-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY/CLIMATE CHANGE: Changing Climate Narratives: Return of the Prodigal Sons

Ø POWER: Transmission needs Transparency

ANALYSIS/ISSUES

Ø A Review of Climate Change Assessments for India (part II)

From a Corner Light: Two Questions for Sustainable Growth and Climate Change Policy

DATA INSIGHT

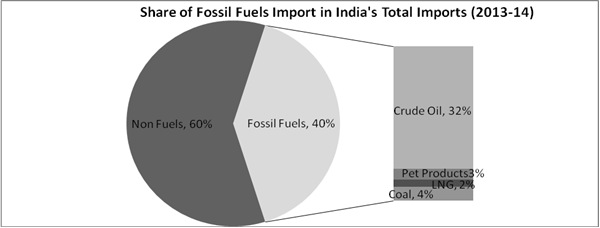

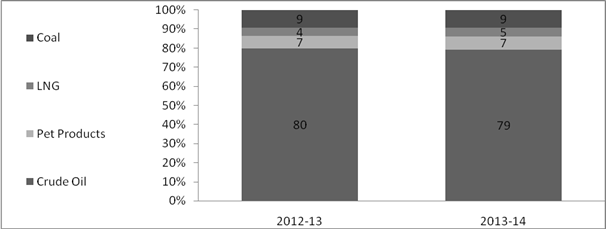

Ø Value of India’s Total Imports and Energy Imports

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· GCA to be appointed to resolve ONGC-RIL dispute

· Cairn to invest $200 mn in Rajasthan gas field

· OIL signs MoU with Russia's Gazprom

· First unit of Talwandi Sabo power plant starts production

· Power Grid okays over ` 55 bn investments in 4 yrs

· NATO commander returns to Balkans hunting for Albanian oil

· Tullow Oil says partner finds O&G in Northern Kenya

· Abu Dhabi's Mubadala Petroleum makes Malaysian gas discovery

· Exxon, BP evacuate Iraq workers as oil drilling continues

· China seen bolstering oil security as stockpiles swell to record

· Chinese bank to fund new nuclear at Romanian power plant

· FirstRand to fund Ghana power plant

· ACWA Power, Taekwang Power sign deal to develop $2 bn coal fired plant in Vietnam

· Alstom approves GE's $17 bn offer to buy its power business

· Delmarva Power plans to rebuild transmission line in US

POLICY & PRICE

· Govt asks oil companies to draw up emergency import plan in view of Iraq crisis

· Fuel prices will not increase, says Oil Minister

· RIL aims to be among global top 50 in 3 yrs

· Govt policies will be predictable, fair for oil industry: Oil Minister

· India nuke enrichment plant expansion operational in 2015 - IHS

· Goyal's 5 steps to solve sector's problems

· MP CM urges Goyal to speed up stalled hydropower project

· Karnataka govt looking at legal action against Udupi Power Corporation

· Kazakhstan Govt approves 15 yr extension to Kyzyloi gas contract

· Singapore billionaire bets big on energy in Africa, Asia

· Japan's JOGMEC says could accelerate investment in oil, gas

· Norway PM joins forces with central bank to support oil industry

· Iran to launch 14 new power plants

· Nuclear regulators ‘overwhelmed’ as China races to launch world's most powerful reactor

· Delhi govt studying Gujarat solar power generation model

· Grid-connected rooftop solar system to come up in Kolkata

· Kinetic Group forays into solar energy business

· Vikram Solar inks pact with Unidaan

· Power Ministry seeks review of anti-dumping levy on solar gear

· Gujarat to test 'green' public transport system soon

· India's carbon emission may increase as it grows: Javadekar

· NTPC's 50 MW solar power plant in MP commissioned

· UK GIB plans offshore wind fund

· France launches financing plan for energy transition

· China sets offshore wind power prices to spur development

· EU needs low-carbon energy union, ministers’ advisory panel says

WEEK IN REVIEW

ENERGY/CLIMATE CHANGE

Changing Climate Narratives: Return of the Prodigal Sons

Lydia Powell, Observer Research Foundation

|

A |

s the 2015 deadline for renewing climate wows draws near, the evangelists of climate action are actively constructing narratives of positive action. Two nations that feature prominently in this new narrative are the United States and China, the original villains in the climate action script. The United States was among the villains because it was a large carbon emitting nation that refused to bind itself to emission reduction commitments under the Kyoto protocol. China was also in the list of villains as it was yet another large carbon emitting nation that was exempt from emission liabilities by the Protocol on the basis of the principle of common but differentiated responsibilities.

In the new positive narrative, China and to a lesser extent the United States are cast as the prodigal sons who have finally returned to the family because they are signalling the possibility of committing to cap on carbon emissions and leading in investments tables for Renewable Energy. Pressure is mounting on India to repent and join the fold or take on the stigma of occupying the space vacated by China and the USA.

The change in the cast of the climate drama started with the announcement by President Obama in early June that he plans to curb emissions from US coal plants by 30% by 2030. This was followed almost immediately with news from senior Chinese leaders about China’s plans to commit to absolute reductions in carbon emissions by 2016. Cheered by these announcements, the UN climate Chief Christiana Figueres observed that these developments could send a positive signal to nations everywhere. During his visit to China, the UN Chief Ban Ki Moon hailed China’s efforts to combat climate change and requested China to offer global ‘climate’ leadership.

China and the USA are now well on their way to claim climate leadership status. It is probably just a matter of time before India concedes defeat and joins the fold. The new Indian Prime Minister’s desperation to be seen as a ‘clean’ leader may speed up the process. Does all this mean that climate doom has been averted and the world can breathe a sigh of relief? This column will not venture into answering this very difficult question. What it will do instead is what it does best: muddy the waters by raising inconvenient questions.

The moral of the story of the prodigal son is that it pays to be bad. In the story, the father celebrates the return of the reckless son who destroyed his wealth and in the process undermines the contribution of his other son, who slogged to feed the pigs that generated wealth. This is exactly what is happening in the climate story. In almost all climate action rankings, countries are rated, not on the basis of how good they are in terms of emission parameters but on the basis of the number of policies they have to address the problem of climate change. The number of policies they have invariably depends on how rich the country is which in turn depends on how bad the country/region is (was), when it comes to carbon emissions.

A ranking study by a prominent consultancy puts Indian states like Tamil Nadu, Gujarat and Maharashtra with high carbon emission levels (on account of their higher degrees of industrialisation) as states that are doing well in combating climate change on the basis of the number of policies they have and ranks states like Arunachal Pradesh which have very low levels of carbon emission (on account of low levels of industrialisation) as states that are doing poorly in terms of climate action because they do not have many policies to combat climate change. The same logic underpins global ranking of countries. Rich, high carbon emission countries that have a number of policies to combat climate change are listed among countries that are climate responsible while poor countries which hardly emit any carbon and consequently do not have policies to combat climate change are listed among irresponsible countries. If the supposedly good regions / countries can afford to be ‘good’ precisely because they were ‘bad’ in the past few decades (that made them rich), then does it mean that one has to be bad first before it can be good? This question is best left un-answered.

Let us now look at some of the good deeds of China and the USA summarised optimistically the Climate Commission of Australia. According to the report by the Commission, China and the USA are responsible for over 37% of world emissions and both are on track to meet their international commitments to tackle climate change. Towards this goal China’s carbon intensity is said to have fallen by 5% in 2012 outperforming its target by 1.5%. China is also said to have achieved a 3.6% reduction in energy intensity in 2012. The report is awe struck by China’s investment in renewable energy which the report estimates at over $65 billion in 2012 unmatched by any country and accounting for 30% of G 20 investment in renewable energy. China is also said to have imposed a 4 billion tonne cap on its coal consumption to be achieved by 2015. As for the United States, the list of good deeds is similar and includes its pledge to reduce its emissions by 17% and the 45 GW renewable energy capacity that it has invested in. The natural gas driven reduction in emissions by 7% from 2005 levels and its state level emissions trading schemes also receive praise.

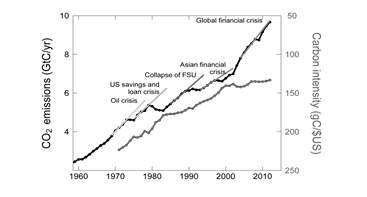

Three observations must be made at this point. First, China ramped up its industrial capacity and coal based power generation capacity so high in the last three decades that the only way it can go now is down by eliminating redundant capacity. Likewise, even in the absence of any climate policy the USA would have reduced its carbon emission levels because of the (a) shift towards natural gas (b) reduction in economic activity. This shift was driven by commercial logic and not by climate logic. Second, the carbon intensity of the world would have fallen systematically even in the absence of climate related policies. The amount of energy released from fossil fuels is dependent on the oxidation state of the carbons in the hydrocarbon which is related to the hydrogen/carbon ratio. The oxidation of hydrogen releases 120 MJ/kg of energy while Carbon only releases 30 MJ/kg. Greater the hydrogen atoms per carbon atom, the lower is the oxidation state and greater is the energy released during the oxidation reaction. In other words, greater the H/C ratio, greater is the energy release on combustion. Increased energy available from hydrogen rich fuels has been a key factor in the continuous de-carbonization of the energy system through coal (1:1), oil (2:1) and natural Gas (4:1). The only problem is that while primitive energy systems followed a net neutral carbon cycle through natural sequestration, carbon is not sequestered through the growing cycle of trees in the fossil fuel era. Third, notwithstanding the good deeds of prodigal sons, global carbon emissions have continued to increase as the chart from the carbon project shows. The factors that temporarily halted the growth of carbon emissions were related to economic crises and not climate related good deeds. If the so called good deeds do not lead to expected outcomes why do we make so much of them? Once again this question is best left unanswered. There is so much money riding on the good deed story that no one is likely to opt out until the music stops.

Source: The Carbon Project 2030 based on CDIAC data

Before India hurries to join the club of climate leaders, it may want to pause to think. The statement by the new Environment Minister that India ‘has the right to grow’ and ‘unless India tackles poverty it cannot tackle climate change’ become important in this context (see this week’s news item). The Minister has also said that ‘India is committed to reduction of carbon emissions but it may actually increase in the process of poverty alleviation and development’. Is the Minister actually saying ‘let us be bad first so that we can become good like you later on’? This may anger eco-centric climate evangelists who tend to put nature before people. People do matter and so does their quality of life. But climate action is about power politics and not about people or science. In fact science is the politics of climate change. Actions of States are determined not by moral principles and legal commitments but by considerations of interest and power. As Foucault observed forms of knowledge are connected with form of power. The danger in portraying ideal ends that are likely to be achieved through good climate deeds is that it may become the basis for new forms of power and domination. India must choose wisely rather than jumping into the bandwagon of the hegemons.

Views are those of the author

Author can be contacted at [email protected]

POWER

Transmission needs Transparency

Ashish Gupta, Observer Research Foundation

|

T |

here have been debates on coal shortage, stranded power generation capacity, reform of the coal sector, easing norms for the power sector but one very important link is missing and that is the transmission sector. There is no point in having more generation capacity when we do not have power evacuation infrastructure. Unless a due attention is given to this very important sector, we will end up with more generating capacity further burdening on the already stressed financial sector. Now a new government is in place and it is high time to understand the complexities of this crucial sector in order to reform the ‘known’ lacuna in the sector. It is very important because these issues are generally not highlighted in the media, unless there is a storm, blackout or overdrawal!

India is a place where 300 million people lack access to electricity and another 300 million have intermittent power supply which necessitates adding more transmission lines across the country. In 2012 India lost USD 68 billion (0.4 percent of the GDP) due to power shortages. Interestingly, the transmission sector is open for the private players but it is not getting enough attention from private capital. If timely measures are not taken, no new private investments will come and competent players will shy away entering this sector.

Generating Capacity vs Transmission Capacity: On an average power generating capacity increased by 51 percent compared to transmission capacity which grew at the rate of only 27 percent. Analysts cannot go on blaming coal shortages for all power crises. As per best business practice, for every dollar invested in power generation capacity, 45-50 cents (2:1) must go towards transmission capacity. Unfortunately, India does not follow this and the ratio of power generating investment vs transmission investments stands very low ie 1: 0.30. The reason lies in statutory hurdles and biased policy framework.

Private Investment in Transmission sector: The Electricity Act, 2003 provided for non-discriminatory open access in the transmission sector. The National Tariff Policy, 2006 mandated competitive bidding for transmission projects from January, 2011 which paved the way for private participation. As per the Twelfth Plan, the transmission sector requires investment of around USD 35 billion in which 19 billion will have to come from the Power Grid Corporation of India Ltd (PGCIL) and the remaining USD 16 billion will have to come from the private players. Given the prevailing situation, private participation is the need of the hour but whether they will come forward is highly doubtful!

Biased Treatment: The transmission sector is open for the private participation but when it comes to selecting a bidder, most of the projects go to PGCIL. Why is it so? PGCIL is a part of the Empowered Group which plays a crucial role in approving the projects and at the same time PGCIL also acts as bidder for the projects. So the possibility of having classified knowledge by PGCIL beforehand about the new projects cannot be ruled out. This is not the case with private players. Though PGCIL is an efficient company with good track record a built in conflict of interest situation is not in the interest of the industry. The government must be clear in their approach whether they really want private companies in the sector? Simply adopting the National Tariff Policy, 2006 mandate on paper is not going to produce any results in the wake of dual treatment for Public Service utility (PSU) and Private utility.

No level Playing Field: There is different set of rules to be followed by PSU and private companies when it comes to acquiring forest land. PGCIL has to compensate for the land in monetary terms whereas private company has to compensate the land by acquiring another chunk of land. Land issues in India are already in vogue and following irrational approach will make the things worse. A fresh look is required on this issue with written framework which can felicitate conducive environment for the private players.

Rent seeking industry for non-serious Private players: Just as captive coal blocks awarded to unqualified players, transmission sector too is rife with the same problem. In the absence of any pre-qualification criteria, many enter the sector for making quick money by selling stakes to other companies. Also these non-serious players bid aggressively on pricing which make the projects unviable at a later stage. It is a major hurdle especially for the global entities who are not convinced of the bidding mechanism. In this light, there is a genuine need to separate transmission players from the power generators and only credible infrastructure players with concrete experience in the field must be awarded the new projects.

Financial discrimination: Unfortunately financial institutions also discriminate between PGCIL and Private companies in lending money. Cost of debt for PGCIL is only 8 percent while for private players it is 12 percent. Though it can be understandable that PSU return on equity is very low compared to private utilities the difference is huge. Financial institutions can continue lending to PGCIL on the same terms but they can at least provide some cushion to private players by reducing the cost of debt to 10.5 percent or 10 percent.

Incentives for Efficient Private Players: There is no room for reward for the players if they complete the transmission projects ahead of time. On the contrary they panelised twice, once through payment of interest and second through no earnings for the period. The developer is not entitled to earn revenue from the transmission lines before the contractual date. They are left with no option but to delay the project. In such cases, efficiency must be encouraged through proper incentive mechanism.

Up gradation of old lines: There is no need to always opt for new transmission lines. India needs transmission lines but before awarding any new project it must be explored whether it can be solved through up gradation of the existing line. Transmission projects reduce the value of land and therefore up gradation are the best way to bypass Right of Way hurdle. This will not only save time and money but also provide immunity from unnecessary statutory hurdles which is a norm in India. Sometimes the solution is not a new project but the existing one!

Overburdening of PGCIL: The Company is efficiently managed and has performed exceptionally well in the transmission sector. But now the time come to reduce their burden. Adoption of Ultra Mega Project Guidelines is the way forward while selecting project developer in this regard. It does not mean that they should not be accorded priority but the point is to ask why a profitable company must be made sick units by overburdening it with new projects. PGCIL can carry on with their existing ongoing projects without compromising on the profitability but new developers must be given the chance. Needless to say, efficiency increases with competition, does it not?

Enforced Technology selection: The Standard Bidding Document for transmission line projects provides no scope for innovative technological solutions. The developer has to choose the technology/ materials as per the Bid Process Coordinator guidelines. For example the tower has to be built using mild/ tensile steel. It must be kept in mind that the developer has to maintain the project not the Bid Process Coordinator. The quality parameter inspection can be done by the Bid Process Coordinator. The question is why limit innovative approach of the developer by enforcing micro guidelines?

Force Majeure Events: As per Transmission Service Agreement (TSA) given by the Planning Commission the definition of Force Majeure Events which is applicable to State Transmission Utility is contradicts that of the Ministry of Power (MoP) TSA. As per MoP (TSA) if a company has to qualify for any Force Majeure Events, the reason given by the company must be verified by the competent court. Given our judiciary system where conclusions in the cases take so many years it introduces unnecessary delays the project. The MoP (TSA) must be streamlined to bring it in line with Planning Commission (TSA).

The concerned Ministry may take the note of the above problems and facilitate a transparent and participatory approach!

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

A Review of Climate Change Assessments for India (part II)

K K Roy Chowdhury*, Energy & Environment Expert, Delhi

Continued from Volume XI, Issue 1......

|

T |

he impact of global warming on Indian monsoon climate using PRECIS, demonstrates first that the model exhibits reasonable kill in simulating the monsoon climate over India and then examines climate projections. The model projections indicate a large warming of about 4.50C towards the end of the 21st century. The summer monsoon precipitation over India is expected to be 9–16% more in the 2080s compared to the baseline (1970s).The rainy days are also projected to be less frequent and more intense over central India.

The winds and surface pressure fields are analysed from the regional model, PRECIS, to study the change in cyclone statistics in the Bay of Bengal, that projects an increase in frequency and intensity of cyclon es during the late monsoon season in the future. However, the spatial pattern of composite tracks of cyclones does not show any appreciable change.

An assessment of impacts of climate change on major crops in the Western Ghats (WG), Coastal districts and North-Eastern (NE) states is made using the crop model, Info Crop, which shows winners and losers under climate change: yields of irrigated rice and potato in the NE region, rice in the eastern coastal regions, and coconut in WG are likely to increase, where as irrigated maize, wheat and mustard in NE and coastal regions, and rice, sorghum and maize in WG are projected to yield less, suggesting adaptation strategies such as change in variety and altered agronomy.

An assessment made of the impact of projected climate change on forest eco systems in India, using a dynamic vegetation model, shows about 45% of the forested area in India is likely to undergo vegetation-type change. Climate change is predicted to be larger in higher elevations that makes the mountainous forests particularly susceptible to the adverse effects. It is also found that forests in North-East India are least vulnerable because rainfall is projected to increase there. Planning adaptation interventions in the forest sector are expected to receive guidance from these regional impact assessments.

To quantify the possible impact of climate change on the water resources of Indian river systems using data from PRECIS, a hydrological model, SWAT (Soil and Water Assessment Tool) is used to simulate all the river basins of the country. The main goal is to identify the vulnerable hotspots in view of the climate change in various parts of the country as well as to identify the impacts on sub-components of water that are responsible for environmental functions and biomass production.

Projection from PRECIS is used to assess malaria incidence that would help health managers to cope with the threat of climate change.

Climate-change vulnerability profiles are developed at the district level for agriculture, water and forest sectors for the North-East region of India for the current and projected future climates. The results indicate that majority of the districts in North-East India are currently subject to climate-induced vulnerability, and will do so in the future. This is the first such study that comes up with a ranking of districts of North-East India on the basis of the vulnerability index values. Such ranking is useful in identifying and prioritizing the most vulnerable sectors and districts.

An interesting perspective is presented on environment and infrastructure assets. Conventionally only the impacts of projects on the environment are studied. Some crucial reverse impacts of environment on the energy, aviation, water supply and irrigation, road, communications, posts, health and housing, and railway infrastructure assets are highlighted. These risks span beyond physical risks as strict mitigation regimes could jeopardize their profitability and even future existence. Therefore, it is suggested that the key to manage risks lies in identifying them and initiating appropriate risk management and adaptation initiatives.

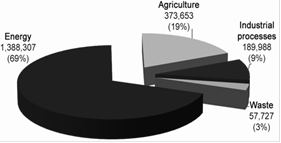

Finally, we have the report on the greenhouse gas (GHG) emission inventory of anthropogenic origin from India for the year 2007 prepared under the aegis of INCCA. In 2007, emissions from India were of the order of 2000Tg of CO2 equivalents, excluding emissions from the land use, land-use change and forestry (LULUCF) sector.

Figure 1. Greenhouse gas emissions by sectors (Gg) in 2007 without land-use, land-use change and forestry sector (CO2 equivalent). The number indicated under each sector represents the total CO2 equivalent emissions and the percentage of emission with respect to the total CO2 equivalent emissions.

Table 2. Key Source Categories of Emissions

|

Source category |

CO2 equivalent (Gg) |

Cumulative CO2 equivalent (Gg) |

Percentage of total CO2 equivalent |

|

Electricity production |

719,303 |

719,303 |

35.81 |

|

Enteric fermentation |

222,804 |

942,107 |

46.90 |

|

Residential |

130,477 |

1,072,584 |

53.40 |

|

Road transport |

123,434 |

1,196,018 |

59.54 |

|

Nonspecific industries |

88,231 |

1,284,249 |

69.94 |

|

Agricultural soils |

70,037 |

1,354,286 |

67.42 |

|

Rice cultivation |

69,789 |

1,424,075 |

70.90 |

|

Iron and steel |

69,534 |

1,493,609 |

74.36 |

|

Refinery |

67,815 |

1,561,424 |

77.73 |

|

Cement production |

67,219 |

1,628,643 |

81.08 |

|

Iron and steel production |

47,782 |

1,676,425 |

83.46 |

|

Cement |

44,778 |

1,721,203 |

85.69 |

|

Agricultural / fisheries |

33,445 |

1,754,648 |

87.35 |

|

Refinery |

32,947 |

1,787,594 |

88.99 |

|

Food and beverages |

27,718 |

1,815,313 |

90,37 |

|

Domestic wastewater |

22,982 |

1,838,295 |

91.52 |

|

Industrial wastewater |

22,050 |

1,860,345 |

92.62 |

|

Chemicals |

18,930 |

1,879,275 |

93.56 |

|

Oil and natural gas |

18,259 |

1,897,534 |

94.47 |

|

Production of halocarbons |

16,632 |

1,914,166 |

95.29 |

Table 3. Compounded annual growth rate (CAGR) of CO2 equivalent* emission between 1990-1994 and 1994-2007

|

|

1990 (Gg CO2 equivalent) |

1994 (Gg CO2 equivalent) |

CAGR (1990-1994) |

2007 (Gg CO2 equivalent) |

CAGR (1994-2007) |

|

Energy |

622,587 |

743,820 |

4.5 |

1,388,307 |

4.9 |

|

Industrial processes |

24,510 |

102,710 |

43.1 |

159,620 |

3.4 |

|

Agriculture |

325,188 |

344,485 |

1.5 |

372,653 |

0.6 |

|

LULUCF |

1,467 |

14,291 |

76.7 |

-177,028 |

-221.4 |

|

Waste |

14,133 |

23,233 |

13.2 |

57,727 |

7.3 |

|

Total emissions with LULUCF |

987,885 |

1,228,539 |

5.6 |

1,978,307 |

3.7 |

|

Total emissions without LULUCF |

986,418 |

1,214,248 |

5.3 |

1,801,279 |

3.1 |

* Does not include HFC, PFC and SF6

There has been significant progress in climate science in the past two decades, but there are still large uncertainties with respect to emission estimates, carbon sinks overland and oceans, climate projections and impact assessments.

Following are some of the areas where there is scope for improving the impact assessments:

1. The impact assessment studies have used only projections from a single GCM, namely Had CM3 and a single regional model, namely PRECIS. However, assessments of impacts of climate change should use results from multiple GCMs and regional models to assess the uncertainty and build confidence in the analysis.

2. Multiple impact assessment models and tools could be employed to provide a range of impact projections for the same climate-change information for different sectors.

3. Typical resolution of today’s regional climate models use climate projections at about 50 km. The accuracy of projections at the district level is expected to be higher at finer resolution, such as 10 km. Future work should attempt to use finer resolution data.

4. Improvements in GHG inventory estimation should continue to be an important issue.

5. Improved monitoring and documentation of observational evidence for climate change over India from terrestrial and marine ecosystems and Himalayan glaciers are needed.

India is a large developing country with nearly two-thirds of the population depending directly on the climate sensitive sectors such as agriculture, fisheries and forests. Climate change is likely to have adverse impacts on coastal settlements, food production, freshwater supply, biodiversity and livelihoods. Thus, India has a large stake in developing a sound science base, and the technical capability to adopt and mitigate climate change.

