-

CENTRES

Progammes & Centres

Location

[The Environment or the People: Who is important?]

“The enforcement of ‘environment’ focussed approach that marginalises people is an artificial way of restricting energy supplies in the developing nations which can increase their energy cost significantly. The effect will be devastating for the nations having the least ability to pay, thereby impacting the rate of economic developing and living standards in these developing nations…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· The Environment or the People: Who is important?

ANALYSIS / ISSUES…………

· Blackout in Bangladesh: Significance for Regional Energy Cooperation in South Asia

· Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (part II)

DATA INSIGHT………………

· Hydrocarbon Scenario 2013: China

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC nod to Cairn’s Rajasthan gas production plan

· Adani-Welspun to invest $1.5 bn in US shale, Canadian oil sands assets

· CAG not factoring project delays if decision is not taken: RIL

Downstream……………………………

· NRL sees spurt in business opportunity with take off of refinery expansion

Transportation / Trade………………

· RIL seeks interest on KG-D6 gas payments

· BPCL to deploy speed boat for security of SPM terminal

· India, others set 3-month deadline to fix TAPI pipeline issues

· Oman-India gas pipeline a most promising option

Policy / Performance…………………

· Panel probing delay in ONGC’s KG basin gas find: Oil Minister

· Govt may find ethanol fix for liquor, oil companies

· India in a sweet spot as LNG prices crash in Asia

· Oil and gas E&P companies: Smaller ones surge past big guns

· IOC's credit profile to improve: Moody's

· No one found suitable for OIL CMD job

· Users of KG-D6 gas to pay $4.2/unit; additional $1.41/unit to be deposited in GAIL-operated gas pool a/c

· Devise formula to fix premium on natural gas from deep-water: Oil Ministry

· Kelkar slams new gas pricing norms

· CAG seeks KG-D6 block audit for 2012-13, RIL agrees for 2013-14 too

· NRL bags Jawaharlal Nehru Centenary Award for Energy Performance

· October fuel sales fall 0.99 per cent year-on-year: Govt

· India to pay Iran $400 mn frozen oil money

· Law Ministry says govt can renegotiate fiscal terms of Cairn block

· Oil Ministry seeks assurance on gas supply from Turkmenistan

[NATIONAL: POWER]

Generation………………

· Sumitomo to set up a 4 GW ultra super critical power plant in AP

· Adani Power to acquire Avantha group’s Korba project for ` 42 bn

· Goenka Group's Haldia plant to produce power by December

· NTPC keen to develop 2.4 GW coal-fired plant via JV

· DVC fails to clear strategic investor plan for Purulia project

Transmission / Distribution / Trade……

· Power supply deficit declines to one of the lowest levels this year

· Victory for Modi: Coal India trade unions call off strike

· Union Cabinet clears ` 51 bn power system improvement project for North-East

· NTPC plans 26 per cent stake buy in coal mines overseas to fuel its power plants

Policy / Performance…………………

· Canada to tie up with AP in farm, power sectors

· Govt appoints firm to find ways to offset any spike in power production costs after e-auction of coal blocks

· Govt's power sector reforms in right direction: Nomura

· Private power producers ask RBI for bailout

· Cabinet approves ` 326 bn power scheme

· Govt to invest $4 bn to tackle power theft

· Govt plans funding for thermal and hydro power plants worth over ` 6k bn

· UP CM to meet Power Minister over coal, power crises in UP

· IL&FS Engineering Services wins ` 2.4 bn RE power contracts

· Fitch rates NTPC's proposed $2 bn notes secure

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Russia's Gazprom Neft partners with Petrovietnam to tap Arctic oil

· Total ‘hints’ may spend 29 per cent less exploring

· Oil at $75 won’t shut in much US shale

· Petrobras says 2nd Libra well confirms good quality oil

· Exxon seeks other jobs for rig as sanctions close off Russia

· Shell may close Norway field a decade before target on oil slump

Downstream……………………

· Chile's Aconcagua refinery halted in part until December

· China Sinopec starts 16 mn barrel crude storage base in Hainan

· KNPC to invest $40 bn to 2022

· Iraq’s biggest oil plant to reopen after militants moved

Transportation / Trade…………

· Cyprus eyes gas exports to Egypt via pipeline

· Shell shuts Nigeria pipeline carrying Bonny Light crude

· Mexico's IEnova wins CFE gas pipeline project near US border

· Iran nuclear talks extension seen delaying oil-export boost

· Venezuela ships first crude mixed with Algerian oil to China

· Iran leases oil storage in China; ships crude to India from there

· US welcomes establishment of TAPI gas pipeline project

· Keystone foes use narrow win in US senate to prepare for 2015

· Halliburton gaining pump technology in Baker Hughes deal

Policy / Performance………………

· OPEC fault lines spur hedge funds to trim bullish oil bets

· Russia hasn’t decided to cut oil output in preparation for OPEC

· Oil-price slide won’t deter Saudi Aramco from expansion strategy

· Ghana gives Eni green light for $6 bn offshore gas project

· Uribe says oil price drop is ‘big shock’ for Colombia

· Iran may propose 1 mn barrel daily OPEC cut in Saudi talks

· US welcomes oil deal between Kurdistan, Baghdad

· Norway ready for oil price slump, Central Bank Governor says

· Widodo subsidy cut seen threatening fuel profits in Asia

[INTERNATIONAL: POWER]

Generation…………………

· Focus on nuclear energy for power generation

· Nigeria signs agreements to boost power generation

Transmission / Distribution / Trade……

· UK's blackout prevention plans in doubt after back-up power plant fails

· Gulf Coast Embraces US coal shippers Rejected by West

Policy / Performance………………

· Nepal gives Indian firm green light for $1 bn hydroelectric plant

· Ghana gets power ministry amid deepening electricity crisis

· OPG given approval to increase electricity rates

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India to double renewables in energy mix, Minister says

· Power Ministry for changes in renewable energy obligations

· Maharashtra needs clear policy on grid connectivity to solar power

· MNRE takes cue from PM Modi, starts work on solar projects

· Govt identifies 12 locations for setting up new solar parks

· India offers training in solar energy to foreign professionals

· Railways to go green by setting up 26 MW windmill in Rajasthan

· Ministry frowns at PCMC for ignoring plastic waste rules

· TPREL to invest in wind energy firms

· Poor can't be burdened with fight against climate change: Mahajan

· India’s solar power capacity addition to pick up after dismal 2014

· NTPC to invest in Odisha's solar energy sector

· IREDA to raise lending to solar power projects in next 3 yrs

GLOBAL………………

· China plans national carbon market by 2016 amid emission pledge

· BHP seeks to spur carbon fix for China’s belching power plants

· China buying REC Solar for $640 mn avoids trade spat

· US-China climate agreement won’t slow warming enough, World Bank says

· US rejects proposal for solar project in California desert

· UK Green bank invests in $172 mn wood-to-power plant

· EU risks blackouts without clean-coal inducement, IEA says

· Cut emissions to zero by 2070: UN body

· China curtails less wind energy in 2014

· India needs to improve energy efficiency by 2030: UN report

· Spanish wind energy firm Gamesa to invest over €100 mn in 5 yrs in India

[WEEK IN REVIEW]

COMMENTS………………

The Environment or the People: Who is important?

Ashish Gupta, Observer Research Foundation

|

T |

he definition of ‘electricity access’ as per the International Energy Agency estimating 50 kilowatt hour (Kwh)/person/year for rural household and 100 kwh/person/year for urban dwellers is drastically low compared to parameter set by Lawrence Livermore National Laboratory. The Lawrence Livermore National Laboratory parameter described in its study ‘Global Energy Futures and Human Development: A Framework for Analysis’ concluded that a nation will require at least 4,000 kwh/ per capita/ year electricity consumption rate to even have chance for development. This chance of development is not limited to only energy access but to the overall elevation of the human development. The correlation between electricity and human development is not rocket science and does not require complex computer modelling; it is just a universal fact.

The UN conference on Human Environment that took place on June, 1972 in Stockholm brought forth one very important declaration: the ‘environment’ is really about people. Since then United Nations has stressed on the importance of human environment:

· Of all things in the world, people are the most precious. It is the people that propel social progress, create social wealth, develop science and technology, (Stockholm, 1972)

· Social and economic development and poverty eradication are the first and overriding priorities of developing countries, (Copenhagen, 2009)

· Eradicating poverty is the greatest global challenge facing the world today and an indispensible requirement for sustainable development, (Rio, 2012)

§ Reducing modern energy supply in developing nations in the name of ‘environment’ contradicts Stockholm declarations for the ‘environment’.

