Envision a world where homes are powered by the sun's abundant energy, where dependence on the grid diminishes, and where every rooftop becomes a catalyst for change. Imagine slashing your electricity bills, embracing sustainability, and fueling your electric vehicle—all thanks to the PM Surya Ghar Muft Bijli Yojana. But amidst this bold vision, questions linger: Can rooftop solar (RTS) truly revolutionise our energy landscape? Are the benefits worth the challenges? This article delves into the promise and the pitfalls of this groundbreaking initiative, illuminating the path to a brighter, greener future.

On 29 February 2024, the Cabinet approved the PM-Surya Ghar Muft Bijli Yojana, a groundbreaking initiative aimed to provide up to 300 units of free electricity per month by installation of RTS panels in one crore households at a total cost of INR 75,021 crore. Launched by the Prime Minister on 13 February 2024, the scheme will provide substantive subsidies directly to people's bank accounts and offer heavily concessional bank loans to ensure no cost burden on the people, resulting in an annual saving of INR 15,000-18,000 per year.

Imagine slashing your electricity bills, embracing sustainability, and fueling your electric vehicle—all thanks to the PM Surya Ghar Muft Bijli Yojana.

This visionary initiative synchronises with India's ambitious target of achieving 500 gigawatts (GW) of non-fossil fuel-based energy by 2030, positioning it as the world’s largest expansion plan in renewable energy. This aligns seamlessly with the remarkable growth witnessed in India’s solar energy sector in recent years.

India’s solar energy sector has witnessed significant growth, with installations increasing from 2.63 GW to 49 GW in the last seven years. It ranks 4th globally in terms of solar power capacity, which has increased by 30 times over the last nine years, reaching 74.30 GW as of January 2024. The country’s estimated solar energy potential stands at an impressive 748 GW. Overall, India’s solar energy sector plays a crucial role in the nation’s sustainable energy goals.

