-

CENTRES

Progammes & Centres

Location

[The Climate has Not Changed]

“If we replace ‘communism’ with ‘industrialisation plans’ of developing countries, we will arrive at climate discourses today. Unimaginable sums of money are underwriting studies on climate change to tell the target country (or region) how it will be ruined by climate change if it does not change its plans for energy driven development and tell the sponsoring country how preventing this from happening would be in its (sponsoring country’s) national interest…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Climate Change …...

· The Climate has Not Changed

Coal………….

· CIL must change its mindset

DATA INSIGHT………………

· Availability & Production of Coal in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Oil Ministry extends deadline for comments on revenue sharing draft

· RIL gas field investments depend on acceptable pricing: Niko

· Govt clears 5 per cent stake sale in ONGC

Downstream……………………………

· NRL readies DFR for massive capacity addition

Transportation / Trade………………

· Oil Ministry wants RIL to stop sale of KG-D6 crude to Jamnagar

· GAIL makes gas available from alternate sources to Gujarat industries

· IGL takes snapshots of meter readings to curb under-reporting

· Oil companies like HPCL restore fuel supply in Kashmir

· BPCL offers first Euro III diesel cargoes for export

Policy / Performance…………………

· Govt to consider diesel deregulation and price cut

· Free diesel prices at the earliest, says RBI Governor

· Odisha to get ` 1k bn energy investment: Oil Minister

· Iran's hydrocarbon complement India's energy need: Vice President of India

· IOC plans to automate 7,500 retail outlets in 2014-15

· Delay in gas price hike frustrating: BP

· UP govt, IOC sign MoU for city gas projects

[NATIONAL: POWER]

Generation………………

· BHEL to accelerate UP thermal power projects

· Over burdened West Bengal Govt goes for new hydropower projects

· UCIL's Jaduguda mine closure to impact nuclear power output

· MCL's 1.6 GW thermal power project to seek board nod

Transmission / Distribution / Trade……

· DVC to resume power supply to Madhya Pradesh after coal stock rises

· CERC pushes for smooth electricity import from Bhutan

· UP facing unprecedented power crisis

· No power shortage in Haryana: Discoms

· 'Transmission reforms would bring down power losses'

Policy / Performance…………………

· 24-hour power supply to all from October: AP CM

· 60 per cent power supply restored in Kashmir: Omar

· Delhi homes consume the most power, Tamil Nadu ranks third

· NDA govt fast tracking power projects in the Northeast India

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· OVL to expand O&G exploration in offshore Vietnam

· FOGL makes progress ahead of 2015 drilling campaign

· Ophir finds gas at Silenus East-1 well in Equatorial Guinea's Block R

· Homes near gas wells in Texas face worsening water issues

· CNOOC makes deepwater gas field discovery in South China Sea

· Thai PTTEP to spend $1 bn for Mozambique project in next 5-6 yrs

· Russia's SeverEnergia launches new gas production stage

· Saudis cut production as Brent slips below $100 a barrel

· Billionaire Fredriksen’s Rosneft deal still risks sanctions

· Kuwait Energy discovers oil at Faihaa-1 well in Block 9 in Basra, Iraq

Downstream……………………

· Spain's Tecnicas Reunidas wins $500 mn order from Pemex

· Egypt expects $425 mn from IDB

· Cheapest US gasoline since 2010 set to get cheaper

Transportation / Trade…………

· Ukraine conflict forces eastern states to stockpile gas

· BASF buys oil, gas assets from Statoil to secure European supply

· Japan's Tepco signs 17 year LNG supply deal with BP unit

· Shell revives plan to sell European LPG business

· Gazprom first-quarter profit falls 41 per cent on Ukrainian gas debt

· Australian LNG contracts under pressure from US, Russia supply

Policy / Performance………………

· Nigeria to triple natural-gas output for power supply

· BP seeks access to $750 mn Transocean insurance

· Indonesia expects output from Exxon Mobil's Cepu block to peak in July or Aug

· Congo preparing tender for several oil blocks: Oil Minister

· 45 year high US oil output may cut pump price, imports

· Norway wins interest from 47 oil firms in licensing round

· IEA cuts oil-demand estimates as Saudi exports drop to 2011 low

[INTERNATIONAL: POWER]

Generation…………………

· Singapore's Sembcorp to launch power project in China

· Iran to start construction of 2 new nuclear power plants

· South Africa's Eskom says delayed Medupi power plant to start Dec 24

Transmission / Distribution / Trade……

· Nigeria mulls $20 bn offers to sell transmission assets

· USDA invests $518 mn to improve reliability of rural electric systems

Policy / Performance………………

· China bans use of coal with high ash or sulfur to combat smog

· France failing to keep up with nuclear reactor maintenance

· South Africa plans support to avert downgrade of Eskom

· Rosneft’s China gas ambitions said to hit bureaucratic setback

· China bid to curb coal output seen lifting prices by 10 per cent

· Japan takes another step toward restarting nuclear power plants

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· NTPC MoU with Govt of AP for 1 GW solar power projects

· Tamil Nadu sets solar tariff as program stalls

· BHEL to develop 20 MW solar power plant

· IPCL plans more renewable power procurement

· India offshore wind policy to target 1 GW by 2020

· NRL inks MoU with Chempolis Oy to study ethanol production from bamboo biomass

· IFC, Yes Bank to lend $ 150 mn to Continuum Wind Energy

· $100 bn investment likely in renewable energy in 4 yrs: Goyal

· PFS, PFC Green to jointly finance renewable energy projects

· J&K floods a grim reminder of increasing climate change impact in India: CSE

GLOBAL………………

· Fight against climate change seen driving economic growth

· Fixing climate change may add no costs, report says

· Musk Solar strategy used as model for record investments

· Rising demand for wind turbines and solar panels altering Germany’s landscape

· Duke spends $500 mn to expand solar power in North Carolina

· German clean-energy shift can do without storage: Study

· Google spends $145 mn for solar power plant in California

· Obama's mountaintop coal mining legacy still to be determined

· California oil marketers want cap-and-trade investigated

· Solar storms sending biggest threats to earth today and tomorrow

· Ratchaburi Electricity to invest in Japan solar power generation

· German consumers can expect green power surcharge to fall next year

[WEEK IN REVIEW]

ENERGY/CLIMATE CHANGE………………

The Climate has Not Changed

Lydia Powell, Observer Research Foundation

|

F |

ormal and informal conversations over ambitions and commitments to combat climate change are going on in India and other important regions of the world as part of preparations for discussions in Lima in 2014 and Paris in 2015. Most of these conversations are beyond amateur observers who are not familiar with the vocabulary invented for the purpose of climate negotiations. But there is something that even they would understand very clearly and that is that the climate has not changed in the last six decades when it comes to conversations between diversely developed countries.

Nobel Laureate Gunnar Myrdal observed in his 1968 classic, ‘Asian Drama: An Inquiry into the Poverty of Nations’ that post war interest in other (underdeveloped) countries started with the rise of new independent States after the liquidation of colonial power system and the influence of communism in their ambitious plans (to develop into advanced countries).[1] Myrdal pointed out that the Western nations, driven by the ‘immense interests at stake in the neutrality of the underdeveloped States’, sponsored studies on underdeveloped nations that were expected to come to ‘opportune conclusions’ to be presented in the context of the national interest of the sponsoring country. If we replace ‘communism’ with ‘industrialisation plans’ of developing countries, we will arrive at climate discourses today. Unimaginable sums of money are underwriting studies on climate change to tell the target country (or region) how it will be ruined by climate change if it does not change its plans for energy driven development and tell the sponsoring country how preventing this from happening would be in its (sponsoring country’s) national interest. The ‘opportune conclusion’ here is that if developing countries reduce carbon emissions (‘turn away from communism’) then developed countries do not have to compromise on their own national interests (‘will not have too many enemies to fight with’).

Csanad Toth, who was Vice President of the Inter-American Foundation and a Visiting Fellow at the Overseas Development Council observers in an insightful article written in 1978 that States were seen as ‘red’ or ‘dead’ (primarily by the United States) and with ‘naive and idealist arrogance’ that Toth says was typical of that age, despatched ‘development gorillas’ all over the world to fight the ‘war against poverty’ and ‘population growth’ thought to be the cause of poverty on the basis of ‘strategies’ and ‘tactics’ that were designed for the purpose.[2] According to Toth, development was a military exercise and people in the developed world were ‘targets’. Toth also describes how the humiliating defeat in Vietnam changed the war like vision on development to one of negative problem solving. People were not targets anymore but objects with needs defined by their deficiencies and not their potential. Toth describes how a ‘Malthusian spectre of the apocalypse’ was presented using inadequacies in the educational attainment, nutritional intake, health status and housing conditions. If we come to the present, we can see that nothing much has changed except that the development gorilla has been replaced by the climate gorilla fighting a war on emissions (or fossil fuel use). People are not victims of poverty but villains who burn coal (even if it was used to light up a single bulb for the first time or just to keep warm). On the whole, the same Malthusian crisis narrative underpins climate related reports sponsored by western think tanks and development assistance agencies.

The most surprising consistency between then (developing the under-developed) and now (combating climate change) is that the material resources committed to develop or clean up under-developed countries remains insignificant compared to the grand visions of development and climate safety that the rich world supposedly desires for the under-developed world. Even at the height of the cold war development spending by the United States (for combating communism) was less than 5% of its military spending.[3] According to a UN exhibit in a study by the International Peace Bureau, global military spending was more than 12 times official development assistance in 2010.[4] According to the UN most rich countries have failed to meet their target of 0.7% of Gross National Income (GNI) for overseas development assistance barring a few Nordic countries. According to a study by the University of Zurich, share of mitigation projects (alternative energy) in total aid projects of OECD nations peaked at just over 0.02% after the oil crises in the early 1980s and is currently at less than 0.015%.[5] What this piece of data says is that problems in oil supply were considered to be bigger threats than climate change. The argument being made here is not that rich countries should part with more money but to ask if they actually believe in the ideas that they promote. The reports that they produce says that climate change is impending Armageddon and that it can only be addressed by spending huge sums of money on new forms of energy, efficiency technologies and so on. Logically if they believe what they are saying should they not be spending a little bit more? Or are these reports intended to induce poor countries to change their priorities and spend on things that they would have otherwise not considered a priority.

At the time when development was the weapon of choice and population growth was the enemy studies that showed a link between population growth and development were used to inject a sense of objectivity into the discourse. Today a similar sense of objectivity is introduced by what is often referred to as the scientific consensus over the science of climate change. Two issues can be raised here. First neither the conversation over development nor the conversation over climate change is about science. It is about politics or what we could call social science (who gets what and at whose cost and who gets to decide who gets what) and as Myrdal pointed out there is no such thing as value free social science.[6] The value laden climate discourse has always been a contest between forces of instrumentality and the forces seeking intrinsic values such as fairness and equity. Developed countries represent the instrumentality dimension that explain voluminous reports on Green House Gas (GHG) build up in the atmosphere and plans for global surveillance on emission of GHGs. As observed by Damodaran, the problem is that this type of instrumentalism denies freedom which affects intrinsic human values such as equity and fairness considered to be basic human rights.[7] Instrumentalism which makes science and technology more real is social construction (embedded in social and cultural factors) and this is why it is possible for developed countries to argue that instrumental positions should negate concerns for equity and fairness. Myrdal observed that there are no exclusively economic problems (in poor countries) that could be dealt with economic solutions like markets, wages, prices, employment, savings, investment etc; there are just ‘problems’. If we can borrow his insightful words, there are no exclusive climate problems in the poor world that could be dealt with solutions like low carbon technologies, carbon markets, national mandates and missions, there are just ‘problems’. What instrumentalism does is to turn this poor man’s problem into just a speck of dust that must be wiped out from the rich man’s solution.

Views are those of the author

Author can be contacted at [email protected]

COAL……………

CIL must change its mindset

Ashish Gupta, Observer Research Foundation

|

T |

he Energy Committee which was institutionalised recently under the Former Union Minister of Power Shri Suresh Prabhu was entrusted with the task for advising government on the issues related with the energy sector. Interestingly, the committee has come up with a very good proposal to make Central Mine Planning and Design Institute Ltd (CMPDIL), the technical arm of the CIL to be made independent. Though it is not the part of restructuring it is certainly a move in the right direction. The proposal is not new as many analysts have sought the same in the past. But the most important thing is whether this will become reality? If the proposal will be implemented, we will certainly be seeing a new CMPDIL with improved efficiency, accountability and more professional approach and CMPDIL could be rubbing shoulders with the private companies in the consultancy and exploration space!

On the privatisation front the government has already taken a firm stand that currently they are not looking to privatise the coal sector. But steps for restructuring of CIL are not very clear. Earlier attempts have not been in the right direction because restructuring of CIL was limited to tackling of unions, reducing workforce, more mechanisation, infusing technology, adoption of best techniques and so on. In this case CIL will not be able to achieve much in the long run. The important question is why all solutions are related with technology? CIL has other issues and they must be addressed. The adoption of best Management techniques is more critical than only going hi-tech.

Starting from the establishment of the CIL in 1975, more thrust was on acquiring engineering skill. In those years the approach was good because most work was done manually so increasing technical people was the right choice. But other skills are important now. Engineers cannot be playing the role of environmentalist, human resource person, finance manager and so on. All theses disciplines are now distinct from one another and require special skill set. Private companies are hiring people from diverse fields. But companies like CIL and other PSUs are following the same old school of thought. This is one of the reasons why CIL is facing problem in many other fronts. Its solutions are merely engineering solutions when they require social and economic solutions as well.

Interestingly, in many PSUs posts such Director Tech. (HR), Director Tech. (Finance) are held by engineers. This does not mean they are incompetent people but their skill is not suitable for the post. Therefore one cannot expect any improvement in efficiency or productivity when right positions are occupied by wrong person. Economist is a position which is very crucial for any company but it is not given any importance in companies like CIL. Also these companies as a general practice do not hire persons having management background and that is one of the important reasons why their management is inadequate.

A company is known by its workforce rather than what technology it has infused. Putting the correct person on the right position will make a huge impact on the overall working style of CIL. These are simple basics. There has been a lot of improvement in CIL hiring pattern but lot more still needs to be done. CIL is an energy company and it needs to energise itself with the right people.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Availability & Production of Coal in India

Akhilesh Sati, Observer Research Foundation

|

Particulars |

2011-12 |

2012-13 |

2013-14 |

|||

|

Quantity (Million Tonnes) |

Value (Rs Million) |

Quantity (Million Tonnes) |

Value (Rs Million) |

Quantity (Million Tonnes) |

Value |

|

|

Indigenous Coal Production |

539.95 |

|

556.40 |

|

565.64 |

|

|

Exports |

2.03 |

5900 |

2.44 |

8651 |

2.15 |

10187 |

|

Imports by Source |

||||||

|

Indonesia |

55.26 |

258417 |

82.39 |

329706 |

103.07 |

418554 |

|

Australia |

27.79 |

366256 |

30.45 |

315969 |

34.77 |

319486 |

|

South Africa |

12.22 |

77107 |

20.29 |

113565 |

20.62 |

111462 |

|

USA |

2.97 |

39746 |

6.39 |

55033 |

3.65 |

32070 |

|

Russia |

1.19 |

9885 |

0.37 |

3564 |

0.74 |

6116 |

|

New Zealand |

0.96 |

12986 |

1.05 |

11356 |

1.16 |

10962 |

|

China PRP |

0.48 |

4939 |

0.02 |

342 |

0.21 |

2014 |

|

Canada |

0.23 |

3157 |

1.00 |

10843 |

1.25 |

12248 |

|

Mozambique |

0.05 |

492 |

0.98 |

10187 |

1.50 |

11863 |

|

Others |

1.69 |

15391 |

2.85 |

27890 |

1.47 |

8154 |

|

Total Imports |

102.85 |

788376 |

145.79 |

868455 |

168.44 |

932929 |

|

Coal Availability |

640.77 |

699.74 |

731.93 |

|||

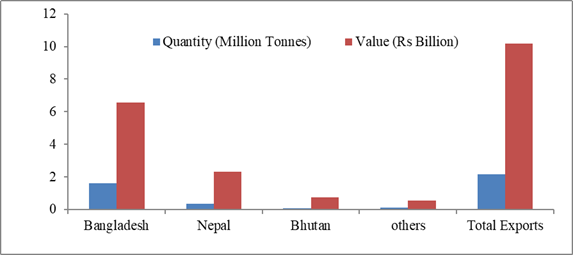

India’s Coal Exports

2013-14

Source: Rajya Sabha, Question Nos. 1215 & 2610

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Oil Ministry extends deadline for comments on revenue sharing draft

September 15, 2014. The Petroleum Ministry has extended by the deadline for commenting on a simpler revenue sharing contract it wants to replace the present Production Sharing Contracts (PSC) with. The ministry had floated a model revenue- sharing contract for exploration and production of oil and gas and sought comments from stakeholders by September 10. This deadline has been extended to September 20. Besides suggesting doubling of natural gas prices, a Committee headed by C Rangarajan had suggested moving to a revenue sharing regime where companies bid upfront the quantity of oil and gas they will share with the government for winning an exploration acreage. (economictimes.indiatimes.com)

RIL gas field investments depend on acceptable pricing: Niko

September 12, 2014. Reliance Industries’ USD 10 billion investment in new fields off the east coast depends on the government approving acceptable gas price, its junior partner Niko Resources said. Reliance Industries Ltd (RIL) has an array of natural gas discoveries in the Krishna Godavari basin KG-D6 block as well as NEC-25 area off the Odisha coast and it along with its partners BP plc of UK and Niko has detailed plans to bring them to production in the next few years. While the previous UPA government had approved a formula that would have doubled natural gas rates to USD 8.4 per million British thermal unit, the present dispensation is reviewing it and is likely to take a decision by month-end. Niko said final investment decisions to develop R-Series gas fields as well as satellite discoveries in KG-D6 block is “waiting on favourable resolution of gas price.” The partners say new field developments are economically unviable at the current price of USD 4.2. (indianexpress.com)

Govt clears 5 per cent stake sale in ONGC

September 10, 2014. Government cleared 5 per cent disinvestment in oil major ONGC, which may fetch the exchequer about ` 18,000 crore. The Cabinet Committee on Economic Affairs (CCEA), headed by Prime Minister Narendra Modi, has cleared the ONGC stake sale proposal. The disinvestment department had selected 5 merchant bankers -- Citigroup and HSBC Securities, UBS Securities, ICICI Securities and Kotak Mahindra Capital for managing the stake sale. The merchant bankers will advise the government on the timing and modalities of Offer For Sale (OFS) and ensure best returns to the government, which holds 68.94 per cent stake in ONGC. The Cabinet nod for the ONGC stake sale comes as the Petroleum Ministry too has consented to the stake sale. The government had last sold 5 per cent stake in ONGC in 2012 for ` 14,000 crore. In the current fiscal the government plans to mop up ` 43,425 crore from selling stake in various state-owned firms. (economictimes.indiatimes.com)

Downstream………….

NRL readies DFR for massive capacity addition

September 13, 2014. Bharat Petroleum Corporation Ltd's Assam based refinery, Numaligarh Refinery Limited (NRL) is preparing detailed feasibility report (DFR) for expanding its refining capacity from 3 to 9 million metric tonnes per annum. NRL announced that faced with the dual challenge of sub-economic refining capacity and declining trend in domestic crude oil supplies from North Eastern oil fields, the Company is actively pursuing a proposal of refinery expansion from at an estimated cost of ` 16,600 crores, sourcing incremental crude through imports. Imported crude oil is envisaged to be transported from an Eastern port to Numaligarh through a new pipeline. The company is also actively pursuing the project to lay a 135 kms product pipeline from its terminal at Siliguri in West Bengal to Parbatipur in Bangladesh to facilitate sustained export of MS (petrol) and high speed diesel (HSD). (economictimes.indiatimes.com)

Transportation / Trade…………

Oil Ministry wants RIL to stop sale of KG-D6 crude to Jamnagar

September 16, 2014. Petroleum Ministry has asked Reliance Industries Ltd (RIL) to stop sale of crude oil from KG-D6 block to its affiliate Jamnagar refinery, saying it was not an arms- length sales. The Ministry wants to deduct $ 115 million from sale proceeds of the crude oil to make up for the additional profit petroleum it believes is due after disallowance of $ 1.797 billion in cost for KG-D6 gas output falling short of target. It has asked RIL to sell oil to Chennai Petroleum Corp Ltd (CPCL) on an interim basis.

GAIL makes gas available from alternate sources to Gujarat industries

September 14, 2014. GAIL India Ltd said it has made available natural gas from alternate sources to industries in Gujarat whose domestic fuel allocation was snapped to give fuel for CNG sector. The Oil Ministry had directed GAIL to cut domestic gas supplies, called APM gas, to non-priority sector so that cheaper fuel can be made available for supply as compressed natural gas (CNG) to automobiles and piped cooking gas (PNG) to households in cities. Considering the requirement of gas to other industries, GAIL has offered to supply equivalent amount of alternate gas, possibly imported LNG, so that the production of such industries do not suffer, the company said. The additional gas being supplied to domestic and transport sector will enable the Government to reduce subsidy burden on account of LPG and will result in substantial saving in outgo of foreign exchange for import of LPG as well as crude oil. The reallocation of this natural gas to city gas distribution (CGD) entities will enable cooking gas supply to more than 6.0 lakh households. Presently, more than 8 million standard cubic metres per day (mmscmd) of natural gas is being supplied to CNG and PNG sector which includes more than 2 mmscmd supplies to CGD entities in Gujarat. (economictimes.indiatimes.com)

IGL takes snapshots of meter readings to curb under-reporting

September 13, 2014. The ubiquitous mobile phone is helping Indraprastha Gas Ltd (IGL) plug revenue leakage. Executives of IGL, the sole natural gas supplier in Delhi and NCR, have been instructed to take snaps of meter readings in the about 460,000 households that use it for cooking, as the state-run company tries to curb under-reporting. IGL claims it loses lakhs of rupees every year due to under-reporting by some meter readers, who are suspected of conniving with customers. IGL rolled out its pilot project for collecting meter readings through smartphones in March after a barrage of consumer complaints regarding inflated bills. (economictimes.indiatimes.com)

Oil companies like HPCL restore fuel supply in Kashmir

September 12, 2014. State-run oil marketing companies have restored supply of fuels, particularly cooking gas, to Kashmir valley from Ladakh after restoration of road connectivity to the flood-affected region by the Indian Army and the Border Roads Organisation. Oil minister Dharmendra Pradhan asked Hindustan Petroleum Corporation Ltd (HPCL) to make alternative arrangements for bottling LPG (liquefied petroleum gas) at Srinagar because its plant has been inundated with water. The minister has also asked Indian Oil Corp (IOC) to airlift jet fuel to the flood-affected areas so that the Army can conduct uninterrupted rescue and relief works using its planes and helicopters. (economictimes.indiatimes.com)

BPCL offers first Euro III diesel cargoes for export

September 12, 2014. Bharat Petroleum Corp Ltd (BPCL) has offered its first Euro III diesel cargoes for export, as domestic inventory stands at high levels due to weak demand. The rare exports are expected to weigh on an already oversupplied diesel market in Asia as refineries expand capacity and demand slows amid weaker economies, possibly dragging down refinery margins. BPCL has only occasionally exported high sulphur gasoil, which it uses as feedstock for secondary units, when there is unit maintenance but has not exported an Indian diesel grade. (economictimes.indiatimes.com)

Policy / Performance………

Govt to consider diesel deregulation and price cut

September 16, 2014. The government will consider decontrolling diesel and cut the fuel's price by 40 paise per litre this month as the sharp fall in global crude oil prices has paved the way for a major reform in fuel pricing. The fall in global prices has helped state oil firms make a profit on diesel, which has been a source of heavy subsidy burden for about a decade. The government is weighing the political impact of fuel pricing as elections in crucial states of Maharashtra and Haryana are due in weeks. The government has to take a call on whether or not it should announce price deregulation simultaneously with the cut in diesel prices. Finance Minister Arun Jaitley and RBI Governor Raghuram Rajan have already expressed their keenness on fuel price reforms. Before the unexpected fall in global oil prices, Jaitley had told Parliament that the government would be able to decontrol diesel fully in a year if there are no international shocks in the oil sector. Diesel price deregulation will be a major policy reform of the Narendra Modi government but, it is concerned about sudden spike in international oil prices in the near future that would adversely affect ruling BJP's polls prospects in Maharashtra and Haryana. (economictimes.indiatimes.com)

Free diesel prices at the earliest, says RBI Governor

September 15, 2014. The government must take advantage of the lowest oil prices in a year to deregulate diesel, RBI Governor Raghuram Rajan said. Brent crude, a benchmark for Asian and Indian buyers, has fallen 14 per cent since June to USD 96.38 per barrel. This together with monthly price increases of up to 50 paisa a litre has trimmed losses on the nation's most consumed fuel to just 8 paisa per litre. The next revision in diesel prices is due this month-end and going by the present trend the under-recovery or the difference between the imported cost and the retailing selling price, will be wiped out with a minimal hike. Even after the under-recovery is wiped out, the Cabinet has to approve de-regulation or freeing of diesel prices. This will empower the oil companies to change rates in tandem with cost like they do in case of petrol since June 2012. Rajan admitted that there are significant geopolitical risks with Ukraine and the Middle East in turmoil leading analysts to worry that the current low oil prices may be a temporary phenomenon. Last year, India imported more than 118 million tonnes of crude worth USD 144 billion, making it the largest contributor to a historic high current account deficit which had shot up to over 6 per cent in the middle of last fiscal forcing the government to unleash some unconventional measures like curbs on gold imports. (economictimes.indiatimes.com)

Odisha to get ` 1k bn energy investment: Oil Minister

September 15, 2014. Union minister of state for petroleum and natural gas Dharmendra Pradhan said he hopes to make his home state of Odisha the "energy gateway" in eastern India as he announced a clutch of projects that he said will bring in ` 1 lakh crore in investments and employ 50,000 people. These include linking of IOCL's refinery to a proposed petroleum and petrochem park in Odisha and oil-gas pipelines from ports to Ranchi and Surat. Pradhan said that Odisha is among the few states which will have gas from three sources - imported LNG, domestic natural gas, coal bed methane. IOCL's 15 million tonnes (mt) refinery, entailing a ` 34,000-crore investment, near port town of Paradip is nearing completion and will be commissioned by February 15, kicking in an 11-year tax deferment agreement that will cost the state ` 3,000 crore in earnings annually. It was also agreed at the meeting that GAIL and IOCL will tie up with Industrial Infrastructure Development Corporation for a city gas distribution. Odisha hopes to attract investment of ` 2.74 lakh crore at a proposed petroleum, chemicals and petrochemicals investment region at Kendrapara and Jagatsinghpur. (economictimes.indiatimes.com)

Iran's hydrocarbon complement India's energy need: Vice President of India

September 12, 2014. Iran's location and its hydrocarbon resources complement India's energy appetite and quest for new markets, Vice-President Hamid Ansari said. Ansari said the building of an under-sea gas pipeline from southern Iran to the west coast of India is among one of the four areas of cooperation for mutual benefit that are currently said to be on the drawing board. The other three areas relate to peace, stability and inclusive governance in Afghanistan, operationalisation of the road and possible rail link to Afghanistan through the Iranian port of Chabahar, functioning of the North-South Corridor through Iran to Central Asia and Europe, and a framework for ensuring freedom of navigation in the Persian Gulf and the Straits of Hormuz involving littoral, regional and global powers. He said that India's association with Iran runs deep into the past and bears marks of its vicissitudes. (economictimes.indiatimes.com)

IOC plans to automate 7,500 retail outlets in 2014-15

September 12, 2014. State-run Indian Oil Corporation plans to automate 7,500 outlets by 2014-15. Union Minister of State for Petroleum and Natural Gas Dharmendra Pradhan inaugurated the automation facility simultaneously at all Indian Oil retail outlets here by remote control. In Odisha, Indian Oil has automated 192 retail outlets and has planned to increase it to a total of 230 outlets in the financial year 2014-15, he said. The Union Petroleum Minister announced that a toll free helpline in Odia language will be launched soon. Any consumer dissatisfied with the services of a retail outlet or any other petroleum outlet will be able to lodge his complaint in the Odia language based toll free helpline. Pradhan also urged the consumers and general public to use facebook and twitter handle to communicate freely with the state-run oil utilities to vent their grievances. (economictimes.indiatimes.com)

Delay in gas price hike frustrating: BP

September 11, 2014. BP Plc, Europe's second-largest oil company, said the delay in implementation of a natural gas price hike was frustrating as the delay was holding back investments. BP, whose $7.2 billion investment in 2011 is the largest foreign investment in the energy sector in India, has lined up projects that will reverse the sinking natural gas production from eastern offshore KG-D6 fields. The investment, however, is unviable at current $4.2 per mmBtu gas rate. The government had in June 2013 approved a new gas pricing formula, which would have doubled the rate on its implementation from April, 2014. Sashi Mukundan, Regional President and Head of Country (India), BP Group, said after the formula was notified in January, only input numbers had to be keyed in and a new rate announced but this was delayed. He said China had announced a new gas price on June 27 and implemented it on June 28, 2013 while India is still debating. He said BP had a long term commitment to India. BP had in 2011 bought 30 per cent stake in Reliance Industries' 21 oil and gas blocks including Krishna Godavari basin KG-D6, for $7.2 billion. It has drawn elaborate plans to put satellite discoveries in the KG-D6 block on production as well as interventions to reverse the declining trend at the main fields in the block. (economictimes.indiatimes.com)

UP govt, IOC sign MoU for city gas projects

September 10, 2014. The Uttar Pradesh (UP) government and Indian Oil Corp (IOC) signed a memorandum of understanding (MoU) to expedite city gas projects and promote distribution of natural gas in the state. As a part of the MoU, it has been decided that a joint team would be constituted which would take necessary steps for speedy implementation of city gas project in Allahabad and other cities. In addition to this action plan for suitable schemes to promote natural gas in the state would also be prepared. Principal Secretary industrial development Sanjiv Saran said that under the MoU a plan would be chalked out to promote distribution of natural gas and infrastructure jointly by the state government and IOC. He said that under the plan new pipelines of city gas project and CNG stations would be set up. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

BHEL to accelerate UP thermal power projects

September 16, 2014. State-run engineering and power equipment enterprise Bharat Heavy Electricals Limited (BHEL) assured the Uttar Pradesh government of meeting timelines on the various thermal power projects in the state. The Navratna enterprise is working on commissioning unit one and two of Anpara D project (2X500 MW) before April and June 2015 respectively. Besides, it has undertaken repair of several units of Obra and Harduaganj thermal power projects. Two units of these projects are likely to be ready by November 2014. BHEL would assist UP state power generation utility, Utpadan Nigam, in improving the performance of 4 units of 250 MW each commissioned in the last two years in Harduaganj and Parichha. Jaypee Group paid ` 589 crore to BHEL against dues related to the 3X660 MW Bara thermal power project in Allahabad. Jaypee venture Prayagraj Power Generation Co is completing the project. (www.business-standard.com)

Over burdened West Bengal Govt goes for new hydropower projects

September 15, 2014. Over burdened with over 300% escalation of payable price for the output of major upcoming hydropower projects in its northern hilly region due to cost and time overrun because of political turmoil, West Bengal is going for four new projects in the same area. These projects are 84 MW Teesta Intermediate, 81 MW Teesta Low Dam I & II H.E. Project, 48 MW Rammam Stage-I and 80 MW Teesta Low Dam-V. But, the apparently encouraging news comes riding the fact that the state is already shouldering a huge load of cost and time overrun with the two existing large NHPC projects in the region. But the state does not seem to have any plan yet on how to handle that. (economictimes.indiatimes.com)

UCIL's Jaduguda mine closure to impact nuclear power output

September 15, 2014. The closure of Jaduguda mine of Uranium Corporation of India Ltd (UCIL) is set to impact nuclear power generation in the country, the company said. Jaduguda's uranium ore supply accounts for 25 per cent of raw-material that fuel 5,000 MW of nuclear power generation of the country. Jaduguda mine is the first uranium mine of the country where mining operations began in 1967. The current capacity is 1,000 tonnes of uranium ore per day. (economictimes.indiatimes.com)

MCL's 1.6 GW thermal power project to seek board nod

September 13, 2014. The first 1600 MW pithead thermal power project by Coal India Ltd (CIL) subsidiary Mahanadi Coalfields Ltd (MCL) is expected to be ratified at the next board meeting. Located in the Sundergarh district of Odisha, it is the maiden pithead thermal power project of CIL involving an investment of around ` 10,000 crore. MCL said the project has seen significant delay on account of issues regarding land acquisition, environment and forest clearance. MCL said around 800 acres has already been acquired and water linkages are in place. The plant would utilise coal from MCL's Basundhara coal mines. However, the end use of the power generated from the two 800 MW units - captive consumption or merchant power is still to be determined by Coal India board, MCL said. MCL has set a target of 127 million tonnes (mt) of coal production in 2014-15, a growth of 15 per cent over the previous fiscal. MCL has produced 36.28 mt of coal in the period from April-July 2014, surpassing the target of 36.10 mt. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

DVC to resume power supply to Madhya Pradesh after coal stock rises

September 16, 2014. Government-run power producer Damodar Valley Corporation (DVC), which had snapped supply to Madhya Pradesh after dues mounted to ` 800 crore, has agreed to resume the service once the coal stock in its plants improves. Coal stocks in the Kolkata based company's three plants are barely sufficient for two-three days and these units cannot increase generation unless the fuel supply improves. DVC had been supplying 500 MW power to Madhya Pradesh that was first reduced and then completely stopped. The units 5 and 6 of DVC's Mejia Thermal Power Station supplied about 200 MW, as did its Chandrapura Thermal Power Station, while DVC's Durgapur Thermal Power Station contributed the rest. According to data provided by the National Load Des patch Centre, demand in Madhya Pradesh ranges between 6,000 MW and 7,500 MW, and the state has not reported any shortfall in power supply during the peak period even after DVC completely snapped supply. DVC's total dues from utilities stand at ` 7,700 crore, of which the Jharkhand state utilities owe about ` 5,000 crore, BSES Yamuna and BSES Rajdhani about ` 1,000 crore, Madhya Pradesh owes about ` 700 crore and a number of small companies in West Bengal account for the rest. (economictimes.indiatimes.com)

CERC pushes for smooth electricity import from Bhutan

September 14, 2014. To facilitate seamless integration of upcoming Bhutanese power projects with Indian market, Central Electricity Regulatory Commission (CERC)) has asked Central Electricity Authority (CEA) to discuss the matter with various stakeholders from both sides and complete the deliberations in three months time. The CERC's proposal comes at a time when many power generation projects are in the pipeline in Bhutan. India already imports electricity from hydel projects located in the neighbouring nation. In August, 1,004 million units of electricity was imported from Bhutan. India has an installed power generation capacity of over 2.53 lakh MW, as per latest official data. CEA is the apex planning body for domestic power sector. Besides, the CERC has said that the concerned Bhutanese authorities to participate in the discussions to arrive at a mechanism while keeping in mind the emerging requirements of multi-seller and multi-buyer power transactions between the two countries. The suggestion is part of a CERC order, issued on September 11, on a petition filed by Tata Power Trading Company for importing electricity from the upcoming 126 MW Dagachhu hydel project in Bhutan. The project, being developed by a joint venture of Druk Green Power Corp and Tata Power Company, is likely to be declared under commercial operation shortly. Druk Green Power Corp is an undertaking of Bhutan government. Tata Power Trading Company, a wholly-owned subsidiary of Tata Power Company, has been granted a license for inter-state trading in electricity. The regulator has approved an interim arrangement, that is subject to certain conditions, for Tata Power Trading Company for scheduling and energy accounting of power injected from Dagachhu project. (economictimes.indiatimes.com)

UP facing unprecedented power crisis

September 11, 2014. Even as war of words between the Centre and Akhilesh Yadav government escalates over coal supply to Uttar Pradesh power plants, the power situation continues to be grim. Coal supply shortage has led to temporary shutdown of several thermal power units, while other units are facing similar fate unless their depleting coal reserves are replenished early. The state has blamed the Centre for not giving adequate coal supply to existing power plants plunging UP into unprecedented power crisis. Of late, the chief minister had been writing to the Centre seeking greater coal supply for thermal power units. Recently, two proposed power plants to be set up by Torrent Power (1,320 MW in Sandila) and Bajaj Hindusthan Group (Lalitpur extension project 1,980 MW) had withdrawn from projects due to lingering delays in getting coal linkage. In his fresh letter to union minister of state (independent charge) for power and coal Piyush Goel, Yadav has sought long term power linkage for seven power plants totalling 7,040 MW capacity proposed under the memorandum of understanding (MoU) route. Nine entrepreneurs had signed MoUs with the state government during the previous Mayawati regime to establish power plants of 10,340 MW capacity. These required long term coal linkage of 25 years. Now, the state wants the remaining seven projects to stay afloat, including the 1,980 MW Lalitpur project, so as to enable commissioning of its first unit of 660 MW by July 2015. He said unit I of this plant had been provided only with ad hoc long term coal linkage so far. Yadav mentioned UP was facing acute power shortage of power. Meanwhile, the power generation of state owned power plants has dipped to 1,700 MW and UP Power Corporation Limited (UPPCL) is importing almost 6,400 MW from central sector, besides procuring power from energy exchange to the extent of 1,500 MW. Together with power generation from hydropower units, private sector and bilateral arrangement, the total power availability in UP is roughly 10,000 MW against the demand of over 13,000 MW. As a result, the state is facing long hrs of power cuts with rural areas getting only about 6 hrs of power every day. Even the big cities are facing long power cuts. (www.business-standard.com)

No power shortage in Haryana: Discoms

September 10, 2014. Haryana power utilities claimed no power shortage in the state despite contracted power supply from Adani Power and other sources. Coastal Gujarat Power Ltd (CGPL) is supplying 220 MW power Haryana daily against the contracted 400 MW. Haryana government had already threatened to take legal action against Adani Power (APL) by charging it with the "breaching terms" of power purchase contract. The Haryana Government had accused APL of disconnecting 1,424 MW of contracted power to the state "arbitrarily" and with "mala fide intention". Haryana had contracted 1,424 MW of power from APL in 2007 from its power project located at Mundra in Gujarat.

Haryana Power Minister Harmohinder Singh Chattha sought intervention of Union Minister of State for Power, Coal and New and Renewable Energy Piyush Goyal to resolve the issue of suspension of power supply to Haryana by Adani Power. Power utilities claimed to have made adequate arrangements of up to 10,625 MW of power supply during June to September this year to meet the requirement of power consumers. (economictimes.indiatimes.com)

'Transmission reforms would bring down power losses'

September 10, 2014. The Centre has asked states to do their bit in transmission reforms and strengthening last-mile connectivity. The annual meeting of power ministers of states and Union Territories with Piyush Goyal, Union minister of state for coal, power and renewable energy, and the officials of these ministries, focused on the rollout of two major schemes for the sector announced in the Budget. The schemes are: Deendayal Upadhyaya Gram Jyoti Yojana, which proposes feeder separation for the rural areas; and Integrated Power Development Scheme, which focuses on strengthening the sub-transmission and distribution networks and metering in urban and semi-urban areas. (www.business-standard.com)

Policy / Performance………….

24-hour power supply to all from October: AP CM

September 16, 2014. Andhra Pradesh (AP) Chief Minister (CM) N Chandrababu Naidu declared that his government would ensure round-the-clock supply of power to industry and domestic consumers from next month. AP will be the second state to achieve this distinction after Gujarat. Marking the completion of 100 days in office, the Andhra Pradesh government signed a number of MoUs with private and central government entities for projects entailing a total investment of over ` 80,000 crore of which the power sector contributes a substantial portion. These projects include 2,500 MW of solar power parks proposed to be set up in three different locations and a 4,000-MW super critical thermal power project proposed in Visakhapatnam district by NTPC Limited. The government also signed a joint statement with the Centre towards committing 24-hour supply of power for all in the state. By 2019, AP will have 27,000 MW of installed capacity, three times that of the present capacity in the state. Power Minister Piyush Goyal advised the AP government to encourage consumers to pay their power bills through bank accounts to give a further push to the ‘Jan Dhan Yojana'. (www.business-standard.com)

60 per cent power supply restored in Kashmir: Omar

September 14, 2014. Stepping up efforts to re-establish normalcy in the flood ravaged state, Jammu and Kashmir Chief Minister Omar Abdullah said 60% power supply has been restored in Kashmir Valley so far. On restoration of power infrastructure the Chief Minister said 85 per cent power supply has been restored in Jammu region. He assured that that cent per cent power supply will be restored across Jammu division within 15 days. Floods caused by incessant rains had extensively damaged the power infrastructure in Jammu and Kashmir. (www.business-standard.com)

