-

CENTRES

Progammes & Centres

Location

[Solar or Grid: To Choice is ‘Yours’!]

“Solar roof top power is propagated as energy for the poor people. In this light it is interesting to analyse the case of two hypothetical persons from the Below Poverty line category and see who will be in a better position, the one who uses power from the grid or the one who opts for solar roof top?…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Solar or Grid: To Choice is ‘Yours’!

· Open Letter to the Prime Ministers of Nepal and India

ANALYSIS / ISSUES…………

· Global CO2 Emissions from Fuel Combustion: Gloomy Picture from the IEA

DATA INSIGHT………………

· Energy for Cooking & Lighting in Rural India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC targets to start production by mid-2018 from KG-D5 block

· ONGC lines up $3 bn investment in Mozambique

Downstream……………………………

· Indian Oil eyes West coast for new refinery project

Transportation / Trade………………

· India weighs piping diesel to Bangladesh

Policy / Performance…………………

· Excise duty on petrol, diesel hiked; no impact on prices

· Assam govt moves Guwahati High Court on oil royalty issue

· LPG rate cut by ` 113, jet fuel prices by 4.1 per cent

· Gas price in India to dip to $5 in 3 yrs: Goldman Sachs

· National interest, energy security more important than procedures: CAG

· From March 31, pay market rate for LPG cylinders

· New gas price policy inconsistent with PSC, says RIL's partner

· Expert's report on ONGC-RIL gas theft dispute by June: Oil Minister

· ONGC finalises gas sales at $10.1-11.2: Oil Minister

· Modi to Abe favour oil bears as plunge aids Asian economies

[NATIONAL: POWER]

Generation………………

· Tata Power may not source coal from Indonesia for Mundra

· Kudankulam likley to resume power generation in December

· Package to rescue 16 GW of gas-based power plants ready

Transmission / Distribution / Trade……

· JSW Energy may buy JP Power's Bina, Nigrie assets

· Saving power may fetch rewards from Delhi discoms

· Indian power exchanges expect volume to grow due to SAARC energy co-operation deal

· Coal supply to power plants in Maharashtra improving

· Alstom T&D bags ` 560 mn order to supply energy management system to Sri Lankan grid

· APTEL upholds Tata Power's distribution licence in Mumbai

· Delhi discoms lose crores to meet winter power shortfall

· Fuji Electric to study smart energy grid for AP

· World's 2nd tallest power transmission towers in West Bengal

· Relief for Tata Power, Adani Power as fuel costs decline by 10 per cent from a year ago

Policy / Performance…………………

· Centre to collect ` 100 bn as additional coal levy: Power Minister

· Efforts on to link coal mines with nearest power plants: Govt

· Cabinet approves Bill on mines auction to replace coal ordinance

· Govt will focus on gas-based power: PM Modi

· Govt mulling new policy to recover power arrears: Haryana CM

· TPC-RInfra porting row: APTEL flays MERC decision

· PM Modi inaugurates second unit of Palatana power project

· Power Minister says govt will act soon to resolve fuel scarcity issue

· Coal India to start mining in Mozambique

· Coal India to adopt latest technology: Coal Minister

· Power ministry to move cabinet soon to revive stranded assets

· Shortage of 81 mn tonnes of domestic coal for power sector

· CERC approves Tata Power's Maithon plant tariff plan

· Need clarity on coal block auction guidelines: Tata Power

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· RAK Petroleum increases stake in Cote d'Ivoire oil field

· UK oil producers press for tax cuts as crude prices collapse

· Thailand’s PTT sees US acquisitions after oil slump

· Total makes new oil discovery in Iraqi Kurdistan

· Exxon, Rosneft scrap Arctic deals as Russia sanctions bite

· Karoon discovers oil at Kangaroo-2 appraisal well, offshore Brazil

· Mexico shrugs off OPEC as Exxon to Chevron line up to bid

Downstream……………………

· Ecopetrol refinery overhaul to boost profit in oil slump

· Pembina plans to expand gas processing capacity at Musreau facility in Canada

· US refiners looking closer to home to buy their crude

Transportation / Trade…………

· Iraq to boost northern oil exports after deal with Kurds

· Junk bonds backing shale boom facing $11.6 bn loss

· Ukraine gets loan to modernize gas pipelines

· Japan's Petro-Diamond pays nearly double for December cargo from ONGC

· Return of $2 gas seen for some in US as OPEC stands pat

Policy / Performance………………

· Saudi cabinet says oil policy purely economic in motive

· Iran wary of oil ‘shock therapy’ as OPEC vies for market

· China winning in OPEC price war as hoarding accelerates

· Oil price drop forces OPEC member Iraq to weigh spending cuts

· ECB confronts cheaper oil spilling onto stimulus debate

· Energy acquisitions on cards as OPEC output stirs repeat of 1998

· Japan imports first US oil in 4 yrs amid shale boom

· OPEC policy ensures US shale crash, Russian Tycoon says

· OPEC seen by UAE doing ‘whatever it takes’ to balance market

[INTERNATIONAL: POWER]

Generation…………………

· Saudi Arabia's Acwa to develop $1 bn power plant in Turkey

· Chilean coal-fired power generation falls 5.9 per cent in October

Transmission / Distribution / Trade……

· EIB to support electricity transmission grid upgrade in Czech Republic

Policy / Performance………………

· US nuclear plants squeezed by cheap gas, uranium costs

· Australia opens door to nuclear energy

· Uranium best energy performer on rebound from Fukushima drop

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Union Cabinet approves India's stand at climate change meet

· Welspun Energy forays into solar rooftop space

· MSME Ministry urged to promote use of renewable energy

· AP to partner with Japanese Softbank for solar power projects

· Mumbai, Kolkata most vulnerable to climate change: Govt

· Tamil Nadu data centres tap green energy

· Only 1.37 per cent bioethanol in petrol against mandatory 5 per cent: Goyal

GLOBAL………………

· Germany's $132 bn green energy lead is fortified by EON's split with fossil fuels

· OPEC squeeze on oil spares renewables from energy turmoil

· Rich nations will make $100 bn climate goal, US says

· Argentina province schedules auction to build first solar farm

· China solar project delays mean Japan could be largest market

· Pollution to follow as gas replaces hydropower: Corporate Brazil

· Molten aluminum lakes offer power storage for German wind farms

· EPA power plant mercury rule gets US Supreme Court review

· New carbon market is key part of climate agreement, UK says

[WEEK IN REVIEW]

COMMENTS………………

Solar or Grid: To Choice is ‘Yours’!

Ashish Gupta, Observer Research Foundation

|

S |

olar roof top power is propagated as energy for the poor people. In this light it is interesting to analyse the case of two hypothetical persons from the Below Poverty line category and see who will be in a better position, the one who uses power from the grid or the one who opts for solar roof top? As you may be aware, at a bare minimum level at least 1000kwh/ per capita/ year consumption is required to have decent quality of life. Therefore, in the case given below, Person A is assumed to fulfil his per capita electricity consumption through grid based electricity and Person B by installing a 1 Kilo watt solar plant at his residence. Assume that both are identical having same small income for the sake of simplicity. Again for the sake of simplicity, the fixed charge for grid based electricity is taken as nil and cost of maintenance and repair for solar plant is also taken as nil. Since most of the poor people do not own their homes, they may have to pay a charge for using the roof top but this is taken as nil.

|

|

Cost of constructing power plant |

Consumption |

Tariff |

Monthly bill |

Savings = Difference between monthly instalment – actual bill |

|

Person A consuming grid based electricity |

Nil |

1000 kwh / per capita/ year consumption kwh taken as the benchmark criteria Monthly consumption = 1000 kwh/ 12 = 83 kwh/ per month Per day consumption = 83 Kwh/ 30 = 2.8 kwh |

Retail supply tariff schedule for FY 2013-14 (51 units – 100 un its) in Delhi ` 2. 60 |

83 kwh x ` 2.60 = ` 216 |

Monthly saving= ` 934 – ` 216 = ` 718 (since he has not invested in the plant) Yearly saving = ` 718 x 12 = ` 8616 Deposited the amount in the savings bank account at 4% compounded annually. Savings at the end of 25 years = ` 8616 (invested annually at 4% = ` 3,73,174 (rounded figure)[1] |

|

Person B having Solar roof top power Plant |

Initially investment for installation of 1 kwp solar rooftop plant = ` 80,000 (benchmark capex cost as per CEA is ` 8 Crore/ Mega Watt) The person take personal loan from Public bank at the rate of 10.10 % for 25 years (life of the Plant) Total initial cost= 80000 x 110.10/ 100 = ` 88, 080 Yearly instalment = ` (` 88, 080+24 x 8000 (app. Figure of ` 8, 000 taken for calculation rather than ` 8, 808) / 25 = ` 280080/25 = ` 11203 Monthly instalment will be = ` 11203/ 12 = ` 933.6 or ` 934 (eventually this will be his monthly bill) |

1000 kwh / per capita/ year consumption kwh taken as the benchmark criteria Monthly consumption = 1000 kwh/ 12 = 83 kwh/ per month Per day consumption = 82 Kwh/ 30 = 2.8 kwh On an average, 1 kw solar plant can generate 4 kwh energy / per day |

Tariff is nil. After consuming his 2.8 Kwh, he will sell 1.2 kwh at ` 9.56 (KERC solar tariff order 2013 for roof top & small solar plants) Monthly Revenue from the sale = 1.2 x 9.56 x 30 = ` 344 (rounded off) |

Monthly revenue – monthly instalment = ` 344 – ` 934 = - ` 590 (rounded off) |

Yearly loss = ` - 590 x 12 = ` - 7080 Money lost in 25 years = – ` 7080 x 25 = - ` 1,77,000 + Plus interest Conclusion: return on investment -Negative Plus he has to buy new solar roof top setup |

CEA = Central Electricity Authority

For those who do not want to go through the calculations here is a summary of the result. Person A using grid based electricity will be better off by ` 3,73,174 in 25 years compared to the person installing roof top solar system who will be in debt. Some may argue that is a subsidy is given for purchase of roof top and if the cost of avoided carbon is taken the tables will turn in favours of Person B. This raises the question as to why people who barely consume any electricity should be shouldering the burden of securing a loan/installing a roof top etc to save few grams of carbon when others who consume electricity even to brush their teeth just have to flick a switch for electricity and emit kilograms of carbon. We will ignore this for the moment and only pose the question: What would the poor choose purely on the basis of value?

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

Open Letter to the Prime Ministers of Nepal and India

Rt. Hon. Sushil Koirala, Prime Minister of Nepal

His Excellency Narendra Damodardas Modi, Prime Minister of India

We, the undersigned concerned citizens, who have been keenly observing and following developments in the water resources sector including the award of the water related projects for hydro power generation to the national and external private sectors, have had our attention drawn to the recently signed (19th September 2014) Power Development Agreement (PDA) between the Investment Board of Nepal (NIB) and the GMR-ITD Consortium of India, allowing the latter to develop a 900 MW Upper Karnali Project, as a run-of-river (RoR) project.

We feel that the proposed project, as it stands, remains deeply flawed technically, economically, environmentally and socio-politically; and, therefore, if implemented in the present form, would directly undermine the vital interests of the people and economies of Nepal and India and would also set an unpardonable precedent with long-term consequences. The following are some of the major technical and institutional deficiencies built into the current project design:

1. Displacement of "jewel in the crown" multipurpose project

1.1 With the potential of building 2 sites in Karnali Bend, KR1A (240 MW) and KR1B (main power plant 3,532 MW and second power plant 408 MW) total potential capacity stands at 4,180 MW. As a reservoir storage project, this scheme will generate economically and financially valuable peaking power compared to flood energy with a peaking RoR plant. These are mutually exclusive options; hence, building the 900 MW RoR plant would produce relatively expensive 1,000 GWh firm energy annually while the storage option with redesign would produce 9,000 GWh. The current option thus constitutes “killing” the full potential of this site. Due to the ever increasing carbon content and resulting climate change the world is required to reduce generation and use of electricity from unclean/un-renewable sources and increase generation and use from clean/renewable sources. Against this backdrop, it doesn’t make sense to harness this site at one-fourth of its full potential.

1.2 In the Karnali Bend there is a natural head of 140m and the required tunnel length between dam and powerhouse is less than 2km due to which the construction cost will be commensurately lower. Given the unique and highly advantageous topography of the region, reputed international consultants such as the US energy giant, Bechtel International, and those from Canada have dubbed the project as a "jewel in the crown" and one of the most attractive hydro development sites. The current version would thus be a crime of debasing this gift of nature.

1.3 The storage option (with live storage of 4 billion cubic meters) will reduce flood peak on Karnali River by 50 percent with significant flood control benefits for the Open Letter to the Prime Ministers of Nepal and India re UKP downstream reaches of Karnali River in both Nepal and India. The reservoir will also generate 500 m3/s lean season augmented flow that can irrigate and additional 1.2 million hectares of agricultural land. Nepal is land-limited and, after irrigating about 200,000 hectares of land in Nepal, India can irrigate an additional 1 million hectares of agricultural land. While reservoir projects are generally accompanied by huge environmental and social costs, the impact of this storage project is relatively minimal for its capacity with positive benefits being relatively much larger.

2. Potential social and environmental disaster

2.1 Nepal’s power planning of the last several decades has bequeathed the country a “flood-drought” syndrome whose recurrent feature is electricity glut of a few years upon the implementation of a single large (for its system) project followed by years of chronic load-shedding. This pathology has become acute in the last few years with power cuts of fifteen hours per day in the roughly 700 MW sized Nepal Integrated National Grid. Currently, the “suppressed demand” in Nepal is between three to five thousand MW, much of which is needed for a transition to a carbon-neutral Nepal fuelled by renewable energy to accelerate her industrialization and provide jobs to her youth at home. This “suppressed demand” is being partially met by almost 700 MW of expensive private diesel generators that have skyrocketed import of petroleum and therefore, makes little economic sense. Against such a backdrop, pursuing an export oriented strategy as underlined by this project and its PDA is suicidal in its very intent, and is, therefore, already provoking adverse public reactions towards not only its own government but also against a friendly neighbor. However, once Nepal has achieved its requirements in power generation, all of the undersigned would see export of surplus power as eminently sensible.

2.2 Designed as a peaking RoR project, the current option is slated to interrupt the river flow for 20-21 hours a day and to discharge the pent up volume for 3-4 hours a day during the lean season. This daily flood pulse and drought will have a devastating impact on downstream irrigation projects, on the local communities and on the wildlife reserves of Bardia National Park in Nepal and Dudhwa National Park in India. The project was initially conceptualized as a 300 MW RoR further 2 kms downstream, which was later changed to the current capacity of 900 MW at the present location. While both the IBN and GMR seem to have acknowledged these problems and have suggested the possible construction of another re-regulating dam immediately downstream within six months, It fundamentally calls into question the technical and financial feasibility and viability of the current project at its very core, thus rendering it evidently unworthy of implementation in its present shape on technical as well as ethical grounds.

2.3 We also find it necessary to point out that the current UKP PDA and related agreements have been entered into by bypassing Article 156 of the Nepal's current Constitution that requires their endorsement by its parliament. We note that a procedure that is not supported by the requirements of the fundamental law of the land constitutes a rather shaky foundation on which to build enduring trans-boundary cooperation in this vital sector for both Nepal and India. Besides, we could not also fail to notice a strange Open Letter to the Prime Ministers of Nepal and India re UKP and unfortunate veil of secrecy surrounding the making of the current project that would otherwise mark the historic onset of power trading cooperation between two friendly countries, Nepal and India.

3. Possible way ahead

3.1 As upstream and downstream riparian neighbors, Nepal and India are destined to cooperate in the multipurpose development of the water resources in the Ganga basin for the multi-dimensional benefits for the people of both the countries such as hydropower, irrigation, flood control, navigation, tourism and fisheries. To this end, we are convinced that a more sagacious development of the UKP is crucially in order, and it would also go on to constitute a very healthy precedent for other projects too in future. We also find it necessary to recall that the bane of most of the projects in Nepal in recent years have been enormous cost and time overruns, mainly due to severe disjuncture between the interests of the project developers, local stakeholders as well as the general power consumers. We sense early warning signs of this malaise overtaking UKP as well if the current shortsighted option is not corrected at the earliest.

3.2 In view of the enormous loss that the implementation of the UKP in its present form would cause to the people of both Nepal and India, four alternative options – which had also been submitted to the Government of Nepal and IBN for their consideration earlier – are being proposed, so that even as GMR goes ahead with its maiden undertaking in Nepal, the potential of a better project as mentioned above would not be compromised. These options are: a) building high dam and reservoir by Nepal, and GMR to tap water from tailrace of powerhouse; b) building diversion structure downstream of Ramagad for a capacity of approximately 850 MW that would prevent backwater rising up to the high dam site; and c) building a single project to generate 4,200 MW with GMR sharing the costs and benefits. In case these options do not work, the fourth option would be to have the government of Nepal build the high dam project on its own and to compensate GMR for necessary costs incurred so far.

In the light of the above, we are seeking your statesmanlike intervention for a more rational use of Upper Karnali Project site in the Karnali Bend in such a way that bigger optimal benefits could be reaped by the people of Nepal and India.

Kathmandu

22 November 2014

Civil Society Alliance for Rational Water Resources Development in Nepal

Signatories

1. Prof. Dr. Hari P. Pandit, Institute of Engineering, TU

2. Mr. Bihari Krishna Shrestha, anthropologist/former Additional Secretary

3. Dr. Prakash Chandra Lohani, former Minister of Finance/Foreign Affairs

4. Dr. Ananda B Thapa, former Executive Secretary, WECS

5. Dr. Dwarika Nath Dhungel, former Secretary Ministry of Water Resources

6. Mr. Dipak Gyawali, Academician, NAST, former Minister of Water Resources

7. Prof. Dr. Mohan P Lohani, former Ambassador

8. Mr. Bharat Basnet, The Explore Nepal

9. Mr Ajit Narayan Singh Thapa, former MD, NEA

10. Mr. Lok B Rawat, Chair, KARBACOS

11. Mr. Ratna Sansar Shrestha, former member, NEA board of directors

12. Mr Lila Mani Pokhrel, UCPN (Maoist)

ANALYSIS / ISSUES……………

Global CO2 Emissions from Fuel Combustion: Gloomy Picture from the IEA

K K Roy Chowdhury, Energy & Environment Expert, Delhi

|

T |

he International Energy Agency (IEA), Paris has specially designed a publication, titled, “CO2 EMISSIONS FROM FUEL COMBUSTION HIGHLIGHTS”-2014 Edition and released it for delegations and observers of the twentieth session of the Conference of the Parties to the UN Climate Change Convention (COP 20), in conjunction with the tenth meeting of the Parties to the Kyoto Protocol (CMP 10), held in Lima, Peru from 1 to 12 December 2014.

Key findings include:

· Global CO2 emissions increased by 51% since 1990, reaching 31.7 Giga tones of Carbon-di-oxide (GtCO2) in 2012. Despite some decoupling between economic growth and energy use, increasing wealth and population, with a practically unchanged carbon intensity of the energy mix, drove this dramatic emissions increase.

· In 2012, two-thirds of global emissions originated from just ten countries, with the shares of China and the United States far surpassing those of all others. Increased coal and oil consumption drove emissions increases in developing countries, while developed countries slightly decreased their emissions compared to 2011.

· CO2 emissions for the group of countries participating in the Kyoto Protocol were collectively about 14% below 1990 levels in 2012, although large differences were observed at an individual country level.

The full-scale study CO₂ Emissions from Fuel Combustion 2014 includes even more comprehensive information, such as tables and graphs by country and region. Complete time series of CO2 emissions data and indicators are also found at the IEA online data services.

The IEA estimates of CO2 emissions from fuel combustion are based on the IEA energy balances and the Revised 1996 IPCC Guidelines for National Greenhouse Gas Inventories.

In the lead-up to the UN climate negotiations in Lima, the latest information on the level and growth of CO2 emissions, their source and geographic distribution will be essential to lay the foundation for a global agreement as input to and support for the UN process.

This annual publication contains, for more than 140 countries and regions:

· estimates of CO2 emissions from 1971 to 2012

· selected indicators such as CO2/GDP, CO2/capita and CO2/TPES

· a decomposition of CO2 emissions into driving factors

· CO2 emissions from international marine and aviation bunkers, and other relevant information.

Recent years have witnessed a fundamental change in the way governments approach energy-related environmental issues. Promoting sustainable development and combating climate change have become integral aspects of energy planning, analysis and policy making in many countries, including all IEA member states. The IEA’s energy data are the figures most often cited in the field making it appropriate for them to publish this information in a comprehensive form.

The IEA has also reported that these data are only for energy-related CO2, not for any other greenhouse gases. Thus they may differ from countries' official submissions of emissions inventories to the UNFCCC Secretariat. However, the full-scale study contains data for CO2 from non-energy-related sources and gas flaring, and emissions of CH4, N2O, HFC, PFC and SF6. In addition, the full-scale study also includes information on ‘Key Sources’ from fuel combustion, as developed in the IPCC Good Practice Guidance and Uncertainty Management in National Greenhouse Gas Inventories.

The estimates of CO2 emissions from fuel combustion presented in this publication are calculated using the IEA energy balances and the default methods and emission factors from the Revised 1996 IPCC Guidelines for National Greenhouse Gas Inventories. There are many reasons why the IEA Secretariat estimates may not be the same as the numbers that a country submits to the UNFCCC, even if a country has accounted for all of its energy use and correctly applied the IPCC Guidelines.

A summary of the recent trends in CO2 emissions from fuel combustion as given in the IEA publication is stated below.

The growing importance of energy-related emissions of CO2, given the concentrations of Carbon Dioxide (CO2) in the atmosphere that have been increasing significantly over the past century and also much reported, need not be over-emphasised. Significant increases have also occurred in levels of methane (CH4) and nitrous oxide (N2O). The Fifth Assessment Report from the Intergovernmental Panel on Climate Change (Working Group I) states that human influence on the climate system is clear (IPCC, 2013). Some changes in the climate system would be irreversible in the course of a human life span.

Given the long lifetime of CO2 in the atmosphere, stabilizing concentrations of greenhouse gases at any level would require large reductions of global CO2emissions from current levels. The lower the chosen level for stabilisation, the sooner the decline in global CO2 emissions would need to begin, or the deeper the emission reduction would need to be over time. The United Nations Framework Convention on Climate Change (UNFCCC) provides a structure for intergovernmental efforts to tackle the challenge posed by climate change. The Convention’s ultimate objective is to stabilize GHG concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system. The Conference of Parties (COP) further recognised that deep cuts in global GHG emissions are required, with a view to hold the increase in global average temperature below 2°C above pre-industrial levels, and that Parties should take urgent action to meet this long-term goal, consistent with science and on the basis of equity.

Energy use and greenhouse gases: Among the many human activities that produce greenhouse gases, the use of energy represents by far the largest source of emissions.

Within the energy sector, CO2 resulting from the oxidation of carbon in fuels during combustion dominates the total GHG emissions. CO2 from energy represents about three quarters of the anthropogenic GHG emissions for Annex I countries, and almost 70% of global emissions. This percentage varies greatly by country, due to diverse national structures. Increasing demand for energy comes from worldwide economic growth and development. Global total primary energy supply (TPES) more than doubled between 1971 and 2012, mainly relying on fossil fuels.

Despite the growth of non-fossil energy (such as nuclear and hydropower), considered as non-emitting, the share of fossil fuels within the world energy supply is relatively unchanged over the past 41 years. In 2012, fossil sources accounted for 82% of the global TPES.

Growing world energy demand from fossil fuels plays a key role in the upward trend in CO2 emissions. Since the Industrial Revolution, annual CO2 emissions from fuel combustion dramatically increased from near zero to almost 32 GtCO2 in 2012.

Recent emissions trends: In 2012, global CO2 emissions were 31.7 GtCO2. This represents a 1.2% year-on-year increase in emissions, about half the average annual growth rate since 2000, and four percentage points less than in 2010, year of initial recovery after the financial crisis.

Emissions in non-Annex I countries continued to increase (3.8%), albeit at a lower rate than in 2011, while emissions in Annex I countries decreased by 1.5%. In absolute terms, global CO2 emissions increased by 0.4 GtCO2 in 2012, driven primarily by increased emissions from coal and oil in non-Annex I countries.

Emissions by fuel: Although coal represented 29% of the world TPES in2012, it accounted for 44% of the global CO2 emissions due to its heavy carbon content per unit of energy released, and to the fact that 18% of the TPES derives from carbon-neutral fuels. As compared to gas, coal is nearly twice as emission intensive on average.

Those shares evolved significantly during the last decade, following ten years of rather stable relative contributions among fuels. In 2002 in fact, oil still held the largest share of emissions (41%), three percentage points ahead of coal.

In 2012, CO2 emissions from the combustion of coal increased by 1.3% to 13.9 GtCO2. Currently, coal fills much of the growing energy demand of those developing countries (such as China and India) where energy-intensive industrial production is growing rapidly and large coal reserves exist with limited reserves of other energy sources.

Emissions by region: Non-Annex I countries, collectively, represented 55% of global CO2 emissions in 2012. At the regional level, annual growth rates varied greatly: emissions growth in China (3.1%) was lower than in previous years, however, emissions grew strongly in Africa (5.6%), Asia excluding China (4.9%) and the Middle East (4.5%). Emissions in Latin America (4.1%) and Annex II Asia Oceania (2.5%) grew at a more moderate rate, while emissions decreased in Annex II North America (-3.7%), Annex II Europe (-0.5%) and Annex I EIT (-0.8%).

