-

CENTRES

Progammes & Centres

Location

[Correcting Global Imbalances: The Role of Oil Trade]

“Given that half of US trade deficit is made up of energy imports, increase in domestic production and falling imports have shrunk and continue to shrink this deficit rapidly. On the other hand energy imports were eating into China’s surpluses. Russia’s energy exports had given it a trade surplus but as a percent of GDP its trade surplus showed a declining trend…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Correcting Global Imbalances: The Role of Oil Trade

DATA INSIGHT………………

· Foreign Direct Investment in Energy Sector in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn makes second oil find offshore Senegal

· DGH approves commerciality of discoveries in ONGC's D5 block

Downstream……………………………

· HPCL to take 8 per cent stake in Petronet's Gangaravam LNG terminal

· IOC takes mega insurance cover of ` 50 bn for its refineries

Transportation / Trade………………

· ONGC, RIL disclose tax payments abroad

· Reliance Industries, Pioneer Resources to sell off stake in US company

· GAIL says has cut gas supplies to Gujarat units on Oil Ministry order

Policy / Performance…………………

· Modi begins Myanmar wooing game

· Will policy change help boost India’s oil production?

· Govt says domestic LPG cannot be sold to non-PSU marketeers

· Oil Ministry seeks ` 81.8 bn in fuel subsidy

· New gas price of $5.61 per unit inadequate to attract investments

· Oil ministry may direct RIL-KG basin gas users to pay old rate of $4.20 per unit to producers

· Gas pooling proposal on petroleum ministry table

· ONGC disinvestment roadshows from November 17

· 'India's gas deficit to continue on unimpressive new policy'

· India can get Iran gas at $2.85 if it builds a fertiliser unit: Gadkari

· Govt plans $2.8 bn ONGC stake sale by early December

[NATIONAL: POWER]

Generation………………

· NTPC to set up power projects in Andhra Pradesh and Telangana

· NHPC prepared to wait for amicable resumption of stalled 2 GW Lower Subansiri hydro power project

· Nepal, India finalise PDA for 900 MW Arun III project

· GTA receives ` 80 mn for Sidrapong hydel power plant

Transmission / Distribution / Trade……

· Acme signs power purchase deal with Chhattisgarh discom

· Rattan India Power to bid for coal blocks to revive units

· State-run discoms take lessons from private firms to trim losses

· Centre govt to rationalise coal supply to Maharashtra

· L&T bagged orders worth ` 15.7 bn in October

Policy / Performance…………………

· CIL should set up washeries near reject based power plants: IMC

· Tariff cap prices to stop power companies from passing on auction cost of coal blocks

· Coal controller to collect data for 74 auction coal blocks

· CIL to mine 1k mn tonnes coal by 2019

· PSPCL's plea on coal import not admitted by power regulator

· CIL signs 161 fuel supply pacts with power plants

· Tata, Adani Power may have to wait longer for tariff hike

· Coal ministry to consider Odisha's plea to allot blocks to PSUs

· Coal India board ratifies ` 110 bn thermal power foray

· Private sector to play important role in coal production: Goyal

· Govt cautious on West-discarded nuclear technology: Goyal

· Power reforms on cards in Haryana

· Industries want deferment of power tariff hike till April

· Russia's TPE raises fresh demand of $248 mn from NTPC

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Canadian heavy oil boosted as imperial shuts Kearl operation

· UAE's Mubadala Petroleum says 2nd Thai oilfield starts production

· Kashagan oil field seen by total producing 2017 at latest

· Libya plans to resume output at biggest oil field

· Norway's gas output cut by 9.3 mcm per day due to Gjoea field outage

· Egypt awards BP two new exploration blocks

· China oil producers face cuts after period of ‘runaway’ spending

· OVL eyes stake in Tullow Oil's Africa assets

· Saudi flexing met with crickets by US shale frackers

Downstream……………………

· Venezuela's 310k bpd Cardon refinery hit by Electrical Fault

· Iran plans to develop oil refineries in Indonesia

· More refinery closures likely after third UK plant shuts

· Thai PTT works on funding for $22 bn Vietnam refinery, Petchem complex

· Saudi Arabia develops oil refineries to boost downstream market

Transportation / Trade…………

· Sinopec Canada unit fined $132,000 for pipeline spill

· Veresen talking to Japanese buyers for Jordan Cove LNG

· First Shah Deniz II gas to reach Europe in 2020: BP

· Caspian Pipeline plans to boost oil exports by 20 per cent in November

· California oil-by-rail drops as Canada faces competition

· BHP seen shipping first US condensate without ruling

· Oil import decline to US revealed by Louisiana as truth

· Swiss prosecutors contact oil traders in Nigeria fuel scam probe

· Saudi oil market fight shifting to US as Asia prices climb

· TransCanada says Keystone XL costs increase to $8 bn

Policy / Performance………………

· Namibia expects explorers to drill up to 5 oil wells in 2016

· Nigeria won’t cut spending yet with oil above budget peg

· Hungary urges EU to ensure route for Azeri gas to central Europe

· Putin plan for second China gas pipe will depend on price

· Norway oil lobby cuts spending forecasts on costs, crude slump

· EmiratesLNG import terminal tender result due by early 2015

· Russia, China add to $400 bn gas deal with accord

· Romania does not have shale gas: PM Ponta

· Kuwait Oil Minister sees no OPEC output cut

· Japan rethinks LNG approach

· Oil price a concern says Venezuela as Al-Naimi visits

· OPEC oil basket price falls below $80 to least in 4 yrs

· White House monitoring oil drop as no action seen on reserves

· US gasoline prices move with Brent prices rather than WTI prices

[INTERNATIONAL: POWER]

Generation…………………

· Abengoa to construct hydroelectric power plant in Peru

· RusHydro, China Three Gorges to jointly develop hydropower projects

· APR suspends Libya power generation operations

· EBRD offers $80 mn loan for construction of hydroelectric power plant in Georgia, US

Transmission / Distribution / Trade……

· Qatar to buy fuel for Gaza's sole power plant

Policy / Performance………………

· BHP coal mine meeting relocation resistance in Colombia

· Fukushima radiation found in pacific off California’s coast

· Germany eyes energy investments in Pakistan, says Merkel

· Iran to sign nuclear power plants construction deal with Russia

· Japan's Sendai nuclear plant wins regional vote to restart

· Pakistan’s Sharif seeks energy deals during China visit

· Mystery drones in France expose vulnerability of nuclear sites

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· China’s Trina Solar heeds Modi’s call, plans to ‘make in India’

· Reliance Power commissions 100 MW solar CSP project in Rajasthan

· Punjab aims to produce 100 MW solar power

· World Bank agrees to consider Assam's agriculture project

· Navi Mumbai to house largest solar panel installation on dam

· Tripura's capital city Agartala gets green city award

· Energy supply will be the basis for future development

· Gujarat CM inaugurates world's tallest hybrid wind tower

· Gujarat govt begins probe in alleged irregularities in solar park land purchase

· Jakson Group investing ` 3.5 bn in UP solar power plants

· Indian Railways to power 4k locomotives with alternative fuel

· KMC plans to turn waste into energy

GLOBAL………………

· Nordex wins wind-turbine contract for power plant in Lithuania

· JinkoSolar, Wells Fargo sign $20 mn credit agreement

· G20 spends $88 bn a year on fossil-fuel exploration

· Ergon Peru awarded 15 year contract to deliver solar electricity

· UK Environment Agency likely to grant permits for shale firm Cuadrilla

· Texas utility plans $2 bn battery fix for wavering wind and solar power

· Kobelco Eco-Solutions, Idemitsu to build 6 MW biomass power plant

· Climate talks grapple with regional carbon markets: IEA

· Energy policy seen ripe for compromise in GOP Congress

[WEEK IN REVIEW]

COMMENTS………………

Correcting Global Imbalances: The Role of Oil Trade

Lydia Powell, Observer Research Foundation

Just prior to the financial crisis, reports from leading economic institutions highlighted how global imbalances are being accentuated by oil price increases. For example, the 2006 world energy outlook of the International Monetary Fund (IMF) highlighted how (1) large global imbalances including a large current account deficit in the United States was matched by surpluses in other advanced economies in emerging Asia and in fuel exporting countries and that (2) the strengthening of oil prices from 2003 driven by strengthening global demand and by concerns over future supply was partly driving this imbalance.[1]

The report observed that the result of an almost $30/barrel increase in oil prices during 2002-05 and to a lesser extent rising production, global oil exports increased. Based on a broad sample of oil exporters, the report concluded that oil exports more than doubled to $800 billion in 2005 and well above previous peak in 1980. On the other hand the import bill of China and USA, two of the largest oil importing countries, had increased to roughly 152 billion (4% of GDP) and 135 billion (1% of GDP) respectively.

Admitting that any long run oil price forecast is subject to enormous uncertainty, it went on to predict that the price shock that started in 2003 would be permanent in nature based on market expectations and an assessment of medium term market fundamentals. The report went on to recommend that consuming (oil importing) countries should pursue full pass through of world oil prices into domestic energy prices accompanied by a monetary stance that guarded against potential spillovers into core inflation.

The 2014 world economic outlook of the IMF observed that global current account imbalances in large deficit countries such as the United States and large surplus countries such as China and Japan had more than halved and that this had reduced the systematic risk to the global economy. [2] The report attributed this correction to demand compression in deficit economies or the growth differentials related to faster recovery of emerging market economies and commodity exporters but did not emphasise the changing nature of oil trade (in terms of geographic origin of stocks and flows) in correcting global imbalances.

A recent paper from the University of Paris on oil shocks and global imbalances points out that the nature of the oil shock mattered in understanding the effects of oil price shocks on global imbalances and that the main adjustment mechanism to oil shocks is based on the trade channel rather than the asset valuation channel.[3] The paper observes that supply driven oil shocks contribute more to the increase in current account imbalances than demand driven shocks and that the impacts of supply driven shocks are closely related to the degree of energy dependence. It also points out that the weak impact on current account imbalances of a demand driven oil shock could be explained by the trade channel when the rise in oil prices comes from an increase in global economic activity. The paper concludes that the trade channel (rather than the asset valuation channel or the real exchange rate) represents the main adjustment mechanism to oil shocks.

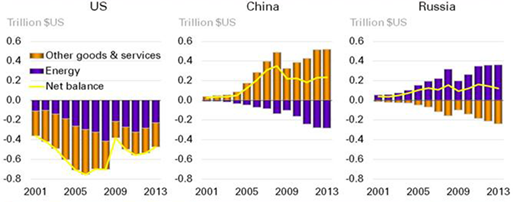

This conclusion finds some appreciation in BPs 2014 review of energy markets, though the trade channel here is actually an energy trade channel.[4] The report highlights the linkage between energy and the economy and illustrates how the remarkable shift in physical energy balances has affected global imbalances. Taking China, USA and Russia, the three largest energy consumers and producers (in that order) the report illustrates how the shift in domestic production and consumption of fossil fuels in these three countries have also changed their respective current account balances.

Trade Balances & Energy

Source: BP Statistical Review of World Energy[5]

According to the report, United States had the largest increase in oil and gas production and the largest decrease in oil and coal consumption, China had the biggest increase in coal production and the consumption of all three fossil fuels and Russia had the second biggest increment in oil production. Between 2001 and 2013, China’s deficit for oil and gas worsened by almost the same magnitude by which the US deficit improved. As a result China’s energy deficit overtook that of the United States for the first time in 2013. Russia’s surplus improved for every fossil fuel over this period allowing it to maintain its position as the world’s largest holder of an energy surplus. Given that half of US trade deficit is made up of energy imports, increase in domestic production and falling imports have shrunk and continue to shrink this deficit rapidly. On the other hand energy imports were eating into China’s surpluses. Russia’s energy exports had given it a trade surplus but as a percent of GDP its trade surplus showed a declining trend.

The take away from these developments is that we can no longer be certain over fundamental assumptions on the geographic origin of stocks (for example assuming that the Middle East will be the holder of most stocks of oil) and directions of flows of oil (from the Middle East to the rest of the World). We cannot even be certain over the direction of oil price movements or the direction of change in global economic output. Given the extent of uncertainties, caution must be exercised in advocating strong responses to importing countries.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

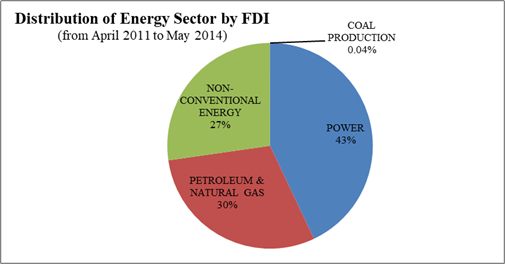

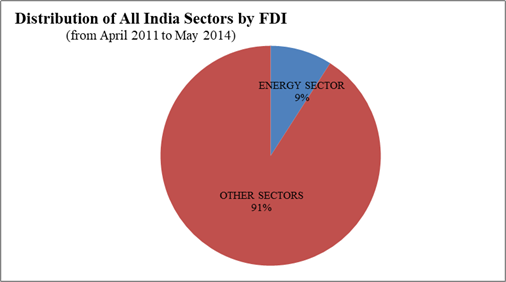

Foreign Direct Investment in Energy Sector in India

Akhilesh Sati, Observer Research Foundation

|

Sr. No. |

Sector |

FDI Equity Inflow ($ million) (from April 2011 to May 2014) |

|

1 |

POWER |

3,400.87 |

|

2 |

PETROLEUM & NATURAL GAS |

2,357.01 |

|

3 |

NON-CONVENTIONAL ENERGY |

2,154.87 |

|

4 |

COAL PRODUCTION |

2.96 |

|

5 |

Total (Energy Sector [1+2+3+4]) |

7,915.71 |

|

6 |

Grand Total (for all Sectors in India) |

87,152.46 |

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn makes second oil find offshore Senegal

November 10, 2014. Oil explorer Cairn Energy has made a second oil discovery off the coast of Senegal. The British-based energy firm, which currently has no producing assets, said it had found oil at its SNE-1 well around 100 kilometres off the coast of the west African country. The well, located near its FAN-1 well where it found oil, could hold 150-670 million barrels of recoverable resources, Cairn said. Analysts said the two successful oil discoveries could provide Cairn with an option to sell parts of its 40 percent stake to raise cash for its 2015 exploration work in northwest Europe and Morocco. Cairn is the operator and 40-percent owner of three blocks off the coast of Senegal, while other stakeholders include oil major ConocoPhillips, which owns 35 percent. The oil explorer has been unable to tap its $1 billion stake in Cairn India, a business whose backdated taxation practices are being investigated by Indian authorities. (in.reuters.com)

DGH approves commerciality of discoveries in ONGC's D5 block

November 9, 2014. Upstream oil regulator DGH has approved commerciality of the oil and gas discoveries in the northern area of ONGC's prolific KG-D5 block in Bay of Bengal. Oil and Natural Gas Corp (ONGC) has so far made 11 oil and gas discoveries in the Krishna Godavari basin block KG-DWN-98/2 or KG-D5 which sits next to Reliance Industries' KG-D6 area. The discoveries in KG-D5 are divided into northern and southern areas, with the former having a total of 10 finds and the later the ultra-deep UD-1 discovery. ONGC had divided these and a couple of finds in a neighbouring block, into three clusters. The gas discoveries D and E in the northern part of KG-D5 will be brought to production together with G-4 find in a neighbouring KG block at an investment of $1.92 billion. The remaining eight discoveries in the Northern Development Area (NDA) will be brought to production as Cluster-II.

The Directorate General of Hydrocarbons (DGH), the technical advisory arm of the Oil Ministry on upstream oil and gas exploration and production issues, has approved the Declaration of Commerciality (DoC) of Cluster-II. Over $4.07 billion is planned to be invested in bringing to production the Cluster-II finds. NDA holds a total inplace reserves of 78 billion cubic meters (bcm) of gas and another 121 million tons of oil. The Southern Development Area, compromising of UD-1 find, has a total inplace gas reserves of 80.8 bcm. Cluster-I is likely to start production in 2017 with over 8.5 million standard cubic meters per day (mmscmd) of output, which will peak to 14.5 mmscmd in two years thereafter begin to slide. This cluster will remain in production for 15 years. From Cluster-II, ONGC will produce over 90,000 barrels per day of oil (4.5 million tons a year) from 2019. This set of discoveries would also give a gas output of 11.09 mmscmd in the first year and touching a peak of 18 mmscmd in the second year. (economictimes.indiatimes.com)

Downstream………….

HPCL to take 8 per cent stake in Petronet's Gangaravam LNG terminal

November 11, 2014. Hindustan Petroleum Corp Ltd (HPCL) may pick up 8 per cent stake in Petronet LNG Ltd's ` 5,000 crore liquefied natural gas (LNG) terminal at Gangavaram in Andhra Pradesh. The Viskhapatnam refinery of HPCL, which is only a few kilometers away from Gangaravam port, is being expanded to 15 million tonnes per annum from current 8.33 million tonnes and the expanded unit will have a gas requirement of close to 2.5-3 million standard cubic meters per day. Andhra Pradesh government too has evinced interest and is likely to get 5 per cent stake, leaving Petronet with 69 per cent shareholding. Years ago, HPCL had missed the LNG bus when it got left out of the PSU consortium that formed Petronet. Indian Oil, ONGC, GAIL and Bharat Petroleum each have 12.5 per cent stake in Petronet. GAIL India Ltd has evinced interest in booking half of the 5 million tonnes a year import capacity of the proposed terminal. The Gangavaram project received all approvals of the state government only last month, a good one-and-half-year behind schedule, and Petronet is now looking to build an import facility by 2018. This will be Petroent's first import facility on the east coast. It already has a 10 million tonnes a year terminal at Dahej in Gujarat and a 5 million tonnes unit at Kochi in Kerala. Petronet is expanding Dahej to 15 million tonnes by end of 2016 and plans to add another 2.5 million tonnes capacity at a cost of about ` 1,100 crore. (economictimes.indiatimes.com)

IOC takes mega insurance cover of ` 50 bn for its refineries

November 5, 2014. Indian Oil Corp (IOC) has taken a mega insurance cover of ` 5,000 crore for each of its 10 refineries, potentially setting a new benchmark for other domestic oil refinery companies. In a deal signed recently, insurers led by United Insurance have agreed to cover damages up to ` 5,000 crore per refinery if the company faces business interruption for more than 60 days. Business interruption insurance covers loss of income that the company suffers after shutting plants or facilities due to a disaster. One of few Indian companies listed in Fortune 500, IOC operates refineries spread across the country with combined refining capacity of 65.7 mmtpa (million metric tonnes per annum). According to insurance industry, IOC renewed its cover with insurance companies led by United Insurance that will cover damage resulting from fire or any natural calamity, loss of profit occurring due to business interruption and any other damage to its property, plant and machinery. However, loss limit - the initial loss incurred due to the damage to the property and which is borne by the company - is pegged at ` 5 crore. The co-insurers include New India Assurance, National Insurance and Oriental Insurance. (economictimes.indiatimes.com)

Transportation / Trade…………

ONGC, RIL disclose tax payments abroad

November 6, 2014. Oil and Natural Gas Corporation Ltd (ONGC) and Reliance Industries Ltd (RIL) are the only two Indian companies that disclose tax payments in almost all the foreign countries where they operate, according to a report by Transparency International India (TII). According to a report, the world's biggest companies disclose little or no financial details about their operations outside their home country. Ninety of the 124 companies assessed do not disclose the taxes they pay in foreign countries, while 54 disclose no information on their revenues in other countries, it said. Only BHP Billiton, Statoil and Indian firms ONGC and Reliance Industries disclose tax payments in almost all the foreign countries where they operate, the report said. ONGC and RIL have performed well. ONGC is the first PSU to adopt IP by entering into MoU with TII. RIL is ranked at ninth position, while ONGC is at 26th place among the 124 companies list. RIL has scored 5.6 out of ten, while ONGC has scored 4.8, as per the report. The report, Transparency in Corporate Reporting, analysed 124 companies from the Forbes list of the world's biggest publicly-traded companies. The companies, whose combined market value is more than USD 14 trillion, are ranked on the basis of their reporting of the measures they take to prevent corruption, information about subsidiaries and holdings and key financial information about overseas operations. (economictimes.indiatimes.com)

Reliance Industries, Pioneer Resources to sell off stake in US company

November 6, 2014. Reliance Industries, along with its partner Pioneer Natural Resources Co, plan to divest their joint venture (JV) company Eagle Ford Shale Midstream Business. US-based Pioneer Natural Resources, which holds 50.1% in the JV and is operator of the project, said that the divestment is part of its strategy to focus more on its shale gas explorations business. Reliance group, which holds 49.9% in the JV through arm Reliance Holding USA, is also pursuing sale of its stake. The Midstream business of Eagle Ford owns and runs 10 gathering plants and around 460 miles of pipelines. The JV, which was formed in 2010, is likely to generate $100 million in cash flow in 2015. Besides, its stake in Eagle Ford, RIL owns stakes in two more shale ventures in the US. RIL owns 40% in Chevron's Marcellus shale asset and 60% in and asset of the Carrizo Oil and Gas Inc in Central and Northeast Pennsylvania. (economictimes.indiatimes.com)

GAIL says has cut gas supplies to Gujarat units on Oil Ministry order

November 5, 2014. GAIL India Ltd said it slashed gas supplies to small industries in Gujarat on Oil Ministry orders. Small industries in South Gujarat, which were forced to shut few lines in their plants following GAIL cutting supplies of administered price mechanism (APM) gas, have accused the state-owned firm of arbitrariness and selective targeting as supplies to similar units in other states have not been touched. The company, however, did not respond to claims that small industries were included in priority sector along with power and fertilizer and no subsequent order has changed that. Also, the ministry guidelines do not define non-priority industries. The company said emphasis is being given to protect the interest of small customers (those presently having allocation of domestic gas up to 50,000 standard cubic meters per day). GAIL said the changes had also impacted gas supplies to its own petrochemical plant, which is undergoing a cut of up to 88 per cent. GAIL said based on the Ministry directive, supplies of APM gas to non-priority sector customers have been curtailed by 3-4 million standard cubic meters per day (mmscmd). For South Gujarat customers, this is to the tune of 0.3-0.4 mmscmd. (economictimes.indiatimes.com)

Policy / Performance………

Modi begins Myanmar wooing game

November 11, 2014. Prime Minister Narendra Modi thrust India into an increasingly high-stakes game of wooing Myanmar's generals, dangling before the strategically critical nation a bouquet of economic promises at a time it is trying to wean itself away from its overarching dependence on China.

India has over the past decade been worrying about Myanmar's growing proximity to China, the largest investor in the country and its heftiest trading partner. The southern and western regions of Myanmar are rich in oil and natural gas, and China has built a pipeline that funnels these resources from fields in regions where locals often don't have electricity of their own. (www.telegraphindia.com)

Will policy change help boost India’s oil production?

November 10, 2014. Is auctioning of energy resources the best way to increase production? The experience of India’s hydrocarbon sector would certainly prove to the contrary. After 15 years and 9 rounds of auctions under the New Exploration and Licensing Policy (NELP), the country has managed to award 260 hydrocarbon blocks to the private sector. However, only three of the discoveries have actually started commercial production. This is the reason why India imports 75 per cent of its fuel requirements accounting for one third of India’s import bill at $168 billion (` 102,480 lakh crore) in 2013-14. Out of the three blocks under production, one is under arbitration where the contractor is accused of misrepresenting the investment figures with the government levying a penalty of over $2 billion on the contractor for not producing the projected quantity of gas.

The newly elected NDA government, like in other sectors, has decided to overhaul the hydrocarbon policy in the country, even though the recommendations were prepared by a committee appointed during the Congress-led UPA government. The government has prepared a draft Model Revenue Sharing Contract (MRSC), which seeks to fill up the loopholes of the previous hydrocarbon policy and create a more conducive and competitive environment to attract foreign companies to invest money in India’s hydrocarbon basins.

The government has prepared an uniform policy for the hydrocarbon sector this time. The NELP policy was only for the Oil and gas. Other hydrocarbon resources like CBM and shale gas were governed by separate policies. Merger of all policies into one was being demanded by the industry for many years. The new policy proposes a model that does not allow cost recovery of investments. Rather the company will have to indicate the quantity of oil and gas it will share with the government at different stages of production as well as at different rates. Under the newly proposed model, the government’s share of revenue will be determined through production price matrix. (www.businessworld.in)

Govt says domestic LPG cannot be sold to non-PSU marketeers

November 10, 2014. In a setback to non-state LPG marketeers, the government's top law officer has ruled that all domestically produced cooking gas (LPG) should necessarily be sold to PSUs for subsidised sale to consumers. Ranjit Kumar, Solicitor General of India (SGI), the nation's second highest law offer, has upheld oil ministry view that sale of LPG by domestic producers to anyone other than state-owned oil marketing companies (OMCs) is not permissible under LPG Control Order. He said non-state LPG sellers, called parallel marketeers, cannot source the fuel from domestic refiners. They have to import LPG if they intend to sell the cooking fuel in domestic market.

Kumar in his opinion upheld ministry's view that parallel marketeer's distribution/sale in the domestic market could only be of imported LPG subject to conditions prescribed in the LPG Control Order. While India is surplus in refining capacity, it does not produce enough LPG to meet all of its demand. LPG is produced by both public sector firms like Indian Oil Corp (IOC) as well as private firms like Reliance Industries. This LPG is sold to consumer mostly through distributors appointed by government at subsidised rates. Reliance Industries, the largest single location LPG producer in the country, had last year contested the ministry view saying rules do not mandate that all domestic LPG must be sold only to state firms. It had allegedly sold the cooking gas produced at its Jamangar, Hazira and Patalganga plants to retail customers.

The SGI on ministry's query on what action should be initiated against those LPG producer who had sold LPG in parallel market, said the action should be in accordance with the law. The SGI said the LPG Control Order of 2000 defines parallel marketeer as someone who is carrying on business of importing, storing, transporting, marketing and distributing of LPG. It does not prohibit the parallel marketeer from producing LPG but it cannot sell such production directly to consumers. The LPG Order nowhere permits the domestically produced LPG to be sold by a parallel marketeer, who is a person other than a government oil company, and that such parallel marketeer could only distribute/sell imported LPG. (economictimes.indiatimes.com)

Oil Ministry seeks ` 81.8 bn in fuel subsidy

November 10, 2014. The Oil Ministry has sought over ` 8,183 crore cash subsidy to make good one-third of the losses that retailers like Indian Oil Corp (IOC) incurred on selling diesel and cooking fuel below cost in the September quarter. IOC, Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) had reported a revenue loss of about ` 24,563 crore in the July-September quarter. Of this, upstream oil and gas producers -- ONGC, Oil India Ltd and GAIL India Ltd will make good ` 16,379.55 crore and the rest ` 8,183.33 crore is being sought from the government as cash subsidy, the ministry said.

Fuel retailers sold diesel, domestic LPG and kerosene at government-controlled rates which are below market price in Q2. The loss they thus incur is made good through cash subsidy from the government and dole from upstream firms like ONGC. Of the upstream compensation, Oil and Natural Gas Corp (ONGC) will provide ` 13,641.25 crore, OIL ` 2,238.30 and gas utility GAIL ` 500 crore. GAIL has already declared its second quarter earnings without accounting for the subsidy payout and will now have to make adjustments. IOC will get ` 9,097.81 crore from upstream firms, HPCL ` 3,750.95 crore and BPCL ` 3,530.79 crore.

During the April-June period, the three fuel retailers cumulatively lost ` 28,690.74 crore on diesel, domestic LPG and kerosene. Of this, the upstream firms met ` 15,546.65 crore or 54 per cent of the under-recovery or revenue loss. The government gave cash subsidy of ` 11,000 crore. Of the upstream share, ONGC chipped in ` 13,200.10 crore, OIL ` 1,846.55 crore while the share of GAIL was ` 500 crore. Diesel price has since been regulated and the government will from the third quarter not provide any subsidy on the fuel. Only domestic LPG and kerosene remain to be subsidised. Petrol prices were deregulated in June 2010. (economictimes.indiatimes.com)

New gas price of $5.61 per unit inadequate to attract investments

November 7, 2014. The new gas price of $5.61 per unit will not be adequate to attract investment in exploration as most discoveries in deep-sea need a higher rate to be economically viable, top research organisations have said. While deepwater producers want to produce and sell -- albeit at gas price upwards of $8 -- industrial consumers are willing to pay for these productions, but due to the limit imposed by the current pricing formula, they will have to buy costly imported LNG. Stating that the 33 per cent increase in gas price from November 1 was negative for new upstream investment, Nomura said the key reason and need behind revising the gas price was to encourage upstream investment by monetising existing discoveries and further encouraging exploration for more gas.

Deutsche Bank said the lack of clarity on gas price for new deepwater discoveries -- which will be higher -- could delay capex and production. Credit Suisse said $5.6 may work for Reliance Industries' R-Series gas field in the KG-D6 block but the economics for its satellite fields and NEC-25 block are uncertain. Nomura said there is no clarity yet on the likely premium for new discoveries in deep-sea and ultra deep waters and so the pace of further exploration will also remain slow. India's gas deficit is unlikely to improve over the next 5-6 years, implying that reliance on imported LNG is unlikely to abate, CIMB said. HSBC said while the hike imposes a higher price on the end consumer, it is unlikely to result in investment beyond what the upstream industry would have invested anyway at the old gas price of $4.2 per million British thermal unit (mmBtu). (economictimes.indiatimes.com)

Oil ministry may direct RIL-KG basin gas users to pay old rate of $4.20 per unit to producers

November 7, 2014. The oil ministry may direct users of gas produced from the Reliance Industries Ltd (RIL)-operated KG-D6 block to pay the old rate of $4.20 per unit to the producer and deposit $1.41 per unit in a gas pool account operated by Gail India from this month.

The Cabinet approved a policy under which the domestic gas price went up from $4.20 per unit to $5.61 from November 1. It also said RIL will get the old rate of $4.20 per unit from its producing D6 fields pending the final outcome of arbitration and legal proceedings, while consumers will pay $5.61 per unit. As the Cabinet has not specified who would collect the difference, the thinking in the oil ministry is that customers should continue to pay the old price to RIL and deposit the balance $1.41 per unit directly in the GAIL-operated gas pool account. (economictimes.indiatimes.com)

Gas pooling proposal on petroleum ministry table

November 7, 2014. The power ministry has worked out a plan to pool the existing limited supply of domestic gas with imported regasified liquefied petroleum gas to help operationalise stranded gas-based power plants with a cumulative capacity of 16,107 MW. The proposal has been forwarded to the petroleum ministry. If implemented, the move will lead to an additional generation of 39,000 million units of power valued at ` 25,000 crore annually.

The Union Cabinet could take up the matter soon for discussion. India has 21,211 MW of gas-based power capacity commissioned. An additional 5,900 MW is likely to be commissioned soon. Of this, 16,107 MW is stranded including 6,997 MW based on KG-D6 allocation and 3,761 MW commissioned without gas allocation. According to the proposal, GAIL India will be the pool operator and will supply the fuel to power stations at an average pooled price of domestic and imported gas. According to the plan, states might have to waive value-added tax (VAT) on incremental gas, gas transporters such as GAIL and Reliance Gas Transportation will be asked to cut pipeline tariff by up to 20 per cent, GAIL would have to cut marketing margin by half. The government had announced raising the price of gas from domestic fields by 33 per cent to $5.6 a unit from November 1. (www.business-standard.com)

ONGC disinvestment roadshows from November 17

November 6, 2014. The government will begin roadshows to attract investors to the planned 5 per cent stake sale in Oil and Natural Gas Corp (ONGC) from November 17. Roadshows will be held in Singapore, Hong Kong, London, New York and Boston. The government has not yet firmed up a timeline for the stake sale that at current rate will fetch it over ` 17,200 crore. Citigroup, HSBC Securities, UBS Securities, ICICI Securities and Kotak Mahindra Capital are managing the sale. Government, which holds 68.94 per cent stake in ONGC, is selling 42.77 crore or 5 per cent of its holding. The roadshows will end by last week of November and the stake sale can happen immediately after that or in the first half of December. The government is keen to appoint three new independent directors on the board of ONGC before the roadshows. (economictimes.indiatimes.com)

'India's gas deficit to continue on unimpressive new policy'

November 6, 2014. India's natural gas deficit and its reliance on imports will continue as the just announced gas pricing policy with its low rates and lack of roadmap to free pricing may not revitalise near stagnant exploration and production, a research report said. Existing gas discoveries in deep-sea areas of Bay of Bengal are not viable at the new gas price of $ 5.61 per million British thermal unit, which is just 33 per cent higher than old rate of $ 4.2, it said. Besides raising price of gas from existing fields, the government had also announced that a yet-to-be- determined premium will be paid for new discoveries in deepwater and difficult projects. (economictimes.indiatimes.com)

India can get Iran gas at $2.85 if it builds a fertiliser unit: Gadkari

November 6, 2014. Iran has promised that it will supply natural gas at $2.85 per unit if India builds a fertiliser plant in the Gulf country, Road Transport & Highways, Shipping and Rural Development Minister Nitin Gadkari said. India, which plans to develop Iran's Chabahar Port, could build a fertiliser plant there and import urea, which will be 50% cheaper than its domestic output, Gadkari said.

