-

CENTRES

Progammes & Centres

Location

[Shades of Grey: The Annals of the Indian Coal Industry (part II)]

“Contrary to common belief that this ‘mafia mode of production’ is one of the key barriers to reform of the coal sector, the investigative report claims that it is in reality a ‘complementary department’ of the coal industry through which the industry outsources control over low cost casual workers, strike breaking thug operations and strong integrated trade unions with political links…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Coal…………………

· Shades of Grey: The Annals of the Indian Coal Industry (part II)

DATA INSIGHT………………

· Scenario of Industrial Pollution in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn discovers oil offshore Senegal

· Oil Ministry sets up panel on delays in ONGC's gas discovery

Downstream……………………………

· RIL likely to lease, restart retail pumps

Transportation / Trade………………

· GAIL in talks to buy 2-2.5 MT LNG from US

Policy / Performance…………………

· Oil Ministry cuts natural gas supplies to small industry in Gujarat

· Govt set to revamp crude import policy

· Losses on diesel sales wiped out, says govt

· Fuel companies absorbed ` 266 bn losses on sales in 5 yrs: Oil Ministry

[NATIONAL: POWER]

Generation………………

· GMR's 1.3 GW Chhattisgarh power plant begins generation

· Cost of power generation likely to increase by 33 per cent following SC order

· TS GENCO, BHEL sign MoU to establish thermal power plants

· NMDC puts UP's Gonda power plant project on back burner

· Power generation in Gujarat unaffected due to coal shortage: Patel

· Neyveli's ` 49.1 bn Tuticorin power project nearing completion

· SJVNL signs pact for Bhutan hydro project

Transmission / Distribution / Trade……

· Tripura to supply 100 MW of power to Bangladesh

· Cancel projects given to Chinese companies, demand local power firms

· IPCL lines up investment to strengthen distribution infrastructure in Bihar

· New transmission capacities must for competitive power market: IEX

· APTEL directs Adani Power to restore power supply to Haryana

Policy / Performance…………………

· Power outages forcing firms to reconsider investment, expansion plans in Telangana

· Govt seeks AG's opinion on need for Ordinance on coal blocks

· PFC to appoint consultants for Power Project Monitoring Panel

· Coal India awards contracts for two washeries

· DERC to review fuel surcharge, tariff may go up in November

· Karnataka invites bids for 500 MW round-the-clock power

· Sikkim govt to buy 100 per cent stake in Teesta-III if other investors exit

· SC order to derail Vedanta's plans to raise power capacity

· All efforts will be made to ease fuel crisis at power plants: Coal Ministry

· Govt mulling to offer package to kickstart 16 GW of gasfired power plants

· Open coal, power sectors to private competition to revive investment: Deepak Parekh report

· BJP to submit review petition against power tariff hike in UP

· India, US commit to implement civil nuclear agreement

· MP to set up panel to improve capacity of thermal power plants

· UPERC approves increase in power rates

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Gazprom output to rise 5 per cent in 2015 after fall this year

· Chevron to sell stake in Canadian shale for $1.5 bn

· Russia's Rosneft offers OVL stake in Vankor oilfield

· Kuwait in talks with oil giants to help boost production

· Goldman losing faith in $100 Brent as WTI spread seen wider

· US firm Stratum Energy to boost gas production in Romania

· BP Oman awards $730 mn drilling contracts for Oman's Khazzan project

· Exxon signs Pemex accord as Mexico prepares oil opening

· Russia oil production near record with sanctions yet to bite

· Ophir makes gas discovery at Kamba-1 well in Tanzania's offshore Block 4

· Gulf Keystone staff return to Kurdistan to increase oil output

Downstream……………………

· Japan refiner Nansei restarts marine ops after typhoon passes

· Kuwait's KPI cancels $1.4 bn Dutch refinery investment

Transportation / Trade…………

· Keystone delay won’t slow Canada pipelines

· New pipelines threaten US gulf coast oil premium

· Orphaned Russian oil heads to US West on Asia overflow

· Brent approaches bear market on supply

· Rising US crude exports move closer to 1957 record

· Thailand's PTT eyes third LNG terminal in Myanmar

Policy / Performance………………

· Angola delaying increase in oil output to 2017 from 2015

· Oil plunge magnifies Russia’s sanctions pain

· Tumbling oil prices punish hedge funds betting on gains

· Petronas threatens 15 year delay of Canada LNG plant if no tax deal

· Petrobras CEO said to tell minister to boost fuel prices

· Queensland Govt seeks bids to explore 2 blocks in Bowen Basin

· BP seeks revised verdict or new trial on spill negligence

· OPEC price war signaled by Saudi move risks deeper drop

· Goldman sees global LNG projects at risk as demand growth slows

· Republicans craft 2015 plan to force Obama's hand on Keystone

· Worst seen over for crude prices as Saudis cut production

[INTERNATIONAL: POWER]

Generation…………………

· Nigerian President to flag off $1 bn Azura-Edo power plant

Transmission / Distribution / Trade……

· Tanzania says power link to Kenya, Zambia to be completed next year

· Texas power prices drop on below-forecast demand

Policy / Performance………………

· China begins building largest hydropower station in Tibet

· New Zealand plans inquiry after power cut to 85k Auckland homes

· Turkey to speed up nuclear power plant construction

· Jordan signs shale oil power-generation agreement

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· REIL proposes solar panel manufacturing unit in AP

· Gujarat getting warmer every year: Study

· All govts falter on renewable power purchase targets

· Net metering for solar power not so sunny for distribution companies

· DERC sets rules for users supplying green power

· India agrees to US demand to discuss cut in climate-damaging HFCs

· India plans first demonstration offshore wind power project

· Global warming driving migration of species in India

· No one has right to exploit environment: Modi

GLOBAL………………

· EU moves closer to deal on 2030 climate, Energy Strategy

· UK Tory wind-power phobia hurts industry, Cable says

· EU manufacturing reaps $2.5 bn permit win: Carbon & Climate

· US aids Ukraine on heat plan as EU warns on winter

· Chile top renewables market on sunny desert, windy shores

· Sweden’s Greens plan to close reactors ducking parliament

· World failing to meet goals for protection of biodiversity: UN report

· Climate change could affect male-female ratio

· UK seen hurting consumers with renewable energy deals

· Iwatani expects hydrogen sales to jump on fuel cells

· OneRoof Energy getting $16.7 mn financing for rooftop solar

· Bolivia first solar project commissioned in department of Pando

· UK renewable energy subsidy changes anger solar industry

· Canada to start first carbon-capture coal power plant

[WEEK IN REVIEW]

ENERGY/COAL………………

Shades of Grey: The Annals of the Indian Coal Industry (part II)

Lydia Powell, Observer Research Foundation

Continued from Volume XI, Issue 16 (http://www.orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=73127&mmacmaid=73128)

Part I of this essay that appeared in last week’s issue of the ORF energy news monitor ended with the observation that labour and wages have always been significant issues for the coal industry in India. The second part of the essay continues from there.

A casual survey of literature on mining labour in the Indian coal industry reveals that it is the result of a complex interplay of factors beginning with caste & class at the local level, colonial interests, nation building and politics at the national level and war, market forces and geo-politics at the global level. In the early periods of coal mining in India, Zamindars (land owning classes) who owned coal mines gave small holdings to labourers on condition that they work on the mines.[1] Mineral rights rested with the Zamindars and the miners paid royalty to the owners.[2] Most of these coal mining labourers were classified by the Chief Inspector of Mines as ‘semi aboriginals’, (probably the British way of referring to people from lower castes).[3] For reasons that are not evident, the British chose to see this system as a form of human exploitation. This resulted in the passing of the Indian Mines Act in 1901 to enforce measures for labour safety and protection by Lord Curzon on the advice of Sir Thomas Holland.[4] The 1901 Act could be called the first incidence of interference by the State on the otherwise free Indian coal sector and it prohibited the employment of children and women in coal mines, regulated working hours and conditions of work and in addition enforced safety measures in the mines.[5]

As pointed out by Subrahmanyam, the immediate impact of this piece of legislation was not improvement of labour conditions across coal mines but the enhancement of differences in the cost of production between mines that worked under favourable conditions (geological, logistical etc) which were the large western owned coal companies and those that did not (which were invariably Indian owned small collieries).[6] There was no scheme for assistance to mines that were operating under challenging conditions. Nor was there any serious attempt to enforce these regulations. When the demand for coal increased after the onset of the World War, issues of safety and welfare of workers were set aside in order to increase coal production. Contract recruiters known as recruiting Sirdars (or Arkattis) were used to recruit labourers for coal mining.[7] Chakrabarti observed that some of the land (and mine) owners became recruiters of labour as it was more lucrative than collecting royalties from coal mining.[8] He noted that a Coalfield Recruiting Organisation (CRO) was set up by the land owners with active connivance of the British Government to recruit workers on a temporary basis to meet wartime demand for labour.[9] If we fast forward to the present, we will see that nothing has really changed in the context of labour use in coal mines. As pointed by an investigative report on the Dhanbhad coal fields, the launch of CIL as the world’s largest low cost coal producing company just prior to its initial public offering (IPO) in 2010 depended on the control of what the report calls ‘the undesired by-product’ of coal mining: the large mass of unruly industrial workers.[10] According to the report the re-composition of the mining workers in the coal belt was influenced by uneven development, technological changes and migration. The report notes that the concentrated local space of mining workers consisted of pauperised indigenous people (labelled as ‘adivasis’ today and ‘semi-aboriginals’ by the British in colonial times as observed earlier), the rural poor in the fringes of mining areas, which the report claims is the main recruiting base for the armed struggle against the State (labelled Maoism), workers in illegal mines, casual workers in the main (legal) mines earning 10% of their permanent peers, the families and unemployed off-spring of all of the above.

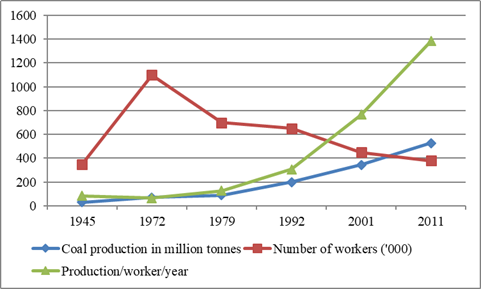

The report goes on to describe how this ‘peculiar composition of workforce and industry brought about specific forms of mediation of the class struggle’. The recruiters of mining labour evolved into money-lenders, labour contractors and then indulged in what we could call backward and forward integration in the coal industry as transport contractors, real estate agents and illegal miners. Contrary to common belief that this ‘mafia mode of production’ is one of the key barriers to reform of the coal sector, the investigative report claims that it is in reality a ‘complementary department’ of the coal industry through which the industry outsources control over low cost casual workers, strike breaking thug operations and strong integrated trade unions with political links. The question that comes to mind at this point is whether the status of low cost coal producer was achieved through real efficiency gains or through the mechanism that essentially legitimised the ‘casualisation’ of labour to suppress wages. To answer this question let us look at available figures on the progress of the Indian coal sector (see chart).

Progress of the Indian Coal Sector: 1945-2011

Source: Volume of coal production and number of workers Sanhati (see reference).

The chart is an oversimplification of issues on account of two factors. It does not capture complex social, political, economic and geo-political factors that shaped outcomes and it does not differentiate between casual and permanent workers. However it may be treated, with caution, as a representation of reality from which it could lead to some conclusions: (1) production and production per worker increased by over 15 times in the 66 year period between 1945 to 2011 (2) the number of employees returned to 1945 levels after peaking in the 1970s. Shri Kumar Mangalam, who was India’s Minister for Steel and Mines at that time, was the architect of nationalisation of the coal industry. He thought that nationalisation was the only solution to poor labour conditions, absence of economically and geologically sound scientific methods for mining and low production volumes of coal.[11] If we overlook inaccuracies, we could say that the vision Late Shri S Mohan Kumar Mangalam was achieved in a limited sense. The reality was that dramatic progress on production concealed and eventually marginalised the absence of progress on the better mining practices and labour reform.

Shri Kumar Mangalam died in 1973 just as nationalisation was being completed and the coal industry was ‘orphaned and rudderless’ as the Late Shri Gulshan Lal Tandon put it.[12] The result was exploitation of the coal industry on a scale that had not been seen in its long history. Part of the blame could be assigned to the oil crises of the 70s.

A cursory reading of the India’s Plan documents from the fifth plan period onwards reveal that the increased emphasis on coal as fuel for power generation began in the 1970s as part of India’s response to the increase in crude oil prices. During the Fifth Plan period (1974-79) the outlay for the coal sector was increased to ` 1025 crores (~$ 78.92 billion)[13] following the recommendations of the Fuel Policy Committee formed after the first oil crisis in 1973-74.[14] This was a tenfold increase over the outlay during the Fourth Plan period. The Sixth Plan document (1979-84) recommended a strategy of ‘self reliance’ based on coal, hydropower and nuclear energy to reduce the economy’s exposure to crude oil prices.[15] Even though the document cautioned that in per person terms India’s coal resources were small compared to that of countries like USA, Russia and China, implementation of the strategy of ‘self-reliance’ skewed in favour of coal at the expense of hydro power. This was in spite of the Plan documents pointing out the risk of increased foreign exchange exposure on account of import of coal powered generators. Returning to the chart, dramatic increase in coal production since Nationalisation in the 70s was the result of the tenfold increase in State investment in the sector.

G L Tandon observed that in the 1970s the ‘Indian Government was only interested in producing more and more coal and in the process sidetracked the building of an organisation and overlooked systems and rules needed to restore order and health of the industry’.[16] He also highlighted how unwanted manpower was thrust on the sector. At the time of independence, the Indian coal industry is estimated to have had over 320,000 people in about 900 coalmines that produced about 26.89 million tonnes (MT) of coal.[17] In 1966 the number of employees increased to over 425,400 and the production increased to 70.38 MT. G L Tandon noted that just before nationalisation (Coking coal in October 1971 and May 1972; and all non-coking coal mines in January 1973), the number of employees had fallen to well below 400,000. But it increased to well over 600,000 (or 1 million if casual labour is included) by November, 1975 when Coal India was formed. He noted with regret that the addition of contract unskilled labour and unwanted persons under political pressure and vested interests could not be checked. He narrated how ‘telegrams were sent to far off places inviting loved ones to come and join in the big bonanza and how in some cases the industry had a situation where sons had retired but fathers were still working’. The situation had not changed in 2004 as pointed out by P C Parakh in his recent book. [18] Parakh documents how the coal industry is constantly under pressure from various political leaders to employ workers of their respective parities, as labourers or as even as Directors on the Board, build speciality hospitals or give away coal to well-wishers of a political party.[19] One of the letters written by a Member of Parliament (in 2005) in response to denial of one such request (reproduced in the book) takes strong objection to the coal industry wanting to become competitive and argues that State owned companies are constitutionally required to meet social obligations.[20] to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

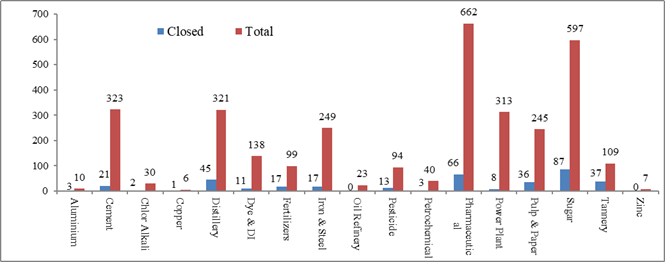

Scenario of Industrial Pollution in India

Akhilesh Sati, Observer Research Foundation

|

State |

No. of Industries* |

|||

|

Complying with pollution norms |

Non Complying |

Closed |

Total |

|

|

Andhra Pradesh |

359 |

74 |

39 |

472 |

|

Arunachal Pradesh |

2 |

0 |

0 |

2 |

|

Assam |

36 |

12 |

1 |

49 |

|

Bihar |

16 |

4 |

0 |

20 |

|

Chattisgarh |

71 |

6 |

1 |

78 |

|

Chandigarh |

0 |

0 |

0 |

0 |

|

Daman & Diu |

1 |

1 |

1 |

3 |

|

Delhi |

2 |

0 |

0 |

2 |

|

Goa |

13 |

2 |

0 |

15 |

|

Gujarat |

302 |

7 |

8 |

317 |

|

Haryana |

119 |

6 |

16 |

141 |

|

Himachal Pradesh |

14 |

0 |

3 |

17 |

|

Jharkhand |

103 |

48 |

22 |

173 |

|

Jammu & Kashmir |

7 |

0 |

3 |

10 |

|

Karnataka |

175 |

30 |

26 |

231 |

|

Kerala |

21 |

11 |

19 |

51 |

|

Lakshadeep |

0 |

0 |

0 |

0 |

|

Madhya Pradesh |

65 |

16 |

2 |

83 |

|

Maharashtra |

317 |

145 |

58 |

520 |

|

Meghalaya |

4 |

12 |

1 |

17 |

|

Mizoram |

1 |

0 |

0 |

1 |

|

Odisha |

37 |

17 |

11 |

65 |

|

Puducherry |

5 |

2 |

0 |

7 |

|

Punjab |

57 |

12 |

18 |

87 |

|

Rajasthan |

69 |

31 |

18 |

118 |

|

Sikkim |

3 |

1 |

0 |

4 |

|

Tamil Nadu |

165 |

19 |

5 |

189 |

|

Tripura |

10 |

1 |

6 |

17 |

|

Uttar Pradesh |

278 |

36 |

89 |

403 |

|

Uttarakhand |

33 |

4 |

6 |

43 |

|

West Bengal |

43 |

74 |

14 |

131 |

|

Total |

2328 |

571 |

367 |

3266 |

*Based on 17 categories of highly polluting industries (given in the graph below)

Source: Lok Sabha (Question No. 216).

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn discovers oil offshore Senegal

October 7, 2014. Oil explorer Cairn Energy and its joint venture partners have discovered oil at a well offshore Senegal and further exploration work nearby is already planned, the company said. The companies encountered 29 metres of net oil bearing reservoir at the FAN-1 well, located around 100 km off the coastline and 1,427 metres deep. Cairn Energy has a 40 percent interest in three offshore blocks in Senegal, while ConocoPhillips has 35 percent, FAR Ltd 15 percent and Senegal's national oil company Petrosen owns 10 percent. (www.reuters.com)

Oil Ministry sets up panel on delays in ONGC's gas discovery

October 3, 2014. The Petroleum Ministry has set up a committee headed by DGH to inquire into the reasons for delay in developing gas discoveries in ONGC's Krishna Godavari basin KG-D5 block. The panel will inquire into delay in developing fields by Oil and Natural Gas Corp (ONGC) in the block KG-DWN-98/2 or KG-D5, and submit its report by end-October. ONGC's KG-D5 sits next to Reliance Industries' eastern offshore KG-DWN-98/3 or KG-D6 block in Bay of Bengal. Both blocks were awarded in the first round of auction under New Exploration Licensing Policy (NELP) in 2000. While Reliance Industries Ltd (RIL) began oil production from its KG-D6 block in September 2008 and gas output in April 2009, ONGC, which has made 11 oil and gas discoveries in KG-D5 block, is at least four years away from first gas. The ministry wants to investigate the reasons for the delay. ONGC welcomed constitution of the committee and said the company will extend all cooperation in the investigation. ONGC said gas production from the block is planned to begin in 2018 and oil output in 2019. KG-D5 will produce up to 90,000 barrels per day (4.5 million tonnes per annum) - the largest from any field on the east coast. ONGC will produce 17 million standard cubic meters per day of gas from the block. KG-D5 is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). NDA holds an estimated 92.30 million tonnes of oil reserves and 97.568 billion cubic metres of in-place gas reserves spread over seven fields. (economictimes.indiatimes.com)

Downstream………….

RIL likely to lease, restart retail pumps

October 2, 2014. Reliance Industries Ltd (RIL) may lease fuel retailing outlets to public sector oil marketing companies and is also preparing to restart some of them on hopes diesel prices will be freed from government control. RIL closed all its 1,432 fuel outlets across India by 2008 as sales declined and losses mounted because private marketers could not match the subsidised prices offered by state-owned Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation. RIL is trying to come up with a plan to optimise returns on its assets amid expectations that prices of diesel, India's most-consumed fuel, will be deregulated. Reliance is said to be waiting for more clarity on deregulation of diesel prices, which appears imminent, given the changes in the pricing regime. The government, seeking to cut its subsidy bill, allowed diesel prices to be increased by about 50 paise per litre almost every month since January 2013. In addition, global prices have softened and the rupee has appreciated against the US dollar, helping oil marketing companies (OMCs) to make a profit on the fuel. OMCs said RIL has initiated talks but they are at a very early stage and the proposals have not been considered by the companies yet. In 2002, private companies including RIL and Essar captured almost 15% of the fuel retail market. Industry players expect competition to revive with the re-entry of private players. (economictimes.indiatimes.com)

Transportation / Trade…………

GAIL in talks to buy 2-2.5 MT LNG from US

October 1, 2014. State-owned gas utility GAIL is in talks to buy an additional 2-2.5 million tons (MT) of liquefied natural gas (LNG) from the US to meet India's growing energy demand. US Federal Energy Regulatory Commission approved construction of LNG export project south of Washington which GAIL plans to use for export of gas in its liquid form to India. GAIL India Ltd has taken 40 per cent of the project's capacity to liquefy 5.75 million tons a year of natural gas for export in ships. The $3.8 billion project, being built by Dominion Resources at Cove Point, Maryland, is likely to be completed in June 2017. Petronet LNG Ltd, the nation's largest liquid gas importer, buy 7.5 million tons a year of LNG from RasGas of Qatar at 12.67 per cent of the prevailing crude oil price. At $95 a barrel oil price, RasGas LNG at loading terminal costs over $12 per million British thermal unit. GAIL already holds 20 per cent stake in Carrizo's Eagle Ford Shale acreage and has a deal with Cheniere Energy Partners to buy 3.5 million tonnes per annum of LNG from Sabine Pass Liquefaction, a subsidiary of Cheniere, from 2017-18. (economictimes.indiatimes.com)

Policy / Performance………

Oil Ministry cuts natural gas supplies to small industry in Gujarat

October 6, 2014. Oil Ministry has cut natural gas supplies to small industries in south Gujarat by 60 per cent to feed CNG demand, a move that has threatened their survival and is being seen as a contravention of the stated policy. The ministry had recently decided to meet 100 per cent gas requirement for CNG and piped cooking gas supplies in cities of firms like Indraprastha Gas Ltd, from domestic production. This was to be ensured by cutting domestic gas supplies to non-priority sectors. In furtherance to this, Administered Price Mechanism (APM) gas or regulated production of ONGC/OIL to 30 small industries in South Gujarat was cut by almost 60 per cent, threatening their survival as they cannot afford imported LNG that costs four times the domestic gas price of $4.2 per million British thermal unit. In case of reduction in supplies, pro-rata cuts were to be applied on all APM consumers. South Gujarat Small Gas Consumers Association has written to Oil Minister Dharmendra Pradhan saying the 30 small glass consumers in South Gujarat including Pragati Glass, Piramal Glass, Haldyn Glass, Gujarat Borosil and Savana Ceramics are facing closure due to the cut announced by GAIL in the APM natural gas supplies. The Association said it had represented the case of small industries to Pradhan where Pradhan assured to get the matter examined. (economictimes.indiatimes.com)

Govt set to revamp crude import policy

October 4, 2014. The government is revamping the crude import policy to leverage the shifting sands of global oil market as new players gnaw at the existing world order of suppliers amid tepid demand. At present, Indian state-run refiners buy crude under term contract directly from national oil companies (NOCs) as well as a select band of global majors that have a share in oil from fields operated by them around the world. Crude is bought on the basis of an 'official selling price (OSP)' declared by some of the NOCs, while it is negotiated with some. The emphasis on term contracts remains as strong as ever but procedural problems have arisen as NOCs have changed the way of doing business. Many of them sell crude through subsidiaries with the aim of extracting higher price as refineries become more sensitive to various grades of oil. There has also been a shakeout among the global majors due to mergers, while some others have lost significance or have been eased out by new entrants. These changes have a direct bearing on the decision making process of the state-run refiners who face delays in seeking clarifications and approvals from the government. The policy changes propose to cut red tape and time by laying down clear criteria for qualifying a seller as an NOC or its subsidiary, swapping of a particular grade of oil between NOCs and MNCs and pricing of grades not available on OSP. The list of MNCs is also to be updated in line with current Fortune and Platts rankings. Oil ministry said the existing system for buying crude was put in place in 1979 with the establishment of an Empowered Standing Committee to approve contracts. Indian Oil was the sole importer and also supplied crude to Bharat Petroleum and Hindustan Petroleum. The committee's composition underwent changes in 1981 and in 2002 when separate panels were set up for BPCL and HPCL as crude import was deregulated. In 2003, another panel was formed for MRPL, which had by then been taken over by ONGC. These changes are now proving to be inadequate in the complex trade dynamics of the global oil market. (economictimes.indiatimes.com)

Losses on diesel sales wiped out, says govt

October 2, 2014. With the rates of the Indian basket of crude oil falling below $95 a barrel, the petroleum ministry said losses on diesel sales had been wiped out with the government now looking at a profit of nearly two rupees a litre on the fuel sales. The country is on the threshold of market pricing of diesel since under-recoveries, or the difference between retail price and its imported cost, have been wiped out by the monthly hikes in diesel price. Diesel prices are being raised monthly by 50 paise a litre in line with the government's January 2013 decision, while September was the first month that passed without a hike. Rates have cumulatively risen by ` 11.81 per litre in 19 instalments since January 2013. The under-recovery on High Speed Diesel (HSD) applicable for the first fortnight of September will go down to 8 paise per litre, the petroleum ministry had said on the first of the month. This is possibly the first time that retail prices in India are higher than global rates. (economictimes.indiatimes.com)

Fuel companies absorbed ` 266 bn losses on sales in 5 yrs: Oil Ministry

October 2, 2014. With CAG castigating state-owned fuel retailers for overcharging customers by ` 26,626 crore over 5 years, Oil Ministry has defended the PSUs saying they had absorbed ` 28,680 crore in losses on fuel sales during that period. The Comptroller and Auditor General (CAG) of India in its latest report stated that Indian Oil Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp overcharged customers by ` 26,626 crore from 2007-08 to 2011-12 by charging notional levies like customs duty on fuel they sold. In comments on CAG observation, the ministry defended the pricing methodology followed by the oil marketing companies (OMCs) of calculating the desired retail price in a manner as if the product was imported - adding customs duty, freight, insurance, ocean loss and wharfage charge to prevailing international price of petrol, diesel, LPG or kerosene. This they do because they import nearly 80 per cent of their raw material (crude oil) need and pay import parity price for the oil they buy from domestic producers. The retail price for diesel, LPG and kerosene has always been lower than cost and the difference has been met through subsidy support. Refining is a cyclical industry characterised by very volatile prices. Providing some level of protection and thereby adequate refining margins is necessary for encouraging investment in expansion, and more importantly in modernisation of domestic refineries. Failure on this front can impede our quest for energy security. Also, the profit margins of OMCs are only around 1 per cent of their total turnover which are the lowest as compared to the global peers -- 10 per cent of Exxon Mobil, 11.2 per cent of Chevron and 7.6 per cent of Brazil's Petrobras. Similarly, as compared to the profit margin of their PSU peers in energy sector -- NTPC (17.5 per cent), Coal India (21.9 per cent) and ONGC (26.5% per cent), the profit margin of OMCs are negligible, they said. During 2007-08, 2008-09 studies were conducted by the Cost Accounts Branch of Department of Expenditure, in Ministry of Finance to work out the amount of under-recoveries of the OMCs under the current methodology and actual refinery cost method. Similar study was also conducted for the period April- September 2010 and 2011-12. Only small differences were observed in the under-recovery amount worked out kinder both the mechanisms, they said. Currently, there is no customs duty on crude oil while a 2.5 per cent import duty is charged on inward shipment of petrol and diesel. During post part of the audit period, crude oil attracted a 5 per cent customs duty, while a 7.5 per cent import duty was levied on products. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

GMR's 1.3 GW Chhattisgarh power plant begins generation

October 7, 2014. The first 685 MW unit of GMR Chhattisgarh Energy's 1,370 MW supercritical coal-based thermal power plant at Raikheda in the state has commenced electricity generation. The unit used fuel oil to achieve this first synchronisation. The project has been implemented on multiple packages concept by Doosan of Korea. Work on the second unit of 685 MW is in progress. Since 2013, the GMR Group has commissioned two coal-based thermal power plants - the 2x300 MW EMCO Energy at Warora in Maharashtra and three units of the 4x350 MW GMR Kamalanga Energy at Kamlalanga in Odisha. The GMR group signed the Memorandum of Understanding (MoU) with the Government of Chhattisgarh for the power plant in 2008 and received environment clearance and consent to establish the same in 2011. Besides Chhattisgarh, this plant will cater to the power needs of other states in the country. (economictimes.indiatimes.com)

Cost of power generation likely to increase by 33 per cent following SC order

October 7, 2014. The cost of power generation is likely to increase about a third, according to industry estimates, as 36 coal blocks get transferred from private sector to state-run miner Coal India following a Supreme Court (SC) order. Coal India's cost of production is more than that of private firms due to higher overheads and strict adherence to the rules requiring key postings in all of its mines, said a coal expert, who has worked with the miner in the past. Rating agency ICRA has estimated that about 18 GW capacity of independent power producers will be affected by the Supreme Court order. This comprises a mix of operational projects (6.3 GW as of July) and under-construction projects (11.4 GW expected to become operational over the next two years). (economictimes.indiatimes.com)

TS GENCO, BHEL sign MoU to establish thermal power plants

October 6, 2014. Bharat Heavy Electricals Limited (BHEL) has already executed thermal power projects in Telangana in Bhupalapally, Singareni Colleries and Kothagudem, whose performance is above the national average in terms of plant load factor. Telangana State Power Generation Corporation (TS GENCO) and Bharat Heavy Electricals Limited (BHEL) have signed a Memorandum of Understanding (MoU) to establish thermal power plants to generate 6,000 MW of electricity in Telangana. The MoU was signed in the presence of Telangana Chief Minister K Chandrashekar Rao. TS GENCO has an installed power generating capacity of 4,364 MW and has technical capability in the area of installing, owning, operating as well as maintaining power plants.

BHEL has already executed thermal power projects in Telangana in Bhupalapally, Singareni Colleries and Kothagudem, whose performance is above the national average in terms of plant load factor. The chief minister reposed faith and confidence in BHEL, which would execute the project as the nominated engineering procurement and construction contractor within three years. (www.business-standard.com)

NMDC puts UP's Gonda power plant project on back burner

October 6, 2014. NMDC has put its proposal to set up a ` 3,000 crore-power plant in Gonda of Uttar Pradesh on the back burner, as it feels it is not viable. In August last year, an MoU was signed between NMDC Power Ltd, a wholly owned subsidiary of Navratna Public Sector Undertaking, NMDC Limited and IEDCL, a subsidiary of IL&FS, for setting up a 2x250 MW thermal power plant under joint venture at Gonda, with the investment outlay of over ` 3,000 crore. An Expert Appraisal Committee under the Ministry of Environment and Forest in October last year had refused to clear the proposal on the grounds that the place where the project is proposed is fertile agriculture land. (economictimes.indiatimes.com)

Power generation in Gujarat unaffected due to coal shortage: Patel

October 5, 2014. Power generation in Gujarat is not affected due to coal shortage and the state is meeting demand of its various consumers without imposing any restrictions, Energy Minister Saurabhbhai Patel said. The total power generation in Gujarat stands at around 12,830 MW as of now that includes power generated by the Gujarat State Electricity Corp Ltd (GSECL), state government owned IPPs (independent power producers), other power producers and central sector power projects, he said.

It also includes 202 MW of wind power generation and 566 MW of solar power generation in the state, he said. On October 1, the GSECL and National Thermal Power Corporation (NTPC) signed a Memorandum of Understanding (MoU) to swap 1 million tonne of coal, Patel said. At present, GSCEL receives its domestic supply from the Coal India Ltd (CIL) mines in Bilaspur of Chhattisgarh, whereas NTPC imports coal for its power plants located in Chhattisgarh from Gujarat-based ports. The ministry of power has permitted NTPC to swap the coal it receives through Gujarat for its thermal plant in Chhattisgarh with the fuel available at Bilaspur mines. In turn, Gujarat will utilise the imported coal for its power plants, Patel said. (www.business-standard.com)

Neyveli's ` 49.1 bn Tuticorin power project nearing completion

October 3, 2014. State-run miner Neyveli Lignite Corp (NLC)'s 1,000 MW thermal power plant at Tuticorin is in advanced stages of completion, a development that will help it achieve over 4,200 MW generation capacity. The plant, which entailed an investment of ` 4,910 crore, could achieve 86% progress by August. The ignite miner plans to take its installed power generation capacity to 4,240 MW by the end of the current fiscal, on the back of ongoing power projects. It has an installed capacity of about 3,000 MW at present. NLC has plans for growth in power generation capacity. It is already in the process of setting up two power projects in Tamil Nadu and Uttar Pradesh at an estimated cost of ` 24,770 crore, to take its capacity to 11,195 MW. In Tamil Nadu, it has plans to set up a 4,000 MW coal- based power plant near Thirumullaivasal village of Sirkali taluk, Nagapattinam district. In Uttar Pradesh, it will set up a 1,980 MW (3X660 MW) plant in Ghatampur in Kanpur Nagar district at an estimated cost of ` 14,375.4 crore. It has planned to set up another new power plant in Rajasthan with a capacity of 250 MW as an extension of the existing power plant there at an investment of ` 2041.78 crore. (www.business-standard.com)

SJVNL signs pact for Bhutan hydro project

October 1, 2014. The public sector Satluj Jal Vidyut Nigam Ltd (SJVNL) has signed an agreement for commissioning of the 600 MW Kholongchu Hydro Electric Project in Bhutan, whose foundation stone was laid by Prime Minister Narendra Modi, the company said. The agreement was signed by SJVNL and Druk Green Power Corp in Bhutan. This is the first hydro electric project being developed by a joint venture company of public sector undertakings of both the governments, the SJVNL said. It will be implemented under build, own, operate and transfer (BOOT) model. Earlier, the inter-government agreement between Bhutan and Indian governments was signed April 22 for execution of four hydropower projects. The Kholongchu project is a run-of-the-river project located on the Kholongchu river. On completion, the project will generate 2,568.52 million units of energy. The project is estimated to cost ` 3,868.87 crore which will be shared in the ratio of 50:50 by the two joint venture partners. Modi laid the stone of the project June 16 where Bhutanese Prime Minister Dasho Tshering Tobgay was also present. (www.newkerala.com)

Transmission / Distribution / Trade…

Tripura to supply 100 MW of power to Bangladesh

October 7, 2014. India has initiated the process to supply 100 MW of power from Tripura to Bangladesh, an Indian diplomat said. Several steps were taken about the Indian government's commitment of supplying 100 MW of power to Bangladesh from southern Tripura's Palatana power plant, Indian Deputy High Commissioner in Dhaka Sandeep Chakravorty said. He said that supplying power from Tripura to Bangladesh will be similar to the system between West Bengal's Baharampur and Bheramara in Bangladesh. India had commenced supply of 250 MW of power to Bangladesh last year after the government-run Bangladesh Power Development Board and India's NTPC Vidyut Vyapar Nigam Ltd (NVVN), a subsidiary of India's National Thermal Power Corporation (NTPC), signed a deal Feb 28, 2012 to supply 250 MW of electricity, following an agreement signed during Bangladesh Prime Minister Sheikh Hasina's visit to New Delhi in January 2010. To provide power to Bangladesh, 400 kV switching station has been set up at Baharampur in West Bengal. The cross-border inter-connection has been established between Baharampur (India) and Bheramara (Bangladesh). (economictimes.indiatimes.com)

Cancel projects given to Chinese companies, demand local power firms

October 7, 2014. Domestic electrical and electronics equipment makers have asked the government to cancel projects awarded to Chinese state-run firms, arguing that India's critical power distribution system could prove vulnerable and the country may face blackouts if these firms decide to manipulate and damage the national grid. According to the Indian Electrical and Electronics Manufacturers' Association (IEEMA), Chinese firms have been awarded a number of projects to install supervisory control and data acquisition (SCADA) systems for better power distribution management in 18 cities of Tamil Nadu, Rajasthan, Madhya Pradesh and Puducherry. The IEEMA wrote to the power ministry that China had reportedly mounted almost daily attacks on both government and private computer networks in India, showing its intent and capability over the past one and a half years. The association said that the data of the system was vulnerable to threat and its connectivity to transmission system could pose a threat to the national power transmission grid. Till March, the power ministry had sanctioned projects worth about ` 40,000 crore under its restructured accelerated power development and reforms programme to reduce the transmission and distribution losses. The association, which was founded in 1948 and has 800 gear makers for power sector as its members, has been opposing imports of Chinese equipment that have been making increasing inroads into the Indian market with their cost competitiveness. Cyber security experts also believe Chinese equipment poses a threat to Indian power transmission and distribution system. (economictimes.indiatimes.com)

IPCL lines up investment to strengthen distribution infrastructure in Bihar

October 6, 2014. India Power Corp Ltd (IPCL) plans to invest at least ` 33 crore as the first tranche towards beefing up power distribution infrastructure at Gaya and Bodh Gaya in Bihar. The company has submitted its plan to upgrade infrastructure and induct new power distribution technology to the Bihar Electricity Regulatory Commission (BERC) and is awaiting a formal approval to start work. In June 2014, IPCL's wholly owned subsidiary, India Power Corporation (Bodhgaya) Ltd, entered into an agreement with South Bihar Power Distribution Company Ltd for a 15-year distribution franchise for supply of power to Gaya, Bodh Gaya and Manpur areas of Bihar. The company has identified core areas which would need management and investment interventions to ensure quality service to the customers of Gaya. The company had initiated consumer awareness programmes in tandem with the requisite changes to existing infrastructure, like providing improved earthings to ensure reliability and quality of supply as well as consumer safety. It has put in place a call centre aligned with its operational control room for daily monitoring and take customer feedback and complaints. On similar lines, four customer-care centres and 130 bill collection counters have been linked across the command area for error-free billing, bill collection and to deal with other customer-related issues. (economictimes.indiatimes.com)

New transmission capacities must for competitive power market: IEX

October 5, 2014. With transmission congestion curtailing millions of units of electricity supply every month, Indian Energy Exchange (IEX) has said there is a need to build new transmission capacities to ensure a well-functioning power market in the country. The exchange said transmission capacities are a key enabler for power market. As much as 5,300 million units of electricity remained unsold due to congestion in the transmission system in financial year 2014, according to IEX. In August alone, about 223 million units of electricity were curtailed due to unavailability of inter-regional transmission corridor. IEX sees an average daily trade of about 80,000 MWh electricity. The bourse has more than 3,000 participants. Among others, the exchange offers products in Day-Ahead and Term-Ahead markets. Under Day-Ahead Market (DAM), participants carry out trade in electricity on 15-minute block basis, a day prior to the delivery of power. Contracts under Term-Ahead Market (TAM) are for a duration of up to 11 days. (www.business-standard.com)

APTEL directs Adani Power to restore power supply to Haryana

October 2, 2014. Cracking the whip on Adani Power, the Appellate Tribunal for Electricity (APTEL) directed the power generation company to restore power supply to Haryana, which the firm had abruptly stopped after the Supreme Court put a stay on the Tribunal's order on increase in rates. Following the stay from the apex court on the petition of Haryana power utilities, Adani Power stopped power supply on August 25, without informing the court or APTEL. The Tribunal passed an order directing Haryana utilities to make the payment to Adani Power, adding the compensatory tariff. This was later stayed by the Supreme Court on the appeal by Haryana power utilities and ruled out any increase in tariff. Thereafter, Adani Power stopped supply of 1,424 MW to Haryana. (www.business-standard.com)

Policy / Performance………….

Power outages forcing firms to reconsider investment, expansion plans in Telangana

October 7, 2014. Frequent and long power outages are forcing industries based in Telangana to reconsider their proposed incremental investments, expansions and greenfield projects in India's newest state. Telangana chief minister K Chandrasekhar Rao has blamed N Chandrababu Naidu, the chief minister of Andhra Pradesh, for the power woes of his state. Andhra Pradesh, from which Telangana was carved out on June 2, owns over 60% of the two states' combined power generation assets of 16,465MW in terms of location. While Rao has sought three years to fully resolve the power crisis, industry leaders say they cannot afford to miss out on the overall improvement in business sentiment in the rest of the country. The Andhra Pradesh Reorganisation Act of 2014 stipulates division of power plants among the successor states based on their geographical location. Telangana later secured nearly 54% power allocation based on the consumption track record formula through a contentious government order in April, two months after the Parliament passed the Act. At a time when Andhra Pradesh is supplying uninterrupted power across sectors, Telangana has imposed 4-12 hours of daily power cuts on farmers and domestic consumers, and four-day-amonth production holiday on industries. Against a demand of 161 million units (mu) a day, the Telangana government is able to supply only 137 mu. Besides, the state is unable to buy electricity from power-surplus states because of grid connectivity issues. The industry agrees that the decades-old power supply issue cannot be resolved overnight by a government that has been in office just for 100 days, but it wants the government to spell out mediumand long-term plans to address the problem, said K Sudheer Reddy, president of Telangana Industrialists' Federation. (economictimes.indiatimes.com)

Govt seeks AG's opinion on need for Ordinance on coal blocks

October 6, 2014. The Coal Ministry has sought the opinion of Attorney General (AG) on whether the government needs to bring out an Ordinance to deal with the issues arising from the Supreme Court decision to de-allocate coal mines The issues that need to be resolved by the government in the coal mine case include forfeiting of bank guarantees and title deeds of the land mines purchased by the companies. Depending on the advice of the Attorney General of India, the ministry will take a view on the Ordinance so as to deal with the implications of the Supreme Court's order in the coal case. In a major blow to the corporate sector, the Supreme Court had quashed allocation of 214 out of 218 coal blocks alloted to various companies since 1993 terming the method as "fatally flawed" and allowed the Centre to take over operation of 42 such blocks which are functional. The apex court said the beneficiaries of the illegal process "must suffer" the consequences and refused to show sympathy to private companies which submitted that ` 2.87 lakh crore have been invested in 157 coal block and ` 4 lakh crores in end-use plants. It, however, saved from the "guillotine" four allocations one each to SAIL and NTPC and two blocks to Sasan Power Ltd owned by Reliance Power and also gave six months breathing time to rest of them to wind up their operations by March 31, 2015. (www.business-standard.com)

PFC to appoint consultants for Power Project Monitoring Panel

October 6, 2014. Power Finance Corporation (PFC) is looking for consultants for monitoring the ongoing electricity generation and transmission stations and for facilitating the removal of bottlenecks in project completion. A Power Project Monitoring Panel has been set up through the Power Project Progress Assessment Society to monitor the progress of power projects so as to commission them on time. There is requirement of Power Project Monitoring Consultants in the area of coal availability and logistics. The consultants will be appointed on a contract for a period of two years. The applicant should not be more than 64 years of age on the date of appointment. The primary function of the consultants will be to handle issues related to coal supply for power projects under development and in operation including any other facet considered critical.

Consultants will also have the responsibility of facilitating the identification of bottlenecks and suggest remedial measures for the requirement. For this purpose, the consultant would be needed to interact in his assigned area of function with State governments, ministries of the central government, financing institutions, regulatory agencies and other agencies involved with project implementation. PFC is engaged in providing funds for various power projects in generation, transmission, and distribution sectors. (www.business-standard.com)

Coal India awards contracts for two washeries

October 6, 2014. Coal India has awarded contracts for construction of two washeries as part of efforts to augment its capacity to crush coal and ensure better quality of the dry fuel. The government had earlier said that comprehensive measures for enhancing domestic coal output were being put in place along with stringent mechanism for quality control and environmental protection, which includes supply of crushed coal and setting up of washeries.

Of the 16 coal washeries, six are coking coal with a capacity of 18.6 million tonnes per year and 10 non-coking coal washeries with a capacity of 82 million tonnes per year. At present, CIL operates 17 coal washeries with a total capacity of 39.4 million tonnes per year. Out of these, 13 are coking coal washeries with a total capacity of 24.90 million tonnes, while four are non-coking coal washeries with a total capacity of 14.50 million tonnes.

The Standing Committee on Coal and Steel had earlier pulled up Coal India for delays in setting up of washeries and had desired that the coal PSU prepare an action plan to expedite the work of commissioning of washeries. The committee had also observed that the washeries were not set up despite the Ministry of Environment and Forests restricting the use of coal containing more than 34 per cent ash content in power stations located 1,000 km away from pit heads. (www.thehindubusinessline.com)

DERC to review fuel surcharge, tariff may go up in November

October 5, 2014. Power tariff in the city may go up next month as Delhi Electricity Regulatory Commission (DERC) is all set to levy a fuel surcharge to help the private distribution companies adjust their power purchase cost. While hiking the power tariff by up to 7.5% for domestic consumers, the DERC in July had withdrawn Power Purchase Adjustment Cost (PPAC) of around 8% till October. DERC said a decision on "readjusting" the tariff will be taken by end of the month after examining the petitions of the three private discoms to review the PPAC.

The regulator had introduced PPAC in 2012 to help the private power distribution companies recover additional cost on account of increase in coal and gas prices. Delhi gets power from a number of gas and coal-based power generation plants. Power experts said the three discoms Tata Power Delhi Distribution Ltd, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd may see a hike in the range of 6 to 8%. While hiking the power tariff by up to 7.5% for domestic consumers, the DERC in July had withdrawn PPAC of around 8% for three months. The withdrawal of the PPAC resulted in marginal decline of tariff for the consumers, whose monthly consumption does not exceed 400 units. (www.business-standard.com)

Karnataka invites bids for 500 MW round-the-clock power

October 5, 2014. Karnataka is planning to buy 500 MW RTC (round-the-clock) power from producers to meet demand for the next eight months. The power is being bought on a short-term basis from generators, trading licensees, State utilities, captive power plants (CPPs) and co-generators within the southern region for power supply. The Power Company of Karnataka Ltd (PCKL), which has invited bids, is buying power on behalf of Government-owned distribution companies such as Bescom, Mescom, Hescom, Gescom and Cescom. (www.thehindubusinessline.com

Sikkim govt to buy 100 per cent stake in Teesta-III if other investors exit

October 4, 2014. The Teesta-III hydro power project, promoted jointly by the Sikkim government, private players and a group of private equity (PE) investors, is likely to be sailed out of rough waters by the state. If the PE investors exit the project, the state government is ready to bail out the venture, which had faced contractual delays and natural calamities. After the consortium of PE investors, under holding company Varuna Investments, had complained to the Centre about cost overruns of the project running up to ` 615 crore, the Sikkim government has expressed its desire to buy out the equity of other investors. (www.business-standard.com)

SC order to derail Vedanta's plans to raise power capacity

October 4, 2014. Vedanta group’s plans to become a formidable player in the power sector will suffer a major setback due to unavailability of coal after the Supreme Court (SC) judgement recently. The Supreme Court had cancelled coal blocks allocated to two group companies — Balco and Sterlite Energy — which will impact profitability of the companies. The group operates power plants in Korba, Chhattisgarh, and Jharsuguda, Odisha. Balco’s 1,200 MW power plant in Korba has been dormant due to lack of approvals. Now with its coal mine gone, the power project will keep bleeding money, said analysts. At Jharsuguda, Sesa Sterlite has two power plants — a 2,400 MW power plant with independent power producer status and a 1,200 MW captive power plant to feed the nearby aluminium smelter of 0.5 million tonnes per annum. (www.business-standard.com)

All efforts will be made to ease fuel crisis at power plants: Coal Ministry

October 3, 2014. The Coal Ministry has said that with the Supreme Court clearing the air with regard to coal blocks it will make efforts to ensure that the fuel is made available for electricity generation and the crisis at power plants is eased. The coal stock position at thermal power plants is critical as more than half of the generating stations have less than a week's fuel stock. The ministry said that it is keen to move forward in the matter of allocating the coal blocks which stand reverted to the government. (economictimes.indiatimes.com)

Govt mulling to offer package to kickstart 16 GW of gasfired power plants

October 2, 2014. The government plans to offer a rescue package to kickstart 16,000 MW of gasfired power plants that are idling after an investment of about ` 64,000 crore by providing fuel and subsidy to make them financially viable. This will benefit Lanco Infratech, Essar Power, Reliance Power, GVK Group, GMR Energy and other companies that had set up plants on the basis of official projections of gas availability.

The package includes a proposal that any additional gas produced in the next four years (above the current level of output) should be supplied to power stations. This should be pooled with imported liquefied natural gas (LNG). As LNG costs about $15 per unit, compared with the prevailing domestic gas rate of $4.2, the government plans to provide subsidy so that electricity is not too costly for distribution companies. The power sector will be given priority in allocation of incremental gas from blocks awarded under the National Exploration Licensing Policy (NELP) till 2018-19. The planned measures will come as a relief to the power sector which has been under stress as the shortage of coal and natural gas has affected about 35,000 MW of capacity, mostly built by the private sector. (economictimes.indiatimes.com)

Open coal, power sectors to private competition to revive investment: Deepak Parekh report

October 2, 2014. Days after the Supreme Court cancelled coal block allocations to the private sector between 1993 and 2010, a committee headed by HDFC chief Deepak Parekh has pitched for public-private partnerships (PPPs) in the coal mining and power distribution segments. The committee, set up in 2010 to look at financing for infrastructure development, gave its report, after filing an interim one in July 2012. The latest report provides a plan for reviving investment in key sectors during the 12th Plan. The 190 coal blocks allotted through the past two decades have been directed to CIL, for re-auctioning in six months. The report also recommends setting up a new public sector undertaking to award and manage PPP concessions. The power distribution segment faced losses of ` 1 a unit and was nearing a financial collapse, the committee said. (www.business-standard.com)

BJP to submit review petition against power tariff hike in UP

October 2, 2014. Blaming Samajwadi Party government's "wrong policies" for increase in power tariff in Uttar Pradesh, BJP said it will move the UP State Electricity Regulatory Commission against the hike. The state government should have increased power tariffs in such areas where electricity is supplied for 24 hours like Rampur, Etawa and Mainpuri and not in the entire state where power is supplied for only eight to ten hours. (economictimes.indiatimes.com)

India, US commit to implement civil nuclear agreement

October 1, 2014. Prime Minister Narendra Modi and United States (US) President Barack Obama, in their bilateral talks held at the White House, agreed to commit to the implementation of the civil nuclear agreement between the two countries. Prime Minister Modi and President Obama reaffirmed their commitment to implement fully the U.S.-India civil nuclear cooperation agreement. They established a Contact Group on advancing the implementation of civil nuclear energy cooperation in order to realize early their shared goal of delivering electricity from U.S.-built nuclear power plants in India. They looked forward to advancing the dialogue to discuss all implementation issues, including but not limited to administrative issues, liability, technical issues, and licensing to facilitate the establishment of nuclear parks, including power plants with Westinghouse and GE-Hitachi technology. (www.newkerala.com)

MP to set up panel to improve capacity of thermal power plants

October 1, 2014. The Madhya Pradesh (MP) government and the Centre would jointly set up a high-power committee for collaborating with public sector energy major NTPC. The committee will be headed by Principal Secretary (Energy) on behalf of the state while Joint Secretary, Government of India, and Director (Finance) of National Thermal Power Corporation (NTPC) will be included as members. The decision in this regard was taken at a meeting between Union Power and New & Renewable Energy Minister Piyush Goyal and Chief Minister (CM) Shivraj Singh Chouhan. The committee will evaluate the thermal power plants. The objective is to increase the capacity of thermal power plants above 80 per cent.

The CM brought to Goyal's notice the requirement of power during festive seasons, which the latter justified and assured that the demand will be fulfilled and NTPC will immediately start power supply to the state. Goyal also said that additional electricity would be given to Madhya Pradesh from the Centre's unallocated quota for the Rabi season. The Chief Minister said the demand of power will increase up to 40 per cent during Rabi season. Goyal said additional 500 MW will be allocated to Madhya Pradesh for 100 days from October 15. Goyal assured all possible help from the Centre to help Madhya Pradesh increase its share up to 30 per cent in renewable energy in the state's total power generation capacity by 2017. (economictimes.indiatimes.com)

UPERC approves increase in power rates

October 1, 2014. The Uttar Pradesh Electricity Regulatory Commission (UPERC) approved power tariff hike of about 12 per cent for domestic consumers. However, tariff increase for industries, commercial and agricultural connections were 7.38 per cent, 6.28 per cent and 12.20 per cent, respectively. The new rates would be effective seven days after the Uttar Pradesh Power Corporation Limited, the state-owned power utility, issues a public notice. For residential consumers, the average rate has been raised from ` 3.55 a unit to ` 3.97 a unit. Similarly, power tariff for industries has been increased from ` 7.04 a unit to ` 7.56 a unit while that for the commercial and agricultural connections are from ` 6.64 a unit to ` 7.05 a unit and from ` 3.19 a unit to ` 3.58 a unit, respectively.

Last year, power tariffs were increased by about 30 per cent in the month of June. Therefore, the aggregate hike across different consumers comes to about 8.90 per cent, with the per unit rate increasing from ` 4.97 to ` 5.41. UPERC said the tariff had been designed in such a way that the effective tariff for consumers having lower consumption would be lesser compared to consumers having a higher consumption pattern. According to UPERC, the tariff for unmetered rural agricultural consumers had not been increased. Meanwhile, Uttar Pradesh Rajya Vidyut Upbhokta Parishad, the power consumers forum, has flayed the hike saying it would only put additional burden on consumers. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Gazprom output to rise 5 per cent in 2015 after fall this year

October 7, 2014. Russia's top natural gas producer Gazprom expects its gas output to rise by around 5 percent next year, as this year's production is poised to drop to an all time low. Gazprom expects its gas output to fall to 463 billion cubic metres (bcm) this year due to a pricing dispute with Ukraine, however some analysts believe that it would barely reach 450 bcm, a record low level since 1989, when the company was created out of the Soviet gas ministry. In January-September, Gazprom's natural gas production reached 311.6 bcm. (www.rigzone.com)

Chevron to sell stake in Canadian shale for $1.5 bn

October 6, 2014. Chevron Corp agreed to sell a 30 percent stake in a venture to develop oil and natural gas from Canada’s Duvernay shale to Kuwait Petroleum Corp, giving the Mideast producer a foothold in a top North American play. Chevron, the second-largest U.S. oil and gas producer, said the $1.5 billion purchase price includes cash and an agreement to contribute to the venture’s capital costs. Chevron has drilled 16 exploration wells in the area so far, the San Ramon, California-based company said. The Duvernay area in Alberta is among the most promising shale opportunities in North America. So far, wells in the region have proven more expensive and taken longer to drill than similar shale formations in the U.S., Tudor Pickering Holt & Co. said in a research note. The Duvernay, in central Alberta, holds an estimated 443 trillion cubic feet of gas and 61.7 billion barrels of oil, according to a report last year by the Energy Resources Conservation Board. Kuwait has relied on traditional drilling while hydraulic fracturing and horizontal drilling have helped the U.S. unlock oil and gas reserves in shale plays. The Kuwait Oil Co. has identified a shale gas deposit and was planning to develop the resource soon. (www.bloomberg.com)

Russia's Rosneft offers OVL stake in Vankor oilfield

October 5, 2014. On the heels of selling 10 per cent stake in its Vankor oilfield to China for $ 1 billion, Russia's biggest oil company Rosneft has offered a similar stake to India's Oil and Natural Gas Corp (ONGC). Rosneft has made a formal offer to sell 10 per cent stake in the strategic oilfield in Siberia to ONGC Videsh Ltd (OVL). Vankor is the largest field to have been discovered and brought into production in Russia in the last 25 years. As of January 1, 2014 the initial recoverable reserves in the Vankor field are estimated at 500 million tons of oil and condensate, and 182 billion cubic meters of gas. OVL is doing due diligence on the proposal and will make an offer post that. Vankor will reach peak output of 500,000 barrels per day or 25 million tons a year in 2019. The field, has driven recent Russian output growth, pumped 435,000 bpd in September. Russia is the world's top oil producer with current output of 10.5 million bpd but its key producing region - West Siberia - is maturing. The field is estimated to hold 991 million barrels of oil equivalent reserves and is planned to start production in 2017. Yurubcheno-Tokhomskoye will reach a production plateau of up to 5 million tonnes a year (100,000 barrels per day) in 2019. Rosneft, Russia's biggest oil company and the world's largest listed producer by output, offered to make a management presentation along with Physical Data Room (PDR) access to OVL in Moscow. OVL is interested in expanding its presence in Russia as it looks to source one million barrels per day of oil and oil-equivalent gas from Russia. OVL already has 20 per cent stake in Sakhalin-1 oil and gas field in Far East Russia and in 2009 acquired Imperial Energy, which has fields in Siberia, for $2.1 billion. (economictimes.indiatimes.com)

Kuwait in talks with oil giants to help boost production

October 3, 2014. Kuwait is in talks with five major oil companies to help boost crude production and develop some of its oilfields including Burgan, the world's second largest, a move that has faced fierce political opposition in the past. Kuwait has invited Britain's BP, France's Total, Royal Dutch Shell, ExxonMobil and Chevron, to bid for a so-called enhanced technical service agreement for the northern Ratqa heavy oilfield, Kuwait Oil Co (KOC) said. The plan is part of efforts to meet Kuwait's target of producing 4 million barrels of oil per day (bpd) by 2020. The OPEC member currently produces around 3 million bpd and exports around two thirds. KOC also plans to open up other oilfields such as its North Kuwait fields and areas of the giant Burgan field for foreign oil companies to develop, and will send a letter to the five majors seeking their interest in bidding. It is the first time KOC will develop such a big heavy oil reservoir and the plan is to produce 60,000 bpd from Ratqa, which lies close to the Iraqi border, by 2018-2019 in the first phase, and then ramp it up to 120,000 bpd by 2025, KOC said. North Kuwait produces around 700,000 bpd and the plan is to boost its output to 1 million bpd by 2017-2018, KOC said. KOC is also working to sustain current production potential of 1.7 million bpd from Burgan after moving ahead with a water injection project to help boost oil recovery rates. Kuwait's oil production comes mainly from a few mature fields, dominated by the Burgan field in the south of the country. Kuwait's current capacity is around 3.25 million bpd, with KOC's share at around 3 million bpd. To bring the capacity up to 4 million bpd by 2020, KOC will contribute an extra 650,000 bpd. (www.arabianbusiness.com)

Goldman losing faith in $100 Brent as WTI spread seen wider

October 3, 2014. Goldman Sachs Group Inc. says it’s losing confidence in its forecast that Brent crude will recover to $100 a barrel next year. While the Wall Street bank is maintaining its projection for now, it says that a lack of signs of accelerating global economic growth and uncertainty over OPEC’s production plans amid rising Libyan output are weakening its conviction. Brent, the benchmark for more than half the world’s oil, closed at $93.42 a barrel, the lowest in more than two years. Prices slumped as U.S. crude production climbed last month to the highest level since 1986 and the Organization of Petroleum Exporting Countries (OPEC) pumped the most oil in a year. The International Energy Agency cut its projections for global consumption growth through next year due to a weakening economic outlook while Saudi Arabia lowered prices, signaling the world’s biggest exporter is prepared to let them fall rather than cede market share. West Texas Intermediate (WTI), the U.S. benchmark grade, for November delivery was at $91.52 a barrel in electronic trading on the New York Mercantile Exchange, bringing its decline this year to 7 percent. WTI’s discount to Brent shrank to $2.41 based on settlement prices, the smallest since August 2013. The spread is “far too narrow given logistic economics” and needs to “widen,” Goldman said in its report. At this level, the spread will boost U.S. imports, increasing inventories on the Gulf Coast and at Cushing, Oklahoma, the delivery point for WTI, Goldman said. The bank forecasts the difference will rebound to $10 a barrel in 2015. The chance of a price recovery to Goldman’s $100 forecast for 2015 may also be capped if longer-term prices, which have risen this year, catch up with the slide in prompt contracts, the bank said. (www.bloomberg.com)

US firm Stratum Energy to boost gas production in Romania

October 2, 2014. U.S. firm Stratum Energy said it would invest $150 million next year to expand its gas production business in Romania. Romanian Energy Minister Razvan Nicolescu said Stratum Energy began delivering gas to the national system a few days ago, becoming the country's third gas producer after state-owned Romgaz and Petrom, majority-controlled by Austria's OMV. The company said it was currently producing 450,000 cubic meters per day of gas and 100 cubic meters per day of a condensate and light crude mixture via two operating wells at its block in the eastern Romanian county of Bacau. Stratum said it had so far invested $70 million in Romania, including building a pipeline that connects it to the national gas grid operated by state firm Transgaz, through which it can deliver up to 4 million cubic meters per day. Its development plan will be submitted for approval to the country's agency for mineral resources this year. (in.reuters.com)

BP Oman awards $730 mn drilling contracts for Oman's Khazzan project

October 2, 2014. BP Oman announced that the firm has awarded two long term drilling contracts for the Khazzan project in Block 61 in Oman. KCA Deutag has been awarded more than $400 million contracts for the construction and operation of five new build land rigs for Khazzan. Oman’s Abraj Energy Service has been awarded more than $330 million contracts to supply three drilling rigs for the full field development of the Khazzan Project. (www.rigzone.com)

Exxon signs Pemex accord as Mexico prepares oil opening

October 2, 2014. Exxon Mobil Corp, the world’s most valuable crude producer, signed an agreement with Petroleos Mexicanos as Mexico’s oil industry opens to private investment. Exxon and Pemex, as the state-owned producer is known, signed a three-year memorandum of understanding and cooperation to exchange academic, scientific and technical knowledge, according to the companies. The companies agreed to analyze exploration, drilling and refining opportunities, according to the Pemex. The Irving, Texas-based company joins a growing list of major oil producers to express interest in entering Mexico’s energy industry, which is ending a 76-year state oil monopoly. Congress passed legislation to allow private companies to tap the country’s 13.4 billion barrels of proven reserves, which the government estimates will bring in $50 billion of investment between 2015 and 2018. Chevron Corp, Noble Energy Inc and BHP Billiton Ltd are among companies interested in exploring for oil in Mexico. Authorities next year will auction 169 oil blocks -- 109 for exploration and 60 for production. (www.bloomberg.com)

Russia oil production near record with sanctions yet to bite

October 2, 2014. Russian oil output rose to near a post-Soviet record last month, a sign the biggest source of revenue for President Vladimir Putin’s government has yet to be eroded by U.S. and European sanctions. The nation increased output 0.7 percent to 10.61 million barrels a day, according to preliminary data from CDU-TEK, which is part of the Energy Ministry. The figure is within 0.3 percent of the record in January and is for crude and condensates, a type of oil that yields a greater proportion of high-value fuels. The U.S. and the European Union have targeted Russia’s oil industry by banning exports of some equipment and technology, blaming Putin’s government for stoking a separatist insurgency in eastern Ukraine. Russia produced 10.64 million barrels of crude and condensate in January. It was as high as 11.48 million barrels a day in 1987, the Soviet-era peak, data from BP Plc show. Oil and oil products represented 46 percent of the nation’s budget revenues in the first eight months of this year, the biggest single contributor, government data show. (www.bloomberg.com)

Ophir makes gas discovery at Kamba-1 well in Tanzania's offshore Block 4

October 2, 2014. Ophir Energy plc announced the Kamba-1 discovery and an update on its drilling program in Tanzania. The Kamba-1 well in Block 4 has resulted in gas discoveries of 1.03 trillion cubic feet (Tcf) in the Kamba and Fulusi prospects. BG operates the Block 4 license and Ophir holds a 20 percent interest. The Kamba-1 well encountered a 50 foot gross gas column in the Fulusi prospect and, after sidetracking to test the Kamba prospect, the Kamba-1ST well established another gas column of 459 feet with high net to gross, good quality, reservoir sands. (www.rigzone.com)

Gulf Keystone staff return to Kurdistan to increase oil output

October 1, 2014. Gulf Keystone Petroleum Ltd returned all key foreign staff to Iraqi Kurdistan and will increase output after U.S. air strikes eased the militant threat that prompted a mass evacuation of expatriate oil workers. The explorer is on target to produce 40,000 barrels of oil a day at its Shaikan wells, it said. Gulf Keystone has been producing about 23,000 barrels a day since Aug. 28, the Hamilton, Bermuda-based company said. Oil companies including Chevron Corp, Marathon Oil Corp and Afren Plc evacuated staff and halted drilling in August after Islamic State seized control of a vast swath of northern Iraq and neighboring Syria. ShaMaran Petroleum Corp resumed work at its Demir Dagh field in Kurdistan and Oryx Petroleum Corp said it would boost output in the region as the security situation improves. Producers have also been caught in a dispute between the Kurdistan Regional Government and the central Iraqi government over how to share oil revenue. Regional authorities have been exporting via Turkey since the start of the year against the wishes of the government in Baghdad. Gulf Keystone is exporting about 70 percent of its output to international markets via Turkey and selling the rest locally, it said. It has exported about 4 million gross barrels so far and is in negotiations with Kurdish authorities about payment. The company sold about 220,000 barrels of oil to local customers for about $9.4 million, it said. (www.bloomberg.com)

Downstream…………

Japan refiner Nansei restarts marine ops after typhoon passes

October 6, 2014. Japanese refiner Nansei Sekiyu restarted marine berth operations at its 100,000 barrels-per-day Nishihara refinery in Okinawa. The refiner, which is wholly owned by Brazil's Petrobras, suspended sea operations ahead of the arrival of Typhoon Phanfone. The storm did not impact crude oil refining operations at the plant. (www.downstreamtoday.com)

Kuwait's KPI cancels $1.4 bn Dutch refinery investment