Flexibility and transparency critical for a gas-based economy; last mile pipelines get a boost in India — and other news and analyses from the energy sector.

Quick Notes

Flexibility & Transparency Critical for a Gas-based Economy

Gas Based Economy

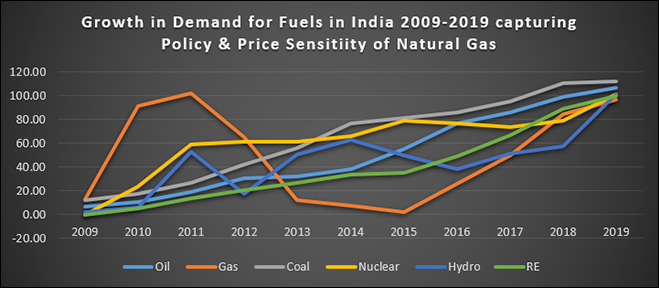

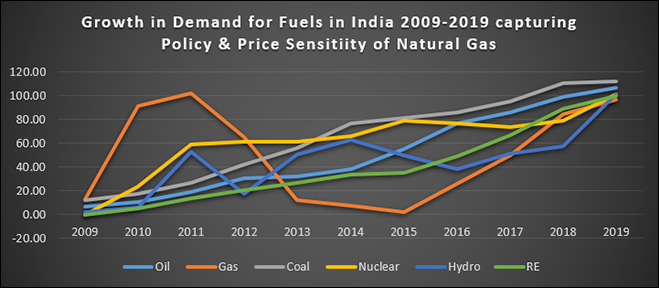

The Government of India seeks to increase the share of natural gas in India’s commercial energy basket from 6.3 percent in 2019 to 15 percent by 2030 to make India a ‘gas-based economy’. To reach the target of 15 percent, annual growth in consumption of natural gas has to increase from less than 5 percent in the last decade (less than 3 percent in 2019) to well over 10 percent in the next decade. India’s natural gas consumption in 2019-20 was about 175 mmscmd. To increase consumption to 600 mmscmd by 2030, the annual growth rate in consumption has to be more than 13 percent. This is not an impossible target. In the period 2008-2018, natural gas consumption in China grew by over 13 percent. Behind this double-digit growth rate for natural gas consumption in China was an annual average economic growth rate of over 8 percent, regulatory reform for transparency and flexibility along with focussed policy mandates.

Supply and Demand

Natural gas consumption in India rose by an estimated 10 percent y-o-y during the first quarter of 2020. However, the introduction of a nationwide lockdown in March led to a sharp and immediate decrease in demand. In the early months of the lock-down decrease in gas consumption was led by small industry and CNG distribution for transport. However, gas-fired power generation increased by 14 percent as cheap imported natural gas was used to meet peak demand. This was despite the fact that there was an overall decrease in electricity demand.

In 2020 (calendar year) domestic production of natural gas was about 29.5 BCM, consumption was 61.5 BCM which meant an import of 33.9 BCM of LNG. Overall consumption of gas in India fell by about 5.4 percent in 2020 but the Indian case was not an exception. Global natural gas demand which started to slow down in 2019 fell sharply in 2020 because of the mild winter initially and later because of the partial and complete lock-down around the World. Globally the demand for natural gas declined by about 3-4 percent in 2020 and in Europe which is one of the largest markets for gas, demand fell by about 7 percent. The global gas market remained oversupplied in 2020 which combined with declining demand resulted in record low prices.

In India, the fertiliser segment remains the largest consumer of natural gas followed by power, CGD, refinery and other sectors. But growth in the future is expected to come from demand from the CGD sector in general and the industrial sector in particular. Most of the post-2021 growth in natural gas demand in Asia is likely to be led by China and India where gas is expected to benefit from strong policy support. Unlike mature natural gas markets in Europe and North America where demand is led by power generation, in India (and China) the industrial sector (through CGD) is the main source of demand growth, making it highly dependent on the pace of the economic recovery in domestic and export market. Supply is expected to be met increasingly by imported LNG but there is optimism in India that domestic gas production by the private sector in complex deep-water prospects will meet at least 15 percent of gas demand in the future. Even if this materialises, India’s dependence on LNG imports is likely to continue. This will necessarily mean exposure to price volatility as recent developments in the LNG market has shown.

Price Volatility of LNG

LNG imports by India, Pakistan and Bangladesh increased by 8 percent in 2020 to a record 50.48 BCM despite the pandemic. Covid-19 pushed Asian and European spot prices to historical lows but it contributed to some demand growth in South Asian countries. Unexpectedly Asian spot LNG prices more than quadrupled between the start of December 2020 and mid-January 2021, climbing above $30/mmBtu in some cases breaking the record prices experienced after the Fukushima nuclear accident in Japan in 2011. Unprecedented cold weather in key LNG markets, low nuclear power availability in Japan and limits to coal-based generation in South Korea contributed to the price spike. China, the world’s top natural gas importer also faced stronger demand because of lower-than-average temperatures and lower pipeline import flows from Central Asia. On the supply side outages at regional liquefaction plants, including in Australia and Indonesia added to the upward pressure on prices.

The South Asian market lacks flexibility and responsiveness to address price volatility in global gas markets. Regulatory policies are yet to guarantee open and transparent access to gas infrastructures in India. Frameworks for third-party access rules exist or are being developed but they sometimes lack implementation due to the market position of incumbents. The online capacity trading platform established in India in 2018 has brought in some transparency in the market but this is just a step in the long road to reform. India could replicate the Chinese move that incorporated PipeChina in 2020 to ensure independence of infrastructure operators from supply incumbents.

China and India, have reformed their pricing policies to increase market indexation or have enabled big consumers to develop their own supply. Market-based pricing and price-responsive demand support the development of domestic market hubs that promote liquidity. This in turn will reinforce access to flexible and diversified supply. Such a transition in Asian gas markets is even more important in the wider context of the global clean energy transition, where natural gas will be required to make a more flexible contribution as the share of variable renewable energy sources grows and coal use progressively declines. Asian gas market and pricing structures are evolving albeit slowly to reinforce market resilience to price volatility and supply disruption risks.

CGD: city gas distribution, mmscmd: million metric standard cubic meter per day, y-o-y: year-on-year, CNG: compressed natural gas, BCM: billion cubic meters, LNG: liquefied natural gas, mmBtu: million metric British thermal units

Source: Calculated from BP statistical Review of World Energy 2020 data

Source: Calculated from BP statistical Review of World Energy 2020 data

Monthly News Commentary: Natural Gas

Last Mile Pipelines Get a Boost

India

Pipelines

Duliajan Numaligarh pipeline Ltd has begun work to bring the gas line from Numaligarh in Upper Assam to Nagaon. A consortium of three Public sector units, AGCL, Oil India Ltd and GAIL Gas Ltd, have incorporated a new company for implementation of the CGD networks. AGCL is also willing to provide piped gas in seven other districts, and has participated in the expression of interest. The National Gas Grid Pipeline (Urja Ganga Project) which was originally planned for extension from Jagadishpur in Western Uttar Pradesh, to Haldia in West Bengal, was consented to be extended to Guwahati in Assam, by the Government of India through an intermediate spur line from Barauni in Bihar to Guwahati and the Gas Pipeline construction work is being carried out by GAIL (India) Ltd. The Barauni to Guwahati section of the Nation Gas Grid is likely to be completed by next year. Thereafter, eight states of the North East will be connected by Indradhanush Gas Grid Ltd. to the National Gas Grid.

The Infrastructure and Industrial Development department has issued a government order to all the Chief Executive Officers of aforementioned industrial development authorities to implement the 'Dig and Restore' policy of the Urban Development department in industrial areas in compliance of PNGRB directives for development of CGD network based on geographical area. These industrial development authorities have been directed to permit and facilitate infrastructure development by authorized gas companies for supply of PNG. Under the 'Dig and Restore' policy, permission has been given to lay underground pipelines for gas supply through the use of such technologies that do not affect or interrupt traffic and normal activities. It provides that the gas company must submit a bank guarantee before getting the permission for laying a gas pipeline or setting up a pit or chamber. If the digging and restoration work done by the company is found to be satisfactory, then a NoC will be provided and the bank guarantee will be returned within a month from the receipt of such NoC.

GSPL wants to pull out of a northern India gas pipeline project that would link Punjab state to the hilly areas of Jammu and Srinagar due to high construction costs. GSPL wrote to the PNGRB to surrender authorisation to extend the pipeline beyond Punjab to Jammu and Srinagar citing low gas demand and technical complexities. GSPL won a licence in 2011 to lay the 740 km pipeline from Bathinda in Punjab state, with the condition that extension to Jammu and Srinagar would depend on a technical and commercial feasibility report. The PNGRB asked GSPL in February to build part of the pipeline from Bathinda to the border of Punjab by the end of this year and extend it to Jammu and Srinagar by 24 February 2022. The oil ministry said the government is considering giving financial assistance for the project to help kick-start economic growth and the use of gas in a region that has trailed the rest of the country. The federal government has provided financial aid to two projects -- the 2,500 km pipeline linking the states of UP, Bihar, Jharkhand, West Bengal and Odisha; and the 1,656 km grid in the north east.

The UP government has issued guidelines for the supply of PNG to the industrial development authorities with the objective of environmental conservation and providing safe fuel to the industries. Necessary steps are being taken to convert the major highways of the state into Green Energy Corridors to promote the use of pollution-free fuel in the transport sector. Industrial Development Authorities had been directed to allow authorized gas companies and facilitate them in laying pipelines for the network of natural gas in areas of state's industrial development authorities.

CGD

Private CNG pump owners in Mumbai, Thane and Navi Mumbai have declared a strike in the New Year if MGL attempts to ‘force’ them into signing lease agreement for 15 years. The pump owners had support from the Petrol Dealers Association and threatened a major showdown. MGL said that they were prepared with an “alternative arrangement” in case there was a strike. There are 700,000 CNG consumers in Mumbai and a majority of them are private car owners, followed by auto and taxi drivers. If there is a strike, it could hit public transport.

All the industrial units spread across 50 areas in Delhi have been directed to switch over to PNG by 31 January 2021. This move is aimed at reducing the city's air quality index which has been deteriorating regularly. Though a sizeable number of industries are using PNG, the Commission stressed the need for all identified industries in Delhi to switch to PNG. Indraprastha Gas Ltd and GAIL were impressed upon to complete the pipeline network, metering and associated infrastructure.

CNG stations anchored on petrol pumps will not be open to third party hiring according to the PNGRB. Also, oil marketing companies - such as IOC will be barred from setting up their own CNG dispensing units in their petrol pumps that have been let out for CNG supplies to a city gas licensee. PNGRB has notified the final regulations, governing open access for CGD networks whose marketing exclusivity period has ended. After the expiry of the exclusivity period, which is of minimum five years, third parties can access pipelines that carry gas within a city as well as district regulatory stations for a fee. As per the law, PNGRB gives out licences to entities for the retailing of CNG to automobiles and piped natural gas to household kitchens and industrial users with a specified area. PNGRB, in the notification, detailed the methodology for the determination of transportation rates for the pipelines with a city distribution network. A third party can access pipelines with the city to sell gas to an industry or a domestic consumer. They can also use the same for transporting their own fuel to a CNG station it may set up.

Torrent Gas has signed an agreement with the government of Tamil Nadu, committing to invest ₹50 bn for the development of city gas distribution infrastructure in the state. Torrent Gas was earlier authorised by PNGRB to provide CNG and PNG in Chennai and Thiruvallur districts in the state. Torrent Gas will be laying pipelines and other requisite infrastructure in Chennai and Thiruvallur districts over an area of 3,569 square kilometres to provide PNG connections to homes, industries and commercial establishments and CNG to vehicles. As part of the first phase of the infrastructure roll-out, the company aims to commission over 30 CNG stations in Chennai and Thiruvallur districts in the last quarter of the current financial year. Torrent Gas has recently commissioned the first CNG station at Nagapattinam in Tamil Nadu and started the work of laying the pipelines.

LNG

India and its biggest LNG supplier Qatar agreed to set up a task force to identify projects in India for investment by the gas-rich Gulf nation. India imports 8.5 MTPA of LNG from Qatar under a long-term contract. It also buys LPG to meet the fast-expanding cooking gas requirements in the country. At the beginning of this year, India asked Qatar for renegotiation of its long-term supply contract, but the Gulf state was not inclined to renegotiate the price. An investment of $66 bn is said to be lined up in developing gas infrastructure which includes pipelines, city gas distribution and LNG re-gasification terminals. Qatar, for its part, sees LNG as an important part of India's plans to increase its gas-based economy. India is targeting to raise the share of natural gas in its energy basket to 15 percent by 2030 from the current 6.3 percent.

India’s H-Energy will commission its Jaigarh LNG at Jaigarh port in Western Maharashtra state in March 2021. H-Energy will deploy Hoegh LNG Holding’s FSRU for 10 years. The FSRU, built in 2017, has storage capacity of 170,000 cubic meters and has a peak regasification capacity of about 6 MTPA. The FSRU will deliver regasified LNG to the 56 km Jaigarh-Dabhol pipeline connecting to the National Gas grid. The FSRU is also capable of reloading LNG onto other LNG vessel’s for providing bunkering services.

Production

RIL and BP Plc have started production from the R-cluster, ultra-deep-water gas field in block KG D6 off the east coast of India. RIL and BP are developing three deep-water gas projects in block KG D6 - R-cluster, Satellites cluster and MJ – which together are expected to meet around 15 percent of India’s gas demand by 2023. The commissioning of the R-Cluster is the first of three deep-water projects. It is expected to reach plateau gas production of about 12.9 mmscmd in 2021. These projects will use the existing hub infrastructure in KG D6 block. RIL is the operator of KG D6 with a 66.67 percent participating interest and BP holds a 33.33 percent participating interest. RIL-BP’s production of gas has started at a time the LNG prices in the international spot markets are roaring. Spot LNG rates in Asia have jumped to above $11/mmBtu this month, a six-year-high, from a record low of under $2/mmBtu in May on colder-than-normal winters in north Asia, higher freight, and supply outage at some LNG exporting plants. Most of the gas currently being produced by RIL-BP’s new field was sold last year at a price linked to crude oil and can’t rise above the government-set ceiling of $4.06/mmBtu unit until March. Consumers will also be inclined to partly replace expensive spot purchases with cheaper long-term volumes, which are mostly linked to crude oil prices. Customers are using more spot buys when prices had sharply fallen due to the pandemic in previous months. Long-term contracts usually offer customers the flexibility to partly switch between long-term and spot volumes. Since some of the customers of RIL-BP were already using imported LNG, they may cut such imports. Imports meet 55 percent of domestic gas demand compared to 51 percent last year.

Demand

Natural gas consumption in the country has risen 2 percent in November from a year earlier, signalling a rebound in the industrial activity. The consumption rose to 5.2 BCM from 5.1 BCM last November. The demand for the April-November period is down nearly 5 percent from last year. Lockdown had curbed public transport, a key consumer of compressed natural gas in big cities like Delhi and Mumbai. With schools still shut, a big segment of CNG buses are still not on the roads. But the deficit is being met by new CNG pumps being set up in new city gas license areas. Increased activity in smaller factories, which get supply from city gas distributors, has also helped. Lower international prices for many months also helped boost domestic demand.

Trade

IGX has secured authorization from the PNGRB to operate as a Gas Exchange. IGX has secured the necessary authorization to operate as a Gas Exchange as per the provisions of the PNGRB (Gas Exchange) Regulations, 2020 for a period of 25 years. India is expected to see a massive $66 bn investment in the building of gas infrastructure as the government pushes for greater use of the cleaner fuel with a view to cutting down carbon emissions.

Rest of the World

Price Trends

Asian spot prices for LNG rose to a nearly two-year high this week as demand continued to be firm for heating during winter and as buyers faced supply issues. The average LNG price for January delivery into Northeast Asia was estimated at about $8.10/mmBtu up 70 cents from the previous week. Shell, for instance, sold a cargo for late January delivery to BP at $8/mmBtu, according to data from S&P Global Platts. South Korea’s Korea Gas Corp likely bought seven LNG cargoes for delivery in winter through a tender and could be seeking more. South Korea will reduce the operations of coal-fuelled power plants this winter to cut fine dust emissions, which in turn is stoking demand for LNG in power generation. Eight of the nation’s 60 coal power plants will be halted during the season. Russia’s Sakhalin LNG likely sold a cargo at about $7.50/mmBtu while Trafigura may have sold a mid-January cargo to Centrica at above $8/mmBtu. Taiwan’s CPC Corp may also have bought about 5 to 6 cargoes for delivery over January to February instead of the initial two that it had sought.

A unit of Japan’s Inpex Corp has made an agreement to sell natural gas from its Masela gas project to Indonesia's gas utility company, Indonesia's upstream oil and gas regulator said. Indonesia approved last year Inpex’s revised development plan for the $20 bn Masela project, which is among the biggest gas ventures in the Southeast Asian country. It is expected to produce around 9.5 MT of LNG per year and supply 150 million cubic feet of natural gas daily through pipelines. SOCAR Trading (UK) Ltd and ENOC Singapore have offered the lowest prices to supply two LNG cargoes to PLL for delivery in February 2021. SOCAR offered a cargo for delivery between 15 to 16 February at a percentage of the Brent crude oil futures price, known as a slope rate, of 23.4331 percent while ENOC offered a slope rate of 20.8483 percent for a cargo for 23 to 24 February, according to the PLL. Global LNG supply has been tight amid production issues and that has pushed spot prices to a near two-year high and freight rates for LNG tankers to a more than one-year high. Pakistan is yet to decide on whether it will award the tenders, the country’s petroleum ministry said. The South Asian country has become an emerging buyer in the international LNG market over the last few years, with an increasing gap between demand and supply of gas.

USA

North American LNG exporters are sounding more confident about the prospects for new projects in 2021 due to a sharp rally in prices driven by surging Asian demand, even as most industry analysts expect next year to be another difficult one. Natural gas futures in Europe and Asia have climbed to their highest levels in more than a year due to a sharp increase in demand late in 2020, especially out of China, where buyers have scrambled to secure supply. Asian nations have driven record growth in LNG as they seek to replace dirtier coal plants and fuel growing energy consumption.

Europe

Italian energy group Eni has struck deals with Spanish gas firm Naturgy and Egyptian partners to resolve disputes over a shuttered gas plant it part owns in northern Egypt. The new agreements would pave the way for the LNG plant in the port city of Damietta to restart operations by the first quarter of next year. The new deal, which still needs the green light from European Union authorities as well as other conditions to be met, will allow Eni to increase its LNG portfolio and strengthen its gas foothold in the Eastern Mediterranean. Naturgy will receive a series of cash payments totalling around $600 mn under the deal, which when completed will result in its departure from Egypt and the end of its joint venture with Eni. Eni, one of the biggest foreign oil and gas producers in Africa, discovered Egypt’s biggest-ever gas field Zohr in 2015 and has other assets in the Mediterranean. Like other majors, Eni is looking to decarbonise and sees LNG and gas as important resources in that transition. Eni would take over UFG’s marketing of natural gas in Spain, bolstering its presence in the European market. Naturgy has been renegotiating supply contracts after a gas price slump caused by lower demand and oversupply.

Russia

Gazprom has lost a third of its Finnish gas market share after a new pipeline made it possible to import LNG via the Baltic States, data from Gazprom and Estonian gas grid operator Elering showed. The pipeline, called Balticconnector, which opened early this year, links Finland and Estonia and can also send gas to the Baltics. In the first nine months of 2020, a total of 5.8 TWh of gas was exported to Finland via the pipeline. Meanwhile, direct gas exports from Russia to Finland over same period dropped by 35 percent to 11.4 TWh, from 17.6 TWh over January-September in 2019. Natural gas prices between Finland and the Baltic states of Estonia, Latvia and Lithuania vary due to their access to the global LNG market, ability to store gas in Latvia and different Russian gas supply contracts. Most of the gas came from the only large-scale LNG import terminal in the Baltic states, in Lithuania, with capacity of 39 TWh per year. Built to transport about 25 TWh of gas per year, Balticconnector has been limited to about 11 TWh per year due to delays upgrading compressor stations. Gazprom is also facing competition in other parts of Europe from LNG imports, including from the United States. The Baltic and Finnish gas markets will get connected to mainland Europe at end-2021 by a new pipeline linking Lithuanian and Polish gas grids, potentially bringing in more competition.

Australia

An Australian community group has launched a court challenge against Santos Ltd’s A$3.6 bn ($2.7 bn) Narrabri coal seam gas project, saying an independent panel that approved the development failed to consider its climate impacts. The action was launched by the Environmental Defenders Office, a not-for-profit legal firm, on behalf of a group of 100 residents and farmers from the town of Mullaley, about 110 km (68 miles) south of Narrabri in northern NSW. The challenge said the NSW Independent Planning Commission had failed to look at the impact of greenhouse gas emissions from the project and the environmental effects of a gas pipeline needed for it to go ahead. BP Plc said it has found no oil or gas at its Ironbark-1 exploration well off Western Australia, in what had been seen as a multi-trillion cubic feet gas prospect. The result marked a big disappointment for BP’s partners in the prospect, which had been seen as a potential gas supplier to the North West Shelf LNG plant, where BP is a co-owner, within five to 10 years.

West Asia

Qatar Petroleum’s newly formed trading unit participated in a buy tender by PLL for the supply of LNG for the first time. Qatar Petroleum said in November that it had set up a trading unit, Qatar Petroleum Trading Company, which will be headquartered in Doha and aims to build a diversified global portfolio of LNG produced locally and internationally. The parent company typically negotiates the supply of LNG to Pakistan on a government-to-government level. This was the first time any Qatari company had participated in a Pakistan tender. The trading unit, which signed its first contract in November to supply LNG to Singapore’s Pavilion Energy, placed the lowest offers for three of six LNG cargoes sought by Pakistan for January delivery, a document of PLL showed. PLL is a government subsidiary that procures LNG from the international market. Pakistan’s gas needs typically rise in December and January. The deficit in supply versus demand is expected to increase this year as consumption rises and indigenous supply declines.

China

Operations have started on the middle portion of the China-Russia East natural gas pipeline, allowing natural gas from the Power of Siberia system in Russia to be transmitted to the smog-prone Beijing-Tianjin-Hebei region in northern China. The 1,110 km pipeline aims to help improve air quality in the region, where about a quarter of China’s steelmaking capacity is located, by adding 27 MCM of gas supply per day. This portion starts at Changling city in Jilin and ends at Yongqing city in Hebei. The pipeline also connects the existing gas pipelines in northeastern and northern China, as well as the gas storage projects in Dalian, Tangshan and Liaohe. The northern part of the China-Russia East gas pipeline started operations in December 2019 and has transmitted nearly 4 BCM natural gas, according to PipeChina. China had started construction on the southern portion of the China-Russia East pipeline in July, extending the route to Shanghai in eastern China. Volumes of Russian gas transported via the pipeline could reach 38 BCM per annum once the line is completed by 2025.

Subsidiaries of Chinese energy firms PetroChina and China National Offshore Oil Corp (CNOOC) will invite global bids for LNG on the Shanghai Petroleum and Natural Gas Exchange. PetroChina will award its tender. The Shanghai exchange had launched its international LNG tender services in late October. China imported nearly 6.4 MT of LNG in November, its highest monthly volumes since December 2019, with this month’s volumes expected to surpass that of November. The increase in imports by the world's second largest economy is one of the main factors pushing up spot Asian LNG prices LNG-AS to nearly two-year highs. China’s economy has seen a steady rebound from the coronavirus pandemic, with both exports and manufacturing activity rising rapidly in November. Its latest factory gate prices had also fallen at a slower pace last month.

PetroChina, Asia’s largest producer of oil and gas, has struck a large natural gas discovery in northwest China’s Xinjiang region with an initial estimated reserve exceeding 100 BCM. PetroChina tapped 610,000 cubic meters of daily gas flow and 106.3 cubic meters of crude oil at exploration well Hu-1, located in an exploration zone totalling 15,000 square kilometres at the southern rim of the Junggar basin. Xinjiang is among the top areas for PetroChina’s domestic exploration and production spending as the state energy giant has vowed to spend 150 bn yuan ($22.90 bn) between 2018 and 2020 to boost total oil and gas output at the region to 1 mn barrels per day oil equivalent. PetroChina Co Ltd, Asia’s largest oil and gas producer, aims to more than double shale gas output from operations in the Sichuan basin to more than 22 BCM by 2025 from this year’s level. That will surpass a target set by Sinopec, which led China’s shale gas development with the first commercial find at Fuling, also in the Sichuan basin, and which aims to nearly double its shale gas output to 13 BCM in 2025. Shale gas operations managed by PetroChina’s Southwest Oil and Gas division will top 10 BCM this year, making the company China’s single largest shale gas producer. The operation covers Yibin, Zigong, Neijiang, Luzhou and Yongchuan regions of the gas-rich Sichuan province in southwest China as well as Yongchuan in Chongqing municipality. PetroChina sunk more than 240 wells this year in the sprawling blocks of Sichuan, resulting in daily shale gas output 40 percent higher than at the beginning of 2020. PetroChina started appraising shale gas blocks in the Sichuan basin in 2006 and made its first major discovery with the Wei-201 well in 2010.

AGCL: Assam Gas Company Ltd, NoC: No-objection certificate, PNGRB: Petroleum and Natural Gas Regulatory Board, CGD: city gas distribution, PNG: piped natural gas, GSPL: Gujarat State Petronet Ltd, km: kilometre, UP: Uttar Pradesh, mn: million, bn: billion, tn: trillion, MGL: Mahanagar Gas Ltd, CNG: compressed natural gas, MTPA: million tonnes per annum, FSRU: floating storage and regasification unit, LPG: liquefied petroleum gas, RIL: Reliance Industries Ltd, IGX: Indian Gas Exchange, mmscmd: million metric standard cubic meter per day, mmBtu: million metric British thermal units, MT: Million Tonnes, UK: United Kingdom, TWh: terawatt hour, PLL: Pakistan LNG Ltd, NSW: New South Wales, BCM: billion cubic meters, MCM: million cubic meters

News Highlights: 30 December 2020 – 5 January 2021

National: Oil

No change of course in new year, petrol, diesel prices remain static

5 January: The new year has not disturbed the mood of fuel consumers as petrol and diesel prices have not burnt a hole in people’s pocket even though the global oil prices have firmed up. The Oil Marketing Companies (OMCs) kept the pump prices of petrol and diesel unchanged, maintaining the trend started in the second week of December. Accordingly, the pump price of petrol remained at ₹83.71 a litre and diesel ₹73.87 a litre in Delhi. Across the country as well the price of the two petroleum products remained unchanged. The price of petrol in Mumbai remains at ₹90.34 and diesel ₹80.51, the two fuels remains at ₹86.51 and ₹79.31 a litre respectively in Chennai. The retail price of petrol remains at ₹85.19 and ₹77.44 a litre in Kolkata. OMCs have gone on a pause mode at a time when news of successful coronavirus and expectations of big pick up in demand had kept crude on the boil with prices breaching $50 a barrel mark.

Source: The Economic Times

Ethanol blending in petrol will cross 8% in 2020-21: Petroleum Secretary

5 January: Ethanol blending in petrol will cross 8 percent in 2020-21 after reaching 5 percent in the previous year despite the pandemic, Petroleum Secretary Tarun Kapoor said. State Oil Marketing Companies (OMCs) received 1.73 bn litres of ethanol for blending with petrol during ethanol supply year that ran between December 2019 and November 2020. The volume was lower than 1.89 bn litres of 2018-19 but the share in petrol blending was the same at 5 percent due to the overall decline in fuel sales due to the pandemic, which also curbed the availability of ethanol. The rise in ethanol supply offers has come on the back of the government widening the basket of raw materials that could be used to produce the green fuel. The government has set a target of 10 percent ethanol blending in petrol by 2022 for state-run oil companies. Blending is being promoted to help cut expensive oil import and reduce air pollution.

Source: The Economic Times

India’s 40th Antarctica trip fuelled by IOC

5 January: In a step towards self-reliance, the Indian Oil Corp (IOC) has supplied specialised fuel, lubricants and Marine Gas Oil (MGO) for India’s 40th Antarctic scientific mission. The move to locally produce and procure fuel and lubricants that can sustain the harsh temperatures of the Antarctic region comes after 22 years. The National Centre for Polar and Ocean Research (NCPOR), used to procure the specialised fuel and lubricants from international suppliers, but turned to IOC for aviation Jet A1 fuel. The bulk fuel and some packed in barrels were loaded on to a Russian ice-class ocean-going vessel. IOC is also the first oil company in the country to produce BS-VI compliant winter-grade High Speed Diesel (HSD) capable of withstanding extremely low temperatures of up to -33 degree centigrade in winter in the Himalayan region and supply of NATO-grade HFHSD (High Flash HSD) for the Indian Navy from Paradip and Haldia refineries.

Source: The Economic Times

Cheaper LPG may help the fight against pandemic: PGI study

3 January: Linking the supply of ‘costlier’ LPG (liquefied petroleum gas) during the lockdown and the spread of coronavirus infection, a study by PGI scientists has recommended reducing the price of the clean fuel to prevent insufficient access to clean energy, especially in the rural areas, which may aggravate the Covid-19 situation. In the study, published in a high-impact journal — Environment International, the researchers have reasoned that exposure to solid biomass fuels is associated with respiratory problems, such as reduced lung function and increased prevalence of respiratory symptoms, that could lead to exacerbation of respiratory diseases. The study mentions that in June this year, when ‘Unlock 1’ was announced, the rates of LPG cylinder were hiked nationwide after a consecutive price cut for three months.

Source: The Economic Times

Oil Minister launches missed call facility for booking of LPG refills

2 January: Oil Minister Dharmendra Pradhan launched a unique missed call facility for booking LPG refills and registration of new connections. Facility for booking LPG (liquefied petroleum gas) refill by giving a missed call on 8454955555 has been rolled out pan-India and for registering a new LPG connection has been rolled out in Bhubaneswar, the Minister informed. He said service for registration of LPG connections through missed-call will be available across India shortly.

Source: The Economic Times

RIL-BP to offer online fuel delivery services

31 December: Reliance BP Mobility Ltd, a joint venture between Reliance Industries Ltd (RIL) and UK’s energy major BP Plc, is planning to offer doorstep delivery service of diesel in 2021. Reliance BP Mobility, which was formed in July, will operate under the Jio-BP brand. RIL-BP also plans to expand retail outlets from 1,400 to 5,500. In July, Oil Marketing Companies (OMCs), including Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), invited expressions of interest (EoIs) from startups wishing to deliver fuel on demand. So far, over 500 EoIs have been received. RIL-BP, however, plans to go solo and has not partnered with any startups. Startups, including Repos Energy, Pepfuels, MyPetrolPump, FuelBuddy, and Humsafar, have already rolled out on-demand fuel delivery services.

Source: Livemint

National: Gas

India launches first remote monitoring system for oil refineries

30 December: Indian Oil Corp (IOC), the country’s largest fuel retailer, announced it has launched the country’s first remote monitoring system for oil refineries' turbines. The project, located in Hyderabad, was inaugurated by Oil Minister Dharmendra Pradhan. The Remote Monitoring & Operation Centre for Tracking of IOC’s Refinery Gas Turbines was implemented by BHEL-GE Gas Turbine Services (BGGTS), a joint venture of BHEL and General Electric. The technology -- called Proactive Predictive Analytics-based Automated Anomaly Detection -- will allow Gas Turbune Operational Data flowing in digitally from 27 turbines of the eight IOC refineries to be analysed round-the-clock in Hyderabad. This analysis will help in detection and diagnosis of emerging issues relating to gas turbines before they become critical and triggers corrective actions. This will help avoid refinery process unit shutdowns.

Source: The Economic Times

RIL-BP consortium invites bidders for gas from KG D6 basin

30 December: India’s Reliance Industries Ltd and UK’s BP Plc invited companies to bid for gas produced from the KG D6 basin. They expect to sell the gas from February. The gas produced for KG D6 will be available for sale at the delivery point at Gadimoga near Kakinada, Andhra Pradesh tentatively from 01 February 2021, the companies said in a notice. CRISIL Risk and Infrastructure Solutions Ltd, a unit of S&P Global Inc, will conduct the bidding process through an online platform, the notice said. The RIL-BP consortium is developing and producing from deep water gas fields under a production sharing agreement with the Indian government.

Source: Reuters

National: Coal

JSPL bags Gare Palma coal mine block in Chhattisgarh

1 January: JSPL (Jindal Steel and Power Ltd) said its subsidiary Jindal Power has been declared as the successful bidder for a block of Gare Palma coal mine in Chhattisgarh. JSPL said the coal ministry has declared Jindal Power as the successful bidder for Gare Palma IV/1 Mine. Part of the OP Jindal Group, JSPL has a presence in steel, power, mining and infrastructure sectors.

Source: The Economic Times

CIL’s coal supply to consuming sectors grows 9% to 154.6 mt

1 January: Coal India Ltd (CIL) said the supply of coal to the consuming sectors rose 9.2 percent to 154.6 million tonnes (mt) in the third quarter of the current financial year. The company had supplied 141.6 mt of dry fuel in the corresponding quarter of the previous financial year, the company said. CIL produced 115 mt of coal in the previous quarter. CIL supplied 36.62 mt to non-power consumers in the October-December 2020 period, compared with 25.53 mt a year ago. Despite the tepid demand, there was a nominal growth of 1.5 percent in supplies to power plants during the third quarter of 2020-21.

Source: The Economic Times

Vedanta wins Radhikapur west coal block in Odisha

31 December: Vedanta Ltd has emerged as the highest bidder for Radhikapur west coal block located in Angul district of Odisha at a distance of about 190 km from the company’s Jharsuguda aluminium smelter. The coal block is an optimal fit for Jharsuguda smelter, given its logistical location and annual capacity, the company said. The mine has total reserves of 312 million tonnes (mt) and an approved per annum extraction capacity of 6 mt.

Source: The Economic Times

National: Power

December spot power price falls 3% to ₹2.83 per unit

5 January: Average spot power price fell 3 percent year-on-year to ₹2.83 per unit in December 2020, compared to the year-ago month, the Indian Energy Exchange (IEX) said. With trading of 5,606 mn units of electricity, the volume in the day-ahead market rose 29 percent on a year-on-year (y-o-y) basis, it said. It said that this consequently led to an attractive average market clearing price of ₹2.83 per unit which saw a 3 percent y-o-y decline. The 'One Nation-One Price' prevailed for 31 days during the month. The inter-state congestion for the remaining days was on account of import of power to southern states. The term-ahead market comprising intra-day, contingency, daily and weekly contracts traded 436 mn units volume during December 2020. According to the data published by the National Load Dispatch Center (NLDC), the national peak demand in December 2020 saw a 7 percent y-o-y increase while the energy consumption registered 5 percent y-o-y growth. On 30 December, when peak demand touched 182.9 GW, IEX electricity markets contributed to a significant 6.9 percent of the peak demand met.

Source: The Economic Times

300 acre on offer in Ratlam for power gear production zone

5 January: As part of the Centre’s plan to set up power gear production zones in the country, Madhya Pradesh Industrial Development Corp (MPIDC), Indore has proposed 300 acre in Ratlam to set up the facility. MPIDC office has sent a proposal to the head office proposing to offer 300 acre in an industrial belt at Ratlam to develop the proposed manufacturing zone for clean power equipment under ministry of power and renewable energy. The ministry has planned to set up three manufacturing zones - one each in a landlocked state, a coastal state and a hill state. Aimed at curtailing imports of power equipment, the locations for the proposed power gear production zones will be selected amongst states offering competitive rates for power, land and manufacturing incentives while the Centre has proposed to offer ₹5 bn each as assistance for establishing common facilities. Indore office has urged to submit the plan to the ministry with a competitive proposal on land rates, power charges and industry promotion incentives.

Source: The Economic Times

Government nudges, Chandigarh moves SC on power department privatisation

4 January: The UT (Union Territory) administration has challenged the Punjab and Haryana High Court (HC) order to stay the privatisation of the power department in the Supreme Court (SC) by filing a special leave petition. The move comes following a letter from the ministry of the power to the UT adviser on 28 December last year making the recommendation. The date of hearing is yet to be fixed. The administration will take the services of senior lawyers of the SC to back its decision and is shoring up its defence. The High Court had ordered a stay on a petition filed by UT Powermen Union, fixing the next date of hearing in February.

Source: The Economic Times

Andhra Pradesh to focus on power sector transformation in 2021-22

4 January: The government will focus on power sector transformation in 2021-22 to change the scenario of the sector and make it the best in the country, Energy Secretary Srikant Nagulapalli said. The Secretary said the major objective of the government is to extend quality, affordable and uninterrupted power supply. Secretary said that utilities have set a target of reducing annual power purchase cost by ₹7 bn.

Source: The Economic Times

India moved from power deficit to surplus under Modi government: Singh

4 January: Union Minister R K Singh said India has become power surplus under the leadership of Prime Minister Narendra Modi over the past six years and is also witnessing the highest growth rate in renewable energy in the world. He said there is more investment from the private sector rather than the public sector in the generation of electricity. Likewise, he said the rural areas used to get electricity for 18.5 hours but after the reforms and schemes introduced by the government, the consumers there are now getting 20 hours power supply in 24 hours. He said a new system of smart prepaid meters was introduced to replace the manual preparation and delivery of electricity bills.

Source: The Economic Times

Delhi’s winter peak power demand crosses 5 GW

2 January: Delhi’s peak power demand hit the season’s highest level at 5,021 MW, owing to the ongoing cold wave conditions, power distribution company (discom) BSES said. It is the first time this winter that the national capital’s peak power demand has crossed the 5,000 MW mark, the company said. Last year, the peak power demand on 1 January was 5,226 MW. BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL) successfully met the electricity demand of 2,054 MW and 1,145 MW in their respective areas. On 1 December, Delhi’s peak power demand was 3,504 MW, according to BSES. Since then, it increased by over 43 percent. Since 1 November, Delhi’s peak power demand has increased by nearly 60 percent. Delhi’s highest peak power demand last month was at 4,671 MW recorded on 30 December 2020. In two days, the demand increased by over 7 percent to 5,021 MW. Peak power demand in the city last winter touched 5,480 MW. The peak power demand last winter in the BRPL and BYPL areas had reached 2,020 MW and 1,165 MW, respectively. This year, it is expected to reach 2,200 MW and 1,270 MW, respectively.

Source: The Economic Times

India’s power consumption grew 6.1% in December

2 January: India’s power consumption grew by 6.1 percent to 107.3 bn units in December, showing spurt in economic activities. Power consumption in December 2019 was 101.08 bn units. After a gap of six months, power consumption recorded a year-on-year growth of 4.5 percent in September and 11.6 percent in October. In November, the power consumption growth slowed to 3.12 per cent to 96.88 bn units compared to 93.94 bn units in the same month last year mainly due to early onset of winters. Experts said that the 6.1 percent growth in power consumption and all time high peak power demand of 182.88 GW in the month of December clearly indicate that there is considerable spurt in economic activity in the country. They think that the power demand growth would be more stable in coming months. The government had imposed a nationwide lockdown on March 25 to contain the spread of Covid-19. Power consumption started declining from March due to fewer economic activities in the country.

Source: The Economic Times

India gets a new power central transmission utility

31 December: India created a central power transmission utility, separating the business from Power Grid Corp of India (PGCIL). The Central Transmission Utility (CTU) of India has been incorporated and a certificate of incorporation had been issued for the same. Hiving off of electricity transmission system planning business from PGCIL had been a long pending demand of the industry for fair bidding of transmission lines. The move will help PGCIL diversify to other businesses and comes just in time when the government has kicked off a power distribution programme starting with the union territories. The government had in June last year directed PGCIL to immediately set up CTU as a 100 percent subsidiary with separate accounting and board structure which would identify and plan transmission network in the country. Private power transmission companies have alleged that PGCIL purposefully mismanages transmission planning so that the lines get delayed and are given to the state–run firm on nomination basis.

Source: The Economic Times

Sterlite Power and AMP Capital join hands to develop $1 bn transmission projects

30 December: Infrastructure company Sterlite Power Ltd and global investment manager AMP Capital announced they have joined hands to set up four power transmission projects in India with a total capital outlay of $1 bn. Under the equal partnership, the two companies will invest an initial amount of around $150 mn each and have put in place debt financing too. The power transmission projects will have a circuit length of 1,800 km of transmission lines across India.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Tata Power, SIDBI to finance MSMEs in rooftop solar segment

5 January: Tata Power announced a partnership with Small Industries Bank of India (SIDBI) to provide affordable financing scheme for MSME customers in the rooftop solar segment. The scheme will empower MSMEs to adopt sustainable energy for their businesses and promote greener, India’s largest integrated power company said. Easy and affordable financing has been one of the barriers for penetration of solar energy in the MSME sector. Tata Power and SIDBI will provide a financing solution without any collateral at an interest rate of less than 10 percent. The scheme is for MSME customers of Tata Power for both off-grid and on-grid connections.

Source: The Economic Times

India’s power ministry proposes pushing back emission norms deadline

4 January: India’s power ministry has proposed pushing back the deadlines for adoption of new emission norms by coal-fired power plants, saying “an unworkable time schedule” would burden utilities and lead to an increase in power tariffs. India initially had set a 2017 deadline for thermal power plants to comply with emissions standards for installing Flue Gas Desulphurization (FGD) units that cut emissions of toxic sulphur dioxide. That was later changed to varying deadlines for different regions, ending in 2022. Under the latest proposal, no new dates have been set. However, a final decision will have to be approved by the Supreme Court, which is hearing the issue. The ministry proposed a “graded action plan,” whereby areas where plants are located would be graded according to the severity of pollution, with Region 1 referring to critically polluted areas, and Region 5 being the least polluted. Indian cities have some of the world’s most polluted air, much of which is blamed on coal-fired plants in close proximity to urban centres. Vehicular pollution, dust, industries and crop burning add to the bad air quality.

Source: Reuters

Wind power falls out of favour in Rajasthan, new capacity dwindles to 45 MW in 4 years

31 December: The recent focus on solar and lack of policy support has stalled the growth of wind power in Rajasthan with new capacity addition falling to 45 MW in the past four years. But the hybrid park policy can revive interest if RERC increases discoms’ renewable purchase obligation (RPO) from wind which has also stagnated over the past four years. Renewable power journey in Rajasthan started with wind in 1999 having 2MW and the capacity reached 4,292 MW by March 2017. But since then the capacity has inched up to 4337 MW so far in 2020-21. Experts in the renewable energy sector said that the state needs to promote both wind and solar. They said the hybrid park concept is the right strategy as it saves cost, maximizes resources and neutralizes risks that come when the focus is only on solar. At one time, Rajasthan was the third largest wind power producer in the state after Tamil Nadu and Gujarat. Tamil Nadu has a capacity of 9,426 MW and Gujarat 8,042 MW. States like Maharashtra and Karnataka have progressed rapidly leaving Rajasthan behind. After 2016, there have been no new tenders for wind power following the scrapping of feed-in tariffs and making bidding mandatory like in solar. The bidding regime discouraged developers as their margins were reduced significantly.

Source: The Economic Times

Adani Green Energy commissions 100 MW solar power plant in Gujarat

30 December: Adani Green Energy’s wholly-owned subsidiary, Adani Solar Energy Kutchh Two, has commissioned a 100 MW solar power project at Khirsara in Gujarat. With this, the Gautam Adani-led firm’s total operational renewable capacity reached 2,950 MW with a compound annual growth rate of 55 percent since March 2016, the company said. The subsidiary has a 25-year power purchase agreement with the Gujarat Urja Vikas Nigam India at ₹2.44 per unit price. Adani Green has a total renewable capacity of 14,195 MW, which includes 11,245 MW awarded and under-implementation projects. The company has a target of commissioning 25 GW renewable capacity by 2025.

Source: The Economic Times

Delhi wants clean energy but idle fossil fuel power capacity is a headache

30 December: India’s capital city is seeking to shed its onerous contracts with fossil fuel power plants to reduce costs and free up funds for clean energy. Tata Power Delhi Distribution Ltd., which retails electricity to customers in New Delhi, is in talks with Delhi’s provincial government and the federal power ministry to get some of its contracted thermal power re-allocated to other states, Chief Executive Officer (CEO) Ganesh Srinivasan said. It also plans to oppose any life time-extension plans for aging plants it has contracted to buy electricity from, he said. The effort underscores how India’s electricity sector continues to struggle with debt and overcapacity after a massive build-out of plants to power a surge in economic activity that never fully materialized. The pandemic has accentuated the problem, leaving nearly half of India’s thermal power capacity idled, with the cost overhang impeding investment toward renewables and grid improvements. The company plans to expand its renewable power portfolio, as cheaper modules and policy support drive down auction prices. It’s awaiting regulatory approvals for a project that would add 300 megawatts of renewable power, and hopes to request bids from developers by March, he said. Renewable power forms about 17 percent of the company’s supply portfolio and may expand to 20 percent in six months, he said. Improving reliability of power supplies is another focus area for the company. Tata Power plans to spend about ₹10 bn to take Delhi’s notoriously tangled thicket of overhead cable networks underground, he said.

Source: Business Standard

International: Oil

Oil prices rise on expectations that OPEC+ likely to maintain output

4 January: Oil prices rose on expectations that OPEC (Organization of the Petroleum Exporting Countries) and allied producers may cap output at current levels in February at a meeting later in the day as the coronavirus pandemic keeps worries about first-half demand elevated. Broader macro momentum trends including a weaker dollar and investors positioning for a recovery in the oil sector this year could be supporting oil prices, Energy Aspects analyst Virendra Chauhan said. OPEC Secretary General Mohammad Barkindo said that while crude demand is expected to rise by 5.9 mn barrels per day (bpd) to 95.9 mn bpd this year, the group sees plenty of downside demand risks in the first half of 2021. Prices ended 2020 about 20 percent below 2019’s average, still recovering from the impact of global economic lockdown measures imposed to battle Covid-19 that slashed fuel demand, even though the world’s major producers agreed record output cuts through the year. OPEC and allied producers including Russia, a grouping known as OPEC+, decided at a meeting last month to raise output by 500,000 barrels per day (bpd) in January, anticipating a boost in demand, and agreed to meet every month to review production. In the United States, crude oil production stayed under pressure from weak prices and tepid demand, down more than 2 mn barrels per day (bpd) in October from earlier this year, a government report showed on 1 January.

Source: Reuters

Venezuela’s oil exports sink to 1940’s level under tighter US sanctions

4 January: Pressured by strict US (United States) sanctions, Venezuela’s oil exports plunged by 376,500 barrels per day (bpd) in 2020, according to Refinitiv Eikon data and internal documents from PDVSA, financially squeezing socialist President Nicolas Maduro. The administration of US President Donald Trump also put curbs on PDVSA’s main trading partners, the owners of tankers still transporting Venezuelan oil and on fuel supply to the gasoline-thirsty nation. Venezuela’s exports of crude and refined products fell 37.5 percent in 2020 to 626,534 bpd, the lowest in 77 years. The decrease was even larger for fuel imports, which fell 51 percent compared with 2019, to 83,780 bpd, according to the data. The drop in the crude oil offer was several times that of the global market, which fell about 9 pedrcent last year from Covid-19 constraints. Venezuela’s oil exports swung wildly during the year, plummeting after Washington imposed sanctions on two units of PDVSA’s main trade partner, Russia’s Rosneft, and bouncing back when the Venezuelan state oil company found new customers and vessels to ship its oil.

Source: Reuters

Russian annual oil output falls for the first time since 2008 on OPEC+ deal, pandemic

2 January: Oil production in Russia declined last year for the first time since 2008 and reached its lowest level since 2011 following a global deal to cut output and sluggish demand caused by the coronavirus, statistics showed. Russian oil and gas condensate output declined to 10.27 mn barrels per day (bpd) last year, according to the energy ministry. In tonnes, oil and gas condensate output dropped to 512.68 mn in 2020 from a post-Soviet record-high of 560.2 mn, or 11.25 mn bpd, in 2019. The 512.68 mt reading for 2020 was the lowest since 511.43 mt in 2011, and the first annualised decline since 2008 amid the global financial crisis and falling oil prices. Russia agreed to reduce its oil production in April last year by more than 2 mn bpd, an unprecedented voluntary cut, along with other leading oil producers and the Organization of the Petroleum Exporting Countries (OPEC). The move was designed to bolster the oil market beset by the fallout from the Covid-19 pandemic. Since the April agreement, a record for global supply reductions, the group known as OPEC+ has progressively reduced the cuts and is expected to release an extra 500,000 bpd into the market in January. Russia has been expected to increase its oil output by 125,000 bpd from the New Year. Russian Deputy Prime Minister Alexander Novak, in charge of Moscow’s ties with OPEC+, has said Russia would support a gradual increase of the group’s output by another 500,000 bpd starting in February.

Source: Reuters

Saudi Arabia expected to raise February crude prices for Asia

30 December: Top oil exporter Saudi Arabia is expected to raise its official selling prices (OSPs) for Asian buyers for a second straight month in February, tracking stronger benchmark prices and product cracks, a survey showed. Three sources at Asian refiners expect the February OSP for the flagship grade Arab Light to rise by 33 cents a barrel on average, with their forecasts ranging between an increase of 30 cents and 40 cents. Asia’s cracks for a range of oil products - naphtha, gasoil, jet fuel and fuel oil, strengthened this month on improved demand. Asia’s gasoline crack, however, has dipped recently on concerns that restored mobility restrictions to combat a new coronavirus variant would dent near-term demand. Saudi crude OSPs are usually released around the fifth of each month and set the trend for Iranian, Kuwaiti and Iraqi prices, affecting more than 12 mn barrels per day (bpd) of crude bound for Asia. State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices.

Source: Reuters

International: Gas

China gas price surge likely to be shortlived as winter supply measures kick in

4 January: A recent surge in liquefied natural gas (LNG) prices in China is likely to be shortlived, traders and analysts said, as state-run producers build up supplies to cope with winter chills and prevent a repeat of the 2017 crunch. Wholesale prices of the super-chilled fuel almost doubled over three weeks in December as an early cold snap was accompanied by robust post-pandemic manufacturing activity and some provinces burning more gas as part of a national drive to shift away from coal. The spike in wholesale delivered prices to a peak of more than 9,000 yuan ($1,376.36) per tonne at factories and LNG filling stations in northern China on 21 December, the highest in three years, was exacerbated by dealers hogging imported fuel. Heating demand surged in northern regions, where gas is now a dominant heating fuel for more than 20 mn homes, and several provinces in central and east China reported power surges and shortages.

Source: Reuters

UAE’s SNOC announces start of gas production at Mahani field in Sharjah

3 January: UAE (United Arab Emirates)’s Sharjah National Oil Corp (SNOC) and partner ENI announced the start of gas production at the recently discovered Mahani field in Sharjah. SNOC and Italian energy giant Eni announced the discovery of Mahani last year, a new find of natural gas and condensate onshore in Sharjah, and the first in the emirate since the early 1980s. Production would start at the Mahani-1 gas well in the Mahani field in Area-B in Sharjah. Last March, SNOC said the impact of the coronavirus pandemic would delay the startup of production at its Mahani gas exploration project by up to two months.

Source: Reuters

Pakistan to buy costliest LNG amid increasing gas shortage

30 December: With an increasing gas crisis in the country, Pakistan will be buying an all-time high priced liquefied natural gas (LNG) for February 2021. The Pakistan LNG Ltd (PLL) has received high bid at 32.48 percent of Brent with a gap of 31-days between tender opening and advertisement. LNG supplies were invited to bid for the supply of at least two LNG cargoes on delivered former ship bases at Port Qasim in Karachi, which attracted extremely high bids from two LNG cargoes for 15-16 February, 2021, and at least four LNG suppliers for 23-24 February 2021. Interestingly, for the month of January, Qatar Petroleum had offered the lowest bids of up to 17 percent of Brent, compelling Pakistan to buy the cargoes at high prices. The high bids are being criticised and questioned by the opposition parties, who say that the percentage for LNG being bought under the Imran Khan-led government is more than twice the long-term price obtained by the former PML-N regime.

Source: The Economic Times

International: Coal

Indonesia’s January coal benchmark price at 19-month high: Energy ministry

5 January: Indonesia's monthly coal benchmark price (HBA) is set at $75.84 per tonne for January, up from $59.65 a month earlier, the Energy and Mineral Resources Ministry said. It was the highest pricing since June 2019, Refinitiv data showed. Demand from China, Indonesia’s second biggest coal export destination, has helped prices recover, the ministry said.

Source: The Economic Times

US electric utility AES to sell stake in coal-fired plant in Vietnam

4 January: US (United States) electric utility AES Corp said it would sell its equity interest in the Mong Duong 2 coal-fired power plant in the Quang Ninh province in Vietnam to a consortium led by a US-based investor. Vietnam has been developing renewables, along with LNG-to-power and coal-based projects, as hydropower has been nearly fully tapped while oil and gas production has peaked. Plans to build nuclear power plants were scrapped in 2016.

Source: Reuters

Ban on Australian coal imports: Power outages in Southern China

3 January: China's Southern provinces curiously experienced widespread power blackouts and this can be attributed to the fact that Beijing has recently banned the import of coal from Australia. In 2019, about 60 percent of China’s coal used in electricity generation came from Australia. China reportedly uses coal to meet 70 percent of its energy needs and therefore it emits more carbon dioxide than the United States and the European Union combined. After the ban on coal imports from Australia, coal imports from Indonesia, Russia and South Africa have been rising sharply.

Source: The Economic Times

Japan, South Korea run with Vietnam coal plant despite climate vows

31 December: Japan and South Korea are pushing ahead with a controversial coal plant in Vietnam and will provide $1.8 bn in loans for the project, despite having announced ambitious pledges to become carbon-neutral on their home turf. Japan said in July it would tighten rules for investment in foreign coal-fired power stations on environmental grounds, but stopped short of promising to end government funding for projects or axe existing ones. The Global Energy Monitor watchdog said in 2019 that Japan accounted for over $4.8 bn in financing for coal power plants abroad -- particularly in Indonesia, Vietnam and Bangladesh.

Source: The Economic Times

International: Power

German power export surplus shrank 46.2% in 2020

4 January: Germany saw its electricity export surplus shrink by 46.2 percent in 2020 to 18.9 terawatt hours (TWh), raising the prospect that its dependency on neighbours could rise in future as it switches off more coal and nuclear power stations. Power exports by Europe’s biggest economy, which shares borders with nine countries, fell 11.6 percent to 52.5 TWh last year compared with 59.4 TWh in 2019, the energy regulator, called the Bundesnetzagentur, said. Meanwhile, electricity imports into Germany in 2020 increased by 38.8% to 33.6 TWh, compared with 24.2 TWh in the prior year. Germany also started up an interconnector with Belgium last November and a direct power cable link with Norway in December.

Source: Reuters

International: Non-Fossil Fuels/ Climate Change Trends

Germany exceeds 2020 climate target due to pandemic

5 January: Germany exceeded its target for reducing greenhouse gas emissions in 2020 as a result of the coronavirus pandemic, according to an analysis published by the think tank Agora Energiewende. The analysis said that Germany's greenhouse gas emissions in 2020 were 42.3 percent lower than the reference year 1990, exceeding the target of 40 percent lower. According to estimates by Agora Energiewende, two-thirds of the decline in carbon dioxide (CO2) emissions in Germany was driven by the impact of the Covid-19 crisis and related drops in energy consumption, industrial production and transportation. Without Covid-19 effects, CO2 emissions in Germany would have only declined by 37.8 percent, just short of the national emission target, the analysis found.

Source: The Economic Times

Australia flags caps to renewable energy connections in overhaul of power grid

5 January: Australia is seeking to overhaul its power grid to improve its stability as the fast uptake of renewable energy generation risks overburdening a transmission system originally built for more reliable but dirtier coal-generated energy. Connection caps on “renewable energy zones” with tender processes would help the orderly introduction of new generators, the report said, and the improved stability would reduce uncertainty for investors and benefit customers in the long-run. Nearly two-thirds of coal-fired capacity in the National Electricity Market (NEM), one of the world’s largest interconnected electricity systems, is due to close by 2040. Australia, the world’s top coal and gas exporter, faces the complex challenge of managing the rise of weather-dependent renewables and flexible power sources on its power grid as coal plants shut, while households increasingly turn to roof-top solar energy, batteries and electric vehicles. The government previously said that gas, not solar or wind projects, would be key to the country’s transition towards cleaner energy generation.

Source: Reuters

Wind energy powers more than half of UK electricity for first time

30 December: Wind power accounted for more than half of Britain’s daily generated electricity in the wake of Storm Bella, according to energy giant Drax. The percentage of wind power in the country’s energy mix hit a record 50.67 percent, the company said, beating the previous record of 50 percent in August. The British government wants offshore wind farms to provide one third of the country’s electricity by 2030, as part of its strategy to reach net zero carbon emissions by 2050 to help meet its commitments under the Paris climate accord. The UK (United Kingdom) has also placed nuclear power at the heart of its low-carbon energy policy.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Calculated from BP statistical Review of World Energy 2020 data

Source: Calculated from BP statistical Review of World Energy 2020 data PREV

PREV