Concluded

*Views are based on published information on the subject and are attributable to the author. The author may be contacted at [email protected]

From a Corner Light

Two Questions for Sustainable Growth and Climate Change Policy

Lalloobhoy Battiwala

1. Accepting for the sake of discussion purposes that the term "growth" refers to economic growth as measured by national GDPs, what instances do we know over the past 200 years where national GDP growth has not been sustainable over a reasonably long period - say, two decades - and what have been the primary causes of such failures to sustain growth? What, specifically, are the empirical bases for fearing limits to sustainable growth?

2. Considering that fossil fuels have so far proven to be sustainable over the past century - i) the 1973 reserves, for example, having been exhausted several times over, with still more left in the ground, and ii) the recent price increases still inadequate to have more than a marginal supplement of non-fossil energies to the overall supply growth in the last ten or the next ten years - why is leaving them in the ground by imposition of prohibitive carbon taxes worldwide not a threat to sustainable growth? Put differently, except for the predictions of speculative long-term Integrated Assessment Models of the world economy and climate - famously dismissed by Bob Pindyck and grudgingly accepted by Nick Stern (both in the Fall 2013 issue of Journal of Economic Literature) - is there any reason to fear that climate change is a threat to sustainable economic growth? Is it not possible, rather, that re-building the infrastructure for climate resilience - from roads and bridges to dykes and seawalls to public health and food/water logistics - will contribute more to economic growth and employment than to hastily conceived and likely poorly implemented, and even that only in the countries that produce a third to a half of world GDP at most, carbon tax or other such cockamamie schemes? Arguably, more cement and metals for climate resilient infrastructure will hasten fossil fuel exhaustion and a near-term increase in CO2 emissions, but will save more lives in the short as well as long term.

Views are those of the author. Answers and comments may be sent to [email protected]

DATA INSIGHT

Value of India’s Total Imports and Energy Imports

Akhilesh Sati, Observer Research Foundation

` Billion

|

Commodity |

2012-13 |

2013-14 |

|

Crude Oil |

7,856.02 |

8,715.88 |

|

Petroleum Products |

653.29 |

769.04 |

|

LNG |

411.42 |

516.99 |

|

Coal |

925.38 |

1001.30 |

|

Total Energy Imports |

9,846.11 |

11,003.21 |

|

India's Total Imports |

26,691.62 |

27,173.60 |

Share of Fossils Fuels in India’s Energy Imports

Source: Compiled from Ministry of Commerce & Industry.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

Oil output drops marginally in May, gas production dips

June 24, 2014. India's crude oil production dropped marginally in May as a fall in output at fields operated by Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) negated increased flows from private firms including Cairn India. Crude oil production was at 3.16 million tonnes in May compared with 3.17 million tonnes in the same period a year ago, according to data released by the Oil Ministry. ONGC reported a 1.3 per cent drop to 1.87 million tonnes as its fields in Gujarat produced less. OIL produced 5.2 per cent less at 284,143 tonnes, while output from fields operated by private firms rose 3.1 per cent to 1.005 million tonnes. Natural gas production dipped 2.2 per cent to 2.94 billion cubic meters (bcm) as private operators saw an almost 10 per cent drop in output. While ONGC's gas production was almost unchanged at 1.93 bcm, production from offshore fields of private firms such as Reliance Industries Ltd (RIL) dropped 9.8 per cent to 685.22 million cubic meters. India's April-May oil production at 6.26 million tonnes was almost unchanged from the previous year. Gas output in the period dropped 5 per cent to 5.94 bcm. (economictimes.indiatimes.com)

GCA to be appointed to resolve ONGC-RIL dispute

June 22, 2014. Global independent consultant Gaffney, Cline & Associates (GCA) is likely to be appointed to verify ONGC's claims that gas from its Krishna Godavari fields may have flowed out of the neighbouring KG-D6 wells of Reliance Industries Ltd (RIL). RIL and Oil and Natural Gas Corp (ONGC) have shortlisted DeGolyer and MacNaughton (D&M) and GCA to decide if four wells drilled on the boundary of the KG-D6 block were drawing gas from the neighbouring discoveries of the state-owned firm. GCA is a worldwide petroleum consultancy with over 50 years of experience in providing independent technical, commercial and strategic solutions in areas such as exploration studies and assessment of reserves and resources. ONGC had moved the Delhi High Court alleging that RIL may have drawn natural gas worth thousands of crores of rupees from its fields adjacent to the RIL's KG-D6 block in the Krishna Godavari basin. The legal case will continue with ONGC seeking court-monitored assessment by the independent expert on whether its gas fields extend into RIL's KG-D6 block. ONGC believes its Godavari Block (known as G-4) and New Exploration Licensing Policy (NELP-1) discovery block KG-DWN-98/2 are contiguous to RIL-operated NELP-1 Block KG-DWN-98/3 (KG-D6). It believes the KT-1/D-1 gas find in block KG-DWN-98/2 and G-4 Pliocene gas find in Godavari Block extend outside the block boundaries into KG-D6. (economictimes.indiatimes.com)

Cairn to invest $200 mn in Rajasthan gas field

June 19, 2014. Cairn India Ltd has said it will invest $200 million over the next three years in developing natural gas finds in the largely oil-bearing Rajasthan block. The $200 million investment during FY2015-17 will be towards developing existing Raageshwari Deep Gas field and associated field facilities and pipeline, Cairn said in its 2013-14 annual report. Cairn which in January 2004 began the Rajasthan success story with discovery of Mangala field - the largest onshore oil find in India in the last two decades, has till date made 31 discoveries in the Barmer basin block. In March last year, it started gas production from the block, with a cumulative sale of 2.7 billion standard cubic feet in 2013-14 fiscal. It however estimates a higher gas potential in the block and is building facilities that can handle up to 100 million standard cubic feet per day (mmscfd) of output. (economictimes.indiatimes.com)

OIL signs MoU with Russia's Gazprom

June 19, 2014. Oil India Ltd (OIL) signed an agreement with Russia's Gazprom for joint pursuit of exploration opportunities across the globe. Through the memorandum of understanding (MoU), OIL and Gazprom plan to jointly participate in upstream oil and gas exploration and production opportunities in different parts of the world as well as collaborate on LNG. (timesofindia.indiatimes.com)

HMEL shuts VGO unit at Bathinda refinery after fire

June 20, 2014. HPCL-Mittal Energy Ltd (HMEL), a joint venture of steel tycoon L N Mittal and Hindustan Petroleum, shut a small unit at its Bhatinda refinery after a minor fire. No one was injured in the fire that was brought under control, HMEL said. The fire was reported at one of the pipelines from the vacuum gas oil (VGO) unit, which removes sulphur from crude oil. The VGO unit had to be shut down because of the fire but the rest of the 9 million tonnes a year refinery is operating normally. (economictimes.indiatimes.com)

Transportation / Trade

India bets on easing Iran oil curbs as fighting engulfs Iraq

June 20, 2014. India spent the past five years cutting its Iranian oil imports to comply with international sanctions. Now, Asia’s second-largest energy user needs the curbs to ease as fighting threatens its supply from Iraq. Tougher U.S. sanctions on Iran meant India was obliged to halve purchases from the Persian Gulf nation since 2009. Indian refiners, which get 85 percent of their crude from overseas, say they expect the restrictions to soften. Benchmark crude prices are trading at a nine-month high as Islamic militants battle government forces in Iraq, which is now India’s second-biggest oil supplier. That’s boosting costs for importers and taking a toll on India’s currency. Iran was the second-biggest supplier to India until three years ago, when it was displaced by Iraq. India cut purchases from Iran to 11 million metric tons in the year ended March 31, compared with a peak of 21.8 million tons in 2008-09, according to data from the oil ministry. The nation’s refiners bought about 25 million tons from Iraq. (www.bloomberg.com)

Policy / Performance

Govt considers staggered LPG and kerosene price hike

June 24, 2014. Keen on replicating the diesel de-regulation model, the Oil Ministry is mulling a staggered monthly price hike for both LPG and kerosene. The government is looking to up LPG prices by ` 5 per month per cylinder and kerosene by ` 1 per litre per month. A ` 1 per litre hike in kerosene will cut under-recoveries by ` 850 crore per annum. However Kirit Parikh, former Advisor, Energy, Planning Commission, was of the opinion that the proposed hike on LPG is much less than what is required. The news comes after Petroleum Minister Dharmendra Pradhan had said that the price of domestic LPG cylinders will not be increased and the number of subsidised refills given to consumers would continue. (economictimes.indiatimes.com)

