-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY/CLIMATE CHANGE: IPCC AR5: One More Step for Dialectic Reasoning?

Ø ENERGY/CLIMATE CHANGE: Climate Change and India: Morality does begin at Home!

DATA INSIGHT

Ø Modes of Transport of Crude Oil & Petroleum Products

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC, RIL to appoint joint expert to resolve gas dispute

· Oil India said to study purchase of Shell’s Nigerian blocks

· Vedanta full-year oil and gas output rises

· GAIL uses Shell's Hazira terminal to import LNG

· Boiler light-up achieved for fourth unit of Reliance Power's Sasan UMPP

· Iraq approves South Korea's Daewoo $588.8 mn oilfield contract

· Total goes ahead with $16 bn Angolan Kaombo oil project

· Goodrich Petroleum success in Louisiana field

· Congo republic state oil firm seeks to revive oilfields

· Statoil discovers up to 75 mn barrels at Valemon Nord

· Mexico Salamanca refinery operations normal after outage

· Venezuela's Paraguana refining center working at 67 pc capacity

· Shell, BP said to sign LPG supply deals with Kuwait

· Riding shale boom, US to become major LPG supplier to China

· Nandipur project to start power generation from May: Shahbaz

· Siemens wins $590 mn Saudi power plant order

· ZPC identifies three sites for power generation

· Potomac Edison rebuilds power transmission line in Maryland

POLICY & PRICE

· Petrol price cut by 70 paise a litre

· Oil ministry drops plan to set up inter-ministerial panel to decide gas price

· Small hydro projects will fetch big fortune: KSEB

· NHPC wants centre to recover dues from J&K’s plan allocation

· PSPCL petitions APTEL about CERC's compensatory tariff order

· Govt receives 36 applications for three coal mines

· Report on Indian nuclear plants presented at global convention

· Kuwait plans to award $4.3 bn oil project deal

· Angola to launch tender for 10 new onshore oil blocks on May 30

· Russia, China aim to finish gas talks before Putin's May visit

· UAE energy minister hopes Western partners keep oilfields role

· Oman plans LPG plant aimed at local market

· Coal's best hope is costly power plant in Mississippi

· Iran to build four new nuclear power plants

· Japan atomic power’s role supported in basic energy plan

· China plans ban on imports of coal with high ash, high sulfur

· Indonesia to build $1.8 bn power plant in Jakarta

· Gamesa India to commission 800 MW of wind power projects in 2014-15

· Rays Power commissions 14 solar power projects in FY'14

· Suzlon Energy sells 240 MW Illinois-based wind farm to EverPower

· Post-Fukushima Japan chooses coal over renewable energy

· Renewables, nuclear must triple to save climate, UN says

· EPA consulted with hundreds of groups on carbon rule for existing power plants

· China cuts in coal use may mean world emissions peak before 2020

· Clean power funding easier as investors seek simplicity

· Global solar energy sector sees $7 bn corporate funding in first quarter of 2014

· China's middle class will drive environmental clean-up

· Grandfather utilities threatened by spreading renewable

WEEK IN REVIEW

ENERGY/CLIMATE CHANGE

IPCC AR5: One More Step for Dialectic Reasoning?

Lydia Powell, Observer Research Foundation

|

T |

he contents of the three fifth assessment reports (AR 5) that the IPCC released recently are largely similar to the earlier reports. The prophets of the IPCC offer volumes of threatening numbers and seductively coloured charts to tell us that we are all doomed if we do not accept their dialectic reasoning and follow their prescriptions. The report of the working group I, which looks at the Physical Science basis of climate change, concludes in its summary for policy makers that ‘human influence on the climate system is clear and this is evident from increasing green house gas concentrations in the atmosphere, positive radiative forcing, observed warming and understanding of the climate system’ (page 15). What is striking in this sentence is the absence of the qualifying word ‘likely’ or ‘most likely’ that is sprinkled liberally across the rest of the document. If this was a sentence from a paper of an undergraduate student, the teacher would mark ‘correlation does not mean causation’ but since this is from the high priests of the IPCC we are expected to accept it as the word of God.

A few pages later we find an even more startling sentence: ‘human influence has been detected in the warming of the atmosphere and in the global water cycle, in reductions in snow and ice, in global mean sea level rise, and in changes in some climate extremes’ (page 17). We all know that ‘human influence’ is the criminal that the IPCC has been searching for all along but to declare that the criminal has been found in all the places that they have looked in one sweeping statement does not do justice to the claim that the report is the result of 259 authors from and 54,677 comments.

True to the tradition of IPCC assessment reports, a declaration of increase in certainty in all claims of causation of physical effects is given as a percentage (all above 90%) in almost every section of the document. No one really knows how they arrive at these figures. Where the IPCC chooses not to quantify the level of certainty for some reason, words such as ‘very likely’ and ‘likely’ are used to give an illusion of certainty as in this sentence: ‘the evidence for human influence has grown since assessment report 4 and it is extremely likely that human influence has been the dominant cause of the observed warming since the mid-20th century’ (page 17). It is not clear why the multitude of authors and reviewers failed to notice that the level of certainty over the same issue actually falls as we go from page 15 to page 17.

The most interesting chart in the report is on page 87 which shows observed temperature records from four datasets against temperature projections from 138 models. The observed temperature, especially after the 2000s is flat and at the lower bond of the 138 lines. When such a wide range of probabilities covering temperature increases from 0.5C to 2.5C by 2050 is created by models, is there any surprise that the observed temperature line falls within these lines? What is surprising however is that the IPCC explains away the divergence between observed and predicted temperatures since the 2000s as the consequence of natural causes notwithstanding the fact that the rest of the report is dedicated to demolishing all claims of natural causes contributing to climate change.

The real problem in the climate discourse promoted by IPCC is not the accuracy of its science but the concealed political undertones in its prescriptions captured in the reports of the second and third working groups. Let us start with the basic premise of the IPCC: ‘human activity is the cause and so the logical solution is to stop, modify or manage human activity. The problem arises when IPCC embarks upon answering questions such as whose activities should managed, how they should be managed and who should manage them. The video available on the website of working group II is unambiguous in answering this difficult question. The only white man in the video (apart from the authors of the report featured in the video) is sitting comfortably at his computer and is doing something that looks like coming up with ways to manage the activities of ‘others’. The ‘others’ whose activities he wants to ‘manage’ are poor black and brown peasants shown slogging in what looks like Africa, South Asia and South America. The white man’s computer probably requires emission of more carbon than all activities of the others in the video put together but apparently that does not give them the right to ‘manage’ their own activities.

But there is a ray of hope in the report of working group II on adaptation as it seems to admit that climate change is probably not an exceptional problem that supersedes all other human problems such as poverty, war, genocide, discrimination and deprivation. In some sections, the report seems to be saying that it would probably be better to adapt to change rather than trying to stop change. This is a substantial improvement over the previous reports of the same genre. In certain sections, the report actually admits that the most effective reduction in vulnerability to climate change will come from efficient implementation of programmes for the provision of basic human needs such as healthcare and clean drinking water. This is essentially what some of the developing countries have been trying to point out over the last two decades of climate negotiations. Bjorn Lomborg and the Economist have welcomed this as the end to climate exceptionalism, but the report is full of what one could call crisis narratives that essentially draw on neo-Malthusian environmental security discourses to portray the poor as villains (climate migrants who will invade and pollute the white man’s lifestyle?) rather than victims. If the report is apolitical as it is claimed, it is not clear why one of the expert authors who refused to endorse the final version as it was too alarmist in suggesting that the world faced ‘the four horsemen of the apocalypse’, has been labelled as ‘member of the non serious fringe’. Is there any surprise in everyone agreeing to the IPCC when only those who agree to agree are allowed a say?

The report from working group III on mitigation of climate change is the most controversial and was released amidst protests from many developing countries. India was among the 12 countries that registered reservations on the underlying report and the technical summary. The issues raised by these countries are not new and essentially centre on the same questions mentioned earlier: who gets to manage whose activities, at what cost and at whose cost? ‘We get to manage and we do not care at whose cost and at what cost’ is what the IPCC seems to say when it endorses expensive solutions such as carbon capture and sequestration in its section energy.

There is no doubt that the climate is changing but the IPCC report’s definitive positions in assigning responsibility and in the identification of responses are rooted in dialectic rather than apodictic reasoning. The consequences of making huge shifts in human activity based on the reasonable, plausible and probable is a risk, especially for developing countries which face more immediate and pressing challenges. Under dialectic reasoning there are no correct and incorrect arguments but only strong and weak arguments. This will become a huge problem in climate negotiations as asymmetric powers try to impose symmetric climate solutions on all.

The prophets of the IPCC can continue to curse human activity and predict ruin just as the prophets of the Old Testament cursed human life and predicted punishment from God. But they must keep in mind that human life has not only managed to survive and thrive but also managed to keep its vices intact.

Views are those of the author

Author can be contacted at [email protected]

ENERGY/CLIMATE CHANGE

Climate Change and India: Morality does begin at Home!

Ashish Gupta, Observer Research Foundation

|

C |

limate Change is becoming a major cause of concern but the important thing that is lacking in Climate Change deliberations is that it is concentrated on poor developing countries including India. Indeed measures must be adopted to combat climate change, but “do’s and don’ts” must not be restricted to developing nations! Being a responsible country, India is committed towards addressing climate issues. The National Mission on Climate Change, 2008, the Performance, Achieve and Trade (PAT) scheme 2012, the Star Labelling Program for electric appliances, measures for enhancing efficiency of power plants, the shift towards ultra critical technology and the National Solar Mission reflect India’s actions. Despite this genuine effort, India is criticised as if it does not understand Climate Change in a holistic way. For India Climate Change measures are interlinked with energy issues and India’s stand on climate negotiations must be viewed in the light of energy security.

Climate Change models and projections: There are different models but all of them focus on the energy sector because of carbon emissions from the energy sector dominates. Top-to-Bottom, Bottom-to-Top or Integrated Models are used to show India’s vulnerability towards climate variability and India is threatened of consequences if India does not resort to alternative energy sources. Irrespective of the accuracy of the models, all are used to portray just one thing: vulnerability of developing countries. Most of the models make projections for the very long term such as 2035 or 2050. It is not clear if all social, demographic and economic changes in a complex country like India can be captures by oversimplified quantitative models. This approach needs to be replaced by a more short term approach such as the Five Year Plans which will be more realistic. This too must be qualified by what the other countries are doing. In this competitive world there is no good deed that goes unpunished.

Climate Policy Reports: Generally these reports can be subdivided into two categories based on the solutions that they propose:

o Technocratic Solutions: These solutions are purely engineering solutions that advocate that India should become self reliant and climate resilient by shifting to alternative source of energy. They say that otherwise the country will be doomed partly by climate calamity and partly by import dependency. On the cost front they generally cover their arguments with things like ‘economies of scale’ and justify large investments on the basis of import costs or by pointing out that we are running out of fossil fuels. These technocratic solutions are confined to the belief that the future is certain but this is a myth! Most importantly these solutions are not comprehendible by the common public at large.

o Pro-poor Solutions: These are green solutions generally meant to help rural populations that do not have any power to participate in the decision making process. These solutions are generally enforced upon them whether they want it or not. Since they do not have deep understanding of this subject others think that it is better that some expert group should take decisions on their behalf as they are seen to be more vulnerable to climate variations. Interestingly green decisions to be imposed on rural populations are taken in air conditioned halls running on coal fired electricity located in urban areas without a single participation from the rural fraternity. This practice needs to change as this is not a level playing field.

CO2 Emissions and India: It is known where India stands in terms of per capita CO2 emission. Per capita annual emissions of USA are in the range of 20 Tons; European Union – 11 Tons; China – 9 Tons and India less than 2 Tons. On a national basis our CO2 emissions are rising and that is because of our quest for providing electricity access to all. There will be rise in emissions, but eventually it will come down once the “power for all” mission is achieved along with the mission to grow in per capita income. China which has 100% electricity access is looking towards other alternative sources of energy. CO2 emissions are also correlated with efficiency: 1% efficiency enhancement in coal based power plants will reduce the carbon emissions by roughly 1%. Climate experts are not looking at the situation from the social angle. If we ignore the social and economic angle then a clear framework can be devised for India on how to reduce the carbon emissions to maintain the global temperature at 2 degree centigrade. But does the moral responsibility lie only on India and other poor countries? But the question is what will happen if India and other poor countries keep their promise while others do not? Can India adopt a de-growth strategy destroying all its dreams?

Road Map for Developed Nations: The emphasis on guidelines for India and other developing nations is based on the premise that they are growing and emitting carbon fasters than others. But we need to talk more about developed nations and their emissions that was key to their current prosperity. Why is there is no platform discussing their consumption, emissions and high emission lifestyles? There is no sign of emission from these nations coming down to 2 Tons per capita/ year. Here again the question is why India and other poor countries have to compromise on the development with costly alternate energy solutions?

o Can a strong climate policy make any difference to fossil fuel rich countries whose economic development is based on the exports of the fossil fuels such as Norway? There will be massive job cuts and social unrest. Just as countries cannot survive, companies such as Coal India, NTPC, ONGC, Reliance, Tata, Jindal, BP, Xstrata, Rio Tinto to name a few will face extinction and consequent job loss and social unrest. Climate deliberations do not take into account this disaster social scenario even as they pain disaster environmental scenarios. Climate policies that ignore social and economic reality are likely to fail.

Can Strong Climate Policy make a Difference: India has a very robust climate policy but as always questions remain on implementation. India is yet to resolve small issues like washing of coal though it is mandated by law. But this does not mean that India is overlooking the climate issue. India is committed and will be able to reduce the emissions by 25% by 2030 especially in the light of its ambitious push on renewable and nuclear energy.

Sustainability: Climate change deliberations are mostly put forward on the basis of sustainable growth in the energy sector. This is a vague term because the definition of sustainability differs from country to country. What is sustainable for the developed nations may not be sustainable for India. Sustainability is also interlinked with affordability, therefore alternative energy sources cannot become sustainable when it is not affordable. Therefore an inclusive approach for adopting various sources of energy is required. Where sustainability is complemented with affordability, viability and accessibility it will succeed. India’s climate morality has begun at home; the question is what about other rich nations?

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

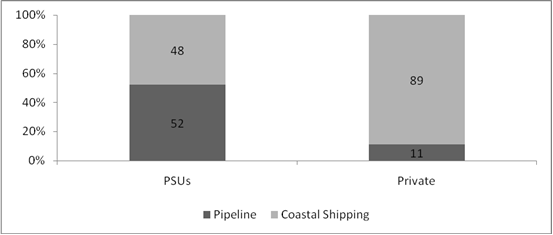

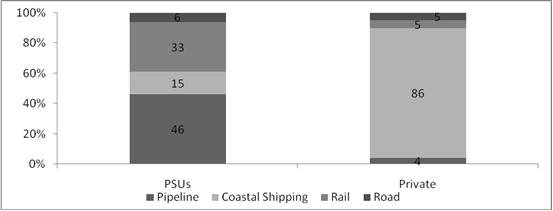

Modes of Transport of Crude Oil & Petroleum Products

Akhilesh Sati, Observer Research Foundation

(for 2011-12)

|

Oil Company |

Pipeline |

Coastal Shipping |

Rail |

Road |

Total |

|

Petroleum Products (Million Tonnes) |

|||||

|

PSUs |

57 |

19 |

41 |

7 |

123 |

|

Private |

3 |

61 |

4 |

4 |

71 |

|

Total (PSU + Pvt.) |

60 |

79 |

44 |

11 |

194 |

|

Crude Oil (Million Tonnes) |

|||||

|

PSUs |

70 |

65 |

135 |

||

|

Private |

8 |

67 |

75 |

||

|

Total (PSU + Pvt.) |

78 |

132 |

210 |

||

Share of Different Modes for Transport of

a) Crude Oil

b) Petroleum Products

Source: National Transport Development Policy Committee

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC, RIL to appoint joint expert to resolve gas dispute

April 14, 2014. Oil and Natural Gas Corp (ONGC) and Reliance Industries Ltd (RIL) will appointed a common international expert to resolve the dispute over their Krishna Godavari basin gas fields being inter-connected. ONGC says at least three wells drilled by RIL on the boundary of KG-D6 block in Bay of Bengal are within "few hundred meters" of its gas fields. It fears the fields are connected and RIL may be drawing out its gas. RIL disputes the ONGC theory and the two firms have shared data to collaborate on their claims. The two firms have decided to appoint a reputed global consultant to study data on both sides. ONGC and RIL will share names of their preferred consultants and arrive at a common name thereafter. Also, the scope of work for the third party opinion would be finalised jointly by the two sparring companies, they said. Previously, the Directorate General of Hydrocarbon (DGH) had asked RIL to share data on the gas reservoir on its side of the block as well as production flows with ONGC. It also asked ONGC to share data based on which it had felt that RIL's wells --- D6-A5, D6-A9 and D6-B8 in KG-D6 block -- may be drawing gas from its gas pools called G4-2, G4-3 and D-1. ONGC fears that gas discoveries in its nomination block G4 (Godavari PML) and Block KG-DWN-98/2 (KG-D5) extends into RIL's KG-DWN-98/3 (KG-D6 block). Incidentally, wells D6-A5, D6-A9 and D6-B8 are among the handful of wells that have remained in production since the KG-D6 block was put on production in April 2009. Half of the wells on D1&D3 gas field and MA oil and gas field in the KG-D6 block have shutdown due to water and sand ingress, resulting in output plummeting to about 13 million standard cubic meters per day. (economictimes.indiatimes.com)

Oil India said to study purchase of Shell’s Nigerian blocks

April 12, 2014. Oil India Ltd (OIL), the nation’s second-biggest state-run explorer, is studying an acquisition of Nigerian oil and gas assets owned by Royal Dutch Shell Plc. Oil India is weighing a bid for stakes Shell holds in some onshore blocks, valued at as much as $2 billion. It will partner with India’s Sandesara Group on the potential purchase. The explorer joins Dangote Group, controlled by Africa’s richest man, and Seplat Petroleum Development Co. in seeking to acquire Nigerian assets being sold by Western rivals. Shell and Chevron Corp. are divesting fields in the country amid persistent violence and crude theft in the oil-rich Niger River delta.

India’s government-run oil companies are building on their record $5.5 billion of acquisitions last year to secure supplies for Asia’s second-biggest energy consumer. Oil India, which had ` 124.9 billion ($2.1 billion) of cash at the end of September, has purchased stakes in gas fields in Mozambique and shale assets in the U.S. over the past two years.

Sterling Energy & Exploration Production Ltd., a unit of Sandesara Group, has more than 250 million barrels of certified oil reserves and one trillion cubic feet of natural gas reserves in the Niger Delta. Nigeria pumped about 2.1 million barrels of crude a day. Shell, Europe’s biggest oil company, said in October divestments in Nigeria have been deferred to 2014. The Anglo-Dutch company’s earnings in the country were curbed by almost $1 billion last year because of oil theft and a liquefied natural gas export blockade by the government.

ONGC and Oil India paid $2.5 billion for a 10 percent stake in a Mozambique natural gas field. Securing fuel supplies is crucial for Prime Minister Manmohan Singh as India relies on imports to meet about three-quarters of its oil requirements. (www.bloomberg.com)

Vedanta full-year oil and gas output rises

April 10, 2014. London-listed Vedanta Resources PLC said its average gross oil and gas production increased 6% during the financial year ended March 31, driven by higher output at its Rajasthan block in India.

Average gross production for the year rose to 218,651 barrels of oil equivalent per day (boepd) from 205,323 boepd a year earlier. The mining and oil and gas company said mined metal production for the year from its zinc business in India was marginally lower at 880,000 tonnes. The business generates about 15% of overall revenue. (www.livemint.com)

Transportation / Trade

NRL enters into tripartite B2B pact with ONGC and OIL

April 12, 2014. Assam based, Numaligarh Refinery Limited (NRL) has implemented a tripartite B2B (Business to Business) integration with upstream Oil Companies, Oil & Natural Gas Corporation Limited (ONGC) and Oil India Ltd (OIL) for crude oil transactions. Implementation of B2B between NRL, ONGC and OIL has automated a business process of crude oil supply and invoicing. OIL is the major producer of crude oil in Assam. Around 70 percent of NRL's Crude throughput of 2.67 million metric tonnes (MMT) for the year 2013-14 has been met by OIL while the balance 30 percent has been supplied by ONGC. NRL said implementation of B2B process will enable NRL to cover transactions worth over ` 8,000 crores per annum with OIL and over ` 3000 crores with ONGC into the ambit of IT enabled settlement. The companies felt that this process will enable in enhancing transparency and increase business efficiency. (economictimes.indiatimes.com)

GAIL uses Shell's Hazira terminal to import LNG

April 9, 2014. GAIL India Ltd has imported its first shipload of LNG at rival Royal Dutch Shell's Hazira terminal in Gujarat. GAIL, which part-owns Petronet LNG that operates 10 million tonnes Dahej terminal in Gujarat and operates 5 million tonnes a year capacity Dabhol plant in Maharashtra, last weekend imported a cargo of liquefied natural gas (LNG) at Hazira. The company previously imported all the LNG it bought from overseas either at Dahej or at Dabhol. This is the first time since India started importing LNG in January 2004 that GAIL, the nation's largest gas marketing and transmission firm, has used a privately operated terminal for imports. The cargo imported from Hazira came from French energy giant GDF Suez with whom GAIL had in 2012 signed a term contract to buy 0.8 million tonnes of LNG. GAIL is also talking to Shell for buying LNG on a short-term contract. The company is aggressively scouting for LNG the world over to meet the nation's growing gas demand, which is expected to grow from 58 billion cubic metres in 2012 to 220 billion cubic metres in 2020, representing a compounded annual growth rate of over 18 per cent. It had in August 2012 signed a contract with GDF bot buy 12 cargoes or shiploads (0.8 mn tonnes) from 2013 to 2014. GDF supplied six cargoes of LNG in 2013 beginning January and an equal number are to come in 2014. It supplies one cargo once in two months, most probably from its Yemen portfolio. The price of LNG would be linked to prevailing oil rates. GAIL had previously roped in GDF Suez for a 3.5 million tonnes a year floating LNG import terminal it plans to set up off the east coast. The French firm would have 26 per cent stake in the project. GDF, which holds 10 per cent stake in Petronet LNG Ltd, had in November 2011 agreed to supply 9 cargoes of LNG to the nation's largest liquefied natural gas importer (Petronet). GAIL as well as Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Oil and Natural Gas Corp (ONGC) hold 12.5 per cent stake each in Petronet. GAIL has been expanding its global presence to secure gas supplies. It had earlier signed a 20 year Sales and Purchase Agreement with Sabine Pass Liquefaction LLC, a unit of Cheniere Energy Partners, USA for supply of 3.5 million tonnes per year of LNG beginning 2017. (economictimes.indiatimes.com)

Policy / Performance

Petrol price cut by 70 paise a litre

April 15, 2014. The price of petrol was cut by 70 paise a litre, excluding local levies, the second reduction in rates this month as appreciation of the rupee against the US dollar made oil imports cheaper. The reduction excludes local sales tax or value added tax (VAT) and the actual cut will be higher, varying from city to city. The price of petrol in Delhi will be lowered by 85 paise to ` 71.41 a litre. This follows a 75 paise a litre reduction on 1 April, which translated into a cut of 90 paise in Delhi to ` 72.26. In Mumbai, petrol will cost ` 80 a litre as against ` 80.89 currently. For diesel, the government had decided to allow oil firms to raise rates by up to 50 paise a litre, excluding local levies, every month until losses on the fuel are wiped out. Since January 2013, diesel rates have risen by ` 8.33 over 14 monthly installments. IOC said it still loses ` 5.49 on the sale of every litre of diesel. (www.livemint.com)

Oil Ministry to move Cabinet to allow RIL to retain gas finds

April 15, 2014. The Oil Ministry is moving the Cabinet to allow Reliance Industries Ltd (RIL) retain three gas discoveries worth $1.45 billion in the eastern offshore KG-D6 block even after expiry of timelines. Upstream regulator Directorate General of Hydrocarbon (DGH) had sought taking away the three finds from RIL as the company had failed to prove their commerciality by not conducting prescribed tests. The Oil Ministry is, however, seeking relaxation of the rules for RIL as it feels rebidding the finds may lead to delay in development of the discoveries, which hold 345 billion cubic feet of recoverable gas reserves. Also, it feels RIL may go to arbitration which may lead to further delay in production and extra cost associated with the arbitration. The three finds, which can be quickly put on production by RIL using existing infrastructure of currently producing gas fields as well as those being developed, are worth USD 1.45 billion at current gas price of USD 4.2 per million British thermal unit. The ministry is likely to seek approval of the Election Commission before floating a draft note for inter-ministerial consultations. After comments are received from the finance and law ministries besides the planning commission, it will be put to the Cabinet Committee on Economic Affairs (CCEA) for approval. RIL will have to conduct DGH prescribed Drill-Stem Test (DST) on D29, 30 and 31 discoveries and only half of the USD 93 million will be allowed to be cost recovered. If the CCEA approves, the same rule will then be applied to RIL's four gas discoveries (D-9, 10, 32 and 40) in North-East Coast block NEC-0sn-97/1 (NEC-25) which hold recoverable reserves of 1.032 Trillion cubic feet. Out of a total area of 7,645 square kilometres in KG-D6 block in Bay of Bengal, the government allowed RIL and its partners BP plc of UK and Canada's Niko Resources to retain only 1,4462.12 sq km area where regulator DGH- recognised discoveries have been made. The area snatched away from RIL was more than 5,367 sq km that the company had offered to relinquish voluntarily and contained five discoveries - D4, D7, D8, D16 and D23 for which the DGH had opined that RIL missed deadlines for submission of investment plans. The five discoveries together had 0.805 Tcf of reserves, or about one-fourth of the restated reserves in the currently producing D1&D3 fields in KG-D6 block. The 1,4462.12 sq km area that RIL was allowed to retain included the currently producing D1&D3 gas fields and D26 (MA) oil and gas field. Besides, a cluster of four satellite fields (D2, D6, D19 and D22) and two other significant discoveries (D42 and D34), for which investment plans have already been approved, are also being allowed to be retained by RIL. The area allowed to be retained also includes three yet-to-be-confirmed discoveries of D29, D30 and D31. (economictimes.indiatimes.com)

Oil ministry seeks more flexibility for exploration companies

April 14, 2014. The Oil Ministry has approached the Cabinet to give companies including Cairn India and Reliance Industries Ltd (RIL) greater flexibility to continue exploring for oil and gas even after the expiry of deadlines. The government had allowed companies to launch probe missions to find more oil and gas within already-producing areas. The approval was subject to severe conditions such as ensuring the government's share of profit from existing fields was not affected due to the additional investments needed to find and produce more oil or gas. The ministry moved a draft note for the consideration of the Cabinet Committee on Economic Affairs (CCEA) to relax some of these conditions. Under production sharing contracts (PSCs) signed before and after the advent of the New Exploration Licensing Policy (NELP) in 1997, companies are allowed to recover costs incurred on finding oil and gas from sales before sharing profit with the government. However, the recovery of expenses is not allowed in an area where the initial exploration phase of up to seven years has been completed and discoveries have either been put on production or are being developed. The February 2013 policy for continuation of exploration activities in mining lease areas was aimed at facilitating that. After the February policy, RIL and its partner BP of UK made the MJ-1 discovery about two kilometres below the currently producing Dhirubhai-1 and 3 gas fields. The discovery is estimated to hold 0.5 to 3 trillion cubic feet of gas reserves. Cairn has claimed that extension of exploration in the Barmer field would result in the addition of 1.25 lakh barrels of oil a day to the current output of 1.75 lakh barrels a day. (economictimes.indiatimes.com)

Indian army, BPCL jointly created oil infrastructure in West Kameng

April 14, 2014. Indian army and Bharat Petroleum Corporation Limited (BPCL) has jointly created oil infrastructure with tankages in West Kameng in India's frontier state of Arunachal Pradesh. Army said the project is a symbol of joint national effort on part of the Public Sector undertaking and Army to develop infrastructure and facilities in the Northeast. The facility, for storage of all types of oils and lubricants and for bulk distribution is constructed at a cost of around ` 8 crores in a record time of two years. Army said. (economictimes.indiatimes.com)

Oil ministry drops plan to set up inter-ministerial panel to decide gas price

April 10, 2014. The oil ministry has dropped its plan to form an inter-ministerial committee to determine gas price every quarter based on the C Rangarajan committee formula, and has decided to rely on its own expertise to calculate new rates, a ministry note shows. The ministry now wants its number-crunching wing, the Petroleum Planning & Analysis Cell (PPAC), to "approve" and "notify" gas price calculated on the basis of the complex formula every quarter. The formula was notified in January and the new system to fix gas price every quarter was to be implemented starting April 1. But since the model code of conduct for elections prevents the government from taking any policy decisions, the Election Commission stopped the ministry from implementing the new system. Initially, the ministry wanted the committee to be led by the PPAC's director-general and its other members were to be the financial adviser to the integrated finance division, Gail India's marketing director, Petronet LNG's commercial director and a customs official.

Oil Minister Veerappa Moily was initially against this proposal, but later approved it after consultations with officials. But the reference to the committee was dropped when the ministry sent the pricing proposal to the Cabinet, the note shows. According to the note, the price can be fixed by the ministry after obtaining data.

|

June 19, 2013 |

Note on gas price submitted to CCEA |

|

June 27, 2013 |

CCEA approved gas pricing guidelines |

|

July 4, 2013 |

Finance ministry raised contractual/financial issues |

|

Dec 19, 2013 |

CCEA deliberated issues raised by finance ministry |

|

Jan 10, 2014 |

Gas pricing guideline notified |

The oil ministry had asked the PPAC to determine gas price three weeks before the beginning of every quarter, according to the note. The ministry has already given the approval to obtain data subscriptions and manpower from GAIL, which has expertise in gas marketing.

According to the note, the PPAC could notify the price on a quarterly basis based on the procedure approved by the Cabinet Committee on Economic Affairs (CCEA) and by obtaining the data from standard sources. (economictimes.indiatimes.com)

RIL seeks guarantee from fertilizer companies for costlier gas

April 10, 2014. Reliance Industries Ltd (RIL) has again asked fertilizer companies to provide a guarantee for paying a higher price of gas despite the Election Commission's order that the oil ministry should defer implementation of a new pricing formula. It sought immediate action by customers so that it can keep supplying gas. RIL has written to fertilizer firms pointing out that in January the government had notified a gas price formula that would be effective from April 1, replacing the old price of $4.2 per unit that was valid up to March 31, 2014. Last year the Cabinet approved a formula, proposed by a committee headed by the Prime Minister's Chief Economic Advisor C Rangarajan, that is estimated to nearly double the price of domestic natural gas, although it would still be about half of the price of liquefied natural gas (LNG) that India imports. RIL's demand for payment security was the subject of lengthy discussions between the two sides at a meeting on March 31 in which top government officials from the oil and fertilizer ministries played the role of mediator.

Fertilizer industry officials say they would accept whatever price the government notified. But till a new price is notified, the price of $4.20 per unit should hold without the need of a new guarantee. RIL had agreed to continue with gas supplies until the matter is resolved. Some analysts say RIL may be allowed to charge the new rate retrospectively.

Research house Nomura said in a report that it is likely that when the new price is made applicable, it can be applied from an earlier date for Reliance Industries since its gas price formula was valid till March 31, 2014. (economictimes.indiatimes.com)

POWER

Generation

Boiler light-up achieved for fourth unit of Reliance Power's Sasan UMPP

April 9, 2014. Reliance Power announced that boiler light up has been achieved for its fourth 660 MW unit at the 3,960 MW Sasan Ultra Mega Power Plant (UMPP). This is a critical milestone of the boiler commissioning activities for the unit. The first 660 MW unit of the Sasan UMPP was commissioned in March 2013 and the second unit in Jan 2014. The third unit was synchronized to the grid in March 2014, reached full load and is operational. First three 660 MW units of the project comprising 50 per cent of total capacity are already operating, the fourth unit boiler has been lighted up and the balance two units are in advanced stages of construction. The Sasan UMPP is the largest integrated power plant and coal mining project in the world. Coal production has already commenced from the 20 million tonnes Moher and Moher-Amlohri, the coal mines associated with the power project. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

Power supply problem in Odisha shows inability of BJD govt: Modi

April 11, 2014. Consistent power supply problem in Odisha despite abundant coal reserve indicates inefficiency of the Biju Janata Dal (BJD) government in Odisha, said Narendra Modi, the prime ministerial candidate of Bharatiya Janata Party (BJP). Odisha produces nearly 1200 MW power from thermal generators and hydro power stations and receives nearly 1500 MW as its share from Central pool. Three power producers and several dozen captive power units in the state generate around 2500 MW, much lower than their actual capacity. Taking a dig at slower clearance process of the Odisha government, the BJP leader said, many power plants in the state are sitting idle or running at less than installed capacity because of insufficient coal supply from Mahanadi Coalfield Ltd (MCL). Several private power producers in the last year had to give up the coal mines allotted to them because of lack of clearances from the state government. (www.business-standard.com)

Small hydro projects will fetch big fortune: KSEB

April 15, 2014. As continuous protests threw a spanner into the Kerala State Electricity Board’s (KSEB) plans objecting to the generation of power from mega projects, the board has decided to shift its focus to various small hydro-projects to quench the thirst of the power-starving state. The board has chalked out a plan to generate 68.1 MW power from eight small hydel projects in the state by February 2016. The tender process for the Kakkayam project, which also falls in this category, is completed and subsequent procedures are underway. The small hydro-projects policy of KSEB envisages to produce about 295 MW power from small projects by 2017. This includes 150 MW additional capacity from small hydropower projects by then, through private participation. Going by present statistics, the average daily demand in Kerala is 65 to 68 Million Units (MU) of which 25 to 28 MU is being purchased from outside. (www.newindianexpress.com)

NHPC wants centre to recover dues from J&K’s plan allocation

April 13, 2014. NHPC Ltd has upped the ante to recover its outstanding dues of ` 1,125 crore from Jammu and Kashmir (J&K) by asking the Union government to deduct the sum from the central devolution to the terrorism-hit state. With ` 625 crore in dues pending for more than six months, India’s largest hydropower generation utility wrote to the power ministry suggesting the drastic course of action for its biggest debtor.

This follows publicly traded NHPC withdrawing its notice of regulation to suspend electricity supply to the state over unpaid dues. Of the total outstanding dues from Jammu and Kashmir, ` 1,037 crore is pending for more than 60 days. Out of a total ` 1,531 crore owed to NHPC, Jammu and Kashmir alone accounts for ` 1,125 crore. In 2012-13, the approved Plan outlay for the state was ` 7,300 crore.

The power ministry is the nodal ministry for NHPC, which has a generation capacity of 5,702 MW and includes projects taken up in joint ventures. Of the 4,857 MW generated by NHPC, around 2,000 MW is generated from the state. NHPC supplies 820 MW to Jammu and Kashmir. (www.livemint.com)

PSPCL petitions APTEL about CERC's compensatory tariff order

April 12, 2014. Punjab State Power Corporation Ltd (PSPCL) has petitioned Appellate Tribunal for Electricity (APTEL) challenging electricity regulator CERC's order granting compensatory tariff to two Mundra projects of Tata Power and Adani Power. Punjab in its petition, with the APTEL, said that the Central Electricity Regulatory Commission (CERC) 'erred' on various grounds while deciding on the compensatory tariff for the two power companies. Three Rajasthan power distribution utilities - Ajmer Vidyut Vitaran Nigam, Jaipur Vidyut Vitaran Nigam and Jodhpur Vidyut Vitaran Nigam - had also approached APTEL on the same matter. The CERC allowed Tata Power and Adani Power higher tariff and total compensation amounting to more than ` 1,100 crore for their Mundra projects in Gujarat. Tata Power runs a 4,000 MW ultra mega power project at Mundra, while Adani Power operates a 4,620 MW plant. Tata Power won the bid for the Mundra plant in 2007 by offering a levelised tariff of ` 2.26 per unit for 25 years. The CERC said the higher tariff would be imposed with retrospective effect from April 1, 2013, entitling Tata Power to recover ` 329.45 crore and Adani Power almost ` 830 crore from customers. (economictimes.indiatimes.com)

MahaVitaran wants cut in interest rate for Mundra UMPP

April 12, 2014. The Maharashtra State Electricity Distribution Company (MahaVitaran) has strongly argued that the Central Electricity Regulatory Authority’s (CERC) order on a compensatory rate for Mundra ultra mega power project (UMPP) was arbitrary, unreasonable and against the scheme of the Electricity Act, 2003. MahaVitaran has a power purchase agreement with the Tata Power arm, Coastal Gujarat Power Ltd, for 760 MW. In its petition to the Appellate Tribunal for Electricity, it has asked for modification or setting aside the CERC order, issued in February. (www.business-standard.com)

Finance ministry steps in to rescue Dabhol power project

April 11, 2014. The finance ministry has stepped in to rescue the Dabhol Power Project, which is struggling to collect ` 400 crore dues from Maharashtra's power utility. The ministry says it would deduct the amount from central funds to be transferred to the state if the dispute is not resolved amicably. The project, which was built by Enron Corp, has been in trouble since last year, when dwindling gas supply from Reliance Industries' KG-D6 block forced it to shut down. The company had billed ` 400 crore to the utility last year, but this has been challenged by the customer. The matter is now before the appellate authority. At a recent meeting, the central government asked Maharashtra State Electricity Distribution Company to urgently clear its dues because of the poor financial condition of the supplier. It urgently needs about ` 630 crore to service its debt and avoid asset downgrade. (economictimes.indiatimes.com)

NTPC pays dues, ends conflict with Coal India

April 10, 2014. NTPC has settled the dues of two Coal India subsidiaries, bringing to a close a protracted tussle over quality of fuel the state-run miner was providing. Dues of the other subsidiaries were likely to be cleared in a fortnight. As on March 23, NTPC owed Coal India ` 3,000 crore. The dues have now come down to about ` 2,000 crore. The finance ministry had advised both companies to arrive at a price based on the average quality of coal supplied by Coal India's subsidiaries. The miner had initially rejected the proposal, saying it would violate the terms of the contract signed with NTPC, but later agreed after executives of the two companies met. (economictimes.indiatimes.com)

Govt receives 36 applications for three coal mines

April 10, 2014. The government has so far received 36 applications from companies, including Jindal Steel and Power Ltd (JSPL) and Tata Steel Ltd, in response to a notice inviting applications for allotment of three coal blocks on tariff-based bidding.

The government had put three mines in Jharkhand and West Bengal for auction for captive use. The much-delayed auction features mines that have total reserves of 500 million tonnes. The move followed the centre drew flak for delaying the auction and the Comptroller and Auditor General (CAG) said that allotment of 57 mines to private firms without auction had resulted in a notional loss of ` 1.8 trillion to the exchequer. The ministry of coal offered three blocks for auction for captive use for steel, cement and sponge iron companies—two in Jharkhand and one in West Bengal. The government had allocated 17 coal mines to central and state public sector units, including four to NTPC Ltd. It had planned to auction 54 coal blocks with total estimated reserves of about 18 billion tonnes. (www.livemint.com)

Report on Indian nuclear plants presented at global convention

April 9, 2014. India has submitted its latest national report on safety status of its atomic power plants and its nuclear safety review and regulatory system at the Convention of Nuclear Safety at Vienna. A 14-member Indian team led by Atomic Energy Regulatory Board (AERB) chairman S S Bajaj presented the report at the sixth review meeting of the Convention of Nuclear Safety (CNS) held between March 24 and April 4, AERB Secretary R Bhattacharya said. The recent safety enhancements in Indian nuclear plants following the Fukushima accident in Japan and the Indian system of licensing of power plants based on periodic safety reviews were also highlighted in the report, he said. A total of 74 countries, including India, are signatories to the Convention of Nuclear Safety as on March this year and all of them have to submit a national report on safety of their nuclear power plants every three years. These reports are also peer reviewed and presented in the CNS review meeting. (economictimes.indiatimes.com)

SC committee rejects 23 of 24 proposed Uttarakhand hydro projects

April 9, 2014. The Supreme Court (SC) monitoring committee formed by the Ministry of Environment and Forests (MoEF) to study 24 proposed hydro projects on the Alaknanda and Bhagirathi rivers in Uttarakhand has published minutes of meetings on the MoEF website, and unanimously decided not to recommend 23 of the new projects, worth 2683.6 MW. The committee was set up in October 2013 after the SC took note of a Wildlife Institute of India report that pointed the extensive threat to biodiversity because of these projects. The court directed the MoEF to set up a committee to examine the projects. The committee's recommendations could hit Uttarakhand's ambitious plan for self-sufficiency in the power sector. (timesofindia.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Iraq approves South Korea's Daewoo $588.8 mn oilfield contract

April 15, 2014. Iraq's cabinet approved an $588.8 million oilfield service contract with South Korea's Daewoo Engineering & Construction for the development of the Zubair oil field, the cabinet said. Under the contract, Daewoo E&C will handle engineering, procurement and construction work for a gas separation facility at the giant Zubair oilfield in Iraq's south, whose output is forecast to reach 850,000 barrels of oil per day (bpd) in 2017. (www.rigzone.com)

Total goes ahead with $16 bn Angolan Kaombo oil project

April 14, 2014. French oil company Total said it had decided to go ahead with its Kaombo oil project offshore Angola after lowering its cost by $4 billion to $16 billion. The ultra-deep field will have a production capacity of 230,000 barrels per day, for a start-up date in 2017, Total said. Total is already the top operator in Angola, with the 600,000 barrels it produces per day at its Girassol, Dalia and Pazflor deepwater fields in the huge Block 17 representing over a third of the country's output. Angola is Africa's second largest oil producer and it wants to increase production to 2 million barrels per day next year from 1.73 mbpd in 2013. (www.rigzone.com)

Goodrich Petroleum success in Louisiana field

April 14, 2014. Goodrich Petroleum Corp drilled its second successful well in the Tuscaloosa Marine shale prospect in Louisiana. Goodrich said the well achieved a peak average production rate of 1,270 barrels of oil equivalent per day, comprising 1,250 barrels of oil and 115 million cubic feet of gas. Goodrich drilled the well on acreage it acquired from Devon Energy Corp last July. The company is drilling three more wells in the field. The Tuscaloosa Marine field holds about 7 billion barrels of oil, according to estimates by the Louisiana Department of Natural Resources. Goodrich has more than 300,000 net acres in the field and is currently running three rigs, with plans to ramp up to five by the end of the year. The company also operates in the Haynesville shale field in East Texas and the Eagle Ford shale field in South Texas. (www.rigzone.com)

First production from Sumatra's Lemang block likely in 2H 2015, early 2016

April 14, 2014. Ramba Energy Ltd, an oil and gas exploration and production company with interests in Indonesia, disclosed the results of an independent evaluation of the Group’s Indonesian oil and gas assets by RISC Operations Pty Ltd. The RISC evaluation reviews the technical and commercial potential of Ramba’s Western Indonesia asset portfolio, namely the Jatirarangon block, the Lemang block and the West Jambi block. For the Lemang block, the RISC evaluation reviews the development concept for the block’s Selong and Akatara structures, the locations of the Group’s oil and gas discoveries. The evaluation projects peak production of 57,000 barrels of oil per day (bopd) and 101 million standard cubic feet of natural gas per day (MMscf/d) for the high-case scenario (P10), 25,000 bopd and 47 MMscf/d for the mid-case scenario (P50), and 11,000 bopd and 26 MMscf/d for the low-case scenario (P90). SKK Migas, Indonesia's oil and gas regulator, has halted all exploration activity for the Lemang Block and instructed the Company to work on hydrocarbon production as soon as possible. Based on the current schedule, first hydrocarbon production is expected sometime in the second half of 2015 or early 2016. (www.rigzone.com)

Congo republic state oil firm seeks to revive oilfields

April 11, 2014. Republic of Congo's state oil company SNPC said it hopes to develop a strategy to pump more oil from fields under-exploited by foreign investors as part of a plan to revive oil production. Societe Nationale des Petroles du Congo (SNPC) said that it had completed two geological surveys since December in the Mengo-Kundji-Bindi (MKB) permit to assess their potential. The Kundji field is currently being exploited by SNPC in collaboration with Ivorian state oil company Petroci and Canada's Orion Oil and Gas, SNPC said. It was previously abandoned by now dissolved French oil company Elf. The Mengo field was similarly abandoned by Elf in the 1990s. SNPC also carried out a survey of the Mayombe licence, not currently being exploited, to assess its potential for drilling. Oil production in Republic of Congo has been in decline for years due to maturing fields and is down from around 310,000 bpd in 2010, according to data from the U.S. Energy Information Administration. The country projects output of 242,000 barrels per day this year, up slightly from 242,000 bpd in 2013. Oil revenues make up more than 70 percent of the state's budget. (www.rigzone.com)

Statoil discovers up to 75 mn barrels at Valemon Nord

April 11, 2014. Norway's Statoil reported that it has made gas and oil discoveries at the Valemon Nord prospect in the North Sea, some 100 miles northwest of Bergen in the North Sea. Statoil estimates the total volumes found at Valemon North to be in the range of 20 to 75 million barrels of recoverable oil equivalent. The Valemon field, discovered in 1985, is one of Statoil’s largest ongoing development projects on the Norwegian Continental Shelf, with recoverable resources estimated at 206 million barrels of oil equivalent. (www.rigzone.com)

Downstream

Mexico Salamanca refinery operations normal after outage

April 11, 2014. Mexico's state-owned oil company, Pemex, said its Salamanca refinery was operating normally after it was gradually restarted following a power outage. The refinery was forced to shut down on March 30, and the following day engineers began a five-day restart of operations at the installation, Pemex said. Pemex did not specify the impact on refining output. The Antonio M. Amor refinery in Salamanca, in the central state of Guanajuato, has a capacity to process 245,000 barrels per day (bpd). Pemex had previously said that the refinery was operating normally the day after the electrical outage. The Mexican oil giant has six refineries in Mexico, with capacity for up to 1.6 million bpd. (www.downstreamtoday.com)

Venezuela's Paraguana refining center working at 67 pc capacity

April 9, 2014. Venezuela's largest refining center is working at 67 percent capacity, a slight decline compared to January even though state-run PDVSA restarted two of its crude distillation units in recent months, according to an internal document. The 955,000 barrel per day (bpd) Paraguana Refining Center, which includes the Amuay and Cardon refineries on Venezuela's western coast, has had frequent operational problems since a big explosion in 2012 that killed more than 40 people. The complex was working at 70 percent capacity in January. But with a crude distillation unit running partially, the flexicoker undergoing unplanned maintenance and another 10 units halted, its output declined to 643,000 bpd as of March 27, the document said. The document said the 645,000 bpd Amuay refinery, the world's fourth largest, has five operational units out of service, including the 72,000 bpd flexicoker. Also, distillation unit No. 3 was runnning less than 10,000 bpd of crude, compared to normal processing of 87,000 bpd. (www.downstreamtoday.com)

UK govt sees more scope for refinery closures

April 9, 2014. Britain said there was scope for more UK refining capacity to close without undermining energy security but set up a new task force to help the struggling sector fend off overseas competition. The government's long-awaited review of Britain's refining and fuel imports sector comes a week after Murphy Oil said it could be forced to close its loss-making Milford Haven plant in Wales after talks with a potential buyer collapsed. The Department of Energy and Climate Change said environmental regulation along with the U.S. shale boom and the rise of new refiners in Asia made it harder for Britain's seven refineries to compete. European refiners have struggled with stagnant demand and increased overseas competition which has crushed margins and seen several plants closed or idled in recent years. (www.downstreamtoday.com)

Transportation / Trade

UK gas extends biggest rally since 2011 amid Ukraine tensions

April 14, 2014. U.K. natural gas extended its biggest rally since 2011 as Ukraine tensions escalated, deepening a crisis that may affect flows from Russia to Europe. Front-month gas in the U.K., a European benchmark, gained as much as 3.2 percent to its highest level since March 27. Russia called for an emergency meeting of the United Nations Security Council after Ukrainian security forces clashed with pro-Russian gunmen in eastern Ukraine. Russia and the U.S. blamed each other for orchestrating the unrest. Futures advanced after climbing the most since September 2011, when Russian President Vladimir Putin threatened to halt gas shipments to Ukraine over unpaid debt. Price disputes between Russia and Ukraine, which carries about 15 percent of western Europe’s needs for the fuel, disrupted flows to Europe in 2006 and 2009 amid freezing weather. Western nations probably won’t impose energy-export sanctions on Russia as Europe has little alternative to Russian gas, Goldman Sachs Group Inc. and Citigroup Inc. said. Europe could displace Russian gas imports for eight weeks before prices need to rise to attract supplies of liquefied fuel, Goldman said in a report. Spare capacity on the Nordstream pipeline from Russia to Germany under the Baltic Sea wouldn’t cover lost volumes if Ukraine transit was disrupted, Citigroup said. Ukraine, which ships about half of Russia’s gas exports to Europe, is struggling to pay a debt of more than $2.2 billion to OAO Gazprom, the Russian exporter, for past supplies. Russia will have to halt gas shipments to Ukraine if payment violations continue, President Putin said. Russian natural gas exports to Europe through Ukrainian pipelines are proceeding as normal. Russia has been a reliable supplier of gas to Europe in even more challenging times than now, and the West should be concerned only about Ukraine’s position. Gas exports to Europe are “an important source” of revenue for Russia, making reductions unlikely, according to Goldman Sachs. Northwest Europe will remain well supplied this year after a mild winter, Goldman Sachs said. Gas inventories in European storage sites were about 47 percent full on April 11, compared with 21 percent a year earlier, according to Gas Infrastructure Europe, a Brussels-based lobby group. (www.bloomberg.com)

Shell, BP said to sign LPG supply deals with Kuwait

April 13, 2014. Royal Dutch Shell and BP have signed deals to supply Kuwait with liquefied natural gas (LNG) over the next few years, Kuwait Petroleum Corp (KPC) said. Kuwait began importing LNG in 2009 and signed deals for Shell and Swiss-based trader Vitol to supply it during the peak power demand period from April to October over the last four summers. KPC said that Shell and BP have been contracted to supply the OPEC member country over the next 5-6 summers. KPC said the total volume of super-cooled gas to be delivered between the two companies would be around 2.5 million tonnes a year. Kuwait will sign another contract to buy LNG from a third company, KPC said. (www.arabianbusiness.com)

Gas carousel making Spain Europe’s biggest LNG exporter

April 12, 2014. Spain overtook Norway to become the region’s biggest exporter of liquefied natural gas. The southern European nation has never produced any of the fuel. The twist is a consequence of the crisis that left more than a quarter of Spain’s workers unemployed as the economy weakened for nine straight quarters. Utilities that contracted to buy LNG before the slump are now contending with a sixth consecutive year of diminishing domestic demand, spurring them to re-export cargoes. (www.bloomberg.com)

Turkmen president: 2015 start for pipeline work

April 11, 2014. Turkmenistan's president, Gurbanguli Berdymukhamedov, has demanded that construction work begin in 2015 on a pipeline that will carry natural gas from his energy-rich country to Afghanistan, Pakistan and India. The president said all the agreements required for the project's launch should be completed this year. A memorandum of understanding between the four countries linked by the TAPI pipeline was signed in 2010 and a supply deal was completed in 2012. According to the project specifications, the 1,735-kilometer pipeline will cost around $8 billion to complete and have an annual capacity of 33 billion cubic meters of gas. The pipeline will cross the Afghan cities of Herat and Kandahar and end in the Indian-Pakistani border town of Fazilka. (www.downstreamtoday.com)

Phillips 66 says exporting US oil to Canada

April 11, 2014. Phillips 66 joined a long list of companies exporting U.S. oil to Canada after it secured a license to do so last year, the company said. The Houston-based company does not own a refinery in Canada, unlike other exporters like Valero Energy, which sends U.S. oil to its Quebec refinery. The United States does not allow exports of its own oil, but makes exceptions such as barrels going to Canada and re-exports of foreign oil. (www.downstreamtoday.com)

Natural gas loses decades-old tie to oil in landmark deal

April 11, 2014. A contract for France’s largest natural gas company to buy the commodity from Azerbaijan shows the decades-old structure of Europe’s energy market is starting to crumble. For the first time, GDF Suez SA signed a 25-year contract to buy gas from BP Plc and partners in the former Soviet republic at prices tied to those in Western Europe’s domestic gas markets. The change matters because purchases previously were made at prices tied to crude oil, which has doubled in the last five years, an expense then passed on to consumers. Europe’s gas contracts have been tied to oil since the 1960s as a way of providing certainty to suppliers who would then invest billions to build fields and pipelines. More recently, as gas prices fell and oil rose, utilities including GDF and Electricite de France SA as well as Germany’s EON SE and RWE AG pressed Russian gas-export monopoly OAO Gazprom and Norway’s Statoil ASA to revise long-term agreements. (www.bloomberg.com)

Pacific Rubiales building Colombia LNG pipeline

April 11, 2014. Toronto-listed oil company Pacific Rubiales said it will spend as much as $200 million to build its pipeline in Colombia to export liquefied natural gas (LNG), with a contract to supply Russia's Gazprom for five years from 2015. Pacific Rubiales is Colombia's biggest private oil producer with average output in the Andean nation last year of 129,386 barrels per day and plans to export LNG using the 84-km 18-inch diameter pipeline from some time next year. (www.downstreamtoday.com)

Democratic senators press Obama for Keystone decision by May 31

April 10, 2014. Eleven U.S. Democratic senators urged President Barack Obama to make a final decision on whether to approve TransCanada Corp's Keystone XL crude oil pipeline from Canada to the U.S. Gulf Coast no later than May 31. The group included several lawmakers expected to face tough re-election battles this year. The proposed 1,179-mile (1,898-km) line, which would transport crude from Alberta to refineries on the Gulf Coast, has been under U.S. government review since 2008. (www.downstreamtoday.com)

Riding shale boom, US to become major LPG supplier to China

April 10, 2014. A deal between China's top refiner Sinopec Corp and Phillips 66 could be a game changer that signals the United States is on track to become one of the top suppliers of liquefied petroleum gas (LPG) to the world's second-biggest economy. China is the biggest consumer of LPG, a compressed mix of propane and butane, used for heating and transport, and now increasingly being considered for making petrochemicals. As demand in China soars, the U.S. shale boom has led to a surge in production of LPG, which is bringing down global prices and challenging established suppliers in the Middle East. Washington restricts exports of crude and has only slowly opening up liquefied natural gas shipments for energy security reasons, but there are no such limits on LPG sales. China's first purchases of U.S. LPG were made last year, amounting to 3,530 barrels per day, according to Chinese customs' data, in deals done by little known private firms. But marking the entry of big oil Sinopec Corp and U.S. refining company Phillips 66 struck a deal last month to supply U.S. LPG for delivery likely to start in 2016 and put by traders at about 34,000 bpd worth around $850 million at current prices. Sinopec, China's top ethylene producer, is looking at using U.S. LPG for making petrochemicals due to cheaper pricing and shortages of the traditional feedstock naphtha, a product from processing crude oil. U.S. exports of LPG could roughly triple by 2020 from last year to around 635,000-795,000 barrels per day, energy consultancy FACTS Global Energy estimated. China has lined up about 100,000 bpd of long-term U.S. LPG imports with supplies mostly starting in 2015-16, including the Sinopec deal and otherwise mainly involving smaller firms, traders said. China's total LPG imports could reach half-a-million bpd by 2020, up nearly four-fold from last year and overtaking other key Asian importers such as Singapore and Indonesia, they said. Middle East suppliers such as Qatar, the United Arab Emirates and Saudi Arabia together supplied 80 percent of China's LPG imports of 132,000 bpd in 2013. China is the world's largest LPG consumer, using about 874,000 bpd, though the bulk of this is for heating or transport and only 5 percent is used in the petrochemical sector. Most of China's own LPG supplies come as a by-product in refineries and normally contain olefins containing coke that can create unwanted residue in steam crackers that makes it more dirty and expensive to use as a feedstock for petrochemicals. LPG from gas fields contains no olefins. (www.downstreamtoday.com)

Iraq hopes to complete oil pipeline to raise exports this year

April 9, 2014. Iraqi Oil Minister Abdul Kareem Luaibi said his country hoped to complete construction of a 200 km (124 miles) oil pipeline to raise exports to Turkey to more than 1 million barrels per day (bpd) this year. (www.downstreamtoday.com)

Policy / Performance

Kuwait plans to award $4.3 bn oil project deal

April 15, 2014. Kuwait plans to award a KD1.2 billion ($4.3 billion) contract for the first phase of a project to produce heavy oil at its northern Ratqa field, the state-owned Kuwait Oil Company (KOC) said. The project is part of efforts to meet Kuwait's target of producing 4 million barrels of oil per day (bpd) by 2020. The OPEC member currently produces around 3 million bpd and exports around two-thirds. The deadline for bids for the engineering, procurement and construction (EPC) contract is May 11, but this may be extended if companies continue to have queries, KOC said.

KOC will spend about three months assessing the bids and award the contract by about October. The 60,000 bpd should be online by 2017 or 2018, KOC said. By 2020, the production should be 120,000 bpd and KOC will evaluate whether it needs to raise this to 270,000 bpd beyond that date, KOC said. Kuwait's oil production comes mainly from a few mature fields, dominated by the huge Burgan field in the south of the country. Kuwait's current capacity is around 3.25 million bpd, with KOC's share at around 3 million bpd, KOC said. To bring the capacity up to 4 million bpd by 2020, KOC will contribute an extra 650,000 bpd, KOC said. Currently KOC is producing around 700,000 bpd there and will boost this by 300,000 bpd, KOC said. (www.arabianbusiness.com)

Tanzania leader wary of backlash as gas super tax considered

April 14, 2014. Tanzania may reconsider the proposed introduction of a super-profit tax on natural gas production after gold miners criticized a similar measure recommended three years ago, President Jakaya Kikwete said. Tanzania’s government may levy windfall taxes and royalties in addition to corporate and other income taxes, according to a draft natural gas policy published in November.

The state also plans to take an unspecified share in gas production projects, according to the policy. Tanzania has an estimated 46 trillion cubic feet of gas reserves, discovered by companies including Statoil ASA and its partner Exxon Mobil Corp., and BG Group Plc working with Ophir Energy Plc. The government expects gas reserves to increase after it offered eight new blocks for exploration in its fourth bidding round, for which the petroleum agency is receiving applications until May 15. (www.bloomberg.com)

Angola to launch tender for 10 new onshore oil blocks on May 30

April 14, 2014. Angola will start the tender process for onshore oil exploration at 10 new blocks in the Congo Basin and Kwanza Basin on May 30, state oil firm Sonangol said. Companies that want to take part in the tender must submit documentation on their business structures, activities and finances by April 30 to enter the pre-qualifying stage, Sonangol said. Angola, Africa's biggest oil producer after Nigeria, extracts nearly all its crude from offshore fields, but is seeking to develop its onshore potential. Sonangol said that the 10 blocks may hold, on average, reserves of 700,000 barrels of oil each. The government puts Angola's total reserves at just under 13 billion barrels. Seven of the new blocks are in the Kwanza basin and three in the Congo Basin. (www.rigzone.com)

Russia, China aim to finish gas talks before Putin's May visit

April 14, 2014. Russia and China aim to wrap up a 10-year series of talks about Russian gas supplies before President Vladimir Putin visits China in May. The Russian deputy premier, Arkady Dvorkovich, also said China is interested in alternative energy projects on the Black Sea peninsula of Crimea, annexed by Russia from Ukraine in March. Moscow and Beijing have been involved in painstaking talks about possible Russian gas supplies to China, with price being the main obstacle to a deal. Dvorkovich went to China as part of a Russian delegation to discuss cooperation in the energy sector. Putin has urged Russian companies to expand their exposure to Asia as Europe's economy falters and countries there seek less dependence on energy supplies from their former Cold War foe. Europe is the key buyer of oil and gas from Russia. Russia's top natural gas producer Gazprom plans to start supplying China with 38 billion cubic metres of gas per year - around a quarter of Russia's exports to Europe - in 2018. Dvorkovich also said Russia and China plan to boost cooperation in oil and oil products, as well as in coal and power supplies. Russia's top oil company Rosneft aims to triple oil supplies to China from the more than 300,000 barrels per day it sent last year. He also said China is interested in developing Crimea. (www.rigzone.com)

Shale gas offers nearby communities the good, the bad and the uncertain

April 11, 2014. Research on the local impacts of shale gas development finds a host of positive and negative impacts, with the long-term consequences still to be determined, according to scholars reviewing different aspects of the activity. Three scholars speaking April 10 at the think tank Resources for the Future described a very mixed picture of economic benefits, local burdens, and both increases and decreases in property values. In Pennsylvania, development of the Marcellus Shale has produced more than $200 million a year in “impact fees” that have been shared between localities and state agencies. The fees help to cope with such problems as increased demand for services of all kinds, increased wear on roads and more traffic accidents. The recently created Pennsylvania fees generated $204.2 million in their first year, $202.5 million in their second year and $224.5 million in their third year. It remains a point of debate as to whether the fee is better than the more conventional severance tax levied on oil and gas production in many states. (www.bloomberg.com)

UAE energy minister hopes Western partners keep oilfields role

April 11, 2014. The energy minister of the United Arab Emirates (UAE) said he hoped Western oil companies historically in charge of Abu Dhabi's biggest oilfields would keep a role, but that no one was assured of keeping their seat when concessions are renewed. The OPEC member country has held a 60 percent stake in Abu Dhabi Company for Onshore Oil Operations since acquiring an interest in fields that produce over half the United Arab Emirates' oil. (www.rigzone.com)

California lawmakers advance bills to stop fracking

April 11, 2014. The Senate Committee on Natural Resources and Water Quality advanced measures April 8 seeking to impose a moratorium on hydraulic fracturing activities at oil and gas fields in California and to update the state's oil spill response program to address the risks of importing crude oil by rail. Both bills now head to the Senate Committee on Environmental Quality for further action. The measure to halt oil and gas well stimulation treatments cleared the committee on a 5-2 vote. The bill to update the state's oil spill prevention and response program cleared the committee on a 7-1 vote. (www.bloomberg.com)

Polar politics threaten Norway’s deepest drive in Arctic

April 10, 2014. An ice chunk that can swell to the size of Russia will shape Norway’s future oil income. The Arctic ice cap floats above vast deposits of oil and gas while sustaining along its perimeter one of the most biologically productive ecosystems on earth, supporting polar bears, walruses, commercially important fisheries and huge populations of migratory birds. The Norwegian government, seeking to sustain oil revenues that have fueled the country’s prosperity, has floated plans to let drillers push closer than ever to the ice cap -- only to run into the strongest opposition yet. The uproar frames a larger and increasingly contentious fight over whether the Arctic Ocean’s mostly untouched oil and gas reserves can be safely or economically exploited. Key political allies of Norway’s Conservative Party-led government that help keep it in power are pushing to cut plans to offer 54 blocks in the Arctic Barents Sea to explorers like Statoil ASA and France’s Total SA. The Arctic accounts for more than 20 percent of the undiscovered hydrocarbon resources in the world, with an estimated 90 billion barrels of oil, 1,669 trillion cubic feet of natural gas and 44 billion barrels of natural gas liquids, according to the U.S. Geological Survey. About 84 percent is expected to lie offshore, hidden beneath the seabed off the coasts of Alaska, Canada, Russia, Greenland and Norway. (www.bloomberg.com)

South Africa shale-boom outcome won’t mirror mining: ANC

April 9, 2014. South Africa will make sure its population benefits when it develops its shale gas and offshore oil industries and won’t repeat the errors it made with mining, said Zweli Mkhize, treasurer of the ruling party African National Congress (ANC). A law approved by South Africa’s parliament that will give the state a free 20 percent stake in new oil and gas ventures and enable it to buy an unspecified additional share at an agreed price is awaiting the signature of President Jacob Zuma. Companies including Exxon Mobil Corp. and Total SA have said the law will deter investment. (www.bloomberg.com)

Australia invites bids for 30 offshore exploration blocks

April 9, 2014. Australia invites investors to bid for 30 oil and gas blocks under the 2014 Offshore Petroleum Exploration Acreage Release, the country's Department of Industry announced. The 2014 Acreage Release comprises 30 areas located across four basins in the offshore areas of the Northern Territory, the Territory of Ashmore and Cartier Islands and Western Australia. Of these, 26 areas are available for work program bidding and 4 areas are available for cash bidding. Prequalification for the 4 Areas under the Cash Bid Round will close Oct. 30 and prequalified applicants have to submit their Cash Bid by Feb. 5, 2015. The areas available in the Cash Bid Round are W14-20, W14-21, W14-22 and W14-23. (www.rigzone.com)

Oman plans LPG plant aimed at local market

April 9, 2014. Oman Gas Company (OGC) plans to build a liquefied petroleum gas (LPG) processing plant and export facility at Salalah port, the company said. The complex, which he said would cost about $500 million, could produce up to 800 tons a day of LPG, mainly propane and butane, the vast majority of which will be consumed in Oman. OGC expected the design phase of the project to be done by early 2015, with the plant starting up by 2018. Sixty percent of the projected cost is expected to be financed by local and international banks, with the rest funded by the government of Oman, the company said. OGC runs Oman's gas network and will use the new facility to extract propane, butane and gas condensate from gas flowing through the grid in the south of the country. (www.arabianbusiness.com)

POWER

Tehran, Baku finalize power plant deal: Iran envoy

April 15, 2014. The Iranian envoy to Azerbaijan Republic says Tehran and Baku have finalized an agreement on the construction of a hydroelectric power plant during a recent visit by Azeri President Ilham Aliyev to Iran. During the visit, Tehran and Baku signed three Memoranda of Understanding (MoUs) as well as an agreement on building a joint hydroelectric power plant. (www.presstv.ir)

Nandipur project to start power generation from May: Shahbaz