composition, functions and responsibilities of SEMA.

3.24. It is proposed that the revised project approval process envisages ‘single-window’ unified, streamlined, purposeful, time-bound procedures.

3.25. It is proposed that special treatment is offered to linear projects, power/ mining and strategic border projects.

3.26. It is suggested to review of A/B category units, to delegate a large number brought under the purview of SEMA.

3.27. It is suggested to strengthen the present monitoring processes, exclusively based on physical inspection by induction of technology, measuring instruments incorporating latest improvements; the standard setting and verification systems be tightened to ensure all violators are identified.

3.28. It is suggested to:

3.28.1. Create a new ‘umbrella’ law – Environmental laws (Management) Act (ELMA) –to enable creation of the institutions NEMA and SEMA.

3.28.2. Induct the concept of ‘utmost good-faith’, holding the project proponent responsible for his statements at the cost of possible adverse consequences; thus also contributing to reduction in ‘inspector raj’.

3.29. It is suggested that the new law prescribes new offences, as also for establishing special courts presided over by session judge. ‘Serious offences’ as defined to attract heavy penalties, including prosecution/ arrest.

3.30. It is suggested that the central and State Pollution Control Boards be superseded by NEMA/SEMA.

3.31. It is recommended that noise pollution be incorporated as an offence in EP Act.

3.32. It is suggested that the procedure for appeals is created through the creation of an appellate tribunal.

3.33. It is suggested that the role for NGT (National Green Tribunal) is reviewed judicially.

3.34. It is suggested to

3.34.1. Establish a National Environment Research Institute, through an Act of Parliament.– SEMA

3.34.2. Identify specific technical institutions/ universities in India to act as technical advisors to the proposed NEMA/ SEMA and other environmental enforcement agencies, to provide credible technical back-stopping for management of the environment.

3.35. It is suggested that an Indian Environment Service may be created, as an All India Service, based on qualifications and other details prescribed by MoEF&CC/ DoPT/ UPSC.

3.36. It is suggested that the Indian Forest Service may encourage specialisation in various aspects of forestry and wildlife management, among the members of the service, as well as familiarity with all aspects of management of environment.

3.37. It is suggested that the MoEF&CC undertake a comprehensive review of departmental forest management policies, practices and procedures, to initiate wide-ranging improvements and reforms. This preferably should not be an internal exercise, and should include independent knowledgeable experts from India and abroad, as well as qualified researchers.

3.38. It is recommended that the MoEF&CC consolidate all existing EIA Notifications/circulars/ instructions into one comprehensive set of instructions. Amendments or additions may normally be done only once a year.

3.39. It is suggested that the MoEF&CC arrange to revamp the Environment Protection Act, by inducting relevant provisions of the Water Act, 1977 and the Air Act, 1981; the latter two could be repealed, when the revamped EP Act, 1986 comes into force. This exercise may be done keeping in view the provisions of the proposed Environment Management Act.

3.40. It is suggested to create an Environment Reconstruction Fund for facilitating research, standard setting, education and related matters.

3.41. In the light of the fact that though overall responsibility vests with the Ministry, State Governments and the local bodies play an effective role in management of the environment, it is suggested that Governments should provide dedicated budgetary support for environmental programmes as a part of each development project in all the sectors.

3.42. It is suggested that a comprehensive database be created using all instruments available, on an on-going basis, in respect of all parameters relating to environment.

3.43. It is suggested that environmental mapping of the country is undertaken, using technology as an on-going process.

3.44. It is suggested that identification & recovery of environmental reconstruction cost relating to each potentially polluting unit be in-built in the appraisal process.

3.45. It is recommended that the system of empanelment of ‘consultants’ is reworked.

3.46. It is recommended that a ‘green awareness’ programme is sponsored, including interweaving issues relating to environment in the primary and secondary school curriculum.

3.47. It is recommended that the MoEF&CC prepare a regional plan for carrying out remediation of polluted sites in consultation with the State Governments and incorporate enabling provisions in the EP Act for financing the remediation task.

3.48. It is recommended that the Municipal Solid Waste (MSW) management is given requisite attention hitherto. New systems and procedures for handling MSW need to be put in place early for effective management of MSW and with accountability. Cities should set a target of reaching 20% of current levels in 3 years time to work out a mitigation plan.

3.49. In the light of the fact that vehicle emissions are the major cause of deterioration of air quality in urban areas, it is recommended that a concerted multi-pronged effort is launched to not only to contain it, but to improve the situation in relatively short time.

3.50. It is recommended that the use of science and technology is encouraged wherever possible and appropriate; approval and enforcement agency should use latest technology to the maximum possible.

3.51. The MoEF&CC may finalise the CRZ demarcation, and bring it into public domain to pre-empt ambiguity.

3.52. In view of the key role played by the power sector, as also mining of various minerals in national development, NEMA may have a suitable cell, with specialisation, to speedily deal with environmental approvals in these sectors, with due regard to environmental considerations.

3.53. It is recommended that all specified type of units employ fully qualified technical personnel to manage their pollution control/ management equipment, and to keep the emission levels within prescribed limits.

3.54. It is suggested that the MoEF&CC consider reworking standard-setting and revising a system of financial penalties and rewards to proceed to a market-related incentive system, which encourages ‘green projects’.

4. It is now reported that the government will bring a bill in the budget session of Parliament to amend the five environmental laws - Environment Protection Act, Forest Conservation Act, Water Act, Air Act and Indian Forest Act, to minimize judicial intervention on such issues. Hon’ble Environment Minister (Independent Charge), Mr. Prakash Javadekar, is reported to have said now that the Centre will bring key changes in five green laws in the next session of Parliament. “We should expect a new green regime in 2015”, Minister is reported to have observed, without specifying what would the changes be in the environmental laws.

He aforesaid HAC has felt environmental regulation was driven too much by judicial intervention which was not desirable. It is learned that most of the changes proposed are on the lines of Subramanian Committee recommendations. Also government is going to use satellite for environmental purpose including emissions and monitoring forest areas.

Views are those of the author

Author can be contacted at [email protected]

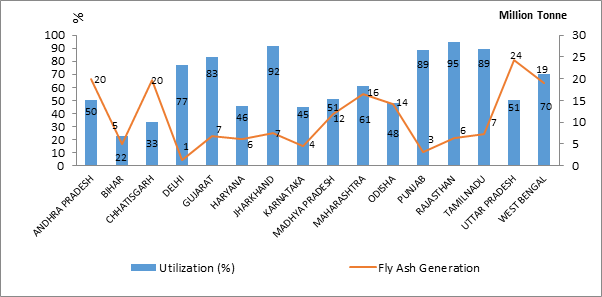

DATA INSIGHT……………

Installed Thermal Power Capacity & Fly Ash

Akhilesh Sati, Observer Research Foundation

|

STATE |

No. |

Installed Thermal Capacity (MW) (during 2013 -2014) |

Total Coal Consumption (during 2013-14) |

Total Fly Ash Generation (during 2013-14) |

|

ANDHRA PRADESH |

11 |

10442.5 |

523.52 Million Tonne |

172.87 Million Tonne |

|

BIHAR |

3 |

2780 |

||

|

CHHATISGARH |

14 |

10973 |

||

|

DELHI |

2 |

840 |

||

|

GUJARAT |

11 |

14712 |

||

|

HARYANA |

5 |

5987.8 |

||

|

JHARKHAND |

8 |

5347.5 |

||

|

KARNATAKA |

4 |

4780 |

||

|

MADHYA PRADESH |

6 |

9142.5 |

||

|

MAHARASHTRA |

19 |

16696 |

||

|

ODISHA |

7 |

8788 |

||

|

PUNJAB |

3 |

2630 |

||

|

RAJASTHAN |

7 |

6390 |

||

|

TAMILNADU |

11 |

7450 |

||

|

UTTAR PRADESH |

16 |

14804 |

||

|

WEST BENGAL |

16 |

11618 |

||

|

TOTAL |

143 |

133381.3 |

State wise Fly Ash Generation & Utilisation by TPS* during 2013-14

*Coal & Lignite Based Thermal Power Stations

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn-ONGC moots $700 mn proposal to drill Barmer gas

December 29, 2014. Private explorer Cairn India, along with its joint venture partner, state-run ONGC, has put forward a $700 million plan to develop and produce gas reserves at the Raageshwari fields in the prolific Barmer block in Rajasthan. The Management Committee, comprising petroleum ministry, Directorate General of Hydrocarbons (DGH) and the explorers that oversees operations of the block, is likely to discuss the proposal. This assumes significance as volumes of commercially produced gas from the block would determine whether Cairn India gets a renewed lease for the asset for 10 or five years. So far, the DGH has held the view that Barmer is primarily oil producing and, hence, contract can be extended only for five years. Cairn India’s contract for the Barmer block in Rajasthan – RJ-ON-90/1 – is valid till May 14, 2020. The Anil Agarwal-promoted explorer wanted the contract to be extended till oil flows or at least by another 10 years till 2030. Of the $700-million programme, nearly $245 million would be spent for drilling 35-37 wells and another $315 million will be utilised for setting up surface facilities. Recently, the ONGC, which holds 30% stake in the block, approved the proposal to develop Raageshwari Deep Gas field.

The gas output from Raageshwari fields in the Barmer block is pegged to go up to 2.80 million metric standard cubic meters per day (mmscmd) by 2017 from nearly 0.25 mmscmd now. It is yet to be seen whether the latest field development plan (FDP), to be approved by Management Committee, would qualify the block to get a 10-year extension based on gas potential. The Barmer block in Rajasthan, the biggest onshore crude oil fields contributing nearly 25% of country’s production, touched the peak output of 200,000 barrels of oil per day (bopd) in FY14 but has gradually dropped from the high levels. (www.financialexpress.com)

L&T Hydrocarbon bags ` 8.9 bn offshore contract from ONGC

December 29, 2014. Larsen & Toubro (L&T) said it has bagged an offshore contract worth ` 894 crore from Oil & Natural Gas Corporation (ONGC) for additional development of the Vasai East project. The company's fully owned subsidiary L&T Hydrocarbon Engineering (LTHE) has bagged the contract on complete turnkey basis from ONGC to improve recovery factor of Vasai East field where production started in 2008, and it is scheduled to be completed by April 2016. The ` 2,500 crore project will result in incremental oil production of 1.83 million metric tonne and incremental gas production of 1.971 billion cubic metres by 2030. (economictimes.indiatimes.com)

RIL, BP, Hardy Oil give up gas block in KG basin

December 25, 2014. Reliance Industries Ltd (RIL), along with partners BP and Hardy Oil, has surrendered its discovered gas block KG-D3 in the Krishna-Godavari (KG) basin due to operational restrictions placed by the defence ministry. The basin is estimated to contain 500 billion cubic feet of in-place gas reserves. Hardy Oil, the consortium partner, cited the uncertainty over long-term natural gas pricing in India as one of the other reasons for the decision as well as the government-imposed gas price being lower than expected. The consortium led by RIL is expected to write down about ` 1,400 crore invested in the block so far and the relinquishment of the block will release them from any further work programme liability, including any further financial liability related to unfinished minimum work programme penalties.

Hardy said that the access restrictions imposed in 2012 covered more than a third of the block, affecting exploration, development and production. Reliance has a 60 per cent stake in the D3 block in the KG basin off India's east coast. BP has a 30 per cent stake and Hardy Oil owns the remaining 10 per cent. (economictimes.indiatimes.com)

Downstream………….

Oil firms face ` 100 bn inventory loss, depreciating rupee

December 30, 2014. Indian Oil Corp (IOC) and other state-run fuel retailers have piled up inventory loss of over ` 10,000 crore which together with depreciating rupee has severely strained their finances ahead of a revision in petrol and diesel prices. IOC along with Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) are to decide on revising petrol and diesel prices, amidst clamour for a rate cut on falling crude oil prices. The firms, however, rue that petrol and diesel prices are not set based on trends in crude oil prices. They are benchmarked against internationally traded rates of gasoline (for petrol) and gas oil (for diesel) as well as rupee-dollar exchange rate. (economictimes.indiatimes.com)

India refiners boom amid oil bust as investors eye risks

December 29, 2014. Oil’s slump has almost doubled the value of India’s big, state-owned refiners, outpacing the rest of the industry from China to the U.S. The companies had been forced to make a large proportion of sales at below cost for over a decade. Now, they can profit from fuels after India’s new government saw its opportunity in falling oil prices to deregulate the market without bothering its inflation targets. OPEC’s decision to sit on its hands in the face of an oil glut has only accelerated share gains. India’s big three state refiners -- Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp -- are up 53 percent, 84 percent and 131 percent respectively over the year to Dec. 24. Hindustan Petroleum is the best performing oil stock in the world. For comparison, Asia’s biggest refiner, China Petroleum & Chemical Corp, is down 1.4 percent, while the largest U.S. processor, Phillips 66, has lost 6.5 percent. Whether India’s refiners can maintain their tear will depend on the constancy of politicians and markets. In the meantime, there’s a new-found freedom to make money. India’s refiners have to mostly import their oil to turn it into petroleum products. In the case of diesel, which accounts for almost half the fuels consumed in India, the selling price was below the cost of production to deliver on a government mandate to keep energy cheap and inflation low. That changed in October, when the government ended price controls. The companies continue to sell cooking fuels such as kerosene and liquefied petroleum gas below cost, in a country where about a third of its 1.2 billion citizens live on only a few dollars a day. The global refining industry has done better from oil’s slump than other energy businesses because of lower input costs. It’s a different story if you drill for oil. Russia’s OAO Rosneft, the world’s biggest publicly traded oil producer, has lost about half its value this year in London trading. Exxon Mobil Corp, the world’s largest oil company by market capitalization, is down about 7.3 percent. Since June, when oil began to slide, analysts covering India’s refiners have become more bullish. Indian Oil and Hindustan Petroleum’s average ratings are either at or near the year’s highs. (www.bloomberg.com)

IOC to start land acquisition for expansion of Gujarat facility

December 26, 2014. The Gujarat refinery of Indian Oil Corp Ltd (IOC) will start the process of land acquisition for its proposed ` 6,800 crore capacity expansion project, the company has said. IOC said the process will start and they have received directives from the Gujarat government to purchase private land. The refiner will invest ` 5,000 crore to increase its overall capacity to 18 million tonnes from the present 13.7 million tonnes and ` 1,800 crore to make the end product compliant with the low-sulphur Bharat Stage norms. The refinery, located at Koyali on the outskirts of the city, is spread across 1,950 acres, which includes its Asoj and Dumad terminal operations. The expansion will lead to improved distillate yield, thereby enabling production of more value added products from the refinery, IOC said. The process of negotiations with land owners to acquire a large chunk of land has started, IOC said. (economictimes.indiatimes.com)

Transportation / Trade…………

Diesel worth lakhs stolen from pipeline in Mathura

December 25, 2014. Diesel worth lakhs of rupees was stolen from a Mathura oil refinery pipeline, police said. The incident took place, when thieves stole diesel from a Bharat Petroleum Corp Ltd (BPCL) pipeline after drilling a two-inch hole and using a valve in Chainpura village, police said. The supply to the pipeline was restored after sealing the orifice, police said. A complaint filed in this connection by BPCL at Chata police station, police said. (economictimes.indiatimes.com)

RIL signs shipping deal with Japan's Mitsui

December 25, 2014. Reliance Industries Ltd (RIL) said it has signed a long-term agreement with Japan's biggest shipping company Mitsui OSK Lines for transportation of liquefied ethane from North America to India. Mitsui will manage six very large ethane carriers (ships) that the Indian conglomerate is building at Samsung Heavy Industries. It will supervise the construction of 87,000 cubic meter ships and upon vessel delivery, manage the ships. Mitsui said the very large ethane carriers (VLECs), being built by Samsung, are expected to be delivered in the last quarter of 2016. Neither of the companies disclosed the value of the deal. Ethane, a natural gas component, is expected to be produced in large volumes in North America due to the shale gas revolution, which has generated an abundance of liquefied natural gas (LNG) and cooking gas LPG. Ethane is primarily used as a petrochemical feedstock to produce ethylene by steam cracking. RIL plans to ship 1.5 million tonnes a year of ethane from its US shale joint ventures to its chemical complex in Gujarat. (economictimes.indiatimes.com)

Policy / Performance………

Cap in gas pricing formula in the works to combat global volatility

December 30, 2014. The government is examining a proposal to tweak the newly approved gas price formula to bring in a cap with the aim of protecting consumers from volatility in the international market. Under a formula approved by the cabinet on October 18, the prevailing domestic rate is aligned with global benchmarks. As a result the price of gas, which was set at $5.61 per unit from November 1 this year, was potentially liable to change every six months. According a recent Cabinet decision, the Directorate General of Hydrocarbons (DGH) will examine the concept of a cap in the recently approved price formula under which domestic gas price was set at $5.61 per unit. The gas pricing mechanism approved by the cabinet in October was based on the recommendations of a committee of secretaries (CoS), which had also proposed a cap on the price, the government said. CoS had asked the Cabinet to consider a cap, as gas consumers had sought introduction of a ceiling. Officials from the oil and gas disputed this logic. Several members of Association of Oil & Gas Operators (AOGO) said India's pricing policy discourages natural gas production. (economictimes.indiatimes.com)

Oil Minister hails quick registration of DBTL in Odisha

December 29, 2014. Expressing satisfaction at quick registration of Direct Benefit Transfer of LPG (DBTL) in Odisha, Oil and Natural Gas Minister Dharmendra Pradhan said he was optimistic about seeing all LPG consumers in the state getting the benefits of subsidy by the end of January. Though the pace of registration of DBTL in Odisha was not very encouraging barely 20 days ago, it has picked up and reached the level of national average, Pradhan said. Pradhan visited Keonjhar and Balasore districts during the day. Ahead of the country-wide launch of DBTL scheme from January 1, 2015, Pradhan said the number of subsidised gas consumers was gradually increasing. The deadline for the implementation of DBTL scheme across the country is March 31 next year. (economictimes.indiatimes.com)

India's oil consumption rises 4.9 per cent in November

December 29, 2014. With oil prices slumping to five-year low, India's fuel consumption has risen by 4.9 per cent in November on back of a sharp recovery in diesel sales. Fuel consumption in November rose 4.9 per cent to 13.9 million tonnes from 13.3 million tonnes in the same period a year ago, according to latest data available from the Oil Ministry. Diesel, the most consumed fuel in the country, saw a sharp recovery with sales rising 3 per cent to 6.002 million tonnes. The rise was in contrast to drop in consumption in the previous two months. Fuel consumption this fiscal has risen by 3.88 million tonnes or 3.7 per cent to 108 million tonnes. International oil prices have fallen 46 per cent this year, the biggest annual drop since 2008, as oil cartel OPEC resisted supply cuts to defend market share even as production in the US climbed to the highest level in three decades amid a shale boom. Brent crude, a pricing benchmark for more than half of the world's oil, is trading around USD 60 per barrel. With retail prices been successively cut since August, petrol consumption has been on rise - it grew by 3.6 per cent to 1.5 million tonnes in November and by 9.5 per cent in April-November to 12.5 million tonnes. Diesel, which makes up for 43 per cent of all petroleum products consumed in the country, saw sales rise by 1 per cent in April-November to 45.8 million tonnes. LPG consumption rose 14.5 per cent to 1.57 million tonnes in November and by 10.4 per cent to 11.6 million tonnes in first eight months of current fiscal that began in April. With domestic output stagnant at 3.1 million tonnes, India imported 3 per cent more crude oil in November at 15 million tonnes. However, in value terms the imports cost USD 8.8 billion, down from USD 11.2 billion in November 2013. India had paid USD 142.9 billion for oil imports in 2013-14 fiscal. Imports in first eight months cost USD 89.3 billion, down from 95.4 billion in April-November 2013. Crude oil imports this fiscal have been marginally lower at 125.7 million tonnes as compared to 126.9 million tonnes a year ago. (economictimes.indiatimes.com)