Govt to finalise hike in gas prices soon

June 24, 2014. A decision on increase in natural gas prices is expected in the next few days even as meetings between oil minister Dharmendra Pradhan, finance minister Arun Jaitley and top officials in the Prime Minister's Office (PMO) continued. Pradhan and Jaitely had met Modi to explore ways to revise gas prices to incentivise output without stoking inflation and increasing the subsidy burden on power and fertiliser sectors. The new government is looking at tweaking the United Progressive Alliance-government approved price formula --- known as the Rangarajan formula--- that recommended raising prices to $8.4 a unit from the existing $4.2. The new price based on the formula could not be implemented by the previous government because of the electoral code of conduct. The oil ministry has informed the PMO about the need to take a decision well before July 1 in view of arbitration proceedings initiated by Reliance Industries Ltd (RIL) against the central government over what the company says is the state's failure to abide by the terms of the Production Sharing Contract (PSC) which provides for marked based pricing, the oil ministry said. (economictimes.indiatimes.com)

India's energy imports may rise to $230 bn by FY23: Goldman

June 20, 2014. India's annual energy import bill could jump to $230 billion by FY'23 from the current $120 billion but could get reduced significantly by switching from oil to natural gas and improving conservation, says a Goldman Sachs report. According to the global financial services major, the country's annual energy imports in the next decade could go up to $230 billion from $120 billion currently, driven by economic growth, greater industrialisation and urbanisation. India is facing energy challenges as the country doesn't produce enough to meet its needs. In FY14, India's net energy imports were at 6.3 percent of GDP. (zeenews.india.com)

Govt asks oil companies to draw up emergency import plan in view of Iraq crisis

June 20, 2014. The government has asked energy companies to prepare contingency plans for oil imports as the crisis in Iraq has put a cloud on India's second-biggest source of crude oil, while rising prices threaten to raise subsidies, stoke inflation and upset India's fiscal calculations. Oil supply has not been disrupted and the country has adequate stocks, but officials and industry executives are worried as Brent crude oil, the most widely used international benchmark, has soared to a nine-month high of nearly $115 per barrel, government and industry officials said. The government wants to make sure that there is no disruption in oil supply, which can severely unsettle economic activity. It is also concerned about the rising oil prices. Brent crude soared to a nine-month high of nearly $115 per barrel. Oil minister Dharmendra Pradhan held a series of meetings with senior bureaucrats and top executives of Indian Oil Corp (IOC) officials on back-up plans for oil imports as Iraq, world's second-largest oil exporter after Saudi Arabia, asked US for airstrikes to fight insurgents, the oil ministry said. IOC said the company has prepared its back-up plan but does not expect the effects of crisis in Iraq to spill over to India. Indian refiners will be hit only if the disruptions in Iraq continue for a longer time and the insurgents move toward southern part of that country that accounts for almost 70% of crude production. (economictimes.indiatimes.com)

Fuel prices will not increase, says Oil Minister

June 20, 2014. Oil companies aren't currently considering petrol or diesel price hikes as they don't see the flare up in Iraq violence to hit India's crude imports, Petroleum Minister Dharmendra Pradhan said. The price India's crude-oil basket has risen $5 a barrel to $112 in the past few days. International prices have risen on fears that the Islamic militants who have taken control over tracts of northern Iraq could disrupt supplies from the Middle Eastern nation. Pradhan said the government has asked oil marketing companies to prepare contingency plans. He said crude supply from Iraq hasn't stopped and state-run oil marketing companies have already lifted 45% of the annual contracted quantity from that country. (economictimes.indiatimes.com)

Govt looks at ways to resolve gas pricing issue

June 20, 2014. Centre may tweak Rangarajan formula or allow higher prices for 2013-14 excess output. The government is keeping all options open on the contentious issue of natural gas prices, ranging from tweaking the Rangarajan formula, that will double rates to about $8.4 per unit, changing the international benchmarks used to calculate the price and setting up a new panel to make recommendations. Another possibility is to allow higher prices only on output that is in excess of what was produced in 2013-14; or to allow higher gas prices only for production from fields discovered under the New Exploration Licensing Policy. These include fields in the Reliance Industries-operated KG-D6 block, but will exclude many fields of ONGC. The government may exclude LNG prices in Japan and include Russia in the formula used to calculate natural gas prices in India. While many options are being considered for the pricing formula, the ministry is of the view that gas should be priced on the basis of the net calorific value, which is the actual heat recovered after combustion, not the gross calorific value which is about 10% higher. The international benchmarks are usually based on the gross value, but pricing in India has been traditionally on the basis of net value. The Rangarajan formula is silent on this aspect, leading to differences between producers of natural gas and the ministry. (economictimes.indiatimes.com)

OVL signs pact with Turkish oil firm TPAO

June 20, 2014. ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corp (ONGC), has inked an agreement with Turkish petroleum firm TPAO for jointly bidding for oil assets in other countries. OVL and Turkish Petroleum Corp (TPAO) signed the memorandum of understanding (MoU) on the sidelines of World Petroleum Congress in at Moscow, the company said. (economictimes.indiatimes.com)

Gujarat HC issues notice to Adani Gas for collecting deposits from consumers

June 19, 2014. Admitting a public interest litigation (PIL) alleging charging of unauthorised deposits from consumers with domestic PNG connection, the Gujarat High Court (HC) issued notices to Adani Gas Ltd and Petroleum and Natural Gas Regulatory Board. A two-judge bench, comprising Chief Justice Bhaskar Bhattacharya and Justice J B Pardiwala, issued a notice and posted further hearing on July 3. The High Court acted on the PIL filed by three city-based social activists Dhanesh Desai, Sanjay Raval and Bharat Shah who alleged Adani Gas Ltd has been charging an additional amount of ` 500 as "security deposit" from its customers. (economictimes.indiatimes.com)

RIL aims to be among global top 50 in 3 yrs

June 19, 2014. Reliance Industries Ltd (RIL) hopes to be among the world's top 50 companies as it implements game-changing projects with an investment of ` 1,80,000 crore in the next three years to make it a major player in telecom and retail in addition to its traditional business of oil exploration and refining & petrochemicals, chairman Mukesh Ambani said. RIL reported net debt in 2013-14 after staying debtfree at a net level for two years. In 2014-15 and 2015-16, the conglomerate will focus on executing plans to bring on-stream projects in petrochemicals, refining, retail and Reliance Jio. Ambani said that the petrochemicals business would benefit from the highest allocation of capital among its three energy businesses. In its refining and marketing business, RIL said that despite a volatile and challenging environment, it reported record earnings due to high capacity utilisation, focus on operations excellence, sourcing of cheaper crude oil, efficient placement of products, optimisation of shipping and distribution costs and ensuring safe and reliable operations at the refinery. RIL was gradually reducing imports from the Middle East and increasing purchases from Africa and Latin America where prices have fallen due to lower demand from the US. The company is now in the process of setting up the largest coke gasification project in the world at Jamnagar to convert low-value petroleum coke from the refinery to useable, high-value fuel. The Jamnagar expansion may, at its peak, employ 100,000 people at for the expansion project, making it one of the world's largest construction sites. On the issue of gas from KG-D6 fields, Ambani said that RIL, along with partners BP and NIKO, had initiated arbitration process seeking implementation of the "Domestic Natural Gas Pricing Guideline 2014" and has another ongoing arbitration with the government on the issue of disallowance of cost recovery. Ambani also briefly referred to the controversy surrounding the oil and gas exploration business. (economictimes.indiatimes.com)

Govt policies will be predictable, fair for oil industry: Oil Minister

June 18, 2014. Oil minister Dharmendra Pradhan said the government would overhaul policies for the oil industry to make them "predictable, transparent and fair" to investors, even as BP plc chief Bob Dudley flagged the frustration among foreign investors by describing his company's experience in India as "disappointing". The oil ministry proposes to replace the present exploration block auction method, called NELP, with a uniform licensing policy to facilitate production of all forms of hydrocarbons — from oil to shale gas — under a single policy regime. The next round of auctions will be done with all statutory clearances with a view of de-risking exploration activities to some extent, the statement quoted Pradhan as saying. Dudley said delay in gas price reforms would put the survival of India's offshore oil industry at risk. BP and its partners — RIL and Canada's Niko — issued an arbitration notice days before the UPA-II government's tenure came to an end seeking announcement of the higher gas prices finalized in January. BP had invested over $7 billion in 2011 to buy 30% stake in Reliance's blocks, including the KG-D6 block off the Andhra coast that has been at the centre of political controversy and a tug-of-war with the government due to a sharp fall in production. (economictimes.indiatimes.com)

