This article is part of the series Comprehensive Energy Monitor: India and the World

Dominance of two-wheelers

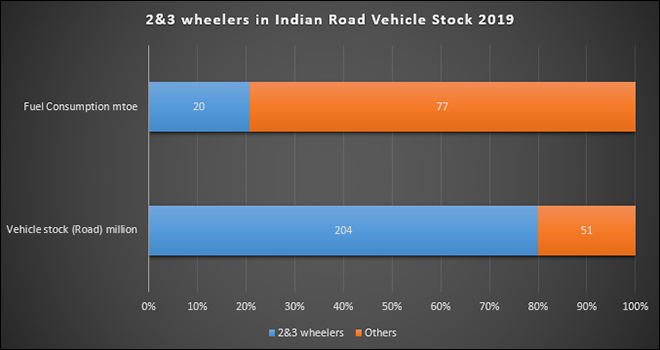

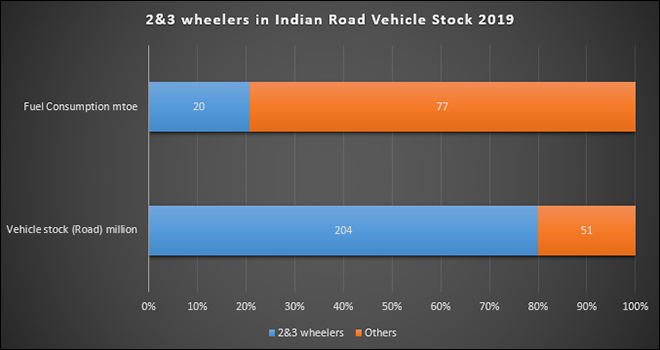

Indians travel nearly 5,000 kilometres (km) each year, a threefold increase since 2000. Vehicle ownership per person has grown five‐fold since 2000, with particularly significant growth in the fleet of two- and three‐wheelers. In the total vehicle stock of just over 200 million, the share of two- and three-wheelers is 80 percent (five times more than that of passenger cars) but their share of fuel consumption is only 20 percent. Three‐wheelers provide shared mobility and public transport, complementing a relatively low stock of 2 million buses that serve mass and public transport needs. Two- and three‐wheelers have grown faster than any other mode of personal transport in the last decade. The average daily distance travelled by two-wheelers in Indian cities is about 27−33 km with a maximum of 86 km and the average annual distance travelled is about 8,800 km with a maximum of 22,500 km.

According to the International Energy Agency (IEA), the transport sector is now the fastest‐growing energy end‐use sector in India. Energy use in India’s transport sector has increased fivefold over the past three decades, reaching more than 100 million tonnes of oil equivalent (Mtoe) in 2019. < style="color: #000000">

The issue for consideration in the push for electrification is whether the focus on two-and three-wheelers for electrification will achieve the goal of decarbonising road transport. The high share of two- and three‐wheelers in India’s vehicle fleet is the reason why personal vehicles account for only 18 percent of its overall transport emissions and 36 percent even if two‐and three‐wheelers is added. This is much lower than many other countries; in the United States, for example, passenger cars account for 57 percent of total transport emissions.

According to the International Energy Agency (IEA), the transport sector is now the fastest‐growing energy end‐use sector in India. Energy use in India’s transport sector has increased fivefold over the past three decades, reaching more than 100 million tonnes of oil equivalent (Mtoe) in 2019. Transport is heavily reliant on oil, with 95 percent of demand met by petroleum products. Just under half of India’s oil demand is accounted for by transport. Oil demand has more than doubled since 2000 because of growing vehicle ownership and road transport use. The rapid growth of mobility was enabled by the expanding road network in India, which increased from 3.3 million km in 2000 to 5.9 million km in 2016. India’s total road network is now the second largest in the world, behind the United States (US).

According to the Ministry of Road Transport & Highways (MORTH), about 75,000 vehicles of all types are sold daily, and there are now at least 42 cities and towns in India that have over a million vehicles each. Indian cities with more than 1 million inhabitants already account for nearly 30 percent of total registered vehicles in India, and the level of vehicle ownership in urban households is higher than in rural households. In 2019, the motorcycle ownership rate was 1.4 times higher in urban areas than rural areas and the passenger car ownership rate was twice as high.

As in the case of most electric vehicles (EVs), electric two-wheelers face power and cost challenges. The rapidly falling price of batteries could reduce the total cost of the electric two-wheeler; however, to achieve cost parity with ICE two- wheelers (motor bikes), the ratio of the battery pack cost to total vehicle cost also needs to be higher, in addition to a low battery pack price. A higher battery-to-vehicle cost implies a reduction in the cost of the rest of the vehicle.

In this context, the policy on electrification of road transport should include cars that are predominantly owned by relatively affluent households. This will enable policy to use ‘sticks’ (disincentives) to move affluent urban families towards investing in ICE vehicles and limit the use of ‘carrots’ (incentives such as subsidies) that target low-income users of two-wheelers. This will shift the burden of decarbonisation, at least partly, on the affluent population in India. As vehicles excluding two- and three-wheelers are responsible for 80 percent of CO2 emissions it will only be rational to make these the focus of India’s decarbonisation effort.

Subsidising electrification

While India has a range of policies that support the increased adoption of a wide variety of EVs, electrification of road transport so far has largely come from two- and three‐wheelers. The number of electrified two- and three‐wheelers has grown by more than 60 percent each year on average since 2015. In 2019, India had a stock of 1.8 million electric two- and three‐wheelers on the road, and battery‐powered electric three‐wheelers (also called e‐rickshaws) were serving the demands of over 60 million people per day, mostly in urban areas. Sales are modest in terms of the size of the overall market, around 740,000 electric two- and three‐wheelers were sold in 2019, accounting for about 3 percent of total sales.

To increase the uptake of EVs, Faster Adoption and Manufacturing of Electric Vehicles (FAME), a subsidy programme was introduced in 2015. The second phase of the policy, FAME‐II, was approved in 2019 with a budget of US $1.4 billion for a three‐year period. This includes policy incentives for the purchase of electric and hybrid vehicles as well as for the deployment of charging stations. FAME‐II aims to increase the number of electric buses, two- and three‐wheelers and cars. Subsidies are offered only for vehicles with advanced battery chemistries, rather than lead‐acid variants that make up most electric two- and three‐wheelers sold today. In addition to these policies. State and city governments have also introduced policies to incentivise the uptake of EVs.

The recent increase in subsidies by 50 percent (US $200/kWh) and bulk tendering plans under Phase II of FAME is expected to reduce the cost of electric two-wheelers by 10 percent. But there are challenges. FAME II has been extended by another two years to March 31, 2024, from the earlier closure of March 31, 2022. The maximum cap is also increased to 40 percent of the e-two-wheeler cost compared to 20 percent earlier. 78,045 vehicles have benefited under the scheme as of 26 June 2021. The new revision of FAME and strong state support policies like the recently announced ones by the Gujarat government and Delhi government last year, may facilitate total cost of ownership (TCO parity with internal combustion engine ICE).

EV sales in India are expected to grow at 26 percent by the end of March 2023. High taxes on gasoline and diesel (about 60 percent of retail prices), lowering of goods and services tax (GST) from 12 percent to 5 percent on EVs along with tax and other incentives offered to EV purchasers are expected to drive growth of EVs.

The government values cumulative adoption of EVs and the international prestige of achieving targets for decarbonisation but the government should also be concerned overspending public funds on electrification.

The issue for consideration is the extent to which India can subsidise electrification of road transport and how this may affect other developmental and economic goals. It is not uncommon for policy makers to subsidise adoption of new technologies. These subsidies will evolve over time according to developments in technology. Policymakers have employed these subsidies to increase adoption of EVs, but these subsidies also interact with other goals such as limiting public spending and spending on other more immediate and vital necessities such as education and health care. The government values cumulative adoption of EVs and the international prestige of achieving targets for decarbonisation but the government should also be concerned overspending public funds on electrification. Potential adopters of electric two- and three-wheelers have heterogeneous, private values for EVs. Subsidies for EV adoption has a strong impact when there are a lot of inframarginal consumers who would adopt even at low subsidy levels, but it is weak when most consumers are on the margin like two-wheeler users in India. This means that without subsidies two-wheeler users are unlikely to opt for EVs. As noted above, policy should include not only incentives for adoption of EVs but also disincentives for investing in ICE vehicles by users who can do without subsidies.

Lifecycle Carbon Emissions of EVs

Cradle-to-grave assessments in the transportation sector model the environmental effects associated with the “complete” life cycle of a vehicle and its fuel. This consists of the vehicle’s raw material acquisition and processing, production, use, and end-of-life options, and the fuel’s acquisition, processing, transmission, and use. Life cycle assessments (LCA) of EVs, both in isolation and in comparison to ICE vehicle technology, is extensive and growing. However, as the literature grows, so does the range of results. The divergence is due to the differing system parameters of each study, including the selected goals, scopes, models, scales, time horizons, and datasets.

One recent research concluded that EVs must be driven 200,000 km before its “whole of life” carbon emissions equal that of an ICE. The large quantity of energy—and by extension carbon dioxide (CO2) emissions—needed to manufacture a lithium-ion battery and the typical weight of an EV which is on average 50 percent higher than a similar ICE that requires more steel and aluminium in the frame are amongst the reasons. The “embedded carbon” in an EV before sale is, therefore, 20 to 50 percent more than an ICE. A modern lithium-ion battery has approximately 135,000 miles of range before it degrades to the point of becoming unusable. According to the study, an EV will reach CO2 emission parity with an ICE just as its battery requires replacement. If this is correct, it raises concerns over CO2 reduction potential of EVs. Other studies on the time it takes for how long EVs need to be driven to reach CO2 parity with ICE varies. It varies on factors such as the size of the EV’s battery, the fuel economy of an ICE car and how the type of power used to charge an EV is generated.

The issue for consideration is whether policy should pick technologies (such as EVs) or be technology agnostic and focus on outcomes such as level of CO2 reduction. In this light, it is important to note that efficiency and emission parameters of ICE vehicles have substantially increased in the last decade and are likely to continue improving in the future. For example, Euro 6 diesels have emission levels comparable to EVs. In addition, lower acceleration and lighter weight of ICE vehicles create less road dust and tyre and road degradation which is an important source of urban pollution. Globally, an increase of EVs from the current level of about 5 million vehicles out of a billion to over 300 million out of 2 billion vehicles in 2040 is estimated to reduce oil demand only by less than 1 or 2 million barrels annually. However, improvement of efficiency of ICE vehicles is expected to reduce oil demand by over 20 million barrels per day which could substantially reduce pollution and CO2 emission levels.

Policies for decarbonisation of road transport through electrification without decarbonisation of power generation will merely shift pollution from tail pipes of vehicles to smokestacks of thermal power generators. Huge prior investment must be made in developing charging infrastructure. Though power generation capacity is not likely to be a deterrent to EV adoption in India in the next five years, advances in anticipation of electricity demand pattern for EVs and grid management will remain challenges. Most importantly ways and means to recoup taxes on petroleum derivatives that make a significant contribution to public finances must be found.

Source: India Energy Outlook 2021, IEA

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV