-

CENTRES

Progammes & Centres

Location

Ø ENERGY: Not all Fair & Lovely: Modifying the Energy Fairy Tale

Ø ENERGY: A new wave required for energising India!

ANALYSIS/ISSUES

Ø COPs and Robbers (part III)

DATA INSIGHT

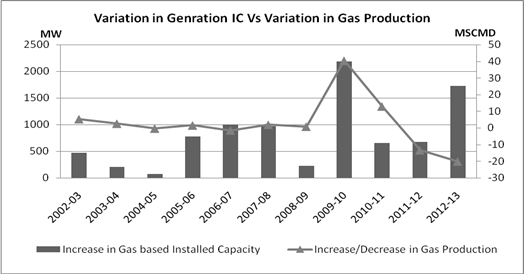

Ø Power Sector and Natural Gas- Artificial Scarcity or Surplus

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· Cairn seeks 10-year PSC extension, DGH says 5

· ONGC moves RIL to Delhi HC over KG-D6 dispute

· BPCL signs crude oil import deals with UAE, Kuwait

· Cairn expects substantial gas output from Rajasthan in 3 yrs

· Reliance Power commissions fourth 660 MW unit of Sasan UMPP

· BHEL signs pact with Indonesian firm to set up power plant

· Tata Power invests ` 3 bn to strengthen Mumbai network

· L&T wins $126.5 mn power transmission contracts in Saudi Arabia and Oman

· Korea Gas Corp looks to sell 20-40 excess LNG cargoes

· Petronas in talks to sell more stake in Canadian LNG project

· Aboitiz Group to double power capacity to 4 GW in 5 yrs

· Glastonbury firm begins construction of 829 MW power plant

· Bosnia's 300 MW coal-fired power plant extends outage until June 1

· OPPD to build part of transmission line carrying power to Missouri

POLICY & PRICE

· BJP govt to take a call on hiking LPG, Diesel prices

· New gas rates to be applicable from April 1: RIL to buyers

· Oil ministry hopes to resolve gas price row with RIL

· Odisha to seek FRBM clearance for ADB assisted power sector project

· Electricity panel starts consultation for power price in Chhattisgarh

· No hike in power tariff this fiscal, demands Punjab industry

· CCI again finds Coal India violating competition norms

· Coal India gains most since debut on Modi optimism

· Uranium slides as banks reduce outlook amid Japan delays

· Indiana approves $670 mn in power plant upgrades

· Japan plans to have a power plant in space in a decade

· 'India needs to invest $834 bn to lower emissions by 2030'

· Imported solar cells to get costlier as govt likely to impose a steep dumping duty

· Major respite to solar power players in Punjab

· Jakson Group receives ` 2 bn EPC orders last fiscal

· Renewable Energy industry happy over BJP victory

· India may back solar duties after probe finds dumping

· Statkraft, Soedra join forces to produce wood-based clean fuel

· Obama said to consider power-plant rule that tests law

· China targets 70 GW of solar power to cut coal reliance

· Linde to make hydrogen from surplus wind power at German plant

· Musk sees need for hundreds of battery ‘gigafactories’

WEEK IN REVIEW

ENERGY

Not all Fair & Lovely: Modifying the Energy Fairy Tale

Lydia Powell, Observer Research Foundation

|

T |

he outcome of the elections is seen to be electrifying for the energy sector. Like most people, the observers of the Indian energy sector have bought the fairy tale of a fair & lovely regime just as they would buy a tube of cream that is sold with a promise of a fair and lovely complexion. Gushing comments and observations from purveyors of everything from coal to solar power betray irrational exuberance over modification and transformation not very different from that of the pretty girl on TV who vouches for the whitening cream that transformed her life. Wally Olins (God bless his soul) is indeed very good at selling dreams and fairly tales, first packaged for Obama and now for Modi! He knew that they could all be packaged as ‘snow white’ irrespective of where they stood politically.

The fair & lovely similarity can be taken further. The tube of whitening cream is shown to come with a ‘tint-o-meter’, a strip of paper with varying degrees of whiteness that may be achieved each week as more and more of the cream is applied (under test conditions of course!). Likewise, the fair & lovely results of the new government will have its own ‘success-o-meter’ that would probably take the form of exuberant announcements week after week about bullet trains carrying coal across the nation or solar panels that lift up the nation in eyes of the West and in addition combat climate change. Whatever is done or left undone will be declared fair & lovely by the compliant media. After all selling fairy tales has become their primary preoccupation, as long as they are paid for it!

What is worrying here is not that macho capitalism has won but that the victory for capitalism and its machinery is being portrayed as a victory for democracy. This trend is neither new nor path breaking. Small nations such as Sri Lanka got on to this path before us and they too project it as a grand victory for democracy. When these South Asian leaders meet next week they can finally greet each other with a coy ‘same-to-same!’

As Ashutosh Varshny pointed out in a column last year, the relationship between capitalism and democracy is a very uneasy one. While democracy is about political equality, capitalism is viscerally opposed to equality, political, economic or otherwise. Capitalism is about freedom (to produce, own and market) and any threat to that freedom will be addressed through an ‘investment strike’ as Varshny put it in his column. What we witnessed in the energy sector last year was indeed an ‘investment strike’, a form of extortion or blackmail under which the potential investors hold the State at ransom until State complies. The State has indeed complied. It is not that the State does not know that wealth must be generated before it is distributed. But the questions of concern are how the wealth is generated and how the need to invest is balanced with the need to share.

Detailed studies point out that in Uttar Pradesh, 29% of all power transmitted from 1970 to 2010 was not billed for. More interestingly, line losses (includes but not limited to electricity stolen, given away or lost technically) have been found to be substantially higher in period immediately prior to state elections and the incumbent political party was more likely to retain its seat when the loss is higher. In UP, line losses are higher now than they were in the 1970s illustrating the desperation of political parties to use public resources for electoral gains. As Joel Ruet, the French economist pointed out in his book on the Indian electricity sector, if the Soviet Union was about communism plus electricity India has so far been about democracy plus electricity. Whether or not this relationship will be retained or broken in the next five years is hard to say but will be interesting to watch. Studies on the politics of public goods provision point out that in poor countries democratic institutions shift electricity provisioning from industries to households but authoritarian institutions shift electricity from households to industry. We could probably look at which way electricity is flowing and decide whether our democratic institutions are being transformed into dictatorships.

The exuberance of the energy companies, irrational or otherwise, shows that things may indeed be fair and lovely for them. Their value has increased by billions of dollars in the last few months not because they added any value to their activities and produced something valuable to the people but because the barriers to their access to natural resources such as coal, oil and gas and the barriers to higher prices at which they can sell these resources was expected to be dismantled by the political patronage that they cultivated. This generates wealth but mostly in the form of rents that accrues to a small number of people. As Abhijit Banerjee and Thomas Piketty’s work has shown, the income share of the top 1% of the rich in India is now as much as 8.5%, most of it derived from rent thick natural resource industries. Only in the times of the British Raj did 1% of Indians (Maharajas) command a similar share of income. The tube of whitening cream can get away with poor results with the excuse that ‘conditions did not apply’. All we can hope for is that there is no such excuse for the Government.

Views are those of the author

Author can be contacted at [email protected]

ENERGY

A new wave required for energising India!

Ashish Gupta, Observer Research Foundation

|

T |

he electorate must be congratulated for putting an end to coalition governments. The BJP has emerged as a single largest party and the new Prime Minister (PM) will take the oath in the coming week. The discourse has started in the media on the need for major reforms in the manufacturing, agriculture, steel, health & pharmacy, education, employment etc. But the problem is how this can be done? Though all these sectors are different, electricity is common to all. Without electricity economic and social development of the country is not possible.

Rooting out lacunae in this huge rent seeking industry is not going to be easy for the new government. But it serves no purpose to be pessimistic about the coal and power sectors. There are some positive developments internally and externally. The new Hon’ble PM is coming from a state where the power utilities have performed very well and therefore there is a reason to be optimistic. The Indian industry is already seeing an upswing in their shares and there is optimism that coal and power sector will attract required investment.

In the context of building energy relationships across the neighbourhood, felicitations by the PM of Pakistan and the invitation to all SAARC leaders to join in his swearing ceremony could be the stepping stone. Energy infrastructure and trade across the border will contribute to economic confidence building measures rather than security based confidence building measures.

Many western nations which were apprehensive of the PM have decided to work with him. It is likely that USA and other western nations will make up for the energy business lost to France and Russia.

On the renewable energy front we may see huge investment coming in from the developed nations. Gujarat has awarded most renewable projects by offering huge incentives and high tariff for renewable energy. There is a hope that same kind of green wave will sweep through the nation. If renewable based manufacturing receives a boost it may face tough competition from Chinese companies. Our indigenous renewable industry was built with the Indian market in mind and not the global market. The new government should strike a balance between procuring overseas technology and at the same point giving a boost to the indigenous green industry. Prolonged conflict through the World Trade Organisation is not in the interest of any country wanting to develop renewable energy.

On the domestic green energy sector, as per the guidelines of the Central Electricity Regulatory Commission there is obligation to purchase renewable energy. But utilities have been reluctant. The new government must look into the issue carefully, rather than enforcing the mandate forcefully.

There also a discourse in the media to reduce the number of ministries handling the energy sector. This is also in line with the new PM’s ideology “Minimum government, maximum governance”. If implemented, the move will certainly help in reducing unnecessary delays and red tape.

Lastly and most importantly, coal will remain the heart of India’s energy security, irrespective of criticism on coal use. India must diversify its energy basket but ignoring an important sector will be a setback. Those with a vested interest in pushing green energy equate India with the developed nations. We must keep in mind that India is not Japan which imports almost 100 percent of energy sources but spends only 3 percent of its GDP. India imports only 33 percent of the energy fuels but spends more than 6 percent of the GDP. It must be understood that coal is the only fuel that India has in abundance it has to be exploited to the fullest. This will not only save our vital foreign exchange reserves but also help in energising many unelectrified villages. The new government is well aware of the problem and understands the importance of the coal sector. In this light the new PM must take concrete steps to ensure ‘Power for All’.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

COPs and Robbers (part III)

Nikhil Desai*

Continued from Volume X, Issue 48......

|

E |

nd of the year is a good time for connecting with family and for reflection, humility, and recharging. We recognize that we are the cops as well as robbers in some manner or another. Each of us adults has vested interests and ideologies, and we owe a re-assessment once in a while on our portfolio of interests and ideologies.

This is also close to the 20th anniversary of FCCC becoming effective (21 March 1994). Some reflection on the past may give a clue as to what the future might be like if we keep on the road leading us to the bridge to nowhere. If the ‘Carbo-Cult’ train does not stop on its own, running out of energy, at least it needs to be slowed down.

Thinking of energy and environmental security, around now is also –

¾ Sixty years to the Atoms for Peace and the birth of nuclear power into the grids (which in due time led us to Fukushima);

¾ Fifty years to the commercial nuclear orders from US utilities as well as developing countries (and US president JFK’s speech in June 1963 on “peace for all time”, declaring negotiations with the USSR and UK on a comprehensive nuclear weapon test ban treaty, still awaiting ratification);

¾ Forty years to the Arab oil embargo and the sense of an “energy crisis”, along with the first rumblings of a “New International Economic Order” (which came in due time in an entirely unexpected manner);

¾ Thirty years to the weakening of OPEC control and a downward spiral for world oil prices (in turn affecting Soviet earnings of hard currencies and subsequent developments to the end of the Cold War).

The expected rarely materializes beyond the planning horizons (a decade to five decades). Surprises are no surprise. Long-term forecasts of any kind are hazardous to thinking even though lucrative for crafty modellers and glib soothsayers. Climate change may lead to spread of dengue fever in the US but there may also be new medicines that can help, including over two billion people in other parts of the at risk of the disease, not because of climate change but because of no change in public health systems for protection against such diseases.

Perhaps it is time to set aside quarrels and going up alleys only to find they are blind. To ask if FCCC is a circust of blind elephants trying to define mankind. To re-examine concepts, belief systems, models quantitative or otherwise, and reach a realistic ideal based on the prospects of human and institutional capability to realize paper answers into concrete solutions. Time is always running out, the time for action is always yesterday, doom is around the corner and gloom we can never afford; still, re-thinking can lead to re-imagination and a different conversation.

How could that come about? I have some ideas to advance:

1. The climate system is a phenomenon, not a problem to be solved. There are too many confounding variables in any particular impact of climate on any aspect of human or natural systems. To assign “prime cause” to fossil CO2 emissions is possible ONLY if we can regulate the overall CO2 fluxes AND ignore the non-CO2 co-products of carbon combustion (from fossil fuels or biomass) as well as other non-CO2 GHGs.

2. Process determines substance. This is as true of physical systems – individual carbon combustion process determines the profile of co-emitted substances – as of social and legal aspects of climate vulnerability and resilience. The former observation implies taking an “all emissions, all impacts” view for analytical purposes. The latter in turn implies focus on human capabilities to deal with all risks, not just climate risks, and to recognize the limits of public or private finance and administration, and the demands from competing agenda for attention. Pretensions to the contrary, the climate system is not controllable, only the climate-human interactions are, up to a certain point that has not yet been reached by about a half of the humanity. (The picture above of the coal-fired plant in Warsaw shows haze due to conventional air pollution, not from CO2.)

¾ Cleaner combustion of organic fuels will result in higher CO2 emissions but lower emissions of PICs (products of incomplete combustion), some of which are far more potent atmospheric warming agents, negating whatever incremental damage the CO2 emissions may imply in the long term, and yielding a healthy return on investment in terms of lower burden of disease.

¾ As a negotiating and legal process, the FCCC is a relic of the Cold War mindset on the one hand and of the debates over acid rain legislation in the US or the form of the Montreal Protocol on the other. It is extremely unlikely – to use the IPCC phraseology – that this process would yield anything meaningful in terms of its objective of avoiding dangerous human interference of the climate system. Indeed, that objective itself needs to be questioned, for the danger to humanity may well arise from the failure to protect against climatic vulnerabilities generally rather than from GHG emissions. After all, what is “danger” except in terms of impacts, directly or indirectly upon humans? In any case, scientific models still do not give us an unequivocal answer as to the extent of climate change attributable to human interference; all we have been told is that climate change to date most likely carries a human imprint, not how that imprint is compared to an underlying natural shift in climate.

3. Humanizing climate and energy policy: In the last 20-odd years, the world has seen a tremendous growth in economic wealth, entailing environmental costs that are disproportionately incident on the poorer half, in part because the distribution of this new wealth has changed old assumptions about economic power and equity.

¾ The governments of rich nations are relatively poorer, and the governments of many poor nations are relatively wealthier, some financing the deficits of the former in ways that may not be sustainable. Additionally, the extent of “black market”, corruption in both the public and private sectors, and the fragility of financial systems burden meaningful actions on climate resilience.

¾ The numbers of extremely poor have not changed much in these 20-odd years. By one count, some 400 million children still live in abysmal “absolute poverty”. While there has been progress in MDGs, public human capital investments in the coming generation of the world has been far short of that needed for a productive, reasonably satisfied workforce with a revolution in home economics and agricultural practices that began to happen in the developed countries over a century ago.

¾ An unprecedented demographic transition has begun in the poor countries, with a youth bulge in sub-Saharan Africa (age 15-24 population doubling from 2010 to 2050) as well as an elderly bulge (age 75+ population quadrupling in Africa, South Asia, and China over the same period), in the context of a massive urbanization (doubling of urban population and stagnation in rural population over this period in these regions).

World population increase in the last 30-odd years is entirely due to gains in longevity; gross birth rate has been fairly unchanged in the aggregate, with sharp declines in some regions compensated by increases in some others. Overall, the poor shall be with us, and the climate – or climate change – will also be with us. There is a “pipeline” of future poverty, just as, according to the models, additional global warming is in the “pipeline” over the next few decades even if all anthropogenic carbon emissions were to cease tomorrow.

Current president of the World Bank has proposed elimination of extreme poverty by 2030. While some of these extremely poor people live in areas prone to extreme climatic events, all of them are subject to the climatic influences on their health, livelihoods, shelter. The Great Recession has not yet fully run its course, and the aftermath may be as unpredictable as Fukushima cleanup. The question is, what are the points of convergence in vulnerabilities of the poor, and most promising entry points for poverty reduction, risk reduction and empowerment?

Upliftment of the poor - in income and asset terms but also in terms of resilience, security and productivity – probably has the highest return on public investment, provided such investments are defined and executed in a sustainable manner. Sustainability of humanity would as much influence sustainability of natural resources as the other way around. Not only do some 1.5 billion people – mostly in South Asia and Sub-Saharan Africa – have no grid electricity, another 1.5 billion or more people – in those regions as well as elsewhere in the world – have rationed supplies or frequent long-term outages, limiting their growth and capital accumulation in financial or human terms.

Time to create a new page for the new year and beyond. A Plan D for FCCC when plans A, B and C have failed. Rather, a plan for inclusive green growth. Addressing air, water and land quality and access rights. ‘Low-carbon’ development or ‘green growth’ must not mean more poor children. A renewable energy project can wait five years; some 20 million children a year should not have to. The most promising measures for removing extreme poverty among children of the future are in directing high-quality, quick-response public services to the children today. Every five-year delay in cleaner energy services – and thereby high-quality health, education, and social protection services to the poor – means losing a cohort of 100 million children, disproportionately girls, to a lifetime of ill health and low earnings.

As a first step, it would be honest to declare that CO2 is not an air pollutant, and that human resilience to climate vulnerabilities is the policy goal, not any other “climate action” whose results cannot be observed within the next 20 to 30 years. This will permit China, India and other developing countries to deal with the problems of household and outdoors air pollution and to formulate sensible land and water use plans and related infrastructure.

All climate expertise and prognoses are of limited relevance if the poor continue to bear the burden of preventable diseases and ignorance; in any event, it will take skilled, experienced labor force and strong institutions to turn ‘sustainable development’ and ‘green growth’ from periodically renewed wish lists and perennial calls for action to a reality. Laws of physics and chemistry can be used to adjust to the physics and chemistry of climate change. It is too early to lose faith in humanity.

In due time, who knows, higher-quality feed for poultry and cattle in the developing countries – or a shift to vegetarianism as Lord Stern argues – may reduce the volume of manure production and/or methane emissions. We have had too much of chicken and bull manure fed to us by the Carbo Cult in the last 20 years. As the Syria-Iran events of the past few months remind us, CO2 is hardly a WMD to rank high in global priorities.

A small beginning – just to recognize the human systems and strengthen them – may, who knows, get the academe to return to policy-relevant research instead of flights of fancy to hypothetical worlds. The robbers may get jobs as cops and practice their protection skills with suitable guidance, instead of joining wars of Don Quixote’s imagination (or crusades of other varieties). The children, of course, can be attracted to realistic ideals. Then every year we could have a celebration instead of whining.

Concluded

* The author is a US-based energy and environmental economist, routinely spending some time in India or elsewhere. He is also a pro-bono senior advisor to the Small-Scale Sustainable Infrastructure Development Fund (www.s3idf.org).

Views are those of the author. The author may be contacted at [email protected]

DATA INSIGHT

Power Sector and Natural Gas- Artificial Scarcity or Surplus

Akhilesh Sati, Observer Research Foundation

|

Year |

Installed Generation Capacity* (Gas based) |

Gas Required (at 90% PLF) |

Gas Supplied |

Gas Production (Net) (All India) |

|

MW |

MMSCMD |

|||

|

2000-01 |

9028.7 |

44.54 |

24.4 |

76.33 |

|

2001-02 |

9432.9 |

46.31 |

24.33 |

76.81 |

|

2002-03 |

9949 |

48.26 |

25.12 |

82.09 |

|

2003-04 |

10,154.90 |

49.25 |

25.62 |

84.67 |

|

2004-05 |

10,224.90 |

49.73 |

30.7 |

84.32 |

|

2005-06 |

10,919.62 |

53.38 |

35.37 |

85.82 |

|

2006-07 |

12,444.42 |

61.18 |

35.1 |

84.36 |

|

2007-08 |

13,408.92 |

65.67 |

38.14 |

86.24 |

|

2008-09 |

13,599.62 |

66.61 |

37.45 |

86.98 |

|

2009-10 |

15,769.27 |

78.09 |

55.45 |

127.45 |

|

2010-11 |

16,639.77 |

81.42 |

59.31 |

140.41 |

|

2011-12 |

16,926.27 |

81.78 |

55.98 |

126.92 |

|

2012-13 |

18,362.27 |

90.7 |

40 |

106.69 |

*monitored capacity PLF- Plant Load Factor Net= Production – flared-auxiliary consumption

Variation denotes increase or decrease as compared to preceding year

Source: Central Electricity Authority

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

OVL aims higher O&G output in 2014/15

May 20, 2014. ONGC Videsh Ltd (OVL), the overseas investment arm of explorer Oil and Natural Gas Corp (ONGC), aims to produce 3.6 percent more oil and gas during the fiscal year to March 2015. OVL is aiming for 8.66 million tonnes of oil and gas in 2014/15, compared with 8.36 million tonnes produced in the previous fiscal year. (in.reuters.com)

Cairn seeks 10-year PSC extension, DGH says 5

May 20, 2014. In a blow to Vedanta Group company Cairn India, the Directorate General of Hydrocarbons (DGH) has turned down its request for a 10-year extension of the production-sharing contract (PSC) for its prolific Barmer block, the biggest onshore oil asset in the country right now. The PSC is set to expire on May 14, 2020, and the DGH said not more than a five-year extension from that date could be given. The private explorer that reported an operational expenditure of $3.90/barrel in FY14 for the Barmer asset targets to spend $2.4 billion over the next three years and believes that the entire oil cannot be taken out before 2030. Cairn has projected Barmer production to grow at 7-10% (CAGR) for the three years starting FY16. Effectively, the DGH’s move is favourable to ONGC as an early termination of the contract with the Anil Agarwal-promoted firm indicates a producing asset would eventually be handed over to the PSU. A final decision, however, has to be taken by the ministry. The Rajasthan block was awarded before the New Exploration Licensing Policy (NELP) regime came into force. In the case of acreages auctioned under NELP, the contractor can continue to operate until output ceases, as there are no ‘specific term’ for their validity. The Mangala field in Barmer, Rajasthan, discovered in January 2004, is the largest onshore oil discovery in India in more than two decades. The Mangala, Bhagyam and Aishwariya fields — major discoveries in Rajasthan — have gross ultimate oil recovery of over 1 billion barrels from primary, secondary and enhanced oil recovery (EOR) methods. Cairn India is the operator with 70% participating interest. Its joint venture partner, ONGC, has the remaining 30% participating interest. At present, five oil fields — Mangala, Bhagyam, Aishwariya, Raageshwari and Saraswati — produce about 200,000 barrels of oil per day. Also in March 2013, Cairn India commenced commercial sale of gas. In FY14, Cairn India gross contribution to the exchequer stood at ` 24,299 crore and accounted for about 30% of domestic crude oil production. (www.financialexpress.com)

Modi’s pet firm ready to produce gas

May 18, 2014. The first major project to be commissioned after Narendra Modi takes over as Prime Minister may be one by his pet Gujarat firm GSPC, which is ready to produce gas from a field in the Krishna Godavari basin. Gujarat State Petroleum Corp (GSPC) has completed the USD 2 billion development of the Deen Dayal shallow-water gas field and is conducting pre-commissioning and testing activities. Gas production is likely to start in June. Gujarat government-owned GSPC, which faced several technical difficulties in developing the field in the Bay of Bengal, is keeping the commissioning date under wraps. Most facilities – both offshore as well as the onshore receipt and processing plant – are ready and first gas is expected in June, by when the gas pricing issue would have been sorted out. GSPC sought to sell gas at the rate at which India imports long-term LNG (liquefied natural gas) from Qatar. At USD 100 per barrel of oil, the LNG import price comes to about USD 13 per million British thermal units (mBtu). The UPA government did not approve this rate and instead went by a formula suggested by a panel headed by C Rangarajan, under which the price of gas in this quarter should be about USD 8.3 per mBtu. The price wasn’t notified due to the elections and the new government under Modi is expected to decide on the matter. (indianexpress.com)

ONGC moves RIL to Delhi HC over KG-D6 dispute

May 16, 2014. Oil and Natural Gas Corp (ONGC) has alleged that Reliance Industries Ltd (RIL) may have drawn natural gas worth thousands of crores of rupees from a common reservoir in the KG-D6 block, and taken the matter to the Delhi High Court (HC), accusing the oil ministry and its technical arm of turning a blind eye to the issue. Justice Manmohan issued notices to the Union government, the Directorate General of Hydrocarbons (DGH), and RIL, and posted the case for further hearing on May 29. ONGC told the court that it wants a "truly independent" agency to examine the matter, and compensation from RIL if the independent agency finds that the private company has drawn gas from a common reservoir. ONGC may claim compensation of over ` 25,000 crore. Government accepted the notice. Government said the issues were being sorted out in a joint committee comprising RIL and ONGC under the aegis of the DGH. RIL said ONGC's litigation was unwarranted as the two firms had constructively engaged in sharing data and resolving the matter with the help of a third party expert - the most recent meeting being as late as on May 9. ONGC has dragged even the former DGH and its administrative ministry to court. ONGC said the DGH should have been vigilant while clearing RIL's field development plan, which involved drilling wells "at such a tantalisingly close distance of 50 metres to 350 metres" from the common boundary of the blocks. It also said that the Management Committee, which has two government representatives, should not have approved RIL's plans to drill wells near ONGC's block, particularly when it had access to RIL's data. RIL said its plans had been approved by the committee. (economictimes.indiatimes.com)

Transportation / Trade

BPCL signs crude oil import deals with UAE, Kuwait

May 16, 2014. Indian refiner Bharat Petroleum Corp Ltd (BPCL) has signed a deal with ADNOC, national oil company of the United Arab Emirates (UAE), to import 60,000 barrels per day (bpd) oil in 2014/15. BPCL, along with its subsidiary Bharat Oman Refineries Ltd (BORL), has also signed a deal with Kuwati Petroleum Company to buy 84,000 bpd oil in the fiscal year to March 31, 2015. BPCL operates a 2,40,000 bpd Mumbai refinery in western India and a 1,90,000 bpd Kochi refinery in the south of the country. (economictimes.indiatimes.com)

Cairn expects substantial gas output from Rajasthan in 3 yrs

May 15, 2014. Cairn India expects 'substantial' gas production from its oil-rich Rajasthan block in the next three years and has floated global tenders for setting up a natural gas transportation pipeline and a gas processing terminal. Rajasthan block has been known for its oil reserves, but it could produce significant amount of gas in the next two-three years, according to industry experts. Cairn India plans to set up a gas processing plant at its existing Raageshwari gas terminal for processing 100 to 300 million cubic feet gas per day. The Gurgaonbased oil and gas firm, owned by UK's Vedanta Resources, also plans to build a 200-km long, 24-30 inch natural gas pipeline from Raageshwari, Barmer to Gujarat State Petronet Ltd's terminal at Palanpur, Gujarat. Depending on the terrain, the company will incur ` 800-1,000 crore on building the gas pipeline. The fact that the company is investing so much in infrastructure shows that it has got access to gas. In 2013, Cairn had announced an investment plan of $3 billion over three years, proposing to spend over 80% capex on the Barmer oil block alone. The new pipeline will serve as the main export pipeline for the envisaged gas project and provide connectivity to the gas grid in Gujarat that has a higher demand. (economictimes.indiatimes.com)

Policy / Performance

Modi’s win may help India curtail $24 bn oil subsidy

May 20, 2014. Narendra Modi’s sweeping election victory gives him the mandate to accomplish a previously unpalatable change to India’s fuel market—raising prices to cut a $24 billion subsidy bill and shrink the budget deficit. The Bharatiya Janata Party (BJP), which took more than half the seats in Parliament’s Lower House in India’s biggest election win in 30 years, will introduce a new fuel policy as soon as it can form a government. Implicit in that will be raising prices to spur investment and cut imports that account for 80% of the nation’s crude oil and more than 30% of its natural gas needs. Indian energy companies’ shares have surged since Modi’s win. Oil and Natural Gas Corp. Ltd (ONGC) shares in Mumbai increased 12% since exit polls on 12 May showed the BJP securing its biggest poll win. Indian Oil Corp. Ltd (IOCL) climbed 16%, while HPCL rose 14% and Bharat Petroleum Corp. Ltd (BPCL) gained 12%. The benchmark S&P BSE Sensex index increased 3.7%. Modi has promised to revive the economy from the slowest pace of growth in a decade and expedite foreign investments in sectors including energy, where the government administers most prices. Accelerated price increases are possible. The BJP’s fuel policy will include a diesel component, said Narendra Taneja, national convener of the party’s energy division. Diesel makes up more than half of the fuels sold in the country. While gasoline prices have been freed, the government’s control on diesel and cooking fuels caps the earnings of state-run refiners including IOCL and HPCL. ONGC gives up almost half of its profit every year in crude oil discounts to state-run refiners to partly compensate them for selling fuels below cost. The refiners are also reimbursed by the government and themselves assume a portion of the losses. Diesel losses at refiners were ` 628.4 billion ($10.7 billion), or 45% of the ` 1.4 trillion revenue lost on fuel sales, in the year ended 31 March, according to oil ministry data. Refiners in China, the world’s second biggest oil user, are usually allowed to adjust gasoline and diesel prices every 10 working days in line with global crude oil prices. (www.livemint.com)

BJP govt to take a call on hiking LPG, Diesel prices

May 19, 2014. The outgoing UPA government has recommended a sharp increase in cooking gas and raising diesel prices to international levels in one shot to deregulate the fuel, making it politically easier for the Narendra Modi regime if it wants to undertake politically sensitive measures to cut subsidies. The UPA's oil minister Veerappa Moily had sent a proposal to Cabinet seeking a ` 250 increase in cooking gas cylinder, which costs about ` 414. He had also proposed raising diesel prices, which are currently ` 4.40 per litre lower than the assumed international price. The proposals was sent recently to the Cabinet Secretariat after the oil minister's approval, but it was not taken up by the Manmohan Singh government. The cabinet had deregulated petrol price in June 2010. It had also approved decontrol of diesel, but this decision was never implemented. The cabinet allowed state oil firms to raise diesel rates by about 50 paise per litre a month until they rise to market levels. Deregulating diesel currently requires prices to rise by ` 4.40 per litre but the gap would be lower if the rupee appreciates. The new government would have to take a call on this issue. If prices are deregulated, it would fully open the fuel retailing market for companies such as Reliance Industries and Essar Oil, which had made a significant dent in the market nearly a decade ago when fuel prices were market determined. It would also increase revenue of state firms such as Indian Oil Corp, Bharat Petroleum Corp Ltd and Hindustan Petroleum Corp Ltd, which are forced to sell fuel below market rates. ONGC, which shares the burden of state refiners, would also gain. State firms have estimated they will lose revenue of about ` 47,000 crore on cooking gas in the current financial year and about ` 51,000 crore in diesel unless the government raises their rates, officials said. It is expected that the new government won't raise kerosene rates, which is considered fuel of the poor. Companies are estimated to lose about ` 29,000 crore revenue by selling kerosene below ` 34 per litre. (economictimes.indiatimes.com)

Oil companies get ` 80 bn as March quarter subsidy

May 19, 2014. The Finance Ministry has paid ` 8,000 crore to state-run oil marketing companies as part subsidy for the March quarter of 2013-14 fiscal. While the oil ministry had sought ` 35,000 crore subsidy for the January-March quarter of 2013-14 fiscal, the finance ministry has given a letters of comfort for ` 11,000 crore. An amount of ` 24,000 crore is being provided in cash to the state-run fuel retailers. The letters of comfort will enable oil companies to account for the subsidy in their annual accounts. The actual amount would be received by them only after Parliament nod. In the interim budget for 2014, the government has estimated oil subsidy at ` 63,427 crore, of which ` 35,000 crore was rolled over from the fourth quarter of last fiscal. Oil subsidies are given to state-run oil marketing firms like IOC, BPCL and HPCL for selling diesel, domestic LPG to households and kerosene through the PDS system below cost. The revised estimate for petroleum subsidy for 2013-14 is ` 85,480 crore against a budget estimate of ` 65,000 crore. (economictimes.indiatimes.com)

BJP Manifesto: Energy

May 19, 2014. The BJP government has some good job up its sleeves for India's energy sector. The party which will shortly form a government at the centre had laid out a road map for a responsible and comprehensive 'National Energy Policy' in its election manifesto, focusing on development of energy infrastructure, human resource development and upgradation of technology. BJP which said it considers energy efficiency and conservation crucial to energy security, would take steps to maximize the potential of oil, gas, hydel power, ocean, wind, coal and nuclear sources. The industry keenly awaits the BJP plan of action now. BJP's national energy policy includes setting up of small-hydro power generation projects to harness the hydropower that is not being used at the moment. For the upstream, midstream and downstream sectors a five point agenda that needs to be addressed is-- diesel price hike; LPG reforms; natural gas price hike; subsidy sharing formula and clarity on the E&P reforms. The industry is also expecting that the NDA government may consider lowering the cap on LPG cylinders back to 9 which was successfully implemented by the oil marketing companies in FY14. A key decision that would decide the future course of investments in upstream segment is the increase in gas price which would provide a road map towards free pricing. The upstream industry is hopeful of that the new government would take a serious look at the subsidy sharing formula. BJP's manifesto promised that oil and gas explorations would be expedited in the country which would help to reduce the import bill. The industry awaits clarity on E&P reforms and expects the government to stick to Kelkar committee recommendations of continuing with the cost recovery mechanism. (www.business-standard.com)

Jefferies sees new govt speeding up decisions in oil sector

May 19, 2014. International brokerage Jefferies expressed hope that incoming government will speed up decision-making in oil sector, especially on the production and exploration front. Key decisions pending in the E&P sector include a policy on product sharing contract (PSC) extension, resolution of the DST issues, approvals for budgets and investment proposals, new PSC model for future NELP rounds. These decisions will have the maximum impact on Cairn India and Reliance. The real boost would come if the new government takes up more bold steps such as full elimination of fuel subsidy and privatisation of some of the state-run oil marketing companies. It expects fuel subsidy reforms to continue by eliminating the diesel subsidies by FY16. (economictimes.indiatimes.com)

New gas rates to be applicable from April 1: RIL to buyers

May 14, 2014. Forced to sell gas at rates that have long expired, Reliance Industries Ltd (RIL) has categorically told buyers of its KG-D6 gas that new rates as and when approved, will apply from April 1. RIL said it was supplying about 12.5 million standard cubic meters per day of gas since April 1 at provisional price of USD 4.205 per million British thermal unit, and will charge them the difference between this and the new rate as and when it is approved by the government. The government had in 2007 fixed a price of USD 4.205 per mmBtu for gas from KG-D6 block in Bay of Bengal for first five years of production. Dhirubhai-1 and 3 and MA fields in the KG-D6 began production in April 2009 and the rate approved expired on March 31, 2014. The Cabinet had approved a new formula for pricing of all domestically produced gas from April 1. The formula was notified on January 1 and published in Gazette of India on January 17 but before a new rate based on 12-month average price prevailing in international hubs and actual cost of importing LNG into the country, could be announced general elections were declared. The Election Commission asked the government to defer announcement of the new price till completion of the polls and so RIL was asked to continue selling the gas at old rates. Price according to the new formula is likely to be USD 8.3. While several customers in sectors like power have accepted the terms of gas supply from KG-D6 from April 1 and have already executed Term Sheet, fertilizer sector buyers have refused to sign even as they continue to take gas without a contract. RIL told the fertiliser firms that their acceptance or receiving of KG-D6 gas meant that they acknowledge and accept that the gas price formula leading to a gas price of USD 4.205 per mmBtu has expired on March 31, 2014 and new rates will apply from April 1. RIL and its partners BP Plc of UK and Canada's Niko Resources had slapped an arbitration notice on the government over delay in implementation of the new rates. (economictimes.indiatimes.com)

Oil ministry hopes to resolve gas price row with RIL

May 14, 2014. The oil ministry hopes to resolve the gas price dispute and the arbitration notice from RIL amicably but there are doubts whether this can be done by the outgoing UPA government or the new regime that may take the matter to cabinet. RIL has served an arbitration notice against the government for the delay in announcing new gas price from April 1, which it says has cast a shadow on billions of dollars of investment in gas fields. The ministry is confident that the matter will be resolved within the 90-day period available for amicable settlement under the contract. However, there are differences within the ministry over when and how this may be resolved. Oil Minister Veerappa Moily wants the new price announced as soon as the election code of conduct is withdrawn. The Election Commission had earlier blocked the implementation of the Rangarajan formula, which would have doubled gas prices to about $8.4 per unit from April 1. The exploration division of the oil ministry, however, feels that fresh Cabinet approval is needed to get a clear decision on several related issues. These are: whether the new price can be charged retrospectively; allowing BP and Niko to get the new price against bank guarantees; and whether the price should be charged on the basis of the net heat value, which is the practice in India, or the gross heat value, which is about 10 per cent higher. The Rangarajan formula is silent on the heat content of gas. (economictimes.indiatimes.com)

POWER

Generation

Reliance Power commissions fourth 660 MW unit of Sasan UMPP

May 20, 2014. Reliance Power's fourth 660 MW unit of Sasan Ultra Mega Power Project (UMPP) in Madhya Pradesh has commenced electricity generation. Post commissioning of the fourth unit, total operational capacity of the plant has reached 2,640 MW, Reliance Power said. The remaining two units are in advanced stage of construction and will be commissioned in the next few months. The total power generation capacity of Sasan UMPP is 3,960 MW (6x660 MW). Coal production has already commenced from the 20 million tonnes Moher and Moher-Amlohri mines associated with the power project. With this unit, Reliance Power's generation capacity has increased to 4,525 MW that includes 4,440 MW of thermal and 85 MW of renewable energy based capacity. The first 660 MW unit of the Sasan UMPP was commissioned in March 2013, second in January 2014 and the third one in March 2014. (www.business-standard.com)

Karnataka to get 50 pc power from Jurala project

May 20, 2014. The Andhra Pradesh Power Generation Corporation (APGENCO) agreed to provide 50 per cent of power generated from the 234 MW Priyadarshini Jurala Hydro Power project at a relatively low rate. The idea of sharing half of power from this project took shape in 1976, when the project was conceived. The 50 per cent power-sharing arrangement was finalised since 2,466 acres of land was submerged in Karnataka by the backwaters of the Jurala project, which is an irrigation and power project. Though the project that has six generating units with a capacity of 39.1 MW each was commissioned in 2011, it had not been possible for Karnataka to get its share of power due to technical problems in finalising the terms and conditions. However, all such formalities have now been completed with the keen interest taken by the officials of both the States. According to the Karnataka power sector, Karnataka will get 202 million units of energy each in 20014-15 and 2015-16, with an installed capacity of 117 MW from this project. The State’s share of energy will be pegged at 174 million units a year from 2016-17 onwards. Separate power purchase agreements in this regard for a period of 35 years were signed by Escoms of Karnataka with the APGENCO. (www.thehindu.com)

BHEL signs pact with Indonesian firm to set up power plant

May 19, 2014. State-owned power equipment maker BHEL said it has signed an initial agreement with PT Star Vyobros, Indonesia for setting up a 200 MW coal fired plant in the island nation. It has signed an MoU with PT Star Vyobros, Indonesia for setting up a 200 MW coal fired power plant in Sulawesi region in Indonesia, BHEL said. BHEL has earlier signed one more MoU with PT APAC INTI, Indonesia for setting up a 25 MW-30 MW Solar Photovoltaic based power plant in the Java region in Indonesia. In Indonesia, BHEL is executing a coal-fired power plant for PT CKP, besides having commissioned two more coal-fired power plants in recent years. (www.business-standard.com)

Commissioning of first unit of Kudankulam nuclear project may take longer

May 18, 2014. Commercial operations of the Kudankulam nuclear power plant's first unit is expected to take more time with the Nuclear Power Corporation setting the deadline till July 22 for commissioning the 1,000 MW unit. Nuclear Power Corporation of India is implementing the 2,000 MW Kudankulam project in Tamil Nadu. The plant, which has two units having 1,000 MW generation capacity each, is being set up with the technical co-operation of Russia. In a petition submitted to the Central Electricity Regulatory Commission (CERC), Nuclear Power Corp has sought permission to inject 'infirm power' into the grid from the first unit up to the date of commercial operation or till July 22, 2014. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

DVC threats to regulate power to Jharkhand

May 20, 2014. The Damodar Valley Corporation (DVC) threatened to reduce power supply to the Jharkhand electricity board due to non-payment of dues. The DVC said that it would reduce supply to the Jharkhand Urja Vikash Nigam Limited after it failed to clear dues amounting to around ` 7,000 crore and regular monthly bill of ` 160 crore. (economictimes.indiatimes.com)

Efforts on to pay NTPC dues so power supply isn't affected

May 20, 2014. Power supply is unlikely to be affected in the national capital with two BSES discoms already in touch with a number of banks to make payments of ` 690 crore in dues to state-owned electricity generating company NTPC by May 31 as directed by the Supreme Court. Delhi government said there will be no power cuts in Delhi as power distribution companies BSES Rajdhani and BSES Yamuna were making efforts to clear the dues to the NTPC at the earliest. The Supreme Court refused to extend the deadline to pay the arrears to the NTPC for electricity supplied to the BSES discoms in the last four months. (economictimes.indiatimes.com)

Karnataka signs PPA with Andhra Pradesh

May 20, 2014. As soon as the monsoons set in, the state will get 117 MW of power every week from the Jurala hydro-electric project in Andhra Pradesh. The memorandum of understanding signed by the two states in 2011 will be implemented from this year and the state will get power once a week, Energy Minister D K Shivakumar said. He was speaking at the signing of a power purchase agreement (PPA) to share power from the Priyadarshini Jurala hydro-electric project between Karnataka Power Transmission Corporation Ltd and Andhra Pradesh Power Generation Corporation (APGENCO). He said the amount of power to be shared was agreed upon by government officials from both the states. Though the project was conceived in 1978, it really took shape only after over three decades. The minister said the additional power supply is expected to reduce load-shedding in the state. Karnataka will get half the power generated and has to pay ` 3.23 per unit annually. Shivakumar said the agreement lasts till 2023-2024. (www.newindianexpress.com)

Delhi faces darkness as SC refuses to extend deadline for BSES discoms to clear NTPC bills

May 20, 2014. The national capital is staring at possible power cuts at the peak of summer as the Supreme Court (SC) refused to extend the deadline for Delhi's Anil Ambani-controlled electricity distribution companies (discoms) to pay arrears owed to state-run power producer NTPC. The Supreme Court asked BSES Rajdhani and BSES Yamuna to pay ` 690 crore to NTPC or be ready for power cuts from May 31. The discoms have not been able to manage the funds. The companies approached the court to seek an extension for the payment, but a vacation bench rejected their interim application and asked them to pay the money first. The discoms have also requested the Delhi Electricity Regulatory Commission to allow them to recover their arrears from consumers to be able pay NTPC for the electricity purchased from it. The regulator has yet to make a final decision on the demand. NTPC is in no mood to oblige BSES that approached the top court early this year to prevent the country's largest power producer from pulling the plug. NTPC said that the company has no choice but to disconnect power supply to Delhi if BSES discoms fail to pay their bills. BSES is under pressure since the beginning of this year. In January, the then Delhi Chief Minister Arvind Kejriwal asked the Comptroller and Auditor General to audit the accounts of BSES Rajdhani, BSES Yamuna and Tata Power Delhi Distribution, accusing the discoms of manipulating their accounts and levying higher tariff on consumers. Incidentally, the Delhi government is a minority stakeholder in the BSES discoms. (economictimes.indiatimes.com)

Tata Power invests ` 3 bn to strengthen Mumbai network

May 19, 2014. Private utility Tata Power said it has invested over ` 300 crore in FY2013-14 to strengthen distribution network in the metropolis. The company laid a total network of 602 km and commissioned six distribution and 85 consumer sub-stations in Mumbai during the year, Tata Power said. The private power firm has five lakh consumers in Mumbai as on April 30. (economictimes.indiatimes.com)

Govt to buy PowerGrid arm for ` 350 mn

May 17, 2014. The road to an independent grid manager is clear with the government deciding to take over Power System Operation Corporation Ltd (Posoco), a wholly-owned subsidiary of the PowerGrid Corporation of India. In a meeting, an inter-ministerial group approved buying out PowerGrid’s equity in Posoco. The matter would be put up to the Cabinet for approval. Power transmission utilities will be required to charge a small levy on every unit of power, which would go towards meeting the working expenses of Posoco. (www.business-standard.com)

L&T wins $126.5 mn power transmission contracts in Saudi Arabia and Oman

May 14, 2014. India-based Larsen & Toubro (L&T) has announced that its power transmission and distribution business has secured contracts worth INR7.54bn ($126.5 mn) in Saudi Arabia and Oman. The contract received in Saudi Arabia from National Grid, a subsidiary of Saudi Electricity Company, covers construction of two 115/13.8kV substations at Dammam Industrial Estate and Al-Majeedia, Qatif. The other contract is for constructing a new 106km, 132kV double circuit transmission line in Wadi Dawasir Area. In Oman, L&T has bagged a contract from the Oman Electricity Transmission Company for the design and construction of a new 400kV Izki Grid station near Nizwa. It includes supply and erection of 400kV GIS, 500MVA transformer and control relay panels, substation control system and related civil works. Additionally, the business has received an order in India from Vizag Transmission Limited for constructing a 765kV D/C transmission line with associated system strengthening in Andhra Pradesh. (utilitiesnetwork.energy-business-review.com)

Odisha to seek FRBM clearance for ADB assisted power sector project

May 20, 2014. The Odisha government will take the nod of its Cabinet and obtain FRBM (Fiscal Responsibility & Budget Management) clearance from the department of expenditure, Government of India, to avail loan from Asian Development Bank (ADB). ADB had agreed on a loan of $100 million to help rebuild power infrastructure in regions of Odisha affected by the Phailin storm that struck the state's southern coast on October 12. The cost of the project, 'Odisha Power Sector Emergency Assistance Project' (OPSEAP), is estimated at ` 1,000 crore. While ADB has agreed to provide a loan of around $100 million, the balance cost of the project will be funded by the state government. The ADB loan is meant for cyclone insulated infrastructure for transmission and distribution of electricity in the coastal zone and also for strengthening river and saline embankments. Under OPSEAP, the state government plans to go for a smart grid power network. (www.business-standard.com)

Power generation companies with coal blocks under scanner over loans

May 20, 2014. Loans availed by private power companies with captive coal mines have come under lens. The finance ministry has asked the coal and power ministries about details on loans to private power companies owning coal blocks and their recovery process. This was triggered by a letter from Hansraj Ahir, Member of Parliament, to finance ministry saying there are irregularities in ` 49,000 crore worth loans sanctioned by the Power Finance Corporation (PFC) to private companies. The department of financial services has sought comments on Ahir's allegations from the ministries of coal and power and the Indian Banks' Association. While the coal ministry has declined comments, the power ministry is yet to respond. The letter was part of a routine process as per which complaints and queries are forwarded to the concerned ministries for comments and action. In its letter, Ahir alleged that many private companies inflated their balance sheets to avail loans above their eligibility. (economictimes.indiatimes.com)

Electricity panel starts consultation for power price in Chhattisgarh

May 19, 2014. Chhattisgarh State Electricity Regulatory Commission (CSERC) started consultation with different sections to recommend the new power tariff for different categories of consumers the state. The process of recording opinion of different section of the consumers would be completed by June 22, the commission said. On May 21, the CSERC had convened a public hearing to seek common man's suggestion on whether to increase the power tariff. On May 22, the representatives of state-run South Eastern Coalfields Limited and Railways besides cement manufacturers' association, mini steel plant, sponge iron manufacturers' association would be invited for discussion on the issue. The commission would later submit its recommendation to the state government for a possible revision in power tariff that could be announced in the first week of June. The state-run Chhattisgarh State Power Distribution Company had reportedly asked for a big hike to increase its revenue. The company had planned to enhance its revenue from ` 6000 crore to ` 8100 crore. To execute the plan, the power tariff had to increase by about 30 per cent in the state that the company had been stressing for. (www.business-standard.com)

CCI again finds Coal India violating competition norms

May 19, 2014. Finding Coal India Ltd (CIL) again guilty of abusing its dominant position in fuel supplies, Competition Commission has directed the state-run miner to "cease and desist" from indulging in unfair business practices. The latest ruling on a batch of complaints come a few months after the Competition Commission of India (CCI) slapped a ` 1,773.05 crore penalty on Coal India and its subsidiaries in December last. CCI's common order, made public, has come on complaints filed by Sponge Iron Manufacturers Association, Madhya Pradesh Power Generating Company and West Bengal Power Development Corporation. The order, dated April 15, have been passed against Coal India and seven of its subsidiaries. They are South Eastern Coalfield, Eastern Coalfields, Bharat Coking Coal, Mahanadi Coalfields, Central Coalfields, Western Coalfields and Northern Coalfields. Again the fair trade regulator has asked the coal miner to modify its fuel supply agreements. The complainants had alleged Coal India of various anti- competitive practices such as one-sided Fuel Supply Agreement (FSA) and MoUs, restricting the supply by means of diverting the coal to sale through e- auction. CCI's December order has been challenged by the company at Competition Appellate Tribunal (Compat) which has ordered for maintaining status quo till further orders. (economictimes.indiatimes.com)

No hike in power tariff this fiscal, demands Punjab industry

May 19, 2014. The Punjab industry said there should be no hike in power tariff for current fiscal, as it will render the sector uncompetitive and block new investments into the state. Seeking maximisation of power generation and efficient management of power utility PSPCL, the industry pointed out that power tariff rather should come down in the wake of power utility's claims of availability of surplus power. Notably, the demand for not raising power tariff came at a time when fledgling Aam Aadmi Party (AAP) sprung surprise in Punjab by winning four Lok Sabha seats. Power regulator Punjab State Electricity Regulatory Commission (PSERC) is likely to announce new power tariff for 2014-15. Revision in power tariff was not announced in the wake of code of conduct coming into place in the wake of Lok Sabha elections. Power utility Punjab State Power Corporation Ltd (PSPCL) has projected revenue gap of ` 2,595.30 crore for 2014-15 in its ARR and is looking at 10 per cent hike in power tariff to cover difference between revenue generation and revenue requirement. (www.business-standard.com)

Coal India gains most since debut on Modi optimism

May 19, 2014. Coal India Ltd (CIL) gained the most in Mumbai since its trading debut more than three years ago on optimism a new federal government will remove obstacles to increase production at the world’s biggest miner of the fuel. Prime Minister-elect Narendra Modi’s government should focus on building railway infrastructure, helping plug a supply shortfall and curb imports of coal, Chirag Shah, an analyst at Barclays Plc in Mumbai, wrote in a May 16 report titled ‘Material Modi-fication’. Deregulation and opening up the coal sector to private investment will bring efficiency in state-run companies, the report said. India’s coal production has lagged behind demand as the state monopoly faces delays in getting land and environment approvals, while mines with a potential to meet the shortfall lack railway connectivity. Modi, set to lead the nation after his party’s election victory, has been vocal about the need to reform the coal industry, stoking expectations his government will work to remove the hurdles. India’s coal imports are expected to grow at 9 percent annually over the five years ending March 2017, leading to an unsustainable import bill, according to Shah’s report. Coal India plans to invest ` 75 billion in a 203 mile (327 kilometer) railway network to produce 300 million metric tons of coal from mines in the states of Jharkhand, Chhattisgarh and Odisha, helping eliminate the need for imports. (www.bloomberg.com)

Peak power deficit drops to 5.4 pc in April: CEA

May 18, 2014. Peak power deficit in the country fell to 5.4% at 7,556 MW in April from 7.4% a year ago due to increased capacity and lower electricity consumption by states. The decline in consumption in certain north Indian states was due to a weak intra-state network for dissemination of electricity. According to the latest data by the Central Electricity Authority (CEA), the total requirement in the country last month was 1,40,998 MW, as against the supply of 1,33,442 MW— a peak power deficit of 5.4%. (www.livemint.com)

Adani's Maharashtra project gets MERC nod for compensatory tariff

May 16, 2014. In a big relief for Adani Power, the Maharashtra Electricity Regulatory Commission (MERC) has approved a compensatory tariff of ` 1.01 a unit for its 1,320 MW Tiroda power project in the state. This will be above the tariff of ` 2.67 a unit according to the power purchase agreement between Adani Power Maharashtra Ltd (APML) and the Maharashtra State Electricity Distribution Company (MahaVitaran). However, MERC has proposed a reduction of 20 per cent in return on equity. Thereby, the total power purchase cost from the 800 MW for MahaVitaran works out to ` 3.56 a unit. MERC said that the indicative compensatory energy charge would be reduced when APML progressively secured 100 per cent domestic linkage coal for 800 MW. (www.business-standard.com)

INTERNATIONAL

OIL & GAS

Upstream

Statoil shuts production at part of Norway's 4th biggest oilfield

May 19, 2014. Norwegian energy firm Statoil shut oil production at its Snorre B platform in the North Sea and evacuated a quarter of the personnel there after detecting a soil shift under a drilling template and then oil leak, the company said. The Snorre field in the northern part of the North Sea is Norway's fourth-biggest oil producer with output averaging 88,000 barrels of oil per day in 2013, data from Norwegian Petroleum Directorate (NPD) showed. The field has two production platforms but Statoil declined to provide a breakdown between Snorre B and Snorre A, which is operating normally. Production at Snorre B was first shut after a subsea robot detected a pit under the drilling template, which helps to connect the underwater site to the semi-submersible platform at the water's surface. (www.rigzone.com)

Chesapeake drops as gas-field sales crimp production

May 17, 2014. Chesapeake Energy Corp., the U.S. natural gas explorer that was on the verge of running out of cash two years ago, said output will grow by the slimmest margin in 14 years as the company sheds its weakest-performing assets. Chesapeake cut its output growth estimate for this year to 2.2 percent, compared with a 4.3 percent target announced. The fall-off stemmed from wells the Oklahoma City-based company is selling from Pennsylvania to Wyoming as part of $4 billion in divestitures by Chief Executive Officer Doug Lawler. Chesapeake said full-year production will be equivalent to 675,000 to 695,000 a day on average, compared with the 690,000 to 710,000 estimate announced. The mid-points of those ranges are 685,000 and 700,000, respectively. In 2013, output averaged 669,600 barrels a day. A 2.2 percent production increase for Chesapeake would be the worst performance since 2000, when output declined by 8.5 percent. Lawler said that he envisions an overseas expansion to take advantage of Chesapeake’s shale-drilling expertise. The company has been evaluating oil and gas formations from New Zealand to Central Asia and Scandinavia to Argentina. Chesapeake also said that it plans to shrink its workforce by half to the smallest since 2006 in a rig spinoff by the end of next month. (www.bloomberg.com)

China’s oil drilling over South China Sea escalates tensions with Vietnam

May 16, 2014. Anti-China riots in Vietnam blew up after China's towing of an oil rig into the South China Sea waters, claimed by both the nations. The situation claimed more than 21 people and also led to the destruction of a huge foreign steel project. China will continue oil rig drilling will continue in the contested waters off South China Sea, despite anti-Beijing riots in Vietnam. China claims majority of the oil- and gas-rich South China Sea, rejecting rival claims to parts of it from Vietnam, the Philippines, Taiwan, Malaysia and Brunei. According to the experts, Beijing is simply interested in pushing its neighbors as much as possible to maximize the swath of sea it ultimately will control, rather than targeting an energy-rich zone. (explorationanddevelopment.energy-business-review.com)

US crude output advances to 28-year high on shale boom

May 15, 2014. U.S. crude production climbed to a 28-year high as the shale boom moved the world’s biggest oil-consuming country closer to energy independence. Output rose 78,000 barrels a day to 8.428 million, the most since October 1986, according to Energy Information Administration (EIA) data. The combination of horizontal drilling and hydraulic fracturing, or fracking, has unlocked supplies from shale formations in the central U.S., including the Bakken in North Dakota and the Eagle Ford in Texas. The U.S. met 87 percent of its energy needs in 2013, and 90 percent in December, the most since March 1985, according to the EIA, the statistical arm of the Energy Department. Crude output will average 8.46 million barrels a day this year and 9.24 million in 2015, up from 7.45 million last year, the EIA said. Next year’s projection would be the highest annual average since 1972. The EIA forecasts that the gain in production at shale fields will be augmented by greater offshore output this year and next. Crude output in the waters of the Gulf of Mexico will climb by 150,000 barrels a day in 2014 and by an additional 240,000 barrels in 2015, following four consecutive years of declines. U.S. Energy Secretary Ernest Moniz said that the mismatch between rising production of light oil in the U.S. and the country’s refining ability is driving the debate over whether to lift a ban on crude exports. The crude unlocked from shale deposits is too low in density to be absorbed entirely by the U.S. refining system, Moniz said. (www.bloomberg.com)

Saudi gas reserves up as Aramco taps new shale deposits

May 15, 2014. Saudi Arabia’s natural gas reserves rose last year as it explored for the fuel in the Red Sea and tapped shale gas to free more crude oil for export, according to the kingdom’s state-run oil company. Saudi reserves increased to 288 trillion cubic feet of gas last year from 285 trillion in 2012, Saudi Arabian Oil Co. said. The company is ready to use shale gas to fuel a 1,000 MW plant that will feed electricity to a large phosphate mining project, the company known as Saudi Aramco said. The shale gas drive will help the kingdom free more diesel and crude oil for export, the company said. Aramco said it is looking for unconventional gas in the Northwest, the Empty Quarter desert, and near Ghawar, the world’s largest oil field. A “significant” gas field discovered in the Red Sea, called Shaur, is also “a potential game-changer in the future of the Kingdom’s energy mix,” the company said. Saudi Aramco increased gas production last year to 11 billion cubic feet a day, compared with 10.72 billion in 2012, it said. (www.bloomberg.com)

Downstream

Rosneft plans to ship 180k bpd to its China oil refinery from 2020

May 20, 2014. Russia's top oil producer Rosneft has reached an agreement to ship 180,000 barrels per day (bpd) of oil to its jointly owned Chinese refinery project from 2020, the company's head Igor Sechin said. The Kremlin-controlled company, which had already agreed on the volumes but had yet to pin down the start date, plans to triple its oil sales to China from the roughly 300,000 bpd shipped last year. The Tianjin refinery, a project between Rosneft and CNPC, will be operational by the end of 2019 with Rosneft shipping 9.1 million tonnes a year of crude oil for the plant from 2020 via the Pacific port of Kozmino, Sechin said during Russian President Vladimir Putin's visit to China. Sechin, a close ally of Putin, also said that Russia had offered to scrap extraction taxes for gas supplies designated for China, while Beijing was looking to abolish import taxes for Russian gas. Rosneft has been lobbying for the rights to sell gas abroad via pipelines, aiming to end the monopoly of another Russian energy champion, Gazprom. (www.downstreamtoday.com)

Mexico's Pemex to export oil to Swiss refinery beginning in July

May 19, 2014. Mexico's national oil company Pemex plans to launch exports of extra light Olmeca crude to the Cressier refinery in Switzerland beginning in July, the company said. Pemex will send Olmeca crude shipments of between 300,000 and 500,000 barrels each to the Cressier refinery over a six-month period. The crude exports to Switzerland are part of Pemex's strategy of diversifying its export markets away from an increasingly self-sufficient United States, which has for decades been the destination for most of Mexico's crude oil shipments. Pemex announced plans to market more of its crude to buyers in India and Japan, as well as new clients along the U.S. West Coast. (www.downstreamtoday.com)

Transportation / Trade

Korea Gas Corp looks to sell 20-40 excess LNG cargoes

May 20, 2014. Korea Gas Corp. is looking to sell 20 to 40 cargoes of liquefied natural gas (LNG) after misjudging the scale of its demand and committing to buy excessive supply, traders said. Kogas, faced with an over-supply it is unable to absorb, is seeking to offload cargoes through a combination of time-swap deals and reducing offtake from its suppliers, several traders said. Time swaps would allow Kogas to direct its excess cargoes to needy buyers, and in return receive replacement deliveries at some point in the future. (www.downstreamtoday.com)

Natural gas bets drop to five-month low on US supply

May 19, 2014. Faster-than-expected gains in U.S. natural-gas inventories are easing concern that a shortage is looming next winter, spurring speculators to cut bullish bets. Money managers’ net-long position fell 9.1 percent in the week ended May 13 to the lowest level since December, the U.S. Commodity Futures Trading Commission (CFTC) said. Bearish wagers are the highest in more than four months. Production from shale deposits in the U.S. Northeast and Midwest climbed to a record 16.1 billion cubic feet a day in the week ended May 9, Credit Suisse Group AG said in a report. The Energy Information Administration said inventories rose 74 billion cubic feet in the week ended May 2. Analysts predicted an increase of 70 billion. Supplies climbed by 105 billion the following week, narrowing the deficit to the five-year average to the least since Feb. 28. Output from shale formations will lead to a record increase in stockpiles through the end of October, when heating demand kicks in, Goldman Sachs Group Inc. said. In other markets, hedge funds and other large speculators increased bullish crude oil wagers by 11,652 futures and options combined, or 3.9 percent, to 311,195. U.S. marketed gas output will increase 3 percent to average 72.26 billion cubic feet a day this year, an all-time high, EIA projections show. Net-long positions on four U.S. natural gas contracts held by money managers dropped by 35,222 futures equivalents to 351,116 in the week ended May 13, falling for a third week, according to the CFTC. Long positions decreased by 5.1 percent, while bearish bets gained 3,955 to 230,883. (www.bloomberg.com)

Azerbaijan's SOCAR to lower gas exports in 2014

May 19, 2014. Azeri state energy company SOCAR's exports of natural gas are set to fall to 2.6 billion cubic metres (bcm) in 2014 from 2.84 bcm last year on lower volumes to Russia, SOCAR said. There will be lower exports from gas fields where SOCAR operates alone, but not from Shah Deniz, where it works with foreign companies including BP and Statoil, SOCAR said. Azerbaijan suspended gas shipments to Russia citing maintenance work on a motorway between the Azeri capital Baku and the Russian border adjacent to the pipeline. It has not yet resumed Russian shipments but it is ready to fulfil its obligations, SOCAR said. Prior to the suspension, Azeri gas supplies to Russia amounted to 3 million cubic metres a day, a small fraction of Russia's total gas consumption. (www.rigzone.com)

Atlas Pipeline completes sale of 20 pc interest in West Texas LPG Pipeline

May 16, 2014. Atlas Pipeline Partners, L.P. announced the Partnership has completed the sale of its subsidiaries holding a 20% interest in the West Texas LPG Pipeline Limited Partnership to a subsidiary of Martin Midstream Partners L.P. for $135 Million, subject to certain closing adjustments. Proceeds from the sale will be used to reduce the Partnership's outstanding debt. (transportationandstorage.energy-business-review.com)

Petronas in talks to sell more stake in Canadian LNG project

May 14, 2014. Petroliam Nasional Bhd., Malaysia’s state oil company, said it’s in talks to sell an additional stake in a Canadian gas project. Petronas may sell as much as a 12 percent in the proposed liquefied natural gas facility in British Columbia, Chief Executive Officer Shamsul Azhar Abbas said. Discussions are on with at least three parties, he said. Petronas, which began a review of its assets four years ago, last month cut its stake in the Canadian project to 62 percent, having concluded deals with buyers from China, India, Brunei and Japan. It’s also looking to sell stakes in exploration and production projects in Vietnam and last month said it would proceed with a $27 billion investment in a refining and petrochemicals project in the southern state of Johor, bordering Singapore. The company said first-quarter net income fell 8 percent to 16.2 billion ringgit ($5 billion) in the three months through March, from 17.6 billion ringgit a year earlier. Revenue increased 9.6 percent to 84 billion ringgit. The drop in first-quarter profit was due to increased operating costs after the company booked impairment expenses mainly in Egypt, Petronas said. It also incurred costs for LNG imports at a new regasification terminal in Malaysia, the company said. (www.bloomberg.com)

China LNG demand a bright spot as producers weigh major investments

May 14, 2014. China's imports of liquefied natural gas (LNG) are growing at a record pace as it aims to use cleaner fuels to cut smog in big cities, creating a powerful new source of demand that has the potential to reshape the market for the super-chilled gas. Rising Chinese demand gives LNG producers such as Chevron, Royal Dutch Shell, ExxonMobil and Total a crucial new sales avenue as they weigh whether to go ahead with $180 billion in investments into potential new or expanded LNG projects. Producers face rising costs in Australia - where many LNG projects are based - and uncertainty about longer-term demand in Japan and South Korea, the world's top two buyers of the fuel. The Chinese, though, are spending billions of dollars in buying LNG-related interests overseas and in building new import terminals. LNG imports are up 35 percent to 5.62 million tonnes in the first quarter against the year-ago period, according to customs data. (www.downstreamtoday.com)

Russian slowdown to shield Europe from Ukraine gas cuts