Gas price hike: RIL' Mukesh Ambani says will win public trust

June 18, 2014. Facing criticism from certain political quarters over natural gas price hike, Reliance Industries Ltd (RIL) Chairman Mukesh Ambani expressed confidence the company will win public trust as it believes in creating wealth and livelihood for millions in a transparent manner. AAP leaders, including its national convener Arvind Kejriwal, alleged that the proposed gas price hike would lead to further inflation and only benefit RIL. In February this year, the party went to the extent of going to the courts against the petroleum ministry, two former oil ministers -- Murli Deora and M Veerappa Moily -- and RIL over the previous government's plan to almost double natural gas prices. RIL had said at that time the allegations were baseless and devoid of any merit. (www.financialexpress.com)

POWER

Generation

First unit of Talwandi Sabo power plant starts production

June 21, 2014. The first unit of the 1980 MW Talwandi Sabo Power Ltd (TSPL) became operational, adding 660MW to the national grid that might help fulfill the anticipated demand of 10,000 MW per day during June and July. Earlier, the first unit of the 700 MW super-critical (2x700 MW) Rajpura thermal power plant was made operational on a trial basis. Besides, the third power project, GVK's Goindwal plant, will become operational shortly as the coal supply issue has been resolved. The TSPL will provide cheapest power to the state for years to come. This largest and green power plant in the state has added more than 12 million units of power itself. (timesofindia.indiatimes.com)

Bhutan’s proposed 600 MW Kholongchu Hydropower Project raising concern in Assam

June 18, 2014. Prime Minister Narendra Modi's unveiling of 600 MW Kholongchu Hydropower Project in Bhutan has raised concerns in Assam as there is fear that the state might face the downstream impact of the project. Modi during his first international visit after he assumed the office last month has announced the partnership between the Indian and Bhutanese PSUs for the hydel power project in Trashiyangtse in Eastern Bhutan. Regional political party, Asom Gana Parishad (AGP) has stated BJP has gone back on its promise of not allowing mega dams in Northeast India. Students' body, All Assam Students Union (Aasu) has sought white paper on the project. Aasu stated it has to raise the demand for a white Paper on the hydel project in Himalayan kingdom as tremendous devastation was caused by its Kurichu Hydel Project in 2004 and 2007 in five districts including Baksa, Nalbari, Barpeta, Kokrajhar and Bongaigaon. The student body added government must clarify if any study done was conducted on the cumulative downstream impacts of the project on Assam areas. Student body, Asom Jatiyatabadi Yuba-Chatra Parishad (AJYCP) said that there must be a moratorium on all the upcoming power projects in the neighbouring country, till the downstream impact study is done. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

Coal supply to thermal power plants dwindles

June 24, 2014. Coal supplies to thermal power plants are dwindling, resulting in reduced electricity generation at a large number of units. The country's largest utility National Thermal Power Corporation Limited has been forced to shut some of its units to cope with the situation as have some of the other power producers. The situation has been steadily deteriorating as partly reflected in data released by the Central Electricity Authority. (economictimes.indiatimes.com)

Power sector faces $27 bn in annual losses: World Bank

June 24, 2014. The power sector faces annual losses of $27 billion by 2017 unless sweeping reforms are taken to tackle inefficient subsidies, theft and political meddling in utility companies, the World Bank said. New Prime Minister Narendra Modi has pledged to bring electricity to the 300 million Indians who still lack power and improve the reliability of supplies, one of the biggest complaints of companies doing business in the country. Blackouts this summer have underlined the scale of that task, with large parts of north India suffering from severe power cuts after a rise in temperatures triggered a jump in demand that suppliers and an antiquated transmission system failed to meet. Launching its report into the sector, the World Bank said that despite the gains made in the past decade, when 280 million Indians gained access to electricity, India would struggle to make further progress unless it gave its utilities the freedom to improve their performance. (economictimes.indiatimes.com)

Power Grid okays over ` 55 bn investments in 4 yrs

June 23, 2014. Central transmission utility Power Grid Corporation approved investments of ` 5,500 crore for upgrading networks in about 4 years. Board of Directors of the Company approved strengthening the transmission corridor for independent power producers in Chhattisgarh at an estimated cost of ` 5,151.37 crore, Power Grid Corporation informed the stock exchanges. The commissioning schedule of the transmission project is 45 months from the date of investment approval. The board also approved investment for upgradation of the transmission system associated with Lara thermal power project of NTPC at an estimated cost of ` 400.47 crore, with commissioning schedule of 34 months from the date of investment approval. (economictimes.indiatimes.com)

Three 220kV lines fixed; full restoration soon: Delhi govt

June 23, 2014. Restoration work on three more 220kV lines has been completed after these were damaged in the May 30 storm that crippled the power supply system in the national capital. The three lines -- Mandola-Gopalpur, Bawana-Rohini, Bamnauli-Pappan Kalan -- have been fully restored, Delhi government said. The repair work on almost all damaged transmission lines was over. Thus, the 220kV line for Maharani Bagh-Ghazipur will be restored by June 24 while the Maharani Bagh to Trauma Centre line will be restored by June 30, as per schedule. The Dadri-Loni-Harsh Vihar Line (being executed by NTPC through PGCIL) will be restored by July 7. (economictimes.indiatimes.com)

Goyal assures coal supply to power producers

June 20, 2014. Piyush Goyal, minister for coal, power and renewable energy, has assured power producers on regular fuel supply and directed Coal India to provide a minimum of 60 per cent of fuel supply to all power generation companies. In a meeting with members of the Association of Power Producers, the minister also said he would request the environment ministry to allow additional mining of coal. Goyal also shot down a proposal to split Coal India into different companies. The previous UPA government had indicated that Coal India could be split to improve coal output and end its monopoly. Goyal refused to discuss the issue of new gas pricing regime in detail because the matter was sub-judice. Power project developers have been complaining that natural gas fired power projects would become unviable and power prices would shoot up if gas price is doubled to $8.4 per mmbtu. He also made it clear that the government does not plan to change its policy on Ultra Mega Power Projects (UMPPs) despite some power producers deciding to stay away from the bidding process for such projects. Power producers such as Adani Power, Tata Power, Jindal Steel & Power, JSW Energy, Sterlite, CLP and GMR Energy decided to withdraw from the race for building two UMPPs with capacity of 4,000 MW each, opposing the existing bidding terms. The minister also said an inter-ministerial group would be formed to sort out the issues of coal and power sector. He would meet financial institutions to look into financing related bottlenecks faced by the power sector. (economictimes.indiatimes.com)

Power crisis can be tackled by upgrading T&D infra: Goyal

June 18, 2014. Modernising transmission and distribution infrastructure will help in overcoming the electricity crisis, Power Minister Piyush Goyal said. Goyal, who met Rajasthan Chief Minister Vasundhara Raje, applauded the state's efforts in the generation of power through renewable energy sources. The meeting (with Raje) reinforced my belief that power crisis can be solved to a large extent by modernising T&D (transmission and distribution) infrastructure, he said. The minister has set transmission and distribution as his focus areas and is working to bring states on board for reforms. As much as 30% of the power generated in India is lost during transmission and distribution. Goyal met Vasundhara Raje and Rajasthan Energy Minister Gajendra Singh Khimsar on "ensuring 24x7 power supply" in the state. (www.business-standard.com)

Govt asks CIL to improve performance to avoid restructuring

June 24, 2014. In a stern message to Coal India the government has asked the world's largest coal company to improve efficiency to avoid restructuring. The Power and Coal Minister Piyush Goyal has asked the state-run company to improve the quality of its coal by December 31, 2014. The Minister has also said that the coal major should pull up its socks and perform in order to avoid restructuring. The Coal Ministry had earlier planned to restructure Coal India to improve its operational efficiency. Coal India which accounts for over 80% of the domestic coal production, missed its output target of 482 million tonnes in 2013-14 and produced only 462 million tonnes of coal. The company's 7 subsidiaries include Eastern Coalfields Ltd (ECL), Bharat Coking Coal Ltd (BCCL), Central Coalfields Ltd (CCL) and South Eastern Coalfields Ltd (SECL). (www.business-standard.com)

8 mines can be considered for power sector: Coal Ministry panel

June 24, 2014. A Coal Ministry panel has recommended that eight regionally explored mines in states like Jharkhand, West Bengal and Odisha could be considered for allocation to power producers. The suggestion comes at a time when power plants across the country are facing acute fuel shortages. The coal blocks includes Pokharia Paharpur mine and Gosai -Pahari-Siulibani mines in Jharkhand), Kuraloi (A) North mine and Saradhpur (N) Sector-1 mines in Odisha, and Kapsdanga- Bharkata block in West Bengal. (economictimes.indiatimes.com)

NDA may unveil 24x7 electricity plan in Union Budget

June 24, 2014. Prime Minister Narendra Modi’s National Democratic Alliance (NDA) government is likely to spell out a plan to supply electricity through separate feeders for agricultural and rural household consumption in the Union budget it will unveil in July, aimed at eventually providing round-the-clock power.

The plan, based on the Jyotigram Yojana in Modi’s home state of Gujarat, may be made applicable across states to ensure around eight hours of quality power to agricultural consumers and 24-hour electricity to households. The initiative, billed as “Power to all 24x7”, also envisages complete metering and strengthening of the electricity distribution system. (www.livemint.com)

Acquisition of coking coal assets abroad becomes imperative: Govt

June 22, 2014. As domestic coking coal's crunch may lead to annual imports of 180 million tonnes (MT) by 2033, acquisition of assets abroad becomes "imperative" for public and private steel companies, a report by the Steel Ministry has said. In case of coking coal, import dependence will rise significantly despite the best results from the domestic industry as its capacity to supply coking coal is not likely to increase beyond 20-25 MT, the report said. (economictimes.indiatimes.com)

India nuke enrichment plant expansion operational in 2015 - IHS

June 20, 2014. India is expanding a covert uranium enrichment plant that could potentially support the development of thermonuclear weapons, a defence research group said. The revelation highlights a lack of nuclear safeguards on India under new Prime Minister Narendra Modi, while sanctions-bound Iran faces minute scrutiny in talks with world powers over its own nuclear programme. New units at the Indian Rare Metals Plant would boost India's ability to produce weapons-grade uranium to twice the amount needed for its planned nuclear-powered submarine fleet, IHS Jane's said. The facility, located near Mysore in southern India, could be operational by mid-2015, the research group said. Unlike Iran, India is not a signatory to the nuclear Non-Proliferation Treaty. New Delhi tested its first nuclear weapon in 1974, provoking international sanctions that barred it from importing nuclear technology and materials. (in.reuters.com)

Goyal's 5 steps to solve sector's problems

June 20, 2014. Power Minister Piyush Goyal discussed a plethora of issues, ranging from generating issues, fuel supply problems to ease of doing business. We take a look at five prominent steps that the power ministry hopes to take in order to solve the sector's problems: 1) Additional mining of coal: As an interim measure, the government is looking at mining additional coal to solve the supply problems of the power sector. 2) Enhance Coal-linkages: The government will focus on enhancing coal-linkages across the country. The government will release additional capacity to transport more coal to far off stations. On an experimental basis, the sae would be followed at the unloading station for government generating stations and PSUs to see that the process works well, Goyal said. 3) Augmenting supply of Coal India: The government will also look to enhance the supply of CIL in order to provide more linkages and expand the power generation in the country. 4) Reduce E-auctions of coal: The government wants to trim e-auction of coal to up power companies' supply. 5) Resolving conflicts between power producers and bankers: The Power Minister will meet principal bankers to discuss a possible way forward to resolve the conflicts between the power sector borrowers, both state and public and the banking sector. (economictimes.indiatimes.com)

Govt may restore power subsidy

June 18, 2014. Subsidized power for domestic consumers using up to 400 units may become a reality in the months ahead. Following a meeting with lieutenant governor Najeeb Jung, the power department of the Delhi government is preparing a proposal to make allocations for power subsidy in the 2014-15 budget. The quantum of the subsidy will be decided either by the Centre when the budget is presented in Parliament or whenever the new government takes charge in Delhi. Ever since power had been privatized in Delhi in 2002, people consuming up to a certain number of units were getting subsidy till March 31, 2014. The AAP government had enhanced the subsidy given by the Sheila Dikshit but the relief was available till the end of the 2013-14 financial year. All subsidies stopped from April 1 leading to inflated bills. The rising power cuts in peak summer have added to the public anger and now a provision in the budget for a subsidy is seen as an attempt to bring some relief. Politically, it is bound to benefit BJP in Delhi. (economictimes.indiatimes.com)

MP CM urges Goyal to speed up stalled hydropower project

June 18, 2014. Madhya Pradesh (MP) chief minister Shivraj Singh Chouhan has urged power, coal and renewable energy minister Piyush Goyal to help expedite a ` 5,000-crore hydropower project in the state that has been in the works since the early 1990s, becoming the second high-profile leader to seek an intervention for the project after Congress general secretary Digvijaya Singh. The 400 MW project on the river Narmada, is located about 100 kilometres from Indore and could reduce the peak-power shortage in the state by over 25%. (economictimes.indiatimes.com)

Karnataka govt looking at legal action against Udupi Power Corporation

June 18, 2014. The Karnataka government is mulling legal action against the Lanco Infratech-owned Udupi Power Corporation if it does not resume power generation at its 1,200 MW thermal plant in coastal Karnataka. The private developer has stopped generation since June 14 citing lack of money to buy coal. Its two 600 MW units are fired on Indonesian coal, and they generate 25-26 million units a day at 85% plant load factor. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

NATO commander returns to Balkans hunting for Albanian oil

June 24, 2014. Fifteen years after Wesley Clark led NATO’s bombing campaign against Serbia, the retired U.S. general is back in the Balkans -- looking for oil. Clark, who was also a presidential candidate in 2004, is a director of two Canadian explorers working in Albania, Bankers Petroleum Ltd. and Petromanas Energy Inc. They’re using modern drilling techniques to revive production in one of Europe’s poorest countries, where oil was first produced in the 1920s. Oil exploration is part of Albania’s strategy to repair the damage of four decades of economic isolation under the communist regime of Enver Hoxha, who built more than 700,000 concrete military bunkers before he died in 1985. Albania’s economy, where per capita income remains the lowest in Europe after Bosnia, Ukraine and Moldova, has almost doubled in size in the last decade, according to the World Bank. (www.bloomberg.com)

Tullow Oil says partner finds O&G in Northern Kenya

June 24, 2014. Independent oil and gas (O&G) explorer Tullow Oil said its partner in northern Kenya, Africa Oil, had found oil and gas at the Ngamia-2 well. The London-listed explorer has a 50 percent operated interest in Blocks 10BB and 13T in northern Kenya. Flow rates at the Agete-1 well were also tested at 500 barrels of oil per day, the company announced. In total, the partners are currently drilling in five locations in Kenya and Ethiopia. (www.rigzone.com)

ExxonMobil in talks with Turkey over shale gas exploration

June 23, 2014. U.S. oil firm ExxonMobil is in talks with Turkish Petroleum Corporation over a venture to explore for shale gas in the country's southeast and northwest regions. Exxon held talks with TPAO in 2012 to over a partnership in shale, but the negotiations were inconclusive.

ExxonMobil was interested in onshore opportunities in the southeast and Thrace, in northwestern Turkey. Turkey wants to reduce its annual energy bill of around $60 billion and is developing domestic resources including nuclear, coal, solar and wind energy. With domestic gas consumption rising, and its location well-placed to supply international markets, major exploitable reserves could be a game changer for Turkey's economy and highly lucrative for whoever finds them. Investors from the United States, Europe and Canada are also interested in Turkey's shale gas and oil. (www.rigzone.com)

Abu Dhabi's Mubadala Petroleum makes Malaysian gas discovery

June 23, 2014. Abu Dhabi's Mubadala Petroleum said it made a new gas discovery with significant commercial potential in Malaysia, its fourth discovery within its operating block. Mubadala Petroleum, a unit of Abu Dhabi's investment fund Mubadala said it found substantial gas in the Pegaga well in its operating block SK320. The four gas discoveries are in close proximity, including the original M-5 well success, Mubadala said. (www.rigzone.com)

Repsol makes Russia's biggest discovery in 2 yrs

June 23, 2014. Spain's Repsol reported that it has made two new hydrocarbon discoveries in the Karabashsky 1 and 2 blocks in western Siberia, Russia. Repsol said that the finds could add 240 million barrels of oil equivalent to the company's reserves tally – which, according to Russia's Ministry of Natural Resources and Environment, would means they amount to largest discovery in Russia for two years. (www.rigzone.com)

Exxon, BP evacuate Iraq workers as oil drilling continues

June 19, 2014. Exxon Mobil Corp. and BP Plc began removing employees from Iraq, OPEC’s second-largest oil producer, after Islamist militants seized cities north of Baghdad and attempted to capture a refinery. Exxon evacuated some workers from the West Qurna oil field. BP Plc removed non-essential workers, Chief Executive Officer Bob Dudley said. Malaysia’s Petroliam Nasional Bhd. moved 28 of its 166 Iraq employees to Dubai, the company said. Royal Dutch Shell Plc isn’t evacuating staff yet and is ready to do so, Andy Brown, head of Shell Upstream International, said. (www.bloomberg.com)

Circle Oil discovers gas in Morocco

June 19, 2014. UK-based oil & gas exploration company Circle Oil has discovered gas at its SAH-W1 well in the Sebou permit, onshore Morocco. Spud on 19 May 2014, the well has been drilled to a total depth of 1,263m and found gas at three levels within the target areas. (drillingandproduction.energy-business-review.com)

Statoil says discovers additional 2-3 Tcf of gas off Tanzania

June 18, 2014. Norway's Statoil said it has made a high-impact gas discovery in Block 2 offshore Tanzania, boosting discovered gas volumes by 2-3 trillion cubic feet (Tcf). That brings the total discovered gas volumes in Block 2 to about 20 Tcf, the company said.

Statoil operates the licence on Block 2 on behalf of Tanzania Petroleum Development Corporation and has a 65 percent stake, with ExxonMobil and Production Tanzania Limited holding the remaining 35 percent. (www.rigzone.com)

Downstream

China seen bolstering oil security as stockpiles swell to record

June 24, 2014. China may be bolstering its emergency crude reserves as refiners in the world’s second-largest oil consumer expanded commercial stockpiles to a record high in May. China’s commercial oil stockpiles can be channeled for strategic use, according to industry consultants including ICIS-C1 Energy in Shanghai and FGE in Singapore. Refiners accelerated crude imports in April and May as the nation sought to increase its energy security with prices at a “fairly” high level, ICIS-C1 analyst said. China, which trails only the U.S. in consumption, is also maximizing its gasoline production amid rising domestic demand and improved refining margins, ICIS-C1 analyst said. (www.bloomberg.com)

Russia's refinery runs up 6.1 pc in May from April

June 23, 2014. Russian oil refinery runs in May rose by 6.1 percent month on month or 329,911 barrels per day (bpd) following seasonal maintenance, data from the energy ministry showed. Refineries processed 5.76 million barrels of crude oil per day in May versus 5.43 million in April.

Rosneft's Novokuibyshevsk and Ryazan refineries increased oil processing by 126.4 percent and 48.4 percent, respectively, in May after major planned seasonal maintenance. Two other Rosneft refineries - Kuibyshev and Achinsk - started thorough repair work on crude distillation units in May, reducing their capacity by 79.7 percent and 67.8 percent, respectively. (www.downstreamtoday.com)

Transportation / Trade

LNG rally fading on new supply as nukes set to restart

June 20, 2014. The three-year rally in liquefied natural gas (LNG) is cooling as Asia-Pacific supplies jump and demand slows from Japanese utilities preparing to restart nuclear reactors. LNG shipped to northeast Asia next winter may be sold at the lowest price since 2012 for that time of year, when demand typically peaks, according to a survey of traders and analysts. Exxon Mobil Corp. and BG Group Plc are bringing new supplies to Asia this year before at least four projects start in 2015, including the first U.S. exports. (www.bloomberg.com)

India main importer of Nigerian oil, overtakes US

June 19, 2014. Nigeria's state oil company says India has overtaken the United States (US) as the biggest importer of Nigerian crude. The US has drastically reduced imports to 250,000 barrels a day. India is importing one-third of Nigeria's daily output of 2.5 million barrels, followed closely by China and Malaysia. The US boom in domestic shale oil production is behind the shift. (economictimes.indiatimes.com)

Ukraine ties guard EU from gas cut as siphoning unlikely

June 18, 2014. Ukraine seeking closer ties to the European Union (EU) means natural gas flows from Russia to the 28-nation bloc are unlikely to be disrupted, according to Maplecroft Ltd. and Energy Aspects Ltd. UkrTransGas is shipping full volumes from Russia to Europe, the Ukrainian pipeline operator said, the day after its own supply was cut by Russia amid a two-month long pricing dispute. All imports needed to meet domestic needs can be replaced with gas from Europe for now, NAK Naftogaz Ukrainy’s Chief Executive Officer Andriy Kobolyev said. (www.bloomberg.com)

Kurd oil supply seen growing as region grabs territory

June 18, 2014. Iraq’s Kurdish region may be able to gain more autonomy and increase crude exports after taking control of territory around the nation’s fourth-largest oil field, analysts from Saxo Bank A/S and JBC Energy GmbH said. Kurdish troops are protecting the Kirkuk oil field and surrounding areas after an offensive by Islamist insurgents prompted Iraqi central-government forces to flee. The Kurdistan Regional Government (KRG) is “willing to help” Iraq export crude from Kirkuk, Taha Zanghana. (www.bloomberg.com)

Policy / Performance

Kazakhstan Govt approves 15 yr extension to Kyzyloi gas contract

June 20, 2014. The Ministry of Oil & Gas of the Republic of Kazakhstan has given green light to UK-based Tethys Petroleum’s proposal to extend the Kyzyloi gas production contract for 15 more years until June 2029. The move follows the recent approval of the contract by Kazakh State Reserves Committee. The company is currently producing natural gas from the Kyzyloi sandstone covering around 70,918 acres of area. The extended contract will give the company more time to produce gas from the area. According to Tethys, the Kyzyloi area, with rich oil and gas fields, is developing rapidly and still has potential for exploration and discovered deposits. (drillingandproduction.energy-business-review.com)

Rising US output seen curbing impact of Iraq on oil

June 20, 2014. The U.S. shale boom, which has sent the nation’s output to a 28-year high, is curbing the impact of the Iraq crisis on the oil market, said Nansen Saleri, former head of reservoir management at Saudi Arabian Oil Co. Prices would have climbed more this month if techniques such as hydraulic fracturing and horizontal drilling hadn’t bolstered U.S. crude output, said Saleri, who is now chief executive officer of Houston-based consultant Quantum Reservoir Impact. West Texas Intermediate (WTI) oil, the U.S. benchmark, has climbed $5 to $10 on supply anxiety, he said. (www.bloomberg.com)

Singapore billionaire bets big on energy in Africa, Asia

June 20, 2014. In September 2007, almost a year after New Zealand–born billionaire Richard Chandler founded investment firm Orient Global in Singapore, he made a rare appearance at a forum on social responsibility. Abandoning his penchant for privacy, Chandler outlined the link between giving and investing. Chandler is betting on gas and oil in far-flung locales from Papua New Guinea to Kenya and Ethiopia, banking on demand from Asia’s growing middle class.

The firm invested in InterOil Corp, which has offices in Singapore and Port Moresby, Papua New Guinea. InterOil Corp controls 35.5 percent of the exploration license that contains Papua New Guinea’s Elk and Antelope fields -- the island nation’s biggest undeveloped gas plays, according to InterOil Corp. (www.bloomberg.com)

Japan's JOGMEC says could accelerate investment in oil, gas

June 19, 2014. Japan Oil, Gas and Metals National Corp (JOGMEC) could accelerate its investment in oil and gas resources in the long term, as it looks to ensure stable commodity supplies for the world's No.3 economy. President Hirobumi Kawano said that JOGMEC would in particular focus on boosting its investment in liquefied natural gas assets, with Japanese appetite for the fuel rocketing following the shutdown of all the country's nuclear reactors in the wake of the Fukushima crisis. Japanese government had previously set a goal to boost the country's self-sufficiency ratio of oil and gas to 40 percent by 2030 from around 20 percent although the target is currently under the review. (www.downstreamtoday.com)

Norway PM joins forces with central bank to support oil industry