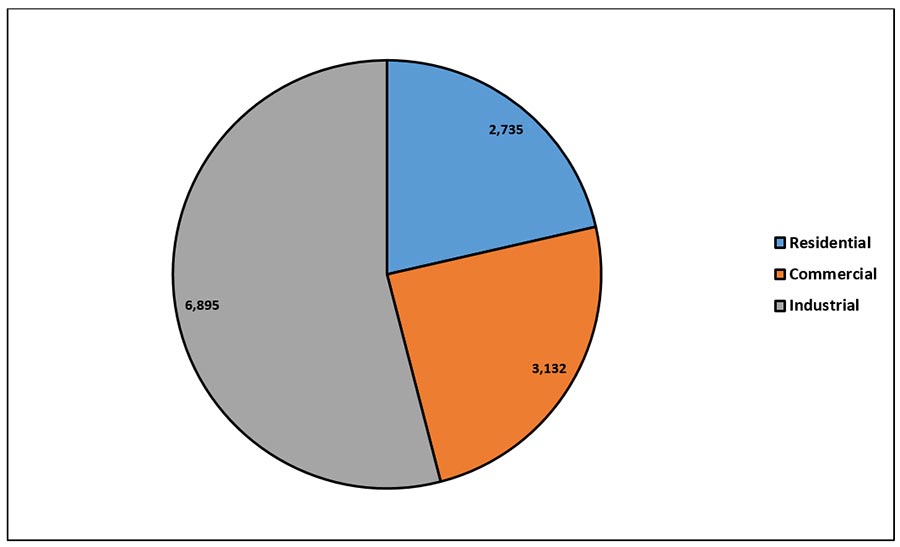

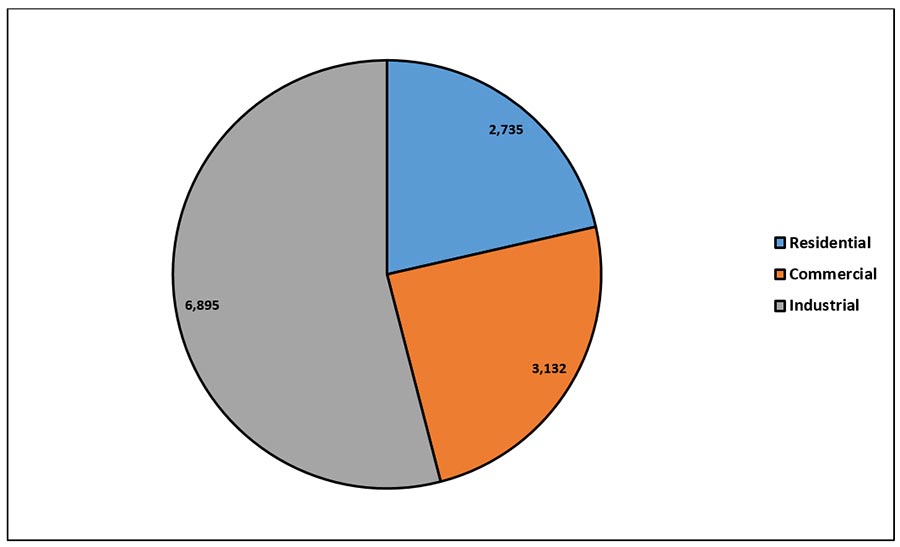

With an installed capacity of about 2.73 GW (Figure 1) in the residential sector as of June 2023, India is tapping into its enormous potential for RTS power, which was estimated at 637 GW in 25 crore households. By the close of fiscal year 2023, India's residential RTS capacity reached around 2.7 GW out of a total of 11 GW, showing substantial growth from 2 GW in fiscal year 2022.

India’s solar energy sector has witnessed significant growth, with installations increasing from 2.63 GW to 49 GW in the last seven years.

Over the past 5 years, there has been a gradual improvement in residential RTS installations in India. The household RTS sector experienced a significant revival after nearly stagnant annual growth of 100-200 MW until fiscal year 2020, according to a report by consultant Bridge To India. From the fiscal year 2022 to 2023, residential RTS capacity saw a nearly 60 percent year-on-year increase, propelled by factors like growing cost-saving demands, rising consumer awareness, and robust government backing.

Figure 1: India's sectoral installed capacity of solar rooftops as of June 2023, (MW)

Source: Statista 2024

Earlier, India's Jawaharlal Nehru National Solar Mission, launched in 2010, aimed to generate 100 GW of solar power by 2022. Of this, 60 GW was designated for utility-scale installations, while 40 GW was allocated for rooftop solar.

Notably, the inaugural phase of the RTS programme commenced on 30 December 2015, offering incentives and subsidies for residential, institutional, and social sectors. Additionally, achievement-linked incentives were extended to the government sector. Following this, the Rooftop Phase-II was launched in February 2019, with an ambitious target of achieving a cumulative capacity of 40 GW by 2022. However, by December 2023, the cumulative installed capacity of RTS had surged to only 10.5 GW. Despite this, it still marked a significant increase from the 1.8 GW recorded as of 31 March 2019.

The Phase-II programme, with a target capacity of 4 GW for the residential sector by 2026, has allocated approximately 3.57 GW capacity to various state implementing agencies. An amount of INR 2917.59 Cr has been disbursed to them under the programme, benefiting 4.3 lakh beneficiaries reported to date.

The inaugural phase of the RTS programme commenced on 30 December 2015, offering incentives and subsidies for residential, institutional, and social sectors.

Although Rooftop Solar Phase-II provided incentives and subsidies for various sectors, it didn't fully address the issue of electricity access and affordability for all households. Thus, PM Surya Ghar Muft Bijli Yojana seeks to extend solar energy benefits to more households, particularly in terms of electricity access and affordability.

The proposed scheme aims to add 30 GW of rooftop solar capacity in the residential sector, generating 1000 BUs of electricity and cutting 720 million tonnes of CO2 equivalent emissions over 25 years. The scheme is a visionary initiative aiming to provide free electricity to one crore households through rooftop solar panels by 2025 and has acknowledged the challenges hindering the widespread adoption of solar energy in India. The scheme has taken steps to address the following challenges.

- Low consumer awareness: The government is undertaking extensive awareness campaigns to educate consumers about the benefits of solar energy and the specifics of the scheme. The provides comprehensive information about the scheme, including a step-by-step procedure for application.

- Hurdles in net metering approval and administration: This scheme has also addressed several concerns about the net-metering regulations of the states. The scheme streamlines net metering approval, simplifying the process for consumers. Once a solar plant is installed, applying for net metering is effortless, leading to the generation of a commissioning certificate post-DISCOM inspection. Unlike certain state regulations, this scheme imposes no minimum kW restriction, enhancing accessibility to more households. Additionally, it facilitates selling surplus energy to distribution companies, ensuring a reasonable return and reducing electricity bills by optimising consumption and contribution.

- Delays in central and state subsidy disbursement: The scheme has also streamlined the subsidy disbursement Upon receipt of the commissioning report, consumers can conveniently submit their bank account details and a cancelled cheque through the portal. Subsidies are anticipated to be deposited in the bank account within 30 days.

- Limited attractive financing options: The central government will offer a 60-percent subsidy (Table 1) for rooftop solar installations under the Scheme. The remaining 40 percent will be provided through loans repayable over 10 years, with repayment possible through excess electricity sales. After repayment, households can earn additional income from electricity sales. Implementation in states will be overseen by public sector undertakings of the Ministry, potentially through subsidiary/special purpose vehicles. This financial support makes the scheme more attractive to potential consumers.

Table 1: Suitable Rooftop Solar Plant Capacity for Households

| Average Monthly Electricity Consumption (units) |

Suitable Rooftop Solar Plant Capacity (Kw) |

Subsidy Support (INR) |

| 0-150 |

1-2 |

30,000/- to 60,000/- |

| 150-300 |

2-3 |

60,000/- to 78,000/- |

| > 300 |

Above 3 |

78,000/- |

Source: PM – Surya Ghar: Muft Bijli Yojana, GoI

These subsidies will help reduce the installation cost (Capex) by percentages ranging from 27.86 percent to 42.86 percent as shown in Table 2 across different consumption levels.

Table 2: Impact of Subsidies on Solar Installation Costs Based on Monthly Consumption

| Monthly Consumption |

Solar Plant Capacity (kW) |

Subsidy (INR) |

Assumed installation Cost (Capex) (INR) |

Cost Reduction (%) |

| 0-150 units |

1 |

30,000 |

70,000 |

42.86 |

| 150-300 units |

3 |

78,000 |

2,10,000 |

37.14 |

| >300 units |

4 |

78,000 |

2,80,000 |

27.86 |

- Quality concerns regarding residential solar installations: The scheme upholds quality standards by permitting installations exclusively by registered vendors. They can apply at the division/circle level, and their inclusion in the list of empanelled will be confirmed within one month from the application submission date.

However, while the scheme addresses many concerns, there may still be lingering issues. Nevertheless, the programme includes a structured mechanism for resolving these concerns.

- Dependency on government support: While heavily reliant on government subsidies for viability, the scheme's future sustainability faces uncertainty if these subsidies diminish. However, it catalyzes solar adoption, with anticipated technological advancements and economies of scale lessening subsidy dependency. Moreover, incentivising surplus power sales to the grid offers independent income, irrespective of subsidies. Ensuring a smooth subsidy transition necessitates gradual reduction, clear communication, and ongoing research investment to lower installation costs and improve accessibility.

- Challenges in grid integration: While the scheme enhances grid resilience, distributed generation, peak demand management, reduced transmission losses and grid support services through advanced invertors used in rooftop solar systems, it also presents integration challenges. These include solar power intermittency, inadequate grid infrastructure for bidirectional flow, technical hurdles in voltage regulation, and regulatory complexity in surplus power sales tariffs. Addressing these requires investments in grid upgrades, advanced management strategies, and fair regulations, alongside continuous monitoring and technological advancements for successful solar integration.

- Maintenance and upkeep: Regular maintenance is crucial for rooftop solar panels' longevity and performance, yet homeowner awareness may be lacking. The scheme emphasizes vendor training and encourages the use of registered vendors for quality installations and upkeep. Consumer awareness initiatives should highlight maintenance importance. Inbuilt feedback mechanisms could aid in identifying and correcting substandard installations for sustained household benefits, while ongoing monitoring ensures installation quality assurance.

- Environmental concerns: Rooftop solar energy, while environmentally friendly, raises concerns about panel production, disposal, and recycling. The scheme stresses vendor registration and training to ensure adherence to environmental standards. Though direct recycling and disposal aren't addressed, the scheme acknowledges their importance. In this case, national policies can guide proper disposal, even as consumer awareness efforts promote environmental sustainability. Continuous monitoring and technological advancements could be aimed to mitigate solar panels environmental impact.

Thus, RTS remains a crucial element in India’s strategy to achieve its net-zero target by 2070. India ranks fourth globally in solar power capacity at 74.30 GW as of January 2024. The scheme plans to add 30 GW of rooftop solar, aiming to generate 1000 BUs of electricity and cut 720 million tons of CO2 emissions over 25 years. Challenges such as subsidy dependency and grid integration persist but are addressed through awareness campaigns and streamlined processes. Despite hurdles, RTS is pivotal in India's transition to a cleaner, sustainable energy future.

Manish Vaid is a Junior Fellow at Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV