-

CENTRES

Progammes & Centres

Location

[Delhi’s Power Crisis: Coal, Gas or Kejriwal?]

“While the shortage of coal may not be a part of the affordability argument, the shortage of gas is definitely a consequence of the affordability constraint. If the clear priority of the citizens of Delhi is that of cleaner air, then gas can be procured, at least in theory, at a cost. If affordability is the clear priority of the citizens of Delhi then a compromise must be made on the shift to gas…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Coal Ordinance has nothing for retail consumers!

ANALYSIS / ISSUES…………

· Delhi’s Power Crisis: Coal, Gas or Kejriwal?

DATA INSIGHT………………

· Is the Gap between Retail Selling Prices of Petro & Diesel Widening?

[NATIONAL: OIL & GAS]

Upstream…………………………

· India to accept additional oil blocks in South China Sea

· ONGC scripts turnaround, plans to ramp up oil output by 23 per cent

· ONGC on the hunt for overseas producing assets

· Big oil discovery made near Ahmedabad

Downstream……………………………

· RIL, Essar Oil say cyclone Nilofar will not disrupt output

Transportation / Trade………………

· No preference for local companies in oil PSU contracts

· City gas distributors likely to take a hit of ` 5 bn in profits in current fiscal

· Fuel stations being automated to prevent fraud: BPCL

· GAIL in search of partner for LNG import terminal at Paradip

Policy / Performance…………………

· BP writes down KG-D6 value by $770 mn

· No plan to curtail supply of subsidised LPG cylinders: Oil Minister

· Assam govt prohibits strike in oil, gas, refinery services

· How gas price formula was cracked

· Govt provides operational flexibility to oil firms

· India's oil demand rises 3 per cent in September

[NATIONAL: POWER]

Generation………………

· Kudankulam turbine to run with parts from another unit

· BHEL bags ` 4.2 bn order for Uttarakhand hydel project

· Vedanta's stalled power plant casts shadow on other projects

· Power generation at NLC to improve as strike ends

Transmission / Distribution / Trade……

· AP to buy 2.4 GW of power on a long term basis

· Scheduled power rate hike may be put on hold

· Empee Sugars board approves disinvestment of power business

· Gridco may earn ` 7 bn from power trading

· Telangana eyes 2 GW power from Chhattisgarh

· Navayuga Power in talks with Toshiba, Sumitomo, Mitsubishi & GDF Suez to sell power stake

· Power tariffs to rise in Delhi after festive season

Policy / Performance…………………

· Govt forms panel to review reports on Ganga Hydropower projects

· Tata Power to speed up $1.8 bn Vietnam power station

· Govt plans to fuel up 91 GW of stuck power projects

· Assocham for coal preference to operational end use plants

· Private Discoms worried over proposed changes to Electricity Act

· Peak power deficit in April-September 2014 at 4.7 per cent: CEA

· AP Irrigation Min meets Governor on power sharing with Telangana

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Shell seeks 5 more yrs for arctic oil drilling drive

· Eni finds gas at Merakes well in East Sepinggan Block off East Kalimantan

· Chevron starts gas production from Bangladesh's Bibiyana expansion project

· Crude at $80 a barrel? no sweat: Oil producer CEOs

· CNOOC makes mid-to-large oil, gas discovery in Bohai Bay

· BP shouldn’t get trial on spill ruling: Halliburton

· Norway’s Arctic oil ambitions threatened by slump in oil

· China’s Cnooc considers Norway exploration as oil trumps Nobel

· Total new CEO will contend with slump in production, oil

Downstream……………………

· Sasol says US cracker costs to shape GTL plant decision

· Trinidad refinery swaps crude sources on Ebola scare

Transportation / Trade…………

· Saipem in talks to lay two new pipelines in Kashagan

· Rosneft extends monthly decline before earnings report

· Mercedes drivers stung by shale boom’s quirks at the pump

· Berkshire’s BNSF to Add Surcharge on Older Oil Tank Cars

· China scores cheap oil 14k miles away as glut deepens

· Eastern Europe shivers thinking about winter without gas

· US oil seen as buffer for global prices and supply

· China cuts Saudi oil imports amid Colombia shipment boost

Policy / Performance………………

· Kuwait said to deny work permits for Saudi Chevron staff

· Singapore evaluating sites for second LNG terminal: Minister

· Huntsman Chief says most chemicals benefit from oil drop

· Goldman cuts oil forecasts as US market clout increases

· Venezuela scraps plans to sell US refining arm Citgo Petroleum

· Merkel says Ukraine may lose EU gas without Russia deal

[INTERNATIONAL: POWER]

Generation…………………

· Zimbabwe targeting 5 GW of additional power generation

· Coal miners fired in Appalachia getting hired in Wyoming

Transmission / Distribution / Trade……

· Europe blackout threat looms amid power-supply risks, study says

· Ofgem unveils funding plans for £1 bn transmission subsea link

· Britain faces tight power supply this winter: National Grid

· Power storage group plans $1 bn US plant

Policy / Performance………………

· Japan vote risks split over spoils of nuclear industry

· Mongolia coal miners ‘burning cash’ as prices drop, Moody’s says

· German power poised to fall for fourth year on economy

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· SunEdison Inc signs MoU with Rajasthan govt

· Govt chalks out plans for massive solar power push

· NTPC awaits forest dept nod for wind project in Bagalkot district

· Govt to launch 'zero liquid discharge' pilot project

· MNRE seeks loan from KfW to promote solar project

· ReGen Powertech launches made-for-India wind turbine

· Solar energy prices to come down with tech breakthrough

· NTPC goes for rooftop solar plants

· Centre to provide ` 5 bn grant to AP for solar parks

· NHPC to set up its first solar project in UP

GLOBAL………………

· Poor countries tap renewables at twice the pace of rich

· Most Canadians say environment trumps energy prices

· Stealthy Norwegian entrepreneur aims to revolutionize US energy storage

· Enel Green Power brings new wind farm in Mexico online

· UK energy minister sees rapid reform of EU carbon market

· EU on track so far with green energy goals, 2030 a challenge

· Fight over $100 bn aid stalls global warming deal

· Vestas wins 50 MW China order from Hanas New Energy

· EU sets challenge to US with toughest emissions target

· Battery backup for rooftop solar power systems too costly

· Eskom coal mine may risk South Africa water supply

· EU braces for battle to set energy goals for next decade

· Australia seeks to reduce renewable energy target to ‘real’ 20 per cent

[WEEK IN REVIEW]

COMMENTS………………

Coal Ordinance has nothing for retail consumers!

Ashish Gupta, Observer Research Foundation

The coal sector in India is never far away from problems and the judgement by the Supreme Court to scrap all coal block allocations is the most recent. The judgement was shocking not only for the coal sector but also for the nation which has to live with the impacts. In order to fix the problems, the government came out with an ordinance.

The problems in coal block allocation scheme were exposed by the Comptroller and Auditor General of India in 2012. The procedure for investigation was also initiated in the same year. Since then FIRs have been lodged, some files went missing, the Law Minister stepped down, companies tried to prove lobby and this drama continues even today. Discussions and suggestions on what must be done have poured out of reports and conferences.

The Government has come out with an ordinance as a quick fix solution. These are the highlights of the ordinance:

· Coal land area will be acquired by the state government.

· National Thermal Power Corporation (NTPC), State Electricity Boards (SEBs), central and state owned companies will acquire coal blocks without bidding.

· The revenue from the coal blocks will go to the particular state where coal blocks are awarded (Chhattisgarh will become the major beneficiary).

· All the other coal blocks will be put into a central pool which would be auctioned to private miners.

The issue is who will lose and who will gain?

For NTPC, it is a win- win situation as they are already a profitable company and getting additional coal blocks is icing on the cake. Due to economies of the scale generation cost will come down as well.

Giving additional coal blocks for SEBs does not make much difference. Any benefit may balance their losses. Income of States may increase due to e-auctioning but whether the State will capitalise this revenue windfall is uncertain. Even though they have huge coal reserves, many States are economically challenged. Armed conflict and poverty ravage the States.

For private companies this is not a positive development as they have to fulfil their coal demand through e-auction which means additional cost. Unfortunately, when they had mines they did not produce and now they don’t have mines and so the coal shortage will continue. They can bid for coal blocks which were originally given to them provided they are not proved guilty in the investigation. Private miners have to put in more money for coal and the price hike will be passed on to the consumers. Discoms are already crying and are gearing up for filing petition for tariff hikes. The process has already been initiated in the capital and many other States may follow.

Consumers will remain on the receiving end. The benefits of cheaper coal were never passed on to the consumers. With scrapping of coal blocks, even the hope of benefit to consumers has faded.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Delhi’s Power Crisis: Coal, Gas or Kejriwal?

Neeraj Tiwari, Observer Research Foundation

|

I |

t is a matter of routine to discuss Delhi’s power crisis when the temperature crosses 45°C and the power goes out. Everyone, be it the media or a Member of Parliament does not miss the opportunity to blame someone for the power crisis in Delhi. The general presumption is that there is a ‘supply’ problem. We are told that there is a shortage of coal, gas and most importantly of ‘political will’ to generate and supply power. But a closer look into the situation reveals a nuanced picture which has little to do with the capacity to generate and supply electricity.

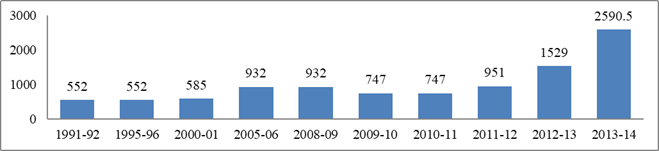

As illustrated below, installed capacity for power generation in Delhi has increased four-fold in the last two decades (Figure 1). In the last five years alone, installed capacity has increased by over 246% but demand for power has increased by only 28%.

Figure 1: Installed capacity within Delhi region (MW).

Source: Economic survey of Delhi & CEA

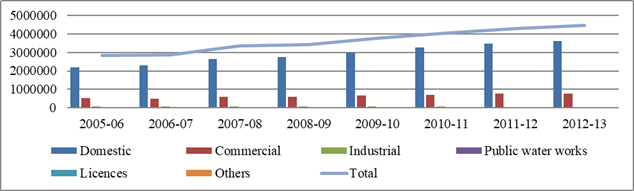

The number of electricity consumers in Delhi has increased by 57% from year 2005-06 to 2012-13.[1] Among consumers of power, the share of domestic consumers which was 76.9% in 2005-06 has increased to 81% by 2012-13.[2] This is a significant difference between consumer profile of Delhi and other States which includes a significant share of agricultural and industrial consumers. (See figure 2)

Figure 2: Consumer profile of Delhi (in Nos.)

If we look at the gap between Delhi’s total energy generation and its energy consumption, we find that Delhi has always been able to fulfil its energy requirements, at least in theory. The maximum deficit of energy that Delhi has had in last 10 years was just 1.72% in year 2006-07.[3] In the period 2002-03 to 2010-11 the aggregate technical and commercial (AT&C) losses in electricity distribution in Delhi has come down from 52% to 16% as reported by discoms.[4] This is a significant achievement compared to national average where AT&C losses have come down from 36% to 27%.[5] If we assume that figures of AT&C loss reduction by Delhi discoms is an accurate reflection of reality rather than a statistical artefact, then we can say that they have done a commendable job.

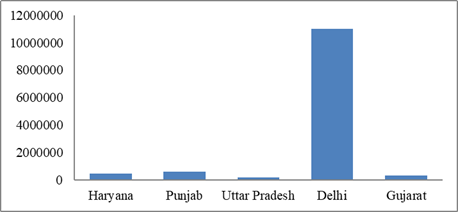

Delhi also stands out in terms of consumption of electricity as illustrated in the chart below (figure 3). If we compare Delhi’s electricity consumption with rest of the country, we see that electricity consumed per sq. Km in Delhi is 34 times to the industrialized states like Gujarat and far above that in poorer States such as Uttar Pradesh.

Figure 3: Annual Electricity Consumption (kWh) per square kilometre, 2007-08

Source: CEA, All India Energy Statistics 2009

As shown in chart (Figure 4), the energy consumed per capita of Delhi is higher than bigger states like Uttar Pradesh and Haryana whereas it is comparable to industrialized states like Gujarat.

Figure 4: Annual Electricity Consumption (kWh) per capita, 2007-08.

Source: CEA, All India Energy Statistics 2009

High per capita consumption, high share of domestic consumers, lower AT&C losses along with its political importance suggests that Delhi has a unique profile that is distinct from most of the other States of India. In this light Returning to the question of Delhi’s power crisis, let us answers to questions that may hold some clues on why Delhi has a power crisis.

As observed earlier, the gap between energy supply and demand is narrow in Delhi and the year 2013-14 was no different with a recorded deficit of only 0.3%.[6] Despite the narrative of shortage that is repeated in the media, the Central Electricity Authority (CEA) has projected a surplus of 5909 million units (20%) of Energy in the year 2014-15 in Delhi.[7]

If we take a closer look at Delhi’s demand-supply situation, we find that Delhi’s total installed capacity in 2013-14 was 7078.5 MW[8] out of which 2590.5 MW[9] was owned and located within the National Capital Region (NCR) or Delhi. The peak demand in Delhi was 6035 MW in 2013-14 but only 5653 MW of the demand was met.[10] This implies that despite having a capacity of more than 7000 MW, Delhi was not able to meet its peak demand of 6035 MW. The logical conclusion from this is that the shortage of power in Delhi is not because of inadequate capacity and so other factors must be examined.

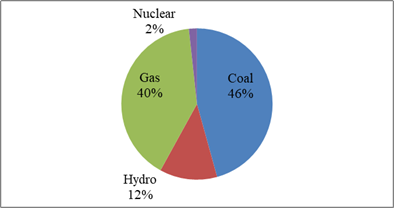

Coal and gas play a dominant role in Delhi’s power supply. 40% of power generation capacity allocated to Delhi is gas dependent and 46% is coal dependent as shown in figure 5.

Figure 5: Fuel share of Delhi’s Total Installed Capacity.

Source: LGBR 2013-14, CEA

If we look at the coal supply for Delhi’s power stations, then as per publicly available information there has been loss of 86 MUs[11] on account of coal shortage in the year 2013-14 (up to December). This was only 0.93% of expected generation for that year which means that coal shortage did not have a huge impact on Delhi’s power supply.

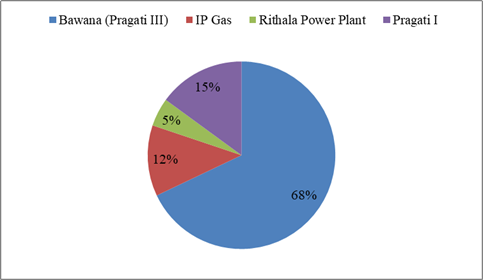

In the context of gas the 1500 MW Bawana plant is worth mentioning. This is the largest gas based plant in Northern India[12] which was set up exclusively to fulfil Delhi’s ambition to move from coal based power to gas based power. Overall there are six power plants in Delhi out of which four are gas based plants.

Figure 6: Delhi’s own gas based installed capacity

As observed earlier Delhi’s own installed capacity is 2590.5 MW out of which 85% is gas dependent. The Bawana plant requires 5.8 mmscmd[13] of gas to operate at 90% PLF.[14] However, only 1.54 mmscmd of non-APM gas and 0.836 mmscmd of KG D6 gas were allocated to the plant. The supply from KG-D6 has stopped since 2013. This has resulted in severe shortage of gas on account of which the plant is currently producing 200-250 MW. It is reported that generation from Bawana is often zero or even negative.[15]

The 108 MW Rithala plant has a similar story. The Rithala plant requires 0.6 mmscmd of gas to run at full potential.[16] However on account of gas shortage, the plant is almost shut down since the last two years. In a nutshell Delhi’s plan of moving from coal based power to gas based power seems to have backfired with the ` 5000 Crore (813.9 million USD) Bawana plant and ` 320 Crore (52.1 million USD) Rithala Plant becoming liabilities.[17] While gas based power seems to offer a compelling argument of gas shortage to explain the power crisis in Delhi there appears to be more to the story that we shall proceed to explore.

Those who closely observed State elections in Delhi in 2013 would have not failed to notice the important role played by the question of affordability of electricity. The Aam Admi party led by Shri Arvind Kejriwal made affordability of electricity one of their main planks for electoral campaigning. This resonated with consumers, especially those at the bottom of the pyramid, as the election results demonstrated. Is it then correct to argue that there is a problem with affordability as Shri Kejriwal has highlighted? Let us see what the data says. In the year 2012-13, 85% of Delhi’s total energy supply was sourced from outside Delhi.[18] As illustrated earlier, gas shortage could be assigned the primary blame for Delhi having to source most of its power from outside. However that would be inaccurate. If the use of gas supposedly to control local pollution was the priority, then it is possible to ask why natural gas in the form of imported LNG cannot be used to make up for shortage of domestic gas? This leads to the question of affordability of imported gas as there is real problem in the availability of imported gas in the form of LNG.

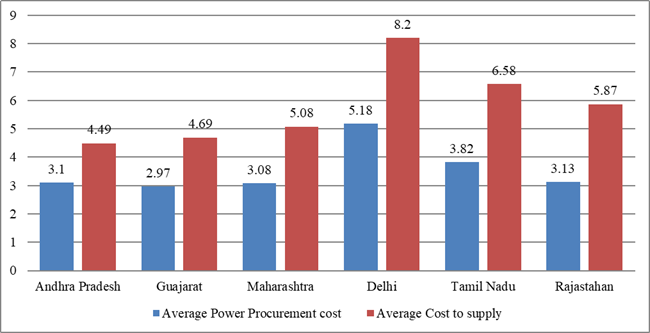

The Bawana plant can be seen as the lead villain in the story. The Bawana plant is in fact producing power from imported LNG but the average power procurement cost is more than ` 13/unit which is 3 times that from Dadri (also gas based) and Aravali Power stations (coal based). On top of this, the Bawana plant runs at a very low Plant Load Factor (PLF) which means that it has to recover its fixed cost on smaller power production capacity range. This results in a higher share of fixed costs in the average power procurement cost.[19]

If we compare average power procurement cost and average cost to supply for gas based power plants of different states then it is no surprise that Delhi is leading the pack as shown in figure 7.

Figure 7: Comparison of average power procurement cost in Delhi and other states (`/unit)

Source: Various Govt. Websites

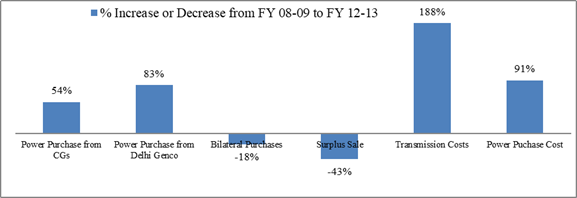

Peak demand of Delhi in summer is around 6000 MW whereas the peak demand in winter falls to around 3400 MW. During off peak hours in winters, the demand further falls to only 1300 MW.[20] This means that Delhi has surplus power capacity in winter. The net power procurement cost for discoms depends on the price at which they can sell surplus power. This factor does not favour Delhi as it is often forced to sell the surplus power at loss.

Figure 8: Sale of Surplus Power

Source: NDPL

The average price at which NDPL was selling its power was ` 5/unit in 2008-09. It fell to ` 2.83/unit in 2012-13. As shown in figure 8 the cost of every component of power procurement has increased since 2008-09 except surplus power and bilateral purchases. The sale price of surplus power has decreased by 43% in the same period.[21] This means that Delhi has to buy power at higher prices and sell it at lower prices. One of the key reasons is that cash strapped Discoms of other states like Uttar Pradesh are more than happy to resort to load shedding which shuts out real demand rather than buy power from Delhi at a higher price.

There seems to be yet another subsidiary reason for Delhi having to sell its surplus power at a loss. 30% of Delhi’s power comes from Badarpur Thermal Power Station, Dadri 1&2 & Aravali stations of NTPC. These are the most expensive stations of central pool with average cost of power procurement around ` 5-6/unit. This explains why the cost of power procurement is higher for Delhi than it is for other States.[22]

Going by the data presented, it appears that the price of electricity (affordability for consumers and the viability for discoms) is among the primary reasons for the power crisis in Delhi as highlighted by Shri Kejriwal. While the shortage of coal may not be a part of the affordability argument, the shortage of gas is definitely a consequence of the affordability constraint. If the clear priority of the citizens of Delhi is that of cleaner air (to be achieved by a shift to gas based power generation), then gas can be procured, at least in theory, at a cost. If affordability is the clear priority of the citizens of Delhi then a compromise must be made on the shift to gas.

As shown earlier in figure 2 Delhi has more than 80% share of domestic consumers. Since majority of consumers are from middle or bottom of the pyramid, it can easily be predicted that given a choice between affordable power and cleaner air, what the majority will choose. In most other states agricultural and household consumers are cross subsidized by industrial consumers but there is no scope in Delhi to cross subsidize the domestic consumers with high rate paying industrial or commercial consumers. Even though it is true that 80% of the household electricity consumption is accounted for by 20% of the households, extracting a cross subsidy from this group would not be possible.

It is also a matter of debate whether by moving away from coal based stations Delhi’s air will really get clean. According to 1997 white paper on pollution 67% emission are from vehicles and only 13% emissions are from thermal power plants.[23] Since then the number of vehicles has increased by 135.59%.[24] Currently Delhi is adding 1400 vehicles per day. Barely 20 Indian cities including Delhi follow Euro IV emission standards for new vehicles while all others follow euro III. Euro IV is seven years behind European standards and Euro III is behind by 12 years.[25] Instead of putting stringent regulations on automobile sector which is responsible for most of air pollution, the blame is assigned on coal leading to false and unviable solutions. The unviable solutions add to Delhi’s power crisis.

The problem is discoms appear to be striking a balance between affordability for consumers and viability for themselves by backing off demand rather than by prudent business decisions based on accurate demand projections and appropriate generation choices. Rather than demanding high quality dependable power supply, most of the affluent households and commercial businesses have resorted to using diesel based power generation to make up for power outages. Only those consumers who cannot afford diesel based power generation, cling on to discom power. Their attempt to use political pressure to obtain dependable power at affordable prices through the efforts of Shri Kejriwal did not succeed. What then is the solution to Delhi’s power crisis?

· The Transition from coal to gas may have to be slowed down till the required amount of ‘cheap’ gas is available. After having invested ` 5000 Crore in gas based plants Delhi is buying power from central coal stations, with the gas stations lying idle. This situation is unsustainable.

· The old coal based stations may be upgraded to work at high PLF. This will bring down the cost of power procurement for the discoms.

· Gas may be diverted from old gas based stations like Indraprastha gas station which have low efficiency and running at low PLF to new gas stations like Bawana and Rithala plant which are more efficient.

· There is a need to list Delhi’s (and the countries) priorities in the context of electricity: what is more important: 24 hour dependable and affordable electricity or punishing coal in the name of cleaning the air? In the current context it is clear that both are not achievable simultaneously. Once the priority is established the right fuel choices can be made. This is not a simple exercise in a democracy that consists of a wide range of consumer preferences and paying capacities. But a choice must be made democratically and once it is made it must be clearly communicated to everyone. If this is not done, the problem will be incorrectly framed leading to incorrect and unsustainable solutions.

· There must be strict regulations against load shedding in the form of universal supply obligation. The state and central regulatory commissions should facilitate the sale of surplus power at appropriate price and impose penalties against discoms resorting to load shedding even when the power is available.

Views are those of the author

Author can be contacted at [email protected]

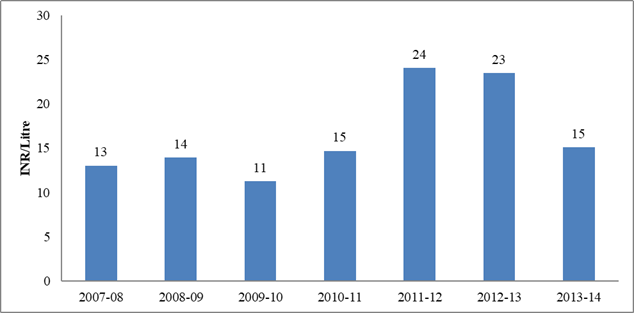

DATA INSIGHT……………

Is the Gap between Retail Selling Prices of Petro & Diesel Widening?

Akhilesh Sati, Observer Research Foundation

|

Financial Year |

Avg. Diesel Prices (INR/Litre)* |

Avg. Petrol Prices (INR/Litre)* |

|

2007-08 |

30.60 |

43.65 |

|

2008-09 |

33.33 |

47.27 |

|

2009-10 |

32.62 |

43.90 |

|

2010-11 |

37.96 |

52.67 |

|

2011-12 |

40.28 |

64.36 |

|

2012-13 |

44.56 |

68.04 |

|

2013-14 |

55.20 |

70.31 |

Gap between Petro & Diesel Prices*: Trends

*RSPs are for Delhi.

Source: Compiled from the Data from Petroleum Planning and Analysis Cell.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

India to accept additional oil blocks in South China Sea

October 28, 2014. India and Vietnam will sign an agreement for oil exploration in South China Sea with the visiting Vietnamese Prime Minister Nguyen Tan Dung declaring that Indian ships would be allowed into the area despite Chinese protestations. India has decided to accept 2-3 Vietnamese oil blocks in the South China Sea based on the techno-commercial feasibility report by the ONGC Videsh Ltd (OVL) and an agreement in this regard would be inked after the talks. In addition to the current three oil blocks, Vietnam had offered India five oil blocks and the OVL was looking at them in terms of their feasibility. Recently, Vietnam had renewed India's lease of two oil blocks in the South China Sea for another year. China and Vietnam have an acrimonious relationship due to their standoff over the South China Sea, a major source of hydrocarbons. China has been objecting to India's oil exploration projects in the disputed waters. Meanwhile, ahead of his talks with Modi, the Vietnamese Prime Minister pitched for India's "active support" to peacefully resolve all disputes and sought its greater linkages across the region. (economictimes.indiatimes.com)

ONGC scripts turnaround, plans to ramp up oil output by 23 per cent

October 28, 2014. After scripting a turnaround at its mainstay western offshore fields, Oil and Natural Gas Corp (ONGC) plans to ramp up oil output by 23 per cent to 28-29 million tonnes by 2019/20 as it brings newer fields into production. ONGC, which has been under scrutiny of the Petroleum Ministry for falling output in past years, had in 2013-14 produced 22.24 million tonnes of crude oil from its fields. This year it is targeting 23.51 million tonnes. Next fiscal, the production is projected to rise to 24 million tonnes and will reach 28-29 million tonnes by 2019-20. Natural gas production, which was 23.2 billion cubic metres (63.5 million cubic metres per day) in 2013-14, will touch 24 billion cubic metres (bcm) this year and 90-100 bcm in 2019-20. While Mumbai High field and Neelam-Heera fields have been almost flat at 206,000 bpd, Bassein Satellite fields have seen output rise from 30,700 bpd to about 53,000 bpd. ONGC will use a floating production system to ramp up output from the Cluster-7 fields by 50 per cent to 12,000 bpd. Also, another 10,000 bpd is expected from D1 while improved oil recovery and enhanced oil recovery drilling at Mumbai High and Heera fields will help arrest the natural decline that has set in these ageing fields. WO-16 and B-127 fields also will add 15,000 bpd of production. KG-DWN-98/2 (KG-D5) is predominantly a gas rich block and sits next to Reliance Industries' KG-D6 in Bay of Bengal. On gas, ONGC's C-26 cluster project off the Mumbai coast will begin giving 203 million standard cubic meters a day (mmscmd) from 2015-16 while Daman/C-Series fields in western offshore will start producing 2 mmscmd in 2016-17 and go up to 8.5 mmscmd by 2019. A substantial 20 mmscmd of gas will come from KG-D6 by 2018-19. Discoveries in Kutch fields will give 2 mmscmd by 2021-22. (economictimes.indiatimes.com)

ONGC on the hunt for overseas producing assets

October 27, 2014. Oil and Natural Gas Corp (ONGC) wants to take advantage of falling oil prices to more than double its overseas output to the equivalent of 400,000 barrels per day of oil by 2018. Global oil prices hit a four-year low at below $83 a barrel, hitting valuations of oil explorers. India is the world's fourth-biggest oil consumer, importing four-fifths of its needs as its own output shrinks. The government, which is preparing to float a $3 billion stake in ONGC, wants state firms to secure energy assets abroad to reduce the exposure of the economy to supply risks. (economictimes.indiatimes.com)

Big oil discovery made near Ahmedabad

October 26, 2014. A significant oil discovery has been made near Ahmedabad in the Cambay basin that by some estimates may be the biggest onland find this year. Jay Polychem (India) Ltd, a unit of city-based Jay Madhok Group, made the oil discovery in the very first well it drilled on the block CB-ONN-2009/8 in Gujarat's Cambay basin. The firm has drilled two wells and discovered huge oil pay zones in both the wells. The discovery in the well Kharenti-A has been notified to the upstream regulator DGH and the government. The discovery by Jay Polychem is huge and similar to oil being produced by ONGC in the neighbouring Padra field as also by GSPC in Ingoli field. The block is operated by Jay Polychem (India) Ltd with 87 per cent interest, while Jay Polychem Pte Ltd holds the rest. Cambay basin, which extends from Surat in the south to Sanchor in the north, covers an area of about 59,000 sq km with a hydrocarbon resource of more than 15 billion barrels. Few dozen discoveries, mostly oil, have been reported in the basin. ONGC produces oil from most of them and recently Oilex of Australia too has found tight oil. (economictimes.indiatimes.com)

Downstream………….

RIL, Essar Oil say cyclone Nilofar will not disrupt output

October 28, 2014. Top private oil refiners are taking precautions but do not anticipate any impact on their operations from cyclone Nilofar, which is expected to hit the country's west coast. Nilofar, classified as a 'very severe cyclonic storm', is expected to weaken to a 'cyclonic storm' when it makes landfall on the northern Gujarat coast, according to the Indian Meteorological Department. Reliance Industries Ltd (RIL) operates the world's biggest refining complex in Gujarat, where its two adjacent plants can process about 1.4 million barrels per day (bpd) of oil. But that complex and Essar Oil Ltd's 400,000-barrel-per-day Vadinar refinery do not lie directly in the expected path of the cyclone, the companies said. Essar Oil said that it was taking "all due precautions" and did not expect any production outage. (economictimes.indiatimes.com)

Transportation / Trade…………

No preference for local companies in oil PSU contracts

October 28, 2014. The oil ministry has abolished the decades-old system in which domestic suppliers would win contracts even if their price bid was up to 10% higher than a competing foreign offer. The change in the policy, which was implemented to help domestic supplier grow, will have a direct bearing on planned expenditure of ` 421,229 crore on various projects of oil and gas firms between 2012 and 2017. The government thinks that the policy of "price preference" has served its purpose as domestic suppliers have had adequate exposure to international competition, and they should stand on their own feet. This move is in continuation of recent policy reforms announced in oil and gas sector to global private investments that included deregulation of diesel prices and raising the price of domestic gas. The policy of price preference was formulated in May 1984 and continued in one form or other despite stiff resistance by state oil companies. Companies, particularly ONGC, GAIL India and Oil India were against allowing price preference to domestic vendors to ensure level playing fields. (economictimes.indiatimes.com)

City gas distributors likely to take a hit of ` 5 bn in profits in current fiscal

October 27, 2014. City gas distribution companies fear a hit of ` 500 crore in their profit margins in the remaining part of this fiscal as they find it difficult to pass on all the additional cost to their customers. The economics of city gas sale has changed after the government's decision to raise natural gas to $5.61 per unit from $4.2. They said that the companies need to maintain a gap between the price of compressed natural gas (CNG) and diesel to be competitive in the market. IGL, the sole supplier of compressed natural gas and piped natural gas in the national capital, will alone take a hit of ` 1 crore per day. Most city gas operators in the country are joint ventures of government-owned gas transporter GAIL. Even the most mature city gas market of the country, Gujarat, is mainly operated by the state government-owned GSPC. MGL and IGL distribute gas in Mumbai and Delhi and are joint ventures between GAIL and British Gas and, GAIL and BPCL, respectively. (economictimes.indiatimes.com)

Fuel stations being automated to prevent fraud: BPCL

October 27, 2014. Bharat Petroleum Corporation Ltd (BPCL) has automated some of its pumping stations while it has made applications for LPG only through online, the company said. According to the company, BPCL has installed automation systems at 888 retail outlets and the total network of automated retail outlets as of last financial year was 4,408. On the supply of Liquefied Petroleum Gas cylinders to households, the company said the process was mandated to be done only in the online platform so as to bring in more transparency. (economictimes.indiatimes.com)

GAIL in search of partner for LNG import terminal at Paradip

October 27, 2014. GAIL India Ltd, the nation's largest natural gas distributor, is looking for a strategic partner for its ` 3,108 crore floating LNG import terminal at Paradip in Odisha. GAIL has floated expression of interest (EoI) to induct a strategic partner in 4 million tonnes a year floating liquefied natural gas (LNG) terminal planned off the Paradip coast. The company is seeking a LNG supplier or a major consumer of gas as strategic partner. Site selection for the project has been completed while market survey has just been commissioned. The Floating Storage Regasification Unit (FSRU) would have an initial capacity of four million tonne per annum (mtpa) in first phase, reaching a peak capacity of 4.8 mtpa, with a storage capacity of 170,000 cubic metres. The first phase of the project is to become operational by 2017. GAIL had signed a MoU with the Paradip Port Trust for setting up of the LNG import terminal. While the port would invest ` 650 crore on breakwater and dredging, GAIL would invest ` 2,458 crore. In the second phase, four mtpa capacity will be added (peak capacity- 4.8 mtpa), raising the terminal's total capacity to 8-10 mtpa. Paradip will be the fourth LNG terminal on the east coast. GAIL is already in advanced stage of planning for setting up a floating LNG receipt facility at Kakinada in Andhra Pradesh. Petronet LNG Ltd, a firm in which GAIL has 12.5 per cent stake, is setting up another 5 million tonnes a year facility at Gangavaram in Andhra Pradesh while Indian Oil Corp (IOC) is setting up a similar facility at Ennore in Tamil Nadu. India currently has four LNG terminals - Dahej and Hariza in Gujarat, Dabhol in Maharashtra and Kochi in Kerala. Of these, Kochi and Dabhol are only partially operational on account of absence of pipeline for taking gas to consumers and operational issues respectively. Gas in its liquid form (LNG) will be imported at a floating jetty (FSRU) off the Paradip coast and transported onland via pipeline. The fuel after being turned back into its gaseous state will be transported to consumers using GAIL's proposed Jagdishpur-Haldia and Surat-Paradip pipelines. (economictimes.indiatimes.com)

