-

CENTRES

Progammes & Centres

Location

[The Supreme Court is ‘On’ and the Private Coal Sector is ‘Gone’!]

“The new government has made it clear that they will not be opening the coal sector. Therefore the analysts who are pushing for privatisation must adopt a pragmatic approach. But the private sector could continue to play an important role in the coal sector though in limited capacity…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Climate Change…..

· Climate Change: Property Rights versus Human Rights

Coal………….

· The Supreme Court is ‘On’ and the Private Coal Sector is ‘Gone’!

DATA INSIGHT………………

· Plant Load Factors of Coal & Lignite based Power Plants of India

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL gas output from KG-D6 likely to improve: UBS

· ONGC to begin oil production from KG basin block in 2019

· ONGC invests ` 818.9 bn for raising output

· Cairn India discovers three new oil fields in Rajasthan block

Downstream……………………………

· BPCL looking to raise the Bina refinery capacity to 15 million tonnes

Transportation / Trade………………

· BPCL says no plan to tie up with private companies for retail expansion

· India ships in 50 per cent more Iranian oil in January-August

Policy / Performance…………………

· Ethanol-blended petrol to cost more

· Oil Ministry again extends deadline for comments on revenue sharing

· Oil Ministry sets up panel to probe output delay from ONGC’s KG block

· Govt mulls raising excise duty on unbranded diesel

· Give Modi govt a chance in gas price revision case: SC

· Oil companies make LPG, petrol available in Jammu and Kashmir

· 3-4 oil blocks offered by Vietnam viable: Petroleum Minister

[NATIONAL: POWER]

Generation………………

· GMR signs agreement with Nepal for 900 MW project

· Pakistan water experts to inspect 120 MW Miyar hydropower project

· BHEL wins ` 35.3 bn order from GSECL

· Reliance Power withdraws from Dadri power project in UP

Transmission / Distribution / Trade……

· Power companies ask for tariff hike in Bihar

· Power Engineers seek UP CM's intervention on UPPCL decision to allow coal exports to firms

Policy / Performance…………………

· UP targets doubling power availability by 2016-17

· India, Nepal begin talks to build 5.6 GW Pancheshwar project

· CIL has so far signed fuel supply pacts for 161 power units

· CAG begins performance audit of fuel linkages for IPPs

· CERC asks JPVL to expedite Karcham Wangtoo tariff petition

· Obama-Modi pact on power sector in logjam

· After 2 rejects, Dibang hydro plant set to get environmental clearance

· Aptel rejects Tata Power's appeal against April 2013 compensatory tariff order

· Tenders for disaster resilient power system by March 2015: Odisha

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· SKKMigas expects Banyu Urip field to commence production in Feb 2015

· Drillers can return to fight oil slump after Scotland’s ‘no’

· BP plans deeper drilling for offshore oil despite ruling

· Eni makes 300 mn barrel oil discovery in Ecuador

· Leaky wells spur call for stricter rules on gas drilling

· Apache said to seek up to $840 mn for Alberta assets

· Libya halts biggest oilfield Sharara amid rebel attacks

Downstream……………………

· Oneok Partners plans to build two natural gas processing facilities in US

· Chevron seeking buyer for Kapolei oil refinery in Hawaii

· China's refining capacity to reach 15.8 mn bpd by 2020

Transportation / Trade…………

· Surging gas supply masks risk of winter price shock

· Nigerian oil unions halt strike after pension dispute

· Petrobras says to sign Libra production ship contract

· TransCanada Keystone cost may rise 85 per cent before US ruling

· Oil clogging US railways seen limiting exports of grain

· Poland sets sights on gas hub to loosen Russia’s energy grip

Policy / Performance………………

· OPEC yet to decide on supply cuts as crude prices extend retreat

· Exxon gets US sanctions extension to shut Russian arctic well

· Egypt awards O&G exploration blocks

· Finland grants support to three small LNG terminals

· Ministry of Energy awards exploration Block 44 in Zambia to Swala Energy

· Deeper Saudi oil cuts seen after biggest drop since ’12

· Kenya sees oil resources almost doubling with more drilling

· North Dakota Governor sees oil production dip from flaring rule change

· Oil-price volatility seen by banks if Scotland votes yes

· Fracking bans enrage Coloradans sitting on energy riches

· Sinopec, PetroChina plan 40 per cent growth in shale output to meet goal

[INTERNATIONAL: POWER]

Generation…………………

· Bangladesh, Malaysia sign agreement for 1,320 MW power plant development

· Russia to build nuclear power plant in Jordan

· IFC, others commit $400 mn to power generation

· Chinese JV plans Zimbabwe power plant

Policy / Performance………………

· Coal mogul Murray says more bankruptcies probable

· Iran plans to construct mini power plants

· Japan preparing to reopen nuclear power plants

· Nigeria’s power woes slow to abate after privatization

· China power plants exempt from ban on using low-quality coal

· Nepal clears GMR plan for $1.4 bn hydroelectric plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India, China ignore UN climate change summit

· Private companies pitch for preferential tariff model for green projects

· PM wants 2 lakh MW more from sun, wind with US help

· Odisha begins land scouting for UMSPPs

· CIL said to plan building $1.2 bn of solar projects

· IFC to give ` 2 bn for 100 MW solar project in Rajasthan

· Tamil Nadu should set up Wind Energy Forecasting Mechanism

GLOBAL………………

· Australia energy industry blueprint sees large scale deregulation

· Toshiba Lighting bets on solar-powered Indian border plan

· Japan emission targets tough without N-plants

· Cities may reduce carbon emissions 8 gigatons by 2050

· Merkel’s taste for coal to upset $130 bn green drive

· Rockefeller Fund built on oil to abandon fossil fuels

· Saudi Arabia to build 5 solar power stations

· Scotland ‘no’ removes doubt for $23 bn in renewables

· Obama urged to plug methane leaks to meet climate goal

· Germany opens first renewable energy storage facility

· Chevron’s search for alternative fuels stumps best minds

[WEEK IN REVIEW]

ENERGY/CLIMATE CHANGE………………

Climate Change: Property Rights versus Human Rights

Lydia Powell, Observer Research Foundation

Common but Differentiated Responsibilities (CBDR) is one of the fundamental premises of both the United Nations Framework Convention on Climate Change (UNFCCC) of 1992 and of the Kyoto Protocol of 1997 which are binding instruments devised to address climate change. The origin of CBDR is traced to the 1972 declaration of the United Nations Conference on the Human Environment in Stockholm (also known as the Stockholm Declaration).[1] Later the 1992 Rio Declaration on Environment and Development gave the CBDR concept full recognition at the United Nations Conference on Environment and Development.[2]

While both the Stockholm and Rio Conventions were non-binding under international law, the UNFCCC and Kyoto which incorporate CBDR are binding and consequently the subject of contestation by Parties to the Convention. The problem is that the term ‘Common but Differentiated Responsibility’ was coined at a time of climate innocence when climate guilt and its costs were not fully grasped. As understanding over this issue evolves developed countries that have been assigned a larger share of the climate burden on the basis of the CBDR principle are pouring resources on an industrial scale to extract a legal interpretation of the principle that would reduce their burden. What they are seeking to do is to invalidate differences between Annex I and non-Annex I countries that are at the core of CBDR in both the UNFCCC and the Kyoto Protocol.

Developed countries are effectively using a two pronged strategy in their effort to equalise unequal countries. Their first strategy is to organise Global Summits under the UN banner but outside the jurisdiction of CBDR (UNFCCC/Kyoto) to put emotional pressure on national leaders (of non Annex I countries) to reduce carbon emissions. The recent UN climate summit that both Indian and Chinese leaders ignored (see this week’s news item) falls into this category. These global climate gatherings are organised like Christian evangelical events in which the preacher assisted by music and song whips up a frenzy over the wages of sin and convinces the audience that the only way out is to part with their money. In climate carnivals, the preachers tell us that wages of climate sin is death and the only way out is to pay up. According to media reports, that this year’s climate summit in New York featured poetry from the low-lying Marshall Islands, a small nation in the Western Pacific, to ‘shame world leaders for not acting fast enough to prevent sea level rise’ as well as an anthem ‘love song to the Earth’ by a popular singer.[3],[4] Not surprisingly some observers labelled the climate event as setting the mood music for the official gathering at Lima this year and in Paris next year. Shrewd observers will know that this was not just mood music but black mail by the back-door. The young poet from Marshall Islands may change her poem if she realises that poverty has killed and continues to kill far more people than climate change ever will and yet the World did not and will not act with the degree of seriousness required to address the complex issue of poverty.

The second part of the developed country strategy is more serious and defendable, at least legally. What has come to their aid in this regard is Gross Domestic Product (GDP) of a country, a number that Fioramonti calls the world’s most powerful number.[5] As he points out in his insightful book Gross Domestic Problem, the number has been used for different purposes ranging from a powerful propaganda tool during the cold war to a technocratic recipe for responsible management of the business cycle today[6] But this number which is a ticket to entry into exclusive and powerful economic clubs such as the G 8 or the G 20 is also the ticket to hell, which is membership of the Annex I club of UNFCCC and the Kyoto Protocol. Annex I countries are putting forward a simple argument to make everyone a member of Annex I: If a country is a member of the G 20 GDP club it should naturally also be a member of the Annex I club. It is a valid argument but developing countries within the G 20 group are naturally not happy. If we look at countries only through the lens of GDP, a developed country with 20 million people is the same as developing country with 1 billion people as long as both, in theory, have a GDP of $ 1 trillion. The insignificant detail that we are expected to overlook is that the former has a per person income of $ 50,000 and the latter only $1000.

Whether this was the consequence of irresponsibility on the part of developing countries or the result of historic and geographic misfortunes or both are matters that are irrelevant for Annex I countries or their foot soldiers, the growing numbers of climate policy advisors/makers. Those social scientists who have taken it upon themselves to seek ‘first causes’ for these human problems and establish clear responsibilities have been relegated to the fringes of academic scholarship and words such as ‘equity’ and ‘fairness’ that they tend to use often have been turned into four letter words by the Annex I parties. What this constituency is seeking is an instrumental goal: ‘limit global mean temperature increases to 2°C’. All else including how, at what and at whose cost, does not matter. When one is driven by a narrow instrumental goal, it does not make any sense to get emotionally engaged in intrinsic values like eradicating poverty, hunger, illiteracy, deprivation and disease. Their response is that when the climate problem is being addressed through national targets, peaking dates, solar panels and wind mills, the problem of poverty will be solved automatically. How this will happen is left to our imagination. But imagining that a poor Indian farmer contemplating suicide could become a climate policy advisor and redeem himself from all his troubles seems cruel and perverse.

The causal link between the increase carbon emissions and the increase global mean temperature may be contested but that between energy consumption and increase in living standards is fairly well established. If energy consumption is to be permitted to improve quality of life then carbon space is essential. If everyone is given the right to a decent standard of living through energy consumption, then everyone on the planet should get equal right to carbon emissions, about 5 tonnes of carbon-di-oxide emissions (CO2) at current emission levels.[7] Those emitting more than that today (say the United States at about 17 tonnes per person or perhaps even a rich Indian) would be required to pay $ 360 a year at a carbon price of $ 30/tonne to sustain his consumption at current levels. Redistributive justice would require this sum to go to those emitting below their quota (say India at about 1.4 tonnes per person or the poor in Africa, South Asia and South America who emit nothing at all). Even if such a transfer is to be organised the Government of the poor country rather than the people would receive the sum. Clearly this would be unacceptable to anyone. This explains why the USA along with countries such as Canada and Australia has consistently opposed the Right to Development which could legally be translated into the Right to Emissions. As captured in an insightful paper on Human Rights, the United States cast the only negative vote in 1986 when the UN General Assembly proclaimed development as a human right in its Declaration on the Right to Development with eight countries abstaining.[8] In 2003, a similar Resolution on the Right to Development received negative votes from USA, Japan and Australia with Sweden, Canada and S Korea abstaining.[9] Many efforts in the period in between have received similar results. The United States and its representatives have pointed out that one has the responsibility to develop (even if it entailed using slave labour or fossil fuels before others?) and cannot claim the right to development and that the Commission on Human Rights had no jurisdiction on matters of trade, international lending, financial policy and activities of transnational corporations (material interests and rights).

This explains why we have devised a compromise instrument called Kyoto Protocol that acknowledges some degree of human rights through the CBDR principle but depends heavily on property rights rather than human rights for it implementation. Kyoto seeks a market for emission rights with well established property rights conferred on trading parties (governments or corporations). Currently it includes only Annex I countries with a transfer of wealth from permit-buying countries to selling countries depending on the price of permits and the initial allocation of rights. United States knew that it would cost $200/tonne of carbon to meet the Kyoto target of 93% reduction of 1990 emissions by 2012.[10] When trade is allowed between Annex I countries its cost would come down by 72% to $56/tonne and adding India and China to the trading countries would reduce it to $23/tonne.[11] This is essentially the rationale for the ongoing effort towards equalising unequal countries before a new Treaty is put in place of Kyoto. This objective may not be achieved given that China and India are now smart enough to play their own game, but that would not be an undesirable outcome for Annex I. They can shift the blame on China and India and get on with their lives as usual.

Views are those of the author

Author can be contacted at [email protected]

COAL……………

The Supreme Court is ‘On’ and the Private Coal Sector is ‘Gone’!

Ashish Gupta, Observer Research Foundation

|

O |

n 23rd September, 2014 there was coal summit in the capital where the chairperson expressed concern over the judgement on coal blocks allocation. The chairperson is likely to be really worried now. The Supreme Court at a single stroke cancelled all the licences of the allottees leaving only four blocks intact. There is joy for one private company whose stock prices are soaring but sorrow for others. Some banks such as Andhra bank, Allahabad Bank and UCO bank which lent money to these companies are also worried. Whatever course of action is adopted by the new government, the coal conundrum will continue to churn.

The new government has made it clear that they will not be opening the coal sector. Therefore the analysts who are pushing for privatisation must adopt a pragmatic approach. But the private sector could continue to play an important role in the coal sector though in limited capacity.

Auction is a process that the government is looking at with revenue sharing model for captive blocks allottees. In this model, there will be no upfront payment but the amount will be paid in due course without hampering the financial viability of the allottees. This approach is good for captive blocks that were in operation or on the verge of completion. These allottees have suffered huge financial damage and such a mechanism would also act as a cushion for financial institutions. These companies must also be asked to pay a penalty. For other captive blocks, the government must resort to auction mechanism.

In the past, there have been voices against auctioning on the premise that revenue maximisation is not the only goal of the government. Auction is not seen as preferable for the small and medium sized companies. But auction may become a reality and all have to accept it. The coal sector is not meant for small and medium sized companies given the expertise and huge investment required for coal mining. They do not have such capability and therefore they could be excluded from participation. However they could be invited for small captive blocks.

With regard to private participation in the coal sector, various models have been propagated in many reports such Joint venture with Coal India, Mine Developer and Operator etc. These models are already in place but the important question is whether it has served any purpose. Such arrangements are good companies who would like to be seen as contractors. But for big companies it makes no sense as they want to be seen as commercial miner not as contractor of Coal India. The case of Thiess and Leighton, Australia and ESPA, Spain is a reflection of failure for such models. Also companies like Rio Tinto are not going to invest in the coal sector because of social and political uncertainties. Giving complete freedom to these companies by extending commercial miner status would be wise. Participation of such commercial coal companies is necessary for reform. Lastly, given the changing dynamics, outdated laws covering the coal sector need to be amended so that there will be a level playing field for all the stakeholders!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

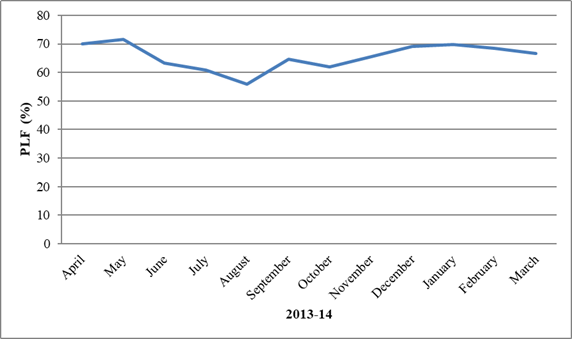

Plant Load Factors of Coal & Lignite based Power Plants of India

Akhilesh Sati, Observer Research Foundation

|

Months (for 2013-14) |

PLF (%) of Coal & Lignite Power Plants |

|

April |

69.97 |

|

May |

71.55 |

|

June |

63.4 |

|

July |

60.86 |

|

August |

55.85 |

|

September |

64.65 |

|

October |

61.85 |

|

November |

65.44 |

|

December |

69.05 |

|

January |

69.82 |

|

February |

68.44 |

|

March |

66.58 |

Source: Central Electricity Authority.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL gas output from KG-D6 likely to improve: UBS

