-

CENTRES

Progammes & Centres

Location

For electricity consumers in India, one of the most attractive proposals in the Electricity Amendment Bill (EA 2014) (yet to become law) is the proposal to introduce consumer choice in electricity procurement. Consumers presume that this will allow them to switch from state-controlled distribution companies (discoms) to private electricity suppliers just as easily as they do mobile telecommunications providers, largely based on the economic value proposition offered by various telecommunication service providers. For the government and electricity regulators, creating competition for the provision of electricity can lead to lower electricity tariffs in the short run. Additionally, introducing competition can create incentives to provide customers with new value-added services. However, introducing competition in electricity retail in India is not likely to be as straightforward as in the wireless telecommunications sector because of the unique features of electricity that require real-time matching of supply and demand. In addition, real-time will be muted as most discoms purchase most of their electricity on a long-term contract basis rather than through a wholesale electricity market that reflects the temporal and spatial value of electricity. Behavioural changes expected in electricity use by the consumer may not play out as anticipated without the intervention of technological inputs. If consumers are unwilling to switch suppliers, deregulated retail electricity markets will not become as desired.

In mature electricity markets that have competition at the wholesale and retail level, distribution companies other than the incumbent monopoly (which is also the distribution network owner) can purchase electricity through the wholesale market for electricity at rates based on the consumers load profile. Effectively the distribution company pays an average wholesale price for electricity load profile that is representative of the consumer class regardless of the actual pattern of the consumer and the relationship between the actual physical consumption and the real-time wholesale price of electricity.

However, if consumers do not participate actively in exercising choice, it can reduce the benefits of retail choice, even in mature markets. Households who are not used to retail choice may not exercise the option even if alternative suppliers offer lower prices. Some households may not actively seek information on electricity prices, and some households may also be attached to the brand name of the established monopoly supplier. These sources of friction can reduce consumer gains from retail choice.

There are several examples from western electricity markets that illustrate customer inertia in exercising the power of choice in electricity procurement. New Zealand, US, UK, Norway, Sweden, and Australia initiated electricity market reforms in the 1980s. These reforms aimed to replace monopolies with an efficient and competitive electricity sector, but success was limited, particularly in the retail electricity sector, where most consumers were reluctant to switch suppliers.

Norway and the UK who were early adopters of electricity reforms have been studied extensively. Most studies raised concerns about the competitive nature of retail markets and identified problems that were associated with a lack of active consumer participation and retail market concentration. In the mature and transparent retail market of UK, consumers often made suboptimal choices and switch to more expensive contracts. The British regulator, Ofgem, observed in 2011 that the competitiveness of the market had deteriorated in several dimensions and switching rates had dropped drastically. This outcome is attributed to the highly restrictive price interventions by the British regulator.

In the Norwegian retail market, coexistence of a very competitive market segment with low mark-ups and active consumers, and a monopolistic market segment where suppliers may exploit the consumers’ passivity was observed. In both markets, the top three electricity retailers had a market share of 70 percent or more. However, product innovation was observed in contract duration, additional services and sustainability. The key conclusion was that the transition towards a competitive and efficient retail market depended on the ability and the willingness of individual well-informed households to actively search for and select contracts that best fit their needs.

New Zealand introduced retail competition in 1998. The main objective was to increase consumer choice, encourage innovation, and ultimately result in lower prices than would otherwise be charged. In 2009, a ministerial review of the performance of the electricity market found that consumer switching rates were insufficient to curb non-competitive behaviour by retailers, and that the full benefits of retail competition had not been realised, particularly for domestic customers. It was observed that most electricity customers exhibited a tendency to stay with their default retailers even when cheaper competitors were available. Switching promotions were organised with the creation of switching websites, which acted as one-stop-shops by offering price comparisons and allowing consumers to switch to the cheapest available supplier. But switching websites and their extensive publicity proved ineffective at increasing switching rates in most regions, even during periods of rapidly increasing retail prices when substantial potential savings were available. Residential consumers faced rapidly increasing prices during the period 1985–2010, yet most consumers did not switch despite large price differences and entry of new suppliers into the retail markets. The relatively low switching rates resulted in insufficient discipline on incumbent retailer supplier leading to higher prices.

In 2002, residential electricity customers in Texas were allowed to choose their retail provider. Initially, all households were by default assigned to the incumbent. In every subsequent month, households had the option to switch to one of several new entrant electricity retailers. Though the incumbent electricity retailer’s price was consistently higher than that of new entrants, most households did not switch to alternative suppliers. If households had switched to suppliers who offered lower prices, it would have saved them about 8 percent of their expenditure on electricity. Four years after the introduction of competition the incumbent suppliers market share was over 60 percent.

In most parts of India, consumers are connected to traditional electrical meters, and meters are read once in one or two months. Consumers pay per-kilowatt-hour (kWh) tariff that is independent of the actual timing of their electricity consumption. In most regions, the discom is the monopoly distributer of electricity and the discom purchases electricity on long term power purchase agreements (PPAs). The discom does not measure the realised consumption profile of individual consumers but rather the realised total consumption profile of all consumers in a given region. This information is used by the discom to make electricity purchase decisions. As the consumer is on a traditional electricity meter, there is no incentive to adjust consumption to peak and off-peak timings as only total consumption over a month or two is recorded. Effectively neither the discom nor the consumer make electricity purchase decisions on the basis of value of electricity at different times. The consumer does not pay more when consuming mainly at peak when electricity is more valuable rather than spreading consumption between peak and off-peak hours. As a result, the consumer consumes too much electricity when demand peaks (late evening) and too little off peak. Even without retail competition, consumers can move some of the electricity consumption to off-peak times, to reduce their electricity expenditure, provided electricity is priced according to value (more during peak hours and less off-peak hours). This will reduce overall costs for discoms and consumers will benefit from lower prices. However, if retail competition is prematurely introduced in India as proposed, small retail consumers (households) are unlikely to switch suppliers on a large scale because the transaction costs (time and effort) are likely to be high relative to benefits. Uniquely for India, if competition in electricity retail is introduced, it may force competition in wholesale markets. In most mature markets, it was the other way around.

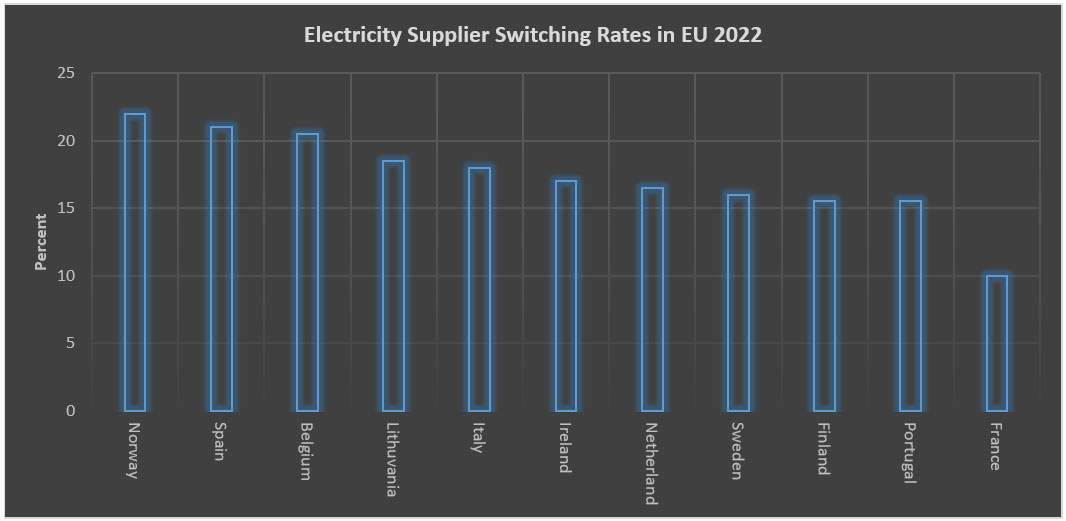

Source: European Union Agency for Cooperation of Energy Regulators; Note: only countries with switching rates above 10 percent are shown

Imports

Indian investigators are seeking to restart a probe into Adani Group for alleged overvaluation of coal imports and have asked the Supreme Court to allow them to collect evidence from Singapore, a step they say the company thwarted for years, legal documents show. The Directorate of Revenue Intelligence since 2016 has been trying to procure transaction documents related to Adani’s dealings from Singapore authorities. The agency suspects many of the group’s coal shipments imported from Indonesian suppliers were first billed at higher prices on paper to its Singapore unit, Adani Global Pte, and then to its Indian arms. Adani Enterprises and its subsidiaries, led by billionaire Gautam Adani, have successfully mounted repeated legal challenges in India and Singapore to block the documents' release, court papers show. Adani has denied wrongdoing, saying that Indian authorities assessed its coal shipments before releasing them from ports. The effort to revive the coal probe comes amid wider regulatory scrutiny of Adani since Hindenburg Research in January accused the tycoon and his conglomerate of improper use of tax havens and stock manipulation.

The All India Power Engineers Federation (AIPEF) demanded withdrawal of the power ministry’s order extending coal imports till 30 June 2024, saying there is no shortage of the dry fuel in the country. In a 23 October notification, the government asked imported coal-based power plants to operate at full capacity until 30 June 2024, amid a surge in electricity demand and inadequate domestic coal supplies. Earlier, the directive was extended till 31 October 2023. The government in March this year issued the first directive under Section 11 of the Electricity Act to ISB (imported-coal based) plants. The data and statistics released by the coal ministry indicate that coal import was not justified, and coal stock on 21 October 2023 was 71.35 MT as against 60.44 MT last year. The power ministry issued an advisory to domestic coal based plants to increase ceiling of imported coal for blending from four percent to six percent.

India has extended by eight months the operation of power plants using imported coal, as high consumption and poor supply deplete domestic stocks of the fuel, according to a government order. The order invoked emergency powers in asking such plants, with a capacity of nearly 17 gigawatt (GW), to operate so as to meet high demand for electricity until next June. Indian power plants that use imported coal, such as those owned by Tata Power and Adani Power, stop operations when prices of fuel shipments rise. The extension came as worries mount over shrinking coal stocks at power plants, where inventories fell in the first half of October at their fastest in two years.

