-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Anulekha Nandi, “Building National Semiconductor Capabilities: India in the Global Value Chain,” ORF Occasional Paper No. 471, April 2025, Observer Research Foundation.

Semiconductors power the essentials of contemporary life as we know it, from consumer electronics to advanced Artificial Intelligence (AI) applications. Current geopolitical considerations around increased Chinese assertions in the Indo-Pacific, along with export controls imposed by the United States (US), have foregrounded the risks associated with globally interlinked value and supply chains.[1] This has prompted countries to secure their supply chains and develop national competencies in semiconductor technology.[2] However, the capital-intensive industry is highly concentrated and entails enormous sunk costs in research and development (R&D). Scaling the success involves high costs of development and operation even in geographies like the US and Europe.[3]

The challenge is compounded by the complexity of semiconductor supply chains. According to estimates, on average, 25 countries are involved in the direct supply chain and 23 countries in the market functions for each segment of the value chain. Inputs travel somewhere around 25,000 miles and crossing international borders 70 times or more before being used in a product for an end user.[4] The large number of risk interfaces and exposure could result in indirect effects if one part of the supply chain is affected.

For instance, the chip shortage of 2020-2023 was exacerbated by environmental risks such as droughts in Taiwan, which produces 60 percent of all chips in the world and 90 percent of advanced chips.[5] Semiconductor production facilities are extremely water-intensive. The droughts disrupted production and raised operating costs such as those for procuring water, amounting to US$1,000 for 20 tonnes.[6] The 2022 earthquake in Japan also forced manufacturers to cease operations.[7] The shortages, in turn, resulted in downstream production in the automotive and electronics sectors coming to a halt, with Europe and North America suffering 24 percent and 25 percent of global losses, respectively, in 2021.[8] The demand-supply gap unfolded amidst rising geopolitical tensions, especially in the Taiwan Strait, where China’s increasing belligerence threatened to destabilise global supply chains.[9]

With the US imposing export controls for advanced chips on China, semiconductors have become the centre of aggressive global competition.[a],[10] Within this context, in 2022, India launched the India Semiconductor Mission (ISM).[11] The policy aims to develop national capabilities and strategically position India within the global value chain across the design, manufacturing, and assembly and packaging segments. The ISM also aims to combine innovation and industrial policy through its focus on R&D, human resource development, and incentivising private companies. Building national capabilities across public and private institutions is key to unlocking economic value from industrial policies.[12] At the time of the ISM’s launch in 2022, the Indian semiconductor market was valued at US$26.3 billion and was projected to increase to US$271.9 billion at a CAGR (Compound Annual Growth Rate) of 26.3 percent by 2032.[13]

This brief evaluates the ISM in the context of global interdependencies and outlines ways to strengthen efforts in positioning and integrating India within global value chains and to achieve India’s semiconductor ambitions.

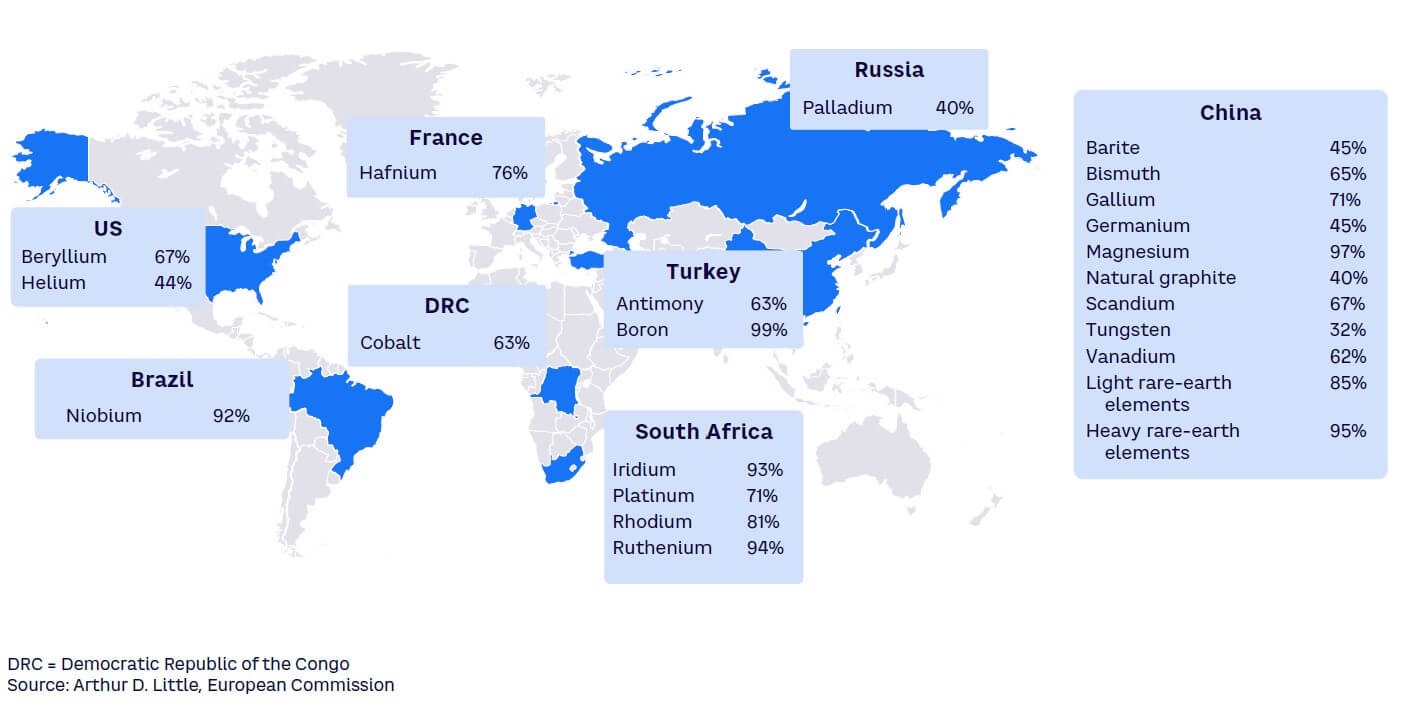

Semiconductor value chains, from design and fabrication to assembly, testing, and packaging (ATP) are characterised by geographic hyper-specialisations. The US and the United Kingdom (UK) dominate 90 percent of the higher end of the value chain in design and core intellectual property (IP), Taiwan dominates fabrication, and Southeast Asia and China dominate in ATP.[14] The Indo-Pacific region accounts for 95 percent of the world’s ATP facilities, with China, Taiwan, and Southeast Asian countries like Singapore, Malaysia, Vietnam, and the Philippines being major players.[15] A similar concentration is evident across critical inputs, with China having outsized control over critical minerals and Russia and Ukraine being major suppliers of palladium and noble gases.[16]