September 23, 2014. Reliance Industries' eastern offshore KG-D6 gas output is likely to improve to 15 million standard cubic meters per day by second half of current fiscal as it completes work-over on the main fields, financial services company UBS said. Gas production from Krishna Godavari basin block has dropped to just over 12 million standard cubic metres per day (mmscmd) and Reliance Industries Ltd (RIL) is carrying out work-over on main Dhirubhai-1 and 3 gas fields. RIL's USD 13 billion capex including USD 8.5 billion in expansion of petrochemical units, was on track. Also refinery cost advantages will increase with pet-coke gasifer becoming operational by 2016, enabling steady USD 8-plus refining margin. RIL has two refineries in Jamnagar, Gujarat, with a capacity of 1.2 million barrels per day. It also has an integrated petrochemical facility and a 60 per cent interest in KG-D6. It has a presence in shale gas in the US, as well as retail and telecom services, where it is in the process of scaling up operations over the next two to three years. (economictimes.indiatimes.com)

ONGC to begin oil production from KG basin block in 2019

September 20, 2014. ONGC's significant oil discovery in Bay of Bengal will begin production in 2019, with a peak output of 4.5 million tonnes a year, 20 per cent more than previous estimates. The oil discovery in Krishna Godavari (KG) basin block KG-DWN-98/2 or KG-D5 will be the first large oil production from the east coast. The block also has 10 gas discoveries. While a bulk of its near 25 million tonnes crude oil production comes from western offshore and fields in states like Gujarat and Assam, KG-D5 will produce up to 90,000 barrels per day (4.5 million tonnes per annum) - the largest from any field on the east coast. Another company official put the peak output at 90,000 bpd. Oil and Natural Gas Corp (ONGC) will produce 17 million standard cubic meters per day of gas from the block, which sits next to Reliance Industries' producing KG-DWN-98/3 or KG-D6 area. KG-D5 is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). Investment in NDA may be at least USD 9 billion, the company said. The company's internal assessment was that gas can start flowing from the block only in 2021-22 but ONGC wants the development to be fast-tracked so as to begin production by April 2018. (economictimes.indiatimes.com)

ONGC invests ` 818.9 bn for raising output

September 19, 2014. Oil and Natural Gas Corp (ONGC) said it has invested ` 81,890 crore in bringing on stream newer discoveries and arrest natural decline that has set in its ageing fields. However, ONGC has taken measures to arrest this trend and uphold production from such fields. ONGC has deployed the best-in-class technologies in its Improved Oil Recovery (IOR) and Enhanced Oil Recovery (EOR) schemes on these fields. ONGC said out of 15 prospective projects taken up for development, 7 projects are already complete and 8 are under various stages of implementation. Some of these projects like C-24, B-22 Cluster, SB-14, B-46, BHE & BH-35, North Tapti, C-Series and D-1 are already on stream and producing. ONGC was focused on development of Daman gas fields in western offshore and oil and gas discoveries in KG-DWN-98/2 or KG-D5 block, which sits next to Reliance Industries' eastern offshore KG-D6 area. During 2013-14, 84.99 million tonnes of oil and oil equivalent gas reserves were accreted, the highest in last 23 years. (economictimes.indiatimes.com)

Cairn India discovers three new oil fields in Rajasthan block

September 17, 2014. Cairn India Ltd said it had made three new oil discoveries in its exploration block in Rajasthan, taking its total oil discoveries in the block to 36. One of the wells is in close proximity to the company's Mangala field and it is planning fast track appraisal to commercialise the discovery, Cairn India, part of London-listed Vedanta Resources Plc, said. The company is spending $3 billion over three years to boost oil production and natural gas output from its Rajasthan block, which had an output of 66.3 million barrels of oil equivalent in the year ended March 31. Cairn India has a portfolio of nine blocks, one in Rajasthan which contains multiple assets, two on the west coast and four on the east coast of India, and one each in Sri Lanka and South Africa. (www.business-standard.com)

Downstream………….

BPCL looking to raise the Bina refinery capacity to 15 million tonnes

September 20, 2014. Bharat Petroleum Corp Ltd (BPCL) plans to more than double capacity of its Bina refinery in Madhya Pradesh to 15 million tonnes, Madhya Pradesh Chief Minister Shivraj Singh Chauhan said. Chauhan was talking to a select group of reporters after meeting the Steel Minister Narendra Singh Tomar, Fertilizer Minister Ananth Kumar and Petroleum Minister Dharmendra Pradhan in connection with a planned investor meet. The meeting took place in the backdrop of the 'Global Investors Summit' to be held from October 8-10 in Indore with the theme 'Invest Madhya Pradesh'. The Bina refinery is located in Sagar district of Madhya Pradesh, owned and operated by Bharat Oman Refineries Ltd (BORL). BORL is promoted by BPCL. Meanwhile, the three-day investors summit is being organised to attract major investment in the state, besides leading captains of the industry the ambassadors and high commissioners of 11 countries are also expected to take part in the summit. (economictimes.indiatimes.com)

Transportation / Trade…………

BPCL says no plan to tie up with private companies for retail expansion

September 21, 2014. Bharat Petroleum Corp Ltd (BPCL) has ruled out tying up with private players, saying the PSU has enough capabilities for expanding its retail presence on its own. Rival Hindustan Petroleum Corp Ltd (HPCL) recently said it would be keen to tie up with private players like Reliance Industries Ltd (RIL) or Essar for sharing their idle retail infrastructure. BPCL had opened more than 900 outlets last fiscal, taking the company's total retail network to over 12,500, the company will open more outlets, but did not specify a number. It can be noted that private players like Reliance and Essar Oil with thousands of outlets have shut down marketing following the government refusal to free diesel prices after the 2006 oil spike. But with diesel being sold at market price now, they are likely to re-enter marketing. Currently, oil firms are selling diesel at 35 paise above market rate as the government has not allowed them officially to cut prices. BPCL will invest over ` 12,000 crore over the next four years in the Mozambique and Brazil upstream business. This is nearly double of what the state-run company had spent in exploration and production in the past decade. BPCL will be booking 1-3 mn tonnes LNG annually as part of its plans to improve its gas business through its East and West coasts terminals. The company will be laying the country's first cross-country pipeline that will connect to Bangladesh. Its subsidiary Assam-based Numaligarh Refineries will shortly begin work on laying the 170-km pipeline from Siliguri in Bengal to Parbatipur in Bangladesh. The pipeline will help BPCL penetrate the Bangladeshi market and ensure sustained supply of oil products to Bangladesh. (economictimes.indiatimes.com)

India ships in 50 per cent more Iranian oil in January-August

September 18, 2014. Indian imports of Iranian oil rose by nearly half to 271,000 barrels per day (bpd) in January-August from a year ago, when refineries cut purchases due to worries about insurance coverage for processing crude from Tehran, data from trade sources shows. World powers and Iran are working to resolve a decade-old dispute over the OPEC (Organization of the Petroleum Exporting Countries) nation's nuclear programme, with an interim deal that eases some sanctions on the country extended by four months to late November. India, the Islamic state's top client after China, had boosted imports in the first quarter of this year to make up for the cuts in 2013 and to hit its target of importing 220,000 bpd from Iran in the fiscal year to March 31. India shipped in 273,500 bpd of Iranian oil in August, up 30 per cent from the previous month and about 81-per cent higher than a year ago, the data showed. Shipments in August were bolstered as Indian Oil Corp (IOC), the country's biggest refiner, bought Iranian oil after a two-month gap, shipping in nearly 2 million barrels. IOC is not a regular buyer of Iranian oil as it has a deal to buy only 24,000-25,000 bpd, or about 9 million barrels, from the country in 2014/2015. In August, IOC also received its first cargo of Caspian Sea oil from Kazakhstan, the data showed, joining private refiners Essar Oil and Reliance Industries in buying the grade. Essar was Iran's top Indian client in August, followed by Mangalore Refinery and Petrochemicals Ltd, the data showed. Essar and MRPL are the regular buyer of Iranian oil. Chennai Petroleum Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp have halted Iranian oil imports since 2013/14 due to worries over whether their insurance policies would cover refining the cargoes. But other refiners have stepped up purchases drawn to discounts offered by Tehran, risking possible disputes with insurers in the case of an accident. Under the interim agreement with world powers, Iran's total crude exports were to be held at just above 1 million barrels per day (bpd), after surging as much as 40 per cent above that level in the early part of the year. Iranian oil's share of India's total crude imports rose to 7.1 per cent in the first eight months of the year compared with 4.6 per cent last year, the data indicated. Overall, India took in 14 per cent less crude in August than a year ago, the data showed, as HPCL-Mittal Energy did not ship oil during the month due to the closure of its 180,000 bpd Bathinda refinery in northern India for maintenance. The refinery is expected to resume operations by the end of this month. India's total crude imports for the January-August period fell nearly 3 per cent, the data showed. Latin American oil's share of India's overall imports rose slightly to nearly 20 per cent in the first eight months of 2014, while Africa's increased to about 16 per cent, the data showed. Purchases from the Middle East accounted for about 60 per cent of overall intake during the period, down from 64 per cent a year ago. (economictimes.indiatimes.com)

Policy / Performance………

Ethanol-blended petrol to cost more

September 23, 2014. The government's emphasis on blending ethanol with petrol is going to pinch consumers in the coming months as ethanol prices have zoomed ahead of petrol. The government's 'Green Initiative' has apparently turned into a 'Save Sugar Industry' drive as the oil marketing companies have been asked to procure the sugar industry's byproduct at more than 10% of the prevailing petrol price. But this hasn't improved the ethanol supplies to the industry. When the three oil marketing companies (OMCs), Indian Oil, BPCL and HPCL, were asked to procure ethanol for blending through the tender route last year, they took petrol's lowest trade parity price (TPP) in the previous year as a base to set the ethanol bid price. TPP is the import parity and export parity price of a refined petroleum product in 80:20 proportion. Meanwhile, the drop in global crude prices has caused petrol prices to soften. According to Indian Oil, the refinery transfer price (RTP), or the cost of producing petrol stood at ` 42.99 per litre on September 16, 2014, before adding all the taxes, duties, transportation costs and dealer margins, etc. Thus ethanol procured under the current tender is going to cost 10% higher than that of petrol. As a result, the blended petrol price will be higher than the pure petrol price. The Indian government has decided 5% blending of ethanol with petrol at the all-India level, which can go up to 10% in a state with a view to generate revenue for sugar mills enabling them to make timely and better payment of cane price to sugarcane farmers. While the price has gone up, the response to the ethanol tender has been tepid, just as in the previous year. (economictimes.indiatimes.com)

Oil Ministry again extends deadline for comments on revenue sharing

September 22, 2014. The Petroleum Ministry has once again extended the deadline for seeking comments on a simpler revenue sharing contract which it wants to replace the present Production Sharing Contracts (PSC) with. The Ministry had on August 21 floated a model revenue- sharing contract for exploration and production of oil and gas and sought comments from stakeholders by September 10. It on September 11 extended the deadline to September 20. The same has now been extended till month-end. No reason was assigned for the extension. Besides suggesting doubling of natural gas prices, a Committee headed by C Rangarajan had suggested moving to a revenue sharing regime where companies bid upfront the quantity of oil and gas they will share with the government for winning an exploration acreage. (economictimes.indiatimes.com)

Oil Ministry sets up panel to probe output delay from ONGC’s KG block

September 19, 2014. The oil ministry has set up an enquiry committee headed by Director General of Hydrocarbons (DGH) to investigate the inordinate delay in production from ONGC's Krishna-Godavari (KG) block, the government said. Apart from the DGH, the three-member committee will have the financial advisor and a director in the ministry. In a letter to ONGC, the committee has directed ONGC to explain the delay in production from the block. ONGC will now have to submit a chronology of events in the block. ONGC has faced widespread criticism for not producing any gas from this block in many years. Reliance, which operates the adjoining KG-D6 block, has produced natural gas from its deep-sea field for five years. But it has faced severe scrutiny by the national auditor and the government. The earliest possibility of any gas from the ONGC block may take place only in 2017. While ONGC has not produced any gas, it has taken an aggressive position and accused Reliance of drawing gas from the state-firm's fields. It has even taken the oil ministry to the court accusing of not protecting ONGC's interests. ONGC said the government is probably acting under pressure from the prime minister, who wants domestic output to rise. Earlier this year, RIL told the Supreme Court that vested interests were targeting the company that had done the maximum exploration and produced gas quickly while there was no scrutiny of ONGC, which found gas in the same basin, raised its cost many times and produced nothing in 18 years. (economictimes.indiatimes.com)

Govt mulls raising excise duty on unbranded diesel

September 19, 2014. With softening global oil rates leading to first ever profit on diesel sales, the government is considering raising excise duty on unbranded diesel to take away the gains. State-owned oil companies are making a profit of 35 paise a litre from this week after falling international prices wiped away losses or under-recovery on the nation's most consumed fuel. The Finance Ministry has written to Oil Ministry seeking its view on raising excise duty on unbranded diesel, the finance ministry said. Normal or unbranded diesel currently attracts basic excise duty of ` 1.46 a litre and an additional excise duty of ` 2 per litre. In comparison, branded or premium grade diesel is levied with a total excise duty of ` 5.75 a litre. The differential in duty rates results in varied prices of the two - a litre of normal or unbranded diesel costs ` 58.97 while branded fuel is priced at ` 62.34. A similar differential exists on petrol as well - a litre of branded petrol costing ` 73.47 while unbranded version coming for ` 68.55. (economictimes.indiatimes.com)

Give Modi govt a chance in gas price revision case: SC

September 19, 2014. The government has told the Supreme Court (SC) that it would take a call on the contentious issue of gas price revision after a committee of secretaries examining the matter submits a report by the end of this month, prompting the court to defer hearing three PILs on it till November 14, 2014. The committee is expected to submit its recommendations by September 30, 2014. Government aware of the deliberations of the committee of secretaries said that the panel is in favour of honouring contracts between the government and oil and gas producers in letter and spirit, within the ambit of the Supreme Court's 2010 judgement, which says the government is the sole owner of gas. Petroleum ministry said the broad contours of the report by the committee of secretaries was already known and the ministry would shortly send the gas price issue to the Cabinet for which a cabinet note was being prepared. The court told the petitioners that the new government must be given a chance to apply its mind to the matter. The court is hearing petitions challenging the erstwhile UPA government's decision to adopt a new pricing formula that would double the price of gas to an estimated $8.4 per unit. The petitioners have also sought cancellation of the exploration agreement between RIL and the government and award the KG-D6 block to a state-owned entity. If the government does something, it will be questioned in Parliament. Why should we determine whether a price hike is justified or not?" The bench shrugged off a demand by activist lawyer Prashant Bhushan, appearing for NGO Common Cause, for urgent court intervention to prevent the government from effecting any further price increase for already developed fields. RIL lawyer Harish Salve strongly resisted any such stay, on the ground that none of the gas supplied goes to the common man. (economictimes.indiatimes.com)

Oil companies make LPG, petrol available in Jammu and Kashmir

September 18, 2014. As efforts are stepped up to return normalcy in the flood-ravaged Kashmir valley, state- owned oil firms have made available about 33,300 domestic cooking gas (LPG) cylinders and several hundred litres of petrol and diesel in Srinagar. Stating that several measures to ensure availability of essential petroleum products in the aftermath of floods in Jammu and Kashmir have been taken, an official statement said the availability of petrol, diesel and LPG is normal in Jammu division. Oil Marketing Companies (OMCs) have made available 33,296 LPG cylinders, 1,807 kilolitre (kl) of petrol and 3,783 kl of diesel in Srinagar. Further, 54,804 LPG cylinders, 1,661 kl petrol and 3,292 kl of diesel have been dispatched to Srinagar via Jammu- Srinagar Highway, Kishtwar-Sithan Top route and the Leh- Srinagar route. A private LPG bottling plant at Srinagar is operational while a LPG filling plant of HPCL in the city is still inundated with water. (economictimes.indiatimes.com)

3-4 oil blocks offered by Vietnam viable: Petroleum Minister

September 17, 2014. Vietnam has offered India oil and gas blocks outside the territory claimed by Beijing in the South China Sea, Petroleum Minister Dharmendra Pradhan said. India is considering exploring in 2-3 blocks out of the 5 areas in South China Sea that Vietnam had offered on nomination basis in November last year. The five blocks or areas - 17, 41, 43, 10&11-1 and 102&106/10 lie outside the territory claimed by China in the South China Sea. Pradhan said 3-4 of the blocks offered look viable. ONGC Videsh Ltd (OVL) forayed into Vietnam as early as 1988, when it bagged the exploration license for Block 06.1. The company got two exploration blocks - Block 127 and Block 128, in 2006. However, OVL relinquished Block 127 in offshore Phu Khanh Basin after it failed to find any oil or gas in the area. Though it had decided to withdraw from adjacent Block 128, it has decided to stay put because of India's strategic interests in the region. The exploration period for the block has been extended until June 15, 2015. China claims sovereignty over most of the South China Sea where Block 127 and 128 are located and had warned the Indian arm from drilling in the region. OVL continues to own 45 per cent in Vietnam's offshore block 6.1 and its share of production was 2.023 billion cubic metres of gas and 0.036 million tonnes of condensate. Pradhan said Vietnam is a "good place" for acquisition of foreign assets for his ministry and departments under him. He also said India will invest about $50 million in the textiles and petrochemical sector in Vietnam by the year 2020. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

GMR signs agreement with Nepal for 900 MW project

September 22, 2014. GMR Group announced the signing of project development agreement (PDA) for the 900 MW Upper Karnali Hydro Power Project with the Government of Nepal on September 19, 2014. The Project is located on Karnali river, in the Surkhet, Dailekh and Achham districts of Nepal. The power generated, net of Free Power and power supply to Nepal, if any, is planned to be evacuated through a 400 Kv double circuit transmission line up to the interconnection point of Power Grid Corporation of India (PGCIL), in India. The financial closure of the project is expected to be achieved by September 2016 and thereafter the commencement of the commercial operation is expected by September 2021. The project is expected to generate about 3,500 million units of energy annually and 420 million units of energy (12% of installed capacity) has been earmarked as free power to Nepal. The Nepal Electricity Authority will hold 27 per cent free equity stake in the project including all project royalties and the 100% ownership of the project will be transferred to the Government of Nepal, at the end of the 25 year concession period. (www.business-standard.com)

Pakistan water experts to inspect 120 MW Miyar hydropower project

September 21, 2014. A three-member Pakistani delegation will inspect the 120 MW Miyar hydropower project near Udaipur town in bordering tribal district of Lahaul-Spiti. The project is being commissioned by private firm Moser Baer in the Miyar Valley on a tributary of the Chandrabhaga River. The purpose of the Pakistani team's visit is to ascertain whether any diversion has been made in the original flow of the Chandrabhaga, which later enters Jammu and Kashmir and merges into Chenab River. During the five-day trip, the delegation will also visit four "controversial sites" on the Chenab River where New Delhi is planning to construct new dams. (economictimes.indiatimes.com)

BHEL wins ` 35.3 bn order from GSECL

September 19, 2014. Bharat Heavy Electricals Limited (BHEL) has won a ` 3536 crore contract from Gujarat State Electricity Corp Ltd (GSECL) for setting up a supercritical thermal power project on EPC (Engineering, Procurement & Construction) basis. Significantly, this is the first ever project of 800 MW unit rating ordered in the country on EPC basis and is also the highest valued order placed by GSECL. With this project, BHEL has now won orders for supply and installation of 33 supercritical boilers and 28 turbines of 660 / 700 / 800 MW ratings. BHEL has a significant presence in Gujarat with 78.3% share in the installed capacity of 9,653 MW in the state utilities for coal, lignite, hydel and gas based power plants. (www.business-standard.com)

Reliance Power withdraws from Dadri power project in UP

September 17, 2014. Reliance Power has formally withdrawn from the Dadri power project in Uttar Pradesh (UP) after a protracted legal battle over acquisition of land for the plant. Reliance Power had in a surprise move told the top court that it wasn't interested in setting up the proposed 7,480 MW gas-fired power plant in Dadri and would return about 956 acres of land acquired for the project. Land acquisition for the project has been mired in legal wrangles. The judgement of the Allahabad High Court on Dec 5, 2009, quashing the move to acquire land through the emergency clause, made it mandatory for the state government to go back and get an NOC from each seller or get them to return the compensation received. Reliance Power and the state government had both contested the high court ruling. After arguments in the case were completed and the top court reserved its verdict a fortnight ago, Reliance Power submitted an affidavit, saying it would have set up the project had there been no legal issues with the land acquired for the project. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Power companies ask for tariff hike in Bihar

September 22, 2014. Ahead of the festive season, the power distribution companies, in Bihar, are pushing for tariff hike. They are also planning to impose Fuel Surcharge in a bid to put the operation costs down. According to state government, these companies are already reeling under heavy losses. The state owned power distribution companies have recently submitted their revised proposal to the Bihar Electricity Regulatory Commission (BERC), in which they have asked for 30-50 per cent hike in the power tariffs. However, the BERC has shown reluctance to accept this proposal. Instead they may allow up to 10-12 percent hike. These companies are reeling under heavy losses. (www.business-standard.com)

Power Engineers seek UP CM's intervention on UPPCL decision to allow coal exports to firms

September 20, 2014. Terming Uttar Pradesh's power utility UPPCL's decision to allow coal export to two private firms as "wrong", Power Engineers Associations have sought immediate intervention by Chief Minister (CM) Akhilesh Yadav. Raising questions on coal export and procuring it from the open market, All India Power Engineers Federation and Uttar Pradesh Power Corp Ltd (UPPCL) Engineers Association said that it would hike power rates by 50 to 60 paise per unit, which would be ultimately be realised from the consumers. The organisations have demanded the CM to intervene immediately. (economictimes.indiatimes.com)

Policy / Performance………….

UP targets doubling power availability by 2016-17

September 23, 2014. Uttar Pradesh (UP), which is currently facing coal shortages at several of its thermal power plants, has set a target to double power availability to 21,000 MW by 2016-17. The government has estimated peak-hour power demand to rise to 23,000 MW by 2016-17. Currently, the total power available with Uttar Pradesh Power Corporation Limited (UPPCL) stands at roughly 10,500 MW from several sources, including public and private sector thermal and hydro power generation, procuring from energy exchanges and bilateral agreements, among others. Uttar Pradesh is expecting that new power plants which are under development, both in the public and private sectors, would be ready within the stipulated time. Besides, the state would seek additional power through first case bidding to make up for the shortfall. The state is targeting to provide 22 hours power to all district headquarters and 16 hours in rural areas by the end of 2016 with augmented power availability. The prevailing coal shortage had resulted in the temporary shutdown of several thermal power units. The state government had accused the Centre of providing sub-optimum coal supply to its plants, deepening the crisis. (www.business-standard.com)

India, Nepal begin talks to build 5.6 GW Pancheshwar project

September 22, 2014. After many years of delay and uncertainty India and Nepal resumed talks to build the 5600 MW Pancheshwar multipurpose hydro power project. The talks are a follow up of an agreement reached between both nations during Prime Minister Narendra Modi’s Nepal visit last month to set up a Pancheshwar Development Authority (PDA) within six months. It was also agreed that the project development agreement (PDA) would finalize the detailed project report (DPR) of the project located on the Mahakali River in the Indo-Nepal border and begin work within a year. The Pancheshwar project was part of the 1996 Mahakali Treaty between India and Nepal. (www.hindustantimes.com)

CIL has so far signed fuel supply pacts for 161 power units

September 22, 2014. Coal India Ltd (CIL) has so far entered into fuel supply pacts with 161 power units for a capacity of 73,675 MW. The Cabinet Committee on Economic Affairs (CCEA) had earlier directed for coal supplies in respect of power projects worth 78,000 MW capacity, it said. The status of the pending 11 FSAs was reviewed in the meeting of the standing linkage committee held last month, it said. As many as 177 LoAs (Letter of Assurances) were issued by the CIL and its subsidiaries for power projects to be commissioned during 11th and 12th Plan. The LoAs cover a capacity of about 1,08,000 MW projects, it said. The coal ministry had earlier said that CIL is yet to enter into fuel supply pacts with some of the power units as issues like change in ownership and extension of coal supplies are still being examined by it. (economictimes.indiatimes.com)

CAG begins performance audit of fuel linkages for IPPs

September 22, 2014. The office of the Comptroller & Auditor General of India (CAG) has initiated the process of performance audit on ‘Fuel Linkages to Independent Power producers (IPPs)’. The performance audit will cover a period of five years from 2009-10 to 2013-14. The audit work is being taken up by H R Biswal, senior audit officer at the office of the Accountant General, Bhubaneswar. The scope, coverage, audit objectives, criteria and tentative time schedule will be discussed in an entry conference with the state officials scheduled on September 27. The state government has signed memorandum of understanding (MoU) with 28 IPPs, envisaging a total generation capacity of 37,510 MW with the state share being 5,887 MW.

Till date, three IPPs have commissioned thermal power capacity of 4,050 MW, the state being entitled to a share of 947 MW power from these commissioned units. The proponents to have put their units on stream include Vedanta Group firm Sesa Sterlite (2,400 MW) at Bhurkamunda nea Jharsuguda, GMR Kamalanga (1,050 MW) at Kamalanga near Dhenkanal and Jindal India Thermal Power Ltd (600 MW) at Dernag near Angul. JITPL is likely to commission another 600 MW unit by the end of 2015. By that period, three more IPPs are expected to commission their projects- Ind Barath Energy (Utkal) Ltd (700 MW), Monnet Power (1,050 MW) and Maa Durga (60 MW). Coal blocks have been allocated to 10 IPPs while 10 others have obtained coal linkages. But none of the coal blocks allocated to the power producers has been able to commence mining due to delay in obtaining the necessary clearances. (www.business-standard.com)

CERC asks JPVL to expedite Karcham Wangtoo tariff petition

September 21, 2014. Central Electricity Regulatory Commission (CERC) has asked Jaiprakash Power Ventures Ltd (JPVL) to expedite filing of tariff petition for 1,000 MW Karcham Wangtoo hydel project. The direction from the CERC came after the utility sought withdrawal of provisional tariff petition related to the plant. This is one of the three hydropower projects being sold by Jaypee group to Reliance Power in a ` 12,000 crore deal and regulatory uncertainties around tariff issues of this plant have been threatening to delay the transaction. JPVL has informed the regulator that an interim arrangement for payments for electricity supplied from Karcham Wangtoo has enabled it to meet immediate financial obligations, according to the Record of Proceedings (RoP) available with the CERC. (economictimes.indiatimes.com)

Obama-Modi pact on power sector in logjam

September 20, 2014. The pact on the power sector between the US and India, to be signed when Prime Minister Narendra Modi meets US President Obama, has hit a logjam. The US has pushed hard to link a parallel agreement on climate change with the power pact, which the Indian side has refused to do till date. The Memorandum of Understanding (MoU) between the two countries on power is primarily about sharing of knowledge and technical know-how about areas such as energy efficiency and smart-metering, but the US wants to include another element to do with phase-out of refrigerant gases that add to global warming. The US negotiators raised the issue with the power ministry also initially but the power minister, Piyush Goyal, conveyed clearly that while he was not in favour of such linkages in the MoU, the decision on climate change issues lay with his colleague Prakash Javadekar, heading the environment ministry. (www.business-standard.com)

After 2 rejects, Dibang hydro plant set to get environmental clearance

September 19, 2014. The environment ministry is all set to give the Dibang Hydropower Project in Arunachal Pradesh the green light, resulting in the diversion of more than 4,500 hectares of bio-diversity rich forest. This despite the proposal for the 3,000 MW project having been rejected by the Forest Advisory Committee (FAC), on two earlier occasions, the last as recently as April, on the grounds that the ecological costs and loss of livelihood to the local population would far outstrip the benefits that could accrue from the project. The project is being taken up for consideration for the third time at FAC meeting. Project developer, NHPC, had been asked to provide sensitivity studies — that is co-relating the lowering of the height of the dam to area being submerged and the loss in power generation. Data for a reduction from 1 to 40 metres will be considered at the FAC meeting. (economictimes.indiatimes.com)

Aptel rejects Tata Power's appeal against April 2013 compensatory tariff order

September 19, 2014. Appellate Tribunal for Electricity (Aptel) has rejected an appeal of Coastal Gujarat Power Limited (CGPL), a wholly-owned subsidiary of Tata Power Company Ltd, against the original April 2013 compensatory tariff order of the Central Electricity Regulatory Commission (CERC), for inordinate delay in filing appeal, lack of bonafide diligence. The appellate body, while rejecting the company's application for condonation of delay in filing appeal against original order of April 2013, has severely criticised CGPL for being negligent in filing appeal after long period of time, 374 days. It also did not find company's explanation for delay in filing appeal valid in any manner.

CGPL had petitioned CERC seeking relief on account of adverse impact of the unforeseen, uncontrollable and unprecedented escalation in the imported coal price. CERC on April 15, 2013 had allowed the CGPL to raise power tariffs from its 4,000-MW Mundra ultra mega power project in Gujarat, to compensate for an unexpected increase in coal cost. However, the central regulator had rejected CGPL's argument that the situation it was facing was due to the 'Change in Law' by the Government of Indonesia and 'Force Majeure'. (www.business-standard.com)

Tenders for disaster resilient power system by March 2015: Odisha

September 18, 2014. The state government hopes to initiate the tender process for the Asian Development Bank (ADB) assisted disaster resilient power system project by March 2015. The project to cost ` 999 crore will be implemented in Ganjam, the southern Odisha district worst hit by Phailin. The detailed project report (DPR) for the disaster resilient power system is ready. Of the total project cost, ` 280 crore would be spent on transmission, ` 700 crore on distribution, ` 11 crore on smart grid and ` 8 crore on setting up 8 MW solar photo voltaic (PV) power plant. ADB has agreed to provide ` 615 crore loan for the project. The residual ` 384 crore will be borne by the state government. The ADB loan is meant for cyclone insulated infrastructure for transmission and distribution of electricity in the coastal zone and also for strengthening river and saline embankments. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

SKKMigas expects Banyu Urip field to commence production in Feb 2015

September 22, 2014. Indonesia's upstream oil and gas regulator SKKMigas expects the Banyu Urip oil field in Cepu, East Java to commence full production early next year as development work nears completion. Field development work at the Banyu Urip field is 92.5 percent complete as of mid-September, with the its early production facility currently producing 30,000 barrels of oil per day (bopd), according to SKKMigas. Oil production at Banyu Urip, which contained an estimated 450 million barrels of oil reserves and will account for 20 percent of Indonesia’s oil production, willl rise gradually until it reached a peak of 165,000 barrels per day by mid-2015. Peak production at the field is expected to be maintained for three years, SKKMigas indicated. (www.rigzone.com)

Drillers can return to fight oil slump after Scotland’s ‘no’

September 19, 2014. U.K. oil companies can stop fretting about Scottish independence and go back to combating a slump in output that’s the steepest of any major producer. Royal Dutch Shell Plc Chief Executive Officer Ben van Beurden and BP Plc head Bob Dudley were among those who said before referendum that keeping Britain’s 307-year union was good for the oil industry. Both companies led development of the North Sea in its production heyday during the 1970s and ’80s, when the Scottish National Party first cried the slogan “It’s our oil!” Output has long since peaked and production collapsed 74 percent from a high in 1999, according to energy analysts at Raymond James. After the vote, the U.K. government will work with oil companies on incentives to invest in mature fields and make it worthwhile to produce from more marginal deposits. The Scottish government, claiming almost all the North Sea’s oil under independence, used the referendum campaign to accuse the U.K. of failing to provide stable and predictable stewardship of the resources.

That will be essential if operators are to extract the greatest possible value from the fields. While the equivalent of 10 billion barrels of oil are already included in development plans, 40 percent of that has yet to secure investment, Oil & Gas UK said in its Activity Survey for this year. The right conditions for investment in exploration, appraisal and development are crucial, it said in the report. The Office of Budget Responsibility (OBR), an independent body set up to report on public finances, forecast U.K. oil and gas receipts falling to 3.5 billion pounds by 2018-19 from 4.7 billion pounds in 2013-14. While the OBR is more pessimistic than some, actual money raised has often come in below its figures. All six of its budget forecasts that included outlooks for 2013-14 were higher than the outcome. (www.bloomberg.com)

BP plans deeper drilling for offshore oil despite ruling

September 18, 2014. Even as it faces $50 billion in potential liabilities from the worst U.S. offshore oil spill, BP Plc is leading the effort to extract crude from deep below the sea, a place as extreme and inhospitable as the surface of Mars. BP, Chevron Corp. and Royal Dutch Shell Plc are among companies developing a new generation of oilfield technology to reach through more than seven miles of water and rock, where temperatures can reach 400 degrees Fahrenheit and the pressure hits 20,000 pounds per square inch -- and to do it safely. The conditions are more challenging than BP’s Macondo well in the Gulf of Mexico, where a 2010 rig explosion killed 11 people and caused a spill that fouled hundreds of miles of coastline. The companies are seeking to tap into $1 trillion in reserves offshore, where a major discovery can produce more oil over its life than 1,000 of the shale wells that are driving an unprecedented energy boom in the U.S. (www.bloomberg.com)

Eni makes 300 mn barrel oil discovery in Ecuador

September 18, 2014. Italian oil and gas group Eni said it had made an important oil discovery in Ecuador with an estimated 300 million barrels of crude in place. The discovery was at the Oglan-2 exploration well located in Block 10, approximately 260 kilometers southeast of Quito, Eni said. (www.rigzone.com)

Leaky wells spur call for stricter rules on gas drilling

September 17, 2014. A study that blamed natural gas drilling for water pollution in two states has spurred calls for stricter regulations to keep wells from leaking methane into aquifers. The study backed the oil and gas industry in one respect: It discounted hydraulic fracturing, or fracking, as the source for harmful methane in water. Some environmentalists contend that by blasting rock with a mixture of water, chemicals and sand, producers can force the gas into drinking water near the surface. The analysis, published in the peer-reviewed Proceedings of the National Academy of Sciences, found instead that leaks in the steel-and-cement casings surrounding the well bore were to blame. Imperfections in the seal allowed gas to escape before it reached the surface, making water undrinkable and in some cases explosive. Fracking has pushed natural gas production to record levels in the U.S., lowering energy costs, supplanting higher-carbon coal in power generation and creating thousands of jobs. It has boosted industries like chemical makers that use it as both an ingredient for their products and a fuel. The process has been dogged by questions of its environmental risks, however, with groups like the Sierra Club pressing for stricter national rules to guard against water contamination. The Bureau of Land Management (BLM), part of the Interior Department that regulates oil and gas production, three years ago said it planned to update rules for natural gas production on federal lands, given the increased development enabled by hydraulic fracturing, or fracking. The rules haven’t been issued. As proposed, the BLM rule would require testing for leaks before hydraulic fracturing begins. Wells that penetrate underground drinking water sources also would have to record data on their cementing of wells to prevent leaks, and report the results to the government. (www.bloomberg.com)

Apache said to seek up to $840 mn for Alberta assets

September 17, 2014. Apache Corp, the oil producer under investor pressure to shed its international assets, is seeking to raise as much as $840 million from the sale of oil and gas projects in Alberta. Apache is working with Bank of Nova Scotia (BNS) to sell the assets in the Provost region. The projects produce the equivalent of almost 10,000 barrels of oil and natural gas, and have an annualized net operating income of $119 million. Apache, with a market value of more than $37 billion, expects to raise $600 million to $840 million from the sale. The sale is a small part of a broader restructuring under way at the Houston-based oil and gas producer, which is being pushed by activist investor Jana Partners LLC to focus on more lucrative U.S. oil projects. (www.bloomberg.com)

Libya halts biggest oilfield Sharara amid rebel attacks

September 17, 2014. Libya said it halted the Sharara field, its biggest oil producer, following a rocket attack at the connected Zawiya refinery, threatening almost 30 percent of the Organization of Petroleum Exporting Countries (OPEC) member’s production. The Sharara field, producing about 250,000 barrels a day before the disruption, was shut as a precaution after an attack on the refinery. The North African nation, still restoring output after more than a year of political unrest and protests, was producing 870,000 barrels a day as of Sept. 14, National Oil Corp said. (www.bloomberg.com)

Downstream…………

Oneok Partners plans to build two natural gas processing facilities in US

September 23, 2014. Oneok Partners is planning to spend approximately $480 mn to $680 mn till the end of the third quarter of 2016 for the construction of two new natural gas processing facilities and related infrastructure in North Dakota and Wyoming, US. The company will build the 80 million cubic feet per day Bear Creek facility and related infrastructure, with an investment of approximately $265 mn to $375 mn, by the second quarter of 2016 to process natural gas produced from the Bakken Shale in the Williston Basin. (refiningandpetrochemicals.energy-business-review.com)

Chevron seeking buyer for Kapolei oil refinery in Hawaii

September 20, 2014. Chevron Corp is seeking a buyer for one of its smallest refineries, the Kapolei plant on the Hawaiian island of Oahu. The sale of the 54,000-barrel-a-day Kapolei complex is part of a larger plan to divest $10 billion worth of assets over the next three years. Closing the plant would leave Hawaii with a single 93,500-barrel-a-day refinery, which Par Petroleum Corp bought from Tesoro Corp last year.

Chevron previously considered turning the Kapolei complex into a terminal. The company decided to continue to run it as a refinery. The refinery ran 39,000 barrels a day in 2013, down from 46,000 in 2012, the company said. Last year, the plant imported 87 percent of its oil from Indonesia, Thailand and Vietnam, Energy Information Administration data show. (www.bloomberg.com)

China's refining capacity to reach 15.8 mn bpd by 2020

September 17, 2014. China, the world's top energy consumer, plans to have a total refining capacity of 790 million tonnes a year, or 15.8 million barrels per day (bpd) by 2020. That represents a rise of 32 percent from around 600 million tonnes a year (12 million bpd) the government has planned for 2015. According to a new development plan and layout for China's petrochemical industry, which was approved by the cabinet earlier this month, China's ethylene production capacity will reach 33.5 million tonnes in 2020 and 50 million tonnes in 2025. Chinese oil majors such as Sinopec and PetroChina have been expanding their refining capacity rapidly over the past two decades to chase the robust demand growth in the world's second-largest economy. (www.downstreamtoday.com)

Transportation / Trade……….

Surging gas supply masks risk of winter price shock

September 20, 2014. Gas traders betting that ample supply will limit price gains risk a repeat of last winter’s rally as forecasts for another frigid season raise the specter of supply constraints. AccuWeather Inc. and Commodity Weather Group LLC predict below-normal temperatures for much of the U.S. this winter. The price difference between gas for delivery in October and January is the narrowest for this time of year since 2000, a sign that the market views stockpiles as adequate to meet peak heating demand. Goldman Sachs Group Inc. cut its forecast for average gas prices in the fourth quarter of this year and throughout 2015 to $4 per million British thermal units from $4.25. Last winter, a polar vortex left gas supply at an 11-year low and sent futures to a five-year high. Gas inventories will enter the heating season at the lowest level for the time of year since 2008, the U.S. Energy Information Administration predicts. (www.bloomberg.com)

Nigerian oil unions halt strike after pension dispute

September 20, 2014. Nigeria’s oil unions called off a four-day strike, averting a threat to exports from a nation whose shipments equate to about 2 percent of global demand. The Pengassan union that represents managers and blue-collar Nupeng oil union suspended industrial action after talks with Petroleum Minister Diezani Alison-Madueke and Nigeria National Petroleum Corp. The strike started in a dispute over pensions and unions representing workers at NNPC.

Nigeria is the continent’s largest oil producer and relies on the commodity for more than 70 percent of government revenue and 95 percent of foreign-exchange income. The West African nation pumped 2.3 million barrels a day of oil in August, the most since 2006. Nigeria exported about 1.9 million barrels a day last year, according to data collated by the International Trade Centre’s Trade Map, a venture between the World Trade Organization and the United Nations. Global demand is about 92 million barrels a day. (www.bloomberg.com)

Petrobras says to sign Libra production ship contract

September 19, 2014. Brazil's state-run oil company, Petroleo Brasileiro SA, will sign a contract to build and lease a floating production ship for its giant Libra offshore project this month, the company said. The contract will be the first for a floating production, storage and offloading vessel, or FPSO, to be used in the giant Libra prospect northeast of Rio de Janeiro that Petrobras, as the company is known, won in an auction with Anglo-Dutch, French and Chinese partners. Libra will be the first area developed under new production sharing rules and will direct about 42 percent of its output to the Brazilian government for it to sell on its own account. Petrobras owns 40 percent of the project with Anglo-Dutch Shell Plc and France's Total SA each owning 20 percent and Chinese state oil companies CNOOC Ltd and China National Petroleum Corp. each owning 10 percent. (www.rigzone.com)

TransCanada Keystone cost may rise 85 per cent before US ruling

September 19, 2014. The cost of building the Keystone XL oil pipeline, which is awaiting approval from the U.S. after an initial rejection, may climb 85 percent to $10 billion, according to developer TransCanada Corp. The new estimate increases the project cost from the current $5.4 billion. TransCanada, the second-largest Canadian pipeline operator, applied six years ago to build Keystone XL to carry rising supplies of oil-sands crude to U.S. Gulf Coast refineries. The pipeline was rejected by President Barack Obama in 2012. TransCanada then split up the project to build the southern portion first and refiled for approval for the northern leg with an alternate route in Nebraska. The U.S. State Department is awaiting the outcome of a Nebraska court battle over the regulatory review of the line’s path through the state before making a ruling. The department has jurisdiction over the project because it would cross the U.S. border with Canada. (www.bloomberg.com)

Oil clogging US railways seen limiting exports of grain

September 19, 2014. Shipping companies probably will miss out on exports from the record U.S. grain harvest because the shale-oil boom is clogging up rail lines to ports. While the U.S. will reap the most crops ever, fourth-quarter export cargoes will be 15 percent lower than last year, according to RS Platou Markets AS, a Norwegian bank specialized in shipping. The U.S. shale-oil boom means energy shipments are dominating rail networks at the expense of grains. The Association of American Railroads says crude moved by rail almost doubled last year. The bottlenecks may persist because the Energy Department is predicting the most oil output in 45 years in 2015. (www.bloomberg.com)

Poland sets sights on gas hub to loosen Russia’s energy grip

September 18, 2014. Poland is taking steps towards creating a gas trading and transit hub in Central and Eastern Europe aimed at accomplishing what much of the region has failed to do: shake off almost complete reliance on Russian gas imports. Poland will open a liquefied natural gas terminal in 2015 and build new pipelines -- including a planned north-south corridor stretching to Croatia -- to help ease the grip of Russia's Gazprom over former Soviet bloc nations. Central Europe's biggest economy, which also intends to upgrade gas links to Lithuania to allow the re-export of gas to the Baltics, has said it plans to build 2,000 km of pipelines criss-crossing the country over the next 10 years. (www.downstreamtoday.com)

Policy / Performance…………

OPEC yet to decide on supply cuts as crude prices extend retreat

September 23, 2014. OPEC has yet to decide to cut its production target, the United Arab Emirates (U.A.E.) Energy Minister Suhail Al Mazrouei said, as crude prices extend a slide since June amid a boom in U.S. shale oil and signs of slower demand growth in China. All 12 members of the group must agree before any decrease in its official limit of 30 million barrels a day, the U.A.E.’s Suhail Al Mazrouei said, a week after OPEC’s secretary-general said it may lower the ceiling in 2015. The Organization of Petroleum Exporting Countries (OPEC), supplier of about 40 percent of the world’s oil, faces growing competition from North American shale deposits even as economic growth cools in China, the world’s second-biggest oil consumer after the U.S. OPEC’s monthly report on Sept. 10 showed demand for its oil will decline to 29.2 million barrels a day in 2015 from 29.5 million this year. The group will review its target when it meets next on Nov. 27 at its Vienna headquarters. OPEC may reduce its official daily limit by 500,000 barrels to 29.5 million next year, the group’s Secretary-General Abdalla El-Badri said. El-Badri specified that this was an outlook, not a decision. He attributed the slide in crude prices to seasonal demand and predicted a recovery by year-end. (www.bloomberg.com)

Exxon gets US sanctions extension to shut Russian arctic well

September 20, 2014. Exxon Mobil Corp said the U.S. government is giving the company more time to shut its Russian Arctic well beyond the deadline for sanctions aimed at halting the $700 million project. Exxon asked Washington for an extension to allow it to continue performing shut-down work on the Universitetskaya-1 (University-1) well in Russia’s Kara Sea to make sure the well was safe before it’s temporarily abandoned. The Irving, Texas-based company already had ceased drilling the offshore well after U.S. sanctions set a Sept. 26 deadline for ending the work. The most-recent round of sanctions intended to punish Russia for its involvement in separatist violence in Ukraine barred U.S. and European Union companies from helping Russia exploit oil resources in the Arctic, deep seas and shale formations. The measures had prompted Exxon and its partner OAO Rosneft to temporarily halt drilling at the well, which lies about 260 feet beneath the sea surface off Siberia’s northern coast. The well is aiming to tap a resource estimated to hold as much as 9 billion barrels of crude, worth $880 billion at current prices. (www.bloomberg.com)

Egypt awards O&G exploration blocks

September 19, 2014. Egypt has signed oil and gas exploration deals worth $187 million with several Western companies and a Tunisian firm, the petroleum ministry said. The agreements cover seven exploration areas. Germany's RWE won two exploration blocks in the Gulf of Suez, while Tunisia's HBSI, Canada's TransGlobe and Italy's Edison secured five blocks in Egypt's western desert. In December, Egypt's General Petroleum Corporation (EGPC) and Natural Gas Holding Company (EGAS) announced an international auction for oil and gas exploration concessions in accordance with production sharing agreements. The concessions are for areas in the Suez Canal, Egypt's western desert, the Mediterranean sea and the Nile Delta, the state-owned firms said. Exploration companies have been hesitant to develop untapped gas finds in Egyptian waters partly because the amount the government pays them barely covers their investment costs. Egypt has been struggling with soaring energy bills caused by the high subsidies it provides on fuel for its population of 85 million. The subsidies have turned the country from a net energy exporter into a net importer over the last few years. Egypt has started repaying some of its debt to foreign oil companies, which had reached more than $6 billion. (www.rigzone.com)

Finland grants support to three small LNG terminals

September 18, 2014. The Finnish government granted 65.2 million euros (84.22 million US dollar) in subsidies to build three small liquefied natural gas (LNG) terminals to cut on use of fuel oil and liquefied petroleum gas (LPG) in industry, the economy ministry said. Finland is building a network of LNG terminals along its coastline, expecting that LNG will be increasingly used as a shipping fuel in the Baltic Sea. Investments into the three terminals with a combined storage capacity of 90,000 cubic metres will total more than 200 million euros, and they are expected to come in operation in 2016-2017, the ministry said. The government is still assessing requests for providing investment support for another three terminals. (www.downstreamtoday.com)

Ministry of Energy awards exploration Block 44 in Zambia to Swala Energy

September 18, 2014. East Africa-focused Swala Energy Ltd announced that its 93 percent owned subsidiary company, Swala Energy (Zambia) Ltd, has been formally awarded hydrocarbon exploration rights over Block 44 in the Republic of Zambia. The Company had been offered exploration rights over Block 44 and was awaiting the formal award of the rights from the Ministry of Energy. The award of Block 44 has now been granted following ministerial consent from the Ministry of Energy in Zambia. (www.rigzone.com)

Deeper Saudi oil cuts seen after biggest drop since ’12

September 18, 2014. Saudi Arabia will need to keep cutting oil output to sustain prices above $100 a barrel, even after the kingdom’s largest reduction in two years, according to BNP Paribas SA and Societe Generale SA. The world’s biggest crude exporter told OPEC it pumped 408,000 barrels a day less last month, about as much as Australia produces. Output rose in Iran, Iraq and Nigeria, adding to supply that drove benchmark Brent crude futures below $100 this month for the first time since June 2013. Saudi Arabia probably will have to cut a similar amount again to stabilize prices, the banks said. Global oil demand growth this year will be the weakest since 2011, just as the U.S. shale boom means oil production from countries outside OPEC rises by the most since the 1980s, according to the International Energy Agency. The glut is prompting most of OPEC’s Middle Eastern members, including Saudi Arabia, to cut prices to customers. (www.bloomberg.com)

Kenya sees oil resources almost doubling with more drilling