Centre to provide subsidy to BPL families for new LPG connections

December 27, 2014. Union Petroleum Minister Dharmendra Pradhan said his ministry would launch a new pilot project providing concession to Below Poverty Line (BPL) families seeking new gas connections in the country. The project to be launched Jan 25, 2015 will provide subsidy of about ` 1,400 on new gas connections to the BPL families up to March. A consumer has to spend ` 2,400 for a new gas connection in the country. The minister has also targeted to bring the gas penetration in Odisha at par with national level. He said every block will have distribution points in the state. (economictimes.indiatimes.com)

Modi govt set to lure investors to O&G rich North-East

December 26, 2014. Prime Minister Narendra Modi's focus on northeast India has prompted the government to engage a global consultant to prepare an incentive package for investors following its decision to extend subsidy on gas supplied by private producers in the region. The subsidy on gas was until now limited to state-run Oil and Natural Gas Corp (ONGC) and Oil India. Besides ONGC and Oil India, companies such as Geopetrol International of France, GAIL India, Hindustan Oil Exploration Company (HOEC) and Jubilant Energy are active players in the north-eastern states. Companies have already found oil and gas in Arunachal Pradesh, Assam, Nagaland, Tripura and Mizoram. The government recently decided to extend subsidy on gas produced by private firms to send a positive signal to global investors, the oil ministry said. In 2010, the government had announced a 113% hike in the price of gas produced from fields awarded without auction to ONGC and Oil India.

Narendra Modi government set to lure investors to oil and gas rich North-East In order to protect customers in the northeast region from the steep hike, the government had decided to bear 40% of the gas price. But this subsidy was not available to customers who bought gas from blocks awarded to public or private explorers through auctions. The Cabinet recently corrected this anomaly, the oil ministry said. The development of the region is the focus of NDA government, the oil ministry said. The Directorate General of Hydrocarbons (DGH) has been directed to appoint a global consultant by January to conduct a study, which aims to have a policy that would encourage exploration and production of oil and gas in the region, the oil ministry said. The oil ministry said the consultant will identify infrastructure gaps and accessibility issues that are essential for exploration in the region. It will also examine needs and means to create common hubs of service providers in the region and resolve issues related to skilled manpower. (economictimes.indiatimes.com)

Cash subsidy on LPG world's largest direct benefit transfer scheme

December 25, 2014. The ambitious scheme of giving cash subsidy on cooking gas directly to consumers has become the world's largest direct benefit transfer with 2.5 crore households getting about ` 550 crore since November 15. The direct benefit transfer on LPG (DBTL), under which cash subsidy is paid to consumers so that they can buy cooking gas at market price, was rolled out in 54 districts from November 15 and will be extended all over the country from January 1. The scheme has surpassed number of beneficiaries in direct benefit transfer programmes in China and Brazil. Oil Minister Dharmendra Pradhan said he has personally reviewed roll out of the scheme in as many as 42 districts so far and will do so in 10 or so before the end of the year. His ministry officials as well as top executives of oil marketing companies have adopted one district each in the country to oversee roll out of the scheme under which consumers have to get their bank accounts seeded with their LPG connection. The moment they join the scheme, oil companies transfer advance cash subsidy in their bank accounts to enable them to buy LPG refills at market rate. Once a consumer takes delivery of the cylinder, another advance cash subsidy is transferred to the bank account.

At present, a subsidised LPG cylinder costs ` 417 per 14.2-kg bottle while its market price is ` 752, the difference being the subsidy component. From January 1, LPG consumers across the country will have to buy cooking gas at market rates. They will get the difference between current subsidised rate and market price for 12 cylinders in a year in cash that will be transferred to their bank accounts. The Direct Benefit Transfer Scheme for LPG, which has now been renamed PAHAL, has been modified to exclude the requirement of unique identification number (Aadhaar) for availing the cash subsidy. Aadhaar is now optional but consumers should have a bank account linked to their LPG connection number. PAHAL or Pratyaksh Hanstantarit Labh has been rolled out in 54 districts from November 15 and will extend to rest of the country from January 1. DBT (direct benefit transfer) is designed to ensure that the subsidy meant for genuine domestic customers reaches them directly and is not diverted. In 54 districts covering 11 states, the scheme covers 2.33 crore households. Currently, the Aadhaar generation level is 95 per cent in these districts. (economictimes.indiatimes.com)

Govt may give ONGC, RIL disputed gas sites to develop

December 25, 2014. The government may soon allow ONGC and Reliance Industries Ltd (RIL) to develop six gas discoveries, which have been unexploited for several years because of disputes over methods to confirm their commercial viability. These discoveries have at least 4 trillion cubic feet (Tcf) by way of reserves, enough to generate 4,000 MW of power for two decades. The oil ministry has prepared a framework for the cabinet to resolve these dispute. The ministry is in favour of allowing contractors to conduct any appropriate test. But in case the contractor gets the assessment wrong, it will be barred from recovering expenditure incurred in developing the field. Testing the commercial viability of a discovery is an important step in the development of oil and gas fields and the contractor's estimates of expenditure and output are based on the test results. The ministry plans to allow ONGC and RIL to develop at least six discoveries in various blocks in the Krishna-Godavari basin. In case of RIL, the discoveries were earlier rejected by the Directorate General of Hydrocarbons (DGH) as the company resisted carrying out a test known as the drill-stem test (DST) to establish that the discoveries are economically viable. DGH said that DST is a must because it is more predictable and precise in estimating oil and gas reserves. Explorers have disputed DGH's stand citing the production sharing contract (PSC), which left selection of testing methods to the technical judgment of the contractor. RIL and ONGC chose a modern and less expensive method, known as the Modular Dynamic Test (MDT) to prove viability of their discoveries. Companies argued that DGH earlier certified dozens of discoveries on the basis of MDT. However in October 2010 after sitting on their proposals for over eight months, DGH insisted on the DST route. In July 2012, RIL agreed to the DST method on the insistence of DGH. But, it missed the timeline for developing the discoveries because of prolonged delays in getting approvals, sources said. RIL's three discoveries are D-29, D-30 and D-31 in the KG-D6 block. A similar exemption will be given to ONGC, which is also in a similar dispute with DGH. Its UD-1 discovery alone holds about 2.8 trillion cubic feet of gas reserves and other two discoveries (D and E) have estimated 587.6 billion cubic feet of gas. The move may also give fresh lease of life to about half-a-dozen more gas discoveries in Reliance's NEC-25 and KGDWN-2003/1 blocks in the east coast. In April this year, former Oil Minister Veerappa Moily had circulated a Cabinet note intended to resolve such disputes. (economictimes.indiatimes.com)

