-

CENTRES

Progammes & Centres

Location

[Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices]

“Although the share of crude oil in the worldwide energy consumption is continuously declining for the benefit of cleaner forms of primary energy as natural gas or renewables but also coal, its significance for serving as a global reference price marker for energy remains unbroken. After a long period of rather unusual stability crude oil is caught in a quite significant and constant downward trend…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· US-China Climate Deal: Not a Big Deal

· Can India become Self Reliant in Coal Production?

ANALYSIS / ISSUES…………

· Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (part I)

DATA INSIGHT………………

· All India Small Hydro Projects

[NATIONAL: OIL & GAS]

Upstream…………………………

· Kelkar panel opposes revenue-sharing model for deep sea blocks

· ONGC to invest ` 106 bn in western offshore fields

· Canada's Niko Resources says evaluating plans for India assets

Downstream……………………………

· Oil marketing companies seek flexible deals to tap new markets

· PM Modi likely to inaugurate ` 350 bn Indian Oil refinery

· Indian Oil defers Koyali units' shutdown to March-April

· Indian Oil to set up first LNG Terminal on the East Coast

Transportation / Trade………………

· India may propose getting China company to lead pipeline consortium

· India's Oct Iran oil imports rise 60 per cent y/y

· IGL gets govt backing over power to fix transport tariff in Delhi

· GAIL, partners form SPV for TAPI pipeline project

Policy / Performance…………………

· India expects foreign investment in petroleum sector: Oil Minister

· Centre making efforts to reduce fuel import bill by ` 100 bn

· First dissent on gas price, GSPC seeks higher rates

· Only 0.006 per cent ready to give up LPG subsidy

· Diesel prices up in Punjab as SAD-BJP govt raises VAT

· New subsidy regime in New Year: LPG sop will go directly to accounts

· Excise on petrol, diesel hiked; no increase in retail rates

· Oil Ministry grapples with payment options for RIL's KG-D6 gas

· Govt provides operational flexibility to oil firms

· IOC, BPCL, HPCL to go for round III of fuel price cuts, reduction likely on Nov 15

[NATIONAL: POWER]

Generation………………

· Indian group plans Mozambique power plant after buying Rio asset

· BHEL commissions second gas-based power plant in Tripura

· India, Nepal to sign deal for 900 MW power project

· Uttarakhand hydel projects fail to take off

Transmission / Distribution / Trade……

· Power Grid gets board approval for ` 10 bn worth projects

· JSW buys Jaypee's hydro plants for ` 97 bn

· Sterlite Grid commissions country's first Ultra Mega Tranmsission Project

· Power firms eye a turnaround with transmission overhaul

· Power restoration worth ` 620 mn completed in Vizag

· Goyal says may stop thermal coal imports in 2-3 yrs

· BEST set to take row with Tata Power to Supreme Court

Policy / Performance…………………

· Hike in power tariff in Delhi unlikely before assembly polls

· Indian billionaires fret as coal auctions to raise debt

· Maharashtra finance department wants cut in power subsidy

· Govt considers financial relief to restart 16 GW gas-based power plants

· PM Modi pushes ahead with Coal India stake sale

· Adani lines up $1 bn SBI loan for Australian coal venture

· UMPP bidding norms may be revised soon: Power Ministry

· BJP urges Centre to review power projects in Arunachal Pradesh

· OIPL disburses ` 4.9 bn compensation for Bhedabahal UMPP

· Commercial operation of Kudankulam nuclear plant only in 2015

· Uninterrupted power to farmers in next two years: Power Minister

· Delhi power tariff hike rolled back

· 4 GW UMPP for Bihar announced

· SAARC power grid likely to get leaders' approval this month

· Maharashtra's new energy policy will seek to improve power supply, says governor

· West Bengal CM to unveil CESC's ` 46 bn Haldia plant

· Delay in mining by NTPC from Jharkhand coal block under lens

· Coal scam: Court directs CBI to further investigate case

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Arctic finds still viable for Statoil as crude falls below $80

· Pertamina says may double output from overseas assets by end-2014

· Petrobras says 3Q Brazil oil output rises to 2.09 mn barrels per day

· Argentina's YPF, Chile's ENAP agree extra $200 mn for offshore gas project

· Eni signs Angolan gas-development deal

· US drillers shift oil rigs to tap most reliable fields

· Pakistan's Zarghun South Field Surface Processing Facilities Operational

· Deepwater Gulf production to set new record in 2016

· US retreat from oil investment in Asia paves way for rivals

· Norway embraces Chinese cash in race for Arctic oil riches

· Interra ups CHK 1180 well production in Myanmar's Chauk oil field

· UAE concerned that oil glut may curb exploration, output

Transportation / Trade…………

· Halliburton may sell fewer baker assets than expected

· Mounting pressure on OPEC spurs more wagers on oil rally

· US gives final approvals to Freeport for LNG exports

· Flip side of Russia-China gas deals benefits Australia suppliers

· US shale boom masks threats to world oil supply, IEA says

Policy / Performance………………

· Bank Indonesia raises key rate after fuel-price increase

· Goldman says OPEC in dilemma as output cut seen helping US

· Oil diplomacy takes new twist as Venezuela seeks non-OPEC help

· Russia sees recession next year if oil price falls to $60

· Putin readies aid as Rosneft’s $21 bn of debt looms

· Finland and Estonia agree LNG terminal plan

· JPMorgan settles claims it cheated shale-rights owners

· Oil-price rout seen deepening by IEA as pressure on OPEC mounts

· Saudis reject talk of OPEC market share war as oil slides

· Metgasco responds to gas plan mooted by NSW Govt in Australia

· Egypt says to repay debts to foreign oil companies

· US EIA reduces crude, gasoline price forecasts through 2015

· EmiratesLNG to start operations mid-2018

· Japan LNG spot price rises to $15.30 per mmBtu in October

· In new oil order, OPEC’s choice is pricing power or sales

· Oil majors praise Indonesia's new approach to investment

[INTERNATIONAL: POWER]

Generation…………………

· Ghazi Fabrics plans 8.1 MW power plant

· Ayala boosts power generation portfolio

· Ghana needs $1.5 bn to improve power generation

Transmission / Distribution / Trade……

· Buffett-California power market dealing with price anomalies

· Nepal needs regulatory reforms for power trading with India: IPPAN

· Toshiba plans $30 mn investment in power T&D

Policy / Performance………………

· Govt offers IEC incentive to sell power plant

· Norway grants ` 5.8 bn to overcome power cut

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· MP Govt to invite bids for first solar UMPP in March 2015

· IREDA, US Exim Bank ink $1 bn pact for clean energy projects

· India seeks renewables without subsidy as solar target increased

· PM Modi proposes global virtual centre for clean energy research

· India for early capitalisation of green climate fund

· MEIL commissions 50 MW solar plant in AP

· Centre to provide ` 13.5 bn from NGEF for Andhra power projects

· PM Modi invites ASEAN to 'new environment in India'

GLOBAL………………

· NTT unit plans to build 15 MW solar power plant in northern Japan

· Electricity from fuel cells sparking demand for platinum

· Australia pushes ahead with coal despite climate concerns

· Power bills for 12 mn German households to fall from January

· Peru to unveil plans for renewable power auction during UN talks

· OneraSystems offers to build $90 mn solar power plant in Egypt

· Solyndra program vilified by republicans turns a profit

· China hunger for clean energy to leave no rooftop behind

· New EU bosses want to scrap some green energy laws

· Alberta to follow US and China on CO2 rules: Prentice

· IEA pushes nuclear as carbon emissions set to reach limit

· US, China agree to new cuts to combat Climate Change

· Fossil fuels with $550 bn in subsidy hurt renewables

· Abbott Govt renewable energy plan rejected by opposition

[WEEK IN REVIEW]

COMMENTS………………

US-China Climate Deal: Not a Big Deal

Lydia Powell, Observer Research Foundation

|

L |

ast week, the United States and China released a ‘Joint Announcement on Climate Change’. Some of the mainstream media outlets concluded that it was a historic agreement (see for example BBC which called it a historic green house gas pledge[1] or CNN which said simply that it was a historic agreement[2]). On the other hand, the Indian media outlets conveyed shock over the unexpected announcement and the impact the deal could have on the Indian position (see for example Times of India which said that pressure would increase on India to match with similar pledges[3] or the Hindustan Times which said that it was a surprise for India[4]).

Subsequent news stories in the Indian mainstream media quoted the Minister for Environment & Climate Change as saying that the ‘US-China deal was a good beginning but not ambitious enough’.[5] We will have to wait for India’s follow up response to see if the Minister implied that India would be coming out with a more ambitious target or that India would follow the leaders and get away with an announcement lacking in ambition. In the mean time here is some unsolicited advice on the best option for India.

Going strictly by the text of the joint announcement[6], China said that:

‘It intends to achieve the peaking of CO2 emission around 2030 and make best efforts to peak early and intends to increase the share of non-fossil fuels in primary energy consumption to around 20% by 2030 and intends to increase the share of non-fossil fuels in primary energy consumption to around 20% by 2030.’

And the United States said that:

‘It intends to achieve an economy-wide target of reducing its emissions by 26%-28% below its 2005 level in 2025 and make best efforts to reduce it to its emissions by 28%.’

For good measure both sides also said that:

‘They will continue to work to increase ambition over time’

The numbers and the language used in the announcement by two of the largest carbon emitters in the world that together account for 35.7% of global emissions[7] do not justify labelling it as ambitious or game changing. One could even say that the agreement is deliberately irresponsible as the loop holes are too large even by the loose standards permitted in global diplomacy.

As many observers have pointed out, the two countries only intend to act and so it is not a guarantee of future action. But the word ‘intend’ is not something that China and USA inserted wilfully to avoid commitment. They were merely responding to the invitation by the UNFCCC which asked countries to communicate their intended nationally determined contributions (INDCs) to the agreement in the first quarter of 2015.

In reality, China’s announcement that it intends to peak its emissions could be seen as a statement on the natural course of its economic life. In the context of peaking, the question is not whether China would peak in emissions, but when it will peak and at what level. On both, China’s announcement is uncertain. Here is a tip for India. There is no risk in making announcements on peaking irrespective of whether it is about oil production or carbon emission as long as the date is uncertain. These will peak eventually just as any human being will die eventually. The key is to be uncertain as to exactly when this will happen.

Many commentators have concluded that China only intends to peak its emissions at around 2030 and that this means that China’s emissions will continue to grow even after 2030. They use the low per person consumption of energy in China compared to industrialised economies and the fact that only a small share of the population own cars and other energy consuming appliances in China to make their case for continued growth in emissions in China. This may not be an accurate assumption. As pointed out by the World Energy Outlook 2014 (WEO 2014) released by the International Energy Agency just a week ago, China’s emissions may peak just after 2030.[8] As for the level at which it would peak there appears to be some inaccuracy. In 2011, China’s annual per person CO2 emissions was estimated to be 7.63 tonnes of CO2 (tCO2). This was just below the EU average (EU 28) of 8.4 tCO2 and higher than world average of 6.58 tCO2.[9] Surprisingly according to WEO 2014, China’s per person emissions will be 7.1 tCO2 in 2040, lower than what it is today, under its New Policies Scenario. We will have to examine WEO 2014 closely to see how exactly this will be achieved.

China’s promise that it will increase consumption from non-fossil energy sources to 20% can be kept on solely the basis of its existing policies. But the numbers are fascinating, especially for Indian energy observers. China has said that it will have in place over 800-1000 GW of non-fossil fuel capacity (including 180 GW nuclear and 130 GW hydro) by 2030.[10] This is roughly the same as the 800 GW coal based capacity that China has today (or equal to total power generating capacity of the United States) and just over three times India’s total power generating capacity today).

India could draw some inspiration from WEO 2014 for its follow-up announcement and easily reiterate what former Prime Minister Manmohan Singh promised on per person emissions. This would be in line with the tendency of the new government to modify old policy positions and convey them as path breaking measures through the obliging media. As per WEO 2014, India’s per person emissions will not exceed global average even by 2040 at just 2.9 tCO2 under WEO’s New Policies scenario and its emissions would peak sometime around that time.

Coming to the announcement by the United States, some analysts have concluded that China offered to do nothing and in return the United States agreed to tighten its belt further. This is not necessarily true. What the United States agreed to is merely a slightly modified version of what it plans to do anyway. This is not very different from what China has agreed to do. The United States stated intention is essentially an extension of its existing commitment to reduce emissions by 17% below 2005 levels by 2020 as admitted in the fact sheet issued with the announcement.[11] This can be achieved with almost no additional effort on the part of the United States. According to WEO 2014, coal and oil use peak somewhere between 2015 and 2020 while gas use continues to grow until 2040 under its New Policies Scenario. With gas availability and use increasing in the United States, the slight improvement in its promise of emission reduction would be achieved any way, whether or not the Climate mandate required the United States to do so.

Moving on, the text of the joint announcement says that ‘the United States and China hope that by announcing these targets they can inject momentum into the global climate negotiations and inspire other countries to join in coming forward with ambitious actions as soon as possible, preferably by the first quarter of 2015’.[12] Given that the only politically acceptable behaviour now is to become weather-wanes to the direction in which winds from China and the United States are blowing, India could easily oblige by an announcement that says India would peak in emissions sometime after China and that India’s per person emissions would not exceed that of global average. India may achieve this target without even trying.

All this is fine for the diplomatic dance that countries have to perform until the music stops, but what about the contribution all this will make to reducing emissions. The answer simply is: not much. According to WEO 2014, even under the New Policies Scenario (which assumes that countries will deviate from business as usual paths and implement policies to reduce carbon emissions) carbon emissions will grow by over 20% to 38 GtCO2 by 2040 that is over the prescribed budget for that period. If intentions of USA and China are implemented, the WEO expects a saving of 1.3 tCO2 and 2.9 tCO2 that will make no difference to the concentration of Green House Gases in the atmosphere. Anyone from Mars (or Venus) will wonder why the supposedly intelligent human race continues to invest in fooling itself year after year that it can and it will change the climate.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Can India become Self Reliant in Coal Production?

Ashish Gupta, Observer Research Foundation

|

T |

he continuous increase in imports of coal in the past few years has become a major source of concern, especially in the light of increasing current account deficit during the last few years. Coal is becoming a major import item and this is being viewed as a source of vulnerability to the Indian economy. If one compares figures in the Xth Plan (initial year) with that in the XIIth Plan (initial year), one can easily see how imports have risen and how supply of coal to various power plants are declining on continuous basis. The comparison is given below:

Comparative Analysis

|

Xth Plan 1st Year (2002-03) Actual |

XIIth Plan 1st Year (2012-13) Actual |

|||||||

|

Power |

||||||||

|

|

Utilities |

CPP |

Total Power |

Total (Including other sectors 2002-03) |

Utilities |

CPP |

Total Power |

Total (Including other sectors 2012-13) |

|

Consumption (MT) |

255.5 |

19.6 |

275 |

363.4 |

461.5 |

45.3 |

506.9 |

707.8 |

|

Domestic supply (MT) |

252.2 |

17 |

269.2 |

340.1 |

399 |

45.3 |

444.3 |

570.2 |

|

Imports (MT) |

3.3 |

2.5 |

5.8 |

23.3 |

62.5 |

0 |

62.6 |

137.6 |

|

Consumption, Domestic supply and Imports (%) |

||||||||

|

Consumption |

70.3 |

5.4 |

75.7 |

100 |

65.2 |

6.4 |

71.6 |

100 |

|

Domestic supply |

74.2 |

5 |

79.2 |

100 |

70 |

7.9 |

77.9 |

100 |

|

Imports |

14.1 |

10.9 |

25 |

100 |

45.5 |

0 |

45.5 |

100 |

|

Consumption, Domestic supply and Imports in Total consumption (%) |

||||||||

|

Consumption |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

Domestic supply |

98.7 |

87 |

97.9 |

93.6 |

86.5 |

100 |

87.7 |

80.6 |

|

Imports |

1.3 |

13 |

2.1 |

6.4 |

13.6 |

0 |

12.3 |

19.4 |

In the year 2002-03, domestic supply of coal to power utilities were at 98.7% and for captive power plants it was 87%. 97.9% of the total demand of the power sector was met through indigenous supply. Total supply including the demand from other sector was 93.6%. Total imports were 23.3 Million Tons (MT) which was only 6.4% of the total consumption. These figures are fairly impressive. But in the year 2012-13, domestic supply of coal to the power utilities reduced to 86.5%. Interestingly, supply to captive power plants was entirely met through indigenous supply even when total supply reduced from 97.9% to 87.7%. Also the total indigenous supply of coal to the all coal consumers reduced dramatically from 93.6% to 80.6%. Total imports rose to 137.6 MT (19.4 %) from the meagre 6.4 % in 2012-13 which is shocking. What were the reasons behind this sudden surge in imports? Is it possible to identify reasons merely by looking at past coal production trends?

There is always uncertainty over whether India can become self reliant in domestic thermal coal supply? Unfortunately, after analysing the production growth from 2002-03 to 2012-13, the goal of becoming self reliant looks next to impossible, despite improvements in the production rate from 2007 -08 to 2009-10. These three years were quite impressive as growth in coal production improved continuously from 6.1 % to 7.8 % to 8 % respectively.

Coal Production Growth

|

Year |

Production (MT) |

Growth% |

|

Xth Plan |

||

|

2002-03 |

341.3 |

|

|

2003-04 |

361.2 |

5.9 |

|

2004-05 |

382.6 |

5.9 |

|

2005-06 |

407.0 |

6.4 |

|

2006-07 |

430.8 |

5.8 |

|

XIth Plan |

||

|

2007-08 |

457.1 |

6.1 |

|

2009-09 |

492.8 |

7.8 |

|

2009-10 |

532.0 |

8.0 |

|

2010-11 |

532.7 |

0.1 |

|

2011-12 |

540 |

1.4 |

|

XIIth Plan |

||

|

2012-13 |

557.5 |

3.13 |

The main reasons behind this impressive performance was the sudden increase of coal based installed capacity during 2007-08 to 2011-12 (27,000 MW) and continued pressure from state utilities on coal suppliers to fulfil their demand. Also in these years there were only few strikes. The year 2009-10 in which coal production achieved 8 % growth, there was no strike at all and consequently no man days lost. Whereas in 2010-11 when production remained stagnant at 532.7 MT, 2 industrial strikes took place leading to a shortfall of 8.1 MT. Similar incidents happened in 2012-13 when 2 strikes reducing the coal production by 5.58 MT. These strikes are becoming a regular feature of the Indian coal sector showing how coal production is vulnerable to these unionised labour forces.

The fall in production after 2009 onwards was also due to introduction of the idea of ‘no-go’ area and moratorium on mining in polluted areas due to enforcement of Comprehensive Environmental Pollution Index (CEPI) norms adopted by the environment and forests ministry. Coal projects have struggled to get environment clearances since 2009, when the ministry's ‘no-go’ classification disallowed mining in 203 coal blocks and CEPI norms had prohibited mining in areas with high pollution index even if pollution was because of some other industry. The enforcement of these approaches forced many utilities to go for costly imported coal.

Apart from the regulatory, administrative and labour issues, inadequate drilling capacity, backlog in the overburden removal, mismatch between excavation and transportation capacities, low availability and under utilisation of heavy earth moving machinery are cited as a major hindrance for increasing the coal production. As per the Comptroller and Auditor General of India, target for detailed drilling by Central Mine Planning & Development Institute (CMPDI) for CIL blocks was 7.50 lakh metre and 13.7 lakh metre for non-CIL blocks against which the achievements were only 5.88 lakh metre and 7.82 lakh metre respectively leading to a shortfall by 1.62 lakh metre for CIL blocks and 5.88 lakh metre for non-CIL blocks. Unfortunately, whatever planning was undertaken in this regard it was limited to paper only and no concrete steps were implemented on the ground.

With regard to mismatch in excavation and transportation capacity, CMPDI reported in 2011 that in 31 projects the excavation capacity is more than transportation capacity and in 12 projects excavation capacity was much lower than the transportation capacity. This is a major issue showing administrative and regulatory measures are not taken in a timely manner to bridge this imbalance. In the year 2011, CIL requested the railways to provide them 200 rakes/ day but got only 186 rakes/ day which translated into loss of loading of 50,000 tonnes/ day. The same trend is continuing every year.

Productivity is another area which was not given much importance in Indian coal mines and thus far remained merely a tool for comparative analysis with other coal producing countries. There is no denying that there has been continuous rise in production from open cast mines. However there was aggregate shortfall of production by 9.1 MT Eastern Coalfields (ECL), 5.80 MT Central Coalfields (CCL) and 22.86 MT Mahanadi Coalfields (MCL) during 2006 to 2011. Interestingly, ECL which occupies the first rank in labour force with 74,276 workers, where as CCL stands at rank third with 46,686 workers and MCL which occupies the rank fourth with 52,484 workers were not able to effectively utilise their workforce. Companies are aware of good practices but they rarely apply them in day to day operations. Ironically, there is a section on productivity in the Annual Reports of all the companies but productivity given fails to translate into actual performance.

On the private sector participation in commercial coal mining there is always scepticism but it is pushed in the name of efficient practices and lower coal shortages. Well, the foundation was laid by the Ministry of Coal to amend the Coal Mines Nationalisation Act and was approved by the Cabinet on 11/02/1997 and subsequently on 27/05/1997 after new government took charge. The Bill got vetted by Ministry of Law and Justice on 08/07/1997 but before it could be introduced in the Parliament, strike notice was served by the trade unions demanding withdrawal for the Bill. In 1998 the matter was re-examined and in 1999, a fresh note was sent to the Cabinet Secretariat. The Group of Ministers (GoM) convened several meetings in this regard and the last meeting was held in 09/04/2002. The Bill is still pending and no final decision has been taken by GoM on the issue whether to pursue Coal Mines Nationalisation Amendment Bill 2000 in the Parliament in view of threat of strikes by the Trade unions. The government currently wants to end this dilemma through the Coal Ordinance 2014. But there is a problem because government does not have muscle in the upper house (Rajya Sabha) whose consent is crucial!

In the wake of these existing challenges, the government announced that Indian coal production target must reach to 1 billion tons by 2019. Unfortunately until the structural issues discussed above are not addressed in a time bound manner, the ambitious goal looks impossible. Another statement issued by the coal ministry in which it stated that India will reduce thermal imports to nil in three years time does not seem logical. This is because some imports are institutionalised by the very fact that many coastal based power plants are based on imported coal. It is a good that India will reduce its coal imports but still imported coal will be required.

The government wants to disinvest its share from CIL to bridge current account deficit by reducing its shareholding from 89.65 % by another 10 %. The move is very logical as it brings required funds as well as transparency and accountability. But let us not forget the fact that the move will also invite more strikes, which means more man days lost and consequently less production. This means that more imports will be required to bridge the shortfall. How can problems be solved? Well solutions are known but how solutions will be implemented, that is a call on the government!

Source:

Coal Controller Office, Coal Statistics

Ministry of Coal, Annual Reports

Ministry of Coal, Legislation Document

Occasional Working Paper Series, Ministry of Coal

The Comptroller and Auditor General of India (CAG) audit report on coal block allocation

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Facing Downside Risks –The Oil Price Slump and how it might affect Gas Prices (part I)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

T |

his paper is split into two parts: This present part (I) is dealing with the currently vibrant oil price trends and the second part (II) will take a closer look at its effects on natural gas markets and pricing.

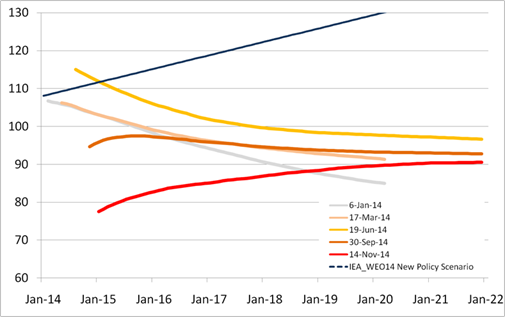

Although the share of crude oil in the worldwide energy consumption is continuously declining for the benefit of cleaner forms of primary energy as natural gas or renewables but also (at least temporarily) coal, its significance for serving as a global reference price marker for energy remains unbroken. After a long period of rather unusual stability crude oil is caught in a quite significant and constant downward trend since mid of June: The price of North Sea Brent crude oil, the most widely acknowledged crude oil benchmark worldwide, has fallen below $ 80/bbl, the lowest level in more than four years, and more than 30 % lower than its year-to-date peak of $ 115/bbl mid June (see Figure 4). Before its recent decline, average monthly Brent spot prices have been traded at quite low volatility within a remarkable narrow $ 5/bbl margin of about $ 107‑112/bbl for 13 consecutive months through July 2014.

The reason for past stability was market driven and based particularly on the U.S. supply surge: since a couple of years, even most substantial supply disruptions (for example resulting from the Arab Spring as the complete shutdown of Libyan production in early 2011) have been offset by the impressive surge in U.S. oil production, which has been risen by almost 50 % within only 5 years between 2008 and 2013 due to the unconventional tight oil boom.[13] On current trends the U.S. is widely expected to catch up with Saudi Arabia and Russia on pure crude oil production soon.[14] Figure 1 clearly demonstrates the dramatic rise of the U.S. crude oil and lease condensate production, which exceeded 8.6 million bbl/d in August 2014, a production volume not observed since July 1986. That is giving the U.S. the role of being the crucial contributor of (non-OPEC) crude oil supply growth, even if EIA has slightly revised downward its U.S. total supply growth forecast by 0.1 million bbl/d for 2015 because of the ongoing plunge in crude oil prices.[15] Together with the ongoing North-American shale gas bonanza and tendentially weakening global oil demand prospects, this might for sure churn global energy pricing for a quite a while.

Figure 1: U.S. Crude Oil and Lease Condensate Production (1960‑08/2014)

Source: EIA (2014), Crude oil and lease condensate production at highest volume since 1986, Today in Energy, Nov. 17, 2014, http://www.eia.gov/todayinenergy/detail.cfm?id=18831&src=email

On the other hand the plunge in oil prices is triggered by the current malfunctioning of the OPEC. After some time of speculation about the reasons behind it (including conspiracy theories aiming at a strategic collaboration of some oil producers to bring Russia into budget troubles) this can now be clearly attributed to Saudi Arabia’s more long-lasting strategic attempt to squeeze U.S. tight oil producers out of the market. After months of silence along with sustained high oil supply level, OPEC’s largest producer, state oil company Saudi Aramco, has cut the prices of its oil deliveries to U.S. Gulf coast (as well as Asian customers) considerably. Consequently, the Saudis are trying to capture their share on the American market in a kind of unexpected price war and consequently squeeze out indigenous tight oil producer. Whether this strategy turns out to be politically and economically sustainable will have to be seen; first of all at OPEC’s regular discussion on pooled oil output policy at the 27th Nov. meeting. Already now some of Saudi Arabians cartel partner has got into dire straits (particularly Venezuela) prompting to call for action to bring the oil price slide to an end. According to The Economist Iran is even more vulnerable, however, for Russia the impact will be less dramatic for the time being. The Saudis themselves are calculating their budget with a relative low break-even oil price of about $ 95/bbl or even below and are expected to withstand low prices because they put aside some windfall profits gaining from high oil prices in the past.[16]

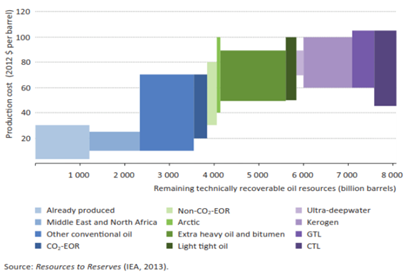

Whether the strategy can economically succeed might be seen by how fast how much volume of U.S. tight oil production will shut down and squeezed out of the market therefore. IEA’s global oil production cost curve, as shown in Figure 2, illustrates that at current most of the global oil production generally comes from the cheap conventional variety from the Middle East and North Africa, all comprising production cost below $ 70/bbl (blue bars). In contrast the far scarcer tight oil resources will require a considerably higher oil price of about $ 50-100/bbl to become profitable (dark green bar).

Figure 2: Global Oil Production Cost Curve

Source: IEA (2013). Resources to Reserves - Oil, Gas and Coal Technologies for the Energy Markets of the Future.

Nevertheless, the IEA has recently made clear that global oil prices could indeed continue to fall into 2015 despite the expectation that some unconventional oil production could become uneconomic at prices under $ 80/bbl and JP Morgan as well as Goldman Sachs has significantly slashed their 2015 Brent price forecast to $ 82-85/bbl, with a chance that the price could sink even to $ 65‑75/bbl by early January if OPEC’s struggle for the consolidation of prices is going to fail.[17]

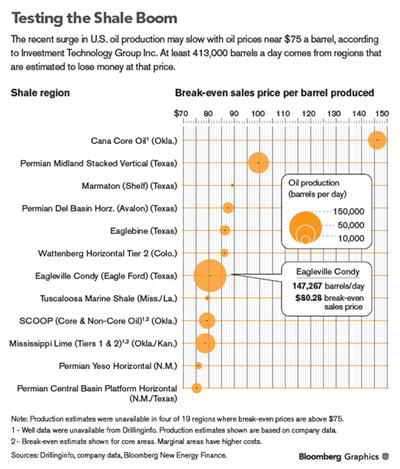

However, there are some rumours and speculation about the real impact of low prices on U.S. oil production: The IEA stated that production growth was showing few signs of abating by now. In contrast, some market players have estimated that some of U.S. light, tight oil production could become uneconomic and OPEC Secretary-General Abdalla El-Badri has effectively communicated that current oil prices could take 50 % of shale oil output “out of the market” as investment in higher-cost production dries up.[18] Hereof, an analyst of Barclays Bank reckons that only four fifths of shale reserves are economic at around $ 85/bbl.

Data compiled by Bloomberg (Figure 3) are showing a wide spectrum of profitability, hinging on rocks’ depth and density, pipeline access and the mix of oil and gas that wells pump: Drillers in the Eagleville Condy Shale in Texas break even at roughly $ 80/bbl. The cheapest field was the Green River basin in Colorado and Wyoming, at about $ 50/bbl. The largest producing fields Bakken (North Dakota) as well as the Permian and Eagle Ford (Texas) are expected to remain in the black even at a level of $ 60/bbl according to Investment Technology Group Inc..[19]

Figure 3: U.S. Crude Oil Break-Even Sales

Source: Bloomberg (2014), Oil at $75 Means Patches of Texas Shale Turn Unprofitable, , Nov 20, 2014, http://www.bloomberg.com/news/2014-11-20/oil-at-75-means-patches-of-texas-shale-turn-unprofitable.html

However, in the long run the Saudi’s price strategy might even turn out to backfire on them, as the tight profitability might trigger a productivity boost that makes U.S. tight oil production even more efficient and competitive in future. Halliburton’s recent $ 35 billion hush-hush operated acquisition of Baker Hughes has created a new oilfield service giant and might have given a small foretaste on what is to come.

Figure 4 illustrates the mere market expectations on the future oil market in contrast with IEA's World Energy Outlook forecast published last week: four different oil future curves are plotted, with the highest (orange line) settled only five month ago at June 19th and the lowest as of Nov 14th (red line). The curves are falling apart especially at the very front end, showing up the dramatic spread of about $ 40/bbl for the respective front month settlement, a destruction of more than one third in value. However, at the back end of the curve, the assessment of the market participants is less dramatic as the curves are going to converge more or less and the spread peaks off to far less than $ 10/bbl by the end of the decade. As opposed to this the recently published World Energy Outlook 2014 from energy analyses heavyweight International Energy Agency predicts a modelled rise to about $ 130/bbl by 2020 in its central New Policy Scenario.

Figure 4: Brent Crude Oil Futures and WEO2014 Forecast (2014-2022)

Source: Brent future front month settlements (as of dates stated) from ICE Intercontinental Exchange (www.theice.com); IEA Word Energy Outlook 2014. Compiled by author.

Even if oil’s global market share is on a steady downturn since decades and its position as the leading fuel is becoming more and more challenged by coal, the crude oil price is still broadly appreciated as the world’s leading and most influencing price benchmark for energy. Since oil, gas and coal markets are characterised by many and varied interactions locally, regionally and globally along the value chain, price interdependencies are prevalent and reflected in demand side substitution competition in almost all sectors and even more widely distributed long-lasting oil-linked gas pricing, for example.

The impact of the oil price on gas markets and its prices shall be scrutinised more closely in the subsequent part (II) with a more general look at the relationship between oil prices and gas spot prices as well as a more specific but theoretical examination of what would have been the impact on a gas formula that has been proposed by the Rangarajan Committee for Indian NELP gas pricing. This exercise can be seen as a kind of a rather informal ex-post sensitivity analysis according to the incorporated risk exposure of pricing approaches such as the above mentioned.

to be continued.......

Views are those of the author

Author can be contacted at [email protected]

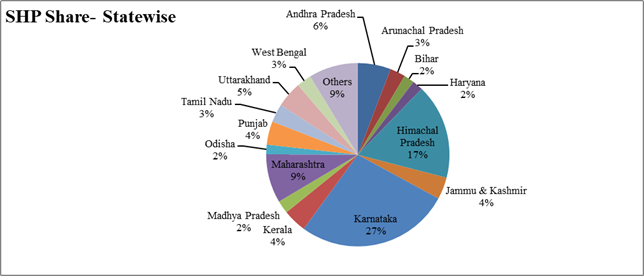

DATA INSIGHT……………

All India Small Hydro Projects

Akhilesh Sati, Observer Research Foundation

|

S. No. |

State |

As on Mar 2014 |

S. No. |

State |

As on Mar 2014 |

||

|

No. |

Installed Capacity (MW)* |

No. |

Installed Capacity (MW)* |

||||

|

1 |

Andhra Pradesh |

68 |

221.03 |

16 |

Manipur |

8 |

5.45 |

|

2 |

Arunachal Pradesh |

149 |

103.905 |

17 |

Meghalaya |

4 |

31.03 |

|

3 |

Assam |

6 |

34.11 |

18 |

Mizoram |

18 |

36.47 |

|

4 |

Bihar |

29 |

70.70 |

19 |

Nagaland |

11 |

29.67 |

|

5 |

Chattisgarh |

9 |

52.0 |

20 |

Odisha |

10 |

64.625 |

|

6 |

Goa |

1 |

0.05 |

21 |

Punjab |

47 |

156.20 |

|

7 |

Gujarat |

5 |

15.60 |

22 |

Rajasthan |

10 |

23.85 |

|

8 |

Haryana |

7 |

70.10 |

23 |

Sikkim |

17 |

52.11 |

|

9 |

Himachal Pradesh |

158 |

638.905 |

24 |

Tamil Nadu |

21 |

123.05 |

|

10 |

Jammu & Kashmir |

37 |

147.53 |

25 |

Tripura |

3 |

16.01 |

|

11 |

Jharkhand |

6 |

4.05 |

26 |

Uttar Pradesh |

9 |

25.10 |

|

12 |

Karnataka |

147 |

1031.658 |

27 |

Uttarakhand |

99 |

174.82 |

|

13 |

Kerala |

25 |

158.42 |

28 |

West Bengal |

23 |

98.40 |

|

14 |

Madhya Pradesh |

11 |

86.16 |

29 |

A&N Islands |

1 |

5.25 |

|

15 |

Maharashtra |

58 |

327.425 |

|

Total |

997 |

3803.678 |

* Projects upto 25 MW.

Source: Ministry of New and Renewable Energy.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Kelkar panel opposes revenue-sharing model for deep sea blocks

November 17, 2014. An expert panel headed by Vijay Kelkar has recommended the current production sharing regime for oil and gas exploration over the revenue-sharing model that is being considered for the next round of auction. The 10-member Committee, headed by former petroleum and finance secretary Kelkar, said the Production Sharing Contract (PSC) regime was more suited for Indian conditions rather than the revenue-sharing model based on the Rangarajan panel which was adopted by the previous UPA government. Under the present regime, oil companies can recover all costs - of successful and unsuccessful wells - from sales of oil and gas before sharing profit with the government. The Comptroller and Auditor General of India (CAG) had criticised this approach on grounds that it encourages companies to increase capital expenditure and delay the government's share. A panel headed by the then Prime Minister's Economic Advisory Council Chairman C Rangarajan had suggested moving to a revenue-sharing regime that requires companies to state upfront the quantum of oil or gas they will share with the government from the first day of production. The Kelkar Committee, which was last year formed to suggest 'Roadmap for Reduction in Import Dependency in Hydrocarbon Sector by 2030', in its final report said PSC model was more suited to attract investments. It suggested two fiscal regimes - PSC linked to investment multiple with modified contract administration including self-certification of costs by the contractors, or PSC with biddable supernormal profits tax. For boosting local production of oil and gas, the Kelkar committee has suggested improving contract stability and administration as also maintaining contract stability and sanctity and prevent retrospective contract changes. It also favoured contract extension for perpetuity or up to the end of the economic life of the asset and empowering boards of state-owned oil companies for approving equity participation in fields they had got from the government on nomination basis. (economictimes.indiatimes.com)

ONGC to invest ` 106 bn in western offshore fields

November 16, 2014. Oil and Natural Gas Corp (ONGC), India's biggest energy explorer, will invest ` 10,600 crore in raising production from its western offshore fields. ONGC has approved third phase of redevelopment of its prime Mumbai High South oil and gas field at a cost of ` 6,069 crore and integrated development of Mukta, Bassein and Panna formations at an investment of ` 4,620 crore, the company said. The project is designed to carry forward the success of the previous two phases of redevelopment project and give a new lease of life to the giant field, which has been in production for over three decades. The project comprises drilling 36 new wells and 34 sidetrack wells, and facilities. The facilities under the project are scheduled to be installed by April, 2017. Drilling of wells and the overall project completion is scheduled for March, 2019. The Integrated Development of Mukta, Bassein and Panna Formations, located at a water depth of 50-70 meters and about 80-90 kilometres from Mumbai coast, is designed to carry forward the success of the previous two phases of redevelopment through installation of booster compressors. The incremental production is expected to start in 2014-15 with peak incremental production rate of 10 million standard cubic meters per day of gas, 950 barrels of oil per day and about 1100 cubic meters of condensate a day by 2017-18. The cumulative production till 2027-28 is pegged at 19.56 billion cubic meters of gas, 1.97 million cubic meter of condensate and 1.83 million tons of oil. The gas and condensate will be evacuated to Hazira Plant. The project envisages drilling of 18 wells including 5 subsea Wells, installation of one new process platform having gas processing and compression facilities, one nine-slot well head platform and other facilities, associated pipelines and one living quarter platform. The project is scheduled for completion by April 2017. (economictimes.indiatimes.com)

Canada's Niko Resources says evaluating plans for India assets

November 14, 2014. Canada's Niko Resources Ltd said it was evaluating plans for its oil and gas assets in India, citing uncertainty related to the outlook for natural gas prices in the country. Niko owns 10 percent in the D6 Block, off the eastern coast of India. BP Plc has a 30-percent stake in the block, while the rest is owned by India's Reliance Industries Ltd. The company also holds a stake in the Hazira field in western India. Gas output from the block has fallen sharply over the past few years. Reliance says the decline is due to the geological complexity of the block, while the Indian government believes contractors have failed to drill the promised number of wells. Demand for gas in India far outstrips production, but prices have been kept low for important industries such as fertilizer production and power generation, deterring investment in the sector. The Indian government increased gas prices by 33 percent to $5.61 per million British thermal unit from Nov. 1 and is expected to revise rates every six months. Domestic gas producers such as Reliance Industries and ONGC insisted on a price hike because the cost of exploring new reserves is more than the current price, leaving them reluctant to take the risk. Niko said it would receive a cash benefit of $4 million thanks to the jump in gas prices, but added that it remained concerned about long-term prices. (in.reuters.com)

Downstream………….

Oil marketing companies seek flexible deals to tap new markets

November 17, 2014. PSU refiners, who account for about two-thirds of the country's oil processing capacity, are seeking more flexibility in import contracts as they look to tap new sources of supply flushed out by the U.S. shale boom. India, the world's fourth-biggest oil consumer with refining capacity of 4.3 million barrels per day, imports 80 per cent of its crude needs and has traditionally relied on the Middle East for heavy oil supplies and West Africa for lighter, sweet crude. A push to include both fixed and optional volumes in contracts would allow refiners to fill some of their needs from cheaper spot cargoes now on offer from suppliers such as Algeria, Latin America and Canada as U.S. demand has dwindled. The Indian government is also looking to help the industry by changing regulations to lower shipping costs, and widening a list of multinationals eligible to supply oil under term deals. Bharat Petroleum Corp Ltd (BPCL) has negotiated a flexible contract with Chevron for West African grades and with Malaysian state oil firm Petronas. Hindustan Petroleum Corp Ltd (HPCL) has similar contracts with Total for Iraqi Basrah, Petronas and Kuwait. The company has also offset the impact of a fall in global oil prices to four-year lows by paying for spot crude on the basis of prices in the month of loading and the subsequent month, rather than just the month of loading. Mangalore Refinery and Petrochemicals Ltd (MRPL) bought oil from Argentina while Indian Oil Corp (IOC), which has small term deals with Latin American nations, shipped in Canadian barrels. (economictimes.indiatimes.com)

PM Modi likely to inaugurate ` 350 bn Indian Oil refinery

November 16, 2014. Prime Minister (PM) Narendra Modi is likely to inaugurate the much awaited ` 35,000 crore refinery project of Indian Oil Corp (IOC) in March next year, Union Petroleum Minister Dharmendra Pradhan said. The 15 million tonnes per annum (mtpa) capacity oil refinery project of IOC in final stage of completion, is expected to be commissioned in March 2015, Pradhan said while laying the foundation stone of a Poly-Propylene plant. Recalling that former Prime Minister Atal Bihari Vajpayee had laid the foundation stone for the refinery project, Pradhan said its inauguration would be done by Modi. Describing the state-of-the-art refinery as the largest of its kind in the country, the Minister said it would refine all kinds of crude and produce petrol, diesel, LPG, propylene and ATF. Paradip Refinery, which is set to be among the most advanced refineries in the country, would cater to the energy needs of Odisha, Andhra Pradesh, Madhya Pradesh, Uttar Pradesh, Bihar, Jharkhand, Chattisgarh and West Bengal, he said. To draw full advantage of the industrial growth that would be ushered in by Paradip refinery, and to enlarge the kitty of value added products, several other petro-chemical projects have also been envisaged in the area, IOC said. (economictimes.indiatimes.com)

Indian Oil defers Koyali units' shutdown to March-April

November 13, 2014. Indian Oil Corp (IOC) has deferred a planned shutdown of key units at its Koyali refinery in western Gujarat state to March-April 2015 from around October this year to capitalize on sliding crude prices. IOC had initially planned maintenance shutdowns of a cooling tower, the fluid catalytic cracker and other facilities at Koyali in September-October. IOC had already cut throughput at five refineries in September after heavy rains curbed demand for diesel in northern and eastern regions of the country. The maintenance shutdown in March-April means most of the five crude units at Koyali, which has a refining capacity of 274,000 barrels per day (bpd), will not operate for 10-30 days. (economictimes.indiatimes.com)

Indian Oil to set up first LNG Terminal on the East Coast

November 12, 2014. Indian Oil Corp (IOC) has cleared the ` 5,150 crore Ennore-LNG Terminal project, to be set up jointly with Tamil Nadu Government. The land for the project has been acquired and the plant will have 5 million tonne capacity. IOC and Tamil Nadu Industrial Development Corp (TIDCO) had signed pacts for setting up the terminal. The terminal is expected to be commissioned by 2017. Indian Oil, which has stakes in British Columbia and Petronas in Malaysia, would look for import of LNG once the Ennore plant comes into operation. While Indian Oil holds 45 per cent stake, 5 per cent is with TIDCO and the remaining 50 per cent with investors. The company is also in discussions with several companies for a Joint Venture on the Ennore-LNG Terminal project. On the status of LPG project in Tamil Nadu, IOC said the ` 78 crore LPG plant is expected to soon be commissioned in Tirunelveli. On the Paradip Refinery project, IOC said 97 per cent of it was completed and was expected to be commissioned by March 2015. On whether the company would look at setting up new projects in Andhra Pradesh, IOC said the oil major was looking at setting up a pipeline, connecting Paradip to Hyderabad. IOC has set up a toll free number 1800-233-3555 for receiving complaints related to supply of LPG. (economictimes.indiatimes.com)

Transportation / Trade…………

India may propose getting China company to lead pipeline consortium

November 18, 2014. With global energy firms refusing to participate in the ambitious TAPI gas pipeline, India may propose getting a Chinese company to lead a consortium that will build the USD 10 billion Turkmenistan-Afghanistan- Pakistan-India (TAPI) gas pipeline. French giant Total SA had initially envisaged interest in leading a consortium of national oil companies of the four nations in the TAPI project, but backed off after Turkmenistan refused to accept its condition of a stake in the gas field that will feed the pipeline. Since the four state-owned firms, including GAIL of India, neither have the financial muscle nor the experience of cross-country line, an international company that will build and also operate the line in hostile territories of Afghanistan and Pakistan, is needed. Turkmenistan has clearly indicated that its law does not provide for giving foreign firms an equity stake in upstream gas field, without which western energy giants will not be interested to take the risk. The issue of quickly getting a consortium in place will be discussed at the 19th Steering Committee meeting of TAPI pipeline project in Turkmenistan where India will be represented by Oil Minister Dharmendra Pradhan. New Delhi may present three options at the meeting. First, to get a US firm as the consortium leader after Turkmenistan allows US to enter its upstream sector. Alternatively, the consortium of four partner countries or Turkmen Gas of Turkmenistan can become the leader. This option was acceptable to Afghan side and in case India agreed, the Pakistan side too may agree. But this option is fraught with funding and regional security issues. As a last option, a Chinese company can be brought in as a consortium leader. The Chinese are less likely to insist on an upstream stake in this project as they are already present in Turkmenistan. GAIL, along with national oil companies of Turkmenistan, Afghanistan and Pakistan set up TAPI Pipeline Company, a firm that will build, own and operate the gas pipeline across the four countries. The Asian Development Bank is helping the four nations build a 56-inch diameter pipeline from Turkmenistan's giant Galkynysh gas field to serve energy markets in Afghanistan, Pakistan and India. The TAPI pipeline will have a capacity to carry 90 million standard cubic metres a day (mmscmd) gas for a 30-year period and will be operational in 2018. India and Pakistan would get 38 mmscmd each, while the remaining 14 mmscmd will be supplied to Afghanistan. TAPI will carry gas from Turkmenistan's Galkynysh field, better known by its previous name South Yoiotan Osman that holds gas reserves of 16 trillion cubic feet. From the field, the pipeline will run to Herat and Kandahar province of Afghanistan, before entering Pakistan. In Pakistan, it will reach Multan via Quetta before ending at Fazilka (Punjab) in India. (economictimes.indiatimes.com)

India's Oct Iran oil imports rise 60 per cent y/y

November 17, 2014. India bought 60 percent more Iranian oil in October than a year ago as refiners held to higher volumes despite signs that world powers and Iran might not reach a final agreement on Tehran's disputed nuclear programme before a Nov. 24 deadline. A year of negotiations has not resolved deep disagreements between Iran and the major powers, and a final deal is unlikely by the November date. Any agreement would likely be followed by a rapid increase in Iran's oil exports at a time when global markets are already under pressure from a supply glut. India, Iran's top oil client after China, imported about 309,900 barrels per day (bpd) of crude in October from Tehran, tanker arrival data obtained from trade sources shows, the highest since March and up 28 percent from September. India's oil imports from Iran rose about 40 percent over January-October, partly due to a surge in the first quarter as an interim agreement easing Western sanctions went into effect. Growth in Iranian oil imports this year was also due to a bounce off the low base of last year, when shipments were hit hard due to insurance problems triggered by the sanctions, particularly over the April-August period. Private refiner Essar Oil was the biggest buyer of Iranian oil in October followed by Mangalore Refinery and Petrochemical Ltd (MRPL). (in.reuters.com)

IGL gets govt backing over power to fix transport tariff in Delhi

November 17, 2014. The government is backing distributor Indraprastha Gas Ltd (IGL) in the Supreme Court in its dispute against the Petroleum and Natural Gas Regulatory Board (PNGRB) over transportation tariffs for the fuel supplied in Delhi through pipelines. The outcome of the case will likely determine the future of the regulator when it comes to regulating prices of compressed natural gas delivered to vehicles and piped natural gas to homes in the city. The regulator issued a notification in April 9, 2012, fixing network tariffs and compression charges to be levied by IGL with effect from April 1, 2008. It also asked IGL, which has a monopoly over gas distribution in Delhi, Noida, Ghaziabad and Greater Noida, to reveal these two specific components to consumers in its invoices in the interests of transparency. IGL challenged this in the Delhi High Court and won. It argued that it cannot be forced to reveal cost components as this was commercial information and contested the board's powers on this score. IGL had always submitted tariff data to it and this was part of the process of fixing these two components. But the high court ruled that since the government had not yet notified Section 11(e) —which empowers the board to monitor natural gas prices— of the Act under which the regulator was set up, it could not fix these rates. (economictimes.indiatimes.com)

GAIL, partners form SPV for TAPI pipeline project

November 13, 2014. State run natural gas company GAIL (India), along with state gas companies of Turkmenistan, Afghanistan and Pakistan has set up a company that will build, own and operate 1,800-kilometer of gas pipeline across Turkmenistan-Afghanistan-Pakistan-India (TAPI). The company has been incorporated as a Special Purpose Vehicle (SPV) in the Isle of Man, a British Crown dependency and has been named TAPI Pipeline Company. It would be responsible for finance, design, construction, operation and maintenance of the TAPI pipeline. Turkmenistan's national gas company Turkmengas, Afghan Gas Enterprise, Inter State Gas Systems (Private) and GAIL will own equal stake in TAPI Pipeline Company. The TAPI pipeline will export up to 33 billion cubic meters of natural gas a year from Turkmenistan to Afghanistan, Pakistan, and India over 30 years. This will enable the landlocked Turkmenistan, which has the world's fourth-largest proven gas reserves, to expand its gas export market while supplying fuel to energy starved Afghanistan, Pakistan, and India. The pipeline is expected to carry 90 million standard cubic metres per day (mmscmd) gas, of which India and Pakistan would get 38 mmscmd each. Afghanistan's share would be 14 mmscmd but the country has indicated that it may only take 1.5-4 mmscmd, which will result in the balance being shares equally by India and Pakistan. ADB, the advisor for the TAPI gas pipeline project, had advised setting up a TAPI pipeline company such that a consortium leader can be identified to spearhead the operation of the pipeline. (economictimes.indiatimes.com)

Policy / Performance………

India expects foreign investment in petroleum sector: Oil Minister

November 18, 2014. India expects foreign investment in the petroleum sector, Oil Minister Dharmendra Pradhan said. He said Indian trade has got a boost after Narendra Modi became the Prime Minister. Pradhan, who will represent India at the 19th Steering Committee meeting of TAPI pipeline project in Turkmenistan, said the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline will benefit India enormously. He said that the matter of quickly getting a consortium in place will be discussed at the meeting. (economictimes.indiatimes.com)

Centre making efforts to reduce fuel import bill by ` 100 bn

November 18, 2014. The government has turned to oil diplomacy to secure better fuel supply contracts, a move that industry officials say can cut India's import bill by at least ` 10,000 crore. The initiative comes at a time when the members of the Organization of the Petroleum Exporting Countries (OPEC) are battling for market share amid competition from new energy suppliers. Gulf countries too have shown heightened interest in investing in India, particularly after Narendra Modi became the prime minister. India depends heavily on term contracts with Middle East countries, which announce a monthly official selling price. Oil industry executives and officials say the country will save about ` 9,000 crore a year for every $1 reduction in price. Recently, Saudi Arabia raised the price for Asian buyers, but cut it for the US, where the shale revolution has lifted oil output to the highest in three decades. India feels that as one of the largest importers from the Middle-east it too is entitled to such concessions. OPEC heavyweights like Saudi Arabia are fighting to protect their market share, and have resisted calls for a supply cut even after crude prices slumped 30 per cent. Oil Minister Dharmendra Pradhan has recently been to Saudi Arabia, OPEC's biggest supplier. (economictimes.indiatimes.com)

First dissent on gas price, GSPC seeks higher rates

November 17, 2014. In first signs of dissent over the new gas pricing, Gujarat government firm GSPC has demanded market price for its output from KG basin fields saying it cannot be forced to sell fuel at a rate which is less than the cost of production. Days after the October 18 government decision to raise natural gas prices to $5.61 per unit from $4.2, Gujarat State Petroleum Corp (GSPC) shot off a letter to the Oil Ministry, demanding “market determined price” for its ready-to-produce Deen Dayal West (DDW) fields in Bay of Bengal. The firm owned and run by the Gujarat government had discovered a market formula that gives a price of about $10.5 per million British thermal unit at current oil rate of $80 per barrel. (freepressjournal.in)

Only 0.006 per cent ready to give up LPG subsidy

November 17, 2014. An early call of the Narendra Modi government, urging people to voluntarily give up subsidies on cooking gas cylinders has signed up just 0.006% of the customer base of 15 crore connections. In three months since the government exhorted people to give up subsidies on their gas cylinders, just 8,868 people or entities have opted to voluntarily part with subsidies, an embarrassing civic consciousness statistic in a country that takes pride in its ever expanding list of millionaires. And, hardly any of them are occupants of bungalows in Lutyen's Delhi or Mumbai's plush Cuff Parade areas. There are many expatriates, embassies, schools and people from lesser known parts of the country including Begusarai, Cuttack, Guntur, Bhavnagar, Ladakh and Durg, who have chosen to pay the market price for cooking gas. Many posh localities in New Delhi and Mumbai get supply of non-subsidised piped natural gas, hence names of ministers and industrialists are not shown on the list of people who have surrendered their subsidy claims. Oil Minister Dharmendra Pradhan plans to launch an aggressive campaign to persuade about one crore people to give up subsidy. This will save about ` 3,500 crore in the annual LPG subsidy bill. The oil ministry had first appealed to executives of oil companies to voluntarily give up LPG subsidy through a specially created portal in July this year. In August, Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp directly sent text messages to millions of customers to surrender their subsidy claims in the name of nation building. According to data provided by some gas agencies, government and private schools and embassies in New Delhi have taken a lead in giving up subsidy, which will save about ` 4-5 crore in subsidy bill annually. (economictimes.indiatimes.com)

Diesel prices up in Punjab as SAD-BJP govt raises VAT

November 15, 2014. Diesel prices in Punjab went up by about 77 paise a litre with SAD-BJP-led government raising value added tax (VAT) on diesel by 1.5 per cent to 11.25 per cent. The hike in VAT on diesel has led to diesel price jumping to ` 53.38 a litre from ` 52.61. The diesel rates in the state vary from area to area due to transportation charges. The opposition party Congress has lashed out at the state government for increasing VAT. Significantly, the fresh hike in VAT on diesel in Punjab came barely after one and half month with new rate of VAT being fixed at 11.25 per cent (excluding 10 per cent surcharge). Earlier, Punjab government had raised VAT on diesel by one per cent to 9.75 per cent with effect from October 1, the move which had led to fuel prices going up by 55 paise a litre. As per notification issued by Punjab Excise and Taxation department regarding 'change in rate of diesel', the VAT rate on diesel other than premium diesel has now been revised to 11.25 per cent. Punjab also levies 10 per cent surcharge on VAT rates. Petroleum dealers said that they received the message from Punjab Excise and Taxation department about increase in VAT on diesel. Notably, the recent reduction in diesel prices by the Centre had caused revenue loss of up to ` 20-25 crore per annum to Punjab. While Punjab levies tax on petroleum items as per 'ad valorem' method, any increase or decrease in prices of fuel cause affect in tax mobilisation to the state kitty. As per 'ad valorem' method, the tax is charged as per value of goods or services. Punjab annually collects about ` 2,100 crore of tax from petrol and diesel. Interestingly, Union Territory Chandigarh slashed VAT on diesel from 12.5 per cent to 9.68 per cent in order to bring parity with the tax rate in Punjab, thus giving a relief of ` 1.40 per litre in diesel rates. Meanwhile, Congress Legislature Party leader Sunil Jakhar described the SAD-BJP government move of raising VAT as anti-farmer and anti-industry. (economictimes.indiatimes.com)

New subsidy regime in New Year: LPG sop will go directly to accounts

November 15, 2014. All consumers will have to buy cooking gas at market rates from New Year's Day as the government has issued firm instructions that the subsidy will be transferred directly to bank accounts as it seeks to end illicit supplies to restaurants, cars and factories, besides slashing the subsidy bill and boosting private investment. After recently eliminating the diesel subsidy, which had ballooned to ` 62,837 crore, Oil Minister Dharmendra Pradhan has ordered state oil companies to ensure that the scheme — which is being launched as a pilot for 2.33 crore customers in 54 districts — is smoothly expanded to the entire country on January 1, 2015. Some oil industry executives had expressed doubts about the successful rollout of the scheme to the entire country in barely six weeks of the launch in 54 districts after the UPA government botched up the programme after expanding it to 291 districts just before the general election. It had been forced to withdraw the programme after Congress leaders said it was costing them votes. The oil ministry is, however, confident about success this time around. Under the modified DBTL (direct benefit transfer of LPG), a consumer will be eligible for subsidised LPG cylinders even without the Aadhaar number, Pradhan said. Consumers without the unique ID will also receive cash directly in their bank accounts. They can switch to Aadhaar-based cash transfers once they have been enrolled by informing dealers and banks. Customers have six months to tell LPG dealers their bank account numbers without losing the subsidy amount. While subsidised cylinders will be delivered to them in the first three months, they will have to buy at market rates after that. The subsidy will be remitted to their bank accounts within the next three months. For the first subsidy payment, the money will be transferred to the bank account of consumers as soon as they make the first booking for a cylinder after joining the scheme, prior to delivery. This advance ensures that consumers have extra cash to pay for the first cylinder at market price. The permanent advance shall be notified for consumers now joining the scheme separately. (economictimes.indiatimes.com)

Excise on petrol, diesel hiked; no increase in retail rates

November 14, 2014. The government has raised the excise duty on petrol and diesel by ` 1.50 a litre to raise ` 6,000 crore in the current fiscal without raising retail prices, as crude oil's sharp fall is helping both consumers and the exchequer. Oil companies were earlier planning a big cut in petrol and diesel prices after the fortnightly review. The increase in excise duties would significantly reduce the reduction in rates. They may also defer the price cut and offer a bigger reduction by the end of the month during ongoing polls in Jaharkhand and Jammu and Kashmir. (economictimes.indiatimes.com)

Oil Ministry grapples with payment options for RIL's KG-D6 gas

November 13, 2014. Days ahead of the first payment by customers at the new gas price, the Oil Ministry is grappling with the issue of how to bill the gas produced from Reliance Industries' main fields in the KG-D6 block. As per the 15-day billing cycle, gas producers are to raise the first invoice at the revised price of $ 5.61 per million British thermal unit (mmBtu). However, there is still no clarity on how to invoice the fuel from RIL's D1&D3 fields, which is to be sold at the old rate of $ 4.2 per mmBtu. While announcing an across-the-board 33 per cent hike in natural gas prices, the government had stated that customers of D1&D3 gas will pay the revised rates but RIL will get only $ 4.2, with the difference being deposited in a gas pool account maintained by GAIL. The Oil Ministry is still grappling with the easier option of allowing RIL to raise bill at new rate of $ 5.61 and then depositing $ 1.41 in the gas pool account. (economictimes.indiatimes.com)

Govt provides operational flexibility to oil firms

November 12, 2014. In a bid to make it easier to produce oil and gas, the government has notified a set of rules granting operational flexibility to firms like Cairn India and ONGC to start producing from several discoveries that are mired in contractual disputes. The Petroleum Ministry in a notification relaxed rigid timelines prescribed in the Production Sharing Contract (PSC) for development and production of oil and gas. Operational flexibility has been provided in enforcing contracts by way of relaxing some of timelines prescribed for discoveries so that E&P activities do not suffer on account of excessive rigidity in decision making. The PSC between the government and the explorer has rigid timelines for each stage of exploration and actions have been initiated against firms even if deadlines are missed by a day. The notification said 3-6 months extension in the current 18-60 month timeframe for submission of declaration of commerciality (DoC) of discoveries, a prerequisite before investment plans can be finalised, can be given. Also, the deadline for submission of investment plan for the discoveries too would be extended by up to six months. The PSC provides for time period for submission of field development plan (FDP) for hydrocarbon discovery after DOC. There is no provision in the PSC for extension of this time period and non-acceptance of FDP due to late submission results in non-monetisation of discoveries. Also, upstream regulator DGH has been given flexibility to accept discoveries for which operators had failed to provide prior notification to the government. The notification also provided for reduction in committed work programme in case a block or its part is not available for exploration activities consequent to denial of permission by government agencies. Currently, discoveries, mostly of Cairn, ONGC and GSPC are stuck because of lack of flexibility in timelines. These include 10 finds of Cairn in Rajasthan which have not been endorsed by the Directorate General of Hydrocarbons (DGH). Besides FDP approvals for more than two dozen finds are held up for some or the other reason. Fifteen discoveries lie abandoned in areas that have been relinquished by operators. (economictimes.indiatimes.com)

IOC, BPCL, HPCL to go for round III of fuel price cuts, reduction likely on Nov 15

November 12, 2014. State oil firms plan to cut petrol rates for the seventh time since June and diesel for the third time since the fuel was decontrolled on October 18 as Indian consumers gain from the sharp fall in global oil prices before polls in Jharkhand and Jammu & Kashmir. Industry experts said according to current trend Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) are likely to reduce pump price of petrol and diesel by about ` 1 per litre. For consumers, the two fuels are already 10%-13% cheaper than their peak earlier in the year. IOC, BPCL, HPCL to go for round III of fuel price cuts, reduction likely on November 15 The cuts could be steeper depending on further slide in international prices of auto fuels in next four days. The government has allowed state fuel retailers to align pump prices of petrol and diesel with international market. Benchmark Brent crude dropped four years low at around $82 per barrel. Last time, oil companies reduced petrol prices by ` 2.41 per litre and diesel by ` 2.25 on Oct 31. So far, companies have reduced petrol prices by 13% or ` 9.36 per litre in six consecutive rate revision. They reduced diesel price by about 10% or ` 5.62 per litre in just two revision since the fuel price was deregulated on Oct 18. Currently, petrol is sold at ` 64.24 per litre in Delhi and diesel at ` 53.35 per litre. Companies are also expected to marginally reduce revenue losses on cooking gas, where they are losing about ` 394 per 14.2 kilogram cylinder. The government deregulated diesel prices last month. Companies also enjoys petrol pricing freedom since June 2010. But, this freedom is not absolute as companies would require tacit approval of the oil ministry before changing pump prices of petrol and diesel. It is likely that the government would not pass the entire pricing benefits to the consumer for political reasons. The international oil market is highly volatile and a cushion is required to absorb pricing shock if rates move north, especially during month-long assembly elections. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Indian group plans Mozambique power plant after buying Rio asset

November 18, 2014. International Coal Ventures Pvt Ltd (ICVL), the Indian group that bought Rio Tinto Group’s coal-mining assets in Mozambique for $50 million this year, plans to build a power plant in the country. The coal-fired facility will be developed “very soon,” ICVL, as the New Delhi-based group is known, said. ICVL is already exporting coking coal for steelmaking from Mozambique, ICVL said. The plant ICVL plans at the Benga asset will be one of a number of power projects proposed for the northwestern Mozambican province of Tete. The province is home to the country’s richest coal deposits and also the 2,075 MW Cahora Bassa dam and hydroelectric plant, which supplies Mozambique, South Africa, Zimbabwe and Zambia. ICVL comprises Steel Authority of India Ltd and Rashtriya Ispat Nigam Ltd, iron-ore miner NMDC Ltd, power generator NTPC Ltd and coal producer Coal India Ltd. It completed a transaction to buy London-based Rio Tinto’s 65 percent stake in the Benga coal mine along with its undeveloped coal assets at Zambeze and Tete East. (www.bloomberg.com)

BHEL commissions second gas-based power plant in Tripura

November 17, 2014. Bharat Heavy Electricals Ltd (BHEL) has commissioned the second module of ONGC Thermal Power Corp's gas-based power plant in Tripura, completing the combined-cycle power project that would use gas from Oil & Natural Gas Corp's adjoining fields in the northeastern state. The plant comprises two modules of 363.3 MW each, equipped with fuel efficient advanced gas turbines. BHEL commissioned the first module of 363.3 MW in January 2013. BHEL has so far commissioned 911 MW of gas-based and hydroelectric stations in Tripura, accounting for 100% of the state's generation capacity. Across the country, it has built nine modules of power turbines in the combined cycle mode, where waste heat from a gas turbine generator is used to run a steam turbine to produce additional electricity. BHEL has previously commissioned 14 gas turbines in Tripura, but their capacity was limited to a maximum of 21 MW because constraints to transport equipment to project sites. The Palatana project is the largest of its kind in the entire northeastern part of India. BHEL is executing another gas-based project of 100 MW for North Eastern Electric Power Corp at Monarchak in Tripura. (economictimes.indiatimes.com)

India, Nepal to sign deal for 900 MW power project

November 16, 2014. India and Nepal are likely to sign an agreement for the construction of a 900 MW power project and another one for starting a direct bus service between Kathmandu and New Delhi during the visit of Prime Minister Narendra Modi for the upcoming SAARC summit. The agreement for the Arun Hydropower Project being developed by Satluj Vidyut Nigam will be signed after the two countries had finalised a Power Development Agreement (PDA) for constructing the 900 MW Upper Karnali power project being developed by GMR consortium. (economictimes.indiatimes.com)

Uttarakhand hydel projects fail to take off

November 13, 2014. Tyuni Palasu and Aracot Tyuni, two key hydel projects which were allotted to the Uttarakhand irrigation department, are yet to see the light of day despite the acute power shortage being faced by the hill state. Both the projects are in various stages of clearances, the irrigation department said. After the allotment of the two hydel projects in 2008, the department had decided to set up a corporation to develop power plants in the hill state. But after Uttarakhand Parvitya Vikas Priyojana Nigam came into existence, the irrigation department officials did not show any interest to join the new corporation. Though the department is hopeful of bagging more contracts in the near future to develop hydel projects in the state, the corporation remained in dormant stage during the last 3-4 years. This despite the fact that the hill state has 20,000-30,000 MW of hydropower potential whereas only 3600 MW has been tapped till date. (www.business-standard.com)

Transmission / Distribution / Trade…

Power Grid gets board approval for ` 10 bn worth projects

November 18, 2014. State-owned Power Grid Corporation said its board approved two transmission projects worth over ` 1,000 crore. The transmission major would be implementing two projects valued at ` 1,046.71 crore, it said. The company would carry out sub-station works associated with system strengthening in Southern region for import of power from Eastern Region at an estimated cost of ` 972.42 crore. This project is to be commissioned within 36 months from the date of investment approval. Besides, Power Grid Corporation of India would be implementing a "Common Transmission Scheme associated with ISGS Projects in Nagapattinam / Cuddatore Area of Tamil Nadu - Part-A1(b) at an estimated cost of ` 74.29 crore". This project has a completion schedule of 30 months. (economictimes.indiatimes.com)