< style="color: #0069a6;">Power News Commentary: August-September 2016

India

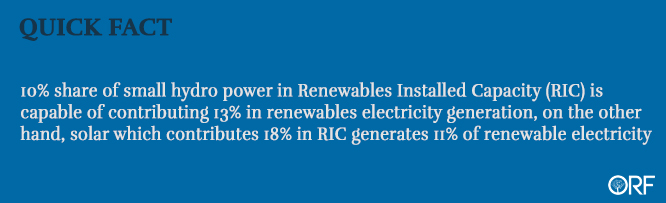

Reportedly, the Power Ministry is planning to shut coal-fired power plants with capacity of about 8000 MW that are more than 25 years old to reduce carbon emissions. It is definitely the right time to close inefficient plants as demand for power is subdued. Closure of old plans may also have the additional benefit of reducing land acquisition problems for new plants. New plants can be constructed at the site of closed plants without going through the complex procedure for acquiring land in new sites. But closing old plants will not address the problem of inefficiency in the Indian power sector. The share of power capacity slated for closure is less than 4 percent of India’s coal based power generation capacity and 12 percent of state owned power generation capacity which has the oldest fleet. Globally over half of thermal power generation capacity is less than 20 years old but in India the share is two thirds. The relative youth of India’s power generation fleet means that relatively few of these plants will reach the end of their technical life time in the next two decades.

The other news that mattered in the last one month is that claims of rural electrification are at best inaccurate and at worst false. Rural electrification plans, irrespective of whether they are called Deen Dayal Upadhyay Gram Jyoti Yojana or Rajiv Gandhi Grameen Vidyutikaran Yojana are a victim of India’s (a) devolved federalism that distributes responsibility over electricity between the State and the Central governments and (b) the conflict between forces of the market and intentions of the Government. Well intended plans of the Centre to electrify villages or poor households often end with putting up the infrastructure such as poles and wires etc or financing such infrastructure. The ownership of the infrastructure and the responsibility to supply of electricity then moves to the State governments. State governments tend to be reluctant to maintain the infrastructure in rural areas or supply electricity but they cannot be blamed. The right hand of the Central government asks State governments to electrify rural and poor households but the left hand of the same Central government (that is under the influence of the invisible hand of the market) asks State governments to submit to the power of the market. The UDAY scheme of the Centre is a good illustration as it is essentially asking State governments to shy away from subsidies and respond to market forces.

One move that can address this problem was also reported. The REC was reportedly working on a scheme to provide long-term loans to States that agree to offer free new electricity connections. The scheme covers funding of expenses like laying of lines to give access to electricity, installation of meters and other accessories. As per the plan, the distribution companies will have to get new connection plans approved by REC, which will reimburse expenses incurred by power utilities in giving electricity access to households. This is not a great idea as it will only increase the role of the bureaucracy in providing access to electricity. The bureaucracy is known for inefficiency and leakages. Instead the Central government should distribute pre-paid smart cards to households with which they can draw say 50-100 units of electricity per month at no cost to the household. Additional consumption could be charged. This scheme of pre-paid smart cards for electricity access have been successfully implemented in countries like South Africa. Not only has this increased access to electricity but also simulated demand for more electricity. Households in South Africa that consumed 50 free units of electricity got used to the comforts it provided and started paying for additional units of electricity.

The procurement price of LED bulbs has reportedly fallen to ` 38 from ` 54.90 per unit under the government’s DELP and it is expected to reduce the final retail price by ` 15. LED bulbs are being distributed at a subsidised price between ` 75-100 per unit by various power distribution utilities across the country depending on the state levies. So far over 152 million bulbs have been distributed. This is expected to avoid 4,000 MW peak demand of electricity and reduce 43,941 tonnes of carbon dioxide per day. If 770 million LED bulbs are distributed as planned it is expected to result in savings of 20 GW avoid carbon emissions of 80 MT every year. This is probably one of the more viable schemes for reducing carbon emissions.

< style="color: #163449;">Rest of the World

According to the report by ‘coalswarm’, an anti-coal group, summarised by Reuters, the amount of coal-fired power generation under development worldwide had shrunk by 14 percent to an estimated 932 GW from 1,090 GW at the start of the year driven down by efforts of China to reduce overcapacity. India’s policies to reduce coal-fired plants, partly due to under-utilization of existing plants are also cited among reasons. Overall, the amount of coal-fired generating capacity in pre-construction planning fell 14 percent. The decline, of 158 GW was almost equal to the coal generating capacity of the EU at 162 GW, it said. China accounted for the largest share with a reduction of 114 GW of coal based power generation capacity, followed by India with a decline of 40 GW. From 2003 to 2015, USA added 23 GW of coal capacity and retired 54 GW.

The news of closure of coal based power plants in China was complemented with the news that China may be investing too much in coal power as reported by Bloomberg quoting the IEA. According to the IEA, China started more than 70 GW of new coal projects last year and had 200 GW under construction at the end of April even though many plants were idle more than half the time. According to Greenpeace China supposedly will ‘waste’ $150 billion on excess power capacity by 2020. It appears that one man’s investment is another man’s waste!

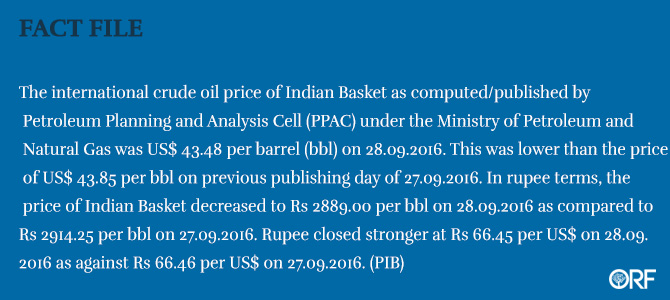

< style="color: #0069a6;">NATIONAL: OIL

< style="color: #163449;">Oil PSUs spend third of annual capex in 5 months

September 27: State oil firms have spent about a third of their annual planned capex in the first five months of 2016-17 with the upstream firms spending at a faster clip than refiners. Between April and August, state oil firms spent ₹31,000 crore against the full year target of ₹88,000 crore. Explorers Oil and Natural Gas Corp (ONGC), ONGC Videsh Ltd (OVL) and Oil India Ltd (OIL) together spent 43% of the planned ₹48,000 crore. OVL has used up nearly two-thirds of its ₹14,800 crore target, the fastest among any state oil firms. ONGC has finished just a third of the capital outlay for the year. In the last fiscal year, ONGC had missed its capex target by a fifth while its overseas arm had slipped by about a third. OIL has spent about ` 1,400 crore in five months, against an annual target of ₹4,020 crore. ONGC and OIL are under pressure from the government to boost production so that India's rising dependence on crude oil imports can be cut.

Source: The Economic Times

< style="color: #163449;">India's petrol consumption to grow 6 percent next fiscal: Moody's

September 26: India's petroleum consumption will grow at 6 percent in 2017-18, double the rate at which fuel demand in China is projected to grow, Moody's Investors Service said. The US Energy Information Administration (EIA) projects total liquid fuels consumption in the Asia Pacific to rise by 0.9 million barrels per day (bpd) in 2017 to 33.3 million bpd. China and India remain the fastest-growing product markets in Asia, collectively accounting for 80 percent of total demand growth in the region. Moody's said Asian refiners have started to dial back their capacity additions and this trend is expected to continue in 2017-18, although the immediate impact on an oversupplied market will be somewhat limited. Moody's said slow but steady demand growth from China and India underpins its stable outlook for the Asian refining and marketing (R&M) industry, despite a likely modest earnings contraction through 2017.

Source: The New Indian Express

< style="color: #163449;">Cairn to spend $150 mn on 10 exploratory wells in AP

September 26: Cairn India will be taking up exploratory and appraisal drilling of ten wells in Palar block at the coast in Nellore district Andhra Pradesh with an investment outlay of $150 million. An Expert Appraisal Committee (EAC) under the Ministry of Environment, Forests and Climate Change examined and gave its nod to the proposal under Coastal Regulatory Zone (CRZ) perspective for drilling to Cairn India. The project was granted environmental clearance in 2011. The PR-OSN-2004/1 block has been awarded by the government during NELP-VI licensing round in 2007 for hydrocarbon exploration. Exploration activities will be carried out as per the Production Sharing Contract (PSC) signed between CIL and the Centre, the minutes of the meeting of EAC held said.

Source: The Economic Times

< style="color: #163449;">BPCL may look at increasing Kochi refinery capacity to 22 MT

September 25: Bharat Petroleum Corp Ltd (BPCL), which expects to finish work on its 15.5 million tonnes (MT) refinery expansion in Kochi by December and commission it in the fourth quarter, may look at further increasing its capacity to 22 MT. The third largest state-run oil marketer BPCL, with 23 percent market share, currently has four refineries -- in Mumbai, Kochi, Bina in Madhya Pradesh in joint venture with Oman Oil Company and Numaligarh in Assam.

Source: Business Standard

< style="color: #163449;">PM Modi hails fellow Indians for giving up LPG subsidy

September 25: Prime Minister (PM) Narendra Modi hailed the people for supporting his call to give up their LPG Subsidy under the 'Give-it-Up' campaign to provide help to the needy. PM Modi in the 24

th edition of his 'Mann ki Baat' programme congratulated people for giving up the LPG subsidies for the nation's welfare. The Prime Minister had in his previous address highlighted an emotional letter written by an 84-year-old retired teacher, who gave up her subsidy.

Source: Business Standard

< style="color: #163449;">OIL investing ₹12 billion to revamp pipeline pumping stations

September 24: Oil India Ltd (OIL) said it is investing ₹1200 crore to revamp the pumping stations of its trunk pipeline. OIL operates a total network of 1,220 km long crude oil pipelines, with a capacity to carry 5.38 million metric tonnes per annum (MMTPA) crude. These pipelines transport crude oil produced from oilfields in Upper Assam to the public sector refineries at Numaligarh, Guwahati and Bongaigaon in the state. OIL Chairman and Managing Director Utpal Bora said at the Annual General Body Meeting that the company achieved highest ever production and sale of natural gas in its history during 2015-16 fiscal. Bora informed the shareholders that crude oil production was 3.247 million metric tonnes (MMT) as compared to 3.440 MMT during 2014-15. The turnover of the company stood at ₹9764.87 crore as against ₹9748.23 crore, while the Profit after Tax (PAT) was ₹2330.11 crore against ₹2510.20 crore during 2014- 15, Bora said. Bora said the contribution to the state exchequer during the year was ₹1861 crore and that to the Central government was ₹3245 crore.

Source: The Financial Express

< style="color: #163449;">India to hold global energy ministerial meet in 2018

September 21: India has accepted Saudi Arabia’s request to host a ministerial session of the International Energy Forum (IEF), a group of 72 oil producing and consuming nations based in Riyadh, in 2018. Saudi minister of energy, industry and natural resources Khalid A. Al-Falih proposed holding the ministerial meeting in India in a telephone call he made to Oil Minister Dharmendra Pradhan, the oil ministry said. Pradhan invited the Saudi energy minister Khalid A. Al-Falih for discussing energy cooperation between the two nations and urged Saudi oil companies to invest in the Indian oil and gas sector, the oil ministry said.

Source: Livemint

< style="color: #0069a6;">NATIONAL: GAS

< style="color: #163449;">RIL, ONGC face 18 percent cut in natural gas price

September 27: India will probably cut the price of natural gas by about 18 percent in a setback for explorers, a survey shows. The government-set price will track a global decline and fall to less than $2.5 per million British thermal units for October through March from $3.06 currently, according to the average of 12 industry estimates. India reviews the rate half-yearly, using a formula capturing international trends. Such a reduction would take the price to less than half the $5.05 per million British thermal units the government set when it first rolled out the formula in 2014. That could put pressure on the margins of explorers such as Oil & Natural Gas Corp (ONGC) and Reliance Industries Ltd (RIL), while benefiting users including fertilizer companies and power generators. India has struggled to follow the U.S. and Europe in giving natural gas a greater role for electricity production in place of polluting coal power. Lower prices threaten to hamper the investment needed to turn around flagging output of the fuel in Asia’s No. 3 economy. A higher tariff of about $6.6 per million British thermal units is available for gas recovered from some deep-sea fields, under a policy change from March that prompted companies to revive plans to tap difficult deposits. That price is also due to be revised from October 1. ONGC estimates that each dollar decrease in gas prices curtails annual revenue by ₹42 billion ($630 million) and profit by ₹24 billion. ONGC said the government may step in if parts of the exploration industry become unviable because the natural gas price falls too far. The current gas-price formula is based on U.S., Canadian, U.K. and Russian rates. The trade association said the government needs to reassess the formula as it’s based on prices from countries where there is an oversupply of gas, unlike in India.

Source: Bloomberg

< style="color: #163449;">ONGC Board approves pact to take stake in GSPC gas block

September 25: The Board of Oil and Natural Gas Corp (ONGC) Board has approved signing of a preliminary agreement for buying a stake in Gujarat government firm GSPC's KG basin gas block. The Board of ONGC approved signing of an MoU (Memorandum of Understanding) for taking a stake in Gujarat Petroleum Corp Ltd's (GSPC) difficult gas block. The MoU approved strangely also incorporates a dispute resolution wherein any differences over issues like valuation or natural gas reserves would be referred to a three-member committee of outside experts.

Source: Business Standard

< style="color: #163449;">BPCL looks for more oil, gas assets already in production

September 22: Bharat Petroleum Corp Ltd (BPCL) is looking at buying more stakes in oil and gas assets that are already producing to speed up investment returns, the company said. The state-run refiner had previously focused mainly on exploration assets overseas, where it has invested just over $1.5 billion. But the company now also looks at fields that are already producing. In March, it bought a stake in Russian oilfields that are in production via its upstream subsidiary Bharat Petro Resources Ltd. Pressure on oil companies to get a quick return on their investment has increased because of lower oil prices which have also hit the industry's capital spending plans. Bharat Petroleum was the first Indian state refiner to venture into the upstream oil business when it bought minority stakes in Brazilian blocks in 2007. In 2008, Bharat Petroleum invested in a gas block in Mozambique but the production has now been delayed to 2020-21 after liquefied natural gas (LNG) prices slumped. The company said it would also continue to look for exploration opportunities. BPCL plans to invest ` 150 to ` 200 billion ($2.25 billion to $3.00 billion) over the next five years in developing existing blocks, the company said.

Source: Reuters

< style="color: #163449;">Govt looks to change rules to boost piped gas consumption

September 21: The government looks to overhaul its city gas distribution policy to clear major hurdles holding back expansion of piped cooking gas in the country. The government has started work on reviewing rules, which companies say need to be changed to encourage them to take up gas distribution in cities and set up gas stations on highways without time-consuming procedures and unnecessary costs. The government aims to treble its domestic piped gas consumer base to one crore by 2019, a target set by Prime Minister Narendra Modi who presided over a deeper penetration of piped gas in Gujarat during his term as chief minister of the state. But at the current pace — the country added barely 3 lakh new domestic piped gas consumers in 2015-16 — the target is unlikely to be met, the oil ministry said. At the beginning of the current fiscal year, the number of domestic piped gas consumers stood at 31.6 lakh. This has driven the oil ministry to set up two committees, with members from small and big city gas companies and Petroleum and Natural Gas Regulatory Board (PNGRB), the downstream regulator. One committee will look at making the bidding process more effective by suggesting a replacement of the current process where fewer cities attract bid in auctions and all bids offer the same tariff, the key competing criterion. The other panel will suggest ways to deal with key obstacles city gas companies face such as high restoration charges levied by local authorities, and delays in obtaining permissions. The panels are to submit their reports by the end of this month, following which the oil ministry will initiate changes. In the sixth round of city gas distribution auction at the beginning of 2016, 14 of the total 34 geographical areas, or districts, received no bid while six attracted just one bid each. Similarly, last year, of the 20 districts, eight got no bid and two got just a single bid each.

Source: The Economic Times

< style="color: #163449;">IOC, GAIL to buy 49 percent stake in LNG terminal in Odisha

September 21: Indian Oil Corp (IOC) and gas transporter GAIL (India) Ltd will buy a combined 49 percent stake in a liquefied natural gas (LNG) terminal being built in the eastern state of Odisha. The Dhamra LNG terminal, with five million tonnes of natural gas regasification capacity, is being built by a unit of billionaire Gautam Adani's Adani Enterprises Ltd. The terminal is expected to be ready by 2019, IOC said. Factories and vehicles are expected to need more natural gas in the coming years, and IOC has been booking capacity in LNG terminals across the country to tap in to the expected gas demand. The company, which is setting up its own 5 million tonne terminal on the south eastern coast, wants its gas trading business to contribute 15 percent of its revenues by 2021.

Source: Reuters

< style="color: #163449;">Expro secures $30 mn MGPP contract with HOEC for India's Dirok gas field

September 21: Expro, an international oilfield services company, reported that it has secured awarded a $30 million contract with the Hindustan Oil Exploration Co. (HOEC) for a Modular Gas Processing Plant (MGPP) for the Dirok gas field in the Assam-Arakan Basin, India. Under the contract, Expro will provide the design, engineering, construction, transportation, installation and commissioning of the MGPP. The facility, designed to process up to 35 million standard cubic feet per day of gas with associated liquid condensates, will fulfil the requirement of a fast-track Early Production System as well as long-term operational goals. Expro will also supply personnel to operate and maintain the MGPP to assist HOEC in maximizing gas and condensate production from the field over the long-term.

Source: Rigzone

< style="color: #163449;">India to fund eastern gas pipeline to kick-start growth

September 21: India's government will partly fund a $2 billion gas pipeline project linking five eastern states to help kick-start economic growth in a region that has trailed the rest of the country, Oil Minister Dharmendra Pradhan said. The 2,500-km pipeline is to be built by GAIL (India) Ltd, and this will be the first time the government is offering budgetary support as part of Prime Minister Narendra Modi's plan for more balanced development. Pradhan said the government will meet 40 percent of the cost of the pipeline that will run through the states of Uttar Pradesh, Bihar, Jharkhand, West Bengal and Odisha, which together account for nearly 40 percent of India's 1.3 billion population. India's economic development has been concentrated in the western and southern states, where there is better infrastructure and more accessible energy supplies. These states get piped gas supplies for household and transportation. Pradhan said the government was hoping the new pipeline would help attract investment in the agro processing industry in the eastern region. The government has already removed the cap on foreign direct investment in the sector but no unit. The new pipeline will also help in efforts to revive three fertilizer plants, which Modi's campaign had promised to do for the region in his 2014 election run. India's gas demand is expected to go up by as much as 10 million cubic meters a day once the pipeline is completed in a little more than two years. Natural gas accounts for about 6.5 percent of India's overall energy needs, far lower than the global average. India plans to raise the share of gas in its energy mix to 15 percent over the next three years.

Source: Reuters

< style="color: #163449;">CCEA approves city gas distribution in Kolkata

September 21: The Cabinet Committee on Economic Affairs (CCEA) has approved development of city gas distribution (CGD) networks in Kolkata as well as cities lying en-route Jagdishpur-Haldia and Bokaro-Dhamra gas pipeline. Varanasi, Patna, Bhubaneswar, Ranchi, Jamshedpur and Cuttack will also get city gas distribution. CGD networks in cities are to be developed by GAIL in collaboration with the concerned state governments. It will bring clean cooking fuel at the door steps of domestic households as well as provide clean fuel to transport sector in the eastern region. About 1.25 crore people living in these cities will be directly benefitted by the establishment of these networks. All these projects will generate direct as well as indirect employment for about 21,000 people and will boost socio-economic development in the eastern part of the country.

Source: The Economic Times

< style="color: #163449;">NATIONAL: COAL

< style="color: #163449;">CIL seeks alternative coal blocks from Mozambique govt

September 26: Coal India Ltd (CIL) has asked for alternative coal blocks from the Mozambique government since it did not find any commercially viable reserves in the block it was allotted a few years ago. Initially, the validity of CIL's exploration licence was August 2014, but it was extended up to August 2019. CIL discovered that out of the 224 sq km of the total license area, 170 sq km had no 'coaly' horizon till a depth of 500 meter and it surrendered this block to the Mozambique government. It, however, retained the remaining 54 sq km of area, for which the Mozambique government had issued a new licence that was valid till August 2019. But

Source: The Economic Times

< style="color: #163449;">Govt forms panel for policy on coal reject disposal

September 25: Government has constituted a panel to frame a "tentative policy" for disposal of low-grade coal rejects from washeries at thermal power plants. The five-member panel has been asked to submit the same in 15 days. Coal quality is enhanced by washing and the plant where such activity is carried out is called coal washery. The terms of reference of the panel also include listing out amendments in the draft policy as formulated by the coal ministry vis-a-vis comments from stakeholders and listing out the reasons for acceptance or rejection of the said comments or suggestions, if any.

Source: Business Standard

< style="color: #163449;">SC allows extracted coal transportation in Meghalaya

September 22: The Supreme Court (SC) has allowed land owners and coal traders to transport the coal already extracted from the mines in Meghalaya from October 1 to May 31, 2017 on payment of royalty to the state government and other fees fixed by the National Green Tribunal. A bench of Justices Dipak Misra and C Nagappan also directed that no other extraction shall take place in the meantime and it would later deal with the NGT's finding that coal, a natural resource vested in the state, was being illegally extracted. The apex court's direction came on an appeal filed by Ka Hima Nongstoi Land Owners, Coal Traders and Producers Association against the green panel's order banning coal mining in Meghalaya since April 17, 2014.

Source: Business Standard

< style="color: #163449;">Govt working to eliminate coal import: Goyal

September 22: The government is working on a plan to end dependency on coal imports in next 3-4 months in order to facilitate consumption of the surplus fossil fuel produced by Coal India Ltd (CIL). For almost 6-7 decades after independence, the country had got used to power and coal shortage but there is a situation of surplus production, Coal Minister Piyush Goyal said. Goyal said there is an availability of almost 20 days stock and there is not a single plant in the country which is shut due to shortage of coal. It was earlier reported that the government has decided to push back its target of coal production of one billion tonne by 2020 as it does not have takers for the produce. CIL had set a target of 598 million tonnes of production in 2016-17.

Source: The Economic Times

< style="color: #163449;">CIL needs to step up to double-digit growth rate

September 21: Coal India Ltd (CIL), which produces 84 percent of the country's coal output, "needs to step up to a double-digit growth rate" to meet its production targets, Chairman Sutirtha Bhattacharya said. In 2015-16, the state miner produced 538.75 million tonnes (MT) of coal against a target of 550 MT and its off-take stood at 534.5 MT. The company envisaged production of 908.10 million tonnes in 2019-20 with a CAGR (Compound Annual Growth Rate) of 12.98 percent over 2014-15 production figures. During 2016-17, the coal production target has been pegged at 598.61 MT with an annualised growth of about 11.6 percent. In 2017-18, coal production is expected to be 660.7 MT with a growth of about 10.5 percent. He said the estimated geological resource of Indian coal stood at 306.59 billion tonnes as on April 1, 2015.

Source: The Times of India

< style="color: #0069a6;">National: Power

< style="color: #163449;">BSES starts WhatsApp for consumers to report power thefts

September 27: In a first by a Delhi power distribution company (discom), the national capital's privately-run utility BSES said it has adopted the messaging application WhatsApp in its attempt to check power thefts. Consumers can send the power theft videos to the WhatsApp number 9555010022 for BSES Rajdhani Power Ltd (BRPL) and 8588892156 for BSES Yamuna Power Ltd (BYPL).

Source: The Times of India

< style="color: #163449;">Reliance Power to double two power plant capacities

September 27: Reliance Power is all set to double the capacity of its Rosa and Butibori power plants to 2,400 MW and 1,200 MW, respectively, even as a solar plant will be set up with a capacity of 300-400 MW, the company said. Reliance Power has signed an agreement with Bangladesh for setting up a 3,000 MW gas-based power project. The company has completed Phase I of Rs 50,000 crore capital infusion programme in record time. Reliance Power has an operating capacity of 6,000 MW.

Source: Business Standard

< style="color: #163449;">Modi govt to bid out ₹46.9 billion power projects in first reverse e-auction

September 26: The Modi government will conduct its first-ever bidding of power transmission projects through reverse auction on an electronic platform and award six mega contracts worth ₹4,697 crore through the novel initiative. The electronic bidding is being seen as a huge opportunity for some of the key players in the sector including Sterlite Power, Adani Transmission, Kalpataru Power, Alstom T&D and KEC International apart from the largest and the Power Grid Corp of India Ltd (PGCIL). Power Minister Piyush Goyal had launched the reverse e-auction process form bidding for power transmission projects on the lines the coal block auctions. The minister had said the e-bidding and reverse auction of transmission projects will facilitate better price discovery. Currently, India has a transmission network of 350,792 curcuit km with a transmission capacity of 59,000 MW. The government plans to raise it to 65,000 MW by March 2017.

Source: The Economic Times

< style="color: #163449;">Short-term linkage to Nalco's captive power plant in Odisha

September 26: An inter-ministerial panel has recommended short-term linkage coal linkage from Coal India Ltd (CIL) to two units of state-run aluminium maker Nalco's captive power plant in Odisha. National Aluminium Company Ltd (Nalco) had submitted an application in June for grant of bridge linkage. In its application, the company had stated that it was earlier allotted tapering coal linkage through letter of assurance route in 2008 for both the units. The units were commissioned and put into operation in 2009 and 2010. Earlier in the year, the government had said that CIL will provide short-term linkages to the end-use plants of those central and state PSUs, both in power and non-power sector, whose coal blocks could not begin production.

Source: The Economic Times

< style="color: #163449;">Tata Power customers can know about their daily consumption

September 25: Tata Power consumers in the city will soon be able to know about their daily electricity consumption and access various other details like reasons for technical fault in transmission line with the company working on a ₹100 crore project to introduce "new-age" technology. Under the first of its kind initiative in the country, domestic consumers of Tata Power Delhi Distribution Ltd (TPDDL), will be no longer required to report to the company about snapping of electricity supplies as real time monitoring of power transmission to each and every consumer will be ensured through a communication network, currently used by very few countries.

Source: Business Standard

< style="color: #163449;">Existing body may get to plan interstate power transmission network

September 23: The government is considering assigning the responsibility of planning interstate electricity transmission network to an existing organisation like the Central Electricity Authority (CEA), reviewing its earlier decision to set up a new central transmission utility (CTU). The power ministry had proposed to move the Union Cabinet for separation of central transmission utility function from state-run Power Grid Corp.

Source: The Economic Times

< style="color: #163449;">Power tariffs revised, up 12 percent in Rajasthan

September 23: The Rajasthan Electricity Regulatory Commission (RERC) announced the revised power tariff, with an average hike of 9.6% in various consumer categories, to be effective from September 1. This is the fifth revision in the state after the National Tariff Policy came into force. The commission cleared the full tariff increase sought by state discoms, which has led to 11 to 12% increase in all consumer categories except for agriculture, where the hike is 5.5%. The power tariff for domestic consumers has been hiked between 35 paise and 75 paise in different categories. In the non-domestic category, the commission announced a revised rate of ₹7.55 per unit from the earlier ₹6.75 for consumption up to first 100 units per month, and from ₹7.15 to ₹8 per unit for consumption from 101 to 200 units a month. In the same category, consumers using 201 to 500 units per month will have to pay ₹8.35 per unit instead of ₹7.45 earlier, whereas for those consuming above 500 units, the rate has been hiked from ₹7.85 to ₹8.80 per unit. For those in the same non-domestic category but with a power consumption of 5 KW, charges have been fixed at ₹7.55 per unit for up to 100 units, ₹8 for up to 200 units and ₹8.80 till 500 units. The commission also increased the tariff for the agriculture sector as well as small, medium and large industries. For small industries, the hike is up to 70 paise, medium 75 paise and large industries 80 paise per unit.

Source: The Economic Times

< style="color: #163449;">CIL sees dip in dues from power companies

September 22: Dues of power generation companies payable to Coal India Ltd (CIL) declined to about ₹11,846 crore in August from ₹13,684 crore in April. However, the disputed amount increased to ₹1649 crore from ₹1809 crore during the period. CIL is still eyeing acquisition of coal assets in Indonesia, South Africa and Australia, Chairman Sutirtha Bhattacharya said. Bhattacharya expressed confidence that something positive would emerge in South Africa soon.

Source: The Economic Times

< style="color: #163449;">CIL arm MCL seeks green nod for ₹100 billion power plant

September 22: Going ahead with its plan of setting up of around ₹10,000 crore power plant in Odisha, Coal India Ltd (CIL) arm Mahanadi Coalfields Ltd (MCL) has approached the environment ministry to seek green clearance for the 1600 MW coal-based thermal plant. Central Electricity Authority — the nodal agency of the power ministry — has recommended the ministry for consideration of coal linkage for the project.

Source: The Indian Express

< style="color: #163449;">Large population still without power in India

September 21: Even though government data shows low power deficit and a surplus situation in the country, a large population is still without electricity and power cuts are part of daily life, clean energy consultant Mercom Capital Group's latest report said. According to report, the power deficit numbers in India do not paint the full picture. Falling demand has led to record low prices on the power exchanges, it said. According to Central Electricity Authority (CEA), plant load factors have fallen by 20-30 percent due to the drop in power usage from commercial and industrial customers, a major source of revenue for discoms.

Source: The Times of India

< style="color: #0069a6;">NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

< style="color: #163449;">Odisha to implement roof-top solar projects in major cities

September 27: The Odisha government has planned to implement roof-top solar projects across all major cities in the state, Energy Minister Pranab Prakash said. The Green Energy Development Corp of Odisha Ltd (GEDCOL) would implement the project in urban areas of the state, Das said. GEDCOL and the Central Electricity Supply Utility have signed a 25-year project implementation agreement with Azure Power Mercury Private Ltd to develop a grid-connected rooftop solar project in Bhubaneswar and Cuttack. The project, with a minimum installed capacity of four MW, will be set up on government buildings in the twin cities, Das said. The project is scheduled to be completed by September 2017. GEDCOL is also developing solar power plants of 16.5 MW capacity on the unutilised lands available inside Odisha Power Transmission Corporation Ltd grid substations, Das said.

Source: The Times of India

< style="color: #163449;">Deputy CM to inaugurate largest solar power plant in Punjab

September 27: Deputy Chief Minister (CM) Sukhbir Singh Badal will inaugurate the largest power plant at a single location in the state in Mansa. Punjab New and Renewable Energy Minister Bikram Singh Majithia said the 31.5 MW solar power plant, set up with an investment of ` 200 crore at Mirpur Kalan village is one of the state’s biggest investments.

Source: The Indian Express

< style="color: #163449;">India to speed up hydropower building on rivers flowing into Pakistan

September 27: India will accelerate its building of new hydropower plants along three rivers that flow into Pakistan. Disagreements over how to share the waters of the Indus and other rivers have dogged relations between the nuclear-armed arch-rivals since independence in 1947. The dispute looks set to be reignited after Prime Minister Narendra Modi said that India should use more of the rivers' resources. India has long accused Pakistan of backing militant groups operating in the Himalayan state of Jammu and Kashmir, through which several of the countries' shared rivers flow. The Indus Water Treaty was signed in 1960 in a bid to resolve disputes, but India's ambitious irrigation plans and construction of thousands of upstream dams has continued to annoy Pakistan, which depends on snow-fed Himalayan rivers for everything from drinking water to agriculture. India currently generates about 3,000 MW of energy from hydropower plants along rivers in its portion of Kashmir, but believes the region has the potential to produce 18,000 MW.

Source: Reuters

< style="color: #163449;">HERC increases incentive on grid connected solar power generation

September 27: In a development that should give a big push to solar power generation in the state, incentive given to rooftop solar plants installed under the state's new solar policy for residential buildings for solar power generation has been quadrupled, from 25p per kWh to ₹1 per kWh. The order from Haryana Electricity Regulatory Commission (HERC) says starting from August 2016, till March 2017, an incentive of ₹1 per kWh shall be given by the discoms, instead of the 25 paise per kWh offered earlier, during financial year 2016-17.

Source: The Economic Times

< style="color: #163449;">Premier educational institutes in Delhi go green

September 26: The renewable energy venture of the Hero group, Hero Future Energies (HFE), commissioned ~ 1 MW rooftop solar projects for Delhi Technical University (DTU), Netaji Subhash Institute of Technology (NSIT), Indira Gandhi Delhi Technical University for Women (IGDTU) and Shaheed Sukhdev Singh College with (Indraprastha Power Generation Co. Ltd) IPGCL as its nodal agency in Delhi. The intent of installing solar projects in educational institutes has far reaching impact on the environment and the society. Once again technical universities of Delhi strengthened its numero Uno position by going solar for four of its institutes in a row.

Source: The Economic Times

< style="color: #163449;">SJVN gets award in ‘Best Hydro Power Generator’ category

September 26: State-run Satluj Jal Vidyut Nigam (SJVN) has been conferred first runners up trophy in ‘Best Hydro Power Generator’ category by Independent Power Producers Association of India (IPPAI). The award has been conferred on SJVN for its outstanding performance in the area of operation and maintenance of hydro power stations, SJVN said. Hydro Power is the core strength of SJVN and the Company has the distinction of implementing India’s largest 1500 MW Nathpa Jhakri Hydro Power Station and 412 MW Rampur hydropower projects in Himachal Pradesh. SJVN has 47.6 MW Khirvire Wind Power Project in Maharashtra, which is already in operation. SJVN is also implementing 12 other projects in Nepal, Bhutan, Arunachal Pradesh, Himachal Pradesh, Uttarakhand, Bihar, Gujarat and Maharashtra.

Source: The Financial Express

< style="color: #163449;">Goldman’s ReNew seeks $300 million for green energy

September 26: ReNew Power Ventures Pvt wants to raise a part of the $300 million required for expansion of its green-energy projects before top shareholder, Goldman Sachs Group Inc, helps bring the company public next financial year. ReNew Power will try to raise $100 to $150 million by March, Chairman Sumant Sinha said. The company, with almost 1 gigawatt (GW) of solar and wind power in operation, wants to double capacity by the end of the financial year in March and has another GW under construction. Indian companies are working to meet Prime Minister Narendra Modi’s ambitious renewable energy goals. He wants to install 100 GW of solar, 60 GW of wind and 15 GW of other types of clean energy by 2022 at an estimated cost of $200 billion. The country currently has about 35 GW of installed solar and wind capacity. ReNew Power has raised total equity of $655 million since its inception in 2011. Included are four rounds from Goldman Sachs totaling $370 million. The company’s other investors include Abu Dhabi Investment Authority and the Global Environment Fund. The company has enough existing equity to develop 2.5 GW and generated cash-flow could be used to reach the 3 GW mark, according to Sinha. Sinha said he only wants to begin ReNew Power’s initial public offering after it has operational assets of 2 GW and can give investors a clear pathway to 3.5 GW of capacity. Sinha will focus on expanding the solar pipeline, as India could potentially tender 90 GW of projects over the next six years to reach Modi’s targets. The focus on solar will also mean doubling the year-on-year head count to 700 by the end of March.

Source: Bloomberg

< style="color: #163449;">Now, apply online with documents to avail subsidy on solar power panels

September 26: Now, you can submit applications online to get subsidy on solar power panels. The online application system has been started by the department of renewable energy, Haryana, also known as HAREDA, to encourage more people to opt for solar power by making the process simpler. Applicants can visit HAREDA's portal — hareda.gov.in — and after filling the forms, you can submit the application along with required documents. However, the application for subsidy has to be submitted before the installation of the power panel and not after that. Every resident, who generates solar power in commercial, residential or educational institutional category, is eligible for subsidy at 30 percent of the benchmark price fixed by HAREDA or 20,000 per kW, whichever is less. The benchmark price is set at ₹75,000 for the slab of up to 10 kW , 68,000 for 10-50kW and 62,000 for 50kW and upwards.

Source: The Times of India

< style="color: #163449;">India to ratify Paris climate change pact on Gandhi Jayanti, US welcomes move

September 26: India will ratify the Paris climate-change deal on October 2, Prime Minister Narendra Modi said, a surprise announcement that will accelerate efforts to control global warming. The pact that is expected to kick in by year-end requires countries to come up with plans to limit greenhouse gas emission to keep global temperature rise to below 2°Celsius. He chose Mahatma Gandhi’s birth anniversary as the freedom icon’s life was an example of minimum carbon footprint, the PM said at the BJP national meet in the coastal town of Kozhikode. India, which accounts for around 4.5% of global greenhouse emissions, held up the final steps of ratification to induce the US to put pressure on China to let New Delhi into the nuclear suppliers’ group, the elite club of countries that control trade in nuclear technologies. At the recent G20 summit, US President Barack the Obama did urge his Chinese counterpart Xi Jinping to let India in and after that New Delhi concluded it had extracted what it could on that front. China and the US, the world’s biggest carbon emitters, ratified the accord ahead of the summit. India would not be able to complete the domestic procedures to ratify the deal by the end of 2016, Niti Aayog vice-chairman Arvind Panagariya had said on the sidelines of the G20 meet. The cabinet has to approve the ratification of the climate deal following which New Delhi will send the documents (instrument of ratification) to the United Nations Framework Convention on Climate Change to complete the process. India took a tough stand on emissions and funding when the deal was hammered out in Paris in December. The agreement requires all countries to put forward their best efforts through “nationally determined contributions” (NDCs) and to strengthen these efforts in the years ahead. India submitted its action plan on October 2, 2015, committing to reduce growth of its carbon emissions by 33-35% of the economy by 2030. To cut down emissions, India has pledged to increase its clean energy share -- solar and wind -- by 40% by 2022. For the deal to come into force, at least 55 countries – responsible for 55% of the total global greenhouse gas emissions - have to ratify it.

Source: Hindustan Times

< style="color: #163449;">Solar sector needs new debt instruments to bring down cost of capital: Ghei

September 25: The Regulators and Policymakers Retreat (RPR) hosted by IPPAI with an overarching theme of 'India meeting the Aspiration' focused on the 360 degrees of the Indian power sector, both the challenges and its solutions. Rajya W Ghei, CEO, Hindustan Clean Energy Ltd, said that that there is an urgent need to bring in new debt instruments to reduce the cost of raising capital for setting up solar projects. The Government has set an ambitious renewable energy target of 175 GW by 2022, of which 100 GW is for solar power. According to Ghei, while this is an ambitious target, it is still achievable. Further, the tariffs have been falling year on year basis and have now becoming competitive to conventional power and this has brought in lot of acceptance from the discoms.

Source: Business Standard

< style="color: #163449;">Philanthropic fund of $80 mn to phase out HFCs

September 24: A philanthropic group has launched $80 million fund to expand energy efficiency in developing countries just ahead of Montreal Protocol negotiations, the biggest opportunity to act on climate change since the historic Paris accord. The new fund is made up of a coalition of foundations and donors that have pledged $80 million, the India Lead- Global Strategic Communications Council said. This money is specifically to bolster energy efficiency efforts in developing nations, which will enable them to move more quickly to potentially double their climate benefits while phasing out hydrofluorocarbons (HFCs), it said. Increasing energy efficiency, specifically in the cooling sector, is crucial to development, it said, adding that cooling, the primary user of HFCs, drives as much as 40 to 60 percent of peak summer energy load and will only grow. The fund and funding commitments from supporting governments and philanthropists will help nations transition to more efficient cooling equipment and phase down the production and use of HFCs and replace them with newer, climate-safe coolants. According to the Global Strategic Communications Council, the meetings at the Climate Week that will conclude are crucial for India in particular as a future consumer of the planet warming HFC gases.

Source: Business Standard

< style="color: #163449;">BPCL to set up green bio-fuel refinery

September 24: Bharat Petroleum Corp Ltd (BPCL)-Kochi Refinery (KR) will set up a green biofuel refinery to produce ethanol at Kochi by converting agricultural and municipal waste. BPCL-KR is setting up a petrochemical complex which will bring about employment opportunity and increased economic activity in Kerala, Oil Minister Dharmendra Pradhan said. He said Presently, Kochi Refinery is undertaking the implementation of its Integrated Refinery Expansion Project (IREP) which is in its final stages.

Source: The Times of India

< style="color: #163449;">Suzlon won 111.3 MW order in August-September

September 23: Wind power company Suzlon announced that the company has won orders totaling 111.30 MW from corporate and small and medium enterprises from between August and September 2016. This combined capacity includes orders from corporate houses such as Serum Institute of India Ltd, Rajasthan Gum Group, and an assortment of SME customers. The projects are spread across the key windy states of Andhra Pradesh, Gujarat, Karnataka and Tamil Nadu, and are scheduled to be completed by March 2017.

Source: The Economic Times

< style="color: #163449;">MP Govt approves domestic solar power units on rooftops

September 23: Now domestic consumers on Madhya Pradesh (MP) can produce their own electricity through solar panels on rooftops. If production is more than the household requirement at any time during the day, then it can be contributed and fed to the grid. Consumer contribution to the grid will get paid by means of adjustments and subtractions in bill payments. The MP government approved the Madhya Pradesh Renewable Energy Policy 2016 with the slogan "Har Chhat Par Muskurata Suraj (Smiling Sun on Every Rooftop)". Notification will be issued by early next week and then consumers can apply to install solar panels on rooftops.

Source: The Times of India

< style="color: #163449;">Govt mulls generating power from tidal waves: Gadkari

September 22: Goa is expected to be the next laboratory of the central government to generate power from tidal waves of the sea using Israeli technology. The Union Transport Minister Nitin Gadkari appealed to Goa Chief Minister Laxmikant Parsekar to try and work out means to shift existing transport from conventional to green fuel.

Source: The Economic Times

< style="color: #163449;">Solar projects in Maharashtra receive ₹4.42 per unit bid

September 22: The proposed 450 MW grid connected solar projects in Maharashtra under National Solar Mission has received lowest bid of ₹4.42 per unit and nine other companies submitted bids of ₹4.43 per unit. Lowest bidder was Vijaya Printing Press Pvt Ltd which offered to build a 10 MW solar plant at a tariff of ₹4.42 per unit. This was followed by Solar Edge Power and Energy Pvt Ltd (130 MW). Others were Light Source Renewable Energy Holdings, Neel Metal Products Ltd (100 MW) and Canadian Solar Energy Holding (80 MW).

Source: The Economic Times

< style="color: #163449;">Three hydro power projects at construction stage: NHPC

September 22: NHPC said three hydro power projects, including Subansiri Lower, with an aggregate installed capacity of 3,130 MW are at the construction stage. Five future projects with a planned capacity of 4,995 MW are in process. A 50 MW wind power project in the Jaisalmer district of Rajasthan is nearing completion and will be commissioned after signing of power purchase agreement (PPA) with Rajasthan discoms, NHPC said. The company is also envisaging development of one 50 MW solar power project in Uttar Pradesh and four hydroelectric projects namely Kiru, Kwar and Pakal Dul in Jammu & Kashmir (2,164 MW) and Chamkharchhu-I (770 MW) in Bhutan, respectively, through JV companies. An MoU has been signed with Kerala for the development of a 72 MW capacity of wind power project at Agali site of Palakkad district in Kerala. Another MoU has also been signed with Solar Energy Corporation of India (SECI) for development of 250 MW solar power projects in India and an agreement has been put in place with Teesta Urja Ltd (TUL) to provide consultancy services for Project Construction Management for 1,200 MW Teesta Stage-III hydroelectric (HE) project in Sikkim.

Source: Business Standard

< style="color: #163449;">India, US Ex-Im Bank in talks on $8-9 billion nuclear loan, snags remain

September 21: India is negotiating with U.S. Export-Import Bank for an $8-9 billion loan to finance six Westinghouse Electric nuclear reactors, two sources familiar with the talks said, although a lending freeze at the trade agency threatens progress. The mega-project, the result of warming U.S.-India ties in recent years, could open up billions of dollars of further investment in India's nuclear power sector, which was for decades shut out of the global market. India now targets a tenfold expansion in capacity to 63,000 MW by 2032, and U.S., French and Russian companies are among those chasing the business. The U.S. bank had not made any request to its Japanese counterpart to extend loans to the nuclear project in India. Both U.S. President Barack Obama and Indian Prime Minister Narendra Modi have been promoting the nuclear deal, which was stuck for years because of an Indian law that made nuclear equipment suppliers liable in case of an accident, and not just the plant operators as is the global norm. India has since set up an insurance pool to indemnify suppliers, and both Westinghouse and India's state-run operator Nuclear Power Corp of India Ltd (NPCIL) are working to a June 2017 deadline to sign the contract laid down by Obama and Modi.

Source: Reuters

< style="color: #163449;">Suzlon wants to raise $3 billion for Australian wind farms by 2020

September 21: India's Suzlon Energy Ltd is seeking Australian partners to develop local wind farms as it taps a surge in global investor appetite for green energy assets after the Paris climate agreement, its Chairman and Managing Director Tulsi Tanti said. The wind-turbine maker plans to raise $3 billion to co-develop the projects in Australia out to 2020, as global investors like Goldman Sachs and Morgan Stanley look to ramp up exposure to geographically diverse renewable assets. Suzlon, which already has a footprint in 19 countries, anticipates it will attempt a similar strategy in Canada, Brazil, New Zealand and parts of Eastern Europe, to boost exports of turbines and gain exposure for its investors in a broad array of renewable assets, Tanti said. In Australia, Suzlon has installed 764 MW of wind energy generation, around a fifth of the market share. Globally it has around 15 GW, which it expects to expand to 35 GW by 2020, he said.

Source: NDTV

< style="color: #163449;">Suzlon to work on hybrid wind-solar model soon

September 21: Wind energy firm Suzlon will start working on its plans for a hybrid wind-solar model next year, the company said. This is the company's first step in working towards an integrated model where wind, solar and storage batteries will be a part of the same renewable energy eco-system. The company has a team of 2,500 people in operations management across India who could oversee this and find a balance between wind and solar power, depending on the conditions at any given time. Suzlon Chairman and Managing Director Tulsi Tanti has set his team an ambitious goal of installing 15 GW of power over the next five years, almost at par with what it's done in its first 20 years. Suzlon estimates there is potential to unlock 300 GW of wind energy in India. At present, Koerbel's focus is improving the efficiency of wind turbines to reduce the levelised cost of energy by 20 percent over the next five years. The strategy is built on four pillars - improving aerodynamics and rotor size, taller towers, smarter pitch control and integrated wind control. Suzlon has created a hybrid tower structure, which will allow it to increase the tower size from the current average of 88 m to over 120 m. The wind has more energy at higher levels and this will permit the company to generate more energy from the same turbines.

Source: The Economic Times

< style="color: #0069a6;">International: Oil

< style="color: #163449;">Iraq mediating between Saudis and Iran to support oil prices

September 27: Iraq is carrying out a mediation between Saudi Arabia and Iran to bring about an agreement that would lift crude prices, at a meeting of crude-producing nations in Algiers, Iraqi Oil Minister Jabar Ali al-Luaibi said. Iran rejected a proposal from Saudi Arabia to limit its oil output in exchange for Riyadh cutting supplies, dashing market hopes that the two major OPEC (Organization of the Petroleum Exporting Countries) producers would find a compromise this week to help ease a global glut of crude.

Source: Reuters

< style="color: #163449;">US diesel demand set to rise as freight, oil drilling pick up

September 27: Freight movements across the United States (US) are showing signs of sustained growth for the first time in 18 months, which should support increases in diesel consumption in 2017. Freight volumes hit a record in July, passing the previous peak set back in December 2014, according to the U.S. Bureau of Transportation Statistics. The Bureau’s freight transportation services index has risen for four consecutive months, after flat-lining or falling for more than a year. Freight firms will continue to struggle for some months more because of the enormous amount of excess capacity within the transportation sector. But the increase in freight, as well as oil and gas drilling activity, which relies on diesel-electric engines, as well as diesel generators for auxiliary drill site power, should boost diesel consumption significantly in 2017. U.S. diesel consumption is forecast to increase by 80,000 barrels per day, just over 2 percent, in 2017, as a result of a colder winter and freight growth, according to the Energy Information Administration (EIA). But the forecast could prove conservative if this winter proves much colder than last year’s exceptionally warm one and there is a sustained rebound in oil and gas drilling as well as freight movements.

Source: Reuters

< style="color: #163449;">BP tanker carrying US crude discharged at Curacao after 100-day wait

September 26: A tanker carrying over 1 million barrels of U.S. light crude finished discharging on Monday after a 100-day wait related to payment delays from Venezuela's state-run PDVSA to oil major BP Plc, according to vessel tracking data. PDVSA in March awarded BP a tender to import up to 8.2 million barrels of U.S. crude for the second quarter, but long payment delays have since April created bottlenecks to discharge about a dozen cargoes, boosting the costs for the oil.

Source: Reuters

< style="color: #163449;">Baker Hughes CEO sees oil depressed for extended period

September 26: Baker Hughes Inc chairman and chief executive officer (CEO) Martin Craighead said oil prices were expected to remain depressed for an extended period. He said that while global demand was expected to increase by one million barrels per day every year, "oil prices are expected to remain depressed for an extended period".

Source: Reuters

< style="color: #163449;">East Africa oil pipelines boon to private funders: AfDB

September 26: Oil pipelines planned in Kenya and Uganda to ferry crude from fields to port present opportunities for private financiers keen to gain a foothold in East Africa’s energy industry, the African Development Bank (AfDB) said. East African countries are in a race to start exploiting crude oil reserves estimated at 1.7 billion recoverable barrels in Uganda and 750 million barrels in neighbouring Kenya. Both nations are planning to start construction on pipelines by 2018, even as oil prices are stuck at less than half the level of three years ago, straining finances of producers across the continent. Kenya expects production by Tullow Oil Plc to start in mid-2017, with the government initially hauling crude by road and rail to a refinery at the port city of Mombasa. East Africa’s largest economy plans to start building an 865 kilometer pipeline linking fields in its northern region to a port at Lamu on the Indian Ocean coast by 2018, the government has said. Work on Uganda’s pipeline, which will run from the western region of Hoima to the Tanzanian port of Tanga, is expected to begin in 2018. France’s Total SA, China National Offshore Oil Corp and London-based Tullow are developing oil fields in Uganda’s Lake Albert basin. The three companies have been awarded production licenses by the Ugandan government that will run for 25 years.

Source: Bloomberg

< style="color: #163449;">Oil market investment needed soon to balance market: Schlumberger CEO

September 26: Investment in exploration and production will have to start increasing soon to help balance the global oil market, Schlumberger chief executive officer (CEO) Paal Kibsgaard said. The medium- to long-term oil environment will remain subject to periods of volatility and the industry may see fewer and larger service operators in the future, the CEO said.

Source: Reuters

< style="color: #163449;">Petrobras to seek builders for six new platforms as of next year

September 25: Petroleo Brasileiro SA (Petrobras), Brazil's state-run oil company, as of 2017 will begin seeking offers for the construction of six new offshore oil platforms envisioned in current investment plans. Petrobras said the six new platforms, together likely to cost as much as $6 billion, are among eight rigs planned to enter service by 2021, with bidding for the other two contracts already under way. The new platforms will come on the heels of another 11 platforms already under construction and expected to enter service through 2019. Petrobras is seeking to ramp up production as part of a five-year, $74.1 billion capital spending plan announced. It slashed investments from a prior plan by 25 percent, seeking to refocus on core operations after years in which the company was battered by a corruption scandal and government interference that, along with low oil prices, led to big losses.

Source: Reuters

< style="color: #163449;">Nigeria lawmakers to investigate $17 billion oil theft claim

September 23: Lawmakers in Nigeria's lower house of parliament are to investigate whether $17 billion of petroleum and fuel exports were stolen by companies and government agencies under the administration led by President Muhammadu Buhari's predecessor. Buhari has said he will recover "mind-boggling" sums of money stolen from the oil sector in the OPEC member nation, which has Africa's biggest economy. Nigeria is in recession for the first time in over 20 years due to low oil prices and militant attacks on energy facilities in its Niger Delta region that cut crude production, which provides 70 percent of government revenues, by around a third.

Source: Reuters

< style="color: #163449;">Crude oil export trends in the Middle East

September 23: Crude exports from Iran and Iraq reached the highest monthly amount in at least two years during August, while volumes sent from Saudi Arabia dropped sharply. The movements exemplified a shift within the landscape of Middle East exports in August, when significant changes in recent exporter and importer patterns emerged. During August, total crude exports from the Persian Gulf were 608.5 million barrels, or 19.6 million barrels per day, just 2 million barrels less than in July.

Source: Rigzone

< style="color: #163449;">Russian Finance Minister wants to raise tax on oil, gas firms

September 23: Russian Finance Minister Anton Siluanov said he wanted to increase taxes on the oil and gas industry by around 50 billion rubles ($787 million) a year. Russia is the world's biggest oil producer and its output has been rising to record highs despite low crude prices. The trend, supported by a weaker rouble, has caught the attention of the treasury, which needs revenues to cover a budget deficit. The current oil tax regime envisages a gradual increase in mineral extraction tax (MET) and export duties on heavy oil refining products, offset by a reduction in duties on exports of oil and high-grade refined products. This year, however, the MET was increased as planned, but there was no corresponding reduction in oil export duty, angering the industry. Russia's oil taxes are already among the highest in the world. Siluanov said the ministry planned to reach the same level of taxation for the gas sector as for the oil industry, in a step-by-step process.

Source: Reuters

< style="color: #163449;">Venezuela PDVSA awards $138 million contract to tackle petroleum coke problem

September 23: Venezuelan state oil company PDVSA said that Maroil Trading Inc has won a $138 million contract to remove a large pile of petroleum coke at the Jose solids terminal in the eastern state of Anzoategui. PDVSA said 2.5 tonnes of petroleum coke are derived from every 100 barrels of upgraded extra-heavy crude from the oil-rich Orinoco Belt. The international price of the product is about $35 per tonne, it said.

Source: Reuters

< style="color: #163449;">Oil industry welcomes Indonesia's tax reform, but says it's not enough

September 23: Indonesia's removal of taxes on oil and gas explorers is a good first step, but more is needed to lure investment from companies that have cut budgets and laid off staff after a precipitous plunge in prices, industry analysts said. The Indonesian government is trying to revive its flagging upstream oil and gas sector as the country's proved oil and gas reserves have fallen and companies slashed spending after a nearly 60 percent drop in oil prices from mid-2014. As a result of the spending cuts, analysts have warned of sharp production declines at Asian oilfields over the next decade, increasing the region's reliance on imported oil. To give the sector a boost, the government announced it is removing taxes on oil and gas exploration. Indonesia wants to ramp up oil and gas production to bolster government finances. The sector is expected to contribute just 3.4 percent to state revenue in 2016, down from 25 percent in 2006. Indonesia is an OPEC member but has been a net oil importer for years. Oil production has declined steadily from a peak of 1.7 million barrels per day in 1991 to an average of 786,000 bpd in 2015, according to Indonesian government data. Indonesia's total proved oil reserves stood at 3.6 billion barrels at end-2015, the lowest since BP started collecting data in 1980. The country holds the second largest proved gas reserves after China, although that has also dropped from a peak in 2008, BP's data showed. Investors are waiting to see if the government will improve the fiscal terms in production sharing contracts, such as giving investors a larger share of the output that would boost returns and cash flow at oil and gas companies.

Source: Reuters

< style="color: #163449;">Iraq OPEC governor says market circumstances right for global oil deal

September 22: Iraq's OPEC governor Falah Alamri said that oil market circumstances are now more favorable for OPEC and other oil producers to reach a deal to support the market when they meet in Algeria. Alamri said some oil producers have managed to reach a better market share than earlier in the year and Iran's output is now higher after the lifting of sanctions, making the time for a deal is right.

Source: Reuters

< style="color: #163449;">Gulf Keystone warns of investment curbs over lack of oil payment

September 22: Gulf Keystone Petroleum, an oil company focused on Iraqi Kurdistan, warned that a lack of export payments from the regional government was preventing it from investing. The oil producer has not been reimbursed for exports of crude in July and August, the first interruptions to steady monthly payments from the Kurdistan Regional Government in a year. The company, which is going through a debt-for-equity restructuring, said it wants to invest to bring production at its Shaikan oilfield to 55,000 barrels per day (bpd). It produced an average of 33,000 bpd in the first half of the year. Gulf Keystone expects its restructuring deal to conclude around October 14, an agreement that will reduce the company's debt to $100 million from $600 million.

Source: Reuters

< style="color: #163449;">Russia says its daily oil output touched highest point

September 21: Russian Deputy Energy Minister Kirill Molodtsov said that Russian daily oil production touched 11.75 million barrels per day. Russia reached the highest level in history, Molodtsov said about daily oil output.

Source: Reuters

< style="color: #163449;">Gasoline shortages highlight US dependence on Colonial pipeline

September 21: Drivers from Tennessee and Georgia to New Jersey may soon breathe a collective sigh of relief as service is restored on Colonial Pipeline, cutting gasoline prices that have surged following a leak on the key line. Still, the 12-day disruption on Colonial, the main artery that flows about 1.3 million barrels per day of fuel from the refining hub on the Gulf Coast to cities all the way up to the East Coast illustrates the impact even a relatively brief disruption can have on gasoline prices. The largest gasoline conduit in the United States was partially shut down after a leak was discovered in Alabama, and motorists have since suffered long waits to fill up at stations across the southeast.

Source: Reuters

< style="color: #163449;">A $24 bn China refinery sees a great future in plastics

September 21: A new $24 billion Chinese refinery that’ll use as much crude oil as some of Asia’s biggest plants is set to take on rivals by helping make plastic bottles rather than fuel for cars. Rongsheng Petrochemical Co. has cleared more than 10,000 acres of land in Zhoushan island to build a 400,000 barrel per day facility by 2018, and will double that capacity by 2020. Once the plant in eastern China reaches it expanded size by the end of the decade, it would rank among the top refineries in Asia, rivaling those of India’s Reliance Industries Ltd and South Korea’s SK Innovation Co. Hangzhou-based Rongsheng plans to consume all of the plant’s output of naphtha, a key ingredient in the manufacture of petrochemicals, while minimizing production of diesel and fuels. At maximum capacity, the refinery will be able to produce 10.4 million metric tons a year of aromatics including paraxylene and 2.8 million tons of ethylene, both of which are used to make plastics, according to the Zhoushan government. The company’s ambition underlines China’s increasing appetite for petrochemicals, used to make everything from sportwear to soda bottles. That will also help drive oil demand in the world’s second-biggest consumer amid a global glut and weak prices. Chinese petrochemical makers will need 90 percent more crude oil in 2030 than last year, while diesel demand growth is entering “a 10-year plateau”, according to Li Zhenguang, a senior analyst at China Petroleum & Chemical Corp., known as Sinopec.

Source: Bloomberg

< style="color: #163449;">Libya exports first oil cargo from Ras Lanuf since 2014

September 21: An oil tanker left the Libyan port of Ras Lanuf for Italy early with the first crude export cargo from the terminal since at least late 2014, boosting hopes of reviving Libya's oil output. Libya's National Oil Corp (NOC) has welcomed a promise by Haftar's forces to allow the NOC to control the ports. NOC Chairman Mustafa Sanalla said that national production had risen to about 390,000 barrels per day (bpd) from less than 290,000 bpd before the change of control at the ports. Any boost in production through the ports could also benefit the United Nations-backed Government of National Accord (GNA) in Tripoli as it tries to unite rival armed factions and stabilize the economy, though Haftar has so far rejected the GNA. The NOC has ambitious goals of producing more than 900,000 bpd by the end of the year, but says it needs funding for its operating budget and the reopening of blockaded pipelines in western Libya to reach that target.

Source: Reuters

< style="color: #0069a6;">International: GAS

< style="color: #163449;">Russia's Rosneft plans to take final investment decision on Far East LNG in 2017-18

September 27: Russia's Rosneft plans to take a final investment decision on its Far East LNG project in 2017-2018, according to a presentation by Rosneft department head Alexander Zharov at a conference. The presentation also showed that the production at the plant may start after 2023. Rosneft, which partners with ExxonMobil, Sodeco and ONGC at the project, plans to produce 5 million tonnes of LNG at the plant at the start, with possibility of rising to 10 million tonnes in the future.

Source: Reuters

< style="color: #163449;">Britain's first US shale gas delivery arrives in stormy Scotland

September 27: Britain's first shale gas delivery from the United States (US) sailed into a heated European political debate on fracking and immediately ran into its first practical problem - the Scottish weather. The huge "Ineos Insight" tanker had entered the Firth of Forth at sunrise, a lone Scots piper playing on its bow, as it headed for the Grangemouth refinery, west of Edinburgh. But gusty squalls prevented it from unloading its controversial cargo before an assembled crowd of dignitaries. Ship tracking data showed the vessel had turned back into deeper waters. Ineos is importing ethane, obtained from rocks fractured at high pressure, or "fracking", in a foretaste of larger deliveries of liquefied natural gas (LNG) from shale set to reach Europe in 2018. Scotland's devolved government imposed a moratorium on fracking last year and Britain's opposition Labour party said would ban it if the party were elected in 2020.

Source: Reuters

< style="color: #163449;">Japan's Jera sells first LNG resale cargo to South Korea

September 27: Japan's Jera Co, the world's biggest importer of liquefied natural gas (LNG), has re-sold an LNG cargo to South Korea, marking the first actual delivery to a customer outside of Japan, a crucial step toward expanding its trading business. Jera agreed to resell about 60,000 tonnes of LNG to the Gwangyang terminal in South Korea for December delivery to a storage tank that trading house Itochu Corp has leased from Posco, Jera's Senior Executive Vice President and Chief Fuel Transactions Officer, Hiroki Sato, said. The company procured the LNG through one of its three long-term purchase contracts for Indonesian supply, Sato said.

Source: Reuters

< style="color: #163449;">Israel's Leviathan gas to supply Jordan in $10 billion deal

September 26: Backers of Israel's massive Leviathan natural gas field signed a $10 billion deal to supply 1.6 trillion cubic feet (Tcf) of gas to Jordan's National Electric Power Company. The deal marks a significant step forward in Israel's efforts to exploit its offshore gas reserves, although it is still looking for a partnership with Egypt or Turkey, or both, which would give it far more export volume and the possibility of linking up with markets in Europe. Talks on the contract began more than two years ago. The 15-year deal for Leviathan, which holds an estimated 22 Tcf of gas, should help the U.S.-Israeli group secure funds to bring it online. Production is expected to begin around 2019 or 2020.

Source: Reuters

< style="color: #163449;">UK Labour Party would ban hydraulic fracking for shale gas

September 26: The U.K. opposition Labour Party would ban hydraulic fracturing for shale gas if it wins the next general election, according to its energy spokesman Barry Gardiner. Labour had previously supported only a moratorium on the process, known as fracking, until the industry met certain environmental safeguards. The policy shift adds more uncertainty to an industry that’s struggled to get up and running despite tax breaks and the easing of planning restrictions since 2010.

Source: Bloomberg

< style="color: #163449;">Petrobras says regulatory issues preventing sale of LNG terminal

September 26: Regulatory issues are preventing Petrobras from progressing with plans to sell its LNG (liquefied natural gas) regasification terminal located in the state of Ceara, Chief Executive Officer Pedro Parente of the state-run oil company said. Parente said a sale would not be possible until these issues are resolved.

Source: Reuters

< style="color: #163449;">Fear of polar vortex repeat lifts US natural gas from doldrums

September 26: Fears that the coming winter will be as brutal as the polar vortex of two years ago has started a scramble in markets for natural gas, driving the primary U.S. heating fuel's price to 16-month highs. Gas futures are up 29 percent so far this year, on track for the largest annual percentage gain in 11 years. Some expect prices to keep rising based on expectations of a tight market this winter, due to lower production and more exports.

Source: Reuters

< style="color: #163449;">Egypt picks Glencore, Trafigura and BB Energy for LNG tender

September 23: Egypt has chosen Glencore, Trafigura and BB Energy to supply three liquefied natural gas (LNG) shipments following a tender, traders said. Egyptian Natural Gas Holding launched a tender to secure shipments for the rest of the year. Trading house Glencore will deliver the October cargo, Trafigura the November cargo and BB Energy, a relative newcomer to LNG trade, will bring in the December shipment, traders said.

Source: Reuters

< style="color: #163449;">Global LNG prices rise on Indian and South Korean demand

September 23: Asian liquefied natural gas (LNG) gas prices rose on renewed Indian demand and prospects of South Korea ramping up term supplies from Qatar to replace lost nuclear output. Prices for November delivery traded at $5.75 per million British thermal units (mmBtu), up around 15 cents- helped by a surge in gas prices at Britain's benchmark gas market which increasingly sways Asian LNG markets.

Source: Reuters

< style="color: #163449;">Ghana to receive $500 mn World Bank guarantee for ENI gas

September 22: The World Bank will provide up to $500 million to Ghana in the form of a partial risk guarantee for use if the country defaults on payments for gas from the Sankofa field, the state oil company said. The guarantee is the largest of its kind to be granted by the Bank and provides security to Ghana over gas expected to flow in 2018 from the $7.9 billion offshore oil and gas field being developed by Italy's ENI. The deal was signed with Ghana National Petroleum Corp (GNPC). GNPC said the country would take 180 million standard cubic feet of gas from the field per day.

Source: Reuters

< style="color: #163449;">ConocoPhillips, Alaska to form JV for LNG marketing

September 22: ConocoPhillips' Alaskan unit and the State of Alaska have entered into a Memorandum of Understanding to form a joint venture to market liquefied natural gas (LNG) from Alaska to global markets. Alaska's Gasline Development Corp said the joint venture (JV) would also focus on buying North Slope gas and pursue support of other major North Slope producers in the formation.

Source: Reuters

< style="color: #163449;">China August LNG imports rise 60.1 percent on year

August 21: China's imports of liquefied natural gas grew 60.1 percent in August over the same month last year to 2.26 million tonnes, data from Chinese customs showed. August imports of kerosene gained 21.3 percent on year to 320,000 tonnes, the data showed.

Source: Reuters

< style="color: #0069a6;">International: COAL