-

CENTRES

Progammes & Centres

Location

[Shades of Grey: The Annals of the Indian Coal Industry]

“Unlike today, the fortunes of the Indian coal mining sector in the colonial era were tied to global economic conditions but this failed to have a positive impact on the Indian coal sector as it did on the rest of the coal industry. Some of the issues that held up reform of the industry continue to haunt the Indian coal industry even today…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Coal…………………

· Shades of Grey: The Annals of the Indian Coal Industry (part I)

DATA INSIGHT………………

· Crude Oil & Energy Security of India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC no longer interested in Yamal LNG project

· ONGC, Mexico's Pemex to jointly start oil exploration

· Delhi HC notice to Centre on RIL's plea seeking dismissal of ONGC petition on gas exploitation

Downstream……………………………

· India's older refineries to face survival test on diesel deregulation

Transportation / Trade………………

· Man Industries wins ` 5.5 bn pipe supply contracts to oil, gas projects

· OIL investing ` 12 bn to revamp pump stations in Assam

· Gulf Petrochem acquires Shell's bitumen plant in Gujarat

Policy / Performance…………………

· Non-subsidised LPG cylinder price cut by ` 21; ATF by a steep 3 per cent

· Petrol price cut by 65 paise; diesel rate to wait for PM Modi's return

· Centre may cap number of subsidised LPG cylinders at 9 to bring down deficit

· Fuel prices: Govt plans to cut diesel prices by ` 2 per litre

· Gas pricing needs to be fixed quickly: Brokerages

· Cabinet headed by PM Modi postpones decision on revision of natural gas prices

· Farmers supply 10 mn litre ethanol to Indian Oil, Bharat Petroleum: Gadkari

[NATIONAL: POWER]

Generation………………

· NTPC ties up $250 mn loan with Mizuho Bank

· Construction phase of Indo-Bhutan JV Kholongchu hydro plant starts

· JSW Energy to acquire JP's 1.8 GW power assets

· Kalinga Power drops ` 65 bn project in Odisha

Transmission / Distribution / Trade……

· ABB India Ltd wins ` 1.7 bn order from Bangladesh power grid

· UP to bring down line losses to tackle power crisis

· 24x7 power supply to entire country a big challenge: Mishra

· Alstom Bharat Forge Power signs ` 11.3 bn contract with NTPC

· Cabinet clears agreement on grid connectivity with Nepal

Policy / Performance…………………

· Coalscam: CBI files closure report, clean chit to govt servants

· NTPC, Gujarat govt ink pact to swap 1 mn tonne coal

· Assam Gas and Assam Power Generation to jointly set up plant in Assam

· India needs over $250 bn investments in power sector

· State utilities' penalty burden close to ` 9 bn in West Bengal

· Associations plead Tamil Nadu CM Jayalalithaa to defer proposed power tariff hike

· DERC may not alter tariff rules till next fiscal

· Govt aims to raise fund by selling 10 per cent stake in Coal India

· Power sector bad loans may rise post SC's scrapping of coal block allotments

· Coalgate verdict: Relief for NTPC, Reliance Power and SAIL

· TN announces 20 per cent power cut for industrial & commercial users

· Nepal, India agree to expedite stalled Pancheshwar project

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· UAE's Dana Gas wins gas exploration deals in Egypt

· Interra starts CHK 1194 oil well development drilling in Myanmar

· Russia says Arctic well drilled with Exxon strikes oil

· Russia’s Rosneft offers ONGC stake in eastern Siberia oilfield

· OVL signs agreement with Petroleos Mexicanos

· Statoil makes uncommercial gas find in Arctic

· Iran plans to double production at Alvand oilfield offshore in Siri Island

· Eni secures 3 new exploration blocks in Egypt

· Petrobras, ONGC find gas in Brazil offshore extension well

· Parkmead finds new gas field in Netherlands

Downstream……………………

· Refinery failures spur bets on higher US gasoline

· PetroChina pushes back Huabei refinery revamp by 2 yrs

· Total to decide French refinery plan by next spring

· Islamic State oil refineries in Syria hit in airstrikes

· Saudi refinery hits capacity as Total, Vitol see EU slump

Transportation / Trade…………

· Conoco uses exemption to export crude to South Korea

· Oil heads for biggest quarterly drop since 2012 on ample supply

· Europe seen coping with Russian gas cut in normal winter

· Canada to push Aboriginal treaties amid stalled pipelines

· Woodfibre LNG signs offtake pact with Guangzhou Gas

· ADB selling up to $120 mn stake in India's Petronet LNG

· Tokyo Gas, Kogas may start joint gas purchases, investments

· Singapore's Pavilion signs 2 long-term LNG purchase deals

· Oil insulated from US strikes on Islamic State by Glut

· Suncor looks east to find buyers for western Canada crude

· Pavilion gas concludes 20 year LNG supply deal with BP

· Indonesia’s Widodo has no plans to suspend energy-trader Petral

Policy / Performance………………

· US FERC approves Dominion's Cove Point LNG export facility

· Russia oil chief says sanctions no bar to Arctic drilling

· BHP backs floating LNG plan off Australia with partner Exxon

· Saudis said to maintain oil output after biggest cut since’12

· CF-Yara talks show how shale gas is shaking up fertilizer

· Crude oil prices down in Asia

[INTERNATIONAL: POWER]

Generation…………………

· Nuclear plants across emerging nations defy Japan concern

· Panda Power Funds commissions 758 MW combined-cycle power plant in US

Transmission / Distribution / Trade……

· Saudi Electricity signs $682 mn deals to power Riyadh metro

· Abengoa to develop power transmission project in Argentina

· Gulf electricity-sharing grid set for expansion

· Feds OK 330 mile Canada-NYC power line

· Tidal Energy signs PPA with EDF Energy

· Uranium rally threatened by surplus as mine strike eases

Policy / Performance………………

· Nigeria signs MoU to establish 1 GW coal power plant in Enugu

· Volcanoes may be next hurdle for nuclear restarts in Japan

· Chinese coal rebounds from 7 year low as output cuts kick in

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· GMDC plans 50 MW wind power project for ` 3 bn

· Nalco to invest ` 6.6 bn on 100 MW wind power plant

· Govt building roof tops in NDMC to generate 12 MW solar power

· Biodiversity conservation plan for Jaitapur gets panel's nod

· India will decide about climate change on its own: Environment Minister

· Rolta Group forays into manufacture of photovoltaic modules

· Centre to spend ` 2k bn by 2019 for 'Clean India'

GLOBAL………………

· US, India partnership will be a model for the world, say Obama and Modi

· Property tycoon revealing $20 bn solar-led portfolio

· Japan has added 11 GW of clean energy since July 2012

· Climate change blamed for raising risk of heat waves

· Solar may become largest global power source by 2050

· SaskPower soon to commission carbon-capture power plant in Canada

· IDB to provide loan for two wind power projects in Peru

· European cars were 38 per cent dirtier than air standards show

· GE, Toyo, Kuni Umi to get $822 mn loan for solar plant

· China leads charge for carbon emissions pricing, UN approves of plan

· Scotland approves wind farm to power 28k homes

· UN chief lauded for role in world climate efforts

· Holland explores community power generation project

· California leading on emissions as brown signs new laws

[WEEK IN REVIEW]

ENERGY/COAL………………

Shades of Grey: The Annals of the Indian Coal Industry (part I)

Lydia Powell, Observer Research Foundation

|

T |

he title of this essay is adapted from an insightful special article in the Economic & Political Weekly (EPW) by K V Subramanyam written in 1968.[1] The article uses a quote from the Burrow’s Committee Report of 1936 that observed: ‘coal trade in India has been rather like a race in which profit has always come first with safety a poor second, sound methods an also ran and national welfare a dead horse.’ This was a time when coal mining was in the hands of the private sector in India. If the Burrows Committee were asked to sum up India’s coal industry today (when it is almost entirely in the hands of the State), it would probably choose to replace only one word: the word ‘profit’ with the word ‘politics’. How has the Indian coal industry which has run for over 200 years managed to stay in the same place? Will the current attempt to swing the pendulum back from ‘politics’ to ‘profit’ through privatisation or other means actually change anything? Most importantly when and how will national welfare, safety and security (both of the coal mines and that of the people who work in them) come before profit or politics? The aim of the series of essays is to find some answers to these questions.