The Cabinet had cleared a proposal to form a joint venture company that would develop the Chahbahar port. The decision was taken after the West softened economic sanctions against Iran. Gadkari said India plans to develop the port in about 18 months, which would be used to import crude oil and urea. The port, which is located in the southeast Iran, is strategic as it would help India to bypass Pakistan while transporting goods from the Gulf country through Afghanistan. The two countries will sign an agreement for development of the port soon. India may get lease of two berths at Chabahar for 10 years. The proposed joint venture would develop a container and multi-purpose cargo terminal. Iran's Chahbahar port is located in the Sistan-Baluchistan province on its south-eastern coast. It lies outside the Persian Gulf and is easily accessed from India's west coast.

India paid Iran $500 million to clear a part of its past dues for crude oil it buys from the Persian Gulf nation. The payment made was in addition to $400 million India paid. Mangalore Refinery and Petrochemicals Ltd (MRPL) paid about $217 million and almost an equal amount was paid by private sector Essar Oil. The remaining amount was mostly paid by Indian Oil Corp (IOC). The $900 million payment in two weeks is on top of $1.65 billion the refiners had paid in June/July. Cumulatively, refiners owe about USD 6 billion to Iran. MRPL had paid about $183 million, Essar Oil $172 million, IOC $ 41 million and Hindustan Petroleum Corp Ltd (HPCL) $4 million. The United States and five other world powers had in July granted Iran access to $2.8 billion of its funds held in foreign banks. This was in addition to $4.2 billion Iran had received between January and July. Of the $2.8 billion, $900 million was to come from India. (economictimes.indiatimes.com)

Govt plans $2.8 bn ONGC stake sale by early December

November 5, 2014. The government plans to sell a 5 percent stake in energy explorer Oil and Natural Gas Corp (ONGC) in the last week of November or the first week of December. Prime Minister Narendra Modi's government has introduced long-awaited reforms in the oil sector, freeing diesel prices and raising natural gas prices - measures which should be positive for ONGC and other oil marketing companies. Presentations to investors on the share sale, worth about $2.8 billion at current market prices, are likely to start from Nov. 17 and will run for about a week. The share sale is part of the government's plan to raise a record $9.5 billion via asset sales in the current financial year through March 2015 to help plug its fiscal deficit. The government has appointed five banks - Citigroup, HSBC Securities, ICICI Securities, UBS Securities and Kotak Mahindra Capital - to manage the sale. In 2012, the government sold 5 percent of ONGC to raise about 140 billion rupees. It retains about 69 percent of the company. ONGC, the country's biggest oil explorer, plans to raise overseas output in two stages to 60 million tonnes of oil plus oil-equivalent gas by 2030, or 1.2 million barrels a day. After oil sector reforms, ONGC's share of subsidies is expected to fall substantially this year. (in.reuters.com)

[NATIONAL: POWER]

Generation……………

NTPC to set up power projects in Andhra Pradesh and Telangana

November 7, 2014. NTPC Ltd said it is in the process of setting up power projects with a combined capacity of 9,000 MW in Andhra Pradesh and Telangana. The company is poised to take up 4,000 MW Pudimadaka super thermal power project near Anakapalli and a 1000 MW solar power projects in Anantapur district in Andhra Pradesh, while a 4000 MW super thermal power project will be set up in Telangana. The Telangana government has identified the land required for the project and the NTPC board has recently approved the feasibility report for the project. (economictimes.indiatimes.com)

NHPC prepared to wait for amicable resumption of stalled 2 GW Lower Subansiri hydro power project

November 6, 2014. NHPC Ltd is prepared to wait and work out consensus before resumption of stalled 2000 MW Lower Subansiri hydro power project along Assam-Arunachal Pradesh border. The project is stalled since 2011 following massive protest from the anti dam groups. NHPC will spend close to ` 150 Crore for embankment building in 30 km long stretch area near the project and will pump in another ` 320 Crore in various livelihood development activities. Around 60 per cent of the work of the power project is almost completed. Union power ministry is likely to soon convene crucial stakeholders meet on stalled project. Construction at the project site started in 2005 and the project was slated to start operating 2014. (economictimes.indiatimes.com)

Nepal, India finalise PDA for 900 MW Arun III project

November 6, 2014. India and Nepal have agreed to a draft of the second Project Development Agreement (PDA) aimed to generate hydroelectric power in the Himalayan nation and the agreement may be signed during Prime Minister Narendra Modi's visit. Both the sides agreed to the 900 MW Arun III project on Arun river, at the end of a two day meeting held here between Nepal Investment Board (NIB) and Staluj Vidyut Nigam. The PDA is expected to be signed between Nepalese and Indian officials towards November end when Prime Minister Narendra Modi will arrive in Nepal to attend the 18th SAARC Summit. Under the proposed PDA, the Indian power company would provide 21.9 per cent electricity generated from the project free of cost to the Nepal government. (economictimes.indiatimes.com)

GTA receives ` 80 mn for Sidrapong hydel power plant

November 5, 2014. The Gorkhaland Territorial Administration (GTA) has received ` 8 crore from the Centre for the renovation of the Sidrapong hydel project, one of the oldest hydel projects of the country. The GTA had already received the amount and a meeting would be convened with officials concerned to draw up a blueprint to renovate the project. The hydel project, situated 12 km from Darjeeling and in the foothills of Arya tea garden, was commissioned on November 10, 1897, by the then acting lieutenant-governor of Bengal, Charles Cecil Stevens. The power station, situated at an altitude of 3,600ft, is fed by three streams, Barbata, Hospital and Kotwali. It still generates 0.6 MW of electricity a day and is currently managed by the West Bengal State Electricity Distribution Corporation Limited. However, the plant produces power erratically as turbines are old and don't function properly. Besides, the dam and the powerhouse are in run-down condition. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Acme signs power purchase deal with Chhattisgarh discom

November 11, 2014. Energy management firm Acme said it has signed a 25-year power purchase agreement with the Chhattisgarh power distribution company to supply power from its 30 MW solar plant to the state. As per the agreement, the company will provide around 50 million units power annually for a period of 25 years at a tariff of ` 6.46 per unit. Acme will be investing ` 210 crore for setting up the project, the work on which is expected to commence by June 2015 and the plant will be commissioned by December next year. The company, which has an existing portfolio of 422.5 MW with projects in the states of Gujarat, Madhya Pradesh, Rajasthan, Odisha, Chhattisgarh, Assam, Uttar Pradesh and Bihar, aims to generate 1000 MW by 2017. (economictimes.indiatimes.com)

Rattan India Power to bid for coal blocks to revive units

November 9, 2014. With the government expected to put 74 coal blocks on e-auction soon, most of them operational, Rattan India Power has decided to participate in the bidding so as to revive its nearly 2,700 MW worth of projects it had earlier shelved for want of fuel. Rattan India Power, erstwhile Indiabulls Power, had put on hold the second phase of two of its projects in Maharashtra - one each in Amravati and Nashik - since 2011 for want of coal and power purchase agreements (PPA) with distribution companies. The company is currently developing a total of 5,400 MW capacity with 2,700 MW each in Amravati and Nashik in two phases and has signed fuel supply agreement with Coal India. While the 1,350 MW Nashik plant is ready for commissioning it has not done so due to want of coal, and the 1,350 MW Amravati project is operational. (economictimes.indiatimes.com)

State-run discoms take lessons from private firms to trim losses

November 7, 2014. State-run power distribution utilities are increasingly turning to their private counterparts for advice on trimming their losses and improving supplies, with the result that Tata Power Delhi and the two BSES distribution companies run by Reliance Infrastructure in Delhi have even created separate wings to cater to this demand. Distribution arms of Tata Power, Reliance Infrastructure, Torrent and Essel group are receiving teams from state-controlled utilities to study their operations and management. According to estimates, state-run utilities have accumulated losses of ` 2 lakh crore, which explains the urgency to cut down losses, said a state utility official who has been closely interacting with private distribution companies. BSES Rajdhani and BSES Yamuna, which distribute electricity to 34 lakh consumers in Delhi, have received teams from state utilities of Haryana, Andhra Pradesh, West Bengal, Himachal Pradesh, West Bengal, J&K, Uttar Pradesh and Meghalaya in the past few months. Their consultancy departments are providing services to Uttar Haryana Bijli Vitran Nigam under a three-year agreement. (economictimes.indiatimes.com)

Centre govt to rationalise coal supply to Maharashtra

November 6, 2014. The central government has promised to "rationalise" coal supply to Maharashtra which is reeling under power shortage due to deficiency of the fuel in its thermal power plants. The state government is also planning a solar power project beside the Mumbai-Pune Expressway to tide over the shortfall in power supply. Coal shortage is stifling the state's power generation utility, which has over 70% of its installed capacity in thermal power (7,980 MW), leading to units with 630 MW capacity being shut down. (www.dnaindia.com)

L&T bagged orders worth ` 15.7 bn in October

November 5, 2014. Larsen & Toubro (L&T) said it has secured projects worth ` 1,576 crore across business segments in October. Its construction arm L&T Construction bagged contracts in its power transmission and distribution, water and renewable energy and heavy civil infrastructure businesses. In the power business, L&T secured orders valued at ` 1,164 crore from Madhyanchal Vidyut Vitaran Nigam under the R-APDRP scheme and the West Bengal State Electricity Distribution Company (WBSEDC). The scope of contract from Madhyanchal Vidyut Vitaran Nigam, which is funded by Power Finance Corporation, includes construction of 33/11kV substations, renovation and modernisation of existing substations, 11kV distribution lines, distribution transformer centres, underground cabling, installation of ring main units and electronic energy metres. (www.business-standard.com)

Policy / Performance………….

CIL should set up washeries near reject based power plants: IMC

November 11, 2014. An inter-ministerial committee (IMC) has recommended Coal India Ltd (CIL) encouraging setting up of washeries along with reject-based power plants so that rejects can be consumed in the same place, doing away with the need to transport them for long distances. The IMC to formulate policy on coal rejects allocation for washery-based power plants, which met recently, has suggested that the present washery based rejects generated by CIL could continue to be sold through e-auction. At present CIL generates about 1.3 million tonne per annum of rejects through washery. At present, CIL operates 17 coal washeries with a total capacity of 39.4 million tonnes per year. Out of these, 13 are coking coal washeries with a total capacity of 24.90 million tonnes, while four are non-coking coal washeries with a total capacity of 14.50 million tonnes. (economictimes.indiatimes.com)

Tariff cap prices to stop power companies from passing on auction cost of coal blocks

November 11, 2014. The government is likely to cap prices of power generated from auctioned coal blocks to prevent companies from inflating electricity bills and profiteering, besides allowing successful bidders to use coal from a block in different power plants of the group. While the government believes that capping prices is necessary to keep electricity tariffs in check, power companies said they should be allowed to pass on the input cost to consumers since they will be paying a huge premium for the coal blocks.

Price ceiling would promote efficient utilisation of coal while discouraging companies from bidding arbitrarily for blocks auctioned for power sector. The proposal, which will be part of the 'auction methodology' being prepared by the coal ministry, will be discussed with the power ministry at a meet to discuss auction methodology for power, cement and steel sectors and will be later sent to the Cabinet for approval. Power firms with existing or proposed end-use projects will be allowed to participate in the auction, expected to kick off before January. Of the 204 coal blocks cancelled by the Supreme Court, 59 were allocated to power plants with combined capacity of over 67,000 MW capacity. Some of these have power purchase agreements with state-run distribution companies at a price determined through tariff-based bidding while some plants have agreements that provide fuel cost pass-through. The capping proposal replaces the bidding framework prepared by the UPA under which it offered 90% discount on coal blocks to power companies to keep electricity rates low. The UPA government sought to offer blocks to power firms via a UMPP-like tariff-based bidding. (economictimes.indiatimes.com)

Coal controller to collect data for 74 auction coal blocks

November 11, 2014. The Centre has asked the coal controller's office to collect data for 74 coal blocks that are to be auctioned and hand it over to a central sector company tasked with arriving at a reserve price for each block after compiling the data. Data will include grade of coal in the reserves, investments made in setting up equipment and building infrastructure. The coal ministry has already asked private companies that were allotted blocks to provide these data to the coal controller. Of the 74 coal blocks, 32 have not started production. These blocks have stage-1 and stage-2 environmental clearances from the government. There are 37 producing blocks while five blocks are ready to produce. Meanwhile, the Centre has yet to arrive at a benchmark price for coal, based on which the reserve prices are to be determined. (economictimes.indiatimes.com)

CIL to mine 1k mn tonnes coal by 2019

November 10, 2014. Union Coal Secretary Anil Swarup said the Coal India Ltd (CIL) would mine 1,000 million tonnes of coal by 2019 -- doubling its present production of 500 million tonnes. The progress of 15 projects of Mahanadi Coalfields Ltd (MCL), including Angul-Sukinda common rail corridor, were reviewed at the meeting. The coal ministry has targeted completion of the railway line project through which coal will be transported to various industries by December 2017. Recently, the Container Corporation of India (Concor) decided to invest ` 156 crore for 26 percent equity to participate in the Angul-Sukinda railway line project.

The project, being constructed under the public-private partnership (PPP) model, will provide a rail link to the steel and power plants located in Angul, Dhenkanal and Jajpur districts. Two other rail links being developed in Jharkhand and Chhattisgarh are important for coal transportation, Swarup said. As the Odisha government has requested the Centre to provide coal blocks to state PSUs during allocation, the coal secretary said he will examine the proposal of the government. The issues of environment and forest clearances were also discussed at the meeting. Odisha Chief Secretary G.C. Pati said the state government would provide all support to MCL for exploring 200 million tonnes from its present production of 110 million tonnes. (economictimes.indiatimes.com)

PSPCL's plea on c oal import not admitted by power regulator

November 10, 2014. Punjab State Electricity Regulatory Commission (PSERC) has not admitted the petition of power utility PSPCL which had sought permission for import of 1.2 million tonne of coal, involving "additional financial liability" of ` 505 crore. In its petition, the Punjab State Power Corporation Limited (PSPCL) had sought approval regarding import of coal for its thermal power stations. PSPCL had cited short supply of coal by Panem Coal Mines Limited and Monnet Daniels Coal Washeries Limited to its thermal power units in the state. PSPCL had faced critical coal stock supplies at its three thermal power units --Lehra Mohabbat, Ropar and Bathinda which have combine power generation capacity of 2640 MW. (economictimes.indiatimes.com)

CIL signs 161 fuel supply pacts with power plants

November 10, 2014. The Coal Ministry has said that Coal India Ltd (CIL) has signed 161 fuel supply agreements (FSAs) for a capacity of 73,675 MW. The ministry said that there are 43 Letter of Assurances (LoAs) which are not covered within the 78,000 MW projects. Of this, 25 projects with a a capacity of 19,635 MW have already achieved their milestones. The coal ministry had earlier said that CIL was yet to enter into fuel supply pacts with some of the power units as issues like change in ownership and extension of coal supplies were still being examined by it. Two deadlines set for the signing of FSAs by CIL with the power producers could not be adhered to. The government had set the deadline of August 31, 2013 for signing of FSAs, which could not be met. The second deadline was set for September, last year. The company, which accounts for 80 per cent of the domestic coal production, dispatched 353.83 million tonnes (MT) of coal to the power sector in FY2014. CIL produced 462 MT in the last fiscal. It has targeted an output of 507 MT in the current fiscal. (www.business-standard.com)

Tata, Adani Power may have to wait longer for tariff hike

November 10, 2014. Tata Power and Adani Power, two of India's biggest private electricity generation companies, may have to wait longer for a decision on their proposals to increase tariffs as the head of the panel hearing their case is due to retire this month. Both companies, which operate separate plants at Mundra in Gujarat, sought higher than-contracted tariffs for electricity sold to state utilities after the price of coal imported from Indonesia increased. Although the Appellate Tribunal for Electricity (APTEL) had approved a tariff increase, the Supreme Court stayed the order and asked it to re-hear and expedite the matter, a process that's under way. APTEL has re-heard the power utilities of Punjab and Haryana and still needs to hear the rest, after which both Tata and Adani will get a chance. APTEL had passed an order allowing an increase of 52 paise per unit and 41 paise per unit to Tata Power and Adani Power, respectively. The decision was challenged by the state power utilities of Punjab, Haryana, Maharashtra and Rajasthan. (economictimes.indiatimes.com)

Coal ministry to consider Odisha's plea to allot blocks to PSUs

November 10, 2014. The Ministry of Coal has agreed to consider the Odisha government's plea to award exclusive coal blocks for its PSUs and provide assured coal linkages to independent power producers (IPPs) that have made substantial headway on their projects. The state government had raised the two demands after the Supreme Court’s order that saw 204 coal blocks being deal located. State PSUs like Odisha Mining Corporation (OMC) and Odisha Power Generation Corporation (OPGC) ended up losing their coal blocks. (www.business-standard.com)

