RE PROJECTS CONTINUE DESPITE SIGNS OF DISTRESS IN THE SECTOR

Monthly Non-Fossil Fuels News Commentary: September - October 2019

India

Rating agency ICRA has downgraded the rating outlook for nearly one-third of its wind, solar power rated portfolio, the agency said. The agency has downgraded rating for 20 percent of its rated portfolio for wind and solar, which is at 1.9 GW. The rating outlook for another 10 percent of such capacity has also been revised. Even as industry analysts warn of slowdown in the renewable energy sector, the segment has added 4,273 MW of new capacity to the grid during the H1 of this fiscal, which is one of the highest additions in a first-half year period in the last several years. However, the addition to capacity during the April-September 2019 is only 36 percent of the target (11,802 MW) set for the fiscal. Solar power segment continues to be the major contributor of new capacity growth in the renewable energy sector with a share of more than two-thirds of the new capacity. 2,921 MW (includes 2,479 MW ground-mounted and 442 MW rooftop) capacity during April-September 2019, according to the MNRE. Wind sector continues to show progress and it added about 1,304 MW of new capacity. During the last fiscal, this segment added 1,481 MW and this year it is expected to add more capacity. As on 30 September 2019, total grid-connected installed renewable power capacity in India stood at 82,589 MW. Industry analysts have warned that the clean energy sector is slipping into slowdown mode though the government is ambitious about its targets in the sector. MNRE said that the government of India has set a target of installing 175 GW of grid connected renewable power capacity by 31 December 2022. However, a CRISIL report has warned that India’s installed capacity in renewable energy could increase by just 40 to 104 GW by fiscal 2022 from 64.4 GW in fiscal 2019, because of enduring policy uncertainty and tariff glitches. This means the sector will be 42 percent short of target. ReNew Power, which until recently was a major acquirer of renewable assets in India, has put 300 MW of solar assets on sale as the company tries to cope with rising uncertainty in the industry. The move to raise capital through sale of assets comes at a time when the renewable energy sector is facing several challenges. The Andhra Pradesh government’s decision to renege on contracts signed by the previous Telugu Desam Party-led state government to buy power from green energy producers has unnerved investors. The 300 MW solar assets, which have been put up for sale, are located in southern states.

Patanjali Renewal Energy is among four bidders that are in the fray for Lanco Solar. Bagadiya Brothers, Kundan Gupta, and JC Flowers Asset Reconstruction Company are the other companies. The companies will be carrying out due diligence on the beleaguered Lanco group company that manufactures solar panels and sets up rooftop solar projects. Four firms of the Hyderabad-based group — Lanco Teesta, Lanco Amarkantak, Lanco Kondapalli, and Lanco Solar — faced insolvency process after the group defaulted on payments. Axis Bank had filed for insolvency against Lanco Kondapalli Power, an Andhra Pradesh-based gas-fired power project, and Amarkantak and solar companies. The last day for submission of bids for Lanco Solar was 30 September. Resolution plans for the company will be submitted by 16 November.

In a major decision, the MNRE clarified that semi-processed solar PV cells, commonly called Blue Wafer cells, will not qualify under the domestically manufactured category for use in projects implemented under government schemes. Many flagship programmes of the government implemented by MNRE such as Kisan Urja Suraksha evam Utthan Mahabhiyan (PM-KUSUM) scheme have provisions for mandatory use of domestically manufactured solar PV cells. The MNRE has clarified that if diffused silicon wafer or Blue Wafer cells are imported and used as raw material for the manufacturing of solar PV cells in India, such solar PV cells will not qualify as domestically manufactured solar PV cells. The ministry issued an order stating the decision would cover programmes being implemented by MNRE where it is mandatory to use domestically-manufactured solar PV cells and domestically-manufactured solar PV modules and also the Manufacturing-Linked-PPA initiative by SECI. The MNRE clarified that the deadline for installing 175 GW of renewable energy is 31 December 2022. Thanks to the devaluation of the rupee, rising finance costs, government-mandated tariff caps in reverse auctions and cancellation of renewable project tenders, the pace of adding renewable generation capacities already slowed down in FY19, when the country added 8.6 GW against 11.3 GW and 11.8 GW added in FY17 and FY18, respectively. The installed renewable capacity now stands at 81.3 GW.

State level solar projects continued with many governments announcing new schemes. Gujarat government’s rooftop solar panel scheme aims to cover 200,000 households by 31 March next year. The state government had made a provision of ₹10 bn in the current year’s budget for the scheme. The households which install solar panels will get 40 percent subsidy from the government for 2 kW capacity and 20 percent subsidy for 3 kW to 10 kW capacity systems. The beneficiaries can avail of subsidy either under the state scheme or the similar Central scheme. The subsidy will also be given to housing societies and residential welfare associations for installing rooftop system for powering common amenities such as water pumps and lights in common areas. Consumers can select any of the 450 firms empaneled by the government for procuring the solar rooftop systems. The UPERC has slashed solar power tariffs to a record low of nearly ₹3/kWh as it cleared competitive bidding for procurement of 550 MW by state utilities. The approved tariffs range from ₹3.02/kWh to ₹3.08/kWh which ranks among the lowest power procurement price approved by the energy regulator for solar projects. The order was passed by the regulator on a petition filed jointly by UPPCL, UPNEDA and Noida Power Company Ltd. The capacity of approved solar projects for their procurement ranges from 25 MW to 100 MW. According to UPERC, while lower tariffs for solar power would reduce the overall power purchase cost of the discoms it would help UPPCL in meeting its Renewable Purchase Obligation and the state in harnessing the potential of solar power. In a bid to produce green energy, the Madhya Pradesh government has decided to set up a 1,000 MW floating solar power plant on the Indira Sagar Dam in Khandwa district. The project cost is estimated at ₹50 mn for each MW. The government is trying to enhance power generation through renewable sources available in the state. As of September 2019, the state produced 2,071 MW using solar power, 2,444 MW from wind power, 117 MW from biomass power and 96 MW from small hydro power plants.

Some of the private sector players announced new projects. Solar power developer Rays Power Infra will invest ₹17 bn to set up 450 MW of green energy projects in four major states of the country. The company will be selling the energy generated to private and industrial consumers in the states of UP, Haryana, Karnataka and Andhra Pradesh. The company recently commissioned a 50 MW solar power project in Vietnam. Tata Power Solar has won the bid for 105 MW floating solar energy project in Kerala. The project will be executed on a reservoir of NTPC Ltd at Kayamkulam in Alappuzha district of the state, and will be commissioned not later than 21 months, the company said. Tata Power Solar, with 29 years of expertise, is one of the pioneering solar manufacturers in the world and India’s largest specialised EPC player. Bharathidasan University plans to double solar power generation from the existing 500 kWp on its main campus at Palkalaiperur on the outskirts of the city. Utilising funding under RUSA, the university has established a grid interactive 500 kWp Solar PV Power Plant at a cost of ₹ 48.5 mn in 2016. While the RUSA funding was ₹40 mn, the university chipped in with the rest. The solar plant generating 2,300 units electricity per day with an average of 69,000 units per month has reduced the monthly energy bill to the tune of ₹550,000. Solar thermal industry players are confident of getting back into the boom trajectory and expect the sector to clock a growth of 10 percent after the reduction of GST rate on inputs for solar components from 18 percent to 5 percent. STFI said they approached GST directorate general and the finance minister and convinced them to consider solar thermal components as part of solar energy and apply 5 percent GST on them. Almost 1.5 mn evacuated tubes for solar water heater were imported during 2018. The STFI has 25 members who almost control 80 percent of the market. The country ranks among the top five markets globally for solar thermal. Apart from domestic use, the solar thermal heating and cooling solutions are a cost-effective substitute for fuel oil and diesel.

India is considering building 30 GW of renewable energy capacity along a desert on its western border known for its sunny, windy and arid expanse. The projects, which will be spread across the states of Gujarat and Rajasthan, are part of efforts to expand the country’s renewable capacity and reduce the share of fossil fuels in its energy mix. India plans to install 25 GW of solar projects, combined with storage capacity, in the high-altitude region of Ladakh in the extreme north of the country. India is likely to install more wind capacity in 2019 than it did last year, but it will still be well below what it used to be earlier. The country will install 2.9 GW in 2019 against 2.3 GW in 2018. In 2016-17, 5.4 GW was added, while 3.4 GW was achieved in 2015-16. Auctions were conducted for 5.2 GW until August 2019 but only 2.9 GW was awarded because of lack of developer interest. In the latest wind auction conducted by the SECI the nodal agency of the MNRE only two developers took part. Even though the original size of the tender was 1800 MW, allotment was reduced to 440 MW. The central government has proposed to tap wind power from three ports Tuticorin, Kandla and Paradip. The plan includes establishing desalination plants at the three ports to solve the drinking water problem. The fate of around 800 MW out of 1,200 MW of wind power auctioned by NTPC last year remains uncertain because the state-owned firm has not been able to get regulatory approvals. Hero Future Energies, Renew Power, Continuum Wind, Sprng Energy, EDF and Mytrah Energy had emerged as the biggest winners of the auction conducted in August 2018, with tariffs ranging between ₹2.77 and ₹2.83/kWh. Among the winners, Mytrah has decided not to commission the project because the state power regulator in Uttar Pradesh has caused a delay. Mytrah was one of the two largest winners of the auction, having bagged 300 MW. AGEL said it has commissioned 50 MW wind generation capacity at Kutch in Gujarat. The company through its subsidiaries is implementing 725 MW wind projects in Kutch. The company plans to commission another 225 MW wind capacity in the area by second half of 2020, for which the evacuation infrastructure is already in place. AGEL has partially charged the evacuation infrastructure for connecting its wind projects of 725 MW capacity.

The IIT Madras said it has entered into an agreement with ExxonMobil Research and Engineering Company for research on energy and biofuels. According to IIT Madras, one of the projects being taken up under this research collaboration is to develop novel approaches to convert Indian agriculture residue biomasses to sugars and high value chemicals. India’s first plant to covert paddy straw into biogas that can be used as CNG in automobiles will come up at Karnal in Haryana as agencies double effort to prevent burning of crop stubble that is said to be the main reason for pollution in the national capital region. The plant will deploy special machines that will chop and bundle paddy straw for transportation to a storage. This storage will used through the year to production CBG. IGL currently supplies CNG and piped cooking gas to households in Delhi, Noida, Greater Noida, Ghaziabad, Rewari, Gurugram, Karnal and Muzzafarnagar. The plant will produce maximum of 10,000 kg CBG every day. The input of plant is majorly paddy straw. The plant has the capacity of consuming around 40,000 tonnes of paddy straw in a year which will be taken from 20,000 acres of farmland in Karnal district. CBG from the plant will run tractors and earth-movers as well as power gensets. Bio manure produced from the plant as a byproduct will be organic and can be used to grow organic food and vegetables. The project aims to convert paddy wheat straw into bio-CNG.

India is set to add around 20,000 MW of nuclear power generation capacity over the next decade. The second 1,000 MW nuclear power unit at TN’s Kudankulam, owned by the Nuclear Power Corp of India Ltd stopped power generation, Power System Operation Corp Ltd (POSOCO) said. Russia’s Roastom State Atomic Energy Corp said it has shipped the second steam generator for the under-construction fourth unit of Indo-Russian joint venture KNPP in TN. Rosatom State Atomic Energy Corp is the technical consultant and main equipment supplier to KNPP and the first steam generator was supplied in May this year, it said. Four steam generators were required for one power unit of a nuclear power plant of this type. The heat generated from the power plant is removed from the reactor’s core by coolant, which passes through the core. Under the pact with Russia, the KNPP would have six units of 1000 MWe each. The first and second units started commercial operations in December 2014 and March 2016 respectively. According to the Nuclear Power Corp of India Ltd, the unit III and IV, currently under different stages of construction, are expected to begin commercial operations in March and November 2023 respectively. India not being a member of the NSG is hindering its ability to get necessary fuel supply for producing nuclear energy and if this problem is solved, the country could become a model for the rest of the world. Ever since India applied for the membership of the NSG in May 2016, China has been insisting that only those countries which have signed the Non-Proliferation Treaty should be allowed to enter the organisation.

The Centre is persuading state governments to forego their share of free power from hydroelectric plants to make the projects viable and put the hydropower sector on track. It proposes to hold a formal interaction on the issue with state governments. India is targeting production of 75 GW of hydropower by 2030, up from 45 GW at present, to balance the electricity grid as the country aims to add 175 GW of renewable capacity. The power ministry has been emphasising on taking up only hydropower projects which are commercially viable. The ministry has been urging state governments to play their part in making hydropower competitive by foregoing, deferring or staggering free power and, if need be, their share of GST. The Himachal Pradesh government signed agreements with NTPC, NHPC Ltd and SJVN Ltd for setting up 10 hydropower projects of 2,917 MW on Chenab River entailing an investment of about ₹280 bn. The government had approved measures in March to promote hydroelectric projects, including treating them as renewable projects and increasing debt repayment period to 18 years from 12 years to reduce tariffs in initial years. In an attempt to ensure that India’s efforts to revive work on the long-pending 2,000 MW Lower Subansiri project in Arunachal Pradesh doesn’t get derailed, Assam has constituted a high power state level task force to facilitate work on the strategic project. Any delay in building hydropower projects in Arunachal Pradesh on rivers originating in China will affect India’s strategy of establishing its prior-use claim over the waters, according to international law. India and China have a dispute over the diversion of the Brahmaputra river, which originates in Tibet. Even as India explores a diplomatic option, accelerating hydroelectric projects such as Lower Subansiri would give it user rights. In order to facilitate transportation of equipment to the NHPC’ project, it is imperative that law and order situation is in control in Assam. Of the eight river basins in Arunachal Pradesh, Subansiri, Lohit and Siang are of strategic importance as they are closer to the border with China than are other basins. The renewed focus on India’s largest hydropower project, delayed in the face of local opposition comes in the backdrop of the government’s “Act East" policy and its message of development. With one of the focus areas being hydropower, the strategy will help establish first-user rights to the waters of the Brahmaputra. The total hydropower generation potential of India’s northeastern states and Bhutan is about 58,000 MW. Of this, Arunachal Pradesh alone accounts for 50,328 MW - the highest in India. NHPC signed an agreement to acquire 500 MW Teesta VI hydro power project, which it bagged under corporate insolvency resolution process. It would supply power at a levelised tariff of ₹4.07/kWh and would be completed in next five years. The company will tie-up with state discoms for entering into PPAs because its existing PPA with Maharashtra is not valid anymore. NHPC has signed the definitive agreement for implementation of approved resolution plan for takeover and resolution of Lanco Teesta Hydro Power Ltd, which was executing the 500 MW (125 MWx 4) Teesta VI hydro project on Teesta river in Sikkim. NTPC said it has signed a pact with the Himachal Pradesh government to set up two hydropower projects totalling 520 MW in the state. Seli and Miyar hydroelectric projects are located in Chenab Basin at the state’s Lahaul and Spiti district. While Seli plant (400 MW) is a run-of-the-river project with pondage scheme, Miyar plant (120 MW) is a run-of-the-river project without pondage scheme, on Miyar tributary of Chenab River. NTPC already has its first hydropower project, Koldam Hydro Power Station, in Himachal Pradesh with an installed capacity of 800 MW.

Rest of the World

Global renewable energy capacity is set to rise by 50 percent in five years’ time, driven by solar PV installations on homes, buildings and industry, according to the IEA. Total renewable-based power capacity will rise by 1.2 TW by 2024 from 2.5 TW last year, equivalent to the total installed current power capacity of the US. Solar PV will account for nearly 60 percent of this growth and onshore wind 25 percent, the IEA’s annual report on global renewables showed. The share of renewables in power generation is expected to rise to 30 percent in 2024 from 26 percent. Falling technology costs and more effective government policies have helped to drive the higher forecasts for renewable capacity deployment since last year’s report, the IEA said. Solar PV generation costs are expected to decline a further 15 percent to 35 percent by 2024, making the technology more attractive for adoption, the IEA said.

A fee levied on German consumers to support renewable power will rise by 5.5 percent to 6.756 cents/kWh in 2020. The levy is a key part of Germany’s policy to switch to lower carbon sources of energy, known as Energiewende, but has sparked criticism from consumers because it makes up 21 percent of their final bills. Germany’s economy ministry presented a schedule to help revive onshore wind turbine construction that has declined due to bureaucracy and citizens’ opposition, hampering efforts to build up renewable energy and meet climate targets. The ministry said various wildlife regulations needed to be aligned and added that new turbines should be built in step with the expansion of electricity networks. Onshore turbine constructions fell 82 percent to 287 MW in the H1 of 2019, the lowest level in nearly two decades.

DEWA selected a contractor that submitted a “record” low bid to build a 900 MW solar power plant in the emirate. The contractor bid 1.7 cents/kWh for the photovoltaic plant. The decision requires a lengthy evaluation before DEWA can publicly announce the winner. DEWA required offers of less than 2.4 cents/kWh. The plant will be the fifth phase of a sprawling facility in in the desert outside Dubai -- the Mohammed bin Rashid Al Maktoum Solar Park, which will have 5 GW of installed capacity by 2030 if DEWA completes it as planned. The UAE, of which Dubai is the financial hub, had 594 MW of installed solar capacity at the end of 2018 -- more than any other country in the Persian Gulf region, according to the International Renewable Energy Agency. Dubai is on track to produce 7 percent of its electricity from solar power by 2020 and targets meeting 75 percent of its needs from solar and other renewables by 2050, according to the UAE’s clean energy strategy. Uzbek energy ministry announced UAE’s Masdar Clean Energy as the winner in the country’s first competitive tender for a solar PPP project. Masdar was awarded the project with a bid to supply solar power at $2.7 cents/kWh one of the lowest tariffs in emerging markets, and is expected to build a 100 MW solar power plant in Navoi region of the country within a year. This announcement opens new markets for private investment and makes progress towards the country’s goal to increase use of renewable energy, IFC said. Uzbekistan plans to establish 25 100 MW solar power factories by 2030 to diversify the country’s energy mix and soon announce two more tenders for an additional PPP for 400 MW and 500 MW solar power plants. Masdar, one of the world’s leading renewable energy companies, will develop the 100 MW utility-scale solar plant, under the IFC’s Scaling Solar program.

French energy group Total said it has begun the construction of its third solar power plant in Japan, the Miyagi Osato Solar Park, planned for a peak capacity of 52 MW. The project is to start up in 2021 and will provide clean and reliable electricity to Japanese households, Total said. Total has made a series of deals this year as it builds up its presence in the renewable energy sector. France has yet to decide whether to build new nuclear reactors and could yet pursue a long-term strategy of 100 percent renewable energy. EDF operates all of France’s 58 nuclear reactors, which account for more than 75 percent of the country’s electricity needs. There will be no decision on new reactors until the commissioning of EDF’s Flamanville 3 EPR reactor under construction in the north of France. The Flamanville 3 reactor - the latest generation of reactor with enhanced safety features put in place after the Fukushima nuclear meltdown in Japan - has been plagued by delays, technical problems and cost overruns. It is now expected to start operating in 2023, more than a decade behind schedule. Electricity generation from French nuclear reactors operated by utility EDF fell 8.6 percent year-on-year in September to 27.5 TWh due to a high number of reactor outages, the company said. The state-controlled utility said total output from its nuclear reactors since the start of the year stood at 288.2 TWh, down 0.6 percent compared with the same period a year ago. EDF’s nuclear electricity generation in France was at 393.2 TWh in 2018 and it is targeting 395 TWh in 2019. The firm operates all of France’s 58 nuclear reactors, which account for over 75 percent of the country’s electricity needs. EDF said nuclear power production at its reactors in Britain fell 11.8 percent in September to 4.5 TWh. It did not give reasons for the fall in output in Britain. Nuclear electricity generation since the start of the year in Britain was down nearly 20 percent at 36.8 TWh compared with the same period in 2018.

Synthos, a chemical group owned by Poland’s richest man has agreed to work with GE Hitachi Nuclear Energy on developing technology for a SMR, Hitachi said. Poland still generates most of its electricity from coal but more and more companies are exploring low-carbon options. Synthos and GE Hitachi joint project to build a 300 MW SMR unit will be completed in the next 10 years with capital spending expected at below $1 bn. Small modular reactors use existing or new nuclear technology scaled down to a fraction of the size of larger plants and would be able to produce around a tenth of the electricity created by large-scale projects. Poland plans to build its first traditional nuclear power plant over the next 20 years but is struggling to work out a financing model for the project. Polish utility Enea aims to maintain the size of its installed capacity while swapping tradition energy sources for more renewable energy. Enea has 6.3 GW of installed generating capacity including 443 MW from renewable energy sources. Poland, which generates most of its electricity from coal, is planning to triple its solar energy capacity this year. In June Poland led a handful of eastern EU states in blocking a push by France and others to commit the bloc to net zero emissions by mid-century. At that time that Warsaw wanted a strong compensation package for its industrial sector in exchange for agreeing to commit the target. Earlier in October the Polish energy minister put the cost of reaching a net zero emissions economy in Poland at €700-900 bn. Undelivered power - a reference to the intermittent nature of some renewable sources, such as solar or wind - often proved to be the most expensive kind to produce.

A US group backed by anonymous donors launched a campaign to promote the benefits of cheap, abundant natural gas against what it called “radical” proposals like the Green New Deal that would phase out use of the fossil fuel. TEA will fund advertising and research to advocate the use of natural gas, which burns cleaner than coal, in the runup to the US presidential election in November of 2020. TEA’s launch comes as environmentalists and some Democratic presidential candidates have called for urgent measures to reduce the nation’s reliance on natural gas, and move more quickly to renewable resources like solar and wind power. The Green New Deal, a nonbinding resolution introduced by two Democrats in the US Congress, calls for a 10-year, government-driven effort for the US to move away from carbon-emitting fossil fuels through investments in clean energy. The US EPA will calculate its new biofuel blending volumes requirements under the Renewable Fuel Standard based on the amounts waived over the previous three years. The ranges are informed by the last three compliance years, EPA said. The Trump administration is close to finalizing a deal that would boost US biofuels consumption and is aiming to get it signed by the President. The policy change is intended to assuage anger in US farm country, a key political constituency for Trump, after the administration exempted 31 oil refineries in August from their obligations under the US RFS - a law requiring that corn-based ethanol and other biofuels be blended into the nation’s fuel. The administration aims to announce the final deal and is unlikely to include a price cap for the biofuel blending credits that refiners must earn or purchase to comply with the RFS, a measure the oil industry was seeking as a concession in the biofuel deal. Under the RFS, the EPA can exempt small refineries with a capacity of less than 75,000 barrels per day from their biofuel obligations if they can prove that compliance would cause them disproportionate economic hardship. US trade officials said they were eliminating the exemption for bifacial solar panels from the Trump administration’s tariffs on overseas-made solar products. The office of the USTR said it was withdrawing the exclusion for imported bifacial solar panels, a new technology through which power is produced on both sides of a cell. The USTR had announced the exemption in June. Under tariffs imposed in early 2018, the rate for solar panels had been set at 30 percent and then lowered to 25 percent.

The Czech Republic will have to build new nuclear power plants to replace aging coal and nuclear capacity even if they are in breach of European law. The government wants CEZ to lead the nuclear projects but the 70 percent state-owned electricity producer has demanded state guarantees the plants would be both viable and deliver returns to shareholders. The EU nation generates more than a third of its electricity from nuclear energy and Babis has advocated nuclear power as a low-carbon alternative to coal, which now produces about 50 percent of power.

Russia’s state nuclear corporation Rosatom would be ready to cooperate with partners from the US, Europe and Asia to build a nuclear power plant in Saudi Arabia. EDF Renewables said it had commissioned 130 MWp worth of solar energy capacity in Egypt, as it steps up the pace of its development in North Africa. EDF said the latest plants moved it closer to meeting its goal of doubling its net renewable energy capacity in France and worldwide to a net amount of 50 GW between 2015-2030. Russia’s state nuclear corporation Rosatom and the Department of Energy of the Philippines sign an agreement to study the possibility of building a nuclear power plant in the Philippines. The agreement of intent was signed at the Russian-Philippine business forum in Moscow timed with the visit of Philippine President Rodrigo Duterte to Russia. Russia proposed to the Philippines a project to build a floating nuclear power plant. The Philippines built a nuclear power plant in 1980s in response to an energy crisis, but it never went into operation for fear of disasters over the decades. Russia’s first floating nuclear power plant Akademik Lomonosov docked at the port of Pevek in the far eastern Chukotka peninsula last month and is expected to start generating electric energy before the end of the year.

Equinor said it will invest nearly $549 mn to build floating turbines to supply power to several North Sea oil and gas platforms, in a move that will allow the Norwegian firm to cut carbon emissions. The 88 MW capacity project, called Hywind Tampen, consisting of 11 turbines, would meet about 35 percent of electricity needs at the Gullfaks and Snorre fields, Equinor said. The project will allow Equinor to reduce CO2 emissions from gas turbines on offshore installations by about 200,000 tonnes per year, an equivalent of emissions from 100,000 cars every year, it said.

Latin American countries have set a collective target of 70 percent renewable energy use by 2030, more than double what the EU is planning. Colombia presented the target at the United Nations Climate Action Summit, where world leaders were asked to deliver concrete proposals to combat climate change. Colombia aims to contribute 4 GW of renewable energy toward the 2030 regional goal of 312 GW, Suarez said.

Italian oil and gas group Eni has signed a co-operation agreement with Mainstream Renewable Power to develop large-scale renewable assets. The two companies plan to cooperate first in the United Kingdom and then expand their collaboration to Africa and South-East Asia. Eni and Mainstream will make a joint bid in the fourth round of Britain’s offshore wind leasing tenders, they said.

EDF said its Hinkley Point C nuclear plant in Britain could cost up to 2.9 bn pounds ($3.6 bn) more than its last estimate, and face further delays. EDF is already grappling with investigations into welding and steel used in its French reactors, and delays and cost over-runs to other new projects in France and Finland. The British project cost hike also comes just days after the country saw an auction for offshore wind projects clear at a record low, raising questions of the cost competitiveness of new nuclear. EDF said Hinkley Point C was estimated to cost 21.5-22.5 bn pounds ($26.8-$28 bn), up 1.9-2.9 bn pounds from its latest estimate. The 3.2 GW plant, which EDF is building with China General Nuclear Power Corp, is now expected to begin generation at the end of 2025. Once complete, Hinkley C is expected to provide around 7 percent of the country’s electricity.

Chinese companies have built a 300 MW solar farm in the highlands of northern Argentina, the largest of its kind in the South American nation. The farm, with a total installed capacity of 315 MW and a contract value of $390 mn, started construction in April 2018, after Chinese firms PowerChina and Shanghai Electric Power Construction Co Ltd jointly won a tender to build it.

Pakistan has launched a solar energy project which aims to electrify 10,000 households across the country in the next three years. The solar power project will provide electricity in two rural areas of Sindh - Baba Bhit Island and Gharo.

Sri Lanka’s SEA, part of the country’s Ministry of Power, Energy and Business Development, has floated two expressions of interests for domestic and foreign companies to develop solar projects of 10 MW capacity with 20 percent energy storage systems. The projects will be developed under a joint venture with the SEA at the Hambantota Solar Energy Park. The SEA has arranged land and other approvals for the solar power projects. Back in March 2019, the Sri Lankan government approved 100 MW of floating solar power projects in Maduru Oya reservoir in Mahaweli Economic Zone. Around the same time, Sri Lanka announced that it would develop 28 small solar power projects in its north-central and eastern regions. The Sri Lankan government signed an agreement with the Asian Development Bank wherein the bank would loan the country $50 mn to help develop rooftop solar projects.

Environmental campaigners called for the EU to curb the number of small hydropower projects in the Western Balkans by pressing for more stringent environmental legislation and a more cost-effective subsidies system as soon as possible. In a report by several environmentalist groups, led by Bankwatch, campaigners said Serbia, Bosnia and Kosovo must change their renewables incentives schemes as soon as possible. In 2018 about 70 percent of renewable energy incentives awarded in the region benefited small hydropower projects, the environmentalists said, despite serious environmental damage and limited potential to contribute to the energy supply. Under plans currently being considered by governments, a network of nearly 3,000 hydro plants could be built across the area, with about a third of them in protected areas.

| FY: Financial Year, MW: megawatt, GW: gigawatt, mn: million, bn: billion, tn: trillion, H1: first half, MNRE: Ministry of New and Renewable Energy, PV: photovoltaic, PPA: power purchase agreement, SECI: Solar Energy Corp of India, kW: kilowatt, UP: Uttar Pradesh, UPERC: UP Electricity Regulatory Commission, kWh: kilowatt hour, UPPCL: UP Power Corp Ltd, UPNEDA: UP New and Renewable Energy Development Agency, RUSA: Rashtriya Uchchatar Shiksha Abhiyan, EPC: Engineering, Procurement and Construction, kWp: kilowatt peak, GST: Goods and Services Tax, STFI: Solar Thermal Federation of India, AGEL: Adani Green Energy Ltd, IIT: Indian Institute of Technology, CNG: compressed natural gas, CBG: compressed biogas, IGL: Indraprastha Gas Ltd, TN: Tamil Nadu, KNPP: Kudankulam Nuclear Power Plant, MWe: megawatt electrical, NSG: Nuclear Suppliers Group, IEA: International Energy Agency, US: United States, DEWA: Dubai Electricity & Water Authority, UAE: United Arab Emirates, TWh: terawatt hour, SMR: small modular reactor, TEA: The Empowerment Alliance, EPA: Environmental Protection Agency, RFS: Renewable Fuel Standard, USTR: US Trade Representative, EU: European Union, MWp: megawatt peak, CO2: carbon dioxide, SEA: Sustainable Energy Authority, |

NATIONAL: OIL

PetroChina International starts direct gasoline exports to India: CNPC

29 October. China’s PetroChina International Co Ltd shipped a cargo of 92 octane gasoline to India, marking the company’s first direct refined oil shipment to the country, its parent company China National Petroleum Corp (CNPC) said. A tanker, departing from Qinzhou Port in China’s south province Guangxi, will deliver the gasoline to India’s Hindustan Petroleum Corp Ltd (HPCL), according to CNPC. PetroChina International clinched its first long-term contract to provide gasoline to HPCL in March, CNPC said.

Source: Reuters

Government relaxes fuel retailing norms, private firms can set up petrol pumps

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Opening up of petroleum fuel retailing will reduce concentration and increase competition!

< style="color: #ffffff">Good! |

24 October. Paving the way for the entry of new players in the fuel-marketing space, the government scrapped a rule that mandated a company to commit at least ₹20 bn investment in the petroleum sector. With this, newer players like Total, Adani, and Saudi Aramco — and even super markets — can open outlets for selling automobile fuel. Entities seeking authorisation will now need to have a minimum net worth of ₹2.5 bn only. Authorised entities will, however, have to meet certain conditions such as setting up a minimum 5 percent of their retail outlets in the notified remote areas within five years of grant of authorisation. The Cabinet Committee on Economic Affairs (CCEA) approved the changes under the Review of Guidelines for Granting Authorisation to market Transportation Fuels. While Total has tied up with Adani for fuel marketing, BP and Reliance Industries Ltd (RIL) have announced a new venture for marketing automobile fuel and electric charging. The deregulation of petrol and diesel has enabled private retailers to compete with government-owned oil marketing companies (OMCs), but the current differentiator is only services being offered at the outlets. These companies charge almost the same rates linked to the global price. Entities seeking market authorisation for petrol and diesel are allowed to apply for retail and bulk authorisation separately or both. Companies have been given flexibility of setting up a joint venture or subsidiary for market authorisation.

Source: Business Standard

4k fuel stations shut across Rajasthan for a day against VAT hike

23 October. About 4,000 fuel stations remained shut across Rajasthan from 6am following a call of a 24-hour strike by the Rajasthan Petrol and Diesel Association against the recent VAT (Value Added Tax) hike. 350 filling stations in Jaipur and 4,000 across the state will remain closed till 6am. The Rajasthan Petrol and Diesel Association is protesting against the Congress government’s decision to increase VAT in July. The Congress government reversed Raje government’s decision to reduce the VAT on petrol and diesel by 4 percent. At that time, VAT on petrol was 30 percent, which was brought down to 26 percent and VAT on diesel was reduced from 22 percent to 18 percent. However, Congress had termed it a corrective measure. RPDA (Rajasthan Petrol Diesel Association) claimed the sale of fuel in a petrol pump in Punjab, Haryana, UP (Uttar Pradesh), Gujarat and Delhi was equal to the sale of 20 filling stations in Rajasthan.

Source: The Economic Times

IOC keen to open another oil terminal in Karnataka

23 October. In an attempt to cater to the demands of petroleum products including Petrol, Diesel, Kerosene and liquefied petroleum gas (LPG) from north Karnataka, Indian Oil Corp (IOC) is planning to open another terminal in the state. According to IOC, the 92 acre terminal situated on the outskirts of Bengaluru caters to 30 percent of the Karnataka’s demand for petroleum products. During 2019-20, IOC has released new connections to the tune of 2.38 lakhs out of which 1.47 lakh were under Ujjwala scheme, which is highest for the industry, the company said. With Supreme Court directing union government to implement Bharat Stage VI (BS VI) emission norms before April 2021, the IOC said that they are going to replace BS IV with BS VI from early 2020 to make the petroleum products more eco-friendly.

Source: The Economic Times

NATIONAL: GAS

Indian LNG customers choosing spot buys over long-term deals: Petronet LNG

29 October. Indian customers are choosing spot cargoes over long-term LNG (liquefied natural gas) contracts as spot purchases are cheaper, Petronet LNG Ltd CEO (Chief Executive Officer) Prabhat Singh said. Petronet is considering renegotiating long term LNG contracts with Qatar’s RasGas, Singh said. Delivered Price Of Spot LNG is $6.30-$6.40 per mmBtu (million metric British thermal units) vs $7.50-$8.50 per mmBtu for supplies under long term deals, Singh said. Russia’s Novatek wants to set up a small scale LNG plant in India for retail sales, Singh said. Singh said Petronet was looking at buying a 26 percent stake in Bharat Petroleum Corp Ltd’s planned east coast terminal

Source: Reuters

GAIL claims 559 households in Patna have started getting PNG

26 October. GAIL (India) Ltd has claimed that at least 550 households in the city have started getting piped natural gas (PNG) supply under the Pradhan Mantri Urja Ganga Yojana. Besides, 6,500 households are connected with the gas pipeline as on date. The PNG in the city is being supplied under Patna City Gas Distribution Scheme, which was launched by Prime Minister (PM) Narendra Modi from Begusarai on 17 February this year. The residents using PNG said it is not only eco-friendly but also an inexpensive solution to the hassles faced in liquefied petroleum gas (LPG) cylinders.

Source: The Economic Times

Punjab government reduces VAT on natural gas to 3 percent

25 October. The Punjab government reduced Value Added Tax (VAT) on natural gas to 3 percent from 14.3 percent. With this, Punjab has become the state with the lowest VAT on natural gas in the northern region comprising Haryana, Himachal Pradesh, Rajasthan, Delhi and Chandigarh. The decision will also give a boost to industrial units in Gobindgarh and Ludhiana to replace conventional fuel. With the reduction in the rate of VAT, the sale of natural gas in Punjab is likely to increase substantially, thereby yielding increased revenue. National Fertilisers Ltd is a major consumer of gas and uses it for plants at Bathinda and Nangal.

Source: Business Standard

NATIONAL: COAL

CIL plans binding bids for coking coal assets

29 October. Coal India Ltd (CIL) plans to submit binding bids for acquiring stakes in coking coal assets in Australia and Canada by March 2020. The firm is in the process of appointing merchant bankers for the assets it has identified. The quantum of stake to be bought would be decided after a due diligence. In Australia, CIL has shortlisted some working mines, while in Canada, it is targeting ready-to-produce blocks where exploration, land acquisition and environmental approvals have been completed. CIL’s domestic reserves are inadequate to meet India’s demand. The plan is to set up coking coal and high-grade thermal coal mining business overseas with a view to acquiring coal resources, producing the fuel and importing it either by opening new mines or through acquisition of equity participation in working mines on production-sharing participation interest basis.

Source: The Economic Times

No coal production at MCL’s Odisha mines in last 14 days

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Coal production shortfall will increase imports!

< style="color: #ffffff">Bad! |

25 October. Coal production at the Balram opencast project of Mahanadi Coalfields Ltd (MCL) remained affected for the 14th consecutive day in Odisha. Since the last two weeks, there was no production of coal due to a stalemate between Danara and Solada villages at the Talcher coalfields in Angul district, MCL said. Till now, 2.2 lakh tonne coal supply, around 1.8 lakh tonne of coal production and more than 4 lakh cubic meter of overburden removal have been affected from the Balram opencast project (OCP) due to an internal rift between the two villages, MCL said.

Source: The Economic Times

CIL to switch over to mechanised coal transportation by FY24

24 October. Coal India Ltd (CIL) said it will switch over to mechanised transportation of coal through piped conveyor belts in its large mines by 2023-24, replacing the existing road movement of the dry fuel. Piped conveyor belt transportation is a covered system for movement of coal and thus promotes environment safety and prevents possible coal pilferage. The system is already operational in some of the mines of CIL. This will be implemented in 35 of CIL’s coal projects each having production capacity of four million tonnes per annum (mtpa) and above. For necessary infrastructure upgrade at these 35 projects, including railway lines, CIL will invest through its capital expenditure. This initiative involves setting up of Coal Handling Plants (CHPs) with silos having rapid loading systems, which will have benefits like crushing, sizing of coal, quicker and quality coal loading. Presently, coal is transported through road by trucks from the pithead to despatch point which tends to add up to dust and air pollution. CIL loaded 151 mt through silos/rapid loading system during 2018-19. Additionally, around 420 mt of coal is planned to be loaded through silos and surge bins, which will be set up at 35 projects identified, elevating the total mechanised loading to 571 mt by 2023-24. CIL aims to produce 880 mt of coal by 2023-24 which means 65 percent of the total coal produced would be moved through covered pipe conveyor system by then and loaded mechanically. Infrastructure for 24 silos and 11 surge bin loading systems will be set up in all subsidiaries of CIL by 2023-24 for mechanised loading.

Source: The Economic Times

NATIONAL: POWER

India looks at overhead electricity link with Sri Lanka

27 October. As part of India’s strategy of creating a new energy ecosystem for the neighbourhood, the National Democratic Alliance (NDA) government is exploring to set up an overhead electricity link with Sri Lanka to supply power to the island nation. The electricity link is part of India’s strategy to negate the growing influence of strategic rival China in the Indian Ocean region and South Asia. The earlier plan involved Power Grid Corp of India Ltd (PGCIL) setting up a link for 1,000 MW between India and Sri Lanka, of which 30 km will be under the sea. The India-Sri Lanka transmission link was to run from Madurai in Tamil Nadu to Anuradhapura in Sri Lanka’s north-central province. Sri Lanka’ Ceylon Electricity Board has an installed power generation capacity of 35.8 GW. India has an installed power generation capacity of 360.45 GW, with the national grid capable to transfer 99,000 MW of electricity from any corner of the country.

Source: Livemint

All government buildings to get prepaid power meters in Uttarakhand

27 October. The Uttarakhand government has decided to switch over to prepaid power meters in all government buildings. The Uttarakhand Power Corp Ltd (UPCL) would be installing the prepaid power meters from next month at the government offices. UPCL has over 8,397 power connections of 25 kW belonging to the state government offices, departments and establishment and the meters would be installed in a phased manner. At present, 5,000 prepaid power meters have been given to temporary consumers at different sites. The prepaid power meters recharge value would be between ₹100 and ₹15,000 per month. However, many people feel that the total shifting to prepaid meters won’t be easy.

Source: The Economic Times

Suspected militants damage 400 kV electricity transmission tower in Shopian of Kashmir

26 October. In what appears to be a major attempt of sabotage, unidentified persons suspected to be militants, cut out a portion of two limbs of 400 kilovolt (kV) electricity transmission tower in Chitragam village of Shopian in southern Kashmir. If the tower was damaged and sabotage was successful, most of the areas in Kashmir Valley could have been pushed suddenly into darkness for many hours and amplified load shedding for many days to come. This transmission line, which comes under Power Grid Corp of India Ltd, is one of the major electricity transmission lines that connects Kashmir Valley to northern power grid. Soon after the damage was discovered a group of armed forces was deployed immediately at the spot to safeguard the electricity tower for the whole night.

Source: The Economic Times

Drop in power demand hints at low-key Kali Pujas in Kolkata

25 October. Power consumption figures indicate a decline in pomp and show during Kali Puja with many organisers shifting focus to the more popular Durga Puja over the past three-four decades. According to CESC Ltd, the number of Kali Pujas in Kolkata is far higher than Durga Puja. However, many Kali Puja pandals are smaller and quite often organisers manage without a special power connection. The maximum demand for power in Kolkata is estimated around 1,850 MW, which is slightly higher than last year’s 1,799 MW. The total load applied by all Kali puja committees is 19 MW, a third of the 52 MW load applied by Durga pujas.

Source: The Economic Times

KSEB to ink power-banking deals to tackle shortage

23 October. In a bid to offset the burden of power shortage during the thick of summer, Kerala State Electricity Board (KSEB) is planning to engage in power-banking agreements with power utilities and traders elsewhere in the country. Through the power-banking option, power utilities and traders will park with one another excess power available with them during a particular period in a year and reclaim the same from the other when they face shortage of power later. KSEB had engaged in such a practice on several occasions in the past, but it is the first time that the board has decided to opt for a competitive bidding process to choose its power-banking partners.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Goa gets first hybrid renewable energy plant at Verna

29 October. Goa’s first 50 kilowatt (kW) wind solar hybrid energy plant has been installed at Pfizer Ltd’s manufacturing unit at Verna Industrial Estate. In the future, Revayu Systems plans to install another 400 kW hybrid rooftop project for United Breweries Ltd at Ponda. Revayu Systems has also completed a three months trial hybrid project for Goa Energy Development Agency (GEDA). The government of Goa already has a solar policy in place and Power Minister Nilesh Cabral has indicated that a hybrid energy policy could be on the cards to take the state towards clean and renewable energy. Goa currently sources all its power requirements from other states. To promote the use of renewable energy, the state government has announced a subsidy of 20 percent on solar projects up to 100 kW.

Source: The Economic Times

Indian Railways to procure power from wind-solar hybrid projects

29 October. The Railway Energy Management Company Ltd (REMCL), a joint venture between the Indian Railways and RITES Ltd, has issued a Request for Selection (RfS) to procure power from wind-solar hybrid projects. In the interest of utilizing the optimum potential offered by the hybridization of solar and wind, the developer is free to declare the rated capacity of the hybrid project at the output level of the sub-pooling substation, which will be considered as the project capacity. The wind-solar hybrid projects will be set up on a Build-Own-Operate (BOO) basis. The cost of the RfS document is ₹29,500 ($417).

Source: Mercom India

Due emphasis would be laid on solar power: Bihar CM

28 October. Bihar Chief Minister (CM) Nitish Kumar launched around 35,000 schemes worth over ₹16 bn, as part of his ambitions 'Jal-Jeevan-Hariyali' campaign that seeks to boost green cover and the water table in the state. Foundation stones were laid for 32,781 schemes worth ₹13.59 bn, while another 2,391 involving an expenditure of ₹2.91 bn were inaugurated by Kumar at a function organised at the Samrat Ashok Convention Centre.

Source: The Economic Times

Post-Diwali pollution in Delhi likely to be lower than last 3 yrs: SAFAR

27 October. The post-Diwali pollution levels in Delhi are likely to be the lowest as compared to the past three years as favourable wind speed would possibly negate the impact of firecracker emissions and stubble burning, according to a government air quality monitor. Although Delhi’s air quality is predicted to touch the "severe" mark in the early hours, the peak level of PM2.5 is likely to be the lowest in the past three years, the System of Air Quality and Weather Forecasting and Research (SAFAR) said in a special report on Diwali.

Source: Business Standard

Centre plans to run Ladakh completely on renewable energy

26 October. The Union government plans to make Ladakh the first Indian Union Territory (UT) to run completely on renewable energy. The newly carved out UT has already about 30 MW of small hydro projects and the government wants to install solar generation units to meet all its power demand from renewable energy sources. MNRE (Ministry of New and Renewable Energy) secretary Aanand Kumar said that the UT currently has a demand of around 53 MW and new solar plants is planned to be added by the end of 2020 to make the area completely run on renewable energy.

Source: The Financial Express

PSPCL floats tenders for 30 MW solar rooftop projects

25 October. Giving a push to solar power energy, the Punjab State Power Corp Ltd (PSPCL) has floated a tender for empanelment of companies to install 30 MW of grid-connected solar rooftop projects in the range of 1 kW to 1,000 kW. As per the capacity distribution and eligibility conditions for the bidders, the PSPCL has stated that the tentative allocation of 30 MW would be distributed among all eligible bidders in all capacity ranges. The last date for the submission of bids is 14 November 2019.

Source: The Tribune

Aditya Birla Group sets up a 24 MW solar power project in Odisha

25 October. In a move that highlights the growing importance of solar power, Aditya Aluminium, which is a unit of the Aditya Birla Group, has set up a 24 MW solar power project at Lapanga in Sambalpur district. This comes as a part of Odisha government’s ambition of installing renewable energy capacity of 2,750 MW, out of which 2,200 MW will be from solar energy. The project was inaugurated by Chief Minister Naveen Patnaik and is spread across 144 acres of land with an investment of ₹1.51 bn (21.2 mn).

Source: Mercom India

NTPC wind energy tender receives tepid response from developers

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Poor response to wind tenders signals distress in the sector!

< style="color: #ffffff">Ugly! |

25 October. Wind tenders continue to draw little interest from developers including those from ‘navratna’ NTPC Ltd, whose latest tender, issued for the second time, drew no response. NTPC first issued the tender of 1,200 MW few days ago setting a ceiling tariff of ₹2.85 per unit. When no developer showed interest, it revised the ceiling tariff to ₹2.93 and issued the tender again. Even then, it did not draw a single bid. The next bid submission date has not been announced yet. Andhra Pradesh’s recent attempt to renegotiate signed wind and solar power purchase agreements (PPAs) has also dampened investor interest significantly. NTPC’s last wind tender, which was conducted in August last year, also has problems. In the latest wind auction conducted by the Solar Energy Corp of India (SECI), the nodal agency of the Ministry of New and Renewable Energy (MNRE) responsible for conducting auctions, only two developers took part.

Source: The Economic Times

Soon, UP to generate solar energy from water bodies

24 October. UP (Uttar Pradesh) may soon tie up with national and international companies for water management, setting up piped canals and generating solar energy from water bodies. Jal Shakti Minister Mahendra Singh said a number of companies attending the seminar evinced interest in working with the department and exploit the potential of water bodies. UP has over 75,000 km-long flowing canals, 33,800 government tubewells, 92 huge water reservoirs and 281 lift-irrigation canals. All of these have a huge potential to generate hydro and solar energy using floating solar panels. Bundelkhand and Mirzapur-Sonbhadra regions have favourable conditions for producing wind energy. UP has the potential to produce over 13,500 MW of energy, Singh said.

Source: The Economic Times

India must focus on carbon-taxing to achieve its climate goals

23 October. India must focus on carbon-taxing as a key policy instrument for its carbon mitigation strategy and meeting the committed climate goals, according to researchers. Carbon taxes aim to induce decision-makers to introduce changes in emissions by putting a price on carbon. A white paper prepared by Council on Energy, Environment and Water (CEEW) along with Environmental Defense Fund (EDF) and Shakti Sustainable Energy Foundation highlights the key aspects of a possible carbon mitigation strategy. There are 26 carbon tax systems worldwide, ning a range of developed and developing countries, which accounted for around $33 bn in revenue in 2017. By 2020, existing and planned taxes will cover around 5 percent of CO2 (carbon dioxide) emissions globally.

Source: The Economic Times

INTERNATIONAL: OIL

South Sudan to offer oil blocks for licensing by Q1 2020

29 October. South Sudan plans to offer 14 oil blocks to exploration companies in a licensing round by the first quarter (Q1) 2020, Oil Minister Awow Daniel Chuang said, switching from its previous method of direct negotiations with explorers. The country gets almost all its revenue from oil and has boosted output, now at 180,000 barrels per day (bpd), as it struggles to rebuild its shattered economy after a five-year civil war. South Sudan’s oil at present comes from blocks 3,7 and blocks 1, 2 and 4. Chuang said the blocks to be offered for licensing will be blocks A1 to A6 and at present data was being collected on them. The government is keen to reach pre-war oil production levels of 350,000 to 400,000 bpd by mid-2020. In August, South Sudan made a small oil discovery in Northern Upper Nile State, its first since independence in 2011 when exploration was disrupted by war.

Source: Reuters

US Coast Guard responds to oil discharge in Louisiana protected wetlands

29 October. The US (United States) Coast Guard said it is responding to an oil discharge in the Pass-a-Loutre Wildlife Management Area in Louisiana. The Coast Guard said it received a report of a crude oil leak from a storage tank owned by Whitney Oil and Gas.

Source: Reuters

PetroChina aims to produce 25 mt crude oil each year at Changqing by 2020

28 October. China’s top oil and gas producer, PetroChina, aims to produce 25 million tonnes (mt) of crude oil per annum and 42 billion cubic meters (bcm) of natural gas at its Changqing field by 2020. Changqing field also set a target of churning out 28 mt per annum of crude and 45 bcm of gas by 2025. Changqing, in the Ordos basin in Inner Mongolia, is China’s biggest gas field. PetroChina in September said that it found additional proved original oil in-place of 358 mt at the Qingcheng oilfield in Gansu province.

Source: Reuters

Russia’s Lukoil, Hungary’s MOL to sign dirty oil settlement

28 October. Russian oil producer Lukoil and Hungarian energy company MOL are set to sign a settlement deal over contaminated oil during Russian President Putin’s visit to Budapest. A high level of organic chloride was found in late April in Russia’s Druzhba pipeline, which connects Siberian oilfields with Belarus, Ukraine, Poland, Germany, Czech Republic and Hungary. Russia and Kazakhstan reached a preliminary deal over compensation for tainted oil, though the final agreement is yet to be signed.

Source: Reuters

US President suggestion of taking Syrian oil draws rebukes

28 October. US (United States) President Donald Trump’s suggestion that Exxon Mobil or another US oil company operate Syrian oil fields drew rebukes from legal and energy experts. Exxon Mobil Corp and Chevron Corp, the two largest US oil companies operating in the Middle East, declined to comment on his remarks. Syria produced around 380,000 barrels of oil per day before the country’s civil war erupted.

Source: Reuters

Shell, Exxon agree to pay $1.7 mn for oil blocks lease: Somalia

25 October. Royal Dutch Shell and Exxon Mobil have paid $1.7 mn to Somalia to lease offshore blocks for 30 years. In June, the oil ministry announced that the two companies were looking to return to Somalia ahead of an oil block bid round later this year.

Source: Reuters

Mexico taps banks, oil major as it nears end of 2020 oil hedge

24 October. Mexico’s finance ministry has completed a majority of its annual oil hedging program, working with at least four top investment banks and oil major Royal Dutch Shell, after challenges slowed the world’s largest oil financial deal this year. JPMorgan Chase & Co, Citigroup Inc, Goldman Sachs Group Inc, BNP Paribas SA and Shell are among those the finance ministry tapped to execute the hedge. Over the past two-three years, oil majors Shell and BP began participating in the highly coveted program, challenging the traditional role of banks in the operation. The oil hedge program runs from December to November the following year. In it, Latin America’s second-largest economy buys as much as $1 bn worth of financial positions, mostly options, in a series of highly anticipated oil trades.

Source: Reuters

INTERNATIONAL: GAS

Sempra and Mitsui Eye Stronger LNG ties

29 October. Sempra Energy and Mitsui & Co, Ltd have signed a Memorandum of Understanding (MoU) for developing liquefied natural gas (LNG) export projects in the United States (US) and Mexico. The MoU reflects a preliminary deal by in which Mitsui would participate in the Cameron LNG Phase 2 project in Louisiana and a future expansion of the Energia Costa Azul (ECA) LNG project in Baja California, according to Sempra. Phase 1 of ECA – under development by Sempra’s IEnova subsidiary – includes one liquefaction train with an export capacity of 2.4 million tonnes per annum (mtpa), Sempra said. The proposed Cameron LNG Phase 2, which has won necessary permits from the Federal Energy Regulatory Commission, would add up to two liquefaction trains – 9.97 mtpa of extra LNG production capacity – and up to two LNG storage tanks at the Louisiana facility, which Mitsui partly owns.

Source: Rigzone

Tests show gas fracked at British site is high quality: Cuadrilla

29 October. British shale gas developer Cuadrilla said initial analysis of gas fracked from the second well at its site in northwest England is high quality and shows the country is sitting on a huge natural gas resource. Cuadrilla began fracking at the second well at Preston New Road but was forced to stop in August after operations caused a 2.9 magnitude earth tremor. The government has signalled support for the shale gas industry and is keen to cut the country’s reliance on imports of natural gas, used to heat around 80 percent of Britain’s homes.

Source: Reuters

Russia, Ukraine gas talks need sense of urgency: EU’s Sefcovic

28 October. Russia and Ukraine need a sense of urgency in their talks on gas transit for Europe, the European Union (EU)’s energy chief Maros Sefcovic said after the latest round of talks he chaired in Brussels failed to yield progress. While the bulk of Russian gas sent to Europe flows via Ukraine, there are a number of obstacles to a new deal, such as a political row between Kiev and Moscow, a pro-Russian insurgency in eastern Ukraine, and litigation between Russian gas supplier Gazprom and Ukraine energy company Naftogaz. The current gas transit agreement between Moscow and Kiev expires after 31 December. The gas talks between Ukraine, Russia and the European Union will continue at the end of November, just a month before the current deal expires, Russian Energy Minister Alexander Novak said after talks.

Source: Reuters

Major gas discovery made offshore Mauritania

28 October. Kosmos Energy revealed that a “major” gas discovery has been made through the offshore Mauritania Orca-1 exploration well. The BirAllah area situated Orca-1 well, which targeted a previously untested Albian play, exceeded pre-drill expectations and encountered 118 feet of net gas pay in “excellent quality reservoirs”, according to Kosmos. In total, Kosmos believes that Orca-1 and the original Marsouin-1 discovery well have de-risked up to 50 trillion cubic feet of gas initially in place from the Cenomanian and Albian plays in the BirAllah area. Kosmos revealed that the Yakaar-2 appraisal well offshore Senegal had encountered approximately 98 feet of net gas pay. Back in July, Kosmos revealed that the Greater Tortue Ahmeyim-1 well offshore Senegal had encountered approximately 98 feet of net gas pay.

Source: Rigzone

Libya’s Faregh field gas production to reach 250 mcfd in November

24 October. Libya’s National Oil Corp (NOC) said that gas production from Faregh field would reach 250 million cubic feet per day (mcfd) in November after completion of a second development phase. Gas production after the first phase of development was 70 mcfd, NOC said. The field’s condensates production would expand to 15,000 barrels per day.

Source: Reuters

INTERNATIONAL: COAL

China approves 196 mt of coal capacity from January-September

29 October. China approved 40 new "modernised" coal mines, with total capacity of 196 million tonnes (mt), in the first three quarters of 2019. The approvals were part of a plan to unleash higher-grade coal production capacity, the National Energy Administration (NEA) said. China has been shutting hundreds of small-scale coal mines that use outdated techniques, and replacing them with bigger mechanised collieries using advanced technology.

Source: The Economic Times

Indonesian coal miner Bukit Asam’s January-September output up nearly 10 percent y/y

28 October. Indonesia’s PT Bukit Asam produced 21.6 million tonnes (mt) of coal in January-September period this year, up 9.6 percent from a year earlier, the company said. Coal sales rose 10.7 percent annually to 20.6 mt in January-September. Average selling price of Bukit Asam’s coal in the nine-month period fell 7.8 percent, due to a depressed Asian coal market.

Source: Reuters

INTERNATIONAL: POWER

South Africa plans sweeping power sector reform as Eskom struggles

29 October. South Africa plans a sweeping overhaul of its power sector by breaking up loss-making state utility Eskom over the next three years and opening the industry up to more competition, a long-awaited government paper showed. President Cyril Ramaphosa promised that he would split Eskom into units for generation, transmission and distribution, but there have been few additional details since then. The paper set out a vision for a restructured electricity supply industry, where Eskom could relinquish its near-monopoly and compete with independent power producers (IPPs) to generate electricity at least cost. The government plans to set up a transmission unit within Eskom by the end of March 2020 and complete the legal separation of all three units in 2022. One or more Eskom generation units will be created to compete with IPPs and the distribution model will be reformed so more power can be procured from small-scale producers. The aim is to change a situation where South Africa is reliant on Eskom’s creaking fleet of mainly coal-fired power stations for more than 90 percent of its electricity and has rigid rules for power procurement. Nationwide power cuts spread over several weeks in the first three months of the year contributed to a steep economic contraction, sending Eskom’s operational and financial crisis to the top of Ramaphosa’s to-do list.

Source: Reuters

European power exchanges plan day-ahead auctions for UK if no-deal Brexit

25 October. European power exchanges operating in Britain plan separate day-ahead interconnector capacity auctions from 1 November if the UK (United Kingdom) exits the bloc without a divorce deal, operator Nord Pool said. In the event of a no-deal Brexit, Britain would no longer be coupled to European power markets. That means capacity allocations via power interconnectors that connect Britain to mainland Europe would be made in a common bidding zone only until 31 October for delivery the next day. Britain’s two market operators are Nord Pool and EPEX SPOT. The first separate auction for day-ahead capacity will take place on 1 November, Nord Pool said.

Source: Reuters

Zimbabwe to cut power to mines, others over $77 mn in unpaid bills

24 October. Zimbabwe’s state-owned electricity distributor, grappling with drought and ageing equipment, said it will disconnect mines, farms and other users as it looks to recover $77 mn in unpaid bills. The southern African nation is experiencing daily power cuts lasting up to 18 hours after a severe drought reduced water levels at the country’s biggest hydro plant. The Zimbabwe Electricity Transmission and Distribution Company (ZETDC) is also being hampered by ageing coal-fired electricity generators which constantly break down. ZETDC said in a public notice it was owed 1.2 bn Zimbabwe dollars ($77 mn) and it was targeting to recover the money from mining, agriculture, commercial and domestic users. The country imports up to 400 MW from South Africa and Mozambique when they have spare capacity. Zimbabwe hiked its average electricity tariff by 320 percent to increase power supplies, angering consumers already grappling with soaring inflation and the country’s worst economic crisis in a decade.

Source: Reuters

Ghana loses $190 mn US grant over cancelled power contract

24 October. The United States (US) has cancelled $190 mn in grants to Ghana under the “Power Africa” initiative in response to the Ghanaian government’s termination of a contract with a private utility provider, the US embassy said. The Millennium Challenge Corporation (MCC), a US government foreign assistance agency, agreed in 2014 to provide $498 mn in funding to Ghana’s power sector to help stimulate further private investment. The financing was the largest by the US under Power Africa, which was launched in 2013 by then President Barack Obama and aims to bring electricity to tens of millions of households in Africa. One reform under the agreement involved handing over operations at Electricity Company of Ghana (ECG) in March to Ghana Power Distribution Services (PDS), a consortium led by Philippine electricity company Meralco. But Ghana’s Finance Minister informed US officials that the government was cancelling the 20-year concession it had signed with PDS, saying payment guarantees provided were not satisfactory.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Singapore to stick with natural gas power for time being, expand solar use

29 October. Natural gas will continue to play a dominant role in generating electricity in Singapore while the state plans to accelerate the use of renewable energy, primarily solar power, in the next decade to battle climate change. Singapore, a low-lying country, is vulnerable to rising sea levels while its weather has also become hotter and rainfalls are heavier due to the effects of climate change, Minister for Trade and Industry Chan Chun Sing said.

Source: Reuters

German metal recyclers want to be included in climate change plans

28 October. German politicians should recognize the value of the domestic metals recycling industry by including its representatives on the planned expert council for climate protection, German Metal Traders Association said. Under the plan, Germany will introduce a carbon dioxide emission price for transport and heating in buildings from 2021, starting at €10 a tonne.

Source: Reuters

French oil major Total targets 25 GW renewable energy capacity by 2025

27 October. French oil major Total CEO (Chief Executive Officer) Patrick Pouyanné said that by 2025 Total wants to have global installed capacity of 25 GW in renewable energy power. At end 2018 Total had the capacity to produce 2.7 GW of low-carbon electricity from gas and renewables worldwide.

Source: Reuters

Japan’s Univergy to invest $200 mn in Zambia solar power

25 October. Japanese renewable energy company Univergy Solar is to invest more than $200 mn in two solar power projects in Zambia that will add 200 MW to the country’s national grid next year, the government said. Zambia mainly relies on hydropower and has an electricity deficit of about 750 MW due to low water levels at generation plants after a severe drought hit power production.

Source: Reuters

Global climate fund gets $9.8 bn in fresh financing pledges

25 October. Donor governments pledged $9.8 bn in fresh financing for the Green Climate Fund, set up to help developing nations tackle global warming, French Treasury head Odile Renaud-Basso said. Renaud-Basso said a number of donor countries, including Britain, France and Germany, had doubled their latest pledges, helping make up for a loss of funds from the United States.

Source: Reuters

China could tap North Korea rare earth mine in exchange for solar investment

24 October. North Korea plans to grant China access to a rare earth mine in exchange for investment in solar energy that could ease its chronic power shortages. Putting the cost of a 2.5 mn kW per day solar plant in North Korea at around $2.5 bn, the Association of China Rare Earth Industry said China’s reward for investing would be mining rights to a rare earth mine in North Pyongan province on its borders.

Source: Reuters

Sweden’s wind power to surpass nuclear this year

24 October. Sweden is set to have more wind power capacity than nuclear this year, Swedish wind energy association Svensk Vindenergi estimated. Installed wind turbine capacity should reach 9.4 GW, topping nuclear capacity of about 8.4 GW, it said. While Sweden is set to add 2 GW of wind capacity, including about 1.2 GW in the fourth quarter, its nuclear fleet is set to decline by 1.8 GW by the end of 2020 as two of Vattenfall’s reactors reach their end of life.

Source: Reuters

DATA INSIGHT

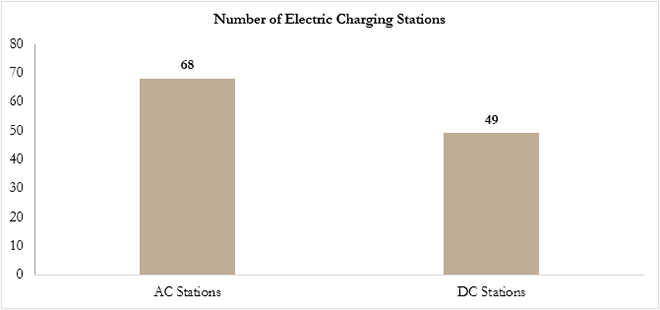

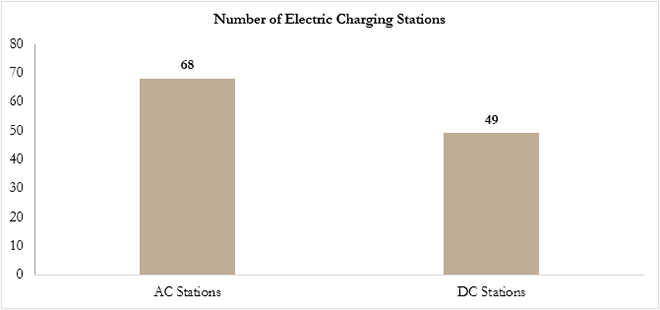

Scenario of Electric Charging Stations in India

Number of Charging Stations in Delhi & NCR

| Name of Office/Institution |

Number of Charging Stations |

Name of Office/Institution |

Number of Charging Stations |

| AC |

DC |

AC |

DC |

| Rashtrapati Bhawan |

3 |

1 |

Prime Minister’s Office |

9 |

6 |

| SDMC |

24 |

11 |

BSES Rajdhani |

1 |

1 |

| NDMC |

28 |

9 |

GIZ |

2 |

- |

| NTPC |

10 |

3 |

AAI |

4 |

5 |

| PFC |

1 |

- |

Ministry of Finance |

6 |

4 |

| Ministry of Power |

4 |

1 |

ONGC Videsh Ltd |

2 |

1 |

| 15th Finance Commission |

2 |

1 |

EESL |

1 |

1 |

| POWERGRID |

5 |

2 |

BSES Yamuna Power Ltd |

1 |

1 |

| MNRE |

2 |

1 |

Ministry of Health |

1 |

1 |

| GMDA |

5 |

1 |

NHPC Ltd |

1 |

1 |

| NISE |

1 |

- |

CAG |

1 |

1 |

| CEA |

2 |

1 |

Rail Coach Factory |

2 |

1 |

| IREDA |

1 |

- |

MEA |

2 |

1 |

| UNEP |

1 |

- |

Parliament House |

4 |

3 |

| NITI Aayog |

7 |

3 |

PGIMER, Dr. Ram Manohar Lohia Hospital |

1 |

1 |

| Gujarat Bhawan |

1 |

1 |

Department of Heavy Industries |

6 |

- |

| Delhi/ NCR NDMC Public Charging Station |

- |

20 |

|

|

|

Number of Charging Stations in other than Delhi & NCR Region

Source: Parliament Question(s) for Ministry of Heavy Industries & Public Enterprises

Source: Parliament Question(s) for Ministry of Heavy Industries & Public Enterprises

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Parliament Question(s) for Ministry of Heavy Industries & Public Enterprises

Source: Parliament Question(s) for Ministry of Heavy Industries & Public Enterprises PREV

PREV