Get mini LPG cylinders at petrol pumps, grocery stores soon

December 25, 2014. In a bid to make cooking gas (LPG) easily available to consumers, 5-kg mini LPG cylinders will now be available at select petrol pumps and neighbourhood grocery stores besides regular gas agencies in almost all major cities. Till now, cooking gas (LPG) was available for domestic use in 14.2-kg cylinders only from gas agencies. Consumers were entitled to 12 such bottles in a year at a subsidised rate of ` 417 in Delhi. Now the subsidised cooking gas will also be available in 5-kg cylinders. Those entitled to subsidised gas can buy 34 bottles of 5-kg each at ` 155 per cylinder in Delhi. While the subsidised 5-kg mini LPG cylinder will be available only at regular LPG distributor, market-priced mini LPG cylinders costing ` 351 can be bought across-the-counter without prior booking and minimal paper work at petrol pumps, gas agencies and select grocery stores.

Oil Minister Dharmendra Pradhan used the 'Good Governance Day' to relaunch the scheme at more outlets across the country. The sale of market-priced mini LPG cylinder, which was launched in March by the then Oil Minister M Veerappa Moily at a handful of petrol pumps that are owned and operated by state run fuel retailers, has now been expanded to other outlets as well as grocery stores. The market-priced LPG was being sold at 610 petrol pumps in major cities and this list has been expanded now. It is available at additional 100 locations in the national capital alone, Pradhan said. Also, the 5-kg subsidised LPG cylinder which is available only in remote and hilly areas, will also be available in cities, he said.

Pradhan said BPL-card holders will get new LPG connection at concessional rate. Earlier the scheme, under which the security deposit of 14.2-kg LPG connection and cost of pressure regulator amounting to ` 1600 was borne by oil companies, was only available for BPL families in rural areas under Rajiv Gandhi Gramin LPG Vitran Yojana. This has now been extended to all households below the poverty line including in urban areas, he said. The cost of connection will be borne by oil companies from their corporate social responsibility (CSR) fund. (economictimes.indiatimes.com)

Petrol prices to be hiked in Goa

December 24, 2014. The BJP-led government announced that the decision to abolish Value Added Tax (VAT) on petrol after coming to power in Goa, would now be reversed. The cost of petrol is lesser than diesel in Goa, which is not fair. The state government will impose five per cent VAT on petrol so that its price is little more than diesel, Chief Minister Laxmikant Parsekar said. He said that petrol prices would be matched with diesel. At present, petrol prices in Goa are the lowest. Petrol per litre is costing ` 53 and diesel ` 55. The imposition of VAT will hike petrol prices to ` 55-56 per litre, Parsekar said. BJP led government after assuming power in the state in 2012 had abolished VAT on petrol as an anti-inflation measure reducing the prices on fuel by almost ` 11 per litre. The decision which was taken by then chief minister Manohar Parrikar was hailed across the country. The CM said that the state treasury had suffered after abolition of VAT on petrol. The VAT imposition is expected to bring in ` 70-75 crore more to the coffers. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

KNPP first unit to start commercial operation

December 30, 2014. The first 1,000 MWe unit of Kudankulam Nuclear Power Project (KNPP) is expected to start its commercial operation at midnight tonight. Though the unit has been running at full capacity of 1,000 MW since last ten days, the commercial operation would get KNPP better tariff from the grid, KNPP Station Director R S Sundar said. Sundar said that continuous generation of power from the unit during the trial period was over, and the Director (Operations), Nuclear Power Corporation of India, had permitted commercial production of power from midnight tonight. In July last year, the first unit attained criticality and has been generating power and connected to the southern grid. (economictimes.indiatimes.com)

AP to add about 16 GW capacity in five yrs

December 26, 2014. Andhra Pradesh (AP) government is planning to add 15,869 MW power generation capacity in the next five years. The state energy department said that this capacity in addition would include thermal power (3,240 MW), central generating stations (1,949 MW), solar (3,150 MW), wind (7,030 MW) and other sources. Chief Minister N Chandrababu Naidu, reviewing the power situation in the state, said that the government was confident of sustaining round the clock power supply and seven-hour supply for agriculture, the department said. Naidu emphasised the need to work out ways to expedite the construction of power projects to meet the increasing demand which is expected to be around 15 per cent, it said. (economictimes.indiatimes.com)

Govt to set up new power plant in Yamunanagar: Haryana CM

December 25, 2014. In a bid to meet the growing demand of electricity in the state, Haryana Chief Minister (CM) Manohar Khattar said that efforts are being made to set up a new power plant at Yamunanagar. A meeting has already been held with the officers of Power department in this regard. The state government has urged the Centre to allot a special coal block keeping in view the growing demand of coal for power generation, he said. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

` 31.9 bn for power transmission in Arunachal

December 30, 2014. The Centre has earmarked an amount of ` 3199.45 crore for Arunachal Pradesh to undertake a comprehensive project for strengthening of power transmission and distribution systems in the state. The ambitious project was approved by the Centre for Arunachal and Sikkim to create reliable state power grid and its connectivity to the upcoming load centres, state BJP President Tai Tagak said. He said a regional research station of Central Institute of Temperate Horticulture in the state had been approved by the Union Agriculture Ministry in the 12th plan expenditure finance committee meeting. (economictimes.indiatimes.com)

Punjab power utility plans to use imported coal

December 30, 2014. Having seen "reduction" in power generation due to short-supply of coal in summer this year, Punjab State Power Corp Ltd (PSPCL) has proposed to use imported coal worth ` 1,552 crore to run its thermal power plants without any "disruption". In its Aggregate Revenue Requirement (ARR) petition submitted with the power regulator PSERC for the fiscal 2015-16, Punjab State Power Corp Ltd (PSPCL) has "considered the option of importing coal" to meet coal requirements of its thermal power units during next financial year 2015-16. PSPCL has pointed out that the "short supplies" of coal by Panem coal mines had caused "depletion in its coal stock" at its plants that led to "decrease" in power generation.

PSPCL has claimed the coal supplier supplied 2.5 rakes on an average per day as against linkage of 5 rakes of coal per day during April 2014 till August 2014. Punjab government had even sought intervention of the Centre for stepping up coal supplies when coal stock of PSPCL plants reached critical stage. PSPCL gets coal supplies from Panem Coal mines sourced from its captive mine Pachwara coal block and also from Central Coalfields Ltd (CCL) for its three thermal plants. (economictimes.indiatimes.com)

CIL arm BCCL plans to allocate accumulated coal to power consumers

December 29, 2014. Coal India Ltd (CIL) arm Bharat Cooking Coal Ltd (BCCL) plans to allocate the piled up dry fuel to power consumers having long-term purchase agreements with distribution companies. The development comes at a time when the country is grappling with coal shortages and as many as 42 thermal power plants are facing significant fuel deficit. A PPA (Power Purchase Agreements) is a contract between two parties, one who generates electricity and one who is looking to purchase electricity. BCCL said that interested power consumers will have to evacuate the coal on their own from the stock till the month-end. However, the commercial arrangement for such lifting shall be as per FSA (Fuel Supply Agreement) or prevailing arrangement, as applicable. As per latest data from the Central Electricity Authority (CEA), 42 thermal power plants had coal available for less than seven days as on December 25. (economictimes.indiatimes.com)

States face power deficit as Power Grid delays transmission lines

December 26, 2014. Even as Power Grid Corporation gets big-ticket transmission projects from the government, about 15 major transmission lines are pending with the company. In most cases, the commissioning date has been extended by at least three years. For transmission corridors scheduled to have been readied by 2012, commissioning has been postponed to the end of this year or early next year. The company has told the government securing land for sub-stations and right of way for laying transmission lines is extremely difficult in certain areas. Among the delayed inter-regional transmission lines are those connecting thermal power plant sites in Vindhayachal, Bokaro and Rihand. The line connecting Solapur and Pune, an important link for southern India, has also been delayed. The recent synchronisation of the southern grid with the national one awaits the commissioning of transmission corridors, which will connect it to areas in Jharkhand and Odisha that have many coal-based thermal power plants. Between April and August, Uttar Pradesh, which accounts for about half the delayed projects, recorded peak power supply deficit of 15 per cent. Owing to transmission bottlenecks, Tamil Nadu and Andhra Pradesh recorded supply deficits of 2.6 per cent and 7.9 per cent, respectively. (www.business-standard.com)

BSES plans to launch mobile app for power supply transparency

December 26, 2014. With power tariff being a major poll plank in the Delhi elections, power distribution companies are adopting transparency tools to manage electricity supply. Reliance Power-owned BSES plans to launch a mobile application for its consumers to view consumption, bill details and status of new connection, among others. BSES will become the first in Delhi and among a handful of power utilities in the world to launch a mobile application. The new tool would make it easier for consumers to access important information and services related to their electricity accounts. During the last polls, Arvind Kejriwal-led Aam Aadmi Party (AAP) had alleged fudging of electricity bills by discoms. The discoms have always contested their quantum of supply is not in tandem with the retail tariff. With AAP promising to halve the electricity bills, discoms are now coming up with innovative measures to educate consumers about the tariff-supply equation. The BSES app also allows consumers to lodge ‘no supply’ complaints. It will help consumers view their consumption history, bills details (past five bills), status of a new connection and also get energy saving tips. According to BSES, the mobile app will be functional before the next summer. Delhi has a peak demand of 5,000-6,000 MW during the summer months of June to September, leading to load shedding in parts of the city. Initially, the app will run only on Android phones, but will be extended other platforms later on. The company will also later add new features. Consumers will be able to download the App from ‘Google Play’ or from www.bsesdelhi.com. BSES will also launch a user-friendly wireless application protocol site for mobile phones — m.bsesdelhi.com. Through this, a consumer can access their bill and connection account on phone, among other things and also get their customercare-related queries answered. (www.business-standard.com)

Policy / Performance………….

Govt may allow power companies to swap coal supplies with nearest fuel source

December 30, 2014. The government is likely to allow power companies to swap coal supplies with the nearest source to save costs and decongest the rail network. A policy for rationalisation of coal linkages is in the works and Coal India Ltd (CIL) will be overseeing swapping. The government will set up a separate designated authority for swaps between supply from CIL and other coal sources. Interested parties could go in for mutual consultations. The coal and power ministries would assist the parties in coming to an agreement. The government has already identified rationalisation proposals of 21 public and private thermal power plants in Gujarat, Tamil Nadu, Maharashtra, Punjab, Haryana and Rajasthan. Global consulting firm KPMG — appointed to look into benefits of re-organising coal tie-ups— had reported that swapping coal supplies to fuel power plants with closest coal mines could save up to ` 6,000 crore spent by power companies and Coal India in transporting the fuel across nation. Besides logistics savings of ` 4,500-Rs 6,000 crore, rationalisation of supplies would also lead to additional power generation of 3,500 MW with potential benefit of ` 3,500 crore, KPMG report had said. The report, submitted to the power ministry, said this will also decongest the railway network as average distance travelled by coal will come down to 429 km per tonne, from 589 km per tonne. It will hedge coastal power projects against any interruptions in supply. (economictimes.indiatimes.com)

Give coal to EUPs linked to cancelled mines: Panel

December 30, 2014. An inter-ministerial panel on fuel linkages has recommended providing coal to end-use plants linked to the blocks that have been cancelled by the Supreme Court. The first category is of those end use plants (EUPs) which already had long-term linkages/LoAs (Letter of Assurances) but were later converted to tapering-linkage. The second category is of those EUPs which were granted tapering linkages. Tapering linkages are interim supply arrangement made for power projects where production from linked captive coal blocks is delayed. Tentatively, additional 5-7 million tonnes of coal may be made available under current arrangement and till March 31, 2015. EUPs linked with the operational blocks should not be covered under the current arrangements as they are entitled to receive coal till March 31, 2015. EUPs to be supplied coal under current proposal will be offered coal from the mines nearest to them and they should lift coal by road. EUPs linked with those coal blocks which are under the investigation of CBI and FIRs have been registered against them shall not be considered for supply of coal. In a major blow to the corporate sector, the Supreme Court had in September quashed allocation of 204 coal blocks allotted to various companies since 1993 terming it as "fatally flawed". (economictimes.indiatimes.com)

