-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: New Energy Identities: False Notions of ‘Us’ and ‘Them’

Ø COAL: Clubbing Coal, Power & Renewable energy Will Generate Multiplier Effect

DATA INSIGHT

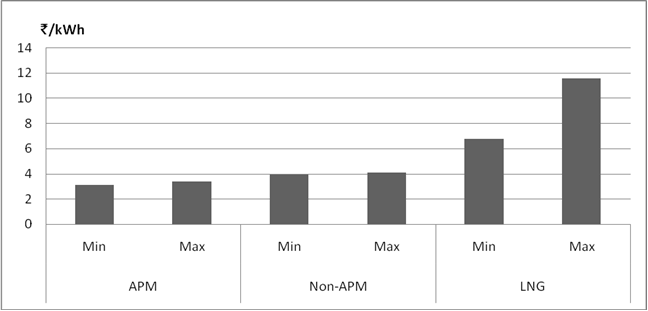

Ø Is LNG based Power Generation viable?

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· Oil found in KG basin gas field

· OVL and Russia's Rosneft in pact to explore oil, gas

· Cairn India's Rajasthan oil fields may return to ONGC if term not extended

· HPCL to buy 11-15 pc stake in Petronet LNG’s east coast terminal

· Alstom commissions NHPC's Uri project in J&K

· Tata Power eyes SAARC, SE Asia, Africa for growth

· NTPC might build plant to run on imported coal

· BHEL commissions 520 MW hydro power project in HP

· KPTCL to take up works to mitigate power situation

· India Power secures distribution licence for Gurgaon

· Alstom T&D India bags order to renovate Bihar grid

· Hungary's MOL finds oil, gas onshore Kazakhstan

· Total agrees to Lukoil shale deal, brushing off Russia sanctions

· UK’s south England holds billions of barrels of shale oil

· Russia's refinery runs down 6.1 pc in April from March

· Increase in US oil production creates new issues for refiners

· Australia's Woodside scraps landmark Israeli gas field deal

· Russia, China sign $400 bn gas deal after decade of talks

· EDC to invest in 220 MW plant in Indonesia

POLICY & PRICE

· India debates gas price hike, China contracts at US $11-13 per mmBtu

· GAIL plans more LNG deals with US

· Govt directs ONGC to pay record ` 563.8 bn in subsidy

· 24x7 supply a priority: PowerMin to new govt

· Coal India unions okay with splitting units, but not stake sale

· Tamil Nadu govt lifts power curbs on bulk consumers

· Pre-paid electricity meters can help people manage consumption

· No hike in power tariff in Madhya Pradesh for 2014-15

· UP govt to expedite pending power projects

· Can't waive 50 pc power bills of defaulters: Delhi govt to HC

· 5 challenges Modi govt will face to reform Coal India

· China CNPC sees to invest at least $2 bn in Peru after Petrobras deal

· Iraq will import gas for power generation till 2018

· ‘Indonesia's Cepu block to triple oil output this year’

· Modi govt may focus on increasing wind, solar power capacity: PwC

· TEDA to organize Renergy 2014 in June

· Suzlon Energy expects environment for huge investments in Modi regime

· Mercom may lower India solar power installation forecast if duties are imposed

· British Columbia said to seek lower LNG carbon emissions

· Hareon Solar to build 2 MW PV power plant in Kochi, Japan

· Saudi Arabia’s key clean energy strategist leaves post

· Australia set to fund second clean-energy project at remote mine

· China boosts offshore wind power development

· US wood pellet exports double on British demand surge

· China solar makers seek talks to resolve trade dispute with US

WEEK IN REVIEW

ENERGY

New Energy Identities: False Notions of ‘Us’ and ‘Them’

Lydia Powell, Observer Research Foundation

|

T |

he war against fossil fuels in general and coal in particular is gathering momentum. First was the Grantham institute report titled ‘Un-burnable Carbon 2013: Wasted Assets and Stranded Capital’ released last year. The report essentially sought to label fossil fuel assets of energy companies as sub-prime assets. This was Grantham’s way of nudging investors away from fossil fuels. In early 2014, the World Bank President commented that pension funds should pull out from investing in fossil fuels and instead put their money in green assets. This month Stanford University announced that its $18.7 billion endowment would pull out from investing in coal companies in response to calls by student environmental activists. Media reports suggest that pressure is mounting on Harvard to pull out its much larger endowment money from coal companies. The Guardian has reported that the movement is spreading into Europe and is backed by the likes of Rev Desmond Tutu. It also reported that the Natural Resources Defence Council has teamed up with the big investment house Blackrock and the FTSC group to launch a global equity index that specifically excludes fossil fuels. Given that the cost of generating mass hysteria over anything has come down dramatically, we can expect many more ‘me-too’ moves from around the world in the future.

Some observers have dismissed the revolt against coal (and fossil fuels) as being merely symbolic. The sum likely to be withdrawn from the sector by Stanford for example is insignificant compared to the total size of the industry. According to the international energy agency (IEA) cumulative investment in coal based power generation between 2013 and 2035 is expected to be in the range of $13 trillion. Out of this, more than half is expected to come from China which is unlikely to be affected by any decision taken by Stanford or Harvard. Overall the exit of few billion dollars is unlikely to have an impact on coal use, especially in developing nations such as China and India.

However the symbolic war against fossil is creating false identities of ‘us’ (those who shun investments in coal and fossil fuels) and ‘them’ (those who invest in fossil fuels) which cannot be dismissed as harmless activism. Identities are defined through difference and a ‘self’ requires an ‘other’. Though ‘otherness’ does not necessarily imply danger, the climate discourse is predicated on the discourse of danger and this could become the means by which false energy identities are generated. It is very likely that the constant articulation of danger through climate policy has played a part in students from these reputed academic institutions to separate ‘us’, those who do not invest in coal and ‘them’, those who invest in coal. Those who invest in coal (China and India and their evil coal companies) are now the new ‘them’ that threatens the ‘us’, the righteous students of Stanford and Harvard.

Contrary to what the ill informed students of Stanford think, Indian (and other) coal companies do not burn coal to threaten the world and annoy environmentalists. They burn coal (and other fossil fuels) because that is the only affordable way to power every activity that underwrites human life as we know it today. Even the President of Stanford has acknowledged that university officials were careful to structure the disinvestment narrowly so that it does not seriously affect the wealth of the institute. The students had originally asked Stanford to divest shares it holds in any of the 200 publicly traded fossil fuel companies. Stanford chose to limit its divestment to companies that mine coal so that it is not ‘hypocritical’ in the words of the President of Stanford ‘since Stanford like the rest of the world runs mostly on fossil fuels.’

Grantham’s effort to label fossil fuel assets as ‘sub-prime’ has failed to have an impact as Bjorn Lomborg points out. He illustrates his point using the global oil & gas index STOXX (including Exxon and Chevron) and global renewable energy index RENNIXX which includes Tesla and Vestas. $100 invested in fossil fuels in 2002 would be worth $ 238 today while the same invested in renewable will be worth $28. It is one thing for Stanford students to ride a bicycle to university to show their disregard for fossil fuel driven cars but quite another to ask that pension funds and endowments of others be burnt on renewable energy stocks. In the words of Bjorn Lomborg this is indeed ‘a great way to feel good with other people’s money’.

Yet another report by the Stranded Assets Programme of the Smith School of Entrepreneurship and Environment and Oxford University is even more bizarre as it compares investing in fossil fuels companies to investing in tobacco companies or investing in South Africa during the apartheid era. In Mckinsey style charts with boxes and arrows, the Smith School report shows how apartheid was defeated by Harvard and other university activism. It also shows how similar action by prestigious universities arrested the growth of tobacco companies. The environmentally enlightened will find these comparisons very compelling but in doing so they overlook two key differences that separate investing in fossil fuels from the practice of apartheid or the addition to tobacco. First is that both the practice of apartheid and the use of tobacco could be discarded easily as they were not essential to human life as fossil fuels are. Second, unlike the opponents of apartheid and tobacco who were not involved in the practice of either, the opponents of fossil fuels (such as the students of Stanford) are beneficiaries of fossil fuels and will continue to remain so for the foreseeable future. Ironically even their internet and media campaign against fossil fuels is underwritten by fossil fuel generated electricity that moves information around the world.

It is also worth noting that the IPCC climate regime modelled on the Montreal Protocol that addressed the ozone depletion problem successfully is proving to be impotent in addressing climate change precisely because the fossil fuel problem is unlike any other in human history. The ozone depletion problem was confined to a limited area and substitutes to ozone depleting substances were available. In fact one of the factors that made the Montreal Protocol successful was the participation of companies that manufactured the substitutes. Moreover, poor countries did not use as much ozone depleting substances as rich countries did and so ‘the problem’ was largely confined to rich countries. More importantly the rich were rich enough to afford expensive substitutes. None of this applies to the case of fossil fuel use. If substitutes are available and affordable, fossil fuel companies would probably be the first to be selling them. Most of the key patents on renewable energy technologies are in fact owned by fossil fuel companies.

The new energy identities are creating false notions of ‘us’ and ‘them’ which can do more harm than good. If the students really shed all hypocrisy and actually shun all fossil fuels, they would have to actually give up even their bicycles smart-phones and computers. These are made with petrochemicals derived from fossil fuels probably in a country like China that is driven by fossil fuels. They may actually have to give up much of the food they consume as they are grown with fossil fuel based fertilisers and energy. The ‘us’ in this world will be a primitive being living off the jungle and the ‘them’ the prosperous material man living comfortably in a city. This is the real choice facing ‘us’ and ‘them’ and those trying to divide and conquer the climate argument must at the very least be honest about it.

Views are those of the author

Author can be contacted at lydia@orfonline.org

COAL

Clubbing Coal, Power & Renewable energy Will Generate Multiplier Effect

Ashish Gupta, Observer Research Foundation

|

T |

he best part of the recently concluded election was that one party got full majority. It will now be easier for the government to pursue national goals like “Power for All”. Since the government has full majority, it can take decisions in a timely manner and will be accountable for all shortcomings, unlike the previous coalition government. The election not only gives hope to the unelectrified masses of the country but also to the coal & power industry.

We have already started witnessing radical changes at the ministerial structure which may help in reducing the burden on the exchequer. Apart from that, the recent move of clubbing the coal, power and renewable portfolio under one head is a much desired decision which will not only help in curbing the red-tape prevailing in the sector but also speed up processes.

Conflict between the Coal & Power Sector: The coal & power industry are always at loggerheads over coal quality and pricing issues. There have been meetings between the two heads of two ministries but they have ended up criticising one another. Now that they are under the same minister, one can hope for concrete solution to these problems.

Criticism against Coal India: Criticism of CIL is becoming a norm and all problems in the sector are traced back to inefficiency of CIL. Their genuine concerns are labelled as inefficiency. Their reluctance to sign Fuel Supply Agreements with power producers were portrayed as stubbornness. They were forced to comply through Presidential directives. Now that they are handled by the same minister, the new government can understand CIL‘s genuine problems and figure out solutions in a holistic manner. There is hope that CIL will no longer be seen as the only culprit.

Import Figures Distortions: There have been inconsistencies in coal import figures quoted by various agencies whether private or government. For private players showing scarcity and seeking more imports is profitable but for the government agencies the lack of consistency only shows lack of coordination among them. Interestingly all these agencies do not quote figures from Central Agency Authority which has got technical competency in the matter. On the contrary they all release guesstimates. Hope under the new structure the practice of giving guesstimate figures for imports will stop.

Pathetic status on Clearances: This is a major nuisance for the coal and power sector projects. Though there is well defined stipulated period for getting environmental & forest clearances, these are unfortunately limited to paper only. Now that coal & power are handled by the same leadership, it can reduce delays in obtaining clearances from the environment ministry and also get a helping hand from the Railway Ministry. Though it is not as simple as it looks in the writing, there is hope that the new structure will unleash some reforms in the clearance process.

Coal, Power & Renewable Portfolio: Now that they are under one Minister, there will be synergy among them rather than turf wars and labelling one source as unviable or unprofitable. Interestingly it was reiterated in many of the deliberations that in the Indian context renewable energy must be seen as a helping hand rather than as “panacea” for climate problems for the time being. Hope the turf wars and unwarranted negative competitions will end under the new mechanism.

Privatisation: There have been apprehensions that the new government will open the door for complete privatisation in the coal sector. Before moving ahead, retrospection is required to find out why captive mining was a failure. Many of the captive power plants came online without captive coal blocks in operation and the responsibility was assigned to CIL. For allowing private players in commercial mining amendment will be required in the Coal Mines Nationalisation Act, 1973. Now the amendment looks easy as the coal and power are integrated and the new government comes with full majority. The move must be backed with rationality with lessons leant from previous mistakes. CIL is not incapable but if it has to be opened up to competition it has to be gradual. Otherwise the apprehensions will remain.

Power Sector Reforms without Direction: Reforms in the power sector is always equated with tariff hike. Every time the sector seeks a tariff hike in the name of reform. This is certainly not true! There is no discourse on why benefits of coal blocks allocated at throw away prices were not passed the consumer. There is no reason that consumers must take a beating every time? The conclusion that the consumer is willing to pay higher prices is not correct. Of course there may be some consumers who are willing to pay any price but generalising this does not reflect reality. Therefore if the new government is looking only to administrative reforms, they are again moving in the wrong direction. The problems prevailing in the sector are due to lack of political reforms. In the new structure the issues will be addressed comprehensively and so one can expect that irrational demands and solutions will be avoided.

Views are those of the author

Author can be contacted at ashishgupta@orfonline.org

DATA INSIGHT

Is LNG based Power Generation viable?

Akhilesh Sati, Observer Research Foundation

Tariffs of Gas based Power Stations: APM, Non-APM and LNG

As on Mar 31, 2013

|

Power Station |

Installed Capacity (MW) |

Tariff (`/kWh) |

|

Using APM Gas as fuel |

||

|

Dadri CCGT |

829.78 |

3.43 |

|

Faridabad |

431.00 |

3.18 |

|

Anta CCGT |

419.33 |

3.31 |

|

Auraiya GPS |

663.36 |

3.21 |

|

Gandhar GPS |

657.39 |

3.37 |

|

Kawas GPS |

656.20 |

3.14 |

|

Using Non APM gas as fuel |

||

|

Gandhar GPS |

657.39 |

4.09 |

|

Kawas GPS |

656.20 |

3.94 |

|

Using LNG as fuel |

||

|

Dadri CCGT |

829.78 |

9.02 |

|

Anta CCGT |

419.33 |

6.78 |

|

Auraiya GPS |

663.36 |

9.09 |

|

Faridabad |

431.00 |

7.49 |

|

Gandhar GPS |

657.39 |

11.60 |

|

Kawas GPS |

656.20 |

8.20 |

Note: The data is based on the Gas based Power Stations of NTPC.

Source: Central Electricity Regulatory Commission.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

Oil found in KG basin gas field

May 26, 2014. The Oil and Natural Gas Corporation (ONGC) has discovered 100 million tonnes of oil in the offshore Krishna-Godavari (KG) block called KG-DWN-98/2 off the coast of Andhra Pradesh. The ONGC will start producing oil from the field from 2017-18. It was the ONGC which discovered the Ravva hydrocarbon-bearing field, off the Andhra coast and handed it over to the private companies. A well drilled by the ONGC in the KG offshore basin had a bathymetry of 3,070 metres, which was the deepest bathymetry for an offshore well in the world. ONGC said the corporation had to stop drilling two wells near Madanam in Sirkali, Tamil Nadu, after local villagers protested against the drilling. (www.thehindu.com)

OVL and Russia's Rosneft in pact to explore oil, gas

May 25, 2014. ONGC Videsh Ltd (OVL), the overseas arm of the state-run explorer ONGC has signed a deal with Russia's largest oil and gas producer Rosneft to jointly explore hydrocarbons in the offshore Arctic. The parties will consider forming a consortium led by Rosneft and involving other partners. The memorandum of understanding was signed by Igor Sechin, president and chairman, Rosneft, and Dinesh Kumar Sarraf, chairman OVL, at the St. Petersburg International Economic Forum in the presence of Russian President Vladimir Putin. (economictimes.indiatimes.com)

Cairn India's Rajasthan oil fields may return to ONGC if term not extended

May 25, 2014. Cairn India's prolific Rajasthan oil fields may return to ONGC if the government and the state-owned firm do not extend the term of the block beyond the stipulated period provided in the contract. The Rajasthan Production Sharing Contract (PSC) provides for ONGC becoming the owner of all facilities once their cost is recovered from sale of crude oil. The cost of Mangala, Bhagyam and Aishwariya oil field facilities in the block as well as the heated pipeline that carries the crude from the field to Gujarat refiners will be recovered much before the current term of PSC ends in 2020. (www.financialexpress.com)