Coal India board ratifies ` 110 bn thermal power foray

November 9, 2014. The Coal India board has ratified the first 1,600 MW (800 MW x 2) pithead thermal power project by it's subsidiary Mahanadi Coalfields at a capital expenditure of ` 11,000 crore for the foray into electricity generation by the world's biggest coal producer. The management, without any independent directors on the board, cleared the project. It also cleared five other mining projects which would generate an additional 30 million tonnes of coal. Coal India said as these projects were treated as regular business and not policy decisions. The Government is yet to appoint any of the seven independent directors out of total board strength of 14. The independent director berths have been vacant since September 11, 2014. The Mahanadi Coalfields power project, located in the Sundergarh district of Odisha, is the maiden pithead thermal power project of Coal India Ltd (CIL) and could be operational over the next three years. (economictimes.indiatimes.com)

Private sector to play important role in coal production: Goyal

November 6, 2014. Providing 24X7 power will be one of the most pressing challenges for the new government, Piyush Goyal, Minister of State for Power, Coal, New and Renewable Energy, said. Goyal said that the slogan "power for all" has seen many milestones over the years, and it's time that it finally culminates into action and performance. He said that the government is committed to provide power for all businesses and homes across the country by 2019. India has 53 million homes that do not have access to electricity, and many businesses depend on generator sets. (businesstoday.intoday.in)

Govt cautious on West-discarded nuclear technology: Goyal

November 6, 2014. As government charts out a multi- pronged growth agenda for power sector, it is cautious about not being saddled with technology discarded by West in the name of nuclear energy, Union Minister Piyush Goyal said. Goyal said that the US and many European countries have discontinued installation of nuclear plants. He said that he has yet to determine the life-cycle costs of nuclear power right through to decommissioning. The Minister predicted a "huge investment opportunity" of nearly USD 250 billion in the energy sector over the next four to five years, including USD 100 billion in renewables and USD 50 billion in transmission and distribution. (economictimes.indiatimes.com)

Power reforms on cards in Haryana

November 5, 2014. Haryana Chief Minister Manohar Lal Khattar has indicated a thrust on power sector reforms. Khattar, who also holds the portfolio of minister of power, said in the ongoing Assembly session the transmission and distribution losses of the state power utilities stood at 16 per cent and this plain theft of power restricts the power supply to the end-users. He said schemes to ensure the efficient management of power sector would be drawn. Khattar also said the Opposition and the general public would be involved in decision-making process of the government. Khattar said the present installed capacity was 5,000 MW against the demand of 4,000 MW. The total number of power plants in Haryana is 20 and on an average eight to nine plants remain functional. The state can have surplus power if the optimum utilisation of the power generation capacity is restored. The open-ended subsidies on power, giveaways such as no tariff revision in the financial year 2014-15 and subsidies to the agriculture consumers put an extra financial burden on the power utilities. The short-run power liabilities of the state till March 31, 2012, are ` 18,000 crore.

According to the Haryana Electricity Regulatory Commission, Agriculture power subsidy bill of the state amounts to ` 5,284 crore on June 1, 2014. To bridge the gap between the average revenue realised and average cost of production, the tariff should have been revised by 52 paise a unit. The revision was deferred, owing to the impending Assembly elections in the state. Haryana is an agriculture dominant state and the power availability for agriculture is indispensable for irrigation. The state is also dotted with the clusters of information technology outfits and automobile manufacturers. The rapid urbanisation of the state also adds to the demand for power every year. (www.business-standard.com)

Industries want deferment of power tariff hike till April

November 5, 2014. About 20 industrial bodies, under the banner of Tamil Nadu Electricity Consumers Association, urged the state government to defer till April next the power tariff hike, proposed by Tamil Nadu Electricity Regulatory Commission (TNERC). The bodies, which met and discussed the issue, were of the opinion that the present proposal to hike the tariff was unnecessary and unwanted, since there could be another revision again in April 2015, the association said. The last revision should have taken place in April this year, for which TANGEDCO had to send a proposal to the Commission in November 2013, but now it has been asked to send the proposal by the end of November for next revision to be taken place in April 2015, he pointed out. The cost of power in the state had been highest in the country since 2010 except in 2012. Also, transmission and distribution loss had been high in the state for the last 20 years. (economictimes.indiatimes.com)

Russia's TPE raises fresh demand of $248 mn from NTPC

November 5, 2014. The government finds itself in a bind as Russian engineering, procurement and construction company TPE continues to give state-run generation utility NTPC a run-around, raising the prospect of further delaying the 1,980 MW Barh power project in Bihar. After overshooting the completion schedule by more than three years and receiving $190 million in 2010, TPE has raised a demand for an additional $248 million for completing the remaining work. TPE has raised the demand even after Sberbank Rossii, Russia's biggest bank, extended a $328 million line of credit to help the government-run engineering firm complete its contract for supplying boilers for the Barh project. But NTPC has refused to entertain the demand since the amount demanded by TPE is "beyond" the terms of the contract. Peeved with the demand, NTPC has also drawn the government's attention towards TPE constantly shifting commissioning dates. NTPC wants to complete the job on its own after scrapping TPE's contract and encashing its bank guarantee of $174 million. According to the contract, NTPC can pay $169 million for supplies and erection and $71 million for price variation. It would then appear that TPE has the money to complete the remaining work, which would require $580 million. Of this, TPE has $328 million from Sberbank. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Canadian heavy oil boosted as imperial shuts Kearl operation

November 11, 2014. Canadian heavy oil strengthened the most in more than a month after Imperial Oil Ltd. shut operations at its Kearl oil sands project. Operations were suspended after vibrations were detected in an ore crusher unit at the site, the company said. The shutdown will last “several weeks” and customers will be supplied from inventories and through purchases of crude on the market. Imperial was producing 92,000 barrels a day at Kearl in the third quarter, the company said. Kearl, located 70 kilometers (44 miles) north of Fort McMurray in Alberta, contains about 4.6 billion barrels of recoverable bitumen, which is mined from the earth, according to the company. Imperial plans to ramp up production to 110,000 barrels a day, the company said. Production from Kearl will average 62,400 barrels a day in the fourth quarter, RBC Capital Markets said. Canadian oil sands producers are projected to raise production at an annual rate of 170,000 barrels a day through 2030, according to data by the Canadian Association of Petroleum Producers. Oil sands output will increase to 2.3 million barrels a day in 2015 from 1.9 million barrels a day last year, according to the group. (www.bloomberg.com)

UAE's Mubadala Petroleum says 2nd Thai oilfield starts production

November 11, 2014. Mubadala Petroleum, a unit of Abu Dhabi state investment fund Mubadala, said it has started production at a second oilfield in Thailand, which it operates with partners. Output is expected to reach a peak rate of around 15,000 barrels of oil per day (bopd) as the wells are completed at the Manora oil field, the company said. Mubadala Petroleum, operates the Manora oil field in the northern Gulf of Thailand in partnership with Tap Energy (Thailand) Pty Ltd and Northern Gulf Petroleum Pte Ltd. Up to 10 production wells and five injection wells are planned in the oil field where the investment is $300 million, the company said. Mubadala also operates the Jasmine oil field which has produced over 50 million barrels of oil so far. Mubadala is also in the process of developing the Nong Yao oil field with first output expected by mid-2015, by which time the company's oil production in Thailand will have more than doubled from current rates, it said. (www.rigzone.com)

Kashagan oil field seen by total producing 2017 at latest

November 10, 2014. Kazakhstan’s $48 billion Kashagan oil project in the Caspian Sea will definitely resume output by 2017 after partners replace pipelines, said Arnaud Breuillac, Total SA’s president of exploration and production. Output will start at the earliest in 2016, Breuillac said. Total, along with partners Exxon Mobil Corp, Eni SpA and Royal Dutch Shell Plc, stopped output in October last year, a month after production began, due to a natural gas leak. The cost of developing Kashagan doubled and the planned start of output was delayed by eight years to 2013 as remote islands had to be built to support drilling equipment and staff quarters. Output from Kashagan will contribute to Total’s plan to boost output to 2.8 million barrels a day in 2017 from 2.1 million on average in the first half this year, Breuillac said. Oil producers will seek to cut costs amid falling crude prices and boost production from technology that allows for a wider range of sources from shale to deep sea offshore deposits, Breuillac said. Total will focus on exploring for and producing energy from offshore fields and on liquefied natural gas projects, he said. (www.bloomberg.com)

Libya plans to resume output at biggest oil field

November 10, 2014. Libya, holder of Africa’s largest crude reserves, is resuming output at its biggest oil field even as operations at some export terminals are disrupted. The Sharara and Elephant fields in southwestern Libya will restart production after gunmen returned equipment they had stolen from the sites, National Oil Corp., said. Two other export ports, Es Sider and Mellitah, were shut because of bad weather. Es Sider, Libya’s largest port, has capacity for 340,000 barrels a day of crude, while Mellitah can handle 160,000 barrels and Hariga can ship 110,000 barrels. Libya is seeking to restore crude output after more than a year of political unrest and violence. The nation produced 850,000 barrels a day, compared with 1.6 million barrels before the 2011 ouster of former leader Muammar Qaddafi. (www.bloomberg.com)

Norway's gas output cut by 9.3 mcm per day due to Gjoea field outage

November 10, 2014. Norway's gas output was reduced by 9.3 million cubic metres (mcm) per day due to compressor problems at the offshore Gjoea gas field and it was unknown how long the outage would last, the country's gas system operator Gassco said. The outage is affecting Norwegian gas flows entering the FLAGS pipeline which delivers gas to Shell's SEGAL terminal in Britain, it said. Gas flows from Norway, Europe's second-biggest gas supplier, had already been reduced by 10.9 mcm per day due to another outage at BP's Skarv field. (www.rigzone.com)

Egypt awards BP two new exploration blocks

November 10, 2014. BP reported that it has been awarded two new exploration blocks as a result of Egypt's 2013 EGAS bid round. BP said it and its partners have committed to invest a total of $240 million in the blocks over different phases. Block 3 (North El Mataria) will represent BP's entry into the onshore Nile Delta. The block is located in the northeastern part of the Nile Delta cone, approximately 35 miles to the west of Port Said city. BP will operate the block with a 50-percent equity participation, while Abu Dhabi's Dana Gas will hold the remaining 50-percent interest. Block 8 (Karawan Offshore) is located in the Mediterranean Sea in the northeast part of Egypt's waters, some 135 miles to the northeast of Alexandria. BP will also hold a 50-percent interest here while Italy's ENI will hold the remaining 50 percent. The program for the two blocks will include 3D seismic data acquisition and three exploration wells in each block over a six-to-eight year period. (www.rigzone.com)

China oil producers face cuts after period of ‘runaway’ spending

November 7, 2014. The slump in oil prices is a boon to China as the world’s second-biggest oil consumer. It’s a different story for the country as a major producer. The slide in prices to a four-year low threatens to cut spending, production and profit for the country’s oil companies including PetroChina Co. Brent, the global benchmark, has fallen 26 percent this year to below $83 a barrel. The decline, amid signs that global supply is outpacing demand, is pressuring profits from oil extraction across the globe. After a flurry of acquisitions and spending that’s stretched the balance sheets of Chinese oil companies, the country will also have a diminished appetite for deals, according to Sanford C. Bernstein & Co. If Brent averages $80 a barrel next year, earnings at the large oil companies in China, the world’s fourth-largest oil producer, would drop as much as 54 percent from a year earlier, according to a report from Bernstein. Prices staying at that level in 2015 would lead to a 1.5 percent decline in domestic production as companies struggle to cover the cost to replace reserves, the report found. (www.bloomberg.com)

OVL eyes stake in Tullow Oil's Africa assets

November 6, 2014. ONGC Videsh Ltd (OVL), the overseas investment arm of Oil and Natural Gas Corp (ONGC), is looking to buy a stake in the assets of Africa-focused exploration company Tullow Oil Plc. India, the world's fourth biggest oil consumer, has charged state oil firms with acquiring assets overseas to improve the security of its energy supplies. The country imports about 80 percent of its crude needs. OVL aims to get 400,000 barrels per day (bpd) of crude from its overseas assets by 2018, compared with about 167,000 bpd produced from overseas holdings in the fiscal year to March 2014, ONGC said. To meet its objective the company is looking at acquisitions, preferably of producing assets, in politically less risky countries. OVL wants to acquire assets in stable geographies like North America, Canada and Mexico, and expand its presence in Africa. London-listed Tullow has a number of oil assets in Africa, including its flagship Jubilee oil field offshore Ghana. (in.reuters.com)

Saudi flexing met with crickets by US shale frackers

November 6, 2014. Saudi Arabia’s rivals in the shale fields from North Dakota to Texas aren’t flinching as the Persian Gulf kingdom wages a price war to reclaim market share and chill competition. The U.S. companies believe they have a lot more staying power than many of Saudi Arabia’s partners in the Organization of Petroleum Exporting Countries (OPEC). Several producers plan on increasing production. Executives at several large U.S. shale producers, including Chesapeake and EOG Resources Inc. (EOG), have vowed to maintain -- and even raise -- production as they reported. They say their success in bringing down costs means they can make money even if prices slump further. Shale producers cite their success in reducing costs as proof that they can still be profitable at prices below $70. In Chesapeake’s two largest production areas -- Pennsylvania’s Marcellus Shale and the Eagle Ford formation in Texas -- well costs dropped 11 percent and 13 percent, respectively, during the first seven months of this year compared with 2013, the company said. EOG can make money at $40 a barrel in the Eagle Ford. The region produces about 1.6 million barrels a day, about the same as the nation of Qatar. U.S. producers will come under more pressure to throttle back spending if crude prices continue to fall, and stay at $70 a barrel or less through 2015, Barclays Plc said in a report. Even with lower costs, companies that have relied on debt to fund drilling will face greater pressure as interest rates rise and access to funding is reduced. About half of U.S. shale resources would be “challenged” next year if prices remain at $70, according to the Barclays analysts. (www.bloomberg.com)

Downstream…………

Venezuela's 310k bpd Cardon refinery hit by Electrical Fault

November 10, 2014. Venezuela's state oil company PDVSA said its 310,000 barrel-per-day Cardon refinery was hit by an electrical fault during a weekend storm, resulting in the halting of some units. A storm on the Paraguana peninsula knocked out electricity, the company said. The nearby 645,000 barrel-per-day Amuay refinery is being restarted after a blackout had shut it down. PDVSA said it still had enough fuel inventories to cover domestic and international demand. (www.downstreamtoday.com)

Iran plans to develop oil refineries in Indonesia

November 10, 2014. Iran plans to construct a number of oil refineries and supply crude oil to Indonesia. Indonesian Energy and Mines Ministry oil and gas acting director general Naryanto Wagimin said that Iran is planning will construct the refineries with an investment of $3 bn in Indonesia's western provinces of Banten and West Java. Indonesia identified Iran's crude oil suitable for processing at Cilacap refinery in the southwestern part of Central Java Province, Wagimin said. Iran's Nakhle Barani Pardis has signed an agreement with Indonesian PT Kreasindo for the construction of oil refineries in Indonesia. The Iranian oil firm will deliver between 20,000 and 300,000 barrels per day (bpd) of crude oil over a 20-year period to the refineries. (www.energy-business-review.com)

More refinery closures likely after third UK plant shuts

November 5, 2014. A third U.K. refinery shutdown in five years will put hundreds of people out of work while making only a small dent in the estimated 2 million barrels a day of European capacity that must go by 2020. Murphy Oil Corp will close the Milford Haven refinery in Wales after a sale to Klesch Group collapsed, ending a four-year search for a buyer and resulting in “significant” redundancies, the U.S. oil company said. All but 60 of 400 positions will probably go, the BBC reported without saying where it got the information. European refiners have struggled to turn a profit as recession curbed demand for fuel, more efficient plants opened in Asia and the Middle East and a boom in U.S. shale-oil output closed a major export market. That led to more than a dozen plants shutting, the biggest wave of closures since the 1980s. The latest shutdown leaves the U.K. with six operating refineries. Milford Haven was the smallest, with a processing capacity of 135,000 barrels of oil a day. Murphy Oil, based in El Dorado, Arkansas, boosted capacity by about a quarter in 2010, three years after it paid $250 million to Total for its 70 percent stake. (www.bloomberg.com)

Thai PTT works on funding for $22 bn Vietnam refinery, Petchem complex

November 5, 2014. Thailand's top energy company, PTT Pcl, said it would finalise the funding plan for a $22 billion refinery and petrochemical complex in Vietnam in the third quarter of 2015. Vietnam's trade and industry ministry recently gave the go-ahead for the project, subject to approval from the government. PTT will join with Saudi Aramco, the world's biggest oil producer, to develop the project, which includes a 400,000 barrel-per-day refinery and an olefins and aromatic petrochemical plant making 5 million tonnes a year. PTT and Aramco will each own 40 percent of the project in Binh Dinh's Nhon Hoi economic zone, with the Vietnamese government holding the remaining 20 percent. PTT has said the oil refinery could begin construction in 2016 and start operation in 2021. (www.downstreamtoday.com)

Saudi Arabia develops oil refineries to boost downstream market