In all the above stated objectives, poverty eradication and human development were given utmost importance. This clearly indicates the human being is more important than the protection of the ‘environment’ that is limited to protection of rivers, forests, air, oceans etc. Cheap and affordable energy supply is essential for improving human development. A shocking fact that was brought out by a study by Columbia University’s Mailman School of Public Health was that there were only 446 deaths due to extreme weather in 2013 in United States, compared to 900,000 deaths/ year from poverty and other social factors. It is not the environment, but the poverty, that is a greatest threat developing nations face today. A lack of cheap energy is the silent killer that leads to poverty, hunger and easily preventable diseases.

As per the World Population Prospects: the 2012 Revision by United Nations Department of Economic and Social Affairs, by 2050, there will be rise of 87% in population in developing nations which indicates that more people will be deprived of energy. This energy deprivement has a devastating effect on women and girls in particular. As per a Water.Org report, women and girls in the developing world spend an estimated 200 million hours each day simply collecting water – the number of work hours to build 29 Empire State Buildings in a single day. This also indicates that female life expectancy in these developing nations is not going to improve if the same situation prevails. The development index for women is not likely to improve in an energy starved scenario because women will spend most of their time gathering fuel and other basic necessities in the developing world, instead of learning, making money, and bettering their situation. China, on the other hand which tripled its energy consumption since 2000 lifted female life expectancy from 73 years in 2000 to around 78 today.

Contrast to the picture shown above, most developed nations having higher electricity consumption with higher per capita CO2 emissions has the highest living standards. The carbon emission chart is given below:

|

Region |

Population (Millions) |

Per Capita CO2 Emissions (Tonnes) |

|

World |

6609 |

4.38 |

|

USA |

302 |

19.10 |

|

UK |

61 |

8.60 |

|

Japan |

128 |

9.68 |

|

Germany |

82 |

9.71 |

|

South Africa |

48 |

7.27 |

|

France |

64 |

5.81 |

|

China |

1327 |

4.58 |

|

India |

1123 |

1.18 |

Source: Interim Report of the Expert Group on Low Carbon Strategies for Inclusive Growth, 2011

Cheap and abundantly available fossil fuels which is criticised nowadays on account of carbon emissions, actually laid the foundation for the world richest economies. Stockholm, 1972 demonstrated why the goal to restrict energy sources is the real anti-environment movement because less modern energy is equal to more dependence on the environment. Coal, for instance, is now the backbone of the fastest growing economies, China and India, both of whom, importantly, have seen their life expectancies surge. Over 50% of the developing world’s electricity comes from coal; a cheap energy source that vitally increases the disposable income has a direct correlation with health. As per the Lawrence Livermore National Laboratory Analysis of Human Development Index, critical indicators of health improve when access to modern energy is provided. Increased life expectancy has a 72% correlation with access to electricity; the correlation is strongest for the lowest-income countries.

The US’s coal-based electricity, oil-based transport era since 1900, increased the life expectancy dramatically from 32 years to 79 years. Coal-electricity has played an enabling role in the plummeting of the US infant mortality rate, from 160 per 1,000 births in 1900 to around 5 today. Ethiopia which consumes a meagre 70 kwh/person/ year has an infant mortality rate of 56 per 1,000 births and Nigeria which consumes 150 kwh/person/year has a life expectancy of 52 years only. In a nutshell, people are healthier and live longer when their energy is cheaper and therefore have more money to take care of themselves.

The enforcement of ‘environment’ focussed approach that marginalises people is an artificial way of restricting energy supplies in the developing nations which can increase their energy cost significantly. The effect will be devastating for the nations having the least ability to pay, thereby impacting the rate of economic developing and living standards in these developing nations. As per the International Macroeconomic Data of United States of Department of Agriculture Research, the developing world, for instance, has an average GDP/capita of just $3,000 (real 2005 $), compared to $40,000 in the developed nations, which is an indicator that they cannot absorb the higher cost of less reliable, naturally intermittent energy.

Also as per the World Bank, International Debt Statistics, 2013, the total external debt outstanding of the developing countries is around $5 trillion (compared to $2.6 trillion in 2005), mounting by approximately $300-400 billion per year. Debt significantly affects global poverty because borrowed money accrues interest, which augments that debt and quickly erodes a country’s ability to invest in much-needed infrastructure. The message is that the advocacy for more expensive energy in developing nations is not the solution to problems of developing nations but contribution to their problems. Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Blackout in Bangladesh: Significance for Regional Energy Cooperation in South Asia

Mirza Sadaqat Huda*

Introduction

|

O |

n the 1st of November 2014, Bangladesh suffered an electricity blackout that lasted 10 hours, making it one of the worst power failures in the country’s history. Although the current government has made significant improvements in the generation of electricity in recent years, which has increased from 4,130 MW in 2007 to 8,525 MW in 2013[1], this was the fourth blackout since 2003[2] and load shedding is still a reality[3] with electricity shortages of up to 1000 MW in the peak summer season[4]. However, the blackout in November is particularly significant due to initial reports stating that the source of the power outage was a glitch in the 500 MW India-Bangladesh electricity transmission line between Bheramara and Baharampur, which subsequently had a cascading effect on the entire system causing all power plants to shut down. Although the exact cause of the blackout is still being investigated, most reports suggest that some technical issues regarding the bilateral transmission line had exposed severe vulnerabilities in Bangladesh’s power system. A significant issue that has not been adequately highlighted by the media and most analysts is that this blackout has implications for regional cooperation on energy in South Asia in general and between Bangladesh, India, Bhutan and Nepal in particular, as poor energy infrastructure is an issue that affects all countries in the region. Therefore, as government officials and analysts in Bangladesh reiterate the importance of upgrading infrastructure in response to the blackout, the policymakers of all South Asian countries should recognize the fact that the undertaking of regional energy cooperation implies that each country will have a vested interest in the energy infrastructure of the neighboring state, as interdependence on energy will essentially mean dependence on the partner country’s’ infrastructure. It is with this understanding that the countries of the region should emphasize on a collective approach to the development of domestic and cross border energy infrastructure.

Regional Cooperation on Energy Infrastructure

In addition to political and security issues, one of the key impediments to regional energy cooperation that has been highlighted by the power outage in Bangladesh is the lack of adequate energy infrastructure in all eight countries of South Asia. According to the International Energy Agency, by 2035, India’s electricity sector will need 1.8 trillion in investment, of which 42% has to be dedicated to transmission and distribution.[5] Bangladesh, Nepal and Bhutan all have varying levels of vulnerabilities in their energy infrastructure, with investment of 6 billion, 1.2 billion and 3.3 billion required to enable these countries to undertake cross border energy cooperation.[6] Lack of infrastructure as well as the inadequacy of current systems as impediments to regional energy cooperation have been highlighted by a number of academics such as Ebinger (2011)[7], Lama (2000; 2007)[8], Pandian (2002)[9], Lahiri-Dutt (2006)[10], and also in studies by international institutions such as the WB (2008), ADB (2013) and SAARC (2010). To overcome this issue, a SAARC Energy Trade Study has recommended cooperation among member countries to optimize investments for infrastructure development.[11]

The development of energy infrastructure is inherently linked to the success of multilateral energy projects. This reality requires the joint development of electricity transmission lines, transformers, technology and most importantly, a technically and operationally capable manpower. Although there has been progress in the field of technical capacity building and advocacy on the need to harmonize markets, policies and legislation, particularly through the work of projects such as the South Asian Regional Initiative for Energy Integration (SARI/EI),[12] there is still not a recognition, at the policy and academic level, of the vested interest that each country has in the development of the energy infrastructure of its neighbours. This of course, is quite understandable, given the conflict-prone nature of the subcontinent and the inward-looking, nationalistic policies that have dominated for decades. However, as the countries of the region slowly overcome the myopia of bilateralism to take the difficult but necessary path towards multilateral energy cooperation, there needs to be an appreciation, at the highest political level, to draw out a plan for the collective development of energy infrastructure and manpower in South Asia. As the vision of the SAARC Electricity Grid gradually takes shape, within the broad plan of creating an interdependent power pool, facilitated by a smart grid that reduces inefficiency and transmission and distribution losses, South Asian nations must also collectively seek financial and technical assistance to upgrade domestic infrastructure. The Asian Development Bank, the World Bank and the United States Agency for International Development have all undertaken projects to enhance energy security in individual counties in South Asia and have also assisted in facilitating bilateral cooperation. One issue that may compliment this process is open communication between India, Bangladesh, Nepal and Bhutan about projects that they feel is important in facilitating multilateral cooperation and ensuring that domestic donor-financed projects in individual countries are technically and operationally interlinked to the broader goal of regional energy cooperation.

Regional collaboration on developing domestic infrastructure is therefore the key in ensuring that the interdependence brought about by transnational energy projects do not make counties vulnerable to disruptions but enhance the collective energy security of the region.

Conclusion

Despite the negative impact on businesses and individuals, two recent political statements, one at the national and the other at the regional level have revealed the far sightedness of the political leadership in conceptualizing energy interdependence between South Asian countries.

Firstly, the current government in Bangladesh has shown pragmatism in seeing the opportunity the power outage has provided to revaluate the adequacy of the country’s energy infrastructure to undertake cross border cooperation. This has been made apparent in a statement by Tawfiq-e-Elahi Chowdhury, the Prime Minister’s energy advisor: “It (the blackout) has come as a blessing in disguise for us, as it has created the scope to adopt preventive measures for any such future incidents, since we are going to take up many projects that would depend on cross-border connections.”[13]. Secondly, Piyush Goyal, India’s Minister of State with Independent Charge for Power Coal and Renewable Energy at the recently concluded SAARC Energy Ministers meeting stated “Rivers can flow only in one direction, but power can flow in the direction of our choice! I dream of a seamless SAARC power grid within the next few years. For example : Hydroelectric power generated in North East India could be transported via Bangladesh, India and Pakistan, on to Afghanistan or offshore wind projects could be set up in Sri Lanka’s coastal borders to power Pakistan or Nepal. The possibilities are limitless!”[14] Within the achievable but difficult goal of a regional electricity grid and the realities propounded by a power blackout, India, Bangladesh, Nepal and Bhutan must come together to explore the means of upgrading domestic infrastructure, construct cross border transmission lines and develop human resources. A term that has become embedded in developmental discourse is the need to ‘act locally and think globally’. When it comes to the 1st of November 2014 power blackout in Bangladesh, one hopes that the repercussions on policymaking circles in South Asia would be that the leaders of the region can bring upon themselves the responsibility to act nationally as well as regionally.

(*The writer is a PhD Candidate at the Centre for Social Responsibility in Mining, the University of Queensland and a Visiting Fellow at the Observer Research Foundation)

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (part II)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 23 (http://www.orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=75275&mmacmaid=75276)

|

T |

his paper is split into two parts: The first part (I) was dealing with the currently vibrant oil price trends. The impact of the oil price volatility on gas markets and more precisely on gas prices shall be scrutinised in greater depth in this subsequent part (II): a more general look at the relationship between oil prices and gas spot prices as well as a more specific but theoretical examination of what might have been the impact on a gas formula that has been proposed by the Rangarajan Committee for Indian NELP gas pricing. This exercise can be seen as a rather informal ex-post sensitivity analysis according to the incorporated risk exposure of pricing approaches such as the above mentioned.

The crude oil price is still broadly appreciated as the world’s leading and most influencing price benchmark for energy. Since oil, gas and coal markets are characterised by many and varied interactions locally, regionally and globally along the value chain, price interdependencies are prevalent and reflected in demand side substitution competition in almost all sectors; and even more the widely experienced, long-lasting oil-linked gas pricing schemes, for example.

In fact the oil price still has a strong influence on gas pricing and therefore on gas price level: The most prompt linkage was established with the concept of oil price escalation in gas pricing formulas that has had a long tradition in the European gas industry and currently still accounts for a share of about 20 % in overall world gas price formation. In Europe this share has been at dominating 80 % in 2005, particularly pronounced in the wholesale contracts of Russian, Norwegian and Dutch gas. However, it has been increasingly displaced by pricing based on gas-on-gas competition in recent years.[15] Another concrete example is the pricing of LNG in long-term contracts, historically linked to oil or oil products particularly in Asia (e.g. Japan). Immature gas spot markets and the influence from the existing contracts can prolong the oil indexed business model for gas trading in Europe and Asia.

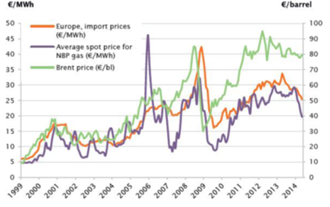

Figure 1 shows the prices for long-term gas import contracts in Europe, the NBP spot market pricein U.K. (left axis in Euro/MWh)and the crude oil price in comparison (right axis in Euro/barrel). It provides a good visual impression of how the price evolution of gas and oil productsin Europe have been correlated to each other for a long time, but also reveals the rising oil-gas spread in recent years due to the pressures of global gas and oil markets.

Even in quite mature gas spot markets, in which thegas price has no formal relation with the price of oil or oil products and theoretically ought to be established by the interplay of gas supply and demand, some correlation can be demonstrated.For the U.S. gas spot market (Henry Hub) some rules of thumb were commonly used to assess the price relation,e.g. a former empirical rule that has often been invoked setthe gas spot vs. crude oil price ratio at 10 (another at 8).

Source: www.gasinfocus.com

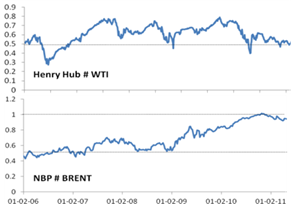

Albeit, since the market developments have enormously widened the gas/oil spread this rule became invalid in years past. Henry Hub gas prices have become relatively autonomous against other price influences due to the shale gas surge on the supply side. The plotted cointegration between Henry Hub prices and WTI crude oil price in Figure 2 (upper chart) actually illustrates that there is no significant long-term relationship to be observed. Conversely, the NBP price was found to become stronger integrated with Brent crude over time (lower chart), revealing increasing market integration with Continental Europe’s gas market, where oil price indexation is still more in place.

Figure 2: Cointegration of Gas and Oil Prices

Source: Report by IEA, IEF, IMF and OPEC (2011)[16]

In a nutshell, the influence of the oil price on other energy markets is concrete and demonstrable as shown above. Furthermore, upstream costs have a strong linkage with oil prices as well, thus the whole natural gas E&P business is strongly influenced by oil price volatility. Since India is currently moving away from administered NELP pricing towards a formula based gas pricing approach, the impact of the crude oil price slump on the price formulas outcome can be demonstrated, calculated with the formula proposed by the Rangarajan Committee (RC) earlier this year. Nevertheless, since this formula has been recently replaced by a new gas price formula (called “2.0” throughout this article), this has to be seen more as an academic exercise just to illustrate the downside risk that is associated with this kind of pricing approach. By now, almost all attention has been concentrated to the incorporated upside risk of rising prices, but unfortunately the oil price has broken into a new direction southwards.

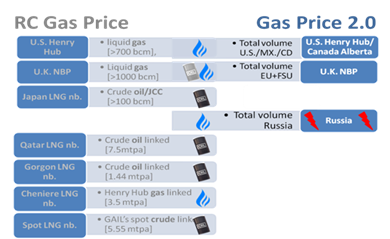

Figure 3 illustrates that the RC gas price formula was principally made up of a two-tiered concept that aims to mirror the world market price for natural gas (interpreted as an ‘arms-length’ competitive price for India): as such, it was computed as the simple average of the weighted average of all Indian (LNG) imports at the wellhead of the exporting countries and the weighted average of some different gas trading points in U.S., Europe and Japan. The formula is dynamic over time and is in fact very much linked to oil (most LNG contracts) in contrast to liquid gas markets (Henry Hub, partially NBP). In contrast, the validated gas price formula 2.0 seems to be far less oil price-prone as shown in the right part of Figure 3: Since all oil price-linked LNG terms have been omitted overlaps can only be demonstrated in the more or less gas price determined pricing terms linked to Henry Hub, Alberta or NBP. Anyhow, the wild card is still with the exact definition of the concept behindthe Russian price term in the formula: on the one hand Russia is one of the global heavyweights in gas trading (roughly 400 bcm/a consumption and 600 bcm/a production)[17], on the other hand it is still not yet officially announced what is the designated domestic price marker for the Russian gas. Since the Russian gas exporters are among the most hard-liners in defending oil-linked gas pricing schemes in Europe it might overshadow the reliability of a so-called “Russian market price” that is established by mere gas configurations. Accordingly, oil price influence might speculatively be supposed at this point. However, in summary in can be said, therefore, that the gas price 2.0 is not very likely to be largely prone to oil price volatility; at least there seems to be no direct linkage while some indirect influence might be expected from NBP or the Russian joker.

