-

CENTRES

Progammes & Centres

Location

[Shades of Grey: The Annals of the Indian Coal Industry (part III)]

“With the unravelling of what is labelled as India’s ‘coal-gate’, narratives on how coal mining should be auctioned off to private parties who are the only saviours of the coal industry are emerging. If those who embrace this narrative care to look back at India’s very long history of coal mining, they would learn that the private sector which had the longest period of control over coal mining in India did not really do a better job…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Coal…………………

· Shades of Grey: The Annals of the Indian Coal Industry (part III)

DATA INSIGHT………………

· Progress Path of Indian Nuclear Power Sector

[NATIONAL: OIL & GAS]

Upstream…………………………

· Investment decision only after clarity on gas price: RIL

· Cairn India's Rajasthan output dips 7 per cent in Q2

Downstream……………………………

· HPCL shuts Vishakhapatnam refinery due to cyclone Hudhud

Transportation / Trade………………

· RIL looking to sell US shale gas stake for $4.5 bn

· Hiranandani Group to build LNG terminal at Jaigarh

Policy / Performance…………………

· IOC to invest in shale-gas and LNG projects in Canada

· Petrol prices may fall by ` 1 a litre before Diwali

· How falling crude oil prices will benefit India

· ` 2.50 per litre cut in diesel rate likely after state elections

[NATIONAL: POWER]

Generation………………

· Power generation in full gear at Sagar, Srisailam

· International consortium proposes to build power plant in Telangana

· Jaitapur project to be scrapped if Shiv Sena comes to power: Uddhav Thackeray

· NMDC, NALCO to set up power plant in MP: Tomar

· Teesta hydel project faces further delay

· Puri Group plans to raise ` 1.4 bn for 14 MW hydropower project in HP

· BHEL bags ` 78 bn contract for power project

· NHPC gains on higher electricity generation

Transmission / Distribution / Trade……

· IEX sees higher demand for electricity than supply in September

· Alstom gets ` 1.3 bn equipment supply contract from Power Grid

· Cyclone Hudhud batters power infra in Odisha districts

· Karnataka to help AP restore power supply in cyclone-hit areas

· TPDDL starts scheme to encourage online bill payments

· Coal supply at 60 projects still critical: CEA

· Power supply yet to be restored in Jammu

· Maharashtra polls: Ahead of election, Maharashtra buys more power

· Adani Power demerges its transmission unit

· Fuel shortage known to discoms; notices given in advance: NTPC

Policy / Performance…………………

· Uttarakhand govt working on policy for micro, mini hydel projects

· Govt seeks personnel, land data for takeover of coal mines

· Gujarat HC asks Torrent Power to deposit ` 200 mn with GSPL

· Revive 100 GW plants to tackle power problems: Advisory group

· NTPC to go for mechanised bagging of fly ash by November-end

· Centre moves to link hydropower projects with Ganga rejuvenation

· Telangana govt to buy 2 GW power on 7 year contract basis

· Power ministry plans to sell LEDs for ` 10

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· DPE discovers gas at T-02 well in Dubai's offshore Fateh field

· First production commences at CNOOC's Enping 24-2 oil field offshore China

· Bakken drillers poised to curb exploratory spending

· 100 mn barrels produced from Varg field

· Biggest US oil field adds rigs as crude prices slide

· Pemex optimistic for ultra-deep water find in Gulf of Mexico

· Shale boom tested as sub-$90 oil threatens US drillers

Downstream……………………

· Kenya yet to decide oil refinery's fate

Transportation / Trade…………

· Israel sees gas as key to transforming Mideast relations

· Gazprom may drop Vladivostok LNG project in favour of pipeline gas to China

· Spain's Gas Natural sees no change to payouts after $3.3 bn CGE buy

· Sound Oil signs gas sales agreements

· Statoil sells Shah Deniz stake to Petronas for $2.2 bn

· Speculators push oil into bear market as supply rises

· Options traders raise bets on $77.50 US oil by December

· New pipelines to cost Kashagan oil project up to $3.6 bn

· Canadian oil discount seen shrinking on US re-exports

· CNPC gets nod for China-Russia gas pipeline design

· Hijackers release Vietnam tanker after diesel fuel theft

· Narrow price gap opens door for African oil exports to US East

Policy / Performance………………

· Slovaks seek to sign 15 year Russian oil-supply deal

· Kuwait joins Saudi view of no immediate OPEC supply cuts

· Oil demand growth this year seen weakest since 2009

· Fuel smugglers line up every day to drain Indonesia economy

· Iraq follows Saudi cuts as Brent slides to 4 year low

· Shell to Halliburton seen winning with Brazil’s Neves

· Indonesia to miss oil output target of 1 mn barrels daily

· Gas-driven growth powers Morales re-election bid in Bolivia

· Fracking setback in Poland dim hopes for less Russian gas

· Europe to boost gas storage as it seek diversification

· Oil bulls keep faith Saudi supply cuts will revive price

· Govt approves EIA for the Arrow Bowen Pipeline in Australia

· Indonesia's Donggi-Senoro LNG project to start up in mid-2015

[INTERNATIONAL: POWER]

Generation…………………

· Marubeni says to build $3 bn coal-fired power plant in Myanmar

· Zimbabwe signs deal with China's Sinohydro to expand power plant

· GVK wins environmental permit for Alpha coal project

· Thailand's Ratchaburi to co-invest in power plant in Myanmar

Transmission / Distribution / Trade……

· China coal tariffs add to pressure on producers in Australia

· Iran, Armenia to build power transmission line in near future

Policy / Performance………………

· Algeria set to run first nuclear power plant before 2029: Algerian Energy Minister

· Norway approves first direct power link to Germany

· Brazil suspends permitting process for three hydropower projects

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· MCL dedicates 2 MW solar power plant to nation

· India faces mounting calls to move solar to fixed tariffs

· German govt sanctions ` 3.2 bn for ecosystem study project for HP

· Gujarat may get India's first offshore wind power project

· Suzlon to invest ` 150 bn for power projects in MP

· Rajasthan govt launches Solar Energy Policy-2014

GLOBAL………………

· German green power surcharge to ease 1.1 per cent in 2015

· French energy transition law to cut red tape on renewables

· Skanska, Ecotricity start up $800 mn UK wind venture

· Pentagon warns climate change will intensify conflict

· Giant battery unit aims at wind storage Holy Grail

· Jiangsu Linyang to raise $294 mn for solar

· China to promote utility-scale solar power projects

· China finally acknowledges unfair pricing, to sharply lower renewable tariffs by 2020

· Canadian Solar to supply EDF with 24 MW of panels

· Renewables to drive power generation growth in Africa: IEA

· Oman’s first wind power plant to come up in Salalah

· Coal, not fracking blamed for US methane hot spot

· Merkel eyes multinational power market to cut renewables cost

· Japan solar boom fizzling as utilities limit grid access

· Renewables to surpass hydropower generation for first time: EIA

· Global solar sector sees $9.8 bn corporate funding in Q3

· California moves to revoke carbon credits after inquiry

· American Water in discussions on fracking services: CEO

· DuPont’s $500 mn ethanol bet panned by Peltz to pay off

· EU nations mull funds to aid clean energy in 2030 climate deal

[WEEK IN REVIEW]

ENERGY/COAL………………

Shades of Grey: The Annals of the Indian Coal Industry (part III)

Lydia Powell, Observer Research Foundation

Continued from Volume XI, Issue 17 (http://www.orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=73410&mmacmaid=73411)

Part II of this essay that appeared in last week’s issue of the ORF energy news monitor offered glimpses of the coal sector just before and after nationalisation in the 1970s. Part III of the essay continues from there.

The dramatic increase in coal production after nationalisation in the early 1970s had three major irreversible consequences in the context of India’s energy supply in general and the role of coal in energy supply in particular. The first is what we may call the carbonisation of India’s energy basket. In the 1960s coal and hydropower had roughly equal share in power generation. By the 1990s, coal’s share in power generation increased to roughly 70%. By most projections the share of coal in power generation is unlikely to change in the next two decades. Carbonisation of India’s energy basket is seen by many observers, especially those from industrialised countries, as a liability in the context of climate change. Others, who are probably more aware of India’s socio-economic and socio-political choices and limitations, see carbonisation as the inevitable price that had (has) to be paid to offer a better life for millions of people. Irrespective of the validity of the arguments for and against coal, the dominance of a single fuel for power generation has increased India’s energy risks. India is now vulnerable to disruptions in power generation on account of even small changes in the price of coal, policy on coal and the physical availability of coal.