Figure 1: Global Supply Chain of Critical Raw Materials, by Largest Players

Source: European Commission[17]

Concentration also varies for different classifications of chips, i.e., memory/logic and mature/advanced. Logic and memory chips have distinct but complementary functions.[18] Logic chips are designed to follow instructions and perform complex operations by processing and manipulating data, whereas memory chips store and retrieve data on a system. The mature/advanced classification is based on size; the smaller the chip, the more cutting edge the technology. Mature chips are generally 22 nanometre (nm) or bigger and are produced by using older technology. [19] Advanced chips are usually 7 nm, 5 nm, and 3 nm.[20] The more advanced the chip, the higher the logic density, speed, and power reduction.[21] Advanced chips have applications in the fields of AI, supercomputers, data centres, machine learning, and military systems.[22] However, US export controls have resulted in a shift in the classification of advanced chips with the inclusion of logic chips of 16nm or 14nm or below.[23] The consumer market for mature chips is large, and China is looking to develop production capacity in the area as it does not fall under US export controls and has access to technological know-how.[24]

The semiconductor value chain can broadly be divided into three stages: design and core IP, fabrication, and ATP.[25] The design stage involves developing a blueprint of the chip architecture aimed at optimising across designated parameters such as cost and power consumption, depending on needs. Some aspects are designed by using reusable pieces of IP to improve cost efficiencies. These aspects are then materialised by using Electronic Design Automation (EDA), which are software tools that help chip designers analyse and evaluate their designs. This stage is dominated by the US, which has nearly 43 percent market share, followed by South Korea with 21 percent.[26] Three US-based EDA firms constitute 70 percent of the market. Factoring in the UK-based ARM, the UK and the US together constitute 90 percent of the core IP market.[27]

The next step in the value chain involves the fabrication of silicon wafers that have chip designs etched on them. This is a highly complex, precise, and multistep process that requires specialised inputs and equipment such as photolithography machines. The Dutch company ASML has near monopoly in this stage by virtue of being the only one that produces advanced equipment in the form of Extreme Ultraviolet (EUV) photolithography machines.[28] In fabrication, Taiwan produces 60 percent of the world’s chips and 90 percent of the most advanced chips.[29] After the wafers are manufactured, they are cut, assembled, and packaged for integration into final products in ATP facilities, which are concentrated in the Indo-Pacific.

The semiconductor industry can be broadly divided into two business models on the basis of the value chain: integrated device manufacturers who control the totality of the value chain from design to packaging,[b] and the fabless model, within which each segment of the value chain is decoupled and produced in a location that maximises efficiencies in cost and production.[c],[30] In the fabless model, chips, after being designed, are manufactured by fabrication units predominantly located predominantly in Taiwan, with TSMC having the highest market share, at 65 percent.[31] After the units are manufactured, they are packaged and assembled in ATP facilities across East and Southeast Asia.

Nevertheless, there are underlying complexities in the value chain. Over 30 types of semiconductor products exist across product categories within the electronics sector. Most advanced semiconductors require 300 critical inputs spanning minerals, chemicals, and bulk gases, which increases risk exposure and interfaces.[32] These inputs are processed by more than 50 classes of specialised engineering equipment, which in turn, use hundreds of mechanical and electronic subcomponents. The manufacturing process is highly sensitive and requires industry-specific equipment supplied by firms in the US, Japan, and the Netherlands. ASML’s EUV is indispensable in the manufacture of the leading node chips required in AI, quantum computing, robotics, and advanced wireless networks.[33] Japan is the largest supplier of assembly equipment in the Indo-Pacific, meeting its domestic demand as well as considerable portions of other countries, such as Taiwan (40 percent), the US (24 percent), China (29 percent), and South Korea (29 percent).[34]

However, with their focus on fabrication and ATP, countries tend to overlook minerals, industrial gases, and chemicals, critical for various stages of the semiconductor value chain, in their industrial and innovation policies to secure supply chains and bolster national capabilities.[35] This is a significant oversight given the high concentration of these elements in areas of geopolitical tensions, such as Ukraine, Russia, and China.

The globally distributed value chain, built up over decades on the basis of cost efficiency, is undergoing a shift due to security concerns and the need to derisk the supply chain. The US has been tightening export controls, beginning with individual Chinese companies in 2018, 2019, and 2020 and progressing to sweeping controls in 2022, 2023, and December 2024.[36] This included instructing US chip designers to halt exports and imposing stringent licensing requirements for designated sales to the country, restricting the sale of semiconductor equipment, and adding more Chinese firms to the blacklist. The measures announced on 2 December 2024 covered 24 types of equipment and three software tools, alongside expanding blacklist of Chinese companies by 140.[37] The US export controls were supported by allies, and ASML and TSMC were asked not to sell equipment and advanced chips to China.[38] However, urging allies to restrict sales have led to ‘piecemeal’ results given the differing systems of export controls; the resulting loopholes have allowed China to acquire these technologies ahead of full implementation.[39] This also stands compounded by the large size of the Chinese market, the loss of which resulted in dropping revenues for US firms through direct and indirect effects.[40]

The overarching aim of these export controls has been to restrict and contain China’s AI ambitions. In December 2024, China retaliated by banning the export of critical minerals like gallium, germanium, and antimony, in addition to the restrictions imposed in 2023.[41] Gallium and germanium are used in the development of advanced chips, while antimony has several defence uses; therefore, the restrictions could result in supply shortages and higher prices in the US defence industrial base.[42]

China has also designated billions of dollars across multiple rounds to the ‘Big Fund’.[43] The aim is to undercut US competitors in price and volume, if not technological prowess. In 2020, SMIC, China’s largest chipmaker, announced four new fabrication units (or fabs) for 28 nm technology, which has wider applications in consumer appliances, automotives, and the Internet of Things (IoT).[44] However, despite large investments in the construction of new fabs, it is estimated that China will need four years to fully meet its own needs in mature logic chips if the rate of annual spending as of 2023 continues.[45] The state’s aggressive investment strategy has made China home to one-third of the new fabs under construction.[46]

Yet, China is not the only country investing heavily in developing internal capacity in semiconductors. There is an increasing focus globally on economic security and boosting domestic capacity as well as securing supply lines closer to home. This has resulted in national policies and legislation in the European Union (EU) and the US. The European Chips Act adopted in 2022 aims to double semiconductor production to 20 percent by 2030 by pooling 43 billion euros. Factoring in complementary initiatives, programmes, and actions announced by member states, the Chips Act will be supported by 100 billion euros.[47] The US Chips and Sciences Act aims to support domestic manufacturing by allocating US$280 billion in spending over a 10-year period across scientific and manufacturing R&D, production capacity, workforce development, tax credits, and developing cutting-edge technologies.[48]

Moreover, given Taiwan’s strategic location in the global value chain and threats of invasion by China, there is concern that the ‘silicon shield’ might not hold.[49] This has led to ‘friendshoring’, or building fabrication facilities in friendly countries like Japan, Germany, and the US, which would reduce exposure to global supply shocks.[50] However, the industry is built on decades of sunk costs in R&D, supply lines, and production facilities. Innovation and R&D in semiconductors are extremely capital-intensive, with high barriers to entry. Countries beginning their semiconductor journeys usually start at the lower end of the value chain through assembly, testing, and packing services.

The US expanded its export controls under the new AI diffusion rules following an outgoing order from the former Biden administration. These include a three-tiered framework.[51] Tier 1 countries comprise the Five Eyes intelligence partners,[d] Western allies, and big semiconductor players like Taiwan, Japan, and the Netherlands, which will enjoy seamless access to advanced chips. Tier 2 countries include India, Israel, Singapore, Switzerland, and Yemen, which will have capped GPU (Graphics Processing Unit) access. Tier 3 comprises embargoed countries like China, Iran, Russia, North Korea, Myanmar, Syria, and Venezuela. The AI diffusion rules are indicative of the economic and strategic power of the US in modulating access depending on a country’s innovation capabilities as well as in exercising its own foreign policy to control the possible diversion of capabilities to China, even at the risk of potentially increasing regulatory bottlenecks for its allies.[52] US technology companies are urging the Trump administration to rethink the AI diffusion rules.[53]

Global supply chains today are threatened by geopolitical tensions and intense competition, with semiconductors being used as the new strategic levers. In the backdrop of these tensions, India and Southeast Asian countries are positioning themselves as key players.[54] Southeast Asian countries, which are key players in the ATP segment, have ambitions of expanding into the higher end of the value chain. India, for its part, started its journey in the semiconductor space with the launch of the ISM in 2022.However, given that other countries already have a head start, what are India’s differentiating factors?

The ISM, launched in 2022, is the flagship programme of the Indian government aimed at providing impetus to the industry. ISM is a specialised business unit within Digital India Corporation anchored by the Ministry of Electronics and Information Technology (MeitY) as the nodal agency.[55] The ISM is a long-term strategy that aims to position India strategically across the semiconductor value chain, from design and IP to manufacturing and ATP. It further aims to build resilient supply chains across raw materials, chemical inputs, and equipment, foster domestic innovation, and forge international collaborations.[56]

The ISM had a US$10-billion fiscal incentive outlay to support semiconductor fabs, ATP, design-linked incentive schemes, and modernisation of the Semiconductor Laboratory (SCL). Subsidies are shared by the central (50 percent) and state governments (over 20 percent), many of which have developed their own semiconductor policies.[57] India’s first semiconductor fabrication unit by Tata Electronics, in Dholera, Gujarat, with technology licensed from Taiwan’s PSMC, aims to start production by the end of 2026.[e],[58] Tata Electronics also has an ATP facility coming up in Assam that aims to start production by mid-2025.[59] Other players in the field include US-based Micron Technologies, which is setting up an ATP facility; Kaynes, which is setting up an outsourced testing and packaging unit; and a collaborative venture between Renesas (the US arm of the Japanese company), Star Microelectronics (Thailand), and CG Power (India) to build an outsourced testing and packaging unit. All three of these facilities will be located in Sanand, Gujarat.[60]

The ISM follows a slightly longer policy direction focused on developing India’s capabilities in electronics manufacturing in an effort to move up from being merely an assembly hub in the value chain. The ‘Make in India’ initiative and the National Policy on Electronics 2019 envision India as a global hub for electronic system design and manufacturing and as provider of an enabling environment that allows industries to compete globally.[61] The ISM aims to strengthen the electronics manufacturing ecosystem in the country along with other, related policies and fiscal outlays for demand aggregation. This includes purchase preference under the Make in India Public Procurement Order 2017[62] and a combined ~US$20 billion fiscal support towards electronics manufacturing and allied sectors.[63] Additionally, the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) provided subsidies of up to 25 percent of capital expenditure for electronic components, semiconductors/display fabs, ATP, specialised sub-assemblies, and manufacture. Firms that have availed incentives under SPECS include South Korea’s Simmtech, which is a key supplier for Micron.[64]

For ecosystem development, toolmakers like Applied Materials is planning to establish a Centre of Excellence in Chennai that is focused on semiconductor equipment manufacturing; AMD has plans to establish its largest design facility in Bengaluru and invest US$400 million in the next five years.[65] Tokyo Electron will provide equipment support and training for Tata Electronics for both front-end fabrication and back-end packaging to help achieve execution targets by 2026.[66]

Besides manufacturing, the ISM aims to support domestic industries across the value chain through design-linked incentive (DLI) schemes and Chips to Start-up programmes (C2S). The DLI schemes aim to provide financial and infrastructure support to domestic companies while the C2S programme aims to develop specialised manpower across all tiers of higher education and promote development and innovation in systems, chips, and reusable core IP.[67] For capacity development, the government has earmarked US$1 billion for modernisation of the SCL; more than 100 institutions have accessed the EDA tools provided by Cadence, Siemens, and Synopsys through CDAC’s ChipIn chip design centre aimed to help students across higher education levels.[68]

India is also part of the Quad’s Semiconductor Supply Chain Contingency Network, which facilitates coordination among Quad countries in securing and ensuring resilient supply chains.[69] Potential partnerships were underway in the form of capability assessments under the CHIPS Act’s International Technology Security and Innovation (ITSI) Fund.[70] Even though the future of the CHIPS Acts is uncertain under the Trump administration, commitment towards partnerships on semiconductor research and supply chain diversification remain a key component of US-India technology relations under the 2025 Joint Leaders’ Statement.[71] These developments unfold amidst talks of the first US-India defence semiconductor fabrication unit coming up in Uttar Pradesh which would make India one of the few countries apart from China to have manufacturing capabilities in complex compound semiconductors in the Indi-Pacific.[72] Japan was the second Quad member after the US to sign an agreement for joint development of the semiconductor ecosystem in India.[73] Similar agreements exist with the EU to promote knowledge exchange, innovation, R&D, and “robust supply chains”.[74]

India’s semiconductor ambitions will be shaped by international competition and comparative financial outlay. However, open-source architectures and internal markets provide opportunities that can be leveraged for advancing the country’s objectives.

India is currently a net importer of semiconductors.[75] Despite generous financial support to provide impetus to the semiconductor industry and the impending renewal of financial commitments under the ISM, the financial outlay of the country remains substantially behind those of the EU, US, and China, which are aggressively investing in the development of new facilities.

India is set to face significant competition from China owing to the latter’s existing capabilities in semiconductor manufacturing led by SMIC. Apart from the Dholera fabrication unit, India’s semiconductor journey is largely starting from ATP, at the lower end of the value chain, and moving up gradually. India has opportunities in positioning itself as a favoured location for supply chain diversification amidst rising tensions between the US and China. However, it is bound to face competition from Southeast Asia, where the semiconductor industry, especially the ATP segment, is well established.

Despite these challenges, enhanced policy support in upper levels of the value chain, the provision of open-source hardware, and leveraging India’s internal markets for demand aggregation can help bolster the country’s semiconductor ambitions. The simultaneous focus on talent development, design, and IP under the ISM, along with the available talent pool in India (estimated to be 20 percent of the global share)[76] might benefit its position in the upper levels of the value chain. Besides legacy players, the semiconductor ecosystem in the country includes start-ups, which have grown 2.4 times yearly since 2014.[77] Some of these companies are innovating on open standard architecture like RISC V.[f],[78] There has also been a rise in the number of design start-ups in the country, with over 100 operating in the domain as of 2024.[79]

These developments highlight the need to identify and develop pathways for supporting, sustaining, and boosting innovation in this space through policy support as well as by enhancing and stimulating private and venture capital investments.

India also has a large internal market for the downstream uptake of chips produced in the country due to its growing electronics manufacturing sector. Proactive policy support for electronics produced in India has resulted in the doubling of electronics production from US$48 billion in 2017 to US$101 billion in 2023.[80] India is also currently the second largest smartphone manufacturer in the world.[81] The production-linked incentive scheme for large electronics has led to the production of ~US$61 billion while SPECS led to production of ~US$2 billion as on 30 June 2024.[82]

Even though the domestic market is an attractive segment for demand aggregation and for reducing import dependency, there is a need to understand the value proposition of exports and international markets. Simultaneously, while the industry can be extremely capital-intensive, requiring decades to mature, the increase in India’s production value in electronics manufacturing highlights its potential to replicate this success in the semiconductor industry. There is a need to develop a strategic plan that factors in these interdependencies and aligns domestic and foreign policies. This can be achieved through interventions across three axes: diplomacy, innovation, and institutions.

India is faced with the challenge of developing its semiconductor capabilities within the constraints of high global interdependencies and intense competition. Therefore, it needs to develop strong diplomatic ties with key ecosystem partners to compete strategically across the value chain. Simultaneously, in order to leverage open standard architectures and internal markets within its financial constraints, the country would need to identify and mobilise innovation engines and enablers. These could include industry-academia collaborations and stimulating the start-up ecosystem for venture capital investment. Semiconductors are highly specialised, complex products that require diverse inputs and have downstream applications. Therefore, the country would benefit from institution building that can provide the industry with strategic advice in terms of global competition, industrial policy, and market entry.

Economic Diplomacy: There is a need to strengthen ties with countries where ecosystem partners are located to boost inward investment, develop domestic production, and become a hub for semiconductor manufacturing equipment, including in export. The presence of these ecosystem players in tools and equipment would offer a counterbalance to China’s dominance in critical minerals and mature node semiconductors. It would also position India as a viable option for global supply chain diversification through friendshoring. In addition to the policy focus and investments in internal capabilities, international agreements and partnerships can highlight India as a viable strategic and economic option, which can encourage key equipment-manufacturing companies to do business in and with India.

Integrated Innovation Policy: Innovation and industrial strategies are inextricably linked, with innovation policies supporting industrial policy by identifying and addressing technology gaps.[83] Identifying innovation engines and enablers is one of the main conditions for ensuring joint optimisation. Innovation engines include public and private institutions within the innovation pipeline, while enablers include policy and regulatory frameworks, skilled talent, and financial and non-financial support.[84]

The semiconductor sector needs an integrated innovation policy that can bring together government, industry, and academia, along with support mechanisms for start-ups. Such a policy can include stimulating venture-capital investment in the domain as an alternative for financing innovation capabilities. While combining industrial policy, skilling, and R&D are important policy priorities under the ISM, a long-term policy would also need to consider viability and time-to-market of promising chips designed under the DLI and C2S. In order to remain competitive, India would need to analyse the types of chips that are produced, existing competition in the international market, and downstream consumption—whether in internal markets or exports—and strategise accordingly.

Non-financial support could include the creation of science and industrial parks.[85] With Dholera poised to become the ‘Semicon City’, there is a need to consider establishing hubs or centres of excellence for specialisations across the value and supply chain and in both primary and applied research.

Institution-Building: The ITRI in Taiwan played a critical role in establishing the country as a global powerhouse in semiconductor manufacturing,[86] demonstrating the link between applied research and manufacturing.[87] It not only focused on research and capacity-building but also made scientifically and strategically informed decisions on business models (e.g., fabless-foundry model) and the types of chips to be manufactured while establishing foundries like the TSMC and the UMC.[88] India needs a similar institution like the proposed India Semiconductor Research Centre (ISRC)[89] that can help provide strategic advisory to industry and policymakers to ensure both economic returns and geopolitical competitiveness.