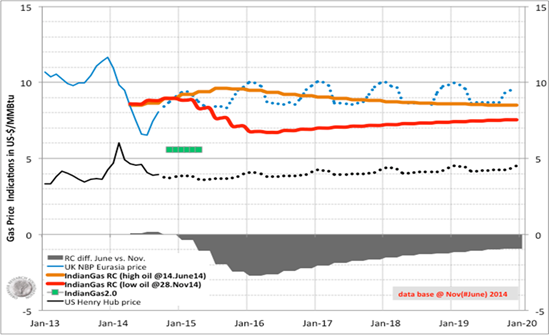

Source: Compiled by author.

Since the details of the new gas price formula 2.0 are not yet known, in lieu thereof the robustness of a gas price formula like the RC against oil price volatility shall be illustrated hereinafter. Based on recent marketassessments the domestic RC gas price formula at high/low oil prices (yellow/red line) as well as the spread between these (grey area) is shown in Figure 4 (gas price 2.0 is indicated in a green sketch for its first known half-year period as a reference point). The divergence in the course of those two RC gas price curves can be largely explained by the historic Brent oil volatility during the last half year and changing Brent future curve shape: the Brent future curve settled last June was characterised by a strong backwardation (i.e. prices at the back end of the curve are lower in comparison with front end prices)that has turned into a soundcontango (i.e. vice versa) by end of November.[18] This explains why the spread between the two RC gas price computations is going to be significantly reduced towards the end of the decade (to less than US‑$ 1/MMBtu). The largest exposure of almost US‑$ 3/MMBtu can be observed in the beginning of 2016, representing the large spread of the Brent crude futures at the front end of the curves (about US-$ 45/bbl) and the concomitantly arithmetic of the RC gas price formula (set up of three months time-lag and creation of twelve months average). Thus the wide gas price difference is largely driven by the oil linked terms (especially Japan’s LNG import price) in the formula.

Figure 4: Sensitivity of Rangarajan Gas Price Formula to Crude Oil Prices Changes (2014-2020)

Source: Own assumptions and calculations based on oil and gas futures as of 28thNov. 2014 (and 19th June, respectively).

In the forefront of the recent Indian domestic gas price building the discussion focussed quite unilateral on the upside price risk and the merchants of doom were predicting prohibitively rising gas prices. But recent developments on international energy markets have disabused them in a way. The computed RC gas price might have fallen down to less than US‑$ 7/MMBtu by 2016 (Figure 4). It is even possible that RC gas price formula might get within reach of the validated gas price 2.0 that by now is only known to be at about US‑$ 5.6/MMBtu until April 2015. However, since OPEC has failed to agree on a stabilising production cut the crude oil price is expected to slide down further on. Moreover reinforced impetus might be expected to come on stream from producers like Iran and/or Iraq. For example, at a Brent crude price of about US‑$ 50/bbl (that is more or less in the same order of about another 30 % decrease as the recent slump), ceteris paribus, the RC price formula can be expected to draw level with the current gas price 2.0.

These calculations demonstrate the theoretical gas price risk exposure that might be associated with the farewell of administered pricing. The good thing is that it is far easier for market participants to cope with and adapt to a transparent and reliable formula based gas price whatsoever as opposed to ineffective, non reasonable, randomly administered gas pricing. Market players should be considered to be capable of withstanding changing market conditions based on their own analyses and risk management according to their own commercial responsibilities. This can preferably be achieved on liberalised and open markets with transparent and accessible information in a just manner at level playing field. At least a formula approach such as RC or gas price 2.0 makes pricing somewhat more reliable and predictable and consequently establishes the option to effectively hedge upcoming market risks at all. Concluded

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Hydrocarbon Scenario 2013: China

Akhilesh Sati, Observer Research Foundation

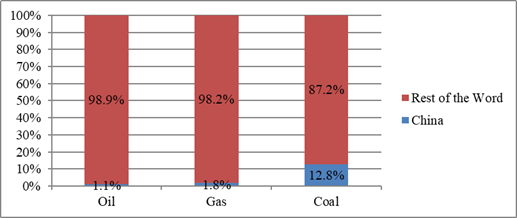

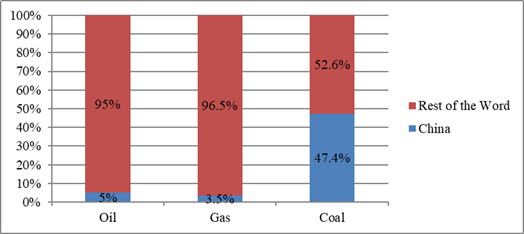

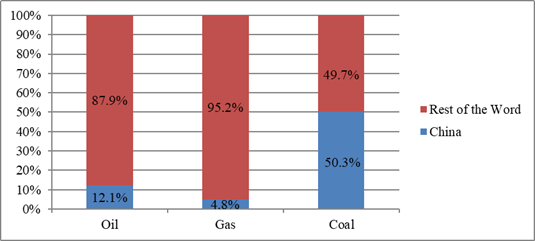

China Reserves (2013):- Oil- 18.1 Billion Barrels; Gas- 3.3 TCM; Coal- 114.5 Billion tonnes

China Production (2013):- Oil- 208 MT; Gas- 105 MTOE; Coal- 1840 MTOE

China Consumption (2013):- Oil- 507 MT; Gas- 145 MTOE; Coal- 1925 MTOE

TCM: Trillion Cubic Meters; MTOE Million Tonnes of Oil Equivalent

Source: Compiled from BP Statistical Review of World Energy 2014.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC nod to Cairn’s Rajasthan gas production plan

November 24, 2014. The board of Oil and Natural Gas Corporation (ONGC) has given its nod to Cairn India’s gas development plan for Rajasthan fields. The ONGC board in its meeting had approved the plan to increase production from the Raageshwari Deep Gas fields in the Rajasthan block to 100 million standard cubic feet a day (2.83 mscmd) by fiscal 2017. Cairn had submitted a revised development plan to ONGC in April. While ONGC was still deciding on the plan, there were hints of the public sector company wanting to raise its stake in the block from the current 30 per cent (Cairn India owns 70 per cent), and using delaying tactics to get its way. According to the Rajasthan production sharing contract (PSC), the operator can get unconditional extension for five years if it is producing oil, and 10 years in case of expected gas production. But this extension will be on terms mutually agreed between the two parties. The Rajasthan PSC expires in 2020.

In the short term, Cairn India is on course to double the Raageshwari Deep Gas daily production by the fourth quarter of the fiscal 2015. At present, it is producing 0.25 mscmd of gas. Meanwhile, it has floated tenders in the market for constructing a gas processing terminal, availing itself of drilling and fracking services. Cairn India is also leaving no stone unturned to exploit the full resource base of 300,000 barrels of oil equivalent per day from its Barmer block. In December, it will conduct roadshows in Calgary (Canada) and Houston (US) to tap into the oil field services companies, offering technology and technical solutions. (www.thehindubusinessline.com)

Adani-Welspun to invest $1.5 bn in US shale, Canadian oil sands assets

November 24, 2014. Adani Group along with the towel-to-pipe conglomerate Welspun is studying liquid-rich shale and oil sands assets in the US and Canada for acquisitions as the two home-grown business houses look to build a formidable oil and gas enterprise. Adani, owned by Gautam Adani, who has close ties to Prime Minister Narendra Modi, and Welspun, controlled by B K Goenka, have a strategic partnership for oil and gas business and the duo hold interests in conventional blocks in India, Thailand and Egypt. The partners plan to invest $1.5 billion towards stake purchases in select Louisiana and Texas shale fields in the US and some Alberta oil sands projects in Canada as they bet big on unconventional resources.

The two groups feel that shale and oil sands, which have significant potential, will play a greater role in the world's total energy mix and, hence, want to invest in these areas, said sources familiar with the matter. However, unlike their earlier strategy where the joint venture firm, in which Adani owns majority shares, bought exploratory blocks and then had to discover oil, this time around the plan is to buy interest in oil-producing assets. With oil prices collapsing, valuations have become attractive, offering buyers like Adani Welspun Exploration opportunities to pick up high-quality unconventional acreage, said an investment banker. Weakening global demand and an oversupply in the US has pulled down crude oil prices to a more than four-year low of $75 a barrel, trimming the once-high valuations of shale and oil sands assets.

If Adani Welspun works out a deal in the North American region, which is known for its rich reserves in unconventional resources, it will mark the Ahmedabad and Mumbai-based groups' first investment in shale and oil sands properties, following in the footsteps of private-sector explorer Reliance Industries and state-run GAIL, IOC and Oil India, which have acquired stakes in similar assets. Indian firms have so far invested over $10 billion in US shale gas, of which Reliance alone has invested over $7 billion.

While the joint venture has an overall investment plan of $1.5 billion for overseas energy assets, it seeks buys entailing a minimum investment of $300 million. Adani Welspun has been on the learning curve in the oil and gas business with some oil blocks yet to be commercially viable. For instance, its Assam block turned out to be a dud, while the Mumbai and Gulf of Kutch offshore blocks have met with some success. Indian companies have been scanning oil and gas assets abroad to meet the growing energy demand of Asia's third largest economy, which meets four-fifths of its crude oil and about a fourth of its gas requirements through imports. (economictimes.indiatimes.com)

CAG not factoring project delays if decision is not taken: RIL

November 23, 2014. Reliance Industries Ltd (RIL) has contested CAG's draft observations on some payments the company made to contractors of KG-D6 fields, saying the auditor had not considered the contract requirement of factoring consequences of delays in procurement of goods and services on the project. RIL in a presentation at an Exit Conference called by CAG at the end of its second audit of KG-D6 for 2008-09 to 2011-12, stated that the auditor was using hindsight to question project efficiencies and procurements made 8 years back. The Production Sharing Contract (PSC) procurement procedures were intended to differ from Government/PSU procurement procedures and to promote investment efficiency, faster decision making in the interest of the project. CAG in its draft report had questioned euro 200 million payment to Allseas Marine Contractors beyond the contracted amount. Stating that the payment was essential to get the project completed in time after some sub-contractors defaulted in timely delivery of goods, the firm drew a parallel of a similar instance with ONGC. ONGC faced with delay in supplies of certain equipment for its shallow water G-1 field in same Krishna Godavari basin from Clough Engineering of Australia. ONGC terminated the contract that resulted in the Australian firm going for arbitration. The state-owned firm, RIL said, settled for an out-of-court settlement to get the project going but the cost has shot up from ` 1,263 crore approved in November 2004 to ` 3,437 crore and yet no sign of the project being completed soon. While government/PSU procedures focus on piece meal & individual tenders taken on standalone basis, avoiding delays and cost of not doing things becomes a primary consideration in PSC procurement. RIL said the CAG appears to conclude that the Contractor was required under the PSC to achieve the levels of gas production estimated in the approved field development plan and that the government is entitled disallow cost recovery for under-utilisation of facilities. (economictimes.indiatimes.com)

Downstream………….

NRL sees spurt in business opportunity with take off of refinery expansion

November 25, 2014. State-run oil refiner-marketer Bharat Petroleum Corporation Ltd's Assam based refinery, Numaligarh Refinery Ltd (NRL) has projected huge increase business opportunities with the proposed massive capacity addition. According to the refinery, NRL at present is rolling out business worth ` 400-500 crores annually, which will increase to the level of ` 1500-2000 crores once the Refinery expansion project takes off. (economictimes.indiatimes.com)

Transportation / Trade…………

RIL seeks interest on KG-D6 gas payments

November 25, 2014. Reliance Industries Ltd (RIL) has sought interest on $1.41 a unit that buyers of its KG-D6 gas are paying into a gas pool account operated by GAIL India, saying the state-run firm ought to invest the amount due to RIL in good interest-bearing instruments. The government had hiked domestic natural gas prices by 33 per cent to $5.61 per million British thermal unit. In case of RIL's main gas field in KG-D6 block, it, however, ordered buyers to pay the firm old rate of $4.2 and deposit the balance $1.41 in the gas pool account. The incremental $1.41 would become due to RIL if it can legally prove that Dhirubhai-1 and 3 gas output dropping to a tenth of projected 80 million cubic meters per day was due to geological reasons, and not because of hoarding. RIL has written to the Oil Ministry saying it is entitled to getting the principal amount together with market interest rate in case it wins the legal case. (conomictimes.indiatimes.com)

BPCL to deploy speed boat for security of SPM terminal

November 24, 2014. Public sector Bharat Petroleum Corporation Ltd (BPCL) will be deploying a speed boat with a contingent of CISF Quick reaction team as part of enhancing the security of the Single Point Mooring (SPM) terminal in the Arabian Sea. Kerala Home minister, Ramesh Chennithala, will formally launch the speed boat at a function at Wellington Island. BPCL had set up the SPM terminal about 19.5 km off shore for receiving crude oil from very large crude carriers through subsea pipe line into storage tanks located at Shore Tank Farm (STF) at Puthuvypin in 2007. Crude oil is thereafter pumped to Kochi refinery for refining. For the security of SPM, BPCL had deployed Marine guards on the Maintenance and located adjacent to the SPM on a round the clock basis. The state government had declared SPM as a prohibited area for a distance of about one nautical mile to prevent fishing boats approaching closer to SPM to avoid any damage to SPM and floating hoses, BPCL said. A review conducted by defence minister had recommended deployment of a speed boat for further protection of the SPM. BPCL has sourced a boat with a speed of 20 knots for this purpose. The deployment of the speed boat with a contingent of CISF Quick Reaction team will help in preventing any intrusion to the protected area around SPM. (economictimes.indiatimes.com)

India, others set 3-month deadline to fix TAPI pipeline issues

Oman-India gas pipeline a most promising option

November 19, 2014. Natural gas, a very highly consumed commodity in India, is at present supplied from two sources: domestic production and imported liquefied natural gas (LNG). Energy demand and supply projections indicate that by 2021-22, due to rising demand, India will also need to start sourcing natural gas from cross-border pipelines to fill the gap between demand and availability. In such a situation, India will have to examine its options carefully to minimise the cost of imports and consider appropriate sources of natural gas to keep the import bills under check. Importing LNG is a rather costly process, but unavoidable because the sources of gas are far away. This cost can be avoided if gas is imported through pipelines and then transported across the country through existing and future-planned pipelines in India. India, as on April 1, 2013, had 14,578 km of pipelines, including 1,146 km of offshore pipelines. (economictimes.indiatimes.com)

Policy / Performance………

Panel probing delay in ONGC’s KG basin gas find: Oil Minister

November 25, 2014. A panel headed by oil regulator DGH will by December 24 submit its report on the reasons for delay in developing gas discoveries in ONGC's Krishna Godavari basin (KG basin) KG-D5 block, Oil Minister Dharmendra Pradhan said. ONGC's KG-D5 (KG-DWN-98/2) sits next to Reliance Industries' eastern offshore KG-DWN-98/3 or KG-D6 block in Bay of Bengal. Both blocks were awarded in the first round of auction under New Exploration Licensing Policy (NELP) in 2000. While Reliance Industries Ltd (RIL) began oil production from its KG-D6 block in September 2008 and gas output in April 2009, ONGC, which has made 11 oil and gas discoveries in KG-D5 block, still is at least four years away from first gas. The ministry wants to investigate the reasons for the delay. The panel, he said, is likely to submit its report within two months from the date of its meeting held on October 24. As per ONGC estimates, gas production from the KG-D5 block is planned to begin in 2018 and oil output in 2019. KG-D5 will produce up to 90,000 barrels per day (4.5 million tonnes per annum) - the largest from any field on the east coast. ONGC will produce 17 million standard cubic meters per day of gas from the block. KG-D5 is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). NDA holds an estimated 92.30 million tonnes of oil reserves and 97.568 billion cubic metres of in-place gas reserves spread over seven fields. ONGC bought 90 per cent interest in Block KG-DWN-98/2 from Cairn Energy India Ltd in 2005. Cairn subsequently relinquished its remaining 10 per cent interest in favour of ONGC. (economictimes.indiatimes.com)

