-

CENTRES

Progammes & Centres

Location

CONTENTS

WEEK IN REVIEW

Ø COAL: Coal Demand: Prognosis Vs Reality

Ø ENERGY: Reforming the Energy Sector: Start from the Other End!

DATA INSIGHT

Ø Renewable Energy Scenario: Target and Achievement

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC sees major jump in FY15 output

· IOC aims to start crude processing at Paradip refinery by Aug-Sep

· HPCL aims to raise refining capacity by 81 pc by 2019

· HPCL to spend $2.8 bn for expanding Mumbai, Vizag refinery capacity

· BPCL, China's Unipec in 1st naphtha term deal

· RIL turns to African crude in shale boom spin-off

· GAIL changes strategy, to focus on non-core operations

· CIL misses production target in April-May 14

· Tata Power plants post strong growth in electricity production

· Power generation rises 11 pc in April, beats target: CEA

· Srei firm in talks to buy Abhijeet Group’s project in Jharkhand

· IFC invests $20.4 mn equity in Power Grid

· Russia's Gazprom Neft says starts oil output in Iraq

· Brazil's Oleo e Gas expects Atlanta field first oil in late 2015

· YPF makes gas discovery in western Argentina

· Russia's Mariysky oil refinery to restart production in June

· Turkey to increase stake in Azerbaijan’s Shah Deniz gas project

· PacificLight Power launches power plant in Singapore

POLICY & PRICE

· Jet fuel price cut by 1.8 pc, non-subsidized LPG by ` 23.50

· Jaya urges Centre to withdraw oil pricing power given to OMCs

· RIL says CAG comment on gas price is part of draft report

· Oil Ministry wants to consult Law and Finance Ministry on revising gas prices

· O&G Industry wants govt to respect sanctity of PSCs

· Mumbai electricity consumers can change power supplier

· Power tariff hiked for section of industrial consumers in Haryana

· Power ministry allays concerns on UP power shortage

· IEEMA seeks higher import duty from new govt

· New power projects will transform J&K to energy surplus state: Omar

· Rajapaksa orders quickening of India power plant project

· Energy supply requires $40 tn investment to 2035, IEA says

· Norway oil riches at stake as political brinkmanship rules

· Oil price becalmed as supply growth means record low volatility

· Repsol wins approval for $10 bn project off Spain

· Pemex in talks for $4 bn investment fund with China

· Ukraine natural gas price risk premium remains for Europe

· Nuclear-free Japan faces summer power crunch in heartland

· Tata Power commissions 25 MW solar farm in Maharashtra

· Modi sets agenda for green minister Prakash Javadekar

· India's solar sector poised for good growth

· Tata Solar boosts production as India prepares for duties

· Japan calls US emissions cut plan a bold step forward

· Politics may sour cap-and-trade sweeteners in Obama plan

· Shell may boost internal carbon price as emission rules tighten

· India and China need to take steps on climate change: US

· Exxon assumes long-term $80 emissions price as investors back GHG disclosure

· China targets heavy industry, vehicles, coal for 2015 carbon cuts

WEEK IN REVIEW

COAL

Coal Demand: Prognosis Vs Reality

Ashish Gupta, Observer Research Foundation

|

T |

he time has come where retrospection is required with regard to projected coal demand and power generating capacity additions also for coal demand from the steel sector. In the last column we highlighted the fact that there is a lack of coordination between the planning agencies and the generating companies that are working in the sector. That is why many of the captive plants came online without captive blocks in the pipeline. This column will elaborate on what was discussed in the last column. This is very important or else we will be subject to irrational criticism.

Captive Coal blocks and captive Power sector: There is no need to reiterate why captive coal blocks failed to meet expectations. Rather than wasting time on discussing mistakes, it is better to correct projection figures based on the current prevailing situation. Past is past and so a new approach is required to estimate the demand for coal in the coming years. Otherwise the end will be devastating as it may create more power generating capacity giving rise to artificial coal demand. Analysts may not believe but this is the real fact:

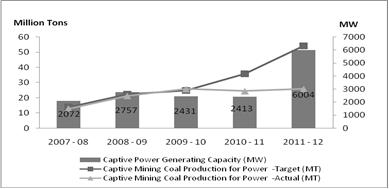

Source: Compiled by ORF from various Government documents

One can clearly see from the graph how captive coal blocks policy has performed in the recent years. Power generating capacity is coming online much faster than the captive coal blocks and the responsibility for fulfilling the demand is put on Coal India. This captive power capacity came up on the assumption that captive miners will rewrite the history of coal sector. That did not happen. Though what happened is bad it can be corrected through rational decision making process complimented with lessons leant from previous mistakes. Therefore rather than stressing on increasing installed power generating capacity we must shift our focus on how to fill the gap by removing the intrinsic hurdles.

Steel Sector: On the steel sector too, we are heading towards precarious situation. Though they rely on coking coal which follows a different logic, the projections need to be re-evaluated. There is no doubt that these projections provide a platform for estimating the demand of coal but it must be re-evaluated at timely intervals. Keeping up enthusiasm all the time is not best policy every time.

|

|

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

2016-17 |

|

Projected Steel Production (MT) |

73.7 |

83.7 |

94 |

104.6 |

116.8 |

128.1 |

|

Coking Coal Requirement (MT) |

46.6 |

53.1 |

60.7 |

66.4 |

72.5 |

77.1 |

Source: Ministry of Steel demand estimation

With due respect, these projection were quite genuine when they were estimated but now things have changed. They were projected when India was growing at the rate of 8-9 percent. In the changed scenario, where it is crystal clear that India will at best grow at the rate 6-7 percent in the prevailing plan period and therefore the requirement of coking coal will also come down dramatically. Interestingly, like the power sector here too different agencies like National Steel Policy, SAIL etc quote different figures. Well projections are projections and they are allowed to differ from reality but a proactive approach will help in reducing the deviation.

Having said that, there is no rational way in which domestic coal will meet the need and coal imports are inevitable for the steel sector. Of course one can come out with optimum utilisation of indigenous coking coal reserves as viable solution. But the fact remains the fact; we do not have much coking coal reserves (17 BT Proved reserves in which only 4 BT is prime coking coal). But if the industry wants to follow the rosy picture then unfortunately they are running away from reality.

The best way forward is to acquire coking coal properties abroad beforehand whether it is Columbia, Mozambique etc. Because the steel sector needs to keep in mind that we are not the only players in the global coking coal market. There is Korea, Japan, China etc who can pay any price which is not the case for India as we cannot absorb high prices. Only diversification in coking equity in foreign soil will reduce the risk!

Views are those of the author

Author can be contacted at [email protected]

ENERGY

Reforming the Energy Sector: Start from the Other End!

Lydia Powell, Observer Research Foundation

|

T |

his is the season for coming up with unsolicited advice to the new government. The energy sector is probably the leading the pack with every energy industry body and consultancy coming up with its own list of things that the Government should do. Since the presumption is that ‘no one has the time to read’, action items are given in bullet points in a page or two. The hope probably is that the neat round bullets from Microsoft word will shoot down the resistance to read.

But one does not have to read through the neatly stacked bullet points to know what the list contains because they are merely reiterating what is now accepted as common wisdom: ‘Unleash the animal spirits of the private sector and allow private capital to take energy starved India to energy surplus India’. Those careful enough to read between the lines will see that they are actually saying ‘we are lazy rent seekers, give us whatever you can give away without the public getting wind of it and we shall see if we can resist real forces of the market such as efficiency and competition and in the process supply some energy, hopefully at monopoly prices’.

The basic premise that underpins what is said and what is left unsaid is that India has a supply problem as far as energy is concerned and the government should do whatever it takes to increase supply. The narrative of scarcity illustrated with cases of stranded power plants starving for gas or coal helps their case. The more sophisticated ‘to do’ lists are likely to invoke the idea of energy security to make a case for supply incentives. The ambiguous but powerful concept of energy security has always been skilfully exploited by energy companies to shape government policy. As distorted as the idea of energy security is, it is an excellent allegory to seek concessions or government assistance for equity investments in coal (for example) that may actually compromise national security in the long run.

If the Government is the messiah of change as it claims to be, what it may want to do is to start at the other end of the problem, namely demand. Two key issues require attention in this regard. The first is the question of demand itself. No one really understands demand in India. It is widely believed that there is a huge unmet demand for energy, a demand so huge that justifies large investments in supply. But there is little to justify the demand. One rich colony cut off from power supply or one bad investment decision by a company that created gas power capacity is interpreted as huge national unmet demand for energy. This claim needs to be unpacked and understood carefully. Take the case of the power sector which is supposed to stand testimony to this claim. As per informed sources in the power sector, only half the installed capacity of over 200 GW is in use at any given time. Power outages in different parts of the country at different times are generally blamed on shortages by the popular media. In reality these are often the result of poor coordination between different parts of the system or the concerned utility deliberately not wanting to supply power below cost. But most believe what the synthetic media tells them. Shortages are traced to inadequate generating capacity and appeals are sent out to the animal spirits of the private sector to come out and invest in more generating capacity. The government rushes to offer incentives to these rare spirits and we get new capacity that cries for fuel.

The business sector has to put its money where its mouth is and so it is, in general, better informed when it comes to assessing demand. However in India the business sector seems to skip this vital step as it presumes that demand will be created by the Government. The business sector creates capacity and waits for demand to come and find it. When this does not materialise it blames government policy that has left it stranded without coal or gas. The media runs stories with graphs and charts on how much gas and coal capacity is crying for fuel. The myth of fuel shortages is generated and perpetuated and cycle goes on. Appeals are made to the animal spirits to produce or import fuel. There is a need to unpack demand for energy in India. It may not be huge or unmet. It just may be misunderstood or deliberately misinterpreted.

The second key issue is the price of energy. It is well known that the high price of energy is one of the major hurdles in developing the manufacturing sector in India. The price of petroleum products is one of the highest in the world on account of the fact that it is the only dependable source for revenue generation in the country. High taxes petroleum raises revenue but this comes at the cost increasing the cost of a vital intermediate good necessary for the manufacturing sector. This holds back the economy and the nation. The case of electricity tariff is even more striking. High tariff for industries and businesses is generally blamed on the household and farm sector. If these cross subsidies are the real problem it should only create internal distortions and misallocations. Taking from Paul to pay Peter should only make Paul poor but in India it makes both Paul and Peter poor. This cannot be right. The reality is that the high average electricity tariff is primarily on account of inefficiencies that are built into the system right from the process of coal mining. No one really knows why coal of comparable quality should cost the same in India and as that from industrialised nations when labour costs are low in India. No one really knows why electricity generated by the same processes around the world ends up being more expensive in India. There is a need to unpack and understand energy price and electricity tariff in India. Lower energy price can support a thriving manufacturing sector and unleash the animal spirits of the nation. What is needed is ruthless efforts towards efficiency and competition – competition between fuels, between sectors, and between players. It is time to stop building pyramid schemes where artificial supply thrives on artificial demand and start building the nation that is efficient and competitive.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

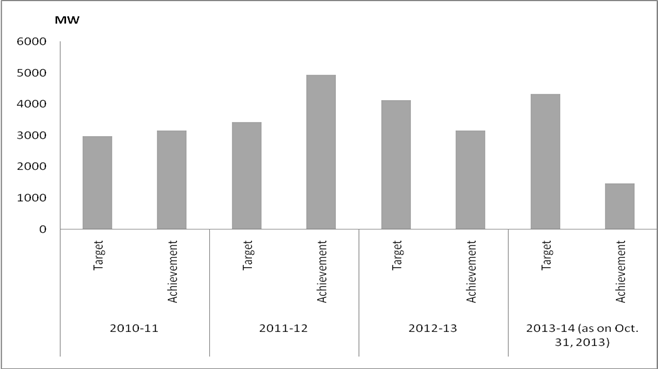

Renewable Energy Scenario: Target and Achievement

Akhilesh Sati, Observer Research Foundation

As on October 31, 2013

|

Source/ Sector |

Target |

Achievement |

Outlay |

Expenditure |

|

Mega Watt (MW) |

` Crore |

|||

|

Wind Power |

2500 |

881 |

230 |

224.95 |

|

Small Hydro |

300 |

114 |

135 |

67.84 |

|

Bio Power |

425 |

78 |

85 |

11.55 |

|

Solar Power |

1100 |

395 |

150 |

121.48 |

|

Total |

4325 |

1468 |

600 |

425.82 |

Trends in Total Generation Capacity Addition*

* for Wind power, Small hydro, Bio power & Solar power

Source: Press Information Bureau, GoI

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC sees major jump in FY15 output

June 2, 2014. Oil and Natural Gas Corp (ONGC) expects a significant jump in production during the current fiscal—a trigger which, along with an expected hike in gas prices this year, will help boost the state-owned company’s revenue. ONGC expects its domestic production of oil and gas combined to rise by 3% in FY15, helped by a significant jump in production from its marginal fields, the company said. According to data available in ONGC’s annual reports, this would be the company’s first increase in production in a decade. Marginal fields are oil and gas-bearing fields whose reserves have depleted over time, making production from these fields an expensive endeavour. The company expects a jump of 1-1.5 million tonnes of oil equivalent (mmtoe) in production during the current year, coming mainly from its marginal fields. The production ramp-up has already begun, with offshore crude production in May rising by 10,000 barrels per day compared with April. For the last 10 years, ONGC has seen a steady decline in production from a high of 47.15 mmtoe in FY05. In FY14, the company’s domestic oil and gas production was 45.03 mmtoe, its lowest in a decade. In FY14, ONGC’s crude oil realization per barrel also fell to a five-year low of $40.97, as the company had to bear the burden of subsidizing losses suffered by oil marketing companies. ONGC expects a 3% rise in output in FY15, helped by a significant jump in production from its marginal fields. While ONGC’s own production has been consistently falling, the company has had the benefit of increased production from its overseas unit ONGC Videsh Ltd, and its joint venture with Cairn India Ltd, which produces crude oil and gas in the Barmer basin in Rajasthan. (www.livemint.com)

RIL counters ONGC claims, says no connectivity between blocks

May 31, 2014. Reliance Industries Ltd (RIL) has accused Oil and Natural Gas Corporation (ONGC) of trying to camouflage its own failure to develop gas fields by alleging that RIL had drawn natural gas illegally from a reservoir that the state firm says straddles the adjoining blocks of the two firms. In its final affidavit to the Delhi High Court, RIL ruled out any connectivity of reservoirs in the company's KG-D6 block and the adjoining area of ONGC. The firm has taken RIL, oil ministry and the directorate general of hydrocarbons to court alleging Reliance may have drawn gas worth thousands of crores of rupees from a common reservoir in the KG-D6 block, while authorities turned a blind eye to the issue. ONGC has argued that Reliance had drilled wells very close to the common boundary of the blocks, but RIL says this does not mean that reservoirs are connected. (economictimes.indiatimes.com)

ONGC plans to spend ` 20 bn in Gujarat

May 29, 2014. Vadodara headquartered Western Onshore Basin of Oil and Natural Gas Corporation (ONGC) is planning to spend ` 2,000 crore in the current fiscal year towards exploration in oilfields and other investments in Gujarat. The basin has a target to drill 38 exploratory wells and achieve 25 million metric tonnes of oil and gas in the financial year 2014-15.

According to ONGC, the corporation received good success at the oil wells in Gandhar field in 2013-14 with one oil well producing 700 barrels. The basin through its Gujarat operations contributes nearly 22 per cent to ONGC's total production in the country. The biggest contribution to the basin's operations in Gujarat comes from Mehsana field, which contributes 33 per cent and Ankleshwar field, which contributes nearly 28 per cent in Gujarat's total production. (timesofindia.indiatimes.com)

IOC to raise $900 mn debt in overseas market

May 30, 2014. The country's biggest refiner Indian Oil Corporation (IOC) will raise $1.65 billion debt in overseas market in the current financial year. The company will raise $900 million through external commercial borrowings to replace short-term costlier loan while another $750 million will be raised over the financial year. The overseas debt interest rate was around 3 per cent - 3.5 per cent. The company raised $1.17 billion foreign debt in the last fiscal. IOC will invest ` 16,600 crore toward business expansion in 2014-15. The firm posted a steep 36 per cent fall in its net profit for the fourth quarter of last fiscal at ` 9,389.85 crore as the government did not compensate it for the under recoveries and its refining margins also shrank. (economictimes.indiatimes.com)

RIL to shut VGO unit at 580k bpd refinery

May 30, 2014. Reliance Industries Ltd (RIL) will shut a vacuum gas oil (VGO) hydrotreater at its 580,000 barrels per day (bpd) export focused plant for up to a month from this weekend. RIL operates the world’s biggest refining complex at Jamnagar in Gujarat, with capacity to process over 1.2 million bpd of crude. The VGO hydrotreater is one of two such units of about 110,000 bpd capacity at the refinery. A VGO hydrotreater removes sulphur from heavy feedstock to produce naphtha, jet fuel and LPG. (www.livemint.com)