The second is the technological shift towards opencast mining. As pointed out by Padma Bhushan late Shri G L Tandon, the dramatic shift towards open cast mining after nationalisation reduced the share of under-ground mining from 74% in 1975 to about 10% now.[1] Shri Tandon lamented that if well managed Western and Indian coal companies such as Bengal Coal Company, McNeill & Barry, Turner Morrison, Chanchani, Worah and others had been allowed to continue their operations independently, several decades of under-ground mining technology / experience may not have been lost. This shift has broader implications in the context of sustainable mining practices as well as the extent of accessible coal reserves available for the future. A short digression into the past explains why this is unlikely to be reversed.

Compromise on scientific mining practices began almost 50 years prior to nationalisation when the urgency of World War I pushed demand for coal. As Subrahmanyam puts it, ‘even leading mining companies that were financially strong indulged in ‘slaughter mining’ and used up high quality metallurgical coal for burning in Railway and Marine engines.[2] Lord Curzon commissioned a report by the British Mining engineer Treharns-Rees in 1918 to take stock of the situation. The report recommended compulsory stowing[3] to obviate dangers arising from ‘slaughter mining’ and the creation of a legally empowered authority to enforce it. The report also recommended that the large quantity of ‘unmarketable’ coal that was accumulating in the mines be used for pit-head power generation.[4] The Coalfields Committee endorsed these recommendations in 1920 but no action was taken. One of the reasons was that just after war the coal market shifted from a seller’s to a buyer’s market. When the seller was king ‘everything black including stones and rubbish was dug out and sold to the helpless consumer’.[5] The situation is not very different today. It is very common to see news items on the conflict between NTPC a big consumer of thermal coal and CIL over stone, muck and rubbish being loaded and sold as coal.[6] But when buyer became king after the end of the war, only coal desired by the customer in terms of quantity and quality was dug out. Unrecovered coal was left behind in such a state that it could not be recovered at any time in the future.[7] This unrecoverable coal is burning even today and is often featured in western news papers as part of their coverage of third world resource and environmental tragedies.[8]

This raises two critical questions in the current context. The first is over how much recoverable coal reserves the country actually has, given that careless and unscientific mining practices have permanently lost some of the resources. The answer to this ranges from just 10 billion tonnes (BT) to over 100 BT. The wide range only tells us that it is not really known. The second is over the logic of compromising on the natural integrity of the coal mine to either allocate blocks to users or to auction them off. As pointed out by Partha Bhattacharya, former Chairman of CIL captive coal mining by consumers is not practised anywhere else in the world and is not optimal from economic, geological and ecological perspectives as it requires coal reserves to be artificially sub-divided.[9] With the unravelling of what is labelled as India’s ‘coal-gate’, narratives on how coal mining should be auctioned off to private parties who are the only saviours of the coal industry are emerging. If those who embrace this narrative care to look back at India’s very long history of coal mining, they would learn that the private sector which had the longest period of control over coal mining in India did not really do a better job in the context of conservation of resources, sustainable mining practices, labour safety and reform or even on prices. In fact many of legacy burdens that the coal sector shoulders today were creations of the private sector.

The third consequence of the dramatic increase in coal production in the 1970s follows from the first two and it is about the plight of the low cost casual labour that underwrote this increase. These impoverished masses are the collateral damage of the first two shifts described above and despite this they are not part of any discussion on coal in India, be it the high politics of energy security or the high finance of coal company listing. But the fact that they are important factors in the economics of India’s coal production cannot be ignored even if one is averse to people centric (‘leftist’) views. Suppression of wages for casual workers that contributes to making CIL a low cost coal producer has a long history stretching back to the early 1990s. The Noycee Committee appointed in 1925 in response to the loss of competitiveness of Indian coal in the global market concluded, presumably under the influence of the coal producers lobby, that the high Railway rates were to blame for the loss of competitiveness. As a solution it recommended that since Indian coal is not amenable to washing a Coal Grading Board would issue certificates of quality to exported coal.[10]

This introduced a layer of bureaucracy into the coal sector to assess coal quality, a mechanism that thrives even today. The comment that ‘Indian coal workers were lazy and that the increase in wages granted a few months earlier had made them lazier leading to loss of competitiveness of Indian coal in the global market’ offered by a western owned coal producer to the Noycee Committee is an illuminative testimony of the disregard for labour in the coal sector.[11] As the coal industry consolidated and grew after the First World War, low cost labour continued to be seen as a substitute to investing in competitiveness enhancing technologies and scientific management practices. In 1939 when the Coal Mining Safety Act was passed World War II broke out and the rationale for reform was destroyed by the dramatic increase in demand for coal. Coal pricing was brought under control in 1944 and prices were fixed by a committee consisting of private producers. According to Subrahmanyam the upper limit to these prices was the ‘sky’.[12] By the 1960s this changed into a form of cost plus method of price fixing which continues in slightly evolved form even today. When the ceiling on prices was held high and the floor on costs were held low with poorly paid casual labour, a huge gap emerged in between that was padded with administrative, commercial and technical inefficiency. The controlled pricing regime also opened up opportunities for a grey market to be created for lower grade coals with secret discounts offered to consumers from the power generation to brick manufacturing sectors. Despite nationalisation in the 1970s, what we have today is just an extrapolation of the coal industry that had existed prior to nationalisation. The point to note here is that the Indian coal industry is mounted on the backs of low cost casual labour which in turn is loaded with bricks of inefficiency to touch the ceiling that represents artificially high prices. Calls for reform, liberalisation and privatisation of the coal industry would do well to acknowledge that this path dependent set-up has ‘locked-in’ and institutionalised much of the inefficiencies. The tragedy is that all this has consequences on national welfare. As inefficiency packed costs are passed off to the end consumers of coal, we have uncompetitive prices for coal based outputs such as power generation notwithstanding the low cost labour at the bottom. We cannot ‘make much in India’ unless this changes.

Returning to the quote from the Burrows Committee Report of 1936 where this essay started, ‘coal trade in India has been rather like a race in which profit (politics since the 1970s) has always come first with safety a poor second, sound methods ‘an also ran’ and national welfare a dead horse.’ Unless this list is reversed with national welfare coming first, sound methods coming second, safety third and profits coming last, someone could be writing the same story fifty years from now.

Concluded

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

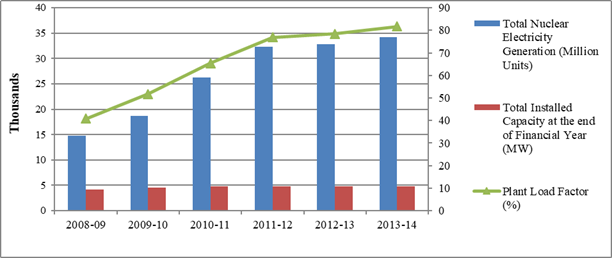

Progress Path of Indian Nuclear Power Sector

Akhilesh Sati, Observer Research Foundation

|

Year |

Total Nuclear Electricity Generation in (Million Units) |

Total Installed Capacity at the end of Financial Year (MW) |

Plant Load Factor (%) |

|

2008-09 |

14716 |

4120 |

40.8 |

|

2009-10 |

18636 |

4560 |

51.80 |

|

2010-11 |

26266 |

4780 |

65.40 |

|

2011-12 |

32287 |

4780 |

76.90 |

|

2012-13 |

32866 |

4780 |

78.49 |

|

2013-14 |

34228 |

4780 |

81.74 |

Nuclear Fuel Imports

|

Firm/Country |

(in Metric Tonnes) |

|||||||

|

Total Quantity ordered |

Quantity of Uranium Imported |

|||||||

|

2008-2009 |

2009–2010 |

2010–2011 |

2011–2012 |

2012–2013 |

2013–2014 |

2014– 2015 (upto July 25, 2014) |

||

|

M/s. AREVA, France |

300* |

60.49 |

239.38 |

Nil |

Nil |

Nil |

Nil |

Nil |

|

M/s. TVEL Corporation, Russia |

2000** |

Nil |

150.33 |

179.79 |

296.08 |

295.64 |

296.31 |

118.57 |

|

58^ |

Nil |

58.29 |

Nil |

Nil |

Nil |

Nil |

Nil |

|

|

M/s. NAC Kazatomprom, Kazakhstan |

2100* |

Nil |

Nil |

600 |

350 |

402.5 |

460 |

Nil |

|

TOTAL |

4458 |

60.49 |

448 |

779.79 |

646.08 |

698.14 |

756.31 |

118.57 |

*In the form of Natural Uranium Ore Concentrate; ** In the form of Natural Uranium Di-oxide Pellets; ^in the form of Enriched Uranium Di-oxide Pellets

Source: Central Electricity Authority, Press Information Bureau

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Investment decision only after clarity on gas price: RIL

October 14, 2014. Reliance Industries Ltd (RIL) has said it will make a final investment decision on producing gas from the R-Cluster discovery in the flagging KG-D6 block only after the government decides on gas price hike. RIL and its partners BP plc of UK and Canada's Niko Resources plan to produce about 13 million standard cubic meters per day of gas for 13 years from D-34 discovery, known as R-Cluster, in the KG-DWN-98/3 or KG-D6 block by 2017-18. The planned output from D-34, which is estimated to hold an in place gas reserve of 2.2 Trillion cubic feet, is equivalent to the combined current production from Dhirubhai-1 and 3 (D1&D3) gas field and MA field in the KG-D6 block.

RIL said it has completed Front End Engineering Design (FEED) as well as geo-mechanical studies for the R-Cluster development. Contracting activity was underway for long lead items. The government for the third time postponed a decision on raising natural gas prices. It is looking at announcing a decision by November 15. For RIL, a revision in natural gas prices was due on April 1, 2014, when the $4.2 per million British thermal unit rate fixed for first five years of production expired. A panel appointed by the previous UPA government had proposed a formula which would have at least doubled the rates but the same is under review with the new government looking at moderating the increase to keep the burden on consuming power and fertiliser industry minimal. RIL has so far made 19 gas discoveries and 1 oil find in the KG-D6 block. Of these, D1&D3 gas fields were brought to production in April 2009 while MA oilfield began pumping oil in September 2008.

D-34 is part of what is known as R-Cluster of discoveries. R-Cluster comprises four discoveries - D-29, 30, 31 and 34. Of these, only D-34 has so far been declared commercially viable while the Declaration of Commerciality (DoC) of others has been refused in absence of DGH prescribed tests confirming the discoveries. The government approved RIL proposal to invest $3.18 billion in bringing D-34 to production. RIL estimates that output from KG-D6 can reach up to 60 million standard cubic meters a day (mmscmd) by 2019 when all of the satellite fields are put into production. The government has already approved $1.529 billion investment in four satellite fields that can produce 10 mmscmd. Investment plans for rest are under consideration. (economictimes.indiatimes.com)

Cairn India's Rajasthan output dips 7 per cent in Q2

October 10, 2014. Cairn India reported seven per cent drop in second quarter production from its flagship Rajasthan oilfields, mainly due to a shutdown at the fields to carry out maintenance work. Rajasthan block production in July-September stood at 163,262 barrels of oil per day as compared to 175,478 bpd a year ago, the company said. Cairn said production is back to normal levels in the current quarter. Cairn produced 204,128 barrels of oil and oil equivalent gas from all its fields in the country in Q2, down eight per cent from 221,190 barrels of oil equivalents per day (boepd) in the corresponding period a year ago. At Cambay, production increased by 23 per cent at 10,651 boepd during Q2 on account of successful well intervention measures. The Vedanta Group firm said overall output was down three per cent in first half of current fiscal at 215,301 boepd. Rajasthan production slipped one per cent to 173,158 boepd while Ravva output was down 22 per cent at 22,259 boepd. Cairn holds 70 per cent interest in Rajasthan block while the remaining 30 per cent is with Oil and Natural Gas Corp (ONGC). (economictimes.indiatimes.com)

Downstream………….

HPCL shuts Vishakhapatnam refinery due to cyclone Hudhud

October 13, 2014. Hindustan Petroleum Corp Ltd (HPCL) temporarily shut its Vishakhapatnam refinery as cyclone Hudhud made landfall on the eastern coast. The company shut the 8.3 million tonnes a year or 166,000 barrels per day refinery at Vishakhapatnam as cyclone Hudhub made landfall with gusts as strong as 195 kilometres per hour. HPCL will resume operations when normalcy returns to the town. (economictimes.indiatimes.com)

Transportation / Trade…………

RIL looking to sell US shale gas stake for $4.5 bn

October 11, 2014. Reliance Industries Ltd (RIL) is looking to sell its 45 per cent stake in the Eagle Ford basin shale oil and gas venture in the US for an estimated USD 4.5 billion. RIL, which bought 45 per cent interest in Pioneer Natural Resources Co's Eagle Ford shale formation of south Texas for USD 1.3 billion, is working with Citigroup Inc and Bank of America Merrill Lynch to find a buyer. Pioneer holds 46 per cent in the Eagle Ford venture while the remaining 9 per cent is with Alpha SAB's Newpeck LLC. Newpek is exploring opportunities to sell its share and is being advised by Tudor Pickering Holt & Co. RIL is also selling its investment in EFS Midstream LLC, an oil and gas gathering treatment and transportation network. EFS Midstream operates 11 central gathering plants in south Texas. RIL has invested a total of USD 3.91 billion in Pioneer joint venture since inception. 472 wells have been drilled to date with average production rate of 676 million standard cubic feet per day. (economictimes.indiatimes.com)

Hiranandani Group to build LNG terminal at Jaigarh

October 9, 2014. Real estate firm Hiranandani Group plans to build an 8 million ton per year LNG import facility at Jaigarh on Maharasthra by July 2018 to meet the growing energy demand. H-Energy Gateway Pvt Ltd, a Hiranandani Group firm, has applied to sector regulator PNGRB to connect the import facility with major trunk pipelines that take gas to consumers. The Petroleum and Natural Gas Regulatory Board (PNGRB), in a public notice, invited comments on the company's proposal to connect the Jaigarh LNG terminal with Dahej-Uran-Dabhol-Panvel (DUDPL) pipeline and Dabhol-Bangalore (DBPL) line. West coast already has four liquefied natural gas (LNG) import terminals - Dahej and Hazira terminals in Gujarat, Dabhol in Maharasthra and Kochi in Kerala. Jaigarh is in Ratnagiri district of Maharasthra which also houses the 5 million tons a year Dabhol LNG import terminal of GAIL India Ltd. H-Energy plans to lay a small 40 kilometer line from the LNG receipt facility to Dabhol to hook-up or tie-in with the two pipelines. The terminal will import gas in its liquid form (liquefied natural gas or LNG) in ships, unload it and re-convert it into its gaseous state before sending to consumers through pipeline. It will also have two LNG storage tanks of 190,000 cubic meters capacity each. H-Energy will act as an infrastructure provider and would not have any interest in the commodity. Gas users will arrange for LNG from overseas and use the terminal to unload and transfering it to trunk pipelines. The company is also evaluating the feasibility of setting up a 6 million tons per annum Floating Storage and Regasification Unit (FSRU) Project in the Bay of Bengal. (economictimes.indiatimes.com)

Policy / Performance………

IOC to invest in shale-gas and LNG projects in Canada

October 14, 2014. Indian Oil Corp (IOC) will invest USD 4 billion in the British Columbia province, Canada, to source liquefied natural gas (LNG) from the region. IOC signed a deal to buy 10 per cent stake in shale-gas assets and a linked LNG project in British Columbia. The Canadian asset will produce as much as 19.68 million tonnes of LNG a year for 25 years starting in 2018. The Canadian province is also expecting big ticket investments in its energy space from other geographies as well. It is likely to finalise USD 36 billion from Petronas of Malaysia by this new year. (economictimes.indiatimes.com)

Petrol prices may fall by ` 1 a litre before Diwali

October 14, 2014. Petrol prices are poised to fall to a 16-month low before Diwali as state oil firms plan to cut rates by about ` 1 a litre because the global oil market is in a bear phase, with Brent crude dropping more than 20 per cent since its June peak. The government, which regulates retail prices of diesel, is also considering cutting diesel prices as retailers are getting over ` 3 per litre more than the market rate. IOC, BPCL and HPCL are expected to hold a meeting to slash petrol prices. But, the decision on diesel price cut would require a Cabinet approval, which is expected after assembly elections. The Cabinet on June 2010 freed petrol from price control and took an in-principle decision to deregulate diesel prices in an opportune time. In January last year, the government allowed oil marketing firms to raise diesel rates in small monthly doses of around 50 paise per litre until pump prices are aligned with market rate. Intent of the government was to deregulate diesel once its pump price was aligned with the market rate. Diesel sales are revenue positive from September, but the government has decided to watch the volatility of the international oil market for some more time before taking a view on deregulating it. The oil ministry is awaiting the decision of higher authorities before the matter is taken to the Cabinet. It was seen that the demand of petroleum products in Western countries jump during the winter season due to a sudden rise in energy demands for heating. That may lead to a spurt in fuel prices. As diesel price may stroke inflation, the government is taking a very cautious approach. (economictimes.indiatimes.com)

How falling crude oil prices will benefit India

October 13, 2014. The slide in crude oil prices to four-year lows is a huge positive for India as the country depends on imports for more than three-fourths of its consumption. It is expected to help improve pivotal macroeconomic indicators such as current account and fiscal deficit besides giving a fillip to energy firms, tyre makers and consumer companies. India's net imports of crude oil amount to about a billion barrels every year. So, if crude oil prices average about $100 per barrel in the current fiscal, the country's import bill will fall by $10 billion (` 61,000 crore), which is close to one-third of the current account deficit or CAD in 2013-14. Analysts say that if crude oil averages at $100 per barrel this fiscal, India's CAD will reduce to 1.3% of GDP from 1.7% in the previous year. Cooling crude prices will also help bring down fuel under-recoveries (cost of selling LPG & kerosene below cost), lowering the government's share in the total under-recoveries and, therefore, resulting in narrowing of fiscal deficit. (economictimes.indiatimes.com)

` 2.50 per litre cut in diesel rate likely after state elections

October 8, 2014. A ` 2.50 per litre cut in diesel prices and a little less than ` 1 a litre on petrol is in offing as international oil rates fell to a 27-month low. Prices may be cut after Maharashtra and Haryana assembly elections are completed. Benchmark Brent crude slid by as much as $1.35 to $90.76 a barrel, its lowest level since June 2012. Prices have declined 18 per cent this year. The drop in rates will result in profit on sale of diesel expand from ` 1.90 a litre calculated based on average rate prevailing in the second half of September. Despite wiping out of under-recoveries or the difference between retail selling price and its imported cost, on sale of diesel and the subsequent resultant over- recovery to ` 1.90, the government has not cut rates due to election code. Oil industry wants diesel rates to be reduced to protect their market share which they otherwise would lose to private retailers who price the fuel in tandem with international prices. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Power generation in full gear at Sagar, Srisailam

October 14, 2014. The complete shutdown of the Simhadri Thermal Power Plant in Visakhapatnam has doubled the power woes for Telangana which is in dire straits in terms of power availability. Notwithstanding generation of hydel power to its full capacity at Srisailam and Nagarjunasagar hydro electric projects, the State experienced acute power shortage, forcing it to cut down supply to agriculture and impose emergency load reliefs in State capital. The first two units of Simhadri Thermal Power Plant went down under the impact of cyclone Hudhud, resulting in a shortage of about 1,500 MW together for Andhra Pradesh and Telangana states. Loss to Telangana amounted to about 800 MW, to make up for which the Telangana State Power Generation Corporation began to run the hydel units at the Srisailam and Nagarjunasagar at 792 MW and 789 MW capacities respectively. (www.thehindu.com)

International consortium proposes to build power plant in Telangana

October 12, 2014. A Saudi-American-Chinese consortium has proposed to build a coal-fired power plant in Telangana at a cost of around $ 3-4.5 billion. Telangana Deputy Chief Minister Mohammed Mahmood Ali welcomed the proposal and said his government's top priority is to attract foreign direct investment from abroad, especially Saudi Arabia and will discuss the proposal with Chief Minister K Chandrasekhar Rao. The group has built 17 power plants in Saudi Arabia and abroad, including Turkey. The cost of the plant is expected to be around $ 3-4.5 billion. (economictimes.indiatimes.com)

Jaitapur project to be scrapped if Shiv Sena comes to power: Uddhav Thackeray

October 12, 2014. Reiterating its strong opposition to the proposed 9,900-MW nuclear power plant in Jaitapur, Shiv Sena president Uddhav Thackeray said his party would scrap the project if it is voted to power in the state after the October 15 assembly polls. There has been a stiff opposition to the project as local residents want it scrapped and shifted from Jaitapur in the district. (economictimes.indiatimes.com)

NMDC, NALCO to set up power plant in MP: Tomar

October 10, 2014. NMDC and NALCO will set up a thermal power plant in Madhya Pradesh (MP) at a cost of ` 22,000 crore once the issues following the cancellation of coal mines by the Supreme Court are resolved, Steel and Mines Minister Narendra Singh Tomar said. Besides, steel major SAIL is studying the prospect of iron ore availability in Chhatarpur district in the state, he said. If 50 million tonne iron ore is available, the company will set up a pellet plant with an investment of ` 1,500 crore. (www.business-standard.com)

Teesta hydel project faces further delay

October 9, 2014. A clutch of private equity investors has written to power minister Piyush Goyal raising concerns over the delay in the commissioning of the 1,200 MW Teesta-III hydro power project in Sikkim as other stakeholders show reluctance to infuse the extra equity needed in view of the cost overruns. Teesta-lll is expected to make Sikkim self-sufficient in electricity, enabling it to be a net power exporter. About 12%-15% of Teesta-III power will be available free of cost to the state. About 70% of the rest will be transmitted to power-starved States of Delhi, UP, Haryana and Rajasthan, while the balance will be sold on spot basis. (www.financialexpress.com)

Puri Group plans to raise ` 1.4 bn for 14 MW hydropower project in HP

October 9, 2014. Delhi-based Puri Group plans to raise about ` 140 crore to fund a proposed 14 MW hydropower project in Himachal Pradesh (HP). The diversified group is looking to sign long-term power-supply agreements before it ventures into the market to raise the funds. The group plans to separate its hydropower business under a new company to pay more focus. This will also make fundraising easier. He said the group decided to diversify into power business to establish its presence in environment-friendly energy generation. Next, it plans to start working on commissioning a 7.5 MW project at Killibehl-Kullum in Himachal Pradesh. (economictimes.indiatimes.com)

BHEL bags ` 78 bn contract for power project

October 8, 2014. Bharat Heavy Electricals Ltd (BHEL) bagged a ` 7,800 crore contract for setting up a 1,320 MW thermal power project in Tamil Nadu. The order is for setting up a 2x660 MW coal-fired thermal power project at Ennore Special Economic Zone in Tamil Nadu. The power plant will be constructed on a reclaimed ash pond, calling for specialised civil design, utilising an otherwise barren land. The equipment for the contract will be manufactured at BHEL's Trichy, Haridwar, Bhopal, Ranipet, Hyderabad, Bangalore and Jhansi plants, while the company's Power Sector - Southern Region will be responsible for civil works and erection or commissioning of the equipment. (economictimes.indiatimes.com)

NHPC gains on higher electricity generation

October 8, 2014. NHPC, engaged in hydro power generation, gains 0.8 percent. Electricity generation for the first six months is 21 percent higher than last year, said Central Electricity Authority website. New dams and some of the dams damaged by Uttarakhand floods of last year became operational, investors said. (www.financialexpress.com)

Transmission / Distribution / Trade…

IEX sees higher demand for electricity than supply in September

October 14, 2014. Demand for power continued to outstrip supply on the Indian Energy Exchange (IEX) in September, while electricity price came down to ` 4.18 per unit as compared to the previous month. Bids for purchase of electricity touched 4.17 billion units whereas the sell bids stood at 3.11 billion units in September. The increase in demand could largely be attributed to extended summer coupled with the onset of the festive season, Indian Energy Exchange (IEX) said. According to the bourse, the average Market Clearing Price (MCP) at ` 4.18 per unit was characterised by supply restrictions and eased inter-state transmission congestion. The price is lower than ` 4.50 per unit seen in August. In September, there were 642 participants in the spot market on an average daily basis. (economictimes.indiatimes.com)

Alstom gets ` 1.3 bn equipment supply contract from Power Grid

October 14, 2014. Alstom T&D India has received a contract worth ` 138 crores from PowerGrid Corporation for supply of transformers and reactors to strengthen the southern grid. Under the contract, Alstom will supply six units of 400/200 kV, 500 MVA transformers and two units of 420 kV, 125 MVAr shunt reactors. The company said the project is a part of Power Grid’s system strengthening scheme to boost power handling capacity of substations, and stabilise the transmission infrastructure in Southern India. This is Alstom’s second such project in the country after it was awarded contract to expand grid substations across eastern India. (www.business-standard.com)

Cyclone Hudhud batters power infra in Odisha districts

October 14, 2014. The cyclonic storm Hudhud caused extensive damage to the power infrastructure in five districts of Odisha before weakening into a deep depression and crossing over to south Chhattisgarh. Koraput, Malkangiri, Rayagada, Nabarangpur and Gajapati suffered the most damage to power distribution after the cyclone struck the Andhra Pradesh coast near Visakhapatnam and moved inward into southern Odisha. Around 600 electricity poles and 20 power transformers were damaged as squalls uprooted trees. Transmission lines and grid sub-stations have survived the cyclonic storm. Electricity is expected to be restored in all blocks of the five districts. (www.business-standard.com)

Karnataka to help AP restore power supply in cyclone-hit areas

October 13, 2014. Karnataka has agreed to provide man power assistance to neighbouring AP to restore electricity supply in cyclone Hudhud hit parts of that state. Andhra Pradesh (AP) Chief Minister Chandrababu Naidu spoke to his counterpart in Karnataka Siddaramaiah and sought the state's assistance to restore normalcy in coastal Andhra Pradesh that bore the brunt of the cyclone. Naidu apprised the Chief Minister of the magnitude of the destruction the cyclone has caused to power supply in cyclone hit districts as electric poles and transformers have been damaged and sought assistance in restoring them. Siddaramaiah has agreed to send engineers from Karnataka Power Transmission Corporation and other power supply companies to assist in restoration work. (www.business-standard.com)

TPDDL starts scheme to encourage online bill payments

October 13, 2014. In an effort to encourage people to pay their bills online, Tata Power Delhi Distribution Ltd (TPDDL) has introduced awards like smart phones and LED TVs to "lucky" consumers. Under its unique 'E-Bill Payment and Win' scheme, the discom has already given away gifts to several consumers at a function held here recently. The winners were selected through a lucky draw held in the presence of eminent consumers. Since the introduction of online payment option, there has been up to 41 per cent increase in the number of customers opting for online transactions. The numbers have gone up from 2.30 lakh in financial year 2012-13 to 3.24 Lakhs in 2013-14. (economictimes.indiatimes.com)

Coal supply at 60 projects still critical: CEA

October 10, 2014. More than half the country's 103 thermal power plants are struggling with less than a week's stock of coal at their disposal, says latest official data. According to the latest data by Central Electricity Authority (CEA), 60 coal-based power plants have critical fuel stock position with less than seven days of raw material. Of the 60 power stations with less than seven stocks, 37 generation plants have fuel for less than four days. As per the reasons given by CEA for the stock situation, it is mainly due to low supplies by Coal India and its subsidiaries. Country's largest power producer NTPC is the worst sufferer with nil stocks at five thermal plants. As per the official data, coal stock position at the company's Badarpur (Delhi), Tanda & Unchahar (Uttar Pradesh) and Vindhayachal (Madhya Pradesh) is nil. (economictimes.indiatimes.com)

Power supply yet to be restored in Jammu

October 10, 2014. Power supply is yet to be restored in some parts of Jammu city, which are without electricity for the past 60 hours after strong winds snapped electricity lines. Several parts of Jammu city including Talab Tiloo, Bohri, Udhaywala, Hazuribagh, Gole belt and dozen of villages plunged into darkness after strong gusts disrupted power supply on October 7. Nearly one lakh people have been affected in these areas. The residents said many poles are damaged with wires literally on the roads, but the department is yet to reach the spot. There were protests in Talab Tilloo overnight as people raised anti-government slogans and demanded immediate restoration of power supply. The residents of these areas alleged that their pleas to Chief Engineer Power department, Jammu Shahnaz Goni to restore power supply at the earliest fell on deaf ears. They have urged Chief Minister Omar Abdullah to intervene and get the power supply resorted at the earliest. (www.business-standard.com)

Maharashtra polls: Ahead of election, Maharashtra buys more power

October 10, 2014. Poll-bound Maharashtra is procuring electricity aggressively. The state's power distribution firms, that were absent from the spot electricity market last year, have emerged as largest procurers this year. Maharashtra's distribution firms accounted for one third of the turnover on the Indian Energy Exchange platform that recorded its highest trade volume of 125 million units. Maharashtra paid in the range of ` 3.37-6.99 per unit, which is much higher than the normal supplies from the thermal plants that offers electricity at less than ` 3 per unit under the long-term arrangement. Among others, West Bengal, that sold 28 million units in the market during the first week of October last year, bought 35.2 million units between October 1 and 8 due to the Durga Puja festival. In Gujarat, electricity demands crossed the 13,500-mark because of the nine night-long Navratri celebrations. The electricity exchange provides platform to power procurers and generators to register their demands and supplies respectively, for the supplies needed or available the next day. The platform is used by the distribution utilities to meet their short-term demands. (economictimes.indiatimes.com)

Adani Power demerges its transmission unit

October 8, 2014. Adani Power said that it has demerged its transmission business from itself and its subsidiary, Adani Power Maharashtra, to form another wholly-owned subsidiary, Adani Transmission (India), in order to improve operational efficiency and focus on growth opportunities in the power transmission business. The consideration for the transaction between Adani Power and Adani Transmission (India) was calculated to be ` 168.47 crore with fair value of assets priced at ` 4,293.61 crore. With respect to Adani Power Maharashtra, the consideration was estimated at ` 201.82 crore and assets were valued at ` 665.62 crore. Adani Power is executing four projects such as a high voltage direct current line of approximately 990 kms from its Mundra plant in Gujarat to Mohindergarh in Haryana, a 400 kv 50-km line from Mohindergarh to Power Grid of India’s Bhiwani sub-station in Haryana and another to Dhanonda in Haryana. Adani Power Maharashtra also transferred its 218-km long transmission line stretching from its 3,300 MW Tiroda plant in Maharashtra to Warora sub-station. (www.financialexpress.com)

Fuel shortage known to discoms; notices given in advance: NTPC

October 8, 2014. Amid reports of complaints by power company of short supply of electricity, the state-run power producer NTPC said fuel shortage is known to discoms and notices is given to them in advance about shortage of raw material. At instances where coal is not available because of non- availability of coal or non-availability of rakes, normally notice is given a day ahead, as per the grid code and if any revision is required for any reason, notice is given to RLDC 4 blocks in advance i.e. one hour, it said. As per the latest data (September 29) by the Central Electricity Authority (CEA), 56 coal-based power plants reported critical fuel stocks of less than seven days. As many as 11 power stations were left with nil stocks on the day, the data said. Of the 56 stations, 33 had less than four days of stockpiles. These 33 stations include 10 power stations run by country's leading thermal power producer NTPC. The country's largest producer of power NTPC said that it is trying its best to run the stations on whatever coal is made available. (economictimes.indiatimes.com)

Policy / Performance………….

Uttarakhand govt working on policy for micro, mini hydel projects

October 14, 2014. The Uttarakhand government is working on a new policy for micro and mini hydel projects which will pave the way for a bigger role to gram panchayats and local entrepreneurs in their development, Chief Minister Harish Rawat said. Under the proposed policy micro hydel projects with a capacity of producing 2 MW of power will be reserved for local gram panchayats. Gram panchayat under whose jurisdiction the project site falls will be given priority. The state government will not claim any royalty or water user charges on such projects which will have the status of an industry, the chief minister who also holds the power portfolio said. Both the centre and the state government will lend a helping hand to local entrepreneurs (domiciles and regsitered firms) who come forward to invest in projects worth up to 5 to 25 MW, he said. Captive power producer will get a concession of 20 per cent in premium and if captive power is used in projects set up in hill areas the concession in premium may be extended upto 50 per cent, Rawat said. Different aspects of the proposed policy is being discussed with experts and organisations engaged in the field so that a flawless draft is worked out soon, he said. Apart from hydro power the ambit of the policy will also cover pine needle and solar energy, he said. A single window or online processing system will be introduced so that investors don't have to run from pillar to post to complete the formalities before starting an investment in the hydel sector, the chief minister said. The union government will prove ` 1.25 lakh per KV for setting up projects upto capacity of 100 KV and ` 0.75 lakh per KV for projects with a capacity of 100 KV. The state government will also give assistance for projects between 100 KV and 2 MW of capacity. The remaining amount will be given through a special purpose Vehicle Company made by Gram Panchayat. The government will take no royalty or water user charges on projects on upto 2 MW Capacity. In the second stage, projects between 2 MW and 5 MW will be included while the third stage will concentrate on projects between 5 MW and 25 MW. (economictimes.indiatimes.com)

Govt seeks personnel, land data for takeover of coal mines

October 14, 2014. The coal ministry has asked companies for details of blocks allotted to them over the past two decades in preparation for a government takeover of coal mines whose licences were struck down by the Supreme Court. The ministry has asked 204 coal block owners for details of land ownership and human resource deployment. It wants to know the number of employees with a break-up of managers, supervisors and workers in these companies. It also wants to know the land ownership status and whether the remaining land has been acquired and forest and environment clearances granted. Jindal Steel & Power, Adani Power, Monnet Ispat & Energy, Hindalco, JSW Steel, Tata Power and Essar Group are among a host of companies that have lost rights to mine coal. Approximately 40,000 million tonnes of unexplored coal capacity will move to the government after the court verdict. The government faces the issue of acquiring land titles and taking over the mining leases. The Supreme Court cancelled all but four coal block allocations made over two decades. It gave the government six months to decide the way forward and state-owned Coal India to adjust to the changed situation. The 42 blocks where coal is being mined and whose deallocation is effective from next April have also been asked to furnish details. These blocks will be taken over by Coal India. Around 268.2 million tonnes of coal production will move to Coal India after March 31, 2015. (www.business-standard.com)

Gujarat HC asks Torrent Power to deposit ` 200 mn with GSPL

October 14, 2014. The Gujarat High Court (HC) directed Torrent Power Ltd to deposit ` 20 crore with the Gujarat State Petronet Ltd (GSPL) as an "interim deposit" until the petition filed by the company against a recovery order by the GSPL is settled. In a petition before the Gujarat High Court, Torrent Power had challenged an order, passed in July 2014, levying transport tariff on the electricity generation company by the GSPL as per norms of the Petroleum and Natural Gas Regulatory Board (PNGRB). The Gujarat-based electricity giant has also demanded setting aside of the recovery order of the amount to the tune of ` 49 crore. (economictimes.indiatimes.com)

Revive 100 GW plants to tackle power problems: Advisory group

October 13, 2014. India's electricity problems can be solved within a short time by reviving the 1 lakh MW thermal power capacity plants that are lying idle, Chairman of the Advisory Group for Integrated Development of Power, Coal and Renewable Energy Suresh Prabhu said. Within 18 months the country can solve energy problems by putting in place thermal capacity of about 1 lakh MW, which is lying incomplete, blending it along with about 2,50,000 MW capacity available, said Prabhu who was power minister in the previous NDA-led government. (economictimes.indiatimes.com)

NTPC to go for mechanised bagging of fly ash by November-end

October 12, 2014. NTPC's thermal power plant at Kahalgaon in the state is setting up bagging machines in the unit for mechanised packing of ash for use in cement firms in North-East, after warning from pollution control board and protests from locals against open filling of fly ash. The six machines would fill 4,800 bags an hour, NTPC said. Initially, the machines would scientifically deal with 4,000 metric tonnes of fly ash daily coming out from thermal power plant, NTPC said. Kahalgaon Super Thermal power station is the seventh station of NTPC with an installed capacity of 4x210 MW (Stage 1) and 3x500 MW (Stage 2). NTPC Kahalgaon generates about 10,000 metric tonnes of fly ash daily in the process of manufacture of electricity from coal. (economictimes.indiatimes.com)

Centre moves to link hydropower projects with Ganga rejuvenation

October 9, 2014. The government plans to link hydropower projects (HEPs) in the country with its ambitious Ganga rejuvenation plan, in the process proposing a whole new set of norms to be complied with by all the project proponents before procuring environmental clearances. The bulk of hydro power projects are either commissioned or being constructed in Ganga sub-basins in Uttarakhand. 24 of the total 39 proposed projects in the state were stalled after the Supreme Court (SC) held them to be significantly impacting biodiversity in two sub-basins of the Alaknanda and Bhagirathi rivers. Besides Uttarakhand, the other four Himalayan states of Himchal Pradesh, Jammu & Kashmir, Sikkim and Arunachal Pradesh also have HEPs. (www.financialexpress.com)

Telangana govt to buy 2 GW power on 7 year contract basis

October 8, 2014. Telangana government issued the orders for purchasing 2,000 MW of power immediately on a long term basis for a period of seven years from generators on a pan India basis. These orders were issued in modification of earlier orders according to which the government proposed to procure power on a medium term basis (5 years) from generators in the Southern region. The change in scope and time frame of the procurement was aimed at reducing the power purchase costs. The state was reeling under severe power crisis, which led the power utilities to declare two-day power holiday to industries, on account of the supply-demand mismatch. (www.business-standard.com)

Power ministry plans to sell LEDs for ` 10

October 8, 2014. The power ministry launched a business model enabling the sale of LEDs to households at ` 10 against the market price of ` 400. Under an MoU (Memorandum of Understanding) between EESL and the Andhra Pradesh government, Energy Efficiency Services Limited (EESL) completed the procurement of two million LEDs. Andhra Pradesh Chief Minister N. Chandrababu Naidu launched the Energy Conservation Mission's Demand Side Efficient Lighting Programme (DELP) in the state, which promotes replacement of incandescent bulbs with energy-efficient LED bulbs. The DELP is covering 3.7 million households, who will be provided with two high quality LED bulbs each at a subsidized price of ` 10. The programme started in Guntur, to be followed by Anantapur, West Godavari and Srikakulam districts.

The union power ministry has already decided that all below-poverty line households at the time of electrification under the Rajiv Gandhi Grameen Vidyuthikaran Yojana (RGGVY) would be provided LED technology. LEDs are emerging as the most energy-efficient source of lighting as they use one-tenth of the energy of a normal incandescent bulb and half as much energy as a Compact Fluorescent Lamp (CFL) to produce the same amount of light. The first LED lamp made in India, in 2010, was sold for ` 1,200, the ministry said. EESL has already completed a number of projects to retrofit existing streetlights to LED streetlights as well as a 750,000 LED bulb replacement project for households in Pudhuchery. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

DPE discovers gas at T-02 well in Dubai's offshore Fateh field

October 14, 2014. Dubai Petroleum Establishment (DPE), owned 100 percent by the Government of Dubai and responsible for the Dubai's offshore oil and gas development and production, announced that it has identified significant volumes of gas in its T-02 well deep gas exploration well. The high pressure and high temperature T-02 well was drilled to 18,248 feet into the Pre Khuff formation and is the deepest well in Dubai to date. The well is in the offshore Fateh field where oil and gas was first discovered at depths of around 10,000 feet in 1966. (www.rigzone.com)

First production commences at CNOOC's Enping 24-2 oil field offshore China

October 14, 2014. China's largest offshore crude oil and natural gas producer CNOOC Ltd announced that it has commenced first production at the company-operated Enping 24-2 oil field in the Pearl River Mouth Basin, South China Sea offshore China. CNOOC indicated that the main production facilities at the Enping 24-2 oil field, located at average water depth of around 282-315 feet, include one drilling and production platform, one floating production storage and offloading unit (FPSO) and 17 producing wells, the firm said. Two wells are currently producing approximately 8,000 barrels of crude oil per day and the Enping 24-2 development is expected to reach peak production of approximately 40,000 barrels per day in 2017. (www.rigzone.com)

Bakken drillers poised to curb exploratory spending

October 13, 2014. Bakken shale-oil producers are under pressure from tumbling prices to scale back their 2015 drilling plans in a region that accounts for one of every eight U.S. barrels of crude. Bakken oil fell 1 percent to $79.40 a barrel, the first time it’s dropped below $80 in 11 months. Crude prices have been declining worldwide as ample North American supplies tempered the U.S. appetite for imports and Persian Gulf producers signaled they’re prepared to keep output high to protect their market shares in Asia. Companies drilling expensive, experimental wells in frontier regions such as the Tuscaloosa Marine Shale beneath Louisiana and Mississippi will be first to feel pinched by the drop-off in prices. Bakken producers will soon feel the pain as well as their returns dwindle. Bakken producers need oil prices between $70 and $80 a barrel to earn a 15 percent to 25 percent return, a typical profit target for shale drillers.

During the past six months, Bakken has lost 21 percent of its value, making it the second-worst performing domestic crude. Only Kern River crude, a thick, sulfury oil produced in southern California, fell more with a 24 percent decline during the period. Bakken wells produced a record 1.047 million barrels of crude in July, accounting for 12 percent of total U.S. output. (www.bloomberg.com)

100 mn barrels produced from Varg field

October 13, 2014. Norwegian producer Det norske oljeselskap reported that its Varg field has produced 100 million barrels. Production on the Varg field, offshore Norway, began in December 1998, with the original estimate being that the field would produce approximately 63 million barrels. Det norske said that new discoveries, the drilling of new wells and gas production has made the field viable long after the plan to decommission the field was approved in 2001. (www.rigzone.com)

Biggest US oil field adds rigs as crude prices slide

October 11, 2014. Rigs targeting crude in the Permian Basin of Texas and New Mexico, the nation’s biggest oil field, jumped to the second-highest level on record, defying a $17-a-barrel drop in prices over the past three months. Oil rigs in the Permian rose by six to 560, one rig shy of a record set on Sept. 12, according to Baker Hughes Inc. The gain in one of the country’s oldest crude plays accounted for one-third of the rise in the total U.S. oil count, data posted on the Houston-based field services company’s website show.

Oil rigs are continuing to climb even as a slide in energy prices threaten to shrink the profitability of drilling operations in U.S. shale formations that have almost doubled the total U.S. rig count in the past five years. Producers are using horizontal drilling and hydraulic fracturing to pull record volumes of oil and gas out of tight, rock formations, increasing domestic crude output to the highest level in 28 years. Crude producers will “sober up” on spending if oil prices drop to $80 a barrel for long enough, T. Boone Pickens, founder and chairman of BP Capital LLC in Dallas, said. (www.bloomberg.com)

Pemex optimistic for ultra-deep water find in Gulf of Mexico

October 11, 2014. Petroleos Mexicanos, Mexico’s state-run oil producer, is optimistic of a crude discovery at the Vasto-1 ultra-deep water exploratory well by year-end, said Exploration and Production Director Gustavo Hernandez. Pemex, as the Mexico City-based producer is known, has found “evidence of hydrocarbon content” at the Vasto-1 well and hopes to announce an ultra-deep water find, Hernandez said. If confirmed the discovery would be the latest in the Perdido area, where the company estimates that as much as 10 billion barrels of potential reserves can be pumped.

Drilling at the Vasto-1 well started on April 11 with the Bicentenario rig, according to a company. Pemex is “practically done” drilling, having reached a depth of 6,500 meters, 600 meters shy of a 7,100 meter goal, Hernandez said. Pemex is also drilling an exploratory well 17 kilometers from the U.S-Mexico border at Maximino to determine the size of the field, Hernandez said. The company announced its third ultra-deep water discovery at the Maximino field. (www.bloomberg.com)

Shale boom tested as sub-$90 oil threatens US drillers

October 8, 2014. The U.S. shale boom is producing record amounts of new oil as demand weakens, pushing prices down toward levels that threaten to reduce future drilling. Domestic fields will add an unprecedented 1.1 million barrels a day of output this year and another 963,000 in 2015, raising production to the most since 1970, according to the U.S. Energy Information Administration (EIA). More supply from hydraulic fracturing and horizontal drilling, and less demand, are contributing to the tumble in West Texas Intermediate (WTI) crude. The U.S. benchmark is down 18 percent since June 20 and fell below $90 a barrel on Oct. 2 for the first time in 17 months.

The EIA cut 2014 and 2015 crude price forecasts because of rising production and falling consumption. WTI will average $94.58 next year, down from a September projection of $94.67. The outlook for Brent oil, the benchmark for more than half of the world’s crude, was lowered to $101.67 from $103. U.S. output reached 8.7 million barrels a day in September, the most since July 1986, the EIA said. U.S. demand is down because Americans are driving less and using more fuel-efficient cars, according to the EIA. (www.bloomberg.com)

Downstream…………

Kenya yet to decide oil refinery's fate

October 10, 2014. Kenya is yet to decide whether to turn east Africa's only oil refinery into an oil storage facility or pay for its upgrade after buying the remaining 50 percent stake from India's Essar Energy, the energy minister said. Fuel distributors have long complained about the poor quality products from the 50-year-old refinery in the port city of Mombasa and prefer importing cheaper and better imports. Kenya's government has agreed to pay Essar $5 million to buy the Indian firm's half of the refinery after Essar exited the joint venture in November 2013 and abandoned plans for a $1.2 billion upgrade on the advice of consultants who said it was not economically viable. Essar said it had planned to increase the refinery's crude handling capacity to 4 million tonnes of crude per year (79,000 barrels per day) from 1.6 million. (www.downstreamtoday.com)

Transportation / Trade……….

Israel sees gas as key to transforming Mideast relations

October 14, 2014. By the end of the year, Israel may have binding agreements to sell billions of dollars of gas to Egypt, Jordan and the Palestinian Authority. Preliminary talks are taking place with customers in Turkey, even though President Recep Tayyip Erdogan is among Israel’s fiercest critics. Gas may even help improve relationships in the Gaza Strip. Israel’s chance to be a regional energy power comes from two mammoth fields under the Mediterranean Sea, holding more gas than the country could consume in decades. In addition to building ties with neighbors that have often been antagonistic since the state was founded in 1948, gas exports will be a fillip for Israel’s economy, improving the balance of trade and boosting economic growth by as much as a percentage point. Israel’s gas bonanza “is a huge strategic advantage that allows us to enjoy both political and economic fruits,” Israeli Energy Minister Silvan Shalom said. (www.bloomberg.com)

Gazprom may drop Vladivostok LNG project in favour of pipeline gas to China

October 13, 2014. Russia's state-controlled gas company Gazprom may drop its Vladivostok LNG project in Russia's Far East in favour of pipeline gas supplies to China, the firm said. Gazprom could supply 15 billion cubic metres (bcm) of gas per year to China on top of earlier agreed volumes. Russia and China agreed that Gazprom would supply gas to China via the yet to be built Power of Siberia pipeline, which is expected to carry 38 bcm of gas to China per year. (www.downstreamtoday.com)

Spain's Gas Natural sees no change to payouts after $3.3 bn CGE buy

October 13, 2014. Spain's Gas Natural said it was leaving its 2015 payout plans unchanged after announcing a $3.3 billion takeover offer for Chile's biggest electricity distributor Compania General de Electricidad (CGE). The acquisition, announced, one of the biggest takeovers in Chile's history, will be through an all-cash offer of 4,700 pesos ($7.92) per share, a premium of over 70 percent to CGE's average share price over the past 12 months. The buy will give Gas Natural access to a swathe of energy assets in South America, including electricity distribution in Argentina, Chilean capital Santiago's chief gas supplier, and stakes in liquefied natural gas (LNG) businesses at a time when energy-hungry Chile is seeking to increase its use of LNG. (www.downstreamtoday.com)

Sound Oil signs gas sales agreements

October 13, 2014. Italy-focused junior producer Sound Oil reported that it has signed two gas sales agreements for gas from its Rapagnano and Casa Tiberi fields. Meanwhile, the firm has agreed to purchase industrial land in the Lombardy region of Italy that will host the drill site for its initial Badile exploration well. Sound said that it has entered into a 12-month gas sales agreement for Rapagnano with Steca Energia and another 12-month gas sales agreement for Casa Tiberi with Prometeo. (www.rigzone.com)

Statoil sells Shah Deniz stake to Petronas for $2.2 bn

October 13, 2014. Statoil ASA, Norway’s biggest energy company, will sell its 15.5 percent stake in the Shah Deniz field in Azerbaijan to Malaysia’s Petroliam Nasional Bhd for $2.25 billion as it seeks to reduce investment and prioritize high-value projects. The transaction includes sales of the interests in the field’s production-sharing agreement, the South Caucasus Pipeline Co. and its holding company, and a 12.4 percent stake in the Azerbaijan Gas Supply Co., the Stavanger-based company said. The deal reduces Statoil’s capital-expenditure commitments by about $4.3 billion as the Shah Deniz partners, led by operator BP Plc, invest to expand gas exports in the project’s second phase. Statoil’s exit follows Total SA’s $1.5 billion sale of its 10 percent stake in the Shah Deniz project in May as big oil companies seek to rein in investments to fight rising costs and falling returns. The second phase of Shah Deniz in the Caspian Sea, which will boost gas production for export through new pipelines as far as Italy and reduce Europe’s dependency on Russian fuel, is expected to cost $28 billion. Petronas, Malaysia’s state-owned energy company, has exploration and production ventures in at least 22 countries in Southeast Asia, the Middle East, Central Asia, Latin America and Africa, accounting for almost a quarter of its total oil and gas reserves, it said. The company announced it signed agreements with Mexico and Argentina to expand its operations in the region. Petronas said it may delay construction of its C$10 billion ($8.9 billion) Canadian liquefied natural gas project past 2030 unless proposed taxes are lowered. (www.bloomberg.com)

Speculators push oil into bear market as supply rises

October 13, 2014. Money managers reduced bets on rising oil prices by the most in five weeks, helping push U.S.- traded futures into a bear market. Hedge funds and other large speculators lowered net-long positions in West Texas Intermediate (WTI) crude by 4.8 percent in the seven days ended Oct. 7, U.S. Commodity Futures Trading Commission (CFTC) data show. Short positions climbed 8 percent, the most in almost a month. WTI joined Brent, the European benchmark, in falling more than 20 percent from its June peak, meeting a common definition of a bear market. U.S. oil inventories rose the most since April in the week ended Oct. 3 as domestic production rose to a 28-year high and refineries shut units for maintenance. Demand nationwide will slip this year to the lowest since 2012, the government predicted Oct. 7. U.S. crude stockpiles climbed by 5.02 million barrels to 361.7 million in the seven days ended Oct. 3, according to the Energy Information Administration (EIA). Weekly production averaged 8.88 million barrels a day, the highest since March 1986. Output will climb to 9.5 million barrels a day next year, the most since 1970, the EIA estimated Oct 7. Production is surging as a combination of horizontal drilling and hydraulic fracturing, or fracking, unlocks supplies from shale formations. Global supply is also growing. The Organization of Petroleum Exporting Countries (OPEC) increased output by 402,000 barrels a day in September to 30.47 million, the group’s Vienna-based secretariat said. Iran was said to sell its oil to Asia in November at the biggest discount in almost six years, matching cuts by Saudi Arabia. (www.bloomberg.com)

