-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø NUCLEAR ENERGY: Nuclear Energy Report Card: 2013

ANALYSIS/ISSUES

Ø Options for Increasing Viability of Investments in Solar Energy

DATA INSIGHT

Ø Gas Requirement as a Feedstock and Fuel for Urea Plants for 2012-13

Book Review: Dynamics of Corporate Social Responsibility

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· MRPL to boost heavy oil processing, cut fuel oil output

· HPCL seeks first low sulphur fuel oil import

· First phase of NTPC's 800 MW Koldam hydel project impounding successful

· Adani Power says it is India's largest private producer with capacity of 8.6 GW

· Tata Power plans to add nearly 850 MW generation capacity

· Neyveli Lignite surpasses power production target

· ABB bags $18 mn contract from Power Grid

· CIL gets single bid from MMTC for coal import contract

· China pushes Tibet drilling in search for oil

· Shell drilling rig in Arctic was moved in winter to avoid tax

· Statoil starts up Gudrun field

· France's Total gets rights to explore Russian shale oil

· Northern Petroleum to increase Canadian exploration

· Ecopetrol's Cartagena refinery to restart around May 2015

· Japan pushes to build hi-tech power plants abroad

· EON to boost Turkish power trading amid rising demand

POLICY & PRICE

Oil regulator seeks consultants to set RIL marketing margin

Decision to hike gas price was necessary to attract investments: Govt

RIL asks EC to reconsider order on deferring gas price hike

IOC begins 5 kg LPG cylinders sale in kirana stores

Gas contract not for life time, revision must every 5 yrs: Govt

Rajasthan discoms challenge compensatory order for Tata UMPP

Punjab might raise power rates in May

EC nod to atomic energy department on Kudankulam pact

Turkey’s fracking push won’t be stalled by bribery probe

Africa’s biggest investor’s energy plan includes shale, Inga

Kuwait hopes to raise oil output to 3.5 mn bpd in 2015

Singapore sees LNG trading hub ambition fulfilled after 2018

Ukraine in emergency talks with EU neighbours on gas imports

Canada invites CIL to explore mining opportunities

Mena to invest $316 bn in power projects during 2015-2019

Egypt approves use of coal for power generation

BLP aims at 1 GW power generation capacity in 5 yrs

SunEdison drops Indian solar project on supply concerns

'Govt need to tweak norms on renewable energy to reach target'

Expedite tariff adoption & approval of PPAs for solar power: Assocham to TN Govt

Suzlon Group acquires Big Sky Wind Park in US

India to award 1 GW of solar permits by 2015

Su-Kam wins solar power project for 40k UP rural homes

India mulls fuel standards lagging Brazil as cities choke

Enel Green sees Africa as ‘next big place’ for renewables

Japan policy stops short of setting clean energy targets

Uranium miners in Namibia face rise in water price, Paladin says

Clean-energy investment rises in 3 countries amid global decline

Mystery property tycoon makes $533 mn bet on solar

France to build Petkim's new wind power plant

Merkel agrees to ease cuts in wind aid to appease regions

WEEK IN REVIEW

NUCLEAR ENERGY

Nuclear Energy Report Card: 2013

Ashish Gupta, Observer Research Foundation

|

T |

he time has come to evaluate the position of the Nuclear Power sector. Though it is contributing to the generation side, its overall share has declined from 4% (2012) to 3.4% (2013) due to dramatic increase in generation from other sectors. Nuclear is one sector which is renewable to a certain extent and clean but yet it is not counted in the renewable category due to potential shortfalls in fuel supply. Indeed the nuclear sector has the capability to contribute a much larger share but still it has not taken off in a big way. There are many issues which still need to be resolved but the civil nuclear industry is optimistic. How far this optimism will lead to India’s energy security is yet to be seen.

Atomic Energy Regulatory Board (AERB): It is one of the oldest regulatory bodies in energy which is high in technical capability but has no decision making power. Its role is limited to inspection only though as per law it is mandated to perform duties beyond inspection. It is also criticised for playing a subordinate role to the Atomic Energy Commission (AEC) as AERC is mandated to inspect the working of AEC. AERC is capable but unfortunately it is not empowered to take any action. Like the coal sector, the nuclear sector enjoys monopoly power and so the presence of a watchdog does not make any difference. In this light how far the government’s decision to institutionalize another regulatory authority such as the ‘Nuclear Safety and Regulatory Authority’ will help in bringing transparency is not clear. Most importantly the need for an additional regulatory authority is not clear. Two authorities, with more or less the same responsibility may create a winner and a loser.

Department of Atomic Energy (DAE) vs Ministry of Coal (MoC): It is very interesting both are part of the government machinery but do not concur on coal reserve estimates. MoC claims that India has coal reserves which would last for hundred years whereas DAE claims that coal reserves have life of thirty years only. The reason for the difference is not clear but it clearly shows that the DAE is desperate to promote civil nuclear power. But the DAE’s promotion of nuclear energy is quite understandable as it is mandated to do so by contradicting another important department is not going to produce any fruitful result. On the contrary it will send the wrong signal to foreign investors. The strategy of the DAE needs to be redefined with focus on inclusivity!

Aspirations vs Reality: DAE is projecting that India will have 20 GW of nuclear power generating capacity by 2020. Given the growth performance of the civil nuclear sector, there is a doubt that DAE will be able to achieve the target by 2020. Since it is only a projection, DAE will probably revise the targets later on. Interestingly international institutions have already revised the target to 14.6 GW by 2020 and so revision from DAE can be expected. International Institutions have eased the pressure on DAE but the ball is in the DAE’s court.

Thorium based reactor to become reality: For almost 34 years India was kept away from the global nuclear trade for having conducted a nuclear test in 1974. Due to the ban, India has been trying to develop a nuclear fuel cycle based on thorium. But the reality is that Research and Development is going on but success is far away. Since the ban has been lifted and India is now free to engage in civil nuclear trade and can procure materials, reactors and fuel from the global market which puts India in a dilemma as to whether it should continue with thorium research or run the show with readily available solutions. The infamous third stage nuclear reactors may or may not become a reality but only the future can tell for sure.

Costly proposition till now: Though many sites have been proposed for civil nuclear power but none have made progress excluding Kudankulam where one unit went critical but is yet to produce power at full potential as some tests are yet to be performed. The Kudankulam projects got the approval in 1988 with an estimated cost of US $ 2.6 billion and till date only one unit has started working partially with cost escalation to US $ 3.4 billion (See Figure below). These delays are draining the exchequer because of cost overruns. Low public acceptance for civil nuclear projects means public agitation will continue and there will be more cost overruns. Fortunately this is public money for which no one is accountable!

Civil Nuclear Power Projects: Progress Card

|

Project |

Capacity in MW |

Schedule date of Commercial Operation |

Expected date of Commercial Operation |

Physical Progress |

|

Kudankumal Atomic Power Project (Unit 1 & 2) |

2 x 1000 |

Dec-2007 & Dec-2008 |

May-2014 & Dec-2014 |

99.85 % as on Mar-2014 & 97.03 % as on Mar-2014 |

|

Rajasthan Atomic Power Project (Unit 7 & 8) |

2 x 700 |

Jun-2016 & Dec-2016 |

June-2016 & Dec-2016 |

No Physical progress given (cost overrun likely) |

|

Kakrapar Rajasthan Atomic Power Project (Unit 3 & 4) |

2 x 700 |

Jun-2015 & Dec-2015 |

Jun-2015 & Dec-2015 |

No Physical progress given (cost overrun likely) |

Source: NPCIL (Just an indication of how civil nuclear projects are progressing)

Safety and liability: After the Fukushima accident, safety and liability issues have become a very genuine concern. When it comes to safety every company including foreign companies are confident about their efficiency and safety standards. But when it comes to liability no one wants to take responsibility. Interestingly they want to do business considering India as unique as we are yet to sign a Non-proliferation Treaty but on the liability front the proposition of ‘unique’ has changed to ‘international practice’ and the liability has to be borne by the operator. Since the operator in India is a public company any liability due to mishaps will have to be borne by the public. Why India should remain on the receiving end both on safety and liability is not clear?

Nuclear as a source of energy has many positives including that of being relatively clean and green but the issues described above are concerns which not only jeopardize the people’s lives but also the nation’s energy security. Hope the issues will be resolved strategically so that civil nuclear program will take off as envisaged without compromising on safety, security, liability and most importantly on public money.

Views are those of the author

Author can be contacted at [email protected]

Book Review: Dynamics of Corporate Social Responsibility

Prof Usha Dhar’s recent book ‘Dynamics of Corporate Social Responsibility’ jointly authored by R Bandyopadhyay, Former Secretary, Ministry of Corporate Affairs, comes at a time when Corporate Social Responsibility (CSR) has become more than just a buzz word. Under the new companies act in India, mid sized and large companies are mandated to spend 2% of their three year annual average net profit on CSR activities. By some estimates this is likely to generate over $2 billion in social and environmental spending. Irrespective of the validity of this estimate it has become the next big thing for many who are supposedly in the business of being socially and environmentally responsible. One can hear wide-eyed presentations from those in the renewable energy and other social sectors on how they plan to use the $2 billion magic wand to take the marginalised people in India to the mainstream. Sadly their enthusiasm fails to conceal their poor grasp of the concept of CSR and they would do well to spend some time with this new book. Opening with a chapter on the history of CSR the book proceeds to illustrate the challenges in implementing CSR projects using case studies that span wide range of national and international companies. The case studies cover a wide range of CSR strategies that include but not limited to the energy efficiencies programme in HPs global citizenship strategy to Novelis’ effort to recycle aluminium cans. ITC’s effort to create sustainable livelihoods in the Indian agriculture sector is also analysed in great detail. The book resists the temptation to portray CRS as the answer to the paradox of democratic capitalism and offers a valid critique of the glossy reports that tout the company’s dedication to CSR and the achievements of its CSR projects. The book stands testimony to the authors’ deep understanding of social and environmental issues that are tempered with their expertise in economics and corporate affairs.

Editorial Team, ORF ENM

‘Dynamics of Corporate Social Responsibility’ by Usha Dhar (Distinguished Professor, EMPI Business School) and R Bandyopadhyay, Former Secretary, Ministry of Corporate Affairs, EMPI B School Publishing House, New Delhi, Price $30, INR 800.

ANALYSIS/ISSUES

Options for Increasing Viability of Investments in Solar Energy

Praveen Kumar Kulkarni*

|

T |

oday in India, corporate companies / entities or the crony capitalist system is enjoying free equity due to the prevailing policies / political expediency:

1. through Accelerated Depreciation (AD) earning 19 to 24% Return on Equity (ROE)

2. through Capital Subsidy earning 19 to 24% ROE

3. through Viability Gap Funding (VGF) + AD earning 19 to 24% ROE.

4. through equity padding – ‘jacking up the total project cost’ and earning 19 to 24% ROE

This is the basis for my strong suggestion for 100% debt funding with full control stakes till the debt repayment for decentralized renewable energy projects. Many projects are not functional today even after these generous give-aways. The debt is not paid back and the projects are non functional and yet the promoters have become rich!!

Thus, we are unable to create new generation honest entrepreneurs who can make capital work for them and their country.

The Govt of Gujarat sanctioned a loan of ` 2100 Crore at 0.105% interest rate for 20 years to set up TATA NANO project to create jobs in Gujarat. Why can a similar scheme not be devised for renewable projects?

http://www.financialexpress.com/news/tata-nano-gujarat-loan-amount-row-/991861

a). With Japan International Cooperation Agency (JICA) or Asian Development Bank (ADB) or equivalent Impact Investor or through other Development Loan Agencies or Debt syndicates loans at 3% interest rate for a 14 to 15 year period on rupee term, a decentralized renewable energy project will be viable on 100% debt (with interest subsidy of 5%):

Recently JICA has given 4 to 5% interest rate loan to Solar Energy Corporation of India (SECI) to develop the 1000 MW Solar PV park at Mehboob Nagar in Andhra Pradesh, which means that the Government (both State and Centre) can provide or access such low cost funds very easily.

I have assumed a total interest rate of 8% for 100% debt fund. I have also mentioned 5% interest subsidy so that the project interest rate is only 3%. Term loan is for 14 to 15 years. Total Interest subsidy paid over 14 to 15 years is only ` 23 Crore, lower if depreciating rupee is considered and hence, it is much better than quick VGF payment in the first 6 years assuming ` 2.3 Cr/MW for 10MW = ` 23 Crore as stipulated by SECI. This will be a great savings to the nation and it will avoid opportunities for crony capitalism. It can create large number of entrepreneurs in each taluk. In 4500 taluks, we can easily create 90 GW of Solar PV through 9000 entrepreneurs which will contribute to sustainability and offer low tariff to poor consumers.

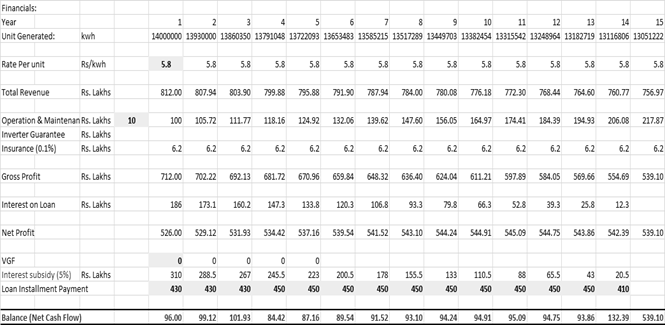

You can see from the table that:

a. The small entrepreneur will pay the debt installment of ` 4.5 Cr/year and still makes a profit of ` 90 laksh/year, which is enough for two entrepreneurs.

b. The interest subsidy of 5% from the Government given under condition of assured generation will be of lower burden especially if the depreciation of the rupee is taken into account. There will be no loss on tax or loss of revenue through accelerated depreciation (which can be used to pay this Interest subsidy). It will eliminate the need for VGF (which is an additional saving for the Government) and also eliminate the need for capital subsidy and the corruption ridden process of reverse bidding.

c. Tariff on power purchase agreement (PPA) is likely to be just ` 5.8/kwh, which is same as what comes out of projects under SECI with VGF operated mainly by large companies. This model is being proposed for two engineers / entrepreneurs at the taluk level to own the plant after 15 years while earning ` 80 to 90 lakhs/year and serve their taluk by creating local jobs. After 15 years, the project will be belong to these entrepreneurs and they will earn over ` 5 Crore from year 15 till year 25, which is an acceptable business proposition.

|

Project Capacity |

10 |

MW |

Interest rate = 3% |

|

Yearly Generation |

1400000 |

kwh/MW |

|

|

Total Generation |

14000000 |

kwh |

|

|

Project Cost |

INR 6.2 |

Crore per MW |

|

|

Total Project Cost |

INR 62 |

Crore |

|

|

Bank Loan |

INR 62 |

Crore |

|

|

VGF 50% |

INR 0 |

Crore |

|

|

Equity |

INR 0 |

Crore |

|

|

Total |

INR 62 |

Crore |

Renewable Energy Generation:

a). Such local taluk level entrepreneurs with open and transparent business model and with low cost 100% debt finance will result in return of 5 to 10 lakh/year/MW after paying loan installment, interest and expenses for the entrepreneur and decentralized renewable energy for consumers. With such a model, it is possible to harness 100,000 MW solar PV. This is likely to be the best intermediate solution till we find better storage technology for renewable energy. As the need for viability gap funding, accelerated depreciation and capital subsidy will be eliminated, Government burden will be much lower. It will also facilitate public participation and create a large number of jobs through local entrepreneurs. Subsidiary industries and EPC companies will also flourish as a result.

Germany, USA and China can learn from India rather than India learning from them as it is usually the case. This is entirely in our hands if entrepreneurs, policy makers and the people come together to make a long term change.

Views are those of the author

* The author, BE (MECH), MIE, Ex- JICA /UNIDO, is a solar entrepreneur.

Author can be contacted at [email protected]

DATA INSIGHT

Gas Requirement as a Feedstock and Fuel for Urea Plants for 2012-13

Akhilesh Sati, Observer Research Foundation

|

S. No. |

Urea Unit |

Production (Tonne) |

Gas Requirement (Million SCM) |

|

1 |

BVFCL - Namrup-III |

281265 |

435.21 |

|

2 |

IFFCO - Aonla-I |

1091952 |

757.71 |

|

3 |

Indo-Gulf -Jagdishpur |

1085358 |

732.48 |

|

4 |

Kribhco - Hazira |

2135590 |

1550.13 |

|

5 |

NFL - Vijaipur-I |

966450 |

701.5 |

|

6 |

RCF-Trombay-V |

384110 |

448.24 |

|

7 |

NFCL-Kakinada-I |

787848 |

548.8 |

|

8 |

CFCL Gadepan-I |

1035794 |

710.02 |

|

9 |

TCL-Babrala |

1127421 |

744.79 |

|

10 |

KSFL-Shahjahanpur |

1008296 |

702.36 |

|

11 |

NFCL-Kakinada-II |

777954 |

541.91 |

|

12 |

IFFCO-Aonla-II |

1152829 |

776.33 |

|

13 |

NFL-Vijaipur-II |

964860 |

672.11 |

|

14 |

KFCL-Kanpur |

722800 |

691.68 |

|

15 |

SFC-Kota |

385360 |

368.77 |

|

16 |

IFFCO-Phulpur-I |

673102 |

622.54 |

|

17 |

MCFL-Managalore |

379500 |

340.44 |

|

18 |

MFL-Madras |

435771 |

443.05 |

|

19 |

SPIC-Tuticorin |

481820 |

433.76 |

|

20 |

ZIL-Goa |

386718 |

344.65 |

|

21 |

IFFCO-Phulpur-II |

992011 |

711.71 |

|

22 |

CFCL-Gadepan-II |

1055986 |

731.21 |

|

23 |

GNVFC-Bharuch |

708795 |

690.56 |

|

24 |

NFL-Nangal |

471380 |

547.09 |

|

25 |

NFL-Bhatinda |

413794 |

515.78 |

|

26 |

NFL-Panipat |

394491 |

464.44 |

|

27 |

GSFC-Baroda |

347206 |

293.64 |

|

28 |

IFFCO-Kalol |

600325 |

483.7 |

|

29 |

RCF-Thal |

1951200 |

1650.91 |

|

30 |

BVFCL - Namrup-II |

109428 |

168.28 |

|

Total |

23309414 |

18823.8 |

Source: Lok Sabha Unstarred Question No. 2819

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC looks for equity partner in Vietnam project

April 6, 2014. Having extended its stay in South China Sea to promote India's strategic interest, Oil and Natural Gas Corp (ONGC) is looking for an equity partner to continue exploration for oil and gas offshore Vietnam. ONGC Videsh Ltd (OVL), the overseas investment arm of ONGC, had in July 2012 reversed its decision to exit Block 128 as Hannoi offered additional data that could help it make future exploration economically feasible and discovering hydrocarbons commercially viable. OVL wants to retain a majority 51 per cent stake in Block 128 and the remaining it wants to offer to PetroVietnam to de-risk exploration in the block over which China had claimed territorial rights. Ignoring objections from China, OVL had in July 2012 decided to continue to explore for oil and gas offshore Vietnam in the South China Sea. OVL had in June 2012 decided to return Block 128 to Vietnam as exploration there wasn't commercially viable but it did an about-turn at the insistence of the Ministry of External Affairs which wanted India to continue its presence in the South China Sea. Vietnam gave a two-year extension of exploration period, which now expires in June 15, 2014. China had opposed India's presence in the region, claiming its own territorial rights over the potentially energy-rich sea. China claims sovereignty over much of the South China Sea, including areas close offshore some of its bordering states, putting it in conflict with Vietnam, the Philippines, Malaysia and Brunei. (economictimes.indiatimes.com)

ONGC asks for nearly $13 for deep-sea gas

April 4, 2014. Oil and Natural Gas Corp (ONGC) has told the government that gas production from some of its deep-sea fields would be viable only at prices of up to nearly $13 per unit, far more than the controversial price of about $8.4 that Reliance Industries Ltd (RIL) would have charged from April 1 if poll authorities had not vetoed it. It has asked for prices of $10.72 to $12.63 for two blocks in the Mahanadi basin, close to RIL's KG-D6 block, where gas has been sold at $4.2 since 2009. The government had approved a new formula in June 2013 that would have nearly doubled the rates but it could not implement it because the election code of conduct was enforced before the oil ministry could collected the necessary data to calculate the new price. The new price also faced strong opposition from the Aam Aadmi Party, which has made it an election issue. (economictimes.indiatimes.com)

MRPL to boost heavy oil processing, cut fuel oil output

April 3, 2014. Mangalore Refinery and Petrochemicals Ltd (MRPL) will change its crude mix and production pattern in the year to March after commissioning of a coker unit to boost its profitability. MRPL's current crude processing is tilted in favour of costlier lighter grades and produces a significant volume of fuel oil, which normally sells at a discount in global markets. MRPL, which runs a 300,000 barrels per day (bpd) refinery in southern Karnataka state, will boost output of premium products like naphtha and gasoil, and cut fuel oil production in the fiscal year that began on April 1. MRPL is in talks to buy at least 10,000 bpd of Iraqi oil in this fiscal year and plans to retain its imports from Iran at 80,000 bpd if sanctions against Tehran are not eased. The state-run refiner currently buys Iranian mix oil from the OPEC member and after commissioning of the coker unit it aims to lift heavier grades like Soroush and Nowruz. It aims to buy as much as 40,000 bpd of Latin American grades in the fiscal year. In January MRPL became the first Indian refinery to buy Argentina's Escalante grade for delivery in April-May. (economictimes.indiatimes.com)

Assam-based NRL enters into agreement with EIL to produce petroleum wax

April 2, 2014. Assam based, Numaligarh Refinery Limited (NRL) has entered into a strategic agreement for commercialization and joint ownership for production of petroleum wax with Engineers India Limited (EIL), Delhi and Indian Institute of Petroleum (CSR-IIP), Dehradun.

NRL is implementing the Wax project investing close to ` 577 crores. The wax project envisages production of high value low volume Paraffin and Micro-Crystalline Wax utilizing inherent properties of North East Crude. (economictimes.indiatimes.com)

Transportation / Trade

HPCL seeks first low sulphur fuel oil import

April 3, 2014. Hindustan Petroleum Corp Ltd (HPCL) is seeking for the first time to import atleast 20,000 tonnes of low-sulphur fuel oil in Chennai for the month of April. An import tender by HPCL is rare and it is sourcing for domestic customers. It was unclear whether demand from HPCL will continue or this was a one-off import. Specifications for the 180-centistoke fuel oil cargo include a maximum sulphur content of 0.95 percent and a density of 0.99 kilograms per litre. The cargoes shall be delivered to Chennai in cargo sizes of either 20,000-25,000 tonnes or 25,000-30,000 tonnes over April 22-30. (economictimes.indiatimes.com)

GAIL India slaps show-cause on Rolls-Royce for not disclosing a commission paid to agents

April 3, 2014. GAIL India has slapped a show-cause notice on Rolls-Royce for allegedly not disclosing a commission of ` 30 crore paid to agents in contracts worth ` 1,639 crore. Rolls-Royce has over the years supplied 63 out of the 72 gas turbines installed on nationwide pipeline network of GAIL. The British company also provides spares and services to the turbines. Unlike the defence deals, PSU tendering allows for commission to be paid to agents but that has to be declared upfront during the bidding process. Rolls-Royce allegedly paid a commission of 10-11.3 per cent in 24 spares and services deals to agent Aashmore, Singapore, without declaring the same at the time of bid submission. In another contract for new engines, a fee of 2 per cent was paid to another firm Infinity in addition to the pre- declared commission of 2 per cent paid to its authorised spares and service agency Turbotech Energy Services in New Delhi. (economictimes.indiatimes.com)

ONGC's naphtha sales fetch year-high price

April 3, 2014. ONGC sold 35,000 tonnes of naphtha to Japanese petrochemical maker Idemitsu Kosan for May 5-6 loading from Mumbai at nearly $41 a tonne above Middle East quotes on a free-on-board (FOB) basis. This is the highest premium ONGC has fetched for a naphtha cargo sold out of Mumbai in about a year. Unlike trading houses, petrochemical makers who buy directly from refiners do not have to resell the cargo at a higher price. ONGC also exports naphtha out of Hazira. Naphtha sentiment is expected to improve compared with the first three days of the week as South Korea's Samsung Total and Malaysia-based Titan were out to buy spot cargoes for second-half May delivery. Buyers were unwilling to come forward earlier in the week as they were hoping prices would ease after premiums went beyond $10 a tonne to Japan quotes on a cost-and-freight basis for delivery to Taiwan and South Korea in first-half May. (economictimes.indiatimes.com)

Policy / Performance

Oil regulator seeks consultants to set RIL marketing margin

April 8, 2014. Oil regulator PNGRB plans to hire consultants to advise it on fixing the margin that natural gas marketers such as Reliance Industries and GAIL India can charge from urea manufacturers and LPG plants. After grappling with the issue for two years, the Ministry of Petroleum and Natural Gas had ordered that the margin to be charged, over and above the gas sale price, should be fixed between the seller and buyers in all sectors other than urea and LPG. It asked the Petroleum and Natural Gas Regulatory Board (PNGRB) to determine the margin for supply of domestic gas to urea and LPG producers through its independent process. The PNGRB in turn is seeking consultants to help it. Bids were called by April 11 but the PNGRB extended the deadline to April 21. The rates determined by the PNGRB would thereafter be notified by the government. For users other than urea and LPG plants, the oil ministry had ruled that any complaints about the exercise of monopoly power should be addressed to the PNGRB and/or the Competition Commission of India. Presently, marketing margins charged by producers and sellers of gas range from 11 cents to 20 cents per million British thermal units (mmBtu). RIL charged 13.5 cents per mmBtu as marketing margin over and above the government-set price of $4.205 for KG-D6 gas for the first five years of production ended March 31. For the financial year that began on April 1, it proposed to move from charging the margin on net calorific value (NCV) basis to gross calorific value (GCV) basis as the new price formulation uses inputs based on GCV. The change would result in marketing margins rising by 11 per cent, a move opposed by the 16 urea making plants - the only customers of KG-D6 gas presently. Fertiliser firms have to pay 12.2 cents if RIL was to change the pricing methodology from NCV to GCV during the time PNGRB takes to decide on the marketing margin. All domestically produced natural gas will be priced at an average of international hub rates and the cost of importing liquefied natural gas. Implementation of this formula, which will almost double the rate to $8.3, has been deferred till general elections are completed. (economictimes.indiatimes.com)

Decision to hike gas price was necessary to attract investments: Govt

April 4, 2014. The oil ministry justified the decision to revise gas prices, insisting that it was necessary to attract more investment in oil exploration to ensure the energy security of the country in the long-run, brushing aside court concerns that any such hike would affect consumers across the board. A bench, comprising of Justices BS Chauhan, Jasti Chelameswar and Kurian Joseph, had made remarks to this effect shortly after RIL counsel Harish N Salve had claimed that any such hike would not affect LPG or CNG prices as the gas was being supplied only to the power and fertiliser sectors. Forty-five to 50% of the gas deposits are in the high seas and require huge investments, he said. The success rate of discovery was also only 25% to 40%, he said. The court would normally not interfere with such policy decisions, he said, citing an earlier decision by the court to keep its hands off another similar controversy involving ONGC and a Rajasthan gas field. (economictimes.indiatimes.com)

RIL asks EC to reconsider order on deferring gas price hike

April 4, 2014. Hit hard by Election Commission (EC) deferring gas price revision, Reliance Industries Ltd (RIL) has written to the poll watchdog asking it to reconsider the directive as the decision to raise rates was taken months before polls were declared and even the Supreme Court has not stayed the move. The revision of its eastern offshore KG-D6 gas price was a contractual necessity as the old rate of USD 4.2 expired on March 31. To decide on the rate to be effective from April, 2014, the government had in 2012 constituted a committee under Prime Minister's Economic Advisory Council Chairman C Rangarajan. Based on the panel's recommendations, the Cabinet in June approved a new pricing formula. The Cabinet on December 19 again approved the applicability of the formula on KG-D6 fields and the Oil Ministry notified the formula on January 10 this year. Giving a detailed account of how gas prices were set and what methodology was followed in the present case, RIL said the Supreme Court is hearing a petition opposing the gas price hike on a day-to-day basis. The Election Commission on March 24 asked the government to defer implementation of the formula, which would have nearly doubled the rates to USD 8.3 per million British thermal unit, on grounds that the matter is sub-judice. (economictimes.indiatimes.com)

IOC begins 5 kg LPG cylinders sale in kirana stores

April 3, 2014. Indian Oil Corporation (IOC) has begun sale of market-priced 5-kg Free Trade LPG (FTL) cylinders through kirana stores and supermarkets. The sale of the 5-kg FTL cylinders from kirana stores and supermarkets has been launched in Bangalore, Chennai, Gorakhpur, Lucknow and Aligarh, to begin with, IOC said. The cost of a new 5-kg FTL cylinder with LPG will be approximately in the range of ` 1600 to ` 1700. At the time of subsequent refills, only the cost of the product will be payable while exchanging the empty cylinder for a filled one. This new initiative will make available LPG freely through easily approachable sales points, and local corner stores such as kirana shops, retail stores and malls and will benefit migratory population such as students, IT professionals, BPO employees and persons with odd duty timings, it said. To begin with, sale of the 5-kg FTL cylinders has been launched from 11 kirana stores in five cities, and will be extended to 50 more cities in the near future. Earlier, in October last year, sale of 5-kg FTL cylinders was launched from select Indian Oil retail outlets (petrol/ diesel stations) pan-India. (economictimes.indiatimes.com)

Gas contract not for life time, revision must every 5 yrs: Govt

April 3, 2014. The government argued before the Supreme Court that any price stipulated under a long-term production-sharing contract (PSC), such as the one with RIL over the KG basin, could not be regarded as fixed for all times to come and was subject to revision every five years. In this case, Solicitor General Mohan Parasaran pointed out that the contract, which was signed in 2000, was valid till 2023. The top court is hearing twin petitions seeking cancellation of the PSC in the face of alleged failure of RIL to stick to its terms, a charge RIL denies. There is no bar on price revision in the PSC, the solicitor general said. The government, he also claimed, did not fix prices. It was up to the contractor to arrive at an arm's length price, "another name", he said, "for market prices". The government only approves it, he said. The government in exercise of this power has revised prices and the EGoM (empowered group of ministers) cleared the revision as well as the utilisation policy in 2009, he said. (economictimes.indiatimes.com)

SC withdraws Australian judge as arbitrator in RIL case

April 3, 2014. The Supreme Court (SC) has cancelled its own directive to appoint an Australian judge to preside over arbitration between Reliance Industries Ltd (RIL) and the government, after a lawyer representing the government pointed out that the jurist, James Jacob Spigelman, was on top of a list of potential arbitrators recommended by RIL. Further, in another rollback of a directive in the same order, Justice SS Nijjar also clarified that all issues could be examined by the arbitration panel after the government's counsel Dushyant Dave pointed out that the bench had framed some issues for arbitration. The earlier order would have limited the proceedings to these issues, effectively reducing the government's room for maneuver, but the court has now clarified that the arbitral panel would be free to identify all issues which it wanted to deal with. Reliance had welcomed the court's original order in a video released on YouTube. The company has been the target of regular attacks by Aam Aadmi Party leader Arvind Kejriwal, who alleges that both Congress and BJP are influenced by RIL Chairman Mukesh Ambani. Justice Nijjar, who ordered the appointment of James Jacob Spigelman, recalled the order after Dave made an out-of-turn mention in the court, saying "There's a bona fide error in the judgment" and urged him to retract the directive. Reliance counsel Harish N Salve did not object to the recall of the order. Arbitrators from India, Canada, and UK were ruled out in the order in keeping with the global practice of keeping out arbitrators of nationalities of the parties to the row, in this case Reliance, Niko, BP on one hand and the Indian government on the other. RIL had earlier approached the court, seeking the appointment of the presiding arbitrator after the two sides could not agree on whom to appoint. (economictimes.indiatimes.com)

POWER

Generation

First phase of NTPC's 800 MW Koldam hydel project impounding successful

April 7, 2014. The first phase of impounding of NTPC's 800 MW Koldam hydel project in Himachal Pradesh has been successfully tested. The final impounding of the project would be started after the monsoon season this year. Now after the successful completion of additional work as suggested by technical experts, first stage impounding work has successfully been completed and as per the schedule water was being held at 560-M level so that tunnel, dam and other components could properly be tested. The 800 MW Koldam situated on the border of Mandi and Bilaspur was the first hydroelectric project undertaken by NTPC. (economictimes.indiatimes.com)

Adani Power says it is India's largest private producer with capacity of 8.6 GW

April 4, 2014. Adani Power, a subsidiary of Adani Enterprises and part of the ` 50,000 crore Adani Group, said it had become the largest private power producer in India with the commissioning of the fourth unit of 660 MW at its power plant at Tiroda in Maharashtra. The overall capacity is 8,620 MW. Adani Power added 2,640 MW the last financial year, accounting for 15 per cent of the addition of 17,000 MW in India. It is developing six power projects across Gujarat, Maharashtra, Rajasthan and Madhya Pradesh. (www.business-standard.com)

Tata Power plans to add nearly 850 MW generation capacity

April 3, 2014. Tata Power is in the process of completing projects having a total generation capacity of nearly 850 MW, which would take its overall capacity to more than 9,000 MW. At present, the country's largest private power producer has an installed generation capacity of about 8,560 MW. Out of the total, 7,647 MW comes from thermal projects and 912 MW from green energy sources.

Among the projects under execution are two wind energy plants in South Africa. Both projects are being developed by Cennergi (Pty) Ltd -- a 50:50 joint venture between Tata Power and Exxaro Resources. Tata Power said the company has a strong track record of successfully implementing large and complex projects across the power sector. (www.business-standard.com)

Neyveli Lignite surpasses power production target

April 2, 2014. Neyveli Lignite Corporation Limited, Navratna Public Sector Enterprise, reported total power generation from all the thermal stations put together at 19,988.73 Million Unit (MU) (19,902.34 MU in 2012-13) in 2013-14, the highest for any year since inception. The target fixed by the Government of India was 18,929 MU, NLC achieved 5.60 per cent more than the target. The company has witnessed a growth of 0.43 per cent than 2012-13. The total lignite production from all the mines put together was 26.61 million tonnes (26.22 million tonnes in 2012-13) achieved during 2013-14 and is the highest for any year since inception. While the target fixed by the Government of India was 25.2 million tonnes, NLC overshot the target by 5.59 per cent. The company has witnessed a growth of 1.47 per cent over the previous year (2012-13). Under the administrative control of the Ministry of Coal, NLC at present operates three open cast lignite mines at Neyveli and one at Barsingsar, Rajasthan which takes the total capacity to 30.60 million tonnes, and three thermal power stations at Neyveli and one at Barsinsar with a total installed capacity of 2,740 MW. (www.business-standard.com)

Transmission / Distribution / Trade

ABB bags $18 mn contract from Power Grid

April 8, 2014. Power and automation technologies provider ABB has bagged $ 18 million worth order from Power Grid Corporation to construct a 400 kV gas-insulated switchgear (GIS) substation at Kolhapur in Maharashtra. The new substation will help strengthen the inter-regional grid between the western and southern regions. ABB's scope of the project, which is expected to be completed in 2016, includes design, engineering, supply, installation and commissioning of the substation. The company will supply 400 kV GIS, shunt reactors, control and relay panels based on IEC 61850 platform. (economictimes.indiatimes.com)

Electricity rate falls on Indian Energy Exchange

April 8, 2014. Price of electricity sold on the Indian Energy Exchange declined to ` 3.03 per unit as transmission constraints and restrictions imposed by some states took a toll on the spot market. The average market clearing price in March touched ` 3.03 per unit, almost 8 per cent lower than the level recorded in previous month. In February, the price per unit stood at ` 3.29. Total cleared volume on the exchange last month was 2.3 billion units, almost similar to the level seen in February. Around 550 million units of electricity could not be traded due to network congestion in March. (economictimes.indiatimes.com)

CIL gets single bid from MMTC for coal import contract

April 6, 2014. Coal India Ltd (CIL) received a single expression of interest from MMTC for its plan to import the fuel to meet supply agreements with power plants. The company did not import coal in the previous financial year because the requirement of consumers was less. The world's largest coal miner had to invite fresh applications after an earlier tender elicited no response. CIL had first invited bids for coal imports in November 2013. It had said in September that it may import 15 million tonnes of coal for power utilities as part of meeting supply commitments to power utilities. The company intends to import 5 million tonnes of coal to meet the shortfall against deliveries under fuel supply agreements (FSAs) signed with power plants. According to the FSA, Coal India will supply 65% of the contracted amount from domestic sources and another 15% through imports. (www.business-standard.com)

Rajasthan discoms challenge compensatory order for Tata UMPP

April 8, 2014. The Rajasthan government’s three power distribution companies have moved the Appellate Tribunal for Electricity (APTEL) challenging a February 21 order passed by the power regulator, the Central Electricity Regulatory Commission (CERC), which allowed a compensatory tariff to Tata Power for electricity generated at the company’s Mundra Ultra Mega Power Project (UMPP). The discoms have sought quashing of the CERC order on multiple grounds. They have argued the regulator does not have the power to revise tariff for a project based on competitive bidding; CERC ignored the in-principle approval given by procurers and whether the analysis of hardship faced by the company is correct. CERC had allowed Tata Power 52 paise per unit tariff over and above the project’s levelised tariff of ` 2.26 per unit as compensation for loss incurred due to change in Indonesian coal regulations in 2011. The company took around ` 1,800 crore impairment on the Mundra investment in 2011-12 followed by ` 8,500 crore impairment in 2012-13. The CERC order had made power costlier for millions of consumers across five states — Gujarat, Maharashtra, Punjab, Rajasthan and Haryana. According to ratings agency ICRA, the retail tariff from the 4,000 MW project for consumers in five procuring states after the compensation are expected to increase in a range between 3 paise and 10 paise per unit.

However, the compensatory tariff could be offset by at least three factors -- sharing of profits earnedby Tata's Indonesian mining companies, sacrificing 1% Return on Equity (RoE) and lower auxiliary consumption of 4.75% allowed by CERC. The three factors, put together, are likely to bring down the effective compensatory tariff from the project to 47 paise per unit, according to an estimate.

Tata Power holds 30% stake in three coal mines in Indonesia which supply fuel for the imported coal-based Mundra project located in Gujarat. The compensation announced by CERC was based on the recommendations of Deepak Parekh committee report. The Rajasthan discoms have argued CERC accepted the report signed by three members only and decided the matter by allowing compensatory tariff overriding the conditions and objections of the Procurers. (www.business-standard.com)

Punjab might raise power rates in May

April 7, 2014. The Punjab State Electricity Regulatory Commission (PSERC) might announce increase in electricity tariff by next month. According to sources, the state power utility, the Punjab State Power Corporation Limited (PSPCL) has proposed to the regulator to allow a raise of 10 per cent in the current financial year. PSPCL has projected a revenue gap of ` 2,595.30 crore for 2014-15 in an Aggregate Revenue Requirement (ARR) petition submitted with PSERC. To meet this gap, an increase in tariff was sought.

The commission said as a pre-election code of conduct has been enforced in the state, the state government could not commit to the subsidy it offers to the agricultural sector. Once the state government commits, the proposal of the PSPCL would be finalised. The power regulator issued orders that the existing tariff would continue for all categories of consumers till a new tariff is announced. The tariff order issued by PSERC for the year 2013-14 was to remain operative till March 31. In its tariff order in 2013-14, PSERC announced an average overall increase of 9.06 percent in the existing tariff across all categories, including domestic, agricultural pumpsets consumers, industrial, commercial, etc. The consolidated revenue gap determined by the commission for FY 2013-14 was ` 1,782.50 crore. To meet this, an increase of 9.06 per cent is required across the board, so it was raised. However, industrialists already opposed the PSPCL move to hike the power tariff in the state in its annual revenue requirement (ARR) submitted to the PSERC for the financial year 2014-15, stating it would be demoralising for the industry. (www.business-standard.com)

Cheaper coal, rising rupee help fire up JSW Energy

April 7, 2014. The worst appears to be over for JSW group's power company — JSW Energy. International coal prices have come down, the rupee has gained and merchant rates have remained stable. These could well boost the profitability of the company going forward. The 3,140 MW power company uses international coal to fire two-third of its total capacity. Since the start of the year, Indonesian and South African coal prices have fallen by 12% and 15% respectively in dollar terms due to lower global demand, especially from China. In rupee terms, the correction is sharper as the currency has strengthened 4% in the year-to-date. It is a huge positive as fuel cost is close to 85% of the company's total expenditure or more than half of the company's total revenues. On the sales front, around half of the company's power produced is sold in the open merchant market, while the remaining is on long-term agreements. Merchant tariffs have remained stable between 4.5-5 in the southern markets.

JSW Energy also has a strong balance sheet with debt to equity of 1.7 compared to an average ratio of 4 for the industry has allowed the company to consider acquiring power assets. It is in talks with two or three companies, but is yet to finalise a deal. Despite a weak macro-economic scenario, the firm's operating profit (Ebidta) grew by 20% y-o-y in the first nine months of FY14. However, its profit after tax was higher by only 6% on higher interest. In the first nine months, its sales were 6,533 crore, Ebidta was 2,190 crore and profit after tax was (PAT) 601 crore. (economictimes.indiatimes.com)

CIL receives Rio Tinto, GVK Group proposals to sell coal mines

April 7, 2014. Coal India Ltd (CIL) has received at least 60 proposals from firms including Anglo-Australian miner Rio Tinto Plc and the GVK Group to buy equity in their coal mines. CIL seeks to consolidate its position as the world’s largest coal miner, leveraging around ` 45,000 crore cash on its books and the bargains on offer. This follows a similar attempt by another state-owned entity, NTPC Ltd, to consolidate its position as India’s largest power generation company by acquiring distressed assets in the backdrop of reasonable valuations. India has been trying to cut its dependence on coal and oil imports by buying stakes in overseas assets, a move that could reduce both supply risks as well as price shocks. (www.livemint.com)

EC nod to atomic energy department on Kudankulam pact

April 7, 2014. The Election Commission (EC) has given clearance to the Department of Atomic Energy (DAE) to sign an agreement with its Russian counterpart for units 3 and 4 of Kudankulam Nuclear Power Plant project (KKNPP) and a deal is expected to be signed soon. The Nuclear Power Corporation of India Ltd (NPCIL), a public sector undertaking under DAE which builds and operates nuclear power plants in the country, has also approached its Russian counterpart. The agreement could be signed as early as this month. Units 3 and 4 of the KKNPP were stuck over the liability clause. The deal could not be signed over the same issue when Prime Minister Manmohan Singh visited Russia. However, after hectic negotiations between both the parties the issue was sorted out. The UPA government has signed nuclear deals with US, UK, France, Kazakhstan, South Korea for exchange of technology on nuclear issues and import of good quality uranium required for nuclear plants. Unit 1 of KKNPP was also commissioned during this time. (www.livemint.com)

BHEL FY14 provisional net profit goes down by 51 pc

April 5, 2014. Bharat Heavy Electricals Ltd (BHEL), India's state-run top power equipment maker, reported a 51 per cent fall in provisional net profit for the fiscal year ended March 31.

India's power sector has been badly hit by shortages of coal and gas supplies, delays in environmental approvals for power and mining projects and drying up of funding, severely denting the demand for equipment. Provisional net profit at the company fell to ` 32.28 billion ($536.26 million) in the last fiscal year 2013/14 from ` 66.15 billion reported in the fiscal year 2012/13, the company said. (economictimes.indiatimes.com)

Reliance Power refutes AAP allegations on coal allotment for Sasan project

April 3, 2014. Reliance Power Ltd has refuted the allegations made by Aam Admi Party (AAP) and said all allegations leveled by the party are baseless. The party has raised questions over allotment of coal to the 4,000 MW Sasan Power project of Reliance Power and questioned role of the state chief minister Shivraj Singh Chouhan in a coal deal. AAP has raised a slew of questions and alleged that the role of MP CM in 'pressurising' the Central government to allot Mahan Coal Block to Essar and Hindalco despite disagreement of Ministry of Forest and Environment. Till March 2009, Union Ministry of Coal took the stand that the two coal blocks (Moher & Moher Amlohri) initially allocated were sufficient for Sasan project and that the third block (Chhatrasal) was not required. (www.business-standard.com)

NPCIL holding programmes to sensitise people on nuclear energy

April 2, 2014. Nuclear Power Corporation of India Ltd (NPCIL) has been conducting programmes to generate awareness about the various positive aspects of the nuclear energy. Nuclear energy is very safe and it is the future of the country. After protests from people at Kudankulam, Tamil Nadu, and at Mithivirdi village in Bhavnagar district of Gujarat against nuclear power projects, the NPCIL has been conducting public awareness programmes to create awareness amongst the local population and remove doubts from their minds on safety of the nuclear power plant. The awareness programmes cover issues like nuclear power plant, radiation, environment impact, nuclear safety. The information is disseminated through lectures, films, pamphlets and plant visits. Quiz contests are also conducted for students. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

China pushes Tibet drilling in search for oil

April 8, 2014. Chinese miners have drilled a record seven-km-deep borehole — the deepest ever dug by a Chinese company on the Tibetan plateau — in the latest push by the government to accelerate the search for oil and minerals on the untapped but energy-rich “roof of the world.” Chinese geologists have said the secretive project, about which little has been reported in state media and whose exact location in Tibet remains unknown, is part of a wider push to “lessen the country’s dependence on oil imports,” the South China Morning Post reported. Li Haibing, a professor with the Chinese Academy of Geological Sciences who has led drilling projects in Tibet said the government was “reviewing a proposal for a new deep-earth project” to drill wells as deep as 10 km. China’s energy giants Sinopec and China National Petroleum Corporation (CNPC) have both carried out exploration projects on the Tibetan plateau, with the latter estimating the oil reserves of the Qiangtang basin in central Tibet at 10 billion tonnes or 70 billion barrels. Besides energy reserves, the plateau is also said to hold among China’s biggest reserves of copper, iron, gold and other minerals. (www.thehindu.com)

Oklahoma swamped by surge in earthquakes near fracking

April 8, 2014. There have been more earthquakes strong enough to be felt in Oklahoma this year than in all of 2013, overwhelming state officials who are trying to determine if the temblors are linked to oil and natural gas production. The state experienced its 109th earthquake of a magnitude 3 or higher, matching the total for all of 2013, according to Austin Holland, a research seismologist with the Oklahoma Geological Survey. More quakes followed, including a magnitude 4 near Langston about 40 miles (64 kilometers) north of Oklahoma City. A surge in U.S. oil and gas production by fracturing, or fracking, in which drillers use a mix of water and chemicals to coax liquids from rock formations, has generated large volumes of wastewater. As fracking expanded to more fields, reports have become more frequent from Texas to Ohio of earthquakes linked to wells that drillers use to pump wastewater underground. (www.bloomberg.com)

One in five global shale basins may succeed, Wood Mackenzie says

April 8, 2014. Only one in five global shale regions may succeed in producing significant amounts of oil and gas as countries from China to Argentina seek to emulate the U.S. boom, said energy consultants Wood Mackenzie Ltd. Argentina is leading the pack, with plans to drill about 200 shale wells this year, more than three times the number in China, Andrew Latham, Wood Mackenzie’s vice president for exploration research, said. Shale explorers are targeting China, Russia, Australia, India, South Africa and Argentina in pursuit of deposits similar to those that have revolutionized energy supply in the U.S. Argentina will drill half the shale wells in the world outside the U.S. this year, Wood Mackenzie estimates. (www.bloomberg.com)

Shell drilling rig in Arctic was moved in winter to avoid tax

April 8, 2014. A desire to avoid millions of dollars in Alaska state taxes played a role in Royal Dutch Shell Plc's decision to move a drilling rig, which later broke free from a towboat and ran aground on an uninhabited island in Alaska, the U.S. Coast Guard said in a report. Shell had decided to move the Kulluk drill rig to Seattle for repairs because it might have been subject to a state property tax had it remained in Alaska waters beyond Jan. 1, 2013, according to the report. Shell has spent billions of dollars in its effort to drill for oil Alaska's Beaufort and Chukchi seas, which are part of the Arctic Ocean. The Hague-based company hasn't resumed work in Alaska waters, and said that it doesn't plan to return to the Arctic this year. The decision followed an appellate court ruling that challenged the validity of a lease sale in the Chukchi. (www.bloomberg.com)

Age of gas seen as sideshow to US producers prizing oil

April 8, 2014. The “golden age of gas” that the International Energy Agency (IEA) foresees as a result of the U.S. energy boom is hardly the future being embraced by industry executives. At least based on comments from company officials presenting at the Independent Petroleum Association of America’s conference in New York. For them, oil is still the prize. Gas is almost an afterthought. Abraxas Petroleum Corp. Chief Executive Officer Bob Watson boasted about how much of his company’s proved reserves are oil and liquids rather than gas (74 percent). PDC Energy Inc. said it’s sitting on huge leases in gas fields that aren’t worth drilling. Whiting Petroleum Corp. Chairman and CEO James Volker explained why: oil sells for three times as much as the equivalent amount of natural gas. That’s no knock against the producers for chasing oil - the commodity that makes the best return for their shareholders. Still, at a time when President Barack Obama is saying natural gas will be a bridge for the U.S. economy from fossil fuels to clean energy, the industry’s views put some realism into the discussion about what energy resources get unlocked by fracking shale rocks. (www.bloomberg.com)

Statoil starts up Gudrun field

April 7, 2014. Statoil ASA and its partners announced the start-up of the Gudrun oil and gas field in the Norwegian North Sea. Owned by Statoil (51 percent), GDF Suez (25 percent) and OMV (24 percent), the field began production. Discovered in 1975, Gudrun is a high-temperature, high-pressure field that remained undeveloped for decades because new drilling technology was required to exploit it. Statoil expects to recover 184 million barrels of oil and gas from the field during its lifetime. (www.rigzone.com)

Japex begins Japan's 1st commercial shale oil production

April 7, 2014. Japan Petroleum Exploration Co (Japex) said it has begun the country's first commercial production of shale oil in Akita prefecture in northern Japan this month. Daily production from shale layers deep below the Ayukawa oil and gas field was about 220 barrels of crude (35 kilolitres), the company said. The company also said it would begin drilling for shale oil in Fukumezawa oil field in Akita from late May. Japan's total oil and gas production was about 77,000 barrels per day (bpd) of oil equivalent in the year ended March 2013, including 25,400 bpd of oil and gas from Japex. www.rigzone.com)

Thai PTTEP signs petroleum exploration deal with Brazil's BG

April 4, 2014. Thailand's top oil and gas explorer, PTT Exploration and Production Pcl (PTTEP), said its subsidiary has signed an agreement with BG E&P Brasil Ltda (BG Brasil) for a 25 percent stake in four deepwater blocks in the South American country. The signing of the deal is the first step for PTTEP to expand its investment in South America, one of the world's highest potential oil resources, PTTEP said. The deal is subject to approval from Brazil's National Agency of Petroleum, Natural Gas and Biofuels. PTTEP's subsidiary will hold 25 percent stake in the blocks, while BG Brasil, the operator, will hold 75 percent. (www.rigzone.com)

France's Total gets rights to explore Russian shale oil

April 3, 2014. French oil major Total has secured the rights to explore three hard-to-recover oil blocks in West Siberia. Total will join other majors, ExxonMobil, Statoil and Royal Dutch Shell, to develop Russian shale oil, a key driver in Moscow's efforts to at least maintain its oil output at more than 10 million barrels per day. Total has long eyed Russian shale oil, the world's largest by estimated resources. The U.S. Energy Information Administration puts the possible resources at 75 billion barrels, more than the 58 billion barrels held by the United States, current leader in shale oil production. (www.rigzone.com)

Northern Petroleum to increase Canadian exploration

April 3, 2014. Oil and gas explorer Northern Petroleum said it planned to increase exploration at its Canadian operations after all three of its concept wells in the region proved successful. The London-listed company said it discovered economically recoverable light oil around the Keg River formation in northwest Alberta, and long-term production testing was already under way. (www.rigzone.com)

Britain confronts gas mother lode with fracking by Lord Browne

April 3, 2014. Browne, an independent member of the House of Lords and a nonexecutive director in the U.K. government’s Cabinet Office, is lamenting how the protests may slow his efforts to bring America’s shale boom to Britain. Browne says fracking would secure a new domestic energy source, create thousands of jobs, generate billions of pounds in tax revenue and be a far cheaper alternative than constructing nuclear plants. U.S. wildcatters, who started the shale boom in the mid-2000s, are ready to pounce now that Mexican President Enrique Pena Nieto has opened his country to foreign petroleum investment. One choice target: the gas-rich Eagle Ford formation that snakes from Texas into the Mexican state of Tamaulipas. Even relatively small Britain is sitting on a gas mother lode. The Bowland-Hodder formation, a belt of shale that stretches across England’s midsection, holds more than 37 trillion cubic meters (1,300 trillion cubic feet) of natural gas, according to estimates from the British Geological Survey. (www.bloomberg.com)

Downstream

Ecopetrol's Cartagena refinery to restart around May 2015

April 4, 2014. The 80,000 barrel per day (bpd) Cartagena refinery of Colombian state-run oil company Ecopetrol SA will reopen in the first half of 2015, most probably in May, after its current expansion is completed, the company said. The crude distillation unit at Cartagena was shut down, while the plant's cracking unit was taken off line last year. Ecopetrol is expanding the refinery's capacity to 165,000 bpd to boost exports and reduce imports. (www.downstreamtoday.com)

Malaysia's Petronas to proceed with $16 bn refinery & petrochemical project

April 3, 2014. Malaysia's state oil firm Petroliam Nasional (Petronas) has given the green light for a $16 billion refinery and petrochemical integrated development (Rapid), the company said. Located within the Pengerang Integrated Complex in the southern state of Johor, Rapid is poised to start refinery operations by early 2019. Other associated facilities within the complex will also involve up to $11 billion of investment, the company said. Rapid, Malaysia's largest liquid-based green-field downstream development, was previously twice delayed due to issues with relocation of residents. The Pengerang project is stretched across a 6,242-acre site and will consist of a 300,000 barrels-per-day refinery and a petrochemical complex. Construction will only begin after the state government hands over the project site to Petronas. (www.downstreamtoday.com)

Transportation / Trade

Pipeline violation penalties in US breaks record in 2013

April 8, 2014. The Pipeline and Hazardous Materials Safety Administration (PHMSA) proposed $9.78 million in civil penalties against pipeline operators for alleged violations of federal law in 2013. PHMSA said that 2013 saw the highest yearly amount of proposed penalties in the agency's history. The agency has proposed more than $33 million in penalties in pipeline enforcement cases since 2009, while seeing the number of serious pipeline incidents resulting in fatalities or major injuries decline each year during that time period, according to PHMSA. The record amount of fines proposed by PHMSA in 2013 includes a proposed $2.66 million penalty against the Exxon Mobil Pipeline Co. for alleged violations of federal pipeline regulations related to a March 2013 rupture of the Pegasus pipeline near the town of Mayflower, Ark. PHMSA proposed the civil penalty after determining that the company committed probable violations of federal regulations related to integrity management requirements in densely populated areas. Of the $9.78 million in proposed civil penalties for 2013, 22 cases representing $1,532,300 have been resolved, with $1,308,000, or 85 percent of the proposed penalties, ultimately assessed and collected. There are still 41 pending cases from 2013. (www.bloomberg.com)

Libya oil sales to rise as rebels surrender two ports

April 7, 2014. Libyan rebels surrendered control of two oil ports to the government, potentially enabling the OPEC member to triple crude exports this month with an increase of at least 180,000 barrels a day. Brent futures dropped. The self-declared Executive Office for Barqa handed over the oil terminals of Zueitina and Hariga overnight. An agreement with the government also provides for the rebels to relinquish the other two ports they control, Es Sider and Ras Lanuf, in two to four weeks. The government confirmed the agreement. (www.bloomberg.com)

OVL in talks to import LNG at $15 from Mozambique

April 7, 2014. ONGC Videsh Ltd (OVL), which holds a minority interest in Anadarko-operated giant gas field in Mozambique, is in talks with the consortium to import liquefied natural gas (LNG) for $15 per unit. The consortium's gas pricing formula is based on a combination of JCC (Japan customs cleared crude) and Henry Hub, the benchmark rates for oil and gas. OVL has 16% stake in the Rovuma Area-1 project. Other state-run Indian oil companies—Oil India and Bharat Petroleum Corporation— together hold 14%. The gas marketing right is with the Anadarko-led consortium, where Indian firms are also members, but partners have to negotiate capacity purely on commercial terms. The consortium, which is setting up huge LNG facilities in gas-rich Mozambique, has already contracted the first LNG train of 5.5 million tonne to Chinese, Thai and Japanese importers. Even part of the train-II capacity is booked by them. OVL is in discussion with the consortium to book some capacity, which will depend on availability of transpiration facilities. First gas from Mozambique field is expected from December 2018. The consortium has recently upgraded reserves of the block to 45-70 trillion cubic feet (tcf) from 35-65 tcf post two new discoveries in December last year. (economictimes.indiatimes.com)

To export US oil or not boils down to industry profit

April 5, 2014. When Big Oil began preparing last year to challenge the decades-old rules against exporting U.S. crude, the debate seemed fanciful. Then Russia took over Crimea and the idea of using American energy -- oil as well as natural gas -- to reshape global affairs became a Washington pet project. Oil producers want to chase higher prices overseas. Refiners want to keep cheaper domestic supplies. Politicians want to balance those interests with concerns that gasoline prices would rise. Everyone invokes the goal of energy independence. Putting the posturing aside, it’s useful to imagine what actually happens to supply, demand and prices in an oil market without the export restrictions that date to the 1970s Arab oil embargo. That’s what JBC Energy GmbH, a Vienna-based research company, offered in a report. Lifting the ban would increase U.S. crude-oil production by about 700,000 barrels a day, raise exports by about 1.5 million barrels a day and push up imports by about 500,000 barrels a day by 2020, JBC estimates. So the net effect on the country’s energy balance sheet is pretty negligible. Global supply wouldn’t change much either, as other producers would adjust, according to JBC. (www.bloomberg.com)

Ships colliding in Houston expose risks in oil channel

April 5, 2014. By the time the ships’ pilots realized they were on a crash course, it was too late. The fog was just beginning to lift on the Houston Ship Channel midday March 22 as a bulk carrier and a fuel barge found themselves three-quarters of a mile apart. For five minutes, they exchanged radio messages as they tried slowing down, speeding up and reversing while nearing a collision that closed one of the world’s busiest waterways for three days, according to U.S. Coast Guard recordings and radar data. (www.bloomberg.com)

Gazprom stops courting US investors after Crimea crisis

April 4, 2014. Russia’s largest company OAO Gazprom will stop marketing to U.S. and European investors after the Crimea crisis and work to increase bond and shareholders from the Middle East, Latin America and Asia, especially China. Senior managers at Russia’s gas-export monopoly, which has a market value of $90 billion and $37 billion of outstanding bonds, told investor relations staff to find more shareholders in Asia and other emerging markets after completing investor meetings in New York and London in early March. The shift shows how the worst crisis in Russian relations with the U.S. and Europe since the Cold War is feeding into financial and economic relationships. China was the only country not to vote against Russia’s action in Ukraine at the United Nations Security Council and President Vladimir Putin travels to Beijing in May hoping to sign a 30-year gas-supply deal. (www.bloomberg.com)

Enel close to 20 yr deal to buy US LNG from Cheniere

April 3, 2014. Italian utility Enel is close to signing a 20-year deal to buy gas from U.S. liquefied natural gas (LNG) producer Cheniere Energy, the company said. Deliveries are expected to start from 2019, Enel Chief Financial Officer Luigi Ferraris said. The deal is for 1 billion cubic metres of U.S. shale gas per year over a 20-year period and could be extended for a further 10-year term, he said. It comes after Spain's Endesa, which is controlled by Enel, agreed to buy 1.5 million tonnes of LNG for 20 years from Cheniere's proposed plant in Corpus Christi, Texas. That is equivalent to 2 bcm of shale gas per year. A boom in shale gas production in the United States has prompted companies to try to build plants to liquefy and export the fuel on tankers to distant markets not reachable by pipeline. Cheniere has already secured around a dozen LNG sales deals from its Sabine Pass export plant in Louisiana and is now focusing on locking-in customers for the Corpus Christi plant, even though U.S. regulators have not yet approved that site for exports. Countries across the world have been quietly signing deals in recent months to import LNG from the United States, revealing a growing appetite for the fuel overseas. (www.downstreamtoday.com)

Itochu writes down Samson Investment as US shale bet sours

April 2, 2014. Itochu Corp., Japan’s third-largest trading house, said it booked another writedown on its investment in oil and gas producer Samson Investment Co., as its bet on the U.S. shale boom sours. The latest impairment of 29 billion yen ($279 million) follows charges of about 33 billion yen reported by the Tokyo-based company. Itochu has now written down most of the 78 billion yen, worth $1.04 billion at the time, it paid in 2011 for a 25 percent stake in family-owned Samson. The development of shale, which involves extracting hydrocarbons from rock formations through chemical injections, has slapped investors with writedowns in the last two years after U.S. gas prices fell to their lowest level in more than a decade in April 2012. BHP Billiton Ltd., the world’s largest mining company, in August 2012 announced a $2.8 billion writedown of its U.S. shale gas assets. The Samson purchase included oil-producing fields in North Dakota and the U.S. northwest, and shale-gas fields in Texas and Louisiana. It excluded its onshore Gulf Coast and deep-water Gulf of Mexico assets, which were retained by Samson’s family owners. (www.bloomberg.com)

A little less rich: Qatar gas dominance challenged

April 2, 2014. Blazing gas flares 70 meters high brighten the night sky above Qatar’s Ras Laffan Industrial City. The 295-square-kilometer complex houses the world’s largest assemblage of liquefied natural gas plants and the biggest port for LNG exports on the globe. Ras Laffan chills to a fluid more gas in a year than Canada consumes and then ships it to run electric plants and warm homes from Tokyo to Buenos Aires. The gas facilities within its grounds produce almost a third of the world’s LNG exports. The government takes every precaution against sabotage. Entry to the Industrial City for those who don’t work there is severely restricted; photography inside the facility is forbidden. Ras Laffan is what makes Qatar the richest nation in the world, with a per capita income for its citizens of $101,000 in 2012, according to International Monetary Fund data. The greatest threat to Qatar’s enormous wealth is competition. Other nations are challenging its LNG dominance. Australia is constructing liquefaction plants that will more than triple its annual LNG-manufacturing capacity to 85 million tons by 2018, surpassing Qatar, according to data compiled by Industries. (www.bloomberg.com)

Policy / Performance

Turkey’s fracking push won’t be stalled by bribery probe

April 8, 2014. Turkish Prime Minister Recep Tayyip Erdogan has been embroiled in a corruption scandal that helped send the country’s currency to an all-time low. It hasn’t discouraged foreign oil companies eyeing the country’s shale gas reserves. Royal Dutch Shell Plc, TransAtlantic Petroleum Ltd. and Valeura Energy Inc. are among explorers shrugging off the bribery probe that has ensnared Turkey’s rulers and undermined Erdogan’s 11-year rule. They’re forging ahead with plans to drill shale rock that holds as much as 4.6 trillion cubic meters of gas and 94 billion barrels of oil, according to the U.S. Energy Information Administration. (www.bloomberg.com)

Africa’s biggest investor’s energy plan includes shale, Inga

April 8, 2014. The Public Investment Corp. plans to lead investment in energy projects in Africa by buying into South African shale gas projects and helping to fund what could be the world’s biggest power generation complex in Democratic Republic of Congo. The continent’s largest money manager, which is based in the South African capital of Pretoria and has 1.6 trillion rand ($152 billion) under management, will buy stakes in energy companies operating in Africa. Africa’s two biggest economies, Nigeria and South Africa, are among countries on the continent suffering power shortages that are restraining economic growth. The PIC’s focus on energy comes as South Africa explores developing shale projects in its arid Karoo area and attempts to develop the Inga hydropower complex on the Congo River are revived. (www.bloomberg.com)

Kuwait hopes to raise oil output to 3.5 mn bpd in 2015

April 7, 2014. Kuwait has increased its oil production capacity to 3.3 million barrels of oil a day (bpd) and is hoping to reach 3.5 million bpd in 2015, Kuwait Petroleum Corporation Chief Executive Nizar al-Adsani said. Kuwaiti officials have previously said that capacity in the OPEC member state was around 3.1-3.2 million bpd. Kuwait hopes to reach 4 million bpd of capacity in 2020, despite slow progress in developing new projects. But Adsani said the Gulf Arab state needed more help from abroad to achieve that target. Kuwait hopes to choose a winning bid this month for the Heavy Oil Phase One project, which is worth around $1.1 billion-$1.2 billion, he said. (www.arabianbusiness.com)

Singapore sees LNG trading hub ambition fulfilled after 2018

April 7, 2014. Singapore’s political neutrality and English-speaking workforce will help the city-state become an Asian hub for LNG trading, according to the government. Singapore will become a LNG trading hub within the next five to 10 years, Seah Moon Ming, chairman of government trade promotion agency IE Singapore, said. Singapore’s location, financial system and common law system will also boost its chances of becoming a regional center, he said. Singapore, Asia’s oil-trading center, has spent S$1.7 billion ($1.4 billion) on its first LNG terminal. Asia has overtaken Europe as the world’s biggest gas importer, accounting for 46 percent of global trade, according to the International Energy Agency, which cites Singapore as best-placed to be the hub for liquefied natural gas. (www.bloomberg.com)

Old math casts doubt on accuracy of oil reserve estimates

April 5, 2014. In 1945, Arps, then a 33-year-old petroleum engineer for British-American Oil Producing Co., published a formula to predict how much crude a well will produce and when it will run dry. The Arps method has become one of the most widely used measures in the industry. Companies rely on it to predict the profitability of drilling, secure loans and report reserves to regulators. When Representative Ed Royce, a California Republican, said at a March 26 hearing in Washington that the U.S. should start exporting its oil to undermine Russian influence, his forecast of “increasing U.S. energy production” can be traced back to Arps. The problem is the Arps equation has been twisted to apply to shale technology, which didn’t exist when Arps died in 1976. John Lee, a University of Houston engineering professor and an authority on estimating reserves, said billions of barrels of untapped shale oil in the U.S. are counted by companies relying on limited drilling history and tweaks to Arps’s formula that exaggerate future production. That casts doubt on how close the U.S. will get to energy independence, a goal that’s nearer than at any time since 1985, according to data from the U.S. Energy Information Administration. (www.bloomberg.com)

Ukraine in emergency talks with EU neighbours on gas imports