TN govt opposes allotment of KNPP power to Telangana

December 29, 2014. The Tamil Nadu (TN) government has raised questions over the Centre's proposal to allocate 50 MW of power from the Kudankulam nuclear power plant (KNPP) to Telangana. In a letter to the Prime Minister, Tamil Nadu Chief Minister O Pannerselvam said it has learnt that 50 MW of the 150 MW unalloacted power of Kudankulam Atomic Power Plant Unit-II will be given to Telangana. He said the state government in a memorandum submitted in June 2014 had asked for the entire un-allocated power for Tamil Nadu. (www.business-standard.com)

Dabhol Management, Maharashtra oppose plan to sell LNG terminal

December 29, 2014. The Dabhol power project's management and promoters NTPC and the Maharashtra state government oppose the plan of lenders and the central government to sell the plant's liquefied natural gas terminal to pare its ` 8,500 crore debt. The plan is unviable and one sided and only protects lenders' interests, putting an unfair financial burden on the promoters, according to the promoters. NTPC and GAIL India own 32.74% each of Ratnagiri Gas and Power Pvt. Ltd (RGPPL), while the Maharashtra State Electricity Board has a 16.94% stake. ICICI Bank, IDBI Bank, SBI and Canara Bank collectively hold 18.12%. (economictimes.indiatimes.com)

India to complete process of placing nuclear power reactors under IAEA safeguards

December 28, 2014. Paving the way for having imported fuel for its nuclear power reactors, India will complete the process of placing its civilian reactors under International Atomic Energy Agency (IAEA) safeguards in the next two days. The last lot of the two reactors- units 1 and 2 of the Narora Atomic Power Station in Bulandshahar in Uttar Pradesh- will go under safeguards of the international atomic energy body in the next two days and necessary paper work is under process. Until now 20 facilities have gone under IAEA safeguards. This includes unit 1 and 2 of Tarapur Atomic Power Station (TAPS), units 1 to 6 of Rajasthan Atomic Power Station, units 1 and 2 of Kudankulam Nuclear Power Plant, units and units 1 and 2 of Kakrapar Atomic Power Station. These reactors are eligible for using imported uranium India is procuring from different countries. Apart from it, Nuclear Material Store, Away from Reactor (AFR) Fuel Storage Facility, both at Tarapur, Uranium Oxide Plant, Ceramic Fuel Fabrication Plant, Enriched Uranium Fuel, Enriched Uranium Oxide Plant, Enriched Fuel Fabrication Plant and the Gadolinia Facility- all the Nuclear Fuel Complex in Hyderabad- have been placed under the IAEA safeguards. The new reactors, which will come up with the help of foreign collaboration, will automatically be placed under the IAEA regards safeguards. Unit 1 of the two Pressurised Heavy Water Reactors (PHWR) - each with a capacity of 220 MW- was commissioned in January 1 while the second unit was commissioned in July 1992. Indian power reactors have been running below the capacity "due to the mismatch of power and supply demand of uranium". The two reactors, which have been running below their capacity, will get much needed fuel. The development comes ahead of the visit of US President Barack Obama to India next month, hereby completing the mandatory

process under the Indo-US nuclear deal. Under the Indo-US nuclear cooperation agreement, India was to sign and ratify the Additional Protocol of the IAEA. A separation plan was chalked out after the deal, segregating the military and civilian reactors. The civilian reactors were to be placed under the IAEA safeguards by December 2014, which will enable India to use the much needed international fuel for civilian reactors. Incidentally, before Prime Minister Narendra Modi's visit to US in September last year, India ratified the Additional Protocol with the IAEA in June this year. The IAEA on its part refused to share details of the safeguard issues. (economictimes.indiatimes.com)

Govt invites bids for 24 coal mines

December 27, 2014. In the first tranche of coal block auction, government invited bids for 24 mines, including seven in Chhattisgarh. Besides six blocks are being offered in Madhya Pradesh, three each in West Bengal, Maharashtra and Jharkhand and one each in Andhra Pradesh and Odisha, according to the bid document available in public domain. The Union Cabinet had approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations. Entire auction process will be transparent, efficient and conducted online, Coal and Power Minister Piyush Goyal had said while launching the portal for e-auction of 24 coal mines -www.mstcecommerce.com/auctionhome/coalblock. Goyal had said the auction process will comprise techno- commercial bid for qualification and financial bid (e-auction) for selection of successful bidder. (timesofindia.indiatimes.com)

Competition in power sector will help rationalise tariff: FM

December 26, 2014. Competition in the power distribution sector will improve efficiency and rationalise tariff, Finance Minister (FM) Arun Jaitley said. The Electricity (Amendment) Bill 2014, which aims to bring reforms in the power sector and safeguard consumer interest, was introduced in Lok Sabha. The amendments will usher in much needed further reforms in the power sector. It may be recalled that Power Minister Piyush Goyal had earlier said that this proposed legislation would promote competition, efficiency in operations and improvement in quality of supply of electricity in the country. This would result in capacity addition and ultimate benefit to the consumers, Goyal had said. The concept of multiple supply licencees is proposed by segregating the carriage from content in the distribution sector and determination of tariff based on market principles, while continuing with the carriage (distribution network) as a regulated activity. Jaitley said the coal block auction was the first step towards controlling power tariff as the lowest bidders would supply electricity at a cheaper cost. The process of coal block auction for cancelled coal mines began with the launch of a portal for electronic bidding for 24 coal blocks in the first tranche. The Cabinet has approved re-promulgation of the coal ordinance and necessary guidelines for mine allocations, a move that could make the kitty of coal-rich states fatter by ` 7 lakh crore over the next 30 years. (www.business-standard.com)

TN electricity demand set to grow by 20 per cent in 2014-15

December 25, 2014. Electricity demand in Tamil Nadu is estimated to grow by around 20 per cent in 2014-15 as compared with last year. The demand in the current year is pegged at 91,642 million units as against 76,445 million units in 2013-14. Last year, this was higher by 14 per cent over that of the previous year. Electricity minister Natham R Viswanathan said while the all India average usage per person was 917 units a year, in TN this stood at 1,196 units. Demand has increased to 12,500 MW from 10,500 MW. Of the total demand, 37.38 per cent is met through the TN Electricity Board, 33.32 per cent from the Centre allocation, 16.28 per cent through long-term agreements and the balance through other sources. (www.business-standard.com)

Power Minister may cut short the term of power regulators

December 25, 2014. Power Minister Piyush Goyal has sought to cut the term of the members at electricity regulatory commissions from the present five years to three years sending a panic wave among the sitting members. The appointees at electricity regulatory commissions, both at the Centre and in States, are closely reading the 50-page amendments to the Electricity Act, 2003, the minister has tabled in the Lok Sabha to see if there could any escape route. There is none, apparently. The power sector experts are trying to figure out if there is a political spin to this particular amendment to Section 89 of the Act. An appointee can hold office for five years or up to the age of 65 years, whichever is earlier. The Power Minister, while wanting to trim the term to three years, however, has proposed reappointment of members or the chairman for a second term of three years. While experts, including members at regulatory bodies, say the new set of amendments has quite a few positives for the power sector, and are aimed at improving the health of the public sector utilities, the one about slashing the tenure has not gone down well. (economictimes.indiatimes.com)

Peak power deficit lowers slightly to 3.7 per cent in November: CEA

December 25, 2014. The shortfall in electricity supply when demand is the highest, or peak power deficit declined to 3.7 per cent in last month from 4.4 per cent in October mainly on account of weaker demand. Power requirement during November was 1,37,620 MW of which 1,32,530 MW was met, leaving a shortfall of 5,090 MW, according to the Central Electricity Authority (CEA) data. Northeastern region, comprising Assam, Meghalaya, Manipur, Arunachal Pradesh, Mizoram, Nagaland and Tripura, was the worst affected reporting a deficit of 15.8 per cent in the month. Total demand of the region was 2,525 MW and supply was 2,125 MW, the data showed. Northern region (Delhi, Haryana, Himachal Pradesh, Punjab, Jammu & Kashmir, Rajasthan, Uttar Pradesh and Uttarakhand) reported a shortage of 1,525 MW or 3.8 per cent. The total electricity requirement of the region was 40,595 MW of which 39,070 MW was met. Western states including Gujarat, Chhattisgarh, Madhya Pradesh and Maharashtra recorded a peak power deficit of 1.9 per cent, as 43,293 MW demand of the region was met with a supply of 42,462 MW. The peak electricity shortfall in the South Indian states of Andhra Pradesh, Telangana, Karnataka, Kerala, Tamil Nadu, Puducherry and Lakshadweep was 6 per cent. The total power demand of the region was 35,096 MW of which 33,003 MW was met leaving a shortfall of 2,093 MW, the CEA data said. Eastern states of Bihar, Jharkhand, Odisha, West Bengal, Sikkim reported a deficit of 1.5 per cent. Their demand stood at 16,111 MW and against the supply of 15,870 MW. Meanwhile, peak power deficit in the April-November period, this year, stood at 7,006 MW or 4.7 per cent. Total electricity demand during the period was 1,48,166 MW as against supply of 1,41,160 MW, the CEA data said. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Oil rigs in US drop by 37 to lowest level since April

December 30, 2014. U.S. oil drillers, facing the lowest crude prices in five years and rising competition from suppliers abroad, idled the most rigs since 2012. Rigs targeting oil declined by 37 to 1,499, the lowest since April, Baker Hughes Inc. said. Those drilling for natural gas increased by two to 340, the Houston-based field services company said. The total rig count, which includes one miscellaneous rig, dropped 35 to 1,840.

The number of rigs targeting U.S. oil is down from a record 1,609 following a $55-a-barrel drop in global prices since June, threatening to slow the shale-drilling boom that’s propelled domestic production to the highest in three decades. As the Organization of Petroleum Exporting Countries (OPEC) resists calls to cut output, U.S. producers including Continental Resources Inc. and ConocoPhillips plan to trim spending.

While the U.S. rig count has dropped, domestic production continues to surge, with the yield from new wells in shale formations including North Dakota’s Bakken and Texas’s Eagle Ford projected to reach records next month, Energy Information Administration (EIA) data show. Oil rigs dropped by five to 527 in the Permian Basin in Texas and New Mexico, by three to 188 in the Eagle Ford of Texas and by two to 178 in the Williston of North Dakota, Baker Hughes said. In basins outside the 14 majors listed by Baker Hughes, oil rigs fell by 27 to 375. (www.bloomberg.com)

Iran earmarks $15.2 bn for joint oilfields

December 30, 2014. Iran has allocated $15.2 billion for the development of joint oilfields with neighbouring Iraq as part of its plans to increase output. The plan for developing joint oilfields in Iran's Karoun region is aimed at bringing about an added production capacity of 550,000 barrels of crude oil per day. The development plan will be implemented over the course of four years. Iranian Oil Minister Bijan Namdar Zanganeh has described the project as one of the largest development plans of his ministry, saying the implementation of the project would boost the country's oil output.

Based on studies, there are 23 joint hydrocarbon fields between Iran and Iraq, which are divided into exploration, development and production categories. Iran's total in-place oil reserves have been estimated at over 560 billion barrels, with about 140 billion barrels of recoverable oil. Heavy and extra heavy varieties of crude oil account for roughly 70-100 billion barrels of total Iranian reserves. (www.newkerala.com)

PPL finds gas, condensate at Faiz X-1 well in Gambat South Block in Sindh

December 29, 2014. Pakistan Petroleum Limited (PPL), operator of Gambat South Block with 65 percent working interest (WI) along with its joint venture partners Government Holdings (Private) Limited and Asia Resources Oil Limited with 25 percent and 10 percent WI, respectively, announced another gas and condensate discovery at its exploration well Faiz X-1 located in District Sanghar, Sindh, Pakistan. This is the sixth discovery in the block. This discovery will translate into approximately 4,030 barrels per day in oil equivalent and foreign exchange saving of $282,000 per day. (www.rigzone.com)

Sinopec starts pumping gas from Sichuan's Yuanba field

December 25, 2014. Sinopec Corp started a processing plant in China's southwest that treats high-sulphur natural gas pumping from a new field at Yuanba, Sinopec group reported. Yuanba, located in China's top gas producing province of Sichuan, will be able to produce 3.4 billion cubic metres (bcm) of gas a year by end of 2015, doubling the present 1.7 bcm/year, the report said. The start-up of the new gas field came a few days after Sinopec, China's second-largest energy major, announced it would raise its winter gas supplies to domestic users by 11 percent to meet a surge in heating demand. Yuanba field, spanning Guangyuan, Nanchong and Bazhong cities over 3,200 sq km, has a proven reserve of 219.4 bcm, the Sinopec report said. The gas reservoir has an average depth of 6,700 metres, among the deepest in Chinese conventional gas deposits. (af.reuters.com)

BP said in talks for share in Rosneft East Siberia oil producer