Govt may find ethanol fix for liquor, oil companies

November 25, 2014. The battle for alcohol between the liquor industry and oil companies is likely to end. The government plans to allow petrol blending with ethanol produced from non-edible plants. Currently, ethanol produced from sugarcane is the only source for blending, which makes it scarce for alcohol and chemicals manufacturing. The oil ministry has recently moved a proposal for the Cabinet to allow blending petrol with cellulosic ethanol produced from biomass such as switchgrass, paper pulp, sawdust, municipal waste and non-edible parts of plants. This would be an alternative to ethanol made from molasses, a byproduct of sugar manufacturing, the government said. This would help in reducing India's dependence on energy imports, keep cities and villages clean and avoid confrontations with liquor and chemical industry, the oil companies said. The government had launched sale of ethanol blended petrol in 2003 and gradually made 5% blending mandatory in 20 states and four Union Territories, subject to availability of the biofuel. (economictimes.indiatimes.com)

India in a sweet spot as LNG prices crash in Asia

November 25, 2014. Spot liquefied natural gas (LNG) prices are plunging and are expected to fall further notwithstanding the onset of winter, which traditionally drives prices higher. The fall is not just an outcome of drop in oil prices, but also a strategic shift in the demand-supply balance, and augurs well for Indian consumers. India imported a total 13 million tonnes LNG in FY14 for $8.5 billion, according to the export-import data published by the ministry of commerce. India is the fourth biggest LNG importer with consumption of natural gas slated to grow faster than oil. Hence, the crash in spot prices is good for India. Recent spot LNG contracts were struck at prices as low as $10.5 per million British thermal units (mmBtu), nearly 45% down from year ago period and 25% down from those struck in October 2014. These contracts are for delivery after two months; hence, contracts in November related to deliveries in January 2015. There are indications the trend will continue well in future. (economictimes.indiatimes.com)

Oil and gas E&P companies: Smaller ones surge past big guns

November 24, 2014. The share prices of some of the country's largest oil and gas exploration and production (E&P) companies may give the impression that the sector is yet to emerge out of its slumber, but a look at mid- and small-cap shares in the sector shows that they are enjoying a dream run on the bourses. The stock price of offshore services companies has given returns of up to seven times this year so far, and it is even more if one considers their rise from their annual lows. However, despite a sharp run-up in prices, there's a belief that there's steam left in the share price of these companies. Among the companies whose shares have risen despite a slack in the sector include Alphageo, Global Offshore, Dolphin Offshore, Duke Offshore, SEAMAC, Mercator, Shipping Corporation and Aban Offshore, to name a few. While the largest private E&P player in India, Reliance Industries, has underperformed the Sensex by a huge margin, the Oil and Natural Gas Corporation (ONGC) is up around 30 per cent, in line with the index. ONGC could be paying between $24,000 and $32,000 per day for each supply or rig-toeing vessel and also for services like blocking and deblocking of rigs. The charges are mainly based on the quality and life of the vessel. (economictimes.indiatimes.com)

IOC's credit profile to improve: Moody's

November 24, 2014. Indian Oil Corp (IOC), which posted weak financial results for the July-September quarter, will see improvement in its credit profile because of diesel price deregulation and falling crude oil rates, Moody's has said. IOC's second quarter earnings were weak "because of lower refining margins and inventory valuation losses," Moody's Investor Service said in a report. The company reported a negative refining margin of $2 per barrel in the quarter as against $2.3 per barrel gross refining margin in first quarter. It projected weak regional refining margins over the next 12 months as new capacity comes online in the region against the backdrop of slowing demand growth. Moody's said the deregulation of diesel prices along with declines in oil prices is expected to reduce fuel under- recoveries to around ` 85,000 crore this fiscal compared to ` 140,000 crore in 2013-14. Borrowings will also fall when the government rolls out the Modified Direct Benefit Transfer Scheme from January 2015 in the entire country. Under this, the cost of subsidies for LPG cylinders will be directly transferred to the consumer and oil marketing companies, including IOC, will be able to sell their products at market prices. Also, earnings will improve on commissioning of new refinery at Paradip. (economictimes.indiatimes.com)

No one found suitable for OIL CMD job

November 24, 2014. Government may invite fresh applications for top job at Oil India Ltd (OIL) after Public Enterprise Selection Board (PESB) did not find any of the six applicants, including the firm's Director (Finance) R S Borah, suitable. Public Enterprise Selection Board (PESB) interviewed six candidates including Borah, to select a new Chairman and Managing Director (CMD) of the nation's second biggest state explorer. With PESB not finding anyone suitable candidate, the government can seek fresh applications PESB was interviewing candidates to select a successor of incumbent S K Srivastava, who retires on June 30, 2015. Besides Borah none of the other three were qualified to appear for the interview. (economictimes.indiatimes.com)

Users of KG-D6 gas to pay $4.2/unit; additional $1.41/unit to be deposited in GAIL-operated gas pool a/c

November 22, 2014. The government has directed users of gas produced from the Reliance Industries Ltd (RIL)-operated KG-D6 gas field to pay the old rate of $4.20 a unit to the producer and deposit balance $1.41 a unit in a gas pool account operated by state-run GAIL India. The Cabinet approved a new gas pricing formula, which raised the domestic gas price from $4.20 a unit to $5.61 from November 1. It had, however, directed the oil ministry to credit the difference between the revised price and the old price to a gas pool account, pending final verdict of an ongoing arbitration between RIL and the government. According to government, GAIL will bear all administrative costs related to maintaining the gas pool account.

The government was favourably considering the option of directly transferring the differential amount to the gas pool account as there were legal or technical hassles in other two options. One option that was proposed by the contractor was to allow it to collect the entire sales proceeds and then deposit the differential amount in the gas pool account. The other option was to ask GAIL to collect gas revenues, pay RIL as per the old rate and keep the differential in the gas pool account. There could be legal problems with the first option because RIL had filed arbitration cases against the government over various disputes related to KG-D6, and allowing it to collect the entire sum could weaken the government's stand. The second option was technically cumbersome as customers have signed contracts with RIL and not GAIL, so the public sector company could not collect revenues without changing the contracts. The Cabinet decided that RIL should wait for the final verdict before getting new rates for gas produced from its controversial D1 and D3 fields. This is because the arbitration is over the government's power to prevent RIL from recovering its costs on account of a shortfall in production targets. While the production sharing contract allows the producer to recover costs, the government has disallowed some of the cost recovery on the ground that RIL had failed to produce the promised amount of gas. RIL says the government's action runs contrary to the PSC. (economictimes.indiatimes.com)

Devise formula to fix premium on natural gas from deep-water: Oil Ministry

November 21, 2014. The oil ministry has asked the director general of hydrocarbons (DGH) to devise a transparent formula to determine the premium on natural gas produced from challenging deep-water, ultra deep water or high-temperature and high-pressure finds, the government said. The government had announced earlier that natural gas would be priced on the basis of a formula based on international benchmarks, but a premium would be allowed for discoveries made in regions where exploration and drilling is costly and challenging. It later said it would consult experts to determine the premium. Under the new formula, the gas price would rise from $ 4.2 to $ 5.61, but there would be an incentive for difficult terrains. The DGH said that specialists would be consulted for this purpose as it is a complex issue and the DGH was not involved in arriving at the formula for natural gas pricing. After the Cabinet approved the new formula, the oil ministry had stated stakeholders will be consulted on the mechanism of premium determination and pricing of these three categories. The ministry had said a transparent process would determine the premium and that the government would address apprehensions about the process being discretionary. (economictimes.indiatimes.com)

Kelkar slams new gas pricing norms

November 20, 2014. Vijay Kelkar, who headed a panel on energy security appointed by the UPA government, said the new gas pricing mechanism will not attract investments in exploration and criticized the decision to give a premium on price of gas from challenging deep-sea fields saying that it reflected a cost-plus approach. Government said the Russian price was reliable and closer to the Indian reality compared to the National Balancing Point price. With the new gas pricing formula the price works out to be $5.61. The UPA regime had approved the Rangarajan formula, which would have raised the price from $4.20 per unit to about $9.3 per unit based on its net calorific value. Government said the formula was based on international benchmarks, and even BP Plc described it as a step in the right direction although the British major wants more clarity and free market prices. (economictimes.indiatimes.com)