Positioning India within the global semiconductor value chain requires a strategic reflection on the country’s comparative advantages in light of existing geopolitical tensions and international competition. In addition to policy-linked investments in building capabilities across the value chain, India also needs to focus on ecosystem development, partnerships, and coordination mechanisms to manage its industrial and innovation policy for the efficient utilisation of resources towards realising its semiconductor goals.

[a] The use of semiconductors to retain global leadership in advanced technologies like AI is reinforced by the US’s ‘Framework for Artificial Intelligence Diffusion’, which categorises countries according to a three-tiered framework for the export of advanced chips. See: https://www.csis.org/analysis/ai-diffusion-framework-securing-us-ai-leadership-while-preempting-strategic-drift. The AI Diffusion rules released by the former Biden administration is now subject to intensive lobbying by the industry exhorting the Trump administration to do away with it. See: https://www.bloomberg.com/news/articles/2025-03-25/tech-chiefs-foreign-leaders-urge-trump-to-rethink-ai-chip-curbs

[b] Examples are Intel, Texas Instruments, and Samsung.

[c] Examples are AMD, Nvidia, and Qualcomm.

[d] These include the United States, Canada, United Kingdom, Australia, and New Zealand.

[e] According to the announcement, “PSMC provides access to a broad technology portfolio in leading edge and mature nodes including 28nm, 40nm, 55nm, 90nm and 110nm and also collaboration for high volume manufacturing.” See: https://www.tata.com/newsroom/business/first-indian-fab-semiconductor-dholera

[f] RISC V (pronounced RISC five) is an open instruction set architecture designed using RISC (Reduced Instruction Set Computer) principles. The number five refers to the number of generations of the architecture since its inception in 1981. The design aims to optimise power and resources and is free from proprietary restrictions. See: https://semiengineering.com/what-does-risc-v-stand-for/. RISC V also has policy support from the Indian government in the form of the 2022 Digital India RISC V Programme to boost domestic chip design and development. See: https://pib.gov.in/PressReleasePage.aspx?PRID=1820621

[1] Andreas Kuehn and Jeffrey Bean, “De-risking Semiconductor Supply Chains Comes with Different Risks,” ORF America, October 4, 2024, https://orfamerica.org/orf-america-comments/semiconductor-supply-chains-derisking

[2] Kuehn and Bean, “De-risking Semiconductor Supply Chains Comes with Different Risks”; June Park, Semiconductors in Key European and Indo-Pacific Economies: Geopolitical Risk in the Supply Chains into 2030 and Beyond, The Hague Centre for Strategic Studies, 2023, https://hcss.nl/report/semiconductors-european-indo-pacific-economies-geopolitical-risk-supply-chains/

[3] Gaurav Tembey, Adriana Dahik, Christopher Richard, and Vaishali Rastogi, “Navigating the Costly Economics of Chip Making,” Boston Consulting Group, September 28, 2023, https://www.bcg.com/publications/2023/navigating-the-semiconductor-manufacturing-costs?t

[4] Syed Alam, Timothy Chu, Shrikant Lohokare, and Shungo Saito, Globality and Complexity of the Semiconductor Ecosystem, Accenture and Global Semiconductor Alliance, 2020, https://www.gsaglobal.org/globality-and-complexity-of-the-semiconductor-ecosystem/

[5] Kevin Zhang, “How Water Scarcity Threatens Taiwan’s Semiconductor Industry,” The Diplomat, September 19, 2024, https://thediplomat.com/2024/09/how-water-scarcity-threatens-taiwans-semiconductor-industry/

[6] Zhang, “How Water Scarcity Threatens Taiwan’s Semiconductor Industry”; Dave Makichuk, “TSMC to Hire 9,000, as Water Woes Continue,” Asia Times, March 9, 2021, https://asiatimes.com/2021/03/tsmc-to-hire-9000-as-water-woes-continue/

[7] Sebastian Moss, “Japan's 7.3 Magnitude Earthquake Caused Chip Fab Shut Downs,” Data Center Dynamics, March 18, 2022, https://www.datacenterdynamics.com/en/news/japans-73-magnitude-earthquake-caused-chip-fab-shut-downs/

[8] Shinichi Akayama, Daniel Chow, and Subrat Gupta, Localising the Global Semiconductor Value Chain, Arthur D. Little, 2024, https://www.adlittle.com/id-en/insights/report/localizing-global-semiconductor-value-chain

[9] Lindsay Maizland, “Why China-Taiwan Relations Are So Tense,” Council on Foreign Relations, February 8, 2024, https://www.cfr.org/backgrounder/china-taiwan-relations-tension-us-policy-biden

[10] Office of Congressional and Public Affairs, Bureau of Industry and Security, U.S. Department of Commerce, https://www.bis.gov/press-release/commerce-strengthens-export-controls-restrict-chinas-capability-produce-advanced, 2024; Gracelin Baskaran and Meredith Schwartz, “China Imposes Its Most Stringent Critical Minerals Export Restrictions Yet Amidst Escalating U.S.-China Tech War,” Center for Strategic and International Studies, December 4, 2024, https://www.csis.org/analysis/china-imposes-its-most-stringent-critical-minerals-export-restrictions-yet-amidst

[11] Ministry of Electronics and IT, Government of India. https://pib.gov.in/PressReleasePage.aspx?PRID=1885367, 2022.

[12] “Strengthening National Innovation Systems,” UN Trade and Development, https://unctad.org/topic/science-technology-and-innovation/STI4D-Reviews

[13] “India’s Emergence as a Semiconductor Manufacturing Hub,” India Brand and Equity Foundation, July 18, 2024, https://www.ibef.org/blogs/india-s-emergence-as-a-semiconductor-manufacturing-hub#:~:text=Semiconductor%20industry%20in%20India%20%2D%20An%20overview,26.3%%20to%20US$%20271.9%20billion%20by%202032

[14] Akhil Thadani and Gregory C. Allen, Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region, Center for Strategic and International Studies, 2023, https://www.csis.org/analysis/mapping-semiconductor-supply-chain-critical-role-indo-pacific-region

[15] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[16] “Localising the Global Semiconductor Value Chain”

[17] Arthur D. Little, European Commission, https://www.adlittle.com/id-en/insights/report/localizing-global-semiconductor-value-chain

[18] Vinod Kumar, “A Deep Dive into Logic Chips vs Memory Chips – 10 Key Differences,” Infinitalab, March 15, 2024, https://infinitalab.com/blogs/machining/a-deep-dive-into-logic-chips-vs-memory-chips-10-key-differences/?srsltid=AfmBOopZQAVmQPH8GciOVmtrSwE0yNeLv-Z8PJTS2hv3egowxZi4nDEX

[19] Andreas Schumacher, “China’s Mature Semiconductor Overcapacity: Does It Exist and Does It Matter?,” Center for Strategic and International Studies, November 19, 2024, https://www.csis.org/analysis/chinas-mature-semiconductor-overcapacity-does-it-exist-and-does-it-matter

[20] “Modern Life Runs on Mature Node Semiconductors,” Kearney, September 7, 2023, https://www.kearney.com/industry/technology/article/modern-life-runs-on-mature-node-semiconductors

[21] “Modern Life Runs on Mature Node Semiconductors”

[22] “Modern Life Runs on Mature Node Semiconductors”

[23] William Alan Reinsch, Jack Whitney, and Matthew Schleich, The Double-Edged Sword of Semiconductor Export Controls: Semiconductor Manufacturing Equipment, Center for Strategic and International Studies, 2024, https://www.csis.org/analysis/double-edged-sword-semiconductor-export-controls-semiconductor-manufacturing-equipment; Office of Congressional and Public Affairs, Bureau of Industry and Security, U.S. Department of Commerce, https://www.bis.doc.gov/index.php/documents/about-bis/newsroom/press-releases/3158-2022-10-07-bis-press-release-advanced-computing-and-semiconductor-manufacturing-controls-final/file, 2022

[24] Schumacher, “China’s Mature Semiconductor Overcapacity: Does It Exist and Does It Matter?”

[25] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[26] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[27] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[28] Katie Tarasov, “ASML is the Only Company Making the $200 Million Machines Needed to Print Every Advanced Microchip. Here’s an inside look,” CNBC, March 23, 2022, https://www.cnbc.com/2022/03/23/inside-asml-the-company-advanced-chipmakers-use-for-euv-lithography.html

[29] “Taiwan’s Dominance of the Chip Industry Makes it More Important,” The Economist, March 6, 2023, https://www.economist.com/special-report/2023/03/06/taiwans-dominance-of-the-chip-industry-makes-it-more-important

[30] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[31] “Global Semiconductor Foundry Market Share: Quarterly,” Counterpoint Research, November 26, 2024, https://www.counterpointresearch.com/insights/global-semiconductor-foundry-market-share/

[32] Ryan C. Berg, Henry Ziemer, and Emiliano Polo Anaya, Mineral Demands for Resilient Semiconductor Supply Chains, Center for Strategic and International Studies, 2024, https://www.csis.org/analysis/mineral-demands-resilient-semiconductor-supply-chains

[33] “Mineral Demands for Resilient Semiconductor Supply Chains”

[34] “Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region”

[35] “Mineral Demands for Resilient Semiconductor Supply Chains”

[36] “Timeline of US Actions Against China's Chip Industry,” The Economic Times, June 30, 2023, https://economictimes.indiatimes.com/tech/technology/timeline-of-us-actions-against-chinas-chip-industry/articleshow/101382551.cms?t; “US Imposes New Export Controls on China, Targeting Semiconductor Technology,” The Economic Times, December 3, 2024, https://economictimes.indiatimes.com/tech/technology/us-imposes-new-export-controls-on-china-targeting-semiconductor-technology/articleshow/115939309.cms?from=mdr; Kirti Gupta, Chris Borges, and Andrea Leonard Plazzi, “Collateral Damage: The Domestic Impact of U.S. Semiconductor Export Controls,” Center for Strategic and International Studies, July 9, 2024, https://www.csis.org/analysis/collateral-damage-domestic-impact-us-semiconductor-export-controls

[37] “US Imposes New Export Controls on China, Targeting Semiconductor Technology”

[38] Toby Sterling, “Dutch government retakes export control over two ASML tools from US,” Reuters, September 6, 2024; Karen Freifeld and Fanny Potkin, “Exclusive: US Ordered TSMC to Halt Shipments to China of Chips used in AI Applications,” Reuters, November 10, 2024, https://www.reuters.com/technology/us-ordered-tsmc-halt-shipments-china-chips-used-ai-applications-source-says-2024-11-10/

[39] Sujai Shivakumar, Charles Wessner, and Thomas Howell, A Seismic Shift: The New U.S. Semiconductor Export Controls and the Implications for U.S. Firms, Allies, and the Innovation Ecosystem, Center for Strategic and International Studies, 2022, https://www.csis.org/analysis/seismic-shift-new-us-semiconductor-export-controls-and-implications-us-firms-allies-and?t

[40] Gupta, Borges, and Plazzi, “Collateral Damage: The Domestic Impact of U.S. Semiconductor Export Controls”

[41] Baskaran and Schwartz, “China Imposes Its Most Stringent Critical Minerals Export Restrictions Yet Amidst Escalating U.S.-China Tech War”; Elaine Kurtenbach, “China Bans Exports to US of Gallium, Germanium, Antimony in Response to Chip Sanctions,” The Associated Press, December 3, 2024, https://apnews.com/article/china-us-tech-semiconductor-chip-gallium-6b4216551e200fb719caa6a6cc67e2a4

[42] Baskaran and Schwartz, “China Imposes Its Most Stringent Critical Minerals Export Restrictions Yet Amidst Escalating U.S.-China Tech War”

[43] Lizzi C. Li, “China’s Big Fund 3.0: Xi’s Boldest Gamble Yet for Chip Supremacy,” The Diplomat, June 6, 2024, https://thediplomat.com/2024/06/chinas-big-fund-3-0-xis-boldest-gamble-yet-for-chip-supremacy/

[44] “Modern Life Runs on Mature Node Semiconductors”

[45] Schumacher, “China’s Mature Semiconductor Overcapacity: Does It Exist and Does It Matter?”

[46] Schumacher, “China’s Mature Semiconductor Overcapacity: Does It Exist and Does It Matter?”

[47] “Chips Act,” Shaping Europe’s Digital Future, European Commission, https://digital-strategy.ec.europa.eu/en/factpages/chips-act

[48] McKinsey & Company, The CHIPS and Science Act: Here’s What’s In It, 2022, https://www.mckinsey.com/industries/public-sector/our-insights/the-chips-and-science-act-heres-whats-in-it

[49] Robyn Klingler-Vidra, “The Microchip Industry Would Implode if China Invaded Taiwan, and It Would Affect Everyone,” The Conversation, June 9, 2023, https://theconversation.com/the-microchip-industry-would-implode-if-china-invaded-taiwan-and-it-would-affect-everyone-206335

[50] “Armed with 5b Subsidy, TSMC Breaks Ground on 11b German Chip Factory,” The Economic Times, August 20, 2024, https://economictimes.indiatimes.com/news/international/world-news/armed-with-5-b-subsidy-tsmc-breaks-ground-on-11-b-german-chip-factory/articleshow/112662664.cms?from=mdr

[51] Barath Harithas, The AI Diffusion Framework: Securing U.S. AI Leadership While Preempting Strategic Drift, Center for Strategic and International Studies, 2025, https://www.csis.org/analysis/ai-diffusion-framework-securing-us-ai-leadership-while-preempting-strategic-drift

[52] “The AI Diffusion Framework: Securing U.S. AI Leadership While Preempting Strategic Drift”

[53] Mackenzie Hawkins and Jenny Leonard, “Tech Chiefs, Foreign Leaders Urge Trump to Rethink AI Chip Curbs,” Bloomberg, March 25, 2025, https://www.bloomberg.com/news/articles/2025-03-25/tech-chiefs-foreign-leaders-urge-trump-to-rethink-ai-chip-curbs

[54] “Chips and Challenges: Southeast Asia and India’s Semiconductor Manufacturing Crossroads,” IDC, September 30, 2024, https://blogs.idc.com/2024/09/30/chips-and-challenges-southeast-asia-and-indias-semiconductor-manufacturing-crossroads/

[55] “About ISM,” Indian Semiconductor Mission, https://ism.gov.in/about-ism.html

[56] “Objectives,” India Semiconductor Mission, https://ism.gov.in/objectives.html

[57] Electronics India, India Semiconductor Mission, Ministry of Electronics and Information Technology, “Modified India Semiconductor Programmes,” https://www.semi.org/sites/semi.org/files/2022-11/10%20Amitesh%20Kumar%20Sinha%20India_NEW.pdf; Sharveya Parasnis, “States Jostle For Semiconductor Investment At SEMICON India 2024,” Medianama, September 16, 2024, https://www.medianama.com/2024/09/223-indian-states-aim-semiconductor-investment-semicon-india-2024/

[58] Dia Rekhi and Surabhi Agarwal, “First Chip from Dholera Plant by 2026 End: PSMC Chairman Frank Huang,” Economic Times, March 13, 2024, https://economictimes.indiatimes.com/tech/technology/first-chip-from-dholera-plant-by-2026-end-psmc-chairman-frank-huang/articleshow/108443331.cms?from=mdr

[59] “Tata Group to Build the Nation’s First Indigenous Semiconductor Assembly and Test facility in Assam to Serve Global Customers,” Tata Electronics, February 29, 2024, https://www.tata.com/newsroom/business/first-indian-semiconductor-assembly-test-facility

[60] Tapanjana Rudra, “Can Kaynes Semicon Supercharge India’s Chip Manufacturing Ambitions?,” Inc42, October 16, 2024, https://inc42.com/startups/can-kaynes-semicon-supercharge-indias-chip-manufacturing-ambitions/; Suraksha P, “Union Cabinet Approves OSAT Proposal of Kaynes Semicon to Set up in Sanand,” Economic Times, September 3, 2024,

[61] Gazette Notification, Ministry of Electronics and Information Technology, 2022, https://www.meity.gov.in/writereaddata/files/Notification%20Modified%20Scheme%20for%20Semiconductor%20Fabs.pdf

[62] Guidelines for Modified Scheme for Setting Up of Semiconductor Fabs in India, Ministry or Electronics and Information Technology, 2023, https://d2p5j06zete1i7.cloudfront.net/Cms/2023/May/31/1685527229_Guidelines_for_Modified_Scheme_for_setting_up_of_Semiconductor_Fabs_in_India.pdf

[63] “Modified India Semiconductor Programmes”

[64] “Simmtech to Invest Rs 1,250 Cr for Chip Components Plant in Gujarat,” Deccan Herald, January 12, 2024, https://www.deccanherald.com/business/simmtech-to-invest-rs-1-250-cr-for-chip-components-plant-in-gujarat-2845238; Gulveen Aulakh, “Micron’s Top Supplier Simmtech Gets Approval for Set Up Unit in Sanand,” Mint, September 23, 2023, https://www.livemint.com/companies/news/microns-top-supplier-simmtech-gets-approval-for-set-up-unit-in-sanand-11695467454328.html

[65] “Applied Materials signs pact with T.N. Government to set up Centre of Excellence in Chennai,” The Hindu, August 30, 2024, https://www.thehindu.com/news/national/tamil-nadu/applied-materials-signs-pact-with-tn-government-to-set-up-centre-of-excellence-in-chennai/article68582380.ece; “AMD Inaugurates its Largest Global Design Center in India,” AMD, November 28, 2023, https://www.amd.com/en/newsroom/press-releases/2023-11-27-amd-inaugurates-its-largest-global-design-center-in-india.html

[66] “Tokyo Electron and TATA Electronics Private Limited Announce Strategic Partnership to Grow Semiconductor Ecosystem in India,” Tokyo Electron, September 10, 2024, https://www.tel.com/news/topics/2024/20240910_001.html; Gulveen Aulakh, “Tokyo Electron Ltd to Supply Equipment to Tata Electronics, Train Workforce at India’s First Fab,” Mint, September 09, 2024, https://www.livemint.com/companies/news/tokyo-electron-tata-electronics-chip-fabrication-unit-semiconductor-fab-facility-ai-11725896297854.html

[67] Design Linked Incentive Scheme, Ministry of Electronics and Information Technology, https://chips-dli.gov.in/

[68] Aashish Aryan & Surabhi Agarwal, “Semiconductor Laboratory Revamp: Tata, Tower Among Nine Bidders,” Economic Times, February 5, 2024, https://economictimes.indiatimes.com/tech/information-tech/semiconductor-laboratory-revamp-tata-texas-tower-among-nine-bidders/articleshow/107270493.cms?from=mdr; Ministry of Electronics and Information Technology, Government of India, 2024 https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2012317; Design Linked Incentive – Ministry of Electronics and Information Technology, “National EDA Tool Grid,” https://chips-dli.gov.in/DLI/EDANew

[69] Prime Minister’s Office, Government of India, https://pib.gov.in/PressReleasePage.aspx?PRID=2057460; Ministry of External Affaris, Government of India, https://www.mea.gov.in/press-releases.htm?dtl/38317/Prime+Minister+attends+the+sixth+Quad+Leaders+Summit+in+Wilmington+Delaware; “Semiconductors on agenda of 1st Quad Commerce and Industry meeting: WH,” Business Standard, September 23, 2024, https://www.business-standard.com/external-affairs-defence-security/news/semiconductors-on-agenda-of-1st-quad-commerce-and-industry-meeting-wh-124092300351_1.html

[70] Office of the Spokesperson, U.S. Department of State, 2024, https://2021-2025.state.gov/new-partnership-with-india-to-explore-semiconductor-supply-chain-opportunities/; “India & US Partner to Establish Semiconductor Fabrication Unit for National Security Needs,” Economic Times, September 26, 2024, https://economictimes.indiatimes.com/news/defence/india-us-partner-to-establish-semiconductor-fabrication-unit-for-national-security-needs/articleshow/113695049.cms?from=mdr

[71] David Shepardson, “Trump Wants to Kill $52.7 Billion Semiconductor Chips Subsidy Law, Reuters, March 05, 2025, https://www.reuters.com/technology/trump-wants-kill-527-billion-semiconductor-chips-subsidy-law-2025-03-05/

[72] “India & US Partner to Establish Semiconductor Fabrication Unit for National Security Needs,” Economic Times, September 26, 2024, https://economictimes.indiatimes.com/news/defence/india-us-partner-to-establish-semiconductor-fabrication-unit-for-national-security-needs/articleshow/113695049.cms?from=mdr

[73] “Japanese Firms Keen to Set up Semiconductor Units in India: Deloitte,” Economic Times, December 3, 2024, https://cfo.economictimes.indiatimes.com/news/economy/japanese-firms-keen-to-set-up-semiconductor-units-in-india-deloitte/115929832

[74] European Commission, 2023, https://ec.europa.eu/commission/presscorner/detail/en/ip_23_4380

[75] “Semiconductor chip import increased 18.5% to Rs 1.71 lakh crore in FY24,” Economic Times, December 6, 2024, https://economictimes.indiatimes.com/tech/technology/semiconductor-chip-import-increased-18-5-to-rs-1-71-lakh-crore-in-fy24/articleshow/116047484.cms?from=mdr

[76] “India's Semiconductor Industry Faces Supply Chain and Limited Talent Challenges: Jefferies Report,” Economic Times, March 25, 2025, https://economictimes.indiatimes.com/tech/technology/indias-semiconductor-industry-faces-supply-chain-and-limited-talent-challenges-jefferies-report/articleshow/119453491.cms?from=mdr

[77] Inc42, The Rise of India’s Semiconductor Start-ups: Report 2024, Inc42 Datalabs, 2024, https://inc42.com/reports/the-rise-of-indias-semiconductor-startups-report-2024/

[78] Ministry of Electronics and IT, Government of India, 2022, https://pib.gov.in/PressReleasePage.aspx?PRID=1820621

[79] “The Rise of India’s Semiconductor Start-ups: Report 2024”

[80] “Time to Tap GVCs to Achieve $500 Bn Electronics Manufacturing Target by FY30: ICEA,” Economic Times, September 17, 2024, https://manufacturing.economictimes.indiatimes.com/news/hi-tech/time-to-tap-gvcs-to-achieve-500-bn-electronics-manufacturing-target-by-fy30-icea/113431551

[81] Shubhobrota Dev Roy, “India Produced 2.5 Bn Phones In 10 Years, Becomes 2nd Largest Smartphone Maker Globally,” Inc42, March 8, 2024, https://inc42.com/buzz/india-produced-2-5-bn-phones-in-10-years-becomes-2nd-largest-smartphone-maker-globally/

[82] Ministry of Electronics and Information Technology, Government of India, 2024, https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2037597

[83] Adnan Merhaba, Ben Thuriaux-Aleman, Eddy Ghanem, Tobias Aebi, and Yves Takchi, The National Innovation Ecosystem, Arthur D. Little, 2020, https://www.adlittle.com/en/insights/viewpoints/national-innovation-ecosystem

[84] “The National Innovation Ecosystem”

[85] Konark Bhandari, “Taiwan-India Chips Cooperation and the Logic of Choosing India,” Carnegie India, August 8, 2024, https://carnegieendowment.org/research/2024/08/taiwan-india-chips-cooperation-and-the-logic-of-choosing-india?lang=en¢er=china

[86] Cheng Wu, “ITRI, a Pillar of Support for Taiwan’s Industries,” Commonwealth Magazine, September 26, 2023, https://english.cw.com.tw/article/article.action?id=3516

[87] “Appendix A3: Taiwan’s Industrial Technology Research Institute: A Cradle of Future Industries” in

21st Century Manufacturing: The Role of the Manufacturing Extension Partnership Program, National Academies of Sciences, Engineering, and Medicine (Washington, DC: The National Academies Press, 2013). https://doi.org/10.17226/18448. https://nap.nationalacademies.org/read/18448/chapter/14

[88] “Appendix A3: Taiwan’s Industrial Technology Research Institute: A Cradle of Future Industries”

[89] Ministry of Electronics and Information Technology, Government of India, 2023, https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1969400

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Dr. Anulekha Nandi is a Fellow - Centre for Security, Strategy and Technology at ORF. Her primary area of research includes digital innovation management and ...

Read More +