-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: The Problem with PPP measures: Implications for Energy

Ø COAL: Coal: Are we moving in the right direction?

ANALYSIS/ISSUES

Ø COPs and Robbers (part II)

DATA INSIGHT

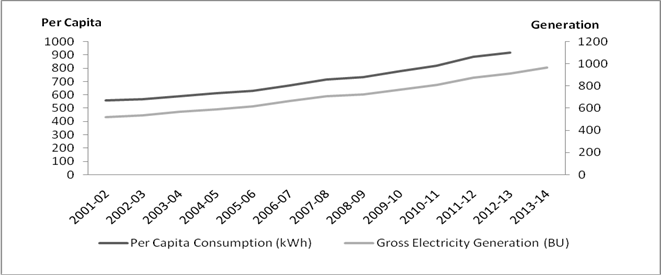

Ø Trends in Electricity Generation & Per Capita Electricity Consumption

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· OVL to bid for O&G block in Tanzania

· ONGC to spend $1.1 bn on drilling to revive Mumbai High fields

· OIL buys 50 pc stake in Russian oil block for $85 mn

· ONGC's presence in South China Sea: Beijing sets up oil rig to reinforce its territorial claims

· Andhra’s bifurcation delays Petronet LNG project in Vizag

· BHEL commissions 600 MW thermal unit in Odisha

· Adani, GVK, Lanco seek to cut stake in Australian coal mines

· Libya oil output may double as western protests end

· Chevron first major oil producer seeking Pemex partnerships

· Japan's JX to develop Malaysia's Layang gas field

· Philippines offers oil, gas exploration area in waters disputed with China

· Oil industry risks $1.1 tn of investor cash: Study

· Kuwait signs $3 bn deal to buy gas from BP

· US orders railroads to tell states about crude trains

· Duke Energy to build power plant in Florida

· ABB to automate new power plant in Bangladesh

· China to build 12 power transmission lines

· Transpower wins approval for $161 mn power line upgrade in New Zealand

POLICY & PRICE

· India to overtake Japan to become third-largest oil consumer: US

· Diesel prices hiked by ` 1.09 per litre

· IEA terms India’s plan to become energy independent as ambitious

· RIL takes Indian govt to arbitration over gas pricing delay

· Euro-IV petrol, diesel in 50 more cities by March 2015

· CIL modifies performance incentive clause in FSAs

· India considers splitting power utilities to cut losses

· Power tariff to go up by 32 paise a unit in Karnataka

· Inter-Ministerial panel meet on coal supply to end-use plants postponed

· No power rate hike in Uttarakhand

· Finance Ministry seeks details on coal availability for power sector

· BP aims to invest $1.5 bn in Egypt in 2014

· Russia to discuss gas price cut with Ukraine only if debt paid

· Lebanon gas licensing round deadline delayed to Aug 14

· Lithuania offered LNG cheaper than Gazprom natural gas

· Europe gas options seen limited by costs at $200 bn

· EIA expects crude oil prices to decline in 2014

· Venezuela to ration electricity after Colombia cuts gas

· Senate Republicans seek electoral gain on energy bill

· Stanford University ending investments in coal companies

· Govt, IIT-Bombay launch solar project to reduce kerosene subsidy

· Jakson says solar to match diesel-generator sales by 2017

· VGF model for solar projects needs financial engineering techniques: India Ratings

· NHPC, KSEB sign pact for solar project

· Welspun Renewables receives ISO certification

· Hanergy to build 50 MW solar power plant in China

· Cleanest fossil fuel is Wall Street's bet on climate change

· Solar seen bailing California out of summer hydro shortage

· Obama scores third court victory in air pollution fight

· EPA underestimates fracking's impact on climate change

· German cabinet passes plans for green energy rebate for industry

WEEK IN REVIEW

ENERGY

The Problem with PPP measures: Implications for Energy

Lydia Powell, Observer Research Foundation

|

W |

hen the question is ‘who is the biggest of them all?’ it is quite natural that the wicked witch in everyone comes out as it did when China was declared as the world’s largest economy (and India the third largest) in terms of purchasing power parity (PPP) by the World Bank’s international comparison programme last week. Commentators on western media channels could barely conceal hurt pride and inherent prejudices as they sought to reclaim the superiority of western nations. Many resorted to citing ‘per person’ income levels in China (and India) to put these countries in their places. Not surprisingly, when India or China bring up per person comparisons of incomes, energy consumption or carbon emission levels to point out that they are not rich, energy guzzling and polluting countries, it is dismissed it as climate irresponsible socialist rhetoric. This hypocrisy has gained the status of commonsensical truth but not worth commenting upon.

The purpose of this note is to draw attention to two important issues that reactions to the PPP based rankings failed to highlight. First, the change in the relative economic power of nations has more to do with the size of the country in terms of population numbers and less to do with the shift from market to PPP measures. China’s or India’s relative positions have shifted by only few places by PPP measures compared to their positions measured at market exchange rates. What contributed to their dramatic rise on the economic league tables is primarily their size. A small country like Peru which apparently has a higher per person income than China is unlikely to be declared as an economic power any time in the future irrespective of how well it does economically.

Quantity rather than quality is underwriting economic power and this is something that the world has not seen before. Small changes at the unit level become formidable forces at the aggregate level. The sheer size of India (and China) and the consequent impact on energy demand affects the boundary conditions of the energy market as well as the externalities that the market fails to account for. The entry of India and China into the global market can push up the price of globally traded coal to such an extent that it becomes unaffordable, ironically to India. More importantly, when minute quantities of commercial forms of energy such as electricity and LPG is introduced to millions of households that live in the dark ages as far as energy is concerned, it is seen to threaten the global biophysical boundary conditions such as the climate. Never before in the history of mankind have thatched huts switching on their first electric bulbs become a threat to global survival.

The second issue is far more important in the context of energy. The PPP measure capitalises on the fact that the world is divided into zones of low productivity and low wages and high productivity and high wages. In the former, capital and intermediate goods are more expensive than consumer goods than that in the latter. This means that it is more costly to produce in the former than in the latter unless labour remains very cheap and can be used instead of capital and intermediate goods, such as energy. Cheap consumer goods gives the impression of high purchasing power but this ignores the cost of capital and intermediate goods (energy) which are important for production and productivity gains. Fall in the price of consumption goods that underwrites optimistic PPP measures are, in the world of Radhika Desai, ‘development by statistical redefinition, which add insult to injury of low incomes by congratulating the people for it’.

This highlights a point that is critical to the pursuit of development: low wages cannot be traded for productivity advantage (which depends on access to cheap energy among other things). A 2002 UNCTAD report concludes that India’s wages are 1.5 times that of China, costs 1.4 times that of China (partly on account of high energy prices) and labour productivity just 1.1 times that of China. In comparison, wages in USA are over 47 times that in China, costs 1.3 times that of China (partly on account of low energy prices) and labour productivity over 36 times that of China. An average Indian has to work for over a day to buy a litre of petrol compared to an average Chinese who needs to put in just 3 hours of labour. This is not a competition that India can win unless some terms of the competition change dramatically. Development of high-end skill and technology can change terms of the competition but this will take a long time.

In the short term, reduction in the price of energy could contribute to significant gains in productivity. This too is unlikely to be easy. In the last decade, commodity prices in general and energy prices in particular have increased by over 150% in real terms after a sustained fall / stagnation over most of the 20th century. This trend of increasing energy prices is unlikely to change in future, especially if the efforts of those working over-time to increase the price of energy supposedly to arrest climate change succeeds (see the three part series titled ‘COPs and Robbers’ for more on this). But India has an opportunity. On account of multiple macro and micro factors energy prices in India have been padded by what may be called inefficiency penalties. These originate in technical, administrative, economic, social and governance inadequacies that are part of the design of the system. If this default setting of inefficiency can be reduced and eventually removed, energy prices in India should actually fall driving significant productivity gains.

Views are those of the author

Author can be contacted at [email protected]

COAL

Coal: Are we moving in the right direction?

Ashish Gupta, Observer Research Foundation

|

A |

recent report released by the Institute of Energy Economics and Financial Analysis (IEEFA), Melbourne stated that the international coal projects coming up in Australia relying on India as market face a huge financial risk. It is correct that at the prevailing Current Account deficit situation and increasing inflation, it will not be viable to bring imported coal for the Indian power sector. Australian coal is costly because of the high labour and shipping cost. This news letter has already highlighted this fact (Indian Overseas Coal Mines Will Capitalize on Demand from China rather than India, Volume 9, Issue 25, Published, December, 2012). We highlighted the relative ease of acquiring coal properties abroad but this comes with a cost. The cost of mining is high (especially Australia) which has forced Indian companies to review their plans of transporting the entire quantity of coal mined to India. From the perspective of the Indian private sector investing in overseas mines, the move is justified on the ground that rather than run huge losses by sending the coal to India, it would be better to minimise losses by capitalizing on the demand from China.

Having said that, hopes of low demand for coal in China is not very rational especially if it is based on the proliferation of renewable energy in the country. India too has invested in green technology but the dominance of coal continues and will remain so in the coming decade. The same is the case with China and it is quite visible from the reports of very reputed international organizations like IEA or BP. Some years back it was highlighted that India will overtake China in coal import demand by 2025 as China demand was expected will be flat after 2025. This prediction has become more uncertain and the India is expected to dominate the market only by 2035. Demand for coal cannot be wished away and companies can capitalise on the demand coming from both China and India.

But the demand for imported coal from Indian side will be low as far as Australian coal is concerned especially from power sector. But for coking coal, the demand will remain as India hardly has any choice. Given the increasing coal shortages, this is a warning for India that it has no choice but to increase domestic coal production. Interestingly Coal India Ltd. (CIL) production target for 2014-15 has been put at 507 mt which is extraordinarily high, given the company’s performance last year in which coal production grew only by 2.3%. The new target looks impossible. Even during its best years, 2009 and 2010, the incremental production was 6-7%. Therefore it is not clear how they will achieve 9.6% growth.

Simply offering higher targets cannot solve problems. It is not that CIL does not have the capability to enhance the production but when mining clearance process for new projects is slow, what is the way out for the miner? Apart from that, the miner is not even allowed to mine extra coal from its existing projects as it again requires clearance. If somehow the miner is able to secure clearances then where is the railway infrastructure to evacuate that extra coal? Ministry of Coal & Ministry of Railways are trying hard to get approval for Tori-Shivpuri-Kathotia in North Karanpura, Jharkhand; Bhupdeopur-Korichhaapar to Mand Raigadh mines in Chhattisgarh; and Barpali-Jharsuguda in Ib Valley, but failed. Some projects do not even have the environmental clearances and so the Ministry of Railway is not in a position to conduct even a feasibility study. These projects were identified many years back but got stuck at various levels with Ministry of Environment & Forests. Even in the case of the dedicated freight corridor projects, nothing has moved except the completion date.

But somehow this looks like it is only one side of the story which seems to emphasise shortages whereas the ground reality is somewhat different. There were no reasons given for why states like Gujarat, Rajasthan and West Bengal are reluctant to lift coal from CIL. Even Haryana completely stopped buying coal from the miner which indicates either they have good amount of coal stock or there is reluctance on the part of the generators on account of the weak financials. Whether it is imported coal or domestically produced coal, where is the demand? Though coming to conclusion is unwise there can be no question on the fact that India needs transparency, good governance and regulation for strategic and not impulsive reasons. Governance of the Indian energy sector in general and coal sector in particular has to radically change if India wants to take advantage of the 'three As' of coal i.e., availability, access and affordability. Being an important sector, it must be given priority treatment. Important question is: are we moving in the right direction?

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

COPs and Robbers (part II)

Nikhil Desai*

Continued from Volume X, Issue 47......

|

J |

ust before the Warsaw COP we learnt that estimates of radiative forcings have changed, the size of carbon sinks have changed, climate sensitivity has been given a wider range it used to have before the previous IPCC report. Since then COP, we have learnt that methane emission rates are higher than previously thought, a new gas has been identified as having “greenhouse warming” property and said to be 7,000 times more powerful in warming than mundane CO2.

And we have known for some time that of the calculated anthropogenic GHG emissions, CO2 accounts for only about a half if judged in terms of radiative forcing, and that CO2 emissions from fossil fuel combustion are about 2/3rd of the total CO2 , meaning a third of the total GHG emissions, weighted in warming terms. Put differently, the anthropogenic CO2 emissions from fossil fuel combustion are less than 2 percent of the natural carbon flux (6-7 billion tons a year compared to 400 billion tons a year of natural flux or exchange between the atmosphere and the earth) and that any number of interacting variables come in from emissions to additions to atmospheric stocks to temperature changes to wind and rain changes to specific impacts.

And we have known, also, that SO2 and other aerosol co-products of fossil fuel combustion has kept the earth cooler than it would have been otherwise, under the modelled scenarios, and that even if the fossil fuel CO2 emissions ended somehow, the carbon addition to the atmosphere is going to continue for hundreds of years, exercising its climatic influences, we just cannot tell what, where and when.

And that the Montreal Protocol on Ozone Depleting Substances (ODS) has reduced warming so far, under the modelled scenarios, more than that from zero-carbon energies.

And that some of the zero-carbon and lower-carbon energy sources pose enormous, at least enormously complex in relation to response capabilities, risks to the health and welfare of humans close-by and thousands of miles away, immediate and over decades. Nuclear power – and its nuisance Siamese twin, nuclear weapons – is one example. Shale oil and gas from fracking another. And the supposedly limitless supply of hydro, biomass, solar and wind ultimately depends on limited supplies of land, water, and finance, each of which may have equally legitimate claims by alternative uses and users.

Unless, of course, the fictitious carbon budget and implicit or explicit carbon prices rob the alternative users of land and water, as they have already done with aid finance.

Stripped of its moralistic pretensions, the current FCCC schema of nationally binding GHG emissions limits is environmental imperialism in disguise, currently only in a fetal form but deformed enough to require consideration of alternatives to successful birth.

As with imperialism of the past, this endeavour is also rooted in the desires of the elite for extractive advantage and control, on the one hand, and spreading the good word – of God, or Liberty, or Law – on the other. Europe seems to have for now abandoned threats of trade war via embedded carbon content, but perhaps only because there is no telling how the marginal costs will shift and when.

In the meantime, rich countries that have lost market shares in exports of capital goods see, in climate change policy negotiations, some room for subsidizing the exports of one good (or bad) they still seem to have considerable market power in – known (or marketed) as “knowledge”. Its policy analysts of any number of hues and colours can keep on generating and debating reports like “climate change and x”, “climate change and y”, and perhaps soon enough, “Climate change and Hercule Poirot – the rebirth of Agatha Christie”.

This will go on to Lima and Paris and beyond. Since climate is a given, climate change is a given. There will be an annual festivity – and breast-beating, wailing, together with caviar and cognac (perhaps from Siberia, not France) – for a long time. Coal use will go up or down, poor people may be born and die of preventable diseases, air-conditioning will ameliorate heat waves, and experts will go on counting the number of angels on the head of their own personal pins.

And yes, the children. They had their wish lists. They might even have behaved very thoughtfully and shown great school results, published papers and attended mock or real conferences. It is painful to judge who is deserving and who is just demanding, who will behave of own accord and who needs to be bribed.

Kumi Naidoo said on Facebook (12 November 2013)

“Governments at the UN Climate talks can steer the world away from catastrophic climate change. But many of these politicians are in fact defending the interests of oil and coal corporations.

After 19 years of talks, after 19 years of political brinkmanship, 19 years of corporate sponsorship, compromise and cowardice, governments have let us down.

If the politicians gathering in Poland cannot find the courage to act against climate change then we need to find other politicians who will.”

Children can afford fantasies.

In the meantime, roughly twice as many people suffer the extreme deprivations and insecurities of climate variability as did at the end of 19th Century (total world population 1.65 billion). And another as many people (i.e., 1.65 billion) will be added to those rolls of multi-dimensional poverty under the new “business as usual” – neglecting the poor and their service demands and instead subsidizing the rich for their knowledge and their pet technologies.

........to be continued

* The author is a US-based energy and environmental economist, routinely spending some time in India or elsewhere. He is also a pro-bono senior advisor to the Small-Scale Sustainable Infrastructure Development Fund (www.s3idf.org).

Views are those of the author. The author may be contacted at [email protected]

DATA INSIGHT

Trends in Electricity Generation & Per Capita Electricity Consumption

Akhilesh Sati, Observer Research Foundation

|

Year |

Per Capita Consumption (kWh) |

Gross Electricity Generation (BU) |

|

2001-02 |

559 |

517 |

|

2002-03 |

567 |

533 |

|

2003-04 |

592 |

565 |

|

2004-05 |

613 |

587 |

|

2005-06 |

631 |

618 |

|

2006-07 |

672 |

663 |

|

2007-08 |

717 |

704 |

|

2008-09 |

734 |

724 |

|

2009-10 |

779 |

768 |

|

2010-11 |

819 |

811 |

|

2011-12 |

884 |

877 |

|

2012-13 |

917 |

912 |

|

2013-14 |

- |

967 |

Note: BU- Billion Units or Billion KWh

Source: Central Electricity Authority.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

OVL to bid for O&G block in Tanzania

May 11, 2014. ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corp (ONGC), is likely to bid for deep sea oil and gas blocks in Tanzania as it looks to expand its presence in energy-rich Africa. Tanzania is offering eight blocks in its fourth Offshore Licensing Round, bids for which close on May 15. The bidding round includes seven deep offshore blocks and the Lake Tanganyika North Offshore Block. The deepsea blocks are located in water depths of 2,000 to 3,000 meters adjacent to proven prospective blocks. The Lake Tanganyika North Block is located in water depth of up to 1,500 meters along the western arm of the East African Rift System that is proven prospective for commercial liquid hydrocarbons. The blocks offered exclude offshore Blocks 1B and 1C which are reserved for the government and the Tanzania Petroleum Development Corporation who will look to gain a strategic partner to explore these areas through a competitive process. OVL currently has producing and exploration assets in Sudan, South Sudan, Nigeria and Libya. Tanzania's fourth deepwater round was originally to be launched in April 2011. At the time, nine offshore areas - Blocks 1B, 1C, 2A, 3A, 3B, 4A, 4B, 5A and 5B were to be offered. But the round was postponed for technical reasons. The bidding round was finally announced in October last year with Block 2A, 3A, 3B, 4A, 4B, 5A, 5b and North Lake Tanganyika put on offer. As per ONGC Group's Perspective Plan 2030, OVL's oil and gas production should increase from the existing level of 8.36 million tons of oil and oil equivalent gas to 20 million tons oil equivalent by 2017-18 and 60 million tons by 2029-30. OVL currently has stakes in 34 oil and gas assets in 17 countries. (economictimes.indiatimes.com)

ONGC to spend $1.1 bn on drilling to revive Mumbai High fields

May 7, 2014. Oil and Natural Gas Corp (ONGC) plans to drill a record 130 wells at its prime Mumbai High oil and gas fields in a bid to rejuvenate the ageing reservoir in the Arabian Sea. The drilling campaign, which will cost over US $ 1.1 billion, will start later this year and continue for three-four years. The wells are part of the third phase of the Mumbai High redevelopment plan. ONGC is investing almost ` 20,000 crore in the third phase of redevelopment at Mumbai High, targeting production of 132 million to 147 million barrels of additional crude oil. 73 new offshore wells will be drilled on the northern part and another 50 in Mumbai High South. Also, 38 poor producer wells on Mumbai High North will be side-tracked. Besides, new wellhead platforms and sub-sea pipelines will be built to replace old ones. ONGC wants integrate the development of small reservoirs (L-II and L-I) with the main reservoir (L-III) to improve overall oil production and development economics. The company has already undertaken two phases of redevelopment at Mumbai High. During the first phase, more than US $ 1.5 billion was spent, which led to 57 million tonnes of incremental crude and 16 billion cubic metres of gas. In the second phase, US $ 2.83 billion was spent to get 36 million tonnes of incremental crude oil and 6 billion cubic meters of gas. The phase-1 redevelopment was completed in 2007, with production levels rising from 131,400 barrels per day in June 2001 to 173,000 bpd by the beginning of 2007. Phase II, which was launched after the completion of the first phase, is expected to improve oil recovery to 34.5 per cent by March 2030. (economictimes.indiatimes.com)

OIL buys 50 pc stake in Russian oil block for $85 mn

May 7, 2014. Oil India Ltd (OIL), the nation’s second-biggest state-run explorer, has bought a 50% stake in an oil block in Russia for $85 million. OIL signed an agreement with Ireland- registered but Russia-focused firm PetroNeft Resources plc to take a 50% non-operating interest in License 61 in Tomsk Oblast in Russia. The deal includes a three-stage payout including $35 million in cash up-front, $45 million in exploration and development spending and a performance bonus of up to $5 million. (www.livemint.com)

ONGC's presence in South China Sea: Beijing sets up oil rig to reinforce its territorial claims

May 7, 2014. Days after India and Vietnam agreed to additional presence by ONGC in oil blocks in South China Sea region, Beijing has upped the ante and set up oil rig to reinforce its territorial claims in the region. In what could spark fresh tension in the region the China National Offshore Oil Corporation in a sudden move on May 1 moved oil drilling rig 'HD 981' for operation at the location about 120 nautical miles from the Vietnamese coast, which is within the exclusive economic zone and continental shelf of Vietnam. This development has brought back memories of 2011 when China locked with Vietnam over claims in South China Sea region. Sources in the Indian government expressed surprise over the Chinese move in Vietnam's territorial waters. They are particularly surprised as China made the move after ONGC decided to increase its presence in Vietnam. Vietnam has offered two more exploration blocks to ONGC Videsh (OVL) in addition to the five already offered. The company has selected only one of the five blocks that were offered in November, and will assess the two new blocks also. All the blocks have been offered to the company without competitive bidding.

ONGC had signed an agreement with PetroVietnam to promote the joint cooperation in hydrocarbon sector. Vietnam is one of the focus countries for OVL where it would like to acquire stakes in oil and gas assets depending on techno-commercial viability, a company executive said. OVL is present Vietnam since 1988. The company has already invested more than $500 million in the country. It may be recalled that China had earlier opposed Indian presence in Vietnam's oil blocks in the South China Sea region. But Delhi ignored such reservation and OVL continues to maintain presence in Vietnam whose strategic partnership with India is growing. (economictimes.indiatimes.com)

Central Excise slaps ` 46 mn tax notice on IOC

May 13, 2014. The Directorate General of Central Excise Intelligence (DGCEI) has issued a show cause-cum-demand notice of over ` 4.6 crore to the nation's largest oil firm Indian Oil Corporation (IOC) for not paying service tax under the head of a 'goods transport agency'. IOC will have to reply why the amount of ` 4.64 crore along with interest, penalty and additional penalty for suppressing the value of toll charges paid to the transporters should not be charged, said the notice issued by DGCEI. IOC has not been paying their tax properly as a goods transport agency by not including toll charges paid to its transporters as actual expenses in the taxable value between October 2008 and September 2013, the notice said. The transporters involved are plying their trucks on various routes for transporting the goods of IOC and that there are certain roads where toll charges are collected from these vehicles, the notice said. Hence, the notice said, the expenditure incurred by the transporter becomes an intrinsic part of the cost of transportation, as without incurring the expenditure on toll charges, the provision of service of a goods transport agency is not possible. Therefore, the toll charges cannot be disintegrated from the value of taxable services of a goods transport agency as they are inextricably connected with the service provided, the notice said. (economictimes.indiatimes.com)

Transportation / Trade

Ruias win shareholder approval to buy Essar Energy

May 9, 2014. Essar Energy Plc's majority stakeholder won shareholder approval to buy the company after other investors with a stake of 8.29 percent tendered their shares in favour of the offer. Essar Global Fund Ltd (EGFL), which owns about 78 percent of the India-focused resources company, in March offered 70 pence for each share it does not already own. The valid acceptances from other shareholders effectively paves the way for EGFL, in which brothers Shashi and Ravi Ruia are beneficiaries, to delist Essar Energy despite opposition from minority shareholders. EGFL said it was extending its offer to May 23 from May 9 to those shareholders and bondholders who had not yet tendered in their securities. Essar Energy said its independent committee set up to examine the offer would make an announcement in due course. (in.reuters.com)

Andhra’s bifurcation delays Petronet LNG project in Vizag

May 7, 2014. The long wait for fuel for almost 3,000 MW of stranded power plants in Andhra Pradesh may get longer, with India’s first liquefied natural gas (LNG) terminal on the east coast likely to be delayed because of the bifurcation of the state. The 5 million-tonne Gangavaram Port LNG terminal, being developed by Petronet LNG Ltd in Visakhapatnam, will be held up till a new government comes to power in Seemandhra, the residual state formed after Telangana was carved out of Andhra Pradesh. Petronet LNG will try to expedite the process of awarding sub-contracts to build the terminal, once approvals come in. Petronet LNG, along with Gangavaram Port announced a joint venture agreement to set up an LNG terminal at the port which would primarily supply gas to the fuel-starved power plants in Andhra Pradesh. The project was announced at a cost of ` 4,500 crore and was expected to come up by early 2016. (www.livemint.com)

Policy / Performance

Diesel prices hiked by ` 1.09 per litre

May 13, 2014. Diesel prices have been raised by ` 1.22 per litre in New Delhi, immediately after the end of elections as the government ordered the biggest increase in the fuel price since September 2012. The Election Commission (EC) had rejected the oil ministry's proposal to shelve the 2013 Cabinet decision of raising diesel prices in small monthly doses because revenue losses on the fuel had dropped below ` 6 per litre.

State oil firms — Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) — have raised pre-tax diesel prices by ` 1.09 per litre across the country, but hikes in pump rates differ from city to city because of local levies. IOC, BPCL and HPCL regularly exercised their limited pricing freedom with the approval of the oil ministry. (economictimes.indiatimes.com)

India to overtake Japan to become third-largest oil consumer: US

May 13, 2014. India will overtake Japan to become the world’s third largest oil consumer behind the US and China by 2025, the US Energy Information Administration (EIA) said. EIA in its Annual Energy Outlook said India’s oil consumption will rise from 3.68 million barrels per day (bpd), or 173.5 million tonnes, in 2012 to 5.19 million bpd in 2025, overtaking Japan’s 4.38 million bpd consumption. Japan consumed 4.75 million bpd of oil in 2012. India currently is the fourth largest oil consumer in the world behind the US, China and Japan. The US will continue to be the world’s biggest oil consumer but with almost no demand growth. The US consumed 18.21 million bpd of oil in 2012, projected to rise to 19.23 million bpd in 2020 before falling to 18.97 million bpd in 2025 and to 18.42 million bpd in 2040. China’s oil consumption is projected to rise from 10.36 million bpd in 2012 to 15.70 million bpd in 2025 and 20.48 million bpd in 2040, posting a compounded annual growth rate of 2.5%. India’s oil consumption growth rate from 2012 to 2040 will be highest in the world with a 3% compounded annual growth rate. Its oil consumption, according to EIA, will reach 6.11 million bpd in 2030 and 8.33 million bpd in 2040. As much as 80% of India’s oil need is met through imports. China’s gross domestic product (GDP) is roughly 4.5 times more than that of India and the US gross domestic product almost nine times that of India. India had in 2013 overtaken Japan as the world’s third-biggest crude oil importer. It imported 3.86 million bpd of crude oil, nearly 6% higher than Japan’s customs- cleared imports of 3,648,372 bpd. The International Energy Agency estimates that India will become the world’s largest oil importer by 2020. (www.livemint.com)

IEA terms India’s plan to become energy independent as ambitious

May 12, 2014. The International Energy Agency (IEA) has termed India’s plan to become energy independent by 2030 as a “very ambitious” and an “idealistic challenge”. This comes in the backdrop of oil minister M. Veerappa Moily’s plan of achieving the target by 2030, even as India, the world’s fourth largest energy-consuming nation, imports 80% of its crude oil and 25% of its natural gas requirements. India’s energy demand is expected to more than double by 2035, from less than 700 million tonnes of oil equivalent (mtoe) to around 1,500 mtoe, according to the oil ministry’s estimates, even as there is rapidly diminishing interest in the Indian hydrocarbon sector. Moily has set ambitious targets to reduce crude oil imports by 50% by 2020, 75% by 2025, and achieve self-sufficiency and energy independence by 2030. By 2025, India will also be the world’s second largest consumer of coal after China. The World Health Organization said Delhi has the most polluted air in the world. India and China have sparred intermittently over hydropower projects in Arunachal Pradesh, with China planning to divert waters from rivers that flow into the Brahmaputra to the arid zones of Xinjiang and Gansu. India has also been pitted against China in a geopolitical race to sew up as much of the world’s resources as it can. The IEA has been trying to get large energy-consuming nations, including India, China and Russia, which are not a part of the 29-member Organisation for Economic Co-operation and Development, to act in concert to counter supply disruptions. In one of the scenarios, the IEA said global population and economic growth can be decoupled from energy demand, even for oil. (www.livemint.com)

RIL takes Indian govt to arbitration over gas pricing delay

May 10, 2014. Reliance Industries Ltd (RIL), with its partners UK oil and gas giant BP Plc (BP) and Canadian explorer Niko Resources Ltd (Niko), slapped an arbitration notice on the Government of India, seeking a hike in natural gas prices which was notified by the government on 10 January, 2014. The Domestic Natural Gas Pricing Guideline 2014 proposed to increase the price of gas from $4.2 per million metric British thermal units (mmBtu) to above $8 per mmBtu effective 1 April, 2014 as per a formula proposed by the Rangarajan Committee in June 2013. The parties were planning to invest $ 8-10 billion in the next few years to significantly increase production from the KGD6 block. The company and its partners had discovered a huge gas field 2 kilometres below the existing gas field D1 and D3 in the Krishna Godavari basin in the east coast of India. The partners were expected to complete the appraisal programme by July this year. RIL said that the delay in notifying the higher prices of gas has resulted in a loss of ` 300 crore per month. The contractor group which was getting ready to sanction the first major project with an investment of $4 bn in June/July 2014, is now forced to halt activities. The arbitration notice was issued to the government on 9 May 2014. While the government had published the hike in gas price in January 2014 to be effective from April 2014, the same could not be implemented as the Election Commission had directed the Government on 24 March to defer the price hike till the general elections were over and the model code of conduct was lifted. The Election Commission had acted on a request by Aam Aadmi Party (AAP) convenor who had complained that the increase in gas price was against the Model Code of Conduct. (www.livemint.com)

Euro-IV petrol, diesel in 50 more cities by March 2015

May 9, 2014. The government will extend supply of Euro-IV grade petrol and diesel to 50 more cities by March next year in an attempt to cut vehicular pollution in major towns. Presently, Euro-IV or Bharat Stage-IV petrol and diesel are being supplied in 26 cities including Delhi, Mumbai, Chennai, Ahmedabad and Lucknow. Ultra-low sulphur petrol and diesel, meeting Euro-IV emission norms, began selling in 13 cities like Delhi, Mumbai, Chennai, Kolkata, Bangalore, Kanpur, Agra, Pune, Surat, Ahmedabad, Hyderabad, Lucknow and Sholapur from April 1, 2010. In rest of the country, Euro-III or BS-III grade fuel was being supplied. Since then the supply of Euro-IV grade fuel has been 13 more cities. Now the Oil Ministry has decided "to go beyond Auto Fuel Policy recommendation and to expand BS-IV auto fuels to 50 more cities by March 2015 with preference to most polluted cities, state capitals and cities with million plus population," a ministry order said. The Ministry has constituted a committee under Additional Director, Petroleum Planning and Analysis Cell (PPAC) for identifying these cities, it said. After the launch in April 2010, Euro-VI fuel supply was expanded to seven cities of Puducherry, Mathura, Vapi, Jamnagar, Ankleshwar, Hissar and Bharatpur in 2011-12. In the following year, 10 more cities were added Silvasa, Daman, Diu, Aligarh, Rae Bareilly, Unnao, Karnal, Kurukshetra, Yamunagar and Valsad. Three more cities of Medak, Nizamabad and Mehbub Nagar were added on July 5, 2013. In January this year, Euro-IV fuel supply was started in Vrindavan, Kosi Kalan, Hindaun city, Dholpur, Ahmednagar and Mahabaleshwer. Oil companies will have to invest ` 35,000 crore in upgrading their refineries so that they can produce lesser polluting Euro-IV and higher grade fuels. Oil firms had previously invested ` 30,000 crore when they began supply of Euro-II and III grade fuel in 2005. Supply of Euro-IV grade fuel would mean an additional cost of ` 0.41 a litre on petrol and ` 0.26 per litre on diesel, they said. (economictimes.indiatimes.com)

POWER

Generation

NTPC cancels ` 2.1 bn contract with Punj Lloyd

May 13, 2014. NTPC has cancelled a ` 210 crore contract with Punj Lloyd due to alleged "poor performance" of the private infrastructure company. The private firm had won the contract from NTPC for civil work of a 750 MW thermal power project in Bongaigaon district of Assam in 2011. The public sector firm cancelled a ` 23,000 crore contract with Thiess Minecs India due to delays in development and operation of the Pakri-Barwadih coal block. Thiess Minecs India was appointed mine developer and operator for NTPC's Pakri-Barwadih captive coal block in Jharkhand on November 30, 2010, after a global tender. The company wanted to start mining coal to reduce dependence on the market for the fuel. NTPC generates over 43,000 MW power from all sources of energy. (economictimes.indiatimes.com)

BHEL commissions 600 MW thermal unit in Odisha

May 13, 2014. BHEL said it has commissioned the first unit of 600 MW capacity of a thermal power project at Angul in Odisha. The commissioning of this unit is part of the ` 2,600 crore contract given to BHEL by Jindal India Thermal Power. The order for the 2x600 MW power project was placed by Jindal India Thermal Power Limited, BHEL said. (www.business-standard.com)

BHEL commissions gas turbine unit in Oman

May 8, 2014. BHEL has commissioned another Gas Turbine Generating unit at a power project in Oman. This is the second successive project after the commissioning of the 2x126 MW Petroleum Development Oman Amal Gas Turbine Generating project in 2012. The Gas Turbine Generator units were engineered, manufactured and supplied by BHEL's Hyderabad Plant while the control system has been supplied by the company's Bangalore works. These Gas Turbine Generator Units have been supported with the required auxiliaries supplied by BHEL. (www.business-standard.com)

Transmission / Distribution / Trade

Tata Power's Mumbai consumer base crosses 5 lakh mark

May 13, 2014. Tata Power said its customer base in Mumbai crossed the five lakh mark in April. The company added 2 lakh customers consuming electricity below 300 units. Tata Power's consumers below 300 units account for almost 65 per cent of its total consumers in the city. The company has also added seven additional distribution sub stations (DSS) and 118 consumer sub stations (CSS), taking up the total to 24 DSS and 637 CSS. (economictimes.indiatimes.com)

Discoms not co-operating with audit: CAG

May 13, 2014. The Comptroller and Auditor General (CAG) of India told the Delhi high court in an affidavit that Delhi's power distribution companies are not cooperating in the audit ordered by Arvind Kejriwal when he was chief minister. BSES Yamuna and BSES Rajdhani as well as Tata Power's distribution arm have maintained that they are providing all the information sought by CAG. Government of Delhi says that out of 190 requisitions raised by the CAG team to Tata Power Delhi, only 112 have been responded to as on April 30, while BSES has not provided information for 152 of the 348 queries from the auditor. (economictimes.indiatimes.com)

PSPCL to buy short-term power due to demand-supply gap

May 10, 2014. Punjab State Power Corporation Limited (PSPCL) in Punjab has resorted to purchase 5,047 million units (MU) of short-term power through competitive bidding in order to bridge gap between demand and supply during May till September. With its own power plants' generation capacity coming down to merely one-third because of "reduced availability" of coal, PSPCL has filed a petition with power regulator PSERC, seeking its approval for purchase of short-term power. PSPCL is grappling with the problem of gap between demand and supply of power primarily because of less power generation in its own power plants, delay in commissioning of new power plants and reduced availability of power under banking arrangements. (economictimes.indiatimes.com)

Adani, GVK, Lanco seek to cut stake in Australian coal mines

May 9, 2014. The Adani, GVK and Lanco groups are looking to sell part of their stakes in Australian coal mining projects to reduce debt and get financial and technical partners on board. The Adani and GVK groups confirmed they were in talks with contractors and customers to pick up stakes in their coal, port and railway projects because that would help them get technical and construction experts on board. Coal mine stakes are also being offered to companies that have set up power plants across Asia and want guaranteed coal supplies. (www.business-standard.com)

Tata Power receives SC nod to lay network

May 9, 2014. Tata Power Company said the Supreme Court (SC) dismissed the appeal filed by Brihanmumbai Electric Supply and Transport (BEST) in which it sought to restrain the company from laying its network to provide power supply to consumers in its license area. The Apex court ruled that there is no provision given in the statute which gives BEST a privileged position of being the sole distribution licensee in that area, Tata Power said. The Supreme Court’s ruling allows consumers serviced by BEST in the Mumbai Island City to choose their service provider for electricity. This ruling will foster competition and pave the way for customers to avail competitive tariffs and better customer service. (www.business-standard.com)

Haryana targets to cut power distribution losses

May 8, 2014. The Haryana government has set a target to reduce the total distribution losses of power from 27.44 per cent to 20.99 per cent during the current financial year. Haryana Power Minister Ajay Singh Yadav said line losses in domestic rural sector were 67.15 per cent, whereas these were 25.23 per cent in the urban sector, 15.19 per cent in agriculture sector and 4.40 per cent in industrial sector. (www.business-standard.com)

Coal import into India has financial risks: Report

May 7, 2014. A new report of Institute for Energy Economics and Financial Analysis (IEEFA) says that international coal projects relying on new import markets such as India were facing financial risks. IEEFA report said that Chinese coal demand growth continued to slow down and the focus was increasingly turning to India. The study which used in-depth financial modelling to evaluate the prospect of India as the next big coal import market said that the results demonstrated the fundamental financial problems facing the coal and coal-fired generation sector in India. Key findings of the report included coal sent to India from the Galilee Basin in Australia, which said it would need a wholesale electricity price double of India's current level to be viable, categorically discrediting the argument that it might alleviate India's energy problems. The report noted that a key difference between coal fired power generation and renewable energy was the issue of inflation - fossil fuels are inflationary while renewables are deflationary The cost of electricity generation from solar in India had fallen 65 per cent in the last three years alone and double-digit declines were forecasted to continue. It said the financial modeling demonstrates that renewables not only start out cheaper than building new imported coal power capacity, but also get cheaper over time. In contrast, the average price escalation for imported coal in India equated to four per cent annually in rupee terms because it requires purchasing this US dollar denominated fuel. It may be recalled that in September, 2011, Australian mining heiress Gina Rinehart sold most of her coal assets in Queensland's Galilee Basin to Indian company, GVK. (economictimes.indiatimes.com)

No election bonanza for merchant electricity producers

May 7, 2014. It is a slow election season for electricity generators. Many had expected pre-election buying to drive up demand and prices in the short term. But there is not much buying activity there. The buy bids for short-term power in the Indian Energy Exchange Ltd (IEX) have been lower than the sell bids since the beginning of this year. Overall, between January and March, demand for power increased 0.4% from a year ago, data from the Central Electricity Authority (CEA) shows. Availability increased 6%. Financially weak electricity distributors have refrained from purchases. Hence, spot market electricity prices on IEX fell 2% in January-March from a year ago. Short-term prices increased in April but the rates were driven higher by constraints in transmission, especially in the south. All eyes will be on the new government to see if it can make tough structural changes that are necessary to boost the sector. That will take time. (www.livemint.com)

CIL modifies performance incentive clause in FSAs

May 13, 2014. Coal India Ltd (CIL) has tweaked the performance incentive clause in fuel supply agreements (FSAs) with non-power consumers. Under the performance incentive clause, if the seller (CIL) issues sale orders for coal to the purchaser in excess of 90 per cent of the assured contracted quantity in a particular year, the purchaser shall pay the seller an incentive. Under the revised clause, performance incentive is applicable only on actual delivered quantity of coal. (economictimes.indiatimes.com)

India considers splitting power utilities to cut losses

May 13, 2014. India is considering breaking up its power distribution utilities to stem losses that have saddled the mostly state-controlled industry with more than $32 billion in debt. The nation plans to separate the wire-network business from electricity retail and privatize the latter, power secretary Pradeep Kumar Sinha said. The proposal will need approval of the next government in New Delhi set to take charge this month and would require a change in the law. (www.livemint.com)

Power tariff to go up by 32 paise a unit in Karnataka

May 13, 2014. Karnataka Electricity Regulatory Commission (KERC) approved an average electricity tariff hike of 32 paise per unit ranging from 10 paise to 50 paise per unit for different categories of consumers other than irrigation pumpsets and Bhagya Jyothi / Kuteer Jyothi households. This is against the 66 paise per unit increase sought by the electricity supply companies (Escoms) uniformly for all categories of consumers other than IP set users and Bhagya Jyothi / Kuteer Jyothi beneficiaries, KERC said. The tariff increase for domestic consumers is 20 paise per unit for monthly consumption of less than 30 units and 30 paise per unit for consumption exceeding 30 units. The revised tariff for domestic consumers in urban areas will be ` 2.70 per unit for 30 units, ` 4 per unit for consumption between 31 and 100 units, ` 5.25 per unit for consumption between 101 and 200 units and ` 6.25 per unit beyond 200 units per month. For domestic consumers in rural areas, the revised rates will be ` 2.60 per unit up to 30 units, ` 3.70 per unit between 31 and 100 units, ` 4.95 per unit between 101 and 200 units and ` 5.75 per unit beyond 200 units per month. For residential apartments under HT category, the tariff has been increased from ` 4.90 to ` 5.30 per unit. (www.business-standard.com)

Cleaning up coal in India

May 12, 2014. India’s Enforcement Directorate has filed charges of money laundering against a former minister of state for coal, Dasari Narayana Rao, and Naveen Jindal, a member of Parliament who also happens to be chairman of Jindal Steel and Power. This is the latest turn in a major corruption scandal in India, known as Coalgate, in which the coal ministry awarded a handful of companies lucrative mining rights on a non-competitive basis. The charges are a hopeful sign that India is ready to clean up its coal industry. But much more needs to be done. Coal mining has long enjoyed sweetheart status in India, whatever the social and environmental costs. An 1894 land acquisition law that became an instrument of abuse, eventually fueling a Maoist insurgency, was finally replaced this year by a statute promising transparency and fair compensation. Even so, activists are regularly harassed and even assassinated by thugs paid by powerful business interests to force people from their land. Ramesh Agrawal, who used India’s Right to Information Act to expose an illegal coal-mining venture by Jindal Steel and Power in Chhattisgarh, was shot and left for dead after he refused to back off. He accuses Mr. Jindal of ordering the attack. Mr. Agrawal was honored with a 2014 Goldman Environmental Prize for his fight for the communities threatened by the venture. (www.nytimes.com)

Inter-Ministerial panel meet on coal supply to end-use plants postponed

May 12, 2014. The meeting of the Inter- Ministerial panel set up to look into the issues pertaining to supply of fuel to certain end-use plants linked to coal blocks scheduled has been postponed. The new date for the meeting will be intimated in due course. The Inter-Ministerial Committee, under the chairmanship of Additional Secretary (Coal), A K Dubey, was constituted in March last year to consider issues related to fuel supply to end-use plants that are linked to coal blocks which could not be developed or were de-allocated. (economictimes.indiatimes.com)

No power rate hike in Uttarakhand

May 9, 2014. The Uttarakhand Electricity Regulatory Commission (UERC) has rejected the proposal of the Uttarakhand Power Corporation Ltd. (UPCL) to hike power tariffs by 19.42 per cent for the year 2014-15. The UERC said the UPCL had been instructed to submit a concrete action plan for improving the status of metering, collection system, recovery of arrears, curtailing outstanding billed amount and energy audit. The UPCL has also been told to ensure 100 per cent metering by September 30 and submit its compliance report to the UERC by October 30. (www.business-standard.com)

Finance Ministry seeks details on coal availability for power sector

May 8, 2014. The finance ministry has sought information from power and coal ministries on fuel availability for existing and future power plants, a move aimed at facilitating banks in lending to the stressed sectors. The idea is to provide banks information about existing and future projects, so that they can evaluate the risks properly before taking further exposure, the finance ministry said. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Libya oil output may double as western protests end

May 13, 2014. Libya’s daily oil output may double to 500,000 barrels after protesters agreed to reopen pipelines carrying crude from fields in the country’s western region. The valves at the Sharara field have reopened and oil will reach the Zawiya refinery. The protesters agreed to stop blocking oil shipments after the authorities started preparations to hold elections for a new parliament, National Oil Corp. said. Repsol SA-operated Sharara and Eni SpA-operated Elephant are the largest fields in western Libya, with daily capacities of about 340,000 barrels and 140,000 barrels respectively before the shutdowns in March. Protests in western Libya and a separate rebellion for self-rule in the east have curtailed the North African nation’s production to 237,000 barrels a day, according to National Oil. The country was producing about 1.6 million barrels a day before the revolt that toppled Muammar Qaddafi in 2011. (www.bloomberg.com)

Chevron first major oil producer seeking Pemex partnerships

May 13, 2014. Chevron Corp., the world’s third-largest energy company by market value, became the first major international oil producer to reveal partnership plans with state-run Petroleos Mexicanos since Mexico signed landmark legislation to reopen its doors to foreign producers. Chevron, which operates several rigs on the U.S. side of the Gulf of Mexico, is in talks with Mexico City-based Pemex for exploration opportunities in deepwater, shallow water or shale. Chevron produces more crude in the U.S. section of the Gulf of Mexico than anyone except Royal Dutch Shell Plc and BP Plc, according to the U.S. Interior Department. Mexico passed an energy law last year that ended Pemex’s 75-year production monopoly to allow for private firms to tap the country’s 13.44 billion barrels of proven oil reserves. (www.bloomberg.com)

Japan's JX to develop Malaysia's Layang gas field

May 12, 2014. JX Nippon Oil & Gas Exploration Corp said it had decided to develop Layang gas field off the coast of the Malaysian state of Sarawak on Borneo island for an undisclosed sum, aiming to start production in April-June 2016. Layang field, which is located about 8 km (5 miles) east of Helan gas field, now under production, in the same SK10 block, will have a floating production, storage and offloading system (FPSO) installed, the company, a wholly-owned unit of JX Holdings, said. Production is set to start initially at 100 million cubic feet per day of gas (17,000 barrels per day (bpd) of oil equivalent) and about 7,000 bpd of condensate and crude. (www.rigzone.com)

Philippines offers oil, gas exploration area in waters disputed with China

May 9, 2014. The Philippines launched a tender for exploration rights in 11 oil and gas blocks, including one in a disputed area of the South China Sea that is likely to fuel further tension with China. China claims virtually all of the South China Sea and is already involved in a dispute with Manila over a Chinese fishing boat that was seized in the Spratly Islands on suspicion its crew was poaching protected turtles species. Beijing is also in the middle of a stand-off over an oil rig it has moved into waters claimed by Vietnam. Philippine energy sought to downplay the issue of territorial dispute with China in offering to investors the so-called Area 7 in Reed Bank - or Recto Bank as it is known in the Philippines. The Area 7 block, like the rest of the South China Sea, is believed to hold huge oil and gas deposits. Manila calls the South China Sea the West Philippine Sea. The area is also near the Malampaya offshore natural gas oil field operated by a local unit of Royal Dutch Shell. China, the Philippines and Vietnam, along with Malaysia, Taiwan and Brunei, all claim parts of the South China Sea. Area 7, according to the Philippines' Department of Energy (DOE), holds an estimated resource potential of 165 million barrels of oil and about 3.5 trillion cubic feet (tcf) of natural gas. Water depths range between 800 and 1,700 meters. (uk.reuters.com)

Oil producer pleas snubbed by Norway as offshore costs surge

May 9, 2014. Oil and gas companies can expect little help from Norway on tackling surging costs as the government of western Europe’s biggest crude producer tones down plans for measures that producers hope will boost earnings. Petroleum and Energy Minister Tord Lien said his administration could by the end of the year present measures, including tax incentives, aimed at cutting costs that have doubled during the past 10 years. (www.bloomberg.com)

Oil industry risks $1.1 tn of investor cash: Study

May 8, 2014. Oil explorers like Exxon Mobil Corp. and OAO Rosneft risk wasting $1.1 trillion of investors’ cash through 2025 on expensive, uneconomic projects from the Arctic and deep seas to tar sands, according to a study. That’s the sum the industry may spend on developments that need market prices of at least $95 a barrel to break even, the Carbon Tracker Initiative said. The money risks being wasted as the total amount of oil the world can afford to burn without warming the planet to unsafe levels is available from less costly deposits that are economical at $75 a barrel, according to its report. (www.bloomberg.com)

Angola may miss 2015 oil-production goal, Wood Mackenzie says

May 7, 2014. Angola, Africa’s second-biggest oil producer, probably won’t reach an output target of 2 million barrels a day next year because new projects will be too late to boost declining flows, Wood Mackenzie Ltd. said. Sonangol EP, the state oil company, said that the target remains in place after government-run newspaper Jornal de Angola reported that the goal was deferred to 2017. The Organization of Petroleum Exporting Countries member pumped 1.54 million barrels a day. (www.bloomberg.com)

Downstream

Abu Dhabi to commission Ruwais refinery by 2014 end

May 12, 2014. Abu Dhabi's Ruwais refinery will be commissioned by the end of 2014, Abu Dhabi Oil Refining (Takreer) said. The Ruwais refinery expansion would have more than double the capacity of from 415,000 barrels a day (bpd) and will process Abu Dhabi's Murban crude oil grade. A member of the Organisation of Petroleum Exporting Countries, UAE had planned to complete the refinery expansion program in the first quarter of 2014. (refiningandpetrochemicals.energy-business-review.com)

Petrobras steps up cost cuts to counter fuel subsidies

May 12, 2014. Petroleo Brasileiro SA is stepping up cost-cutting measures to avoid a fourth straight profit decline amid losses derived from government fuel subsidies. Petrobras, as Brazil’s state-run oil producer is known, raised a 2013-2016 cost-saving target to 37.5 billion reais ($16.9 billion) from 32 billion reais, the Rio de Janeiro-based company said. Chief Executive Officer Maria das Gracas Foster is attempting to counter operational losses at the company’s refining and distribution unit of about $40 billion since 2011 when President Dilma Rousseff started using Petrobras to subsidize fuel imports to rein in inflation. Foster has sought to close the gap between domestic and foreign prices, while cutting operating expenses and increasing production. Petrobras’s cash flow will improve after it starts a new refinery. The company will also “gradually” adjust domestic prices to international benchmarks. Petrobras, the only gasoline and diesel producer in Brazil, ran its 11 crude refineries at an average 96 percent of capacity during the quarter in an attempt to lower reliance on imports. The over-stretching of workers and machinery was one of the reasons behind fires at two plants in December and January, according to the country’s oil workers union. Petrobras said that it expects 13 billion reais in savings through 2018 with a voluntary dismissal program. (www.bloomberg.com)

Transportation / Trade

Ukraine rebels seek to join Russia as gas deadline is set

May 13, 2014. Rebels in eastern Ukraine said they’re seeking to join Russia after disputed referendums as the government in Kiev was handed a deadline to pay for Russian gas to prevent supplies being cut off. The self-styled Donetsk People’s Republic declared itself a sovereign state after saying 90 percent of voters backed breaking away from Ukraine. Separatists in neighboring Luhansk announced a similar move. Russia’s state-controlled gas monopoly, OAO Gazprom, said Ukraine must pay for next month’s supplies by June 2 or face a shutoff the next day. (www.bloomberg.com)

Kuwait signs $3 bn deal to buy gas from BP

May 13, 2014. Kuwait signed a five-year liquefied natural gas (LNG) supply deal with BP, worth an estimated $3 billion, as it seeks to meet rising energy demand to power air conditioning during scorching Gulf summers. Kuwait, a major OPEC oil producer, already signed a $12 billion LNG supply deal with Royal Dutch Shell and will also import gas from fellow Gulf state Qatar. The BP deal, signed by Kuwait Petroleum Corp (KPC), will help Kuwait run its power plants through the hottest time of the year. KPC expects Kuwait will import a total of around 2.5 million tonnes of LNG, natural gas frozen to a liquid for transport on tankers, per year over the next few years through such contracts, the company said. (english.alarabiya.net)

US senators against export of natural gas to India, China

May 10, 2014. A bi-partisan group of 22 American senators have expressed reservation on the export of natural gas to Asian countries such as India and China, arguing that such a move by Obama Administration would result in an increase in cost for consumers and businesses at home. The senators urged Obama to consider the impacts on American manufacturing and families that rely on natural gas. They pointed to the hundreds of thousands of American manufacturing jobs created in the last few years, in part because of low natural gas prices. The senators said that the recent approval for export of liquefied natural gas from a sixth export facility has meant that the total approved exports now exceeds the amount of gas currently being used in every single American home and commercial business. (economictimes.indiatimes.com)

Tumble in fuel sales adds to evidence of China slowdown

May 9, 2014. Declining demand for ship fuel in Singapore, the merchant fleet’s biggest refueling hub, is signaling weakening prospects for a rebound in Chinese growth. Fuel oil for immediate delivery traded at the biggest discount to later supplies in 16 months on April 28, according to data from PVM Oil Associates Ltd. Sales of so-called bunker dropped for a third month in March, the longest retreat since November 2007, the latest Maritime and Port Authority data show. The discount in Singapore’s fuel market shows how growth in demand to ship goods in and out of the world’s second-biggest economy weakened this year. While China’s trade volume unexpectedly rose last month, economists surveyed anticipate the slowest annual economic growth in almost a quarter century. Sales of bunker in Singapore, which supplied fuel valued at about $26 billion last year, dropped to the lowest level since February 2013 in March, Maritime and Port Authority data show. The 2 percent decline in the first quarter was the biggest for the period since at least 2005. China’s exports in April were 0.9 percent higher than a year ago, when data were inflated by fraudulent invoicing. That compares with the median estimate for a 3 percent drop in a survey of analysts. Exports fell 6.6 percent in March and 18.1 percent in February. Fuel-oil imports by China, the region’s second-biggest buyer after Singapore, fell to 1.51 million tons in March, the least in three months, government data show. First-quarter purchases dropped 23 percent from a year earlier. (www.bloomberg.com)

Worker fatalities surge in North Dakota oil boom: study

May 9, 2014. Oil and gas workers in North Dakota are six times more likely to die on the job than their peers in other states as inexperienced workers join the state’s oil and gas boom, according to a report by a labor group. In North Dakota, 104 out of every 100,000 oil, gas and mining workers died of job-related injuries in 2012, according to a report from the AFL-CIO labor federation. North Dakota had the highest fatality rate at 17.7 per 100,000 workers across all sectors, the AFL-CIO said. (www.bloomberg.com)

China boosts crude imports to record on new plant, stockpiling

May 8, 2014. China, which uses more oil than any country except the U.S., raised daily crude imports to a record in April as a new refinery and stockpiling bolstered demand. Overseas purchases increased to 27.88 million metric tons, according to data released by the General Administration of Customs in Beijing. That’s about 6.81 million barrels a day, up from the previous record of 6.66 million in January. Some of the overseas crude will go to refilling commercial inventories, Amy Sun, an analyst with ICIS-C1 Energy, said. Stockpiles fell about 3 percent at the end of March from a month earlier, according to China Oil, Gas & Petrochemicals. Imports also rose as Sinochem Group’s Quanzhou refinery in southeast China ramps up processing after starting commercial operations last month, Sun said. The plant should run at about 90 percent of its 241,000 barrel-a-day capacity by June, up from 70 percent now, according to Sun. (www.bloomberg.com)

US orders railroads to tell states about crude trains

May 8, 2014. The U.S. Transportation Department issued an emergency order designed to reduce the risks of transporting crude from North Dakota’s booming Bakken region by rail, a week after an oil train derailed and burned in Virginia. The order requires railroads to notify state emergency agencies when they haul Bakken crude through communities. A separate advisory discourages carriers from using an older tank car known as the DOT-111 tied to some accidents, though the order doesn’t ban their use. (www.bloomberg.com)

No gas, no problem, for pipelines backed by private equity

May 7, 2014. Pipeline companies are so eager to grab a stake in the U.S. energy boom that they’re building transmission networks before getting the traditional commitment from drillers that anyone will actually use them. Instead of negotiating guarantees from drillers that they’ll pay fees or pump a minimum volume of oil and gas through their systems, pipeline companies such as Eagle Rock Energy Partners LP and Oryx Midstream Services LLC say they are signing agreements based on the acreage of the fields the producers plan to drill. Producers are getting away with it because there’s more competition to ship as domestic crude-oil output has risen to its highest level since 1988. Six years into the shale-driven energy boom, pipeline companies, many of them backed by private-equity funds, are taking on the risk usually shouldered only by drillers -- if the wells come in, they can reap a bonanza. If not, they face losses. Infrastructure firms have historically been less vulnerable to energy-price changes and unpredictable wells. Consider Apache Corp.’s holdings in Oklahoma and the Texas panhandle, where the Houston-based company pumped more than 91,000 barrels of oil and gas a day last year. Apache said in its annual report that the region has proved reserves of 304 million barrels of oil, gas and liquid fuels. In contracts with companies such as Eagle Rock to build pipelines to those wells, Apache didn’t promise to deliver a single barrel. That means Apache won’t get stuck drilling unprofitable wells just to fill pipeline capacity it already paid for, said Mark Bright, vice president of Apache’s North America oil and gas marketing. (www.bloomberg.com)

Libya rebels threaten eastern ports that signaled oil revival

May 7, 2014. Rebels blocking oil shipments from eastern Libya threatened to occupy two ports just weeks after they restarted cargo loadings, jeopardizing a revival in shipments from the North African country. The port of Zueitina shipped its first cargo since July on May 4, about three weeks after a similar resumption from Hariga farther east. The restarts followed an April 6 accord between rebels and the government and were a precondition for the return of Es Sider and Ras Lanuf, the east’s biggest oil ports. Eastern Libya federalists agreed to hand over control of Zueitina and Hariga to the central government in exchange for an amnesty and the payment of salaries to defectors from Libya’s Petroleum Facilities Guard. Another round of talks with the government was planned for them to hand over the ports of Es Sider and Ras Lanuf. (www.bloomberg.com)

Repsol completes Argentine exit with $1.3 bn YPF sale

May 7, 2014. Spanish oil major Repsol bid farewell to 15 years of business in Argentina with the $1.3 billion sale of a stake in energy firm YPF, opening a new era that is likely to focus on acquisitions. The sale through Morgan Stanley, which follows a $5 billion settlement with Argentina over its 2012 expropriation of a 51 percent stake in YPF from Repsol, ends a thorny chapter in the Spanish company's history. (www.reuters.com)

Policy / Performance

BP aims to invest $1.5 bn in Egypt in 2014

May 12, 2014. BP plans to invest $1.5 billion this year to increase its production of natural gas in Egypt, hit by an energy crisis following three years of political turmoil. Egypt is seeking to raise $2.5 billion to cover natural gas imports until the end of December, the Egyptian Natural Gas Holding Company said. Egypt needs to import liquefied natural gas (LNG) for power generation to make up for shortfalls as domestic gas production declines, a sensitive issue awaiting the new president who is due to be elected in a national vote on May 26-27. Former army chief Abdel Fattah al-Sisi, who is expected to win the vote, has suggested he will take a cautious approach to Egypt’s energy problems, saying the government cannot get rid of costly subsidies overnight. (english.alarabiya.net)

‘Gazprom gas deal with China nearly ready’

May 12, 2014. Russian Deputy Energy Minister Anatoly Yanovsky said a long-awaited deal for natural gas producer Gazprom to supply China with gas was close to completion. Gazprom, Russia's top natural gas producer, has been in talks on gas supplies to China for over a decade. In April, it said it was aiming to finalize the deal this month. (www.reuters.com)

Russia to discuss gas price cut with Ukraine only if debt paid

May 12, 2014. Russia will consider a compromise on natural gas prices with Ukraine only after its neighbor pays its debt for previous supplies, the Energy Ministry said. Ukraine hasn’t used any of the funds received under a $27 billion international package to pay down its gas debt, Russian Deputy Energy Minister Anatoly Yanovsky said. The country sandwiched between Russia and the European Union received the first $3.2 billion of aid. OAO Gazprom, Russia’s gas exporter, has billed Ukraine for $3.51 billion for fuel delivered in 2013 and through April. (www.bloomberg.com)

OPEC, Naimi see output flat amid rising supply elsewhere

May 12, 2014. The Organization of Petroleum Exporting Countries (OPEC) should keep pumping crude at about 30 million barrels a day in the near term amid rising global supply, according to the group’s Secretary General and Saudi Arabia, its largest member. OPEC has no reason to change the current output ceiling of 30 million barrels a day at its next meeting on June 11 because oil markets are stable, Saudi Arabia’s Petroleum Minister Ali Al-Naimi said. Supply and demand will remain “fairly balanced” throughout the year, according to OPEC’s Secretary General Abdalla El-Badri. (www.bloomberg.com)

Lebanon gas licensing round deadline delayed to Aug 14

May 9, 2014. Lebanon has pushed back the deadline for its first offshore gas and oil licensing round to Aug. 14, its energy minister said, the fourth such delay caused by legislative hold-ups. Lebanon may have as much as 96 trillion cubic feet of gas and 850 million barrels of oil under its waters - an amount that is unproven but even a fraction of which would be transformative for the Mediterranean country of 4 million people. Significant finds in Israeli and Cypriot waters suggest Lebanon is likely to discover gas as well, but political disputes have prevented it from starting exploration.

Energy and Water Minister Arthur Nazarian renewed his call for politicians to approve two decrees delineating blocks and setting up a model exploration and production agreement. The two decrees need to be approved so that companies can submit their bids and the round can be closed. The ministry aimed to close the first round within about four months. Political dysfunction caused three delays under the former minister - Lebanon was unable to form a government from March 2013 to February 2014, and the caretaker cabinet said it did not have authority to approve the decrees needed to close the round. A new government finally won a vote of confidence in March this year, but the decrees have still not been approved. Companies that pre-qualified for the first licensing round included Anadarko, Chevron, Exxon Mobil, Inpex, Eni, Maersk, Petrobras , Repsol, Petronas, Statoil , Total and Shell. But the risks of investing mean that some, including Statoil and Eni, now show at best lukewarm interest. (english.alarabiya.net)

Lithuania offered LNG cheaper than Gazprom natural gas

May 8, 2014. Lithuania, one of four European Union nations fully dependent on Russia for their natural gas, would pay less for shipments from countries including Qatar than for pipeline supplies from its eastern neighbor. The Baltic state will be able to start importing fuel via a new floating regasification terminal in January and partly replace deliveries from Russia, for which it now pays the highest price in the EU, Lithuania’s Energy Minister Jaroslav Neverovic said. Lithuania relies on OAO Gazprom for all of its natural gas and is battling the Russian pipeline gas export monopoly to cut prices it says are at least a quarter more than other European buyers pay. A final agreement on lower prices and other supply terms seems likely this month, Prime Minister Algirdas Butkevicius said. (www.bloomberg.com)

BP’s former CEO Tony Hayward named chairman of Glencore

May 8, 2014. Glencore Xstrata Plc appointed former BP Plc Chief Executive Officer (CEO) Tony Hayward chairman as the mining company run by billionaire Ivan Glasenberg adds to its oil assets. A member of Glencore’s board since its $10 billion initial public offering in April 2011, Hayward resigned from BP in October 2010 following the Gulf of Mexico oil spill. Glencore, already among the world’s biggest crude oil traders, last month expanded its interests in oil production with the $1.35 billion takeover bid for Caracal Energy Inc., gaining assets in Chad. Hayward’s “knowledge of the oil industry and his contacts will likely be very useful for Glencore over the coming years,” analysts at Nomura Holdings Inc. said. (www.bloomberg.com)

Iran Oil Minister rejects export limit from nuclear deal

May 8, 2014. Iran will export crude oil at the maximum level possible, regardless of restrictions imposed in an interim deal that offered the country some relief from sanctions over its nuclear program, Oil Minister Bijan Zanganeh said. Iran shipped about 1.37 million barrels a day of crude on average during the first three months of the year, according to data from the International Energy Agency. Under an interim accord aimed at curbing the country’s nuclear program in return for easing some sanctions, Iran should limit exports to an average of 1 million barrels a day in the six months through July, the U.S. said. (www.bloomberg.com)

Europe gas options seen limited by costs at $200 bn

May 7, 2014. Europe will struggle to eliminate its dependence on Russian natural gas any time soon, with Sanford C. Bernstein & Co. estimating the cost at more than $200 billion. Existing projects and anticipated future supply suggest the region’s reliance on Russia can drop to 25 percent by the end of the decade, from 30 percent now, according to Wood Mackenzie Ltd., a consultant. That’s about the same proportion as in 2011. While Europe has 12 options for replacing Russian gas, they would require $215 billion of infrastructure and boost annual costs by $37 billion, analysts at Sanford C. Bernstein said. (www.bloomberg.com)

EIA expects crude oil prices to decline in 2014

May 7, 2014. In its May Short-Term Energy Outlook (STEO), EIA forecasts that the spot price of North Sea Brent crude oil will fall through the remainder of 2014, declining from current levels of $108 per barrel (bbl) to average $103/bbl during the fourth quarter. For full-year 2014, EIA expects the Brent price to average $106/bbl, down $2 from the 2013 average, but more than $1 higher than last month´s forecast. EIA expects crude prices to decline through the end of the year as demand for OPEC crude falls to offset the combined increases in non-OPEC total liquids supply and OPEC noncrude supply, which are projected to exceed growth in world liquids demand. (www.eia.gov)

Fracking revolution may hurt Russia’s China ambitions, ODI says