CAG seeks KG-D6 block audit for 2012-13, RIL agrees for 2013-14 too

November 20, 2014. Comptroller and Auditor General of India (CAG) has sought an audit of Reliance Industries' spending on eastern offshore KG-D6 block in 2012-13, a request the company responded by asking the auditor to scrutinise records of not just that year but also 2013-14. CAG, in the third round of audit of KG-D6 as well as three other oil and gas fields, on November 11 wrote to Reliance Industries Ltd (RIL) seeking records to audit spending in 2012-13. To this, RIL responded with a request to add financial year 2013-14 to the scope for the audit of KG-D6. It offered full co-operation to CAG for this audit but cautioned that audit should be in letter and spirit of the Production Sharing Contract (PSC) signed by the government for KG-D6 fields. The company said it is agreeable to such an audit whose scope and nature should be in line with what was spelt out in the Oil Ministry's letter of January 2013. The Ministry had in January 2013 agreed that the audit under PSC should be a financial scrutiny and not a performance audit of the company. (economictimes.indiatimes.com)

NRL bags Jawaharlal Nehru Centenary Award for Energy Performance

November 20, 2014. Numaligarh Refinery Ltd (NRL) has been conferred with the prestigious Jawaharlal Nehru Centenary Award for Energy Performance of Refineries for 2013-14. The award is given by the Centre for High Technology (CHT) under the aegis of the Ministry of Petroleum and Natural Gas. The company won the third prize in the category of refineries having composite energy factor greater than or equal to 7.5, NRL said. Refineries with minimum Specific Energy Consumption, which is a measure of energy efficiency, are conferred with this award by CHT. (economictimes.indiatimes.com)

October fuel sales fall 0.99 per cent year-on-year: Govt

November 19, 2014. Local oil product sales declined 0.99 per cent in October, its first decline in about 11 months, government data showed, as diesel demand continued to ease indicating lower industrial growth during the month. Local oil product sales, a proxy for oil demand in the world's fourth-largest oil consumer, totalled 13.09 million tonnes last month, according to data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry.

Diesel consumption, which makes up over 40 per cent of local fuel sales, declined 3.02 per cent, while gasoline demand rose 10.49 per cent from a year earlier. India shipped in about 3.74 million barrels per day of oil in October, a growth of about 2.97 per cent from a year earlier. Imports of oil products increased by 5.38 per cent, while exports rose nearly 1.17 per cent. (economictimes.indiatimes.com)

India to pay Iran $400 mn frozen oil money

November 19, 2014. India will soon pay a third tranche of $400 million to Iran ahead of a Nov. 24 deadline to an interim deal with six world powers that allows Tehran to recover part of its overseas frozen oil revenues. Indian oil refiners are preparing to release the payments. Mangalore Refinery and Petrochemicals Ltd and Essar Oil will make the bulk of the payment. The other refiners that will also make payments are Indian Oil Corp and Hindustan Petroleum Corp. India has already paid $900 million in two instalments under the interim deal that allowed Iran to recover $2.8 billion of its funds held in foreign banks, in addition to $4.2 billion paid between January and July. The latest payments would be made using an existing mechanism of a series of back-to-back transactions in different currencies that are initially channelled through the Reserve Bank of India (RBI). Iran will eventually get paid in Dirhams from the central bank of United Arab Emirates. Iran's top oil client after China, India has imported 40.3 percent more oil from Tehran in the first ten months of this year than in the same period last year, data obtained from trade sources show. (www.reuters.com)

Law Ministry says govt can renegotiate fiscal terms of Cairn block

November 19, 2014. The government may alter terms of Cairn India's Rajasthan oil block after Law Ministry opined that fiscal terms can be renegotiated while granting extension beyond contractual period. The government can look at raising its share of oil from the fields from a current cap of up to 50 per cent as well as allowing Oil and Natural Gas Corp (ONGC), which is the licensee of the block, to raise its stake. Cairn's contractual term for exploring and producing oil from the Rajasthan Block RJ-ON-90/2 expires in 2020 and the company has made a formal application for extending the license by another 10 years saying the block also has significant potential to produce natural gas. The Law Ministry said the Production Sharing Contract (PSC) for the Rajasthan block clearly states that extension can be granted on "mutually agreed" terms and conditions. (economictimes.indiatimes.com)

Oil Ministry seeks assurance on gas supply from Turkmenistan

November 19, 2014. Petroleum Minister Dharmendra Pradhan, on a three-day visit to Turkmenistan, sought assurance of gas supply from the central Asian nation’s President Gurbanguly Berdimuhamedov. Pradhan also met Pakistan’s Petroleum Minister Jam Kamal Khan on the sidelines of the TAPI Steering Committee Meeting between the petroleum ministers Turkmenistan, Afghanistan, Pakistan and India. Pradhan assured Khan of India’s cooperation on natural gas exports from India to Pakistan apart from expediting commission of TAPI project. The meeting between the two sides in Ashgabat comes amid revival of talks to set up the much-delayed TAPI gas pipeline project. As part of the project, a 1,800-km pipeline is being set up to export up to 33 billion cubic metres (bcm) of natural gas a year from resource-rich Turkmenistan to India via Afghanistan and Pakistan over 30 years. (www.business-standard.com)

[NATIONAL: POWER]

Generation……………

Sumitomo to set up a 4 GW ultra super critical power plant in AP

November 25, 2014. The Andhra Pradesh (AP) government is signing four MoUs with Japanese global business giant Sumitomo Corporation and one of them corresponds to the setting up of a 4,000 MW ultra super critical power project as a joint venture project in collaboration with the state power utility AP Genco. Chief Minister N Chandrababu Naidu is betting big on Sumitomo's expertise ranging from power to agriculture to make a mark in the state. The AP government is signing two more MoUs, one with the Ministry of Economy, Trade and Industry (METI), Government of Japan, on industrial innovation and environmental fronts and the other with the New Energy and Industrial Technology Development Organisation (NEDO), Japan, for bringing energy-efficient technologies to the state. (www.business-standard.com)

Adani Power to acquire Avantha group’s Korba project for ` 42 bn

November 23, 2014. Adani Power is all set to acquire Avantha group's Korba West Power, a wholly owned subsidiary of Avantha Power that has an installed generation capacity of 600 MW in Chhattisgarh and is implementing another 600 MW in the second phase for an enterprise value of about ` 4,200 crore. The second divestment will mark the Avantha Group's exit from the power generation business. In April this year, the Adani group announced it had become the largest private power producer in India, with an overall installed capacity of 8,620 MW. (economictimes.indiatimes.com)

Goenka Group's Haldia plant to produce power by December

November 21, 2014. Calcutta Electric Supply Corporation (CESC), the flagship company of the R.P.-Sanjiv Goenka Group, is all set to commission its ` 4,600 crore thermal power plant at Haldia in West Bengal's East Midnapore district. The plant will become operational early next year. Chief Minister Mamata Banerjee will inaugurate the 600 MW (two units of 300 MW each) plant, which has been set up by Haldia Energy Ltd., a wholly owned subsidiary of CESC. China-based Shanghai Electric Corp. supplied the boiler turbine-generator for the plant set up over 317 acres of land. Punj Lloyd was the engineering procurement and construction contractor for the project. (economictimes.indiatimes.com)

NTPC keen to develop 2.4 GW coal-fired plant via JV

November 19, 2014. The country’s largest power producer, NTPC Ltd has evinced interest to develop the 2,400 MW coal-based power station proposed at Kamakhyanagar in Dhenkanal district through the joint venture (JV) route. The 2,400 MW coal fired plant is being developed by OdishaThermal Power Corporation Ltd (OTPCL), an equal JV between two state controlled entities- Odisha Mining Corporation (OMC) and Odisha Hydro Power Corporation (OHPC). Besides NTPC, engineering giant Larsen & Toubro (L&T) and Bharat Heavy Electricals Ltd (BHEL) were also inclined to pick up stake in OTPCL’s project. Both these central PSUs were keen for only 26 per cent stake and that too with a rider that their equipment would be used in the power plant. (www.business-standard.com)

DVC fails to clear strategic investor plan for Purulia project

November 19, 2014. The Damodar Valley Corporation (DVC) board has failed to invite Expression of Interest (EoI) for a strategic investor in the proposed 2,500 MW Raghunathpur power plant at Purulia. Facing acute funds crunch, the DVC was planning to bring in equity partners for the 2X600 MW phase-I and 2X660 MW Phase-II (Raghunathpur Thermal Power Project). The agenda in the board meeting included inviting EoI including from PSUs and private, state government to allow carrying out of due-diligence by new prospective bidders. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Power supply deficit declines to one of the lowest levels this year

November 25, 2014. With the onset of winter, just one ultra mega power plant at full capacity is sufficient to meet India's shortfall that has shrunk to less than 4,000 MW. Although total demand has increased by 5,000-6,000 MW in the past one year, new capacities coupled with better grid management have led to the decline in the supply deficit. Uttar Pradesh (UP) and states in south India continue to show large demand-supply gap specifically due to grid congestion. UP's grid system isn't good enough to meet the demand for the power the state requires. (economictimes.indiatimes.com)

Victory for Modi: Coal India trade unions call off strike

November 23, 2014. The labour unions of Coal India have called off a strike planned in protest against a stake sale and opening up of the industry, setting the stage for Prime Minister Narendra Modi to press ahead with energy reforms. Coal India holds a monopoly on commercial coal mining, accounting for more than 80 per cent of the country's total production. Union leaders met a senior coal ministry official and the strike was postponed until a meeting with the power and coal minister, said S.Q. Zama, secretary general of the Indian National Mineworkers Federation. The date of the meeting with the minister has not yet been fixed. Even before meeting, the government and Coal India officials were confident any strike would have little impact as one of the company's five unions, close to the BJP, had promised not to join. The government's sale of a tenth of Coal India could fetch a third of its $9.5 billion annual divestment target. Asset sales are running behind schedule, pressuring a deficit target of 4.1 per cent of GDP for the fiscal. Emboldened by the biggest electoral mandate in 30 years, Modi has also taken steps to let private companies mine and sell coal in India, for the first time in more than four decades. Zama said the unions would keep resisting any move that could undermine the position of Coal India. He said competition from private companies would make Coal India a "sick" company, risking the jobs of most of its 370,000 workers. (economictimes.indiatimes.com)

Union Cabinet clears ` 51 bn power system improvement project for North-East

November 21, 2014. Union Cabinet chaired by the Prime Minister, Narendra Modi, has approved, North Eastern Region Power System Improvement Project (NERPSlP) for six States (Assam, Manipur, Meghalaya, Mizoram, Tripura and Nagaland) for strengthening of the Intra State Transmission and Distribution System at an estimated cost of ` 5111.33 crore including capacity building expenditure of ` 89 crore. The scheme is to be taken up under a new Central Sector Plan Scheme of Ministry of Power (MoP). The scheme is to be implemented with the assistance of World Bank loan and the budget of MoP. As the Intra-State Transmission and Distribution systems in the North-Eastern States have remained very weak, the Central Electricity Authority (CEA) developed a comprehensive scheme for the North East Region (NER) in consultation with the Power Grid Corporation of the India Limited (PGCIL) and State Governments concerned. The project shall be implemented through PGCIL in association with six NER States in 48 months from the date of release of funds to PGCIL. After commissioning, the project will be owned and maintained by the State Governments. Presently, all the six Northeaster states (NER) States are connected to transmission network at 132 KV and below. The 33 KV system is the backbone of power distribution system in the six NER States. (economictimes.indiatimes.com)

NTPC plans 26 per cent stake buy in coal mines overseas to fuel its power plants

November 19, 2014. State-run NTPC, the country's biggest power generator and thermal coal consumer, plans to acquire at least 26 per cent stake in coal mines abroad to secure long-term fuel supplies for all its power plants. This is a shift from the company's earlier stance of seeking only minority stakes in such mines to ensure fuel for plants that operate only on imported coal. In the current fiscal, NTPC is targeting tie-ups for 17 million tonnes of imported coal. (economictimes.indiatimes.com)

Policy / Performance………….

Canada to tie up with AP in farm, power sectors

November 25, 2014. Saskatchewan Province of Canada evinced interest in collaborating with Andhra Pradesh (AP) in the field of agricultural research, tourism, good governance, and clean technologies in the production of thermal and nuclear power. During the interaction with AP chief secretary IYR Krishna Rao, Saskatchewan deputy minister Doug Meon said his country was interested in having bilateral relations, especially in the areas of energy, security, food security and education. The visiting team showed interest in agricultural research, tourism, good governance, clean technologies, and possibility of collaboration in nuclear energy in consultation with the Government of India and the Nuclear Energy Corporation. (www.newindianexpress.com)

Govt appoints firm to find ways to offset any spike in power production costs after e-auction of coal blocks

November 24, 2014. The government has appointed a consultancy firm to find ways to cushion power companies against a rise in generation costs after they buy coal blocks through e-auctions, and look at the possibility of passing a part of it on to consumers. Some power generation companies had been allotted coal blocks on the basis of their plants. They have also signed power purchase agreements (PPAs) with power utilities to supply electricity at a mutually agreed pre-determined price. PPAs are legally binding documents and increasing this contracted power tariff will lead to violation of the contract. The ordinance to auction coal blocks follows the Supreme Court's order cancelling allocation of several coal blocks, after the Comptroller & Auditor General estimated that coal worth ` 1.86 lakh crore was given away. At present, 42 producing blocks and 32 that are ready to start production will be offered — some through auctions and others through direct allocation to state utilities. The auction will commence on February 11 next year, and the winners will be informed by March 16. The government expects these 74 blocks to produce 210 million tonnes of coal a year. Coal blocks will be auctioned on the basis of their net present value, which is the current value of future earning from the block. The floor price for bidding will be fixed at 90 per cent of the net present value. Winners need to pay 10 per cent of the bid amount upfront. A successful bidder or allottee may utilise coal mined from a particular coal mine in any of its other similar end-use plants by giving a prior intimation to the central government in writing and the government will be free to impose terms and conditions it deems necessary. State utilities would be allocated blocks depending on per-capita power availability in the states and future requirements. They will not be allowed to bring in private firms as joint venture partners in such blocks. (economictimes.indiatimes.com)

Govt's power sector reforms in right direction: Nomura

November 24, 2014. The recently announced power sector reforms by the Indian government are a step in the right direction as easier and assured access to power will help boost productivity of the manufacturing sector, the Nomura report said. According to the Japanese financial services major, besides a shortage of supply, poor transmission and distribution (T&D) infrastructure and a large amount of pilferage are some of the key issues plaguing the power sector. The government approved three key projects in the power sector targeting improvement of T&D. It approved ` 43,033 crore rural electrification scheme, Deendayal Upadhyaya Gram Jyoti Yojana. This scheme would replace the existing Rajiv Gandhi Grameen Vidyutikaran Yojana (RGGVY). The government approved ` 5,200 crore scheme for strengthening power transmission and distribution network in six North-east states. It also approved ` 32,612 crore scheme for strengthening sub-transmission and distribution network in the urban areas. (economictimes.indiatimes.com)

Private power producers ask RBI for bailout

November 22, 2014. Private producers are seeking 10 per cent additional debt exposure by banks to the power sector to fund projects stranded by lack of fuel. In a presentation to Reserve Bank of India (RBI) Governor Raghuram Rajan, the Association of Power Producers (APP) sought easier rules for banks to fund stranded projects. The meeting was attended by executives of Reliance Power, Tata Power, Jindal Power, and the Adani, GMR, GVK, Essar, Indiabulls, Lanco and Welspun groups, among others. APP sought the banking sector’s support in creating an enabling environment for all participants in the power sector — project developers, lenders, distribution companies and consumers. The association gave a debt restructuring plan for power plants stranded by unfulfilled fuel linkages. Investments of ` 1,57,730 crore have been affected by the under recovery of fixed and variable costs in power projects due to factors beyond the control of developers. Close to ` 61,050 crore of investment is stranded in gas-fired power projects totalling 13,566 MW capacity. (www.business-standard.com)

Cabinet approves ` 326 bn power scheme

November 21, 2014. The Cabinet has approved the ` 32,600 crore Integrated Power Development Scheme (IPDS) that will strengthen the transmission and distribution networks and metering in urban areas and smarten it with information technology. It also approved a ` 43,033 crore scheme, which includes the requirement of budgetary support of ` 33,453 crore, for rural areas to separate agricultural supply from non-farm supply. Cutting transmission losses and improving distribution is a key element for the power sector, and the initiative follows steps to ease coal shortage and discussions to formulate a financial package for the sector, where thousands of megawatts of capacity are idling or operating sub-optimally because of fuel shortage or inadequate distribution network. The cabinet had approved last year a scheme for IT enablement of the distribution sector and strengthening of distribution network and laid down targets. It said the budgetary support needed for the scheme was ` 25,354 crore during the implementation of the scheme. (economictimes.indiatimes.com)

Govt to invest $4 bn to tackle power theft