Options traders raise bets on $77.50 US oil by December

October 11, 2014. Trading in options contracts shows a 25 percent chance that West Texas Intermediate (WTI) crude futures will settle below $77.50 a barrel in mid-December, up from 3 percent at the end of September. Implied volatility for January WTI options at that level shows a 25 delta, indicating a 25 percent chance that a $77.50 put contract will be in the money at the Dec. 16 expiration. January WTI futures fell $5.03 since Sept. 30 to $84.73 a barrel on the New York Mercantile Exchange. November contracts, which are nearest to expiration, settled at $85.82. Front-month WTI futures have slumped 20 percent from their June high amid slower global demand growth and rising oil production in the U.S. and elsewhere. The International Monetary Fund said that the global economy will expand by 3.8 percent in 2015, down from a July projection of 4 percent. U.S. oil output increased to 8.88 million barrels a day, the most since March 1986.

U.S. production has increased 65 percent in the past 5 years as companies have used horizontal drilling and hydraulic fracturing to tap into hydrocarbon-rich layers of underground shale rock. The Organization of Petroleum Exporting Countries (OPEC) increased oil production by 402,000 barrels a day in September to 30.47 million, the group said in its monthly oil market report. It was the biggest monthly gain since November 2011 and the largest production in more than a year. Saudi Arabia and Iran, both OPEC members, are discounting their main crude export grades to Asian buyers by the most in almost six years, prompting speculation that some OPEC nations are competing for market share. (www.bloomberg.com)

New pipelines to cost Kashagan oil project up to $3.6 bn

October 10, 2014. Kashagan, the world's most expensive oil project, will have to spend another up to $3.6 billion to replace leaking oil and gas pipelines, which also could delay the restart of production, the Kazakh energy ministry said. Production at the Kashagan reservoir started but was halted after the discovery of gas leaks in the $50 billion project's pipeline network. Replacing the pipelines at the oilfield, which lies in the Caspian Sea off western Kazakhstan, will cost between $1.6 billion and $3.6 billion, the Kazakh Energy Ministry said. The final cost of the replacement will depend mainly on the resistance to corrosion of the pipes used in laying the new pipelines, the energy ministry said. The Kashagan consortium will have to buy pipes adding up to a total length of 200 km to replace the entire network of the field's oil and gas pipelines, the ministry said. (www.downstreamtoday.com)

Canadian oil discount seen shrinking on US re-exports

October 9, 2014. Canadian oil producers, facing delays on new export pipelines, are poised to reap higher prices in Europe and Asia as growing rail deliveries to the U.S. are sent overseas, according to FirstEnergy Capital Corp. In two years, 600,000 barrels a day of Canadian oil sent to the U.S may be re-exported to other destinations, up from 25,000 barrels, Martin King, a commodities analyst at FirstEnergy in Calgary, said. The re-exports are the best way for rising Canadian light and heavy crude output to approach world prices right now, he said. Growing rail shipments and more U.S. pipeline space will lift Canadian supplies to the Gulf Coast, he said. Producers are boosting shipments of foreign crude from the world’s largest refining center as Canada pumps record amounts of oil amid delays to pipelines including Enbridge Inc.’s Northern Gateway to the Pacific and TransCanada Corp.’s Energy East to the Atlantic. U.S. oil output at the highest in 28 years is also expanding supplies to the Gulf Coast, prompting a debate about whether to allow U.S. exports off the continent.

Suncor Energy Inc., the largest Canadian energy company by market value, is among producers seeking new markets outside North America for the world’s third-largest reserves of crude in Alberta’s oil sands. Suncor loaded its first tanker of heavy Canadian crude from Eastern Canada last month for shipment across the Atlantic. The U.S. restricts most exports of unrefined crude except to Canada, and allows shipments of foreign oil from its ports that hasn’t been commingled with domestic volumes. The Commerce Department granted 86 of these re-export licenses from October through August. Shipments have been reported to Switzerland, Spain, Singapore and Italy this year, according to the U.S. Energy Information Administration. Western Canadian Select in Hardisty, Alberta, is priced at around $6.78 a barrel less than Mexican Maya, a similar heavy, high-sulfur crude grade found in abundance on the Gulf Coast. The cheapest transportation from Alberta to the Gulf Coast, via pipeline, costs at least $8 a barrel for committed shippers. (www.bloomberg.com)

CNPC gets nod for China-Russia gas pipeline design

October 9, 2014. China National Petroleum Corp (CNPC) has received government approval for the design of the Chinese section of a giant pipeline that is due to ship $400 billion worth of Russian natural gas to China, the company said. China and Russia signed in May a gas supply deal, securing the world's top energy user a major source of fuel and opening up a new market for Moscow as it risks losing European customers over the Ukraine crisis.

According to initial design, the pipeline will start from Heihe city in the northeastern Heilongjiang province, running through provinces of Jilin, Inner Mongolia, Liaoning, Hebei, Tianjin Municipality, Shandong, Jiangsu to reach Shanghai, CNPC said. Construction of the Chinese section will start in the first half of next year and is slated to complete in 2018. Russia will begin delivering gas to China from 2018, building up gradually to 38 billion cubic metres per year. (www.rigzone.com)

Hijackers release Vietnam tanker after diesel fuel theft

October 9, 2014. Pirates released a Vietnamese oil tanker and its 18 crew members after siphoning part of its diesel cargo, according to the coast guard. The Sunrise 689, which left Singapore on Oct. 3 before vanishing from radar for five days, was about 70 nautical miles from Hon Khoai off Vietnam’s southern province of Kien Giang, said Dao Van Quang, chairman and chief executive officer of Hai Phong Sea Product Shipbuilding Co., the registered owner. It’s expected to reach Phu Quoc island, said Rear Admiral Ngo Ngoc Thu, Vietnam Coast Guard’s vice commander. Ship hijackings are rising in Southeast Asia, with at least six cases of coastal seizing of cargoes since April, the International Maritime Bureau’s piracy reporting center in Kuala Lumpur said in July. The region includes the Malacca Strait, one of the world’s “most strategic choke points,” according to the U.S. Energy Information Administration. The Sunrise 689 was scheduled to arrive Oct. 8 in the central province of Quang Tri, Quang said. It was transporting 5,200 metric tons of diesel, with an estimated value of $4 million, for a Singapore customer, he said. (www.bloomberg.com)

Narrow price gap opens door for African oil exports to US East

October 8, 2014. Oil traders are boosting shipments of Mediterranean and West African crude to the U.S. East Coast as the narrowest gap in more than a year between U.S. and international prices makes imports more affordable. Traders booked cargoes from Turkey and West Africa on Oct. 6 for delivery to the U.S. Atlantic Coast. There were three crude fixtures from Europe and Africa to the East Coast over the four weeks prior to that day, according to shipping data. The shipments are coming as the discount for U.S. West Texas Intermediate crude versus Brent, Europe’s benchmark grade, averages $2.89 a barrel this month. That would be the smallest monthly spread since July 2013. The U.S. has reduced waterborne imports by 47 percent since 2005 as it raises domestic production to the highest level since 1970 and improves its ability to transport oil by rail. (www.bloomberg.com)

Policy / Performance…………

Slovaks seek to sign 15 year Russian oil-supply deal

October 14, 2014. Slovakia plans to negotiate a 15-year supply contract for Russian crude oil as early as in Moscow after its government approves a draft agreement. An agreement will set out conditions for supplies, Slovak Economy Ministry said. Prime Minister Robert Fico’s government must tread lightly between the need to secure Russian oil and pressure from the European Union to help Ukraine in its standoff with Moscow by offering natural gas through a pipeline linking the two countries. Slovakia, a nation of 5 million that joined the EU in 2004, relies on Russia for all its oil and most of its gas needs. Slovakia consumes about 70,000 barrels of crude oil a day, according to the U.S. Energy Information Administration. The oil is delivered through the Druzhba pipeline which, like the gas pipelines, runs through Ukrainian territory. (www.bloomberg.com)