RIL contests ONGC's allegation of gas theft from its blocks

May 24, 2014. Reliance Industries Ltd (RIL) has said it suspects ONGC chairman DK Sarraf is being misled by insiders to hide their failure in developing fields discovered over 13 years ago, and strongly contested Sarraf's statement that the state-run explorer had to sue RIL for alleged "theft" of gas from its blocks adjoining the KG-D6 gas field. RIL said if ONGC suspected the neighbouring blocks had a common reservoir, the state-run firm should have acted long ago. RIL said it was "saddened" by the statement attributed to Sarraf by media reports on this issue. Sarraf had said that ONGC's surprise move to sue RIL for alleged "theft" of natural gas from its blocks was to protect its "commercial interest". ONGC moved the Delhi High Court alleging that RIL might have drawn gas worth thousands of crores of rupees from a common reservoir in the KG-D6 block and had also accused the oil ministry and its technical arm of turning a blind eye to the issue. RIL and ONGC had signed an MoU in July 2013 to share infrastructure in the basin, which would have significantly reduced costs for the state-run firm. RIL expressed surprise in note to editors that the two companies were engaged in infrastructure sharing proposal since mid-2012, but ONGC did not raise the issue of connectivity of reservoirs. RIL said ONGC brought the issue of possible common reservoir to its notice only in August 2013, through the Directorate General of Hydrocarbons (DGH). (economictimes.indiatimes.com)

Refiners processed 2.2 pc less crude in April vs year ago: Govt

May 23, 2014. Refiners processed 2.2 per cent less oil in April than a year earlier at 4.29 million barrels per day (bpd), according to government data. The government data included estimated crude processing by Reliance Industries' 580,000-bpd export-focused plant. Reliance's two refineries at Jamnagar account for about 30 per cent of the country's refining capacity. The country's crude oil output during the month declined marginally to about 758,500 bpd, accounting for a fraction of the overall needs of the world's fourth-biggest crude importer. Natural gas output fell 7.7 per cent to 2.77 billion cubic metres in April from a year earlier. (economictimes.indiatimes.com)

RIL plans to raise up to ` 100 bn in debt

May 22, 2014. Reliance Industries Ltd (RIL) plans to raise up to ` 10,000 crore in debt this fiscal to part fund its $26 billion investment plan. RIL has sought shareholder nod to raise funds through non-convertible debenture in one or more tranches. The company has scheduled an annual general meeting (AGM) of its shareholders to vote on the issue on June 18. India's biggest company is expanding its existing petrochemicals plants and will build new ones to improve margins from its refining business even as it drills more wells to boost slowing oil and natural gas production. Besides, RIL is constructing a plant that will turn petroleum coke into synthetic gas, which will be used at the oil refineries to lower cost. It also plans to open more retail stores and start a high-speed broadband service. RIL has commenced work on all the major value-enhancing projects such as petcoke gasification project and refinery off-gas cracker project (ROGC). After two years of being a debt-free company on a net level, oil-to-yarn and retail conglomerate once again net debt on its balance sheet. In 2012-13, it tied up facilities of around $3.15 billion equivalent to part finance the petrochemical expansions and petcoke gasification projects. In the following year it raised almost a similar amount. (economictimes.indiatimes.com)

Transportation / Trade

Shell in talks to buy stake in the planned Kakinada LNG project

May 26, 2014. Global energy major Royal Dutch Shell is in talks with the Andhra Pradesh state government for buying up to 24 per cent stake in the planned Kakinada liquefied natural gas (LNG) project on the east coast, GAIL said. GAIL Gas, a subsidiary of GAIL (India), is a co-promoter of Andhra Pradesh Gas Distribution Company (APGDC) that will build the project in the southern Indian state. APGDC will have a 50 per cent stake and Gaz de France 26 per cent share in the project, leaving the remainder for the new partner. (economictimes.indiatimes.com)

HPCL to buy 11-15 pc stake in Petronet LNG’s east coast terminal

May 21, 2014. Hindustan Petroleum Corp. Ltd (HPCL) is likely to buy 11-15% stake in Petronet LNG Ltd’s ` 5,000 crore liquefied natural gas (LNG) import terminal on the east coast. HPCL’s Vizag refinery in Andhra Pradesh is being expanded to 15 million tonnes per annum (MTPA) from current 8.33 MTPA and the expanded unit will have a gas requirement of close to 3 MTPA. HPCL had missed the LNG bus when it got left out of the PSU consortium that formed Petronet. Indian Oil Corp. Ltd, Oil and ONGC, GAIL (India) Ltd and Bharat Petroleum Corp. Ltd (BPCL) each have 12.5% stake in Petronet. (www.livemint.com)

Policy / Performance

India debates gas price hike, China contracts at US $11-13 per mmBtu

May 27, 2014. As India debates raising natural gas rates, China has signed a US $ 400 billion deal to buy gas from Russia at US $ 11-13 per million British thermal unit (mmBtu). Russia's Gazprom signed a deal to sell 38 billion cubic meters of gas annually over 30 years to China National Petroleum Corp. While the exact sale price has not been declared, industry analysts said going by the contract value of US $ 400 billion over 30 year period, the price at the Russia-China border is expected to be between US $ 11 to 13 per mmBtu. This rate is almost triple the current domestic price of US $ 4.2 per mmBtu and 50 per cent more than the likely rate of US $ 8.3 per mmBtu when the Rangarajan formula is implemented. The Rangarajan formula, which prices gas at an average of international hub rates and actual rate of importing LNG into India, was to be implemented from April 1 but it had to be put off because of announcement of general elections. The new BJP-led NDA government has so far not stated if it will implement the new rate which will make several gas discoveries in deep-sea commercially viable to produce. (economictimes.indiatimes.com)

GAIL plans more LNG deals with US

May 26, 2014. Gas firm GAIL (India) Ltd aims to sign more deals with the United States for sourcing liquefied natural gas (LNG) as it hopes to lock-in customers for existing contracts by the end of July, the company said. GAIL has a deal to buy 3.5 million tonnes per annum (mtpa) of LNG for 20 years from U.S.-based Cheniere Energy and has also booked capacity for another 2.3 mtpa at Dominion Energy's Cove Point liquefaction plant. The company is in talks with Indian customers, except those from the regulated power and fertiliser sectors, for gas sales agreements ahead of supplies from the U.S. in 2017/18. GAIL Chairman B. C. Tripathi hoped the new government, led by Narendra Modi, will reform the power and fertiliser sectors and spur local demand for the costly imported fuel and help GAIL build new pipelines. Modi, sworn in as prime minister, is seen as a business-friendly leader GAIL aims to trade 1 mtpa of the super cooled gas sourced from the U.S. through its trading arm in Singapore. Key global companies are willing to buy the remainder of about 1 mtpa LNG at an attractive price, GAIL said. GAIL will float a tender next month to charter 6-8 LNG carriers for shipping gas from the U.S. to India, Tripathi said. To meet local gas demand GAIL aims to import 36 LNG cargoes under short term and spot deals in 2014/15 versus 26 in 2013/14. GAIL operates a 5 mtpa Dabhol LNG terminal on the west coast and partners the Andhra Pradesh government for a planned regasification facility on the east coast. Tripathi said Royal Dutch Shell is in talks with the Andhra Pradesh State government to buy an up to 24 percent stake in the Kakinada LNG project on the east coast. The Dabhol terminal has been shut since May 1 and will resume normal operation after the monsoon at the end of September or early October, Tripathi said. (in.reuters.com)

