This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

Tax revenue from crude oil

Tax on crude imports in India include basic customs duty of

INR1/tonne (t), countervailing duty (CVD) of

INR1/t and INR50/t as national calamities contingent duty (NCCD). In 2019-20, before the pandemic reduced oil imports, India imported about

270 million tonnes (MT) of crude oil which means a revenue of over INR14.54 billion from crude imports. Domestic crude production invited basic excise of

INR1/t, INR50/t as NCCD and a cess of 20 percent calculated ad valorem (Introduced in 2016). In 2019-20, India produced 32.2 MT crude. This would translate into INR1.6422 billion from basic excise and NCCD. The price of crude (Indian basket) in 2019-20 was US

$60.47/barrel (b) which translates into a revenue of

INR857.65/t as ad valorem cess at an Indian rupee US dollar exchange rate of

INR70.88. In total, domestic production of

32.2 MT of crude would have raised a revenue of over INR27.616 billion from cess in 2019-20. Effectively domestic crude production, that is less than an eighth of the volume of crude imports, would have generated twice as much revenue for the government in taxes and levies. Overall, crude oil imports and domestic production generated a total revenue of roughly INR43.8 billion in 2019-20.

Tax revenue from petrol and diesel

In 2019-20, petrol imports amounted to

2.146 MT and diesel imports

2.796 MT. Taxes on petrol imports include customs duty of

2.5 percent, CVD of INR1.4/l (litre), special additional duty (SAD) of

INR11/l agricultural and infrastructure development cess (AIDC) of

INR2.5/l and an additional customs duty of

INR13/l. Imported diesel attracted a customs duty of

2.5 percent, CVD of INR1.8/l, SAD of INR8/l, AIDC of

INR4/l and additional customs duty of

INR8/l. The average price of imported petrol in 2019-20 was US

$66.94/b, the price of imported diesel was US

$71.78/b, and the Indian rupee to US dollar exchange rate was

INR70.88. In total, the taxes should have raised a revenue of over INR83 billion from imported petrol and over INR73 billion from imported diesel in 2019-20.

Central levies on the price of petrol at the pump included basic excise of

INR1.4/l with SAD, AIDC and road and infrastructure cess (RIC) adding to about

INR20.6/l. For diesel basic excise was

INR1.8/l with other components of excise adding about

INR17.03/l. This gives a revenue of about INR931 billion from petrol and over INR1881 billion from diesel in 2019-20 (indicative approximation, does not include higher tax rates for branded petrol and diesel).

On 1 April 2022, the share of taxes in the retail price of a litre of petrol in Delhi was

43.65 percent compared to

45.5 percent in March, and the share of taxes in diesel was

38.04 percent compared to

39.79 percent in March. A year earlier, the share of taxes in the retail price of petrol was

63.22 percent and that in diesel was

56.77 percent in Delhi. Excise on petrol was higher by about

INR5/l and the VAT (value added tax) higher by

INR5.54/l while the excise on diesel higher by

INR10/l and the VAT (state tax) higher by less than

INR1/l, the retail price of petrol was

INR91.17/l and the retail price of diesel was

INR81.47/l. The price of the Indian basket of crude has increased by over

48 percent since April 2021 from US

$63.4/barrel (b) to US

$94.07/b in February 2022. The increase in international crude prices is being passed through to consumer since March 2022 after a pause during state election campaigns in the previous months.

Source: Petroleum Planning & Analysis Cell (PPAC)

Source: Petroleum Planning & Analysis Cell (PPAC)

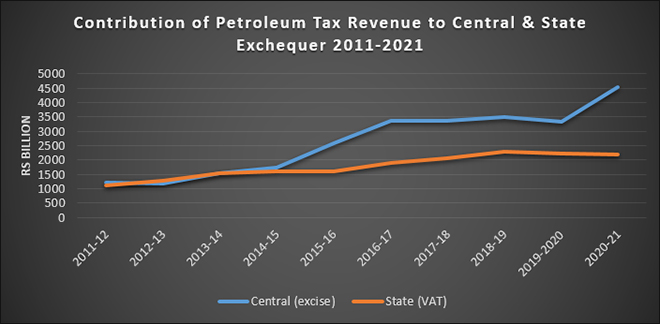

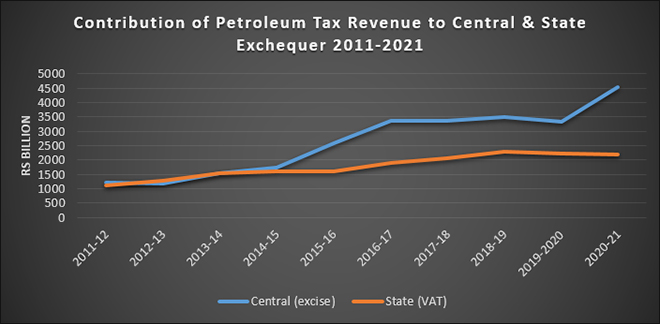

Since 2015, the Union government has used the low crude price environment, extended to 2020 by the pandemic to

substantially increase the taxes on petrol and diesel. The burden of tax increase on diesel was far higher than that on petrol. Between March 2014 and October 2021, the

excise on petrol increased by over 200 percent and the excise on diesel by over 600 percent. The

VAT on petrol in Delhi increased by about 97 percent and that on diesel by about 118 percent in the same period. Other states also increased VAT substantially in this period. Central excise revenue from oil increased by over 163 percent from

INR1.72 trillion in 2014-15 to over

INR4.5 trillion in 2020-21. In the same period (March 2014-October 2021),

VAT revenue from oil products increased by over 35 percent from over

INR1.6 trillion to over INR2.1 trillion. The Centre needs to share only the revenue from basic excise duty on petrol and diesel with the states. For example, of the basic excise on petrol of

INR1.4/l, only 42 percent or INR0.58/l out of the total excise of INR32.9/l in 2020-21 is shared with the states. For diesel only about

INR0.75/l out of the total excise of INR42.33/l is shared with the states.

Utilisation of Petroleum Tax Revenue

It is fairly simple to estimate the tax revenue generated from petroleum products, but it is far less so when it comes to identifying how the revenue raised is utilised by the Union Government. Clues from remarks by the government add to the ambiguity. During the last week of October 2020, the Union

Government stated that taxes on petrol and diesel will be increased to mobilise additional revenue for COVID-19 relief. The statements made by government representatives to the media

reiterated this claim. However, in response to a

specific question in the Lok Sabha in March 2022 on the quantum excise revenue raised from petroleum products and whether the government is using the revenue to fund a free COVID-19 vaccination programme, the government responded that the excise duty rates on petrol and diesel were calibrated to generate resources for

infrastructure and other developmental items of expenditure keeping in view the fiscal position.

In 2021, the

comptroller auditor general (CAG) of India noted that the Oil Industry Development Board (OIDB) did not receive any funds out of the over INR1 trillion collected from 2009-10 to 2019-20 as cess on crude oil. The

Parliamentary Standing Committee on Petroleum & Natural Gas of the 15

th Lok Sabha (2014-15) noted that the funds collected as cess on crude was being allocated by the Ministry of Finance (MOF) in violation of the OIDB Act. The

response of the MOF was that the government was financing various activities from the budget that included proceeds from the cess on crude and that this qualified as development of the oil industry which was part of the mandate of the OIDB. The CAG noted that

treatment of the crude cess as part of the general pool of tax defeated the very purpose of levy of the cess which was to create a non-lapsable pool of funds for a specified use. On the whole, it appears that crude and petroleum product pricing that used to be a black hole of subsidies is now evolving into the black hole of tax revenue.

The International Energy Agency (IEA) published a report titled

Petroleum Product Pricing in India: Where have all the subsidies gone? in 2006. It concluded that though the Indian energy market would be better off if the government would implement a consistent, transparent, and rational fuel pricing system, it is unlikely to be done because of its political implications. If an updated version of the report on petroleum pricing is prepared today, the key conclusion may be retained word for word, but the question posed in the title may have to be changed to: where has all the tax revenue gone?

Source: Indirect taxes: Reserve Bank of India; Oil Excise: PPAC

Source: Indirect taxes: Reserve Bank of India; Oil Excise: PPAC

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV