-

CENTRES

Progammes & Centres

Location

Distributed production and consumption of RE by households and industries, primarily using solar photovoltaic (PV) systems, is projected as a potential driver of RE generation and consumption but challenges remain

Distributed production and consumption of RE by households and industries, primarily using solar photovoltaic (PV) systems, is projected as a potential driver of RE generation and consumption but challenges remain

Draft amendments to the Electricity Act 2003 (EA 2003) in the Electricity Amendment Bill 2014 (EA 2014) suggested, among other things, the separation of carriage and content, to increase consumer choice in electricity procurement and promotion of renewable energy (RE) based electricity consumption. The separation of carriage and content meant separating the distribution and supply function that were expected to promote competition in electricity retail. RE-based electricity promotion in EA 2014 included several incentives at the supply end, along with complementary provisions at the demand end. Under EA 2014, RE-based electricity generation and supply would not require a licence, and cross-subsidy for open access would be eliminated.

Although EA 2014 is yet to become law, the provisions of EA 2003 that were prerequisites for introducing competition at the retail end have not yielded the expected results. Open access is faltering because of high cross-subsidies and a lack of infrastructure. The parallel distribution licensee model has also failed to pick up, as it requires distribution companies to distribute power “through their own distribution system within the same area.” This means duplication of capital-intensive infrastructure leading to higher costs. The distribution licensee model adopted in Mumbai stands as testimony to this outcome.

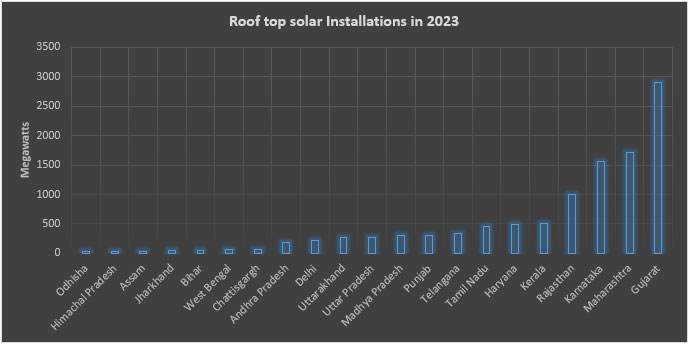

In this context, distributed production and consumption of RE by households and industries, primarily using solar photovoltaic (PV) systems, is projected as a potential driver of RE generation and consumption. In 2023, the cumulative capacity of roof top solar PV installation capacity was 10 GW (gigawatts) which was about 7.5 percent of total installed capacity of RE and 13.8 percent of the total solar installed capacity in November 2023. In India, over 75 percent of rooftop installations are by commercial and industrial entities. Those with solar rooftop installations are both producers and consumers of RE and can drive RE adoption with the support of the right infrastructure and financial incentives provided by distribution companies (discoms). However, caution is recommended as this option may impose costs on economically-challenged households in India.

Incentives for Prosumers

Prosumers are end-use consumers of electricity who also produce their own electricity at the point of consumption to meet their own electricity needs and export surplus electricity to the grid. Increasing the number of prosumers could boost RE consumption and also substantially reduce transmission and other system losses. These potential benefits are particularly important at the city level, where a large share of electricity is consumed, and where consumption is set to rise with rapid rates of urbanization. The major policies that enable the development of prosumers are capital subsidies for installation of solar PV systems, net-metering and feed-in tariffs (FiTs).

Capital subsidies allow middle-class households and small commercial and industrial entities to adopt solar roof-top systems. Net-metering which is the most lucrative billing system for prosumers, allows customers (residential, commercial and industrial) who generate their own electricity from solar power to feed electricity they do not utilise into the grid. Under net metering, the value of electricity the prosumer feeds into the grid is the same as the value of electricity the prosumer imports from the grid. The bill calculation is based on the net value. The net present value (NPV) of a net-metered system is high; a prosumer under net metering does not require investment in a storage system, and a solar PV system with net metering has a short payback period. In India, policy on net metering varies from state to state. Net billing is similar to net metering, except that the tariff for electricity exported to the grid is lower than the tariff charged for electricity used from the grid. In a gross metering system, the prosumer does not directly use electricity produced by solar panels. Instead, the electricity produced is exported to the grid, at a fixed rate (FiT), and the prosumer draws electricity at the tariff charged by the discom like most other consumers. Though gross metering reduces the prosumer’s savings, it offers an incentive to the discom to induct prosumers into the distribution system. From a purely economic perspective, net metering could overvalue the prosumer’s electricity supply, but from a climate action perspective, this valuation may be justified on the grounds that it promotes the decarbonisation of the electricity grid.

Challenges

There are many barriers to the expansion of solar PV prosumerism in India, including high initial costs, insufficient support mechanisms and legal frameworks, resistance by incumbent discoms to provide support, inadequate levels of training and skill of technology providers, poor information, and a host of administrative or financial barriers. Subsidies for the production and use of solar PV can overcome these barriers, but there are limits to subsidising RE adoption, as the case of Spain shows. In the late 2000s, Spain implemented generous support for RE adoption. Under this support mechanism, the prosumer was able to choose between selling electricity generated with solar PV under a FiT mechanism or selling it in the free market that offered market price plus a feed-in premium. This increased solar roof top adoption substantially. However, in 2012, this support scheme was suspended as payment to prosumers exceeded expectations. In 2016 and 2017, the government called for technology agonistic RE auctions. Wind power won as it sought no additional premium apart from the market price. In 2015, Spain imposed a “Sun Tax,” under which systems up to 100 kilowatt (kW) were not allowed to sell surplus electricity to the grid, and systems above 100 kW required registration to sell to the spot market.

The speed and degree of prosumer growth may be influenced by several economic and non-economic factors. In India, the growth of prosumerism could be motivated purely by the economic self-interests of end-users to reduce their costs of energy and constrained only by defined limits to the logistic growth of technological expansion. Affluent urban households that imitate the lifestyle and ideologies of the West could initiate grassroots movements motivated by increasing urgency for climate action, facilitating neo-communal prosumerism. Other drivers for export-oriented services and industries to become prosumers could include compulsion to turn green to navigate trade barriers imposed by developed countries.

The increase in the number of prosumers in the electricity system brings a host of challenges to discoms, the most significant is loss of revenue while maintaining investment in grid security and stability. The impact of growing number of prosumers on reliability and resilience raise concerns. This means additional investment in monitoring, forecasting, aggregation, automation, and control. This is a challenge for financially challenged discoms.

A recent paper reviews the idea of a “death spiral” for discoms, where electricity consumers self-sort to become prosumers, thereby leaving consumers who are financially unable to convert to prosumers bear increasing energy costs pushing more consumers to become prosumers, which drives the price up further. In India, the poor without proper homes with roofs, home renters with no access to space for PV systems, and those who cannot afford PV systems would have to bear the cost of prosumerism. The irony to note here is that consumers who cannot afford to become prosumers pay prosumers to sustain the attraction of prosumerism. Another study on the Spanish case found that most prosumers will not disconnect from the grid, even when they have installed back-up systems and are able to meet their consumption needs comfortably when the incentive system for selling green electricity to the grid are attractive. Prosumersim is in a nascent stage in India. This provides an opportunity for India to weigh the costs and benefits of prosumerism and adopt a model that is relevant for Indian social and economic conditions. Given that residential PV generation is much more expensive than utility-scale PV generation, the subsidy cost per kWh (kilowatt hour) of residential PV generation is substantially higher than the per-kWh subsidy cost of utility-scale PV generation. There is no compensating difference in benefits and thus there is simply no good reason to continue to provide more generous subsidies for residential-scale PV generation than for utility-scale PV generation. Policies for supporting RE generation and consumption need not offer higher subsidies for rooftop residential PV systems than utility-scale PV generation. What is required is a system for recovering distribution costs of discoms that reflects network users’ particularly prosumers’ impacts on those costs.

Source: Ministry of New & Renewable Energy; Note: Only states with installed capacity above 10 MW are shown.

Source: Ministry of New & Renewable Energy; Note: Only states with installed capacity above 10 MW are shown.

CGD/CNG

Major Compressed Natural Gas (CNG) player Indraprastha Gas’s stock has corrected by over 15 percent in the last two days after the Delhi government approved the electric vehicle (EV) policy for cab aggregators and delivery services- the biggest consumers of CNG. The stock has taken a tumble on fears that the Delhi government’s EV policy could lead to a sharp decline in demand for CNG. Delhi cab aggregators constitute about 30 percent of Indraprastha Gas’s CNG volume, with Uber, Ola, and e-commerce delivery services being the largest contributors. The new EV policy of the Kejriwal government is targeted at converting large-scaled cab aggregators, including bike taxis, cabs, and food delivery bikes, to EV technology.

Production

Reliance Industries Ltd (RIL) and its partner BP plc of UK have reverted to oil indexation for pricing the gas they produce from India’s largest private-sector operated field in KG basin as they look to tap into the upside from the buoyant oil market. RIL and BP in a tender have sought bids from buyers for 4 million standard cubic meters per day of gas from KG-D6 block in Bay of Bengal starting 1 December 2023. The sale price however shall be the lower of the government-dictated maximum rate payable for gas from difficult fields like deepsea, and the price arrived through the bidding process. The government bi-annually fixed ceiling price for gas produced from difficult fields such as deepsea and high-pressure, high-temperature (HPHT) fields, effective from 1 April and 1 October. The e-auction for 4 million metric standard cubic meter per day (mmscmd) of KG-D6 gas is planned on 21 November, the tender document said. RIL-BP in that auction had asked users to quote a variable 'v' over and above the JKM price, the spot market benchmark for liquefied natural gas (LNG) delivered to Japan and South Korea.

LNG

GAIL (India) Limited has done the world’s first ship-to-ship LNG transfer to save on shipping costs and cut emissions as the state-owned entity looks at innovative ways as a pivot to boost business. GAIL has contracted 5.8 million tonnes (MT) per annum of LNG (natural gas super-cooled to liquid form) from the United States (US). The company brings this volume to India via LNG ships. The ship typically travels a distance of about 19,554 nautical miles for a round trip to transport LNG from Sabine Pass in the US to India via the Suez Canal and Gibraltar. This journey takes approximately 54 days and emits about 15,600 tonnes of CO2 (carbon dioxide).

India’s top gas importer Petronet LNG is not seeking additional volumes when it renews its long-term LNG deal with Qatar. Petronet has a 7.5 MT per year long-term LNG import deal with Qatar and its promoters Indian Oil Corp, Bharat Petroleum Corp and GAIL (India) Ltd has a 1 MT deal. Petronet previously said that it would seek up to 1 MT per annum of additional LNG when it renews its deal.

Gas Trade

India’s largest gas distributor GAIL (India) Limited posted a bigger-than-expected rise in quarterly profit, buoyed by a boost in its gas transmission volume. Natural gas transmission volume stood at 120.31 mmscmd, 3.4 percent higher than last quarter. The company’s revenue from natural gas transmission segment rose 56 percent year-on-year. Performance, however, was constrained due to lower realisation in polymers and LNG which are expected to improve going forward. Last year, GAIL had to cut gas sales to fertiliser and industrial clients after supplies under its long-term deal with the German unit of Russia’s Gazprom were hit when it was taken over by Berlin, which diverted volumes to its own market.

Rest of the World

Europe

Italian gas grid operator Snam will invest a total of €1 billion ($1.1 billion) in a new LNG offshore terminal near Ravenna, the company said. The floating storage and regasification unit (FSRU) will add to another LNG terminal already set up in Tuscany, increasing Italy’s gas import capacity and reducing dependence from its traditional suppliers, including Russia. The new terminal, which will have an annual capacity of 5 billion cubic meters (bcm) of gas, will be ready at the end of next year and is expected to start commercial activity in early 2025, a city on Italy’s Adriatic coast. Snam is currently working to prepare an offshore platform some 8.5 kilometres from the coast of Ravenna where the new floating terminal will be moored. It is also setting up pipes to connect it to the Italian gas network.

Africa

Uganda and Tanzania have agreed to carry out a feasibility study for a pipeline linking Tanzania’s gas fields to Uganda, according to their energy ministry, as the East African neighbours seek to progress a plan first announced in 2016. Tanzania has an estimated 57.5 trillion cubic feet (tcf) of recoverable natural gas and uses some of it to produce 64 percent of the 1,872 megawatt (MW) electricity on the grid, as per the ministry of energy. Tanzania is currently awaiting cabinet approval for a US$42 billion (bn) LNG project after completing negotiations in May with Equinor, Shell and Exxon Mobil. The project would unlock a natural gas deposit of more than 36 tcf. Tanzania’s Deputy Prime Minister and Energy Minister Doto Biteko said the signing of the agreement for a pipeline feasibility study followed a Memorandum of Understanding dating back to 2018.

Africa is at the forefront of a global wave of new floating gas facilities as countries on the continent seek to meet surging demand in Europe as quickly and cheaply as possible, analysts and energy companies said. Eni, BP and smaller independent players such as Nigeria’s UTM Offshore are driving the surge with projects on Africa’s east and west coasts. Floating Liquefied Natural Gas (FLNG) vessels shipped Mozambique's first-ever gas exports last November, and the Republic of Congo is preparing for its first LNG exports in December. Africa currently exports 40 million tonnes per annum (mtpa) of gas, and Westwood Global Energy group expects the continent to add 10.2 mtpa in new FLNG capacity by 2027, with projects in Mozambique, Nigeria, Senegal, Mauritania and Republic of the Congo. Over the next five years Westwood forecasts US$13 bn in spending on FLNG, with Africa accounting for just under 60 percent of the 18.3 mtpa of added FLNG capacity by 2027. It expects a further 36.5 mtpa to start up after 2027 valued at US$22 bn.

Middle East

Egypt is expected to resume exports of LNG in December or January as domestic demand declines during winter and as it receives more gas from Israel, an executive at Italy’s ENI said. Egypt shipped 80 percent of its LNG exports to Europe last year as the continent sought to replace Russian pipeline gas after Moscow’s invasion of Ukraine. However, LNG exports this year have been lower as high domestic demand over the summer resulted in very low or zero LNG exports in May-September

Chevron had resumed the supply of natural gas from the offshore Tamar field, a month after it was told by Israel to halt operations due to violence in the region. The Tamar field, a major source of gas for Israel’s power generators, is expected to reach full capacity soon. Around 20 percent of the gas from the field typically goes to neighbouring Egypt and Jordan. Israel's largest offshore gas field, Leviathan, has continued to operate normally during the current conflict between Israel and Hamas, the militant Islamist Palestinian group that controls Gaza. Chevron operates and holds a 25 percent stake in Tamar, which delivers about 1 percent of its global output. Without gas from Tamar, Israel relied more heavily on supplies from the Chevron-operated Leviathan field, which exports large volumes to Egypt, as well as Energean’s Karish field.

Israeli natural gas exports to Egypt have resumed after a disruption last weekend but in small volumes, an official in Egypt’s petroleum ministry said. The disruption in exports follows Israel's suspension of production at Chevron’s Tamar gas field on 9 October, shortly after fighting escalated with the Islamist group Hamas in Gaza. In parallel, supplies were also redirected through a pipeline in Jordan, rather than a direct subsea pipeline to Egypt. Egypt’s cabinet said that gas imports fell to zero from 800 million cubic feet per day (mcfd), contributing to a deficit of power generation that has caused months of power cuts. Egypt relies on Israeli gas imports to meet some of its domestic demand, as well as for re-exports that have been a significant earner of scarce foreign currency. Egypt, where there is growing demand for gas from the population of 105 million (mn), has also seen its own gas production decline to a three-year low this year. The country has grappled with power shortages in the summer as heatwaves have driven up demand for cooling.

Turkmenistan revived the prospect of creating a pipeline linking its vast gas fields to Europe, as Western countries seek to fill the void left by Russian gas. The idea of building the Trans-Caspian Gas Pipeline linking Turkmenistan to Europe has been discussed since the 1990s but never came to fruition amid logistical hurdles. Turkmen leader Serdar Berdymukhamedov said his country -- which has the fourth largest gas reserves in the world -- was again interested in launching new projects. The pipeline, which would run under the Caspian Sea to an existing terminal in Turkey, has faced opposition from competitor Russia as well as questions over its cost effectiveness. Turkmenistan sends most of its gas exports to China, but it is increasingly courting interest from European countries looking to end their dependence on Russia over the conflict in Ukraine.

QatarEnergy would supply Italy’s Eni with gas for 27 years, following similar deals this month to supply the Netherlands via Shell and France through TotalEnergies. Affiliates of QatarEnergy and Eni signed a long-term sale and purchase agreement for up to 1 mtpa of LNG from Qatar’s North Field expansion project. LNG will be delivered to the FSRU Italia, a floating storage and regasification unit in Tuscany’s port of Piombino from 2026. Eni has a 3.125 percent stake in the North Field East expansion that, together with the North Field South expansion, will lift Qatar’s liquefaction capacity to 126 mtpa by 2027 from 77 mtpa. Qatar, already the world’s top LNG exporter, in the last two weeks signed 27-year deals to supply 3.5 mtpa from 2026 to Shell and TotalEnergies, its largest and longest European gas supply deals. Until then, Asia - with an appetite for long-term sale and purchase agreements - had outpaced Europe in locking in supply from QatarEnergy's two-phase LNG output expansion. Asian deals included 27-year supply to China’s Sinopec sealed in November for 4 mtpa and an identical one signed in June with China National Petroleum Corporation (CNPC). European Union buyers are signing long-term deals to replace Russian gas, which had accounted for almost 40 percent of supply before Moscow’s invasion of Ukraine last year. Germany was the EU’s biggest buyer of Russian gas. It will now get 2 mtpa from 2026 through a 15-year deal between QatarEnergy and ConocoPhillips signed in November 2022. QatarEnergy said Italy already received more than 10 percent of its natural gas needs from Qatari LNG shipments to the Adriatic terminal.

North and South America

LNG developer New Fortress Energy said it has signed a deal to charter a FSRU from Brazil's Petrobras starting in December. The company said FSRU Energos Winter will be immediately deployed to Terminal Gas Sul, New Fortress' newest LNG import terminal in Santa Catarina, Brazil which will start commercial operations ahead of schedule in January 2024.

US natural gas futures dropped about 7 percent to a one-week low on record output and forecasts for mild weather to continue through late November, keeping heating demand low and allowing utilities to keep injecting gas into storage for at least a couple more weeks. Front-month gas futures for December delivery on the New York Mercantile Exchange fell 25.1 cents, or 7.1 percent, to settle at US$3.264 per million metric British thermal units (mmBtu), their lowest close since 27 October. Gas flows to the seven big US LNG export plants rose to an average of 14.3 billion cubic feet per day (bcfd) so far in November, up from 13.7 bcfd in October and a record 14.0 bcfd in April.

United States (US) LNG company Freeport LNG received approval from federal energy regulators to take more steps to return its export plant in Texas to full operation. A return to full operation would allow the plant, which shut for about eight months from June 2022 to February 2023 after a fire, to supply more LNG to global markets ahead of the winter heating season when demand for natural gas soars in the Northern Hemisphere. Global gas prices spiked to record highs in Europe and Asia over the summer of 2022 due in part to the Freeport LNG shutdown while Russia was reducing the amount of gas it supplied to Europe after Moscow’s invasion of Ukraine.

The US Federal Energy Regulatory Commission (FERC) agreed to a revised commissioning plan for Venture Global LNG’s Calcasieu Pass facility, allowing it to turn on three processing trains while work on faulty power equipment continues. The FERC decision supports Venture Global LNG’s argument that it cannot start full commercial operations because it has reliability issues, Rapidan Energy said. Venture Global LNG is involved in contract arbitration with customers Shell, BP, Edison and Repsol that separately seeks to force the company to supply them cargoes or pay financial penalties. Venture Global started gas processing at its Calcasieu Pass facility in March 2022 and has delivered at least 200 cargoes - which it says are "pre-commissioning cargoes" - through September. But the company has not provided cargoes to its contract customers, insisting the facility is not fully commissioned.

China

Chinese firm Sinopec signed a new 27-year LNG supply and purchase agreement with QatarEnergy, the two companies said. Under the agreement, the two companies will cooperate on the second phase of the Gulf Arab state’s North Field expansion project, which will supply 3 MT of LNG per year to Sinopec. A partnership agreement was also signed under which QatarEnergy will transfer a 5 percent interest to Sinopec in a joint venture company that owns the equivalent of 6 million tonnes per year of LNG production capacity in the North Field South project. The deal, signed at the China International Import Expo in Shanghai, is the third long-term supply deal between Sinopec and Qatar Energy, the world’s top LNG supplier. The two companies signed a 10-year LNG purchase and sales agreement in 2021, followed by a 27-year deal last year. The North Field is part of the world's largest gas field which Qatar shares with Iran, which calls its share South Pars. The North Field expansion plan includes six LNG trains that will ramp up Qatar's liquefaction capacity to 126 mtpa by 2027 from 77 million.

Rest of Asia-Pacific

Pakistan announced a sharp increase in the price of natural gas for most households and industry ahead of the cash-strapped country’s first review of a US$3 bn International Monetary Fund (IMF) bailout. A fixed tariff for 57 percent of household consumers has been raised to 400 rupees (US$1.42) a month, from 10 rupees, the energy minister of a caretaker government. Low- and middle-income households will be charged lower prices and high income households would be charged more, he said. Energy sector debt has been the main issue that the IMF has highlighted in tackling the fiscal deficit and it has been recommending measures to deal with it.

Shell Upstream Overseas Services, a subsidiary of Shell, has completed the sale of a 35 percent participating interest in Indonesia’s Abadi Masela gas project to Indonesia’s Pertamina and Malaysia’s Petronas, Shell said. Abadi LNG, led by Japan’s Inpex Corporation, will use gas from the Masela block, 150 km (93 miles) off the town of Saumlaki in Maluku province, to produce 9.5 mtpa of LNG at its peak, which will be exported from the proposed terminal and 150 million cubic feet of natural gas per day via pipeline to address domestic demand for natural gas. Authorities previously expected that a final investment decision (FID) for the project could be reached in 2024 and the project could start production in 2029.

India stands to gain as crude oil prices fall to 4-month low

17 November: With crude oil prices falling to a 4-month low in the international market, the Indian economy is expected to get a shot in the arm. The country’s current account deficit had started to spiral out of control due to the huge oil import bill and the rupee had been weakening due to the higher demand for dollars to buy expensive oil. The price of the global benchmark Brent crude fell by 4.63 percent to close at US$77.42 per barrel, while the US’s West Texas Intermediate crude oil futures fell 4.9 percent to settle at US$72.90 per barrel. An increase in US crude oil inventories, a rebound in US Treasury yields, and the easing of oil demand due to the global economic slowdown have contributed to the decline in crude prices. Prices have in fact been gradually declining over the last four weeks. India’s merchandise trade deficit rose to a record high in October and the decline in oil prices would bring respite in November. The country imports over 80 percent of its crude oil requirement and any increase in prices leads to a sharp increase in the current account deficit.

CONCOR ties up Indraprastha Gas to explore possibility of LNG/LCNG infra at terminals

20 November: Railway PSU Container Corporation of India Ltd has signed an agreement with Indraprastha Gas Ltd to explore the possibility of setting up LNG or LCNG infrastructure at its terminals in Uttar Pradesh and Gujarat. This strategic partnership aims to revolutionise the logistics sector replacing diesel with natural gas, the Container Corporation of India Ltd (CONCOR) said.

India’s rising power demand pulls up natural gas consumption

18 November: India’s rising electricity consumption aided by growing industrial and commercial activity as well as appreciating household usage, which forced the government to restart gas-based power plants, has led to higher consumption of natural gas. Power consumption in India, which witnessed an all-time high peak power demand met of 241 gigawatt (GW) on 1 September, has grown by more than 20 percent during August, September and October 2023. According to the Gas Exporting Countries Forum (GECF), India’s gas consumption marked its ninth consecutive month of growth with a 24 percent y-o-y increase, reaching 5.8 billion cubic meters (BCM) in September 2023. The government has directed gas-based power plants to continue operations till March 2024 in anticipation of higher demand for electricity. Around 7-8 GW of gas-based capacity is operational.

GAIL issues swap tender for 24 LNG cargoes in 2025

16 November: GAIL (India) Ltd has issued a swap tender offering 24 liquefied natural gas (LNG) cargoes loading out of the United States (US) next year in exchange for 24 other cargoes for delivery to India in 2025. India’s largest gas distributor is offering two cargoes per month, from January to December, for loading from Sabine Pass on a free-on-board (FOB) basis. It is seeking the cargoes for delivery to the Dhamra terminal for the same months on a delivered ex-ship (DES) basis.

India needs to add 80 GW coal power by 2030 to meet demand: Singh

21 November: India needs to add thermal coal-based power generation capacity of 80 GW against the 27 GW currently under construction as the peak power demand in the country would spike to 335 GW by 2030 from 241 GW at present, Union Power Minister R K Singh said. Singh said India’s peak power demand would touch 335 GW in 2029-30 from the present level of 241 GW.

Centre looking to restart probe into Adani coal imports from Indonesia

17 November: Indian investigators are seeking to restart a probe into Adani Group for alleged overvaluation of coal imports and have asked the Supreme Court to allow them to collect evidence from Singapore, a step they say the company thwarted for years, legal documents show. The Directorate of Revenue Intelligence since 2016 has been trying to procure transaction documents related to Adani’s dealings from Singapore authorities. The agency suspects many of the group’s coal shipments imported from Indonesian suppliers were first billed at higher prices on paper to its Singapore unit, Adani Global Pte, and then to its Indian arms. Adani Enterprises and its subsidiaries, led by billionaire Gautam Adani, have successfully mounted repeated legal challenges in India and Singapore to block the documents' release, court papers show. Adani has denied wrongdoing, saying that Indian authorities assessed its coal shipments before releasing them from ports. The effort to revive the coal probe comes amid wider regulatory scrutiny of Adani since Hindenburg Research in January accused the tycoon and his conglomerate of improper use of tax havens and stock manipulation.

Coal ministry launches 8th round of commercial coal mines auction

16 November: The coal ministry launched the eighth round of commercial coal mines auction process. A total of 39 coal mines are on offer. Launching the auction virtually, Union Minister for Coal Pralhad Joshi said that all efforts are on to stop coal import by 2025-26. He also stated that coal production from underground mines (UG) will be further scaled up to touch 100 million tonnes (MT) by 2030 by deploying mass production technology. The mines being auctioned are spread across coal-bearing States of Jharkhand, Odisha, Maharashtra, West Bengal and Bihar, the ministry said. These mines come under the CMSP Act and MMDR Act. Out of 39 coal mines, four mines are being offered under the 2nd attempt of the 7th round under the CMSP/ MMDR Act, where single bids were received in the first attempt. Of the 35 coal mines being offered under the 8th round, 16 coal mines are new ones and 19 mines are being rolled over from earlier tranches. The ministry has taken a series of reforms to ensure that the coal sector grows at a rapid pace and is able to meet the growing energy demand of the country.

Karnataka government decides to waive INR3.8 bn arrears of beneficiaries of three power schemes

21 November: The Karnataka government has decided to waive arrears to the tune of INR3.89 billion of 'Kuteera Bhagya', 'Bhagya Jyoti' and 'Amruta Jyoti' scheme beneficiaries who were either getting power free of cost or at a highly subsidised rates, Energy Minister K J George said. It has already merged these three schemes with its ambitious 'Gruha Jyoti' scheme offering free electricity up to 200 units to residential power connections.

India’s FY24 power demand to rise 7 percent amid strong industrial activity: Fitch

17 November: Amid robust industrial activity in the country, India’s power demand is expected to rise around 7 percent in 2023-24 (FY24), Fitch Ratings said. In the first half of the year, the power demand grew by 7.1 percent. However, FY24 demand will be lower than the 9.5 percent recorded in FY23. Fitch said that high power demand should keep thermal power plant load factors high. In the first 7 months of FY24, it was 68.7 percent.

PEDA signs pact with GAIL to set up 10 compressed biogas projects in Punjab

21 November: Punjab Energy Development Agency (PEDA) has signed an agreement with GAIL (India) Limited to set up 10 compressed biogas projects and other new and renewable energy projects in the state. Punjab New and Renewable Energy Sources (NRES) Minister Aman Arora said the pact will help the state to manage five lakh tonnes of paddy straw per annum and generate clean energy out of it. Punjab is an agrarian state, and it has immense potential for crop residue-based CBG plants, he said.

Rooftop solar potential could be critical to energy transition in India

16 November: Over 250 million households across India have the potential to deploy 637 GW (gigawatt) of solar energy capacity on rooftops, according to a new independent report by the Council on Energy, Environment and Water (CEEW). The CEEW report said that deploying just one-third of this total solar technical potential could support the entire electricity demand of India’s residential sector (about 310 TWh). Currently, India has installed 11 GW of rooftop solar capacity, of which only 2.7 GW is in the residential sector. India’s rooftop solar potential is spread geographically across states in contrast to other renewable technologies like utility-scale solar and wind projects, and could be critical to the energy transition ambitions of states.

IEA sees surplus oil supply in 2024 even if OPEC+ extends current cuts

21 November: The global oil market will see a slight surplus of supply in 2024 even if the OPEC+ nations extend their cuts into next year, the head of the International Energy Agency (IEA)’s oil markets and industry division Toril Bosoni said. At the moment, however, the oil market is in a deficit and stocks are declining "at a fast rate", Toril Bosoni said. OPEC+ is set to consider whether to make additional oil supply cuts when the group meets later this month, three OPEC+ sources have told Reuters after prices dropped by some 16 percent since late September. Oil has slid to around US$82 a barrel for Brent crude from a 2023 high in September of near $98. Concern about demand and a possible surplus next year has pressured prices, despite support from the OPEC+ cuts and conflict in the Middle East. Saudi Arabia, Russia and other members of OPEC+ have already pledged total oil output cuts of 5.16 million barrels per day (bpd), or about 5 percent of daily global demand, in a series of steps that started in late 2022.

US Coast Guard seeks source of some 1.1 million gallons of crude oil in Gulf of Mexico

20 November: The United States (US) Coast Guard said it was still looking for the source of a leak from an underwater pipeline off the Louisiana coast in the Gulf of Mexico that it estimated had released more than a million gallons of crude oil. The 67-mile long pipeline was closed by Main Pass Oil Gathering Co (MPOG), after crude oil was spotted around 19 miles offshore of the Mississippi River Delta, near Plaquemines Parish, southeast of New Orleans.

Russia lifts gasoline export ban: Energy ministry

17 November: Russia has lifted restrictions on gasoline exports, the energy ministry said, after scrapping most restrictions on exports of diesel last month, saying there was a surplus of supply while wholesale prices had declined. Russia, the world’s top seaborne exporter of diesel, introduced a ban on fuel exports in order to tackle high domestic prices and shortages. Only four ex-Soviet states - Belarus, Kazakhstan, Armenia and Kyrgyzstan - were exempt. The government eased restrictions, allowing the export of diesel by pipeline, but kept measures on gasoline exports in place. Overseas supplies of diesel and other fuels by truck and railway also remained prohibited at the time. The scrapping of the ban might complicate Russia’s efforts to reduce its oil and petroleum product exports by 300,000 barrels per day until the end of the year, compared with the average level seen in May and June.

Energy Transfer inks non-binding deal to supply crude to France’s TotalEnergies

16 November: US (United States) pipeline operator Energy Transfer said it has signed a non-binding agreement to supply crude oil to French energy major TotalEnergies from its upcoming Blue Marlin oil export project. Under the agreement, Energy Transfer would supply 4 million barrels per month of crude oil from the terminal in the Gulf of Mexico, amid a boom in shale oil production in the US. The company submitted an application for approval in late 2020 for the project, which converts an existing offshore platform in federal waters in the US Gulf of Mexico so that it could load large crude tankers with up to 2 million barrels of oil piped from Texas daily.

Ghana plans more flexible oil royalties regime to spur investment

16 November: Ghana plans to introduce a more flexible oil royalties regime as soon as next year to spur investment and reduce risk for energy companies, the head of the state oil sector regulator said. Ghana’s current royalty regime is a fixed 4 percent-12.5 percent of gross oil production, and 3 percent-10 percent of the volume of gas exported. Ghana, the world’s second biggest cocoa producer, became an oil producer in 2010. Output is currently at around 160,000-170,000 barrels per day (bpd) of crude oil and about 325 million standard cubic feet per day of natural gas.

Global oil markets to be fairly balanced in 2024

15 November: Global oil markets are expected to be fairly balanced, with a slight surplus next year as demand and non-OPEC supply growth are exceeding expectations, the global head of research at Vitol, the world’s largest independent oil trader, said. Oil demand globally has exceeded 2019 levels and is expected to continue growing as oil intensity - the volume of oil consumed per unit of GDP - for most economies has returned to pre-pandemic levels except in the United States. Global crude price Brent has weakened to just above US$82 a barrel from a 2023 high in September near US$98. Concern about economic growth and demand has pressured prices, despite support from supply cuts by OPEC and its allies, and conflict in the Middle East. The International Energy Agency (IEA) raised its oil demand growth forecasts for this year and next despite slower economic growth in nearly all major economies.

China October oil refinery runs slow from previous month as margins narrow

15 November: China’s oil refinery throughput in October eased from the previous month’s highs amid weakening industrial fuel demand and narrowing refining margins. Total refinery throughput in the world's second-largest oil consumer was 63.93 million metric tons, data from the National Bureau of Statistics (NBS) showed. That was equivalent to 15.05 million barrels per day (bpd), a slight slowdown on September’s record 15.48 million bpd. China’s crude imports were up 13.5 percent year-on-year in October at 11.53 million bpd, though growth from September was relatively muted at 3.6 percent.

Colombia’s Ecopetrol examining gas imports from Venezuela

21 November: Colombia’s Ecopetrol is exploring an offer from Venezuela’s PDVSA to supply the Andean country with gas from December 2024, it said. Options being considered include bilateral projects to supply Colombia with gas via the transnational Antonio Ricaurte pipeline, it said. Ecopetrol said that a gas contract signed in 2007 with PDVSA, but which is currently inactive, was included in the sanctions lifted by the US in October.

Venezuela close to approving offshore gas license with Trinidad, Shell

20 November: Venezuela is close to approving a license for Shell and the National Gas Company of Trinidad and Tobago to develop a promising offshore natural gas field and export its production to the Caribbean country. The license could set in motion a long-running effort by Trinidad to boost its gas processing and petrochemical exports, while providing Venezuela with a much-needed extra source of cash. The two countries aim to speed cross-border energy development since the US (United States) in January issued a two-year authorization allowing the Dragon field’s development. Venezuela, which holds Latin America’s biggest gas reserves, and neighbouring Trinidad, the region’s largest liquefied natural gas (LNG) exporter, would complement each other’s needs to produce and export gas. Both nations are discussing a 25-year exploration and production license for the Dragon field, which holds up to 4.2 trillion cubic feet of gas and lies in Venezuelan waters near the maritime border between the two countries.

Serbia signs gas supply deal with Azerbaijan

15 November: Serbia signed a deal with Azerbaijan to purchase 400 million cubic meters of natural gas per year from 2024, Azerbaijan’s energy ministry said. Serbia, which is almost fully dependent on Russian gas supplies, has long planned to purchase gas from Azerbaijan once an interconnector to Bulgaria’s pipeline is completed. Serbia, which aims to join the European Union, has come under pressure recently from Western countries to align its foreign policy with the bloc and impose sanctions on Russia. Azerbaijan is considered by Europe as an alternative source of energy imports amid a deep political fallout with Moscow over the conflict in Ukraine and sharp cuts in Russian gas purchases.

German hard coal importers want extended run times for reserve plants

21 November: Germany’s hard coal importers want the Berlin government to prolong the operation of hard coal-to-power generation plants enlisted in last year's energy crisis beyond the targeted end of March 2024, the VDKi lobby said. VDKi, at a press conference in Berlin, said the fleet of regularly working hard coal power stations - totalling 18 gigawatt (GW) - was well-prepared for winter, plugging gaps from Germany's complete nuclear exit in April. The government in 2022 temporarily allowed 6 GW of idled hard coal plants, including some operated by Steag and Uniper (UN01.DE), to participate in the market should gas supply fall short of requirements.

AES in talks to sell major coal-fired power plant in Vietnam

17 November: US (United States) energy firm AES Corporation is in talks to sell its majority stake in one of Vietnam’s largest coal-fired power plants, as part of its global strategy to divest coal assets by the end of 2025. AES is one of the US largest investors in Vietnam, mostly involved in the coal power business there. Its divestment would come as chipmaker Intel, which also runs a major operation in the Southeast Asian nation, shelved a planned expansion there. AES had tried to sell its 51 percent stake in the 1.2 gigawatt (GW) Mong Duong 2 coal-fired power plant in 2021 but the deal fell through after the company said it signed a sale agreement with a consortium led by an undisclosed "US-based investor". Vietnam wants to end power generation from coal by 2050, under commitments that have attracted funding pledges from Group of Seven (G7) members and are expected to be fine tuned at the UN Climate Change Conference which begins on Nov. 30 in Dubai.

China’s October coal output slips on mine safety push

15 November: China’s October coal output slipped by 1.1 percent from September’s six-month high, as mine safety inspections limited production. The world’s largest coal producer mined 388.8 million metric tonnes of the fuel last month, according to data from the National Bureau of Statistics, though that was still up 3.8 percent from the year-earlier level. Analysts from the China Coal Transportation and Distribution Association (CCTD), an industry association, had previously warned output for the fourth quarter could be lower than anticipated given the inspections. Coal production over the first 10 months of 2023 reached 3.83 billion tonnes, up 3.1 percent compared with the same period last year.

Capital Power acquires two natural gas -fired power plants in US for US$1.1 bn

20 November: Canadian energy company Capital Power said it was acquiring two US-based natural gas-fired generation facilities in California and Arizona for a net cost of US$1.1 billion. Following the completion of the deal, Capital will become the fifth largest non-regulated gas-powered generator in North America from ninth position. It plans to be net-zero emissions by 2045. The La Paloma natural gas-fired generation plant in Kern County, California has a capacity of 1,062 megawatt (MW) and is owned by CXA La Paloma.

Ukraine’s power plants need missile defence ahead of winter

17 November: Ukraine’s largest private energy company DTEK is ready for another winter and Russian attacks, but its power plants need more missile defence systems to operate safely, Chief Executive Officer Maxim Timchenko said. In the first 10 months of this year DTEK’s power plants produced enough electricity to meet the demand of around 4.1 million households. Every one of DTEK’s 13 power stations has come under fire from Russia, which has launched sustained attacks on the country’s power grid. In recent weeks alone, Russia has attacked Ukrainian energy infrastructure with different weapons 60 times. In total, 13 of DTEK’s power units, with total capacity of 2.3 gigawatt (GW), have been damaged, destroyed, or occupied, causing blackouts, Timchenko said.

China’s carbon emissions set to peak before 2030

21 November: China is on track to meet a goal to bring its climate-warming carbon dioxide emissions to a peak before 2030, according to a poll of 89 experts from industry and academia, though questions remain over how high the top will be. More than 70 percent of respondents said China, the world’s biggest carbon dioxide emitter, will be able to meet the target, with two saying its emissions had already peaked, in a poll compiled by the Centre for Research on Energy and Clean Air (CREA), a Helsinki-based think tank. Doubts have been cast on China’s ability to meet its 2030 pledge, as authorities continue to approve dozens of new coal-fired power stations to meet rising energy demand and avoid a repeat of the disruptive power outages that hit the country in 2021.

Japanese firms, Malaysia’s Petronas to set up CO2 storage by end-2028

20 November: Japanese companies have agreed to develop a carbon capture and storage (CCS) project with Malaysian energy firm Petronas which should start holding its first carbon dioxide (CO2) emissions from end-2028, Japan Petroleum Exploration Co said. Japan plans to be carbon-neutral by 2050 and is actively developing renewable and alternative energy sources from hydrogen and ammonia to solar and wind power, with CCS technology also playing an important role in its strategy. Early this year, Japan set a target of annual CO2 storage capacity of 6-12 million tonnes by 2030 under a long-term roadmap for CCS which removes CO2 emissions from the atmosphere and stores them underground.

BP seeks partnerships to navigate renewables storm

17 November: BP is seeking partners for offshore wind projects in Japan and may invest in hydrogen technology companies to tackle inflation and equipment bottlenecks that have battered the renewables sector. The oil major plans to expand in low carbon energy in the coming decades as it seeks a long-term business model that can survive the global transition from fossil fuels. Some investors have criticised the strategy for taking BP's focus from higher returns on oil and gas businesses. Globally, the renewables sector has been undermined by slow permitting, technological challenges, rising raw material costs and higher costs of capital. BP’s renewable partner Norway's Equinor, also took a related US$300 million impairment, while Denmark’s Orsted, the world’s No.1 offshore wind project company, scrapped two local projects and suffered billions of euros of writedowns. As BP seeks to guarantee it can meet its internal returns target of 6 percent to 8 percent on renewables projects, Dotzenrath said BP was working out how to reduce costs globally.

Sweden plans new nuclear reactors by 2035, will share costs

16 November: Sweden’s government said it aimed to build the equivalent of two new conventional nuclear reactors by 2035 to meet surging demand for clean power from industry and transport and was prepared to take on some of the costs. By 2045 the government wants to have the equivalent of 10 new reactors, some of which are likely to be small modular reactors (SMRs), smaller than conventional reactors. Energy Minister Ebba Busch said the government was planning a "massive build out" of new nuclear power by 2045. Countries like Poland, the Czech Republic, and Britain are looking at expanding nuclear power as societies transition to a fossil-fuel free future. Sweden’s government has already offered 400 billion crowns (US$37.71 billion) of loan guarantees to support new nuclear power, which it says is needed to power developments like fossil-fuel free steel production, but said it was now willing to shoulder more of the burden.

Britain to boost offshore wind auction power price guarantees by 66 percent

16 November: Britain will increase the guaranteed price offered for offshore wind projects in its next renewables auction by 66 percent, the government said, as it seeks to spur more projects after its last auction failed to attract any offshore wind investment. Britain, which is already the world’s second largest offshore wind market after China, is seeking to ramp up its capacity to 50 gigawatt (GW) by 2030 from around 14 GW now, to help meet its climate targets and boost energy security. The offshore wind sector has been hit by surging supply chain and interest rate costs over the past year with some developers cancelling projects, while Britain’s last auction yielded no offshore wind projects when the results were announced in September with developer saying the price offered was too low. The government said despite the absence of offshore wind, the last auction had succeeded in supporting other technologies such as solar, tidal and onshore wind projects capable of generating 3.7 GW, the equivalent to powering some 2 million homes. Britain’s contract-for-difference (CfD) scheme, offers renewable power developers a guaranteed price for their electricity.

Indonesia state utility plans 31.6 GW renewable power capacity in 2024-2033

15 November: Indonesia’s state utility Perusahaan Listrik Negara (PLN) plans to build an additional 31.6 gigawatt (GW) of renewable power capacity between 2024 and 2033, Chief Executive Darmawan Prasodjo said. In the 2021-2030 plan, PLN had proposed building 20.9 GW renewable capacity and nearly 20 GW of gas and coal power capacity. Out of the total additional capacity planned for 2021-2030, 8.6 GW has been built as of September. The new plan is aimed at accelerating adoption of cleaner energy as Indonesia aims to reach net-zero emissions before 2060. The company will also build transmissions to connect hydropower and other renewable energy sources to Java where demand for power is high and Sulawesi where consumption is expected to surge in the future.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.