COAL MINING SURVIVES VIRAL ATTACK

Monthly Coal News Commentary: March 2020

India

Auction and Allocation

Parliament passed a bill that will remove end-use restrictions for participating in coal mine auctions and open up the coal sector fully for commercial mining for all domestic and global companies. The Mineral laws (Amendment) Bill was passed in Rajya Sabha with 83 MPs voting in its favour and 12 against. The Lok Sabha has passed the bill. The legislation is expected to help in bring more FDI in the coal and mining sector, and boost economy. According to the coal Ministry India has one of the largest reserves of coal in the world and if it is not mined it would turn into "mud".

Domestic Production & Demand

Coal stocks at power plants stand at 41.8 mt equivalent to 24 days consumption as of 26 March 2020. CIL has postponed its annual stock measurement from 1 April to 15 April, following advisory issued by the government and cancellation of train movement due to threat posed by outbreak of pandemic COVID-19. Every year, CIL engages an external agency to take stock of inventory at some 360-odd mines operated by its seven coal producing subsidiaries. According to a notice issued by CIL physical stock measurement is to be completed shortly. CIL is also working on the possibility of using drone to measure its inventory to accumulate data faster. Amid concerns that CIL may fall short of its 660 mt production target for the current fiscal, the miner has planned to ramp up daily output to meet the goal. Till December, the miner is expected to produce close to 390 mt of coal and will require another 270 mt in the last quarter of this fiscal to meet the annual production target. Currently, CIL produces 1.8 mt per day while the asking rate to achieve the target is 2.9 mt. Internally, CIL has planned to raise its production to 3 mt per day at least in February and March next year to inch closer to the target. In 2018-19, CIL produced 606.89 mt while dispatch was at 608.14 mt. CIL’s single-day production peaked to a new high of 3.17 mt on 20 March. The figure surpassed the biggest single-day output of 3.14 mt in March last year. Output could have been even higher, but for a disruption at the Lingaraj mine of Mahanadi Coalfields Ltd. CIL is likely to register a 13 percent on-year rise in production in February to 66 mt. The world’s largest miner had produced 58.05 mt in the corresponding month a year ago. Cumulative production for the April-February period is expected to be 517.5 mt. Offtake, however, continues to be muted. It is likely to be 54.5 mt in February, a growth of nearly 6 percent on a year-on-year basis.

With the coal production in all its 18 opencast and 27 underground mines coming to a halt for 24 hours the SCCL plans to achieve the target appear to have become increasingly difficult. The public sector coal company has produced 64.4 mt of coal during 2018-19 and the company management had fixed a pragmatic target of 66 mt for 2019-20. However, production of coal has been less than that was achieved during the August-February period of the current fiscal, compared to the same period last year, mostly due to heavy rains in August and September. Although the production has been halted for a good cause, as an attempt to break the chain of coronavirus spread, the chances of achieving the target for this fiscal appear bleak. The company has achieved 58.1 mt of coal production till February-end. With less than nine days time left in the current financial year, achieving 7.9 mt production for the month of March appears a huge task now with the average daily production coming to 255,000 tonnes during the month. Except for the first four months of the current fiscal, the monthly coal production by Singareni has been lesser in the range of 3.93 percent to 17.1 percent during the August-February period of 2019-20 compared to the same period a year before. The daily average production fell to as low as 1.29 lakh tonnes in July last and the maximum of 190,000 tonnes was achieved in May last. SECL, the largest coal producing subsidiary of CIL, became the first coal company to produce 1 mt of dry fuel in a single day amid the countrywide lockdown to contain coronavirus. Coal mining activity and its transportation has been declared as Essential Service during the lockdown due to COVID-19 outbreak. Owing to huge production loss due to deluge in the mines this monsoon, the SECL output in this year is likely to fall short of its previous year’s production of 157 mt. But it will able to surpass the 150 mt mark and retain the top producer rank among the six CIL subsidiaries. The SCCL has sought approval from the MOEF&CC for mining within a 10 km radius of Shivaram Wildlife Sanctuary in Peddapalli district. Though the mine is almost 7 km away from the sanctuary, it falls under the proposed eco-sensitive zone. However, the environment ministry is yet to notify the zone. If the project is approved, the new coal mine will occupy 195 hectares of the eco-sensitive zone and 173 hectares of space outside the zone. SCCL, the only coal producing company in south India jointly owned by the state and central governments, has been carrying out mining for more than 130 years. It currently operates 29 underground and 19 opencast mines in six districts — Kumaram Bheem, Mancherial, Peddapalli, Jayashankar Bhupalapalli, Bhadradri Kothagudem and Khammam.

CIL’s receivables from power companies crossed ₹138 bn in February, increasing almost 71 percent since April 2019. CIL is alleging that power producers are disputing and refusing to pay incentives accrued for supplying coal beyond annual quota and revised logistics rates since 2017. A set of state-government owned power plants from Uttar Pradesh, West Bengal, Andhra Pradesh, Tamil Nadu and Rajasthan are not paying dues regularly on time which has inflated the overall receivables. All this has bloated the total receivables by ₹57 bn this year. CIL executives are in talks with its customers for bringing down the sum. Fuel supply agreements signed with power companies by CIL include a clause that requires generators to pay an incentive in the form of a premium over notified price, predetermined in the agreement if the dry fuel producer supplies more than 90 percent of the annual contracted quantity for some plants and 75-80 percent for a different set of plants.

Imports

India’s coal imports registered a decline of 14.1 percent to 17.01 mt in February in the wake of the coronavirus outbreak, as per industry data. The country’s coal imports in February last year stood at 19.82 mt, according to a provisional compilation by mjunction services, based on monitoring of vessels' positions and data received from shipping companies. Of the total imports in February 2020, non-coking coal was at 12.25 mt, against 12.38 mt imported in January 2020. Coking coal imports were at 3.15 mt in February 2020, down from 3.95 mt imported a month ago. However, the country’s coal imports registered an increase of 3.7 percent to 221.56 mt in April-February period of the ongoing fiscal. India had imported 213.63 mt of coal in the year-ago period, according to the report by mjunction services. During April-February 2019-20, non-coking coal imports stood at 152.9 mt, slightly higher than 150.11 mt imported during the same period last year. Coking coal imports were at 44.3 mt during April-February 2019-20, as against 44.19 mt imported during the same period a year ago.

Coking Coal

While output of iron ore, another key raw material for the steel industry, in the country is sufficient to meet the current demand, the entire demand of coking coal is not met from domestic production as the availability of high-quality coking coal (low-ash coal) in the country is limited and, thus, no option is left but to resort to import of coking coal. Efforts are being made to import coking coal from the US, Russia and Mongolia to diversify the coking coal import sources. Two coking coal mines Rohne and Rabodih were allocated to steel central public sector enterprises NMDC and RINL. Long-term linkage of raw coking coal was granted to Steel Authority of India Ltd from BCCL and lease of Tasra coking coal block was extended in favour of SAIL.

Regulatory Environment

A committee of the National Green Tribunal has approved transportation of 200,000 tonnes of coal in Meghalaya on condition that safety and environment norms will be followed. The state is likely to benefit by least ₹200 mn as revenue from the process. Of the total auction, 10 percent of the bid value will be deducted by CIL at source while the rest will be transferred to the state government after which royalties will be deducted. The remaining money will be transferred to the respective coal stock owner. Illegal extraction or transportation of coal, if found, will attract legal actions under section 21 of the MMDR Act 1957 (that include a penalty of at least 5 years imprisonment). Different temporary depots will be set up across the state to ensure that strict environmental norms will be followed during the auctions and during transportation of coal.

The Maharashtra Appellate Authority for Advance Ruling for GST has passed an order to exclude the Sajjan Jindal-led JSW Energy from paying GST on steam coal and said that the Group’s flagship steel manufacturing arm, JSW Steel will bear the cost while procuring the coal, in what is seen as a significant clarification as it avoids the spectre of double taxation for the group companies. The Sajjan Jindal-led companies JSW Steel and JSW Energy are two separate legal entities that had entered into a job work contract. Where the steel arm was to supply coal to the energy company and the resultant electricity is used in the manufacturing of steel. In this transaction, GST was levied first on JSW Steel and then when the coal is supplied to the energy company there was another GST payment levied on JSW Energy.

Rest of the World

Global Trends

Global coal power plant development declined for the fourth year running in 2019, while a total of 13 GW of capacity construction has been delayed so far this year due to the coronavirus, research by environmental organizations shows. The annual survey of the global coal plant pipeline by Global Energy Monitor, Greenpeace International, the Sierra Club and the Centre for Research on Energy and Clean Air showed a 16 percent drop last year in capacity under construction and development. This year, 15 plants with a total capacity of 13 GW have so far been delayed by workforce or supply chain issues related to the coronavirus outbreak. However, China’s approval of permits for coal plants has increased in an effort to stimulate its economy. From 1 to 18 March this year, China approved more coal-fired capacity for construction (6.6 GW) than during all of 2019 (6.3 GW). Even with the overall fall in coal plant development in 2019, the world is not on track for the steep reductions in coal power necessary to meet goals to limit global warming, the report said. Scientists have said coal use needs to fall 80 percent by 2030 to keep global warming below 1.5 degrees Celsius. Globally, the amount of power generated from coal in 2019 declined by 3 percent compared with 2018, with coal plants now operating at an average 51 percent of their available operating hours, which is a record low. New coal plant developers face increasingly difficult conditions as restriction on investment have come from banks and insurers, as well as government commitments to phase out coal.

British hedge fund billionaire Chris Hohn has launched a campaign to persuade central banks to starve hundreds of planned coal-fired power plants around the world of finance, aiming to block the projects before they can pose a threat to the climate. Investors are also concerned about possible risks to valuations of coal, oil and gas companies if governments decide to start rapidly cutting carbon emissions in line with the 2015 Paris Agreement to combat climate change. Hohn also urged regulators to force banks to publicly disclose their exposure to coal. London-listed power generator ContourGlobal has scrapped plans to build a coal-fired power plant in Kosovo, a decision welcomed by environmental groups, and said it would make no further coal plant investments globally. ContourGlobal also ruled out any further coal investments.

China

China’s coal output in the first two months of 2020 fell 6.3 percent from the same period a year earlier as the coronavirus outbreak stopped miners from getting back to work after the Lunar New Year holiday was extended in a bid to contain the epidemic. China churned out 489.03 mt of coal over January and February, down from 513.67 mt in the same period last year, data from the National Bureau of Statistics showed. To ensure sufficient coal supplies for power utilities, the central government had urged miners to resume production and rail companies to ensure enough capacity for shipping coal. The National Energy Administration said that production had reached 83.4 percent of total coal mining capacity as of 3 March. Port prices for Chinese thermal coal with energy content of 5,500 kilocalories per kg fell to 560 yuan ($80.03) a tonne from 576 yuan in mid-February when miners started to return for work. China imported 68.06 mt of coal in January and February combined, up 33.1 percent from a year ago, as some coal shipments that were unable to be cleared by Chinese customs in December arrived in early January. Gutted factories, rusting pickaxes and crumbling homes that will soon be abandoned dot the scarred hills in Mentougou -- home to Beijing's last coal mine slated to close this year as the city battles choking smog. One of China’s oldest mining towns, it has powered the capital for nearly 300 years. But more than 270 coal mines in the area have been shut down over the past two decades, as China has scrambled to cut carbon emissions and switch to renewables. According to Beijing Jinmei Group, the state-owned enterprise that owns the mines near the capital, the government-mandated closures will mean the loss of 6 mt of coal production capacity and the "resettlement" of more than 11,000 workers, mostly migrants. Miners suffering from lung diseases after inhaling coal dust are also stuck in this dilapidated town southwest of Beijing, because their government health insurance only covers treatment from hospitals in the area. China accounts for half of the world's demand for coal and almost half of its production. But the country is switching to greener sources of energy to fight chocking smog and reverse the environmental damage from its coal addiction.

Rest of Asia

Mitsubishi UFJ Financial Group sold off its $85 mn loan to Glencore’s WICET in Australia to a hedge fund at about 52 cents on the dollar. The costly decision at a time of extreme market volatility extinguishes MUFG’s exposure to the coal-related asset ahead of the bank’s financial year-end on 31 March. WICET, the world’s most expensive coal terminal, is owned by Glencore Plc and four partners, including New Hope Corp, China’s Yancoal, Coronado Global Resources, and Baosteel arm Aquila Resources. The coal terminal is funded entirely by debt backed by port fees. It owes $2.6 bn in senior debt due September 2026, A$383 mn ($227.96 mn) in junior debt and a A$575 mn shareholder loan maturing in 2020 and 2046 respectively.

The Indonesian government set its coal benchmark price (HBA) for March at $67.08/tonne, higher than $66.89 in February. The benchmark price COAL-HBA-ID rose slightly as coal mine operations in China were affected by the coronavirus epidemic. Indonesia’s government will revoke rules requiring exporters of coal and palm oil to use national shipping companies for the shipments. Indonesia, the world’s biggest thermal coal exporter, in 2018 issued regulations requiring its coal and palm oil exporters to use domestic shipping companies starting in May.

USA

The coal industry’s main US lobby group has asked for sweeping financial assistance to help mining companies weather the economic fallout of the coronavirus, according to a letter to President Donald Trump and the leaders of Congress. The request adds the ailing coal industry to a long list of businesses vying for a bailout to counter the impact of the global pandemic, which has infected more than 227,000 people worldwide, decimated travel and forced massive disruptions in daily life around the world. In the letter, the National Mining Association asked Trump, House of Representatives Speaker and Senate Majority Leader to ensure that "coal companies have access to the necessary cash flow they need to continue operations." The coal industry has sought several federal interventions to help it reverse a slide in demand over the past decade as aging plants retire. The US Federal Trade Commission has rejected a proposed JV between Peabody Energy and Arch Coal, the two largest coal-mining companies in the US, considering that such a JV would eliminate competition. In June 2019, Peabody Energy and Arch Coal announced plans to set up a joint venture (with respective stakes of 66.5 percent and 33.5 percent) to combine their assets in the Southern Powder River Basin and Colorado. This includes Peabody’s North Antelope Rochelle Mine and Arch’s Black Thunder Mine, the Caballo, Rawhide and Coal Creek mines in Wyoming and the West Elk and Twentymile mines in Colorado.

S America

Coal production in Colombia, the fifth-largest coal exporter in the world, fell 2 percent to 82.2 mt in 2019 after output at one of the principle mines declined and operations were interrupted by droughts, the government said. In 2018, the South American country recorded coal production of more than 84.2 mt. A judicial ruling prevented the extension of mining operations at Cerrejon, a coal mine in the La Guajira province which is jointly owned by BHP Group, Anglo American and Glencore. As well as the Cerrejon mine, the Colombian coal industry is dominated by Drummond and Prodeco, which is a unit of Glencore. The majority of members at two unions of Colombian coal miner Cerrejon voted in favor of a strike relating to a dispute over pay and benefits in the contract. A strike at Cerrejon, which is owned equally by BHP Group, Anglo American and Glencore, could cut the company’s coal production and sales outside of Colombia, the fifth biggest coal exporter in the world. Coal is the second largest generator of foreign currency for the Andean country after oil. Cerrejon is trying to reduce, freeze and eliminate benefits for employees using the fall in coal prices as an excuse while ignoring the depreciation of the Colombian peso against the dollar. The company exported 26.3 mt of coal in 2019 and has 5,896 workers, of which 4,600 are union members. The last strike at Cerrejon was in February 2013 and lasted 32 days. Last year, coal prices fell to an average of $51.40/tonne, down from $82.50/tonne in the previous year, according to the mining and energy ministry. The biggest union at the Cerrejon coal mine in Colombia pulled back from launching a previously approved strike and withdrew its demands regarding pay raises and other benefits. The decision by union Sintracarbon extends previously agreed benefits with the company until 30 June this year. An initial 20 days of new negotiations will begin in May. Last year, coal prices fell to an average of $51.40/tonne, from $82.50/tonne in the previous year. Coal is the second largest generator of foreign currency for the Andean country after oil. The company, which has reduced its operations to control the spread of coronavirus, exported 26.3 mt of coal in 2019 and has 5,896 workers, of which 4,600 are union members.

Canada

Canada’s Brookfield Asset Management has put the $2 bn sale or potential listing of its coal export terminal in Australia on hold due to travel restrictions amid the spread of coronavirus. The decision makes the Dalrymple Bay Coal Terminal the largest and most high profile corporate transaction in Australia to fall victim to the volatile financial market conditions sparked by the epidemic.

Russia

Russian businessman Albert Avdolyan has reached an agreement to buy a 49 percent stake in the major Elga coal project in Russia from Russian lender Gazprombank, the bank said. Avdolyan’s company A-Property is still in talks to buy the remaining 51 percent in the project from Russian steel and coal producer Mechel. For Mechel, Elga is the biggest growth asset, but it confirmed that it was in talks to sell it to reduce the debt burden. Elga, one of the world’s biggest coking coal deposits, requires further investments to develop. Mechel’s net debt stood at 400 bn rubles ($5 bn) at the end of 2019, mainly to Gazprombank and another bank, VTB.

Australia

Rio Tinto said it had found several cases where Australia’s biggest mining industry body advocated for thermal coal in contravention of 2015 Paris climate goals, as it released a review of its membership in industry groups. The review comes as investors ramp up pressure on major carbon-linked companies to drop support for thermal, or energy coal, which can be substituted for renewable energy, if the world is to meet the Paris climate accord goals. While Rio sold off its coal assets for billions over 2017-2018, it is the world’s largest producer of iron ore, a key raw material for the steel industry, one of the world’s biggest emitters.

S Africa

South African power utility Eskom said that coal stocks at its power stations were healthy, with at least 20 days of supplies at all stations, before a nationwide lockdown over the coronavirus outbreak. Eskom said all its activities were considered “essential services” under labour law and that it would apply for an exemption from the 21-day lockdown for critical staff. It has asked coal miners, coal transporters and freight company Transnet to continue coal supply operations during the lockdown.

| CIL: Coal India Ltd, FDI: foreign direct investment, MP: Members of Parliament, mn: million, bn: billion, mt: million tonnes, SCCL: Singareni Collieries Company Ltd, SECL: South Eastern Coalfields Ltd, MOEF&CC: Ministry of Environment, Forest and Climate Change, km: kilometre, US: United States, BCCL: Bharat Coking Coal Ltd, GST: Goods and Services Tax, WICET: Wiggins Island Coal Export Terminal, JV: joint venture |

NATIONAL: OIL

Vedanta cuts oil production at its Rajasthan block by a tenth

7 April. Vedanta has cut oil production at its prolific Rajasthan block by a tenth as refiners, faced with deep demand destruction due to nationwide lockdown, have reduced intake, India’s largest private sector oil producer has said. The production has fallen to 160,000 barrels of oil equivalent per day (boepd) from 180-190,000 barrels, Vedanta said. Vedanta didn’t name customers who have cut intake. Indian Oil, Nayara Energy and a couple of other refiners are Vedanta’s key oil customers.

Source: The Economic Times

Cairn asks government to revisit oil taxation regime

7 April. With taxes and government profit share eating away more than three-fourth of revenue, India’s biggest private oil producer Cairn Oil and Gas has sought a review of taxation system during low oil price regime, saying funding exploration will be difficult in the present scenario. Vedanta Ltd said the government levies 20 percent cess on oil price realised and an equivalent amount has to be paid to the state government in royalty. Vedanta said the outbreak of COVID-19 has cost the company 50,000 barrels of oil and oil equivalent gas in production. The company was producing 1,80,000 barrels of oil and oil equivalent gas (boepd) from its flagship Barmer oil and gas fields in Rajasthan before it took a maintenance shutdown in February. The shutdown was meant to hook up a new project that could have helped ramp up production further but it could achieve only 1,60,000 boepd.

Source: Business Standard

Fitch downgrades Cairn India to 'B+' on lower oil prices

6 April. Fitch Ratings said it has downgraded ratings of Vedanta Group firm Cairn India Holdings Ltd’s rating as a drop in oil prices will hurt earnings of the company. Fitch downgraded the Long-Term Issuer Default Rating (IDR) of Cairn India Holdings Ltd (CIHL) to 'B+' from 'BB-'. It revised down its price assumptions for zinc, aluminium and oil and gas, which together contribute about 90 percent of Vedanta Resources Ltd (VRL)’s, previously known as Vedanta Resources PLC) pre-tax profits. VRL is the parent of Vedanta Ltd (VLTD), India’s largest private upstream oil and gas producer, which fully owns CIHL. Fitch expected the EBITDA contribution from oil and gas business to drop by about 45 percent in FY21 and 20 percent in FY22 due to falling oil prices and volume growth. CIHL also expects further cost cuts, as contractor prices are typically negotiated lower in case of a persistent low oil-price environment, it said. VRL, it said, has the ability to defer capex for some of its oil and gas and other mineral projects to mitigate a drop in cash flow from the low-price environment.

Source: Business Standard

ONGC sells June-loading Russian Sokol crude at record discount

6 April. Indian oil explorer ONGC (Oil and Natural Gas Corp) Videsh Ltd has sold one cargo of Russian Sokol crude for loading between 2-8 June at a record discount of around $8 a barrel to Dubai quotes. ONGC sold a Sokol crude cargo 22-28 May at a spot premium of around $3.20 a barrel to Dubai quotes.

Source: Reuters

Volatility in oil prices, uncertain petroleum demand impacting Indian OMCs

3 April. Volatility in crude oil prices and an uncertain petroleum demand over the last fortnight have come as a cause for concern for Oil Marketing Companies (OMCs). US (United States) President Donald Trump had indicated a production cut agreement of 10 mn barrel per day (bpd) to 15 mn bpd. Owing to the fall in demand, reports suggest that companies like India Oil Corp (IOC) and Hindustan Petroleum Corp Ltd (HPCL) have already issued force majeure notices to certain suppliers. Not everyone, however, is convinced the move will help significantly.

Source: Business Standard

IOC’s Mathura refinery ramps up LPG production amid lockdown

2 April. Indian Oil Corp (IOC)’s Mathura refinery has enhanced the production of liquefied petroleum gas (LPG) owing to a sudden spurt in demand for the cooking fuel amid the nationwide lockdown to contain the spread of coronavirus. All precautions are being taken to protect our employees amid the coronavirus outbreak, however, the "round the clock" production of fuel has not been affected, Arvind Kumar, Executive Director of the refinery, said. The Union government had set a deadline for rolling out BS-VI compliant fuel by 1 April 2020, however, Mathura refinery achieved the target on 1 February 2020 despite being shut for in December 2019 and January 2020 for revamping its units, Kumar said.

Source: The Economic Times

Oil producers knock government’s door, seek relaxation in royalty, cess

2 April. Domestic oil and gas operators have approached the government seeking a reduction and deferment of royalty, cess and profit petroleum paid by companies to the government, with the Covid-19 pandemic hitting demand and pushing international crude prices to new lows. In addition, companies batted for a higher gas price compared to the existing $2.39 a million metric British thermal unit (mmBtu), effective from April to September this year. In a letter to the finance ministry, the Association of Oil and Gas Operators said oil and gas operations are now unviable owing to the higher share of government taxes. The industry body’s move comes after a decline in oil prices by around 60 percent since 1 January, leading to a 97 percent decline in operator revenue.

Source: Business Standard

No shortage of petrol and LPG in Chhattisgarh: IOC

2 April. Indian Oil Corp (IOC) has assured residents of the state that there was no shortage of petrol and diesel or LPG (liquefied petroleum gas) cylinders across Chhattisgarh and there is no need for any panic buying. Consequent to lockdown, initially there was a spike in the LPG cylinder refill booking by around 30 percent during 24 to 26 March which got tapered down to normal levels, now. All of our LPG bottling plants in the state are functioning at more than 120 percent of their rated capacity and are following due precautions adhering to health protocols. Also, all our LPG distributorships are fully operational, Santosh Kumar, chief divisional retail sales manager, Raipur divisional office, IOC and State Level Coordinator for Oil Industry in Chhattisgarh, said. LPG Customers are advised not to resort to panic booking as we have sufficient stocks. They can book their refills without visiting showrooms, as all of our other modes of refill booking viz: SMS / IVRS/ Whatsapp / website/ mobile app are operational and working fine, he said.

Source: The Economic Times

IOC declares force majeure on oil purchases from Saudi, UAE, Iraq, Kuwait

1 April. IOC (Indian Oil Corp) has declared force majeure on crude purchases from four of its biggest suppliers - Saudi Arabia, Iraq, UAE (United Arab Emirates) and Kuwait - as refinery run rates have been cut down in view of plummeting fuel demand following a nationwide lockdown. IOC has asked the four suppliers to defer some of the volumes they were to deliver in April. The company has reduced processing at its refineries by at least one-fourth as shutting down of businesses, suspension of flights and most vehicles staying off road due to the 21-day nationwide lockdown has led to drastic fall in demand. Petrol sales fell 8 percent in March compared to February, while diesel demand was down 16 percent.

Source: The Economic Times

LPG cylinders cheaper by up to ₹65, second price cut in two months

1 April. Amid the nationwide coronavirus lockdown, LPG cylinder prices were cut by up to ₹65 per cylinder. The price cut follows the huge fall in global crude prices over the past few weeks. As per IOC (Indian Oil Corp)’s revised rate list that was made public, the 14.2 cylinder will cost ₹744 in Delhi, down ₹61.5 from the last list (₹805.5 per cylinder). For Kolkata the new rate is ₹774.5 (earlier price 839.5), for Mumbai ₹714.5 (earlier price ₹776.5), and for Chennai 761.5 (earlier price ₹826). Rate

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Loss of revenue on new gas price is detrimental to domestic gas producers!

< style="color: #ffffff">Ugly! |

revision is the second consecutive fall in cylinder prices in the past two months.

Source: The Economic Times

India switches to world’s cleanest petrol, diesel with no increase in prices

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Switchover to world’s cleanest petrol & diesel will reduce pollution!

< style="color: #ffffff">Good! |

1 April. India joined a select league of nations having the world's cleanest petrol and diesel as oil companies rolled out Euro-VI emission compliant fuels without either disruption or a price increase. Leapfrogging from BS-IV grade fuel straight to BS-VI grade, equivalent to Euro-VI fuel, petrol and diesel would have resulted in an up to ₹1 per litre increase in cost but oil companies decided against passing this on to consumers and instead adjusted it against the reduction warranted from international oil prices plummeting to a 17-year low. Oil companies have not changed petrol and diesel price for over a fortnight now as they first adjusted the reduction warranted against the ₹3 per litre increase in excise duty and now are setting off the increased cost of BS-VI fuel. Petrol and diesel rates were last revised on 16 March. A litre of petrol in Delhi comes for ₹69.59 and diesel is priced at ₹62.29. Indian Oil Corp (IOC) said the switch over from BS-IV to BS-VI was achieved in just three years, a feat not seen in any of the large economies around the globe. India will join the select league of nations using petrol and diesel containing just 10 parts per million of sulphur as it looks to cut vehicular emissions that are said to be one of the reasons for the choking pollution in major cities.

Source: Livemint

NATIONAL: GAS

ONGC to lose ₹40 bn on new gas price, seeks freeing of gas prices

2 April. Oil and Natural Gas Corp (ONGC) will lose about ₹40 bn in revenue and start making cash losses after the government slashed the natural gas prices by a steep 26 percent by benchmarking it against rates prevalent in gas-surplus nations. Prices of natural gas, which is used to produce fertilizer, generate electricity and gets converted into CNG (compressed natural gas) for use in automobiles and piped natural gas for household cooking, was from 1 April cut to ₹2.39 per million metric British thermal unit (mmBtu) - a rate about 37 percent lower than the cost of production. The BJP-led government had in October 2014 evolved a new pricing formula using rates prevalent in gas surplus nations like the United States, Canada, and Russia to determine the price in a net importing country. Prices using this formula are calculated semi-annually. Oil Minister Dharmendra Pradhan had said that the cost of production of natural gas in the prolific Krishna Godavari basin is between $4.99 -7.30 per mmBtu. The same for other basins is in the range of $3.80-6.59 per mmBtu, he had said. For ONGC, which produces most of its 64 million standard cubic meters per day of gas from western offshore, the breakeven is around $3.8. On 1 April, the gas price was reduced from $3.23 per mmBtu to $2.39 - an 84 cent reduction which translates into annual ₹40 bn of revenue loss. The price of gas produced from difficult fields such as deepsea too has been cut to $5.61 from $8.43 per mmBtu. This would just about breakeven ONGC’s new production from KG basin.

Source: The Economic Times

IGL cuts CNG, PNG prices

2 April. Indraprastha Gas Ltd (IGL), the city gas distributor in Delhi and National Capital Region (NCR), announced a cut of ₹3.20 per kilogram (kg) in the consumer prices of Compressed Natural Gas (CNG) in Delhi and ₹3.60 cut per kg in Noida, Greater Noida and Ghaziabad. It also announced a cut in piped natural gas (PNG) prices with effect from 1 April 2020. The consumer price of PNG in Delhi has been cut by ₹1.55 per standard cubic meter (scm) from ₹30.10 per scm to ₹28.55 per scm, while the price of domestic PNG in Noida, Greater Noida and Ghaziabad would be ₹28.45 per scm, which has been reduced by ₹1.65 per scm from ₹30.10 per scm. In Rewari, the applicable price of domestic PNG would now be ₹28.60 per scm, which has been decreased by ₹1.55 per scm. IGL supplies PNG to over 9 lakh households in Delhi and over 4.5 lakh households in Noida, Greater Noida, Ghaziabad and Rewari. With the revised price, CNG would offer over 56 percent savings towards the running cost when compared to petrol driven vehicles at the current level of prices. When compared to diesel driven vehicles, the economics in favour of CNG at revised price would be over 32 percent, IGL said.

Source: The Economic Times

NATIONAL: COAL

CIL extends payment deadline till 21 April

6 April. Aiming to lower the payment burden on its consumers amid the ongoing lockdown, Coal India Ltd (CIL) has further extended the time limit for payment of coal booked by its customers, by two more weeks till 21 April from the earlier deadline of 7 April. The long-pending demand for Deferred Payment Letter of Credit has now been implemented as an additional mode of payment along with Irrevocable Revolving L/C for the coal supplied to power producers, especially independent power plants. This will help cash-strapped power producers avail credit facility through their banks to tackle the liquidity crunch. As a concentrated effort, CIL has decided to continue with coal supplies despite payment defaults. According to provisions of contracts signed between gencos (generating companies) and CIL, the power producers make monthly payment for the coal purchase in three installments. CIL said that despite payment defaults, coal supplies to gencos are assured although dues from gencos stand at around ₹140 bn. CIL has also decided to extended the validity period for lifting of coal under all auctions without any penalty. Earlier, failure to lift the ordered quantity of coal within a stipulated time period attracted forfeiture of earnest money deposit under auction schemes. Coal stocks in the country now stand at 120 million tonnes (mt) with pitheads of CIL heaped high close to 75 mt. The rest 45 mts of coal stock is at thermal power plants sufficient for 28 days consumption. Power companies importing coal are being encouraged to substitute their requirement of imported coal with domestic coal of CIL by regular monthly allotments.

Source: Business Standard

CIL’s dispatches drop, output increases

4 April. India’s largest coal producer Coal India Ltd. (CIL) has seen a 10 percent fall in dispatches in March 2020 due to a sharp fall in demand from the power sector, leading to an increase in inventories both at power plants and coal mines. This comes amid production rising up 6.5 percent to 84.4 million tonnes (mt). CIL’s dispatches declined 10.3 percent year-on-year (yoy) to 53.5 mt in March 2020 as demand for power plummeted. For FY20, CIL’s dispatches dropped 4 percent yoy to 582 mt, while production declined about 1 percent yoy to 602 mt. India’s nationwide lockdown came at a time when power demand had largely remained muted and production at CIL’s mines ramped up following a heavy monsoon season. Hence, inventories at coal mines and power plants have risen, a general trend seen at the onset of summer but now higher than usual.

Source: The Hindu

CIL arm WCL slashes coal auction floor price for specific mines

3 April. Western Coalfields Ltd (WCL), a subsidiary of Coal India Ltd (CIL), has slashed the coal auction floor price of specific mines by 10 percent. With an effort to provide coal at cheaper price to consumers during the current Covid-19 pandemic, the reduced auction price will be applicable for coal from 'mine specific source' for all auctions to be conducted by WCL in April 2020. WCL had identified 11 out of its total 66 mines in November 2019 as 'mine specific source' specially for use of power plants at an additional add-on price of ₹450 per tonne over the notified price. These 11 mines, including eight greenfield ones -- Dinesh, Makardhokra I, Gokul Bhanegaon, Singhori, Penganga, Yekona, Pauni II & 3 Brownfield- Mungoli, Niljai, and Gondegaon -- were opened during the last five years to provide coal to power consumers in central, western and southern India at their doorstep at cheaper landed price. Earlier, these power plants were getting coal from mines located in eastern India which was costly due to extra railway freight, it said. With opening of new projects by WCL, coal became cheaper for these plants to the tune of ₹1,000 per tonne on an average. All linked power plants, including state generating companies of Maharashtra, Madhya Pradesh, Gujarat, Karnataka and other private sector power plants are getting coal at specific add on price from these 11 mines.

Source: The Economic Times

Insure coal workers for minimum ₹50 lakh against death due to Covid-19: INMF to CIL

2 April. INTUC-affiliated trade body INMF has put forth a demand before Coal India Ltd (CIL) that all workers irrespective of activities they are involved in, should have an insurance cover of ₹50 lakh in case of death due to Covid-19. The Indian National Mineworkers' Federation (INMF) further said that it supports and endorses contribution of one-day salary to combat Covid-19 pandemic. CIL which accounts for over 80 percent of domestic coal output produced 602.14 million tonnes (mt) of dry fuel during 2019- 20 fiscal against the target of 660 mt.

Source: The Economic Times

NATIONAL: POWER

Punjab to reduce fixed charges for electricity consumers

7 April. Punjab Chief Minister (CM) Amarinder Singh announced reduction in fixed charges for electricity consumers, along with deferment of deadline for payment of bills. He instructed the power department to provide uninterrupted supply to all health care institutions. The power utility, Punjab State Power Corp Ltd (PSPCL), will have to bear an additional burden of ₹3.5 bn due to the various reliefs announced for the consumers, it said. The CM lauded the employees of the power utility for their untiring efforts in maintaining continuous supply of power amidst the coronavirus pandemic. The CM asked to not carry out any electricity disconnection against non-payment of bills till restrictions are withdrawn by the Authority. The reliefs have been announced in view of the unprecedented situation in which consumers are unable to pay their dues to PSPCL. As per the CM’s directives, due date of electricity bills of all domestic and commercial consumers having current monthly/bi-monthly bills up to ₹10,000 payable on or after 20 March has been extended up to 20 April, without levy of late payment surcharge.

Source: Business Standard

Government working on package to offer loans to state discoms

7 April. The government is working on a package to offer loans to state power distribution companies (discoms) to help them clear dues of electricity generation plants to prevent blackouts as the projects face a severe liquidity crisis. The power ministry is arranging loans from Power Finance Corp and REC Ltd to distribution companies that can be used only to clear portion of the ₹920 bn dues they owe to power plants, the power ministry said. Recovery of dues by private plants from discoms has been significantly impacted as they are not able to make collections due to the lockdown. The ministry also came to the rescue of the power plants through a clarification, which stated that the discoms will have to continue meeting their payment obligations and pay fixed charges to the projects even in case electricity offtake is not taking place due to less demand.

Source: The Economic Times

DVVNL records 29 percent fall in power consumption

7 April. The 21-day Covid-19 lockdown has significantly reduced power consumption. After the shutdown of industries and factories, Dakshinanchal Vidyut Vitran Nigam Ltd (DVVNL) has recorded an average of 29 percent fall in the power consumption. Before the lockdown, the average consumption of power was 92.57 mn units per day. DVVNL, looks after power supply in 21 districts of UP (Uttar Pradesh). In these districts, the DVVNL has a total of 53.40 lakh household and commercial connections. Out of these 41 lakh are rural consumers and 11 lakh are urban. Following the lockdown, the DVVNL has recorded 29 percent decrease in average power consumption every day. From 92.57 mn units, it has reduced to 65.63 mn per day. According to data by Uttar Pradesh Power Corp Ltd, in the 75 districts of UP, the power consumption has reduced from 24,300 MW to 13,400 MW.

Source: The Economic Times

Telangana CM congratulates state electricity department for smoothly handling 9 pm, 9 minutes lights off initiative

6 April. Telangana Chief Minister (CM) K Chandrasekhar Rao congratulated the state electricity department for smoothly handling the switching off lights in the state on Prime Minister Narendra Modi’s appeal to the nation to mark the fight against the coronavirus. The CM said due to sudden switching off lights at one go, the demand dropped to 1500 MW. The entire country rose to the occasion in unison in response to Prime Minister Narendra Modi’s appeal to switch off lights of houses at 9 pm for 9 minutes and just light candles/diyas, to mark the fight against the coronavirus.

Source: Business Standard

Discoms obligated to pay for electricity within 45 days: Power ministry

6 April. With its relief being construed as a moratorium on payments, the power ministry has clarified that electricity distribution companies (discoms) will continue to be obligated to pay for power within 45 days of presentation of the bill. It, however, lowered late payment charges for the period between 24 March and 30 June. As per the relief granted, the discoms will need to either deposit or give Letter of Credit (LoC) for 50 percent of the cost of power they want to buy. The remaining will have to be paid within the period given in the PPA (power purchase agreement), failing which the delayed payment surcharge will apply, it said. Since August last year, energy discoms are required to set up a payment security mechanism like a letter of credit from a financial institution, for buying electricity from a generator. In case of a default, this LoC is encashed. The government approved a financial relief package for the power sector that provided for easing of payment security mechanism for three months and reduced payment security amount by half for future power purchases. The ministry said late payment surcharge is applicable in case of non-payment of dues within the stipulated period. This surcharge in most cases goes up to 18 percent per year. From 1 July, the delayed payment surcharge shall apply at the rate given in the PPA.

Source: Business Standard

Demand for power fell by 3.2 GW in Maharashtra, but load frequency, grid stability were maintained: MSLDC

6 April. Even as the demand for power fell by 3,237 MW in the state at 9 pm, nearly 90 percent more than the estimates, the Maharashtra State Load Dispatch Centre (MSLDC) said it maintained the load frequency and grid stability. MSLDC had expected the demand to drop by around 1,700-1,750 MW during the nine minutes of blackout. However, it fell by 3,237 MW. Prime Minister Narendra Modi had appealed to 1.3 bn Indians to switch off the lights at their homes for nine minutes at 9 pm to express solidarity with the fight against COVID 19. The demand for power, which was at 13,160 MW at 8.59 pm in the state, dropped to 9,923 MW at 9.05 pm. Of this, the demand in Mumbai alone dropped to 1,255 MW at 9.05 pm from 1,722 MW at 8.59 pm. According to MSLDC, after the nine minutes, the frequency increased and stabilised at 50.24 MW, which was well within the limits prescribed by the Central Electricity Regulatory Commission.

Source: The Economic Times

PM’s 5 April blackout call puts power sector on alert mode to maintain grid stability

4 April. Prime Minister (PM) Narendra Modi’s appeal for a 9-minute blackout at 9 pm, has shaken the babus in the power ministry who have put themselves in a huddle to quickly devise a strategy to prevent the 5 April event from creating ground for a possible grid collapse and resultant blackout throughout the country. The Grid stability in the country is maintained by keeping power frequency within a range specified by Central Electricity Regulatory Authority. Any deviation from identified frequency is managed by increasing or decreasing power flow in the grid. Sudden drop or increase in frequency causes a collapse. The PM’s call for a blackout urging citizens to light a lamp, candle or shine a mobile flashlight to dispel the darkness spread by the coronavirus, is expected to result in sudden drop in electricity demand across the country and has even the potential to disturb grid frequency creating potential situation for a grid collapse. Power System Operation Corp Ltd, a wholly owned Government of India Enterprise, an entrusted with the task of ensuring the integrated operation of the Grid in a reliable, efficient, and secure manner, has also been sounded off to plan scheduling of power with all the five Regional Load Despatch Centres and National Load

Source: The Economic Times

CERC pares late payment surcharge by 0.5 percent on power discoms

4 April. Central Electricity Regulatory Commission (CERC) reduced the late payment surcharge levied on power distribution companies (discoms) for delayed payment to power generators and transmission companies. The regulator passed an order lowering the surcharge to 1 percent per month from 1.5 percent per month for 45 days till 30 June. The power ministry asked the CERC to provide relief to discoms as they are unable to collect payments from consumers because of the 21-day Covid-19 lockdown. At the same time, the high-paying industrial and commercial units are not operating.

Source: Business Standard

JBVNL proposes steep power tariff hike for most sectors

3 April. The Jharkhand Bijli Vitaran Nigam Ltd. (JBVNL), the power-distribution company (discom), has proposed a steep hike in power tariffs for the new 2020-21 fiscal. The JBVNL tariff proposal is currently being examined by the Jharkhand State Electricity Regulatory Commission (JSERC). Once vetted, the commission would begin a series of public consultations, before determining the tariff. The discom has proposed a hike in tariff from the present ₹6.25 per unit to ₹7.5 per unit for urban domestic consumers. The monthly fixed charge, which is currently ₹75, has been proposed to be doubled to ₹150. At current tariff, a consumer is paying ₹700 for using 100 units of power, including ₹75 as fixed charges. If the JBVNL proposal of a hike in tariff is accepted, consumers would need to shell out ₹900 per month, a quantum jump of ₹200 per month in energy bills. For rural domestic consumers, energy tariff has been proposed to be hiked from the present ₹5.75 per unit to ₹7 per unit. The fixed monthly charge has also been proposed to be hiked from the current ₹20 to ₹75. Rural consumers, using 100 units a month, would see a jump in their monthly energy bills from ₹595 to ₹775, an increase of ₹180 per month.

Source: The Times of India

No relief for electricity generators as demand plummets in March

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Plummeting demand for electricity will add to power sector woes!

< style="color: #ffffff">Bad! |

2 April. While electricity consumers and distributors get a three-month relaxation in tariffs and payments to cope with the virus crisis, generating companies are left in the lurch, as the lockdown crimps demand and threatens revenues. After four months of decline, power demand rose in January and February, only to fall off a cliff in March. Energy consumption has declined 21-22 percent after the covid-19 lockdown was implemented. Commercial and industrial demand (C&I) and passenger railways, which account for close to 40 percent of all power consumption, have ground to a halt, hurting discoms (distribution companies) since these segments cross-subsidize lower residential tariffs.

Source: Livemint

No increase in power bills as GERC decides to keep tariffs unchanged

1 April. In a measure of relief for electricity consumers in the state, Gujarat Electricity Regulatory Commission (GERC) has kept power tariffs unchanged for the 2020-21 fiscal. The commission has also given relief to Below Poverty Line (BPL) customers and agricultural consumers using power for lift irrigation. The private sector Torrent Power had sought a 21 paise per unit increase in tariffs for 2020-21 to make up for its earlier dues. TPL supplies electricity to Ahmedabad, Gandhinagar and Surat. State-owned power distribution companies (discoms) did not demand an increase in tariffs in their petitions filed with GERC in December 2019. These four discoms are Uttar Gujarat Vij Company Ltd, Paschim Gujarat Vij Company Ltd, Dakshin Gujarat Vij Company Ltd and Madhya Gujarat Vij Company Ltd. In what could reduce monthly electricity bills of Below Poverty Line consumers by more than 30 percent, GERC raised the applicability of ₹1.50 per unit concessional tariff to 50 units per month from 30 units. Energy charges for agriculture consumers using electricity for lift irrigation has been reduced from ₹1.50 per unit to ₹0.80 per unit. The commission also noted that all distribution companies achieved noticeable reduction in power distribution losses.

Source: The Economic Times

UP first state to pass on Centre’s payment relief for discoms to consumers

1 April. UP (Uttar Pradesh) has become the first state to announce payment relief to power consumers, passing on the benefit given by the power ministry to distribution companies (discoms) with a view to ensuring uninterrupted supply during the lockdown when India is working from home. State Power Minister Srikant Sharma extended the payment period to 30 April for bills generated generated between 1 March and 14 April. He also waived surcharge on late payments. Together, the decisions will especially give domestic and commercial establishments a much-needed breather.

Source: The Times of India

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Tata Power Solar bags 300 MW plant project from NTPC worth ₹17.3 bn

7 April. Tata Power Solar Systems said it has got a letter of award to build a 300 MW plant for state-owned utility major NTPC Ltd at an all-inclusive price of ₹17.3 bn. This follows a post-reverse auction held on 21 February. The commercial operation date for the grid-connected solar photovoltaic project is set for September 2021. With this project, the order book of Tata Power Solar stands at ₹85.41 bn, including external and internal orders. Tata Power (Renewables) president Ashish Khanna said Tata Power Solar is proud to consistently win large and challenging grid-based solar EPC contracts from industry-leading public sector undertaking like NTPC. Tata Power is India’s largest integrated power company and has an installed capacity of 10,763 MW together with its subsidiaries and jointly controlled entities. It has a presence across the entire power value chain -- generation of renewable as well as conventional power including hydro and thermal energy, transmission and distribution, trading and coal and freight logistics.

Source: Business Standard

3 GW of solar and wind energy projects face delays on Coronavirus lockdown

6 April. India could face over 21.6 percent or 3 GW of solar photovoltaic (PV) and wind installations being delayed as a result of the country’s lockdown, according to Wood Mackenzie. The research and consultancy firm said the timing of the lockdown is unfortunate as the first quarter is typically one of the busiest periods for wind project installations. With over 3 GW of wind projects under construction scheduled for 2020 completion, supply and labour disruptions from the current lockdown could delay 400 MW into 2021, equating to a downgrade of 11 percent for 2020. Similar to the wind sector, India’s solar PV installations are expected to be hit hard as the industry is heavily dependent on Chinese PV module imports -- 80 percent of total volume -- which has been disrupted due to the coronavirus. The Indian states with the highest coronavirus infection rates also correspond with the areas that are favourable to wind and solar development. Gujarat delivered 58 percent or 1.4 GW of new added wind capacity in India in 2019, and stands as one of the top ten worst-hit states in terms of coronavirus infections. On the solar front, Karnataka (2.0 GW), Tamil Nadu (1.6 GW) and Rajasthan (1.7 GW) were the top three states accounting for 55 percent of solar PV installations in 2019. All of which are in the top ten worst-hit states.

Source: The Economic Times

Nuclear power plants of 7 GW capacity under construction in India

5 April. Nuclear power plants of 7,000 MW capacity are currently under various phases of construction in the country, according to data shared by Power and Renewable Energy Minister R K Singh in parliament. The plants under construction include Unit 3, 4 and 5 of Kudankulam Nuclear Power Project of 3,000 MW capacity and a 500 MW capacity Prototype Fast Breeder Reactor in Tamil Nadu. Apart from this, there are two upcoming 1,400 MW capacity nuclear power plants including Kakrapar Atomic Power Plant in Gujarat and the Rajasthan Atomic Power Station. A 700 MW project, Gorakhpur Nuclear Power Plant, has also been planned on a 560 hectare area situated west of Gorakhpur village in Fatehabad district of Haryana. India is planning to add around 20,000 MW nuclear power generation capacity over the next decade, K N Vyas, Secretary, Department of Atomic Energy and Chairman, Atomic Energy Regulatory Commission had said in October 2019.

Source: The Economic Times

MNRE permits installations of innovative standalone solar pumps

4 April. The Ministry of New and Renewable Energy (MNRE) has recently decided to permit installation of innovative standalone solar pumps in test mode for which it has issued draft guidelines and has requested for suggestions by 15 April 2020. It said that new technologies for which patent or IP-related filings have been done would also be eligible to participate in the EoI (Expressions of Interest). The applications would be evaluated by an Evaluation Committee constituted by ministry. The Committee might recommend testing of performance of the pump at National Institute of Solar Energy (NISE) or any other NABL-accredited laboratory before allowing installation of such pumps in the field. After the recommendations of the Committee, the technology will be allowed for demonstration in the field after getting consent from the respective state implementing agency and the beneficiary farmers by the innovator. The guidelines highlighted that the innovator would be allowed to install up to 50 solar pumps in different parts of the state or country for demonstration purposes. Every month, the innovator will have to submit a detailed performance report of the pump including a comparative analysis with similar capacity MNRE specified pump along with feedback to the Evaluation Committee. At present, under the ministry’s PM-KUSUM scheme, only those standalone solar pumps which fulfil the ministry specifications are eligible to be installed.

Source: The Economic Times

Solar sector welcomes MERC’s new tariff order

2 April. Maharashtra Solar Sangathan, an umbrella association of over 1,000 solar system manufacturers in the state, has welcomed the latest tariff order issued by Maharashtra Electricity Regulatory Commission (MERC) for rooftop solar power units. While the power regulator has exempted the rooftop units from Grid Support Charges till the cumulative installation of 2000 MW, the association has said the decision will give a breather to the rooftop solar industry, which was said to be in uncertainty for the past six months due to alleged policy paralysis. The association, however, has raised an objection to the capping of 2,000 MW.

Source: The Economic Times

States stop renewable power purchase, hold back payments

1 April. Following the lockdown and fall in electricity demand, several states are now curtailing renewable power purchases and have also issued notices on non-payment to generators. These states have invoked Force Majeure clause in their power purchase agreements (PPA) with renewable projects to nix power supply and payment. While Punjab has told renewable power producers to run their units at their own cost and risk, Uttar Pradesh (UP), Andhra Pradesh and Madhya Pradesh have refused payment and have stated that they are curtailing renewable power. Renewable power including solar, wind, small hydro and biomass comes under ‘must-run status’, that is, it cannot be stalled or shut under any circumstances. The Ministry of New and Renewable Energy (MNRE) in a notice asked the states to comply with the must-run status of renewable energy. It also asked them to ensure timely payment to generating companies even during the lockdown period. Punjab had issued a notice to several renewable power producers that supply to the state, it will curtail electricity power purchase and generation. The demand for power went down by 31 percent, while there was a 68 percent increase in capacity which has been backed down. UP was the first state to refuse payment to solar power projects citing Force Majeure and inability to pay in wake of reduced revenue. The plea was declined by the Solar Energy Corp of India. SECI which comes under the ministry of new and renewable energy and supplies renewable power to UP said inability of paying bills due to “insufficiency of finances or funds” cannot be claimed as force majeure Leading renewable energy players such as Azure Power, ReNew Power, SoftBank Energy and Hero Future Energies supply power to UP. Several group of renewable power producers had requested the Centre to clarify to the states on scheduling of renewable power and payment for the same.

Source: The Economic Times

INTERNATIONAL: OIL

Coronavirus, low oil prices to hit Azeri economy

7 April. Azerbaijan’s economy will take a serious hit from decline in global oil prices and the coronavirus pandemic, but economists and officials said reforms undertaken since a financial crisis in 2014 will help to mitigate the impact. Worldwide demand for fuel has dropped by 30 percent due to the coronavirus pandemic, President Ilham Aliyev said. Some state employees and those in oil industry enterprises are still going to work. Plummeting global oil prices six years ago sent the former Soviet energy producer’s economy into decline, led to bankruptcies among its commercial banks and pushed the manat currency down by a third against the dollar. But changes undertaken since should help the country weather the current difficulties. SOFAZ, which manages the country’s proceeds from oil contracts, oil and gas sales, transit fees and other revenue, has already sold around $2.5 bn on the market in the first quarter this year, up from $1.55 bn in January-March 2019, to support the manat currency and has the right to sell another $4 bn till the end of the year. Azerbaijan based its current state budget on an average oil price of $55 per barrel. Brent was trading at around $33 a barrel.

Source: Reuters

US President open to big oil tariffs, but doesn’t expect to need them

6 April. US (United States) President Donald Trump said he could slap “very substantial tariffs” on oil imports if prices stay low, but does not expect he will need to, since neither Russia nor Saudi Arabia, which are locked in an oil price war, would benefit from continued low prices. Oil prices have dropped by about two-thirds this year as the COVID-19 pandemic caused by the new coronavirus has hammered demand and as major producers Russia and Saudi Arabia boost output in a war over market share. Trump had previously said that he expects the two countries to arrive at a deal to cut output by as much as 15 mn barrels per day (bpd). Neither country has confirmed his comments, but Trump expects tariffs can be avoided. The US in recent years has become the world’s biggest oil producer, at times putting its exports in competition with Russia and members of the Organization of the Petroleum Exporting Countries (OPEC). As oil prices drop, many heavily leveraged US energy companies face bankruptcies and workers are at risk of layoffs. While Trump noted the low oil prices buoyed the battered airline industry and helped consumers, he reiterated his support for the oil sector. The American Petroleum Institute and other energy interests have told Trump they oppose tariffs, fearing the measures would add costs to importing crude and materials for refineries.

Source: Reuters

Norway may cut its oil output if other big producers agree deal

5 April. Western Europe’s largest oil and gas producer Norway said it would consider cutting its oil production if a global deal to curb supply is agreed by the world’s biggest producers. OPEC (Organization of the Petroleum Exporting Countries) and its allies are working on a deal for an oil output cut equivalent to about 10 percent of world supply in what member states expect will be an unprecedented global effort including the United States (US). Oil prices have shed two thirds of their value in the first quarter of the year, pummelled by a drop in demand due to coronavirus lockdowns and after Russia and Saudi Arabia failed to agree on further output cuts. The price of North Sea oil touched an 18-year low of $21.65 a barrel on 30 March. It has since recovered to more than $30 a barrel on hopes of a new global oil output deal. Norwegian Oil and Energy Minister Tina Bru said Norway had been in a dialogue with other oil producing countries, without elaborating on a potential size of the output cut. Norway, which meets about 2 percent of global oil demand, is not a member of OPEC. It has cut its oil output several times before, including in 1990, 1998 and in 2002, always in tandem with other producers when prices fell. During the first half of 2002, Norway cut its output by around 150,000 barrels per day (bpd) after oil prices fell to below $20 a barrel following attacks in the US on 11 September 2001. Norway’s crude oil production stood at 1.75 mn bpd in February, up 26 percent from a year ago thanks to the ramp-up of state-controlled Equinor’s giant Johan Sverdrup oilfield.

Source: Reuters

Mexican President calls on Russia, Saudi Arabia to end oil price war

4 April. Mexican President Andres Manuel Lopez Obrador called on Russia and Saudi Arabia to reach a deal soon and end their oil price war to avoid deepening the oil price crisis. Mexico and others have seen the prices for their crude exports battered in recent weeks after the fallout from the new coronavirus eroded demand and major oil producers could not agree on how to respond. Mexican Energy Minister Rocio Nahle had said that oil prices would not stay this low, and that the oil price crash did not merit a change in strategy.

Source: Reuters

INTERNATIONAL: GAS

BP issues force majeure notice to Golar LNG unit on floating facility

7 April. Golar LNG Ltd said that it received a force majeure notice from a BP Plc unit seeking to delay taking delivery of a floating liquefied natural gas facility by a year. The notice is the latest force majeure claim issued in the LNG (liquefied natural gas) sector that is struggling with a seasonal plunge in demand as well as the spread of the coronavirus outbreak, which has further hammered the consumption of the super-chilled fuel globally. BP is expecting a one-year delay due to the pandemic and currently sees no possibility in reducing the duration of the new timing, according to Golar’s unit Gimi MS Corp. The plant is designed to produce an average of about 2.5 million tonnes (mt) of LNG per annum. The construction of the floating facility was expected to cost about $1.3 bn, excluding financing costs.

Source: Reuters

Shell and partners delay decision on Australia’s Crux gas project

7 April. Royal Dutch Shell said its Australian unit and joint venture partners had decided to delay a final investment decision (FID) on the Crux gas project in offshore Australia that was initially planned for 2020. The Crux project is one of several globally that have been delayed in recent months following the collapse in energy prices. LNG (liquefied natural gas) demand had been hitting record highs until recently thanks to appetite from China and India as they diversify away from dirtier coal power generation, but the crash in oil and gas prices has caused major LNG exporters to put off gigantic new facilities or expansions of existing projects. Crux, owned by Shell, Osaka Gas and a unit of Seven Group Holdings, is one of several gas fields that have been awaiting development off northwestern Australia. The project will be developed to supply backfill gas to the Prelude floating LNG facility off northwest Australia. Cargo liftings from Shell’s Prelude facility, which is the world’s largest floating LNG facility, has been suspended since February following an electrical trip.

Source: Reuters

Qatar Petroleum not scaling down LNG expansion despite delay in bids: CEO

6 April. Qatar Petroleum will postpone the start of production from its new gas facilities to 2025 due to a delay in the bidding process, but is not downsizing the world’s largest liquefied natural gas project despite concerns of a mounting glut, its CEO (Chief Executive Officer) Saad al-Kaabi said. Kaabi said the company is not scaling back a plan to build six new LNG (liquefied natural gas) production facilities, known as trains, needed for an ambitious domestic scale-up, though commercial bids from contractors and the start of output will be delayed. QP had wanted to lift its output to around 110 million tonnes (mtpa) per annum by 2024 from 77 mtpa, as the first phase of its expansion. Kaabi said the company had been expecting to receive final bids from contractors for the first phase - the North Field East project, which will involve the construction of four trains - this month. However, that was delayed as firms asked for more time to submit bids due to the global lockdown linked to coronavirus. The second phase, known as the North Field South project, will boost Qatar’s LNG production capacity to 126 mtpa by 2027 through the construction of two more trains. Global LNG demand has crumbled due to the coronavirus pandemic that has disrupted industrial output, with countries worldwide imposing lockdowns and strict travel curbs to slow its spread.

Source: Reuters

Daily gas production at Iran’s South Pars field tops 700 mcm per day

5 April. Daily gas production at Iran’s South Pars field reached more than 700 million cubic meters (mcm) per day in the last Iranian calendar year, the head of the Pars Oil and Gas Company (POGC) said. South Pars, which Qatar calls North Field, is the world’s largest gas field and is shared between Iran and Qatar.

Source: Reuter

Norwegian gas exports to UK fall sharply as demand slumps

3 April. Pipeline gas flows from Norway to Britain fell 44 percent from the start of the week as the summer gas season starts and coronavirus lockdowns continue to hit demand, according to data from Norway’s gas system operator Gassco. Pipeline gas flows to Britain fell to 49.7 million cubic metres (mcm) per day, down from 88.6 mcm, according to data. Deliveries to continental Europe remained broadly steady at over 240 mcm per day. Gas traders said UK demand was partly reduced by temperatures rising to above normal levels over the weekend and most of the following week, and the beginning of April also marks the end of the heating season when importers adjust volumes. But the market is expecting production reductions due to the unprecedented slump in energy demand in Europe and stoppages in most power-intensive manufacturing due to lockdowns in several European countries. Norwegian gas system operator Gassco and the country’s largest gas producer Equinor were not immediately available to comment on the fall in gas exports to Britain.

Source: Reuters

INTERNATIONAL: COAL

Indonesia sets April coal benchmark price at $65.77 per tonne

6 April. The Indonesian government set its coal benchmark price (HBA) for April at $65.77 per tonne, down from $67.08 per tonne last month, the energy and mineral resources ministry said. The benchmark price COAL-HBA-ID dropped from a month earlier due to lower electricity consumption in importing countries, as the global coronavirus outbreak disrupts economic activity, the ministry said. The HBA is a monthly average of the Argus-Indonesia Coal Index (ICI-1), the Platts Kalimantan 5,900 assessment, the Newcastle Export Index and the globalCOAL Newcastle index from the previous month.

Source: Reuters

Investors line up against Japan’s Mizuho support for coal

6 April. Investors with nearly $200 bn in assets holding shares in Japan’s Mizuho Financial Group said they plan to back a shareholder motion urging the bank to cut its lending for coal and other fossil fuels, they said. Similar shareholder resolutions have succeeded in getting banks to stop financing coal and other fossil fuels. Kiko Network and other non-profit organisations describe Mizuho as the world’s biggest lender to coal power plant developers. Japan is the only major industrialised economy that is expanding use of coal, hit by the Fukushima nuclear disaster in 2011 which led to the shutdown of most of the country’s reactors that once supplied about a third of the electricity in the world’s third-biggest economy.

Source: Reuters

Australia’s ALS probe finds half of coal quality reports amended

2 April. Australia’s Testing laboratory ALS Ltd said an investigation found that about half the certificates it provided for export coal samples over the past decade had been manually altered to improve the quality of the commodity. The assay reports, going back to 2007, had been amended at four laboratories of the coal superintending and certification unit of ALS’s Coal business in New South Wales and Queensland states, it said. Australia, which is known for its high quality coal, is the world’s biggest exporter of the fuel to markets like Japan, South Korea, China, Taiwan and India. The ALS unit has about 40 percent of the market for testing coal samples to ensure shipments meet quality standards agreed with buyers, according to industry estimates. The issue came to light after allegations in an unfair dismissal case that Australian miner TerraCom Ltd had worked with ALS’s Brisbane-based testing laboratory to falsely upgrade the quality of its coal in export documentation.

Source: Reuters

Polish miner JSW’s coal output hit by anti-virus measures

1 April. Poland’s JSW, European Union’s biggest coking coal producer, reported a 40 percent drop in output after it reduced the number of shifts and many miners remained at home because of the coronavirus outbreak. Rising coal stockpiles have been an issue raised by coal trade unions, which said they pose a threat to mining operations. However, the current high stocks and falling demand for coal-fired power could make it easier for Poland to reduce output to ensure miner safety during the coronavirus crisis.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Poland’s PGE can’t radically cut emissions by 2030: CEO

2 April. Poland’s biggest energy group, the state-run PGE, cannot significantly reduce carbon emissions by 2030, its Chief Executive Officer (CEO) Wojciech Dabrowski said. He said that PGE will follow the green energy direction though. PGE Chief Financial Officer, also present, said that the group sees a “significant” fall in power consumption due to coronavirus pandemic.

Source: Reuters

Huge US solar project permit delayed over impact on historic trail

2 April. A US (United States) government agency has delayed issuing a permit for the Gemini solar power project in Nevada, one of the country’s largest proposed solar farms, over concerns about its impact on a historic region traversed by settlers of the American West. The US Bureau of Land Management missed its target to decide on the so-called Section 106 permit governing the project’s historic impact by the end of March, after overshooting a previous deadline in December. Many infrastructure projects are facing construction and supply chain delays due to the coronavirus pandemic.

Source: Reuters

Ethiopia signs $800 mn geothermal power purchase agreement

2 April. Ethiopia has signed a power purchase agreement worth $800 mn with the developers of a 150 MW geothermal plant, Prime Minister Abiy Ahmed said. The Horn-of-Africa nation, which is the second most populous on the continent, has the second biggest electricity deficit in Africa according to the World Bank, with about two thirds of the population lacking a connection to the grid. Geothermal power refers to the use of underground hot steam to drive turbines which in turn generate electricity.

Source: Reuters

Variable renewable energy technologies to contribute 60 percent in power generation by 2050: IRENA

2 April. The share of variable renewable energy (VRE) technologies – mainly solar photovoltaic (PV) and wind power -- in power generation can increase from 4.5 percent in 2015 to around 60 percent by 2050, according to a report by International Renewable Energy Agency (IRENA). It said electricity storage could play a key role in facilitating the next stage of energy transition by enabling higher share of variable renewable energy (VRE) in power systems, accelerating off-grid electrification and indirectly decarbonising the transport sector.

Source: The Economic Times

France approves 1.7 GW of wind and solar power projects

1 April. French Ecology Minister Elisabeth Borne has cleared nearly 300 wind and solar power projects with total installed capacity of about 1.7 GW, saying she has also approved several project deadline extensions because of the coronavirus outbreak. Borne said that progress on several renewables projects and the calendar for France’s renewables tenders have been disrupted by the outbreak.

Source: Reuters

Coronavirus could stall a third of new US utility solar this year

1 April. About 5 GW of big US (United States) solar energy projects, enough to power nearly 1 mn homes, could suffer delays this year if construction is halted for months due to the coronavirus pandemic. The forecast, a worst-case scenario laid out in an analysis by energy research firm Wood Mackenzie, would amount to about a third of the utility-scale solar capacity expected to be installed in the US this year. Even the firm’s best-case scenario would result in substantial delays. With up to four weeks of disruption, the outbreak will push out 2 GW of projects, or enough to power about 380,000 homes.

Source: Reuters

DATA INSIGHT

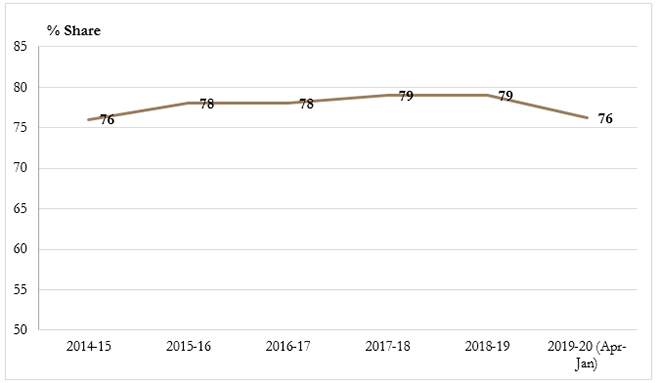

Electricity Generation Scenario and Share of Coal Based Generation

| Year |

Electricity Generation (in Billion Units) |

| From All Fuels |

From Coal |

| 2014-15 |

1048.7 |

800.3 |

| 2015-16 |

1107.8 |

862 |

| 2016-17 |

1160.1 |

910.1 |

| 2017-18 |

1206.3 |

951.8 |

| 2018-19 |

1249.3 |

987.7 |

| 2019-20 (Apr-Jan) |

1053.6 |

803.1 |

Trends in Share of Coal Generation in Total Generation

Source: CEA & Lok Sabha Questions

Source: CEA & Lok Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell