-

CENTRES

Progammes & Centres

Location

Low spot LNG prices may boost margins of Indian CGD companies like Gujarat Gas, IGL and ML. Spot LNG prices have turned soft over the last year, falling to $4.7/mmBtu in January 2020 from $8.4/mmBtu in January 2019. Also, the coronavirus outbreak and its subsequent dropping to $ 3.1/mmBtu in March. The low prices would result in lower gas costs for CGD companies but the impacts would vary depending on the percentage of volumes coming from industrial segment, which uses LNG as feedstock instead of domestic gas, and proportion of LNG requirement met through spot, CGD companies supply domestically-produced gas to residential customers while imported LNG is supplied to industrial sector. Gujarat Gas now meets 55-60 percent of its LNG requirement through spot purchases, from impact on LNG demand has led to spot LNG prices further 25 percent a year ago. MGL is another beneficiary of lower spot LNG prices with the industrial segment constituting over 15 percent of its total volumes. Moreover, LNG requirement is fully met through spot which has been a tailwind for margins. The impact on IGL is expected to be lower as 20 percent of the company’s LNG requirement is met through spot and the industrial segment constitutes less than 15 percent of IGL’s total volumes. CGD companies are also expected to benefit from a downward revision in the price of domestically produced natural gas, which is expected to be revised lower to $2/mmBtu from April 2020. India’s GSPC is seeking 6 LNG cargoes for delivery over March to November through two separate tenders. It is seeking one cargo for delivery over 23 to 31 March on a DES basis. It is also seeking five cargoes for delivery over April to November, also on a DES basis, in a separate tender.

Royal Dutch Shell’s Indian arm Shell Energy India Private has signed a pact with Inox India for door-step delivery of LNG from its terminal in Gujarat through road to customers who are not connected to pipelines. Shell Energy owns and operates an LNG terminal in Hazira, which has a capacity of 5 mtpa. INOX India, which specialises in cryogenic liquid storage, distribution and re-gasification solutions, will create distribution infrastructure, including logistics and receiving facilities to deliver LNG from this unit to customers. The door-step delivery model will reduce the dependence on pipelines and give companies access to a larger market. Inox, under its brand ‘GoLNG’, has a fleet of 20 transport tankers that have collectively logged more than 6.5 mn km and distributed around 100,000 tonnes of LNG, primarily from state-run oil marketing companies, to its consumers spread all over the country. With the tie-up with Shell, it aims to scale up this capacity. Under the arrangement, a customer would have two agreements — one with Shell Energy for buying LNG, the other with Inox for getting the LNG using its network, referred to as “virtual” pipeline. Energy majors are looking at door-step delivery of fuel to expand their market and overcome infrastructure models. On one hand, bigger players like RIL and state run-OMCs are eyeing this segment, on the other, there are startups, which have entered this space, primarily for sale of diesel.

ONGC has begun gas production from its most promising block in the KG basin in the Bay of Bengal and is planning a ramp up production in coming weeks. ONGC’s KG-DWN-98/2 or KG-D5 block, which sits next to Reliance Industries' flagging KG-D6 area, holds key to the company’s output profile that is constrained by aging fields. The company began production from the first well on the KG-D5 block and is currently producing around 0.25 mmscmd. It is doing a build-up mapping and the production is likely to rise to 0.75 mmscmd within next few weeks. ONGC is investing $5.07 bn in developing the oil and gas discoveries in the block. The project will cumulatively produce around 25 mt of oil and 45 bcm of gas with peak production of 78,000 bpd of oil and 15 mmscmd. Thirty-four wells are to be drilled under this project. Of these 34 wells, 15 are oil-producing, 8 are gas producing and 11 are water injecting wells. The discoveries in the block are divided into three clusters- Cluster-1, 2 and 3. Cluster 2 is being put to production first. The Cluster 2 field is divided into two blocks namely 2A and 2B, which are expected to produce 23.52 mt and 50.70 bcm of gas. An Offshore Process Platform for processing and evacuating 6.5 mmscmd of gas has been built. Balance 5.75 mmscmd gas will be transported through ONGC’s existing sub-sea infrastructure and facilities, created at onshore terminal of Odalarevu at the Andhra coast. The Cluster-2B is expected to produce free gas of 12.75 mmscmd from eight wells and has a 16-year life. Vedanta’s upstream arm Cairn O&G is planning to drill 35 hydrocarbon wells and 10 hydrocarbon processing facilities at its Kaza block in Andhra Pradesh at a cost of ₹6.5 bn. It expects production of up to 30,000 bpd of oil and 30 mmscfd of gas through development of the processing facilities in the block. The onshore block situated in the Krishna district was awarded to Cairn last year under the discovered small field round. It had won more than 51 blocks under the recent O&G bidding auctions held by the government in the last four years, and intends to spend close to $800 mn in the exploration phase on these blocks.

The viability of India’s ₹500 bn capital expenditure plan for CGD over the next four years has improved with the price of LNG expected to be subdued during the period. LNG accounts for nearly half of CGD consumption volume and a lower price augurs well for both volumes and operating margins of distributors, and project returns. Spot prices of LNG have more than halved on-year to a decadal low of less than $3/mmBtu in February 2020 because of oversupply and the Coronavirus outbreak. The domestic administered price mechanism-based gas, which accounts for the balance half of CGD volume, is also expected to benefit from low international benchmark natural gas prices. Typically, CGD companies pass on lower inputs costs to their CNG and retail customers, and in return, they get a volume fillip owing to better price competitiveness. The subdued outlook for LNG prices improves the viability of ₹500 bn of CGD capex relating to the ninth and tenth rounds of auctions by the PNGRB. It also improves the prospects for 44 new geographical areas set to be awarded in the upcoming 11th round of auctions.

The impact of the coronavirus outbreak will delay the startup of production at its Mahani gas exploration project of UAE’s SNOC by up to two months. SNOC and Italian energy giant Eni announced in January the discovery of Mahani, a new find of natural gas and condensate onshore in Sharjah, and the first in the Emirate since the early 1980s. The delay is expected to be no more than a month or two. ENI is reviewing all of its projects in the region due to current global market conditions. SNOC awarded a Moveyeid Gas Storage Surface Facility Project to Petrofac Facilities Management International Limited. The project, valued at $40 mn, comprises a new high-pressure compressor facility, a high-pressure pipeline and flow lines to four existing wells in Moveyeid Field. SNOC will continue to evaluate the need for expanding the storage and delivery capacity of the project beyond 2023.

Nigeria will issue a sovereign guarantee to back the bulk of a gas pipeline that is a core part of the government’s energy strategy. The Ajaokuta-Kaduna-Kano natural gas pipeline aims to enable Nigeria to develop gas resources that are often burned at the well due to the focus on crude oil. The sovereign guarantee will back 85 percent of the $2.59 bn pipeline cost, funded in turn by a loan facility from Chinese lender Sinosure. Nigerian National Petroleum Corp will cover the remaining 15 percent of the project’s cost. The government plans to develop gas-fired power plants along the pipeline, and also to use it to encourage companies to capture and sell gas rather than flaring it, which environmentalists say creates a health hazard and contributes to global warming.

Natural gas prices at the Waha hub in the Permian basin in West Texas fell into negative territory, forcing some producers to pay other parties to take their gas. The first swing to negative spot prices in almost seven months occurred due to pipeline constraints and as mild weather cut heating demand. Prices in the forward market have been trading below zero for weeks on expectations there will not be enough pipelines to transport record amounts of gas from the region’s shale oil fields. That gas that comes from oil wells, called associated gas in the industry, helped propel US gas output to record highs, driving prices to their lowest in years as production outpaces demand for the fuel. Gas prices in 2020 are expected to fall to their lowest since 1999. About 95 percent of the gas from the Permian is sent to market, but producers burn or flare some unwanted fuel to get rid of it. Flaring in the Permian reached a record high in 2019 and will likely remain relatively flat in 2020. Gas production in the Permian is expected to rise to a record 17.0 bcfd in March, up more than 21 percent from the same month last year, according to federal energy projections. According to US LNG company Cheniere Energy Inc the steps it has taken to protect employees against the coronavirus will not impact production at its facilities. Cheniere is the biggest buyer of natural gas and biggest exporter of LNG in the US and operates LNG export plants at Sabine Pass in Louisiana and Corpus Christi in Texas. LNG shipments from the US to Asia are set to increase, while cargoes heading to main buyers in Europe will fall as the coronavirus outbreak has started to affect demand across the region. Three to four LNG tankers which loaded from the US are expected to arrive in Asia, compared with only one, ship tracking data from Refinitiv Eikon and Kpler showed. Six US LNG cargoes are due to arrive in Asia, according to data intelligence firm Kpler. At least one LNG tanker, the BW Brussels, has diverted its course to Thailand instead of France as initially scheduled. Gas demand in Europe has been hit by lower industrial output and power demand due to the spread of the coronavirus. Overall LNG shipments to Asia are expected to increase mainly led by a boost from China, the world's second-largest LNG importer, as industrial demand is set to increase with people returning to work amid a slowdown in the number of virus cases in local transmission. The oil price plunge has boosted demand for long-term oil-linked cargoes into Asia, and especially in China. Majority of LNG cargoes are purchased on a long-term basis and these are mainly signed on a Brent-linked basis. China’s top LNG buyer China National Offshore Oil Corp declared force majeure on some imports, while earlier this month PetroChina suspended some gas imports including LNG.

China set the pilot transmission fee for the northern part of the “Power of Siberia” natural gas pipeline at 0.1825 yuan ($0.0261) per 1,000 cubic metres according to the National Development and Reform Commission. The 632 km pipeline section, opened in December last year, starts from the border in the northeastern province of Heilongjiang and ends in Changling in Jilin province. The pilot transmission fee for the Heihe-Changling section will hold until the entire pipeline project is fully launched. The Power of Siberia pipeline is scheduled to be completed in 2023, allowing for natural gas from Siberia in Russia to be pumped all the way to Shanghai. According to CNPC, daily natural gas sales has rebounded to 500 mcm from 460 mcm on 14 February as demand improved. The oil giant also cut oil throughput by 20 percent in February amid the virus outbreak in order to reduce increasing inventory pressure.

Kazakhstan has reduced natural gas supplies to China by 20-25 percent after importer PetroChina issued a force majeure notice to suppliers. PetroChina has suspended some natural gas imports, including on liquefied natural gas shipments and on gas imported via pipelines, as a seasonal plunge in demand adds to the impact on consumption from the coronavirus outbreak. Kazakhstan shipped 7.5 bcm of gas to China last year and planned to gradually increase shipments to 10 bcm a year. Kazakh oil exports to China, suspended in mid-January, have not yet resumed because organic chloride continues to be detected in crude produced by CNPC Aktobemunaigas, a local unit of the Chinese energy firm. Kazakh natural gas exporter Kaztransgas is discussing further gas supplies with PetroChina after it issued a force majeure notice citing the coronavirus outbreak. According to Kaztransgas gas exports to China continued “in the agreed volumes” for now. The Central Asian nation planned to ship 10 bcm of its own gas to China this year, in addition to transhipping even larger volumes from Turkmenistan and Uzbekistan. PetroChina has suspended some natural gas imports, including LNG shipments and on gas imported via pipelines, as a seasonal plunge in demand added to the impact on consumption from the coronavirus outbreak. Turkmenistan has tightened foreign exchange controls, a central bank document showed, after China, the main buyer of its natural gas, slashed imports and global energy prices collapsed. Gas exports to China are Turkmenistan’s main source of hard currency. PetroChina, the main buyer, has suspended some purchases as a seasonal plunge in demand added to the impact on consumption from the coronavirus outbreak.

The EU said it had accepted the commitments of Romanian gas pipeline operator Transgaz to boost natural gas exports particularly to Hungary and Bulgaria. The EU which oversees competition policy in the 27 member EU opened a probe in June 2017 into concerns Transgaz may be hindering gas exports by underinvesting in infrastructure or through tariffs. Romania is the third largest natural gas producer in the bloc, behind the Netherlands and Britain.

France’s Total said it had made a new gas and condensates discovery located in the central North Sea offshore the United Kingdom, around 170 km east of Aberdeen. Total, which holds a 30 percent working interest and is operator of the field, said the well was drilled in water about 80 metres deep. It said analysis of the data and results are ongoing to assess to whether the find is commercially viable.

According to Austria’s OMV it had agreed with Russia’s Gazprom that they would give each other more time for negotiations before sealing the planned purchase of Siberian gas assets. The Austrian group had agreed in summer to pay €905 mn ($1 bn) for 24.98 percent of Gazprom’s Achimov IV and V phase development at the Urengoy gas fields as part of its strategy to increase gas in its upstream business as an alternative to oil. Back then the closing of the deal was planned for end-2019 and production at the Achimov blocks was expected to start this year. The two companies plan to continue negotiations until June 2022. OMV and Gazprom have been cooperating for decades, and OMV also has a stake in Gazprom’s Yuzhno Russkoye field. The new agreement could give both companies the chance to renegotiate the price and OMV, which is also focussing on its business in the Middle East, more time before it has to pay and before it starts operating the fields. The Achimov blocks are expected to contribute more than 80,000 boepd to OMV’s 600,000 boepd output target in 2026, according to OMV.

Bulgaria has agreed 40 percent cut in the price of natural gas it imports under its long-term import contract with Russia, its dominant gas supplier. The new price will be valid as of August and was achieved after Russia’s gas giant Gazprom agreed to link the price to benchmarks such as Western European gas market hubs. Bulgaria imports 2.9 bcm per year from Russia under a long term contract valid through 2022. Egypt has increased the usage fees for its national gas grid by 29 percent to $0.375/mmBtu. The price increase came as part of a "gradual liberalisation of the market". Egypt had first set the usage fees at $0.38/mmBtu in August 2018 for a year. In December 2019, Egypt had lowered the usage fees by 24 percent to $0.29/mmBtu.

Poland’s state-run gas company PGNiG expects 2020 to be very difficult because of the coronavirus-driven fall in oil and gas prices and long-term supply deals agreed when markets were stronger. Poland imports most of the gas it uses from Russia’s Gazprom under a long-term deal that expires in 2022. PGNiG has taken steps to reduce that reliance and agreed on supplies from the US and Qatar.

The Indonesian government will lower gas prices for power plants from 1 April to $6/mmBtu, according to the Energy and Mineral Resources Ministry. Power plants managed by state utility company PT Perusahaan Listrik Negara have paid an average of $8.4/mmBtu for gas this year. The power plant gas price cut follows a gas price cut for industrial buyers announced. The government said the price of natural gas for industries would be cut to a maximum of $6/mmBtu from 1 April.

| LNG: liquefied natural gas, CGD: city gas distribution, mmBtu: million metric British thermal units, mn: million, bn: billion, MGL: Mahanagar Gas Ltd, IGL: Indraprastha Gas Ltd, DES: delivered ex-ship, RIL: Reliance Industries Ltd, OMCs: Oil Marketing Companies, ONGC: Oil and Natural Gas Corp, KG: Krishna-Godavari, mmscmd: million metric standard cubic meter per day, bcm: billion cubic meters, O&G: oil and gas, mmscfd: million metric standard cubic feet per day, bpd: barrels per day, CNG: compressed natural gas, PNG: piped natural gas, PNGRB: Petroleum and Natural Gas Regulatory Board, UAE: United Arab Emirates, SNOC: Sharjah National Oil Company, US: United States, boepd: barrels of oil equivalent per day, bcfd: billion cubic feet per day, km: kilometre, CNPC: China National Petroleum Corp, mcm: million cubic meters, UK: United Kingdom, EU: European Union |

30 March. Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) announced an ex-gratia of ₹5 lakh in case of coronavirus-related death of any LPG (liquefied petroleum gas) delivery boy or other personnel involved in the supply chain. While the entire country has bee locked down with most confining themselves to homes, cooking gas (LPG) supplies have continued uninterrupted with all the distributors and hundreds of delivery boys providing cylinders to 275 mn users on demand. Though the LPG distributor agencies and their staff, including delivery boys, are not part of oil company staff, they have been provided with protective gear by the three firms. But, the risk to the delivery boys and other staff remained as the Covid-19 infection spreads. Recognising the threat, IOC, BPCL and HPCL announced the ex-gratia. LPG being an essential commodity has been exempted from the lockdown, and the personnel are required to attend duty during this crisis period to maintain uninterrupted LPG cylinder supplies across the country to all customers. Oil Minister Dharmendra Pradhan welcomed the humanitarian decision.

Source: The Financial Express

30 March. Faced with a steep reduction in offtake of petroleum products – diesel, petrol and aviation turbine fuel – thanks to nation wide lockdown due to Covid-19, Mangalore Refinery and Petrochemicals Ltd (MRPL) – Karnataka’s only oil refinery has declared ‘force majeure’ to contracted crude oil supplies. With its tanks full and OMCs not lifting petroleum products, MRPL will shed 0.5 million tonnes (mt) of crude up to first week of May. Supplying fuel to entire Karnataka and even neighbouring Kerala and other Southern states, this ‘force majeure’ move by MRPL will in no way disrupt fuel availability, MRPL managing director M Venkatesh said. Consequently, MPRL with an annual refining capacity of 15 mt has shut down its phase one operations completely.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Ensuring supply of LPG cylinders, petrol, diesel during lockdown is a great service to households! < style="color: #ffffff">Good! |

29 March. India, the world’s third largest energy consumer, has enough petrol, diesel and cooking gas or liquefied petroleum gas (LPG) in stocks to last way beyond the three-week nationwide lockdown as all plants and supply locations are fully operational, Indian Oil Corp (IOC) chairman Sanjiv Singh said. Singh, who continued to oversee the mammoth operations of ensuring that fuel reaches every nook and corner despite bereavement of his father on the day 21-day lockdown was declared, said there is no shortage of any fuel in the country and customers should not resort to panic booking of LPG refills. The nationwide lockdown that has shut businesses, suspended flights, stopped trains and brought almost entire vehicular movement to a halt, has impacted fuel demand with petrol, diesel and aviation turbine fuel (ATF) showing negative growth. With most cars and two-wheelers going off the road, petrol demand has fallen by 8 percent in March while diesel demand has been down 16 percent. ATF demand has fallen by 20 percent, he said. He said due to lower demand of liquid fuels, refinery run-rates have been lowered by 25-30 percent - meaning they would produce up to 30 percent less of all fuel petrol, diesel, ATF, naphtha and LPG.

Source: Livemint

28 March. Two Indian refiners declared force majeure on crude purchases from the Middle East after fuel demand plummeted due to a nationwide lockdown to stem the spread of coronavirus and the companies' tanks are full. Indian Oil Corp (IOC), the country’s top refiner, has reduced its crude processing by 30 percent to 40 percent and shut its naphtha cracker plant in northern India because of falling demand and "to avoid tank top-up situation", the company said in its force majeure letter to crude suppliers. IOC, which owns about a third of the country’s 5 mn barrels per day (bpd) refining capacity, has sent a force majeure notice to most Middle Eastern suppliers. The company is yet to decide whether to reduce its crude supplies or cancel lifting of oil cargoes altogether in April. Southern India-based Mangalore Refineries and Petrochemicals Ltd has already shut a third of its 300,000 bpd refining capacity and is preparing to shut the remainder as demand slumped.

Source: Livemint

27 March. Humsafar, an online diesel delivery startup has announced that it will provide the service to the emergency services like healthcare sector, during the ongoing lockdown that has been imposed for 21 days till 14 April, by the Indian government, in a bid to contain the spread of the Covid-19 virus. The startup caters to the bulk diesel buyers like housing societies, hotels, hospitals, malls, construction sites, industries, banquets at their doorstep. The service can be booked using their mobile app called Fuel Humsafar, as claimed by the company.

Source: The Economic Times

27 March. Reliance Industries Ltd (RIL) is seeking to sell some April-loading crude cargoes in a rare move as it plans to cut crude processing after the coronavirus pandemic hit global fuel demand. The private refiner has offered various grades of Middle East crude for sale in Asia’s spot market, including grades such as Abu Dhabi’s Murban crude and Qatar’s al-Shaheen crude.

Source: Reuter

26 March. In a bid to ease the burden on poor amid a nation-wide lock down Finance Minister Nirmala Sitharaman announced a ₹1.7k bn relief package under PM (Prime Minister) Garib Kalyan Yojana. Under PM Garib Kalyan Yojana, gas cylinders, free of cost, would be provided to 80 mn poor families for the next three months, the finance ministry said. Oil Minister Dharmendra Pradhan said measures such as cash transfers, insurance cover, ensuring food security and the decision to provide free LPG (liquefied petroleum gas) cylinders for 3 months to all the beneficiaries of Pradhan Mantri Ujjwala Yojana will give relief to millions of poor and will ensure no one in the country goes hungry. Marketing guidelines have not been provided post the announcement and it is still not clear whether consumers will be able to lift more than one LPG cylinder in a month. Information regarding the number of refills a consumer can avail will be clearer later tonight.

Source: The Economic Times

25 March. India's oil production fell 6.4 percent in February as a decline in output from fields operated by private firms negated a rise in production from ONGC (Oil and Natural Gas Corp) fields. Crude oil production at 2.39 million tonnes (mt) in February was 6.41 percent lower than 2.56 mt output in the same month a year back, according to the oil ministry data. ONGC reported a 4.64 percent rise in production at 1.67 mt as output from its offshore fields saw a pick-up. However, fields operated by the private sector firms reported a 32.6 percent drop with those in Rajasthan seeing a sharp 32.3 percent lower production.

Source: Business Standard

25 March. With demand for cooking gas increasing amid the lockdown, some parts of the city saw long queues outside LPG (liquefied petroleum gas) dealer outlets as staff shortage affected home delivery of cylinders. The supply of LPG from oil marketing firms and the delivery of gas cylinders to dealers across Mumbai is normal. An HP gas agency staffer in Kalyan (West) said many of their staffers did not report for work owing to "health risks" and hence, they were forced to ask customers to collect the LPG cylinder refills from their godown at Khadakpada Circle. In some areas, people complained that they had to pay a 'premium' for a gas cylinder refill. In other parts of Mumbai region, LPG cylinder delivery was on, though the waiting list was 2-3 days.

Source: The Economic Times

25 March. Stocks of petrol, diesel and LPG (liquefied petroleum gas) cylinders are sufficient in Uttar Pradesh (UP) as oil companies are working to maintain the supply of fuel and cooking gas despite the lockdown, an official of Indian Oil Corp (IOC) said. Sufficient stocks of petrol and diesel are being ensured at all retail outlets and gas cylinders at LPG distributorship end, Executive Director and State Head Indian Oil cum State Level Coordinator, Oil Industry, UP, Uttiya Bhattacharyya said. Oil companies have also requested for the issuance of necessary passes from the respective district magistrates of UP to ensure regular availability of these essential commodities, he said. At present, there are total 2178 LPG distributors for catering to around 403 lakh active LPG customers and 7128 Retail Outlets to cater to the various fuel requirements of general public in UP.

Source: Business Standard

25 March. Indian Oil Corp (IOC) aims at ramping up capacity at its Kandla LPG (liquefied petroleum gas) import terminal from 600,000 tonnes per year to 2.5 million tonnes per annum (mtpa) at a cost of ₹5.88 bn. The capacity is being increased to feed liquefied petroleum gas (LPG) into the proposed 2,757 km long Kandla-Gorakhpur LPG pipeline, billed as the longest LPG pipeline in the world. To be laid at a total cost of ₹100.88 bn, the 8.25 mtpa capacity pipeline would connect four big ports including Kandla, Mundra and Pipavav on Gujarat coast, four refineries and 22 LPG bottling plants in Gujarat, Madhya Pradesh and Uttar Pradesh. The Kandla-Gorakhpur pipeline will be a joint venture of three oil marketing companies. The pipeline will connect the two refineries including IOC’s 13.7 mtpa Koyali refinery and the 6 mtpa Bina refinery in Madhya Pradesh.

Source: The Economic Times

25 March. Digital payments platform Paytm has announced that it has entered into a partnership with Indian Oil Corp (IOC) to enable digital transactions across its fuelling stations as well as LPG (liquefied petroleum gas) cylinder delivery ecosystem in the country. With this, IOC customers will now be able to book and pay for LPG cylinders on the Paytm app. IOC’s delivery executives will also carry the Paytm All-in-One Android POS device and All-in-One QR code to facilitate digital transactions at the time of delivery. IOC’s brand Indane Gas has now started accepting digital payments through Paytm All-in-One Android POS and All-in-One QR for home delivery of gas cylinders. It has been working with Paytm and promoting cashless payments to help stop the spread of coronavirus. Paytm’s POS machine will be integrated with Indane delivery application to enable digital recording and updating of cylinder delivery. It will generate an e-invoice or physical copy of the bill as well. IOC retail outlets will also carry Paytm’s All-in-One payment services for unlimited acceptance of Paytm Wallet, UPI from all apps and Rupay cards. Along with this, every customer paying at petrol pumps using Paytm will automatically get credited with points under Indian Oil ‘XtraRewards’ Loyalty Program. These points can be redeemed on the Paytm app for purchasing free fuel from IOC outlets. Paytm users can order their IOC cylinder refills by tapping on 'Book a Cylinder' icon in the 'Other Services' section of the app. The entire process requires minimal details and does not require them to re-enter details on every purchase. They only need to provide their consumer number or the linked mobile number along with the name of the gas agency.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Low gas prices is negative for domestic producers! < style="color: #ffffff">Bad! |

31 March. India has cut the price of locally produced gas for the April-September 2020 period by more than a quarter to a multi-year low of $2.39 per million metric British thermal units (mmBtu), the government said. This would be the lowest price since 2014, when the nation began linking local rates to a formula linked to global benchmarks, including Henry Hub, Alberta gas, NBP and Russian gas. It also set the ceiling price for gas produced from more challenging fields at $5.61 per mmBtu for the same period, down about 33.5 percent from the prior six-month period the statement showed. The prices will be applicable on gross heat value basis. Lower natural gas prices mean reduced costs for gas for fertilisers, automobiles and households. They will also cut earnings for Oil and Natural Gas Corp and Oil India Ltd.

Source: Reuters

29 March. India’s plan to develop a gas-based economy with the cleaner fuel gradually becoming the mainstay of country’s energy security needs has received a major setback as the Covid-19 pandemic has severely impacted demand, resulting in curtailed operations globally. In India the current lockdown has led to 15-20 percent overall demand hit due to the closure of most of the factories in sectors excluding fertiliser, power and refineries. According to brokerage firm Emkay, GAIL (India) Ltd may see a 15-20 million metric standard cubic meter per day (mmscmd) decline in marketing volumes as the lockdown progresses, while transmission volumes may also decline up to 10-15 mmscmd. This has resulted in curtailed operations by gas producing companies such as Oil India Ltd and ONGC (Oil and Natural Gas Corp). Other gas companies such as GSPL (Gujarat State Petronet Ltd) have seen its throughput down by 5 mmscmd, with CGD (city gas distribution) being the major reason. Morbi ceramic offtake is seen falling by over 4 mmscmd to under 3 mmscmd currently, while CNG (compressed natural gas) sales in Gujarat is down 80 percent. CNG sales in Delhi and Mumbai are also estimated to be down 70-80 percent as except for a reduced number of buses and essential service vehicles, other vehicles remain mostly off-road. Indraprastha Gas Ltd (IGL) had said that it will rationalise its services and operate only 55 of its CNG stations in Delhi-NCR till 31 March due to the ongoing lockdown. The Emkay report has further said its channel checks with ONGC indicate a 5-7 mmscmd decline in gas sales volume due to lower demand although the company is trying to shut down some wells and reduce flow-rate to mitigate the impact. Oil India’s gas demand has also been hit and would be 7-8 percent with reduced offtake from smaller industries such as tea gardens.

Source: The Economic Times

25 March. India’s top gas importer Petronet LNG has issued force majeure notice to Qatargas seeking to delay loading of liquefied natural gas (LNG) cargoes under long-term deals as local gas demand has dropped. It seems demand will fall drastically as industrial production is curtailed to a great extent and demand for gas will fall further, after India imposed a lockdown to prevent the spread of the coronavirus.

Source: Reuters

25 March. With the unprecedented nationwide lockdown shutting down factories, ONGC (Oil and Natural Gas Corp) has been forced to cut natural gas production by up to one-tenth as customers refused to take supplies because of business disruption. ONGC, which produced 64.5 million metric standard cubic meter per day (mmscmd) till earlier, has reduced the flow to 59.8 mmscmd, and will further cut by another 3 mmscmd. The company has received requests from customers for reduction in gas supplies of around 7.7 mmscmd. Besides this, another 4-5 mmscmd supply reduction requests have been lodged with the gas transporter GAIL (India) Ltd. Out of the 7.7 mmscmd gas reduction request received by ONGC, 6 mmscmd has come from the Hazira region, the sources said, adding the remaining reduction was sought by factories in Andhra Pradesh and adjoining areas. Besides, GAIL has been piled with requests for cut in supplies for another 4-5 mmscmd along its Hazira-Vijaipur-Jagdishpur pipeline. GAIL would accommodate 4-5 mmscmd of reduction by cutting the use of imported liquefied natural gas (LNG) and fuel sourced from fields other than of ONGC.

Source: Livemint

31 March. South Eastern Coalfields Ltd (SECL), the largest coal producing subsidiary of Coal India Ltd (CIL), became the first coal company to produce 1 million tonnes (mt) of dry fuel in a single day amid the countrywide lockdown to contain coronavirus. Coal mining activity and its transportation has been declared as Essential Service during the lockdown due to COVID-19 outbreak. Owing to huge production loss due to deluge in the mines this monsoon, the SECL output in this year is likely to fall short of its previous year's production of 157 mt. But it will able to surpass the 150 mt mark and retain the top producer rank among the six CIL subsidiaries.

Source: Business Standard

30 March. Amid concerns that Coal India Ltd (CIL) may fall short of its 660 million tonne (mt) production target for the current fiscal, the miner has planned to ramp up daily output to meet the goal. Till December, the miner is expected to produce close to 390 mt of coal and will require another 270 mt in the last quarter of this fiscal to meet the annual production target. Currently, CIL produces 1.8 mt per day while the asking rate to achieve the target is 2.9 mt. Internally, CIL has planned to raise its production to 3 mt per day at least in February and March next year to inch closer to the target. In 2018-19, CIL produced 606.89 mt while dispatch was at 608.14 mt.

Source: The Economic Times

29 March. The government said it is working to ensure critical coal supplies during the lockdown on account of coronavirus outbreak. Coal stocks at power plants stand at 41.8 million tonnes (mt) equivalent to 24 days consumption as of 26 March 2020. Daily meetings of all senior officers of the ministry are being held for monitoring coal production, supplies and despatch, it said. The first such virtual meeting was taken on 26 March 2020 through video conferencing by Coal Secretary Anil Kumar Jain. A daily report will be given to the Coal Minister Pralhad Joshi. As coal ministry is a fully paperless office the entire staff is working on the e-office platform from the ministry or at home as per duty rosters, it said. The Minister appreciated work being done by Coal India Ltd (CIL) where all officers and workers are ensuring the coal production and supplies are not affected in these critical times. The Minister further assured that no approvals requiring concurrence of Ministry of Coal would be held up during the current lockdown.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Fall in electricity demand is detrimental for discom revival! < style="color: #ffffff">Ugly! |

30 March. The lockdown announced to control the Covid-19 pandemic has effected an adverse impact on electricity demand and cash flows of distribution companies (discoms). The shutdown has impacted the industrial and commercial establishments and stoppage of passenger railway services. This has hit the electricity demand, given that these segments constitute about 40 percent of the all-India electricity demand, according to rating agency ICRA. The Union Ministry of Power has issued directions to the Central Electricity Regulatory Commission to provide a moratorium of three months to discoms. The power generation companies are already suffering delays in payments by discoms across most of the States, with a payment due of more than ₹850 bn as of November 2019 at all-India level.

Source: The Hindu Business Line

30 March. The Maharashtra government announced an average of 8 percent electricity tariff cut for the next five years to help businesses and people tide over the COVID-19 crisis. While the industry has been given the highest benefits, farmers will have to contend with a 1 percent reduction in electricity costs. All the revisions are for a period of five years. For the consumers served by private sector discoms (distribution companies) Adani Energy and Tata Power in the financial capital, industrial units will have their power rates slashed by 18-20 percent, commercial establishments by 19-20 percent and residential ones by 10-11 percent. The Maharashtra Electricity Regulatory Commission (MERC) has approved a move to cut tariffs by an average of 7-8 percent as part of the move, which is first such measure in the past 10-15 years. Industrial consumers in the state, excluding the capital Mumbai, will enjoy a tariff cut of 10-12 percent, while residential ones will see their rates go down by 5-7 percent. MERC Chairman Anand Kulkarni said the announcement has been made after extensive consultations with all the stakeholders and also made it clear that the revised tariffs will not be limited to the next one year alone. Kulkarni appealed people not to misuse power because it is available at lower rates.

Source: Business Standard

27 March. India’s electricity use fell to the lowest in nearly five months on the first day of a nationwide lockdown to prevent the spread of the coronavirus, government data showed, with monthly power consumption likely to fall for the first time in four months. National electricity demand fell to 2.78 bn units on 25 March, the first day of the three-week total shutdown called by Prime Minister Narendra Modi. That was nearly 20 percent below the average of 3.45 bn units per day in the first three weeks of March, a Reuters analysis of government data showed. If demand continues at these reduced levels, India’s electricity consumption for March is set to decline at the fastest pace year-on-year since October, when power use fell at its steepest in over 12 years due to a broad economic slowdown. While electricity usage contracted nationally, consumption actually rose slightly in some states, raising concerns that the shutdown may not have been fully observed in all areas, although officials said higher temperatures may have contributed. The rise in power usage in populous states such as Uttar Pradesh and Bihar may have been due to the use of household air conditioners and other appliances, Victor Vanya, director at power analytics firm EMA Solutions, said. States such as Odisha and Jharkhand also showed slight increases in power usage, but these are mineral rich regions and mining remains an essential service.

Source: Reuters

27 March. The government’s pilot scheme to reduce power generation cost, which saved about ₹27.5 mn per day in the April-December 2019 period, has been allowed to run till May 31, 2020. The pilot scheme, Security Constrained Economic Despatch (SCED), currently involves 52 coal-based power plants with a cumulative capacity of 58,060 MW, and their tariffs are decided on the ‘cost-plus’ basis (no competitive bidding) by the CERC (Central Electricity Regulatory Commission). While most participating plants in the pilot belong to NTPC Ltd, few private power units such as Reliance Power’s Sasan unit and Tata Power’s Mundra station are also part of it. The pilot scheme reduced fuel costs by ₹8.45 bn in April–December 2019. Though the weighted average variable cost comes to ₹1.89/unit, the lowest cost can be ₹1.12/unit and the highest can go up to ₹8.15/unit. The total power generating cost in this period was about ₹540 bn. The CERC has extended the implementation period of the scheme to allow the Power System Operation Corp, the national load despatch centre, to run the scheme designed to explore the possibility of minimising costs without major structural changes in the existing system. The electricity regulator in September 2019 had allowed the pilot to run till FY20-end.

Source: The Financial Express

27 March. Power consumption in the state capital has marginally declined with the closure of commercial and industrial establishments due to the 21-day lockdown. The energy department said the city’s peak power demand has declined by 13.61 percent since 22 January when the country observed ‘janata curfew’ to prevent spread of coronavirus. Maximum power demand in the city was 311 MW in the evening hours against 360 MW, a day before the of ‘janata curfew’. Patna Electricity Supply Unit said there was slight fluctuation in power demand in the city, mainly because of closure of malls, restaurants, hotels and coaching classes, hostels, educational institutes (schools and colleges) and industrial units.

Source: The Economic Times

26 March. The consumers won’t have to pay additional charges on the online payment of electricity bills, informed the Uttar Pradesh Power Corp Ltd (UPPCL). Now, these additional charges levied by the bank will be paid by the UPPCL. And the consumers can call on 1912, in case of any inconvenience.

Source: Business Standard

26 March. Electricity price in the spot or current market plunged to a three-year low of 60 paise per unit as shutdown of factories and businesses due to a nationwide lockdown wiped away power demand by as much as 20 GW. According to data from the Indian Energy Exchange (IEX), the previous low of minimum spot electricity price was recorded at 52 paise per unit in 2017 which rose to ₹1.72 per unit in 2018 and then dipped to 94 paise in 2019 before touching a three-year low of 60 paise in 2020 for supply. The power demand from industrial units and distribution companies was down by 40 percent and 42 percent, respectively, on the IEX.

Source: The Economic Times

25 March. Research on Bustards across the world and studies carried out by the Wildlife Institute of India (WII) have identified power-lines, particularly overhead transmission lines, as the biggest threat for the survival of Great Indian Bustards (GIB), a critically endangered bird species. The Supreme Court asked the Rajasthan government to mull options for laying underground cables to protect its official state bird. According to WII power-lines, particularly high-voltage (33-440 kilovolt) transmission lines with vertical alignment, are the biggest threat to GIB. The habitats of this bird have a high density of transmission lines because of the impetus on renewable energy production in Rajasthan and Gujarat.

Source: The Economic Times

25 March. India needs to establish a manufacturing base of smart electricity meters to ensure adequate supply and should ensure that there are multiple players in the segment, Parliamentary Standing Committee on Energy has said in its latest report. Finance Minister Nirmala Sitharaman in her budget speech this year allocated ₹220 bn for the power and renewable energy sector and urged the state governments to implement smart meters in three years. The move is aimed at giving the consumers the right to choose suppliers and the rates. She had said implementation of smart meters programme will address the issue of financial health of discoms (distribution companies). The committee highlighted the advantages of smart meters over conventional meters. Though the cost of smart meter is nearly three times more this extra cost could be recovered in a six-and-a-half year time frame, the committee said. The panel has recommended that henceforth only smart meters should be installed by power ministry under Saubhagya scheme to avoid duplicity of work. Energy Efficiency Services Ltd has announced the completion of installation of 10 lakh smart meters across India under the centre’s Smart Meter National Programme (SMNP). The company has set a target to install 250 mn smart meters over the next few years.

Source: The Economic Times

30 March. Private utility Tata Power said it has commenced commercial operations of 178 MW Shuakhevi hydro power project in Georgia. Adjaristsqali Georgia – a joint venture between Tata Power, Norway’s Clean Energy Invest (CEI) and International Financial Corp- is setting up a 187 MW of hydro project at a cost of around $500 mn. It has commissioned 178 MW of the total capacity. AGL will soon commission the remaining 9 MW Skhalta hydro power project, which is also a component of the overall Shuakhevi project scheme, it said. Shuakhevi project is the only project in Georgia’s energy sector which has been funded by three of the largest financial institutes such as European Bank of Reconstruction and Development (EBRD), Asian Development Bank (ADB) and IFC, a member of the World Bank Group, it said. The project will generate around 450 GW of clean energy to reduce the emission of greenhouse gases by more than 2,00,000 tonne a year. Tata Power has an installed hydro power capacity of around 500 MW with three plants in Maharashtra, which generates power for the domestic market.

Source: The Financial Express

30 March. About 1,000 MW of solar projects in Haryana are unable to transmit electricity because distribution firms are not giving them the required connectivity, a grouping of solar power developers said. The Distributed Solar Power Association, a body of solar rooftop developers, said it’s likely to soon file a petition before the Haryana Electricity Regulatory Commission protesting the power discoms’ reluctance. All these are ‘open access’ projects, where developers supply power directly to their customers without routing it via a discom. But they need the consent of the area’s discom to do so.

Source: The Economic Times

26 March. Renewable Energy (RE) projects under implementation will be given extension of time considering period of lockdown and time required for re-mobilisation of work force, Ministry of New and Renewable Energy (MNRE) Secretary Anand Kumar said. Kumar accepted that the spread of coronavirus has not only disrupted the supply chain of components used in RE projects but also has impacted the availability of workforce. Kumar said, the announcement of the extension of time will provide great relief to all the stakeholders in Renewable Energy sector.

Source: The Economic Times

31 March. Saudi Aramco, the world’s largest oil producer, is weighing the sale of a stake in its pipeline unit to raise money amid a slump in crude prices. Aramco may need to raise cash this year as it confronts a historic rout in oil prices and a burgeoning list of spending obligations. Aramco is ramping up oil supply at a time demand is falling off a cliff as travel restrictions are placed on people all around the world to stop the spread of coronavirus. The company has said it will keeping flooding the market with historic levels of oil at least through May, but the extra volume isn’t enough to compensate for the 67 percent drop in prices this year.

Source: Business Standard

31 March. As a weekend standoff over oil shipments emerged between Texas pipeline operators and shale producers, a state energy regulator has renewed his controversial call for mandated cuts to address a growing crude glut. Oil prices have fallen more than 60 percent this year as the coronavirus pandemic has destroyed fuel demand and Saudi Arabia and Russia kicked off a price war in a battle for market share. Oil in Midland, Texas, home of the biggest US (United States) shale field, traded for under $10 a barrel, far below the cost of production. In the latest sign of a growing oil glut in the state, crude oil purchasers across Texas have warned producers that storage will be limited in May and output must be cut.

Source: Reuters

31 March. China began trading liquefied petroleum gas (LPG) options on the Dalian Commodity Exchange, only a day after the debut of an LPG futures contract, as the bourse experiments with simultaneous launches. The LPG futures contract for November delivery fell 9 percent, its first day of trade, but rallied 7 percent to settle at 2,513 yuan per tonne. During the session, it hit its trading limit as the global oil price staged a recovery from a deep sell-off triggered by the impact of the coronavirus crisis on demand. The derivatives for LPG, a refined oil product used as a fuel in vehicles and for cooking, are the third type of oil and gas product to be listed in China. Oil markets have been particularly hard hit because of a battle for market share between Saudi Arabia and Russia that has increased supply while demand has been destroyed by lockdowns to try to prevent the spread of the new coronavirus. Refiners have been cutting back activity as storage fills and profit margins shrink, which could eventually boost prices of some refined products such as LPG.

Source: Reuters

30 March. The coronavirus pandemic and resulting plunge in crude prices will result in a leaner, stronger oil industry but raise the risk of shortages further down the line, Goldman Sachs analysts said. Crude prices suffered another sharp fall as the pandemic worsened and the Saudi Arabia-Russia price war showed no signs of abating. This would in turn cause an oil shortage, pushing prices above the Wall Street bank’s $55 a barrel target for 2021. This will likely be a game changer for the industry, the bank said. Oil has been hit disproportionately by the “coronacrisis”, sending landlocked crude prices into negative territory, Goldman said.

Source: Reuters

30 March. Egypt’s 2020-21 draft budget is based on an oil price of $61 per barrel, the finance ministry said, down from $68 in the current budget which ends on June 30 but around three times higher than the present price. Oil prices fell sharply, with US (United States) crude briefly dropping below $20 and Brent hitting its lowest in 18 years, on heightened fears that the global coronavirus shutdown could last months and demand for fuel could decline further.

Source: Reuters

30 March. US (United States) President Donald Trump and Russian President Vladimir Putin agreed to have their top energy officials discuss slumping global oil markets, as Trump called Russia’s price war with Saudi Arabia “crazy.” The agreement marks a new twist in global oil diplomacy since a failed deal between the Organization of the Petroleum Exporting Countries (OPEC) and Russia to cut production ignited the price war between Russia and OPEC’s de facto leader Saudi Arabia. The fallout from the coronavirus pandemic also helped to send oil prices into a historic tailspin, threatening higher-cost drillers in the US and around the globe with bankruptcy. The Trump administration is also seeking to persuade the world’s top oil exporter, Saudi Arabia, to cut crude output, and will soon send a special energy envoy, Victoria Coates, to the kingdom.

Source: Reuters

27 March. Iraq has sent a proposal to all international oil companies asking them to reduce the budgets of developing oilfields by 30 percent as the slump in oil prices has hit government revenues, but said the proposed cuts should not affect crude output. International firms operate in Iraq’s southern oilfields under service contracts. Under the contracts, they are paid a fixed dollar fee for volumes produced and Baghdad repays companies for the cost of building projects and approve oilfields development plans. Energy companies around the world are slashing spending after the benchmark Brent oil price more than halved since the start of the year, to trade around $26 a barrel. Iraq, OPEC’s second-biggest oil producer, pumps around 4.6 mn barrels per day. Iraq’s oil ministry said there had been discussions with the oil companies on cost cuts but a decision on that should be taken when there is more clarity on the impact of the coronavirus crisis on the oil market. Meanwhile, ExxonMobil, which is the main developer of the West Qurna 1 oilfield in southern Iraq, has also asked all its suppliers in Iraq to reduce costs, according to a letter seen by Reuters. Exxon Mobil Corp has said it was notifying contractors and vendors of planned near-term cuts in capital and operating expenses due to the coronavirus pandemic. Other Arab oil producers are also reviewing their spending plans. Kuwait Petroleum Corp has instructed all subsidiaries to cut spending this year due to an “unprecedented” decline in oil prices caused by the collapse of a global oil supply cut pact and the spread of the coronavirus which has hit demand. Abu Dhabi National Oil Company has also notified contractors and suppliers that it will review existing deals to find ways to cut costs. Saudi Aramco, the world’s top oil producing firm, said it planned to cut capital spending for 2020 to between $25 bn and $30 bn, from $32.8 bn in 2019.

Source: Reuters

25 March. Venezuelan state oil company Petróleos de Venezuela (PDVSA) is trying to repair the catalytic cracker at its 146,000 barrel per day (bpd) El Palito refinery in an effort to restart gasoline production at the facility after years of inactivity. US sanctions on PDVSA, part of a push to oust socialist President Nicolas Maduro from power, have made it more difficult for Venezuela to import fuel, resulting in widespread gasoline shortages. The OPEC (Organization of the Petroleum Exporting Countries) country’s refineries, which can process up to 1.3 mn bpd, are producing at a small fraction of capacity due to years of lack of maintenance. A plunge in global oil prices as a result of falling demand due to the coronavirus pandemic, as well as a price war between producers Russia and Saudi Arabia, has also left cash-strapped Venezuela with even fewer funds to import goods like fuel.

Source: Reuters

25 March. Russian domestic oil prices for April delivery fell by more than 75 percent from a month ago to 5,272 roubles ($67.2) per tonne, or $9.2 per barrel, at a Rosneft tender following the collapse on global oil markets, traders said. It was the lowest domestic price in Russia’s Volga River region since Reuters began tracking it in 2009. The prices are indicative for the domestic market and have not been approved yet by Rosneft, which sets up the domestic tenders via a joint venture with China’s Sinopec, Udmurtneft.

Source: The Economic Times

25 March. Global oil demand could fall by as much as 4.9 mn barrels per day (bpd), or by about 4.9 percent, in 2020 due to the coronavirus outbreak, Norway’s biggest independent energy consultancy Rystad Energy said. The consultancy had forecast it would fall by 2.8 mn bpd in 2020. Rystad said oil demand in the month of April was forecast to fall by 16 mn bpd, compared to a year earlier. Rystad forecast a fall in jet fuel demand year on year of 20 percent, or 1.4 mn bpd, while air traffic was expected to drop 8 percent. It said demand for vehicle fuel would fall 5.6 percent, or by 2.8 mn bpd, year on year.

Source: Reuters

30 March. US (United States) natural gas stockpiles will hit an all-time high in 2020 as drillers keep producing record amounts of fuel even though demand is expected to slump as governments take steps to slow the spread of coronavirus. Before the outbreak, analysts projected the US would export much of its surplus gas to other countries. But suppliers of liquefied natural gas (LNG) are flooding the market with excess cargoes due to declining demand, and analysts expect buyers to cancel more US cargoes in coming months as gas prices plunge. Analysts polled project US gas storage will reach a record 4.078 trillion cubic feet (tcf) at the end of the summer (April-October) injection season as the pandemic cuts demand before producers can reduce output. That is still well short of US capacity of 4.268 tcf in the Lower 48 states, according to the most recent federal data in 2018. However, the slump in demand headed into the seasonally less active summer means prices are set to drop further. The combination of reduced demand out of Europe and Asia, and fewer new US liquefaction units entering service means the rapid pace of US LNG export growth over the past few years will slow. Even before the coronavirus spread, global gas prices were already trading at their lowest in years as the US-China trade war pressured economic growth while mild weather reduced heating demand in North America, Europe and Asia and filled European gas stockpiles to historic highs. The US has exported record amounts of LNG every year since 2016, reaching an average 5 billion cubic feet per day (bcfd) in 2019. The US Energy Information Administration, however, projected LNG exports will rise 29 percent this year, a steep drop from an increase of 68 percent in 2019.

Source: Reuters

30 March. Poland’s largest gas distributor PGNiG said that an international arbitration court had ruled that Russian gas giant Gazprom must pay it about $1.5 bn in a pricing dispute case. PGNiG said the arbitration tribunal in Stockholm also ruled that a gas pricing formula should be changed to take into account natural gas market quotations, which would “improve the conditions of trading activity”. Gazprom Export said that it had received the Stockholm arbitration ruling and was analysing it. Poland is trying to reduce its reliance on Russian energy imports, where it gets more than a half of the gas it consumes.

Source: Reuters

27 March. Woodside Petroleum halved its forecast spending for 2020 and deferred go-ahead decisions for its two biggest gas projects to ride out the pain of the coronavirus pandemic and plunging oil prices. Australia’s top independent gas producer said it would slash total planned spending this year by around 50 percent to $2.4 bn. That included cutting investment spending by 60 percent to around $1.8 bn and operating expenses by $100 mn. Woodside Chief Executive Peter Coleman said Woodside’s decisions would also help position the company to chase acquisition opportunities that might emerge rather than tying it down to development projects, and could allow it to return cash to shareholders. Woodside said it would defer a final investment decision on its $11 bn Scarborough project, co-owned by top global miner BHP Group, and its Pluto LNG expansion to 2021. It had targeted a go-ahead on the twinned projects in mid-2020. Scarborough, the Pluto LNG expansion and Browse, Australia’s biggest undeveloped gas field, are key to driving Woodside’s planned 6 percent growth a year in output through 2028. In spite of the crash in global oil and gas demand and virus-induced uncertainty, Woodside said it has continued to see gas demand from its core customers in north Asia.

Source: Reuters

30 March. The biggest union at the Cerrejon coal mine in Colombia pulled back from launching a previously approved strike and withdrew its demands regarding pay raises and other benefits. The decision by union Sintracarbon extends previously agreed benefits with the company until 30 June this year. An initial 20 days of new negotiations will begin in May. Last year, coal prices fell to an average of $51.40 per tonne, from $82.50 per tonne in the previous year, according to the energy ministry. Coal is the second largest generator of foreign currency for the Andean country after oil. The company, which has reduced its operations to control the spread of coronavirus, exported 26.3 million tonnes (mt) of coal in 2019 and has 5,896 workers, of which 4,600 are union members.

Source: Reuters

26 March. Rio Tinto said it had found several cases where Australia’s biggest mining industry body advocated for thermal coal in contravention of 2015 Paris climate goals, as it released a review of its membership in industry groups. The review comes as investors ramp up pressure on major carbon-linked companies to drop support for thermal, or energy coal, which can be substituted for renewable energy, if the world is to meet the Paris climate accord goals. While Rio sold off its coal assets for billions over 2017-2018, it is the world’s largest producer of iron ore, a key raw material for the steel industry, one of the world’s biggest emitters.

Source: Reuters

26 March. Global coal power plant development declined for the fourth year running in 2019, while a total of 13 GW of capacity construction has been delayed so far this year due to the coronavirus, research by environmental organizations shows. The annual survey of the global coal plant pipeline by Global Energy Monitor, Greenpeace International, the Sierra Club and the Centre for Research on Energy and Clean Air showed a 16 percent drop last year in capacity under construction and development. This year, 15 plants with a total capacity of 13 GW have so far been delayed by workforce or supply chain issues related to the coronavirus outbreak. However, China’s approval of permits for coal plants has increased in an effort to stimulate its economy. From 1 to 18 March this year, China approved more coal-fired capacity for construction (6.6 GW) than during all of 2019 (6.3 GW). Even with the overall fall in coal plant development in 2019, the world is not on track for the steep reductions in coal power necessary to meet goals to limit global warming, the report said. Scientists have said coal use needs to fall 80 percent by 2030 to keep global warming below 1.5 degrees Celsius. Globally, the amount of power generated from coal in 2019 declined by 3 percent compared with 2018, with coal plants now operating at an average 51 percent of their available operating hours, which is a record low. New coal plant developers face increasingly difficult conditions as restriction on investment have come from banks and insurers, as well as government commitments to phase out coal.

Source: Reuters

25 March. South African power utility Eskom said that coal stocks at its power stations were healthy, with at least 20 days of supplies at all stations, before a nationwide lockdown over the coronavirus outbreak. Eskom said all its activities were considered “essential services” under labour law and that it would apply for an exemption from the 21-day lockdown for critical staff. It has asked coal miners, coal transporters and freight company Transnet to continue coal supply operations during the lockdown.

Source: Reuters

30 March. Brazil’s government is considering an emergency loan package for energy distributors struggling with lower energy use and facing lost revenues because of the coronavirus outbreak. Also, Brazil’s mines and energy ministry is indefinitely postponing projects to auction off energy transmission and generation assets planned for this year because of the coronavirus. The coronavirus outbreak will also delay the privatization of utility Eletrobras. The coronavirus has led to widespread lockdowns of non-essential businesses in Brazil, while citizens are being told to stay home. That is causing lost income for many hourly and informal workers in Brazil, who could be unable to pay their electricity bills.

Source: Reuters

25 March. Norway is postponing a decision on whether to allow companies to construct a new subsea power cable between it and Scotland, the government said. Known as NorthConnect and partly owned by Swedish energy group Vattenfall, the project is controversial as some Norwegian lawmakers fear rising grid costs and power prices as output from wind turbines and hydropower dams is exported. Planning for the €2 bn ($2.17 bn) project is still going on, but the government needs more data on the market impact from other power cables that are currently being built before a decision can be made, Energy Minister Tina Bru said. Publicly owned grid operator Statnett is already building two subsea cables, to Germany and Britain, which are due to start operating this year and next, respectively. While power could flow both ways depending on supply and demand, Norway expects to be a net exporter in most years as prices tend to be higher in major European nations than at home. Vattenfall and Norwegian power producer Statkraft have previously called on the government to approve the new cable as producers have been struggling with the relatively low Nordic electricity prices.

Source: Reuters

31 March. Brazil’s largest fixed-line carrier Oi SA has kicked off a renewable energy project that will cut its operating costs by 400 mn reais ($77.09 mn) per year, the company said. The renewable project, which involves 25 solar, biomass and hydroelectric mills totaling 123 MW in capacity, follows the so-called “distributed generation” model, in which Oi buys clean energy at lower prices. The first plant, a solar one based in the southeastern state of Minas Gerais, was inaugurated and the others are likely to start operations by year-end, Oi said.

Source: Reuters

30 March. Japan has kept unchanged its target, set in 2015, of a cut of 26 percent in greenhouse gas emissions by the fiscal year ending in March 2031, from levels seen in fiscal 2013, the environment ministry said. After submitting the review outcome to the United Nations (UN), Japan plans to send a further notice before the next UN climate summit, due in Glasgow in November, to reflect Tokyo’s reduction effort, Environment Minister Shinjiro Koizumi said.

Source: Reuters

30 March. Finland’s center-left government gave its blessing to majority state-owned Fortum’s strategy to cut emissions, but promised to push the company further towards carbon neutrality, State Ownership and Steering Minister Tytti Tuppurainen said. The Minister rejected WWF Finland’s proposal to include the Paris climate deal’s goal of maximum 1.5 degree Celsius temperature rise in Fortum’s articles of association. She said that the government wants carbon neutrality to be a joint goal for it and Fortum.

Source: Reuters

30 March. Portugal has postponed its second solar energy licensing auction due to the impact of the coronavirus pandemic, but still hopes to launch it by June if the spread of the outbreak starts to slow, the environment ministry said. Initially scheduled to kick off in April, the licensing auction for 700 MW of new solar energy capacity would help Portugal - one of Europe’s countries with most hours of sunshine per day - reach its ambition of having 7,000 MW of renewable energy by 2030.

Source: Reuters

27 March. The US (United States) Environmental Protection Agency (EPA) unveiled measures to help oil refineries cope with fallout from the coronavirus outbreak, including waiving anti-smog requirements for gasoline and extending the deadline for small facilities to show compliance with the nation’s biofuels law. The EPA will also extend the deadline for small oil refineries to prove their compliance with the Renewable Fuel Standard (RFS), the law that requires refineries to blend billions of gallons of biofuels like ethanol into their fuel or buy credits from those that do.

Source: Reuters

27 March. European Union (EU) leaders have agreed that the bloc’s coronavirus economic recovery plan should take heed of its aim to fight climate change. Following a six-hour video conference, the 27 EU leaders agreed to coordinate a coronavirus economic recovery plan. The EU’s executive commission wants its 27 member states to sign up at a summit in June to plans to make the entire bloc greenhouse gas neutral by 2050. So far, Poland is the only holdout. Poland has warned that the pandemic will make EU climate targets harder to reach. A global coalition of more than 300 climate change campaign groups urged governments to use any coronavirus economic rescue packages to help accelerate a transition to a low-carbon future.

Source: Reuters

27 March. California adopted a new emissions target for its electric sector that would double the state’s clean energy capacity over the next decade and close the door to development of new natural gas plants, but green groups said the goal was not aggressive enough. The California Public Utilities Commission (CPUC) set a target of reducing greenhouse gas emissions to 46 million metric tonnes by 2030, 56 percent below 1990 levels. The goal outpaces the state’s overall goal of slashing emissions to 40 percent below 1990 levels by 2030. California electricity providers will need to develop nearly 25 GW of renewable energy and battery storage to achieve the goal, nearly double the amount the state has currently, CPUC Commissioner Liane Randolph said.

Source: Reuters

26 March. Italy’s biggest regional utility A2A said it planned to beef up its climate targets by cutting its carbon emissions 46 percent over the next ten years. The planned reduction by 2030 was for so-called Scope 1 emissions. Scope 1 includes direct emissions under a company’s control such as fleet vehicles or gas boilers on site. A2A said the new target was based partly on the development of at least 1.6 GW of new renewable energy capacity by 2030 as well as the shutting and reconversion of cola and oil-fired power plants.

Source: Reuters

26 March. Abu Dhabi’s department of energy has postponed the announcement of the winning bids for developing a 1.5 GW solar power plant in the Al Dhafra region. The department of energy will continue to ensure continued supply of safe, reliable water, wastewater and electricity services.

Source: Reuters

25 March. Vietnamese private firm Trung Nam Group said it will at the end of this month start building a 450 MW solar farm in central Vietnam that will be the largest of its kind in southeast Asia. The 14 tn dong ($593.22 mn) facility in Ninh Thuan province is scheduled to start power generation in the fourth quarter this year, the company said. Vietnam, which is working to limit its use of fossil fuel, said it would more than double its power generation capacity over the next decade to 125-130 GW to support economic growth. Trung Nam said it has received an approval from the province to build the wind farm, which will be connected to the national power grid. The government said Ninh Thuan province is aiming to have 8,000 MW of renewable capacity by 2030.

Source: Reuters

25 March. More than 60 GW of wind energy capacity was installed around the world last year, driven by market-based mechanisms such as capacity auctions, a market outlook by the Global Wind Energy Council (GWEC) showed. New installations totalled 60.4 GW, up 19 percent from a year earlier and the second biggest annual addition on record. Overall, total wind energy capacity last year was more than 651 GW, up 17 percent from 2018. In 2019, China and the United States remained the world’s largest onshore wind markets, together accounting for more than 60 percent of new capacity. GWEC forecasts that more than 355 GW of wind energy capacity added over the next five years, equivalent to 71 GW of wind energy added each year to the end of 2024.

Source: The Economic Times

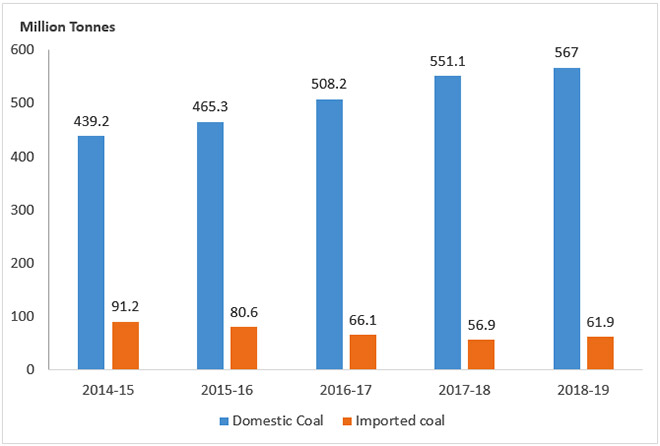

| Year | Coal Consumption by Coal based Power Plants (Million Tonnes) |

| 2014-15 | 530.4 |

| 2015-16 | 545.9 |

| 2016-17 | 574.3 |

| 2017-18 | 608.0 |

| 2018-19 | 628.9 |

Trends in Coal Consumption of Power Plants by Source

Source: Lok Sabha Questions

Source: Lok Sabha QuestionsThis is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.