-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø NUCLEAR ENERGY: Renewed Race for Thorium based power: Chasing a Myth?

ANALYSIS/ISSUES

Ø COPs and Robbers (part I)

DATA INSIGHT

Ø Natural Gas Production: Public Vs Private Sector

New Books on India and Energy

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC's Mozambique gas field holds 50-70 Tcf of recoverable reserves

· RIL seeks joint tech studies to resolve gas dispute with ONGC

· BPCL to invest ` 14.1 bn in Mumbai refinery

· IOC inks pact with NSG for fuel supply

· Petronet LNG to raise Dahej terminal capacity to 17.5 mt

· Kudankulam n-power plant generates 876 MW

· JSPL 540 MW captive power plant becomes fully operational

· GVK awaits coal supply to start power plant in Punjab

· BHEL commissions 160 MW Power Plant in Rajasthan

· CIL modifies fuel supply agreement model for new power plants

· Libyan oil output is 250k bpd as new protest hits east

· Transcorp to start drilling plans after Nigeria oilfield deal

· Statoil discovers up to 63 mn barrels in Barents Sea

· Vietnam offers two more exploration blocks to OVL

· California’s oil refiners double crude-by-rail volumes

· Italy could boost Africa gas imports to offset Russia

· Shale revolution lures trading houses to energy assets

· KenGen, Qatari firm to build 500 MW power plant in Kenya

POLICY & PRICE

· EC rejects govt’s request to review gas price hike order

· CNG price in Delhi hiked by ` 2.95 a kg; PNG ` 1 per unit

· ATF prices cut by 1 pc after a decline in international rates

· No change in power tariffs for most of Gujarat

· Jharkhand CM orders probe into coal smuggling

· CIL modifies e-auction clauses

· KSERC approves tariff revision to mobilise ` 6.5 bn for KSEB

· Corpus fund for power in Meghalaya

· Govt evaluating site in Bihar for 4 GW UMPP

· CIL asked to scale up output by 10 pc

· Europe must embrace fracking, UK Energy Minister says

· Canada finds China option no easy answer to Keystone snub

· Angola may exempt oil cos from services tax, E&Y says

· EU gas prices to extend longest drop in 4 yrs in mild May

· Putin says sanctions jeopardize US, EU energy deals

· Pakistan PM to inaugurate power project in Karachi

· Turkey, China in talks on $10-12 bn energy investment

· Mozambique's revenues from coal and gas to reach $9 bn by 2032: WB

· Suzlon bags ` 7.2 bn PowerWorks order for wind turbine generators

· UP SMEs looking to tap solar energy

· India to have roadmap for cutting carbon emissions

· Suzlon hopes to get new wind projects of 300-500 MW in FY15

· BJP's blueprint for energy sector aimed at starting a renewable energy revolution

· BHEL signs pact for setting up renewable power projects in Yemen

· Rajgarh solar plant fully operational: NTPC

· 15 MW solar energy park commissioned in Tamil Nadu

· Academia Sinica head calls for more solar power in Taiwan

· Climate change is clear and present danger, says landmark US report

· Mars partners with Sumitomo on 200 MW wind farm in Texas

· China fuels highest solar silicon demand since 2011

WEEK IN REVIEW

NUCLEAR ENERGY

Renewed Race for Thorium based power: Chasing a Myth?

Ashish Gupta, Observer Research Foundation

|

T |

here is no doubt that civil nuclear power and uranium mining industry are struggling to survive throughout the world. In order to get a new lease of life, the concept of thorium based reactors is being promoted in new packaging. Not surprisingly they are promoted on the premise of energy security and climate change mitigation. Though the research on thorium based civil nuclear reactor is not new, success is yet to be established. The eagerness to prove supremacy in the technology is nothing but desperation for a new source of energy that is clean and abundant. This is quite evident from the recent collaboration of U.S Department of Energy and China to develop thorium based nuclear reactors with molten salt cores. Many countries have tried this line but they have failed and therefore how the recent partnership is likely to produce any concrete results would be interesting to watch. It is not clear whether the collaboration is really genuine scientific progress or just the result of political clout. Mr. Jiang Mianheng who played a key role in inking the partnership is the son of the former Chinese leader Mr. Jiang Zemin. A brief digression into the history of the subject is necessary here.

Thorium has a long history with regard to its potential as fuel in the nuclear reactors. It was discovered in Norway in 1828 by Jons Jcaob Berzelius and named after Thor, the Norse God of Thunder. Marie Curie first discovered the thorium reactivity in 1898. The world’s interest started in thorium started from the very inception of the atomic energy industry due to its abundance. The research continues but thorium’s industrial history with regard to nuclear fuel efficiency is limited. The USA which pioneered thorium based nuclear reactors, started work on its first commercial scale reactor in the 1957 but it lost momentum and was shut down eventually. The research work on thorium based reactors got shelved in the 1970’s when Nixon Administration decided that the nuclear industry should embark on new generation of fast breeder reactors with uranium as fuel.

The preference for thorium as fuel faded much earlier in 1950’s when U.S. Navy Officer, Hyman Rickover, pressed for water cooled, uranium fuelled reactors to power the world’s first submarine, the USS Nautilus. Many believed that Admiral Rickover preference for uranium over thorium was quite genuine on the premise that it generates plutonium which was useful in fulfilling U.S. quest for increasing nuclear arsenal inventory. After that many countries followed the U.S. and reduced the subsidies on thorium studies as it was extremely difficult to separate uranium for weaponization from thorium. The logic was quite simple that uranium is good for bombs whereas thorium was not. From then onwards, the thorium research limited to academic circles. The recent efforts of Admiral Joe Sestak failed to convince Pentagon to pursue thorium as nuclear fuel in 2009.

Research on thorium continued but with less intensity compared to uranium/ plutonium fuels. Germany, U.S.A, U.K, India, China, Japan and the Netherlands are some of the countries that pursued research. Some tests were also conducted for different thorium fuel forms but these efforts were largely unsuccessful. India’s three stage nuclear programme was aimed to culminate in thorium reactors. India enhanced work on thorium after India was banned in 1974 for conducting nuclear tests. This made sense for India, as it was not allowed to trade in nuclear fuels and had abundant reserves of thorium but the reasons behind China’s renewed interest is unclear. The role of U.S. is also very unconvincing as the USA has scaled back its own thorium projects.

Whatever be the intentions, thorium as a fuel is being propagated on the hope that it will remove all the fears of the nuclear energy and energy security. Indeed it is true that thorium is less fissile but more fertile. These concepts are attractive but the technology only works on paper and there are lot of technical challenges before it transforms the civil nuclear industry. The important question is whether it is really free from all fears of disastrous accidents and military applications? Though thorium does not produce any fissile by-product it does have military applications. Studies have concluded that there is just no way to avoid proliferation problems associated with thorium fuel cycles that involve reprocessing. Thorium fuel cycles without reprocessing would offer the same temptation to reprocess as today’s once-through uranium fuel cycles (Source: Thorium Fuel: No Panacea for Nuclear Power).

When the Nixon Administration aborted the thorium research in their quest for nuclear bombs, Mr. Kirk Sorenson, an enthusiastic engineer from NASA, convinced of the thorium research gathered blueprints from archives which were forgotten. He published the results and a small community of the likeminded shared his views. Interestingly, the U.S. government ignored them but China did not. China’s current enthusiasm for thorium primarily is based on the premise that there is enough thorium reserves for 20, 000 years. They may have also become fans of Mr. Sorenson who believed that one can run a civilisation on thorium for hundreds of thousands of years without dealing with uranium cartels. Though thorium reactors are promoted enthusiastically by new generation of scientists for being ‘smaller, safe and cheap’ the present situation is confusing rather than convincing. Even the nuclear lobby (especially nuclear industry) is ambivalent about this development!

There are mixed reactions in China regarding thorium reactors research and the recent partnership with U.S. One group believes that if China is able to successfully developed thorium reactors, it will bring an end to massive consumption of fossil fuels. Other schools of thought believe that it is Mr. Jiang Mianheng who enjoys privilege positions in political circles who brought the thorium project to the China Academy of Sciences. Who will win this race? Is China trying to capitalise on the new technology which is not proven or is the U.S. getting China to subsidise research on the promise for a magical fuel that will eliminate all worries of climate change and energy security in one go?

If thorium reactors become small and affordable and marketed around the world, what will happen to massive state and privately funded uranium research programmes and commercial operations? Would they be willing to give up on uranium and adopt thorium reactor technology? Curious observers from the industry are participating in the discussions but they do not appear to be convinced. On the question of economic viability some like Dr. Peter Karamoskos, famous Nuclear Radiologist says “Without exception, [thorium reactors] have never been commercially viable, nor do any of the intended new designs even remotely seem to be viable. Like all nuclear power production they rely on extensive taxpayer subsidies; the only difference is that with thorium and other breeder reactors these are of an order of magnitude greater, which is why no government has ever continued their funding”.

Given the rising demand of energy in India and China may find the idea of reactors that run on thorium attractive. Unfortunately as of today, thorium reactors fail on all three key selling points, “small, safe, cheap”. China is naturally proud of its abilities but embarking on this well trodden path seems to defy logic. China may want to be a leader in thorium technology and Indian may want to capitalise on its so called frugal engineering capability. Caution is required from both the Indian and Chinese sides as they may overly depend on the thorium hype! Something new has begun and no one knows why. Who would like to answer: the likeminded or the open-minded?

Source: Article: Thorium Reactors, Asgard’s fire, The Economist

http://www.independentaustralia.net/environment/environment-display/dont-believe-thorium-nuclear-reactor-hype,4919

http://in.reuters.com/article/2013/12/20/breakout-thorium-idINL4N0FE21U20131220

http://www.world-nuclear.org/info/current-and-future-generation/thorium/

http://www.navigantresearch.com/blog/doe-collaborates-with-china-on-thorium-reactors

http://thorium1.com/thorium101/history.html

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

COPs and Robbers (part I)

Nikhil Desai*

[This essay was written in December last year after the COP 19 meeting at Warsaw but its message is more relevant in the context of the recent reports of the IPCC].

This essay is in two parts. First, in the holiday spirit of cheer and reluctant deference to a high authority, Nikhil Desai celebrates the latest among the Conference of Parties – COPs – to the UNFCCC and the Kyoto Protocol – in light of climate change warnings and “action” promises of the past. Second, in the New Year spirit of hope and determination, he suggests that it is time to go past the FCCC dead horse, and take the cart of poverty alleviation and sustainable development right through the real smog of air pollutants rather than human-origin CO2.

A 1973 movie called “Cops and Robbers” showed two NY cops trying to pull of one big robbery instead of weekly wages of a couple of hundred US dollars.

Attendees to the FCC and Kyoto Protocol Conferences of the Parties or COPs – properly named as COPers perhaps – reminded me of the movie. Because some of them do pretend to be cops, as if they are charged with the safety and security of human law and order. To my jaundiced eye, they look like robbers.

Or purveyors of luxuries to rich people, comfortably climate proof, via robbing the very same poor people they say they are trying to save. Or priests. Or children.

I couldn’t find a way of putting all these thoughts together. Suddenly it became all clear. At new years, one has to please the cops and robbers, priests, children, and watch as rich people get to enjoy more luxuries even as they throw some bread crumbs to the poor, give a nickel to a beggar.

Much of the world is getting ready for at least one holiday, maybe two and a few days in between. It is a time of festivities, gifts, getting together with family.

Why, that is just what we had a month ago. The annual ritual of COPs. The human family came together – some representing governments, some self-appointed spokespersons perhaps representing who or what they claimed to but I couldn’t be sure.

All in all a festivity of caviar, cutlets, cake and cognac. Perhaps vodka, since this was Warzsawa after all.

There was also a meeting of the World Coal Association in Warsaw around the same time.

As I said, this was the human family; families have quarrels within.

A few miles away some of the worst polluting lignite-fuelled power plants kept running, to empower both parts of the family – the coal industry as well as the anti-coal warriors.

This reminded me of New Year festivities of my childhood in India.

Some people would stop by as a matter of routine to ask for tips. The street sweeper. The milkman. The newspaperman. The mailman.

So did some policemen and local gangsters or mobsters. Of course, the latter didn’t identify themselves as such but it was generally known that some such people had to be kept happy. Otherwise one might be robbed. Or one’s bicycle may be stolen. Or a window broken. Kidnap a child for ransom? I didn’t worry.

“Your money or your children,” was the implicit message. The assumption was that the robbers acted like cops, this was their protection money.

Lord Nicholas Stern says the same thing, just explicitly.

If my bicycle was stolen – as it once was – I couldn’t have told whether it was because the lords of the street had not been propitiated adequately or if some inter-gang warfare meant one side was trying to get an upper hand and collect more gifts the next time around. Or whether it was only a matter of chance. Bicycles don’t run by themselves, but not every theft and robbery can be ascribed to what the robbers did and the cops did not do.

Is the climate policy – “save the planet” – narrative much different? Some people get together and tell us we must empty our pockets, pay up for nuclear power or zero-carbon energies, disregard the costs and schedules and complexities of interactions between fuel and power industries, politics, technology, and human welfare, just put up the money and we will be saved.

Will we? They surely are not going to offer a guarantee that can be taken to the court. Cops do what cops do, robbers do what robbers do. Extortion is merely a matter of law. If law doesn’t work, it doesn’t really matter whether a robbery is also called a price of protection from even a greater loss.

Propitiating lords – I mean, gods and their representatives – was another such exercise at New Year’s. Their claims of representing gods were as persuasive as those of environmentalist organizations who claim to represent “the people” while in fact only representing their funders, usually with elevated degrees, incomes and assets.

Priests had a similar tactic, and like cops and robbers they did not have to make any explicit assertions. It was understood that if you gave respect and money to the priests, gods will be happy and stars will protect you in the coming year. I couldn’t tell how gods ruled the stars; what mattered is that gods spoke to us via priests. The same way we are to accept that God speaks to us via scientists. Or that scientists are the ultimate gods – omniscient of course, but also omnipotent, delivering us reports of climate change mitigation and adaptation every few years. Via the Incestuous Priesthood, the Clamour for Calamities.

Once again, one couldn’t tell if a drought or a flood was the result of not having listened to the priests and propitiated the gods. A lamb had to go. Or a cow. And we got blessings from smiling pundits.

There were rows of poor people outside homes and temples. They suffered the droughts and the floods much more than the priests and their middle or upper-class clientele. But the clientele got the satisfaction of having done the moral duty. And the trust that when the time came – wedding, election, impending death – the pundits will be around happily.

As the disasters amply show us, natural hazards lead to unnatural calamities when we fail to plan and protect. As climate change hysteria would have it, reducing coal use is the way to save the poor from famines, not better food storage and social insurance schemes. When the floods come and buses cannot evacuate people at risk, at least we can compute and monetize the avoided diesel CO2 emissions.

As with theologians who prepared the tables of indulgences, and created sins out of natural human urges, and virtues out of self-flagellation, the climate priesthood got into the business of carbon footprints, carbon credits, concocted markets that favoured the rich and taxed the poor. It is not as if the priesthood is liberated from wrath, greed, sloth, pride, lust, envy and gluttony, or even the sin it has created – emitting CO2. So long as there are means of expatiation – even just the feeling of self-righteousness that one has done one’s duty to one’s great-grandchildren (not that they would know one way or another) – what are sins in the family?

........to be continued

* The author is a US-based energy and environmental economist, routinely spending some time in India or elsewhere. He is also a pro-bono senior advisor to the Small-Scale Sustainable Infrastructure Development Fund (www.s3idf.org).

Views are those of the author. The author may be contacted at [email protected]

New Books on India and Energy (in alphabetic order):

1. Crusaders or Conspirator: Coal Gate and Other Truths: The book describes the conflict between legislation and execution of policy in the context of the coal sector, P. C. Parakh, former Secretary, Ministry of Coal, Manas Publications, New Delhi, 2014 (` 595)

2. The New Kings of Crude: China, India and the Global Struggle for Oil in Sudan and South Sudan: The book gives the human side of the story on China’s and India’s search for oil in Africa, Luke Anthony Patey, Hurst, London, 2014 (£25.00 or about ` 2,345)

3. The Political Economy of Energy & Growth: The book addresses a wide range of India’s energy challenges and includes chapters by Daniel Yergin and Manishankar Aiyar, Najeeb Jung (ed), Oxford, New Delhi, 2014 (` 995)

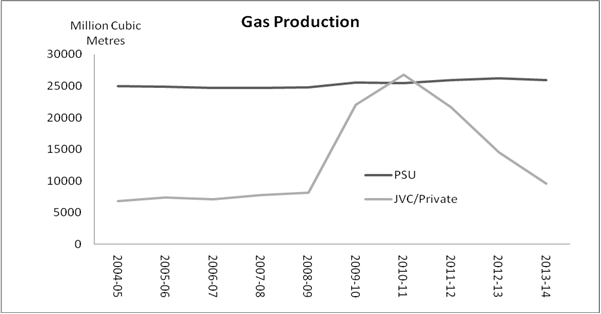

DATA INSIGHT

Natural Gas Production: Public Vs Private Sector

Akhilesh Sati, Observer Research Foundation

Million Cubic Metres

|

Year |

Onshore |

Offshore |

|||

|

OIL |

ONGC |

JV/Private |

ONGC (Mumbai High) |

JV/Private |

|

|

2004-05 |

2010 |

5658 |

1426 |

17313 |

5356 |

|

2005-06 |

2270 |

5751 |

1557 |

16823 |

5801 |

|

2006-07 |

2265 |

5876 |

1131 |

16567 |

5908 |

|

2007-08 |

2340 |

5877 |

882 |

16457 |

6861 |

|

2008-09 |

2268 |

5753 |

742 |

16733 |

7348 |

|

2009-10 |

2416 |

5634 |

635 |

17462 |

21350 |

|

2010-11 |

2350 |

5504 |

720 |

17591 |

26054 |

|

2011-12 |

2633 |

5751 |

699 |

17565 |

20910 |

|

2012-13 |

2639 |

5447 |

791 |

18102 |

13700 |

|

2013-14 |

2626 |

5301 |

1069 |

17967 |

8428 |

Source: Ministry of Petroleum & Natural Gas

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC's Mozambique gas field holds 50-70 Tcf of recoverable reserves

May 6, 2014. Oil and Natural Gas Corp's (ONGC) giant gas field in Mozambique holds 50 to 70 trillion cubic feet (Tcf) of recoverable reserves, 43 per cent more than the minimum estimated resources when it invested US $ 4.12 billion. ONGC Videsh Ltd, the overseas arm of ONGC, bought a 16 per cent stake in the offshore Rovuma Area-1 over the past one year. Oil India has a 4 per cent stake and a unit of Bharat Petroleum Corp (BPCL) owns 10 per cent in the block. The resource estimation is higher than 45 to 70 Tcf range Anadarko had given in March and 35 to 65 Tcf range when OVL bought stake in the block last year. OVL teamed up with Oil India last year to buy Videocon's 10 per cent in Rovuma Area 1 for US $ 2.475 billion. It later bought another 10 per cent stake in the field on its own from Anadarko for US $ 2.64 billion. The 10 per cent stake that belonged to Videocon was split in a 60:40 ratio and the total payout for OVL for the back-to-back acquisitions was US $ 4.125 billion. An estimated US $ 18.4 billion will be required to bring the first set of discoveries to production and convert the gas into liquid (liquefied natural gas or LNG) so that it can be shipped to consuming nations such as India. The Area 1 consortium's 2014 programme is focused on advancing the development towards first LNG cargo in 2018, Anadarko said. (economictimes.indiatimes.com)

RIL seeks joint tech studies to resolve gas dispute with ONGC

May 6, 2014. Reliance Industries Ltd (RIL) has proposed joint studies before an international expert is roped in to decide if its wells on KG-D6 block were drawing gas from neighbouring fields of Oil and Natural Gas Corp (ONGC). RIL and ONGC had agreed to appoint neutral international expert to decide if four wells drilled on boundary of KG-D6 block were drawing gas from neighbouring gas discoveries of the state-owned firm. The two were to exchange list of international experts at the last meeting on April 15, but RIL proposed a joint technical team to do more studies before seeking third party help. ONGC, however, believes the issue can be resolved only by engagement of an international expert. Two subsequent meetings proposed on April 28 and May 2 could not take place as RIL sought deferment. ONGC had approached the Directorate General of Hydrocarbons (DGH) on the matter nine months back with a request to share production and well data of KG-DWN-98/3 or KG-D6 field for analysing if the reservoir of the neighbouring field has same and continuous gas pool. The company's Godavari Block (known as G-4) and NELP-I discovery block KG-DWN-98/2 are contiguous to RIL-operated NELP-I Block KG-DWN-98/3 (KG-D6). ONGC believes KT-1/D-1 gas find in block KG-DWN-98/2 and G-4 Pliocene gas find in Godavari Block extend outside the block boundaries into KG-D6. ONGC believes that RIL's D6-A5, D6-A9 and D6-A13 wells drilled close to the block boundary may be draining gas from G-4 field of Godavari block while the well D6-B8 may be draining gas from DWN-D-1 field of KG-DWN-98/2 block. RIL has maintained that there exist uncertainties with regard to the possibility of channel extension, sand continuity as well as the connectivity. (economictimes.indiatimes.com)

BPCL to invest ` 14.1 bn in Mumbai refinery

May 5, 2014. Bharat Petroleum Corp Ltd (BPCL), India's second-biggest state refiner, plans to invest ` 1,419 crore in replacing an old crude processing unit at its 12 million tons a year Mumbai refinery by May 2015. BPCL plans to install a new crude and vacuum distillation unit of 6 million tons per annum capacity as a replacement of old crude and vacuum units. Old units will be disposed off post stabilisation of the new plant. With the entire 12 million tons Mumbai refinery will have new crude distillation units - the primary unit that converts crude oil into fuel, as other half was built only a few years back. (economictimes.indiatimes.com)

IOC to cut Panipat refinery runs by 50 pc from May 8

May 1, 2014. Indian Oil Corp (IOC), the country's largest refiner, plans to shut half of its 300,000 barrels per day (bpd) Panipat refinery from May 8 for about 40 days as it plans major maintenance work at some of the units. Panipat refinery is IOC's biggest plant and has two crude units of 150,000 bpd each. IOC will shut a crude unit from May 8 to May 22 and when this unit resumes operations the refiner will close the second unit until mid-June. The refiner's 850,000 tonnes per year fluid catalytic cracker, which is already shut down for maintenance since April 29, will resume operations from May 17. (www.business-standard.com)

Transportation / Trade

IOC inks pact with NSG for fuel supply

May 1, 2014. Indian Oil Corp (IOC) has signed a pact with National Security Guard (NSG) for supply of fuels and lubricants. IOC will cater to all fuel requirements of NSG. IOC said it is a privilege for IOC to supply fuel and lubricant to such a prestigious force, which provides security to the Constitutional and high profile dignitaries in the country. NSG said IOC has always been a trusted partner and that NSG could bank upon the company for meeting their various fuel requirements, overcoming all odds every time and on time. (economictimes.indiatimes.com)

Loss on diesel sales climbs to ` 6.80 a litre

May 1, 2014. The loss on sale of diesel has climbed to ` 6.80 even as state-owned oil companies for the second time skipped the monthly price increase on government diktat. State-owned firms Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp are losing ` 6.80 on every litre of diesel sold, up from ` 5.49 a litre last month as rupee depreciated against the US dollar and international oil prices firmed up. The loss, which is made good through government subsidy, was on a declining trend since March when it stood at ` 8.37. This was a result of rupee strengthening against the US dollar. (economictimes.indiatimes.com)

Petronet LNG to raise Dahej terminal capacity to 17.5 mt

April 30, 2014. Petronet LNG Ltd, India's biggest gas importer, plans to hike its Dahej import terminal capacity to 17.5 million tons from current 10 million tons (mt). Further, the company is looking a de-bottlenecking and other improvements in project design to further raise the capacity to 17.5 million tons. Petronet has completed commissioning of a second jetty which will allow larger ships carrying natural gas in its liquid form (liquefied natural gas or LNG) to dock at the port in Gujarat. The second jetty would give Petronet more flexibility of imports. (economictimes.indiatimes.com)

Policy / Performance

EC rejects govt’s request to review gas price hike order

May 6, 2014. The Election Commission (EC) of India has shot down the government's request to review its order to defer a hike in gas prices due to kick in on April 1. Reiterating its stand that there is no immediate need for an increase in gas price, the electoral watchdog replied to the petroleum ministry's reference, saying the decision could easily wait till after the election process is over. EC's reply affirms the fact that the final decision will now only be taken by the new government which will be formed after May 16. The petroleum ministry had written to the commission on May 1 urging it to reconsider its order on gas price on the ground that most contracts on gas sales and purchase expired on March 31 and that the hike was necessary to avoid a breach of contract. The union cabinet has approved a near doubling of gas prices from the current $4.20 per million British thermal units to spur investment in exploration for gas and boost returns for firms including ONGC. This move, however, was seen as motivated as some political parties alleged that the hike was aimed at giving windfall gains to RIL, which operates KG-D6 block in Andhra Pradesh. (economictimes.indiatimes.com)

Fertilizer ministry seeks to cut non-urea units off KG-D6 gas

May 6, 2014. The fertilizer ministry has written to the petroleum ministry to stop supplying gas from RIL’s KG-D6 block off India’s east coast to non-urea or phosphatic and potassic (P&K) fertiliser plants, the fertilizer ministry said. The fertilizer ministry said the prices of P&K fertilizers were not regulated and there was no logic in offering them cheaper domestic gas. KG-D6 gas is supplied to P&K plants of Deepak Fertilizers, Gujarat State Fertilizer Corp. and Rashtriya Chemicals and Fertilizer (RCF) at $4.2 per million metric British thermal units (mmBtu). The fertiliser industry consumes 31.5 million standard cubic metres a day (mmscmd) of gas from domestic sources and receives top priority in allocation of domestic gas. Presently all 13-14 mmscmd of gas produced from the KG-D6 field is supplied to fertilizer units. Non-urea fertilizer units that face supply cuts from KG-D6 will have to substitute domestic gas with costlier imported liquefied natural gas (LNG). RIL currently has agreements to sell KG-D6 gas to 16 fertiliser units. This includes 0.5 mmscmd of gas being consumed by P&K plants. Domestic gas supply to urea plants will continue to be maintained at the current 31.5 mmscmd. (www.livemint.com)

Oil ministry to review previous disputes with cos

May 5, 2014. The oil ministry, locked in a high-profile dispute with Reliance Industries Ltd (RIL), is reviewing dozens of past conflicts with oil and gas companies and is concerned about its track record because so far the government has won only one case, in which an operator sold stake to a Chinese firm without approval. Out of 26 cases where disputes with private companies led to arbitration, 20 are still unresolved. The government lost two and in three cases companies withdrew arbitration as they felt the dispute was hindering regulatory approvals from the oil ministry. (economictimes.indiatimes.com)

Oil ministry returns RIL’s ` 5 bn bank guarantee

May 4, 2014. Reliance Industries Ltd (RIL) had submitted a bank guarantee of ` 509.55 crore to get a higher price for natural gas it produces from the eastern offshore KG-D6 field, which the oil ministry has returned, saying the new rate hasn’t been announced. The surety, given on 10 April, covers the incremental revenue RIL would have got in the April-June quarter if the price of gas were to double to $8.4 per million British thermal units. RIL provided the bank guarantee even though the Election Commission had asked the government to defer implementing the new rate, which was to have come into effect from 1 April, until completion of the Lok Sabha elections. The oil ministry returned the guarantee, saying the new price has not been notified and RIL would have to submit the surety as and when it is announced. (www.livemint.com)

CNG price in Delhi hiked by ` 2.95 a kg; PNG ` 1 per unit

May 2, 2014. CNG price in Delhi was hiked by ` 2.95 per kg and piped cooking gas by ` 1 due to a rise in input cost. Compressed Natural Gas (CNG), whose price was last cut by a steep ` 14.90 per kg in February, will cost ` 38.15 per kg as against the current rate of ` 35.20. Rates of piped natural gas (PNG) that households use for cooking was hiked by ` 1 per standard cubic meters (scm). The new consumer price of PNG to households in Delhi has been revised from ` 24.50 per scm to ` 25.50 per scm up to consumption of 36 scm in two months. Beyond consumption of 36 scm in two months, the applicable rate in Delhi would be ` 48 per scm. Due to differential tax structure in Uttar Pradesh, CNG will cost ` 43.50 in neighbouring Noida, Greater Noida and Ghaziabad, Indraprastha Gas Ltd (IGL), the sole supplier of CNG and PNG in national capital region, said. PNG to households in Noida, Greater Noida and Ghaziabad would cost ` 27.30 per scm for consumption of 36 scm in two months, up from existing ` 26.20 per scm. Beyond consumption of 36 scm in two months, the rate applicable in these cities would be ` 48.75 per scm, IGL said. (www.livemint.com)

ATF prices cut by 1 pc after a decline in international rates

May 1, 2014. Jet fuel or ATF prices were cut by 1 per cent, the second reduction since April, after a decline in international rates. The price of aviation turbine fuel (ATF) in Delhi was lowered by ` 766.34 per kilolitre, or 1 per cent, to ` 71,033.87 per kl, according to Indian Oil Corp (IOC). The price had been reduced by 4 per cent, or ` 3,025.34 per kl, on April 1. International oil prices fell, negating the depreciation of the rupee against the US dollar. In Mumbai, jet fuel costs ` 73,306.89 per kl as against ` 74,105.16 per kl previously, IOC said. Rates at different airports vary because of local sales tax or VAT. (economictimes.indiatimes.com)

POWER

Generation

Kudankulam n-power plant generates 876 MW

May 6, 2014. The first 1,000 MW unit at the Kudankulam Nuclear Power Project (KNPP) touched a peak power generation of 876 MW, said Power System Operation Corporation Ltd. (POSCO). According to POSCO, the KNPP unit reached peak power generation of 876 MW and the average generation for the day was 810 MW. India’s atomic power plant operator Nuclear Power Corporation of India Ltd. (NPCIL) is putting up two Russian nuclear power plants at Kudankulam in Tirunelveli district. The NPCIL got the nod from the Atomic Energy Regulatory Board (AERB) to increase the KNPP first unit’s power levels above 75 percent. The first unit was connected to the southern grid last October. According to NPCIL, the first KNPP unit is expected to begin its commercial operations this month. (www.vancouverdesi.com)

JSPL 540 MW captive power plant becomes fully operational

May 6, 2014. The 540 MW captive power plant of Jindal Steel and Power Limited (JSPL) in Dongamauha of Raigarh district in Chhattisgarh had become fully operational. The plant has four units of 135 MW each. The 540 MW plant to be known as Dongamauha captive power plant (DCPP) had become operational. The JSPL plant had an installed 353 MW Captive Power Plant (CPP) at Raigarh. With the Dongamauha plant becoming fully operational, the captive power capacity of the JSPL had now enhanced to 850 MW. However, the company is planning to shut down the small captive unit that had not been viable. The company said that there were about a dozen small captive units at part of the 353 MW plant. (www.business-standard.com)

Breakdown at hydel projects proving costly for power consumers

May 5, 2014. Three states drawing power from Bhakhra Beas Management Board (BBMB) - Punjab, Haryana and Rajasthan - are being forced to shell out ` 3 crore per day extra to purchase costly power from the national grid as four out of total six units of the 6x165 MW (990 MW) Dehar power house in Himachal Pradesh are under breakdown since April 27. Dehar power house generates power by using water diverted from Beas at Pandoh Dam through Beas-Sutlej canal. Pandoh Dam is located on river Beas in Mandi district of Himachal Pradesh. After using it at Dehar power house, the water is further released into Sutlej where it is further utilized for power generation at Bhakra Dam. (timesofindia.indiatimes.com)

Power generation exceeds target by almost 6 pc in April: CEA

May 4, 2014. Indian utilities generated 86,592 million units of electricity in April, exceeding the target by almost 6 per cent, as power capacity in the country increased. Power generation climbed by 4,852 million units, or 5.94 per cent, over the planned level of 81,740 million units, according to data from the Central Electricity Authority (CEA), a government body tasked with facilitating overall development of the sector. A year earlier, actual generation at 77,579 million units was a tad higher than the target of 76,914 million units. The northeastern region -- Assam, Meghalaya, Manipur, Tripura, Nagaland, Arunachal Pradesh and Mizoram -- performed the best by registering a jump of about 27 per cent by producing 697 million units in April 2014 over the target of 549 million units. In the northern states, including Punjab, Haryana, Himachal Pradesh and Rajasthan, power generation fell short of the goal by about 2.21 per cent, at 21,170 million units. Import of power from neighbouring Bhutan was 78 million units, a drop of 62 per cent from the targeted level of 207 million units. The generation target for 2014-15 is 1023 billion units, according to the CEA. The country's installed power generation capacity was 2,43,028.95 MW at the end of March. One MW can produce 1,000 units of electricity in one hour. (economictimes.indiatimes.com)

GVK awaits coal supply to start power plant in Punjab

May 3, 2014. GVK Power & Infrastructure will start power generation at its 540 MW Goindwal Sahib plant in Punjab as soon as the station starts getting coal, and has no plans to sell the facility to NTPC. But its captive mines in Jharkhand are yet to start production and the coal ministry has so far refused to allocate the dry fuel from other sources, which means it can't immediately operate the station though it is ready to start power generation. (economictimes.indiatimes.com)

BHEL commissions 160 MW Power Plant in Rajasthan

May 2, 2014. BHEL announced the commissioning of 160 MW Combined Cycle Power Plant (CCPP) in Rajasthan. Rajasthan Rajya Vidyut Utpadan Nigam Limited (RRVUNL) had placed the order on the company, for setting up a Gas Turbine based 160 MW CCPP as an expansion project of Ramgarh power plant in Jaisalmer district of Rajasthan. With the commissioning of this plant, the cumulative capacity of Ramgarh CCPP has reached 273.8 MW, taking the gas based generating capacity of RRVUNL to 603.8 MW. The main plant equipment of all these gas-based units has been supplied and commissioned by BHEL. (www.business-standard.com)

Transmission / Distribution / Trade

CIL modifies fuel supply agreement model for new power plants

May 6, 2014. Coal India Ltd (CIL) has tweaked the fuel supply pact model for new private power plants providing them an opportunity to amend/supplement the power purchase agreement (PPA) more than once a year. Amid continuous delays, CIL has so far signed 160 fuel supply agreements (FSA) with power units. The Cabinet Committee on Investment (CCI) had earlier stated that the timelines for signing of fuel supply pacts for power projects of 78,000 MW capacity should be met. Power projects with 78,000 MW capacity have been approved for coal supplies by the Cabinet Committee on Economic Affairs (CCEA). For these projects FSAs would be signed for 172 units covering 134 Letter of Assurances (LoAs). (www.business-standard.com)

NTPC can cut power to BSES if not paid: SC

May 6, 2014. The Supreme Court (SC) has told India's top power producer that it can cut supplies to an electricity distributor in New Delhi if it is not paid arrears by end-May, intensifying a dispute that could lead to blackouts in the capital. The court ordered BSES - part of billionaire Anil Ambani's Reliance Infrastructure Ltd - to pay NTPC the ` 700 crore it is owed by May 31. If BSES fails to pay by the end of May, the court said NTPC is entitled to cut the power it supplies to the distributor, overturning an earlier court order that NTPC should keep power flowing despite the outstanding bill. BSES has previously said lower tariffs and a revenue shortfall meant it could not pay. The case in Delhi reflects a growing battle over who should bear the rising cost of power in India. Pressure to keep prices low makes it tough for distributors to force through tariff rises they say are necessary to keep pace with changes in the cost of power, which has risen as the country imports expensive oil and gas. BSES, which runs two distributors in Delhi, and a third firm say they face a revenue loss, built up over years of operations, totalling more than ` 15,000 crore ($2.4 billion). (www.business-standard.com)

Private power cos want CIL to sell them unsold coal

May 5, 2014. Private power firms are seeking higher coal supplies as Coal India Ltd (CIL) has announced that state firms have cut fuel purchases due to their weak finances. They say newer plants built by companies are more efficient and can better utilise the scarce fuel to meet the country's demand. CIL said it had a pit-head stock of 40 million tonnes at the end of February as offtake has been falling since last September, creating an ironical situation where thousands of megawatts of capacity is stranded due to fuel shortage while the monopoly producer is sitting on a growing heap of unsold coal. Association of Power Producers (APPs) wrote to the ministry of coal saying that attributing reduced offtake to sluggish demand does not convey the right picture. Indian Captive Power Producers Association (ICPPA), which represents industrial houses that are generating electricity for their captive requirements, has also sought higher coal allocation and supplies. ICPPA said that captive power producers have been complaining of poor quality and unavailability of adequate coal supplies besides CIL charging 30-35% more for its supplies to them. APP said that unused coal should be diverted to those plants that have not received the approved level of 65% domestic coal from CIL. It requested the coal ministry to initiate necessary action to ensure higher supplies to power producers in a situation where (CIL) has adequate inventories. Private power companies are struggling because CIL's output has not been able to keep pace with growing demand. Many power plants are idling while others are running at sub-optimal capacity because of the acute scarcity in the country, whose reserves of coal are among the highest in the world. (economictimes.indiatimes.com)

Punjab to buy 2 GW power amid below normal monsoon fears

May 2, 2014. As below normal monsoon fears looms large this year, Punjab State Power Corporation Limited (PSPCL) has decided to buy 2000 MW of power to ensure sufficient energy supply to farmers for paddy sowing and meeting rising demand from domestic and commercial consumers in summer. PSPCL hopes to buy short term power at a rate less than ` 3.90 per unit. (economictimes.indiatimes.com)

No change in power tariffs for most of Gujarat

May 6, 2014. Gujarat's electricity regulator decided against revising tariff rates of four state-owned power distribution companies for 2014-15, bringing relief to millions of consumers in the state. It, however, allowed Torrent Power a partial increase of 44 paisa per unit for all categories, except farmers and those below the poverty line. The company, which supplies electricity to Surat, Ahmedabad and Gandhinagar, had sought an increase of ` 1.22 per unit to bridge its revenue gap of ` 461 crore. At the new rate, Torrent will collect ` 450 crore more. State-owned discoms under the apex body Gujarat Urja Vikas Nigam Ltd had not sought any major change in tariff structure because it's an election year. (economictimes.indiatimes.com)

Adani’s $4.1 bn wealth surge in 8 months fuels attacks

May 6, 2014. Indian billionaire Gautam Adani’s wealth has tripled since Narendra Modi became the top opposition party’s prime minister pick eight months ago, fueling campaign attacks over the Gujarat chief minister’s plans to bolster Asia’s third-biggest eco nomy. Adani, a 51-year-old native of Gujarat state, has seen his fortune triple to $6 billion as of May 2 from $1.9 billion on Sept. 13, equivalent to $25 million per day in a nation where some 800 million people live on less than $2. The surge has spurred criticism from ruling party campaign chief Rahul Gandhi, who says it shows that Modi’s policies will benefit the rich at the expense of India’s poor. Modi improved access to electricity, built more roads and eased investment approvals after taking power in Gujarat in 2001, providing a platform for growth for companies in the state such as Adani Enterprises Ltd. Gujarat Urja Vikas Nigam Ltd. recovered only ` 800 million from Adani Power of a penalty that the auditor said should’ve amounted to ` 2.4 billion based on the power purchase agreement. The auditor rejected an argument from the government that a reduced penalty was agreed upon because of differing interpretations of the deal. Adani Power has outperformed Indian rivals, including Reliance Power Ltd. and Tata Power Ltd., to become India’s largest private electricity producer. The group is also among India’s biggest importers of coal. (www.bloomberg.com)

Indian coal mining scam - Charge sheet against Navabharat Power sent to CMM court

May 6, 2014. A special court transferred CBI's charge sheet filed against Navabharat Power Pvt Ltd and its two directors in the coal blocks allocation scam case to a magisterial court on the ground that no charges under the Prevention of Corruption Act were slapped against them. The charge sheet against Navabharat Power Pvt Ltd and its two directors Mr P Trivikrama Prasad and Mr Y Harish Chandra Prasad was filed before Special CBI Judge Madhu Jain who transferred the matter to the court of the Chief Metropolitan Magistrate (CMM). (coal.steelguru.com)

KMC to ink street light deal with power cos

May 5, 2014. Kolkata Municipal Corporation (KMC) is readying to accept the proposal of a joint venture of four state-run firms to replace about 300,000 street lamps with LED lamps, which will help save ` 15-20 crore a year on power and maintenance costs. The corporation is expected to sign a nine-year contract with Energy Efficiency Services Ltd (EESL) after the ongoing general elections. (economictimes.indiatimes.com)

MP wants govt to allow Reliance Power to mortgage 2 Sasan Coal mining blocks

May 5, 2014. The Madhya Pradesh (MP) government has asked the Centre to allow Reliance Power to mortgage mining leases of two coal blocks attached to the company's Sasan ultra mega power project in favour of the plant's lenders including banks from the US, China and Singapore. The Union government had earlier shot down the company's proposal to mortgage the two assets saying there was no precedence and such a proposal should come from the state government hosting the coal blocks. (economictimes.indiatimes.com)

Odisha drops corpus fund plan for rebuilding power infra after disasters

May 5, 2014. The state government’s plan to create a corpus fund for rebuilding power infrastructure in the aftermath of Phailin-like disaster has been shelved with the power regulator, Odisha Electricity Regulatory Commission (OERC) rejecting the proposal. The government had planned to raise the fund with contribution from power distribution companies (discoms), which, in turn, intended to pass on the burden to the consumers. They had applied to OERC for hike of at least five paise per unit in the power tariff to arrange their contribution to the fund. However, since the regulator recently kept the tariffs unchanged, the government had to drop the proposal. (www.business-standard.com)

MERC allows Adani Power compensatory tariff of ` 1.01 per unit

May 5, 2014. Maharashtra Electricity Regulatory Commission (MERC) has allowed the power producer to charge Mahavitaran an additional ` 1.01 per unit as compensatory tariff for 800 MW. MERC in an order allowed Adani Power to charge a compensatory tariff of ` 1.01 per unit for only 800 MW. With this, the total power purchase cost from the 800 MW works out to ` 3.65 per unit. Adani Power Maharashtra had entered into an agreement with the state utility Mahavitaran to supply power from its two units-- 2 and 3--with a total capacity of 1,320 MW in Tiroda at a levellised tariff of ` 2.64 per unit. The Tiroda plant is linked to the Lohara coal block. (economictimes.indiatimes.com)

CIL modifies e-auction clauses

May 4, 2014. Coal India Ltd (CIL) has modified clauses pertaining to spot and forward e-auctions of coal to include a provision that says both parties shall be entitled to claim and recover from the other excess or differential tax and statutory levies. The clause before the amendment only said sale under each auction shall be individual, independent, unique and complete transactions. The parties shall have a lien on any sums of money belonging to the other, which may come into possession or control to the extent of the sum recoverable from the other, according to the modification. Besides, there are couple of new clauses in the e-auction scheme. (www.livemint.com)

‘Prime Minister sanctioning authority for coal blocks’

May 4, 2014. Former coal minister and film director Dasari Narayana Rao, who was questioned by CBI in connection with alleged irregularities in allocation of Talabira-II coal block, said that the Prime Minister (PM) was the final authority on sanction of coal blocks. Denying his involvement in the scam, Rao said that he had no role in the scam and the truth will finally come out after investigation. (www.deccanchronicle.com)

KSERC approves tariff revision to mobilise ` 6.5 bn for KSEB

May 3, 2014. Kerala State Electricity Commission (KSERC) has approved a revision of electricity tariff to mobilise ` 650 crore for Kerala State Electricity Board (KSEB). There would be a minor hike in charges of all categories of domestic consumers, other than those consuming up to 40 units. The increase ranges from 10 to 50 paise for consumption up to 300 units, which would continue to be billed under the existing telescopic slab system. A telescopic slab system is a mechanism where rate increases as the consumption rises. There is no change in tariff for those consuming below 40 units, numbering around nearly 25 lakh families. Power used for agriculture and in institutions like homes for poor people and orphanages have also been exempted from any hike. However, domestic consumers using more than 300 units per month would be billed under non-telescopic slab system. The tariff for 350 units is ` 5, ` 5.50 for 400 units, ` 6 for 500 units and ` 7 for more than 500 units. There are around one lakh people who consume more than 300 units per month. Similarly, changes have also been brought in charges for new power connections. The hike is between ` 300 to ` 10,000. The Commission estimates a total income of ` 8,496 crore and expenses of ` 9,546 crore, with a revenue deficit of ` 1,050 crore for 2013-14. KSEB had sought an across the board hike in tariff of all categories and also an increase on fixed charges and energy surcharge. The new tariff would come into effect from this month. (economictimes.indiatimes.com)

DERC rejects power discoms' request to raise surcharge

May 3, 2014. The Delhi Electricity Regulatory Commission (DERC) has rejected requests by distribution arms of Reliance Infrastructure and Tata Power to immediately raise a surcharge on electricity rates by 15% to 33% from the current level of 6%-8%. But this may lead to a much higher increase in charges after the election, when the regulator will consider the request, and is likely to compensate the companies for past losses on this account. (economictimes.indiatimes.com)

Corpus fund for power in Meghalaya

May 3, 2014. The state government has decided to start a corpus fund for the power corporation to pay them and have steady supply of power. The corpus can be utilised for clearing dues to power PSUs such as the North East Electric Power Corporation (NEEPCO) and Power Grid at times of crisis. Currently the Meghalaya Energy Corporation Ltd (MeECL) owes ` 379 crore to the NEEPCO, the major reason why the power giant stopped power supply to the state. (news.outlookindia.com)

Jharkhand CM orders probe into coal smuggling

May 2, 2014. Jharkhand Chief Minister (CM) Hemant Soren ordered a vigilance probe into the complaints of coal smuggling in Hazaribagh district and alleged involvement in it by some police officers. Soren asked to submit a report within two months. He also directed to prepare an action plan to contain complaints of coal smuggling in the state. (ibnlive.in.com)

HC asks CAG to file plea against three discoms

May 2, 2014. The high court (HC) asked the Comptroller and Auditor General (CAG) to file a fresh plea in support of its claim that three discoms of Tata Power and Reliance ADAG have not been cooperating in auditing of their accounts. The court then asked the counsel for the CAG to file an application and fixed the matters for hearing on May 12. The bench is hearing a batch of petitions including three appeals filed by Tata Power Delhi Distribution Ltd and Reliance Anil Dhirubhai Ambani Group firms, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd. (www.business-standard.com)

Govt evaluating site in Bihar for 4 GW UMPP

May 1, 2014. The Power Ministry is evaluating a site in Bihar for setting up a 4,000 MW ultra mega power project (UMPP) and has approached the Coal Ministry for allocation of a nearest coal block for the thermal plant. However, the proposed plant is likely to be fed coal from a mine either in Jharkhand or Odisha. Once finalised this would be the first load centre project, as coal will be made available from a nearby coal block through road or railways. The earlier operational or allotted UMPPs have either been pit-head projects (right where the coal mine is) or coastal plants based on imported coal. Power Finance Corporation is the nodal agency for UMPPs in the country. UMPP is coal-based thermal power project that has 4,000 MW generation capacity. Meanwhile, the final price bids for two UMPPs - Odisha and Tamil Nadu - may now open next month. (economictimes.indiatimes.com)

Insurance cos increase premium for hydropower plants

May 1, 2014. Insurance companies have raised the premium for hydropower plants across the country after last year's flash floods in Uttarakhand that led to huge claims. Companies like National Insurance Co Ltd, United India Insurance Co Ltd and Oriental Insurance Co have raised premium rates multifold for hydroelectric projects. Insurance companies have received huge damage claims from hydropower companies like NHPC and Jaiprakash Associates for power plants located in Uttarakhand after the floods, forcing them to revise the existing rates. Insurance contracts for most hydroelectric projects are renewed annually during the first quarter of a financial year. NHDC, a joint venture of NHPC and Madhya Pradesh government, has received exorbitant quotations from insurance companies for its 1000 MW Indira Sagar project in Madhya Pradesh with the lowest bid around 200% higher than the last year. (economictimes.indiatimes.com)

CIL asked to scale up output by 10 pc

April 30, 2014. The government has set unrealistic targets for Coal India Ltd (CIL) this year after the company fell 4.21 per cent short of its production target to 462.53 million tonnes (mt) in 2013-14. Coal India’s production and offtake targets for 2014-15 are 507 mt and 520 mt, respectively. The Kolkata-headquartered company’s performance grew only 2.3 per cent and 1.4 per cent, respectively, on these indicators in the last financial year. Experts said meeting the target of raising production by 9.6 per cent and offtake by 10.3 per cent needed “an extraordinary effort from the company”. An incremental growth target of 45 mt in a single year becomes difficult considering it is 60 per cent of Coal India’s projected increase during the Eleventh Five-Year Plan. The company added 74.93 mt in production between April 1, 2007, and March 31, 2012. Even during its best years, 2009 and 2010, the incremental production was 6-7 per cent.

NTPC buys 30 per cent of Coal India’s supply and 38 per cent of some 353 mt shipped to the sector. Its electricity generation target for 2014-15 has, however, been set at 240 billion units, a 3 per cent increase over last year. Also, power producers like the Damodar Valley Corporation are struggling to find consumers for its electricity. In 2011-12, the domestic coal intake by NTPC was 129 million tonnes, which climbed to 146 million tonnes in 2012-13 and 149 million tonnes in 2013-14. Analysts, however, are optimistic about Coal India meeting its production target for 2014-15. (www.business-standard.com)

Hydropower plants partly blamed for deadly India floods: study

April 30, 2014. Hydropower projects in northern India were partly to blame for devastating floods last year that killed thousands, a government report has concluded, in a warning to other Himalayan nations investing in the alternative energy source. Floods and landslides caused by early monsoon rains tore through the Himalayan state of Uttarakhand last June leaving more than 5,500 people dead or missing, and destroying villages and towns. The world's second most populous country has turned to hydropower projects in the Himalayas for electricity as it seeks to curb its reliance on coal-fed plants as well as reducing its crippling power shortages. Pakistan, China, Bhutan and Nepal are also eyeing expansion of hydropower in the Himalayan range to varying degrees, often in ecologically fragile areas.

In a report commissioned by the Indian government, a panel of experts said some of the more than 30 hydropower projects had caused a build up of sediment in Uttarakhand's rivers, including soil dug up during construction and dumped on the banks. (www.ndtv.com)

INTERNATIONAL

OIL & GAS

Upstream

Occidental won’t drill where not wanted in California

May 6, 2014. Occidental Petroleum Corp. Chief Executive Officer Steve Chazen said the company’s California spinoff will have plenty of places to drill that won’t be hindered by a growing anti-fracking movement in the state. The new company, which will be spun off to shareholders as California Resources Corp. by year end, won’t drill in communities that oppose oil and gas activity or hydraulic fracturing, known as fracking, Chazen said. Occidental can avoid communities such as Beverly Hills, which have passed limits on fracking, he said. Management of the new company will be named in the third quarter. Chazen has said he’ll remain as CEO of Occidental. The company will distribute at least 80 percent of the new shares in California Resources to Occidental shareholders, Chazen said. The California business will have 8,000 employees, generate $2.6 billion in cash from operations and seek to boost output by 5 to 8 percent. Occidental boosted California oil production by 8 percent in the first quarter, when profit rose slightly as global output slipped. Output fell to the equivalent of 745,000 barrels of oil and gas a day, a 2.4 percent decline from the same period a year earlier. (www.bloomberg.com)

Marxist rebel bombings send Colombia oil output to 20-month low

May 6, 2014. Colombian crude production sank to a 20-month low in April as Marxist rebel attacks and community protests curbed output amid continuing peace talks in Havana. Oil production averaged 935,000 barrels per day, according to a government, the lowest since August 2012. Output slumped as repairs to the country’s second-largest pipeline following a March 25 rebel attack were prevented by the indigenous U’wa group. (www.bloomberg.com)

Libyan oil output is 250k bpd as new protest hits east

May 5, 2014. Libya's oil production is currently 250,000 barrels a day while the vital southern El Sharara oilfield remains closed, National Oil Corp (NOC) said. A new protest has shut down the Zultun and Raquba oilfields in central eastern Libya, halting their combined output of 39,000 bpd, NOC said. The fields are operated by Sirte Oil Co, a subsidy of NOC. A protest took place at the nearby Tahadi field, which also produces gas, but it was still working normally, NOC said. Shutting down the gas production there would hit power supply in eastern Libya. The 340,000-bpd Sharara field in the remote southwest was still closed, NOC said. (www.rigzone.com)

Transcorp to start drilling plans after Nigeria oilfield deal

May 5, 2014. Transnational Corp. of Nigeria Plc, which has interests ranging from agriculture to oil, said it will drill wells on its prospecting lease after signing a production-sharing deal with the state oil company. Transcorp paid $30 million for oil-prospecting lease 281, or OPL 281, following a sale by the Nigerian government in 2007. The lease holds an estimated 104 million barrels of oil reserves, 335 million barrels of probable additional reserves and about 4 trillion cubic feet of gas, the Lagos-based company said. Transcorp will partner with Energy Equity Resources, a Nigerian oil and gas company, and Johannesburg-based SacOil Holding Ltd. in the ownership and development of OPL 281, the company said. (www.bloomberg.com)

Statoil discovers up to 63 mn barrels in Barents Sea

May 2, 2014. Norway's Statoil reported that it has made an oil and gas discovery of up to 63 million barrels of recoverable oil equivalent at the Drivis prospect in the Barents Sea. But it said that, despite the discovery, the overall campaign in the Johan Castberg area had not delivered in terms of volumes. (www.rigzone.com)

Drillers hooked on oil bolster Goldman $6 gas outlook

May 1, 2014. U.S. energy producers are sticking with oil over natural gas, boosting Goldman Sachs Group Inc.’s view that gas at a six-year high may still have room to rally. Drillers switched their focus to oil in 2012, when gas futures dropped to a decade low. While gas has more than doubled since then, surging this year as frigid weather eroded stockpiles, crude remains more profitable, according to Loomis, Sayles & Co., which manages $200 billion. Goldman Sachs said that gas may have to trade between $5.75 and $6.50 per million British thermal units to spur a supply increase, up at least 19 percent from current prices. Chesapeake Energy Corp., the second-largest U.S. gas producer, estimated that its output in 2014 will grow at half the rate of the company’s oil production. Chesapeake said oil production adjusted for asset sales may increase 8 to 12 percent this year, compared with 4 to 6 percent for gas. The company boosted average daily oil production 32 percent in 2013 while gas output dropped 3 percent. Devon Energy Corp. said it will invest about $1.1 billion in the oil-rich Eagle Ford formation in south Texas this year, drilling more than 200 wells, after spending $6 billion to buy 82,000 net acres of leases in the basin from closely held GeoSouthern Energy Corp. Only about $600 million of the company’s estimated $5.4 billion capital budget this year will go toward gas production in liquids-rich areas of the Barnett Shale in Texas and Anadarko Basin in Oklahoma, the company said. Encana Corp., which is also seeking to increase investor returns by shifting to oil, said that it would sell natural gas-producing properties in east Texas to an undisclosed buyer for about $530 million. (www.bloomberg.com)

Vietnam offers two more exploration blocks to OVL

April 30, 2014. Vietnam has offered two more exploration blocks to ONGC Videsh Ltd (OVL) in addition to the five already offered. The company has selected only one of the five blocks that were offered in November, and will assess the two new blocks also. All the blocks have been offered to the company without competitive bidding. OVL is currently operating two blocks in the country, one is producing gas and the other is still at the exploratory phase. It had relinquished one Vietnamese block about two years ago. (economictimes.indiatimes.com)

Downstream

California’s oil refiners double crude-by-rail volumes

May 2, 2014. California, the most-populous U.S. state and biggest gasoline market, more than doubled the volume of oil it received by train in the first quarter as deliveries from Canada surged. The third-largest oil-refining state unloaded 1.41 million barrels in the first quarter, up from 693,457 a year ago, data on the state Energy Commission’s website showed.

Canadian deliveries made up half the total and were eight times shipments a year earlier. Supplies from New Mexico jumped 71 percent to 173,081 barrels. Those from North Dakota slid 34 percent to 277,046. (www.bloomberg.com)

Shell writes off $2.3 bn refining assets as Asia adds units

April 30, 2014. Royal Dutch Shell Plc, Europe’s biggest oil company, wrote off $2.3 billion in refining assets this year as expanded capacity in Asia reduces profits. Most of the charge is related to the Bukom plant in Singapore. Net income fell 45% to $4.5 billion in the first-quarter from a year earlier partly because of the impairment, the Hague-based Shell said. Indian and Chinese state-owned companies, such as Oil & Natural Gas Corp. and China National Petroleum Corp., are expanding capacity to meet local demand. Reliance Industries Ltd., operator of the world’s biggest refining complex, is competing in U.S. and European markets, exploiting its ability to process cheaper crude grades into high-quality fuels. (www.livemint.com)

Transportation / Trade

Italy could boost Africa gas imports to offset Russia

May 5, 2014. Italy could increase gas imports from Algeria, Libya and the Netherlands to counter any disruption of supplies from Russia, Deputy Industry Minister Claudio De Vincenti said as G7 energy ministers gathered in Rome. His comments came on the day G7 energy representatives began a two-day meeting to discuss energy policy after a weekend of violence killed dozens in Ukraine, a major transit route for Russian gas into the EU. Italy, which generates more than 40 percent of its electricity from gas, is increasingly dependent on Russian gas as Algerian imports decline and Libyan supplies are limited by growing unrest in the country. Russian President Vladimir Putin has warned Russia could cut off supplies to Ukraine unless it starts to pay off a gas debt which Gazprom says stands at $3.5 billion. Rome is placing increasing importance on completing the Trans Adriatic Pipeline (TAP) to bring Azeri gas to Italy but is also supporting the South Stream project, which will transport Russian gas bypassing Ukraine. (www.downstreamtoday.com)

Buffett’s BNSF sees US tank-car rules matching Canada’s

May 5, 2014. BNSF Railway Co., the carrier owned by Warren Buffett’s Berkshire Hathaway Inc., expects U.S. regulators to match Canada’s plan for phasing out older tank cars used to carry crude oil. A proposal by car owners to eliminate the older equipment over seven years is too long, BNSF Chairman Matt Rose said. U.S. officials are now reviewing crude-by-rail safety proposals after Canada said it would require the older cars to be retrofitted or retired over a three-year period. (www.bloomberg.com)

Shale revolution lures trading houses to energy assets

May 2, 2014. Merchants from Vitol Group, the largest independent oil trader, to a company backed by billionaire Paul Tudor Jones are amassing physical energy assets in the U.S. at an unprecedented rate as shale output revives stagnant fuels markets. Castleton Commodities International LLC, financed in part by hedge fund managers Tudor Jones and Glenn Dubin, acquired Texas gas wells in February. Mercuria Energy Group Ltd. is buying JPMorgan Chase & Co.’s physical commodities business. Vitol and Trafigura AG are helping build oil pipelines, and Freepoint Commodities LLC is investing in offshore production. Of the $1 billion Trafigura has invested in the U.S., the majority was spent in the past five years, the company said. (www.bloomberg.com)

NEB approves two applications for 25 year natural gas export licences

May 2, 2014. The National Energy Board (NEB) approved two applications for 25 year natural gas export licences. A licence was approved for Aurora Liquefied Natural Gas Ltd. (Aurora LNG) to export liquefied natural gas (LNG), for a maximum term amount of 849.82 109m3. The export point would be in the vicinity of Prince Rupert, British Columbia at the outlet of the loading arm of a proposed liquefaction terminal. A licence was also approved for Oregon LNG Marketing Company, LLC (Oregon LNG) to export natural gas for a maximum term amount of 375.17 109m3. The export point would be in the vicinity of Kingsgate and Huntingdon, British Columbia via existing natural gas pipelines. Issuance of both licences is subject to the approval of the Governor in Council. (transportationandstorage.energy-business-review.com)

Colombia warns of emergency decree for pipeline standoff

April 30, 2014. Members of a Colombian indigenous group blocking essential repairs to the country’s second-largest pipeline say they’ll peacefully oppose any government attempts to fix the oil duct using force. The forest-dwelling U’wa want the Cano Limon-Covenas pipeline partially re-routed and a cessation of oil exploration activities by state-controlled Ecopetrol SA at the Magallanes site in the eastern Norte de Santander province. Paralysis at the Cano Limon pipeline following an attack by Marxist rebels March 25 has cut Ecopetrol exports by 2.7 million barrels so far, the company said. The U’wa are also blocking the entrance to the Magallanes site. Government, Ecopetrol and U’wa representatives are scheduled to meet May 1 after earlier attempts to end the standoff failed. The month-long confrontation at the Ecopetrol-owned pipeline is threatening Colombia’s ability to meet oil export targets and may force the government to declare a national emergency, Mines and Energy Minister Amylkar Acosta said. (www.bloomberg.com)

Policy / Performance

Europe must embrace fracking, UK Energy Minister says

May 6, 2014. The Ukraine crisis has become a “wake-up call” for European governments on the need to develop local energy resources, including natural gas from shale, U.K. Energy Minister Michael Fallon said. The use of hydraulic fracturing, or fracking, to tap shale reserves that could meet demand for decades would provide greater security of supply at a time when Russia has threatened to curb gas shipments needed to power European economies, he said. (www.bloomberg.com)

Iran targets oil boost of 1 mn barrels a day, Zanganeh says

May 6, 2014. Iran, hampered by sanctions over its nuclear program, plans within four years to boost crude-output capacity by 1 million barrels a day at fields it shares with neighboring states, Oil Minister Bijan Zanganeh said. The fourth-largest producer in the Organization of Petroleum Exporting Countries is also pressing ahead with work at South Pars, part of a gas deposit straddling the border with Qatar, Zanganeh said. Iran expects to complete several of the project’s 17 phases in about three years, he said. (www.bloomberg.com)

Norway oil unions start wage talks two yrs after record strike

May 6, 2014. Norwegian offshore-platform workers began pay talks that may include an unresolved dispute over pensions responsible for their longest strike two years ago. The row over plans to raise the age that staff can claim full pensions probably won’t lead to a walkout this time, said a union representing about 4,000 of the 7,615 covered by the talks. Norway is western Europe’s biggest oil and gas producer. The Norwegian Organisation of Managers and Executives, representing about 900, will push for pensions to be discussed. (www.bloomberg.com)

UK energy too cheap, says study

May 6, 2014. The government must urgently establish a strategic authority to oversee the future growth of Britain's ageing energy infrastructure, a study argues. Academics at Newcastle University challenge the government's market-based approach, saying the £100bn needed to secure energy security is not being delivered by a fragmented system that lacks central direction. The academics, led by Prof Phil Taylor, argue that the country needs a "systems architect" and that energy, at least for the bulk of the population, is too cheap, which is leading to waste. While the Labour party has already said it wants an energy security board, one leading figure in the industry has said that Taylor was highlighting that "nobody is in charge" of the country's energy policy. (www.theguardian.com)

G-7 resolute in reducing Russia energy ties, UK says

May 6, 2014. The Ukraine conflict is spurring the world’s leading economies to cut their reliance on Russian energy to show President Vladimir Putin that there’s no going back to pre-crisis ties, U.K. Energy Secretary Ed Davey said. There’s “a lot of agreement” and several options to diversify supplies, Davey said in an interview in Rome at the start of a two-day meeting of fellow Group of Seven ministers including U.S. Energy Secretary Ernest Moniz and European Union Energy Commissioner Guenther Oettinger. (www.bloomberg.com)

Gulf states gift Egypt free fuel lifeline worth $6 bn

May 5, 2014. Gulf oil producers have given Egypt a free fuel lifeline totalling $6 billion in value to help fend off unrest on its streets in the summer when consumption soars, the head of its national oil company said. Tarek El-Molla, head of the Egyptian General Petroleum Corporation (EGPC), said that the aid consisted of "huge quantities" of benzene, diesel, heavy fuel oil mazut, butane and crude oil, since last July. The aid helps reduce the heavy costs of government fuel subsidies and the drain on foreign exchange reserves. (www.arabianbusiness.com)

Oman needs up to 30k more O&G workers

May 5, 2014. Oman government is planning to set up two major specialised institutes, including an engineering college, to meet the growing need for 20,000 to 30,000 additional oil and gas industry professionals in the next 10 years. The first proposed technical training institute will come up in Adam, south of Muscat, to offer a three-year diploma programme for school leavers in technical fields required by the industry, which include electrical, mechanical, instrumentation and draftsman, Salim bin Nasser bin Said Al Aufi, undersecretary at the Ministry of Oil and Gas said. The second institute is planned in Muscat for conducting bachelors' degree programmes in different fields in petroleum engineering, chemical engineering and mechanical engineering. The plans to set up these two institutes are part of a larger in-country-value (ICV) initiative and the first part of this move is to review and assess the capabilities of existing institutes, he said. He said that Oman would need 20,000 to 30,000 additional skilled workers in the oil and gas field in the next 10 years. (www.timesofoman.com)

Canada finds China option no easy answer to Keystone snub

May 3, 2014. Canadian Prime Minister Stephen Harper was in need of a new friend with a big appetite for oil. The Americans just weren’t cutting it. It was February 2012, three months since President Barack Obama had phoned the Canadian prime minister to say the Keystone XL pipeline designed to carry vast volumes of Canadian crude to American markets would be delayed. Now Harper found himself thousands of miles from Canada on the banks of the Pearl River promoting Plan B: a pipeline from Alberta’s landlocked oil sands to the Pacific Coast where it could be shipped in tankers to a place that would certainly have it -- China. It was a country to which he had never warmed yet that served his current purposes. Oil was top of mind. He noted that a single country -- the U.S. -- took 99 percent of Canada’s exports, a situation he described as contrary to Canada’s commercial interests. (www.bloomberg.com)

Angola may exempt oil cos from services tax, E&Y says

May 2, 2014. Petroleum explorers including Total SA and BP Plc in Angola, Africa’s second-largest crude producer, will probably be exempt from a consumption tax, the head of Ernst & Young (E&Y)’s local unit said. The proposed 5 percent levy on services and supplies to oil companies and 10 percent on drill rig leases and other equipment rentals won’t be imposed after opposition from the Petroleum Ministry and companies led the Finance Ministry to revise the law. Angola, recovering from a 27-year war that ended in 2002, is attempting to update its tax laws to boost revenue. Companies including Exxon Mobil Corp. and Chevron Corp. spend an estimated $20 billion a year on exploration and production in the nation, and oil taxes contribute about 80 percent of revenue. (www.bloomberg.com)

EU gas prices to extend longest drop in 4 yrs in mild May

May 1, 2014. A sixth month of warmer-than-usual weather in May is set to extend the longest losing streak for European natural gas prices in almost five years. Four of six meteorologists predict temperatures in western Europe will be above normal this month, according to a poll. Above-average gas inventories and easing concerns of cuts in Russian gas supplies to Europe mean fuel prices may fall further, according to Inspired Energy Plc, an energy consultant in Kirkham, England. (www.bloomberg.com)

Saudi oil faces summer heat challenge