Coal Block Auctions

The Ministry of Coal launched the eighth round of commercial coal mines auction process. A total of 39 coal mines are on offer. Launching the auction virtually, the Ministry said that all efforts are on to stop coal import by 2025-26. It also stated that coal production from underground mines (UG) will be further scaled up to touch 100 million tonnes (MT) by 2030 by deploying mass production technology. As per the Ministry, the mines being auctioned are spread across coal-bearing States of Jharkhand, Odisha, Maharashtra, West Bengal and Bihar. These mines come under the CMSP Act and MMDR Act. Out of 39 coal mines, four mines are being offered under the 2nd attempt of the 7th round under the CMSP/ MMDR Act, where single bids were received in the first attempt. Of the 35 coal mines being offered under the 8th round, 16 coal mines are new ones and 19 mines are being rolled over from earlier tranches. The ministry has taken a series of reforms to ensure that the coal sector grows at a rapid pace and is able to meet the growing energy demand of the country.

The coal sector opened for commercial coal mining in 2020, with the first-ever successful auctions of commercial mining launched by the Prime Minister (PM). Since then, the ministry has conducted seven rounds and 91 mines have been auctioned, with a peak rated capacity of 221 million tons per annum (MTPA). Coal from these mines can be utilised towards own consumption, sale or for any other purpose. Of the 35 coal mines, 11 are under the CM (SP) Act 2015 and 24 are under the MMDR Act 1957. Among these, 14 coal mines are fully explored, while 21 are partially explored. Additionally, 4 coal mines are being offered under the second attempt of round 7.

CIL will auction fuel linkages for non-regulated sectors in the month of July every year, according to a tentative auction calendar released by the PSU. Each round of auction is expected to be completed within nine months from the date of commencement of the sale of linkages. The sequence of sub-sectors under non-regulated sector (NRS) linkage auction includes sponge iron, cement, captive power plant and steel (coking), according to CIL’s tentative calendar notice on NRS linkage auction.

Demand

According to Ministry of Power, India needs to add thermal coal-based power generation capacity of 80 GW against the 27 GW currently under construction as the peak power demand in the country would spike to 335 GW by 2030 from 241 GW at present.

CIL’s coal supply to electricity generating plants rose by 11 percent to 50.8 MT in October amid higher power demand in the festive month. The fuel supply by CIL to the power sector was 45.8 MT in October last fiscal. The higher supply of five MT was despite rain lashed across the mines of CIL's subsidiaries based in the eastern part of the country -- Eastern Coalfields Ltd (ECL), Bharat Coking Coal Ltd (BCCL), Central Coalfields Ltd (CCL) and partly Northern Coalfields Ltd (NCL) -- during the first week of October. In the first seven months of the current financial year, coal supply by CIL to the power sector increased by 15 MT to 346 MT from 331 MT a year ago, registering a growth of 4.5 percent. As per the maharatna firm, it is confident of breaching the annual supply target of 610 MT to the power sector. CIL produced 42 MT higher coal at 394 MT in the April-October period compared to 352 MT in the year-ago period.

Production

The Combined Index of eight Core Industries (ICI) has shown a significant increase of 8.1 percent (Provisional) in September 2023, compared to the same period in the previous year. The index of coal sector has showcased impressive growth of 16.1 percent reaching 148.1 points compared to 127.5 points during the same period last year. This is the highest growth in last 14 months except for August 2023. Coal production increased by 16.1 percent in September 2023 over September 2022. Its cumulative index increased by 12.2 percent from April to September 2023-24 over corresponding period of the previous year. Among the eight core sectors of the country, CIL’s contribution was significant in this growth. Coal stock at CIL’s pitheads, meanwhile, stood at 41 megatons ending October, almost 14 MT more than the same period last year providing a comfortable buffer to meet any increase in future demand.

The country’s coal production has picked up momentum in the last 15 days after unprecedented rains in early October in coal producing states, the government said. Total production of coal from all sources during the last 15 days is over 26.40 lakh tonnes (2.64 MT) per day. The trend of coal stocks at coal-based power plant, which was showing a depletion earlier, is now during the last 10 days registering an accretion trend indicating that the supply and receipt of coal at thermal plants is more than the consumption.

South Eastern Coalfields Limited (SECL) had surpassed 100 MT of coal dispatched for the current fiscal year, achieving a growth of 17.65 percent over the previous year when the CIL subsidiary dispatched 85 MT of dry fuel. Of the total dispatch, more than 80 percent went to the power sector, with the company sending around 81 MT of coal to thermal power plants across the country, according to the company. SECL’s Gevra mine, currently the largest coal mine in the country, contributed 30.3 MT, while Dipka and Kusmunda contributed 19.1 MT and 25.1 MT of coal, respectively. SECL’s Korea Rewa coalfield, where most of the old and underground mines are located, also made a notable contribution of 11.75 MT, an increase of about 20 percent compared to last year when the figure was 9.75 MT. SECL is one of the largest coal-producing subsidiaries of Coal India. The company produced 167 MT of coal and accounted for about one-fourth of CIL's total coal production in FY'23. This year, the company has set a target of 197 MT of coal production.

Rest of the World

China

China’s October coal output slipped by 1.1 percent from September’s six-month high, as mine safety inspections limited production. The world’s largest coal producer mined 388.8 MT of the fuel last month, according to data from the National Bureau of Statistics, though that was still up 3.8 percent from the year-earlier level. Analysts from the China Coal Transportation and Distribution Association (CCTD), an industry association, had previously warned output for the fourth quarter could be lower than anticipated given the inspections. Coal production over the first 10 months of 2023 reached 3.83 billion tonnes (3830 MT), up 3.1 percent compared with the same period last year.

Rest of Asia and Asia Pacific

US (United States) energy firm AES Corporation is in talks to sell its majority stake in one of Vietnam’s largest coal-fired power plants, as part of its global strategy to divest coal assets by the end of 2025. AES is one of the US largest investors in Vietnam, mostly involved in the coal power business there. Its divestment would come as chipmaker Intel, which also runs a major operation in the Southeast Asian nation, shelved a planned expansion there. AES had tried to sell its 51 percent stake in the 1.2 GW Mong Duong 2 coal-fired power plant in 2021 but the deal fell through after the company said it signed a sale agreement with a consortium led by an undisclosed "US-based investor". Vietnam wants to end power generation from coal by 2050, under commitments that have attracted funding pledges from Group of Seven (G7) members and were expected to be fine tuned at the UN Climate Change Conference in Dubai.

Glencore has agreed to buy a majority stake in Teck Resources’s coal business for US$6.93 billion, ending a months-long saga and setting the stage for the commodity giant to spin off its own coal unit. Glencore will own 77 percent, and steelmakers Nippon Steel Corp and Posco will hold the remainder of the business, the companies said. The deal implies an enterprise value of US$9 billion for Teck’s coal business. Glencore chief Gary Nagle said the Swiss miner remains committed to reducing emissions even though it is currently bankrolled by coal. The deal will pave the way for Glencore – the largest coal miner in Australia – to hive off its profitable but polluting thermal coal business and focus on mining metals such as copper, nickel and zinc. The company reiterated plans to split out the combined coal operations within about two years.

Europe

Germany’s hard coal importers want the Berlin government to prolong the operation of hard coal-to-power generation plants enlisted in last year's energy crisis beyond the targeted end of March 2024, the VDKi lobby said. VDKi, at a press conference in Berlin, said the fleet of regularly working hard coal power stations - totalling 18 GW - was well-prepared for winter, plugging gaps from Germany's complete nuclear exit in April. The government in 2022 temporarily allowed 6 GW of idled hard coal plants, including some operated by Steag and Uniper, to participate in the market should gas supply fall short of requirements.

The Kolubara coal mine in Serbia never closes - 24 hours a day, 365 days per year, excavators work around the clock gnawing away at the soil to extract the fossil fuel. Although most of the world is shifting away from using coal because of accompanying pollution, Serbia continues to rely on it, depending on coal for some 70 percent of its power. Aside from coal, a quarter of Serbia’s power comes from hydroelectric power stations, with the remaining fraction from renewable energy sources. The coal extracted at Kolubara reportedly powers enough stations to produce half of the country’s electricity, with more than 11,000 workers employed to extract between 26 MT and 27 MT of coal every year. But in places such as Serbia, which have relied on coal for decades and have limited resources for the investment required to switch to greener alternatives, weaning off the power source still seems like a distant project.

ONGC to charge premium over Brent in oil deals with BPCL and HPCL

27 November: Deregulation of the sale of domestically-produced crude oil appeared to be in favour of ONGC as the firm will charge a premium over Brent in oil deals with Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL). The ONGC has signed deals to sell about 4.5 million tonnes of crude oil each to BPCL and HPCL in which it will sell crude oil it produces from Mumbai offshore fields at a premium to international benchmark Brent. The oil has been priced at the prevailing Brent crude oil price plus 1 percent. Brent, which is trading at US$80, after the oil contract the ONGC would get US$80 plus US$0.8. ONGC produces 13-14 million tonnes per annum of crude oil from its fields in the Arabian Sea, off the Mumbai coast. In June last year, the government of India allowed firms like ONGC and Vedanta to sell locally produced crude oil to any Indian refinery for turning it into fuel, such as petrol and diesel, as it deregulated one of the last few avenues that were still under its control. While contracts for oilfields awarded since 1999 gave producers the freedom to sell oil, the government fixed buyers for crude produced from older fields, such as Mumbai High of ONGC and Ravva of Vedanta.

India’s crude oil output up 1.3 percent to 2.5 MMT in October: PPAC

23 November: India produced a total of 2.5 million metric tonnes (MMT) of crude oil in October 2023 - registering a growth of 1.3 percent compared to the year-ago period, according to Petroleum Planning & Analysis Cell (PPAC). Out of 2.5 MMT, Oil and Natural Gas Corporation (ONGC) produced 1.6 MMT of crude oil while Oil India Limited (OIL) and private sector producers contributed 0.3 MMT and 0.6 MMT, the oil ministry data showed. India’s crude oil imports rose in October, after falling in the previous four months, as the world's third biggest oil importer and consumer shipped in more fuel to meet winter demand. According to PPAC data, crude oil imports increased by 2.2 percent and by 0.6 percent during October 2023 and April-October 2023 respectively, compared to the corresponding period of the previous year. The net import bill for oil and gas was US$11.8 billion in October 2023 compared to US$11.9 billion in October 2022. Out of this, crude oil imports constitutes US$11.7 billion, liquefied natural gas (LNG) imports were US$1.2 billion and the exports were $3.6 billion during October 2023. The production of petroleum products was 21.8 MMT during October 2023 which is 4.2 percent higher than October 2022. Out of above 21.5 MMT, 21.5 MMT was from refinery production and 0.3 MMT was from fractionator.

IOC corners more than a third of D6 gas in latest RIL auction

28 November: Indian Oil Corporation (IOC) has cornered more than a third of natural gas that Reliance Industries Ltd (RIL)and its partner BP of the UK (United Kingdom) offered in the latest auction of the KG-D6 gas. IOC got 1.45 million metric standard cubic meter per day (mmscmd) out of the 4 mmscmd of gas auctioned last week. The oil refining and marketing company, which was the top bidder even in the previous two auctions of gas from the eastern offshore KG-D6 block of RIL-BP, bid the volumes as an aggregator on behalf of fertiliser plants. City gas companies including Torrent Gas and Gujarat Gas secured a total of 2.21 mmscmd of gas for turning into CNG for sale to automobiles and piped to household kitchens for cooking purposes. Gujarat Gas won the tender to buy 0.5 mmscmd, Torrent Gas 0.45 mmscmd, Adani Total Gas Ltd 0.29 mmscmd, IndianOil-Adani Gas Pvt Ltd 0.17 mmscmd and Indraprastha Gas Ltd and Mahanagar Gas Ltd 0.30 mmscmd each. RIL and BP auctioned 4 mmscmd of gas from the Krishna Godavari basin block starting 1 December 2023.

PNGRB adds Mizoram to 12th city gas bid round

27 November: Petroleum and Natural Gas Regulatory Board (PNGRB) has added Mizoram to the areas it has offered for bidding for a licence to retail CNG (compressed natural gas) and piped cooking gas in the latest city gas bid round. In a notice, PNGRB said in continuation of the bids invited on 13 October for the development of the city gas distribution network for seven geographical areas, electronic bids are invited for the same in the state of Mizoram. Last date of bidding is 23 February, it said.

India seeks to build strategic reserves by storing gas in depleted wells: GAIL

24 November: India is looking at building its first strategic natural gas reserves by using old, depleted hydrocarbon wells to store the fuel and hedge against global supply disruption, GAIL (India) Ltd said. The strategic facilities would be built in phases in India's western and northeastern regions with an initial capacity to store three to four billion cubic meters (bcm) of gas, GAIL said. India has five million tonnes of strategic petroleum reserves but no storage facilities for natural gas. Indian companies together currently hold two bcm of gas in pipelines and liquefied natural gas tanks for commercial use. GAIL said the first strategic gas storage facility would take three to four years to build after government approval. India aims to raise the share of natural gas in its energy mix to 15 percent by 2030 from about 6.2 percent. The nation consumes around 60 bcm gas annually.

Indian Oil to double Ennore LNG terminal’s capacity to 10 mn tpy

24 November: Indian Oil Corporation (IOC) aims to double the capacity of its liquefied natural gas (LNG) import terminal at Ennore in southern India, the company said. The company plans to expand capacity to 10 million metric tonnes per year (tpy) amid the growing demand for gas in the country, Jain told reporters at an industry event. India wants to raise the share of gas in its energy mix to 15 percent by 2030, up from the current 6.2 percent, as part of an effort to cut emissions. IOC hopes to boost local sales of gas to 20 million tpy by 2030, a substantial increase from the current 6.3 million tpy. Aside from the Ennore terminal, IOC has leased capacity in at least two local projects operated by other companies to import gas. India needs to sign more long-term LNG import contracts to ensure price stability, the company said. IOC recently signed two agreements for 14-year LNG import contracts worth US$11 billion, the company said.

India to step up coking coal shipments from Russia

28 November: India will step up imports of coking coal, a key material in steel manufacturing, from Russia, as cargoes from top supplier Australia drop and steel mills struggle with rising prices. Steel mills in India have struggled with patchy supplies of coking coal from Australia, which normally accounts for more than half of India's annual imports of around 70 million tonnes (MT). Last month, prices for Australian coking coal jumped 50 percent to over US$350 a metric tonne due to factors such as maintenance outages, lower than usual supplies from Queensland and a slower train network. Last year, India’s steel mills tried to boost coking coal shipments from Russia. But stringent economic sanctions against Moscow over the war in Ukraine affected Russian coking coal supplies to Indian mills. But, as Indian buyers and Russian suppliers smoothen payment mechanisms, India’s steel mills are set to boost coking coal supplies. India’s government-backed steel manufacturers Steel Authority of India Ltd (SAIL) and Rashtriya Ispat Nigam Ltd have opted for rupee settlement for Russian coking coal. SAIL is expecting four shipments of 75,000 tonnes of Russian coking coal each for the quarter ending December.

Government asks coal block owners to take necessary steps to operationalise mines

28 November: The government asked coal block owners to take necessary steps to operationalise mines that are at an advanced stage of commissioning. In FY24, India might produce 145 million tonnes (MT) of coal from commercial and captive blocks, that would help bring down the country’s import of fossil fuel. M Nagaraju, Additional Secretary and Nominated Authority, Ministry of Coal, asked the companies allotted coal blocks to take necessary steps to achieve production target of the current fiscal. The coal ministry clarified that post-cancellation of 204 blocks in the year 2014, the mines are being put on auction via a "transparent" mechanism. The clarification comes a day after Congress alleged that the Narendra Modi government reversed the long-standing policy of competitive auction for coal block allocation and gave away lucrative fields to the Adani Group. The coal ministry said that no correlation has been established between Cavill Mining Pvt Ltd and Adani Group.

J&K admin to purchase additional 500 MW of power to meet winter demand

27 November: The Jammu and Kashmir (J&K) administration approved the purchase of an additional 500 megawatt (MW) of power from the Centre to meet the winter demand. As winter approaches, J&K face electricity scarcity because of a low proportion of hydropower in the Union Territory, as water reduces in rivers. Singrauli-II being a thermal power station is a must-run station and the electricity generated by it fulfils the demand of J&K during winter when the generation from hydro generators of interstate generating stations goes down to 150-300 MW, a reduction of 70 to 90 percent as compared to the summer season.

India announces phased introduction of biogas blending for domestic use

25 November: India will start blending compressed biogas with natural gas to boost domestic demand and cut reliance on natural gas imports, the government said. The mandatory phased introduction will start at 1 percent for use in automobiles and households from April 2025, it said. The share of mandatory blending will then be increased to around 5 percent by 2028. India, which is one of the world’s largest importers of oil and gas, ships in about half of its overall gas consumption and wants to cut its imports cost. The government also aims to have 1 percent sustainable aviation fuel (SAF) in aircraft turbine fuel by 2027, doubling to 2 percent in 2028. The SAF targets will initially apply to international flights. The steps are aimed at helping India achieve net zero emissions targets by 2070.

Bundelkhand expressway to be UP’s first solar expressway

23 November: The Uttar Pradesh (UP) government is gearing up to set up solar plants on a 1700-hectare land along the Bundelkhand Expressway, aiming to develop it as the state’s first solar expressway to generate 550 megawatt (MW) of solar power. With this solar plant, the state government aims to supply electricity to one lakh houses along the expressway. The estimated lifespan of the project is 25 years. According to the state government, eight leading solar power developers gave presentations before government authorities on the project. These companies include Tusco Ltd, Torrent Power Ltd, Somaya Solar Solutions Pvt Ltd, 3R Management Ltd, Avaada Energy Ltd, Atria Brindavan Power Ltd, Erisha E Mobility, and Mahapreit.

Black Sea storm disrupts Russian and Kazakh oil exports

28 November: A severe storm in the Black Sea region has disrupted up to 2 million barrels per day (bpd) of oil exports from Kazakhtsan and Russia, according to port agent data. Oil loadings from Novorossiysk and the Caspian Pipeline Consortium (CPC) terminal in nearby Yuzhnaya Ozereyevka have been suspended. Kazakhstan’s largest oilfields - Tengiz, Kashagan and Karachaganak - are cutting combined daily oil output by 56 percent from 27 November as the storm disrupts loadings at CPC, the main export terminal for Kazakh oil, the Kazakh energy ministry said. The disruption is expected to lower Kazakhstan’s oil production by 631,700 metric tonens, it said. Russia’s Black Sea port of Novorossiysk, the largest Black Sea outlet for oil and products, remained closed for loadings on Tuesday, according to port agent data.

Sri Lanka to OK Sinopec’s US$4.5 bn refinery proposal

25 November: Sri Lanka will likely approve a proposal from Chinese state refiner Sinopec to build a US$4.5 billion refinery, the South Asian island nation’s Energy Minister Kanchana Wijesekera Said. Sri Lanka, trying to recover from its worst economic crisis in more than 70 years, is hungry for new investment and local fuel supplies. For Sinopec, the world’s top refinery by capacity and one of the largest petrochemical makers, the investment would mark a breakthrough in a long effort to expand beyond China’s borders. It owns refinery assets in Saudi Arabia and petrochemicals production in Russia. Sinopec will start basic engineering design, including finalising the size of the refinery and technical configuration, after getting official approval. The investment will add to Sinopec’s recently started fuel retailing business, the third international company with a foothold in Sri Lanka, with a license to operates 150 petrol stations. In August Sinopec and commodities trader Vitol were shortlisted by the Sri Lankan government to bid for the refinery. The refinery may target markets beyond Sri Lanka, where local fuel consumption is low, and use its partnership with China Merchants Port to expand bunker fuel supply at Hambantota, a deep-sea port near busy shipping lanes between Europe and Asia, analysts said. Sinopec’s fuel oil division, which runs the retail business there, began in 2019 supplying marine bunker fuel at Hambantota. Sri Lanka’s refinery at Sapugaskanda, commissioned in 1969, can process 38,000 barrels of oil a day.

UAE set to ramp up Murban crude exports in early 2024

24 November: The United Arab Emirates (UAE) will ramp up exports of Abu Dhabi’s flagship Murban crude early in 2024 as a new OPEC+ mandate kicks in and barrels are diverted to the international market owing to refinery maintenance, according to traders. That will add to increased output of other light sweet crude grades, including from fellow OPEC members Nigeria and Angola and non-OPEC countries such as the United States (US) and Brazil. The UAE production baseline under OPEC+ agreements is set to rise 200,000 barrels per day (bpd) to 3.219 million bpd in January. At the same time, maintenance work at Abu Dhabi’s 837,000 bpd Ruwais refinery means less crude demand domestically.

Slovakia gets Czech backing for exemption to Russian-origin oil products

24 November: Czech Prime Minister Petr Fiala said he supported Slovakia’s request to continue exports of fuel produced from Russian oil to the Czech Republic beyond a 5 December deadline. Slovnaft, Slovakia’s sole refiner, owned by Hungary’s MOL, has sought to cut the share of Russian oil in its processing activities this year to about 60 percent, from about 95 percent. The European Union (EU) has imposed sanctions on Russian crude, although Slovakia, the Czech Republic and Hungary have exemptions while they shift to new sources.

Canada oil, gas producers to drill 8 percent more wells in 2024

24 November: Canadian oil and gas producers will drill 8 percent more wells in 2024 to take advantage of greater access to pipelines, with the Trans Mountain oil pipeline expansion due to open, an industry group said. Conventional oil production accounts for a small portion – 14 percent on average this year - of Canada’s overall crude output, which comes mainly from oil sands. Canada is the world’s fourth-largest oil producer. Producers will drill 6,229 wells next year, up 481 from 2023, the Canadian Association of Energy Contractors predicted. The Trans Mountain expansion is scheduled to start shipping crude late in the first quarter of 2024, while the Coastal GasLink is approaching mechanical completion.

China oil demand growth poised to slow to around 4 percent in H1 2024

23 November: China’s oil demand growth is likely to ease in the first half of 2024 to around 4 percent, according to consultancies, with resurgent consumption from the aviation and petrochemical sectors offset by weaker diesel usage due to an ongoing property sector crunch. Slowing demand growth for the world’s biggest oil importer comes amid what remains an uncertain outlook for the Chinese economy and as travel patterns normalise following the post-COVID rebound earlier in the year. The Organization of Petroleum Exporting Countries (OPEC) foresees Chinese demand averaging 16.41 million barrels per day (bpd) in the first half of 2024, up 3.2 percent on 2023 levels, while the International Energy Agency (IEA) forecasts demand averaging 17.1 million bpd for the full year, to show 3.9 percent growth. Even though China’s economy has made a faltering recovery this year, oil consumption was still on course to set record highs, having been subdued between 2020-2022 by strict COVID curbs. OPEC and the IEA expect China’s oil demand to show growth in 2023 of 7.6 percent and 12.1 percent, respectively.

Australia Pacific LNG deliveries disrupted due to tanker outage

28 November: Shipments of liquefied natural gas (LNG) from Australia Pacific LNG (APLNG) have come to a halt after a loaded tanker docked at the site lost power, operator ConocoPhillips and co-owner Origin Energy said. APLNG, which has a capacity of 9 million metric tons per annum (mtpa) of LNG, can only take one vessel at a time and on average loads one tanker every three days.

Gas condensate exports from Russia’s Yamal LNG rise 16 percent in January-November

28 November: Exports of gas condensate, a kind of light oil, from Russia’s Yamal LNG field were up by 15.8 percent year-on-year in January-November at 880,000 metric tonens, according to LSEG ship-tracking data and traders. In November, gas condensate shipment from Yamal’s port of Sabetta reached 80,000 tonnes, down from 120,000 tonnes in October. Two tankers, Boris Sokolov and Yuriy Kuchiev, export gas condensate from Sabetta in the Arctic. Each of them is able to carry 40,000 tonnes of the product, mainly intended for Rotterdam and Terneuzen.

Delfin signs 15-year LNG supply agreement with Gunvor

27 November: Delfin Midstream Inc said it had entered into a long-term liquefied natural gas (LNG) supply agreement with global commodity trader Gunvor. Delfin said in a news release its LNG plant in Louisiana will supply between 500,000 to 1 million tonnes of LNG per annum to Gunvor on a free-on-board basis at Delfin Deepwater Port for at least 15 years. Delfin has been developing the Delfin LNG Deepwater Port project supporting up to four floating LNG vessels with a combined export capacity of about 13.3 million tonnes per annum (MTPA), the release said. The company secured commercial agreements for LNG sales, liquefaction services and is in the final phase towards final investment decisions (FID) on its first three floating LNG vessels.

Russia expects to reach agreement on gas hub project with Turkey soon: Deputy PM

25 November: Moscow and Ankara are set to reach agreement on the creation of a natural gas hub in Turkey in the nearest future, Russian Deputy Prime Minister (PM) Alexander Novak said. He said Russia’s Gazprom and Turkey’s Botas were cooperating closely and had been discussing the project road map. Russia last year proposed setting up a gas hub in Turkey to replace lost sales to Europe, playing into Ankara’s long-held desire to function as an exchange for energy-starved countries.

Germany builds up LNG import terminals

23 November: Czech utility CEZ has booked 2 billion cubic meters (bcm) of annual capacity at a yet-to-be build land-based terminal for liquefied natural gas (LNG) imported into Germany’s Stade from 2027, spurring the build-up of transport infrastructure and securing itself future energy supplies. Germany’s quest to increase LNG import capacity has intensified as it seeks to end reliance on Russian pipeline gas, on which the European region relied heavily prior to Moscow's invasion of Ukraine last year. Pending the provision of fixed terminals, Germany is using floating storage and regasification terminals (FSRUs) to help to replace piped Russian gas supplies. Three FSRUs are working at the Wilhelmshaven, Brunsbuettel and Lubmin ports after Germany arranged their charter and onshore connections.

Ukraine’s coal mines turn to women to solve wartime staff shortages

22 November: After more than a thousand of its workers went to fight Russia’s invasion, a coal mining enterprise in eastern Ukraine suffered a huge staff shortage. Its answer was to allow women to work underground for the first time in its history. For five months, she has worked as a technician 470 meters (1,542 feet) below ground, servicing the small electric trains that haul workers more than 4 kilometres (2.5 miles) from the lift shaft where they descend to the seams of coal. Ukraine’s coal industry, once one of the largest in Europe, has suffered decades of decline since the collapse of the Soviet Union. Russia-backed militias in eastern Ukraine took over many coal-rich regions in 2014. After the 2022 invasion, Russia occupied even more mines.

EU Commission announces electricity grid action plan

28 November: The EU (European Union)’s Energy Commissioner Kadri Simson announced an action plan to overhaul its 40-year-old electricity infrastructure to meet new renewable energy demands as the energy transition speeds up. The Commission expects EU power demand to rise 60 percent from this year until 2030 with more industry, home heating, cars and some hydrogen projecting adding to the mix. In wattage, this translates to an increase of 64 gigawatt (GW) by 2030 of cross-border transmission with an initial aim of adding 23 GW by 2025. The 27-member bloc has 93 GW of cross-border power connectors. The Commission also announced 166 new projects of common interest (PCI) with the majority in electricity and hydrogen. Being on the list is a precondition for projects to apply for EU funding in 2024. Half of the projects will modernise and better connect power networks and add new energy storage facilities, as well as cover 12 offshore projects in the North Seas, Baltic Sea and the Atlantic.

New York gets US$24 mn federal funding to bolster electric grid

27 November: New York has been awarded nearly US$24 million in federal funding to strengthen and improve the state’s electric infrastructure in order to minimize the effects of extreme weather and natural disasters, Governor Kathy Hochul said. The United States (US) Department of Energy’s Grid Resilience and Tribal Formula Grant under the Bipartisan Infrastructure Law will support projects that help ensure the reliability of the state’s power sector infrastructure and access to affordable and clean electricity. The grant money will be administered over a two-year period by the New York State Energy Research and Development Authority (NYSERDA) to harden the power grid against storms, improve forecasting tools, reduce carbon emissions, and make electricity cheaper, Governor said. More than half of the US and parts of Canada, home to around 180 million people, could fall short of electricity during extreme cold again this winter due to lacking natural gas infrastructure, the North American Electric Reliability Corporation (NERC) said.

China braces for record winter electricity demand

24 November: China is expecting record consumption of both power and gas in the winter of 2023/24, but supplies should be adequate, with only localised shortages, as a result of major fuel accumulation over the summer months. Peak electricity demand may increase by as much as 140 million kilowatts (12 percent) compared with winter 2022/23, the National Energy Administration (NEA) said. Power consumption has rebounded sharply as the country has lifted lockdowns and emerged from the exit wave of the coronavirus epidemic. But generation is expected to be sufficient except for some local shortages, principally in Yunnan in the southwest and parts of Inner Mongolia in the northwest. Planners have been anxious to avoid a repeat of the fuel and power shortages that occurred in the autumn and winter of 2021/22. The NEA said power generators’ inventories should be maintained at 200 million tonnes (MT), up from 170 MT a year ago. To maintain electric reliability nationwide, hydro generators have been instructed to impound sufficient water to maintain output through the winter dry season. Total generation increased by 5 percent or 375 billion kilowatt hour (kWh) in the first ten months of the year compared with the same period in 2022.

Brazil signs on to global climate deal to triple renewable energy

24 November: Brazil has signed onto an agreement to triple renewable energy globally by 2030 and shift away from using coal, the country’s foreign ministry said, joining a prospective deal backed by the European Union, US (United States) and United Arab Emirates. Brazil is already a major player in renewable energy. More than 80 percent of the country’s electricity comes from renewable sources, led by hydropower with solar and wind energy expanding rapidly. While Brazil supports tripling renewables globally, mathematically it is not possible domestically, the ministry said.

Indonesia launches first carbon storage project in West Papua

24 November: Indonesia’s President Joko Widodo launched construction of a carbon capture, utilisation and storage (CCUS) project in West Papua province operated by BP Plc, the country’s first carbon storage project. The CCUS project has the potential to store up to 1.8 gigatonnes of carbon dioxide, Energy Minister Arifin Tasrif said. In September, the energy ministry said BP will invest US$2.6 billion in the project, with the first carbon injection expected in 2026. Indonesia is keen to develop CCUS and carbon capture and storage (CCS). It has an estimated carbon storage capacity of 8 gigatonnes in depleted oil and gas reservoirs and 400 gigatonnes in saline aquifers. Energy ministry data shows there are currently 15 CCS and CCUS projects in various stages of preparation in the country with a combined investment of nearly US$8 billion, including BP’s project.

Global fossil fuel subsidies on the rise despite calls for phase-out

23 November: World governments agreed at the COP26 climate summit in Glasgow two years ago to phase out "inefficient" fossil fuel subsidies to help fight global warming. Since then, however, global fossil fuel subsidies have risen US$2 trillion to US$7 trillion, according to the International Monetary Fund, as governments around the world moved to protect consumers from rising energy prices. At this year’s climate gathering in Dubai, EU (European Union) countries will be looking to harden the COP26 deal to phase out the subsidies by pushing for a deadline of 2030 to get it done, but it is unclear how much support the proposal will gain. EU governments were among those that have increased support for fossil fuels since Glasgow, mainly as a response to energy security concerns following Russia’s invasion of Ukraine.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.