-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: The Unnatural Life of Natural Gas in India

Ø COAL: Is there a Coal Shortage?

DATA INSIGHT

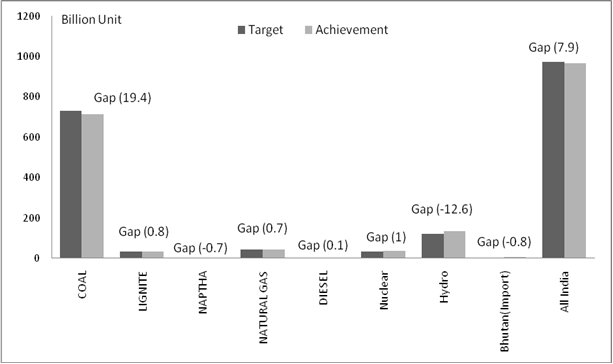

Ø Electricity Generation: Targets and Achievements

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC, RIL, British Gas to abandon Tapti gas field

· RIL divests Peru oil block stake

· RIL, HMEL plan refinery expansions

· Gujarat gas to become Asia’s largest CGD player

· Petronet invites bids to lease out LNG storage tanks at Kochi

· TAPS generated 28 pc of India's atomic power in 2013-14

· CIL drops plans to enter shipping business

· PGCIL gets Stage-I forest nod for transmission line

· PetroChina aims to produce 92 Bcf of shale gas in 2015

· Eni, Ukraine agree on need to increase gas production

· Shell finds gas at Rosmari-1 well in SK318 offshore Malaysia

· Anadarko joins ad blitz to thwart Colorado fracking curbs

· Keystone route ruling should be overturned, Nebraska says

· Summit connects transmission pipeline to Maine communities in US

· Japan’s push for gas exchange to face pipeline-network hurdle

· Petrobras, Mitsui to study LNG import terminal in Brazil's south

· Russia to build two nuclear power plants in Iran

· Transcorp to raise $1 bn to build power plants

· Minnesota Power files to build international power transmission line

POLICY & PRICE

· CAG seeks pending information on KG-D6 block

· PMO seeks status report on gas pricing

· ‘India needs multi-pronged approach to energy security’

· Oil ministry seeks more time for Reliance Industries' gas finds

· Govt plans additional 30 pc charge on diesel vehicles

· India, Bhutan ink preliminary pact for four hydropower projects

· Odisha may reject Vedanta's plea to use IPP power for smelter

· Assam CM orders APDCL to meet shortfall of power

· NTPC frames new policy to weed out unprofessional vendors

· MSERC approves 15 pc hike in power tariff in Meghalaya

· Petronas eyes Brazil, Russia, India and China for E&P Growth

· Restart of Libya’s oil output hard to predict: Oil Minister

· Govt forms project team to execute work on Sahiwal power plants

· Nigeria electricity generation to hit 12 GW by 2016

· Court upholds key EPA mercury standards for power plants

· India said to forecast normal monsoon rainfall

· Rays Power Infra mulls entering highways sector

· Players from Gulf nations plan to invest in Indian solar sector

· Tata Power plans to add 646.7 MW from clean energy sources

· India signs power contracts for 700 MW solar

· Musk says Tesla will make cars in China in next 3-4 yrs

· China Premier Li reiterates plans to boost clean energy

· Ukraine seeks renewable-energy boost to counter Russia

· China’s wind turbine makers face market consolidation

· Nissan offering free Leaf charges to lift US battery car sales

· Merkel ally sees German big energy in last stand to dominate

· Farmers seeking heat relief signal Brazil climate peril

· Alberta considers emissions rules to win support for oil

· Tocardo sees river-power market worth $1.4 bn in 10 yrs

WEEK IN REVIEW

ENERGY

The Unnatural Life of Natural Gas in India

Lydia Powell, Observer Research Foundation

|

D |

elivering the inaugural Rajiv Gandhi lecture titled ‘Towards a New Natural gas Policy’ in 2009, Dr Vijay Kelkar observed that India’s policy approach for gas seemed to be derived from a mindset of scarcity. He pointed out that polices for addressing scarcity such as that of rationing resulted in under-pricing of gas which not only reinforced scarcity (it spurred demand but curbed supply) but also fostered a constituency of rent seekers. A brief look into the history of natural gas in India reveals that the notion of scarcity was actually wrested out of the mouth of abundance.

Natural gas began its life in India the same way it did around the world, as an unwanted by-product of oil production which had to be flared away. However, flaring continued in India long after the global industry realised that it was economically and environmentally irresponsible to do so. In his historical account of the oil and gas industry in India, Mr S N Vishvanath, former MD of Oil India Limited (OIL) observed that gas continued to be flared in India in the early years of its life in India partly because the market was not ready partly because the infrastructure was not in place. He also pointed out that even by the mid 1980s, when the market was supposed to be ready, a large share of gas produced had to be flared because of ‘erratic lifting by consumers’. This was by no means a situation of scarcity.

The 8th Five year plan (1992-97) records that the ‘total cumulative production of gas during the 7th plan period was 59.65 bcm against a target of 59.68 bcm but actual despatches to consumers was only 40.41 bcm due to technical constraints, non-lifting by consumers, non-availability of downstream facilities for utilising gas and also inadequacy of compression and transportation facilities for associated gas’. This observation must be put in the perspective of the gas linkage committee set up in 1991 which in the words of Dr Anil K Jain ‘comprised of representatives from various government departments with executive powers to allocate gas to various users’. Fertiliser manufacture topped the order of priority for gas allocation followed by power generation, city gas and other user segments. Given that fertiliser and power generation had priority in allocation of gas, gas based fertiliser production increased by a factor of 50 and gas based power generation increased by a factor of 20 between the 5th plan period (early 80s) and the 8th plan period (end of the 1990s). The interesting thing is that despite this dramatic growth in capacity, the 9th plan (1998-2002) did not mention natural gas in its list of energy concerns either in terms of demand- supply gap or in terms of price while both coal and oil were mentioned in both contexts. One possible reason could be that substitutes for natural gas to produce fertiliser and power such as naphtha and coal were available at competitive rates in this period. This raises the question as to what the natural state of natural gas in India is: is it one of scarcity that is underwritten by planning for excess capacity or is it one of abundance where the market not only produces more than enough to meet demand but also creates its own demand as Say’s law predicts. This leads to the 10th plan (2002-07) document which articulated the potential for natural gas in India and cautioned that unless imports in the form of LNG are pursued there would be shortages in the future.

The 10th plan was presumably influenced by the Hydrocarbon Vision 2025 document which sought to offer a future path for oil & gas in India. The Vision document was probably the first to report that there was ‘scarcity’ of gas as it observed that demand for natural gas was about 110 mmscmd in 1999-2000 against a supply of 65 mmscmd. But this observation has to be read with some caution as Dr Anil K Jain points out on his excellent book on natural gas in India. He observers that the demand for natural gas is often requirement of gas form planned capacities for power generation and fertiliser production which is not the same thing as market demand for natural gas. A further problem that Dr Jain points out is that is that demand-supply projections did not take into account the fact that potential supply was beginning to be influenced by market forces while ‘demand’ continued to be decided largely by committees. ‘Scarcity’ is bound to materialise when one end is influenced by the market and the other by plans.

In the 2000s the mindset of scarcity was temporarily replaced by the mindset of abundance based on projections of future gas production offered by the private sector. In this period, the gas linkage committee lost its relevance as Production Sharing Contracts were introduced in the context of the New Exploration and Licensing Policy. For a while it was presumed that contracts between willing sellers and buyers will decide the price of natural gas. The price in turn was thought to be the instrument that would balance demand with supply. Ironically the presumption of abundance gave rise to calls for bringing back the gas linkage committee. In 2009 industry veterans argued that if the gas linkage committee is not restored and additional gas based fertiliser and power capacities are not planned, supply will exceed demand and that the precious natural resource of the country will become ‘no man’s baby’. Essentially what they seemed to be saying was that unless ‘scarcity’ is restored the country will be destroyed by abundance. It is possible to dismiss this statement as a desperate call from the rent seeking constituency that has got used to cheap gas. Or use it to highlight the problem with socialist planning. However the question that is rarely asked in this context is whether the ‘market’ would have created gas consuming capacities as large as the one that the plans created. If these planned capacities are removed from the picture, the bottom falls out of the narrative of scarcity of gas on which the case for the ‘market’ rests. The presumed scenario of abundance did not materialise, at least within the country, and everything has reverted back to the mindset of ‘scarcity’ which the industry and the planners can live with. This is probably because we all know that but for the narrative of ‘scarcity’ that was unnaturally created by committees and their plans, there may not be an unnatural market for natural gas.

Views are those of the author

Author can be contacted at [email protected]

COAL

Is there a Coal Shortage?

Ashish Gupta, Observer Research Foundation

|

T |

here is a perception of coal shortages. It is reiterated in public forums, media reports and in debates on energy. Indeed there is some shortage but the extent and reality of the shortage is not understood. Expert minds keep on exaggerating the figure by showing growing import figures. Projections have been made by various agencies about the coal requirements for the next decade on the basis of thermal generating capacity planned. But they do not reveal how much new generating capacity will actually come online because many of the power plants are based on imported coal (eg Case 1 Bidding - Power Projects) where the responsibility of bringing coal lies with concerned company! Unfortunately these failures are projected as Coal India’s (CIL) failures. Most are pre-occupied with import figures without considering CIL stand on coal supply and demand positions. Projecting shortages based on numbers is easy but understanding the issue in a holistic way taking into account underlying structural and institutional factors is more difficult.

CIL got only one bidder for importing coal in its recent call. This is interesting in the context of presumed coal shortages. This also needs to be put in the perspective of power demand. Power plants having an aggregate capacity of 15,200 MW are shown to be reluctant to evacuate coal from CIL which has forced a revision of targets for the year 2013-14. It will be no surprise if CIL is criticised again for meeting yearly targets. Interestingly all these power plants prefer to pay the penalty rather than lift coal leading to excess coal stocks. Is this a case of coal shortage?

When most of the research agencies are showing how coal imports will increase in the future, CIL has come out with a different view that the rate of coal imports will come down substantially on account of economic slowdown. This does not mean that there will be no imports. There will be imports but this will be on account of the prevailing regulatory problems in the country. Since many of the power distribution companies are facing severe financial crunch, there will be low demand from them. There is no need for rocket science to predict this. CIL is correct but its position is not fancy enough to catch the imagination of the experts. That is why it did not find any space in the mass media. But the question remains whether these facts will be captured or we will find ways to show coal shortages?

There are other issues relating to coal shortages which are beyond the control of CIL. But these are structural problems that can only be corrected through administrative reforms.

There is another set of coal shortage problems which are institutional in nature and not captured by expert reports. One must not confuse the so called ‘coal mafia’ which works on extortions with the dedicated ‘diversion industry’ that operates in parallel. This is a separate industry all together! It is operated through a complete chain comprising of people having a vested interest in shortages. In such arrangements all parties are aware of what to do. They work under a formal mechanism though not in written form. They work collectively to create coal shortages on paper. The real idea behind this effort is to channelize coal to grey market especially to brick kilns owners and industrial consumers by procuring fake tapering linkages. It is highly remunerative as these consumers do not have specific linkages and are more willing to pay high price for coal.

This is not a surprise for a country like India where corruption is the norm in the natural resource sector. Coal is available but not utilised for energy security but for personal gains. These institutionalised shortages are very difficult to prove as how much coal is channelized thorough such arrangements cannot be estimated. If these institutionalised shortages along with ‘coal mafia’ created coal shortages can be eliminated, there will be no coal shortage and shortages will be limited to coking coal requirements. But if the dilemma persists, how can we root out the problem? The solution is reforms but unfortunately that is unlikely to happen in the coal sector! However this is a caveat for those experts who profit from promoting the shortage idea.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

Electricity Generation: Targets and Achievements

Akhilesh Sati, Observer Research Foundation

I) Targets for 2014-15 & 2013-14

Billon KWh

|

Sr. No. |

Fuels for Generation |

2014-15 |

2013-14 |

Growth (%) |

|

A |

Thermal |

|||

|

a |

COAL |

784.218 |

733.271 |

6.95 |

|

b |

LIGNITE |

33.337 |

33 |

1.02 |

|

c |

NAPTHA |

0.604 |

0.909 |

-33.55 |

|

d |

NATURAL GAS |

38.919 |

43.57 |

-10.67 |

|

e |

DIESEL |

1.525 |

1.987 |

-23.25 |

|

|

Total Thermal (a to e) |

858.603 |

812.737 |

5.64 |

|

B |

Nuclear |

35.3 |

35.2 |

0.28 |

|

C |

Hydro |

124.297 |

122.263 |

1.66 |

|

D |

Bhutan(Import) |

4.8 |

4.8 |

0 |

|

|

All India |

1023 |

975 |

4.92 |

II) Achievements for 2013-14

Note- Negative values in brackets denote Achievement is more than Target.

Unit = KWh

Source: Central Electricity Authority

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC, RIL, British Gas to abandon Tapti gas field

April 20, 2014. The Tapti field of the Panna-Mukta-Tapti consortium will be abandoned in a year's time by the consortium partners because of its wells' poor output. It will be the first offshore field to be abandoned in India. The field consortium partners are Oil and Natural Gas Corporation (ONGC) with 40 per cent stake and British Gas India and Reliance Industries Ltd (RIL) with 30 per cent stake each, respectively. The JV (joint venture) partners have submitted their proposal to the Ministry of Petroleum and Natural Gas for early abandonment of the field. The Panna and Mukta fields are primarily oilfields while Tapti is a gas field. These are located in the offshore Bombay basin. The production sharing contract for the fields was signed in 1994. While the Panna and Mukta fields began production in December 1994, the Tapti field began production in 1997-98. During FY2014, the Tapti field produced 0.28 million barrels of condensate and 27.3 billion cubic feet of natural gas, a decline of 48 per cent and 38 per cent respectively year-on-year.

The Panna and Mukta fields produced 7.4 million barrels of crude oil and 65.4 billion cubic feet of natural gas in FY2014, a decline of 9 per cent and 8 per cent respectively year-on-year. The decrease in production was due to a 17-day shutdown for field maintenance activities and commissioning of a new single-point mooring (SPM) system, coupled with natural decline. While gas from Panna-Mukta is sold at $5.73 per million metric British thermal unit (mmBtu), gas from Tapti is sold at $5.57 per mmBtu. The abandonment or decommissioning of the field would cost around $300-350 million and the filed would be abandoned by June 2015. (www.business-standard.com)

RIL divests Peru oil block stake

April 20, 2014. Reliance Industries Ltd (RIL) has divested its 30 per cent stake in an oil and gas block in Peru to Australia's Woodside Petroleum and Pluspetrol of Argentina to trim its overseas properties. RIL won two offshore exploration blocks (M17 and M18) in Myanmar. Dubai-based Reliance Exploration and Production (REP) DMCC was founded in 2007 and had steadily acquired 15 conventional oil and gas assets, including four in Peru, three in Yemen (one producing and two exploratory), two each in Oman, Kurdistan and Colombia and one each in East Timor and Australia. RIL has given up most of the blocks due to poor prospects. RIL had built up a presence in the Latin American nation of Peru in 2008. (economictimes.indiatimes.com)

RIL, HMEL plan refinery expansions

April 17, 2014. Reliance Industries Ltd (RIL) and HPCL-Mittal Energy Ltd (HMEL) have sought environment ministry approval for raising capacity of their plants. RIL, whose two plants at Jamnagar in Gujarat has installed capacity to process about 1.2 million barrels per day (bpd) oil, has the capability to turn the heaviest crude into value added products. RIL seeks to add a fifth crude train of 400,000 bpd, some polymer units and changing the fuel for 450 MW of an already approved 2100 MW power plant from gas to coal, the ministry said. The timings and the cost of expansion depend on getting the necessary government approvals, which may take months to years. The new train will also help Reliance in further diversifying its crude portfolio and processing some of the "dirtiest, heaviest and high acid crude". HMEL seeks to raise capacity of its existing 180,000 bpd Bathinda refinery in northern India to 225,000 bpd. (in.reuters.com)

Essar cuts gasoline output after fault at reformer

April 17, 2014. Indian refiner Essar Oil has reduced its gasoline output due to a technical problem at a continuous catalytic reformer (CCR). The problem at the reformer would not affect the crude runs at the plant. Essar operates a 900,000 tonne-per-year CCR at its 400,000 barrels-per-day Vadinar plant in Western India. A CCR converts naphtha into superior grade gasoline. Operations at the CCR were hit and Essar would have to shut the reformer completely in the next few days for maintenance. The refiner has deferred shipment of a 55,000-60,000 tonne 95-octane gasoline cargo that has been sold to BP. (economictimes.indiatimes.com)

Transportation / Trade

Gujarat gas to become Asia’s largest CGD player

April 21, 2014. Asia's next largest city gas distribution (CGD) player is likely to emerge from Gujarat soon. If the proposed consolidation of Gujarat Gas with GSPC Distribution Networks (GDNL), GSPC Gas, Gujarat Gas Financial Services (GFSL) and Gujarat Gas Trading Company (GTCL) gets cleared, the combined volume of the new entity could cross 8 million standard cubic metres a day (mscmd).

At present, China Resources Gas Group is the largest player in Asia in city gas distribution with a volume of 6 mscmd. GSPC Gas serves Piped Natural Gas (PNG) to households and Compressed Natural Gas for domestic transport as well as industries across 11 districts at a volume of 5.5 mscmd, Gujarat Gas does around 2.5 mscmd in two districts.

The new combined volume could also offer possibilities of backward integration for the company in terms of its own LNG terminal. Of their total individual volumes, while GSPC Gas serves 80% of the 5.5 mscmd to industries, Gujarat Gas serves around 75% of the 2.5 mscmd. (www.energysector.in)

Petronet invites bids to lease out LNG storage tanks at Kochi

April 21, 2014. Petronet LNG Ltd, the nation's biggest importer of liquid natural gas, has invited bids to lease out under-utilised storage tanks at its recently commissioned LNG import facility at Kochi in Kerala. The company operates the 5 million ton-a-year Kochi terminal at a sub-optimal 5 per cent of capacity because of a delay in laying of pipelines connecting the port to consumption centres in Karnataka and Tamil Nadu. To make Kochi an economically viable proposition, Petronet has invited bids to lease out two liquefied natural gas (LNG) storage tanks for two years.

Kochi LNG terminal has two LNG storage tanks of nearly 182,000 cubic meters gross capacity each and regasification facilities to regasify 5 million tons per annum LNG, Petronet said in the notice inviting tenders. Petronet plans to lease out a part of the storage capacity for a period of about two years initially at Kochi, the notice said.

It said the Kochi terminal has a jetty with berthing and back-up facility to safely handle LNG carriers from 65,000 cubic meters to 216,000 cubic meters capacity. The storage can be used by traders who want to import gas and resell it to customers or entities seeking to contract LNG for their own use. The facility is also useful for LNG suppliers, like those in the Middle East, who want to use Kochi as an intermittent storage point for supplying customers in the east. The Kochi storage can be used to store LNG during times of glut or low prices. Petronet also has a 10 million ton-a-year LNG import facility at Dahej, which it operates at more than installed capacity. (economictimes.indiatimes.com)

India cuts Iran oil imports nearly a fifth in 2013/14

April 17, 2014. India’s imports of Iranian crude tumbled about a fifth in the fiscal year ended in March, despite a surge of shipments in recent months that came after a deal easing sanctions on Tehran. The Geneva agreement struck between Iran and six world powers in November and implemented for six months from 20 January eased some restriction on Tehran’s oil trade in exchange for curbs to its nuclear programme. India, the world’s fourth-biggest oil consumer and Tehran’s top client after China, imported around 358,000 barrels per day (bpd) in the first quarter, up nearly 43% from a year ago, according to tanker arrival data. Even with the surge over the January-March quarter, India’s oil purchases in the year to 31 March dropped 16.5% to 222,000 bpd, the tanker data showed.

India and other clients of Iran, including China, Japan and South Korea, were forced to cut their oil imports after toughened sanctions were placed on Tehran in 2012. The measures cut Iran’s oil exports in half and slashed its revenues, and according to the West, were the primary reason the OPEC member agreed to curbs on its disputed nuclear programme. India had targeted at least a 15% cut in its imports from Iran to 220,000 bpd for the 2013/14 year. India’s shipments from Iran rose 45.6% from February to about 387,000 bpd, or more than twice the intake in March 2013, the tanker arrival data showed. Iran has been offering free shipping and discounts on crude sales to Indian refiners to boost its exports. Iran’s share of Indian crude imports dropped to about 5.7% in 2013/14, the tanker data showed. Iran accounted for about 16.4% of India’s oil import in 2008/09 and 7.3% a year ago. Iran is now India’s seventh largest crude supplier, down from sixth a year ago, the tanker data showed. Overall, India imported about 3.9 million bpd in the year ended 31 March, up about 6% from the previous fiscal year, the tanker arrival data showed. (www.livemint.com)

Policy / Performance

CAG seeks pending information on KG-D6 block

April 22, 2014. With Oil Ministry not responding to its requests for information on Reliance Industries' KG-D6 block, the Comptroller and Auditor General of India (CAG) has written a curt letter to it, reminding of the requisitions pending for months. CAG, which is doing an audit of Block KG-D6 for the years 2008-09 to 2011-12, on March 25 wrote to the ministry with a list of audit requisitions pending for upto 21 months. The ministry has not responded to "ambiguity" in fixation of gas price formula/basis for valuation of natural gas, performance of the flagging D1&D3 gas fields in KG-D6 and RIL not completing committed minimum work programme. The list includes CAG's request dated July 2, 2012 for information on award of contract for laying of a 1,395-km pipeline by Reliance Gas Transportation Infrastructure Ltd (RGTIL) for shipping KG-D6 gas from east coast to the west. Other pending requisitions include tripartite agreement entered into amongst the gas consumers, RGTIL and RIL for sale of KG-D6 gas, marketing margin charged by RIL, report of Goldman Sachs on global oil and gas finding and development cost and information on transportation of gas through RGTIL. Also, it requested for information relating to exploration activities in discovery area after July 2006 and information on upstream regulator DGH-prescribed discovery verification tests done on D-26, 30 and 31 gas finds in KG-D6 block. The ministry said CAG had sought some information which is completely out of its audit purview like cost and contracts for laying the East-West pipeline by RGTIL. RGTIL is not an affiliate of RIL and the government audit was concerned with cost incurred by RIL only uptil the landfall or delivery point of the gas which in KG-D6 gas is Kakinada in Andhra Pradesh. (economictimes.indiatimes.com)

DGH warns oil ministry against unilateral change in PSCs with cos like BHP Billiton

April 21, 2014. The Directorate General of Hydrocarbons (DGH) has cautioned the oil ministry against unilaterally amending contractual terms and warned it against penalising operators such as BHP Billiton and Eni for not completing committed exploration works for want of defence and space clearances. The government can't unilaterally amend production-sharing contracts (PSCs) for two blocks held by BHP Billiton in Mumbai offshore as the Australian explorer declined the defence ministry's conditional and limited access to these blocks. The government is demanding penalties worth millions of dollars from the contractor for not finishing the committed exploration works before it exits the blocks. DGH said the regulator would calculate penalty amounts only after the government takes a view on this matter. (economictimes.indiatimes.com)

PMO seeks status report on gas pricing

April 21, 2014. The Prime Minister's Office (PMO) has sought a status report from the Oil Ministry on issues around the implementation of the Cabinet decision to almost double natural gas rates. The Cabinet Committee on Economic Affairs (CCEA) had first on June 27, 2013, and then on December 19, 2013, decided to price all domestically produced natural gas, including unconventional fuels such as coal-bed methane and shale gas, at an average of international hub rates and the cost of importing LNG. The new price of USD 8.3 per million British thermal units was to be effective from April 1 but the Election Commission asked the government to defer the implementation until voting in the Lok Sabha polls ends on May 12. The PMO asked Oil Secretary Saurabh Chandra to present the latest status on issues surrounding implementation of the decisions. The new rate was applicable for domestic producers in both the public and private sectors. However, the CCEA decided that in the case of the D1&D3 gas fields in block KG-D6, where output has missed targets, operator RIL will have to provide a bank guarantee equivalent to the incremental revenue it will get from the new price. This surety would be encashed, depriving RIL of any incremental revenue, if it was proved that D1&D3 output dropped to one-tenth of the projected 80 million standard cubic meters per day because of RIL's wilful actions and not due to geological complexities. RIL, which holds 60 per cent interest in KG-D6 block, agreed to give the bank guarantees, paving the way for it to get higher prices. But the same could not be said about RIL's partners BP plc of UK and Canada's Niko Resources, which were not part of the legal case or arbitration over reasons for output lagging targets. The ministry felt that though the three companies are part of the consortium operating the KG-D6 block, they had executed contracts with the government and furnished performance guarantees in their individual capacities. It was felt that as per the CCEA mandate, the bank guarantee was to be taken only from the party in arbitration with the government, which is RIL. Since BP and Niko were not party to the arbitration, neither could a bank guarantee be taken from them nor could the new price be given to them. BP and Niko filed separate notices of arbitration, disputing the penalties proposed for KG-D6 output lagging targets. They have now become eligible to provide bank guarantees and get the higher gas price for their 30 per cent and 10 per cent stakes, respectively. All these will form inputs that Chandra will give to the PMO. (economictimes.indiatimes.com)

‘India needs multi-pronged approach to energy security’

April 18, 2014. India, the world's third largest oil importer, needs multi-pronged approach to addressing its energy security, Oil Secretary Saurabh Chandra has said. There is no single answer to the question of energy security, Chandra said at the International Symposium of Fuels & Lubricants, ISFL-2014, organised by Indian Oil Corporation (IOC). The Oil Secretary stressed on the need for a time-bound action plans for carrying out futuristic research to improve energy security in all sectors. The conference is held biennially to share the latest developments and forge new business relationships in the fuels and lubricant industry. Over 300 delegates from petroleum, automobile and allied industries as well as environmentalists attended the event. (economictimes.indiatimes.com)

Govt plans additional 30 pc charge on diesel vehicles

April 18, 2014. The government plans to impose an additional 30% environment compensation charge on diesel vehicles and is considering tightening the emission norms by mandating fuels compliant with Euro-IV norms by next year and Euro-V norms by 2016 while it is targeting Euro-VI norms by 2021. Supply of higher quality petrol and diesel require huge investments in upgradation of refineries that can be recovered by imposing a cess on auto fuels or by raising their retail prices. In December 2012, the government had constituted the committee, headed by Planning Commission, for preparing an 'Auto Fuel Vision and Policy 2025'. The committee will recommend an auto fuel quality road map for the next 10 years and will also suggest corresponding upgradation of vehicle engine technology. Most domestic refineries are producing Euro-III fuel while some refineries produce Euro-IV fuel to meet the demand of major cities and metros where sale of the higher grade fuel is mandatory. Refiners have already invested over INR 32,000 crore in upgrading their facilities for producing Euro-III and Euro-IV fuel. Most auto companies are preparing the road map to upgrade technology and products in line to meet the new emission norms and adapt to new fuel. In line with the auto fuel policy, harmful lead was phased out from 1 February, 2000 and the government simultaneously introduced Euro-IV grade auto fuels in certain metros and major towns by the end of 2010. (www.energysector.in)

AAP urges EC to stop govt from giving oil field to Essar

April 18, 2014. The Aam Aadmi Party (AAP) has sought Election Commission (EC)'s intervention to prevent the government from giving an oil field to the Essar group and renewing Reliance's contract for three gas basins saying these were major policy decisions and violation of the model code of conduct. The petroleum ministry had also moved a Cabinet note to allow Reliance to retain three oil fields with huge gas reserves. Bhushan, a member of AAP's political affairs committee, had alleged that the government was planning to give Ratna, a developed medium sized oil field off the Mumbai coast to the Essar group. He also said petroleum minister Veerappa Moily had moved a Cabinet note to hand over the oil field to the group 21 years after a decision to do so was taken during which the cost of the oil field increased several times. Handing over the oil field to the private group would mean losses of crores, he alleged. Bhushan alleged that Moily had also approached the Cabinet for relaxation in three gas basins D29, D30 and D31 to benefit RIL and wanted the EC to look into the case. (timesofindia.indiatimes.com)

Oil ministry seeks more time for Reliance Industries' gas finds

April 16, 2014. The oil ministry plans to seek the Cabinet's view on granting an extension to timelines for eight discoveries of Reliance Industries Ltd, which have not progressed because the company and the oil ministry have differed on the kind of test that should be conducted to confirm the finds. The dispute over the test and endless correspondence between the company and the government has delayed work on the project beyond the prescribed deadline. Government said the approval of the cabinet is necessary to allow work on the project after the expiry of deadlines prescribed in the contract. This is because the original contract, which has the deadline, was approved by the Cabinet Committee on Economic Affairs. The oil ministry had moved a cabinet note seeking extension for RIL. The oil ministry has suggested to the cabinet that the company should be given one more year for appraisal of the discovery and another year to prepare the development plan. Otherwise, the discovery area would have to be relinquished, but in that were to happen, it would be offered for bidding again, delaying the development of a proven field and also risking initiation of arbitration proceedings by the contractor. The contract requires relinquishment of the discovery and the related area if the contractor does not start production within 10 years from the first hydrocarbon find. At the heart of the dispute is the mandatory test required to evaluate the discovery. (economictimes.indiatimes.com)

POWER

Generation

Delhi has no gas for its power plants

April 18, 2014. While the demand for power is expected to go up to around 6,200 MW this peak summer, non-availability of natural gas is hampering production in power plants of the Capital. Of the city’s six power plants, four are gas-fired, two have been shutdown due to lack of gas and the remaining two are functioning at only a fraction of their capacity. The biggest of these, the 1,500 MW Bawana power plant, able to produce only up to 320 MW when fully functional, is in “shutdown” mode due to non-availability of gas. It has not been playing the crucial role it was supposed to in meeting the city’s power demand – which had touched a staggering 5,653 MW last summer. The Delhi Government’s failure to arrange a reliable source of fuel supply to the plant also poses a serious question on its ability to make power cheaper and affordable. Power discom said that instead of becoming a reliable option for cheap and affordable source of power generation, the Bawana plant has become more of a “liability” due to its erratic functioning and high cost of power generation. The three power distribution companies -- TPDDL, BYPL and BRPL -- have not been sourcing power from the Bawana plant this season because power from other plants is available at cheaper rates. However, if the Delhi Government is able to run the plant to its full capacity on a regular basis, the Bawana plant can emerge as a ‘reliable’ option for the Delhi discoms. Like the plant at Bawana, even the Tata Power-owned 108 MW plant in Rithala has become non-functional due to non-availability of gas. The proposed 750 MW power plant at Bamnauli has not materialised because the government is unable to arrange gas supply for it. (www.thehindu.com)

TAPS generated 28 pc of India's atomic power in 2013-14

April 16, 2014. Tarapur Atomic Power Station (TAPS) generated 28% of India's total nuclear energy production in the fiscal ended March 31. The total nuclear power generated in the country in the year under review was 35,333 MUs (million units). Of this, TAPS accounted for 9,884 MUs or 27.97%, Nuclear Power Corporation of India (NPCIL) said in a report. The PSU operates all atomic power facilities in the country. There was less than 1% increase in power generation from TAPS during the year as compared to the previous fiscal, the report said. Two Boiling Water Reactors (BWR) of 160 MWe capacity were commissioned at Tarapur on October 28, 1969, while one each of Pressurised Heavy Water Reactor (PHWR) 540 MWe started operation on September 12, 2005 and August 18, 2006. These four reactors have a total power generation capacity of 1,400 MWe. (www.business-standard.com)

Transmission / Distribution / Trade

CIL drops plans to enter shipping business

April 20, 2014. Coal India Ltd (CIL) has dropped its plan to enter the shipping business because of lack of demand for the fuel imported by the miner. Coal India, the world’s largest coal miner, had planned to form a partnership with Shipping Corp. of India Ltd to import coal. The development comes at a time when Coal India mined around 462.5 million tonnes (mt) against the production target of 482 mt in the last fiscal year because of muted demand for the fuel on account of unwillingness of state electricity boards (SEBs) to buy enough power. The production target for 2014-15 has been fixed at 507 mt. The coal miner had earlier also decided to drop its plans for an entry into fertilizers. It had planned to revive the Talcher unit of the Fertiliser Corp. of India involving an investment of around ` 8,000 crore. According to the memorandum of understanding signed in September 2013 by Fertiliser Corp. with Coal India, GAIL India Ltd and Rashtriya Chemicals and Fertilizers Ltd, Coal India was to supply around 5 mt per annum of coal for the project. Demand for coal in India is expected to rise from 649 mt a year now to 730 mt a year in 2016-17, but projected availability is only 550 mt a year. Coal requirement is estimated to hit 850 mt a year by the end of the 13th five-year plan (2017-22). However, analysts remain hopeful about the state-run miner’s prospects. The power sector is the biggest consumer of coal, absorbing 78% of local production. India’s bid to boost coal production has been hit by delayed and more stringent environmental approval processes. The process of allotting mines is also being questioned following allegations of preferential treatment and corruption, including during the period when Prime Minister Manmohan Singh was coal minister. Coal will continue to be the mainstay of India’s energy mix. (www.livemint.com)

PGCIL gets Stage-I forest nod for transmission line

April 17, 2014. Power Grid Corporation of India Ltd (PGCIL) has obtained Stage-I forest clearance from the Union ministry of environment & forests (MoEF) for diversion of 379.57 hectares (ha) forest land for building a transmission line in Odisha. The forest land is to be diverted in Angul, Athmallik, Rairakhol and Sambalpur to make way for PGCIL's transmission line that will connect its pooling station at Angul with that in Jharsuguda. The project includes construction of a 2 x 765 KV single circuit and double circuit line. (www.business-standard.com)

India, Bhutan ink preliminary pact for four hydropower projects

April 22, 2014. In a move that will strengthen the strategic partnership between India and Bhutan, the two countries have signed a preliminary pact for the joint construction of four hydropower projects in the landlocked country that is expected to generate 2,120 MW of electricity, the foreign ministry said. The agreement between Bhutan and India was signed in Thimphu. The largest of the four projects is the 770 MW Chamkarchu project; the others include the 600 MW Kholongchu hydel power project, the 180 MW Bunakha project and the 570 MW Wangchu hydel project. Three hydroelectric projects totalling 1,416 MW, which includes the 336 MW Chukha project, the 60 MW Kurichu project, and the 1,020 MW Tala project, are already operational in Bhutan and are supplying electricity to India, according to the Indian foreign ministry. Three others totalling 2,940 MW, which include the 1,200 MW Punatsangchu-I, the 1,020 MW Punatsangchu-II and the 720 MW Mangdehchu project that are under construction, and are scheduled to be commissioned by 2018, the foreign ministry said. (www.livemint.com)

Assam CM orders APDCL to meet shortfall of power

April 21, 2014. Assam Chief Minister (CM) Tarun Gogoi reviewed the prevailing power situation and directed Assam Power Distribution Company Limited (APDCL) to take immediate steps to meet the shortfall of power. APDCL Chairman Rajiv Yadav apprised the Chief Minister that due to drought-like conditions prevailing in the North East, Assam was not receiving adequate power from the hydro power generating stations of Ranganadi, Kopili, Khandong, Doyang, Loktak and others due to low water level in the reservoirs. This has created a shortfall of about 275 MW with the state now mostly dependent on thermal stations at Kathalguri, Palatana, Ramachandranagar, Namrup and Lakwa. APDCL is trying to meet the huge shortfall by procuring 300 MW from outside the region and the power position was likely to improve with rainfall in the area and further production of gas, Yadav said. (economictimes.indiatimes.com)

Odisha may reject Vedanta's plea to use IPP power for smelter

April 21, 2014. The Odisha government is unlikely to consider the plea of Vedanta Aluminium Ltd (VAL) to use power generated by Sterlite Energy Ltd, also a Vedanta Group firm, to run its smelter complex at Jharsuguda. The company had argued that since Odisha had turned power surplus, sparing 600 MW out of Sterlite's 2400 MW (4x600) coal-fired station could come to the rescue of its smelter lying idle for want of power. The state grid is currently getting 400-450 MW from Sterlite's 2400 MW plant and acceding to VAL's request would cut supply by 50 per cent. (www.business-standard.com)

Completed power plants to get assured supply from Coal India

April 21, 2014. Power plants, at least 30 of them, which do not have a firm coal supply assurance and are ready to be commissioned, will be given the commodity by Coal India, according to a government panel's decision. Coal will be diverted to these plants from old projects that have firm assurances of supply but not been able to meet their commissioning deadline or have not been able to sign power purchase agreements with utilities. The decision was taken recently at a meeting of the Linkage Committee, a panel that decides on coal allocation to power plants. The capacity of the first 15 projects totals about 12.64 MW, requiring some 58 million tonnes of coal, according to the commission. They will be operational this year, well within its original deadlines. There are some 60,000 MW worth of projects that received firm assurances during 2013-14 from Coal India. According to the ministry of power, a few of these projects either do not have the required power purchase agreement or have failed to meet deadline and are beyond schedule. Coal meant for these projects will now be offered to the projects that have already met their target of commissioning. The ministry has decided to reprioritise the entire list of these 60,000 MW as well as the new set of projects that will come on stream this year. There is also another list of 15 projects of 10,765 MW capacity that have been given ad-hoc coal supply assurances through tapering linkage. A tapering linkage is the contract to supply coal to companies that have also been offered coal blocks. The volume of coal supplied will reduce each year as the company's own coal mines starts to produce. (economictimes.indiatimes.com)

NTPC frames new policy to weed out unprofessional vendors

April 20, 2014. Country's largest power producer National Thermal Power Corporation (NTPC), which does ` 50,000-crore worth public procurements every year, has put in place a detailed policy on banning business dealings involving unprofessional and frivolous vendors. The new policy, introduced last month, comes against the backdrop of instances of projects getting adversely impacted due to unprofessional approach of some vendors. The state-run company, which contributes nearly 30 per cent of the country's overall electricity generation, has now put in place a detailed set of guidelines for withholding as well as banning business dealings that involve non-performing and frivolous vendors. Under the 'Policy & Procedure for Banning of Business Dealings', an agency could be banned on various grounds, including instances where it "employs a public servant dismissed/removed or employs a person convicted for an offence involving corruption or abatement of such offences". Besides, an agency could face ban if its proprietor has been guilty of malpractices such as bribery, corruption and fraud. In all other cases, the ban would be deemed to have been automatically revoked on the expiry of the specified period. According to NTPC, the policy would act as a deterrent against fraud, corruption and unethical practices, and non-performance by the agencies. In 2013 alone, NTPC has banned or suspended business dealings with about seven entities. NTPC has an installed electricity generation capacity of 43,019 MW. (economictimes.indiatimes.com)

High-voltage action likely in energy sector if Modi becomes next PM

April 18, 2014. The energy sector can brace for high-voltage action if Narendra Modi becomes Prime Minister (PM). The energetic BJP leader has ruled the state that has India's biggest refineries, highest gas consumption, two LNG terminals and volatile relations with public sector giants GAIL India, ONGC and Coal India - making many in these companies nervous. With poll surveys pointing to a BJP victory, officials in Gujarat are already relishing the prospects of the state's energy companies under Modi. Gujarat's energy minister Saurabh Patel, a strong critic of the UPA government in issues related to the state, said New Delhi has been biased. Modi would like to change the outlook of state firms towards Gujarat and some of its companies. The state even came up with the Gujarat Gas Act to control gas transmission, supply and distribution but this was quashed by the Supreme Court, which said this was a Central subject. Gujarat has many scores to settle with the Centre. It claims injustice in coal allocation and step-motherly treatment towards the state in investment decisions by state firms such as NTPC and NHPC. (economictimes.indiatimes.com)

Commissioning of NTPC's Koldam project may get delayed

April 17, 2014. Commissioning of state-run NTPC's 800 MW Koldam project may get delayed by an year as the repair work at the site is expected to take more time than earlier projected. The company, which started the process of filling up of the reservoir, could not complete the exercise as the reservoir was unable to hold water for the project. According to the company, the work will be delayed and the project commissioning may be postponed by at least an year from its earlier schedule of April 2014. The project will supply electricity to Delhi, Haryana, Punjab, Rajasthan, Uttar Pradesh, Himachal Pradesh, Jammu & Kashmir and Chandigarh.

Koldam has an installed capacity of 800 MW, comprising four units of 200 MW each. The company is also executing three more hydel plants - Tapovan Vishnugad (520 MW) and Lata Tapovan (171 MW) in Uttarakhand and Singrauli Small Hydro Project (8 MW) in Uttar Pradesh. At present, NTPC generates 43,019 MW of electricity and plans to add 14,000 MW in the current plan period (2012-17). (economictimes.indiatimes.com)

MSERC approves 15 pc hike in power tariff in Meghalaya

April 17, 2014. The Meghalaya State Electricity Regulatory Commission (MSERC) has approved a 15 per cent hike in power tariffs, rejecting the state government's proposal for a whopping 89 per cent increase in electricity rates. The Commission has also approved a 13 per cent hike of power tariff of around 2.5 lakh domestic consumers while the tariff for 20,000 odd commercial consumers and 158 industrial consumers have been hiked by about 15 per cent. The power tariff for around 60,000 BPL consumers (Kutir Jyoti metered consumers) has been raised the least with the Commission approving only 12 per cent hike, MSERC said. The approved increase in power tariff will be effective from April 1, 2014 till March 31, 2015. The Meghalaya Public Distribution Corporation Ltd (MePDCL) had proposed an increase of 89 per cent in a tariff petition filed before the Commission for 2014-15 to meet skyrocketing purchase and transmission cost of power, projected over ` 600 crore for the current fiscal. According to the Commission, the fixed power charge for domestic consumers has been raised to ` 40 per KW per month from the existing ` 35 while the fixed power charge for commercial consumers has been hiked by ` 10 per KW per month from the existing tariff of ` 70 per KW. The commercial consumers will have to shell ` 5 per unit as against the previous charge of ` 4.5. The approved charges would entitle the state-owned power company to charge ` 2.9 for the first 100 units from the existing ` 2.60. The energy charge for the next 100 units has been raised to ` 3.40 from the existing Rs 3 and energy charge above 200 units has been raised to ` 4.40 from ` 3.75, MSERC said. The new tariff would however be lesser than neighbouring state like Assam (Rs 3.58-Rs 6.15 a unit), West Bengal (` 3.75-` 6.9) and Tripura (` 4.11-` 7.96 per unit). The Commission has also approved the annual revenue of the Meghalaya Power Distribution Corporation Limited (MePDCL) at ` 618 crore with an approved loss level of about 24 per cent. The total power purchase cost of MePDCL is expected to be ` 489 crore for the current financial year alone and it was estimated that ` 4.7 a unit of revenue will be required to meet the power purchase cost itself, the state-owned discom said. (www.business-standard.com)

INTERNATIONAL

OIL & GAS

Upstream

PetroChina aims to produce 92 Bcf of shale gas in 2015

April 22, 2014. PetroChina Company Ltd., China's largest oil and gas production firm, intends to produce 91.8079 billion cubic feet (Bcf) or 2.6 billion cubic meters (Bcm) of shale gas in 2015, the company said. The supplies will come from the Changning and Weiyuan blocks in the country's southwest Sichuan province, with each producing 35.31 Bcf (1 Bcm) of shale gas, while the Zhaotong block in Yunnan province will produce 17.66 Bcf (0.5 Bcm). PetroChina, which has 10 shale gas wells in operation or under construction currently, plans to have 164 in 2015, and the firm intends to produce 388.42 Bcf (11 Bcm) of shale gas in 2020. (www.rigzone.com)

Genel on track for 60k-70k barrels per day in 2014

April 22, 2014. Middle East and Africa-focused independent Genel Energy reported that its 2014 production and revenue guidance remains unchanged at between 60,000 and 70,000 barrels of oil equivalent per day and between $500 million and $600 million. Genel said that net working interest production for the first quarter averaged 50,000 barrels of oil per day (bopd), representing an increase of 35 percent on the first quarter of 2013. The firm's Taq Taq and Tawke fields in Iraqi Kurdistan averaged 81,000 bopd and 57,000 bopd respectively. Genel said that production and revenues are expected to increase over the course of 2014 as Kurdistan's oil pipeline system comes into operation. At the Taq Taq field the construction of a second central processing facility is progressing and is on track for completion around the end of this year, Genel said. The drilling of the first deviated and horizontal wells on the field will follow completion of the Taq Taq Deep exploration well – where a testing program on Jurassic and Triassic reservoirs is now in progress. Genel said that, during the first quarter of the year, two additional horizontal development wells were completed at the Tawke field and brought on stream at a combined rate of 37,000 bopd. The operator of the field, DNO International, has outlined plans to increase field processing capacity from 100,000 bopd to 200,000 bopd by the end of 2014. (www.rigzone.com)

Eni, Ukraine agree on need to increase gas production

April 17, 2014. Italian oil and gas major Eni said its outgoing chief executive met Ukraine's energy minister and they agreed on the need to increase gas production in the country, which is at the centre of escalating tensions with Russia. Eni is the biggest European gas client of Russian enegry giant Gazprom. Eni has been present in Ukraine since 2011 with two licences located in the Dnieper-Donets basin. In 2012, it acquired a 50 percent stake and the operatorship in LLC Westgasinvest, the company that currently owns the rights of nine areas of unconventional gas in western Ukraine, for a total of about 3,800 square km. (www.rigzone.com)

Shell finds gas at Rosmari-1 well in SK318 offshore Malaysia

April 17, 2014. Royal Dutch Shell plc announced that the company has made a gas discovery at the deepwater Rosmari-1 exploration well in Block SK318, offshore Sarawak, Malaysia. The Rosmari-1 well, located 84 miles (135 kilometers) and drilled to a total depth of 6,965 feet (2,123 meters), encountered more than 1,476 feet (450 meters) of gas column. More exploration drilling is planned, with the discovery a positive indicator of the gas potential in an area of strategic interest for Shell. Shell operates Block SK318 with an 85 percent interest, with Petronas Carigali Sdn Bhd - the upstream subsidiary of Malaysia's national oil company Petroliam Nasional Berhad - holding the remainder 15 percent. (www.rigzone.com)

Anadarko joins ad blitz to thwart Colorado fracking curbs

April 16, 2014. Anadarko Petroleum Corp. and Noble Energy Inc., Colorado’s largest oil producers, are waging a media campaign to promote the benefits of hydraulic fracturing as residents push statewide measures to restrict the drilling technique as a threat to the environment. State officials will review at least 10 oil and natural-gas measures to see if they qualify for petition drives that could put them on the November ballot. The proposals would allow communities to prohibit fracking or require more distance between wells and residences. To blunt that, Anadarko and Noble are buying ads after their Coloradans for Responsible Energy Development spent $1 million on television time in the fourth quarter, according to New York-based Nielsen Media Research. They’ve produced six TV commercials, two special sections in the state’s largest newspaper and paid for radio ads and websites. The fracking debate has gained momentum as drilling moved closer to homes, raising concerns about air and water contamination and even earthquakes. Ohio will require seismic monitors for fracking in some areas after a series of temblors. More than 400 communities from California to New York have passed measures against fracking, according to Food and Water Watch, a Washington-based advocacy group. That includes five in once energy-friendly Colorado, representing about one in 10 of the state’s residents. Anadarko and Noble, which collaborated with the Environmental Defense Fund to develop groundbreaking controls on emissions from oil and natural-gas operations in Colorado, are attempting to hold back discontent with fracking by spending millions on outreach. Ensuring access to Colorado’s resources is just part of the worldwide strategy for the companies. Anadarko, the third-largest U.S. independent oil and gas producer, freed itself to pursue global ambitions with a $5 billion settlement of a pollution case. Noble, a $25 billion company, is developing prospects from the Midwest to Africa. (www.bloomberg.com)

Transportation / Trade

Keystone route ruling should be overturned, Nebraska says

April 22, 2014. A court challenge holding up TransCanada Corp.’s Keystone XL pipeline should be dismissed, Nebraska’s governor Dave Heineman said. The case is delaying the Obama administration’s review of the project. Nebraska Governor asked the state’s top court to throw out a trial judge’s ruling that the route for the pipeline was approved without proper authority. The court may not hear the case until at least September and may not rule until after mid-presidential term congressional elections in November. TransCanada is awaiting a U.S. permit to build the northern leg of Keystone XL, which would supply U.S. Gulf Coast refineries with crude from Alberta’s oil sands. Because it crosses an international boundary, the proposal requires U.S. State Department approval. Based in Calgary, TransCanada is seeking to build the 830,000 barrel-a-day, 1,179-mile (1,897-kilometer) conduit running from Hardisty, Alberta, to Steele City, Nebraska, where it would connect to an existing network. (www.bloomberg.com)

Summit connects transmission pipeline to Maine communities in US

April 22, 2014. Summit Natural Gas has made final connection for the 68-mile steel backbone transmission pipeline from Pittston to Madison that will eventually distribute natural gas to 17 central Maine communities. The completed transmission pipeline is part of Summit Natural Gas' natural gas infrastructure being built in the Kennebec Valley while the steel pipeline provides the backbone for the planned build out of a distribution pipeline system which is being installed. With phase 1 complete, the Summit pipeline is conned to residential customers in Augusta, Fairfield, Gardiner, Hallowell, Randolph and Waterville and are using natural gas. The company is planning to install 85 miles of additional distribution pipeline in the Kennebec Valley region as well as 66 miles in the towns of Cumberland, Falmouth and Yarmouth in 2014. (transportationandstorage.energy-business-review.com)

Rosneft to sell 2 mt of oil to BP for up to $1.5 bn

April 21, 2014. The board of Russia's top oil producer, Rosneft, has approved deals to sell more than 2 million tonnes (mt) of crude oil, worth more than $1.5 billion, to BP, the Kremlin-controlled company said. Rosneft announced deals worth more than $15 billion to sell its crude oil and products to BP, a related party that owns almost a fifth of the state-controlled oil company. It said the board approved plans to sell up to 840,000 tonnes of crude oil to BP for up to $638.4 million under free-on-board Novorossiisk terms. (www.reuters.com)

Japan’s push for gas exchange to face pipeline-network hurdle

April 21, 2014. Japan’s effort to set up a natural gas exchange may be hampered by the lack of a pipeline network across the country, according to a government subcommittee. Japan is considering setting up the exchange as part of measures to deregulate the country’s retail gas market amid surging fossil fuel import costs and nuclear reactor shutdowns. A subcommittee of Japan’s Ministry of Economy, Trade and Industry (METI) will start discussions in coming months about the feasibility of a wholesale exchange. Gas-fired power replaced nuclear energy as Japan’s main source of electricity after an earthquake and tsunami struck the Fukushima Dai-Ichi atomic plant in March 2011. Japan, the world’s largest buyer of liquefied natural gas, spent 7.06 trillion yen ($68.8 billion) to import a record 87.5 million metric tons of LNG in 2013, compared with 3.47 trillion yen in 2010, the year before the disaster in the country’s northeast prompted it to shut all its nuclear reactors. Construction costs for new pipelines to connect networks between Japan’s major cities and associated storage facilities are estimated at as much as 1.96 trillion yen ($19.2 billion), an advisory panel of the trade and industry ministry said in a June 2012 report. Mountainous terrain in the Honshu region and the country’s susceptibility to earthquakes make it difficult to connect its gas pipelines. About 42 percent of Japan’s 127 million people live in cities such as Tokyo, Osaka and Nagoya on Honshu, the biggest Japanese island. METI is seeking a way to price traded gas and its derivatives. The country’s long-term LNG purchase contracts, usually running for more than 10 years, are typically linked to the cost of Brent oil or a basket of prices known as the Japan Crude Cocktail. The country is considering three gas exchanges to serve Tokyo, Chubu and Kansai. (www.bloomberg.com)

Fracking sand spurs grain-like silos for rail transport

April 17, 2014. The U.S. shale oil boom is putting millions of tons of sand onto North American railroads, enabling carriers to pack trains full instead of hauling just a handful of cars at a time. With help from Union Pacific Corp. and Warren Buffett’s BNSF Railway Co., the sleepy silica sand industry that once mostly supplied glassmakers now ships more than 20 million tons of the material a year. Buyers including Halliburton Co. and Schlumberger Ltd. use the sand in hydraulic fracturing at oil fields in Texas and North Dakota. Miners such as Emerge Energy Services LP, U.S. Silica Holdings Inc. and Hi-Crush Partners LP are taking a page from the grain industry’s playbook to deliver sand faster and cheaper. They’re building facilities at their mines to load unit trains, which move just one type of cargo, and near oil fields to empty them. For decades, sand-mining companies catered mostly to glassmakers that sent a few rail cars, said Shearer, whose company was created in 2012 by combining Superior Silica Sands with two energy-service firms. Now, with fracking helping drive oil output, Emerge fills trains pulling 100 cars on newly laid track from shiny metal silos. Unit trains will move about 25 percent of sand sent to oil and gas users this year, a fivefold surge from 2013, and the share could rise to 50 percent in the future, according to U.S. Silica. Union Pacific and BNSF, the two major carriers in the western U.S., are poised to benefit from shale-oil production in the region and sand mines in Wisconsin, Illinois and Minnesota. U.S. frac-sand shipments jumped more than fourfold to 20.9 million tons in 2012 from 4.9 million tons in 2007, according to Freedonia Group, a Cleveland-based market researcher. Demand is expected to more than double to 52.1 million tons by 2022, Freedonia said. (www.bloomberg.com)

Brazil increases natural gas imports from Bolivia to restart power plant

April 17, 2014. Brazil's Petrobras has signed a short-term contract with Bolivian counterpart YPFB to increase natural gas imports from the Andean nation, Petrobras said. Under terms of the contract, Petrobras will import an additional 2.24 million cubic meters/day of natural gas from Bolivia through August 30, the company said. The natural gas will be supplied through the Bolivia-Mato Grosso Gas Pipeline. Petrobras currently imports 30 million cu m/d of gas from its western neighbor. That volume of natural gas is shipped to Brazil via the Bolivia-Brazil Gas Pipeline, or Gasbol. The additional natural gas will be used to fuel a gas-fired power plant at Cuiaba in Mato Grosso state. The plant has been idled since March 27, when a previous natural gas supply contract ended, Petrobras said. (www.platts.com)

Canada-Japan LNG joint venture cleared for exports

April 16, 2014. Canadian regulators approved a 25-year liquefied natural gas export license for the Triton LNG project backed by AltaGas Ltd and Japan's Idemitsu Kosan Co, the latest in a number of planned liquefaction proposals for Canada's West Coast to receive the clearance. The National Energy Board said the Triton Project has been approved to liquefy and ship about 320 million cubic feet a day from a planned floating LNG facility whose site has not yet been chosen. The approval is the latest for the nascent industry, following applications from other would-be projects such as the Kitimat LNG plant planned by Chevron Corp and Apache Corp. The projects are looking to take gas from Western Canada's massive shale fields to high-paying Asian markets, though none have yet been approved by their backers. Eight planned LNG facilities have now been granted export licenses. (www.downstreamtoday.com)

Petrobras, Mitsui to study LNG import terminal in Brazil's south

April 16, 2014. Brazil's state-run oil company Petroleo Brasileiro SA and Japanese trading house Mitsui Corp will study building a liquefied natural gas (LNG) terminal in the country's southernmost state, Rio Grande do Sul, to supply more fuel for local manufacturers and power generators. Petrobras announced the plan after signing a memorandum of understanding on the project with Mitsui and the government of Rio Grande do Sul. Petrobras, Mitsui and the government have 12 months to conclude their work. (www.downstreamtoday.com)

Policy / Performance

Oman fights Saudi bid for Gulf hegemony with Iran pipe plan

April 22, 2014. Oman’s plan to build a $1 billion natural-gas pipeline from Iran is the latest sign that Saudi Arabia is failing to bind its smaller Gulf neighbors into a tighter bloc united in hostility to the Islamic Republic. The accord was signed during Iranian President Hassan Rouhani’s visit to Oman last month, and marks the first such deal between Iran and a Gulf Cooperation Council state in more than a decade. Oman is in good standing with the U.S. too: a $2.1 billion purchase of air-defense systems from Raytheon Inc. was announced during a visit by Secretary of State John Kerry last year. Oman, led by 73-year-old Sultan Qaboos Bin Said Al-Said, hosted secret talks between the U.S. and Iran in the run-up to November’s Geneva agreement, Foreign Minister Yusuf Bin Alawi Bin Abdullah said. Saudi Arabia’s oil reserves and population exceed the combined total of the Gulf Cooperation Council’s other five members, yet it has struggled to impose policy on its smaller neighbors. Some are uncomfortable with Saudi opposition to changes in the region including the U.S.-Iranian thaw and the rise of political Islam. (www.bloomberg.com)

Indonesia LPG demand seen up 7 pc this year - Pertamina

April 21, 2014. Indonesian energy firm, Pertamina, expects domestic demand for liquefied petroleum gas (LPG) to rise to 6.1 million tonnes this year, up 7 percent from 2013, as the government seeks to move away from costly kerosene. A government programme to encourage Indonesians to buy 3-kg LPG canisters instead of kerosene has helped drive demand, Pertamina said. Around 60 percent of Indonesia's LPG consumption would be met through imports this year, up from 59 percent in 2013, Pertamina said. (www.downstreamtoday.com)

Petronas eyes Brazil, Russia, India and China for E&P Growth

April 21, 2014. Malaysia's state-owned Petroliam Nasional Bhd (Petronas) is interested to expand its business into the energy, including oil and gas, sector in Brazil, Russia, India and China (BRICS). Petronas already has oil and gas businesses in South Africa and China, and aims to be a major player in the exploration and production (E&P) sector in the two countries, the source said. The Malaysian national oil company is also seeking opportunities in the energy sector in India, albeit cautiously. (www.rigzone.com)

Bulgarian minister makes passionate case for South Stream pipeline

April 17, 2014. Russia's South Stream pipeline project must not be blocked for political reasons and Bulgaria plans to start construction this year despite the standoff between the West andMoscow over Ukraine, Bulgaria's energy minister said. The future of the 2,400-kilometre (1,490-mile) pipeline from Russia via the Black Sea to southern Europe, avoiding Ukraine, has been cast into doubt since Russia's annexation of Ukraine's Crimea region. (www.downstreamtoday.com)

Radioactive waste booms with fracking as new rules mulled

April 16, 2014. Oilfields are spinning off thousands of tons of low-level radioactive trash as the U.S. drilling boom leads to a surge in illegal dumping and states debate how much landfills can safely take. State regulators are caught between environmental and public health groups demanding more regulation and the industry, which says it’s already taking proper precautions. As scientists debate the impact of small amounts of radiation on cancer risks, the U.S. Environmental Protection Agency says there’s not enough evidence to say what level is safe. Left to police the waste, state governments are increasing their scrutiny of well operators. Pennsylvania and West Virginia are revising limits for acceptable radiation levels and strengthening disposal rules. North Dakota’s doing the same, after finding piles of garbage bags filled with radioactive debris in an abandoned building this year. The waste is a byproduct of the drilling renaissance that has brought U.S. oil and natural gas production to its highest levels in three decades -- while also unlocking naturally occurring radium from rock formations far underground. (www.bloomberg.com)

Restart of Libya’s oil output hard to predict: Oil Minister

April 16, 2014. Libya's Oil Minister Omar Shakmak said there was no clear timetable for the resumption of steady oil output as an end to the stand-off with rebels could still falter and the 9-month port shutdown may have damaged some facilities. A tanker started loading crude at Libya's eastern port of Hariga for the first time since July - the first positive signal of an end to the four-port blockade by an eastern federalist group led by Ibrahim al-Jathran. But Tripoli still faces many hurdles to get the bulk of its oil back online. Negotiations to free the country's largest oil terminals are still on-going and a second port that was due to re-open after the agreement is still under Jathran's control. (www.rigzone.com)

POWER

Russia to build two nuclear power plants in Iran

April 22, 2014. Russia has signed a protocol to build two new nuclear power plants in Iran, according to Behruz Kamalvandi, deputy head of the Atomic Energy Organization of Iran. He noted that Iran was negotiating nuclear power plant construction with European and Asian countries. Ali Akbar Salehi, head of the Atomic Energy Organization of Iran, said that Iran had a contract signed with Russia in 1992 to build four more nuclear power plants. The second power plant construction will start in 2014. The Russian State Corporation for Nuclear Energy said earlier that Tehran and Moscow were negotiating construction of the second energy block at the Bushehr nuclear power plant. (vestnikkavkaza.net)

Transcorp to raise $1 bn to build power plants

April 19, 2014. Transnational Corporation of Nigeria Plc (Transcorp), which has interests in industries ranging from agriculture to oil, plans to raise as much as $1 billion to build power plants as it seeks to triple profit in 2014. The Federal Government sold control of 14 power companies to new owners last year including Siemens AG, Korea Electric Power Corp. and Transcorp to attract private investment to reduce blackouts. Transcorp bought the Ughelli gas plant and plans to boost its output to 700 MW. An increase in power generation capacity will help treble pretax profit to N30 billion ($185 million) this year. (businessdayonline.com)

Azerbaijan’s power generation at HPPs falls but makes up 4.1 pc of total power generation

April 17, 2014. The State Statistics Committee reports that the hydropower plant crisis which started in Azerbaijan in 2012 has weakened to the certain extent. The Committee informs that power generation at hydroelectric power plants (HPPs) reached only 247.6 million kWh for Jan-Mar 2014. Though it was by 8.6% higher than that for Jan-Mar 2013, the share of hydropower that reached 6.63% of total electricity generation in 2013, kept for the reported term 4.1%. At that, in January HPPs generated 74.2 million kWh of power, in February power generation dropped to 66.8 million kWh, and in March totaled 106.6 million kWh. (abc.az)

Iran’s hydroelectric power generation capacity rises 16 pc

April 17, 2014. The power generation capacity of Iran's hydroelectric power plants has increased by 16 percent. Iran's hydroelectric power plants generated 14.6 billion kilowatt hours of electricity in the past Iranian calendar year, which ended on March 20, which is a 16 pc rise year on year. The maximum output of the hydroelectric power plant was related to July 24, 2013, which hit 100,000 MW. The efficiency of Iran's hydroelectric power plants increased by 24 percent in the first half of the past Iranian calendar year. (www.azernews.az)

Zambia signs energy sector agreement for Itezhi Tezhi power generation project

April 16, 2014. The African Development Bank (AfDB), with the Dutch Development Bank FMO, the Development Bank of Southern Africa (DBSA) and Propaco of France signed a USD142 million loan to develop the 120 MW Itezhi Tezhi power project. It is the first public-private partnership energy project in Zambia and is being developed jointly by TATA Africa and ZESCO Limited as an independent power producer, and the Itezhi Tezhi Power Company. (allafrica.com)

Transmission / Distribution / Trade

JICA plans to send a power survey team to Islamabad by July

April 22, 2014. Motoo Taki, Senior Representative of Japan International Cooperation Agency (JICA) Pakistan office said that Transmission and distribution losses are playing a key role in the current power shortage crises being faced by Pakistan since past few years. He disclosed that by July JICA is planning to send a preliminary survey team to Pakistan. He stressed that by enhancing the skills of engineers from National Transmission and Dispatch Company and various distribution companies these transmission and distribution losses could be overcome that will lead towards a significant move to meet the energy crises. He explained that JICA may send preliminary survey team in July for that purpose. Yoshihiro Ozaki, representative in charge of power sector at JICA Pakistan, reiterated JICA will continuously support solution for the serious power crisis in Pakistan. Ozaki referred to the National Energy Policy 2013 and explained JICA’s stance and endeavors for a brighter and prosperous Pakistan, aligning current government effort. During the workshop, the Technical Service Group (TSG) and Asia Engineering Consulting Co Ltd (AEC) presented details regarding current progress, lessons learned and impact generated from the technical cooperation project. Speaker emphasized that Pakistan is facing severe power shortage and one of the reasons is high transmission/distribution loss. (www.dailytimes.com.pk)

PPL Electric Utilities files new electricity purchase plan for default customers

April 21, 2014. PPL Electric Utilities has filed a plan to purchase electricity for default customers with the Pennsylvania Public Utility Commission. Default customers do not choose to buy generation supply and transmission service from a competitive electricity supplier. Under the projected plan, effective 1 June 2015 through 31 May 2017, the price to compare would be updated twice a year in order to provide customers more certainty around shopping and provide retail suppliers with more time and flexibility in creating pricing programs for customers. Currently, PPL Electric Utilities updates its price to compare on a quarterly basis every year. In addition to continuing to buy electricity for non-shopping customers twice a year, the company would continue to solicit a portfolio of laddered contracts, as part of proposed plan. The contracts include a prudent mixture of short-term (under 12 months) and long-term (one year or longer) contracts and spot market purchases. The plan is due to be reviewed and approved by the PUC while the decision is likely to be announced in early 2015. (utilitiesretail.energy-business-review.com)

Kenya Power eyes fibreglass poles to lower electricity transmission costs

April 18, 2014. Kenya Power plans to roll-out fibreglass poles in place of wooden poles, to reduce the cost of maintenance. Despite the fibreglass poles being more expensive than current alternatives, they have a life span of more than 80 years, while wooden poles survive for 25 years on average. The new technology means the electricity transmission company would fast-track connections to household since the fibreglass poles are quicker to make as opposed to timber which needs years to mature. Besides, the poles are impervious to rot, pests and require zero maintenance, which will have positive impact on electricity supply costs. Kenya Power said the poles will complement the on-going process to partly replace wooden poles with concrete poles which began in 2011, as a strategy to connect more households at a cheaper cost. (www.biztechafrica.com)

NGCP to replace Panay Island transmission line

April 16, 2014. The National Grid Corp of the Philippines (NGCP) will soon replace the Panit-an-Nabas transmission line, one of the power facilities that sustained heavy damage during the onslaught of Typhoon Yolanda last November. The company will build new towers to replace the 132 structures of the 138-kilovolt (kV) transmission line. The said transmission line, which traverses the provinces of Capiz and Aklan on Panay Island, was one of the worst hit facilities of NGCP when Yolanda made landfall. (www.interaksyon.com)

Potomac Edison rebuilds 500kV transmission line in US