IOC aims to start crude processing at Paradip refinery by Aug-Sep

May 29, 2014. The Indian Oil Corporation (IOC) aims to start crude processing at its 300,000-barrels-per-day Paradip refinery by August or September, the company said. The refinery will have only one crude distillation unit. (economictimes.indiatimes.com)

Chennai Petroleum may shut refinery units for month in Q4

May 29, 2014. Chennai Petroleum Corp Ltd plans to shut an 80,000 barrels per day (bpd) crude unit and some secondary units for a month-long maintenance in October-December at its 210,000 bpd Manali refinery. The refiner will also shut a 2 million tonne per annum (mtpa) hydrocracker, a 400,000 tonne a year reformer, a 1 mtpa visbreaker and a 2 mtpa diesel hydrotreater for maintenance in October-December. Manali refinery in the southern state of Tamil Nadu has three crude units. Chennai Petroleum also operates the 20,000 bpd Nagapattinam refinery in the state. (economictimes.indiatimes.com)

HPCL aims to raise refining capacity by 81 pc by 2019

May 28, 2014. Hindustan Petroleum Corp Ltd (HPCL) aims to invest ` 540 billion ($9.2 billion) by 2019 to raise its refining capacity by 81 percent. The capacity would rise to about 860,000 barrels per day. Expansion would help the state refiner modify its existing decades-old plants and boost refining margins by processing cheaper grades. HPCL hopes to win environmental approvals by the end of this year to expand its 130,000 bpd Mumbai refinery in Maharashtra, and the 166,000 bpd Vizag plant in Andhra Pradesh. The company is setting up a 180,000 bpd refinery at Barmer in Rajasthan, which would cost 370 billion rupees. It also has a stake in HPCL-Mittal Energy Ltd, which operates a 180,000 bpd refinery at Bathinda in northern India. HPCL would invest about ` 170 billion to expand Mumbai refinery to 200,000 bpd and Vizag to 300,000 bpd. (in.reuters.com)

HPCL to spend $2.8 bn for expanding Mumbai, Vizag refinery capacity

May 28, 2014. Hindustan Petroleum Corp Ltd (HPCL) aims to increase its Mumbai refinery's capacity to 200,000 barrels per day from 130,000 bpd, the company said. The company also aims to increase the Vizag refinery's capacity to 300,000 bpd from 166,000 bpd. HPCL will spend ` 170 billion ($2.88 billion) for expanding the refineries. (in.reuters.com)

Transportation / Trade

BPCL, China's Unipec in 1st naphtha term deal

May 30, 2014. India's Bharat Petroleum Corp Ltd (BPCL) has signed a four-month naphtha sales deal with Chinese trading house Unipec, the first term deal between the two parties, traders said. Unipec will lift a 35,000-tonne cargo each month from Kochi port from July to October, or a total of 140,000 tonnes during the four-month period. The deal was done at around $1.00 a tonne premium to the refiner's own pricing formula on a free-on-board (FOB) basis, the traders said. BPCL which holds two other short-term naphtha contracts with Japan's Idemitsu Kosan, has separately sold a 38,000-tonne spot cargo for June 21-23 loading from Mumbai to another Chinese trader - PetroChina - at a premium of about $40 to $41 a tonne to Middle East quotes on FOB basis, traders said. (economictimes.indiatimes.com)

RIL turns to African crude in shale boom spin-off

May 30, 2014. Reliance Industries Ltd (RIL) is boosting crude imports from Africa and cutting its dependence on the Middle East as the owner of the world's biggest refining complex seeks to benefit from shifting global oil flows caused by the US shale boom. African and Latin American crude, which together account for about 56 per cent of Reliance's imports now, have become cheaper as the United States slows purchases and increasingly turns to domestic shale oil, while Middle Eastern heavy crude grades are pricier due to demand from regional refinery expansions. (economictimes.indiatimes.com)

RIL's June exports seen highest since December

May 30, 2014. Reliance Industries Ltd (RIL) sold 55,000 tonnes of naphtha for June loading from Sikka, traders said, pushing its total exports for next month to 185,000 tonnes, which data shows would be the highest in a single month since December. RIL sold the cargo, scheduled for lifting from Sikka around June 24, to Vitol at a premium in the high $20s a tonne level to Middle East quotes on a free-on-board (FOB) basis. The other two cargoes for June loading were also sold to Vitol previously. (economictimes.indiatimes.com)

GAIL changes strategy, to focus on non-core operations

May 30, 2014. GAIL (India) Ltd, the nation’s biggest gas distributor, will shift its focus to businesses such as gas retailing and petrochemicals because of uncertainties in gas supply and pricing, along with delays in approvals for pipelines. GAIL will slow expansion of its core business of gas transportation and marketing, including its planned investments worth ` 20,000 crore to develop three pipeline networks across the country. (www.livemint.com)

RIL's April oil imports up 9.5 pc on month

May 30, 2014. Reliance Industries Ltd (RIL) imported 9.5 per cent more oil in April than in March, and made its first purchase of Mexico's extra light Olmeca grade while continuing to skip imports from Iraq for the sixth month, tanker arrival data obtained from trade sources show. It imported about 1.21 million barrels per day (bpd) of oil in April for processing at its two complex refineries at Jamnagar in western Gujarat state. The plant can together process 1.2 million bpd of oil. Reliance, which regularly tests new grades and buys cheaper tougher grades to maximise its refining margins, received a rare cargo of Equatorial Guinea's Zaffiro and Alen condensate. In the four months to end-April, Reliance bought three cargoes of Kazakhstan's CPC blend and stepped up purchase of UAE's Umm Shaif and Lower Zakum grades, the data showed. Reliance may boost intake of Brent-linked heavier, cheaper African grades in 2014 and West Texas Intermediate (WTI)-related Latin American oil while cutting intake of those from Middle East. Brent and Latin American grades have turned cheaper after being displaced from the US market because of a shale boom and enhanced Canadian supplies through pipelines and rails. (economictimes.indiatimes.com)

Policy / Performance

PM's 100-day agenda: Energy ministers gear up

June 3, 2014. With the Prime Minister (PM) Narendra Modi led-government asking every ministry to come up with a 100-day agenda, the petroleum ministry is planning to line up a priority list. The list includes clarity on policies relating to the next round of bidding for exploration of oil & gas blocks, gas pricing and removal of bottlenecks in the sector. The power and coal ministries, too, have lined up an agenda that includes increasing coal production, renewable energy generation and financially healthier distribution companies. After issuing a 10-point agenda on the functioning of the government, Prime Minister Modi held a special meeting of the Council of Ministers on a 100-day plan. With Dharmendra Pradhan, minister of state for petroleum, insisting on a pro-poor approach, suggestions by the Kirit Parikh panel on pricing of petroleum products, including a rise of ` 250 in the prices of subsidised domestic cooking gas cylinders, aren’t likely to be implemented. Within 100 days, a decision on the future of direct benefits transfer for liquefied petroleum gas may also be taken. The government’s 10-point agenda included health, water, energy and roads. It sought greater transparency in governance and building confidence within the bureaucracy. To expedite decision making within the government, the Price Minister’s Office had decided to abolish the nine empowered groups of ministers and twenty-one groups of ministers. (www.business-standard.com)

Jet fuel price cut by 1.8 pc, non-subsidized LPG by ` 23.50

June 2, 2014. Jet fuel prices have been cut by 1.8% and rates of non-subsidized cooking gas (LPG) by ` 23.50 per cylinder after the rupee’s appreciation lowered import costs. The price of jet fuel, also known as aviation turbine fuel (ATF), at Delhi was cut by ` 1,285.89 per kilolitre, or 1.81%, to ` 69,747.98 per kilolitre, according to Indian Oil Corp (IOC). This is the third reduction in jet fuel rates since April. Declining international oil prices and the strengthening of the rupee against the US dollar have made imports cheaper. In Mumbai, jet fuel costs ` 71,940.36 per kl as against ` 73,306.89 per kl previously, IOC said. The rates vary because of differences in local sales tax or VAT. Jet fuel constitutes over 40% of an airline’s operating costs and the price cut will ease the financial burden of cash-strapped carriers. Separately, the price of non-subsidised LPG, which customers buy after using up their quota of 12 subsidised cylinders, was cut by ` 23.50 per cylinder, the fifth straight reduction in rates since February. Each non-subsidized 14.2kg cooking gas cylinder will now cost ` 905, down from ` 928.50, in Delhi. The rates were cut on February 1 by ` 107—from ` 1,241 per cylinder to ` 1,134, by ` 53.5 per cylinder in March to ` 1,080.50, by ` 100 to ` 980.50 in April and by ` 52 last month. A subsidised LPG cylinder in Delhi costs ` 414. Non-domestic LPG rates were increased by a steep ` 220 per cylinder at the beginning of the year but have now been cut in line with softening international rates. IOC said losses on LPG have come down to ` 432.71 per subsidized cylinder from ` 449.14 in the previous month. The loss was ` 762.50 in January. (www.livemint.com)

Jaya urges Centre to withdraw oil pricing power given to OMCs

June 1, 2014. Tamil Nadu Chief Minister J Jayalalitha said that the people's hope of a further progress by change of government at the Centre has been dashed with the fifty paise hike in diesel prices. She once again urged the new government to change the oil pricing formula instead of following the wrong economic policies of the erstwhile Congress led government and asked the centre to withdraw the hike, which will have inflationary effect. The oil pricing mechanism should be changed and must factor in the cost of crude (imported and domestically explored) and their refining costs, she suggested. She said if this method is followed the prices of petroleum products would come down and inflation would be contained. Jayalalitha said she will stress the Centre to withdraw the power give to Oil Marketing Companies (OMCs) to fix the fuel price. (www.business-standard.com)

RIL says CAG comment on gas price is part of draft report

May 31, 2014. Reliance Industries Ltd (RIL) said the CAG comment that the company charged a rate in excess of the government approved price for its KG-D6 gas is part of a draft report which has not yet been finalised. RIL said a report of the Comptroller and Auditor General of India (CAG) will come into existence when each audit para including one on pricing of gas "have gone through various stages of comments and clarifications from all concerned parties and the counter of the auditee under review." RIL, however, did not refute the contents of the draft report that has been sent to the Ministry of Petroleum and Natural Gas as well as to the company for comments. The CAG had in a draft report stated that RIL charged USD 4.205 per million British thermal unit as price of gas produced from its eastern offshore KG-D6 block instead of rounding off to two decimal points, i.e. $4.20 as was indicated by the company when it in 2007 undertook price discovery. On top of this sale price, RIL charged a marketing margin of USD 0.135 per mmBtu to cover for its marketing risks but did not include it for calculation of royalties and government's share of KG-D6. RIL said government had in 2007 approved a pricing formula and not a specific price. (economictimes.indiatimes.com)

Oil Ministry wants to consult Law and Finance Ministry on revising gas prices

May 31, 2014. The petroleum ministry wants to consult the finance and law ministries before taking a decision on revising natural gas prices. The petroleum ministry wants to consult the law ministry as Reliance Industries Ltd (RIL) has legally challenged the government by initiating arbitration over delay in the announcement of new gas prices. The previous government had approved a new formula that would have doubled gas prices from April 1 but the Election Commission blocked the move. (economictimes.indiatimes.com)

Diesel prices hiked by 50 paise per litre

May 31, 2014. Diesel prices were hiked by 50 paise a litre, excluding state levies, the second increase in rates three weeks. The monthly hike in price came after several rounds discussions that the new oil minister Dharmendra Pradhan held with state-owned oil firms on continuing with the reform initiated by the United Progressive Alliance (UPA) government. The announcement of the hike gave clear indications that the Bharatiya Janata Party (BJP) government will continue with reforms of the previous Congress regime. The UPA had in January 2013 decided to raise diesel prices in small doses of up to 50 paise every month till such time that the subsidy on nation’s most consumed fuel is eliminated. (www.livemint.com)

O&G Industry wants govt to respect sanctity of PSCs

May 29, 2014. India's exploration activity has crashed due to loss of focus after big discoveries, arbitrary policy changes, lack of respect for sanctity of contracts and deteriorating risk-reward ratio, but the situation can be revived with proper measures, the exploration industry has told the new government. Seismic surveys, a key activity in the hunt for hydrocarbons, plummeted 91% in the five years to 2012-13 in onshore blocks and 95% in the more challenging offshore regions, the Association of Oil and Gas Operators has estimated. Further, the number of wells drilled has dipped 22% in the country, which urgently needs to step up exploration as it imports 80% of the oil it consumes, said the industry body. The exploration industry has been mired in disputes during the UPA government. These include successful explorers such as Reliance Industries and Cairn India, which have found the biggest reserves of oil and gas since the discovery of Bombay High in the Seventies. The industry body says that the government's approach has changed drastically, and in the wrong direction. The industry feels that it is a victim of its own success. The oil and gas industry is worried that India is losing lustre as an investment decision as the government has struggled in its role as contract administrator; the oil ministry failed to resolve policy conflicts in a timely manner, violation of the sanctity of contracts and lack of recognition that the Indian upstream industry derives its strength from the enthusiasm of existing players. It has suggested that the country must realistically assess its geology, focus on providing geological information, improve the risk-reward ratio for investors and remove, or at least minimize, unnecessary controls that do not add value. The government's approach towards exploration and production as well as companies involved in this activity has largely been shaped by high-profile issues relating to the KG-D6 block, which initially hoisted India to global limelight as the world's biggest find in the year it was discovered, and being the pioneering deep-sea venture for India. However, production fell sharply leading to a bitter dispute between the oil ministry, which blamed the company, and RIL, that said it suffered because of complex geology in the challenging deep-sea region. (economictimes.indiatimes.com)

POWER

Generation

CIL misses production target in April-May 14

June 2, 2014. Coal India Ltd (CIL) reported provisional coal production of 36.27 million tonne (mt) for May, falling short by 6 per cent from the target of 38.56 mt. The combined production shortfall for the first two months of 2014-15 fiscal was 3 per cent at 73.79 mt (provisional) against the target of 76.17 mt. The miner though unable to meet its production target registered a growth of 5 per cent for the first two months. Eastern Coalfields, Bharat Coking Coal Ltd and Central Coalfields succeeded in surpassing production targets. (economictimes.indiatimes.com)

Power deficit doubles in May to 7 GW; 20 GW of new thermal capacity still lying idle

June 2, 2014. Power cuts could spread to many parts of the country as the electricity deficit has more than doubled in May, while spot power prices have doubled in the last few days as scorching heat has increased demand. The situation may deteriorate further as the monsoon, forecast to be deficient, is behaving erratically even before hitting Kerala The power deficit has jumped to nearly 7,000 MW from 3,000 MW in early May. As power stations try to increase generation to meet demand, coal stocks have started depleting at some thermal plants — a situation that can add to the deficit in the days ahead. (economictimes.indiatimes.com)

Tata Power plants post strong growth in electricity production

June 1, 2014. Tata Power has generated 23,928 million units of electricity at its Mundra ultra mega power project (UMPP) in the past fiscal year and 6,328 million units at Maithon Power Ltd (MPL). Generation capacities of the Mundra project, which is also known as Coastal Gujarat Power Ltd, and MPL increased by 92 per cent and 38 per cent, respectively, from the previous year, the company said. Tata Power has an installed gross generation capacity of 8,560 MW and aims to distribute 4,000 MW and secure 50 million tonnes per annum of fuel resources by 2022. (economictimes.indiatimes.com)

Power generation rises 11 pc in April, beats target: CEA

June 1, 2014. Power generation increased over 11 per cent in April, exceeding the target for the month, after new projects were commissioned. Electricity generation rose to 86.6 billion units from 77.87 billion in April last year, according to data from the Central Electricity Authority (CEA). Thermal power plants generated 74.02 billion units during the month. Hydel, nuclear and power imports from Bhutan contributed 9.67 billion units, 2.81 billion units and 78 million units, respectively. The electricity generated in April was higher than the target of 81.74 billion units set by the government for the month, according to the data. A thermal power project with a capacity of 135 MW was commissioned in Chhattisgarh in April. NTPC had started at least 2,000 MW of projects during the last quarter of 2013-14, including thermal stations in Uttar Pradesh and Tamil Nadu. The CEA estimates generation of 1,023 billion units in 2014-15, compared with 967 billion units in 2013-14. The peak power requirement in the country in April was 1,40,998 MW, while availability was 1,33,442 MW. (economictimes.indiatimes.com)

Srei firm in talks to buy Abhijeet Group’s project in Jharkhand

May 29, 2014. India Power Corp. Ltd, a group firm of Kolkata-based non-banking finance company Srei Infrastructure Finance Ltd, plans to acquire Abhijeet Group’s 1,080 MW Jharkhand power project, valued at around ` 9,000 crore, in what could be the first of several acquisitions in India’s power sector. Lenders to the Abhijeet project, including state-owned Rural Electrification Corp. Ltd (REC) and State Bank of India (SBI), have been looking to recover or restructure their loans. The Abhijeet group, promoted by Manoj Jayaswal, is one of the alleged beneficiaries of the previous government’s irregular allotment of coal mines. The Central Bureau of Investigation (CBI) is probing the allotments. Jayaswal has been in talks with Srei Infrastructure, which has approached lenders with a buyout plan. The Jharkhand project has four units of 270 MW each, divided into two phases. While REC is the lead lender for two units, SBI is the lead lender for the remaining two. According to Abhijeet Group, the expected date of commissioning of Phase I is December 2014 and Phase II August 2015. (www.livemint.com)

Sasan power project's 4th unit in MP starts generation

May 28, 2014. The power generation at the fourth unit of the Sasan Ultra Mega Power Project (UMPP) in Singrauli district of Madhya Pradesh (MP) has started. The generation at the fourth unit started with Madhya Pradesh getting 250 MW as its share, Madhya Pradesh Power Management Company Limited said. The total capacity of Sasan UMPP is 3,960 MW. A total of six units, of which four are already commissioned, are being set up in the plant. The generation from the fifth and the sixth unit too will start soon. (www.business-standard.com)

Transmission / Distribution / Trade

Jaypee Power, Lanco, GMR, others queue up to sell power assets to NTPC

June 3, 2014. Local power producers, including Jaypee Power Ventures, Lanco Infratech, GMR Infrastructure, and iron ore miner Sesa Sterlite have offered to sell some of their power plants to India's largest power producer NTPC as lenders put pressure on them to divest assets to slash debt. NTPC has received more than 30 offers in response to its offer, known in industry parlance as expression of interest (EoI), made in April to purchase coal-fired power plants. Lanco, which has coal-fired power plants with a capacity of about 3,000 MW, had publicly stated its intention to sell some assets. NTPC was keen to purchase Jaypee's three power plants at Bina (500 MW), Nigri (1,320 MW) and Bara (1,980 MW), which are either operational or in the final stages of commissioning with adequate coal supply arrangements. Bina is already operational while Nigri will be commissioned in the next financial quarter, and Bara will be ready by 2015. (economictimes.indiatimes.com)

IFC invests $20.4 mn equity in Power Grid

June 3, 2014. International Finance Corporation (IFC) said it made an equity investment of $20.4 million in Power Grid Corporation of India (Power Grid). The investment was through its participation in the FPO. Power Grid lined up a project whose cost is estimated at about $16 billion out of which $ 1 billion is funded through an equity infusion in the FPO. The project comprises of several transmission lines and sub-stations in various parts of the country. Power Grid is country's inter-state and inter-regional transmission utility, majority owned by the Government of India. The national transmission utility has a capital expenditure plan of $16 billion during the 2013-17 period (the Project) for further development of national grid. (www.business-standard.com)

UP counters central govt over power supply situation

June 2, 2014. Uttar Pradesh's power utility countered central government's criticism over short supply of electricity when most parts of the state are under heat wave. The centre is distorting facts of power supply situation. Newly formed NDA government and Akhilesh Yadav government in Uttar Pradesh are blaming each other for long power supply cuts in the state where ruling Samajwadi Party failed to make a mark in the general elections. Opposition parties are claiming that Yadav government is victimising voters in the constituencies that did not vote for his party. Of the state's demand for 12,700 MW, power utilities are able to cater about 10,700 MW is met, leaving a shortfall of 2,000 MW. The state's power utilities are suffering transmission and distribution losses to the tune of 32%, which translates into loss of ` 7,000 crore per annum to state exchequer. Power utilities of Uttar Pradesh are able to supply electricity for less than 13 hours in urban areas and eight hours in villages. Centre also suggested Uttar Pradesh to procure adequate power from the power exchanges to meet its shortage while the state has already started buying close to 800 MW from Indian Energy Exchange alone. It also asked NTPC to supply 325 MW of supply till June 7. Uttar Pradesh is unable to procure power from not only southern grid but lack of transmission network is also preventing Uttar Pradesh Power Corporation Ltd (UPPCL) from availing 700 MW of power it tied up early this year to meet summer demands. (economictimes.indiatimes.com)

Unit closures force 2-5 hrs of power cuts across Maharashtra

June 1, 2014. Maharashtra State Electricity Distribution Company (MSEDCL) said that it has had to effect two to five hours of 'load shedding' across the state owing to technical issues at some private sector generating stations and a dip in supply from the central grid. Two units of 660 MW each operated by Adani Power, 600 MW from JSW Energy and 500 MW from Indiabulls Power have stopped delivering power while there is also a 500 MW dip in supply from central grid. (www.business-standard.com)

North India grid had load loss of 8 GW in storm

May 31, 2014. The northern electricity grid suffered a load loss of 8,000 MW, including 3,500 MW in the national capital, during a fierce storm in the region and power supplies are gradually being restored. Supplies were affected due to heavy rains, dust and thunderstorms and wind speeds exceeding 75 kmph in areas of Delhi, Uttar Pradesh, Haryana and Uttarakhand. Piyush Goyal, Minister of State for Power (independent charge) reviewed the situation arising out of the load interruption. The ministry also said restoration work has started. In Delhi, top priority was accorded to restoring power to emergency services such as hospitals, Delhi Metro, water treatment plants and the New Delhi Municipal Council area. Presently, about 3,800 MW load is being met. (economictimes.indiatimes.com)

China's Shanghai Electric Group in talks to buy up to 74 pc stake in eight power projects of ILFS

May 31, 2014. ILFS Energy Development Co, which is developing coal- and gas-based power plants with a capacity of about 7,500 MW across the country, has begun talks with Shanghai Electric Group to sell a stake of up to 74% in eight projects, starting with its 4,000 MW power plant at Cuddalore district in Tamil Nadu. The talks are project-specific and will depend on how the ongoing discussions conclude. Apart from unlocking value, ILFS also wants a strategic investor which can execute engineering and procurement work as well as operations and maintenance once the plants are completed. (economictimes.indiatimes.com)

Telangana Transco to come into being on June 2

May 30, 2014. A separate transmission company has been created for power transmission in the Telangana region. All the functions presently being carried out by AP Transco in the area of Telangana State will be performed by the TG Transco from June 2. An order has been issued by the energy department creating the new power utility for the new state of Telangana as per the section 53 of the AP Reorganisation Act 2014. (timesofindia.indiatimes.com)

Meter inspector beaten as power retailers bleed: Corporate India

May 29, 2014. Inspectors from billionaire Anil Ambani’s electricity retailer BSES Rajdhani Power Ltd. entered a village near New Delhi hunting for tampered meters. Residents responded by beating them with iron rods. The team was also stoned in the May 21 incident, a police report shows. Inspectors who visited another village in 2012 were bound and urinated on. The attacks show the task India’s power distributors face to stem theft contributing to blackouts and $17 billion in lost revenue annually. Losses from stolen power, inefficient transmission and patchy metering pose a pivotal test for Indian Prime Minister Narendra Modi’s pledge to boost energy output as a matter of national security. The government also requires distributors to sell power below cost in India, where about two-thirds of the 1.2 billion population live on less than $2 per day. That forces retailers to increase debt to pay for supplies and curbs the funds flowing to power generation companies to scale up production. Distributors, including Reliance Infrastructure Ltd’s units BSES Rajdhani and BSES Yamuna Power Ltd in New Delhi, owed ` 141 billion ($2.4 billion) to state-run generators as of April 30, the Power Ministry estimates. The assault with rods occurred in the national capital’s Keshopur village, according to the police report. A BSES Rajdhani anti-theft squad was tied up and urinated upon in 2012 in a village near Najafgarh, about 20 kilometers (12 miles) west of central New Delhi, the company said. Assaults have worsened since 2009, when a federal police team known as the Central Industrial Security Force stopped accompanying inspectors on raids, the company said. Insufficient electricity supplies are hurting efforts to spur economic growth from close to a decade-low and leave about 300 million people, or more than the combined populations of Brazil and Argentina, without electricity. The nation’s supply network loses more than 27 percent of the power it carries because of dissipation from wires and theft, according to India’s Central Electricity Authority. That’s about 261,130 gigawatt-hour of power annually, enough to light up all of New York state for 21 months, and worth about ` 1 trillion at an average electricity price of ` 4 a unit. The loss is 5 percent in Australia, 6 percent in China and the U.S. and 16 percent in Brazil, according to the World Bank. To curb theft, BSES started raiding premises across the national capital, sometimes in the dead of the night. The company registered more than 750 cases and discovered that about 3,330 kilowatts had been stolen in the “past few days,” enough to power more than 800 middle-class households in the capital. The raids will continue for three months. (www.bloomberg.com)

New govt pushes Coal India to revive overseas mine buy effort

June 3, 2014. Buoyed by hopes of a speedy reform process to be undertaken by the new government going ahead, Coal India (CIL) has now decided to acquire coal mines abroad, and pick up stakes, particularly, in coking coal and high grade thermal coal. Despite pursuing with handful of proposals in the past, Coal India had failed to firm up any acquisition in the past five years. With the coal ministry, under Piyush Goyal, looking at reviving efforts to boost output, Coal India now wants to go all-out on the acquisition front, especially, at a time when output of coking coal and high grade thermal coal is seen declining from the domestic mines. The state-owned miner, which has a near monopoly, is open to outright takeover of mines or even undertake equity investment on production sharing basis, Coal India has said. Coal India currently has about 17 investment proposals from overseas mining companies. (www.dnaindia.com)

State asked to ensure security for power projects

June 3, 2014. The Ministry of Power has asked the State Government to ensure implementation of standard security guidelines in all vital installations, including hydel and thermal power projects. Even as there are gaping holes in security arrangement of vital installations, the State Government appears callous to the emerging threat from Left Wing Extremists (LWEs). The Naxal attack at Balimela Hydro Electricity Project and Nalco’s explosive depot atop Damanjodi hill in 2009 had exposed the lax security in several key industrial units in the Maoist-affected southern Odisha districts. A couple of years back, miscreants stole copper cables from Indravati Hydro Electricity Project leading to total disruption of power generation for about 16 hours. Following the incident, there were proposals to increase security cover for the hydel projects in the State. (www.newindianexpress.com)

Goyal to meet Modi; to set priorities for power sector

June 2, 2014. Power and Coal Minister Piyush Goyal will meet Prime Minister Narendra Modi to discuss and establish top priorities in the power sector. Coal production, renewable energy and making discoms healthy will top the priority list, he said. The government is looking at holistic solutions to issues faced by the sector. (www.business-standard.com)

Mumbai electricity consumers can change power supplier

June 1, 2014. Electricity consumers in Mumbai can change their supplier if they want and Brihanmumbai Electricity Supply & Transport Undertaking (BEST) cannot prevent it, the Supreme Court has held in the case, BEST vs Maharashtra Electricity Regulatory Commission. Some consumers in the BEST supply area wanted to change to Tata Power Co for power requirement. When they approached BEST, it rejected their request. They moved the Mumbai Electricity Regulatory Commission. Reliance Industries, another supplier, was also made a party to the case. The commission allowed the petitions and held that Tata Power was bound to supply electricity either through BEST wires or its own wires. (www.business-standard.com)

Delhi power crisis averted: BSES discoms clear ` 7 bn dues to NTPC

May 31, 2014. Power Finance Corporation (PFC) and Rural Electrification Corp (REC), have rescued Reliance Infrastructure’s power distribution companies in Delhi by helping them pay off generator NTPC’s past dues. PFC and REC disbursed a combined ` 1,000 crore as loan to the two discoms — BSES Yamuna Pvt Ltd (BYPL) and BSES Rajdhani Pvt Ltd (BRPL), the last day for clearing NTPC’s ` 700-crore dues according to the Supreme Court’s order. NTPC had been threatening to cut Delhi’s supply if its dues were not cleared. NTPC had in May sought the apex court’s permission to begin regulation of power supplied to the BSES firms, arguing nearly 75 per cent of the payments received from these companies went to Coal India, so if they did not pay, NTPC’s Badarpur thermal plant would not be able to supply electricity to Delhi. (www.business-standard.com)

Power tariff hiked for section of industrial consumers in Haryana

May 31, 2014. Haryana raised power tariffs for a section of industrial users--2 lakh out of a total 50 lakh power consumers--but the increase has been offset by other measures. The new tariff order issued by the Haryana Electricity Regulatory Commission (HERC) will have no impact on domestic, tubewell and small, non-domestic consumers. The agriculture tariff, which was reduced to 10 paise per unit from 25 paise effective January 1, has been retained at that level for 2014-15. Supply to farms has risen to 30 minutes short of 24 hours a day from 18 hours previously. (economictimes.indiatimes.com)

Power ministry allays concerns on UP power shortage

May 30, 2014. The power ministry has sought to allay concerns of Uttar Pradesh (UP) residents on an alleged severe shortage of electricity in the state. Angry residents are taking to the streets protesting over near 12-hour power cuts in many areas post the general elections. UP has a peak power demand of 12,700 MW against which over 10,700 MW is being met, leaving a shortfall of around 2,000 MW. This has forced Uttar Pradesh Power Corporation Ltd (UPPCL) to take up rostering or re-allocation in many areas including rural districts. (www.business-standard.com)

Coal India’s March quarter profit falls 18 pc to ` 44.3 bn

May 29, 2014. Coal India Ltd (CIL) said net profit in the quarter ended March declined 18% to ` 4,434.18 crore, weighed down by lower realization from auctions and a ` 876 crore provision to resolve a dispute with its biggest customer NTPC Ltd, a power utility. Though the state-controlled miner managed to sell through electronic auctions 58 million tonnes (mt) in the March quarter compared with 49.14 mt in the same period a year ago, realization fell by around ` 300 per tonne to ` 2,140 per tonne, according to the company. (www.livemint.com)

India to build 4 new hydropower projects in Bhutan

May 28, 2014. India has agreed to build four new joint venture hydropower projects in Bhutan as the two governments agreed to closely coordinate on issues relating to their national security and interests. Prime Minister Narendra Modi met his Bhutanese counterpart Tshering Tobgay in New Delhi and agreed that India would build four new hydropower projects with a capacity to generate 2120 MW in Bhutan. Bhutanese Foreign Minister Rinzin Dorji said Modi also expressed concerns on why the implementation of Bhutan's hydropower projects was delayed. (economictimes.indiatimes.com)

IEEMA seeks higher import duty from new govt

May 28, 2014. The new government should take immediate steps, including levying higher customs duty on imported electrical equipment, to protect interests of the domestic industry, the Indian Electrical Equipment Manufacturing Association (IEEMA) has said. According to IEEMA, which has more than 800 members, the built-up capacity of electrical equipment industry is currently under utilised due to sluggish domestic demand. This is mainly on account of power sector slow down as well as surge in imports of electrical equipment. Suggesting various measures, the grouping has said that only domestic manufacturers should be allowed to participate in bidding for domestically-funded projects. Besides, IEEMA has suggested that basic customs duty on all electrical equipment products should be kept at a uniform rate of 10 per cent. (economictimes.indiatimes.com)

New power projects will transform J&K to energy surplus state: Omar

May 28, 2014. Jammu and Kashmir Chief Minister Omar Abdullah said scores of newly started power projects are set to catapult energy scenario in the state and help achieve the goal of self-reliance in electricity needs in near future. He said the enhanced power generation in the state will benefit not only the domestic and industrial consumers but transform Jammu and Kashmir from power deficit area to energy surplus state. The Chief Minister said the initiatives taken to upgrade power supply and service delivery will widen the base of customer care of the Power Development Department. (www.business-standard.com)

Rajapaksa orders quickening of India power plant project

May 28, 2014. Fresh from his visit to New Delhi for Prime Minister Narendra Modi's swearing-in, Sri Lankan President Mahinda Rajapaksa ordered officials to quicken the progress of a coal-fired power plant being built jointly with India. Sri Lanka and India had announced the finalisation of USD 512 million joint venture coal-powered electricity plant in Sampur in the eastern port district of Trincomalee. The joint venture will see the construction of two power generators of 250 MW each. At the signing of the deal in the presence of then External Affairs Minister Salman Khurshid, it was announced that the construction was to begin within a year and the plant was to be connected to the national grid by 2018, providing cheaper electricity. Sri Lanka currently depends on expensive diesel-powered plants to meet its demand that cannot be fulfilled by hydroelectricity. (www.business-standard.com)

INTERNATIONAL

OIL & GAS

Upstream

Russia's Gazprom Neft says starts oil output in Iraq

June 2, 2014. Russia's Gazprom Neft, the oil arm of natural gas producer Gazprom, said it has started oil production at the Badra field in Iraq. The company hopes production at the field, in the eastern Wasit province, will reach 15,000 barrels per day when the necessary infrastructure is expected to be in place. Production is expected to reach a peak of 170,000 barrels per day (around 8.5 million tonnes per year) in 2017 and then remain stable for seven years, the company said. (www.rigzone.com)

Brazil's Oleo e Gas expects Atlanta field first oil in late 2015

June 2, 2014. Bankrupt Brazilian oil company Oleo e Gas Participacoes SA expects to produce its first oil from the Atlanta offshore field in the BS-4 block in the Santos Basin in late 2015 or early 2016, the company said. Oleo e Gas owns 40 percent of an estimated 147 million barrels of proven, or "1P," oil reserves, and 56 million cubic meters of natural gas in the Atlanta field. The neighbouring Oliva field holds 65 million barrels of recoverable oil and equivalent natural gas, with first oil expected in 2021. (www.rigzone.com)

YPF makes gas discovery in western Argentina

June 1, 2014. Argentina state oil producer YPF said it had made a discovery of 'tight gas' in the western Argentine province of Mendoza. The find by the Paso de las Bardas Norte xp-37 exploration well has a potential 25 million barrels equivalent of recoverable resources, the company said. There was also "important potential" for oil, it said. Tight gas is a type of hydrocarbon found in reservoirs formed by rocks of low permeability. Gas production infrastructure is already in place in the area, allowing for immediate production, said YPF. (www.rigzone.com)

Laredo Energy expands into gas exploration in East Texas

May 30, 2014. After focusing on natural gas for 13 years as a private company, Houston-based Laredo Energy is interested in getting into oil production in east Texas this year, ahead of the decision to go public in 2015, the company said. This is the first time that the company will be focusing on oil production; up until now, it has confined its efforts to natural gas exploration. However, with $130 million in new equity commitments from Avisa Capital Partners and Liberty Energy Holdings, the company will be expanding its drilling program to include the Eaglebine play in East Central Texas as it continues to drill for gas in South Texas. Laredo Energy’s natural gas drilling will focus on plays in Webb County, while the oil production will be in Brazos, Burleson and Robertson counties, where the company will use the knowledge and experience it gained from drilling for gas in South Texas. (www.rigzone.com)

Sundance Energy looks at Eagle Ford deals up to $200 mn

May 28, 2014. Sundance Energy Australia Ltd., an explorer that’s expanding in the Eagle Ford shale formation of Texas, will look at acquisitions of as much as $200 million as some competitors focus on drilling over deals. Sundance plans to add more acreage in the Eagle Ford through leases, small purchases and potentially larger acquisitions. The company may purchase as much as 25 percent of the more than 50,000 acres it’s evaluating. (www.bloomberg.com)

Maersk gets approval to develop two oil fields in UK North Sea

May 28, 2014. Maersk Oil, a unit in Danish shipping and oil group A.P. Moller-Maersk, said it has received approval from British and Norwegian authorities to develop the Flyndre and Cawdor fields. The fields lie approximately 293 kilometres southeast of Aberdeen in the UK North Sea. The Flyndre well is expected to peak at around 10,000 barrels of oil per day with first oil expected in 2016, with Cawdor expected to peak at around 5,000 barrels per day with production beginning in 2017, Maersk Oil said. (www.rigzone.com)

Downstream

Venezuela to appeal arbitration ruling on Sweeny refinery unit

June 2, 2014. Venezuela will appeal an arbitration ruling allowing refiner Phillips 66 to acquire state oil company PDVSA's 50 percent stake in a delayed coking unit at the Sweeny refinery, the Oil Minister Rafael Ramirez said. The 70,000 barrel-per-day coking unit was originally owned by Merey Sweeny LP, a joint venture between PDVSA and Phillips. (www.downstreamtoday.com)

Japan's Idemitsu Kosan shuts Hokkaido CDU for turnaround

June 2, 2014. Idemitsu Kosan Co, Japan's third-largest oil refiner by capacity, shut the 160,000 barrels per day (bpd) crude distillation unit (CDU) at its Hokkaido refinery in northern Japan for scheduled maintenance, the company said. The CDU will be closed until early July. (www.downstreamtoday.com)

Russia's Mariysky oil refinery to restart production in June

May 30, 2014. Russia's Mariysky refinery, which has been closed for around a year due to financial problems, could restart production in June after a change in ownership. The plant had bought more than 100,000 tonnes of crude oil, possibly from Shell's Russian Salym venture with Gazprom Neft. (www.downstreamtoday.com)

SOCAR Turkey signs $3.2 bn financing deal for Star refinery

May 30, 2014. Azeri state oil company SOCAR has signed a $3.29 billion financing deal with 23 banks and export credit agencies for the construction of a refinery on Turkey's Aegean coast, SOCAR's Turkish subsidiary Petkim said. SOCAR is building the $5.5 billion Star refinery to supply feedstock to petrochemicals maker Petkim, which will help cut Turkey's dependence on imported refined oil products. The Star plant in Aliaga on the Aegean coast is expected to have an annual capacity of 10 million tonnes, 1.6 million tonnes of which would be naphtha which could feed the Petkim plant. It will also produce diesel, jet fuel and LPG. (www.downstreamtoday.com)

Spain's Tecnicas Reunidas wins $2.7 bn contract in Peru

May 29, 2014. Spanish oil engineering company Tecnicas Reunidas said it had won a $2.7 billion contract to expand Peru's Talara refinery. Tecnicas Reunidas will be in charge of designing, engineering and building the new facilities, it said in a notice to Spain's stock market regulator. The Peruvian government had announced a deal with Tecnicas Reunidas over a $3.5 billion expansion project at the refinery but did not at the time disclose the exact amount of the contract. The project aims to increase output by 50 percent at the Talara refinery to around 96,000 barrels per day. (www.downstreamtoday.com)

Transportation / Trade

Tanker hauling disputed Kurd crude U-turns in Atlantic

June 3, 2014. An oil tanker shipping crude from Iraq’s semi-autonomous Kurdish region turned back after getting almost 200 miles across the Atlantic Ocean, amid a challenge over the shipment’s legality. The United Leadership, able to haul 1 million barrels, signalled that it was about 5 miles off Mohammedia in Morocco, according to information entered by the ship’s crew and captured by Coulsdon, England-based IHS Maritime. It turned back after getting about 190 miles west of Gibraltar, at which point it was sailing to the U.S. Gulf. The shipment is illegal, SOMO, Iraq’s oil marketing company, said. The tanker is close to the port of Mohammedia in Morocco, tracking data show. Representatives from the facility are meeting their counterparts at the local refinery. At least seven calls to Mohammedia refinery officials weren’t returned. The Kurdistan Regional Government (KRG) estimates its region has about 45 billion barrels of crude reserves. Iraq itself has about 150 billion barrels. A dispute between the two sides escalated when the Kurds began pumping oil through their own pipeline to Ceyhan, the Turkish port in the Mediterranean sea from where ship tracking data show United Leadership loaded its cargo. (www.bloomberg.com)

Turkey to increase stake in Azerbaijan’s Shah Deniz gas project

May 30, 2014. Turkey’s state oil and gas company will sign a deal to increase its stake in Azerbaijan’s Shah Deniz natural gas project, according to the Azeri oil company SOCAR. Turkey will also increase its stake in the Trans-Anatolian Pipeline project, led by BP Plc, to transport Caspian Sea gas to Europe through Turkey, according to the SOCAR. Turkey is seeking to diversify supplies away from Russia and Iran, which supplied more than half of its gas imports. The Azerbaijan pipeline and other Caspian projects also offer European Union countries a chance to reduce their reliance on Russia, amid concerns that disputes over Ukraine may affect energy supplies. (www.bloomberg.com)

Exxon doing Russia business as usual amid US sanctions

May 29, 2014. Exxon Mobil Corp., which extended its partnership with Russia’s OAO Rosneft, hasn’t had to change its business in the country amid Ukraine-related sanctions and said such steps are typically ineffective. Exxon is among American oil producers that ignored U.S. State Department recommendations to skip an energy forum in St. Petersburg as it extended a pact with Rosneft involving drilling for crude in the Arctic and Siberia. Exxon, through a 2011 deal with the state-run crude producer, owns drilling rights across 11.4 million acres of Russian land, including vast swaths of the Kara Sea. (www.bloomberg.com)

Shell signs 20-year LNG supply deal with Japan's Chubu Electric

May 29, 2014. A Singapore-based subsidiary of oil major Shell has signed a 20-year liquefied natural gas (LNG) deal with Japan's Chubu Electric, Shell said. Under the agreement, Shell Eastern Trading will supply up to 12 cargoes of LNG per year to Chubu Electric. The deal, which will start in October, is the first long-term LNG supply agreement between Shell and Chubu Electric. (www.downstreamtoday.com)

BHP Billiton signs LNG supply deal for Escondida mine in Chile

May 29, 2014. Global miner BHP Billiton has signed a liquefied natural gas (LNG) contract for its Escondida project in Chile, helping to secure the future energy supply of the world's largest copper mine. Gas Natural Fenosa will supply LNG to the Mejillones terminal in northern Chile from 2016, when BHP's nearby Kelar power plant, currently under construction, is due to be ready. (www.downstreamtoday.com)

E.ON, RasGas sign LNG supply contract

May 28, 2014. German utility E.ON and Qatar's RasGas said they signed a deal for the supply of liquefied natural gas (LNG) over three years from Qatar to the British Isle of Grain. The medium-term flexible contract is potentially for up to 2 billion cubic metres over the term, the two firms said. (www.downstreamtoday.com)

Angola LNG shutdown to last until mid-2015

May 28, 2014. The Angola liquefied natural gas (LNG) export project is expected to resume production in mid-2015 following a rupture on a flare line that forced it to shut down, the Chevron-led project said. It is expected that this work will continue into next year, with the plant anticipated to restart in mid 2015. (www.downstreamtoday.com)

Policy / Performance

Energy supply requires $40 tn investment to 2035, IEA says

June 3, 2014. Meeting the world’s energy supply needs by 2035 will require $40 trillion of investment, as demand grows and production and processing facilities have to be replaced, the International Energy Agency (IEA) said. More than half of that amount will be needed to compensate for declining output at mature oil and gas fields, and the remainder on finding new supplies to meet rising demand, the Paris-based agency said. The world will increasingly rely on countries that restrict foreign companies’ access to their oil reserves, as North American shale output tails off from the middle of next decade, it predicted. While a boom in shale oil is pushing U.S. production to its highest level in almost 30 years, diminishing the biggest crude consumer’s reliance on imports, this output surge is forecast to fade, restoring the importance of supplies from the Middle East and the Organization of Petroleum Exporting Countries. Spending on extracting oil and gas worldwide will climb by 25 percent to $850 billion a year by 2035, with most of this concentrated in natural gas, according to the report. Global markets will tighten if investments in the resource-rich Middle East are too slow, pushing oil prices $15 a barrel higher on average in 2025, it warned. Brent futures averaged $108.70 a barrel last year. About half of the $40 trillion spent on energy through to 2035 will be on extraction, refining and transporting fossil fuels, the report indicated. Two-thirds of the total will be spent in emerging economies, according to the agency. Investment needed in renewable energy will total $6 trillion, with another $1 trillion in nuclear power. Annual spending on satisfying global energy requirements will increase to $2 trillion by 2035, up from $1.6 trillion last year, the agency projected. Spending on energy efficiency through 2035 pushes the total required investment to $48 trillion, according to the IEA. (www.bloomberg.com)

Norway oil riches at stake as political brinkmanship rules

June 3, 2014. Investors in Norway, western Europe’s largest oil and gas producer, face more political wrangling as the level of brinkmanship in lawmaking picks up. The minority coalition, in office since October, is Norway’s first in almost a decade to rely on opposition parties to push through laws. Those include how to manage the nation’s $880 billion sovereign wealth fund and how to develop key offshore oil projects. The composition of the legislature means stakeholders in Norway’s affairs must gird for “some disturbances,” Finance Minister Siv Jensen said. Investors in Scandinavia’s richest nation have been wrong-footed a few times in the past three years, most notably when the government in 2011 withdrew Eksportfinans ASA’s state backing, turning top-rated bonds into junk notes. Then in 2013, investors balked at a decision to cut gas distribution tariffs, a move they said sliced as much as $6.5 billion off their income. The Labor government that pushed through those measures is now the largest party in the opposition bloc. In May, oil and gas producers warned of delays after a parliamentary majority worked against the government to try to force Statoil ASA and other producers to power North Sea developments from land. Labor backed down and struck a deal with the government to avoid potentially costly delays. (www.bloomberg.com)

Kuwait says looking to import Iranian natural gas

June 2, 2014. Kuwait's oil minister said his country was looking to sign an agreement with Iran to secure much-needed natural gas supplies. The oil-rich OPEC producer lined up $15 billion worth of gas supply from BP and Royal Dutch Shell BP and Royal Dutch Shell last month to help meet soaring demand. Kuwait also signed a contract to import liquefied natural gas (LNG) from fellow Gulf state Qatar to help meet its energy needs to the end of 2014 in April. (www.downstreamtoday.com)

Oil price becalmed as supply growth means record low volatility

May 30, 2014. Oil-price volatility fell to a record amid speculation that crude-supply growth in the U.S. and spare Saudi Arabian production capacity will avoid any shortages resulting from strengthening economies. The 20-day historical volatility of Brent crude declined to 8.1 percent in London, set to be the lowest since the contract began trading in 1988, according to data. Spare capacity in Saudi Arabia and booming U.S. output of oil from shale-rock formations are preventing price surges, while stable global economic recovery and steady stimulus measures by the Federal Reserve avert a slump, BNP Paribas SA said. (www.bloomberg.com)

Repsol wins approval for $10 bn project off Spain

May 30, 2014. Repsol SA won government approval to start a $10 billion oil drilling project off Spain’s Canary Islands, signaling success in its 12-year campaign to start exploration near the Atlantic archipelago. Spain’s environment ministry cleared the plan with conditions. The decision follows a reconfirmation in 2012 of an exploration license first awarded in 2001 and later tied up in court battles. The decision advances plans by Spain’s largest oil company to hunt for fields in an area geologists estimate may be able to supply about 10 percent of national demand. (www.bloomberg.com)

China seen outspending US drillers to chase shale-gas boom

May 29, 2014. China’s effort to catch up with the U.S. in developing shale gas and become more energy independent is coming at a big cost: It’s spending four times as much developing some fields, according to a new report. Holding the world’s biggest potential reserves of natural gas in shale rock, China will spend billions of dollars in trying to close a gap with the shale leader, which is about a decade ahead in developing the energy resource, according to a study. The emergence of shale projects in Asia and Europe affects global gas and oil prices and is changing the energy agendas of governments from London to Beijing. In China, leaders mandated national targets for their producers such as China Petroleum & Chemical Corp., known as Sinopec. (www.bloomberg.com)

Pemex in talks for $4 bn investment fund with China

May 29, 2014. Petroleos Mexicanos, the state-owned oil producer, is negotiating with Chinese companies to create a fund valued at as much as $4 billion to invest and finance projects. The proposed arrangement is in a “final stage of negotiations,” Pemex, as the Mexico City-based oil producer is known, said. The Sino-Mex Energy Fund would be the largest Chinese investment fund in Latin America. The prospective agreement between Pemex’s international unit PMI Comercio Internacional and Xinxing Ductile Iron Pipes, SPF Capital Hong Kong Ltd. and other Chinese companies would be used to finance large-scale projects and create jobs. Pemex is seeking to increase sales to Asia and Europe to offset falling oil exports to the U.S., Mexico’s largest crude buyer. U.S. oil imports from Mexico have fallen 47 percent in the past decade, dropping to a 20-year low, according to the U.S. Energy Information Administration. Pemex has announced plans to export light crude to Japan, Hawaii, India and Switzerland, and will continue to pursue new partners in Asia and the Pacific region, Gustavo Hernandez, Pemex said. Mexico signed a landmark energy bill to end Pemex’s production monopoly and allow for private investment in the oil industry. Pemex’s production has fallen to 2.5 million barrels a day from 3.3 million in 2004. The government is also considering creating a fund allowing it to partner with third-party investors to develop fields, similar to Norway’s Petoro AS, that may require as much as 30 percent participation in contracts it seeks. (www.bloomberg.com)

Lifting of crude export ban will spur US economy, IHS says

May 29, 2014. The U.S. will benefit from increased oil production and lower gasoline prices if the government lifts restrictions on crude exports, according to IHS Inc. The world’s largest oil consumer may save an average of $67 billion a year from its import bill as domestic output may rise as much as 949,000 barrels a day in 2016 with the removal of the export ban, the Colorado-based consultant said in a report. Such a scenario would support 964,000 additional jobs in 2018, it predicted. (www.bloomberg.com)

EU eyes gas transparency, new sources to reduce imports

May 28, 2014. The European Union (EU) should reduce energy consumption, seek new supply sources and examine ways to increase transparency of the gas market to cut its rising dependence on imports from Russia, an EU report showed. Increasing domestic energy production and accelerating the integration of the EU energy market are also ways to increase the 28-nation bloc’s energy security, the European Commission said. EU leaders in March asked the bloc’s regulatory arm to prepare a plan for reducing Europe’s reliance on Russia for energy amid the escalating crisis in Ukraine. (www.bloomberg.com)

Japanese lawmakers to lobby Abe for Russian gas pipeline