-

CENTRES

Progammes & Centres

Location

[The Twists and Turns of Indian Gas Pricing have Come to an End...for the Time being]

“Keeping in mind that the reform on natural gas pricing was politically and economically rather controversial and overdue, the new government has shown once more the will to act and to set examples for the improvement and development of India’s natural gas industry. As always, the devil is in the details, and it should therefore be expected that much work remains to be undertaken to satisfy all the stakeholders involved…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy…………………

· Diesel Price Deregulation: Who did it and Why it matters

ANALYSIS/ISSUES…………

· The Twists and Turns of Indian Gas Pricing have Come to an End...for the Time being

DATA INSIGHT………………

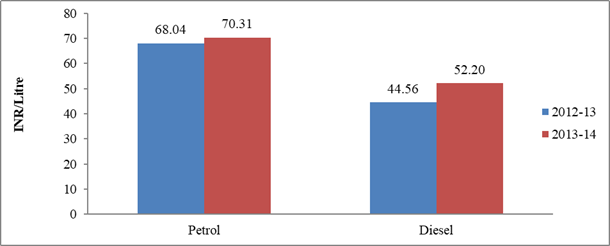

· Fluctuations in Retail Diesel and Petrol Prices for 2013-14

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC to explore Bay for oil, gas deposits

· ONGC Cancels Bengal CBM Block Sale to GEECL

Downstream……………………………

· Scrapping of diesel price controls opens up retail market for private refiners

Transportation / Trade………………

· India to pay Iran $900 mn in crude oil dues

· Hiranandani Group awards contract to Sener-Afcons for LNG facility

· Gujarat industries accuse GAIL of taking arbitrary action

· GAIL skirts Iran undersea pipeline deal for fear of US ire

Policy / Performance…………………

· No premium pricing for undeveloped natural gas fields: Oil Minister

· Govt moves closer to selling stake in oil firm ONGC

· Real gas price for companies to be $6.2 per unit

· Gas price hike to add ` 19.5 bn to ONGC profits this fiscal

· RIL may not gain from the gas price hike: Analysts

· Diesel deregulation to benefit consumers: Essar Oil

· New gas price every six months on the basis of global rates

· Reliance Industries' credit metrics to remain stable over 12 months: Moody's

· The current scenario in India’s natural gas market

[NATIONAL: POWER]

Generation………………

· No shutdown of power plant: DVC

· Srisailam power generation fuels tension between Andhra, Telangana

· Kiren Rijiju against big power projects, favours 300-500 MW projects

· BHEL commissions 600 MW thermal unit in MP

· Adani, Jindal Power, Sterlite and GMR pull out of UMPPs race

Transmission / Distribution / Trade……

· BGR Energy secures ` 2.5 bn order

· CIL signs 162 FSAs with power plants so far

· Power grid gets no-objection for land in Jharkhand

· Talks begin on power grid connecting India with neighbours

· CESC to help AP restore power

· NTPC firming up plans to enter into power distribution business

· Alstom T&D wins ` 1.3 bn contract from PGCIL

Policy / Performance…………………

· Nepal, India sign historic PTA

· 2-day power holiday to continue in Telangana

· Coal auction rules a positive: India Inc

· Revival plan on cards for gas-based power plants

· Coal block allocation scam: CBI registers case against Jindal Steel & Power

· Power supply will be back by Oct 25: AP CM

· Advisory group on power, coal to submit report by Oct 31

· Nagaland to formulate new power policy

· Modi govt following UPA's policies for power sector: AIPEF

· Power ministry assures PM Modi of uninterrupted electricity despite lack of coal supply

· ACME Group gets final approval for $100 mn loan from ADB

· 'Power situation in Telangana to improve by June'

· AERB sets 2015 deadline for additional nuclear safety

· India, Finland to cooperate in civil nuclear energy

· India, Canada clinch nuclear deal in record time

· KPMG to submit coal rationalisation report Goyal

· Power projects hit by SC verdict may get fuel supply from Coal India

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Statoil finds up to 80 mn barrels of oil near Grane field

· Paraguay finds first oil reserves after 70 yrs of search

· Genel may succeed with oil find in Morocco where others failed

· PetroChina on course to beat 2015 Sichuan shale output target

· Inpex begins production at Umm Lulu oil field, offshore Abu Dhabi

· Saudi, Kuwait seen curbing oil output at ’opportune time’

· PPL finds gas-condensate at Kinza X-1 well in Pakistan's Gambat South Block

Downstream……………………

· Petrobras refinery is 60 per cent over budget, audit court says

· Total's European refining margins rise near 2 year high

Transportation / Trade…………

· Brent crude rises as China’s growth exceeds estimates

· Credit Suisse allegedly favored oligarch in oil field sale

· China's Baosteel to supply gas pipes for Turkey-Azerbaijan pipeline

· Israel's Tamar group looks to sell gas to Egypt via EMG pipeline

· Shale boom helping American consumers as never before

· Chevron’s Watson sees secure future in global oil thirst

· Don’t mess with Saudis in oil bear market global shakeout

· Russia proposes building natural gas pipeline to Japan

· Railways enlist Lumberyards in US oil-train speed fight

Policy / Performance………………

· Poland eyes expanding LNG terminal to increase energy security

· Global oil prices likely to touch to $60 per barrel: Osama Kamal

· Thailand to raise transport LPG prices by 0.63 baht per kg

· Oil workers earning $179,000 expose Norway to crude crash

· Tundra balks as court stalls Pakistan’s biggest sale in 8 yrs

· Hedge funds cut bullish bets on crude as prices tumble

· China's NDRC approves RH Petrogas' oil development plan for Fuyu Block

· Cheapest OPEC crude since ’09 still too costly for India

· Kuwait moves toward cutting diesel, kerosene subsidies in key reform

· Venezuela goes from bad to worse as oil prices plummets

· Singapore to supply LNG to ships by 2020: Transport Minister

· Putin loses his best friend: Expensive oil

· OPEC finding US shale harder to crack as rout deepens

[INTERNATIONAL: POWER]

Generation…………………

· Chinese firm picked to set up dual fuel power plant in Chittagong

· Ethiopia to build two more dams for power generation

· Zimbabwe: US$300 mn to refurbish power plants

· Burma, Japan and Thailand sign MoU to build Myeik power plant

· LCRA dedicates new power plant

Transmission / Distribution / Trade……

· Polish railway traders to buy German power as gap widens

· New power transmission Line to be constructed between Iran, Armenia

· 230-kV line in Mindanao energized

· One firm’s $2 mine is another’s start of global coal empire

· ABB to modernize 600 MW Kontek HVDC link between Germany and Denmark

· US FERC cuts level of transmission ROE in New England

Policy / Performance………………

· Pakistan court stops construction work on nuclear plants

· Lockheed says makes breakthrough on fusion energy project

· Japanese governor says too soon for nuke restarts

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Voltech Group forms JV with Kuwait and Zambia-based firms

· Jammu and Kashmir hospitals get solar power plants

· Goa ‘very vulnerable to climate-change impacts’: Pachauri

· Synergy between environment protection and development vital: Javadekar

· Suzlon bags orders worth about ` 12 bn

· NRL inks agreement with Finnish firm to build biorefinery

· Rays Power Experts commissions 20 MW solar project in Rajasthan

· Punjab solar power plant boosts 'sufficient power' hopes

GLOBAL………………

· US, China learning from each other may help climate

· China’s electric-car plans to help Aluminum: Novelis

· Natural gas no miracle cure for climate change: Study

· Dow says world carbon market needs less intervention to work

· German households get small break on green power surcharge

· EU pushes back deadlines 2 yrs in green energy funding scheme

[WEEK IN REVIEW]

ENERGY………………

Diesel Price Deregulation: Who did it and Why it matters

Lydia Powell, Observer Research Foundation

|

T |

he political answer to the question ‘who deregulated diesel prices in India?’ would be ‘the bold new government which is committed to economic reform’. All news papers and television media channels have faithfully followed this line in reporting the story (see this week’s news items). But those who have tracked the long and hard journey of petroleum product price de-regulation in India would know that it was the dramatic fall in global crude prices that de-regulated diesel prices in India. The much maligned former Prime Minister of India initiated the process of diesel price deregulation years ago. He boldly called for rationalisation of energy prices even at unfortunate moments when global crude oil prices were unfavorable.[1] But for his efforts towards phased increase in diesel prices, deregulation of diesel prices last week would have been more difficult. In fact, the move to ‘deregulate’ prices may have increased rather than decreased diesel prices notwithstanding the fall in global crude prices. No rational Government would have missed the opportunity for deregulation that the global market has offered.

Once we accept that it is the global crude markets rather than government determination that has facilitated deregulation, we should also acknowledge that the market can take away, with the same ease, the opportunity it is presenting now. What we need to worry about is whether we are prepared for such a moment. We are told by experts (see some of this week’s international news items) that the moment is not far away.

Global crude oil prices have fallen by over 20% since June this year to touch a two year low. We can choose from a wide range of reasons to explain this fall. We can start at the lower end with conspiracy theories that say that the United States and Saudi Arabia have colluded to keep oil prices low (by increasing/maintaining supply) to bring down Putin and his support for Syria. Or we can start at the upper end with explanations that argue that we are beginning to see the collapse of the debt bubble that fed, not just investment in oil production but also demand for oil and oil based products. This explanation would imply that we may be looking at the beginning of the end of oil demand and supply growth. Alternatively we can also depend on more down to earth explanations based on straightforward short term supply and demand data.

Crude oil production in the United States in September 2014 was 8.7 million barrels per day (mbpd), the highest since 1986 and just over 1.2 mbpd short of the peak production volume of 10.04 mbpd achieved in November 1970.[2] The US Energy Information Administration (EIA) expects world oil and other liquids supply to increase by 1.6 mbpd in 2014 with most of the increase coming from non-OPEC countries. On the other hand global consumption which averaged 90.4 mbpd in 2013 is projected to grow by about 1.0 mbpd in 2014 compared to 1.3 mbpd in 2013.[3] Most of the growth in consumption is expected outside OECD countries with China alone accounting for 370,000 bpd growth in consumption. Projections for consumption growth by the International Energy Agency (IEA) are lower at about 700,000 bpd in 2014.[4] Overall global demand for 2014 has been lowered by 200,000 bpd by IEA to 92.4 mbpd on account of lower expectations on growth. On the other hand, supply for 2014 is expected to increase by 910,000 bpd to 93.8 mbpd.[5] The EIA puts 2014 supply at 91.76 mbpd and demand at 91.47 mbpd.[6] When supply exceeds demand, it is generally expected that OPEC in general and Saudi Arabia in particular would cut production to lift prices. John Kemp of Reuters offers a convincing explanation as to why Saudi Arabia has not acted according to this expectation. He argues that the Kingdom has no choice but to allow prices to drop below $90/bbl or even $ 80/bbl to curb shale drilling and investment in high cost production outside the OPEC.[7] High priced oil not only facilitates growth in shale production but it also encourages ‘conservation, efficiency and substitution’ as Kemp puts it. Kemp argues that allowing prices to fall is not a choice but a necessity as that will facilitate slower growth in shale and bigger increases in demand. The best cure for low prices is apparently lower prices.

Others blame the unwinding of a large speculative bubble that started developing after the financial crisis for the fall in crude prices. As pointed out by Jesse Colombo of Forbes, loose monetary policy encouraged large speculators to bet on hard assets like oil. The bubble was punctured by commercial hedgers who are seen to be more informed over physical supply and demand conditions.[8] Some also point out that oil prices were brought down by the end of the commodity super cycle that lasted for 12 years with China’s slow down.[9] The super cycle doubled investments, boosted production of oil and gas and doubled prices.

The fall in oil prices, if sustained, is expected to reduce the annual growth of India’s energy import bill from over 14% to less than 1.6% this year.[10] Going by the starry eyed reporting of the Economic Times ‘at a stroke the Prime Minister knocked $6.5 billion off the Government’s energy subsidy bill and handed a 6% discount on prices to truckers and drivers’. But this happy situation is unlikely to last very long. According to commentary by CSIS, an American Think Tank, the developments that drove the fall in crude prices carry seeds of future trouble. Under-investment in oil & gas production, instability in resource rich countries dependent on oil & gas revenue, delay/deterring of investment in shale drilling are all likely. All this could bring prices back to earlier levels above $100/bbl.[11] But experts like Fereidun Fesharaki, Chairman of Facts Global Energy prices are more pessimistic (or optimistic as some would see it) on oil prices. According to him, prices could drop to $60/bbl by the end of 2014 before they go up to $80/bbl sometime in 2015.[12]

This leads to the possibility of unravelling debt driving down oil prices. This would signal the beginning of the end of economic growth as some extreme pessimists predict. When global economic growth is in terminal decline, the price of oil must fall. Consequently consumption will fall and carbon emissions will reduce. Unfortunately no one, not even climate alarmists and renewable energy enthusiasts are likely to celebrate. The macho emperors of South Asia will not be an exception as their clock of bold reforms will be blown away by falling economic growth rates. As Fesharaki often points out, as far as oil prices are concerned there is a floor and there is a ceiling and breaking of either is not good news for anyone!

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES……………

The Twists and Turns of Indian Gas Pricing have Come to an End...for the Time being

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

A |

fter years of mulling over gas prices in India there has been a decision now, and that’s a very positive development, at least, since most potential investors shy away from risk and uncertainty as the devil avoids the holy water. Nonetheless, a negative connotation cannot be denied against the backdrop that the announced price hike so far provides only a small step forward towards market pricing and concomitantly bridging the gap between prices for domestic gas and pricier imported LNG, secondly more transparency is still pending (until the detailed formula is not published) and last but not least that it is falling behind the expectations of private gas production companies, which – in a way – is blasting the hope on higher production rates for the time being. Keeping in mind that the reform on natural gas pricing was politically and economically rather controversial and overdue, the new government has shown once more the will to act and to set examples for the improvement and development of India’s natural gas industry. As always, the devil is in the details, and it should therefore be expected that much work remains to be undertaken to satisfy all the stakeholders involved as well as for setting the scene for a sustainable development of the gas sector amid more and more globalised natural gas markets that depend on the interplay of supply and demand.

The long delayed decision on domestic gas pricing was taken by the Cabinet Committee on Economic Affairs (CCEA) and announced by finance minister Jaitley on Oct. 18th, 2014. The new pricing is built on a quite modified formula that has principally been proposed by the Rangarajan Committee (RC) first of all. It seems that not only the individual terms but also the algorithm and adjustment periods have been redefined. It may be assumed that one of the major objectives of this reform of gas pricing was to bring the absolute level of the formula driven gas price down. This could have been easily fulfilled, since the upward revision outcome will be considerably less than what it would have been according to RC formula, which would have doubled the former APM rate to a more or less $ 8.4 per unit in comparison to the fairly smooth present price rise of 33 % to $ 5.6/MMBtu. The new pricing formula will undoubtedly put a temporary end to this long lasting gas pricing issue and might improve market and therewith investor sentiment by removing policy uncertainty.

The initial speculation on whether the new gas price refers to the gross or net calorific has required a clarification from the Oil ministry, that has declared that the price of $ 5.6 /MMBtu will not be inflated on account of calorie value (which was said to would have resulted in a 10 % higher price at about $ 6.17/MMBtu). Nonetheless, since the gas price quotations in international trade and statistics are usually quoted in terms of gross calorific value GCV it should be worth considering an alignment to comply with international gas market standards since it is widely expected that India will rely more and more on LNG imports and cross-border trade interrelations in future. That would be a step forward in respect of transparency and trade facilitation, too.[13]

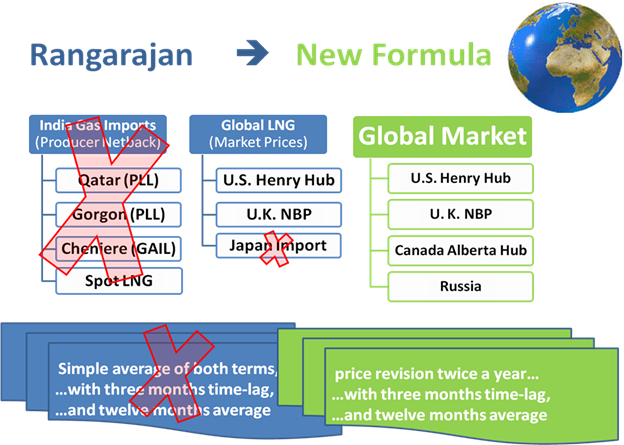

From all that has become known by now from media reports and CCEA press information, the new formula was derived from a combination of the formula that has been proposed by RC and recommendations of the committee of secretaries. The RC formula itself was based on a two-tiered concept and intended to mirror a world market price for natural gas (interpreted as an ‘arms-length’ competitive price for India). Arithmetically it was made up of the simple average of the weighted netback price assessment of all Indian LNG imports at the wellhead of the exporting countries and the weighted average of price assessments at gas trading points in the U.S., Europe and Japan.

The basic concept of the RC formula and the transition to the revised one is illustrated in Figure 1. Basically, all LNG bound price components have been wiped out in the revised formula, i.e. the Indian Gas imports (netbacks) as well as Japan import price. Interestingly enough, there is no domestic price component left over. In lieu thereof Canadian Alberta Hub price and Russian gas price has made its way into the formula. These prices are supposed to be matched and weighted with annual gas volumes consumed in the U.S. plus Mexico, in the EU plus FSU (w/o Russia) and in Russia. Transportation costs and treatment costs shall be deducted ($ 0.5/MMBtu total). The new price is destined to come into effect from November 1 and is intended to be revised every six months with a view to ensuring "stability in the market".

Figure 1: Transition of Rangarajan Price Formula Components to adapted Gas Price Formula

The new component referring to the Alberta gas price, which might actually be the AECO “C” spot price, can be considered not to be a heavyweight in the overall outcome of the formula: Alberta prices are typically slightly lower than Henry Hub notations, but actually follow the same patterns over time more or less. The volume weight is essentially rather low, too. With an assumed annual natural gas consumption of roughly 90 bcm in Canada this represents only a small fraction of the volumes that might be appointed for the American, Russian or European market. With respect to the Russian price it is not yet known, which exact price will be incorporated into the formula: this can either be a Gazprom long-term contract export price whatsoever (e.g. recorded at the German border) or a domestic price or any other price. Oil Minister Pradhan gave a hint on the expected Russian gas price level by annotating that it is around $ 4/MMBtu. However, it might turn out to be tricky to come up with a reliable and convincing concept according to a Russian “market” price. For the sake of clarity and transparency it should be a reliable and comprehensible price, preferably compiled or published by established data provider like Platts or Argus, for example.

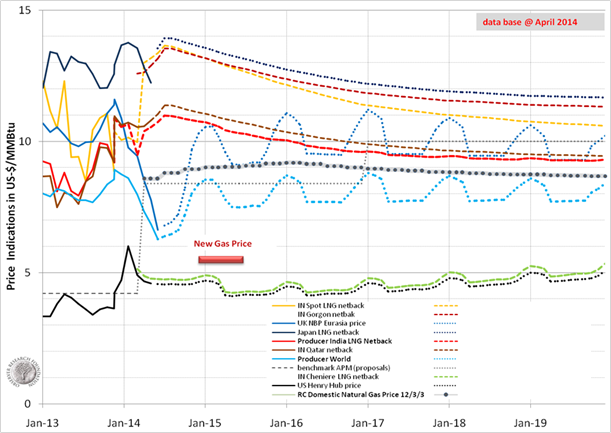

The overall effect of repacking the Formula has been a significant fall in the resulting price level compared to what the RC would have spit out. The price level of the components used in the RC formula is illustrated in Figure 2. The new gas price is some $ 3.5/MMBtu lower than the price that would have been constituted by the former formula and quite low in overall comparison. However, this is the result of replacing the highest price components against some very low benchmarks. Since one of the abrasive criticisms against the RC formula was that it had arbitrarily patched together some global gas price indications and LNG import netbacks to India and then declared the simple mean value as the gas price, now one might get this uncomfortable feeling that an intended value has been put together very arbitrarily by a targeted optimization of international gas prices and volumes. If the logic behind the pricing cannot be completely understood then the new price can be interpreted to be more of an administered price based on a formula than being a market driven price, especially if the formula stability is not trusted by the market participants.

Figure 2: Pricing Indications of RC Formula Terms in Comparison with New Gas Price Level

Source: Own calculations.

Note: Data used for forecast are based on oil and gas futures as of April 2014. LNG forecast are mainly linked to crude oil price and proxies. Historic data from Argus.

The price level move upwards is reasonable, at least according to the supply side. The recent history has shown that administered pricing in India has not achieved the desired results, since gas production in 2013 was more or less the same as it has been a decade ago. In future India will have to bridge the gap to international (LNG) prices more and more as the pressure of higher gas imports is expected to increase. For example, China, which is facing some similar structural gas market challenges, for this reason has forged ahead towards oil price indexation in recognition of the inefficiencies of its regulated pricing system and the adaption of low domestic prices in contrast to higher prices of surging imports via pipeline and LNG as well to mark-up gas prices to economic levels.

The future of incentives for FDIs into deep and ultra-deep natural gas exploration, which is said to partly require production costs of more than $ 10/MMBtu, is quite opaque since the government has said that a premium on price would be given to all new discoveries in ultra deep waters, deep water areas and high pressure temperature areas. However, this should be done in a fair and transparent manner to provide a level playing field and incentivise proper investment into costlier and riskier offshore exploration.

Another aspect that is crossing one’s mind and may have played a major role in the background is the fact that about 80 % of the additional revenue due to the price revision will go to government companies, and the government is expected to get additional revenue of around ` 3,800 crore annually with higher royalty, higher profit on petroleum and higher taxes. In this regard the government has stepped up efforts in the intended divestment of a 5 %‑ stake in ONGC, only two days after its pricing decision. It might certainly help the exchequer to attain a better valuation for its stake on the market, as the OGNC Chairman Sarraf has already declared that each gas price increase of one dollar will add ` 4,000 crore to its top line and another ` 2,350 crore on the bottom line. Consequently the stock exchange traders have hailed the state-run oil and gas companies such as ONGC on the trading day after the decision, whereas the value of private explorers such as Reliance Industries has slipped slightly. However, for private investors and potential international investors it might take a negative connotation with respect to the appraisal of the level playing field. In this regard it can be hoped that the move was not too short-sighted anyway, that evidence can be closely monitored over the next month as to how the Indian gas market will advance.

On the demand side and with regard to the impact on the end consumers, for sure, every price move upwards will worsen the competitive position of natural gas and price some customers out of the market. Especially in the power sector gas might lose out even more against cheaper coal (as long as pollution costs are not considered). However, in the fertiliser industry the government has announced to provide additional subsidies to make up for the enhanced gas price. Consequently the increase in gas prices will inflate the government’s subsidy bill, which is going to be settled with the additional revenue for the exchequer. In a way one spins around to the disadvantage of the other gas users and taxpayers who will have to carry the burden.

A comprehensive gas price reform still seems to be overdue, which would comprise a proper pricing structure to incentivise upstream development as well as the necessary enlargement of required infrastructure on the one hand, and to cope with global market requirements on the other hand. Competitive fuel pricing as an interim solution towards gas-on-gas competition might be an alternative option worth considering. Forging ahead to a more efficient market approach stringently necessitates a gradual tidying up with market distortions such as massive subsidies or prioritising customer segments. However, establishing a more market-oriented path will be a lengthy and bitter process since it involves additional steps even in associated fuel and commodity markets. Price hikes for customers seem to be a safe bet as current prices are below international price levels and won’t attract upstream investors. Anyhow, the current gas price reform fits into Prime Minister Modi’s overall modernisation scheme that recently has been described by Gurcharan Das in the Economist: “Rather than being mad about markets, he says, Mr Modi is a strong-willed moderniser, a man who thinks a capable bureaucracy can fix much of what ails India.”

References

CCEA (Oct 18th, 2014), Revision on Domestic Gas Prices, Press Information Bureau

Government of India, Cabinet Committee on Economic Affairs (CCEA)

Bloomberg (Oct 20th, 2014), Modi Uses Oil Price Slump to Ease Curbs Deterring Chevron, By Rakteem Katakey and Debjit Chakraborty Oct 20, 2014 4:44 PM GMT+0530, http://www.bloomberg.com/news/2014-10-18/modi-frees-diesel-prices-to-curb-subsidies-budget-gap.html

The Business Standard (Oct 18th, 2014), The new domestic gas pricing policy approved, Capital Market October 18, 2014 Last Updated at 21:02 IST, http://www.business-standard.com/article/news-cm/the-new-domestic-gas-pricing-policy-approved-114102000344_1.html

The Economic Times (Oct 20th, 2014), ONGC cheers move to hike gas price, private players unhappy, By ET Bureau | 20 Oct, 2014, 07.04AM IST, http://economictimes.indiatimes.com/industry/energy/oil-gas/ongc-cheers-move-to-hike-gas-price-private-players-unhappy/articleshow/44883205.cms

The Economic Times (Oct 20th, 2014), ONGC, HPCL rally up to 9% post gas price hike, diesel deregulation; RIL in red, By ECONOMICTIMES.COM | 20 Oct, 2014, 03.40PM IST, http://economictimes.indiatimes.com/markets/stocks/news/ongc-hpcl-rally-upto-9-post-gas-price-hike-diesel-deregulation-ril-in-red/articleshow/44883887.cms

The Economist (2014), Yes, prime minister, Oct 18th 2014, http://www.economist.com/news/asia/21625857-more-moderniser-market-reformer-narendra-modi-relies-his-bureaucrats-yes-prime-minister

The Financial Express (Oct 18th, 2014), Govt to approve new domestic gas pricing policy today, Written by Amitav Ranjan | New Delhi | Posted: October 18, 2014 6:10 pm | Updated: October 18, 2014 6:18 pm, http://indianexpress.com/article/business/business-others/govt-to-approve-new-domestic-gas-pricing-policy-today

The Financial Express (Oct 19th, 2014), How Narendra Modi govt worked out gas pricing formula, dumped Rangarajan; 6 questions, Siddhartha P Saikia | New Delhi | Updated: Oct 19 2014, 09:52 IST, http://www.financialexpress.com/news/how-narendra-modi-govt-worked-out-gas-pricing-formula-dumped-rangarajan-6-questions/1299698

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Fluctuations in Retail Diesel and Petrol Prices for 2013-14

Akhilesh Sati, Observer Research Foundation

|

Diesel* |

Petrol* |

||

|

No. of Days |

INR/Litre |

No. of Days |

INR/Litre |

|

15 |

48.63 |

1 |

68.31 |

|

14 |

67.29 |

||

|

25 |

48.67 |

15 |

66.09 |

|

31 |

63.09 |

||

|

21 |

49.69 |

||

|

30 |

50.25 |

15 |

63.99 |

|

13 |

66.39 |

||

|

15 |

68.58 |

||

|

1 |

50.26 |

||

|

30 |

50.84 |

||

|

18 |

70.44 |

||

|

31 |

51.4 |

31 |

71.28 |

|

30 |

51.97 |

13 |

74.1 |

|

17 |

76.06 |

||

|

31 |

52.54 |

31 |

72.4 |

|

30 |

53.1 |

50 |

71.02 |

|

20 |

53.67 |

||

|

14 |

53.78 |

14 |

71.52 |

|

28 |

54.34 |

56 |

72.43 |

|

28 |

54.91 |

||

|

31 |

55.48 |

31 |

73.16 |

Avg. Price for Petrol and Diesel (at Delhi)

*RSPs are for Delhi

Source: Compiled from the Data from Petroleum Planning and Analysis Cell.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC to explore Bay for oil, gas deposits

October 19, 2014. Oil and Natural Gas Corporation (ONGC) in collaboration with Russian experts is planning to explore petroleum in the bed of Bay of Bengal near Rameswaram, said BS Josyulu, ED, ONGC (Chennai). Speaking on the sidelines of a workshop organised at a college, he said that a survey of sub-surface imaging was being done in the Bay using Ocean Bottom Cable (OBC) technology. The experts were probing the presence of three major gas fields through offshore extension mapping. The workshop aims at teaching students about the latest technologies in the field of oil exploration, skills and industrial requirements, apart from developing their employability. (www.newindianexpress.com)

ONGC Cancels Bengal CBM Block Sale to GEECL

October 15, 2014. Oil and Natural Gas Corporation (ONGC) has cancelled its agreement with Great Eastern Energy Corp (GEECL) to divest 25% farm-in right to its Ranigunj CBM block in West Bengal. Coal India, which is also partner in the block, is believed to have prevailed upon ONGC to cancel the stake sale, arguing that it is a competent authority to develop and operate the block. ONGC has 74 percent stake while Coal India owns the rest. Great Eastern and also other parties like Dart Energy and Deep Industries were selected in May 2013 as successful bidders for three CBM blocks of ONGC. (www.naturalgasasia.com)

Downstream………….

Scrapping of diesel price controls opens up retail market for private refiners

October 20, 2014. India's scrapping of diesel price controls opens the door for private sector refiners to return to a domestic retail market from which they have been excluded for years because they could not compete with state firms. But, before they rush to reopen old filling stations that have been gathering dust or used to store grain, they want to make sure that Prime Minister Narendra Modi's commitment to free markets will survive any serious spike in oil prices. Reliance Industries plans to revive its old business cautiously, while Total of France will allow Mangalore Refinery and Petrochemicals Ltd to sell fuel through its modest distribution network. Modi lifted diesel controls, taking advantage of a 25 per cent fall in global oil prices since June to make the move. At a stroke, he knocked $6.5 billion off the government's energy subsidy bill, while handing a 6 per cent discount to drivers and truckers who had grown fed up with monthly hikes in regulated prices. Diesel makes up nearly half of fuel demand in Asia's No.3 economy. Consumption is set to rise as Modi seeks to launch an investment-led economic recovery. The top three state refiners, Indian Oil Corp (IOC), Bharat Petroleum Corp and Hindustan Petroleum Corp, between them sell nearly all of the of the 70 million tonnes of diesel consumed annually in India.

Reliance, operator of the world's biggest refining complex at Jamnagar in the western state of Gujarat, plans to restart about 1,500 of its filling stations. The stations have been shut since 2008, as global oil prices surged towards $150 a barrel and the government's subsidy to state fuel retailers knocked privately-owned retailers out of the market. Reliance will not make significant investments to expand its fuel retail operations and will wait for "clarity and stability" of policy. Royal Dutch Shell, which has a licence to run 2,000 filling stations in India but operates only 78, has no plans to expand retail operations in India following the diesel deregulation.

Total, Europe's biggest refiner, is one of the few companies to see retail opportunities in India. It is in talks with the Mangalore Refinery Petrochemical Ltd (MRPL) to boost its presence. The oil ministry said MRPL's proposal to sell fuel through Total's network would be cleared in 10 to 15 days. In its first foray into the domestic market in 2005, Reliance quickly won market share with modern filling stations and slick loyalty schemes. This time around, the state retailers are not worrying - yet. Private refiners sell 700,000-800,000 tonnes per month of fuel, mainly diesel, to state refiners. It will take as much as two years for them to build up their retail infrastructure so that they can market these volumes directly, IOC said. (economictimes.indiatimes.com)

Transportation / Trade…………

India to pay Iran $900 mn in crude oil dues

October 17, 2014. India will pay Iran $900 million in two tranches to clear part of the past dues for crude oil it buys from the Persian Gulf nation. This payment will be on top of $1.65 billion it had paid in June/July to clear more than one-third of over $4 billion in dues that had accumulated. Indian refiners - Mangalore Refinery and Petrochemicals Ltd (MRPL), Essar Oil, Indian Oil Corp (IOC) and Hindustan Petroleum Corp Ltd (HPCL) will make payment of first installment of $400 million. The remaining $500 million will be paid before November 24. (economictimes.indiatimes.com)

Hiranandani Group awards contract to Sener-Afcons for LNG facility

October 16, 2014. Real estate firm Hiranandani Group has awarded a contract to Sener-Afcons J.V. for an 8 million tonnes per annum LNG import, storage and regasifications terminal at Jaigadh port at Ratnagiri in Maharashtra. This will be the first truly merchant terminal in India which will function exclusively on a tolling model. The Front End Engineering and Design (FEED) of the project was carried out by Hyundai Engineering and reviewed by WorleyParsons.

Bids for the offshore supplies and the EPC works were invited from international and domestic EPC companies in August 2013 and were evaluated by the H-Energy Gateway Private limited (HEGPL), a Hiranandani Group Company, project team with the support of HR Wallingford and WorleyParsons, its technical advisors. The facility would be on its way to commissioning in 2018. (economictimes.indiatimes.com)

Gujarat industries accuse GAIL of taking arbitrary action

October 15, 2014. Facing shutdown due to drastic cut in natural gas supplies, over two dozen small industries of South Gujarat have accused GAIL India Ltd of selectively and arbitrarily taking action that is in contravention of stated policy. GAIL slashed gas supplies to 30 small industries in South Gujarat to meet fuel requirement of CNG and piped cooking gas supplies in cities. South Gujarat industries including Pragati Glass, Piramal Glass, Haldyn Glass, Gujarat Borosil and Savana Ceramics are facing closure as they cannot afford imported LNG that costs four times the domestic gas price of USD 4.2 per million British thermal unit. The total allocation to 30 small consumers in South Gujarat put together is merely 0.6 million standard cubic meters per day (mmscmd). The proposed cut is being forced to make about 0.35 mmscmd available for PNG/CNG use. (economictimes.indiatimes.com)

GAIL skirts Iran undersea pipeline deal for fear of US ire

October 15, 2014. Teheran's troubled ties with the West continue to dog India's efforts to secure energy supplies. In the latest instance, GAIL India has expressed unwillingness to enter into a non-binding framework agreement with NIGEC (National Iranian Gas Exports Company) for buying gas through a transnational undersea pipeline for fear of losing access to international financing. The oil ministry had authorized GAIL as the nodal agency for pursuing the project, being promoted by SAGE (South Asia Gas Enterprise), jointly promoted by a Delhi-based group and UK firm, and has the blessings of governments of Oman and Iran. India formally discussed with foreign ministers of Oman and Iran in February the possibility of joining the project. SAGE proposed signing a three-way framework agreement among gas seller NIGEC, transporter SAGE and Indian gas buyer GAIL, IndianOil and Gujarat State Petroleum Corporation. Since the agreement involved an Iranian entity, GAIL sought opinion on the impact of American sanctions laws from a US law firm, Akin Gump Strauss Hauer & Feld LLP. The legal opinion broadly said signing a non-binding agreement would not attract any US or UN sanctions. But, it could lead to blocking of GAIL's access to international commercial or financial services and capital markets in its global business ventures.

GAIL has substantial investments in US shale gas and LNG facilities. It also plans to tap global funding and technology for its ventures. That's why the company has told the ministry it may not be possible to sign the agreement till such time a clear position emerges on US sanctions on Iran. The 1,400-km SAGE pipeline is an ambitious multi-billion dollar project to wheel gas from Iran, Oman and Qatar. The project has been in the works for several years and has been touted as an alternative to the overland energy lifeline from Iran via Pakistan. The overland pipeline from Iran via Pakistan has been in the freezer since Iran came under US sanctions. The official position is that discussions are still on. Even before the sanctions came in, the overland pipeline had been dogged by India's apprehensions over the physical security of the stretch of pipeline passing through Pakistan. The SAGE pipeline is said to have addressed those concerns. (economictimes.indiatimes.com)

Policy / Performance………

No premium pricing for undeveloped natural gas fields: Oil Minister

October 21, 2014. Deep sea natural gas fields that have already been discovered but not developed so far will not be given any premium on gas pricing but new finds in challenging terrains can charge a price higher than $5.61 per unit approved by the Cabinet, Oil Minister Dharmendra Pradhan said. The government had announced incentives for gas discovered in difficult, costly areas. Analysts had interpreted this as a declaration that fields discovered in deep-sea regions, but not yet developed, would also be able to charge a premium. The minister said that the price of $5.61 per unit will not be inflated on account of calorie value. Some industry executives had argued that the actual price that customers pay would be 11 per cent higher than the announced rate of $5.61 per unit because natural gas also contains moisture for which factories will not pay. Technically, these are called gross calorie value and net calorie value. He said that in terms of gross calorie value, the approved price is $5.05 per unit, which would increase to $5.61 per unit on a net basis.

The gas price is based on a new formula that excludes costly liquefied natural gas (LNG) prices from the calculation, making the increase significantly lower than the price from the Rangarajan formula, which would have doubled the rate to $8.4 per unit and on NCV basis, price would have been $9.3 per unit. While announcing the new gas price, the Cabinet also settled the contentious issue of GCV and NCV. The controversy over the heat value emerged during the previous UPA government when Reliance Industries asked its gas consumers to renew gas sale and purchase agreements (GSPAs) with new terms, which included calculation of gas price at GCV basis. Fertiliser companies raised objection and said it would accept the GCV rate only if the oil ministry specified it in writing because it would have raised urea subsidy. The new price has disappointed private gas producers because they were expecting a price between $7 per unit and $8 per unit. (economictimes.indiatimes.com)

Govt moves closer to selling stake in oil firm ONGC

October 21, 2014. The government has stepped up efforts to sell 5% of its stake in Oil and Natural Gas Corporation (ONGC), the country's biggest explorer, two days after it lifted state control on diesel prices and raised prices of natural gas. The government is hoping decisions will help it get a better valuation for its stake in ONGC as diesel deregulation will reduce the company's subsidy burden while it will get a higher price for its gas. Stake sale in ONGC may take place in November. The disinvestment department has already selected five merchant bankers—Citigroup, HSBC Securities, UBS Securities, ICICI Securities and Kotak Mahindra Capital—for managing the stake sale. (economictimes.indiatimes.com)

Real gas price for companies to be $6.2 per unit

October 20, 2014. Industrial consumers will actually pay about $6.17 per unit for domestic gas instead of $5.6 announced by the government because of changed parameter for determining heating value in the new formula. The government announced a new pricing formula on the basis of recommendations of a panel of secretaries. The new formula made several changes in the mechanism suggested by a panel under C Rangarajan that was approved by the UPA government.

The key change in the new formula is a shift from net calorific value (NCV) to gross calorific value (GCV) for calculating the price for each unit of gas. Calorific value is the quantity of heat produced by burning one unit of fuel at constant pressure and at zero-degree temperature. Gross calorific value assumes that moisture present in fuel turns into vapour, which adds to heating during combustion. Net calorific value is the actual heating users get and assumes that there is heat loss from moisture turning into vapour during combustion. As a result, the heating property under GCV is higher than NCV and entails a 10% lower price for each unit of fuel.

The existing gas price of $4.2 per unit is on the basis of NCV. The gas sale purchase agreements between sellers and buyers specify the price on the basis NCV. Now that the government has changed the heat value parameter to GCV, the actual price on the ground would be higher by 10%, or $6.17 per unit, marking nearly 45% increase against 33% indicated in $5.61 announced by the government. The government was looking at a price of $5.5-6.8 per unit. Gas sellers are expected to change the pertinent terms in tune with the new formula. The fact is that even under the GCV regime, the new price would be much lower than $8.4, or double the present price, estimated on the basis of Rangarajan formula.

Oil minister Dharmendra Pradhan had said PM Narendra Modi made it clear that common man should be protected from any major impact from the gas price hike. Pradhan said CNG and PNG suppliers (such as Indraprastha Gas Delhi) would see how much they can absorb, gas transporter GAIL would look at pruning transportation charge wherever possible and states would be urged to lower taxes to avoid any sharp rise in CNG or PNG prices. The new price appears acceptable to power and fertilizer industries also. Though the cost of power from gas-fired stations is estimated to rise by 45-55 paise per unit, the impact on overall tariffs would be minimal since such type of plants account for about 7% of generation capacity. (economictimes.indiatimes.com)

Gas price hike to add ` 19.5 bn to ONGC profits this fiscal

October 19, 2014. Oil and Natural Gas Corp (ONGC) will rake in about ` 1,950 crore in additional profit this fiscal from the 46 per cent rise in natural gas prices announced by the government. After postponing three times, the government approved a revised formula of pricing almost all domestically produced natural gas from November 1. The current price of $4.2 per million British thermal unit (mmBtu) will rise to $6.17 per mmBtu on a like-to-like basis.

Finance Minister Arun Jaitley said the price from November 1 will be $5.61 per mmBtu on heat value the fuel will generate on gross calorific value (GCV) basis. But the current $4.2 per mmBtu rate is on net calorific value (NCV) basis, which is roughly 10 per more than heat value on GCV basis. In GCV terms, the current price comes to $3.8 per mmBtu. Using GCV methodology announced by Jaitley, the price has gone up from $3.8 to $5.61 per mmBtu, over 46 per cent rise. If compared on NCV terms, the price will rise from $4.2 to $6.17 per mmBtu, a 46 per rise. ONGC said the decision is a positive for the company as it will help monetise some of its small and marginal gas discoveries. An almost $2 increase in gas price will result in ONGC net profit going up by about ` 4,700 crore on an annualised basis. For the five months of current fiscal, ONGC will stand to benefit about ` 1,950 crore. (economictimes.indiatimes.com)

RIL may not gain from the gas price hike: Analysts

October 19, 2014. The Centre's move to increase natural gas prices to $5.61 per million British thermal units (mmBtu) from November 1 would be a negative for Reliance Industries Ltd (RIL), analysts said, as RIL would continue to get the current rate of $4.2 till it made good the shortfall in output from its KG-D6 block. Last year, RIL had secured the government's approval to invest $3.18 billion for production at D-34. D-34, or the R-cluster, comprises four discoveries - D-29, 30, 31 and 34. Of these, D-34 has been declared commercially viable so far. JPMorgan's Asia Pacific Equity Research analysts Samuel Lee and Neil Gupte, in a report on RIL, had said they expected gas prices to rise in a staggered fashion, rather than a large one-time increase.

In the past, RIL and its partners, BP Plc and Niko Resources, have reiterated fresh investment in new fields will not be viable at a price lower than $8.4 per mBtu. RIL and its partners planned to produce about 13 million standard cubic metres a day of gas for 13 years from the D-34 discovery in the KG-D6 block, by 2017-18. (www.rediff.com)

Diesel deregulation to benefit consumers: Essar Oil

October 18, 2014. The government's decision to deregulate diesel will be advantageous for consumers, Essar Oil said. Diesel deregulation will also bring the private oil marketing company (OMC) retail network into system. This will increase competition, benefiting the end consumer, Essar Oil said. The decision has come at a time when global crude prices have been receding. (economictimes.indiatimes.com)

New gas price every six months on the basis of global rates

October 18, 2014. The government has decided to increase prices of domestically produced natural gas from the existing $4.2 per mBtu to $5.61 per mBtu. The new price, based on the recommendations of a Committee of Secretaries (CoS) that reviewed the UPA government's gas pricing guidelines of January 2013, would lead to an impact on prices of power, fertilisers, CNG and PNG consumers. The government will get additional revenue of ` 3,800 crore annually. The new price will be determined on Gross Calorific Value (GCV) basis and reviewed every six months against the Rangarajan committee's recommendation of annual revisions. The first price would be determined on the basis of global prices prevailing between July 2013 and June 30, 2014. This would come into effect from November 2014, and would be valid till March 2015. The price would then be revised for the next six months ending September 2015 on the basis of prices prevalent between January 2014 and December, 2014. The prices would be announced 15 days in advance of the half year. (www.business-standard.com)

Reliance Industries' credit metrics to remain stable over 12 months: Moody's

October 16, 2014. Moody's Investors Services said Reliance Industries' credit metrics will remain stable over the next 12 months on the back of strong earnings contribution across the refining and petrochemical segments. RIL results for the quarter ended September 30 were largely stable on contributions from the downstream refining and marketing segment and a modest improvement in the petrochemicals business, which more than offset the continued weak results from the upstream oil and gas segment, Moody's said.

Moody's report said that the firm's refining business should improve over the next 2-3 years, as the company focuses on improving its yield pattern. Moody's report said that RIL's downstream refining and marketing segment is its key earnings contributor, reporting stable results in 2Q despite continued softness in regional refining margins. Moody's anticipated a $400 million revenue increase for RIL if prices had risen on April 1, 2014. (economictimes.indiatimes.com)

The current scenario in India’s natural gas market

October 15, 2014. According to EY, India’s expanding economy and growing population have led to increased consumption of primary energy resources such as coal, oil and natural gas in the country. In line with this, its primary energy consumption grew at a compounded annual growth rate (CAGR) of 6% to 563.5 million t of oil equivalent (toe) in 2012 from 420.1 million toe in 2007. The share of natural gas in its primary energy mix increased marginally from 8% in 2008 to 8.7% in 2012. This is fairly low, compared to the global average of 24%, primarily due to supply side constraints. Furthermore, in terms on individual consumption, India’s natural gas consumption of 44 m3 per capita is far behind the global average of 470 m3 per person.

Despite low gas consumption relative to global trends, India’s natural gas market is nevertheless seeing a supply deficit, primarily due to low domestic production and an inadequate transmission and distribution infrastructure. According to EY, domestic gas production received a significant impetus with commencement of production at the KG-D6 field, located in the country’s east coast in 2009, however the field’s output has steadily declined and has hit a trough of 12 million m3/d in the third quarter of 2014. According to Reliance Industries Ltd (RIL), the fall in KG-D6’s production is mainly due to geological complexity and a natural decline in the fields. The decline in most of the country’s ageing fields has further compounded the supply deficit. (www.energyglobal.com)

[NATIONAL: POWER]

Generation……………

No shutdown of power plant: DVC

October 21, 2014. Damodar Valley Corporation (DVC) denied reports that it had taken a decision to permanently shut down any of its power plants. Some reports suggested that the DVC authority had decided to shut down the Durgapur Thermal Power Station (DTPS) and the Bokaro Thermal Power Station (BTPS).

The 140 MW unit of the DTPS was set up in December, 1966 and the second unit of 210 MW was set up in September, 1982. It employs some 900 people at the Durgapur units. The DVC currently has an installed capacity of 6357.2 MW. (economictimes.indiatimes.com)

Srisailam power generation fuels tension between Andhra, Telangana

October 19, 2014. Power generation at the Srisailam hydroelectric power station has become the latest bone of contention between Telangana and Andhra Pradesh (AP), already tangled in various issues of power sharing. It all began with a reported request by AP to Telangana to stop the generation at Srisailam left bank power station, in view of the future requirements of AP.

AP Chief Minister N.Chandrababu Naidu reportedly directed the authorities to stop generation at the Right Bank power station, in view of the drinking water requirements of Rayalaseema region. This order came after an MP from Rayalaseema had registered his protest over the unrestrained power generation on both sides. However, Telangana Irrigation Minister T.Harish Rao categorically denied any request from AP, and said there is no question of stalling the power generation from Left Bank, in view of the hardships faced by the Telangana farmers. (www.thehindu.com)

Kiren Rijiju against big power projects, favours 300-500 MW projects

October 17, 2014. Union Minister of State for Home Kiren Rijiju said he is "traditionally" against construction of big dams in North East and favoured smaller ones with 300-500 MW capacities. He supported construction of smaller or mid-level projects in the range of 300 MW or 500 MW capacities in North East. (economictimes.indiatimes.com)

BHEL commissions 600 MW thermal unit in MP

October 16, 2014. State-run power equipment maker BHEL said it has operationalised a 600 MW thermal unit in Madhya Pradesh (MP). The first unit at the same power project was commissioned by BHEL in November, 2013. BHEL's scope of work includes design, engineering and commissioning of project. The company has a share of more than 90 per cent in the thermal generating capacity of the state utility in Madhya Pradesh. BHEL is executing 1x500 MW Vindhyachal and 2x800 MW Gadarwara coal based projects of NTPC in Madhya Pradesh. (economictimes.indiatimes.com)

Adani, Jindal Power, Sterlite and GMR pull out of UMPPs race

October 15, 2014. Adani, Jindal Power, Sterlite and GMR have pulled out of the race for ultra mega power projects (UMPPs) in Odisha and Tamil Nadu, leaving only NTPC in the fray for the proposed 4,000 MW size plants. Only NTPC is left in the fray now for these proposed plants. Power Finance Corporation (PFC) is the nodal agency for UMPPs in the country. For the Odisha UMPP, NTPC, NHPC, Tata, Adani, JSW Energy, Jindal Power, Sterlite, CLP and L&T were among the pre-qualified firms while for the Cheyyur (Tamil Nadu) UMPP, NTPC, Adani, CLP, GMR, Jindal, JSW Energy, Sterlite, L&T were among the pre-qualified parties. Odisha UMPP is a pit-head power project. Based on domestic coal to be sourced from allocated captive coal blocks, it is expected to cost around ` 25,000 crore. The Cheyyur UMPP is a coastal power project, based on imported coal, with an expected investment of about ` 24,200 crore.

The preliminary bids for these projects were invited, after the government revised the existing Standard Bidding Documents (SBDs). Under the revised norms, any escalation in cost of fuel will be passed on to the consumer as higher tariff and the companies executing projects will have to mandatorily source equipment from domestic manufacturers. An UMPP is a thermal power project of at least 4,000 MW capacity. So far, four UMPPs have been awarded. Of this, Sasan (Madhya Pradesh), Krishnapatnam (Andhra Pradesh) and Tilaiya (Jharkhand) have been bagged by Reliance Power. Tata Power is operating the Mundra UMPP in Gujarat. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

BGR Energy secures ` 2.5 bn order

October 20, 2014. BGR Energy Systems Limited, a leading EPC and BoP company has received orders worth ` 250 crore in the electrical sub-stations segment of its Electrical Projects Divison (EPD). Chennai-based BGR Energy's EPD have secured three Substation orders from Tamil Nadu Transmission Corporation Ltd., for Establishment of 230KV AIS Substation at Puraisai, Villupuram, 110KV GIS Substation at Thirumangalam South, 400/230-110 KV AIS substation with all associated equipment, systems and civil works at Palavadi in Dharmapuri district. All orders are on Total Turnkey basis. Besides the new orders, Electrical projects division is currently executing Main Plant Electrical Systems package (including nuclear island electricals) for 4x 700 MW (PHWR) for Nuclear Power Corporation of India Ltd (NPCIL) and 220 KV and 400 KV Air Insulated Substation works. (www.business-standard.com)

CIL signs 162 FSAs with power plants so far

October 19, 2014. Coal India Ltd (CIL) has so far signed 162 fuel supply agreements (FSAs) with power plants. The government had earlier directed the coal major to sign supply pacts with power projects of 78,000 MW capacity. As many as 172 FSAs are to signed in this regard. The remaining fuel supply pacts could not be signed as some of power producers are yet to achieve milestones like forest clearances. The coal ministry had earlier said that CIL was yet to enter into fuel supply pacts with some of the power units as issues like change in ownership and extension of coal supplies were still being examined by it.

Two deadlines set for the signing of FSAs by CIL with the power producers could not be adhered to. The government had set the deadline of August 31, 2013 for signing of FSAs, which could not be met. The second deadline was set for September, last year. The company, which accounts for 80% of the domestic coal production, dispatched 353.83 million tonnes (MT) of coal to the power sector in FY2014. CIL produced 462 MT in the last fiscal. It targets an output of 507 MT in the current fiscal. (www.business-standard.com)

Power grid gets no-objection for land in Jharkhand

October 18, 2014. Jharkhand Agriculture Minister Banna Gupta said the agriculture department has issued a no-objection certificate in transferring six acres of land to Jharkhand State Electricity Board (JSEB) to set up a 100 MW power grid in Baliguma. The construction work of the power grid, which was pending since 2010 despite approval, will start within a month time, Gupta said. The power grid would be set up at a cost of about ` 43 crores, he said claiming that the capacity of the proposed power grid could be expanded to 300 MW in future. (economictimes.indiatimes.com)

Talks begin on power grid connecting India with neighbours

October 17, 2014. Government said initial discussions have started for setting up an integrated power transmission grid connecting India with its neighbouring nations including Bhutan, Bangladesh and Pakistan. Power and Coal Minister Piyush Goyal said that hydroelectric power generated in North East India could be transported via Bangladesh, India and Pakistan, on to Afghanistan, or offshore wind projects could be set up in Sri Lanka's coastal borders to power Pakistan or Nepal. Goyal said this will not only strengthen the economic ties among the SAARC nations but also deepens the people to people relationship. The Power Minister further stated that economic sustainability of SAARC region is based on energy security as 30 per cent of the region's energy demands are met through imports.

In order to improve the situation, Goyal advocated a three pronged strategy by leveraging -- harnessing conventional and renewable sources of energy, building inter-connected transmissions grids and forging efficacious power trading agreements. SAARC is a robust market but constraints are primarily on the supply side as there are pockets where deficits persist, Goyal said. Goyal said that the impact of electricity on human lives is profound ranging from healthcare to education to employment opportunities. He called upon all member countries to take this as a challenge and we all should commit ourselves for pushing up household per capita consumption. For rapid progress and prosperity of the SAARC region, it is imperative that the power sector be expanded to ensure universal access to electricity in the region, Goyal said. (economictimes.indiatimes.com)

CESC to help AP restore power

October 16, 2014. Mysore-headquartered Chamundeswari Electricity Supply Company (CESC) has taken up the restoration of power supply in the hurricane Hudhud-affected areas of Andhra Pradesh (AP). It has supplied 32 capacity distribution transformers, extending its help in restoring power supply to Visakapatnam and other affected areas. CESC said more staff will be deputed depending upon requirement for speedy restoration. (www.business-standard.com)

NTPC firming up plans to enter into power distribution business

October 16, 2014. NTPC is firming up plans to enter power distribution, an area the state-run company has mostly stayed away from so far despite producing more than a quarter of India's total electricity output. It plans to bid for distribution rights in cities that may open up the segment to the private sector. Just a handful of Indian cities at present have private distributors, all in joint ventures with state utilities, a model that NTPC too is considering. NTPC will venture into distribution through its wholly owned subsidiary, NTPC Electric Supply Co, which currently provides turnkey execution of transmission projects, project monitoring, third-party quality inspection and consultancy.

In fact, the company has some experience in distribution. It has an equally owned joint venture with the Kerala Industrial Infrastructure Development Corporation to supply power at the state agency's industrial parks. To begin with, it plans to appoint experts and engage professionals who would advise the company on bidding processes that are currently on or are in the offing. The aim is to win circles that will be profitable. The distribution sector in the country is dominated by state-owned distribution companies or state electricity boards as distribution licensees. But several states have now opened up the sector and are already inviting private companies to take up distribution in cities.

The World Bank in a recent report said India's power distribution sector needed sweeping reforms if it is to bring back the country to a high growth trajectory and meet its goal of expanding access to electricity to all by 2019. The study has identified electricity distribution to the end consumer as the weak link in the sector. The report recommended freeing utilities and regulators from external interference, increasing accountability and enhancing competition in the sector to move it to a higher level of service delivery. The power sector's total accumulated losses were $25 billion in 2011. These losses are concentrated among distributors and bundled utilities — state electricity boards and state power departments, the report said. (economictimes.indiatimes.com)

Alstom T&D wins ` 1.3 bn contract from PGCIL

October 15, 2014. Alstom T&D India has secured a Rs 138 crore (approximately Euro 17 million) contract from Power Grid Corporation of India Limited (PGCIL) to supply transformers and reactors for the expansion of 400/220 kV grid substations across southern India. The project is part of Power Grid’s System Strengthening Scheme to boost power handling capacity of substations, and stabilise the transmission infrastructure in southern India. Under this new contract, Alstom will supply six units of 400/220 kV, 500 MVA transformers and two units of 420 kV, 125 MVAr shunt reactors. All equipment will be supplied from Alstom T&D India’s manufacturing facilities across the country.

This is Alstom’s second win to strengthen the country’s transmission infrastructure under the System Strengthening Scheme. The first power transmission reinforcement contract was awarded in July 2014 to expand 400/200 kV grid substations across eastern India. (www.business-standard.com)

Policy / Performance………….

Nepal, India sign historic PTA

October 21, 2014. India and Nepal inked a historic Power Trade Agreement (PTA), allowing exchange of electricity and opening up new vistas of cooperation in the hydropower sector. During the visit of Prime Minister Narendra Modi to Nepal in August, the two sides had agreed to sign the agreement that would allow exchange of electricity generated from hydel projects in Nepal. A draft agreement of the PTA was prepared by the two governments. Nepalese Secretary in the Ministry of Energy Rrajendra Kishore Kshatra and Energy Secretary of India Pradeep Kumar Sinha inked the agreement at a function held at the Prime Minister's Office.

The joint group will sit every six months and take up issues not only pertaining to the existing cooperation in power sector between the two countries but will also explore and identify new areas of cooperation. Nepalese authorities and GMR group of India last month signed Project Development Agreement to construct 900 MW Upper Karnali Project in the presence of Union Home Minister Rajnath Singh. (economictimes.indiatimes.com)

2-day power holiday to continue in Telangana

October 21, 2014. The weekly two-day power holiday enforced for the industrial sector by the Telangana government would continue till November first week owing to the continued agriculture demand, according to the Federation of Andhra Pradesh Chambers of Commerce and Industry (FAPCCI). FAPCCI has sought relief from the ongoing power holidays as small units cannot afford the backup diesel generation sets and also they do not have the open access facility unlike the large industries. (www.business-standard.com)

Coal auction rules a positive: India Inc

October 21, 2014. Companies reacted positively to the new coal auction rules announced by the Narendra Modi government. They said it would help them to plan future investments properly and save those already made in the coal, power and cement sectors. Chief executive officers (CEOs) in the sectors concerned say a lot of uncertainty was created with the Supreme Court (SC) order cancelling coal block allotments made over the past 20 years. They say the new rules are fair to all and to the state governments, which will get royalties from the mines to be auctioned in future. The government has also decided to keep foreign companies out of the auction process, good news for Indian ones. Among the big beneficiaries of the new rules will be the Adani Group, the country's largest power sector company. The Ahmedabad-based group's coal mines for power projects in Maharashtra were cancelled by the SC. (www.business-standard.com)

Revival plan on cards for gas-based power plants

October 20, 2014. After the big-ticket oil sector reforms, the government is turning to the power sector to help banks. Developers of about 16,000 MW stranded gas-based power plants will be able to service their debt, if a joint proposal of the power and oil ministries is approved by the Union Cabinet. The government proposes to increase the fixed cost of the gas-based plants at ` 1.10 per unit of electricity while keeping the tariff at ` 5.50 per unit, which will allow the operating companies to meet their financial obligations. This will prevent the idling projects, put up at an investment of ` 64,000 crore, from turning non-performing assets. The proposal will benefit power plants of Lanco Infratech, Essar Power, Reliance Power, GVK Group and GMR Energy, among others. The fixed cost cap has been raised from ` 0.85 per unit planned earlier by the two ministries. The proposal has been made after major power companies conveyed their willingness to the government to forego part of their fixed costs.

The fixed cost of ` 1.1 per unit are much less than the actual average fixed cost of about ` 2 per unit that the companies incur in operating the projects. Fixed costs increase when the projects are under-utilised. As per the proposal being prepared jointly by the ministries of oil and power to bailout power plants idling due to acute scarcity of domestic gas, power companies will be supplied domestic and imported gas enough to operate their plants at 40 per cent capacity. (economictimes.indiatimes.com)

Coal block allocation scam: CBI registers case against Jindal Steel & Power

October 19, 2014. A case of alleged cheating and corruption has been registered by CBI against Jindal Steel and Power company relating to the probe into coal blocks allocated during 1993-2005 period. CBI said that it is the 36th FIR in connection with its probe in the coal allocation scam. The fresh case has been registered against Jindal Stripes Ltd (now known as Jindal Steel and Power Limited) and unknown public officials for alleged criminal conspiracy, cheating under the Indian Penal Code and Provisions of the Prevention of Corruption Act, CBI said. Soon after registering the case, the agency carried out searches at four locations in Raigarh, Chhattisgarh, CBI said. CBI said the case pertains to allocation of Gare Palma IV/1 coal block Jindal Strips Limited and JSPL. CBI said the instant case is the outcome of PE registered on September 26, 2012 looking into allocations of coal blocks during the period 1993-2005. (economictimes.indiatimes.com)

Power supply will be back by Oct 25: AP CM

October 19, 2014. Andhra Pradesh (AP) chief minister (CM) N Chandrababu Naidu said power supply in the cyclone-hit Visakhapatnam, Vizianagaram and Srikakulam districts of coastal Andhra Pradesh will be restored by October 25. Naidu said that power supply would be restored up to 90 per cent in Visakhapatnam by October 23, in all the mandal headquarters of the three districts by October 22, and in most of the villages by October 25. Describing the Hudhud cyclone as unprecedented, he said 57 EHT (extra high tension) towers of power transmission corporation had collapsed. Losses in the three districts were estimated at ` 300 crore for APTransco, ` 700 crore for APEPDCL (Andhra Pradesh Eastern Power Distribution Company) and ` 200 crore for others. Naidu said physical inspection had to be conducted for 2,700 km of 33 KV (kilo watt) lines, 18,000 km of 11 KV lines, 42,000 km of LT (low tension) lines and 55,000 DTR in the three districts.

The administration has been able to restore power supply to 1 million power connections and power supply has to be restored to 1.3 million connections under EPDCL in Visakhapatnam. As many as 13,765 engineers and other employees, including contract labour, have been deployed for the electricity restoration work, with 289 cranes and other heavy equipment. Meanwhile, the death toll in the three districts rose to 50 - 36 is Visakhapatnam, 13 in Vizianagaram and one in srikakulam, Naidu said. (www.business-standard.com)

Advisory group on power, coal to submit report by Oct 31

October 19, 2014. The Advisory Group, set up under former Power Minister Suresh Prabhu to suggest ways to enhance growth and address regulatory issues in the coal and power sectors, will submit its report to the government. The issues include enhancing growth of the coal sector, addressing railway bottlenecks impacting the transportation of the fuel and providing solutions for 24x7 electricity supply. As per the latest official data, 61 thermal power stations, out of the total 103 projects, are grappling with critical coal shortage with less than a week's stock at their disposal. The group is also likely to soon finalise new methodology for auction of non-operating coal blocks which were cancelled by the Supreme Court. The Ministry of Coal had said that the policy of coal mines auction and methodology was being revisited by the group. (www.business-standard.com)

Nagaland to formulate new power policy

October 18, 2014. Nagaland Power Minister Kipili Sangtam said the state government was in the process of formulating a new Power Policy to utilise its hydel resources. He did not share details such as what will be the focus of the policy and by when it is likely to be implemented. The state is interested to have thermal power plants to meet the deficiency. He said Nagaland was one of the most backward states and had lowest per capita generation of power. (www.dnaindia.com)

Modi govt following UPA's policies for power sector: AIPEF

October 18, 2014. The Narendra Modi-led government is following the same policies of the previous UPA regime that "crippled" the power sector, an association of power engineers has said. All India Power Engineers Federation (AIPEF) President Shailendra Dubey said the Centre is still following the same policy of privatising the profits and nationalising the losses in the power sector which is "unacceptable". (economictimes.indiatimes.com)

Power ministry assures PM Modi of uninterrupted electricity despite lack of coal supply

October 17, 2014 The power ministry has assured the Prime Minister (PM) that electricity supply will not be affected due to nonavailability of coal from the blocks whose allotment was quashed by the Supreme Court last month even as the ministry promised to maximise generation from other sources.

The ministry said that since the Supreme Court has given six months' time to the coal block allottees, power supply is not likely to be immediately affected due to non-availability of coal from these blocks. The Prime Minister's Office (PMO) had sought a plan of action to ensure thermal power plants in public and private sector are not stranded due to lack of coal. However, the ministry did not suggest any plans or alternatives immediately. (economictimes.indiatimes.com)

ACME Group gets final approval for $100 mn loan from ADB

October 16, 2014. ACME Group, which provides energy efficient and environment friendly solutions, has received final approval for credit facility worth $ 100 million (` 618 crore) from Asian Development Bank (ADB). This is the company's second loan in two months. ACME Group also sourced an investment from IFC in the form of loan of up to $ 34 million (` 201.9 crore) for the 100 MW project in Rajasthan.

The company has a portfolio of 197.5 MW including 100 MW JNNSM (Jawaharlal Nehru National Solar Mission) Phase II Projects, in the states of Gujarat, Madhya Pradesh, Rajasthan, Odisha and Chhattisgarh. It aims to generate 1,000 MW by the year 2017. The portfolio includes 100 MW plants in Rajasthan, 25 MW plant in Madhya Pradesh, 25 MW plant in Odisha, 30 MW plant in Chhattisgarh and a 15 MW in Gujarat. Some of these projects are at various stages of commissioning, the 100 MW Rajasthan projects are expected to be commissioned by April, 2015. (economictimes.indiatimes.com)

'Power situation in Telangana to improve by June'

October 16, 2014. The Telangana government has expressed optimism that the power situation in the state would improve by June next year and was confident the measures initiated in the last few months would lead to availability of additional 2,000 MW by the end of 2015.

IT minister KT Rama Rao said the state had received bids from 108 companies for its plan to award rights for generating 500 MW solar power in the first phase, and the bids for these would be finalised soon. The minister alleged that the Andhra Pradesh government was not cooperating with Telangana on overcoming the power problem even as the Krishnapatnam thermal power plant was ready for operating, from which Telangana is assured of its share. (www.business-standard.com)

AERB sets 2015 deadline for additional nuclear safety

October 16, 2014. The Atomic Energy Regulatory Board (AERB) has set December 2015 as the deadline for implementing long-term additional safety measures in nuclear installations, said its Chairman S.S. Bajaj. Bajaj said that during the safety audit in nuclear installations conducted after the Fukushima disaster, it was found that some additional safety measures had to be put in place for environmental and public safety. (www.thehindu.com)

India, Finland to cooperate in civil nuclear energy

October 15, 2014. India and Finland signed 19 agreements including one for peaceful use of nuclear energy as well as management of radioactive waste from atomic power plants as President Pranab Mukherjee began his two-day visit to the key Scandinavian country. The president began his visit to Finland after inspecting a guard of honour which was followed by a one-to-one meeting with his Finnish counterpart Sauli Niinisto and delegation-level talks. Indian Ambassador to Finland Ashok Kumar and Director General of Radiation and Nuclear Safety Authority of Finland Petteri Tiippana signed the agreement for nuclear cooperation in presence of Mukherjee and Niinisto. The arrangement for cooperation between the Atomic Energy Regulatory Board of India and the Radiation and Nuclear Safety Authority of Finland will ensure cooperation in the field of nuclear and radiation safety regulation concerning exchange of information personnel related to the peaceful use of nuclear energy and radiation related to nuclear installations, radiation and nuclear safety including radioactive waste management, safety related issues and research. It will also cover radiation safety, emergency preparedness, and radioactive waste management associated with the operation of nuclear power plants. Immediately after the signing ceremony, the Finnish president underlined the importance of India in the world order and said his country was keenly observing the 'Make in India' policy announced recently and also that the two sides had agreed for doubling the trade from existing USD 1.5 billion to USD 3 billion in next three years. (www.asianage.com)

India, Canada clinch nuclear deal in record time