Regional differences in contributions to global emissions conceal even larger differences among individual countries. Nearly two-thirds of global emissions for 2012 originated from just ten countries, with the shares of China (26%) and the United States (16%) far surpassing those of all others. Combined, these two countries alone produced 13.3 GtCO2. The top-10 emitting countries include five Annex I countries (United States, Russian Federation, Japan, Germany, Canada) and five non-Annex I countries (China, India, Korea, Islamic Republic of Iran, Saudi Arabia). As different regions and countries have contrasting economic and social structures, the picture would change significantly when moving from absolute emissions to indicators such as emissions per capita or per GDP.

Emissions by sector: Two sectors produced nearly two-thirds of global CO2emissions in 2012: electricity and heat generation, by far the largest, accounted for 42%, while transport accounted for 23%. Generation of electricity and heat worldwide relies heavily on coal, the most carbon-intensive fossil fuel. Countries such as Australia, China, India, Poland and South Africa produce over two-thirds of their electricity and heat through the combustion of coal.

Between 2011 and 2012, CO2 emissions from electricity and heat increased by 1.8%, faster than total emissions. While the share of oil in electricity and heat emissions has declined steadily since 1990, the share of gas increased slightly, and the share of coal increased significantly, from 65% in 1990 to 72% in 2012. Carbon intensity developments for this sector will strongly depend on the fuel mix used to generate electricity, including the share of non-emitting sources, such as renewables and nuclear, as well as on the potential penetration of CCS technologies.

As for transport, the fast emissions growth was driven by emissions from the road sector, which increased by 64% since 1990 and accounted for about three quarters of transport emissions in 2012. It is interesting to note that despite efforts to limit emissions from international transport, emissions from marine and aviation bunkers, 66% and 80% higher in 2012 than in 1990 respectively, grew even faster than those from road.

Reference: IEA STATISTICS/ CO2 EMISSIONS FROM FUEL COMBUSTION Highlights (2014 Edition)

The author may be contacted at [email protected]

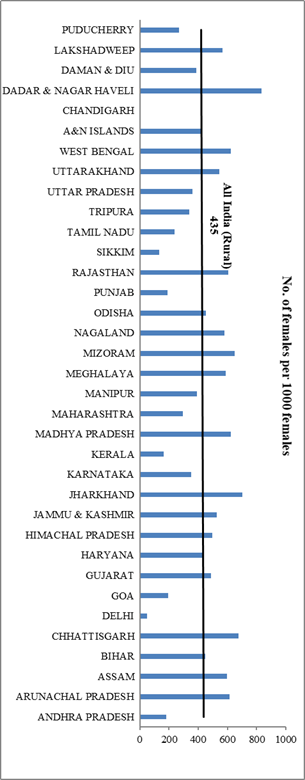

DATA INSIGHT……………

Energy for Cooking & Lighting in Rural India

Akhilesh Sati, Observer Research Foundation

Collection of fire wood by rural women

|

STATE |

No. of Females* Per 1000 Rural Females |

|

ANDHRA PRADESH |

183 |

|

ARUNACHAL PRADESH |

614 |

|

ASSAM |

598 |

|

BIHAR |

447 |

|

CHHATTISGARH |

677 |

|

DELHI |

51 |

|

GOA |

196 |

|

GUJARAT |

487 |

|

HARYANA |

433 |

|

HIMACHAL PRADESH |

497 |

|

JAMMU & KASHMIR |

527 |

|

JHARKHAND |

703 |

|

KARNATAKA |

351 |

|

KERALA |

165 |

|

MADHYA PRADESH |

622 |

|

MAHARASHTRA |

295 |

|

MANIPUR |

392 |

|

MEGHALAYA |

590 |

|

MIZORAM |

651 |

|

NAGALAND |

580 |

|

ODISHA |

451 |

|

PUNJAB |

190 |

|

RAJASTHAN |

608 |

|

SIKKIM |

134 |

|

TAMIL NADU |

240 |

|

TRIPURA |

339 |

|

UTTAR PRADESH |

362 |

|

UTTARAKHAND |

545 |

|

WEST BENGAL |

623 |

|

A&N ISLANDS |

417 |

|

CHANDIGARH |

0 |

|

DADAR & NAGAR HAVELI |

835 |

|

DAMAN & DIU |

387 |

|

LAKSHADWEEP |

568 |

|

PUDUCHERRY |

269 |

*Females of age 5 yrs and above.

Source: NNS 68th Round (Report No. 559)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC targets to start production by mid-2018 from KG-D5 block

December 1, 2014. Oil and Natural Gas Corp (ONGC) is targeting mid-2018 for start of natural gas production from its Krishna Godavari basin KG-D5 block, Oil Minister Dharmendra Pradhan said. ONGC is using cluster approach to bring oil and gas finds in the block KG-DWN-98/2 or KG-D5, which sits next to Reliance Industries' Bay of Bengal block KG-D6, to production by 2018-19, he said. The block (KG-D5) is divided into the Northern Discovery Area (NDA) and Southern Discovery Area (SDA). Estimated reserves of NDA are 121 million tons of oil in-place and 78 billion cubic meters (bcm) of initial gas in place and that of SDA are 80.9 bcm of intial gas in place, he said. ONGC plans to develop the discoveries in the block in three clusters -- 14.5 million standard cubic meters per day of gas for 15 years from Cluster-1 comprising of D&E finds of NDA in KG-D5 block and G-4 find in the a neighbouring area. (economictimes.indiatimes.com)

ONGC lines up $3 bn investment in Mozambique

November 28, 2014. With ONGC lining up USD 3 billion more investment in a giant Mozambique gas field, India pressed the African nation to approve a law that will help protect its investment. ONGC Videsh Ltd (OVL), the overseas arm of state explorer Oil and Natural Gas Corp (ONGC), and Oil India Ltd (OIL) have already spent USD 5 billion in taking 20 per cent stake in Area-1 gas field. Their share of investment for developing the offshore gas field and converting the fuel into LNG for export in ships would be another $3 billion-plus. Though the required law and investment agreements are in place for the Production Sharing Contract (PSC) for the upstream component, the special regimes required for midstream and downstream investment (pipelines and LNG plants) are yet to be finalised. The special regimes for midstream and downstream investment require passing of a decree law and an LNG investment agreement with the approval of the Parliament of Mozambique. While the Mozambique cabinet has approved the decree law, it is awaiting Parliament nod. Oil Minister Dharmendra Pradhan pressed visting Mozambique Foreign Minister Oldemiro Julio Marques Baloi for early passage of the law. Any delay in the Parliament nod will push back the project as Mozambique is headed for general elections and a new Parliament may take some time to constitute and approve the decree. OVL and partners are targeting 2019 for start of gas production. Pradhan and the visiting minister discussed various areas of mutual cooperation in the energy sector. (economictimes.indiatimes.com)

Downstream………….

Indian Oil eyes West coast for new refinery project

November 30, 2014. Indian Oil Corp (IOC) is looking at setting up a greenfield refinery on the West coast as part of its expansion plans. The company is the second largest petrochemical player having 19 per cent market share. IOC's Rs 34,555 crore state-of-the-art 15 million metric tonnes per annum (MMTPA) Paradip Refinery would be commissioned in phases from March 2015 onwards. On cost escalation, the Paradip Refinery was envisaged originally at ` 29,700 crore and has now been estimated at ` 34,555 crore, which includes certain changes, with the addition of a new power plant. The refinery is capable for processing a broad basket of crude oil grades, including cheaper high-sulphur heavy crudes, which would help the company improve its bottom-line. As part of its diversification plan, the company is setting up a polypropylene project having capacity of 680 KTA at Paradip. The INDMAX FCC Unit of 4.2 MMTPA capacity at Paradip, one of the major secondary processing units, is designed to operate in petrochemicals mode to maximise propylene/ethylene production. The unit would produce 700 KTA of propylene. Based on the availability of propylene, a poly-propylene plant of 700 KTA capacity is expected to be commissioned by 2017-18, with an estimated capex of ` 3,150 crore. The company is expanding its portfolio in gas, petrochemicals and upstreams to improve its bottom-line. In the gas sector, IOC sold 3.22 MMT of R-LNG during 2013-2014, which constitutes a market share of 28 per cent in the domestic market. A pioneer in supplying 'LNG by Road' to customers not connected to pipeline networks, it includes transportation of LNG in cryogenic tankers by now. IOC plans to augment its 132-km Dadri-Panipat pipelines. A 5 MMTPA LNG re-gasification terminal project at Ennore in Tamil Nadu is under implementation. IOC is also a consortium partner for implementation of 4,000 km of gas pipeline projects and is also a joint venture partner for city gas distribution in Agra and Lucknow. Another joint venture for city gas distribution is also being implemented for Lucknow and Chandigarh. In the petrochemicals sector, IOC is now the No 2 player in the country. The petrochemical plants of IOC includes LAB at Gujarat Refinery having capacity of 120 TMTPA; PTA at Panipat refinery 553 TMTPA; and Naphtha Cracker at Panipat having Polyethylene capacity of 650 TMTPA. The total investment on these plants is over ` 20,800 crore. IOC has been aggressively automating its retail outlets with a view to optimising the benefits for customers, dealers and the Corporation. About 6,537 retail outlets have been automated till date and the Corporation has aggressive plans to cover the entire network. (economictimes.indiatimes.com)

Transportation / Trade…………

India weighs piping diesel to Bangladesh

December 2, 2014. India is studying the feasibility of exporting diesel to Bangladesh through a pipeline as part of the government's plans to develop the northeast as the gateway for the proposed economic corridor with its eastern neighbours. BPCL's subsidiary, Numaligarh Refineries Ltd, proposes to export about a million tonne of diesel per year from its refinery in Assam if the ` 200-crore pipeline project finally works out. The pipeline would revive an old trade between the two countries. IndianOil in 2003-2004 made a deal with Bangladesh for exporting 2 lakh tonne of diesel a year. But, that deal floundered over the pricing issue. Bangladesh imports some 1.6 million tonne of petroleum products, mostly from Kuwait. The deal fell through even after the two sides had discussed plans to haul petroleum products from IndianOil's Haldia refinery by rail and barges. IndianOil had also offered to revamp the two million tonne Chittagong refinery and construct a fuel import terminal at Mongla. (economictimes.indiatimes.com)

Policy / Performance………

Excise duty on petrol, diesel hiked; no impact on prices

December 2, 2014. The Government raised excise duty on petrol and diesel by ` 2.25 and ` 1 a litre respectively, but consumers will be spared of a price hike. The move, which comes amid declining prices of crude oil in the international market, will boost government revenue and help it contain the fiscal deficit. The move will have no impact on retail prices of petrol and diesel. This is the second hike in excise duty in three weeks. On November 12, the government had raised the excise duty by ` 1.50 per litre on both petrol and diesel but that did not have any impact on the retail prices. In view of the declining prices of crude, oil marketing companies had cut petrol price by 91 paise a litre, the seventh reduction since August, and diesel by 84 paise per litre, the third straight cut. (www.thehindu.com)

Assam govt moves Guwahati High Court on oil royalty issue

December 1, 2014. Assam government has approached the Gauhati High Court seeking a direction to energy firms like ONGC and OIL to pay royalty on crude oil on pre-discounted rate to the state in accordance with a Supreme Court order. The Supreme Court in its interim order had directed ONGC to pay crude oil royalty to Gujarat on pre-discounted crude price beginning February 1, 2014. The Gujarat High Court on a petition filed by the Gujarat government had held that the royalty should be payable to the state on market price of crude oil and not on post-discount price. Assam Chief Minister Tarun Gogoi had strongly mentioned the issue in a memorandum submitted to Prime Minister Narendra Modi during his two-day visit to Assam. (economictimes.indiatimes.com)

LPG rate cut by ` 113, jet fuel prices by 4.1 per cent

December 1, 2014. Price of non-subsidised cooking gas (LPG) was cut by a steep ` 113 per cylinder and that of jet fuel (ATF) by 4.1 per cent as international oil rates slumped to multi-year lows. A 14.2-kg cylinder of non-subsidised LPG will cost ` 752, down from ` 865 previously, in Delhi, oil companies announced. This is the fifth straight reduction in rates of non-subsidised or market priced LPG, which the customers buy after exhausting their quota of 12 cylinders at subsidised rates, since August. In five monthly reduction, non-domestic LPG rates have been slashed by ` 170.5 per cylinder, bringing the price at three-year lows. On similar lines, the price of aviation turbine fuel (ATF), or jet fuel, at Delhi was cut by ` 2,594.93 per kilolitre, or 4.1 per cent, to ` 59,943 per kl. This is the fifth straight monthly reduction in rates. This reduction follows a steep 7.3 pr cent or ` 4,987.7 per kl, cut in prices on November 1. Since August, ATF prices have been cut by 14.5 per cent or Rs 10,218.76 per kl and rates have dipped below Rs 60,000 per kl level for the first time in three years. Brent, the benchmark grade for more than half of the world's oil, have dropped to $ 68.34 a barrel, the lowest level since October 2009. Prices declined 18 per cent last month and are 38 per cent lower in 2014. In Mumbai, jet fuel will cost ` 61,695 per kl from as against ` 64,414.98 per kl previously. The rates vary because of differences in local sales tax or VAT. Jet fuel constitutes over 40 per cent of an airline's operating costs and the price cut will ease the financial burden of cash-strapped carriers. The three fuel retailers -- IOC, Hindustan Petroleum Corp and Bharat Petroleum Corp -- revise jet fuel and non-subsidised LPG prices on the first of every month, based on the average international prices in the preceding month. The oil companies had cut petrol price by 91 paisa a litre and diesel by 84 paisa per litre. The seventh reduction in price since August has meant that petrol costs ` 63.33 a litre in Delhi, ` 10.27 per litre less than what it cost in July. The third reduction in diesel rates in one month has led to price coming down to ` 52.51 a litre. Non-subsidised LPG in Delhi was priced at ` 922.50 in July and rates have in every subsequent month been reduced. (economictimes.indiatimes.com)

Gas price in India to dip to $5 in 3 yrs: Goldman Sachs

November 30, 2014. The new natural gas price of $5.61, which is already among the lowest in Asia Pacific, is likely to drop to around $5 per unit in three years due to the variables included in the formula, Goldman Sachs has said. Stating that Indian prices for new projects are among the lowest in Asia Pacific, Goldman said China pays explorers $11.9 per mmBtu (million British thermal unit) rate for new projects while Indonesia and the Philippines price the fuel at $11 and $10.5 respectively. Gas from offshore fields in Myanmar, where ONGC and GAIL have stake, are sold to China for $7.72. Thailand prices gas from new projects at $8.2 per mmBtu. The only nations with lower rates are Vietnam ($5.2) and Malaysia ($5), it said. The government had approved a new formula that priced all domestic gas at weighted average of rates prevalent in gas-surplus economies of US/Mexico, Canada and Russia. Goldman said encouraging domestic E&P was critical for the Indian oil and gas sector in order to check the rising dependence on imports. (economictimes.indiatimes.com)

National interest, energy security more important than procedures: CAG

November 29, 2014. The national auditor has asked the oil ministry to let national interest and energy security determine its approach towards commercial discoveries instead of niggling with procedural issues and sought "critical review and rationalisation" of contractual provisions that have troubled the industry. The Comptroller & Auditor General (CAG) said in view of energy security, the country cannot afford to lose out on even a small discovery as it urged the government to speed up approvals of budgets and work programmes of blocks, which have been delayed by as much as 16 months after the end of the fiscal year. The auditor also kept an eagle eye on the expenditure and claims by companies such as Reliance Industries, Cairn India and Oil and Natural Gas Corp (ONGC), citing contractual provisions in observations about lapses. The report revealed that the price of crude oil produced from Cairn India's Rajasthan block had still not been finalised by the government, making payment of royalty, tax and state share of profit, tentative. It also recommended disallowing some costs of Reliance Industries in the KG-D6 block, and noted that state-run ONGC sold its share of gas from a joint venture to Torrent Power at a price lower than what was prescribed. This report of CAG was keenly watched because its previous audit had made stern observations that prompted the oil ministry to initiate action against Reliance Industries. This led to arbitration and the company said its contract has a provision only for a financial audit, not the comprehensive performance audit by the CAG. In what should cheer industry, the latest report highlighted huge delays in approvals of budgets for oil and gas blocks and called them a matter of concern. The ministry has already informed the audit team that DGH had given an assurance that from next year, the work programme and budget would be received by December 31 and all efforts would be made to approve it in three months. CAG said certain provisions of the contractual regime needed a thorough relook. (economictimes.indiatimes.com)

From March 31, pay market rate for LPG cylinders

November 27, 2014. Aadhaar or no Aadhaar, LPG cylinders will no more be available from dealers at subsidised rates after March 31, 2015. Moreover, holding an Aadhaar card is no more the necessary criterion for receiving subsidy on cooking gas in bank accounts. The direct benefit transfer of LPG scheme (DBTL), which was re-introduced on November 15 across 54 districts, would now be launched nationally from January 1. The government has also decided to provide a three-month grace period till March 31, 2015 for households to receive subsidised cylinders directly from their dealers. Beyond this date, the LPG cylinders will be sold at market price. And if the consumer enrolls for the subsidy transfer scheme by that time, the subsidy will be deposited in the bank account provided in the application. Otherwise, there will be no subsidy at all. The period - April 1, 2015 to June 30, 2015 — has been termed as the parking period by the government with respect to this transfer scheme. If a consumer enrolls at any time during this period, he will be entitled to receive the entire subsidy at a go, based on the number of cylinders he already bought from his dealer at non-subsidised rates. If one does not enroll within these three months, no subsidies will accrue. For enrolling under this scheme, consumers who have Aadhaar numbers will have to first link the Aadhaar number to their bank account. This can be done by submitting a certain Form 1 to the bank. Alternatively, Form 1 can also be deposited at a drop box provided at the distributor's outlet. The next step would be to link this Aadhaar number with the LPG Consumer Number. It can be done by physically submitting Form 2 to the LPG distributor or via call centre number 1800-2333-555. One can also register at http:rasf.uiadai.gov.in or use the IVRS for cylinder booking. Both Forms can be downloaded at http:www.mylpg.in and the government feels this is the preferred means of enrolling under the scheme. In case a consumer does not have the Aadhaar number, he will have to provide his 17digit LPG ID to the bank using Form 3. The 17digit ID would be available on the cash-memo of LPG cylinders that have been delivered in the past. One can also log on to his respective oil marketing company's website, punch the consumer ID to know the 17-digit LPG ID. However, not all banks are accepting these forms at the moment. Alternatively, the consumer can fill up Form 4 and submit his bank details to the LPG distributor. They can also provide their bank details through the ministry's website, http:www.mylpg.in. Both Forms 3 and 4 can be downloaded from this website or can be collected from the LPG dealer. (economictimes.indiatimes.com)

New gas price policy inconsistent with PSC, says RIL's partner

November 27, 2014. The lower-than-expected hike in natural gas prices is "inconsistent" with the contract that government has signed with oil and gas explorers, said London- listed Hardy Oil, which partners Reliance Industries Ltd (RIL) and BP in a KG basin gas discovery block. The government implemented a new gas price of $5.61 per unit, a rate nearly 40 per cent lower than the price approved by the previous UPA regime but not implemented. Explorers are unhappy with the new rate, which is 33 per cent higher the previous price of $4.2 per million British thermal unit and has been arrived at averaging out prevalent rates in gas surplus economies of US, Russia and Canada, as it is below the cost of producing from most gas discoveries in deepsea. Given the projected shortfall in supply the gas, pricing policy is below expectations and is inconsistent with Production Sharing Contract (PSC) provisions which require the Contractor to ensure the gas price is determined by a regional competitive arms-length price discovery process, Hardy Oil said. Hardy holds 10 per cent interest in KG-DWN-2003/1 (D3) in Krishna Godavari basin in Bay of Bengal. RIL holds 60 per cent stake and is the operator of the block, where four discoveries have so far been made. BP has the remaining 30 per cent. India currently imports 13.5 million tons a year of liquefied natural gas (LNG) and demand of natural gas is projected to grow by 19 per cent per annum. The D3 exploration licence encompasses an area of 3,288 square kilometres, in water depths of 400 meters to 2,200 meters, and is located about 45-km off the east coast. Four gas discoveries Dhirubhai 39, 41, 44 and 52 have been made and the joint venture has acquired about 3,250 sq km of 3D seismic data over the block. (economictimes.indiatimes.com)

Expert's report on ONGC-RIL gas theft dispute by June: Oil Minister

November 26, 2014. Oil Minister Dharmendra Pradhan said international expert D&M will In June submit its report on ONGC's claim that Reliance Industries Ltd (RIL) had extracted gas from its fields in KG basin. ONGC had requested the court to appoint an independent agency to establish the continuity of reservoirs and to estimate the volume of gas. D&M started its work on September 25. ONGC claims three wells drilled by RIL on the boundary of KG-D6 block are within "few hundred meters" of its gas fields. RIL has disputed ONGC's allegations of theft. (www.business-standard.com)

ONGC finalises gas sales at $10.1-11.2: Oil Minister

November 26, 2014. Oil and Natural Gas Corp (ONGC) has finalised sale of gas from its marginal fields at a price of $ 10.10-11.20 a unit, Oil Minister Dharmendra Pradhan said. The price that ONGC is getting for gas from its fields in Gujarat and Andhra Pradesh is almost double of the $ 5.61 per million British thermal unit (mmBtu) rate that the government decided for all domestically produced gas. Pradhan said ONGC has finalised gas price through e-tendering for the marginal fields based on Government of India's guidelines for pricing of the fuel from small and marginal fields dated July 8, 2013. ONGC has finalised a price of $ 10.10 per mmBtu for gas from Gamij-GGS-2 field and a rate of $ 11.10 per mmBtu for Gamij-GGS-3 field, both in Gujarat. For the Warosan-4 field in Mehsana basin of Gujarat, it has finalised a rate of $ 10.50 per mmBtu, he said. In case of Triputallu, Kaza, Mandapeta-23, Gokarnapuram and Suyyaraopeta marginal fields in Andhra Pradesh, the firm has finalised a price of $ 11.20 per mmBtu. Pradhan said based on the recommendations of Rangarajan Comittee Report, the previous UPA government had in January approved Domestic Natural Gas Pricing Guidelines, 2014. According to this formula the gas price came to about $ 8.4 per mmBtu. Based on the recommendation of the committee, the government last month issued New Domestic Natural Gas Pricing Guidelines, 2014. As per the new policy, the price of domestic natural gas applicable for the period November 1 to March 31, 2015 will be $ 5.05 per mmBtu on gross calorific value (GCV) basis and $ 5.61 on net calorific value (NCV) basis. The previous rate of $ 4.2 per mmBtu was on NCV basis. Pradhan said ONGC during April-September this year produced 10.98 billion cubic meters of gas and 1.1 million cubic meters of coal-bed methane or CBM gas which is produced from coal seams. Oil India Ltd produced 1.37 bcm of gas in the same period, he said. (economictimes.indiatimes.com)

Modi to Abe favour oil bears as plunge aids Asian economies

November 26, 2014. Prime Minister Narendra Modi has oil to thank for helping an economic revival in India. Whether his luck holds depends on a meeting in Vienna. Awaiting the outcome of the summit of the Organization of Petroleum Exporting Countries (OPEC) on Nov. 27 are other Asian leaders who depend largely on imported oil. While Chinese President Xi Jinping is looking at shoring up an economy on track to record its weakest annual growth since 1990, Japan’s Prime Minister Shinzo Abe is banking on OPEC’s 12 members sustaining production levels to stem his nation’s slide into recession. Oil’s slump this year is good news for these nations, which are exposed to the risk of global price changes that affect their balance of trade. In India, which imports 80 percent of its oil, the key stock index has risen the most among Asian indexes this year as crude slumped. Not only will unchanged OPEC production help India and Japan, which buys all of its oil from overseas, it will also lower prices of natural gas imports for these two countries. South Korea, the world’s No. 2 LNG importer, will also benefit. The price of liquefied natural gas sold by most producers is linked to crude oil. Lower crude means cheaper LNG. Modi got the room to free diesel prices from state control for the first time in a decade, cutting subsidies on the fuel and narrowing one of Asia’s largest fiscal deficits. Lower oil was a reason HSBC Holdings Plc last month cut its forecast for India’s current account deficit to 1.5 percent of gross domestic product from 2.1 percent. Falling Brent has more than doubled the share prices of Bharat Petroleum Corp. (BPCL) and Hindustan Petroleum this year. Indian Oil Corp (IOC) has gained 60 percent since January, heading for its biggest annual increase since 2007. JPMorgan Chase & Co upgraded Hindustan Petroleum’s stock to overweight from underweight, Bharat Petroleum to overweight from neutral and Indian Oil to neutral from underweight. Hindustan Petroleum’s target price was also raised by 103 percent to 895 rupees a share. All three refiners are state-owned and were selling diesel at rates below cost. The objective was to help the government curb inflation before being allowed to set individual prices starting October. Hindustan Petroleum will be comfortable even if oil reaches as high as $90 a barrel. (www.bloomberg.com)

[NATIONAL: POWER]

Generation……………

Tata Power may not source coal from Indonesia for Mundra

November 30, 2014. Tata Power may cut dependence on Indonesian coal and explore other geographies to source the fuel for expansion of its 4,000 MW Mundra ultra mega power project in Gujarat. The company owns stake in KPC mining company in Indonesia which owns and operates coal blocks in the island nation. The company said the coal for Mundra project expansion can be sourced from any other country and any other mine because one gets it at the market-determined price. The company plans to expand the capacity of its Mundra project by 1,500 MW by adding two units. As per the original plan layout prepared by the Central Electricity Authority (CEA) there is space for space for two additional units. Central Electricity Regulatory Commission asked the power procurers to pay ` 329.45 crore as compensatory tariff for the Mundra plant to partly offset escalation in the price of imported coal. (www.business-standard.com)

Kudankulam likley to resume power generation in December

November 26, 2014. The Kudankulam Nuclear Power Plant (KKNPP), whose unit 1 was shut down due to some issues in turbine functioning in September, is expected to resume power generation by the first week of December, the government said. Jitendra Singh, Minister of State for Department of Atomic Energy, also informed that measures are being taken to avoid recurrence of such an event in unit 2 of the KKNPP, which is presently under commissioning and is also being prepared for hot run. (economictimes.indiatimes.com)

Package to rescue 16 GW of gas-based power plants ready

November 26, 2014. The government finalised details of a package to rescue 16,000 MW of gas-based power plants lying stranded as it looks to increase supplies by raising generation without burdening consumers. Power Minister Piyush Goyal met Oil Minister Dharmendra Pradhan to chalk out the rescue package that may involve rescheduling of loans to power companies as well as making available fuel at affordable price through means like pooling of average cheaper domestic gas price with costly imported LNG. The two ministers did not divulge details of the rescue package finalised which may need the Cabinet approval. Pradhan said the government is taking a comprehensive view of the variety of problems plaguing this industry for a long time. The issues of making power available to the people and addressing peak load shortages were also discussed in the meeting. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

JSW Energy may buy JP Power's Bina, Nigrie assets

December 2, 2014. JSW Energy is close to acquiring Bina and Nigrie thermal power units of JP Power. The deal is likely to value the assets around ` 12,000 crores. The announcement of the acquisition of Bina and Nigrie is waiting for the government's allocation of coal block to the Nigrie project which got cancelled in the Supreme Court's verdict on coal. The government is expected to allocate the mines to the Public Sector Enterprises and State government units by mid-December. As part of the deal, JSW Energy will replace Jaiprakash Associates from the 49:51 joint venture with Madhya Pradesh State Mining Corp Ltd (MPSMCL) for the coal requirements of the Nigrie power plants. Nigrie Thermal Power Project in Madhya Pradesh has a capacity of 1320 MW and is valued at over ` 9000 crores, Bina power project of 500 MW thermal power capacity is valued around ` 2600 crores in the transaction. (economictimes.indiatimes.com)

Saving power may fetch rewards from Delhi discoms

December 1, 2014. Delhi's discoms are planning to come up with innovative ways to keep tabs on the city's power consumption this winter and manage peak load without any unexpected shortfall. While north Delhi discom Tata Power Delhi is planning to incentivize consumers for using more energy efficient gadgets, Reliance discoms propose to reward those who reduce their power consumption during peak morning and evening hours. The ideas are based on Delhi Electricity Regulatory Commission's (DERC) order on 'demand side management' regulations wherein the regulator asked discoms to come up with ideas for reducing load and effective power management. Tata Power Delhi plans to encourage the use of energy efficient electrical equipment. The discom estimates that if consumers change their airconditioners, about 40 MW peak power can be saved. If the proposal gets cleared and is successful, the company plans to extend the rebate system to other electrical equipment as well as well. BSES discoms have also devised plans to tackle load growth in Delhi, mainly targeted at switching off load in peak hours and reducing overall demand. DERC had asked power companies to come up with plans that make use of the demand side management regulations. The regulations seek to flatten the demand-supply curve especially in peak morning and evening hours when consumers tend to use electricity the most and bridge the demand-supply gap. The regulations seek to flatten the demand-supply curve and also have benefits like lower overall cost of electricity to the consumers by economical use of resources as well as reducing difference between power demand during peak periods and off peak period. In the last few months, there has been some concern that Delhi's power demand has been rising ahead of generation due to increase in population and economic activities. (economictimes.indiatimes.com)

Indian power exchanges expect volume to grow due to SAARC energy co-operation deal

November 29, 2014. India’s two power exchanges — Indian Energy Exchange (IEX) and Power Exchange India Ltd (PXIL) —expect that the energy deal signed by the South Asian Association for Regional Cooperation (SAARC) on energy cooperation would be a big boost to the sector. These exchanges engaged in day-ahead transactions hope that India will get more power, especially from hydro power-rich Nepal and Bhutan. On the other hand, Pakistan can expect cheaper power from India through exchanges as power is generated in the northwestern neighbouring country on costly fuel like oil and Low Sulphur Heavy Stock (LSHS). According to the SAARC Framework Agreement for Energy Cooperation, the members will — for the purpose of electricity trade — enable non-discriminatory access to the their respective transmission grid as per the applicable laws, rules, regulations and inter-governmental bilateral trade agreements. The member states will facilitate buying and selling entities to engage in crossborder electricity trading. PXIL said deal is a win-win situation for all eight countries. (www.business-standard.com)

Coal supply to power plants in Maharashtra improving

November 28, 2014. The coal-supply situation is recovering in Maharashtra, the country's most industrialised state where fuel stocks at most power plants had plunged to critically low levels last month. Stocks had dropped as supply from Coal India fell sharply, forcing Chief Minister Devendra Fadnavis and the Union Power Minister Piyush Goyal to intervene. Goyal assured state-run power utility Mahagenco that a coal mine will be allocated to the company to cater to its 1,000 MW of new power capacity coming up in January 2015. (economictimes.indiatimes.com)

Alstom T&D bags ` 560 mn order to supply energy management system to Sri Lankan grid

November 27, 2014. Alstom T&D India has bagged an order worth ` 56 crore contract to introduce the first energy management system to Sri Lanka's national grid and to monitor and control its electricity transmission network. Alstom T&D, a leading player in power transmission business, will supply its energy management system, e-terra platform, to Ceylon Electricity Board for operating its hydro-thermal electricity system, the company said. Under the project, Alstom will build in Colombo a control centre, the National System Control Centre, equipped with supervisory control, data acquisition and energy management system. It will install and integrate 34 remote terminal units (RTU) with the new system and integrate existing substation automation. Equipment will be manufactured from the firm's facilities in Noida near Delhi. RTUs are intelligent devices that collect data from remote locations to enhance network visibility for grid operators. Alstom's e-terra platform software solution analyses the collected data to help grid operators monitor and operate the network on a real-time basis, and make decisions in real-time to ensure security of the national grid. Sri Lanka has an installed generation capacity of 2,214 MW. Its peak demand is 2,014 MW. (economictimes.indiatimes.com)

APTEL upholds Tata Power's distribution licence in Mumbai

November 27, 2014. Electricity consumers, especially from South Mumbai, will now be able to choose their power supplier after the Appellate Tribunal for Electricity (APTEL) dismissed BrihanMumbai Electric Supply and Transport (BEST's) appeal challenging Maharashtra Electricity Regulatory Commission (MERC's) licence to Tata Power. The consumers, currently served by BrihanMumbai Electric Supply and Transport's (BEST), can also expect a competitive power tariff. MERC had granted a distribution licence to Tata Power up to August 2039. Tata Power was entitled to supply power in BEST areas too, between Colaba/Cuffe Parade and Sion/Mahim areas of Mumbai. APTEL said Tata Power had met the conditions for credit worthiness and capital adequacy for the entire area of supply. The issue of Tata Power supplying electricity to areas currently served by BEST will be considered separately in BEST's appeal pending before it. BEST, which is an undertaking of the BrihanMumbai Municipal Corporation engaged in power supply and transport, in its appeal filed against MERC and Tata Power had argued that MERC should not have granted Tata Power the distribution licence as its previous performance was inadequate. Besides, BEST said MERC had erred in holding that network roll out can be prescribed as a subsequent specific condition and argued that the same has to be approved before the grant of licence. (www.business-standard.com)

