-

CENTRES

Progammes & Centres

Location

CONTENTS

WEEK IN REVIEW

Ø ENERGY: India’s Energy Tribes

Ø From a Corner Light: Electric Chaiwallas

Ø ENERGY: Political Flip-Flop over Energy Prices: Who Benefits?

DATA INSIGHT

Ø India’s Upstream Sector: Investments by Private or Joint Venture Companies

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· RIL, OIL bag two blocks each in Myanmar

· HPCL to export gasoline due to maintenance

· Gas cos like GAIL India, RIL, BG India may have uniform sales pact with consumers

· Reliance Power's Butibori plant becomes fully operational

· Jindal Power commissions 2nd 600 MW unit of Chhattisgarh plant

· BHEL wins ` 1.2 bn order for hydro power project in Uttarakhand

· GVK wants to sell Punjab unit to NTPC

· Alstom bags ` 1.8 bn contract from Power Grid

· Tata Power seeks compensation from CLP India

· Mahavitran to sell 100 MW power to BEST for April-March period

· Coal India sees 2014/15 output at 507 million tonnes

· Husky, CNOOC commences first production at Liwan Gas Project off China

· Oil Search disputes InterOil-Total deal in Papua New Guinea

· Statoil gets nod to take Vale's stake in Brazil blocks

· Top Chinese oil firm CNPC to participate in Mexico oil opening

· Shell, Statoil, Total, others win Myanmar oil, gas exploration blocks

· Enel Green Power begins construction of new hydro plant in Brazil

POLICY & PRICE

· Oil Ministry puts diesel price increases on hold

· ATF price cut by 4 pc; non-subsidised LPG by ` 100

· SC appoints Australian judge to preside over arbitration between RIL & oil ministry

· Gas price: New govt may have fresh look at Rangarajan formula

· Hamid Ansari for intensive debate on energy challenges facing India

· Haryana power discom gets Japanese assistance

· Himachal govt seeks ` 27 bn damages from Brakel Corp

· NTPC plans to import 15 million tonnes of coal in FY15

· Russia plans to build undersea gas pipeline to Crimea

· Record natural gas need keeps bulls betting on advances

· Gazprom raises gas export price as Ukraine looks for cash

· Myanmar expects next bidding round for offshore blocks in 2015

· PUCT approves ETT and Sharyland application for 345kV transmission line

· EBRD invests $190 mn in Egyptian power plants

· GEDCOL seeks land transfer for 20 MW solar plant

· NTPC completes 10 MW solar power plant in India

· Merkel may ease cuts for onshore wind power to save jobs

· Exxon says oil reserves in no danger from climate rules

· Companies try to catch CO2 before it touches the sky

· World is ill-prepared for global warming impacts, UN says

· Cool Planet adds $50 mn in equity to build biofuel facility

· BlackRock joins investors in flagging Barrier Reef eco-risks

· Dubai's DEWA hires consultants for new solar power plant

· US unit offers India to co-develop, test carbon capture tech

· Obama issues climate plan to plug methane leaks

· Fuel-cell boom hampered by need for platinum, GE says

WEEK IN REVIEW

ENERGY

India’s Energy Tribes

Lydia Powell, Observer Research Foundation

|

T |

his is a piece that must be read together with last week’s piece on energy models. For ready reference, here is the key conclusion from last week: when looking at future energy scenarios, what is important is not the assumptions that can be easily converted into scenarios by models but rather the system that generates these assumptions. The ‘system’ that generates these assumptions in India consists of producers, consumers, experts, policy makers, institutions, bureaucracies, desires, promises, structures, societies, values and so on. For the sake of simplicity we can divide this complex mix into energy tribes each of which have their own beliefs, structures, powers, desires and of course, visible and articulate energy chiefs.

Not all tribes are powerful enough to have a voice that can make its way into models or policies. The articulate and audible tribes have ‘energy chiefs’ who are a common sight in policy platforms. Most of them would probably answer the question ‘what is India’s energy problem?’ the same way. They would probably draw a diagram that shows growing energy demand and falling energy supply. If nothing is done, they would probably say, the energy supply-demand gap will get worse and India’s economic growth would come to a stand-still. However they would probably differ in how the ‘problem’ should be addressed. Most would suggest measures of increasing supply or decreasing demand but each tribe would have a preferred source of energy or preferred course of action. Most would probably make claims on public finances and resources (labelled respectfully as incentives) that could increase the supply of energy or decrease the demand for energy. Those in the geo-political tribe would probably recommend co-operating with countries with abundant supplies of energy. Those with training in economics may suggest that the supply and demand curves are linked by the price mechanism that this is sufficient to reconcile supply with demand as long as we take into account things like elasticity of supply and elasticity of demand. Those in the technology tribe may swear by breeder reactors or solar power. Marginal tribes would call for a move away from fossil fuels, decentralised energy options, reducing demand and so on. The difference between the tribes and their preferred assumptions for the future arises from their different world views.

Michael Thomson of the International Institute for Applied Systems Analysis (IIASA) points out that most world views from which different assumptions arise fall under three categories: (A) This tribe believes that the present trend of increasing energy demand is desirable and sustainable given our skills & knowledge (commonly described as ‘business as usual’ approach) (B) This tribe believes that the present trend is not sustainable and an orderly transition to a more sustainable future is possible through technology and policy (commonly known as the ‘middle of the road’ or the ‘technological fix’ approach) (C) This tribe believes that the present trend is not sustainable and only radical and dramatic change could lead to a sustainable future (commonly known as the no-growth or de-growth approach). In the Indian situation there are two other energy tribes who do not participate in the energy debate but constitute a significant proportion of the population and therefore not irrelevant to the energy debate. They are: (D) the truly poor who have no access to modern energy sources and do not part participate in the energy debate as they lack the organisational and financial skills to gain access to the debate (E) those who voluntarily stay out of the debate because they are satisfied with their lot for now.

If we turn to the India Energy Security Scenarios 2047 model discussed last week, we find that most of the assumptions are derived from tribe B except for the equivalent of the ‘worst case’ assumptions (or level 1 settings in the model) that are derived from Tribe A. Tribe A could be seen to consist mostly of the businessmen (and women) who see the possibility of limitless growth of both the economy and energy (not to mention their own wealth) especially in the light of their entrepreneurial skills and abilities. For them nature is cornucopian but not free; it is accessed and controlled by their skill. Tribe A does not waste time thinking about other tribes which lack skills or those that were denied access to the skills that tribe A thinks it acquired solely by its merit. Tribe B consists of those who are a part of complex hierarchical organisations (state and non-state) who think that equally complex and hierarchical needs and limits must be imposed upon systems and societies to go into a sustainable future as they see it. They allow an increase in the share of the energy pie for groups in the hierarchy, as long as it does not overtake the size of the pie for groups above them. In their view nature is bountiful but only within accountable limits. But the limits are differential in the sense that there are different limits for different layers in the hierarchy. Ensuring differential limits requires management of energy resources, their volumes and their flows which justifies authority of Tribe B.

Overall the assumptions behind India Energy Scenarios 2047 arise from a system consisting mainly of tribes that have a certain world view of progress. This world view of progress consists of a cornucopian world where an increase in energy consumption is natural (Tribe A) or a bountiful world with limits where an increase in energy consumption must be managed within carefully controlled limits (Tribe B). The limits are set by things like share of imported energy or by the level of carbon emissions. These world views give rise to assumptions captured in levels 1-4 on the India Energy Scenarios 2047 model.

Rather than test the credibility of these assumptions with more assumptions, we could check how assumptions that fed into scenarios generated by International Institute of Applied Systems Analysis (IIASA) in 1981 in their extensive study titled ‘Energy in a Finite World’ fared. The world view that gave rise to assumptions that fed into IIASA’s scenarios was that the third world would catch up with the developed world fairly quickly, fossil fuels would run out and a transition from fossil fuels to nuclear fuels is necessary. One of the papers that accompanied the study strayed away from assumptions and scenarios and waded into prescription and prediction by observing that ‘aggressive action is required to ensure that major technologies such as synthetic fuels (from coal, as this was the period of the oil crises) and fast breeder reactors are in common use by the year 2000’. We are in the year 2014 and there is no sign of either being in common use. The point to note here is that if the problem is thought to be known and defined as one of fossil fuel scarcity a shift away from fossil fuels is the obvious solution. This approach of defining the problem, analysing the problem and arriving at a solution may have been appropriate for simple short-term problems such as where to locate a bus stop but clearly it is not appropriate for complex long term issues such as energy options in the next 50 years. Far from the problem containing some uncertainty it is uncertainty that contains the problem.

Views are those of the author

Author can be contacted at [email protected]

From a Corner Light

Electric Chaiwallas

Lalloobhoy Battiwala

Kirk R. Smith wrote in an e-mail on his trip in Odisha, 'Another unforeseen revelation occurred on the trip, however. On the 3-hour drive back to the airport in the evening, the car driver pointed out to us that all the "chaiwallahs" (tea sellers) along the highway now used ICs (Induction Cook stoves). We stopped at the first one and sure enough, he used his IC as much as he could. Cheaper and faster he said. He was using an LPG stove at the moment, however, which he said was because the voltage had dropped. Indeed, the lights brightened and he shifted back the IC while we chatted. LPG is his backup, IC is his main (such commercial users do not get subsidized LPG). I asked him what his wife used at home -- he bought her an IC he said, which is her primary stove now. And what did she use before -- biomass. Clearly, in this case, familiarity at work helped make it become more comfortable at home to take on such a different technology (See photo in the soft version available at http://orfonline.org/cms/sites/orfonline/EnergyHomePage.html).

From lakri to induction cooking. Just what I had expected and hoped to hear.

I had an idea tailor-made (no, chaiwalla-made) for Narendra Modi: distribute 5 million induction cookstoves (IC) free to chaiwallas in India where grid electricity is available at chai time.

5 million chai stoves will serve some 500 million customers, the entire adult population of India in reach of grid electricity (at tea time at least).

I will write a serious policy proposal with arguments and cost-benefit estimates. (Half page, 10-pt font.)

Even claim GHG avoidance worth roughly 200 million tCO2e. (Average 40 kg of open fire air-dry wood replaced, and gross emissions of 200 kgCO2e at 20-year GWP avoided, per day, 300 days per year, or 60 tCO2e per chaiwalla. Adjustment for charcoal, kerosene and LPG substitution and GHG emissions from power generation at the marginal fuel-mix). Some PhDs can do leakage debates.

My friend Eric Martinot is championing 'No Rooftop Left Behind' for PV installations. Mr Modi could direct NTPC to lease 1 kWp PV rooftops to every chaiwalla with an IC stove. Competitive with the grid for peak use, of course with LPG or kerosene, and gives shelter for chaiwallas and their customers. We know Mr Modi's solar achievements in Gujarat. This would be a crowning goal, another Convenient Action in the face of Inconvenient Truth. And 5 GW grid-interactive plus off-grid PV will deliver more peak capacity, within a year or two, than all the new nukes in the next decade.

Himalayan glacier loss stopped, Pachauri will dutifully claim, standing next to Modi.

Sure, some expert arms will have to be twisted to modify the Kyoto calculus on carbon (20-year GWP, black carbon, non-renewable biomass), but that's what experts are for. At a carbon price of even 12 Euros or 1,000 INR per tCO2e, this scheme will bring some 200 billion INR per year, enough to start putting 1 kWp PV systems for farm irrigation. Any Gujarati has to love that.

Views are those of the author. Comments may be sent to [email protected]

ENERGY

Political Flip-Flop over Energy Prices: Who Benefits?

Ashish Gupta, Observer Research Foundation

|

O |

ne can see many ups and downs during elections times. All parties are struggling to establish their positions and the issue of power and oil prices are gaining significance in party positions. The honeymoon period for the Delhi electricity consumers is over as the subsidy for residential consumers consuming up to 400 units of electricity has been withdrawn from 31st March, 2014. The government has also rolled back the decision to increase diesel prices even though it committed to increase the same by ` 0.50 every month. But as petrol prices were deregulated, it has fallen by ` 0.75 per litre in Delhi. What is the reason for the duality in positions?

The oil retailers say that petrol prices have been reduced due to twin effects: First on account of the dip in international oil prices and second, due to strengthening of rupee against the dollar. Also there were incremental reductions in state government taxes excluding Value Added TAX (VAT) and local taxes. The election commission did not take this into account probably because it did not want to interfere with the market (or because a fall in prices favoured certain parties?). But the decision on diesel price hike fell under the election commission. Are there vested interests?

It is clear that oil companies are still not free to take decisions on pricing on their own and are controlled by political influences. But who is the real beneficiary? If it is the consumer, then the question arises as to whether tax payers’ money would be better spent elsewhere. If the decision is taken by the companies as they claim, it is not clear why they are not shouting from the rooftops about under-recoveries and losses on every litre of fuel sold? It is not clear how subsidies could be withdrawn for one form of energy and not for others?

On the power subsidies front (Delhi only) consumers were beneficiaries only for a short while. It is now said that the subsidy was withdrawn due to the losses suffered by the discoms. That this position is not consistently held by all stakeholders gives rise to suspicion of vested interests. The real beneficiary is the government because the subsidy amount is from the Government’s budget. The savings will be huge which is very good if the money is spent on the development of the power sector. The flip-flop policy gives rise to the suspicion that the move is not in line with the government’s broad vision to do away with the subsidies but in line with short term political interests.

The petrol price reduction and the decision to hold back the revision of diesel prices will give temporary relief to consumers. But this relief is only temporary as it will be reversed soon after elections. The price relief is meant for the small consumers but they hardly consume any liquid fuels. It is only the big consumers like truck operators and owners of large private vehicles who benefit from these subsides even if they are temporary. The savings that can accrue in a few months is large for large consumers of energy. Interestingly even though energy price subsidy is meant for individual consumers who vote the benefit flows to corporations that do not vote. The flip-flop on energy prices does not benefit anyone in the short run but it will hurt everyone in the long run.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

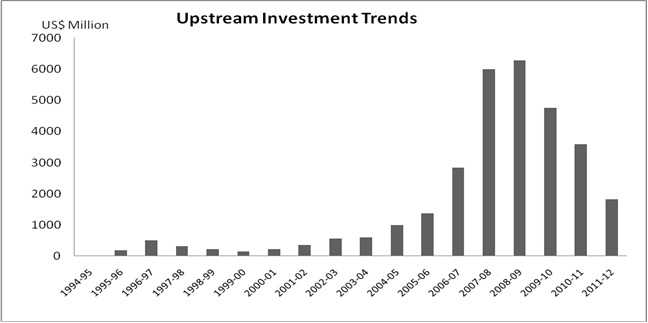

India’s Upstream Sector: Investments by Private or Joint Venture Companies

Akhilesh Sati, Observer Research Foundation

US$ Million

|

Year |

Pre- NELP |

NELP |

Total |

|

1994-95 |

4.8 |

0 |

4.8 |

|

1995-96 |

194.9 |

0 |

194.9 |

|

1996-97 |

511 |

0 |

511 |

|

1997-98 |

319.6 |

0 |

319.6 |

|

1998-99 |

229 |

0 |

229 |

|

1999-00 |

151.2 |

0 |

151.2 |

|

2000-01 |

192.9 |

29.6 |

222.4 |

|

2001-02 |

208.7 |

161.3 |

370 |

|

2002-03 |

282.7 |

293.6 |

576.3 |

|

2003-04 |

294.7 |

306.6 |

601.3 |

|

2004-05 |

391.1 |

601.8 |

992.8 |

|

2005-06 |

461.4 |

922.4 |

1,383.80 |

|

2006-07 |

1,474.20 |

1,372.30 |

2,846.50 |

|

2007-08 |

1,274.00 |

4,732.10 |

6,006.10 |

|

2008-09 |

1,815.60 |

4,463.80 |

6,279.40 |

|

2009-10 |

1,445.60 |

3,311.80 |

4,757.50 |

|

2010-11 |

972.4 |

2,620.60 |

3,593.00 |

|

2011-12 |

458.1 |

1,373.50 |

1,831.60 |

|

Total |

10,681.70 |

20,189.40 |

30,871.10 |

Source: Report on Allocation & Pricing of Gas by the Standing Committee on Petroleum and Natural Gas, Lok Sabha.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

RIL, OIL bag two blocks each in Myanmar

March 27, 2014. Reliance Industries Ltd (RIL) won two offshore exploration blocks in Myanmar. The company said it indicated a renewed overseas focus as its domestic exploration business continued to face rough weather over performance of showcase KG-D6 field and pricing of gas. State-run Oil India Ltd (OIL) also won two concessions in Myanmar's latest round of exploration block auctions, the results of which were announced. Both Reliance and Oil India had separately bid for three blocks each. ONGC Videsh and gas utility GAIL, which have stake in two producing fields in that country, drew a blank. Reliance would be the fourth Indian company and second private firm to foray into Myanmar. The result could be seen as the proverbial silver lining for Reliance, since it comes a day after the Election Commission put on hold the government's June 2013 decision to usher in a new pricing regime from April 1. The new policy would have doubled the price for all domestic producers, including state-run companies. The blocks given to Reliance have been identified as M17 and M18 in Moattama basin of Myanmar in water depths of up to 3,000 ft, called shallow water in industry parlance. Together, the two blocks encompass an area of 27,600 sq km. Oil India has won the YEB and M-14 blocks, also in shallow water. Oil India bid in consortium of with Mercator Petroleum and Oilmax Energy. In all, 36 companies submitted 64 proposals for the 30 offshore blocks on offer. International players Royal Dutch Shell, Chevron, Statoil and BG picked up most of the blocks on offer. (economictimes.indiatimes.com)

RIL shuts Jamnagar paraxylene unit for maintenance

March 27, 2014. Reliance Industries Ltd (RIL) has shut one of three paraxylene units at its Jamnagar refinery complex in Gujarat for maintenance. The shutdown will also be utilised to improve reliability and performance of the unit. RIL has a total capacity of 1.8 million tons per annum of paraxylene at Jamnagar. (economictimes.indiatimes.com)

Transportation / Trade

Fertiliser units to keep getting RIL gas at $4.2 per unit

April 1, 2014. Reliance Industries Ltd (RIL) has agreed to continue supplying natural gas from its KG-D6 fields at the prevailing rate of $4.2 per unit until the Fertilizer Association of India (FAI) and the company reach a new agreement, Fertiliser Secretary Shaktikanta Das said. The existing sales agreements and the government-approved gas price were valid up to March 31. The new pricing formula, which the Cabinet had cleared for sales from April 1, has been deferred by the Election Commission, creating uncertainty about agreements between RIL and its customers. After Reliance's gas sale and purchase agreements (GSPAs) with 16 fertiliser companies expired, the company could not resolve differences over certain crucial terms with fertiliser sector consumers. The fertiliser secretary intervened after FAI expressed concerns over the company's move to change the contract without the announcement of the new price. They contended that crucial terms such as tenure of the contract and the marketing margin had been changed. FAI said an agreement on gas sales was likely in a couple of days. FAI said fertiliser companies would pay the price notified by the oil ministry. One of these issues is related to RIL's demand of slightly higher price on the basis of the calorific value, or heat content, of natural gas. Fertiliser firms had initially objected to the company's move to change certain terms of the existing contracts. (economictimes.indiatimes.com)

RIL's April export volumes seen lower

March 31, 2014. Reliance Industries Ltd (RIL) has sold 55,000 tonnes of naphtha for late April loading from Sikka to a European trading house, but the refiner may limit its exports for next month due to stronger gasoline demand, traders said. Reliance sold the cargo at premiums in the high-$20s-a-tonne level to Middle East quotes on a free-on-board (FOB) basis, similar to the average premium it had fetched for two cargoes totalling 90,000 tonnes for March loading. Reliance sold more than 200,000 tonnes of naphtha for December but started scaling back to an average of about 103,000 tonnes each month for first-quarter. It was not immediately clear what led to the lower month average exports for January to March, but Reliance had to shut a crude unit in December following a power failure and it had also shut a crude unit this month for routine maintenance. (economictimes.indiatimes.com)

HPCL to export gasoline due to maintenance

March 31, 2014. Hindustan Petroleum Corp Ltd (HPCL) has offered gasoline for export in a rare move as it will shut gasoline production facilities at its Vizag refinery for about a month starting April, the company said. The shutdown of the gasoline making units would result in the production of high sulphur gasoline that cannot be sold in India. The units at the plant, located in Southern India, produce about 120,000 to 130,000 tonnes of gasoline a month. HPCL will sell the 25,000- to 30,000-tonne 90-octane grade gasoline for April 26-28 loading from Vizag through a tender valid until April 1. (economictimes.indiatimes.com)

Gas cos like GAIL India, RIL, BG India may have uniform sales pact with consumers

March 29, 2014. The government plans to end domestic gas producers' freedom to sign different sales agreements with various consumers, ruling out any scope for suppliers such as GAIL India, RIL, and BG India to negotiate slightly higher prices on the basis of the calorific value, or heat content, of natural gas. The petroleum ministry called executives of RIL, GAIL and customers from the fertiliser companies for a meeting, after key customers had complained that gas suppliers want to charge them on the basis of gross calorific value, which is about 10% higher than the prevailing norm of pricing domestic gas using net calorific value. The Rangarajan formula's inputs are international prices and LNG rates that are all based on gross calorific value. GAIL said all domestic gas in India is sold on the basis of net value. The issue is not of immediate consequence as the Election Commission has vetoed the government decision to adopt the Rangarajan formula from April 1. The government is free to apply the formula after the election code of conduct is withdrawn in May. Until then, suppliers will keep selling gas at the current price of $4.2 a unit. GAIL said the problem cropped up because of the deficiencies in the Rangarajan formula. RIL signed gas sale and purchase agreements (GSPAs) with 16 fertiliser companies in 2009, which will expire, March 31. Fertiliser firms have objected to the company's move to change some terms instead of renewing the existing contracts with new pricing formula. (economictimes.indiatimes.com)

ONGC fetches year-high premium for Hazira cargo

March 26, 2014. Oil & Natural Gas Corp (ONGC) sold an April naphtha cargo to Unipec at about $44 a tonne above Middle East quotes on a free-on-board (FOB) basis, the highest premium fetched for a cargo out of Hazira in about a year, traders said. The cargo, sold, was scheduled for April 16-17 loading from Hazira. The last time ONGC had fetched a higher price than $44 for a Hazira cargo was in 2013 when it sold a cargo, also for April loading. The current strong market was due to Europe cutting exports to Asia as the former channels naphtha into the gasoline production. Unipec, however, has been on a spree recently, and with the latest purchase of ONGC's cargo, it has locked in 105,000 tonnes, or almost half of all the Indian spot naphtha sold for April loading. Traders expect India to offer more spot cargoes for April loading as refiners such as Indian Oil Corp (IOC) and Reliance Industries Ltd (RIL) have yet to issue their sale tenders. (economictimes.indiatimes.com)

Policy / Performance

Oil Ministry puts diesel price increases on hold

April 1, 2014. The Oil Ministry has put on hold further diesel price increases, citing a reason that had not prevented it from hiking rates uninhibitedly about a year ago. The ministry asked state-owned oil refiners not to raise diesel prices by the scheduled 50 paise a litre on the grounds that the loss on sales of the fuel has fallen to less than ` 6 a litre. The oil firms said there was no need to increase rates because an expert committee headed by Kirit Parikh had suggested that the government should provide a subsidy of ` 6 a litre on diesel. The matter has been referred to the Election Commission. However, the government had never accepted the Parikh Committee recommendation and the January 2013 decision of the Cabinet to increase diesel prices in small doses to cut subsidy did not set any limits. The Cabinet had decided that diesel prices should be raised by 40-50 paise a litre every month until losses on the fuel are wiped out. However, there was no evidence of the ` 6 threshold when diesel prices were raised on May 12 and June 1 last year, when the under-recovery or loss on the fuel slipped to ` 3.81 and ` 4.87 per litre, respectively. The ministry had planned to approach the Cabinet in February to halt further diesel price increases but couldn't do so before last month's announcement of the general elections. There had been demands from within the ruling Congress party to stop the increases, 14 of which had taken place since January 2013 for a cumulative total of ` 8.33 a litre. The oil companies skipped raising diesel prices in April, when assembly elections were held in Oil Minister M Veerappa Moily's home state Karnataka. However, they made up by hiking diesel prices by 90 paise in the following month. IOC said that it had been implementing the government order to "increase the retail selling price of diesel within a small range every month until further orders." (economictimes.indiatimes.com)

ATF price cut by 4 pc; non-subsidised LPG by ` 100

April 1, 2014. Jet fuel or ATF price was cut by 4 per cent and rates of non-subsidised cooking gas (LPG) by ` 100 per cylinder, reflecting global trends. Aviation Turbine Fuel, or ATF, price at Delhi was cut by ` 3,025.34 per kilolitre, or 4 per cent, to ` 71,800.21 per kl, according to Indian Oil Corp (IOC). The rate cut follows a ` 753.34 per kl hike in rates last month. Price was cut as international oil prices fell and rupee appreciated against the US dollar, making imports cheaper. In Mumbai, jet fuel costs ` 74,105.16 per kl as against ` 77,322.6 per kl previously, IOC said. Rates at different airports vary because of difference in local sales tax or VAT. Jet fuel constitutes over 40 per cent of an airline's operating costs and the price cut will reduce the fuel cost of the cash-strapped carriers. Separately, the price of non-subsidised cooking gas (LPG), which customers buy after using up their quota of 12 subsidised cylinders, was cut by ` 100 per cylinder, the third straight reduction in rates since February. The 14.2-kg cooking gas cylinder that consumers buy beyond their entitled 12 bottles at subsidised rates, will now cost ` 980.50, down from ` 1,080.50, in Delhi. The rates were on February 1 cut by ` 107 - from ` 1,241 per cylinder to ` 1,134, and then by ` 53.5 per cylinder last month. A subsidised LPG cylinder in Delhi costs ` 414. Non-domestic LPG rates were at the beginning of the year hiked by a steep ` 220 per cylinder but have now been cut in line with softening of international rates. IOC said losses on LPG have come down to ` 505.50 per 14.2-kg subsidised cylinder from ` 605.50 in previous month and ` 656 in February. The loss was ` 762.50 in January. (economictimes.indiatimes.com)

SC appoints Australian judge to preside over arbitration between RIL & oil ministry

April 1, 2014. The Supreme Court (SC) has appointed an Australian judge to preside over the crucial arbitration between Reliance Industries Ltd (RIL) and the oil ministry, upholding the company's view that a foreigner's appointment would totally rule out any bias, and firmly rejecting the government's concern that an Indian should be nominated to ensure that the global clout of RIL's partner BP does not impact proceedings. The three-member arbitration panel, the other two members are former chief justices of the Supreme Court, will have to decide if RIL deliberately suppressed output from KG-D6 and whether the government has the right under the product sharing contract (PSC) to levy penalties if output fell short of estimates. (economictimes.indiatimes.com)

Gas price: New govt may have fresh look at Rangarajan formula

March 30, 2014. The Rangarajan formula that doubles natural gas prices may not be implemented in totality as the new government is likely to fix infirmities in the formulation before accepting it. The Oil Ministry botched up the first revision of gas prices in five years as it delayed notifying the new rates to the last minute. In the January, 2013 Cabinet note on revision of prices of all domestically produced natural gas, the ministry had proposed immediate implementation of the formula suggested by a panel, headed by Prime Minister's Economic Advisory Council Chairman C Rangarajan, for all producers except in cases where the current rate is valid for a certain period. This meant the new rates would have applied immediately to state-owned firms like ONGC but it would have accrued to RIL only after expiry of the five-year duration of current USD 4.2 per million British thermal unit rate in at end of March, 2014. (economictimes.indiatimes.com)

‘Diesel users like radio, petrol buyers go online’

March 27, 2014. Your fuel bill can tell your media habits, including the medium you tend to use or watch the most, a government survey of petro-products consumers across the country has found. Coming in the poll season, the findings of the survey could come in handy for media planners of political parties vying for voter mindshare and eyeballs. For policymakers and retailers, the survey conducted by the Petroleum Conservation Research Association (PCRA), an arm of the oil ministry, affords a peek into targeting of subsidies, demand conditions and impact of a particular medium on behaviour of a sizeable chunk of the consumer population. Sample this: The survey shows that more users of cooking gas (92%), which is subsidized, watch television daily compared to those who use petrol sold at market rates (72%) and diesel (54%), again a subsidized fuel. Interestingly, more diesel users (28%) listen to radio almost daily than petrol (19%) and cooking gas (10%) users. It also showed that more fuel users have a mobile phone (98%) than cooking gas users (89%). When it comes to the internet, more petrol users (37%) surf the web than diesel (25%) and cooking gas (5%) users. Up to 33% of petrol users go to cinema halls at least once a month to watch a movie. This is significantly more than diesel and cooking gas users. The survey showed only 28% diesel users go to watch a movie once a month, while about 9% of cooking gas users do so. Analysts say such surveys are undertaken by major global retail chains to assess consumer behaviour and impact of advertising campaigns on sales, and the use of such a tool in a sector dominated by state-run firms augurs well. For example, a survey for a major US retail chain some years ago found that beer sold better when stocked next to diapers. PCRA conducted the survey to assess the impact of its conservation campaign among petroleum product users in the domestic and transport sectors. The survey showed that only about 28% of fuel users (30% petrol and 25% diesel users) could recall at least one message of conservation received through SMS. It said that the SMS should not be a preferred media to disseminate fuel conservation messages. It said the campaign on petroleum conservation was highly effective as almost all users who recalled one message adopted it. On an average, cooking gas users accepted three messages out of five, while diesel users accepted five messages out of nine. It said that television was found to be the most preferred medium for campaigning, while radio was found to be more prevalent among fuel users, particularly fleet operators. For print media, regional languages were most preferred over any other language. The survey was undertaken in the four metros of Delhi, Mumbai, Chennai and Kolkata and 10 major cities — Bangalore, Ahmedabad, Hyderabad, Pune, Lucknow, Chandigarh, Patna, Mangalore, Bhubaneswar and Jaipur. The total sample size was 10,395. It included 260 cooking gas users, 4,384 petrol users and 3,851 diesel consumers. (economictimes.indiatimes.com)

Hamid Ansari for intensive debate on energy challenges facing India

March 26, 2014. Vice-president Hamid Ansari urged a more intensive debate on energy challenges facing India, which sources as much as 80 % of its requirements from abroad and is on the lookout for newer sources of fuel to power its economy. Speaking at the launch of the book The Political Economy of Energy and Growth, edited by Delhi’s lieutenant governor Najeeb Jung, which was presented to former finance secretary and secretary in the petroleum ministry Vijay Kelkar, Ansari said “much more needs to be done to focus on the country’s energy security.” The book, which is a compendium of articles written by energy security analysts from India and abroad including former Indian oil minister Mani Shankar Aiyar, looks at the trends in the global oil market, the energy scenario in India and South Asia and the co-relation between energy and the environment besides other issues. Oil diplomacy, the political economy of reforms, the interaction between macroeconomic policies and the energy sector, technology challenges, and innovations in oil industry are the other issues that the book focuses on. According to the external affairs ministry, India sources 180 million tonnes of crude oil annually from abroad which is about 80% of its requirements. Some of the main countries from where India sources its oil include Saudi Arabia and Iraq besides the United Arab Emirates. (www.livemint.com)

POWER

Generation

Reliance Power's Butibori plant becomes fully operational

April 1, 2014. Reliance Power said its 600 MW coal-based power plant at Butibori in Maharashtra is fully operational. Butibori Power Project, being developed by Vidarbha Industries Power Ltd (VIPL), a subsidiary of Reliance Power, is fully operational, the company said. It has commenced supplies under the Long Term Power Purchase Agreement for 25 years with Reliance Infrastructure Ltd, the company said. The project comprises of two units of 300 MW each, one unit will be a group captive plant and the other unit an Independent Power Project (IPP). The project's EPC (engineering, procurement and construction) contractor is Reliance Infrastructure, while Shanghai Electric Corporation, China, is the equipment supplier. With this commissioning the total generation capacity of the company had reached 4,000 MW. (economictimes.indiatimes.com)

Jindal Power commissions 2nd 600 MW unit of Chhattisgarh plant

March 31, 2014. Jindal Power Ltd, a company promoted by Jindal Steel & Power Ltd, has started the second 600 MW unit of the Tamnar project at Raigarh in Chhattisgarh. The third unit of 600 MW is ready for synchronisation, while the fourth unit of similar capacity should be commissioned by October, the company said. (www.business-standard.com)

BHEL wins ` 1.2 bn order for hydro power project in Uttarakhand

March 31, 2014. State-owned power equipment maker BHEL has secured ` 125 crore contract for setting up a 120 MW Hydro Electric Project in Uttarakhand. Located in Dehradun district, the Vyasi power project is a run-of-the-river scheme on the Yamuna. BHEL said the contract envisages design, manufacture, supply, installation and commissioning of hydro generating sets and associated electro mechanical works. While the hydro generating sets will be supplied by BHEL's Bhopal unit, the transformers and Control & Monitoring system will be supplied by the Jhansi unit and Electronics Division, Bangalore respectively. The erection & commissioning of the equipment shall be carried out by BHEL's Power Sector - Northern Region (PS-NR). BHEL has enhanced its manufacturing capacity to 20,000 MW per annum. (www.business-standard.com)

Transmission / Distribution / Trade

GVK wants to sell Punjab unit to NTPC

April 1, 2014. GVK Power & Infrastructure is looking to monetise its 540 MW Goindwal Sahib power plant in Punjab. The company is known to have approached state-owned power generator NTPC for a possible sale. The plant has coal linkages with the Tokisud and Seregarha mines from Jharkhand. It is still under construction and is expected to commission in the first quarter of the coming financial year, according to a Prabhudas Liladher report. It also has a 25-year power purchase agreement with Punjab State Power Commission. The cost of setting up the project is around ` 2,000 crore. NTPC, the country’s biggest power generator, with cash reserves of ` 16,867 crore, had issued an expression of interest (EoI) to buy coal-based power plants, whether operational, commissioned, synchronised, under construction or under planning. State electricity boards (SEBs), independent power producers, power plant developers and captive power producers were asked to offer projects based on domestic coal, imported coal or a mix. EoIs have to be given by April 7. GVK’s power business has been posting lower revenues on account of reduced supplies to its three operating gas-fired power plants, totalling 900 MW in capacity. In the quarter ended December, it posted revenue of ` 97.6 crore, down from ` 237 crore in the same quarter last year. (www.business-standard.com)

Alstom bags ` 1.8 bn contract from Power Grid

April 1, 2014. Alstom T&D India and Alstom Grid UK Limited have won a 22.75 million euro (` 182 crore) contract from state-run Power Grid Corporation to supply and refurbish High Voltage Direct Current (HVDC) converter transformers. The turnkey contract includes designing, engineering, manufacturing, refurbishing, erection and commissioning of HVDC converter transformers. These transformers will be manufactured at Alstom's facilities in Vadodara, India, and Stafford, the UK. Under the new contract, Alstom's technology - HVDC converter transformers - will replace Bhadrawati's old transformers, and extend the life of the existing substation. This strengthens the transmission link with the southern region, and ensures reliable power supply between the Western and the Southern grid. (www.business-standard.com)

NHPC continues to supply power to J&K despite unpaid dues

March 31, 2014. As part of the Union government’s attempt to improve its relations with Jammu and Kashmir, state-run NHPC Ltd continues to supply electricity to the terrorism-hit state despite outstanding dues of ` 1,045 crore. Of this, ` 625 crore is due by over six months. India’s largest hydropower generation utility withdrew its notice of regulation to suspend electricity supply to the state over unpaid dues. According to the law, utilities are allowed to regulate or discontinue power supply if dues haven’t been paid. NHPC, formerly National Hydroelectric Power Corp. Ltd, has a generation capacity of 5,702 MW and includes projects taken up in joint ventures. Of the 4,857 MW generated by NHPC, around 2,000 MW is generated from the state. NHPC supplies 820 MW to Jammu and Kashmir. Of the ` 1,132 crore due to NHPC for more than 60 days, the state owes Rs.970 crore. The balance is to be paid by Uttar Pradesh (` 35 crore), Himachal Pradesh (` 20 crore), Rajasthan (` 4 crore), BSES Rajdhani Power Ltd (` 15 crore) and BSES Yamuna Power Ltd (` 30 crore), Bihar (` 28 crore), Jharkhand (` 10 crore), Assam (` 2 crore) and Meghalaya (` 16 crore). The dues are to be paid by Jammu and Kashmir State Power Development Corp. Ltd (JKSPDC). Electricity supplies are regulated after outstanding due of 60 days. Interestingly, NHPC has regulated electricity supply to Meghalaya. Out of ` 16 crore due by Meghalaya, ` 10 crore is overdue by more than 180 days. (www.livemint.com)

Tata Power seeks compensation from CLP India

March 28, 2014. Tata Power Delhi Distribution Ltd has sought compensation from the Indian arm of Chinese power producer CLP Holdings for wrongly announcing the commissioning of its 1,320 MW Jhajjar Power project for which it had to unnecessarily pay ` 33 crore as transmission charge. The matter is pending before the Central Electricity Regulatory Commission (CERC) while Haryana government has also filed a similar complaint against CLP India before Haryana Electricity Regulatory Commission. (economictimes.indiatimes.com)

Mahavitran to sell 100 MW power to BEST for April-March period

March 27, 2014. Maharashtra's state discom Mahavitran will sell 100 MW power to Brihanmumbai Electricity Supply and Transport Company (BEST), which supplies power to the island city, after settling issues concerning availability of power in rest of the state. According to Mahavitran, the utility has taken power from every possible source to bridge the demand-supply gap. Mahavitran claimed that nearly 85 per cent of the state is free from load-shedding. (economictimes.indiatimes.com)

Coal India sees 2014/15 output at 507 million tonnes

March 27, 2014. Coal India, the world’s No. 1 coal miner, expects to produce 507 million tonnes for the fiscal year 2014/15. The estimate is about 7% higher than the revised 475 million tonnes the miner expects to produce for the year ending 31 March 2014. The state-run miner aims to supply 520 million tonnes in 2014/15. The company would settle for annual output growth of just 30 million tonnes for the next few years, a tenth of the possible 300 million. Delays in getting railway tracks built to ship the coal from new — and often remote — mines have made it tough for Coal India to raise production, and India is the world’s third largest importer of coal despite sitting on what BP Plc ranks as the fifth-largest reserve. (www.livemint.com)

SC tells NTPC to keep up Delhi power supply during payment row

March 26, 2014. Supreme Court (SC) told producer NTPC Ltd to continue supplying power to New Delhi while it waits for money it is owed by a distribution company, avoiding a possible blackout in the country's capital. Distribution companies have said they cannot pay the money they owe while electricity tariffs are kept low and they suffer revenue shortfalls. NTPC had threatened in February to cut off power supply to BSES Yamuna Power, one of the three distributors in Delhi, if the company did not pay its bill. But the Supreme Court reiterated that NTPC must maintain power supply even while it is owed money, and ordered BSES, part of billionaire Anil Ambani's Reliance Infrastructure Ltd, to pay the dues it owes since Jan. 1, 2014. It did not specify the amount BSES must pay. India's power sector, hobbled by rising debts and fuel supply shortages, has struggled to increase output to meet rising demand. Blackouts are common, hurting Asia's third-largest economy. (economictimes.indiatimes.com)

Andhra discoms seek RLNG swapping to utilise 300 MW

March 26, 2014. State power utilities are trying to ramp up power generation to meet the growing demand in Andhra Pradesh, which has been facing scheduled power cuts. A 300 MW of idle capacity in gas-based projects is being already utilised by running them on naphtha fuel while a request has been sent to the Union Petroleum Ministry to allow swapping of regasified liquified natural gas (RLNG) with natural gas for running an additional 300 MW, according to Andhra Pradesh Transmission Corporation (APTransco). Power utilities are purchasing 2,000 MW power on a short-term basis to meet the summer demand, according to APTransco. The discoms met 282 million units (mu) of the 314 mu demand leaving a shortfall of 32 mu. The power-deficit state in the South is yet to get access to the relatively cheaper power available in the northern grid as the new north-south corridor, which was formally inaugurated a couple of months ago, is yet to be put on use. (www.business-standard.com)

Himachal govt seeks ` 27 bn damages from Brakel Corp

April 1, 2014. The Himachal Pradesh government has sought ` 2,700 crore in damages from Brakel Corporation of the Netherlands for delay in the implementation of Jangi Thopan and Thopan Powari Hydroelectric projects. The state government has sent a show-cause notice to the Dutch firm for forfeiting a part of the upfront premium, amounting to ` 280 crore. The two projects, of 480 MW each, were awarded by the state government to Brakel Corporation NV in December 2006, based on international bidding. (economictimes.indiatimes.com)

Haryana power discom gets Japanese assistance

March 31, 2014. The Japan International Cooperation Agency (JICA) signed a loan agreement with the Government of India to provide 26,800 million yen (` 1,604 crore) of Japanese Official Development Assistance for the Haryana distribution system upgradation project. The agreement was signed in New Delhi by Shinya Ejima, Chief Representative of JICA in India and Rajesh Khullar representing the Ministry of Finance. The loan at a concessional interest rate of 0.80 per cent carries a repayment period of 20 years, with a grace period of six years. The project aims to augment distribution facilities with increasing demand and reducing electricity distribution losses in Haryana, where rapid industrial development and economic growth have led to a drastic rise of electricity demand. The loan funds will be utilised for bifurcation and trifurcation of overloaded feeders, construction of new substations, augmentation of existing substations, introduction of Automated Meter Reading, installation of meter pillar boxes and single phase and three face meters, and purchasing of other equipment such as power transformers, current and potential transformers, and vacuum circuit breakers. The project will be executed by the Uttar Haryana Bijli Vitran Nigam Ltd. (UHBVN) covering the northern part of the state and Dakshin Haryana Bijli Vitran Nigam Ltd. (DHBVN) covering the southern part of the state. The project is expected to be completed by June 2019. (www.business-standard.com)

CERC orders on Tata, Adani projects challenged before APTEL

March 30, 2014. Electricity regulator CERC's move to allow compensatory tariff for two Mundra projects of Tata Power and Adani Power has been challenged before Appellate Tribunal for Electricity (APTEL) by an NGO, which alleges that the move would give "undue benefits" to the utilities. Energy Watchdog, a Delhi-based non-governmental group, has filed appeals with the APTEL challenging the CERC's orders issued. In a major relief for Tata Power and Adani Power, the Central Electricity Regulatory Commission (CERC) had allowed them higher tariff and total compensation amounting to more than ` 1,100 crore for their Mundra projects in Gujarat. The rulings would help the companies to mitigate losses suffered by the two Mundra projects, due to a rise in price of Indonesian coal that is used to fire these plants. Tata Power, through its wholly-owned subsidiary Coastal Gujarat Power Ltd (CGPL), is operating the 4,000 MW Mundra plant while Adani Power is implementing the 4,620 MW Mundra project. According to the two appeals, the orders would result in "undue benefit" of about ` 75,000 crore for the two power producers. The regulator had allowed higher tariff as well as compensation of ` 329.45 crore for Tata Power's Mundra plant. It supplies power to the states of Gujarat, Maharashtra, Rajasthan, Haryana and Punjab. The appeal against order related to Adani Power's project has alleged that extra burden on the state exchequers to the tune of ` 31,808 crore. Electricity generated from this plant is sold to the states of Gujarat and Haryana. (www.business-standard.com)

Coal scam: Court fixes May 2 for consideration on charge sheet

March 27, 2014. A Delhi court fixed May 2 for considering the charge sheet filed by CBI in coal blocks allocation scam case against Navabharat Power Pvt Ltd and its two directors. Special CBI Judge Madhu Jain fixed the matter for May 2 as CBI has not yet filed complete set of documents, which were part of the charge sheet filed on March 10. CBI filed some of the documents which were part of the charge sheet in which the firm and its two directors were accused of conspiring and cheating by purportedly misrepresenting facts to "embellish" its applications to get allotments between 2006 and 2009. This was the first charge sheet filed by CBI out of the 16 FIRs lodged by it till date in the multi-crore scam against various firms and top corporates, also including industrialist Kumar Mangalam Birla and Congress MP Naveen Jindal. (www.business-standard.com)

Karnataka seeks to keep its electricity within its borders

March 27, 2014. The Karnataka government, in an unprecedented move, has stopped supplying electricity outside the state. This comes in the backdrop of states, fearful of political backlash, shoring up additional power to avoid outages during the election. The state was facing a power shortage and that demand for electricity peaks during January to May because of school and college exams and the summer. Peak electricity shortage in the southern region to which Karnataka belongs in fiscal 2013 was 18.5%. The Karnataka government’s order was issued under Section 11 of the Electricity Act, 2003, with the maximum demand of 9,223 MW reached in February. The state is facing a peak shortage of 500-1,000 MW since December. Analysts believe that elections are not a good time for the Indian power sector. The Karnataka government’s move follows the Gujarat government’s order wherein state-based firms can’t source electricity from other states and buy more expensive electricity from state-run utilities. With the level of industrialization higher in the southern states—Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Puducherry and Lakshadweep—there is higher demand for electricity. Even as South India has joined the national electricity grid, completing the integration of the entire country into one seamless network for delivering power to consumers, there are transmission constraints. All the five regional grids in the country—northern, southern, eastern, north-eastern and western—are connected to the national grid. India has an inter-regional electricity transmission capacity of 37,000 MW, of which only 17,000 MW can be transferred. Investments in transmission and distribution have not kept up with investments made in power generation. While the country has an installed power generation capacity of 237,743 MW, daily generation is only about 125,000 MW. (www.livemint.com)

NTPC plans to import 15 million tonnes of coal in FY15

March 27, 2014. The country's largest power producer NTPC has set a target of importing as much as 15 million tonnes of coal in the next financial year (2014-15). The target may be lowered if Coal India increases its production, the company said. NTPC currently has an installed capacity of 42,964 MW, of which more than 37,000 MW is coal based. The company plans to add 14,000 MW of capacity in the 12th Plan period (2012--17). Mining at a coal block allotted to the company has missed the planned start date. Work at the site has been stalled due to an agitation against land acquisition. The Pakri Barwadih coal block in Jharkhand was allocated to NTPC in 2004 and mining was expected to start in February. The company ventured into coal mining with the aim of meeting about 20 per cent of its requirements from its own mines by 2017. It has been allotted seven coal blocks, including two that are to be developed through joint ventures. (economictimes.indiatimes.com)

India pulls out all stops for Arunachal power project

March 26, 2014. The central government has held wide-ranging talks with state government officials from Assam and civil society groups in a bid to push the pace of building the 2,000 MW Lower Subansiri project in Arunachal Pradesh and pre-empt threats from Chinese plans. The country’s largest hydroelectric project, being developed by NHPC Ltd, has become a test case for how efficiently India can implement its strategy to harness the hydropower resources of Arunachal Pradesh while countering China’s plans to divert river waters that flow into the Brahmaputra. Of the 7,912 MW capacity awarded through eight projects, only Lower Subansiri has reached the construction stage. In order to facilitate transportation of equipment to the project, a consensus is being built through tripartite discussions between civil society, the government of Assam and the Union government. The talks include sweeteners such as increasing electricity allocation to Assam. (www.livemint.com)

INTERNATIONAL

OIL & GAS

Upstream

Husky, CNOOC commences first production at Liwan Gas Project off China

March 31, 2014. Husky Energy reported that the company and its joint venture partner CNOOC Limited have commenced first production at Liwan Gas Project in the South China Sea, offshore China. The project, located approximately 186 miles (300 kilometers) southeast of the Hong Kong Special Administrative Region, consists of the Liwan 3-1, Liuhua 34-2 and Liuhua 29-1 fields. The development consists of a subsea production system, a subsea pipeline transportation and an onshore gas processing infrastructure. Initial natural gas sales from the Liwan 3-1 field are expected at around 250 million cubic feet per day (MMcf/d) gross before rising to approximately 300 MMcf/d in the second half of 2014, while initial sales of condensates and natural gas liquids are likely to be approximately 10,000 to 14,000 barrels of oil equivalent per day (boed) gross. Meanwhile, the Liuhua 34-2 field will be tied into the Liwan infrastructure in the second half of 2014, subject to final approvals. Production from the Liwan 3-1 field is scheduled to go offline for approximately six to eight weeks to provide for the tie-in of the field. Following the tie in of Liuhua 34-2, combined gas sales from the Liwan project are expected to increase to approximately 340 MMcf/d (gross). Natural gas from both fields will be processed at the onshore gas terminal at Gaolan and sold to China, with initial gas production covered by fixed-price gas sales agreements. Total gas sales are expected to increase to between 400 and 500 MMcf/d (gross) with the planned tie-in of the Liuhua 29-1 field in 2016-2017. (www.rigzone.com)

South Sudan’s rebel leader Machar vows to target key oil fields

March 31, 2014. South Sudanese rebels plan to capture key oil installations to force President Salva Kiir to step down and end more than three months of conflict in the world’s newest nation, former Vice President Riek Machar said. Fighters allied with Machar, known as the White Army, are “mobilizing” to attack the Paloch oil fields that are the main source of revenue for the country’s military, the rebel leader said. Upper Nile is South Sudan’s only remaining crude-producing state after the insurgency forced oil companies to stop pumping in neighboring Unity state in December. The country, which gained independence from Sudan in July 2011, is producing about 160,000 barrels per day of oil from fields in Upper Nile, according to the government. Current output is probably about 150,000 barrels per day, generating about $15 million for the government and oil companies, said Luke Patey, a researcher on South Sudan’s oil industry from the Danish Institute for International Studies. Production has declined from a pre-conflict level of 240,000 barrels per day, he said. (www.bloomberg.com)

Lukoil starts Iraq oilfield as output reaches 35-year high

March 29, 2014. OAO Lukoil started producing crude from Iraq’s second-largest oilfield as the nation boosts output to levels last seen more than three decades ago. The West Qurna-2 field in southern Iraq has been producing at a rate of 120,000 barrels a day. Russia’s biggest publicly traded oil producer expects the field’s daily output to reach 400,000 barrels by the end of the year. Lukoil plans to lift production at the site to its plateau of 1.2 million barrels by end 2017, after drilling 459 wells and using water injection. This volume is a third of Iraq’s current production of 3.6 million barrels a day. (www.bloomberg.com)

Statoil gets nod to take Vale's stake in Brazil blocks

March 28, 2014. Brazil has approved Norwegian oil and gas firm Statoil's acquisition of a stake in an offshore oil concession from mining giant Vale, Statoil said. With the approval, Statoil will acquire 25 percent of the BM-ES-22A concession, which consists of two blocks in the Espírito Santo basin offshore Brazil, near several other blocks where Statoil is either operator or partner. The block is operated by Petrobras, which will hold the remaining 75 percent. (www.rigzone.com)

Oil Search disputes InterOil-Total deal in Papua New Guinea

March 28, 2014. Oil Search Ltd., Papua New Guinea’s largest oil and gas producer, is contesting Total SA’s agreement to acquire a stake in InterOil Corp.’s natural gas discoveries in the Pacific nation. Oil Search, which agreed to buy a stake in the same discoveries for an initial $900 million, lodged a dispute with InterOil, the Port Moresby-based company said. At stake are fields in Papua New Guinea that may underpin an expansion of the country’s liquefied natural gas industry. Oil Search is already Exxon Mobil Corp.’s partner in the $19 billion Papua New Guinea LNG venture that’s proceeding along with seven others in Australia to tap rising Asian demand. Total and InterOil want to build a second export development based on gas from the Elk and Antelope fields. (www.bloomberg.com)

Top Chinese oil firm CNPC to participate in Mexico oil opening

March 27, 2014. China's largest energy company will compete for future oil and gas development rights in Mexico, the company said, which could happen as soon as the end of this year. Mexico's energy overhaul, approved in December, ended state-run oil company Pemex's 75-year monopoly. It aims to lure billions of dollars in foreign or private investment via new contracts that the government says will be auctioned off in public tenders. CNPC, parent of PetroChina, is Asia's largest oil and gas producer. Mexico's energy ministry is in the early stages of implementing energy reforms, currently evaluating which fields Pemex will keep via a so-called "Round Zero" allocation. Pemex submitted its wish list, and now the ministry has until mid-September to decide. CNPC has expanded its presence in Latin America in recent years and is now active in Venezuela, Ecuador, Peru, Colombia, Brazil, Cuba and Costa Rica. CNPC announced it was buying all of the Peruvian assets of Brazil's state-run oil company Petrobras for $2.6 billion. (www.reuters.com)

Shell, Statoil, Total, others win Myanmar oil, gas exploration blocks

March 26, 2014. International oil majors including Royal Dutch Shell, Statoil, ConocoPhillips and Total won rights to explore for oil and gas off Myanmar, according to the Southeast Asian country's Ministry of Energy. Myanmar has awarded 10 shallow-water blocks and 10 deepwater blocks in an auction process that began in April last year, according to the ministry. Winners of deepwater blocks will be able to explore and operate the blocks on their own, while shallow-water winners will need to work with a registered local partner, according to the terms of the production sharing contracts. Myanmar's oil and gas sector attracts the largest share of foreign investment, accounting for $13.6 billion, or 40 percent, of total accumulated foreign investment through September, according to the Central Statistical Organisation (CSO). Myanmar exported $3.7 billion worth of gas in the fiscal year to March 31, 2013, mostly to neighbouring Thailand, up from $3.5 billion the year before. The country's proven natural gas reserves totalled 7.8 trillion cubic feet at the end of 2012, according to BP's Statistical Review of World Energy. (www.rigzone.com)

Downstream

Ukraine wants to regain control of Odessa refinery: Minister

March 31, 2014. The Kiev government wants control of the Odessa oil refinery to return to Ukrainian hands, interior minister Arsen Avakov said. Avakov said the refinery was now controlled by a Russian bank, which he did not name. The refinery, designed to process 3.6 million tonnes of crude oil per year (70,000 barrels per day), suspended oil processing from late February. It also said it planned maintenance in March. (www.downstreamtoday.com)

Saudi JV Jubail refinery to reach full output by mid-2014: Total

March 28, 2014. The joint venture 400,000-barrels-per-day Jubail refinery in Saudi Arabia will reach full production capacity by around mid-2014, Total said. Saudi Aramco Total Refining and Petrochemical Company's refinery in Jubail, a joint venture by France's Total and Saudi Aramco, began a gradual startup of operations last year. Commercial exports from the plant started in September 2013, it said. (www.downstreamtoday.com)

Russia's refinery runs rise 2.3 pc in Feb from Jan

March 26, 2014. Russian oil refinery runs in February rose by 2.3 percent or 128,787 barrels per day (bpd) compared with January, data from the Energy Ministry showed. Refineries processed 5.820 million barrels of crude oil per day in February versus 5.691 million the previous month. February had three fewer days than January, which figured into the calculation of barrels per day. Rosneft's Ryazan refinery cut its oil processing by 11.5 percent in February from January following a fire caused by a railcar crash. The privately owned Antipinsky refinery raised its oil processing by 15.0 percent month-on-month. (www.downstreamtoday.com)

Transportation / Trade

Poland opens gas link to draw reverse flows from Germany

April 1, 2014. Poland opened its first gas link from the West capable of transporting supplies from Germany to help guard against potential cuts of Russian deliveries, Poland's gas operator Gaz-System said. The reverse flow link along the Yamal pipeline through a pumping station in the German town of Mallnow is also part of wider European Union efforts to build new links and infrastructure to ensure security of supply. Expanding the station at Mallnow allows for reverse flow capacity of up to 2.3 billion cubic metres annually with the potential to rise to 5.5 bcm in case of supply disruptions, Gaz-System said. (www.downstreamtoday.com)

Australia's LNG export focus impacting future investment

March 28, 2014. An Energy Users Association of Australia (EUAA) study has forecast that the eastern Australian gas sector’s shift to an export focus to support major liquefied natural gas (LNG) projects will significantly affect future employment and investment. The EUAA, Australia’s peak industry body for energy users, released a scoping study exploring the potential impact of high gas prices on the industry and economy. The EUAA explained that the eastern Australian gas market had transitioned from a domestic focus to an export focus to support the major developments. The three LNG plants currently under construction in eastern Australia – Australia Pacific LNG, Queensland Curtis LNG and Gladstone LNG – have an associated capital expenditure estimated at $54.4 billion (AUD $60 billion), the EUAA said. The EUAA commissioned Marsden Jacob Associates to undertake the study. (www.downstreamtoday.com)

Oil sector withholding info on rail cargoes: US regulator

March 28, 2014. U.S. transport regulators scolded the oil industry for not sharing important information on the kinds of rail shipments that have been involved in a number of fiery train derailments. In letters to regulators and testimony to lawmakers, leaders of trade groups like the American Petroleum Institute have said since January that they will share results of their tests on fuel from North Dakota's booming Bakken oil patch, where the derailed trains were loaded. Despite those assurances, the Department of Transportation said the industry has dragged its feet in cooperating with regulators who are trying to understand why several recent derailments of freight trains carrying crude oil also resulted in explosions. (www.downstreamtoday.com)

Hungary and Slovakia link gas networks to enhance supply security

March 27, 2014. Hungary and Slovakia linked their natural gas pipeline networks as part of European Union efforts to strengthen supply security in a region of the bloc that relies heavily on imports from Russia. The connection of the two grids in the Hungarian town of Szada, 28 km (18 miles) northeast of Budapest, will allow flows to be reversed so that Hungary, rather than import gas from Russia, can bring it from alternative sources in Europe. A new 111 km pipeline with annual capacity of about 5 billion cubic metres (bcm), stretching from the Hungarian town of Vecses to Velke Zlievce in Slovakia, is due to become operational from 2015. Hungary imports about 80 percent of its gas from Russia and the Hungary-Slovak interconnector is part of the North-South Corridor, an EU project aimed at reducing dependence on eastern imports. (www.downstreamtoday.com)

Spain could be gateway for gas to Europe-lobby group

March 27, 2014. Spain's sophisticated gas infrastructure could help Europe reduce its dependence on Russian supplies once projects to pump gas across the Pyrenees become a reality. Europe's most highly diversified gas importer has vast untapped import capacity which it could use to route gas into France and beyond, but underdeveloped pipeline links with other countries have effectively made Spain a gas island. Spain, meanwhile, does not receive any of its natural gas from Russia and was entirely shielded from the EU gas crises of 2006 and 2009 when rows over unpaid bills between Kiev and Moscow led to the disruption of gas exports to western Europe. Spain spent billions of euros on its gas infrastructure during an economic boom and with seven LNG regasification plants has more capacity to turn liquefied natural gas back into gas than any other European country. Now it is lobbying the EU to forge ahead with plans for a new pipeline, called MIDCAT, to transport gas into Europe. (www.downstreamtoday.com)

Policy / Performance

Russia plans to build undersea gas pipeline to Crimea

April 1, 2014. Russia plans to build an undersea gas pipeline to Crimea and could construct three power stations on the Black Sea peninsula following its annexation from Ukraine, Energy Minister Alexander Novak said. The natural gas pipeline, which could cost up to 6 billion rubles to build, would have a capacity of up to 2 billion cubic meters a year, he said. Novak also said Russian state gas company Gazprom would cover all the costs for the construction of the pipeline to Crimea, which has been annexed by Russia although the United Nations General Assembly has adopted a resolution declaring invalid the referendum that backed union with Russia. (www.reuters.com)

Record natural gas need keeps bulls betting on advances

April 1, 2014. The cold snap in the Eastern U.S. persuaded hedge funds and other speculators to keep betting on rising natural gas prices, accumulating the most bullish position for this time of year since at least 2010. The polar vortex that sent temperatures tumbling across the country in January boosted consumption by households and power plants to all-time highs. Waves of frigid weather through March pushed stockpiles to the lowest level in 11 years. Almost 3 trillion cubic feet of gas will need to go into storage during the warm-weather months to cover winter demand, something that’s never been done before. Bank of America Corp. and BNP Paribas SA say stockpiles may rise to less than 3.5 trillion cubic feet by the end of October, about 300 billion short of last year’s high. It will take the record production forecast for this year to get there, said Francisco Blanch, commodities research head at Bank of America in New York. The U.S. experienced the coldest period of December through February in 32 years, based on gas use and population, according to Commodity Weather Group LLC, a forecasting company in Bethesda, Maryland. Prices that surged to a five-year high of $6.493 per million Btu tumbled 33 percent since then as heating demand waned with milder weather. Gas inventories dropped by 2.92 trillion cubic feet from the end of October to 896 billion cubic feet, making it the fastest pace of withdrawals for any U.S. heating season in data going back to 1995, according to the U.S. Energy Information Administration (EIA). A supply deficit to the five-year average widened to a record 51 percent. On average over the past five years, stockpiles have climbed to 3.832 trillion cubic feet by the end of October, according to the EIA. Marketed gas production this year will climb by an average 1.78 billion cubic feet a day, or 2.5 percent, to 71.96 billion, the EIA said in a March 11 report. Gains are being driven by new wells at Marcellus shale deposit in the Northeast, where daily output will reach 14.8 billion cubic feet in April, EIA data show. That is an increase of 4.05 billion, or 38 percent, from a year earlier. The government estimated that this record production will help increase inventories by 2.494 trillion from April through October to 3.459 trillion, toppling the 2001 record injection of 2.402 trillion. The forecast was based on supplies ending March at 965 billion. (www.bloomberg.com)

Gazprom raises gas export price as Ukraine looks for cash

April 1, 2014. Russia’s natural-gas export monopoly raised prices for Ukraine 44 percent after a discount deal expired, heaping financial pressure on the government in Kiev as it negotiates international bailouts. OAO Gazprom said Ukraine is losing its right to pay less because it has piled up a debt of more than $1.7 billion since 2013. Ousted President Viktor Yanukovych won a lower price as he grappled with protests after ditching an association agreement with the European Union, on top of a previous discount in April 2010. That may also be overturned, according to Russia’s government. The move raises the prospect that Gazprom may threaten to halt sales to Ukraine, which relies on Russia for about half its gas. European shipments were disrupted at least twice since 2006 when Russia cut Ukraine’s supplies during price disputes. Gazprom’s pricing decision came after Russian President Vladimir Putin moved to reduce military tensions after annexing Crimea, saying that Russia’s withdrawing some troops from near the border with Ukraine. Ukraine, completing a deal with the International Monetary Fund and waiting for U.S. aid, is critical to EU energy security because about 15 percent of European gas supplies travel through its Soviet-era pipeline network. In January 2009, a dispute between Russia and Ukraine disrupted deliveries to Europe for about two weeks during freezing weather. The second-quarter gas price for Ukraine is rising to $385.50 per 1,000 cubic meters from $268.50 in the first quarter. The average price for European customers this year is seen at about $370 to $380, according to the company’s forecasts. The announced price still includes the 2010 discount, Gazprom said. Ukraine’s price may rise by an additional $100 per 1,000 cubic meters “on the same day” that the Russian state makes a final decision to annul all documents signed under the so-called Kharkiv accord, Gazprom said. That would move Ukraine’s price to a level about 30 percent higher than Gazprom’s EU customers pay. Moody’s Investors Service said that it may cut the bond ratings of Gazprom and OAO Rosneft, after it put Russia’s government bond rating on review for downgrade. Moody’s said it expects the companies’ ratings will not differ from the sovereign rating at the end of the review. Ukraine agreed to extend Russia’s lease to the Black Sea Fleet base in Crimea from 2017 to 2042 in exchange for cheaper gas. Russia has no need for the accords after the peninsula’s accession, Prime Minister Dmitry Medvedev said, calling for Ukraine to pay about $11 billion lost to Russia’s budget. (www.bloomberg.com)

Myanmar expects next bidding round for offshore blocks in 2015

March 27, 2014. Myanmar, having just awarded 20 offshore oil and gas blocks in its latest tender, expects the next bidding round to take place at the earliest 12 to 18 months from now, the energy minister said. Several international oil companies were among the 18 winners, either alone or in partnership, in Offshore Bidding Round 2013, which included 19 deepwater and 11 shallow water blocks in Myanmar. These included companies such as Chevron Corp., ConocoPhillips Co., Eni S.p.A., Royal Dutch Shell plc, Statoil and Total S.A. (www.rigzone.com)

Italy says Ukraine crisis puts south stream pipeline at risk

March 27, 2014. The future of the South Stream pipeline project to transport Russian gas to Europe is at risk after Russia's annexation of Crimea from Ukraine, Italy's Industry Minister Federica Guidi said. The head of Italy's oil major Eni warned that the 2,400 km (1,500-mile) pipeline, led by Russia's Gazprom, was in jeopardy. Besides Gazprom and Eni, the other shareholders in the project are France's EDF and Germany's Wintershall. (www.downstreamtoday.com)

Mozambique spurs gas plans to beat competitors, reduce aid reliance

March 27, 2014. Mozambique is finalising its energy law and looking at a unique pricing formula for natural gas exports as it aims to see off rival gas exporters and reduce its reliance on Western aid. Some of the world's biggest offshore natural gas fields lie off the coast of Mozambique. The challenge for one of Africa's poorest countries is to develop the fields and begin lucrative exports before a wave of supply from rivals, including neighbouring Tanzania, beat them to market. (www.downstreamtoday.com)

Singapore LNG stakes claim for second terminal: Southeast Asia

March 26, 2014. Singapore LNG Corp. is touting its experience running Southeast Asia’s biggest liquefied natural gas receiving terminal as a sign it can manage a second facility planned for the city-state. John Ng, the company’s chief executive, says he’s up for the challenge when the government starts looking for an operator. While Singapore hasn’t said when the second terminal will start, industry consultants including FGE forecast it will be after 2020. As Asia overtakes Europe as the world’s biggest natural-gas importer, Singapore wants to tap burgeoning demand for cargoes and cement its place as the region’s LNG trading hub. The country, which uses gas for more than 90 percent of its electricity, is studying locations on the east of the island for a second terminal to support industries and fuel power stations, Prime Minister Lee Hsien Loong said. Asia accounts for 46 percent of global gas trade, according to the International Energy Agency, which identifies Singapore as best-placed to be a center for LNG trading. The region consumed 75 percent of the world’s LNG last year, data from the International Group of Liquefied Natural Gas Importers show. Singapore’s second terminal will have a capacity similar to the first, according to the Energy Market Authority, the regulator that oversees the country’s energy industry. The existing facility has three tanks that can handle 6 million metric tons a year. A fourth will be added by 2017, increasing capacity to 9 million tons. The site can accommodate as many as seven tanks that could process 15 million tons annually, Lee said. Japan, the world’s biggest importer, consumed about 87.5 million tons in 2013. (www.bloomberg.com)

POWER

Enel Green Power begins construction of new hydro plant in Brazil