Policy / Performance………

BP writes down KG-D6 value by $770 mn

October 28, 2014. British Petroleum (BP) plc has written down the value of its shareholding in the eastern offshore KG-D6 block by $ 770 million dollar following a lower-than-expected gas price hike which it saw as a transition to market-based pricing. BP announced a $ 770 million write down in value of KG-D6 although it said the new gas pricing formula, as a transition to market-based pricing, was a step in the right direction. BP in 2011 bought 30 per cent interest in Reliance Industries' eastern offshore KG-D6 as well as 20 other oil and gas exploration blocks for $ 7.2 billion. Bulk of this was for the producing block of KG-D6 and gas discovery area of NEC-25. The government had approved a new formula for pricing of all domestic gas. The rate, when the formula comes into effect from November 1, would be $ 5.61 per million British thermal unit as against current $ 4.2. The price is lower than $ 8.4 approved by the previous UPA government and general expectation of a rate around $ 6.5 after some deductions from that price. Both BP and Reliance Industries Ltd (RIL) have been advocating market-linked gas pricing and had initiated an arbitration against the government for not revising rates from the due date of April 1, 2014. The $ 4.2 per million British thermal units (mmBtu) rate, fixed in 2007, was for the first five years of production from KG-D6 fields. KG-d6 fields started gas output from April 1, 2009. BP said it expects further clarity on the new pricing policy and the premium that the government has promised to pay for future deep-sea and complex gas discoveries. (economictimes.indiatimes.com)

No plan to curtail supply of subsidised LPG cylinders: Oil Minister

October 24, 2014. The government has no plans to curtail supply of subsidised cooking gas (LPG) from current 12 cylinders per household in a year even as it looks to give cash subsidy to consumers across the country by June. In August, the Narendra Modi-led government gave consumers the freedom to avail their quota of 12 cylinders of 14.2-kg weight at subsidised rate during anytime of the year against the previous restriction of one per month. Oil Minister Dharmendra Pradhan said the Cabinet had modified the Direct Benefit Transfer Scheme (DBTL) for LPG to provide for cash subsidy equivalent to the difference between the current rate and the market price, in bank accounts of each consumer. But unlike the scheme launched during the previous UPA government, having an Aadhaar card for getting the cash subsidy is not mandatory, he said. Currently, the modified DBTL is being launched in 54 districts and from January 1 it will be rolled out in all the remaining districts of the country, he said. LPG consumers who have opened accounts under the Jan Dhan Yojana too would benefit from the revised scheme. Over 6 crore such accounts have been opened so far and 4 crore more are being targetted by the year end to provide for at least one bank account per household. Currently, bank accounts of LPG consumers are being seeded with their cooking gas numbers. Once that is done, cash subsidy will be transfered into the bank accounts so that the consumers can buy the LPG refills at market rates. Presently, 12 cylinders are available to consumers at a subsidised rate of ` 414 each in Delhi. Any requirement beyond this will have to be purchased at market price of ` 880 per 14.2-kg cylinder. Pradhan said the Modi government stands for protecting the interests of poor and at the same time it will ease conditions for doing business in the country. The previous UPA government had linked DBT for LPG to the Aadhaar platform. But there were some legal issues, including some court orders, that prevented implementation of the scheme. So, the new government has decided that in addition to the Aadhaar platform, all those who have a bank account will also get the LPG subsidy in their accounts directly. He said the scheme will be implemented in a mission mode. There will be no consumer who will be denied LPG for want of Aadhaar number. Pradhan said the government is working on fixing the amount of subsidy to be given under DBTL. (economictimes.indiatimes.com)

Assam govt prohibits strike in oil, gas, refinery services

October 24, 2014. The Assam government, in exercise of powers conferred by Section 3 of the Essential Services Maintenance (Assam) Act, 1980, prohibited strikes in the state by all those involved in the services of oil fields, gas sector or refinery. The government, through a notification, prohibited strike by officers, workmen, contract labourers, tanker drivers and 'khalasis' (helpers) involved in the services of oil fields, gas sector or refinery of any establishment or undertaking dealing with the production, supply or distribution of petroleum and petroleum products, including natural gas. The government said the order will remain in force for a period of six months from the date of issue of this notification until further orders. (economictimes.indiatimes.com)

How gas price formula was cracked

October 23, 2014. How to work out a fair price of gas produced from domestic fields in a country such as India, which does not have a free market for gas in the real sense? That was the conundrum facing the government when it set about reviewing the formula that had been approved by the UPA government. That formula, suggested by a panel under C Rangarajan, would have doubled the price to $8.5 per unit from $4.2 at present. This would have seen a spike in cost of CNG, power and of manufacture of urea. But regional markets came with their own set of problems. Daily rates were available for the US and the UK. But they were monthly for Canada and Russia. Though Russia is not really a gas-on-gas market, it was included because it has very high consumption. Then there was the question of determining the average gas price in these markets. This was done on the basis of prices for 365 days where it was available daily and 12 months where it was monthly. The petroleum secretary Saurabh Chandra said even this was not the real price of gas since it was at hubs, which meant there was some transportation and processing costs involved. This was addressed by "deducting 0.50(cents)". Then the price of liquid gas (LNG) imports used in the Rangarajan formula's benchmarks was removed to prevent conflict of interest in case a gas producer is also an importer of liquid gas. This alone, Chandra said, knocked off $2 per unit from the price estimated according to the Rangarajan formula. Next to go was liquid gas imports by Japan, which reduced the price further by 34 cents. All the changes together helped lower the final price by $3.46 per unit. (economictimes.indiatimes.com)

Govt provides operational flexibility to oil firms

October 22, 2014. The government has granted operational flexibility to help firms like Cairn India and ONGC start producing oil and gas from several discoveries that are mired in contractual disputes. Originally proposed by the then Oil Minister M Veerappa Moily a year back, the Cabinet approved a policy framework for relaxation, extensions and clarifications in timelines for development and production of oil and gas under the Production Sharing Contracts (PSC). Operational flexibility has been provided in enforcing contracts by way of relaxing some of timelines prescribed for discoveries so that exploration and production (E&P) activities do not suffer on account of excessive rigidity in decision making. The PSC between the government and the explorer has rigid timelines for each stage of exploration and actions have been initiated against firms even if deadlines are missed by a day. Chandra said 3-6 months extension in the current 18-60 month timeframe for submission of declaration of commerciality (DoC) of discoveries, a prerequisite before investment plans can be finalised, has been approved. Also, the deadline for submission of investment plan for the discoveries too would be extended by up to six months. The PSC provides for time period for submission of field development plan (FDP) for hydrocarbon discovery after DOC. There is no provision in the PSC for extension of this time period and non-acceptance of FDP due to late submission results in non-monetisation of discoveries. Also, upstream regulator DGH has been given flexibility to accept discoveries for which operators had failed to provide prior notification to the government. The Secretary said the Cabinet has also provided for reduction in committed work programme in case a block or its part is not available for exploration activities consequent to denial of permission by government agencies. (economictimes.indiatimes.com)

India's oil demand rises 3 per cent in September

October 22, 2014. India's oil consumption rose nearly three per cent in September, while diesel sales fell for the second time this financial year. Consumption of oil products in the month at 12.3 million tonnes was 2.9 per cent higher than 11.95 million tonnes a year ago, petroleum ministry data said. Total sale of diesel, the most consumed fuel in the country, fell to 4.89 million tonnes during the month from 4.90 million tonnes in September 2013. In April, too, sales had dipped to 5.92 million tonnes as compared to with 6.15 million tonnes in the corresponding month last year. In 2013-14, diesel demand dipped for the first time in more than a decade as monthly price raises and increased power generation clipped consumption. Diesel, India's most consumed fuel, accounting for 43 per cent of the total petroleum product demand, has seen sales growth of six to eight per cent annually since 2003-04. (www.business-standard.com)

[NATIONAL: POWER]

Generation……………

Kudankulam turbine to run with parts from another unit

October 28, 2014. Work on restarting the first atomic power unit's turbine at Kudankulam has commenced by using the components taken from the second unit's turbine. India's atomic power plant operator Nuclear Power Corporation of India Ltd (NPCIL) is setting up two 1,000 MW Russian reactors at Kudankulam in Tirunelveli district. The total outlay for the project is over ` 17,000 crore. On Sep 26, the first unit's turbine was found to have developed some problem and its running was stopped. The first unit is expected to be back in service in six-to-eight weeks' time. The KNPP is India's first pressurised water reactor belonging to the light water reactor category. The first unit attained criticality July 2013, which is the beginning of the fission process. The unit has started power generation and has been connected to the southern grid. The unit was expected to start commercial generation soon when the turbine problem cropped up. (economictimes.indiatimes.com)