Delhi discoms lose crores to meet winter power shortfall

November 27, 2014. Discoms in Delhi spent around ` 750 crore to purchase additional power to meet the peak winter season demand last year. They fear, this year too, they would have to buy power from the spot market to make up for the shortfall. The three discoms in the national capital are Tata Power Delhi Distribution Company (TPDDL), Anil Ambani-promoted BSES Yamuna Power Limited (BYPL) and BSES Rajdhani Power Limited (BRPL). To meet the round-the-clock demand, the discoms need more than the contractual supply. The discoms lose between ` 0.7-1.50 on every unit of surplus power sold, depending on the season. According to the report of discoms, in the last winter, they incurred a loss of around ` 750 crore on the sale of surplus power. The discoms are already facing cash crunch and awaiting tariff hike to pass on the increasing cost of procuring power. The recent tariff hike by the Delhi Electricity Regulatory Commission was rolled back in just 18 hours of issuing it, citing lack of technical details. (www.business-standard.com)

Fuji Electric to study smart energy grid for AP

November 27, 2014. Japan's Fuji Electric will conduct a feasibility study on a smart energy grid for Andhra Pradesh (AP) to monitor the energy consumption and forecast the demand, an exercise aimed at developing a more efficient energy management system in the state. The company, which has already committed to a similar feasibility study for a smart grid project in Panipat in Haryana, agreed to the project following Andhra Pradesh Chief Minister N Chandrababu Naidu's request during his ongoing tour of Japan. The CM said that the company, while responding to Naidu's request when he visited Smart Grid Community at Kitakyushu City, has agreed to send its representatives to Andhra Pradesh in a month or two. Though Andhra Pradesh has an energy monitoring system, it does not have forecasting mechanisms in place, said Naidu. (economictimes.indiatimes.com)

World's 2nd tallest power transmission towers in West Bengal

November 26, 2014. The world's second tallest power transmission towers, built by Haldia Energy Ltd (HEL), has come up in West Bengal. The 236-metre-long twin towers, located at HEL's 600 MW capacity plant at Haldia and Raichak across the river Hooghly, are the tallest in the country. Covering a span of 1.5 km, the twin towers weigh 1,800 tonnes. The world's highest transmission tower (370 metres) is located at Mount Damaoshan in China. HEL is a wholly-owned subsidiary of CESC Ltd run by Goenka and the power generated in Haldia would be used to supply electricity in the power company's licensed areas in Kolkata. Generation of power would begin from next month in the plant. The tallest power transmission towers in India till date were located at Rihand lake in Uttar Pradesh with a height of 185 metres. The company said the towers are designed by Elias Ghannoum, an international expert on designing transmission lines. The 400 KV twin circuit twin moose transmission line is specially designed to withstand wind force on the conductors as well, as these are in a high wind zone. (economictimes.indiatimes.com)

Relief for Tata Power, Adani Power as fuel costs decline by 10 per cent from a year ago

November 26, 2014. A drop in global coal prices has brought relief to Indian power producers that bank on fuel imports and increased the possibility of a respite from higher tariffs for their electricity consumers. Fuel costs have declined by well over 10% from a year ago for Tata Power and Adani Power, the country's largest consumers of imported coal. With prices of imported coal likely to come down further, intensity of disputes between utilities and customers over tariffs may reduce. Tata Power's fuel costs have come down to ` 1.84 per unit this year from ` 2.20 in the previous financial year, while for Adani Power, it has dropped to ` 1.93 per unit from ` 2.19. (economictimes.indiatimes.com)

Policy / Performance………….

Centre to collect ` 100 bn as additional coal levy: Power Minister

December 2, 2014. The government will collect ` 10,494.36 crore as levy from the allottees of cancelled coal blocks for fuel extracted up to March 2015, coal and power minister Piyush Goyal said. The central government's coffers will swell with over ` 10,000 crore on account of the additional levy of ` 295 per metric tonne imposed by the Supreme Court, which cancelled allotments of 204 coal blocks after terming them arbitrary and illegal. In case of 42 coal blocks, 37 of which are producing and five are likely to commence operations, the cancellation will take effect from March 31, the minister said. The 37 operating blocks provisionally produced 325.507 million tonnes cumulatively up to October, the minister said. The total production till October will fetch the exchequer ` 9,602.46 crore. (economictimes.indiatimes.com)

Efforts on to link coal mines with nearest power plants: Govt

December 2, 2014. Efforts are under way to rationalise coal linkages with power plants to save an estimated ` 6,000 crore a year to save on transportation of the fuel, the government said. Exercises are progressing to ensure that coal is supplied to the nearest power plant from the mines' pit-head to save on transportation, Coal Secretary Anil Swarup said. He said this will result in huge indirect benefits like availability of railway rakes. Finance Minister Arun Jaitley had said that an exercise to rationalise coal linkages, which will optimise transport of coal and reduce cost of power, was under way. The government had constituted an inter-ministerial task force to review the existing sources and consider feasibility for rationalisation of linkages with a view to reduce the transportation cost for power utilities, cement, steel and sponge iron sector. (economictimes.indiatimes.com)

Cabinet approves Bill on mines auction to replace coal ordinance

December 2, 2014. The Government cleared a Bill on coal block auctions to replace an ordinance that was promulgated to begin auction of coal mines cancelled by the Supreme Court. The Bill to replace the Coal Mines (Special Provisions) Ordinance, 2014 is likely to be brought before Parliament during the winter session. The Supreme Court had in September cancelled allocation of 204 coal blocks, including 42 operational mines and another 32 ready-to-start blocks. Through the ordinance, the Centre started the process of auctioning at least 74 operational or ready-to-operate blocks with the target of allocating them by March, well before the Supreme Court deadline for companies operating mines to wind up operations. The ordinance has been opposed by central trade unions, including BJP-affiliated trade union Bhartiya Mazdoor Sangh (BMS). BMS, AITUC, CITU, HMS and INTUC have jointly opposed the government’s proposal to allow private players to mine coal and sell it in the open market, a right till now reserved with Coal India Ltd. The ordinance has also come under attack from the Left parties. Meanwhile, the Centre has said that the 74 coal mines the government plans to auction to specific end-users in the first phase of bidding on February 11, will not require any green clearances. The auction will be for the private sector, while state-owned companies will get mines via allotment. The government had announced auctioning and allotment of 74 blocks in the first phase of bidding. These blocks have a potential to produce 210 million tonnes of coal. (www.thehindubusinessline.com)

Govt will focus on gas-based power: PM Modi

December 2, 2014. Prime Minister (PM) Narendra Modi said that the government would promote gas-based generation to power India's economy. Modi announced Oil and Natural Gas Corporation (ONGC) would double its exploration budget for natural gas. Tripura chief minister Manik Sarkar said the state government was keen on setting up gas-based urea and petrochemical plants instead of using gas just for the power plant. The Palantala power plant has a capacity of 726 MW, of which Assam has an allocation of 240 MW, Tripura 196 MW, Meghalaya 79 MW, Manipur 42 MW, Nagaland 27 Mw, Arunachal Pradesh 22 MW, Mizoram 22 MW and 98 Mw is to be sold on merchant basis by ONGC Tripura Power Company (OTPC). Bangladesh is likely to get power from OTPC's share. (www.business-standard.com)

Govt mulling new policy to recover power arrears: Haryana CM

December 2, 2014. Haryana Chief Minister (CM) Manohar Lal Khattar said the state government was contemplating upon framing a new policy for recovery of pending arrears of electricity bills. Khattar who was presiding over a meeting of district officials at Jhajjar said there was no shortage of electricity in the state and government was committed to provide round-the-clock electricity to consumers. (www.hindustantimes.com)

TPC-RInfra porting row: APTEL flays MERC decision

December 1, 2014. The Appellate Tribunal for Electricity (APTEL) has criticised state electricity regulator MERC for ordering transfer of 7.92 lakh low-end consumers of RInfra to Tata Power saying it has "exceeded its jurisdiction" by issuing such directions. The Maharashtra Electricity Regulatory Commission (MERC) had ordered transfer of RInfra's 7.92 lakh low-end residential consumers with a monthly power consumption of up to 300 units to Tata Power's distribution arm from November 1 last year. The regulator said its decision was to foster competition in the distribution business and accordingly allowed Tata Power to take low-end consumers of RInfra from the 11 clusters identified by the regulator. It also said the move would protect consumer interest, specifically that of the low-end ones as Tata Power would be offering power at cheaper rates. Before issuing the order MERC had asked TPC to have its own distribution network in place in the designated 11 clusters, which TPC failed to implement. Currently, Tata Power has a consumer base of over 5.63 lakh which also include the switchover customers. Tata Power charges ` 2.38 per unit and ` 4.45 per unit for changeover customers whose intake is up to 100 units and 300 units, respectively, while RInfra on the other hand charges ` 3.92 per unit and ` 6.84 per unit, respectively. (economictimes.indiatimes.com)

PM Modi inaugurates second unit of Palatana power project