Raising LPG cap was UPA mistake, oil minister to tell Modi govt

May 26, 2014. Raising the annual cap on subsidised cooking gas refills and suspending transfer of fuel subsidy directly to consumers — popularly known as DBTL, or direct benefit transfer for LPG - were mistakes committed by the UPA-2 government, says the oil ministry's briefing for the Narendra Modi administration. DBTL was considered a game changer for the UPA-2 by putting money directly into people's pocket. And at the January AICC session, Congress vice-president Rahul Gandhi forced the government's hands on raising the LPG cap from nine to 12 subsidised cylinders with eye on the polls. Even though the sop didn't work for the Congress, the Narendra Modi government may not find it politically feasible to roll back the cap so early in its stint and ahead of Maharashtra state polls in October. Instead, it would be easier to fix the bugs in the DBTL scheme and speed up its roll-out. The DBTL scheme was launched with much fanfare as a game changer for the UPA-2 that would also plug leakage of fuel subsidy, estimated at ` 140,000 crore in 2013-14. The annual cap and DBTL together succeeded in checking diversion and saved subsidy by lowering growth in demand. The ministry's presentation for the new government also lists the absence of course correction in the government's oilfield contracts and lack of clarity on oil projects in Iran as the other major failures of the Manmohan Singh government. The ministry is grappling with some 26 arbitration cases with companies over interpretation of contracts. About 20 of these remain unresolved, including the one with Reliance Industries Ltd over a $1.8 billion penalty for failure to meet gas production targets in KG-D6 field. The government has lost two cases and won only one so far, while in three cases the companies withdrew the arbitration proceedings. The flip-flop over projects in Iran has also been described as the previous government's faults. The presenation says lack of clarity has delayed development of ONGC Videsh Ltd's Farzad project and stalled the gas pipeline to India via Pakistan. The ministry had drawn up a proposal to set up a separate government company for handling projects in Iran but put the idea was junked after Iran's nuclear truce with the US and five other major economies last year. The relaxation in the annual cap on cooking gas cylinder started in January 2013 when it was raised from six to nine cylinders a year. The oil ministry's presentation clearly says this and the subsequent increase to 12 refills "should not have happened." (economictimes.indiatimes.com)

O&G companies hope govt will let market decide gas pricing

May 23, 2014. The Narendra Modi government's oil minister will have to learn to swim in the deep end. Trillions of cubic feet of natural gas are trapped in deep-sea geological formations, only a small part of which have been tapped. The bigger chunk is waiting to be extracted and flow into factories and homes — if the price is right. Under the UPA regime, deep-sea fields have generated much more political heat than gas, which the country needs to fuel its expanding economy. An estimated 64 trillion cubic feet (tcf) of natural gas is waiting to be discovered, almost as much as the 69 tcf of of proven and probable recoverable gas reserves discovered since 1950, according to a 2013 study by US-based consultancy IHS-Cambridge Energy Research Associates (CERA). About 27 tcf of discoveries made so far are still to be developed, but this requires prices of at least $8 per unit for some discoveries and $10-12 for those in ultra-deep regions, according to IHS-CERA, which advises governments and companies globally. The higher the price, the greater the incentive for exploration. IHS -CERA anticipates discoveries of 24 tcf at a price of $8 and about 55 tcf at $12. Oil & gas companies hope govt will let market decide gas pricing Gas reserves that have not been developed include fields discovered by India's top two exploration firms, Oil and Natural Gas Corporation (ONGC) and Reliance Industries (RIL). While ONGC is yet produce any gas from deep-sea fields, RIL has pioneered India's efforts in producing natural gas from challenging terrains in the KG-D6 block, which saw the world's largest gas discovery in 2002. It is also the most notable discovery of hydrocarbons in India — apart from Cairn India's Rajasthan oilfields — since the discovery of Bombay High decades ago. Producing oil and gas in such terrain is a high-risk and costly business. Oil industry executives frown at comparisons, made by the likes of Arvind Kejriwal's Aam Aadmi Party, with a discovered onshore field in Bangladesh, where Reliance's partner Niko sells gas for $2.3 per unit. Exploration companies say that the deep-sea is a totally different ball game, and to invest risk capital in such challenging conditions, exploration companies, including BP Plc, its partner Reliance, ONGC, and Cairn India, which found deep-sea hydrocarbons in Indian and Sri Lankan waters, demand regulatory clarity and reasonable returns. Analysts are almost unanimous that the new government will raise gas prices. Oil and gas producers, notably the RIL-BP combine, are asking the government to allow the market to set prices. The production sharing contract (PSC) mandates market-based arms length pricing. All that the government needs to do, industry executives say, is to respect the PSC. Former minister Suresh Prabhu, who is widely seen as close to Modi, points out that 48% of India's basins have not even been explored, and in the 52% that have been, India has not been able to produce oil and gas at optimum levels. India needs to step up investment in the sector because hydrocarbon imports drain foreign exchange and hurt the fiscal situation. India's hunger for oil has grown in the past decade. Oil imports have jumped to $143.8 billion in 2013-14 from $18.3 billion in 2003-04 while LNG imports galloped to nearly 11 million tonnes from 0.25 million over the same period. ONGC chairman DK Sarraf is worried about gas fields lying idle. Nearly one-third of India's gas demand is met from imported LNG, which costs $12-15 per unit. Sashi Mukundan, who heads BP Plc's Indian operations, bluntly says that nobody would invest in India at current prices. BP and its partner Reliance Industries, like ONGC, are also waiting for clarity in gas prices. The UPA government first announced new rates in June 2013, then decided to review it after a few days; in a few months it approved the same rates all over again, and said new prices would be implemented from April 1, 2014, subject to some conditions. The Election Commission vetoed higher gas prices after receiving a reference from the ministry. Some of ONGC's fields would require gas prices to be about $10 per unit to make commercial sense. While a decision is awaited, analysts say Indians will be paying a higher price for gas, whatever the government does. The argument is that if prices are not raised, new fields will not be developed, and India will have to increase the share of costly LNG in its gas basket. One-third of the gas consumed in India is imported in liquefied forms at prices 3-4 times the current domestic rates. Analysts say that the government should do its best to speed up arbitration proceedings to make sure that disputes do not cloud the hunt for new oil and gas resources. During a past dispute with Cairn India, the government did not allow the company to increase crude oil production by 25,000 barrels per day — although this could have been achieved virtually by pressing a button. Some say that the new government may settle for a price that is higher than the current $4.2 but lower than the proposed $8.4. (economictimes.indiatimes.com)

Govt directs ONGC to pay record ` 563.8 bn in subsidy

May 23, 2014. The government has ordered Oil and Natural Gas Corp (ONGC) to pay a record ` 56,384 crore in subsidy to help state-owned fuel retailers cover part of the losses they incurred on diesel and cooking fuel in 2013-14. The Oil Ministry asked ONGC and other state oil and gas producers Oil India and GAIL to shell out ` 67,021.14 crore to cover for about 48 per cent of over ` 140,000 crore loss retailers Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) incurred on selling diesel, LPG and kerosene below cost in 2013-14. The government will chip in ` 70,772 crore by way of cash subsidy. Retailers sell diesel, domestic cooking gas (LPG) and kerosene at rates way below cost. The losses they incur is compensated by way of cash subsidy from government as well as assistance from upstream firms like ONGC. (economictimes.indiatimes.com)

POWER

Generation

Alstom commissions NHPC's Uri project in J&K

May 27, 2014. Power gear maker Alstom announced the commissioning of state-owned NHPC's 240 MW Uri-II hydroelectric project in Jammu & Kashmir (J&K). Alstom has commissioned NHPC's Uri II hydropower project after availability of full water for running all the four units of the project, the company said. (economictimes.indiatimes.com)

Tata Power eyes SAARC, SE Asia, Africa for growth

May 25, 2014. Tata Power is focusing on overseas opportunities spread across four regions including South East Asia and SAARC. Besides, Tata Power, which aims to have 18,000 MW generation capacity by 2022, is exploring business opportunities in the African and Middle East regions. Currently, the private power utility has an installed generation capacity of 8,560 MW while projects having capacity of nearly 850 MW are under execution. The company has prioritised four key regions for international play. These include African region, South East Asian region; Middle East region and SAARC (South Asian Association for Regional Cooperation) region. The company has deployed resources in these regional geographies to understand the market dynamics and scout for opportunities.

In the SAARC grouping, there are eight countries, including India. Others are Sri Lanka, Nepal, Pakistan, Maldives, Bhutan, Bangladesh and Afghanistan. At present, Tata Power is developing wind and hydro projects in Africa, Bhutan and Georgia, among others. The 126-MW Dagachhu hydel project, being developed in partnership with the Bhutan government, is expected to be commissioned soon. The company's current generation capacity comprises electricity from thermal, green and waste gases energy sources. (www.business-standard.com)

NTPC might build plant to run on imported coal

May 24, 2014. NTPC, India's biggest electricity producer, is considering building its first power plant to run completely on imported coal to prepare for local shortages and to take advantage of a fall in global prices. The state-run generator is studying the option to set up a 2,400 MW plant in Pudimadaka in Andhra Pradesh. NTPC is weighing the plan amid delays in starting its first coal mine and Coal India, the nation's monopoly coal producer, missing output targets. In addition, a drop in the international prices of thermal coal and rising domestic freight costs have narrowed the difference with imported fuel. (www.business-standard.com)

BHEL commissions 520 MW hydro power project in HP

May 23, 2014. State-owned power equipment maker BHEL has commissioned all the four units of the 520 MW Parbati hydro electricity project in Himachal Pradesh. The first three units at Parbati project were commissioned by BHEL in February and March 2014. Parbati project is located near village Bihali in Kullu district of Himachal Pradesh (HP). BHEL is executing three more hydro projects of NHPC -- 3x110 MW Kishanganga in Jammu & Kashmir, 4x40 MW Teesta Low Dam in West Bengal and 4x200 MW Parbati II in Himachal Pradesh, which are in different stages of execution. (www.business-standard.com)

Power, lignite capacity to increase: NLC

May 22, 2014. Neyveli Lignite Corporation (NLC) said power generation and lignite mining capacity will be increased before March 2017, the end of the current 12th Five Year Plan. NLC said that after completing ongoing projects of 500 MW thermal expansion unit II, 1,000 MW Tuticorin project, renewable energy projects like solar 10 MW project and wind farm project of 50 MW, power generating capacity will be increase from 2,740 MW to 4,240 MW. (www.business-standard.com)

AERB rules out design flaw in valves in KNPP Unit-I

May 21, 2014. Failure to drain out hot water before undertaking maintenance work on valves in Unit-I of Kudankulam Nuclear Power Plant (KNPP) had led to the mishap in which six persons were injured, a preliminary inquiry has found while ruling out any defect in the design of the valves. Investigations by Atomic Energy Regulatory Board (AERB) revealed that there was no design flaw in the valves and the accident occurred when hot hold up water spilled on the workers while they were dismantling the valve of 500-mm size. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

KPTCL to take up works to mitigate power situation

May 27, 2014. The Karnataka Power Transmission Corporation Ltd (KPTCL) plans to take up 244 new works for around ` 5,100 crore this year to improve the power situation in the state, Energy Minister D K Shivakumar said. A sum of ` 142.47 crore had been earmarked for the purpose this year, he said. The reason for small allocation for these projects vis-a-vis the estimated cost was that ground work like the tendering process had to be completed before the projects could take off for physical implementation, he said. (www.business-standard.com)

Sterlite Tech wins 6th UMTP project from govt

May 26, 2014. Sterlite Technologies Ltd said its arm Sterlite Grid Ltd has been awarded sixth ultra- mega transmission project (UMTP) on build-own-operate basis by the Ministry of Power. This Northern Region Strengthening Scheme project (NRSS 29) is a part of the National Grid and is designed to carry over 1000 MWs of electricity from Punjab to the Kashmir Valley, Sterlite Tech, a Vedanta Group firm, said. The Kashmir valley has been troubled by frequent blackouts on account of unavailability of sufficient power. These blackouts occur mostly during the winter months thereby having a severe impact on the lives of Valley residents. (economictimes.indiatimes.com)

Ghaziabad residents write to MP for power solution

May 25, 2014. Reeling under a power crisis that keeps getting worse with the summer, the RWA Federation of Ghaziabad wrote to newly elected MP V K Singh and BJP chief Rajnath Singh, urging them to take up the matter with the state government. Sahibabad area of Ghaziabad has recorded four long outages this month, the worst being 12 hours. While the power corporation attributed the power failures to overloading on the decades-old transmission and distribution infrastructure of the city, residents blame the Akhilesh Yadav-led SP government for not paying attention towards developing the electricity infrastructure of Ghaziabad. Singh said he will talk to state government. The federation complained that in the past 25 years, no new grids or substations were set up, even though the population of Sahibabad increased by over 20 per cent. (timesofindia.indiatimes.com)

'Power surplus' Punjab to buy electricity

May 23, 2014. Punjab State Power Corporation Limited (PSPCL) is all set to purchase 648 lakh units of power from Himachal Pradesh at higher rates than cost of energy production in some of its own state-run thermal plants. The power is being purchased to bridge demand-supply gap which the entire state is facing nowadays. With paddy season nearing in, farmers in most villages are getting power for only half the duration promised by PSPCL. PSPCL said that the power corporation had decided to purchase 300 MW of electricity daily on short term purchase basis from Karcham Wangtoo Hydro Project in Himachal Pradesh. (timesofindia.indiatimes.com)

India Power secures distribution licence for Gurgaon

May 23, 2014. Kolkata-based India Power Corporation has bagged the licence for distributing power in Gurgaon and is aiming to serve one fourth of subscribers in the Delhi suburb, which is plagued by prolonged power cuts. The company is planning to set up its own distribution network in Gurgaon and invest about ` 1,500 crore to supply power round-the-clock. Gurgaon is currently served by Haryana Dakshin Vidyut Bijlee Nigam and consumers face power cuts of 13-14 hours a day. During blackouts subscribers use diesel generators and every unit of power costs ` 12-14. (economictimes.indiatimes.com)

BJP Kanpur unit threatens to protest against power cuts

May 21, 2014. BJP has threatened to stage a protest if the situation is not improved by the Kanpur Electricity Supply Company Ltd. BJP Kanpur has sent a warning to the MD of Kanpur Electricity Supply Company Ltd (KESCO) saying if the situation of the power cuts is not improved, their party will stage protests. However, KESCO said that the problem is arising due to the excessive power load resulting in technical failures of the transformers. (www.business-standard.com)

Alstom T&D India bags order to renovate Bihar grid

May 21, 2014. Alstom T&D India, a unit of French engineering group Alstom, said it has bagged a ` 50.66 crore order to renovate and modernise grid substations in Bihar. Bihar is looking to invest in revamping the power sector in the state. The state government plans to replace the obsolete infrastructure, increasing power capacity and providing reliable and uninterrupted electricity to its 11 crore people. The project will strengthen the transmission system and enhance power evacuation capacity under India's 12th Five Year Plan. (www.business-standard.com)

ACCI raises red flag on state Power department

May 21, 2014. The Arunachal Chamber of Commerce & Industries (ACCI) expressed strong objection to non-optimal use of the state's own hydro power stations by the power department, purchasing power from outside at the cost of the state exchequer and passing the cost to its consumers. ACCI sought clarification in the matter and urged the secretary to direct the department to optimise the use of domestic resources, reduce the cost of power purchase, and increase revenue through sale of surplus power available from state share of the central sector power projects. Referring to the department's petition for annual revenue requirement and tariff proposal for 2014-15, ACCI noted that its transmission and distribution losses for 2012-13 was "abnormally high" at 60.4 per cent. (economictimes.indiatimes.com)

24x7 supply a priority: PowerMin to new govt

May 27, 2014. In a recent presentation to Prime Minister Narendra Modi, the power ministry listed ensuring round-the-clock electricity supply and mitigating power plants’ fuel shortages among its priorities. It added other important steps to be taken included ensuring the financial viability of loss-making distribution companies, tapping India’s vast hydro-generation potential and amending the Electricity Act to bring about a slew of reform measures. Providing 24x7 power supply to consumers will require adequate capacity addition, fuel availability and quicker green clearances, apart from a switch to renewable sources and building additional transmission infrastructure, the ministry has said. It proposed making it mandatory for distribution companies to progressively increase supply to rural areas, as well as rationalising of rates by state regulatory commissions. Also, to ensure the viability of distribution companies, it suggested cutting aggregate technical and commercial losses from the current 27 per cent to 15 per cent. (www.business-standard.com)

HP notice to power company for selling 2 projects

May 27, 2014. Himachal Pradesh (HP) government has issued notice to Jaiprakash Power Ventures Limited for selling two projects in Kinnaur district without taking it into confidence, Chief Minister Virbhadra Singh has already made it clear that Jaiprakash Power Ventures Limited should not have sold its two hydro power projects without the permission of state government. (timesofindia.indiatimes.com)

Coal India unions okay with splitting units, but not stake sale

May 27, 2014. Coal India's worker unions are waiting to hear from the new government on its plans for the coal miner and the mining sector before taking a decision on the next course of action, even as they vow to oppose any move to sell more stake in the state-run company. Though they are against stake sales, the unions are unlikely to oppose splitting of CIL's subsidiaries into independent companies, their leaders have indicated. Protests from the unions had forced the previous Manmohan Singh government to cut by half its target to sell a 10% stake in the company. The divestment plan was subsequently abandoned. The government holds nearly 90% in CIL. The unions had a list of 25 demands, eight of which got settled last time when the government declared its intention of divesting additional stake in the company. The unions want the government to treat CIL as an infrastructure company and stop all initiatives to restructure it. According to reports, taking a decision on the restructuring of CIL for improving its operational efficiency is among the key points of an action plan that the coal ministry has prepared for the sector. CIL, along with its seven subsidiaries, has been drawing negative attention from various quarters for missing production targets. The government is expected to increase delegation of powers to all CIL subsidiaries, which include Eastern Coalfields, Bharat Coking Coal, Central Coalfields and South Eastern Coalfields. The coal ministry document did not elaborate on the mechanism to be adopted by the government to restructure the maharatna company that meets as much as 80% of India's coal demand. Consultancy firm Deloitte, which has been appointed to study the possibilities of restructuring CIL, has recently submitted its draft report to the coal ministry. The final report is awaited. (economictimes.indiatimes.com)

Tamil Nadu govt lifts power curbs on bulk consumers

May 27, 2014. Powercuts imposed on heavy users in Tamil Nadu—factories, shops and offices—will be lifted from 1 June, chief minister J. Jayalalithaa said. In the last three years, Tamil Nadu has been facing severe power shortages, with outages lasting 8-10 hours. In rural areas, power cuts can last up to 14 hours. Chennai is the exception, with two-hour-long cuts. The state has decided to lift the cuts as it expects more wind power to become available from next month—power from wind turbines is only available from May to October. (www.livemint.com)

Pre-paid electricity meters can help people manage consumption

May 27, 2014. Installing prepaid electricity meters in India will have a similar "transformative" effect that was seen in the telecom sector with prepaid services, as people would be able to manage their consumption better, a Sri Lankan think tank LIRNEasia said. Discussing findings of survey on access to electricity covering India, Sri Lanka and Bangladesh, LIRNEasia, an ICT policy and regulation think-tank, said that urban, low income micro-entrepreneurs (MEs) (0-9 employees) face issues in getting new connections and later on with the quality of service. The model has seen success in the telecom industry and has a potential to transform the electricity distribution system too. The body is meeting state-level energy regulators from Bihar, Gujarat and Maharashtra to discuss the findings of the survey, which covered 1,279 people in India (Delhi and Patna). (economictimes.indiatimes.com)

No relief for discoms; Delhi HC defers hearing on CAG audit

May 26, 2014. The Delhi High Court (HC) deferred the hearing on the plea by three private discoms to stay the city government's decision asking the Comptroller and Auditor General of India (CAG) to audit their accounts. A bench comprising Chief Justice G Rohini and Justice R S Endlaw fixed July 22 as the next date of hearing. The bench was hearing a batch of petitions, including three appeals filed by TPDDL and Reliance Anil Dhirubhai Ambani Group firms, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd. Besides these pleas, the court is also hearing a PIL filed by NGO United RWAs Joint Action, seeking CAG audit of the discoms' accounts. The single judge bench, which did not stay the CAG audit, however, had said that the report of the audit will not be released without the court's permission. Advocate Prashant Bhushan, appearing for the NGO, had said that a DERC audit of a discom had revealed massive fudging of accounts and the NGO had also sought action against those involved. The three private firms came into being in 2002 when the then Delhi government decided to privatise power distribution. Delhi discoms are a 51:49 per cent joint venture between the private companies and the Delhi government. (economictimes.indiatimes.com)

No hike in power tariff in Madhya Pradesh for 2014-15

May 25, 2014. To strike a balance between consumers and loss making power discoms (distribution companies), Madhya Pradesh Regulatory Commission has maintained prevailing power tariff in all category consumers. Although power utilities had put up an aggregate revenue requirement of ` 23,178 crore, the commission has admitted to the tune of ` 22,041 crore. The commission has also admitted distribution losses for financial year 2014-15 as per loss level trajectory prescribed in the regulation; 20 per cent for east zone distribution company (23 per cent during 2013-14), 18 per cent (20 per cent during 2013-14) for West Zone company, 21 per cent (23 per cent during 2013-14) for Central zone company. The regulatory commission has, however hinted that power distribution companies may reduce power tariff in future provided they manage retail power distribution properly. The stagnation in power tariff will give them enough room to churn the required aggregate revenue. (www.business-standard.com)

UP govt to expedite pending power projects

May 24, 2014. The Uttar Pradesh (UP) government said improving power supply in the state is its top priority and all efforts are being made to complete pending projects at the earliest. Minister of State for Power Yasar Shah said that on the directives of Chief Minister Akhilesh Yadav a review of all proposed power projects has been started. Any laxity in completing power projects would not be tolerated, he said. (economictimes.indiatimes.com)

Uttarakhand to approach SC for allowing construction of hydel projects

May 23, 2014. The Uttarakhand cabinet has decided to move the Supreme Court to plead for the construction of the hydel projects which were banned after the last year’s June deluge in the hill state. The government will soon hire top advocates to fight its case before the apex court for allowing the construction of the hydel projects in the wake of the acute power shortage. A decision to this effect was taken at a meeting of the state cabinet held last evening which was chaired by Chief Minister Harish Rawat. The Supreme Court (SC) had set up an expert committee to assess the role of hydel projects in the last year’s devastating floods that claimed over 5,000 lives and rendered hundreds of others homeless in the state. The expert committee gave a negative report against 23 of the 24 hydel projects which were under the scanner of the experts from the Wildlife Institute of India (WII). With the change of the government at the centre, Uttarakhand will also send a proposal to the Narendra Modi government to allow construction of small hydel projects upto 25 MW in the eco-sensitive zone in Uttarakashi district. The eco sensitive zone was declared by the UPA government on the recommendations of some environmentalists. The centre had issued a gazette notification declaring 100 km stretch between Gomukh and Uttarkashi along holy Bhagirathi river as eco sensitive zone. But the measure had triggered wide-spread protests in the region on the development issue. The state government had repeated called for a review of the measure with a plea that it will adversely affect the development in the region including hydel projects with a total capacity of 1743 MW. Besides the state government, an association of hydel project companies has also decided to move the Supreme Court for the revocation of the ban on the dams. (www.business-standard.com)

Can't waive 50 pc power bills of defaulters: Delhi govt to HC

May 22, 2014. The city government took a stand contrary to the Cabinet decision of the then Arvind Kejriwal dispensation in the High Court saying it cannot waive 50 per cent of the power bills of the defaulters. A bench of Chief Justice G Rohini and Justice R S Endlaw took note of the reply of the government and disposed of the petition seeking quashing of the cabinet decision on the issue. It, however, gave Vivek Sharma, who had filed the petition, liberty to move the court again if the government again decides to give subsidy to the defaulters. The petition has challenged the decision to give subsidy to the tune of ` 6.82 crore to people who stopped paying bills from October 2012 to December 2013 on the call of Kejriwal during the protests against alleged inflated billing by discoms. (economictimes.indiatimes.com)

5 challenges Modi govt will face to reform Coal India

May 22, 2014. Coal India touched a new all time high of ` 401 on news that the company will be broken up into smaller companies to boost output and cut imports. A Credit Suisse report had pointed out that the disappointing domestic coal output is one of the main reasons for the slowdown in India's investment cycle. Coal output from the company has remained nearly stagnant over the past few years, with the company missing its target continuously. There are many reasons for a poor performance of Coal India and breaking the company into smaller manageable units might not solve the production issue. Apart from governance challenges, inefficiency, allegations of corruption and lack of pricing power have also impacted the performance. There is little doubt that breaking the company up into smaller manageable units and roping in the state governments will help improve production. Further, competition among the mines and states will also improve the quality of coal being sold in the market. Following are five other issues that needs to be corrected in order to improve overall health of the coal sector and improve its availability in the country.

1. Administrative challenges

One of the biggest issues in increasing coal production are delays in getting all the licences. In the present legislative and regulatory framework, the allottee of a captive coal block has to obtain multitude of clearance and approvals with the environment ministry taking the maximum time (around 3-4 years). There are various state and central level agencies involved in clearing a proposal. Let alone private captive consumers, even Coal India has to wait in line to get its mines. A single window clearance is the need of the hour to increase production by starting new mines. Land acquisition is the other big reason for delays, mainly on account of local issues. Taking the state government into confidence and making the locals stake holders as prescribed by the Mines and Minerals (Development and Regulation) Bill, 2011 can help in solving this issue. Having said that, mining companies including Coal India have been known to exploit environmental norms. According to a report titled 'Black and Dirty: The Coal Challenge in India -- Climate and Resources' written by Ashok Sreenivas of Prayas (Energy Group), 239 mines were found to be operating without proper environmental clearances for their expanded operations, while 558 out of 629 mines did not have the requisite environmental management systems. There was a backlog of over 12000 hectares in land-filling and technical reclamation across 7 out of Coal India's 8 subsidiaries.

2. Transparency

Coal allocation under the UPA government ended up in controversy. Intentions of the government were noble. The objective of allocating captive coal blocks was not to maximise revenue for the government but to rapidly increase coal production and reduce electricity tariffs. However no conditions were imposed on allottees to pass on benefits of cheap coal to consumers nor any monitoring on how the blocks were progressing. In the end, neither the government nor the country benefitted from increased production or lower electricity tariff. A transparent mechanism of monitoring allotted mines would have helped the sector immensely. A 2011 report by the government appointed Committee on Allocation of Natural Resources pointed out that lack of transparency on how 'coal linkages' are granted lead to serious doubts about their merits. These linkages are granted by a multi-ministerial committee and as per the report, 1,500 coal linkages worth about 3,000 million tonnes per annum were pending compared to the projected production increase of 175 mtpa up to 2016-17.

3. Pricing

Coal India has almost no control on the price at which it sells its product. Pricing of coal was fixed by the central government until its deregulation in 2000. The right to fix the price was then given to Coal India and Singareni Collieries Company. However the Ministry of Coal interfered with the pricing on political grounds. As a result a D Grade variety of coal in India is sold at a discount of nearly $60 per tonne. Those importing coal are doing so at these higher prices, while Coal India is made to sell at lower prices to power companies.

4. Transportation and Infrastructure

Coal India management have always been saying that the issue of lower output is not related to production but to logistics. Coal stocks are lying at the mines waiting to be evacuated but are not been done on account of lack of proper transportation mode. Even though there are railway tracks there are not enough rakes available to clear the inventory. Road connectivity between consumers and mineral zones is either missing or is in a poor state.

5. Power sector reforms

The only reason Coal India is unable to increase prices of its product is the belief that its consumer -- power producer and power distribution companies cannot afford it. Power tariffs have been kept low due to political reasons and quality and uninterrupted power is denied to the consumers under the garb that they cannot afford it. However, states like Gujarat have proved that availability of power is more important than no power at all. Consumers are willing to pay the extra price. (www.business-standard.com)

Power ministry asks Arunachal Pradesh to scrap hydro projects in limbo

May 21, 2014. The power ministry has suggested Arunachal Pradesh to scrap as many as half the nearly 100 hydroelectric projects awarded to private and state-run developers in the state, the ministry said. At the same time, the ministry has also offered assistance to Arunachal Pradesh for fast-tracking 13 projects with 13,600 MW of capacity as it wants to utilise the vast potential of the mountainous northeastern state for generating hydropower. It has offered to expedite issues related to clearances and road infrastructure to move equipment in the state where most project locations are in difficult-to-reach places. The ministry is also rationalising the process for approval of project reports by the Central Electricity Authority and other watchdogs to speed up the execution of hydropower projects. Some of the proposed projects by Patel Engineering, Sew Energy, Athena Energy, Reliance Power, Jindal Power and Jaiprakash Associates will be put on fast-track while the fate of their other projects is unclear. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Hungary's MOL finds oil, gas onshore Kazakhstan

May 27, 2014. Hungarian energy company MOL said it discovered oil and natural gas while drilling into the Rozhkovskoye field onshore Kazakhstan. MOL said it posted a test flow rate of 1.9 million barrels of oil equivalent and 6 million cubic feet of natural gas per day from the field's Federovsky block.

MOL has a 27.5 percent stake in a consortium controlled by the country's state-owned KazMunaiGas. The Hungarian company said qualitative analysis was underway to get a better understanding of the full reserve potential in the Federovsky block. (www.upi.com)

Argentina turns to next shale partners as Chevron triples output

May 24, 2014. Petroliam Nasional Bhd. is among a group of producers looking to enter Argentina’s nascent shale boom, according to state-owned oil company YPF SA. Petronas, as Malaysia’s state oil and gas company is known, is negotiating a binding deal with YPF to develop an area in southwestern Argentina’s Vaca Muerta shale formation after signing a preliminary accord Feb. 18, YPF said.

Argentina is seeking partners to develop Vaca Muerta, an area the size of Belgium that holds at least 23 billion barrels of oil, according to a survey by Ryder Scott, in a bid to become energy independent. YPF’s output from the Loma Campana area in Vaca Muerta rose to 12,800 barrels a day from 4,200 after investing $1.2 billion in a pilot year with Chevron Corp. The company is also in conversations with Petroleos Mexicanos, without disclosing the subject of the talks. Mexico is pushing through legislation to open up its oil and gas fields, including shale, to foreign investment. (www.bloomberg.com)

CNOOC’s parent determined to finish drilling in disputed area

May 23, 2014. China National Offshore Oil Corp. (CNOOC), operator of an oil rig in disputed waters that’s stoking tension between Vietnam and China, said it’s determined to finish drilling at the site. CNOOC’s parent will oppose Vietnamese disruptions to drilling. The company placed an oil rig near the disputed Paracel Islands off the coast of Vietnam, leading to confrontations between Vietnamese and Chinese boats. The move set off violent anti-China protests in Vietnam and prompted China to evacuate thousands of its citizens. (www.bloomberg.com)

Total agrees to Lukoil shale deal, brushing off Russia sanctions

May 23, 2014. Total SA agreed to seek shale oil in Western Siberia with OAO Lukoil, brushing off U.S. and European sanctions against Russia over its annexation of Crimea. Total and Moscow-based Lukoil will set up a venture to seek so-called tight oil in the Bazhenov area of Siberia under their agreement, the French company said. Investment in the venture will be $120 million to $150 million in the first two years, according to Lukoil. Total says its Russian business isn’t affected by sanctions against the country, including on Gennady Timchenko, shareholder of OAO Novatek in which the French oil producer holds a stake. (www.bloomberg.com)

UK’s south England holds billions of barrels of shale oil

May 23, 2014. Shale rock underneath some of the wealthiest counties in southern England may contain billions of barrels of oil, a government report said. The Weald basin, covering counties south of London including Surrey, Sussex and Kent, may have oil in place of as much as 8.6 billion barrels, according to a report published by the British Geological Survey (BGS). It didn’t say how much could be extracted profitably. The U.K.’s current extractable oil reserves are 3.1 billion barrels, data by BP Plc show. The report is likely to add to the controversy about drilling for shale oil and gas in the U.K. The government wants to develop the resources to cut energy costs and boost the economy. Opponents say the process of hydraulic fracturing, using high volumes of water, sand and chemicals to drill shale, can damage the environment.

The BGS said the Bowland basin, which extends across east and northwest England, may hold as much as 1,300 trillion cubic feet of gas. That’s enough to meet demand for almost half a century with extraction rates similar to U.S. fields. The U.K. government has offered tax breaks to drillers to stimulate the shale industry amid rising fuel imports and declining reserves from the North Sea, which has yielded about 42 billion barrels since the 1970s. The likely range of shale oil in place in the Weald is 2.2 billion to 8.6 billion, the BGS report said. Shale gas potential in the basin is limited. (www.bloomberg.com)

Exxon deepens Russian ties as Ukraine election approaches

May 23, 2014. Exxon Mobil Corp. extended its partnership with Russia’s state-controlled oil company even as U.S. and European nations threaten additional sanctions to punish Vladimir Putin’s regime for its actions in Ukraine. Exxon signed the agreement with OAO Rosneft Chief Executive Officer Igor Sechin at a forum in St. Petersburg, extending a pact that involves drilling for crude in the Arctic and Siberia and liquefying natural gas for export in Russia’s Far East, according to the Moscow-based Rosneft.

Exxon is among American oil producers that rebuffed U.S. State Department pressure to skip the International Economic Forum in Putin’s hometown. With at least $30 billion already invested in Russia’s oil and gas sector, U.S. and European explorers are betting the Ukraine crisis won’t derail their aspirations to capture some of Russia’s 75 billion barrels of reserves. (www.bloomberg.com)

Petronas says Canada gas stocks halfway to goal for LNG investment

May 21, 2014. Malaysia's Petronas has proven up about half of the 15 trillion cubic feet (tcf) target for Canadian gas reserves it needs to make a final investment decision on its C$36 billion ($32.9 billion) natural gas export project. The state-owned oil company plans to drill aggressively through the summer to further prove out its reserves in Western Canada ahead of a final go or no-go decision, anticipated by year-end, on a gas field, pipeline and liquefied natural gas (LNG) export terminal development. The company plans to have 25 to 30 rigs running throughout the summer on its gas fields in northern British Columbia and Alberta. Petronas dove into the Canadian natural gas space in 2012 with its C$5.2 billion takeover of Progress Energy Resources and is now racing to develop its Pacific NorthWest LNG project near Prince Rupert in northern British Columbia. (af.reuters.com)

Downstream

KBR wins contract for refinery project in Western Siberia

May 27, 2014. KBR Inc. announced it has been awarded a contract for project management consultancy (PMC) services for the construction of the advanced oil processing complex which is the part of the major renovation program of the largest operating refinery in Russia owned by JSC Gazprom Neft. The refinery is located in Omsk, Western Siberia, Russia. (www.downstreamtoday.com)

South Sudan chaos halts ex-Blackwater CEO’s refinery plan

May 23, 2014. As the former head of U.S. security company Blackwater USA, Erik Prince thrived in war zones like Iraq and Afghanistan. South Sudan, the world’s newest nation where violence erupted in December, is proving a little tougher. Prohibitive costs, transport difficulties, political instability and growing insecurity have rendered the former U.S. Navy Seal’s plan to build an oil refinery in the north of the country unfeasible for the time being. Talks this month with financiers failed to revive the project that was set to be completed by December. Frontier, a private-equity firm based in Abu Dhabi, has a 12-year agreement with the South Sudanese government to build, own and then transfer to the state a 10,000–50,000 barrel per day refinery that will supply diesel to the domestic market. The landlocked nation currently imports all of its refined fuel. (www.bloomberg.com)

Russia's refinery runs down 6.1 pc in April from March

May 23, 2014. Russian oil refinery runs in April fell month-on-month by 6.1 percent, or 355,496 barrels per day (bpd), data from the Energy Ministry showed. Refineries processed 5.430 million barrels of crude oil per day in April versus 5.786 million in March. Maintenance will be most extensive in April and September this year. The increasing offline capacity will lead to a rise in crude oil supply to the market, which usually dampens crude prices and makes oil products more expensive.

Rosneft's Novokuibyshevsk and Ryazan refineries cut their oil processing by 42.7 percent and 36.5 percent, respectively, in April from March due to seasonal maintenance. Maintenance also cut runs at the Khabarovsk refinery by 34.5 percent compared with the previous month. (www.downstreamtoday.com)

Increase in US oil production creates new issues for refiners

May 22, 2014. The increase in crude oil production in the U.S. and Texas has created issues in the transportation and refining sectors of the oil industry. Crude oil traditionally has been transported by truck and a network of sophisticated pipelines in Texas. However, many crude oil acquisition companies are exploring rail to get large amounts of crude to refineries. Refinery input in the U.S. was 15.949 million barrels per day in the U.S., Energy Information Administration (EIA) reported. The largest refining area is the Gulf Coast, which has more than half of the nation’s refining capacity. The Gulf Coast refined 8.269 million barrels per day. (www.downstreamtoday.com)

Azeri petrol demand helps boost SOCAR refining

May 22, 2014. Azeri state energy company SOCAR plans to increase oil refining by 3.1 percent to 6.7 million tonnes of crude in 2014 on rising domestic fuel demand. SOCAR operates two ageing refineries - the Baku Oil Refinery and the Oil Refinery Azneftyag, both in the capital Baku, that process more than 6 million tonnes of crude per year. Both plants had resumed output after maintenance. Maintenance caused a temporary fall in oil processing to 1.2 million tonnes on January-April this year from 1.7 million tonnes in the same period last year at the Baku Oil Refinery and to 721,280 tonnes at the Oil Refinery Azneftyag from 698,590 tonnes an year ago. SOCAR had imported about 200,000 tonnes of petrol in April due to the maintenance. The company plans to build a major complex processing oil, gas and petrochemicals worth up to $14.4 billion near Baku, scheduled for completion in 2023. Construction is due to start in 2015 and the complex will include a gas-processing plant, an oil refinery, as well as a petrochemicals plant. That will boost refinery capacity will be 8.5-9.0 million tonnes per year. (www.downstreamtoday.com)

Transportation / Trade

US displacing traditional LPG suppliers in Latin America

May 27, 2014. U.S. sales of liquefied petroleum gas (LPG) to Latin America have quintupled since 2007, edging out more expensive exports from countries such as Saudi Arabia and Algeria. With imported volumes surging fast and no domestic projects expected to open soon to produce cooking gas, Latin America's financial outlays for LPG, which governments subsidize for consumers, are expected to grow. A lack of industrial capacity and stagnant natural gas production in Latin America means there is too little LPG to satisfy voracious demand, while the shale boom in the United States has created a growing surplus. In addition to their close proximity to Latin America, U.S. producers are offering lower prices than other major exporters. That has prompted Brazil and Chile, two big buyers, to sign supply contracts with U.S. providers. The switch is benefiting the main U.S. LPG players, Targa Resources Partners and Enterprise Products Partners, which plan to add 400,000 bpd in export capacity by 2018. (www.downstreamtoday.com)

ExxonMobil ships first cargo from PNG LNG Project

May 26, 2014. Exxon Mobil Corporation said it shipped the first cargo of liquefied natural gas (LNG) from the $19 billion PNG LNG project ahead of schedule. PNG LNG, operated by ExxonMobil affiliate ExxonMobil PNG Limited, is expected to produce more than 9 trillion cubic feet of gas over its estimated 30 years of operations. The first cargo is bound for LNG customer Tokyo Electric Power Co. Inc. (TEPCO) in Japan. Production from the first train started in April and production from the second train has also started as additional wells came online. (www.downstreamtoday.com)

Slovak gas pipeline operator opens bids for capacity to Ukraine

May 26, 2014. Slovak pipeline operator Eustream started the so-called open season for interested shippers to bid for capacity on a pipeline that will carry gas into Ukraine via the European Union. Eustream said participants could submit their requests for transfer capacity until June 23 as the pipeline operator gauges market interest. EU member Slovakia and Ukraine signed a deal at the end of April that allows the European Union country to send a limited amount of gas to Ukraine, less than Kiev had hoped for to cushion the blow should Russia turn off the gas. Eustream has said initial bids would be for less than full capacity and for flows that Eustream will be certain it can transport on an unused pipeline that will be pressed into service. The pipeline's capacity is due to be 8-10 billion cubic metres (bcm) per year as of first quarter of 2015 at the latest. First shipments may start in September this year. To help meet its annual consumption of about 55 bcm, Ukraine had pushed to get up to 30 bcm by reversing flows on pipelines currently being used to import Russian gas into Slovakia. (www.downstreamtoday.com)

LNG sellers to chase Japan, South Korea on China-Russia gas deal

May 23, 2014. Liquefied natural gas (LNG) sellers may face more competitive markets in Japan and South Korea, which together bought more than half of the world’s supply in 2013, after China signed a mega gas deal with Russia. China National Petroleum Corp. will buy 38 billion cubic meters of piped gas annually over 30 years from OAO Gazprom’s fields in eastern Siberia at a cost of about $400 billion in an agreement concluded May 21 after 10 years of talks. This supply is equivalent to about 28 million metric tons of LNG, and combined with Sinopec’s purchase of LNG from Petronas’ Canada project, it means 33 million tons of demand has been “taken off the market”. China purchased 18.6 million tons as the world’s third largest buyer of LNG in 2013, according to the International Group of LNG Importers. (www.bloomberg.com)

Noble returns to London LNG trading on US shale volumes

May 23, 2014. Noble Group Ltd., Asia’s biggest commodity trader by sales, is restarting liquefied natural gas (LNG) trading from London as the shale-gas boom in the U.S. is set to boost global shipments of the fuel. Noble hired Gabriel Gonzalez Laguna and Alejandro Sanchez Gestido from Bank of America Corp., Gareth Griffiths, global head of power and gas trading at Noble Europe Ltd., said. They will start in the coming months after leaving the bank’s Merrill Lynch Commodities unit, Griffiths said. The precise date is still to be confirmed.