The first published reference to coal mining in India as recorded by Gee of the Geological Survey of India dates back to 1774 when Warren Hastings granted permission to mine coal in the Raniganj region.[2] Mining activity was initiated but the effort was not a commercial success. Coal mining had to wait for another 40 years for a revival (in 1814). But this time coal mining developed fast riding on the development of the Railways. According to Gee there were 50 collieries in India by 1858.[3] By 1868, 5 companies operating in Raniganj were producing over 492,700 tonnes of coal per year accounting for 88% of total output. When railway lines were extended to Dhanbad, Jharia coal field was developed and soon production from Jharia exceeded production from Raniganj. By 1900 coal production in India was about 6.1 million tonnes (MT) out of which over 5 MT came from Jharia, Raniganj and Giridih (today’s Karharbari field) fields.[4] The Giridih field was in fact the first captive coal block belonging to the Railways which was the biggest consumer of coal.[5] Even in those days access to land was among the most important problems faced by coal companies. As the imperial government was yet to establish rights over minerals beneath the surface, royalty based agreements with land owners was the norm. But according to Gee, many early coal mining ventures failed because of expensive legal disputes on account of ‘complexities of land ownership in India’. Gee would not have to change this observation even if he were writing today. Writing in 1913, R R Simpson, Inspector of Mines and Mining Specialist to the Geological Survey of India observed that lack of demand and also the lack of infrastructure for transport to ports (for transport to overseas coal consuming industries) were initial problems faced by the industry.[6] He records 18 coal fields being worked out of which only 7 were said to be of some significance. This included coal fields in Raniganj and Jharia that accounted for 89% of total production.[7] In this period, British coal arriving as ballast of ships was the biggest source of competition for Indian coal.[8]

The spurt in demand for coal during the First World War is said to have increased coal production in India to over 22 MT by 1919 which fell dramatically during the years of global trade depression in the early 1920s before recovering to over 28 MT just before the Second World War.[9] Unlike today, the fortunes of the Indian coal mining sector in the colonial era were tied to global economic conditions but this failed to have a positive impact on the Indian coal sector as it did on the rest of the coal industry. Some of the issues that held up reform of the industry continue to haunt the Indian coal industry even today. The primary hurdle was fragmented ownership. It not only held up consolidation but also sustained inefficient practices. For example, mineral rights of the numerous surface land owners were not questioned and consequently mining was carried out from a number of small isolated mines in valuable coal seams rather than in large mines that made greater geological and economic sense.[10] This resulted in the use of inefficient methods of exploitation that resulted in waste of valuable resources in barriers separating various concessions. Apparently no lessons were learnt from history. In fact history is being allowed to repeat itself as a tragedy almost a hundred years later through the ad hoc policy on coal block allocation. The captive coal allocation policy may have been the result of good intentions, (that of increasing the production of coal), but it compromised on geological integrity, economies of scale and most importantly national welfare. As observed by former Secretary of the Ministry of Coal P C Parakh in his recent book, captive mining assigned coal mines to several medium sized industries, which fragmented mining activities and consequently lost significant scale advantages in mining.[11] Parakh also notes that when ‘demand for coal blocks increased, the Ministry sub-divided blocks into smaller blocks without reference to geological or geographic features unmindful of the loss at the barriers’.[12] As recorded in Parakh’s book (with concrete evidence), numerous submissions to the Prime Minister’s office calling for a review of the allocation policy were ignored on account of pressure from political leaders of various persuasions including some serving in senior positions in the current Government.[13]

Returning to history, resentment over the absence of a level playing field for coal mining for western and Indian companies and the persistent conflict between labour and capital left deep scars on the industry which are visible even today. According to Ratna & Rajat Ray, the Bengal Coal company which came under the ownership of the European Andrew Yule and Company ruined many Indian colliery and land owners in the Raniganj area in the early 1900s.[14] This marked the beginning of the battle between small Indian coal producers and larger western coal producers operating in India. The Indian coal companies were supplying to small local industries such as brick kilns and households while the latter were captive units of imperial economic interests which included but not limited to large Jute mills.[15] As recorded in detail by the authors, conflict, sometimes violent, between Indian and European coal companies characterised this period with access to transport for coal playing the role of a key weapon. They describe situations where the Indian coal producers attempted to block the transport of coal on the Damodar River to counter the tight control of access to Railway wagons by the European companies. At the height of this conflict, Indian coal producers formed the Indian Mining Federation affiliated to the Bengal National Chamber of Commerce in 1913 with 250 members owning 331 collieries accounting for a third of coal production in India.[16] The authors also point out that when it came to fighting labour unrest (which eventually grew into political unrest), the Indian and European coal producers joined hands and met demands for increase in wages with the threat of complete lock-out.[17] The reason lies in the structure of the coal industry. The proportion of wages to gross value of output is about 6% for petroleum but close to 50% for coal.[18] Obviously, this meant that labour and wages were a significant issue for the coal industry unlike petroleum which depended on capital.

to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Crude Oil & Energy Security of India

Akhilesh Sati, Observer Research Foundation

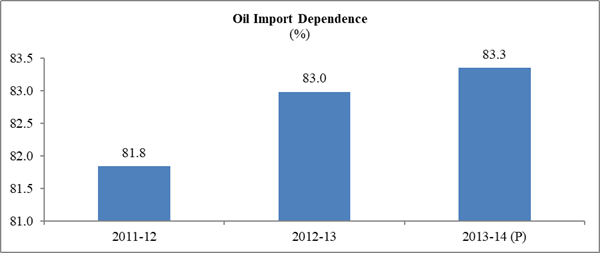

Million Tonnes

|

2011-12 |

2012-13 |

2013-14 (P) |

|

|

Crude Oil Import |

171.7 |

184.8 |

189.2 |

|

Production |

38.1 |

37.9 |

37.8 |

|

Total Availability |

209.8 |

222.7 |

227 |

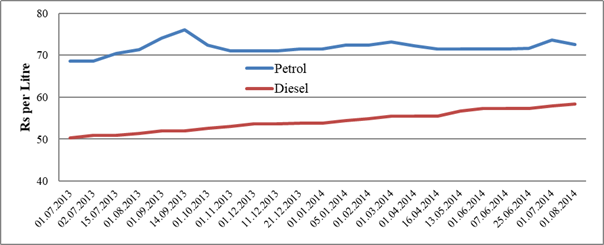

Variations in Retail Selling Price (at Delhi) of Refined Products from Crude Oil

Source: Rajya Sabha, Question No. 2265 and 3045. (P)- Provisional

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC no longer interested in Yamal LNG project

September 29, 2014. Oil and Natural Gas Corp (ONGC) is no longer keen to acquire a stake in Russian natural-gas producer OAO Novatek's USD 20 billion Yamal LNG project. ONGC Videsh Ltd (OVL), the overseas arm of India's largest oil and gas producer, along with Petronet LNG Ltd and Indian Oil Corp (IOC) was last year in negotiations with Novatek for a 9-10 per cent stake in the project. But the company is no longer interested after it carried out a risk assessment of the project. Yamal LNG project comprises of development of the South Tambeyskoye field with proven deposits of 1.3 trillion cubic meters of natural gas and the construction of natural gas liquefaction plant (LNG) for producing 16.5 million tonnes of LNG a year by 2018. OVL was interested in the upstream part of the project while Petronet was keen to offtake LNG. (economictimes.indiatimes.com)

ONGC, Mexico's Pemex to jointly start oil exploration

September 27, 2014. ONGC's foreign arm ONGC Videsh Ltd (OVL) entered into a memorandum of understanding and cooperation (MOU) with Mexico's Pemex national oil company for exploration of hydrocarbons. According to the company, it entered into the MoU, under which the two companies will plan to discuss future cooperation and collaboration in Mexico's upstream sector. Currently, Mexico is the largest crude oil producing country in Latin America. The country has recently opened its oil and gas sector for foreign participation. (www.newkerala.com)

Delhi HC notice to Centre on RIL's plea seeking dismissal of ONGC petition on gas exploitation

September 24, 2014. The Delhi High Court (HC) sought responses of the Centre and the Oil and Natural Gas Corporation (ONGC) on Reliance Industries Ltd (RIL) plea seeking dismissal of the PSU's petition accusing it of exploiting gas worth ` 30,000 crore from the PSU's natural gas block in Krishna-Godavari (KG) basin. RIL has sought dismissal of the petition of ONGC saying an independent third party, US-based DeGolyer and MacNaughton, has been appointed, as per the PSU's plea, to "establish continuity of reservoir and for gas balancing" across the two blocks in the KG basin. Justice Manmohan issued notices and sought response of all the parties in the matter and listed the matter for further hearing on January 21, 2015. RIL in its plea has said that the matter was a contractual dispute between the parties and the only issue, of appointment of an independent third party, has been settled amicably, thus ONGC's petition be dismissed. An activist lawyer and a former bureaucrat had moved the high court seeking to intervene in the matter, saying that apart from the earlier government's alleged pressure on ONGC to withdraw its plea, the present regime has also supported RIL and admonished the PSU for filing the petition. ONGC had submitted before the court that it has suffered loss of gas worth ` 30,000 crore as a result of RIL exploiting gas from its block in Krishna-Godavari basin. In its plea, ONGC has contended that RIL has drawn out 18 billion cubic meters of natural gas from the combined reserves of both companies since 2009. ONGC has alleged that the current situation arose due to lack of vigilance on the part of Directorate General of Hydrocarbons (DGH) and the central government and their failure to take precautionary measures resulted in loss of several thousands of crores of rupees to it. It said that DGH should have insisted upon joint development of the blocks. ONGC has claimed that of the said total quantity of gas exploited by RIL from its block adjoining that of the PSU, more than half belongs to it. RIL has said that the blocks were given to it in 2006 and it made them operational. While it has admitted that it is drawing gas from its block, it said that the independent expert panel will have to determine if the well of the company is connected with that of ONGC. (economictimes.indiatimes.com)

Downstream………….

India's older refineries to face survival test on diesel deregulation

September 26, 2014. Time is running out for India's aging state-run oil refineries as the new government of Prime Minister Narendra Modi looks set to free up diesel prices and open the gates to private sector competition. These refineries, commissioned mostly in the 1950s and 1960s during India's early industrialisation push, are inefficient and costly to maintain compared to their modern counterparts on the coast mainly operated by private companies. Their outdated machinery prevents them from using cheaper imported heavy crude as feedstock. They are also largely situated in remote and landlocked areas, restricting their potential to export fuel products. These factors have put a lid on refining margins, which appear set to narrow further with increased competition. The government may soon deregulate the diesel market so that it no longer needs to subsidise state-run refiners for selling the fuel at below-market prices. The move to market-based pricing is expected to bring the return of private refiners such as Reliance Industries and Essar Oil, threatening to erode the market share of the dominant state-run refiners. The competition will trim already slender margins. Gross refining margins, a key industry measure of profitability, of the aging refineries are below $3 a barrel, Indian oil ministry data shows. (economictimes.indiatimes.com)

Transportation / Trade…………

Man Industries wins ` 5.5 bn pipe supply contracts to oil, gas projects

September 29, 2014. Large diameter pipe maker Man Industries said it has won ` 550 crore new orders from domestic and international customers for supply of pipes for Oil and Gas sector projects. It said it has also received vendor approval from several new customers in oil and gas sector globally and participated in various bids. The company therefore expects good order inflow in near future from the outstanding bids which are at various levels of evaluation by the clients, it said. The company has also initiated the process for upgradation of its Pithampur plant to produce very large diameter pipes to cater to the upcoming mega drinking water supply, river linking and irrigation projects in Madhya Pradesh, Rajasthan and Uttar Pradesh. The upgradation will be completed by December 2014. (economictimes.indiatimes.com)

OIL investing ` 12 bn to revamp pump stations in Assam

September 27, 2014. Energy major Oil India Ltd (OIL) said it is investing ` 1,200 crore to revamp the pump stations of pipelines for carrying crude to refineries in Assam. OIL operates a 1,157 km long crude oil trunk pipeline of 5.5 million tonnes per annum (MTPA) capacity for transporting crude oil produced at oilfields in Upper Assam to the public sector refineries at Numaligarh, Guwahati and Bongaigaon, the company said. In 2013-14, OIL provided subsidy discounts to the tune of ` 8,736.85 crore, which was an increase of 10.7 per cent compared to ` 7,892.17 crore in 2012-13, to oil marketing companies to compensate their under recoveries in line with government policy. OIL has 10 per cent interest in a product pipeline in Sudan. (economictimes.indiatimes.com)

Gulf Petrochem acquires Shell's bitumen plant in Gujarat

September 25, 2014. UAE-based oil company Gulf Petrochem has acquired the Royal Dutch Shell's bitumen plant in Gujarat to meet the increasing demand for road construction products in West and North India. The acquisition of the plant at Savli near Vadodara will complement the construction of a high capacity storage terminal for various petroleum products at Pipavav in Gujarat. The plant will be manned, operated and managed by the existing Shell team as it would also be upgraded to manufacture bitumen products that adhere to new specifications laid down by Indian Roads Congress. The plant's capabilities will also supplement Gulf Petrochem's terminals in India, which includes importing and supplying bulk bitumen from Gujarat, Karnataka, West Bengal, and packed bitumen from depots at Mumbai, Delhi, Bangalore, Patna, Kashipur, Kosi Kalan. Gulf Petrochem is the largest exporter of bitumen to India as it supplies almost 35 per cent of the total imported bitumen. The plant will also supply Shell's existing customers who have registered an interest to continue receiving supplies. (economictimes.indiatimes.com)

Policy / Performance………

Non-subsidised LPG cylinder price cut by ` 21; ATF by a steep 3 per cent

September 30, 2014. Price of non-subsidised cooking gas (LPG) was cut by ` 21 per cylinder and that of jet fuel (ATF) by a steep 3 per cent on the back of falling international oil rates. This is the third straight reduction in rates of non- subsidised LPG since July. A non-subsidised 14.2-kg cooking gas cylinder will now cost ` 880, down from ` 901, in Delhi, according to Indian Oil Corp (IOC). A subsidised LPG cylinder in Delhi costs ` 414. The price of aviation turbine fuel (ATF), or jet fuel, at Delhi was cut by ` 2,077.62 per kilolitre, or 2.98 per cent, to ` 67,525.63 per kl, the nation's largest fuel retailer said. This is the third reduction in jet fuel rates since July. Declining international oil prices have made imports cheaper, resulting in price reduction. In Mumbai, jet fuel costs ` 69,610.50 per kl as against ` 71,829.42 per kl previously, IOC said. The rates vary because of differences in local sales tax or VAT. Jet fuel constitutes over 40 per cent of an airline's operating costs and the price cut will ease the financial burden of cash-strapped carriers. The three fuel retailers -- IOC, Hindustan Petroleum Corp and Bharat Petroleum Corp -- revise jet fuel and non-subsidised LPG prices on the first of every month, based on the average international prices in the preceding month. (economictimes.indiatimes.com)

Petrol price cut by 65 paise; diesel rate to wait for PM Modi's return

September 30, 2014. State oil firms have slashed petrol prices by 65 paise per litre because of falling international oil prices, which may also brighten ruling BJP's prospects in Maharashtra and Haryana assembly elections. This is the fourth consecutive reduction in petrol prices in last two months leading to a total Rs 5.74 per litre drop in its rate in Delhi. The government may also cut diesel rates by about ` 2 a litre soon, which will be the first rate cut for the fuel since January 2009. Falling international oil prices is one of the major reasons for steep diesel price cut. Brent oil dropped below $97 a barrel because of strengthening dollar and oversupply. The other reason for an over-recovery in diesel is the regular 50 paise per month hike in its rate since January last year. Domestic diesel price is now about ` 2 per litre more than the assumed market price. The UPA Cabinet in January last year allowed state-run retailers to raise diesel rates in small doses of 50 paise every month until pump prices were aligned with international ones. Since then, prices have risen by over 24%. Diesel is currently sold at ` 58.97 per litre in Delhi.

Chart: PETROL RATES

(in `/litre)

|

CITIES |

OLD RATE |

NEW RATE |

|

Delhi |

68.51 |

67.86 |

|

Kolkata |

76.14 |

75.46 |

|

Mumbai |

76.41 |

75.73 |

|

Chennai |

71.55 |

70.87 |

(economictimes.indiatimes.com)

Centre may cap number of subsidised LPG cylinders at 9 to bring down deficit

September 29, 2014. The government plans to cut the number of subsidised cooking gas cylinders for households to nine from 12 a year as it takes on the mounting LPG subsidy after effectively eliminating the bill on diesel. The subsidy on cooking gas is estimated to rise 30% to ` 60,000 crore this year, putting a severe strain on the fiscal situation, ironically because commercial establishments are again illegally buying subsidised gas ever since the UPA government, under instructions of Rahul Gandhi increased the number of subsidised cylinders to 12 from nine, hoping to get political mileage, which it didn't. The finance ministry has directed the oil ministry to take urgent steps to cut the subsidy and large scale black-marketing. When the UPA government restricted the supply of subsidised cooking gas, sales of commercial cylinders at market price rose as restaurants, factories and big businessmen could not get hold of subsidised cylinders. But latest data shows an alarming reversal in the trend. Sale of subsidised cyliners had dropped 4.9% between October 2012 and January 2013 when only six subsidised cylinders per year were allowed. When the cap was raised to 9 cylinders, sales were down 2.2% between February 2013 and January 2014. However, in the current fiscal, when the limit was raised to 12, against the estimated average household demand of 7.2 cylinders per year, the sales of domestic cylinders jumped 12.7%. Government officials say that the data establishes that a lot of the subsidy was going to rich people, who were earlier buying at the market rate of about ` 900 per cylinder instead of the subsidised price of ` 414 per cylinder in Delhi. The sale of market-priced gas for households has fallen 57%, while the sale of LPG for automobiles is down 13% since April. Two years ago, former oil minister Jaipal Reddy had capped the number of subsidised gas cylinders to six per household per year. His successor Veerappa Moily first raised it to 9 and then 12 on instructions from the Gandhi family. (economictimes.indiatimes.com)

Fuel prices: Govt plans to cut diesel prices by ` 2 per litre

September 26, 2014. After deferring gas price hike ahead of Assembly elections, the government plans a big cut in diesel prices while state oil firms are preparing to slash petrol rates, a move that can brighten the BJP's prospects in Maharashtra and Haryana. Diesel prices may fall about ` 2 per litre, the first rate cut for the fuel since January 2009. Petrol is likely to fall about 50 paise unless there is a sharp change in international prices or the exchange rate in the next five to six days. International diesel rates, the benchmark for pump prices, have fallen this month, while Brent crude oil slipped to a 14 months low of $96.7 per barrel as the market is oversupplied. International prices fell at the time when domestic price caught up with the landed price of imported diesel because of the regular 50 paise per month hike in its rate since January last year. Domestic diesel price is about ` 2 per litre more than the assumed market price. The oil ministry had announced that local rates were about 40 paise per litre higher. The government had decided to raise diesel prices in small monthly doses until pump prices were aligned with market rates and then deregulate its pricing. Political leaders said the ruling party hopes to gain from the price trends. Oil Minister Dharmendra Pradhan said the government deferred raising gas price because of Assembly elections. The two poll-bound states have millions of piped natural gas (PNG) and compressed natural gas (CNG) consumers. A one dollar per unit increase in gas price would raise CNG rate by ` 2.81 per kg and PNG rate by ` 1.89 per standard cubic meters in New Delhi. (economictimes.indiatimes.com)

Gas pricing needs to be fixed quickly: Brokerages

September 26, 2014. As the government deferred a revision in natural gas prices for the third time, brokerages said pricing needs to be fixed quickly as non-remunerative rates and policy uncertainties had led to sluggish domestic output. Gas prices will continue to be maintained at $4.2 per million British thermal unit (mmBtu) for another 45 days after the September 24 decision of the Cabinet to delay a decision on new gas price guidelines upto November 15. The current energy policies that constrain domestic production and inadvertently encourage energy imports at global prices should be reviewed, Kotak Institutional Equities said in a report. UBS as well as Bank of America Merrill Lynch expected a gas price of around $6.5 per mmBtu to be approved as opposed to $8.3-8.4 per mmBtu rate recommended by the Rangarajan Committee. Kotak said low natural gas prices will prevent any meaningful reinvestment in existing fields and investments in new discovered fields and unexplored regions, which is necessary to sustain and grow domestic production. A comprehensive market-based pricing regime for all forms of energy is ultimately required to remove inefficiencies in the energy chain, rationalise domestic consumption and incentivise indigenous production. Bank of America Merrill Lynch said the Supreme Court (SC) is hearing two public interest litigations against a price hike for gas from Reliance Industries' eastern offshore KG-D6 block. The SC had in its last hearing on September 18 asked the government to clarify its stand on the gas price hike decision taken by the UPA government, which was challenged by two appellants. The government's lawyer had informed the SC that the decision on gas pricing would be taken by the government and an affidavit would be filed. The SC has posted the matter for further hearing on November 14. It said the NDA government may fix the gas price at USD 6-7 per mmBtu vis-a-vis $8-9 as per the UPA government approved formula. (economictimes.indiatimes.com)

Cabinet headed by PM Modi postpones decision on revision of natural gas prices

September 24, 2014. Days ahead of its own deadline for the revision of natural gas prices, government postponed a decision on it by another 45 days to November 15. The NDA government, after coming to power, had put off implementation of the previous UPA-regime approved Rangarajan formula, which would have at least doubled rates to $8.4 per million British thermal unit, till September 30 for holding wider consultations. The Cabinet headed by Prime Minister (PM) Narendra Modi deferred a decision on the issue till November 15, Law and Telecom Minister Ravi Shankar Prasad said. The UPA government had in June last year approved a price formula suggested by a panel headed by C Rangarajan and re-confirmed it in December 2013 with certain conditions for Reliance Industries' eastern offshore KG-D6 block. The formula was to be implemented from April 1, 2014 but before a rate could be notified, general elections were announced and Election Commission asked the then government to defer it till completion of polls. On June 25, the new BJP-led government deferred it for a further three months as it found doubling of rates as per the approved formula unpalatable. Oil Minister Dharmendra Pradhan had recently told Parliament that a new gas price will be announced by September end. In August-end, the government constituted a four-member panel of secretaries to review the formula. The committee comprising of secretaries of power, fertiliser and expenditure with additional secretary in the Oil Ministry as its member secretary, submitted its recommendation on a new pricing mechanism. The deferment will also provide political relief to the NDA government which faces crucial electoral test in assembly elections in Maharasthra and Haryana. Any increase in gas price would have translated into higher power tariff and CNG and piped cooking gas rates. (economictimes.indiatimes.com)

Farmers supply 10 mn litre ethanol to Indian Oil, Bharat Petroleum: Gadkari

September 24, 2014. Efforts are on to promote ethanol to cut the huge ` 6 lakh crore bill on import of crude and farmers have already supplied 1 crore litre of ethanol to Indian Oil and Bharat Petroleum, Union Minister Nitin Gadkari said. Innovation and entrepreneurship are drivers of economic growth and prosperity and can change the face of India, he said. He said, on pilot run, the first ever ethanol-based public transport bus, manufactured by Sania of Sweden has started running in Nagpur and the carbon-dioxide emissions from the bus will be as low as 90 per cent. Gadkari said fate of farmers could change in Uttar Pradesh if they start producing the green fuel from its massive sugarcane industry. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

NTPC ties up $250 mn loan with Mizuho Bank

September 29, 2014. NTPC, country's largest power generation utility, has tied up loans to the tune of $250 million with Mizuho Bank Limited for funding its expansion plans. The company has tied up Syndicated Term Loan Facility of $250 million with Mizuho Bank Limited's Singapore Branch, NTPC said. NTPC has an installed capacity of 43,128 MW and the company has projects with a total capacity of 23,854 MW under construction. The company which is facing shortage in domestic fuel supplies and has plans to import 17 million tonnes (MT) of coal this fiscal which is higher than the quantity purchased last financial year. NTPC plans to add 1,798 MW generation in the current financial year ending March 2015. Its total coal requirement is estimated to be 177 MT for this fiscal. During the 2013-14 period, NTPC consumed 158.57 MMT of coal, with imports accounting for 10.39 MT. (economictimes.indiatimes.com)

Construction phase of Indo-Bhutan JV Kholongchu hydro plant starts

September 26, 2014. A tender has been floated for construction of 40 kilometres of approach road for the ` 4,000 crore Kholongchu hydroelectric plant in Bhutan, kicking off the construction phase of the project for which Prime Minister Narendra Modi laid the foundation stone in June. The plant is being built under an agreement signed between India and Bhutan in April to develop four joint-venture hydro electricity projects with a total capacity of 2,120 MW. Of these, the 600 MW Kholongchu project will be developed first as a joint venture between SJVN Ltd and Bhutan's Druk Green Power Corporation. The two neighbouring countries are cooperating on building hydro electricity projects, which provide clean and low-cost electricity to India and generate export revenue for Bhutan. The Chukha, Tala and Kurichu projects with a combined capacity of 1,416 MW are already operational. Another three -- Punatsangchu I (1,200 MW), Punatsangchu II (1,020 MW) and Mangdechu (720 MW) -- are scheduled to be commissioned in 2017-18. (economictimes.indiatimes.com)

JSW Energy to acquire JP's 1.8 GW power assets

September 26, 2014. JSW Energy said it would acquire Jaiprakash Power Ventures' 1,891 MW power assets. The move comes a day after talks in this regard between Jaypee Group and Reliance Power collapsed and the Supreme Court cancelled the allocation of four coal blocks of Jaypee Group entities JP Associates and Jaiprakash Power Ventures. JSW Energy and Jaypee Group announced they had signed a memorandum of understanding for three operating plants - the 300 MW Baspa stage-II plant, the 1,091 MW Karcham Wangtoo plant (both hydro power plants) and the 500 MW Bina thermal power plant. The companies didn't disclose the deal size and the financing plan. The deal was estimated at about ` 12,000 crore, the sum Reliance Power had offered for the three plants. Jaypee has been considering selling assets, including in the power segment, to cut debt, which stood at ` 28,164 crore as of March-end this year. However, talks for two deals, with Abu Dhabi National Energy Corporation and Reliance Power, collapsed within a few months of each other. Abu Dhabi National Energy Corporation had agreed to acquire the two hydro power plants for ` 9,689 crore. JSW Energy's operational power generation capacity stands at 3,140 MW, while projects with a capacity of 8,360 MW are under implementation. (www.business-standard.com)

Kalinga Power drops ` 65 bn project in Odisha

September 24, 2014. Kalinga Energy & Power Ltd (KEPL), a subsidiary of Kolkata-based Shyam Group, has withdrawn is its 1,320 MW coal-fired power plant proposal in Odisha. Odisha Industrial Infrastructure Development Corporation has asked the Collector of Jharsuguda to stop land acquisition process for the power plant developer. KEPL proposed to establish power plant comprising two units of 660 MW each in Jharsuguda in 2011, after revising its earlier proposal of 1,000 MW plant planned at Sambalpur, according to its memorandum of understanding (MoU) signed in 2009. A status report submitted with the state government showed that it has not achieved financial closure for the ` 6,500 crore project till March this year. It was neither allotted a coal block nor had secured any coal linkage from Mahanadi Coalfields Ltd (MCL). It was also under scrutiny for slow progress of the project. Apart from KEPL, other eight companies — Nava Bharat Power Ltd, Astaranga Power Company Ltd, Chambal Infrastructure Ltd, Sahara India Power Corporation Ltd, KU Projects, JR Power, BGR Energy and Vijaya Ferroalloys have not acquired land for their projects so far. With the withdrawal proposal of KEPL, the number of interested independent power producer (IPP) investors in the state reduced to 27. Before scrapping of the KEPL plan, the total number of IPP investors in Odisha were 28, envisaging a total generation capacity of 37,510 MW with the state share being 5,887 MW. Till date, three IPPs have commissioned thermal power capacity of 4,050 MW, the state being entitled to a share of 947 MW power from these commissioned units. Three more IPPs are expected to commission their projects by the end of this fiscal. These are Ind Barath Energy Utkal Ltd (700 MW), Monnet Power (1,050 MW) and Maa Durga (60 MW). (www.business-standard.com)

Transmission / Distribution / Trade…

ABB India Ltd wins ` 1.7 bn order from Bangladesh power grid

September 29, 2014. ABB India Ltd, a subsidiary of Swiss engineering group ABB, said it has won a ` 172 crore order from Power Grid Company of Bangladesh Ltd. The order is for supply of four 132/33kV turnkey substations. ABB will also help Power Grid Company expand its six other substations. Power Grid Company is in the process of upgrading Bangladesh's electricity generation, transmission and distribution systems to increase capacity, improve efficiency and reduce environmental impact. According to ABB's estimate, 4.5 lakh households in Bangladesh will get new power connections through this programme, while carbon emissions will be reduced by almost 2.5 million tonne per year. (economictimes.indiatimes.com)

UP to bring down line losses to tackle power crisis

September 27, 2014. Faced with an acute power crisis, the Uttar Pradesh (UP) government has decided to take steps to significantly bring down the line losses. At a meeting of senior power officials with Chief Secretary Alok Ranjan, it was decided that the UP Power Corporation Limited (UPPCL) would take the measures. An intensive campaign will be undertaken soon in 155 towns with a population of 30,000 to 400,000, and in 12 big cities of the state with a population of over 400,000. Under this programme, transformer-wise combing will be conducted to remove the flaws at all levels. Consumers, who are not yet in the billing net, will be included in billing and recovery process. Chief Minister Akhilesh Yadav instructed the power department at a review meeting to normalise the power situation in the state. Following the instructions, senior officials ordered combing operation to bring down the line losses. UP Power Corporation Limited (UPPCL) said that in two months of feederwise checking drive from July 1 to August 31 this year, around 24 lakhs new power connections were released and the power load was increased in 207,421 connections and action was taken in 15,763 power theft cases. (economictimes.indiatimes.com)

24x7 power supply to entire country a big challenge: Mishra

September 26, 2014. Ensuring 24x7 power supply, particularly to northern and eastern regions, is a big challenge for the present government, Additional Principal Secretary in the Prime Minister Office, P K Mishra said. Mishra said that the power sector faces several challenges, including fuel supply. Mishra also stressed upon the need for reaching out to all citizens deprived of electricity. Listing issues which need attention, Mishra claimed that all other states look towards Gujarat to improve their power scenario. Gujarat Finance Minister Saurabh Patel said the energy sector used to be in a mess before Narendra Modi took over as Prime Minister. Patel said that installed capacity of around 4,000 MW in different power plants of Gujarat lie idle due to gas shortage. He said that people in Gujarat would have to prepare to pay more for power in the coming months, as the government would have to pay a higher price to import gas to run power plants. (economictimes.indiatimes.com)

Alstom Bharat Forge Power signs ` 11.3 bn contract with NTPC

September 25, 2014. Alstom Bharat Forge Power, the joint venture (JV) company between Alstom and Bharat Forge, has signed a contract worth Euros 130 million (` 1,136.5 crore) to supply equipment to NTPC. The JV company's scope of work involves engineering, manufacturing, testing, supply, erection and commissioning of the two 660 MW supercritical turbine islands and auxiliaries for the plant. The equipment for the project will be manufactured at the JV firm's manufacturing facility at Sanand in Gujarat, which will be commissioned starting October 2014. (economictimes.indiatimes.com)

Cabinet clears agreement on grid connectivity with Nepal

September 24, 2014. The government cleared the agreement on power grid connectivity with Nepal which will facilitate and strengthen cross-border electricity transmission, grid connectivity and power trade between the two countries. During Prime Minister Narendra Modi's visit to Nepal in August, 2014, it was decided that negotiations on the power trade agreement would be concluded within 45 days. Nepal is currently importing about 200 MW electricity from India annually. The new cross-border transmission lines are under construction, which will more than double the transmission capacity, over the next two years. (economictimes.indiatimes.com)

Policy / Performance………….

Coalscam: CBI files closure report, clean chit to govt servants

September 30, 2014. CBI filed a revised closure report regarding the role of public servants in a coal blocks allocation scam case in which Navbharat Power Pvt Ltd and others were earlier charge sheeted as accused. CBI, in its revised supplementary report, told Special CBI Judge Bharat Parashar that during the probe, it has not found any offence committed by the public servants. The charge sheet was filed against NPPL and its officials for offences under sections 120-B (criminal conspiracy) read with 420 (cheating) of IPC for allegedly misrepresenting facts, including inflated net worth, to acquire coal blocks. During the hearing, the court heard part arguments of Special Public Prosecutor R S Cheema, appearing for CBI, on the closure report and fixed the matter for further arguments on October 14. Cheema told the judge that he has instructed the investigating officer (IO) to file all the relevant records of the case in the court. The IO assured the court he would file those documents, including the documents collected during search and statement of witnesses recorded under the provisions of the Code of Criminal Procedure (CrPC), within three-four days. The IO was directed by the court to submit a list of public servants who all dealt with the coal block allocation applications and their subsequent verification. The court asked the investigating officer (IO) to give the present status of those public servants as to whether they have since retired. (www.business-standard.com)

NTPC, Gujarat govt ink pact to swap 1 mn tonne coal

September 30, 2014. National Thermal Power Corporation (NTPC) and Gujarat government run Gujarat State Electricity Corporation Ltd (GSECL) inked a memorandum of understanding (MoU) to swap one million tonne of coal. The arrangement is likely to help both the companies save ` 378 crore per one million tonne. The agreement between NTPC and GSECL has been signed after a proposal for swapping coal was submitted to the Central Government two years back. Recently, the proposal of the Gujarat government was considered and approved by the Narendra Modi-led central government. It may be mentioned here that GSECL receives domestic coal for its power plants located in Gujarat from Coal India Ltd’s (CIL) mines in Chhattisgarh, which is transported through rail route. On the other hand, NTPC imports coal for its power plants located in Chhattisgarh from Gujarat-based ports. This, according to the state government, results cross country transportation and involves huge transportation cost. In order to bring down the freight cost, a proposal for swapping coal was sent to the Central government two years back. As per the new arrangement, the imported coal received by NTPC at Gujarat ports will be utilised by GSECL for power generation in Gujarat and the domestic coal of GSECL from Chhattisgarh will be used by NTPC for later’s power plants in Chhattisgarh. (www.business-standard.com)

Assam Gas and Assam Power Generation to jointly set up plant in Assam

September 29, 2014. Assam will soon set up a gas-based thermal power plant; which for the first time will use 'waste' gas as its fuel. The power plant, proposed to be set up at Titabor in Jorhat district, will come up at an estimated cost of ` 300 crore and would be commissioned in next two and half years time. The project will use the associated gas that is produced as a byproduct during drilling and extraction of crude oil. The associated gas is generally regarded as an undesirable byproduct, which is either re-injected or flared or vented. In oil fields in Upper Assam, these gases are burnt down at the sites after separation from the crude. The project will be executed jointly by two Assam government PSUs - Assam Power Generation Company Ltd. (APGCL) and Assam Gas Company Limited (AGCL), said Pradyut Bordoloi, Assam's power minister. He said some small pockets of gas reserves had been traced in the Jorhat-Golaghat belt, in areas like Nambor, Kachomari, Uriamghat etc. AGCL will divert these associated gases from the production sites to a central place (Titabor) through pipelines. The power plant will be developed by APGCL. It is estimated that that daily around 2 lakh standard cubic metre of gas will be available from these reserves for the proposed project. Though the associated gases are "waste", the state government will have to buy the gas from Oil and Natural Gas Corporation (ONGC). The power department is also exploring the possibility of setting up a similar plant in Barak Valley (South Assam) to use the associated gas reserves available there. The state-owned power generating company is also contemplating on setting up a solar power plant at Amguri in Upper Assam. (www.business-standard.com)

India needs over $250 bn investments in power sector

September 28, 2014. India needs investments of over $250 billion for development of the power sector in the next three years, Integrated Research and Action for Development said in its report. This will give an ample opportunity for investors, developers, power equipment manufacturers in developing power projects and associated transmission infrastructure, it said.

During the 12th plan period (2012-17), India plans to add 88,537 MW capacity, out of which 69,280 MW will come from coal. The government has planned additional renewable energy capacity addition of around 30,000 MW (5,000 MW wind, 10,000 MW solar and 2,100 small hydro). Currently, India's installed generation capacity, from all sources of energy, is close to 2,50,000 MW. It said that the country is likely to suffer a coal shortfall of 200 million tonnes by the end of the 12th plan period. Due to higher share of coal-based power generation, which has a high environmental impact owing to greenhouse gas emissions, India is emphasising on clean energy development, which includes the use of hydro, solar, biomass and so on. (www.business-standard.com)

State utilities' penalty burden close to ` 9 bn in West Bengal

September 28, 2014. An estimated ` 900 crore penalty burden is staring at the state-owned power utilities in West Bengal following the recent Supreme Court verdict that cancelled 214 coal mines allocated since 1993. West Bengal Power Development Corporation (WBPDCL) is the major power generating company that supplies electricity to West Bengal. At a time when the state power utilities are not sound financially and the government is facing financial crisis, the burden could prove to be costly.

ICRA said from 2008 to March 2014 WBPDCL aggregate mining is 24 million tonne of coal from three blocks - Tara east and West and Barjora blocks. Meanwhile, penalty burden on CESC Ltd, a leading private sector utility that supplies power to Kolkata and Howrah is close to ` 700 crore. CESC operates Sarshatali Coal Block as captive linked to 700 MW capacity and they have mined close to 22 million tonne from 2008 to March 2014. The apex court order demands a levy of ` 295 per tonne of coal mined by the owners of the operational captive mines, out of total 214 mines which had been recently cancelled. ICRA estimates total penalty due to the developments to the power sector is around ` 6,000 crore. (economictimes.indiatimes.com)

Associations plead Tamil Nadu CM Jayalalithaa to defer proposed power tariff hike

September 27, 2014. Seven industrial associations in the region requested Tamil Nadu Chief Minister (CM), Jayalalithaa to defer the proposed hike in power tariff effective from April one, 2015, as it would provide industries sufficient time to adjust their prices and mode of operations. Most of the industries, particularly MSMEs, have not picked up their business for various reasons and the proposal to go for a steep increase in the tariff would make them highly uncompetitive with their counter parts in other states, which are offering various sops to industries. The associations said the proposed hike will result in an increase in the average billing rate by ` 2 per KWHR (unit), which is more than 30 per cent to industries. (economictimes.indiatimes.com)

DERC may not alter tariff rules till next fiscal

September 27, 2014. Instead of framing new multi-year tariff regulations for the next fiscal 2015-16, Delhi Electricity Regulatory Commission (DERC) has proposed extending the existing regulations, which were enforced in 2012-13, by another year. The multi-year tariff (MYT) regulations provide the basic framework and principles for tariff determination. A public hearing for this has been fixed for September 30, which will be attended by experts of the power sector, generation and distribution companies. The last MYT regulations were for the period 2007-2011, but this was also extended till March 31, 2012. (economictimes.indiatimes.com)

Govt aims to raise fund by selling 10 per cent stake in Coal India

September 26, 2014. The government is set to launch the largest fund raising so far in the Indian capital market next month by selling 10% stake in Coal India, the world's biggest coal miner, for about ` 22,000 crore. Senior officials of the government, company and the bankers advising the issue will start meeting overseas and local investors — or 'roadshow' in industry parlance — from October 10 and will complete share sale by October end. (economictimes.indiatimes.com)

Power sector bad loans may rise post SC's scrapping of coal block allotments

September 25, 2014. The Supreme Court (SC) verdict scrapping all but four coal block allotments has added to the bad loan headache of the banking industry. Although bank exposure to coal mining sector is estimated to be below ` 20,000 crore, the biggest fear is that coal-fuelled power plants may stop producing power and default on loans. Bank exposure to power companies is around ` 5.16 lakh crore and accounts for 9% of their loans. A large chunk of these depend on coal. (economictimes.indiatimes.com)

Coalgate verdict: Relief for NTPC, Reliance Power and SAIL

September 25, 2014. The Supreme Court’s decision to cancel the allocation of all captive coal blocks during 1993-2010 other than those to government-owned companies (and not operated on a joint-venture basis), has brought relief to NTPC and SAIL. Besides, two blocks allotted to the Sasan ultra mega power projects (UMPP) owned and operated by Reliance Power have also been exempted from cancellation. The Pakri Bardiwh coal block in Hazaribagh, Jharkhand, allotted to NTPC and with capacity of 15 million tonnes (MT) a year, is set to start production by next year. The Tasra coal block allotted to SAIL has already begun production, according to an affidavit filed by the company to the government. The block, in Dhanbad district of Jharkhand, is likely to produce four mt of coal a year. Blocks allocated to companies such as Karnataka Power, Madhya Pradesh State Mining Development Corporation, West Bengal Power Development Corporation, West Bengal State Electricity Board and Punjab State Electricity Board stand to lose, as these firms operate the blocks through joint ventures with private mining companies. The Supreme Court had declared all blocks allocated between 1993 and 2010 illegal, except those allocated to UMPPs. The Sasan UMPP, a pit-head power project, was allocated three captive coal blocks in Madhya Pradesh, out of which two have been let off the noose — Moher and Moher Amlohri extension. The cumulative coal production from the three is 25 MT a year and the coal produced will be used to fire the 4,000 MW UMPP. Four of the six 660 MW units of the Sasan UMPP are operational. The Supreme Court has, however, ruled the coal blocks allocated for UMPPs will only be for captive use; no diversion for commercial exploitation will be allowed. (www.business-standard.com)

TN announces 20 per cent power cut for industrial & commercial users

September 24, 2014. The Tamil Nadu (TN) government announced 20% power cut on industrial and commercial users. The state government has decided to bring back the compulsory power after four months. Experts attribute this to slowdown in the wind energy supply, which helped the state administration tide over the power crisis till now. Tamilnadu Generation and Distribution Corporation Ltd (Tangedco) has issued an order imposing the power cut based on the increasing demand by controlling energy quota for high tension industrial and commercial consumers during non-peak hours (10 pm to 6 pm next day) and permit them to use only 10% of the demand and energy quota fixed during evening peak hours from 6 pm to 10 pm (only for lighting and security purposes). This time, the burden on industrial and commercial users is less than what it was earlier. Users now face a 20% shortage as against 40% earlier. The development comes on the backdrop of slowdown in supply from the wind farms. It may be noted, compared with the national average of 12%, renewable energy accounts for 44% of the power consumption in Tamil Nadu. Of this, 90% comes from wind. Tamil Nadu has over 7,500 MW of wind generation capacity set up by private players. The demand-supply gap in the state is estimated to be about 30% on a demand for about 12,000 MW. (www.business-standard.com)

Nepal, India agree to expedite stalled Pancheshwar project

September 24, 2014. Nepal and India have agreed to expedite the Pancheshwar Multipurpose Development Project, pending for 17 years, which has the capacity to generate 6,720 MW of hydropower along with increased irrigation facilities. The first meeting of the governing body of the Pancheshwar Development Authority (PDA) was convened on September 22 and ended. The project on the Mahakali river is seen as a landmark development in Nepal-India cooperation in hydropower sector. The meeting has finalised and approved the statute for the Pancheshwar Development Authority (PDA), which includes guidelines for establishment and functioning of the authority, formation of the governing body, executive committee and appointment of Chief Executive Officer and other officials. At the meeting, the Indian delegation was led by Alok Rawat, Secretary in Ministry of Water Resources while the Nepalese delegation was led by Rajendra Kishore Kshetri, Secretary in Nepal's Ministry of Water Resources. As per the agreement, the first CEO of the project will be from Nepal while the first additional CEO will be from India. The headquarters of the authority will be stationed in Mahendranagar in western Nepal. During the meeting the two sides have also agreed to establish a corpus fund for the PDA for its initial activities totalling ` 20 crores (NRs 32 crores) or to be shared equally by the two sides. The corpus fund will be a part of the total project cost. It has also been agreed to convene the next meeting of the governing body of the PDA in New Delhi within one month. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

UAE's Dana Gas wins gas exploration deals in Egypt

September 29, 2014. UAE-based energy firm Dana Gas said that it had been awarded exploration deals for two onshore gas blocks in Egypt. The company will operate the North El Salhiya onshore concession area, known as Block 1 and will partner with British company BP to explore El Matariya, Block 3, on a 50:50 ownership basis, it said. If the well proves commercial, BP will have the option to buy up to 50 percent stakes in Dana Gas' adjacent development leases, it said. Block 1 is an extension of Dana Gas' existing conventional gas production business in Egypt, the company said. The new deals are part of the 2014 EGAS bidding round held late last year in Egypt. Dana Gas said it expected to recover the vast majority of overdue payments which the Egyptian government owes it by 2018. Dana has had problems recovering payments from exploration and production assets in Egypt and Iraqi Kurdistan because of political turmoil in those places. (www.arabianbusiness.com)

Interra starts CHK 1194 oil well development drilling in Myanmar

September 29, 2014. Interra Resources’ jointly controlled entity, Goldpetrol Joint Operating Company, has begun drilling development well CHK 1194 in the Chauk oil field in Myanmar. Interra has 60% stake in the improved petroleum recovery contract of the Chauk field. Besides having the basic aim of accelerating production from the reservoirs that generate oil in these two offset wells, the deeper proposed drilling depth will allow CHK 1194 to test deeper reservoirs that generate in other wells in this fault block. The company expects the drilling results in six weeks. (drillingandproduction.energy-business-review.com)

Russia says Arctic well drilled with Exxon strikes oil

September 28, 2014. Russia, viewed by the Obama administration as hostile to U.S. interests, has discovered what may prove to be a vast pool of oil in one of the world’s most remote places with the help of America’s largest energy company. Russia’s state-run OAO Rosneft said a well drilled in the Kara Sea region of the Arctic Ocean with Exxon Mobil Corp. struck oil, showing the region has the potential to become one of the world’s most important crude-producing areas. The announcement was made by Igor Sechin, Rosneft’s chief executive officer, who spent two days sailing on a Russian research ship to the drilling rig where the find was unveiled. The well found about 1 billion barrels of oil and similar geology nearby means the surrounding area may hold more than the U.S. part of the Gulf or Mexico, he said. The discovery sharpens the dispute between Russia and the U.S. over President Vladimir Putin’s actions in Ukraine. The well was drilled before the Oct. 10 deadline Exxon was granted by the U.S. government under sanctions barring American companies from working in Russia’s Arctic offshore. Rosneft and Exxon won’t be able to do more drilling, putting the exploration and development of the area on hold despite the find announced. The development of Arctic oil reserves, an undertaking that will cost hundreds of billions of dollars and take decades, is one of Putin’s grandest ambitions. As Russia’s existing fields in Siberia run dry, the country needs to develop new reserves as it vies with the U.S. to be the world’s largest oil and gas producer. (www.bloomberg.com)

Russia’s Rosneft offers ONGC stake in eastern Siberia oilfield

September 28, 2014. Russia’s biggest oil company Rosneft has offered Oil and Natural Gas Corp (ONGC) a stake in its Yurubcheno—Tokhomskoye oilfield in eastern Siberia. Rosneft sent a formal proposal to ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corp (ONGC), for joint development of Yurubcheno—Tokhomskoye oilfield. The field is estimated to hold 991 million barrels of oil equivalent reserves and is planned to start production in 2017. Yurubcheno—Tokhomskoye will reach a production plateau of up to 5 million tonnes a year (100,000 barrels per day) in 2019. OVL has been interested in expanding its presence in Russia and has for years evinced interest in several fields but to no luck. India is keen on sourcing one million barrels per day of oil and oil—equivalent gas from Russia, and had identified Sakhalin—3 in Far East, Vankor in East Siberia, and Terbs and Titov oilfields in Timan Pechora region. But it has so far been unsuccessful in its attempts. OVL already has 20 per cent stake in Sakhalin—1 oil and gas field in Far East Russia and in 2009 acquired Imperial Energy which has fields in Siberia. (www.thehindubusinessline.com)

OVL signs agreement with Petroleos Mexicanos

September 27, 2014. ONGC Videsh Ltd (OVL), the overseas arm of state-owned Oil and Natural Gas Corp (ONGC), has signed an agreement with Petroleos Mexicanos or Pemex for cooperation in the Latin American nation. Mexico is the largest crude oil producing country in Latin America. It has excellent potential for both conventional and unconventional hydrocarbon. As a result of recent energy reforms in the country, the oil and gas sector is being opened for participation by foreign firms. Besides OVL, Reliance Industries Ltd (RIL), too, is looking to invest in Mexico as North America's third-biggest producer courts foreign companies after a 76-year hiatus. Mexico in December permitted private investment in the oil industry to help reverse a decade-long slump in output. Pemex plans to establish 10 joint ventures in mature, onshore and offshore areas by December 2015. It has fields holding an estimated 20.6 billion barrels. OVL has participation in 35 projects in 16 countries, including Azerbaijan, Bangladesh, Brazil, Colombia, Iraq, Kazakhstan, Libya, Mozambique, Myanmar, Russia, South Sudan, Sudan, Syria, Venezuela and Vietnam. It currently produces about 160,000 barrels of oil and oil equivalent gas per day and has total oil and gas reserves of 637 million tonnes of oil equivalent. (profit.ndtv.com)

Statoil makes uncommercial gas find in Arctic

September 26, 2014. Energy firm Statoil has made a disappointing gas find in the Arctic, continuing an unsuccessful run of exploration drilling in the Norwegian part of the region, an area Statoil has called an "exploration hot spot" with high potential. The company said it found between 5 billion and 20 billion standard cubic metres of gas or 30 billion to 120 million barrels of oil recoverable equivalent at the Pingvin prospect, a discovery it assessed as non-commercial. The find is another disappointment for Statoil, which has so far failed to find any oil during its latest summer campaign in the region. Oil firms are drilling aggressively in the Norwegian Arctic this year but most wells have disappointed so far, dampening interest in the region as its lack of infrastructure and remote, harsh environment make any development more expensive than in mature areas such as the North Sea. (af.reuters.com)

Iran plans to double production at Alvand oilfield offshore in Siri Island

September 26, 2014. Iran is considering to double the production at its major oil field in the Siri island of the Persian Gulf. The company plans to upgrade 11 oil rigs and integrate them with pumping facilities to help boost production output of the Alvand oilfield. The field is expected to contain 1.7 million barrels of in-place oil reserves. The Nasr oil platform extracts crude from Alvand, Dena, Sivand and Nosrat oilfields and delivers through a 33km pipeline to the island's infrastructure. The Alvand oil field is located 50km off the Siri Island. It is one of the six regions operated by Iranian Offshore Oil Company in Persian Gulf. Iran estimates to have 1% enhancement in oil reserves recovery by 2015, when the fifth five-year economic development plan draws to close. The country is estimated to have oil reserves of more than 560 billion barrels as well as heavy and extra-heavy varieties of crude oil of roughly 70-100 billion barrels of the total reserves. (drillingandproduction.energy-business-review.com)

Eni secures 3 new exploration blocks in Egypt

September 25, 2014. Eni S.p.A. announced that it was the successful bidder of 3 new exploration licenses in Egypt following the competitive 2013 EGPC and EGAS bid rounds. The new licenses will be formally awarded soon, after the ratification and finalization of the Concession Agreements. Eni has entered into new countries, such as South Africa and Myanmar, and acquired new areas like, such as in China and Vietnam. Eni has been present since 1954 and is currently the largest international energy player in the country, with a hydrocarbon equity production of approximately 220,000 barrels of oil equivalent per day. (www.rigzone.com)

Petrobras, ONGC find gas in Brazil offshore extension well

September 25, 2014. Brazil's state-run oil company Petroleo Brasileiro SA discovered natural gas in a well being drilled to help measure the potential of a giant Brazilian offshore find, the company said. Petrobras, as the company is known, owns 75 per cent and its Indian partner Oil and Natural Gas Corp 25 per cent of the discovery. The discovery is one of several in recent years in an area believed to hold more than 1 billion barrels of recoverable oil, enough to make the area the biggest discovery in Brazil since the 2007 announcement of giant offshore resources south of Rio de Janeiro. Petrobras plans to begin producing oil from the Sergipe offshore area in 2018 with a 100,000-barrel-a-day floating production ship. A second ship with the same capacity is expected in 2020. Development of the area is likely to require more than two ships, Petrobras said. (economictimes.indiatimes.com)

Parkmead finds new gas field in Netherlands

September 24, 2014. London-listed oil and gas explorer Parkmead said it had found a new gas field in the Netherlands that it expects will feed into existing gas production infrastructure in the area. The company, together with its Vermilion Energy partners, said it had discovered a 157 foot gas column at the Diever-2 well onshore in northern Netherlands. The company also said it had started a site survey at its Skerryvore offshore oil prospect in the UK North Sea ahead of drilling work set to start in 2015. (af.reuters.com)

Downstream…………

Refinery failures spur bets on higher US gasoline

September 29, 2014. Speculators increased wagers on higher U.S. gasoline prices by the most since February as refinery closures constricted supply. The net-long position jumped 45 percent from a four-year low as hedge funds pared record short bets and added long wagers for the first time in six weeks, weekly U.S. Commodity Futures Trading Commission data through Sept. 23 show. Refineries in eastern Canada and Texas shut gasoline units for unplanned repairs as others began seasonal maintenance. Futures contracts for October traded at the highest premium to November since 2012, reflecting heightened concern about supply. The closures threaten the retreat at the pump that has drivers paying the lowest late-September prices since 2010. Gasoline supplies in the Mid-Atlantic region, which includes New York, the delivery point for Nymex futures, dropped three consecutive weeks to 10 percent below a year earlier, Energy Information Administration data show, as Irving Oil Corp. and North Atlantic Refining Ltd. cut production at refineries in eastern Canada. (www.bloomberg.com)

PetroChina pushes back Huabei refinery revamp by 2 yrs

September 26, 2014. PetroChina has delayed a plan to double the capacity of a subsidiary refinery in northern China to 200,000 barrels per day, according to a report published by parent company CNPC, putting the upgrade about two years behind an earlier timeline. PetroChina, China's second-largest state refiner after Sinopec Corp, has been slowing down its downstream investment plans including for refineries since last year, to focus more on oil and gas exploration and production. The expansion program at Huabei Petrochemical Corp in Hebei province - which neighbours Beijing - would cost a total of 10.95 billion yuan ($1.8 billion). The expansion is slated for completion by the end of 2016, with the official start-up set for 2017. (www.downstreamtoday.com)

Total to decide French refinery plan by next spring

September 26, 2014. Total, Europe's biggest oil refiner, is giving itself until the spring of 2015 to review its options for the French refining sector, which could include capacity cuts but no site closures. Total's European refining margins have dropped to near four-year lows this year, as the sector struggles to compete with more efficient plants in the Middle East, overcapacities in Europe and a decline in gasoline and diesel consumption. (www.downstreamtoday.com)

Islamic State oil refineries in Syria hit in airstrikes

September 25, 2014. U.S. and Arab warplanes attacked small oil refineries in eastern Syria controlled by Islamic State to undercut the extremist Sunni group’s revenue and impede its mobility, the Pentagon said. As the U.K. prepared for a parliamentary vote to authorize joining the broadest Arab-U.S. military coalition since the 1991 Gulf War, aircraft and drones operated by the U.S., Saudi Arabia and the United Arab Emirates attacked 12 “modular” refineries Islamic State uses in its oil-smuggling operations, U.S. Central Command said. Islamic State may have been raising more than $2 million a day from oil sales in Iraq and Syria, paid either in cash or bartered goods, according to Luay al-Khatteeb, a visiting fellow at the Brookings Institution’s Doha Center in Qatar. The militant group, which has declared an Islamic caliphate across a swath of northern Iraq and eastern Syria, controls seven oil fields and two refineries in northern Iraq, and six out of 10 oil fields in eastern Syria, al-Khatteeb said. (www.bloomberg.com)

Saudi refinery hits capacity as Total, Vitol see EU slump

September 24, 2014. The newest oil refinery in Saudi Arabia reached full capacity last month, increasing the international competition that Vitol SA and Total SA said will force the closing of more European plants. The Satorp refinery, a venture between Total and Saudi Arabian Oil Co., processed crude at a rate of 400,000 barrels a day, Total said. Europe’s refineries are too small and not sophisticated enough to compete with new plants, Vitol said. (www.bloomberg.com)

Transportation / Trade……….

Conoco uses exemption to export crude to South Korea

September 30, 2014. ConocoPhillips is shipping a cargo of Alaska North Slope crude to Asia, making rare use of a Bill Clinton-era exemption to U.S. oil export restrictions. Conoco, Alaska’s largest oil producer, will deliver the cargo to Asia in the fourth quarter, Houston-based company said. The shipment was first reported by Louisville, Kentucky-based Genscape Inc., an energy intelligence firm. The Polar Discovery, a 140,000-deadweight ton oil tanker, left the oil port of Valdez in Alaska after filling with cargo, according to vessel tracking data. The ship reported that its destination is Yeosu, South Korea. It’s scheduled to arrive Oct. 10. The U.S. bans most exports of unprocessed crude, based on a 1975 law passed after the Arab oil embargo. In 1996, Clinton amended the law to allow exports of crude from the North Slope that traveled on the Trans-Alaska Pipeline System to Valdez. Alaskan crude exports must be transported by ships built and flagged in the U.S. and crewed by American sailors. The Polar Discovery was built in Avondale, Louisiana, in 2003, at a shipyard that Huntington Ingalls Industries Inc. is closing. The U.S. hasn’t exported crude to South Korea since a 24,000-barrel shipment was sent there in September 2006, according to Energy Information Administration data. (www.bloomberg.com)

Oil heads for biggest quarterly drop since 2012 on ample supply

September 30, 2014. Brent and West Texas Intermediate (WTI) headed for the biggest quarterly decline in more than two years as abundant crude supplies offset the risk of disruption from conflict in the Middle East. Futures were up 0.4 percent in London, trimming a drop of 13 percent since the beginning of July. The U.S. and its European and Arab allies have conducted thousands of air missions since starting a bombing campaign to counter Islamic State militants in Syria and Iraq, OPEC’s second-largest producer. U.S. crude stockpiles probably expanded by 1.5 million barrels last week, a survey shows before an Energy Information Administration report. WTI for November delivery was 16 cents higher at $94.73 a barrel in electronic trading on the New York Mercantile Exchange. Prices have lost 10 percent this quarter, the most since June 2012. The U.S. benchmark crude was at a discount of $2.86 to Brent on ICE, compared with $2.63, which was the narrowest closing price since Aug. 9, 2013. (www.bloomberg.com)

Europe seen coping with Russian gas cut in normal winter