BHEL bags ` 4.2 bn order for Uttarakhand hydel project

October 28, 2014. Bharat Heavy Electricals Ltd (BHEL) has received a contract worth ` 422 crore related to 444 MW Vishnugad Pipalkoti hydel power project in Uttarakhand. Located in Chamoli district, Vishnugad Pipalkoti project is on Alaknanda river. It comprises four hydro generating sets of 111 MW capacity each. The order, valued at ` 422 crore, is for setting up of hydro generating sets and associated electro-mechanical works for the Vishnugad Pipalkoti project, BHEL said. The order has been awarded by THDCIL (formerly known as Tehri Hydro Development Corp Ltd). This is the second major order bagged by BHEL for a hydro power project in Uttarakhand this year. Earlier, an order for the 2x60 MW Vyasi hydel project was received from Uttarakhand Jal Vidyut Nigam Limited (UJVNL) in March. BHEL is executing hydro power projects having capacity of about 9,500 MW. (economictimes.indiatimes.com)

Vedanta's stalled power plant casts shadow on other projects

October 27, 2014. London-listed Vedanta Resources said that its stalled power plant in Chhattisgarh's Korba district had hampered other projects of the company in the state. The construction of power plant was completed two years ago and since then it had been lying idle. The stalled power plant had cast shadow on company's expansion and new projects in Chhattisgarh. The project was National property and should be allowed to operate without further delay. The Vedanta Resources said the government should also ensure better linkage of coal for the industry to avoid use of imported coal. The companies had been passing through worst coal crises and hence the government should take immediate action. Reacting to the delay in getting its project approved in Chhattisgarh, Vedanta Resources said it would affect the industrial growth. (www.business-standard.com)

Power generation at NLC to improve as strike ends

October 26, 2014. Navaratna company Neyveli Lignite Corporation (NLC) is expected to improve its operations gradually over the next few days after a settlement was reached between the Joint Action Council of the 10 labour unions and the NLC management. NLC's power production has dropped to around 1300 MW, as against a total generating capacity of 2740 MW. The contract labour had been on a strike for the last 52 days, which came to an end on October 24. According to union, NLC has agreed to increase the wages of unskilled labourers, adding almost ` 110 a day from ` 370 per day, and higher salaries to semi-skilled and highly skilled individuals. (www.business-standard.com)

Transmission / Distribution / Trade…

AP to buy 2.4 GW of power on a long term basis

October 28, 2014. Andhra Pradesh Transmission Corporation (APTransco) is holding a pre-application meeting with the thermal power developers for the procurement of 2,400 MW of power on a long term basis. The process involves buying of power from thermal power stations through public private partnership on design build finance operate and own basis, according to the power utility. The plants need to have Coal India linkage and has to be supplemented by imported coal and should have commercial operation date(COD) before December, 2016, it said. (www.business-standard.com)

Scheduled power rate hike may be put on hold

October 28, 2014. The power tariff hike scheduled from next month may be shelved as Delhi Electricity Regulatory Commission (DERC) is first going to seek a clarification from the Election Commission (EC) due to the model code of conduct. A new power purchase adjustment charges (PPAC) surcharge is scheduled to be announced. If the EC gives a green signal, the surcharge expected to be announced will be implemented from November 1. Sources say a surcharge of 5-7 per cent could be likely. Discoms BSES Yamuna, BSES Rajdhani and Tata Power Delhi submitted their petition to the regulator for PPAC. BYPL has sought an increase of 17.1 per cent, BSES Rajdhani 7.26 per cent and Tata Power for 9 per cent due to fuel costs. The PPAC surcharge is for costs incurred by discoms between July-September 2014 and will be applicable in consumer bills from November 1 to January 31, 2015. The discoms, particularly BRPL and BYPL, have been demanding significant hike in tariff citing rise in power purchase cost. Official figures show around 80-90 per cent of total revenue of discoms goes into purchasing power from central and state government entities through long-term power purchase agreements at rates determined by the central and state regulators. DERC had introduced PPAC in 2012 to help discoms recover additional cost due to increase in coal and gas prices. (economictimes.indiatimes.com)

Empee Sugars board approves disinvestment of power business

October 27, 2014. Empee Sugars and Chemicals Ltd, the sugar business of Chennai-based Empee Group, has decided to disinvest its power business under Empee Power Company Ltd. The company also said that while a notice was sent by Andhra Bank, Chennai, under the SARFAESI act, it is ineffectual since the Bank does not constitute a valid majority under the consortium of bankers. (www.business-standard.com)

Gridco may earn ` 7 bn from power trading

October 24, 2014. State-run power trader Gridco Ltd said, it is at a comfortable position to earn ` 700 crore in the current fiscal by trading power on energy exchanges and selling to other states as better post monsoon rainfall has increased chances of higher hydro power production. The state has generated around 750 MW hydro power in the current month out of total 3200 MW power available from different thermal power and renewable energy generators, compared with less than 500 MW hydro power generated a month ago. Gridco usually buys around 15 per cent of its total power requirement of 3000 MW from hydro power generators. Due to ample hydro power availability, Gridco wants to keep cheaper power for the state and sell costlier thermal power outside to earn profit. However, due to poor demand and lack of transmission facility for supply of power, the trading has remained rather dull for some time. (www.business-standard.com)

Telangana eyes 2 GW power from Chhattisgarh

October 24, 2014. The newly-born Telangana state has sought 2000 MW power from Chhattisgarh to overcome the severe crises that the state had been reeling with. Earlier, Telangana state had demanded 1000 MW power from the Chhattisgarh that had been power surplus during off peak time. The Chhattisgarh government had given its consent for the same and the senior officials of both the states had held meeting to give final shape to the power purchase deal. The state government has sent the proposal to the state-run Chhattisgarh power distribution company to examine it and send the opinion. The state government has been deliberating to provide all possible assistance to neighbouring Telangana state to deal with the power crises that has deepened forcing the authorities to extend the night-time power cuts in the rural areas to meet the deficit. The power deficit in the state is touching 1,500 MW per day while unscheduled cuts are back in parts of city, in addition to the four hours of scheduled cuts. The projects on completion will generate 4000 MW power. Under the agreement with the private power producer, Chhattisgarh will get its share from the production that it could sell. The state government would ink an agreement with the Telangana government for power deal once the power company examine the proposal and send note that it was in a position to provide power. (www.business-standard.com)

Navayuga Power in talks with Toshiba, Sumitomo, Mitsubishi & GDF Suez to sell power stake

October 22, 2014. Navayuga Power, a unit of CVR Group that operates the largest private port on India's east coast, is in talks with several global power producers and equipment makers to sell a significant stake in its power assets. Navayuga is in the process of setting up a 1,980 MW coal-fired supercritical power project at Krishnapatnam, near the CVR Group's all weather, deep water port in Andhra Pradesh's Nellore district. The proposed project has already achieved key milestones such as land acquisition and public hearing for environmental clearances, besides entering into a power purchase agreement of substantial capacity with the Uttar Pradesh power utility.

Navayuga Power said that the conglomerate was looking at strategic partners but refused to divulge the names of potential partners or the exact stake it was looking to sell. The power project coming up near the Krishnapatnam port will have 1,320 MW of capacity in the first phase and add 660 MW in the second phase. It involves a total investment of ` 9,400 crore. Having tied-up with the UP power utility for 85 per cent of capacity, the company plans to sell the balance in the open market. Sasidhar said the company hopes to seal the deal for equity sale over the next 3-4 months and execute the first phase of project by 2018-19. (economictimes.indiatimes.com)

Power tariffs to rise in Delhi after festive season

October 22, 2014. Power tariffs are set to rise in Delhi after the festive season as the three distribution firms have sought a revision citing an increase in their electricity procurement costs. To recover their higher power purchase costs, BSES Yamuna, BSES Rajdhani and Tata Power Delhi Distribution have approached the regulatory commission, which will consider the matter next month. BSES Yamuma, which distributes power to 14 lakh consumers in central and east Delhi, has sought a 17 per cent increase in tariffs as its 'power purchase adjustment charges'. Tata Power's distribution arm in New Delhi has sought 9 per cent increase for its power purchase costs while BSES Rajdhani sought 7.26 per cent rise.

Tata Power Delhi and BSES Rajdhani supply electricity to 14 lakh and 20 lakh consumers respectively. These distribution firms have been claiming that their power procurement costs are high due to their dependence on ageing and natural gas-fired power plants of NTPC and other state-owned firms. 'Power purchase adjustment charges' account for 85 per cent of the electricity bills that consumers receive in Delhi.

Delhi's distribution firms procure 80-85 per cent of their electricity from central government controlled generating companies that are governed by the Central Electricity Regulatory Commission. However, Delhi Electricity Regulatory Commission has not enabled distribution firms to recover their entire cost burden, he said, adding that the tariff hike sought by his distribution firm is as per the provisions and regulations of the Electricity Act. (economictimes.indiatimes.com)

Policy / Performance………….

Govt forms panel to review reports on Ganga Hydropower projects

October 28, 2014. The NDA government has finally taken the first step towards formulating a policy for hydropower projects on the Ganga — Alakananda and Bhagirathi rivers —in Uttarakhand. Water resources minister Uma Bharti informed the National Ganga River Basin Authority that a committee comprising officials of the environment and water resources ministry had been asked to review the reports of three committees dealing with hydropower projects on the two key tributaries of the Ganga in Uttarakhand.

The government had been recently pulled up by the Supreme Court for delaying a decision on the fate of the hydropower projects in the state. The expert group said that hydropower projects had played significant role in the Uttarakhand disaster, and recommended that at least 23 hydropower projects be dropped, and stressed on the urgent need to improve the environment governance of hydropower projects. Successive Uttarakhand governments have been opposed any move to restrict development of hydropower projects, arguing that it would adversely impact the state's economy. (economictimes.indiatimes.com)

Tata Power to speed up $1.8 bn Vietnam power station

October 28, 2014. Tata Power Company Ltd plans to complete work on a $1.8 billion thermal power station in Vietnam three years early, government said, as the two countries strive to showcase the economic ties between them. Vietnamese Prime Minister Nguyen Tan Dung, visiting India just a month after India's president travelled to his country, said he had met Tata group officials and that the 1,320 MW project would be completed by 2019 instead of 2022. Tata Power won the contract last year to develop the coal-fired Long Phu 2 Power Project in the southern Soc Trang province of Vietnam on a build, own and transfer basis. Indian officials also said the project had been brought forward. (economictimes.indiatimes.com)

Govt plans to fuel up 91 GW of stuck power projects

October 27, 2014. After clarity on natural gas prices and an ordinance on coal, the government is set to decide on pooling of imported and domestic fuel prices to help stressed power stations with a combined capacity of 91,000 MW generate electricity that's badly needed as India tries to revive its economy. The Cabinet Committee on Economic Affairs is likely to decide on pooling gas and coal prices at its meeting. The proposals include a bailout package for power plants idling due to scarcity of domestic gas and a plan to meet the needs of coal-based units till 2017. Of the 24,148 MW gas-based projects set up at an investment of about ` 1,50,000 crore, those that can generate about 16,000 MW aren't running while the rest are operating at sub-optimal levels. (economictimes.indiatimes.com)

Assocham for coal preference to operational end use plants

October 27, 2014. Industry body Assocham suggested the government give preference in mines auction to captive block allocatees whose end use plants were operational at the time Supreme Court quashed allocations of mines. The Supreme Court had quashed allocation of 214 out of 218 coal blocks which were alloted to various companies since 1993. The auctions should be opened for others only after coal for these projects is secured, it said. In a note submitted to the Prime Minister Office (PMO), the Chamber stated that coal blocks already allotted for end use steel projects should be auctioned only for steel projects and similarly coal block allotted for end use power projects be auctioned only for power projects, it said. (www.business-standard.com)

Private Discoms worried over proposed changes to Electricity Act

October 27, 2014. Private distribution companies are concerned about some of the proposed amendments to Electricity Act, 2003, such as empowering regulators in states to revoke the licence in case the distributor is unable to meet the prescribed standards, saying the changes may hurt the viability of their investments in infrastructure. According to the proposed amendments, electricity regulators will have a greater say in determination of time period for the distribution licences and selling the assets of the distributors after the term of licence is over or revoked. However, the private companies say they will not be able to make the desired investments if the tenure of the distribution licence is not specified. India has seven private licensees — two each in Delhi and Mumbai and one each in Kolkata, Surat and Ahmedabad. Tata Power, Torrent Power, Reliance Infra and RP-Sanjiv Goenka Group have improved power supply and reduced commercial losses in their respective distribution areas. (economictimes.indiatimes.com)

Peak power deficit in April-September 2014 at 4.7 per cent: CEA

October 26, 2014. Country's peak power deficit in the six months ended September 2014 stood at 4.7 per cent, according to official figures. As against a peak power demand of 1,48,166 MW during April-September as much as 1,41,160 MW was met, leaving a deficit of 7,006 MW, as per the data by the Central Electricity Authority (CEA). The peak power deficit - shortfall in electricity supply when demand is at the maximum - in the same period last year (April-September 2013) stood at 4.2 per cent. North-eastern region was the worst sufferer with 11.3 per cent deficit followed by Southern region with 8.7 per cent shortage and Northern region with 8.3 per cent shortfall, during the period (April-September 2014).

The peak power requirement of the north-eastern region comprising Assam, Meghalaya, Manipur, Mizoram, Tripura, Arunachal Pradesh and Nagaland, was at 2,380 MW of which 2,112 MW was met. During the same period of last year, the region had a shortfall of 8.2 per cent, the data said. South Indian states of Andhra Pradesh, Telangana, Tamil Nadu, Kerala and Karnataka required electricity to the tune of 39,094 MW of which the supply was at 35,698 MW. Last year, the region's deficit was 12.5 per cent. North India -- Delhi, Haryana, Himachal Pradesh, Jammu & Kashmir, Punjab, Rajasthan, Uttar Pradesh, Uttarakhand -- required 51,977 MW of power during the six-month period, while it received 47,642 MW. The region's last year deficit was at 6.9 per cent. This year, country's eastern region including states of Bihar, West Bengal, Jharkhand and Odisha stood at the bottom of the list of peak power deficit regions. They reported a shortfall of 286 MW or 1.7 per cent. As against the demand of 16,628 MW, the supply stood at 16,342 MW, as per the data. CEA, the techno-economic clearance body under the Ministry of Power, is also engaged in setting generation targets and other milestones for the power utilities. (economictimes.indiatimes.com)

AP Irrigation Min meets Governor on power sharing with Telangana

October 26, 2014. Amid a raging row between Andhra Pradesh and Telangana on sharing of electricity, the AP government petitioned common Governor ESL Narasimhan on the issue. AP Irrigation Minister D Umamaheswara Rao said he has explained "all the facts" to the Governor who will go through the relevant material concerning the issue. The current dispute between Andhra Pradesh and Telangana is about power generation at Srisailam (project). Andhra Pradesh wants Telangana to stop power generation at the Srisailam project as continued power generation would lead to water scarcity in AP in future. However, Telangana has refused to stop power generation in view of the prevailing acute power shortage, especially to agriculture. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Shell seeks 5 more yrs for arctic oil drilling drive

October 28, 2014. Royal Dutch Shell Plc is asking the Obama administration for five more years to explore for oil off Alaska’s coast, saying setbacks and legal delays may push the start of drilling past the 2017 expiration of some leases. Shell’s plans to produce oil in the Arctic were set back in late 2012 by mishaps involving a drilling rig and spill containment system, and the company has been sued by environmental groups seeking to block the Arctic exploration. The Hague-based company halted operations in 2012 to repair equipment and hasn’t resumed its maritime operations off Alaska’s northern coast. Leases issued by the government for the right to drill for oil in the Arctic expire in 10 years unless the holder can show significant progress toward development. The Interior Department temporarily stopped the clock on some of Shell’s leases due to court decisions and other delays. Shell said it needed certainty from the U.S. before investing beyond the $6 billion it’s already spent. The U.S. is revising its drilling safety regulations for the Arctic. (www.bloomberg.com)

Eni finds gas at Merakes well in East Sepinggan Block off East Kalimantan

October 28, 2014. Italy's Eni reported that it has made an important gas finding in the Merakes exploration prospect, in the East Sepinggan Block, where Eni is operator with a 100 percent stake. The Block is located in the offshore East Kalimantan (Borneo), Indonesia 105.6 miles south of the Bontang LNG Plant and 21.7 miles from the offshore Jangkrik field, also operated by Eni. Merakes is the first exploration well drilled by Eni in the East Sepinggan Block, which was assigned to the Company in 2012 following an International Bid Round. Merakes finding potential has been preliminary estimated to be 1.3 trillion cubic feet (Tcf) of gas in place. The finding has further upside that will be assessed with a delineation campaign. (www.rigzone.com)

Chevron starts gas production from Bangladesh's Bibiyana expansion project

October 28, 2014. Chevron Corp.'s subsidiary in Bangladesh commenced natural gas production from the onshore Bibiyana Expansion Project in the northeastern part of the country, the company reported. The expansion project will boost Chevron-operated natural gas production capacity in Bangladesh by more than 300 million cubic feet per day to 1.4 billion cubic feet per day, while the company-operated natural gas liquids production capacity will rise by 4,000 barrels per day to 9,000 barrels per day. Facilities for the Bibiyan Expansion Project included an expansion of the existing gas plant to process increased natural gas volumes from the Bibiyana field, additional development wells and an enhanced gas liquids recovery unit. In July 2012, Chevron revealed plans to spend around $500 million to raise production from Bangladesh's largest gas field. The firm's Bangladesh subsidiary has a 99 percent working interest in the Bibiyana development. (www.rigzone.com)

Crude at $80 a barrel? no sweat: Oil producer CEOs

October 28, 2014. U.S. energy companies are shrugging off a 24 percent plunge in oil prices, confident they can adapt and still make money. Amid predictions that the biggest drop in crude prices since the global financial crisis six years ago will choke off cash flow and slow drilling, industry leaders are reassuring investors they still have the means to return ample profits. Improved technology is bringing down costs and most shale producers operate in multiple basins, allowing them to shift work to the most profitable sites.

The industry is used to price swings, Halliburton Co. Chairman and Chief Executive Officer David Lesar said. When prices climb above $100 a barrel, oil companies are “printing money like crazy,” he said. When prices fall below $80, the “doomsdayers start to come out. Oil futures traded in New York lost one-quarter of their value since June 20. The four-month plunge is the longest streak of consecutive monthly declines since July 2008-January 2009. The futures fell one penny to $81, after earlier touching $79.44. (www.bloomberg.com)

CNOOC makes mid-to-large oil, gas discovery in Bohai Bay

October 27, 2014. China National Offshore Oil Corp. Ltd. (CNOOC) announced that it has made a mid-to-large new oil and gas discovery at Jinzhou 23-2 in China's Bohai Bay. The Jinzhou 23-2 structure is located to the north of Liaodong Uplift in Bohai Bay with an average water depth of about 32.8 feet. The Jinzhou 23-2-3 well, drilled and completed at a depth of 3,599 feet, encountered oil and gas pay zones with a total thickness of 224.4 feet. Test at the well yielded around 260 barrels per day of oil.

The latest discovery comes just over a month after CNOOC announced it found gas at Lingshui 17-2 well in the northern part of the South China Sea, 94 miles south of China's southern Hainan Island, with the well drilled by Hai Yang Shi You 981. Driven by rising domestic energy consumption, China has been active in tapping its petroleum resources. In this regard, CNOOC issued an invitation for foreign companies to bid for 33 exploration blocks located offshore China, with submissions to be made by April 30, 2015. (www.rigzone.com)

BP shouldn’t get trial on spill ruling: Halliburton

October 24, 2014. BP Plc’s bid for a new trial over causes of the 2010 Gulf of Mexico oil spill should be rejected because the judge didn’t rely on excluded testimony, Halliburton Co. said. BP’s own lawyers are responsible for trial testimony that the London-based oil company complains led to an unfair gross-negligence finding against it, according to Halliburton, the cementing subcontractor on the blown-out well. U.S. District Judge Carl Barbier, who oversees consolidated spill-damages litigation against BP and its contractors, ruled that BP acted with gross negligence in drilling the Macondo well off the Louisiana coast.

The well gushed more than 4 million barrels of crude into the gulf, the worst offshore spill in U.S. history. The ruling exposes BP to potentially more than $18 billion in U.S. pollution fines. That sum would be on top of the more than $28 billion BP has already paid for spill-related response, cleanup costs and damages. (www.bloomberg.com)

Norway’s Arctic oil ambitions threatened by slump in oil

October 23, 2014. Norway’s push to exploit Arctic waters for oil, already denounced by environmentalists, is under threat from the slump in crude prices. The Arctic Barents Sea off northern Norway is reckoned to contain 40 percent of the country’s undiscovered resources and seen as key to extending oil output as aging North Sea fields decline. But operating there is expensive, and even before the recent plunge in prices, state-controlled Statoil ASA’s key project in the area had been delayed twice. Arctic oil and gas projects from Greenland to Russia have faced hurdles for years, including rising costs, lawsuits, technical challenges and political opposition.

Royal Dutch Shell Plc halted drilling offshore Alaska twice in two years after investing $5 billion, and the development of OAO Gazprom’s Shtokman gas field has been shelved. Norway, where oil workers are the best paid in the world, is already one of the most expensive places to do business.

And while the Barents Sea is more hospitable than other parts of the Arctic thanks to warming currents of the Atlantic Gulf Stream, oil deposits are more expensive to develop than in the North Sea due to a lack of pipelines, platforms and terminals. No crude finds have yet been brought to production here, and Eni SpA’s Goliat field is headed for a 50 percent cost overrun when it starts producing in 2015. (www.bloomberg.com)

China’s Cnooc considers Norway exploration as oil trumps Nobel

October 23, 2014. Cnooc Ltd. is sizing up the potential for oil exploration in Norway’s Arctic as China’s biggest offshore producer ignores a freeze in the two countries’ relations since the 2010 Nobel Peace Prize. The Chinese company and its Canadian subsidiary, Nexen Inc., are looking at buying seismic data covering an area of the Barents Sea where licenses will be awarded in 2016, according to the Norwegian Petroleum Directorate. China reacted with anger after the Oslo-based Nobel Committee awarded the Peace Prize to Chinese dissident Liu Xiaobo in 2010. Yet the deterioration in ties has done little to stem business interests as the world’s second-biggest economy seeks access to energy sources needed to fuel growth. Part of that plan involves establishing a foothold in the Arctic, which could hold more than 20 percent of the world’s undiscovered oil and gas resources. The company’s bid for Arctic exploration follows deals between China National Petroleum Corp. and Russian companies for oil imports and exploration. Norway’s government, which took office last year, has made improved relations with China a top foreign-policy goal. The Conservative-led administration has gone to great lengths to avoid angering China further, including snubbing Tibetan leader Dalai Lama -- another Nobel Peace prize laureate -- during his visit to Norway in May. Cnooc already has oil and gas assets in north and south America, Africa and Australia. It bought Nexen for $15.1 billion in 2013 in China’s biggest overseas acquisition, expanding into the U.K. North Sea. Nexen exited Norway before it was acquired. Statoil ASA, 67 percent owned by the Norwegian state, has an office in Beijing and has had cooperation agreements with CNPC and Cnooc since before bilateral ties worsened in 2010. Cnooc also became a partner of Norway’s fully state-owned company Petoro AS in an exploration license off Iceland’s shores last year. While its subsidiary China Oilfield Services Ltd. operates rigs off Norway, a successful bid in the 23rd licensing round would make it the first Chinese company to obtain a production license in the Nordic country. (www.bloomberg.com)

Total new CEO will contend with slump in production, oil

October 22, 2014. The successor to Christophe de Margerie, the outspoken Total SA boss who died in a Moscow plane crash, will have to contend with a slump in the company’s output and the failure of its exploration strategy. Patrick Pouyanne, currently the company’s refining chief and long-touted as a potential successor, will be nominated as chief executive officer at a board meeting in Paris. The new CEO must see through a round of cost cuts as lower oil prices and weak returns from refining eat into profit at France’s largest company by sales. Total plans to sell another $10 billion of assets by 2017, adding to the $15 billion to $20 billion targeted from 2012 to this year. It has achieved $16 billion so far under that plan, with $4 billion underway, including sales of a stake in a Nigerian field and the Bostik chemicals business. (www.bloomberg.com)

Downstream…………

Sasol says US cracker costs to shape GTL plant decision

October 28, 2014. Sasol Ltd. said a decision on whether to proceed with a U.S. facility to turn natural gas into transportation fuels will depend on cost overruns at an $8.1 billion chemical plant it’s building in Louisiana. Sasol will decide in 2016 whether to build a gas-to-liquids, or GTL, plant at the site of the planned ethane cracker in Lake Charles, Louisiana, Chief Executive Officer David Constable said. A decision to proceed, on what would be the first plant of its kind in the U.S., will depend on costs at the chemical project, the price of oil, diesel and gas and the health of the global economy, he said. Both projects are being proposed to capitalize on a jump in North American gas output from shale formations. The GTL project, which Constable last year estimated would cost $14 billion, would produce diesel fuel and waxes. The project is in the front-end engineering and design phase, the CEO of the Johannesburg-based company said. Sasol approved the final investment decision for the construction of the ethylene plant in Lake Charles. The GTL plant may produce 96,000 barrels of fuel a day. (www.bloomberg.com)

Trinidad refinery swaps crude sources on Ebola scare

October 22, 2014. Trinidad & Tobago is substituting crude from Gabon with Colombian and Russian shipments amid protests by refinery workers alarmed by the outbreak of Ebola in other African countries. Energy Minister Kevin Ramnarine halted oil purchases from Gabon, the Caribbean country’s only African supplier in the past 20 months, he said. The decision follows the refusal of workers from Petrotrin, which operates Trinidad’s sole refinery, to assist with the berthing of a tanker that arrived in Trinidad waters from Gabon. (www.bloomberg.com)

Transportation / Trade……….

Saipem in talks to lay two new pipelines in Kashagan