Delhi homes consume the most power, Tamil Nadu ranks third

September 11, 2014. Delhi is literally the power capital of India, followed by Goa, Tamil Nadu, Punjab, Haryana and Kerala in that order, going by the per capita domestic power consumption statistics for 2013-14 released by a research firm. The national capital and the tourist paradise of Goa have, in fact, held the top two slots for some years, but Tamil Nadu has overtaken Punjab and Haryana to move to third place in 2013-14, according to a study on per capita consumption of power by Chennai-based research-cum-consulting firm Athena Infonomics India. Strangely, some of the more developed states, including Maharashtra, Gujarat, Andhra Pradesh and Karnataka, are ranked further down, indicating lower levels of electrification and wide disparities in affluence and consumption. The study seeks to analyse the link between domestic power consumption and quality of life. It reveals that Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh, along with Odisha, Chhattisgarh, Jharkhand and Assam are far below the national average of 156 kWh (units) in per capita consumption. Bihar is the worst at 43 units per individual per annum, only 7.5% of what an average resident in Delhi consumes. (economictimes.indiatimes.com)

NDA govt fast tracking power projects in the Northeast India

September 11, 2014. NDA government has started fast tracking power projects in Northeast India. The government of India has assured coal linkage to the proposed 660-MW Margherita Thermal Power Project in Assam. Assam applied for 1.83 million metric tonnes of coal per year from the Eastern Coal Fields so that an equivalent quantum of coal from the North Eastern Coal fields can be utilised for the proposed plant at Margherita. Union power ministry is also working for breaking the stalemate in the NHPC's 2000 MW Lower Subansiri hydro power project along Assam-Arunachal Pradesh border which is stalled since 2011 following massive protest from the anti dam groups. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

OVL to expand O&G exploration in offshore Vietnam

September 16, 2014. ONGC Videsh Ltd (OVL), the overseas arm of state-run explorer Oil and Natural Gas Corp (ONGC), has signed an agreement to expand its oil and gas exploration in offshore Vietnam. The Indian flagship firm will consider exploring in 2-3 blocks out of the 5 areas in South China Sea that Vietnam had offered on nomination basis in November last year. The five blocks or areas - 17, 41, 43, 10&11-1 and 102&106/10, offered in November last year lie outside the territory claimed by China in the South China Sea. OVL had relinquished Block 127 in offshore Phu Khanh Basin after it failed to find any oil or gas in the area. Though it had decided to withdraw from adjacent Block 128, it has decided to stay put because of India's strategic interests in the region. The exploration period for the block has been extended until June 15, 2015. China claims sovereignty over most of the South China Sea where Block 127 and 128 are located and had warned the Indian arm from drilling in the region. OVL continues to own 45 per cent in Vietnam's offshore block 6.1 and its share of production was 2.023 billion cubic metres of gas and 0.036 million tonnes of condensate. (www.business-standard.com)

FOGL makes progress ahead of 2015 drilling campaign

September 16, 2014. Falkland Oil and Gas Limited (FOGL) reported that it is making progress with its preparations for its next drilling campaign, which is scheduled to start during the first quarter of 2015. The company has agreed three drilling locations in the North Falkland Basin with its partners, Premier Oil and Rockhopper Exploration. In the South Falklands Basin the firm is working with Noble Energy and Edison International to finalise well locations for the 2015 drilling campaign as seismic data over the area continues to be evaluated. FOGL expects to take part in a five-well drilling program that will target more than 1.3 billion barrels of oil off the Falkland Islands. FOGL is the largest license holder of the six oil companies operating in the islands, with a net interest of more than 14,750 square miles. (www.rigzone.com)

Ophir finds gas at Silenus East-1 well in Equatorial Guinea's Block R

September 16, 2014. Africa-focused Ophir Energy plc announced that it has found gas at Silenus East-1 well in Equatorial Guinea's offshore Block R, with the result providing more resources to expand the block's floating liquefied natural gas project by 0.5 million tons per annum. The Silenus East-1 well contains around 405 billion cubic feet of mean recoverable gas and total mean recoverable gas in the broader Silenus area is now estimated at around 1.2 trillion cubic feet. (www.rigzone.com)

Homes near gas wells in Texas face worsening water issues

September 15, 2014. Homes in a Texas community face worsening water contamination caused by nearby gas production, according to a study released. The findings from an analysis by independent academics counter statements by driller Range Resources Corp and state regulators, who have said their evidence shows gas drilling wasn’t responsible for the presence of explosive methane in the homeowners’ water wells. Separate testing that found evidence of contamination from drilling at seven areas in Pennsylvania also was included in the study. The study, published in the peer-reviewed Proceedings of the National Academy of Sciences, linked contamination to failures of cement or production casing, not the injection of water, chemicals and sand into the ground. It challenges supporters of oil and gas, who say there is no evidence that recent boom in drilling or production has contaminated water. The spread of horizontal drilling and hydraulic fracturing has led to a boom in U.S. production, much of it in the Marcellus Shale in Pennsylvania and the Barnett Shale in Texas. The boom in production has spurred complaints from homeowners who say fracking has made their well water unhealthy. The results from the Duke-led study showed the water from five of the 20 wells tested exceeds minimum safety level, including the two wells that were clean and then acquired dangerous levels of methane in later tests. Researchers said the gas wasn’t from the production zone of the Barnett shale, but from the shallower Strawn formation. That gas was likely conducted through the drilling rings to the groundwater, the paper said. Range Resources say it’s not responsible for the gas in the wells, and said the cause could have been older oil or gas wells, or water wells that penetrated into the Strawn. (www.bloomberg.com)

CNOOC makes deepwater gas field discovery in South China Sea

September 15, 2014. China National Offshore Oil Corp (CNOOC) has made a deepwater gas field discovery in the northern part of the South China Sea, it said. The offshore oil and gas specialist found a high volume of gas flows in the Lingshui 17-2 well in August, it said. Lingshui 17-2 gas well was tested to produce 56.5 million cubic feet of natural gas per day. However, analysts believe it may take a long time before the field can contribute to CNOOC's production. Lingshui 17-2 is the first significant deepwater gas discovery made by semi-submersible rig CNOOC 981, which started operation in May 2012, CNOOC said. (www.rigzone.com)

Thai PTTEP to spend $1 bn for Mozambique project in next 5-6 yrs

September 15, 2014. Thailand's top oil and gas explorer, PTT Exploration and Production Pcl, said it planned to spend up to $1 billion for a Mozambique project over the next five to six years starting from 2015. The project, which will link to a liquefied natural gas terminal, aims to produce 10 million tonnes of LNG a year by late 2018 or 2019. (www.rigzone.com)

Russia's SeverEnergia launches new gas production stage

September 15, 2014. SeverEnergia, a joint venture between Russia's Novatek and Gazprom Neft, has expanded natural gas production at its Arctic field, to help it meet its output targets, Novatek said. Novatek said that SeverEnergia has launched the third stage of the Samburgskoye gas condensate field in Yamal-Nenets Autonomous Region. The development of fields in the Russian Arctic region is important for the country's overall natural gas production. Novatek said the launch of the third stage, which exceeds two billion cubic metres of natural gas each year, will enable the field to achieve peak production capacity of roughly 7 billion cubic meters (bcm) of natural gas and more than 900,000 tonnes condensate a year. The field's proven reserves were 90 bcm of natural gas and 14.3 million tonnes of liquids. Commercial production at the field started in April 2012. In 2013, the field produced 4.8 bcm of natural gas and 646,000 tonnes of liquids. (www.rigzone.com)

Saudis cut production as Brent slips below $100 a barrel

September 11, 2014. Saudi Arabia, the world’s biggest crude exporter, said it cut production by 408,000 barrels a day last month amid signs of a supply glut and Brent oil trading below $100 a barrel. The Saudi reduction came as other members such as Nigeria and Kuwait said they increased output in submissions to the Organization of Petroleum Exporting Countries (OPEC), according to the group’s monthly oil market report. Total production by the 12-member group climbed by 231,000 barrels a day to 30.347 million last month, based on secondary sources, the report showed. The Saudi decline is the largest monthly drop in production since December 2012. Other estimates collated by OPEC, based on secondary sources, show that the kingdom cut output by 55,200 barrels to 9.86 million a day last month. Brent, a benchmark for more than half the world’s oil, fell to a 17-month low this week as supplies from Libya rebounded, and amid speculation of an oversupply. Banks including Citigroup Inc. and UBS AG said the price decline would increase the chances of Saudi Arabia curbing supplies. (www.bloomberg.com)

Billionaire Fredriksen’s Rosneft deal still risks sanctions

September 11, 2014. Seadrill Ltd and North Atlantic Drilling Ltd, the rig companies controlled by billionaire John Fredriksen, said sanctions against Russia may still affect a $4.25 billion deal with OAO Rosneft. North Atlantic and Rosneft rushed to sign five-year contracts for six offshore rigs at the end of July, just days before the European Union broadened sanctions against Russia to target its energy sector directly. Seadrill, which owns 70 percent of Hamilton, Bermuda-based North Atlantic, said at the time the contracts appeared not to be affected by the restrictions. The offshore-rig contracts are part of a broader framework agreement that will also see Rosneft take over a $1 billion stake in North Atlantic in return for about 150 onshore rigs and a cash payment. The second part of the agreement, announced last month, showed Fredriksen, who owns 23 percent of Seadrill, is willing to bet on Russia just as other companies are reconsidering their exposure amid escalating sanctions over the country’s role in the Ukraine conflict. (www.bloomberg.com)

Kuwait Energy discovers oil at Faihaa-1 well in Block 9 in Basra, Iraq

September 11, 2014. Dragon Oil plc, an international oil and gas exploration, development and production firm based in Dubai, United Arab Emirates, announced that field operator Kuwait Energy has struck oil at Faihaa-1 exploration well in Block 9 in northern Basra, Iraq. The successful discovery was made by the consortium, comprising Kuwait Energy and Dragon Oil in a 70-30 percent partnership, at the Mishrif formation at 8,858 feet in the Block 9 exploration well. Preliminary tests of the Faihaa-1 Mishrif formation resulted in a flow rate of circa 2,000 barrels of oil per day of 20 degree API oil on 32/64 inch choke. (www.rigzone.com)

Downstream…………

Spain's Tecnicas Reunidas wins $500 mn order from Pemex

September 15, 2014. Spanish oil engineering company Tecnicas Reunidas said it had won a contract from Mexican state-run oil company Pemex for a refining project worth over $500 million. The two-part contract includes the designing, engineering, construction, supplying and starting up of three new refining units for Pemex's General Lazaro Cardenas de Minatitlan refinery. The work forms part of Pemex Refinacion's $5.5 billion development and modernisation plan, Tecnicas Reunidas said. (www.downstreamtoday.com)

Egypt expects $425 mn from IDB

September 14, 2014. Egypt said it expected to receive around $425 million in funding from the Islamic Development Bank (IDB) to develop an oil refinery in Assiut and an airport in the Red Sea resort of Sharm el-Sheikh. The first agreement is for $198 million earmarked for the refinery, the finance ministry said. A further $8.23 million will go towards the first phase of the Sharm el-Sheikh airport project, it said. Egypt has requested a further $223.2 million for the second phase of the project. (english.alarabiya.net)

Cheapest US gasoline since 2010 set to get cheaper

September 11, 2014. Drivers across the U.S. enjoying the lowest pump prices for this time of year since 2010 will probably see further declines as refineries benefiting from the shale boom produce record amounts of fuel. The average is $3.428 a gallon, down 6.2 percent since Memorial Day on May 26, AAA data show. That’s the largest decline from the start of the summer driving season since 2008. U.S. refineries operated at the highest-ever seasonal rates every week since July 4. Processors are using domestic crude that costs less than foreign imports as horizontal drilling and hydraulic fracturing in shale formations increased output to the most since 1986. Gasoline will drop another 10 to 20 cents a gallon by the end of October as retailers switch to cheaper winter-blend fuel, said AAA, the largest U.S. motoring group. (www.bloomberg.com)

Transportation / Trade……….

Ukraine conflict forces eastern states to stockpile gas

September 12, 2014. Eastern European nations from Poland to Serbia are boosting stockpiles of natural gas after Russia reduced deliveries during the armed conflict in eastern Ukraine and concerns rose about a winter shutoff. Underground storage in the Czech Republic and Poland is at full capacity, while Slovakia expects to top up its storage facilities in the next several days, the countries’ gas companies said.

Serbia, whose sole depot has a capacity of 450 million cubic meters, may ask neighboring Hungary to store as much as 200 million cubic meters of gas in its reservoirs, according to Energy Minister Aleksandar Antic. As a result, southeastern Europe’s governments were long reluctant to halt preparatory work on Gazprom’s South Stream project, designed to run under the Black Sea from Russia and enter the EU in Bulgaria, bypassing Ukraine. Authorities were betting on the 2,446-kilometer pipeline to boost the security of supplies and halted the construction under lobbying from Brussels and the U.S. earlier this year. (www.bloomberg.com)

BASF buys oil, gas assets from Statoil to secure European supply

September 12, 2014. BASF SE’s oil and gas arm agreed to buy assets from Norway’s Statoil ASA for $1.25 billion, diversifying energy supplies for Germany’s biggest chemical maker as relations between Europe and Russia worsen. BASF’s Wintershall is acquiring a share in two producing fields, two development projects, the Polarled pipeline project and a share in four exploration licenses, the Ludwigshafen, Germany-based company said. Wintershall’s daily production in Norway will increase 50 percent to about 60,000 barrels of oil equivalent.

The Norwegian deal will make BASF, Germany’s largest industrial user of gas, less reliant on supplies from Russia as the U.S. and European Union ratchet up sanctions in response to the conflict in Ukraine. An asset swap with OAO Gazprom, agreed to in 2012 and expected to close this autumn, was set to boost Russia’s share of BASF’s supply to more than half the total. (www.bloomberg.com)

Japan's Tepco signs 17 year LNG supply deal with BP unit

September 12, 2014. Japan's Tokyo Electric Power Co (Tepco) said it has signed a 17-year deal to buy up to 1.2 million tonnes per year of liquefied natural gas (LNG) from the Singapore unit of UK oil and gas major BP starting from April 2017. The LNG will be sourced from BP's portfolio, rather than a specific project, and the prices will be linked to the U.S. Henry Hub gas index rather than oil prices. LNG imports by Japan, the world's top buyer of the super-cooled fuel, has risen since 2011 when the Fukushima nuclear disaster lead to all of the country's nuclear reactors being shut down to face more stringent safety checks. (www.downstreamtoday.com)

Shell revives plan to sell European LPG business

September 12, 2014. Anglo-Dutch oil group Royal Dutch Shell has appointed Credit Suisse to advise on the sale of its European liquefied petroleum gas (LPG) business. The business, which it previously tried to sell in 2010, could be valued at as much as 1 billion pounds ($1.63 billion) and is expected to attract bids from private equity firms as well as trade buyers. (www.downstreamtoday.com)

Gazprom first-quarter profit falls 41 per cent on Ukrainian gas debt

September 11, 2014. OAO Gazprom, Russia’s biggest company, said its first-quarter profit slumped 41 percent on a foreign currency loss and Ukraine’s debt for natural gas supplies. Net income dropped to 223 billion rubles ($6 billion) from 381 billion rubles a year earlier, the Moscow-based exporter said. Gazprom, which provides 30 percent of the European Union’s gas, halted supplies to Ukraine in June over unpaid bills, including $1.45 billion from 2013. The Russian producer now estimates it’s owed $5.3 billion after raising the price for Ukraine in April to a level higher than it charges Germany, which the government in Kiev has rejected as unfair. Gazprom’s deliveries to Europe, its biggest market by earnings, have been falling compared with last year’s levels since June. The region has a record volume of gas in underground storage after a mild winter and accelerated pumping earlier this year. (www.bloomberg.com)

Australian LNG contracts under pressure from US, Russia supply

September 10, 2014. Australian liquefied natural gas (LNG) producers may face pressure to renegotiate long-term sales contracts amid a flood of low-cost supply into Asia, according to former BHP Billiton Ltd. executive Alberto Calderon. Russia and the U.S. are developing projects with capacity to produce about 100 million metric tons a year that will determine the long-term LNG price for China, Calderon, a board member of Orica Ltd, said. Cheniere Energy Inc. and Sempra Energy are among companies seeking to tap the U.S. shale boom and build LNG export projects to compete with Australian suppliers that are constructing seven developments at a cost of about $190 billion. Russia will be able to supply gas at about $11 per million British thermal units, compared with $12.50 to $16 for Australian producers, Calderon said. Australia is poised to surpass Qatar as the world’s biggest supplier of LNG. Exports are forecast to climb to 83 million tons a year by 2020, compared with 79 million tons for Qatar. (www.bloomberg.com)

Policy / Performance…………

Nigeria to triple natural-gas output for power supply

September 16, 2014. Nigeria aims to almost triple its natural gas production capacity by 2020 to help meet the West African nation’s power and industrial development needs, Oil Minister Diezani Alison-Madueke said. Africa’s biggest oil producer wants to increase capacity to 11 billion cubic feet per day, from about 4 billion cubic feet, Alison-Madueke said. Royal Dutch Shell Plc and Nigeria LNG Ltd. are among companies with interests in gas production in Nigeria. Along with the power ministry, the central bank and the electricity regulator, the oil ministry has agreed to a sales price of gas to power plants of $2.50 per million standard cubic feet, with an additional 80 cents for transportation, the minister said. (www.bloomberg.com)

BP seeks access to $750 mn Transocean insurance

September 16, 2014. BP Plc, which already has paid more than $28 billion for the 2010 Gulf of Mexico oil spill, seeks to get a $750 million chunk of that back by convincing a Texas court that a missing comma may give the oil company access to Transocean Ltd. (RIG)’s insurance policies on the Deepwater Horizon. BP filed claims with Transocean’s carriers in 2010, seeking to tap a $50 million primary policy issued by Ranger Insurance and $700 million in excess coverage from Lloyd’s of London and other underwriters. The carriers asked the court overseeing the spill litigation to rule that BP wasn’t entitled to unlimited access to Transocean’s insurance.

Energy industry associations representing owners of most of the world’s drilling rigs and insurance syndicates covering global exploration activities are watching the case intently and weighed in with legal arguments of their own, supporting Transocean. At issue is whether BP can claim that insurance policies bought by Transocean, owner of the Deepwater Horizon rig that blew up in the Gulf, covered the oil company for the disaster or if the Macondo drilling contract limited coverage. (www.bloomberg.com)

Indonesia expects output from Exxon Mobil's Cepu block to peak in July or Aug

September 15, 2014. Indonesia expects crude output from Exxon Mobil Corp's Cepu oil block to peak in July or August next year, an official from the country's oil and gas regulator said. The Banyu Urip field, part of the Cepu block near Surabaya in East Java, is expected to produce on average 119,000 barrels per day (bpd) next year. Exxon is developing the Banyu Urip field along with state energy firm Pertamina. With contribution from Cepu, Indonesia is targeting total crude output of 845,000 bpd in 2015. (www.rigzone.com)

Congo preparing tender for several oil blocks: Oil Minister

September 15, 2014. Democratic Republic of Congo plans to issue a tender for oil blocks in its western coastal basin, Oil Minister Crispin Atama Tabe said. Oil Minister Crispin Atama Tabe said that investment opportunities would become available in the Nganzi, Mavuma, Nduna, Yema and Matamba-Makanzi blocks, referring to areas located near the mouth of the River Congo and the border region with Angola's oil-rich Cabinda enclave. Congo is keen to develop its underdeveloped oil sector, which produces just 26,000 barrels per day. (www.rigzone.com)

45 year high US oil output may cut pump price, imports

September 11, 2014. U.S. crude production will surge to a 45-year high next year, lowering prices and reducing the need for imports, government forecasters said. The U.S. Energy Information Administration (EIA) raised its estimate of 2015 output by 250,000 barrels a day to 9.53 million, the most since 1970, the EIA said. The agency forecast output of 8.53 million barrels a day this year, up from 7.45 million in 2013. (www.bloomberg.com)

Norway wins interest from 47 oil firms in licensing round

September 11, 2014. Norway received applications from 47 energy firms, including most majors operating in the country, for oil and gas licences in mature areas, offering a boost for the sector which struggled with poor exploration results this year, the oil ministry said. Norway each year hands out licences in areas already opened for exploration, hoping to attract energy firms back to blocks passed over in previous rounds or already abandoned. The licensing rounds have attracted a plethora of smaller explorers and also yielded major finds, including parts of Norwegian company Statoil's Johan Sverdrup field, which holds up to 2.9 billion barrels of oil equivalent. Energy firms are returning to areas they once passed over as seismic technology improves, or the size of finds in other areas decreases. Norway also offers a 78 percent rebate on exploration costs, make it relatively cheap to drill, attracting smaller explorers. Applicants in the 2014 round include Statoil, Shell, Centrica, ConocoPhillips, ExxonMobil , E.ON and GDF. Awards are expected in January, the ministry said. A year earlier, Norway attracted applications from 50 companies. Spending in Norway's oil sector is expected to hit a record high $33 billion this year. However, Statistics Norway recently forecast a drop of 7.5 percent next year, as energy firms delay or cancel projects to cut costs and save cash. Notable exploration failures, particularly in the Arctic Barents Sea, could also curb the appetite for exploration, analysts said. New licences in frontier areas will not be awarded until 2016 as the government needs more time to prepare to give out blocks in an Arctic zone bordering Russia. (www.rigzone.com)

IEA cuts oil-demand estimates as Saudi exports drop to 2011 low

September 11, 2014. The International Energy Agency (IEA) cut its global oil demand forecasts for 2015 and said Saudi Arabia exported the least in almost three years amid slowing purchases from China and Europe. Global demand will increase by 1.2 million barrels a day, or 1.3 percent, to 93.8 million barrels a day next year, the Paris-based adviser to 29 nations said in a report. The expansion is 165,000 barrels less than it predicted a month ago. Second-quarter growth in consumption slid to a 2 1/2 year low, spurring Saudi Arabia to export the least since September 2011. Brent crude futures slipped below $100 a barrel for the first time in 14 months amid booming U.S. shale output, constrained demand and speculation that crises in Iraq, Libya and Ukraine will spare oil supplies. U.S. production is poised to hit a 45-year high next year, according to the Energy Department. The IEA said it curbed its 2015 estimates in anticipation of weaker economic growth forecasts from the International Monetary Fund in October. Next year’s demand projections for China were cut by about 100,000 barrels a day, to 10.6 million a day. Second-quarter demand growth fell to 480,000 barrels day, the first time in about two years that it’s been below 500,000 barrels, the IEA said. The slowdown fed into forecasts for growth in the third quarter, curbed to 800,000 barrels day from the 1.1 million a day predicted last month. The IEA forecast as recently as June that third-quarter growth would be 1.4 million barrels day. The IEA cut its projection for demand growth in 2014 by 65,000 barrels a day because of weaker performance in China and Europe, forecasting that worldwide consumption will expand by 900,000 barrels a day to average 92.6 million this year. The agency lowered estimates for the amount of crude that the Organization of Petroleum Exporting Countries will need to produce by 200,000 barrels a day for this year and 300,000 a day in 2015. (www.bloomberg.com)

[INTERNATIONAL: POWER]

Generation……………

Singapore's Sembcorp to launch power project in China

September 15, 2014. Singapore's Sembcorp Industries said that it plans to expand its energy business in China by collaborating with a subsidiary of Chongqing Energy Investment Group, Chongqing Songzao Coal and Power LLC, on a mine- mouth coal-fired power project in western China's Chongqing municipality. The conditional agreement includes the acquisition of a 49- percent stake in an existing 300 MW coal-fired power plant as well as in the joint development of an adjacent 1,320 MW coal-fired power plant, which will be one of the most efficient power plants in Chongqing.

The entire project will cost approximately six billion yuan (996 million U.S. dollars), and will enable Sembcorp's power capacity in China by about 2.5 times to 2,607 MW. This transaction is expected to be completed by 2015 upon the satisfaction of certain conditions precedent, while the 1,320 MW project is likely to be completed in 2017, Sembcorp said. (www.globalpost.com)

Iran to start construction of 2 new nuclear power plants

September 15, 2014. Iran plans to start construction of two new nuclear power plants by the end of the current Iranian calendar year. The Atomic Energy Organization of Iran (AEOI) said that the final negotiations are underway with the Russians to build the plants. The two plants will have the capacity to produce 1,000 MW of electricity. AEOI said that Iran has reached an agreement with Russia to construct two more nuclear power plants. Tehran is reportedly negotiating with Moscow over construction of eight nuclear reactors. Iran and Russia has agreed over a nuclear protocol for construction of new nuclear reactors.

If the two sides sign the agreement, Iran will officially be able to construct the new reactors and went on to note that the two countries have already agreed over construction of two power reactors. The country has a contract with Russia which obligates Moscow to build four other nuclear power plants in the country. Based on a contract which was signed in 1992, Russia is supposed to construct the power plants at the request of Tehran. Iran will start construction of its second nuclear plant this year. (en.trend.az)

South Africa's Eskom says delayed Medupi power plant to start Dec 24